Exhibit 99.1

Castle Union Partners, L.P.

676 N. Michigan Ave, Suite 3605

Chicago, IL 60611

May 7, 2014

Dear Fellow Meru Shareholders,

Castle Union Partners, LP (“Castle Union”) owns 5.7% of Meru Networks (the “Company”) common stock.

Over the past few months, we have communicated privately to Meru’s management and Board our concerns about the Company’s consistently weak operating performance. Among the various concerns we have articulated to the Board include Meru’s long history of underperformance relative to its enterprise WLAN peers and the hopelessly subscale nature of Meru’s business. We have also explained to the Board the potential for significant shareholder value creation through a sale of the Company.

Time is of the essence and the time has long since passed for the Board to take proactive steps to maximize shareholder value. We do not believe Meru should remain an independent company and the Board must immediately commence a sale process.

Meru Has Significantly Underperformed Its Peers

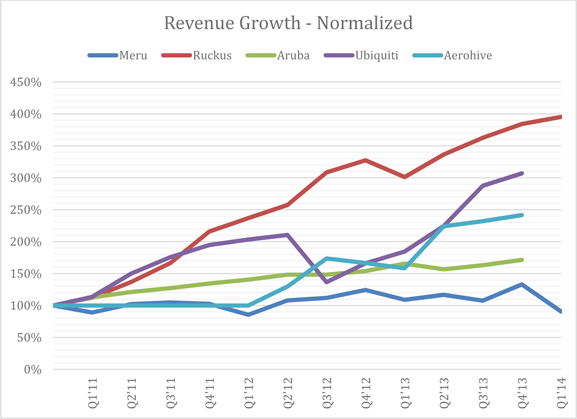

The chart below shows the three-year normalized revenue growth of five participants in the enterprise WLAN market: Meru, Aruba, Ruckus, Ubiquiti, and Aerohive.

The gap between Meru and its peers is startling. Especially telling is the growth Aerohive and Ruckus have achieved relative to Meru. In Q1 2011, Meru reported $20.1 million of revenue. A full three years later, Meru’s Q1 2014 revenue came in at $20.6 million. At the $24 million midpoint of Meru’s sales guidance for Q2 2014, Meru’s first-half 2014 revenue will be down 13% from first-half 2013.

Over this same period, Ruckus has grown from $21.3 million in quarterly revenues to $75 million. From the same starting point, Ruckus is now a 3.75X larger company than Meru. At the $79 million midpoint of Ruckus’ sales guidance, Ruckus’ first-half revenue will be up 27% from first-half 2013.

Also in stark contrast, Aerohive reported revenue of $12.5 million in Q1 2012, a level far below the $19.4 million reported by Meru in the same period. However, by Q4 2013, Aerohive had achieved sales of $30.2 million, a level only matched by Meru because of the pull-in of $2-$3 million of revenue from Q1 2014.

Investors have certainly taken notice of the performance disparity between Meru and its peers. Ruckus trades at 2.6X EV/Sales, while Aerohive trades at 4.1X EV/Sales. Meru’s stock trades at a fraction of those multiples at 0.6X EV/Sales.

As one of Meru’s largest shareholders, we find this long history of underperformance to be unacceptable and we hope other shareholders share this opinion. The status quo cannot be allowed to continue.

Meru is Hopelessly Subscale

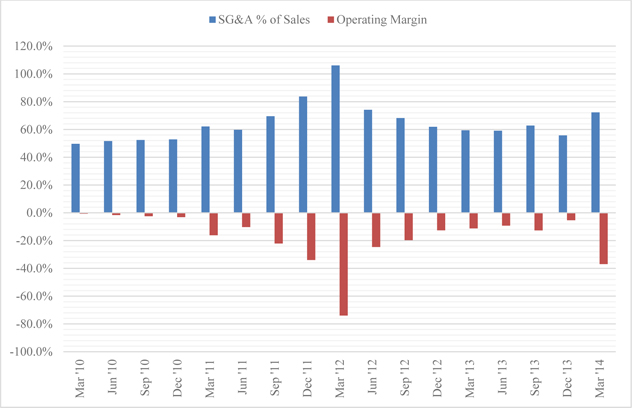

The chart below shows Meru’s SG&A spending as a percentage of sales and operating margin for every quarter the Company has been public.

