UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☐ Filed by a party other than the Registrant ☒

Check the appropriate box:

| | |

| ☐ | | Preliminary proxy statement |

| |

| ☐ | | Confidential, for use of the Commission only (as permitted by Rule14a-6(e)(2)) |

| |

| ☐ | | Definitive proxy statement |

| |

| ☐ | | Definitive additional materials |

| |

| ☒ | | Soliciting material pursuant to Sec.240.14a-12 |

RAIT Financial Trust

(Name of Registrant as Specified in Its Charter)

Highland Capital Management, L.P.

Highland Select Equity Master Fund, L.P.

Highland Select Equity Fund GP, L.P.

Highland Select Equity GP, LLC

Strand Advisors, Inc.

James D. Dondero

Highland Global Allocation Fund

Highland Small-Cap Equity Fund

Highland Capital Management Fund Advisors, L.P.

Strand Advisors XVI, Inc.

NexPoint Real Estate Strategies Fund

NexPoint Advisors, L.P.

NexPoint Advisors GP, LLC

NexPoint Real Estate Advisors, L.P.

HCRE Partners, LLC

Edward S. Friedman

(Name of Person(s) Filing Proxy Statement, if other than Registrant)

Payment of filing fee (Check the appropriate box):

| | | | |

| |

| ☒ | | No Fee Required |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11 |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ☐ | | Fee paid previously with preliminary materials: |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount previously paid: |

| | (2) | | Form, Schedule or Registration Statement No. |

| | (3) | | Filing party: |

| | (4) | | Date filed: |

February 23, 2017

Dear Fellow Shareholders:

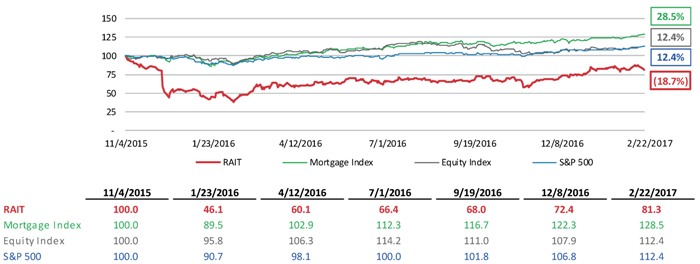

NexPoint Real Estate Advisors, L.P., together with its affiliates including Highland Capital Management, L.P. (“NexPoint”, “we”, or “our”), currently own approximately 6% of RAIT Financial Trust (“RAIT” or the “Company”). As indicated in our prior public letters to RAIT’s board of trustees (the “Board”) and our presentation filed on February 8, 2017, we believe RAIT’s leadership has presided over the destruction of shareholder value for, in the case of the “new” CEO, nearly seven years, and in the case of the Chairman, 15 months. For each respective period, RAIT has significantly underperformed against the benchmarks to which the Company uses in its Form10-K to compare its own performance, as highlighted below:

Scott Davidson’s Tenure – From April 2010

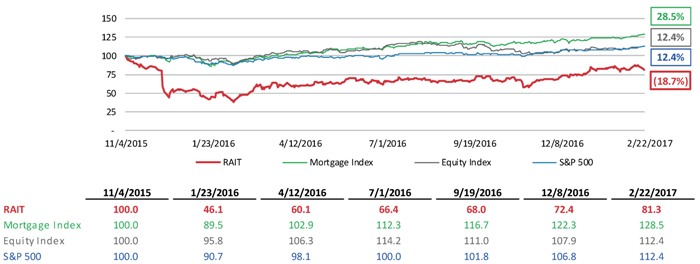

Michael Malter’s Tenure – From November 20151

NexPoint has repeatedly proposed a transaction with RAIT that we believe has a substantial likelihood of greatly improving the Company’s financial results and enhancing total shareholder return. Unfortunately, RAIT’s Board

