Exhibit 99.1

November 10, 2016

VIA EMAIL & CERTIFIED MAIL

The Board of Trustees

RAIT Financial Trust

Two Logan Square

100 N. 18th Street, 23rd Floor

Philadelphia, PA 19103

Attn: Michael J. Malter, Chairman of the Board

Re: Proposed Transaction with RAIT Financial Trust

Dear Mr. Malter:

As you know, over the past several months, NexPoint Real Estate Advisors, LP (“NexPoint”), an affiliate of Highland Capital Management (“Highland”) and Nexbank Capital, Inc. (“NexBank”) have expressed their interest in pursuing a transaction with RAIT Financial Trust (“RAIT” or the “Company”). Management and the Board of RAIT, however, have repeatedly declined to engage with us regarding our proposals to unlock substantial value for shareholders, of which we are one of the most significant. Before you were elected Chairman and as you may recall, the Company (through Mr. Schaeffer and Mr. Stempel) recently indicated that (i) the NexPoint proposal was not in the best interests of the Company, and (ii) the Company was “already working on several initiatives aimed at unlocking shareholder value.” As you might further recall, our proposal to unlock shareholder value centered around five strategic themes:

| | • | | Simplifying the Company’s Business |

| | • | | Reducing run-rate operating costs by 50% or more through externalizing management of the Company to NexPoint and its affiliates with a shareholder friendly management contract |

| | • | | Creating enhanced management alignment with shareholders via a substantial equity infusion of up to $30 million at a meaningful premium |

| | • | | Harvesting value from Independence Realty Trust, Inc. (“IRT”) |

It now seems likely that the main initiative previously under the Board’s consideration was a monetization of the Company’s external management contract of IRT through a termination fee payment as part of the internalization of IRT’s management (the “Internalization”) and a poorly-executed disposition of the Company’s holdings in IRT – simultaneous with IRT’s secondary issuance of 25 million new shares of common stock. While the Internalization may be a positive development for IRT’s shareholders, we believe its execution was not in the best interests of RAIT’s shareholders.

Execution & Lack of Investor Communication

We note that the Internalization was announced on the morning of September 27, 2016, amid press releases lauding the move as a “transformative” positive for the Company. Other than the Company’s press release, which trumpeted the fact that it would receive $120 million in gross proceeds from the Internalization and another indicating the completion of the first closing of the disposition of RAIT shares and deconsolidation, the Company has not disseminated a single investor communication or presentation.

RAIT Financial Trust

November 10, 2016

Page 2

Furthermore, the announcement that “the total proceeds to RAIT including the sale of RAIT’s shares in IRT is expected to be approximately $120 million” was extremely misleading as it revealed (to our knowledge for the first time in the Form 8-K dated September 27, 2016) that the Company’s IRT stake had been previously margined by $50+ million. As depicted in the table immediately below and confirmed on the Company’s 3rd Quarter conference call, the Company’s proceeds were ultimately significantly lower ($18.3 million):

| | | | |

IRT TRANSACTION ANALYSIS ($MM) | |

Internalization Fee Paid to RAS | | $ | 43.0 | |

Proceeds from Share Repurchase (@ $8.55 per IRT Share) | | | 62.0 | |

| | | | |

Gross Proceeds to RAS | | $ | 105.0 | |

Less: Repayment of Loan Collateralized by IRT Shares (a) | | | (43.7 | ) |

| | | | |

Net Proceeds to RAS | | $ | 61.3 | |

| | | | |

Net Proceeds to RAS @ $10.63 per Share (b) | | $ | 76.4 | |

| | | | |

Delta (i.e., Cost to RAS Shareholders) | | $ | 15.1 | |

| | | | |

Notes:

| (a) | Reflects retirement of debt based on Q3 2016 earnings call representing a portion of the up to $51.5MM margin loan disclosed in the Form 8-K dated September 27, 2016. |

| (b) | Reflects IRT price prior to announcement of follow-on offering. |

Also, we query why the Company did not receive at least the secondary offering price of $9.00/share for IRT’s stake, much less the trading price on the day prior to the announcement of the Internalization ($10.63/share). The Board must have been aware of the potential pressure on IRT’s stock given the massive dilutive offering undertaken by IRT needed to effect the Internalization. As a result of this oversight, we estimate that there was at least $15 million of permanent value destruction to the Company. For perspective, that $15 million could have serviced nearly 80% of the dividend requirements of the Company’s Series A, B and C Preferred Stock for an entire year.

