UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant þ Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| þ | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to § 240.14a-12 |

Meru Networks, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| þ | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

MERU NETWORKS, INC.

894 ROSS DRIVE

SUNNYVALE, CALIFORNIA 94089

April 11, 2014

Dear Stockholder:

You are cordially invited to attend the annual meeting of stockholders, or Annual Meeting, of Meru Networks, Inc., to be held at 894 Ross Drive, Sunnyvale, California, on May 22, 2014 at 9:30 a.m. Pacific Time.

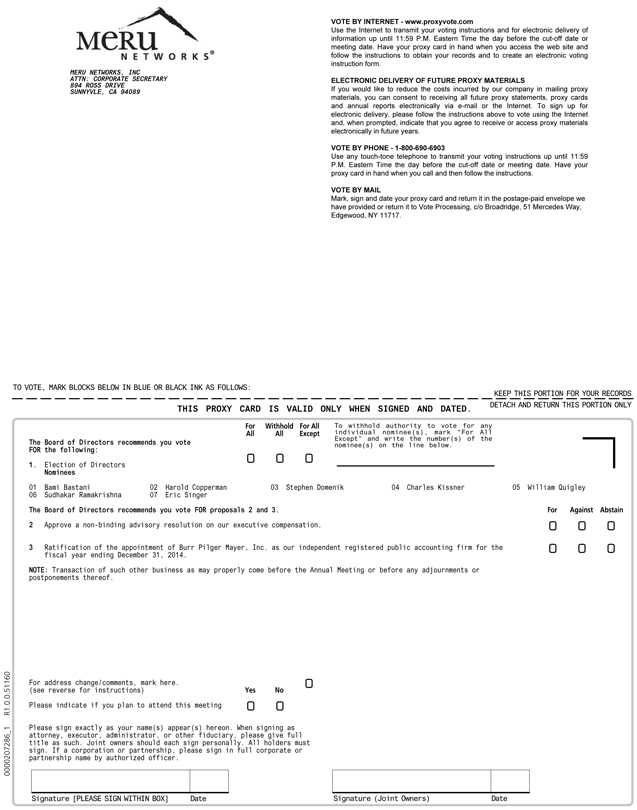

At the Annual Meeting, you will be asked to vote upon three proposals:

| | 1. | the election of seven (7) directors to serve until the next Annual Meeting or until their successors are duly elected and qualified; |

| | 2. | a non-binding advisory resolution on our executive compensation; and |

| | 3. | the ratification of our independent registered public accounting firm for our fiscal year ending December 31, 2014. |

Accompanying this letter is the formal notice of Annual Meeting, proxy statement and proxy card relating to the Annual Meeting, as well as our annual report for the fiscal year ended December 31, 2013. The proxy statement contains important information concerning the matters to be voted upon at the Annual Meeting. We hope you will take the time to review it carefully.

We are pleased to take advantage of the Securities and Exchange Commission’s rules that allow issuers to furnish proxy materials to their stockholders over the Internet. We believe these rules allow us to provide you with the information you need while lowering the costs of delivery and reducing the environmental impact of the Annual Meeting.

All stockholders of record at the close of business on the record date, which is March 28, 2014, are entitled to vote at the Annual Meeting, and your vote is very important regardless of how many shares you own. Regardless of whether you plan to attend the Annual Meeting, we urge you to submit your proxy as soon as possible. Instructions on the proxy card will tell you how to submit your proxy over the Internet, by telephone or by returning your proxy card in the enclosed postage-paid envelope. If you plan to attend the Annual Meeting and vote in person, and your shares are held in the name of a broker or other nominee as of the record date, you must bring with you a proxy or letter from the broker or nominee to confirm your ownership of such shares.

Sincerely,

Dr. Bami Bastani

President and Chief Executive Officer

MERU NETWORKS, INC.

894 Ross Drive

Sunnyvale, California 94089

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 22, 2014

NOTICE IS HEREBY GIVEN that an annual meeting of stockholders, or Annual Meeting, of Meru Networks, Inc., a Delaware corporation, will be held at 894 Ross Drive, Sunnyvale, California, on May 22, 2014 at 9:30 a.m. Pacific Time. At the Annual Meeting, our stockholders will be asked to consider and vote upon:

| | 1. | The election of seven (7) directors to serve on our board of directors, each to serve until our Annual Meeting of stockholders to be held in 2015 and until his successor is elected an qualified, or until his death, resignation or removal. |

| | 2. | A non-binding advisory resolution on our executive compensation; |

| | 3. | Ratification of the appointment of Burr Pilger Mayer, Inc. as our independent registered public accounting firm for the fiscal year ending December 31, 2014. |

| | 4. | Transaction of such other business as may properly come before the Annual Meeting or before any adjournments or postponements thereof. |

Only stockholders of record of our common stock at the close of business on March 28, 2014 are entitled to notice of, and to vote at, the Annual Meeting or any adjournments or postponements thereof.

By Order of the Board of Directors,

Mark Liu

General Counsel and Secretary

Sunnyvale, California

April 11, 2014

IMPORTANT NOTICE

ALL STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE MEETING IN PERSON. TO ENSURE THAT YOUR SHARES ARE REPRESENTED AT THE ANNUAL MEETING, YOU ARE URGED TO SUBMIT YOUR PROXY OVER THE INTERNET, BY TELEPHONE OR BY COMPLETING, DATING AND SIGNING THE ENCLOSED PROXY CARD AND MAILING IT PROMPTLY IN THE ENCLOSED POSTAGE-PAID ENVELOPE, REGARDLESS OF WHETHER YOU PLAN TO ATTEND THE ANNUAL MEETING IN PERSON. EVEN IF YOU HAVE GIVEN YOUR PROXY, YOU MAY STILL VOTE IN PERSON IF YOU ATTEND THE MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE MEETING, YOU MUST OBTAIN FROM THE RECORD HOLDER A PROXY ISSUED IN YOUR NAME. IF YOUR PROXY IS NOT IRREVOCABLE, YOU CAN WITHDRAW YOUR PROXY AT ANY TIME BEFORE THE VOTE PURSUANT TO THAT PROXY.

TABLE OF CONTENTS

i

Meru Networks, Inc.

894 Ross Drive

Sunnyvale, California 94089

PROXY STATEMENT

This proxy statement is being furnished to the stockholders of Meru Networks, Inc., a Delaware corporation, in connection with the solicitation of proxies by our board of directors, or Board, for use at the annual meeting of stockholders, or Annual Meeting, to be held at 894 Ross Drive, Sunnyvale, California, on May 22, 2014 at 9:30 a.m. Pacific Time, and at any adjournments or postponements thereof. At the Annual Meeting, holders of our common stock will be asked to vote upon: (i) the election of seven (7) directors to serve until the Annual Meeting of stockholders to be held in 2015, or until their successors are duly elected and qualified; (ii) a non-binding advisory resolution on our executive compensation; (iii) the ratification of Burr Pilger Mayer, Inc. as our independent registered public accounting firm for the fiscal year ending December 31, 2014; and (iv) any other business that properly comes before the Annual Meeting, or any adjournments or postponements thereof.

This proxy statement and the accompanying proxy card are first being mailed to stockholders on or about April 11, 2014. The address of our principal executive offices is 894 Ross Drive, Sunnyvale, California 94089.

GENERAL INFORMATION

Notice Regarding the Availability of Proxy Materials

Pursuant to rules adopted by the Securities and Exchange Commission, we have elected to provide access to the proxy materials over the Internet. Accordingly, on or about April 11, 2014 we mailed to our stockholders (other than those who previously requested email or paper delivery) a Notice Regarding the Availability of Proxy Materials containing instructions on how to access our proxy materials online (the “Notice”). If you receive a Notice by mail, you will not receive a printed copy of the proxy materials in the mail. Stockholders will have the ability to access the proxy materials on the website referred to in the proxy materials and the Notice. Instructions on how to access the proxy materials over the Internet or to request a printed copy can be found in the Notice.