1. Dividend cut by 50% on December 8, 2015, shortly after Michael Malter joined the Board

| | | | | | |

| | AN AFFILIATE OF | | |  | |

4/1/2010 5/26/2011 7/19/2012 9/12/2013 11/6/2014 12/31/2015 2/22/2017 RAIT 100.0 105.2 82.4 136.4 154.8 65.4 99.8 Mortgage Index 100.0 122.5 139.9 133.4 161.0 146.7 191.5 Equity Index 100.0 129.6 146.1 153.4 191.1 203.3 228.4 S&P 500 100.0 112.5 116.8 142.9 172.4 173.5 200.6 11/4/2015 1/23/2016 4/12/2016 7/1/2016 9/19/2016 12/8/2016 2/22/2017 RAIT 100.0 46.1 60.1 66.4 68.0 72.4 81.3 Mortgage Index 100.0 89.5 102.9 112.3 116.7 122.3 128.5 Equity Index 100.0 95.8 106.3 114.2 111.0 107.9 112.4 S&P 500 100.0 90.7 98.1 100.0 101.8 106.8 112.4

RAIT Financial Trust

February 23, 2017

Page 2

and management has neither (i) engaged us meaningfully in a transactional dialogue, nor (ii) put forth a specific business plan that would generate value for shareholders comparable with NexPoint’s proposal. Instead of convincing the investment community that management is capable of attracting investor interest and capital, RAIT’s new CEO said the following:

“Given that Michael was recently elected Chairman, and I won’t be seated as CEO and trustee for another month, I hope you will understand that while you may be eager to hear about our plans, it will take us some time to refine and communicate them.” – Scott Davidson, CEO, Q3 2016 RAIT Earnings Call

As of the date of this letter, shareholders still have not heard a specific business plan from management. We believe management’s failure to articulate a viable business plan has in part led to two analysts recently dropping research coverage. On February 8, 2017, Compass Point dropped research coverage due to a “reallocation of resources.” In one of their last communications before dropping coverage, the analyst stated:

“We would be more positive on the stock if our conviction increased in RAS’s ability to cut costs sharply or willingness to sell the company to a competitor with better scale and a lower cost of capital.” – Compass Point, November 4, 2016

As the 2nd largestnon-indexed shareholder, we are steadfast in our belief that our plan is superior to RAIT’s status quo. Our proposal further provides better alignment, meaningfully reduces the current outsized G&A and compensation expense, improves corporate governance, focuses the business, restores confidence in the dividend and creates a path to positive shareholder return over the next12-18 months (vs RAIT’s negative 39.8% total return over the past three years, as of close of trading February 22, 2017). We feel we are left with no choice other than to take our case and proposal directly to our fellow shareholders. To that end, we are pleased to announce the nominations of five trustees to RAIT’s Board, including:

Nancy Jo Kuenstner – Ms. Kuenstner has over 30 years of experience in banking and finance. She also chaired the special committee of an externally managed mortgage REIT, CreXus Investment Corp. (formely NYSE:CXS) that successfully negotiated the sale of CreXus to Annaly Capital Management, a mortgage REIT.

John M. Pons – Mr. Pons was formerly the EVP and General Counsel of Cole Real Estate Investments, Inc. (NYSE:COLE).

Andrew R. Richardson – Mr. Richardson served as CFO of The Howard Hughes Corporation (NYSE:HHC) from March 2011 to October 2016. Prior to Howard Hughes, he served as CFO, Executive VP and Treasurer of NorthStar Realty Finance Corp.

James D. Dondero – Mr. Dondero serves as the President of NexPoint Residential Trust, Inc (NYSE:NXRT) and Chairman of the Board of Directors. Mr. Dondero is also theCo-Founder and President of Highland Capital Management, L.P., Founder and President of NexPoint Advisors, L.P. and Chairman of NexBank, an affiliated bank.

Matt R. McGraner – Mr. McGraner serves as the Chief Investment Officer and Executive Vice President of NexPoint Residential Trust, Inc.(NYSE:NXRT) and NexPoint Real Estate Advisors, LP. Mr. McGraner is also a Managing Director at Highland Capital Management, LP.