Despite the $120 million of gross proceeds generating only ~$60 million of net proceeds, we (and the entire investment community) are nonetheless still waiting on a specified use for the capital other than the general language around expenses and working capital purposes reflected in the Form 8-K and on the Q3 conference call.

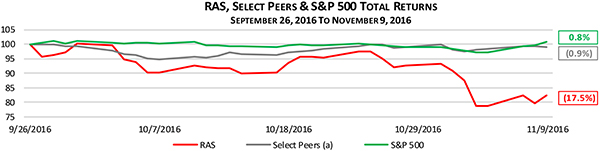

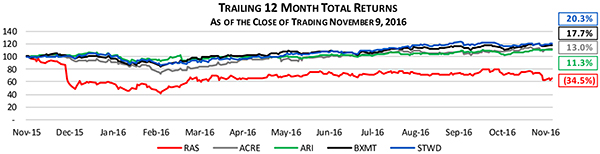

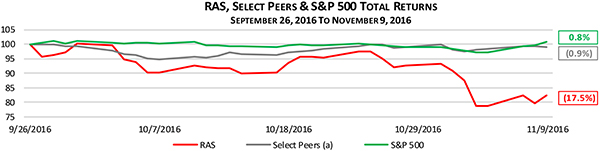

Additionally, what’s more significant is the lack of investor communications around the pro forma income statement on a forward 12-month basis, including the Company’s post-Internalization annual G&A and compensation expenses. We assume the potential for G&A savings was a key factor in the Board’s decision to agree to the Internalization. Shouldn’t this be disclosed and trumpeted? As of the day of this letter, it has been over 40 days since the Internalization was announced and nearly five months since our first letter to you; indeed, more than enough time to develop a business plan (containing pro forma financials) and clearly communicate it. It appears the lack of transparency around a go forward business plan and poor execution of the Internalization (at least from the Company’s standpoint) is shared by investors.

Notes:

| (a) | Select Peers includes ACRE, ARI, BXMT and STWD. |

RAIT Financial Trust

November 10, 2016

Page 3

Reiterating the NexPoint Proposal

We do have a plan. As we’ve previously stated, we believe clear and focused investor communication is paramount within the mREIT sector since no investment manager or index is required to own mREITs; mREITs must articulate and execute a well-defined, focused business plan to attract capital in order to grow. Companies that do this can be rewarded and trade at or above book value (e.g., BXMT, ACRE).

And while the Internalization simplifies the Company’s financial statements, we still know little if any about the Company’s business strategy on a go-forward basis or how the Internalization proceeds will be used. What we do know is that, even though the Company has ~$80 million of leveragable cash on hand to deploy,the Company is not originating loans or investments sufficient to sustain investors’ confidence in the dividend. Given this fact, we fear that using the proceeds for “working capital” means the Company will continue to incur outsized G&A expenses without generating new loans – an unsustainable path. By contrast, between NexPoint and Nexbank, we have an investment pipeline of over $100 million of accretive first mortgage loans and preferred equity investments that will close over the next six to eight months.

Even in the aftermath of the Internalization, the Company still continues to operate property management businesses. We would exit the property management business entirely since we do not believe the business warrants the G&A drag and is a function better outsourced to the extent the Company requires such services at all as a public mREIT. The Company’s business under NexPoint’s leadership would focus almost exclusively on originating senior-floating rate, preferred equity and mezzanine CRE loans on transitional properties requiring flexible interim financing solutions. This is a business where we have deep experience, a network of relationships and history of success.