Record Date

Only holders of record of our common stock at the close of business on the record date, which is March 28, 2014, will be entitled to notice of and to vote at the Annual Meeting. As of the close of business on the record date, there were 23,197,073 shares of our common stock outstanding and entitled to vote, held of record by 107 stockholders.

Quorum

Pursuant to our bylaws, a majority of the outstanding shares of common stock, present in person or by proxy, will constitute a quorum for the transaction of business. Each of our stockholders is entitled to one vote for each share of common stock held as of the record date. For ten days prior to the Annual Meeting, a complete list of stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder, for any purpose germane to the meeting, during ordinary business hours at our principal executive offices.

Voting of Proxies

Stockholders are requested to complete, date, sign and return the accompanying proxy card in the enclosed postage-paid envelope, or vote by Internet or telephone as described below. All properly executed, returned and unrevoked proxies will be voted in accordance with the instructions indicated thereon.Executed but unmarked proxies will be voted FOR each director nominee listed on the proxy card, FOR the approval of the non-binding advisory resolution on our executive compensation, and FOR the ratification of our independent

1

registered public accounting firm for the fiscal year ending December 31, 2014. Our Board does not know of, and does not intend to bring, any business before the Annual Meeting other than that referred to in this proxy statement and specified in the notice of Annual Meeting. As to any other business that may properly come before the Annual Meeting, including any motion made for adjournment or postponement of the Annual Meeting (including for purposes of soliciting additional votes), the proxy card will confer discretionary authority on the proxies (who are persons designated by our Board) to vote all shares covered by the proxy card in their discretion.

Revocation of Proxies

Any stockholder who has given a proxy that does not state it is irrevocable may revoke it at any time before it is exercised at the Annual Meeting by, before the vote pursuant to the proxy, (i) receipt of a written notice of the death or incapacity of the maker by our Corporate Secretary, or (ii) attending the Annual Meeting and voting in person (although attendance at the Annual Meeting will not, by itself, revoke a proxy, delivery of written notice to the Corporate Secretary), stating that the proxy is revoked or by executing a subsequent proxy. If you hold shares through a brokerage firm, bank or other agent, you must contact that brokerage firm, bank or other agent to revoke any prior voting instructions.

Votes Required

Director elections are determined by a plurality of shares of common stock represented in person or by proxy and voting at the Annual Meeting (the seven (7) properly nominated individuals receiving the highest number of votes will be elected). The proposal to approve the non-binding advisory resolution on our executive compensation must be approved by the affirmative vote of holders of a majority of our outstanding common stock entitled to vote at the Annual Meeting. The proposal to approve our independent registered public accounting firm for the fiscal year ending December 31, 2014 must be approved by the affirmative vote of holders of a majority of our outstanding common stock entitled to vote at the Annual Meeting.

Effect of Abstentions

If an executed proxy is returned and the stockholder has specifically abstained from voting on any matter, the shares represented by such proxy will be considered present at the Annual Meeting for purposes of determining a quorum and for purposes of calculating the vote, but will not be considered to have been voted in favor of such matter. As such, an abstention will have the effect of a vote (a) against the non-binding advisory resolution on our executive compensation and (b) against ratification of our independent registered public accounting firm, Burr Pilger Mayer, Inc. for the fiscal year ending December 31, 2014. Abstentions will have no impact on the election of directors.

Effect of “Broker Non-Votes”

If your shares are held by your broker, bank or other agent as your nominee (that is, in “street name”), you will need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker, bank or other agent to vote your shares. If you do not give instructions to your broker, bank or other agent, they can vote your shares with respect to “discretionary” items, but not with respect to “non-discretionary” items. Discretionary items are proposals considered routine on which your broker, bank or other agent may vote shares held in street name in the absence of your voting instructions, such as the vote for ratification of our independent registered public accounting firm. On non-discretionary items, such as the vote for election of directors and the non-binding advisory vote on executive compensation, if you do not give instructions to your broker, bank or other agent, the shares will not be voted and will be treated as broker non-votes.

If an executed proxy is returned by a broker, bank or other agent holding shares in street name that indicates that the broker does not have discretionary authority as to certain shares to vote on a proposal (“broker non-votes”), such shares will be considered present at the Annual Meeting for purposes of determining a quorum on all proposals, but will not be considered to be entitled to vote on such proposal.

2

If a quorum is present, the nominees for director receiving the highest number of affirmative votes of the shares present or represented and entitled to be voted for them shall be elected as directors. Therefore, broker non-votes will have no effect on the election of directors. The approval of the non-binding advisory vote on executive compensation and the ratification of Burr Pilger Mayer, Inc. as our independent registered public accounting firm for the fiscal year ending December 31, 2014 each requires the approval of the affirmative vote of a majority of the shares present or represented by proxy and voting at the Annual Meeting. Because broker non-votes are not voted affirmatively or negatively, they will have no effect on the approval of these two proposals.

Voting Electronically via the Internet or by Telephone

General Information for All Shares Voted via the Internet or by Telephone

Stockholders whose shares are registered in their own name may choose to grant a proxy to vote their shares either via the Internet or by telephone. The laws of Delaware, under which we are incorporated, specifically permits electronically transmitted proxies, provided that each such proxy contains or is submitted with information from which the inspector of elections can determine that such proxy was authorized by the stockholder.

The Internet and telephone voting procedures set forth below, as well as on the enclosed proxy card, are designed to authenticate stockholders’ identities, to allow stockholders to grant a proxy to vote their shares and to confirm that stockholders’ voting instructions have been properly recorded. Stockholders granting a proxy to vote via the Internet should understand that there may be costs associated with electronic access, such as usage charges from Internet access providers and telephone companies, which must be borne by the stockholder.

For Shares Registered in Your Name

Stockholders of record may go tohttp://www.proxyvote.com to grant a proxy to vote their shares by means of the Internet. They will be required to provide the control number contained on their proxy cards. The voter will then be asked to complete an electronic proxy card. Any stockholder using a touch-tone telephone may also grant a proxy to vote shares by calling 1-800-690-6903 and following the recorded instructions.

You may use the Internet to vote your proxy 24 hours a day, seven days a week, until 11:59 p.m. Eastern Time (8:59 p.m. Pacific Time) on May 21, 2014. You may use a touch-tone telephone to vote your proxy 24 hours a day, seven days a week, until 11:59 p.m. Eastern Time (8:59 p.m. Pacific Time) on May 21, 2014. Submitting your proxy via the Internet or by telephone will not affect your right to vote in person should you decide to attend the Annual Meeting.

For Shares Registered in the Name of a Broker or Bank

Most beneficial owners whose shares are held in street name receive voting instruction forms from their banks, brokers or other agents, rather than our proxy card.

If on the record date your shares were held, not in your name, but rather in an account at a brokerage firm, bank or other agent, then you are the beneficial owner of shares held in “street name” and these proxy materials have been forwarded to you by your broker, bank or other agent. The broker, bank or other agent holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting.

As a beneficial owner, you have the right to direct your broker, bank or other agent on how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy issued in your name from your broker, bank or other agent.

3

Solicitation of Proxies and Expenses

We will bear the cost of the solicitation of proxies from our stockholders in the enclosed form. Our directors, officers and employees, without additional compensation, may solicit proxies by mail, telephone, letter, facsimile, electronically or in person. Any materials used in connection with a personal solicitation will be released to the individuals who will make the solicitation on or about April 11, 2014. Following the original mailing of the proxies and other soliciting materials, we will request that brokers, custodians, nominees and other record holders forward copies of the proxy and other soliciting materials to persons for whom they hold shares of common stock and request authority for the exercise of proxies. In such cases, we will reimburse such record holders for their reasonable expenses incurred for forwarding such materials.