These experienced individuals all possess significant relevant experience in real estate finance and more specifically, mortgage REITs. We are confident that these well-established individuals with relevant experience will run a thoughtful process to considerall qualifying proposals (including NexPoint’s) to create value for RAIT’s shareholders.We believe shareholders deserve a chance to decide the future leadership and business plan of RAIT, rather than entrusting those that have presided throughout an era of material underperformance.

| | | | | | |

| | AN AFFILIATE OF | | |  | |

RAIT Financial Trust

February 23, 2017

Page 3

Although we are confident that our message and proposal for change will ultimately resonate with shareholders who are tired of the status quo, we anticipate that current leadership may continue to waste Company resources and follow the familiar playbook of entrenched leadership (i.e., deny our slate of trustees, delay the annual meeting, etc). The Board’s recent approval of shareholder-unfriendly Bylaws would support our contention.Please know that we are committed to our significant long-term investment and will pursue all legally available means to counter any attempt to block the NexPoint nominees.

In the meantime, we will continue working diligently with our trustee candidates, and our advisors to refine NexPoint’s plan for repositioning RAIT’s business to restore shareholders’ confidence and attract capital for growth. We hope you agree that our proposed nominees will implement the change needed at RAIT and look forward to sharing more details of our plan over the coming weeks. Thank you in advance for your support.

Sincerely,

James Dondero, President

| | | | | | |

| | AN AFFILIATE OF | | |  | |

RAIT Financial Trust

February 23, 2017

Page 4

Additional Information Regarding Nominees

Nancy Jo Kuenstner – Ms. Kuenstner has over 30 years of experience in banking and finance. She served as President, CEO and Director of The Law Debenture Trust Company of New York from March 2001 to December 2008. She was an independent Director of the externally managed $1 billion mortgage REIT Crexus Investment Corp. from September 2009 to May 2013 and has served as a Director of EOS Preferred Corp. Her prior banking and finance experience includes time at both Citicorp Inc. and JPMorgan & Co., Inc. She holds an MBA from the University of North Carolina, Chapel Hill and a BA in Spanish from Lafayette College, where she is currently a Trustee.

John M. Pons – Mr. Pons currently serves as CLO of Rincon Partners. Prior toco-founding Rincon, Mr. Pons served as Executive VP and General Counsel, Real Estate, at Cole Real Estate Investments, Inc. (“Cole”), a NYSE-listed REIT, which he joined in September 2003. Prior to joining Cole, Mr. Pons served as Associate General Counsel at GE Capital Franchise Finance Corp. Prior to GE Capital, Mr. Pons practiced real estate and finance law in Phoenix, Arizona. Mr. Pons currently serves as an Independent Director of NexPoint Multifamily Realty Trust, Inc., an SEC registerednon-traded REIT and was a member of the board of directors of Cole Credit Property Trust, Inc. from 2004 to 2010. Mr. Pons served as a Captain in the United States Air Force as a Missile Combat Crew Commander. He received his BS in Mathematics from Colorado State University and a MS in Administration from Central Michigan University before attending the University of Denver Sturm College of Law where he earned his JD (Order of St. Ives).

Andrew C. Richardson – Mr. Richardson has over 20 years of experience in commercial real estate investment and finance. He most recently served as CFO of the Howard Hughes Corporation (NYSE:HHC) from March 2011 to October 2016. Prior to Howard Hughes from March 2006 to March 2011, he served as Executive Vice President, Chief Financial Officer and Treasurer of NorthStar Realty Finance Corp., and was the President, Chief Financial Officer and Treasurer of NorthStar Real Estate Income Trust, Inc., an SEC registerednon-traded REIT advised by NRF. Prior to NorthStar Realty Finance, Mr. Richardson from 2000 to 2006 served as Head of the Capital Markets Group at iStar, Inc., most recently as Executive Vice President. He was an investment banker at Salomon Smith Barney from 1995 to 2000 and served at Ernst & Young from 1988 to 1993. Mr. Richardson holds an MBA from the University of Chicago Booth School of Business and a BBA in Accountancy from the University of Notre Dame.