In connection with exiting the property management businesses, we would also continue to accelerate the dispositions of Company REO, using excess proceeds to retire debt, redeem expensive preferred stock and redeploy the capital into first mortgage, preferred equity and mezzanine financings. As of Q3 of 2016, the Company’s debt to equity stood at 5.5x1, versus the commercial mREIT average of 2.2x per JMP Securities research. Before the Company can grow again, it needs to shrink the asset base by monetizing the ~$1 billion of real estate on the balance sheet. Retiring ~$1 billion of debt and REO would delever the company to~2.8x1 and dramatically improve the Company’s liquidity position. Selling assets would create a near-term drag on CAD; however, the more significant drag results from outsized G&A and compensation expenses.

| 1 | Leverage metrics represent debt to total shareholders’ equity on a de-consolidated basis for RAIT’s balance sheet per RAIT’s Q3 2016 Supplement. |

RAIT Financial Trust

November 10, 2016

Page 4

G&A Reduction

We note that the Company has originated just eight loans through Q3 2016, while recording compensation expense of ~$17 million (~$2 million per loan). In light of total fee income reducing from ~$17 million over the same period inclusive of the IRT contract to ~$8 million pro forma, we view the path forward as unsustainable. We estimate that the Company wouldrealize at least 50% synergies over the course of 12–18 months and reduce the currently outsized G&A to less than ~$25 million (conservatively assessed inclusive of a new market-based management fee (reiterated below)) by focusing the Company’s strategy and utilizing the infrastructure of NexPoint, Highland and NexBank. These resulting synergies will increase pro forma CAD by at least 20%, thereby creating flexible capital to reinvest in the business and/or the ability to return more capital to shareholders.

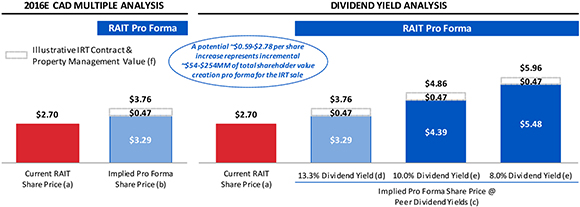

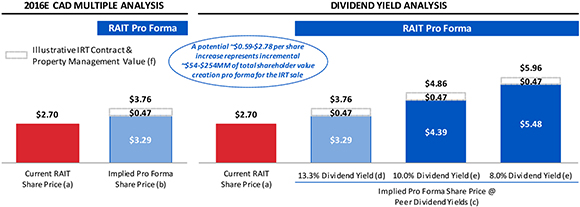

Furthermore, this direct benefit to projected CAD affords the Company an opportunity to achieve share price levels that are challenged under the constraints of the cost burden embedded in the Company’s current operating plan. The Company’s aspirational mREIT peers generally trade within the range of an 8% to 10% dividend yield, assuming ample coverage. Utilizing NexPoint’s, Highland’s and NexBank’s existing origination and servicing infrastructure to create the aforementioned annual G&A synergies of at least ~$20 million, the enhanced CAD could be usedto increase the dividend to $0.44 per share at a constant payout ratio; thus resulting in an imputed price range of $4.39-$5.48 per share which excludes any further value from the Internalization (as further depicted in the following tables and chart) or redeployment of capital.

| | | | | | | | | | | | |

RAIT PRO FORMA CAD PER SHARE | |

| ($ in MM, except per share figures) | | 9 Mos. Ended | | | Annualized (a) | |

| | | 9/30/2016 | | | Annl’d | | | per Share (b) | |

Net Income (Loss) Available to Common Shares | | ($ | 25.4 | ) | | ($ | 33.9 | ) | | ($ | 0.37 | ) |

CAD Adjustments, Net | | | 59.5 | | | | 79.3 | | | | 0.87 | |

| | | | | | | | | | | | |

Cash Available for Distribution | | $ | 34.0 | | | $ | 45.4 | | | $ | 0.50 | |

| | | | | | | | | | | | |

Adjustments Under HCM Proposal | | | | | | | | | | | | |

Plus: RAIT G&A & Compensation Expense (c) | | $ | 29.4 | | | $ | 39.2 | | | $ | 0.43 | |

Less: Estimated HCM Pro Forma G&A Expense | | | (14.7 | ) | | | (19.6 | ) | | | (0.21 | ) |

| | | | | | | | | | | | |

Net Pro Forma G&A with Effect of 50% Synergies | | $ | 14.7 | | | $ | 19.6 | | | $ | 0.21 | |