We believe three important facts are made clear by this chart: 1) Meru has never reported an operating profit; 2) Meru is unprofitable because it must spend an average of 65% of its sales on SG&A; and 3) despite increased investment in SG&A of up to 106% of sales, Meru has not been able to achieve any meaningful revenue growth.

The only reasonable conclusion that can be drawn from these facts is that Meru is hopelessly subscale. The Company has already failed once to drive revenue growth from increased sales & marketing spending and there is no reason to believe another experiment would lead to a different result. Furthermore, after burning $4 million of cash in Q1 2014, Meru simply does not have the balance sheet to support sustained losses from an increased sales & marketing investment.

The chasm to significant profitability is too wide to cross and this leaves the Company with no viable path out of its unprofitable subscale purgatory other than a sale to a strategic acquirer.

Meru is Worth More to a Strategic Acquirer than as an Independent Company

There is no doubt that Meru has good technology and products, and operates in a market with meaningful barriers to entry. There is also no doubt that these assets are stranded in a subscale organization from which shareholders have derived little value. Fortunately, there are other companies with the infrastructure to realize substantial cost and revenue synergies from a Meru acquisition and thus put Meru’s assets to better use.

| | | TTM | | | Pro-Forma | |

| | | | | | | |

| Revenues | | $ | 101,612.00 | | | $ | 101,612.00 | |

| COGS | | $ | 36,150.00 | | | $ | 36,150.00 | |

| GM | | $ | 65,462.00 | | | $ | 65,462.00 | |

| GM % | | | 64.4 | % | | | 64.4 | % |

| | | | | | | | | |

| R&D | | $ | 17,483.00 | | | $ | 17,483.00 | |

| R&D % | | | 17.2 | % | | | 17.2 | % |

| SG&A | | $ | 62,663.00 | | | $ | 12,663.00 | |

| SG&A % | | | 61.7 | % | | | 12.5 | % |

| OpEx | | $ | 80,146.00 | | | $ | 30,146.00 | |

| OpEx % | | | 78.9 | % | | | 29.7 | % |

| | | | | | | | | |

| OI | | $ | (14,684.00 | ) | | $ | 35,316.00 | |

| OI % | | | -14.5 | % | | | 34.8 | % |

In the trailing twelve months, Meru has reported $101.6 million of revenue with strong 64.4% gross margins. Almost the entirety of Meru’s $65.5 million of gross profit was consumed by SG&A expenses, as befits a subscale company. However, a strategic acquirer would be able to realize significant cost synergies by removing duplicative SG&A. Management and director compensation in 2013 alone was $5.4 million.

As shown in the Pro-Forma income statement above, we estimate that a strategic acquirer with already existing infrastructure could remove $50 million of costs and quickly turn Meru in an accretive acquisition. Moreover, a global technology company with a large salesforce could also realize strong revenue synergies that we have not accounted for in the Pro-Forma.

Meru’s Director Compensation is Egregiously High

Meru’s stock began 2011 trading at $15.42/share. On April 30, 2014, the stock closed at $3.66/share. Over this period where shareholders suffered a 76% loss, Meru’s directors collected over $3.8 million of total compensation. In 2013 alone, the Board received 263,157 shares of stock.

To put these numbers in perspective, $3.8 million is a full 6.2% of Meru’s current enterprise value. Meru’s shareholders suffered over 1% dilution in 2013 from stock given to the directors. For an even more nausea-inducing revelation, we note that management and director compensation for the last three years totals $15.7 million, a full 26% of Meru’s current enterprise value.

As a major shareholder, we cannot stand idly by while the Board repeatedly fails to take the appropriate actions to maximize shareholder value. We will withhold our votes for all Board nominees except Eric Singer and Stephen Domenik at the Company’s annual shareholder meeting on May 22, 2014.

Meru’s Board, as historically constituted, cannot be trusted to run the Company for the benefit of shareholders. The status quo of consistent weak operating performance and egregious director compensation cannot be allowed to continue. There is one path to maximize shareholder value and the Board, in discharge of its fiduciary duties, must undertake it: the Board must immediately initiate a sale process for the Company.

Sincerely,

Castle Union Partners, L.P.

By: Castle Union LLC

General Partner

By: /s/ Toan Tran

Name: Toan Tran

Title: Managing Partner