James D. Dondero – James Dondero isCo-founder and President of Highland Capital Management, L.P. (“Highland”). Mr. Dondero is Chairman and President of NexPoint Residential Trust, Inc. (NYSE:NXRT), Chairman of NexBank Capital, Inc., Cornerstone Healthcare Group Holding, Inc., and CCS Medical, Inc., and a board member of Jernigan Capital, Inc. (NYSE:JCAP), and MGM Holdings, Inc. He also serves on the Southern Methodist University Cox School of Business Executive Board. Mr. Dondero has over 30 years of experience in the credit and equity markets, focused largely on high-yield and distressed investing. Under Mr. Dondero’s leadership, Highland has been a pioneer in both developing the collateralized loan obligation (CLO) market and advancing credit-oriented solutions for institutional and retail investors worldwide. Highland’s product offerings include institutional separate accounts, CLOs, hedge funds, private equity funds, mutual funds, REITs, and ETFs. A dedicated philanthropist, Mr. Dondero actively supports initiatives in education, veterans affairs, and public policy. Prior to founding Highland in 1993, Mr. Dondero was involved in creating the GIC subsidiary of Protective Life, where as Chief Investment Officer he helped take the company from inception to over $2 billion between 1989 and 1993. Between 1985 and 1989, Mr. Dondero was a corporate bond analyst and then portfolio manager at American Express. Mr. Dondero began his career in 1984 as an analyst in the JP Morgan training program. Mr. Dondero graduated from the

| | | | | | |

| | AN AFFILIATE OF | | |  | |

RAIT Financial Trust

February 23, 2017

Page 5

University of Virginia where he earned highest honors (Beta Gamma Sigma, Beta Alpha Psi) from the McIntire School of Commerce with dual majors in accounting and finance. He has received certification as Certified Public Accountant (CPA) and Certified Managerial Accountant (CMA) and has earned the right to use the Chartered Financial Analyst (CFA) designation.

Matt R. McGraner – Mr. McGraner serves as the Chief Investment Officer and Executive Vice President of NXRT and NexPoint Real Estate Advisors, LP. Mr. McGraner is also a Managing Director at Highland. Since 2008, Mr. McGraner has led the acquisition and execution of over $2.5 billion of real estate investments and advised on $16.3 billion of M&A and private equity transactions. Mr. McGraner earned a BS from the Vanderbilt University and received his JD from Washington University in St. Louis, Missouri.

Additional Information and Where to Find It

The filing persons (collectively, the “Proposing Persons”) intend to file with the Securities and Exchange Commission (the “SEC”) a proxy statement in connection with the contemplated transactions. The definitive proxy statement will be sent or given to RAIT Financial Trust (“RAIT”) shareholders and will contain important information about the contemplated transactions. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRETY THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE. Investors and security holders may obtain a free copy of the proxy statement (when it is available) and other documents filed with the SEC at the SEC’s website at www.sec.gov. Free copies of the proxy statement and other relevant materials (when they become available) can be obtained from the Proposing Persons by contacting the Proposing Persons by telephone at (972) 628-4100. This is not the Company’s proxy statement.

Certain Information Concerning Participants

The Proposing Persons and certain of their executive officers and their affiliates and associates (collectively, the “Participants”), as such terms are defined under Rule12b-2 of the Securities Exchange Act of 1934, may be deemed to be participants in the solicitation of proxies from RAIT investors and security holders in connection with the contemplated transactions. One or more of the Proposing Persons proposes to become the Company’s investment adviser, for which it would receive advisory fees. Information about the Participants is set forth in the Schedule 13D/A filed by the Participants, among other individuals, with the SEC on the date hereof. The Schedule 13D/A may be obtained for free at the SEC’s website at www.sec.gov. Additional information regarding the interests of Participants in the solicitation of proxies in connection with the contemplated transactions will be included in the proxy statement that the Proposing Persons intend to file with the SEC.

| | | | | | |

| | AN AFFILIATE OF | | |  | |