Less: Property Mgmt. Fees @ 20.0% Margin | | | (1.8 | ) | | | (2.3 | ) | | | (0.03 | ) |

Less: Fees Paid to RAIT by IRT | | | (5.5 | ) | | | (7.3 | ) | | | (0.08 | ) |

| | | | | | | | | | | | |

Pro Forma CAD (incl. HCM Synergies) | | $ | 41.5 | | | $ | 55.3 | | | $ | 0.61 | |

CAD Accretion | | | | | | | | | | | 21.9 | % |

| | | | | | | | | | | | |

| | | |

| | | | | | CAD | | | Dividend | |

Implied Trading Metrics (d) | | | | | Analysis | | | Analysis | |

RAIT Annl’d CAD / Dividend per Share | | | | | | $ | 0.50 | | | $ | 0.36 | |

Implied RAIT CAD Multiple / Dividend Yield | | | | | | | 5.4x | | | | 13.3 | % |

Memo: Implied RAIT CAD Payout Ratio (e) | | | | | | | | | | | 72 | % |

| | | | | | | | | | | | | | | | | | | | |

ILLUSTRATIVE SHARE PRICE ANALYSIS (d) | |

| | | Pro Forma CAD / CAD per Share | |

| | | | | | Current | | | | | | Pro Forma | | | | |

| | | | | | $ | 45.4 | | | $ | 50.3 | | | $ | 55.3 | | | $ | 60.3 | |

| | | | | | | 0.50 | | | | 0.55 | | | | 0.61 | | | | 0.66 | |

Dividend Yield | | | 13.3 | % | | $ | 2.70 | | | $ | 2.99 | | | $ | 3.29 | | | $ | 3.59 | |

| | | 10.0 | % | | | 3.60 | | | | 3.99 | | | | 4.39 | | | | 4.78 | |

| | | 8.0 | % | | | 4.50 | | | | 4.99 | | | | 5.48 | | | | 5.98 | |

Notes:

| (a) | Annualized reflects a ~1.33x multiple applied to data for the 9 Months Ended 9/30/2016. |

| (b) | Per share data is based on 91.1MM shares outstanding. |

| (c) | Estimated synergies based on observed 1H 2016 RAIT G&A & Compensation expense of $25.6 million (~$51.3 million annualized) would imply >30% CAD accretion. |

| (d) | Implied Trading Metrics based on RAIT share price as of 11/9/2016. |

| (e) | Illustrative Share Price Analysis assumes RAIT maintains CAD Payout Ratio of ~72% (exclusive of value ascribed to IRT Contract & Property Management Value). |

Proposed Alignment & External Management Contract

Although widely accepted as the market norm in the mREIT space, we acknowledge that external management structures can be viewed unfavorably by some investors, typically due to perceived and/or actual conflicts of interests and high termination fees. At NexPoint, we have (successfully) crafted a favorable external management structure by focusing on three key elements: (i) alignment, (ii) avoiding large termination fees and (iii) adhering to a total expense cap that compares favorably to the costs incurred by internally managed REITs.

Unlike most externally managed (and, for that matter, internally managed) REITs, we believe the personnel running the business should own a meaningful amount of stock to create significant (as opposed to token or nominal) alignment with the Company’s common shareholders. Currently, management owns just ~1.0% of the Company’s common stock. As part of a transaction with the Company, we would seek to increase our current ownership of 6% to a 15% stake in the Company, subject to an ownership waiver.

RAIT Financial Trust

November 10, 2016

Page 5

In connection with the proposed transaction, we would propose an advisory agreement that contains a market-based management fee with an initial term of two years, but terminable with 60 days’ notice by either a vote by a majority of the board or a vote of a majority of the Company’s shareholders without penalty or fee. Any incentive compensation to NexPoint or officers would be through incentive plans approved by the Company’s shareholders.