Voting Results

The preliminary voting results will be announced at the Annual Meeting. The final voting results will be tallied by our Inspector of Elections and published in a Current Report on Form 8-K to be filed with the Securities and Exchange Commission, or the SEC, within four business days of the Annual Meeting.

Delivery of this Proxy Statement

The SEC has adopted rules that permit companies and intermediaries (for example, brokers) to satisfy the delivery requirements for annual reports and proxy statements with respect to two or more security holders sharing the same address by delivering a single annual report and proxy statement addressed to those security holders. This process, which is commonly referred to as “householding,” potentially means extra convenience for security holders and cost savings for companies.

A number of brokers with account holders who are our stockholders will be “householding” our proxy materials. A single annual report and proxy statement will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker or us that they will be “householding” communications to your address, “householding” will continue until you are notified otherwise or until you revoke your consent. We will deliver promptly upon oral or written request a separate copy of the annual report or proxy statement to a security holder at a shared address to which a single copy of the documents was delivered. If, at any time, you no longer wish to participate in “householding” and would prefer to receive a separate annual report and proxy statement, please notify your broker and either mail your request to Meru Networks, Inc., Attention: Corporate Secretary, 894 Ross Drive, Sunnyvale, California 94089 or call (408) 215-5300.

Stockholders who currently receive multiple copies of the proxy statement at their address and would like to request “householding” of their communications should contact their broker and either mail your request to Meru Networks, Inc., Attention: Corporate Secretary, 894 Ross Drive, Sunnyvale, California 94089 or call (408) 215-5300.

A copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2013, including the consolidated financial statements, list of exhibits and any exhibit specifically requested, filed with the SEC is available without charge upon written request to: Meru Networks, Inc., Attention: Corporate Secretary, 894 Ross Drive, Sunnyvale, California 94089.

4

ELECTION OF DIRECTORS

(Item No. 1 on the Proxy Card)

Our board of directors, or Board, currently consists of nine (9) members and following the Annual Meeting, the Board will consist of seven (7) members. At each Annual Meeting , successors to directors whose term expires at the Annual Meeting will be elected for a term to expire at the succeeding Annual Meeting. The individuals so elected will serve until their successors are elected and qualified.

The Board currently consists of Bami Bastani, Harold Copperman, Stephen Domenik, Charles Kissner, Nicholas Mitsakos, Barry Newman, William Quigley, Sudhakar Ramakrishna and Eric Singer. The terms of all of these nine (9) directors will expire at the Annual Meeting. The Board has nominated Bami Bastani, Harold Copperman, Stephen Domenik, Charles Kissner, William Quigley, Sudhakar Ramakrishna and Eric Singer, as the seven (7) directors to each serve for a one year term that is expected to expire at our Annual Meeting in 2015, and until his successor is elected and qualified, or until his earlier death, resignation or removal. Messrs. Mitsakos and Newman are not standing for re-election to our Board, and their respective terms as director will end on May 22, 2014, the date of the Annual Meeting. The Board appreciates each of Mr. Mitsakos’s and Mr. Newman’s service and contributions to our success. As a result of Messrs. Mitsakos and Newman not standing for re-election, our Board has elected to reduce the authorized number of directors from nine (9) to seven (7), to be effective on May 23, 2014. You can find below the principal occupation and other information about the Board’s nominees.

The election of directors will be determined by the seven (7) nominees receiving the greatest number of votes from shares eligible to vote. Unless a stockholder signing a proxy withholds authority to vote for one or more of the Board’s nominees in the manner described on the proxy, each proxy received will be voted for the election of each of the Board’s nominees. In the event that any nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for the nominee or nominees who shall be designated by the present Board to fill the vacancy. We are not aware that any of the nominees will be unable or will decline to serve as a director.

Stephen Domenik and Eric Singer were appointed to our Board on January 13, 2014 as a result of discussions between our management and Board and Potomac Capital Partners III, L.P., Potomac Capital Management III, L.L.C., Potomac Capital Partners L.P., Potomac Capital Management L.L.C., Paul J. Solit, and Mr. Singer, which we refer to collectively as the Potomac group. Collectively the Potomac group is a significant Meru stockholder. After a recommendation from Mr. Singer, we evaluated Mr. Domenik and in January 2014 agreed to appoint Messrs. Domenik and Singer to the Board and to nominate them for election at our 2014 Annual Meeting in accordance with a Nomination and Standstill Agreement, dated January 13, 2014 between us and the various members of the Potomac group listed therein. There are no family relationships between any of our directors, nominees or executive officers.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE FOR THE ELECTION OF EACH OF BAMI BASTANI, HAROLD COPPERMAN, STEPHEN DOMENIK, CHARLES KISSNER, WILLIAM QUIGLEY, SUDHAKAR RAMAKRISHNA AND ERIC SINGER AS DIRECTORS.

5

Information Regarding Our Nominees and Directors

The following table lists the nominees and current members of the Board, their ages as of March 28, 2014 and current positions with Meru Networks, Inc. Biographical information for each nominee and/or director is also provided. Our restated certificate of incorporation and bylaws provide that the number of our authorized directors, which is currently nine (9) members, but will be seven (7) members following the Annual Meeting, shall be fixed from time to time by a resolution of the majority of our Board. Proxies cannot be voted for a greater number of persons than the number of nominees named.

Director Nominees

The names of the nominees and certain information (ages as of March 28, 2014) about them are set forth below:

| | | | | | | | | | |

Name | | Age | | | Position and Offices | | Director Since | |

Bami Bastani, Ph.D. | | | 60 | | | Director, President and CEO | | | 2012 | |

Harold Copperman(1)(3) | | | 66 | | | Lead Director | | | 2010 | |

Steven Domenik | | | 62 | | | Director | | | 2014 | |

Charles Kissner(1)(2) | | | 66 | | | Director | | | 2011 | |

Sudhakar Ramakrishna(3) | | | 46 | | | Director | | | 2013 | |

William Quigley(1) | | | 49 | | | Chairman of the Board (Director) | | | 2002 | |

Eric Singer | | | 40 | | | Director | | | 2014 | |

| (1) | Member of the Nominating and Corporate Governance Committee. |

| (2) | Member of the Audit Committee. |

| (3) | Member of the Compensation Committee. |

Biographies

Nominees for Directors

Dr. Bami Bastani was appointed as our CEO and President and as a member of the Board in March 2012. Prior to joining Meru, he was Chief Executive Officer and President of Trident Microsystems, Inc., a semiconductor company, from June 2011 through May 2012. In January 2012, Trident entered into Chapter 11 bankruptcy proceedings and its assets were distributed to its creditors and equity holders. Prior to joining Trident, Dr. Bastani was the Chairman and Chief Executive Officer of B2 Global Consulting, LLC, a management consulting firm from August 2008 until June 2011. From October 1998 to August 2008, Dr. Bastani was President and Chief Executive Officer of ANADIGICS, Inc. a semiconductor company providing RF solutions for the wireless and broadband communications equipment markets. From 1996 to 1998, Dr. Bastani was Executive Vice President of Fujitsu Microelectronics, where he led the Systems LSI Group, including ASIC System-On-Chip, Local Area Networks, SPARC processors, and RFICs. Previously, he served for more than a decade at National Semiconductor where he held several key executive positions, most recently as Vice President and General Manager of the Embedded Technologies Division. Dr. Bastani also served on the Board of Directors of CorMedix, a specialty pharmaceutical company, from February 2010 to June 2011. He received a Ph.D. degree and an M.S.E.E. degree in Electrical Engineering from The Ohio State University and a B.S.E.E. degree in Electrical Engineering from University of Arkansas. Dr. Bastani’s prior experiences as a Chief Executive Officer and role as the company’s Chief Executive Officer give him unique insights into the day-to-day operations of the company and his membership on the Board allows him to share these insights with the Board. He also brings to the Board his strong background in senior management at technology companies.

Harold Copperman has served as one of our directors since January 2010 and since January 2013 has served as the Lead Director. Mr. Copperman has served as the President and Chief Executive Officer of HDC Ventures, Inc., a management and investment group focusing on enterprise systems, software, and services, since

6

March 2002. From January 2000 to March 2002, Mr. Copperman was a consultant and a private investor. From 1993 to 1999, Mr. Copperman served as Senior Vice President and Group Executive at Digital Equipment Corp. Mr. Copperman also has held various executive positions such as Chief Executive Officer at JWP Information Services, Inc., President of Commodore Business Machines, Inc. and Vice President and General Manager of Apple Computer, Inc. He also spent 20 years at IBM Corporation, where he held a variety of sales, marketing and executive positions. Mr. Copperman serves on the board of directors of ID Systems, Inc., a provider of RFID wireless solutions for tracking high-value assets. He also previously served as director of Virtual Piggy, Inc., a publicly traded company that provides youth payments technology, from April 2013 until February 2014, director of EDGAR Online, Inc., a publicly traded company that provides financial data, analytics and disclosure management services, from 2011 until August 2012, at which time EDGAR Online was acquired by R.R. Donnelley and Sons Company, a director of Avocent Corporation, a publicly traded company that delivers IT operations management solutions, from 2002 until December 2009, at which time Avocent Corporation was acquired by Emerson Electric Co., a director of AXS-One Inc., a publicly traded company that provides high performance records compliance management solutions, from 2006 until June 2009, at which time AXS-One Inc. was acquired by Unify Corporation, and as a director of Epicor Software Corporation, a publicly held company that designs, develops, markets and supports enterprise application software solutions and services, from 2001 until 2008. He also served on the board of directors of America Online from 1989 to 1993, during which time it became a publicly traded company. Mr. Copperman received a B.S. in Mechanical Engineering from Rutgers University and served as a Captain in the U.S. Army. Mr. Copperman brings to our Board vast experience and understanding of sales, marketing, and distribution in the high technology industry. In addition, his executive management assignments and his service on the boards of directors of many publicly traded technology companies provides us a valuable perspective.

Stephen Domenik has served as one of our directors since January 2014. Mr. Domenik has been a general partner at Sevin Rosen Funds, a venture capital firm, since 1995. Mr. Domenik has also served as a director of EMCORE Corporation, a publicly traded provider of compound semiconductor-based components and subsystems, since December 2013, a director of PLX Technology, Inc., a publicly traded semiconductor company, since December 2013, a director of Pixelworks, Inc., a publicly traded designer, developer and marketer of video and pixel processing semiconductors, since August 2010 and director of MoSys, Inc., a publicly-traded, IP-rich, fabless semiconductor company, since June 2012. He served on the board of directors of NetLogic Microsystems, Inc., a publicly-traded fabless semiconductor company, from January 2001 until it was acquired in February 2012. Mr. Domenik was previously CEO of twohigh-technology companies in the RFID and software domains. He was also vice president of marketing at Cyrix, a Sevin Rosen Funds portfolio company, where he worked until after its IPO in 1995. Prior to Cyrix, Mr. Domenik was the vice president of marketing at Weitek Corporation, aventure-backed startup company that also went public. Mr. Domenik holds an M.S.E.E. and a B.S. in physics from the University of California at Berkeley. Mr. Domenik brings to the Board considerable experience from both established and small companies in the semiconductor and software industries to the Board. Mr. Domenik has both held senior management positions and served on the boards of directors of multiple public and private technology companies. In addition, Mr. Domenik has considerable relevant experience in corporate investments and strategic development of high-technology companies.

Charles D. Kissner has served as one of our directors since November 2011, having previously served as one of our directors until his resignation in September 2010 following his appointment as Chief Executive Officer of Aviat Networks, Inc., a publicly traded independent supplier of wireless transmission systems. He currently serves as the Chairman of the Board of Directors of Aviat Networks. Mr. Kissner also serves as Chairman of the Board of Directors of ShoreTel Inc., a publicly traded business communications systems company, as well as a Director of Rambus, Inc., a publicly traded technology licensing company focusing on the development of technologies that enrich the end-user experience of electronics systems. From 2010 to 2011, he was Chairman and Chief Executive Officer of Aviat Networks. From 1995 to 2006, he served as Chairman and CEO of Stratex Networks. Stratex merged with Harris Corporations’ Microwave Division to create Aviat Networks in 2007. Mr. Kissner previously served as Vice President and General Manager of M/A-COM, Inc., a manufacturer of radio and microwave communications products, President and CEO of Aristacom International

7

Inc., a communications software company, Executive Vice President of Fujitsu Network Switching, Inc. and held a number of executive positions at AT&T (now Alcatel-Lucent). Mr. Kissner has also served on a number of other public and private boards of directors, as well as not-for-profit boards such as the NPR Foundation and Angel Flight, Inc. He currently serves on the board of the non-profit corporation, KQED Public Media. Mr. Kissner brings fifteen years of relevant experience as a Chief Executive Officer, having served in that capacity at technology driven companies such as Stratex, Aviat Networks and Aristacom. Mr. Kissner also brings extensive public company directorship and committee experience to the Board, which has been an invaluable resource as we regularly assess our corporate governance, corporate compliance and risk management obligations. Mr. Kissner has also directly supervised nearly thirty merger and acquisition transactions, which experience is helpful to us in the assessment and integration of acquisition opportunities. In addition, our Board’s determination, in light of his experience as a principal executive officer and director overseeing or assessing the performance of public companies and auditors as described above, that Mr. Kissner is an “audit committee financial expert” lends further support to his financial acumen and qualifications for serving on our Board and as a member of our audit committee.

William Quigleyhas served as one of our directors since November 2002 and since May 2010 has served as the Chairman of the Board. Mr. Quigley is a Managing Director at Clearstone Venture Partners, a venture capital firm. He joined Clearstone shortly after its formation in 1999, from Mid-Atlantic Venture Funds, where he served as an investor and Kauffman Fellow. Mr. Quigley holds a B.S. in Accounting, with honors, from the University of Southern California and he received his M.B.A., with distinction, from Harvard Business School. Mr. Quigley brings to the Board extensive financial experience as well as his experience in the venture capital industry and his understanding of our company and business due to his long tenure with us as a member of the Board.

Sudhakar Ramakrishnahas served as one of our directors since December 2013. Mr. Ramakrishna has served as Senior Vice President and General Manager, Enterprise and Service Provider Division of Citrix Systems, Inc., a publicly traded cloud company that enables mobile workstyles, since March 2013. Prior to joining Citrix Systems, Mr. Ramakrishna served as President of Products and Services at Polycom, Inc., a publicly traded provider of unified communications and collaboration solutions, from February 2012 to March 2013. Mr. Ramakrishna also served as Polycom¹s Executive Vice President and General Manager, Unified Communications Solutions and Chief Development Officer from February 2011 to February 2012 and as Senior Vice President and General Manager, Unified Communications Products and Chief Development Officer from October 2010 to February 2011. Prior to joining Polycom, Mr. Ramakrishna served as Corporate Vice President and General Manager for Wireless Broadband Access Solutions and Software at Motorola, Inc., a mobile infrastructure company, from May 2007 to October 2010. Mr. Ramakrishna earned his master¹s degree in Computer Science from Kansas State, and an MBA from Northwestern University¹s Kellogg School of Management. Mr. Ramakrishna holds and has filed several patents in the areas of IP telephony, soft switching and load balancing. Mr. Ramakrishna has extensive experience in the management of development and selling of technology solutions. He provides important perspectives in technological and business trends in the industry. As a current executive officer of a public technology company, he provides guidance and expertise in technical and business matters to the Company’s executives, including mobility and networking.