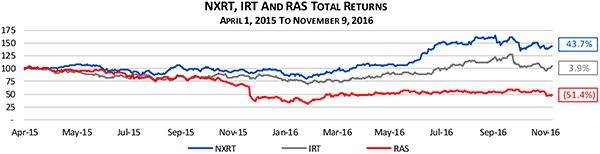

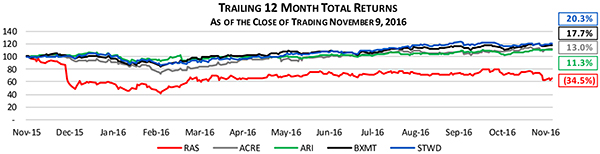

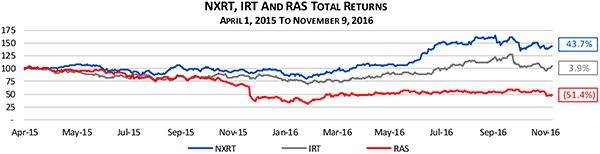

Additionally, we would also propose a total expense cap on G&A, based upon a peer average and agree to operate below the range. We have implemented these features at the NexPoint-managed NexPoint Residential Trust, Inc. (“NXRT”), a small cap multifamily REIT in IRT’s peer group. Since its formation spin-off, NXRT has attracted four new analysts all currently with “Buy” ratings and a strong institutional shareholder base through our transparent approach to shareholder communication. Although NXRT is small and externally-managed, we believe the construct of our advisory agreement has been a factor in our relative outperformance, as shown below.

The Results

We believe that by simplifying the Company’s strategy, creating alignment through a new fee-efficient structure and externalizing management to NexPoint and its affiliates, the Company’s cost of capital could improve such thatthe Company’s share price could be worth ~ $6 per share in 12–18 months following the closing of a transaction. In addition, we believe these measures would normalize the Company’s debt and equity cost of capital while reducing leverage to industry norms.

| | |

| Notes: | | |

(a) RAIT share price as of 11/9/2016. (b) Assumes pro forma $0.61 CAD per share and that RAIT maintains a CAD multiple of 5.4x. | | (c) Assumes pro forma $0.61 CAD per share and a $0.44 dividend in line with RAIT’s current ~72% CAD payout ratio. (d) Assumes RAIT trades in line with its current dividend yield of ~13.3%. (e) Assumes RAIT trades at dividend yield range of ~8-10% observed in line with select peers. (f) Illustrative IRT Contract & Property Management Value based on $43MM paid by IRT to RAIT to terminate the existing external management contract. |

| |

| |

| |

RAIT Financial Trust

November 10, 2016

Page 6

Irrespective of our strategic interest in the Company, we are concerned about our investment under the current Company’s leadership. As of the day of this letter, the Company’s equity cost of capital is ~13% and the share price is $2.70.The Company has reported six sequential quarters in which CAD has declined. The independent members of the Company’s Board of Directors need to consider all alternatives. We believe the Company’s share price, under the direction of NexPoint, could be worth $6 per share in 18 months. We are offering this proposal as a viable alternative to the Company’s current path, which has persistently been a drag on RAIT’s relative total returns.

It is noteworthy that there is successful precedent in the mREIT space for a transaction structured similarly to this proposal. Blackstone has achieved a very attractive outcome for shareholders of the previously internally-managed and underperforming Capital Trust, Inc. (now NYSE: BXMT) since externalizing its management in December 2012.

In comparison to the Company’s current unsustainable path, we believe our plan, platform, significant investment and investment execution will restore investors’ confidence. We continue to believe our proposal represents a unique opportunity to create compelling and certain value for RAIT’s shareholders, and the Company will be better positioned to provide an enhanced value proposition going forward. As your second largest non-index shareholder, it is our hope that you will engage in substantive discussions given our reiterated interest and enthusiasm around the potential value creation. Please have a board member, advisor or other designee contact Matt McGraner (NexPoint Real Estate’s Chief Investment Officer) at (972) 628-4100 to discuss our proposal at your earliest convenience.

|

| Very truly yours, |

|

/s/ Jim Dondero |

| Jim Dondero, President |

Cc:

Scott F. Schaeffer

Andrew M. Batinovich

Edward S. Brown

Frank A. Farnesi

S. Kristin Kim

Murray Stempel

Jon C. Sarkisian

Andrew M. Silberstein