Eric Singer has served as one of our directors since January 2014. Mr. Singer has served as a co-managing member of Potomac Capital Management III, L.L.C., the general partner of Potomac Capital Partners III, L.P., and Potomac Capital Management II, L.L.C., the general partner of Potomac Capital Partners II, L.P. since March 2012 and has served as an advisor to Potomac Capital Management, L.L.C. and its related entities since May 2009. Mr. Singer has also served as a director of PLX Technology, Inc., a publicly traded semiconductor company, since December 2013. Mr. Singer served as chairman of the board of Sigma Designs, Inc. a publicly traded semiconductor company, from January 2013 until December 2013, and was a board member from August 2012 until December 2013. From August 2008 until its sale in February 2010, Mr. Singer served as a director of Zilog Corporation, a publicly traded semiconductor company. From July 2007 to April 2009, Mr. Singer was a senior investment analyst at Riley Investment Management. He managed private portfolios for Alpine Resources,

8

LLC from January 2003 to July 2007.Mr. Singer holds a B.A. from Brandeis University. Mr. Singer brings significant experience as a public companydirector of technology companies. Mr. Singer’s experience as a director within the technology industry, as well as his significant financial and investment experience, including capital allocation and transactional experience, enables him to assist in the effective oversight of our company.

Board Meetings, Committees and Corporate Governance

Our Board held 11 meetings during 2013. Our independent directors generally hold an executive session in conjunction with each regular Board meeting. Our Board also acted by unanimous written consent on six occasions. Except for Mr. Ramakrishna, who attended two out of the three meetings during the period in which he served on the Board in 2013, each incumbent director attended during the periods that he served in 2013, as applicable, at least 75% of the aggregate number of (i) the meetings of the Board and (ii) the meetings of the committees on which he served.

Director Independence

Our Board has determined that all current members of the Board and all Board member nominees, other than Dr. Bastani, is independent, as determined under the rules of The NASDAQ Stock Market and the applicable SEC rules.

Board Leadership

Our Board is led by our Chairman of the Board and our Lead Director, each of whom is an independent director, and several independent directors.

Our Chairman of the Board has the following roles and responsibilities:

| | • | | advising our Chief Executive Officer and other members of senior management on business strategy and leadership development, as appropriate; |

| | • | | working with our Board to drive decisions about particular strategies and policies and, in concert with our independent Board committees, facilitates Board effectiveness; |

| | • | | providing input to our Lead Director and Chief Executive Officer regarding agendas, meeting schedules, and information provided to our Board; |

| | • | | being available, as appropriate, for communication with stockholders; |

| | • | | presiding over stockholder meetings when our Chief Executive Officer is unavailable and such authority has not otherwise been delegated; |

| | • | | the duties of our Lead Director when there is no Lead Director or our Lead Director is otherwise absent or unavailable; and |

| | • | | other duties as may be, from time to time, set forth in our bylaws or requested by our Board to assist it in the fulfillment of its responsibilities, by individual directors, or by our Lead Director or Chief Executive Officer. |

Our Lead Director has the following roles and responsibilities:

| | • | | authority to call meetings of our independent directors as may be necessary from time to time; |

| | • | | presiding at all meetings of our Board, including executive sessions of our independent directors; |

| | • | | serving as principal liaison between our independent directors and our Chief Executive Officer; |

| | • | | discusses any significant conclusions or requests arising from the independent director sessions with our Chief Executive Officer and otherwise communicating from time to time with our Chief Executive Officer; |

9

| | • | | disseminating information to the rest of our Board as appropriate; |

| | • | | providing leadership to our Board if circumstances arise in which the role of our Chief Executive Officer or Chairman may be, or may be perceived to be, in conflict; |

| | • | | reviewing and approving agendas, meeting schedules to assure that there is sufficient time for discussion of all agenda items, and information provided to our Board (including the quality, quantity and timeliness of such information); and |

| | • | | other duties as may be, from time to time, set forth in our bylaws or requested by our Board to assist it in the fulfillment of its responsibilities, by individual directors, or by our Chairman or Chief Executive Officer. |

Our Board structure allows us to leverage the experience of our Chief Executive Officer and the independent perspective of our Chairman of the Board and Lead Director. We believe that this structure, combined with our strong committee system, meets the current corporate governance needs and oversight responsibilities of the Board.

Role of the Board in Risk Oversight

The Board is actively involved the oversight of our risk management process. The Board does not have a standing risk management committee, but administers this oversight function directly through the Board as a whole, as well as through its standing committees that address risks inherent in their respective areas of oversight. In particular, our audit committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, our compensation committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking, our nominating and corporate governance committee monitors our major legal compliance risk exposures and our program for promoting and monitoring compliance with applicable legal and regulatory requirements and our Board is responsible for monitoring and assessing strategic risk exposure, and other risks not covered by our committees.

The full Board, or the appropriate committee, receives reports on risks facing our company from our Chief Executive Officer or other members of management to enable it to understand our risk identification, risk management and risk mitigation strategies. We believe that our Board’s leadership structure supports effective risk management because it allows our Chairman of the Board and Lead Director, who are independent, and the independent directors on our committees to exercise oversight over management.

Committees of the Board of Directors

Our Board has established an audit committee, a compensation committee and a nominating and corporate governance committee, each of which operates pursuant to a separate charter adopted by our Board. The composition and functioning of our Board and all of our committees comply with all applicable requirements of the Sarbanes-Oxley Act of 2002, the NASDAQ Stock Market and SEC rules and regulations. Members serve on committees until their resignation or until otherwise determined by our Board.

Audit Committee

Our audit committee is comprised of Mr. Barry Newman, who is the chair of the committee, and Messrs. Charles Kissner and Nicholas Mitsakos. The future composition of our audit committee will be determined by the Board following the Annual Meeting.

The composition of our audit committee meets the requirements for independence under the current NASDAQ Stock Market and SEC rules and regulations. Each member of our audit committee is financially

10

literate. In addition, our audit committee includes two financial experts within the meaning of Item 407(d)(5)(ii) of Regulation S-K promulgated under the Securities Act of 1933, as amended, or the Securities Act. All audit services to be provided to us and all permissible non-audit services to be provided to us by our independent registered public accounting firm will be approved in advance by our audit committee. Our audit committee recommended, and our Board has adopted, a charter for our audit committee. Our audit committee, among other things:

| | • | | selects a firm to serve as our independent registered public accounting firm for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for us; |

| | • | | helps to ensure the independence of our registered public accounting firm; |

| | • | | discusses the scope and results of the audit with our independent registered public accounting firm, and reviews, with management and that firm, our interim and year-end operating results including our disclosures under the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our reports filed with the SEC; |

| | • | | establishes procedures for employees to submit anonymously concerns about questionable accounting or audit matters; |

| | • | | discusses with management our major financial risk exposures and the steps management has taken to monitor such exposures including our policies with respect to risk assessment and risk management; |

| | • | | reviews and discusses with management and our independent registered accounting firm the adequacy and effectiveness of our internal control over financial reporting and the effectiveness of our disclosure controls and procedures; |

| | • | | reviews and considers “related person transactions” under, and takes other actions contemplated by, our related person transactions policy; and |

| | • | | reviews any proposed waiver of our code of conduct and makes a recommendation to the Board with respect to the disposition of any proposed waiver. |

The audit committee met eight times during 2013, including meetings with our independent registered public accounting firm to review our quarterly and annual financial statements and their review or audit of such statements. The audit committee operates pursuant to the audit committee charter, which has been posted on our website athttp://investors.merunetworks.com/governance.cfm.

Compensation Committee

Our compensation committee is comprised of Mr. Harold Copperman, who is the chair of the committee, and Messrs. Nicholas Mitsakos and Sudhakar Ramakrishna. The future composition of our compensation committee will be determined by the Board following the Annual Meeting.

The composition of our compensation committee meets the requirements for independence under the current NASDAQ Stock Market and SEC rules and regulations. The purpose of our compensation committee is to discharge the responsibilities of our Board relating to compensation of our executive officers. Our compensation committee recommended, and our Board has adopted, a charter for our compensation committee. Our compensation committee, among other things:

| | • | | reviews and approves the corporate goals and objectives relevant to the compensation of our Chief Executive Officer and the other executive officers; |

| | • | | administers our stock and equity incentive plans; |

| | • | | reviews and makes recommendations to our Board with respect to incentive compensation and equity plans; and |

| | • | | establishes and reviews general policies relating to compensation of our employees. |

11

The compensation committee met nine times during 2013. The compensation committee also acted by unanimous written consent on three occasions. The compensation committee operates pursuant to the compensation committee charter. Under its charter, which has been posted on our website athttp://investors.merunetworks.com/governance.cfm, the compensation committee has authority to retain compensation consultants, outside counsel and other advisors that the committee deems appropriate, in its sole discretion, to assist it in discharging its duties, and to approve the terms of retention and fees to be paid to such consultants. The compensation committee may form and delegate authority to subcommittees consisting of one or more members of the compensation committee when appropriate, except to the extent such delegation is limited by law or listing standards. The compensation committee may delegate to our CEO or our other officers, within the limits imposed by law and NASDAQ rules, the authority to grant equity awards under the our stock plans to employees or consultants who are not members of our Board or our executive officers. Our compensation committee engaged Compensia, an independent compensation consulting firm, to provide advice and help evaluate our compensation philosophy and provide guidance in administering our compensation program in connection with the review of compensation for 2013. The Compensation committee also engaged Compensia for similar work in 2012, 2011, and 2010. In September 2013, our compensation committee engaged Radford Consulting with respect to 2014 compensation matters.

The compensation committee considers risk-mitigating factors, in addition to those described in “— Role of Board in Risk Oversight,” including:

| | • | | the use of different types of compensation that provide a balance of short-term and long-term incentives with fixed and variable components; |

| | • | | the design of our executive bonus plans to ensure our named executive officers remain focused on financial performance metrics that drive long-term stockholder value, such as revenue and non-GAAP operating income; |

| | • | | our use of long-term equity awards to balance against short-term decision making; |

| | • | | time-based equity grants to encourage our named executive officers to maintain a long-term perspective; |

| | • | | performance-based equity grants based on future revenue performance to avoid short term risk taking; |

| | • | | caps on bonus awards to limit windfalls; and |

| | • | | the requirement that executive officers must obtain permission from our General Counsel before the sale of any shares of our common stock, even during an open trading period. |

The specific determinations of the compensation committee with respect to executive compensation for fiscal year 2013, and additional discussion regarding the role of Compensia in executive compensation, are described in greater detail in the Compensation Discussion and Analysis section of this proxy statement.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee is comprised of Mr. Charles Kissner, who is the chair of the committee, and Messrs. Harold Copperman and William Quigley. The future composition of our nominating and corporate governance committee will be determined by the Board following the Annual Meeting.

The composition of our nominating and corporate governance committee meets the requirements for independence under the current NASDAQ Stock Market and SEC rules and regulations. Our nominating and corporate governance committee has recommended, and our Board has adopted, a charter for our nominating and corporate governance committee. Our nominating and corporate governance committee, among other things:

| | • | | identifies, evaluates, recruits and recommends nominees for our Board and committees of our Board; |

| | • | | establishes procedures for the submission and consideration of candidates for nomination to our Board recommended by stockholders; |

12

| | • | | oversees the self-evaluation process of our Board and each of its committees; |

| | • | | oversees matters of corporate governance, including the development and monitoring of a process to assess the effectiveness of our Board; |

| | • | | considers and makes recommendations to our Board regarding the composition of our Board and its committees; |

| | • | | develops and recommends to our Board a code of business conduct and a code of ethics; |

| | • | | evaluates our risk management process and system in light of the nature of the material risks we face and the adequacy of our policies and procedures designed to address risk; and |

| | • | | develops and recommends to our Board corporate governance guidelines and reviews and recommends to our Board any changes deemed appropriate. |

The nominating and corporate governance committee met five times during 2013. The nominating and corporate governance committee operates pursuant to the nominating and corporate governance committee charter, which has been posted on our website athttp://investors.merunetworks.com/governance.cfm.

Director Nominations

The nominating and corporate governance committee will consider nominees recommended by stockholders for election as directors. If a stockholder would like to recommend a director candidate for the next annual meeting, the stockholder must deliver the recommendation in writing to the Corporate Secretary, Meru Networks, Inc., 894 Ross Drive, Sunnyvale, California 94089. The recommendation must be submitted not more than 120 days nor less than 90 days prior to the first anniversary of the date of the proxy statement provided in connection with the previous year’s Annual Meeting. If the date of the 2015 Annual Meeting is more than 30 days before or after the anniversary date of the 2014 Annual Meeting, in order for a recommendation to be timely, it must be delivered not later than the close of business on the later of the 90th day prior to the 2015 Annual Meeting or the close of business on the 10th day following the day on which we first publicly announce the date of the 2015 Annual Meeting. The recommendation must be in accordance with the provisions of our bylaws. Evaluations of candidates generally involve a review of background materials, internal discussions and interviews with selected identified candidates as appropriate. Candidates for the Board are generally selected based on desired skills and experience in the context of the existing composition of the Board and needs of the Board and its committees at that time, including the requirements of applicable SEC and NASDAQ rules. The nominating and corporate governance committee does not assign specific weights to particular criteria, and no particular criterion is necessarily applicable to all candidates, and will choose candidates to recommend for nomination based on the specific needs of the Board and our company at that time. Although the nominating and corporate governance committee does not have a specific policy on diversity, in its consideration of the specific needs of the Board and our company, the committee considers diverse backgrounds so that the Board composition reflects a broad spectrum of experience and expertise. Final approval of nominees to be presented for election is determined by the full Board.

The nominating and corporate governance committee recommended to the Board that Messrs. Bastani, Copperman, Domenik, Kissner, Quigley, Ramakrishna and Singer be nominated to serve as directors.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics for that applies to all of our officers, directors and employees. We have also adopted an additional written code of ethics, the Code of and Ethics for Directors and Senior Executive Officers. These codes are available in the “Corporate Governance” section of our website athttp://www.merunetworks.com. If we make any substantive amendments to the codes or grant any waiver from a provision of the codes to any executive officer or director, we will promptly disclose the nature of the amendment or waiver on our website, as well as via any other means then required by NASDAQ listing standards or applicable law.

13

Compensation Committee Interlocks and Insider Participation

During 2013, our compensation committee consisted of Messrs. Copperman and Mitsakos, with Mr. Ramakrishna joining the committee on December 30, 2013. No member of the compensation committee has at any time in the last fiscal year or previously been one of our officers or employees and none has had any relationships with our company of the type that is required to be disclosed under Item 404 of Regulation S-K. None of our executive officers has served as a member of the Board, or as a member of the compensation or similar committee, of any entity that has one or more executive officers who served on our Board or compensation committee during 2013.

Communications with Directors

Stockholders may communicate with the Board by sending written correspondence to: Board of Directors, c/o Corporate Secretary, Meru Networks, Inc., 894 Ross Drive, Sunnyvale, California 94089. Communications are distributed to the Board, or to any individual directors as appropriate, depending on the facts and circumstances outlined in the communication. The Board has instructed the Corporate Secretary to review all correspondence and to determine, in his or her discretion, whether matters submitted are appropriate for Board consideration. In particular, the Board has directed that communications such as product or commercial inquiries or complaints, résumé and other job inquiries, surveys and general business solicitations or advertisements should not be forwarded to the Board. In addition, material that is unduly hostile, threatening, illegal, patently offensive or similarly inappropriate or unsuitable will be excluded, with the provision that any communication that is filtered out must be made available to any independent director upon request. The Corporate Secretary may forward certain communications elsewhere in the company for review and possible response.

Director Attendance of Annual Meetings

We encourage directors to attend our Annual Meetings but do not require attendance. Five of six then-current directors attended last year’s Annual Meeting of stockholders, including two who attended via telephone.

Director Compensation

The compensation committee evaluates the appropriate level and form of compensation for non-employee directors and recommends changes to the Board when appropriate. The Board adopted the following policies with respect to the compensation of non-employee directors during 2013:

Cash Compensation

In 2013, each non-employee member of the Board declined cash compensation. We do not pay fees to directors for attendance at meetings of our Board and its committees, but we reimburse our directors for reasonable expenses in connection with attendance at the meetings.

Equity Compensation

In 2013, each non-employee director who continued to serve on our Board was automatically granted restricted stock units, or RSUs, in an amount intended to convey approximately $85,000 of value to each non-employee director on an annual basis. Each non-employee director who served on our Board was also entitled to receive an annual cash retainer in the amount of $38,000, which each director elected to be paid in the form of RSUs with an intrinsic value equal to $38,000. In recognition of the fact that RSUs are less liquid than cash, we applied a 10% discount to the per share price used to determine the number of RSUs received in lieu of cash.

In 2013, members of our Board serving in specific roles and members of the committees of our Board received the additional cash compensation listed in the table below, which each director elected to be paid in the

14

form of RSUs with intrinsic value equal to the amounts in the table. Again, in recognition of the fact that RSUs are less liquid than cash, we applied a 10% discount to the per share price used to determine the number of RSUs received in lieu of cash.

| | | | |

Compensation Element | | 2013 Compensation

Amount | |

Chairman of the Board | | $ | 5,000 | |

Lead Director | | $ | 10,000 | |

Chairman of the Audit Committee | | $ | 16,000 | |

Chairman of the Compensation Committee | | $ | 12,000 | |

Chairman of the Nominating and Corporate Governance Committee | | $ | 8,000 | |

Committee Member Service (All Committees) | | $ | 3,000 | |

The number of RSUs granted to each director in lieu of cash in 2013 was determined by dividing (a) the total dollar amount to be paid to such director for 2013 cash compensation by (b) the average closing price per share for our common stock over a 30-trading day period, less the 10% discount. The 30-trading day period started 15 trading days before a date fixed in advance by the Board and ended 15 trading days after such fixed date. Each RSU grant vests at a rate of 25% for every three months of continued service.

Mr. Ramakrishna joined the Board in December 2013 and did not receive any compensation for his Board service in 2013. Messrs. Domenik and Singer joined the Board in January 2014 and did not receive any compensation for their Board service in 2013.

2013 Compensation Table

The following table provides information for our fiscal year ended December 31, 2013 regarding all plan and non-plan compensation awarded to, earned by or paid to each person who, served as a non-employee director in 2013. The table sets forth the value of the RSU grants calculated in accordance with the rules of the Securities and Exchange Commission, which value is equal to the fair market value of the RSUs granted on the date of grant (i.e. number of RSUs granted multiplied by $4.10, the price per share of our common stock on the date of grant). However, the price used to determine the number of RSUs to be awarded to each director was based on a price per share of $2.58, which is the discounted 30-day average price per share calculated pursuant to the formula described above.

Other than as set forth in the table and the narrative that follows it, for 2013 we have not paid any fees to our directors, made any equity or non-equity awards to directors, or paid any other compensation to directors. All compensation that we paid to Dr. Bami Bastani, our only employee director, is set forth in the tables summarizing executive officer compensation below.

Director Compensation – Fiscal 2013

| | | | | | | | | | | | |

Name(1) | | Fees Earned or Paid in

Cash(2) ($) | | | Stock Awards(3) ($) | | | Total(4) ($) | |

Harold Copperman | | $ | 150,519 | | | $ | 85,001 | | | $ | 235,520 | |

Charles Kissner | | | 128,244 | | | | 85,001 | | | | 213,245 | |

Nicholas Mitsakos | | | 115,509 | | | | 85,001 | | | | 200,511 | |

Barry Newman | | | 136,198 | | | | 85,001 | | | | 221,199 | |

William Quigley | | | 123,467 | | | | 85,001 | | | | 208,469 | |

Sudhakar Ramakrishna | | | — | | | | — | | | | — | |

| (1) | As of December 31, 2013, each director held outstanding options to purchase the following number of shares: Harold Copperman: 44,903 shares; Charles Kissner: 10,500 shares; Nicholas Mitsakos: 29,782 |

15

| | shares; Barry Newman: 27,500 shares; and William Quigley: 27,500 shares. Mr. Ramakrishna was elected to the Board in December 2013 and did not hold any options to purchase shares as of December 31, 2013. |

| (2) | Amounts shown in this column do not reflect cash amounts actually received by the director. Instead, these amounts reflect the aggregate full grant date fair value for awards granted calculated in accordance with ASC 718. See Note 13 of the Notes to our Consolidated Financial Statements in our Annual Report on Form 10-K for fiscal 2013 for a discussion of all assumptions made in determining the grant date fair values. |

| (3) | Amounts shown in this column reflect the aggregate full grant date fair value for awards granted calculated in accordance with ASC 718. See Note 13 of the Notes to our Consolidated Financial Statements in our Annual Report on Form 10-K for fiscal 2013 for a discussion of all assumptions made in determining the grant date fair values. |

| (4) | In February 2013, in connection with our annual stockholders meeting and consistent with the equity compensation policy adopted by the Board, we granted each non-employee director an RSU; Messrs. Copperman, Kissner, Mitsakos, Newman and Quigley were granted RSUs for 57,444 shares, 52,011 shares, 48,905 shares, 53,951 shares and 50,846 shares, respectively. The fair value of each such RSUs was $4.10 per share. Each of these RSUs: (i) vests quarterly and in full on the twelve month anniversary; and (ii) contains change of control provisions such that all unvested shares vest immediately upon the closing of a change of control transaction. As of December 31, 2013, each director held outstanding restricted units and/or awards that had not yet vested as to the following number of shares: Harold Copperman: 14,361 shares; Charles Kissner: 13,003 shares; Nicholas Mitsakos: 12,227 shares; Barry Newman: 13,488 shares; and William Quigley: 12,712 shares. Mr. Ramakrishna was elected to the Board in December 2013 and did not receive any equity awards in 2013. |

16

ADVISORY VOTE ON EXECUTIVE COMPENSATION

(Item No. 2 on the Proxy Card)

Executive compensation is an important matter for us and our stockholders. We are requesting that stockholders cast a non-binding advisory vote on compensation programs for our named executive officers, also known as “say on pay.”

Stockholders are urged to read the “Compensation Discussion and Analysis” section of this proxy statement, which discusses how our executive compensation policies and procedures implement our compensation philosophy, and the “Executive Compensation” section of this proxy statement, which contains tabular information and narrative discussion about the compensation of our named executive officers. The Compensation Committee and the Board believe that these policies and procedures are effective in implementing our compensation philosophy and in achieving its goals.

As described in the “Compensation Discussion and Analysis” section of this proxy statement, our executive compensation program is designed to attract, motivate and retain highly qualified individuals with the leadership skills necessary for us to achieve our business strategy. We seek to provide executive compensation that is competitive with companies that are similar to us. We also seek to provide near-term and long-term financial incentives that reward well-performing executives when strategic corporate objectives designed to increase long-term stockholder value are achieved. We believe that executive compensation should include base salary, cash incentives and long-term equity awards. In particular, our executive compensation philosophy is to promote long-term value creation for our stockholders by rewarding improvement in selected financial metrics.

As an advisory vote, this proposal is not binding. However, the compensation committee, which is responsible for designing and administering our executive compensation program, values the opinions expressed by stockholders in their vote on this proposal and will consider the outcome of the vote when considering future compensation decisions for our named executive officers.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE FOLLOWING RESOLUTION:

“RESOLVED, that Meru Networks, Inc.’s stockholders approve, on an advisory basis, the compensation of the executive officers, as disclosed in Meru Networks, Inc.’s proxy statement for the 2014 Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the compensation tables and other related disclosures.”

17

RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM,

BURR PILGER MAYER, INC., FOR FISCAL YEAR ENDING DECEMBER 31, 2014

(Item No. 3 on the Proxy Card)

Our audit committee has selected, and is submitting for ratification by the stockholders its selection of, the firm of Burr Pilger Mayer, Inc., or BPM, to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2014 and until their successors are appointed. Representatives of BPM are expected to be at the Annual Meeting. Representatives of BPM will be given the opportunity to make a statement if they desire to do so and they will be available to respond to appropriate questions.

Although action by stockholders is not required by law, the audit committee has determined that it is desirable to request approval of the selection of BPM by the stockholders. Notwithstanding the selection, the audit committee, in its discretion, may direct the appointment of a new independent registered public accounting firm at any time during the year if the audit committee feels that such a change would be in the best interests of our company and stockholders. In the event of a negative vote on ratification, the audit committee will reconsider the selection of BPM as our independent registered public accounting firm.

Principal Accountant Fees and Services

The following table sets forth the aggregate fees and related expenses for professional services provided by BPM during 2013 and 2012. The audit committee considered the provision of the services corresponding to these fees, and the audit committee believes that the provision of these services is compatible with BPM maintaining its independence.

| | | | | | | | |

| | | Fiscal years | |

| | | 2013 | | | 2012 | |

Audit Fees(1) | | $ | 586,913 | | | $ | 387,400 | |

Audit-Related Fees | | | — | | | | — | |

Tax Fees | | | — | | | | — | |

All Other Fees | | | — | | | | — | |

| | | | | | | | |

| | $ | 586,913 | | | $ | 387,400 | |

| | | | | | | | |

| (1) | Audit fees consist of the aggregate fees for professional services rendered by BPM: (i) for the audit of our consolidated financial statements and the effectiveness of the Company’s internal control over financial reporting and reviews of our unaudited condensed consolidated interim financial statements for fiscal years 2013 and 2012, totaling $496,425 and $358,675, respectively; and (ii) in connection with the review of the Registration Statement on Form S-8, the Registration Statement on Form S-3 and the Prospectus Supplement filed by the Company with the SEC during fiscal year 2013 and fiscal year 2012, totaling $90,488 and $28,725, respectively. |

Pre-Approval Policies and Procedures

Our audit committee pre-approval policies and procedures require prior approval of each engagement of BPM to perform services. We adopted these pre-approval policies in accordance with the requirements of the Sarbanes-Oxley Act.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE RATIFICATION OF BURR PILGER MAYER, INC. AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING DECEMBER 31, 2014.

18

EXECUTIVE OFFICERS

Our executive officers, their positions and their respective ages, as of March 28, 2014, are:

| | | | |

Name | | Age | | Position(s) |

Bami Bastani, Ph.D. | | 60 | | President, Chief Executive Officer and Director |

Brian McDonald | | 57 | | Chief Financial Officer and Chief Administrative Officer |

Mark Liu | | 40 | | General Counsel and Secretary |

Ajay Malik | | 45 | | Senior Vice President of Worldwide Engineering |

Larry Vaughan | | 58 | | Senior Vice President of Worldwide Sales and Field Operations |

Sarosh Vesuna | | 54 | | Vice President, General Manager of Business Units |

Our executive officers serve at the discretion of the Board, subject to rights, if any, under contracts. See “Executive Compensation — Potential Payments Upon Termination or Change of Control” for a discussion of these additional rights. Biographical information for Dr. Bastani is provided above. See “— Information Regarding Our Nominees and Directors.”

Executive Officers (in addition to Dr. Bastani)

Brian McDonald has served as our Chief Financial Officer since June 2013. In January 2014, his role was expanded to Chief Financial and Administrative Officer, adding human resources and corporate legal functions. He brings more than 30 years of financial and business experience, working with both private and public technology companies, and possesses a strong operational background. Prior to joining us, Mr. McDonald served as Chief Financial Officer at eASIC Inc., a structured ASIC company from August 2011 to June 2013. From June 2004 to March 2011, Mr. McDonald served as Chief Financial Officer at Advanced Analogic Technologies Inc., a publicly traded semiconductor company which went public during Mr. McDonald’s service in 2005. In addition, Mr. McDonald held an Independent Director and Audit Committee Chairman role at iWatt Inc., a private semiconductor company from August 2011 to until its sale in June 2013. At Meru, Mr. McDonald is responsible for the finance, accounting, information technology, human resources, and corporate legal groups. Mr. McDonald holds a B.S. in business administration from the University of Santa Clara.

Mark Liu has served as our General Counsel and Secretary since June 2013. Mr. Liu is responsible for all legal matters for the company. From 2009 to 2013, Mr. Liu was associate general counsel and assistant secretary at NETGEAR, Inc., a publicly traded global networking company. From 2007 to 2009, Mr. Liu served as assistant general counsel at Prana Investments, a real estate investment firm. Previously, Mr. Liu was an associate at Wilson Sonsini Goodrich & Rosati, where he was part of the founding team in the firm’s San Diego office after initially working in the Austin office. Mr. Liu holds a J.D. from the University Of Texas School Of Law and a B.A. in government from Cornell University.

Ajay Malik has served as our Senior Vice President of Worldwide Engineering since August 2013. Mr. Malik is responsible for our WLAN solutions, including hardware, software development, system architecture and quality assurance. From March 2013 to August 2013, Mr. Malik was Vice President Engineering, Mobility Solutions for HP Networking, a division of Hewlett Packard, a publicly traded technology company. From November 2010 to March 2013, Mr. Malik was Senior Director of Engineering for the Wireless Networking Business Unit of Cisco, Inc., a publicly traded networking company. From January 2008 to November 2010, Mr. Malik was Chief Executive Officer of Todooli, Inc., a mobile location tracking company. Prior to Todooli, Mr. Malik held leadership positions at Motorola, Inc., a publicly traded technology company. Mr. Malik holds a B.E. in computer science from IIT Roorkee, India.

Larry Vaughan has served as our Senior Vice President of Worldwide Sales and Field Operations since April 2011. From June 2007 to April 2011, Mr. Vaughan served as Vice President of Sales & Services for the Worldwide Growth and Emerging Markets for BMC Software, Inc., a software vendor, after serving as

19

Vice President of World Wide Field Operations for BMC Software from November 2006 to May 2007. From May 2004 to May 2005, he served as Vice President of Worldwide Sales Operations, and from April 2005 to October 2006, he served as Executive Vice President of World Wide Sales & Services, for Enterasys Networks, Inc. until it was acquired in a going-private transaction. Mr. Vaughan previously held a number of sales, sales management and executive sales management position with Symbol Technologies, Inc., Novell, Bay Networks Inc. (Nortel), Unisys Corporation, and International Business Machines Corp. Mr. Vaughan holds a B.A. in Business Administration from Western Michigan University.