Periodic Report on Form 8-K filed October 4, 2017

General

| 2. | We note your assertion that your digital assets meet the definition of intangible assets, which suggests they are subject to ASC 350-30. We are unable to identify a scope exception in ASC 30-30 that permits accounting for intangible assets at fair value each reporting period. If your digital assets are within the scope of ASC 350-30, please revise your accounting to comply with those requirements. |

Response

The Company acknowledges the Staff’s comment and has revised its accounting policy regarding its digital assets to comport with ASC 350-30. Specifically, the Company has noted its previous accounting method regarding the treatment of its digital currencies which were made in error, and has revised its policies to comport with ASC 350-30. This change in its accounting policy did not have a material impact on the Company’s financial situation.

In response to the Staff’s comment, the Company has included the following disclosure in the Q3 2018 Report:

Form 10-Q, Part I, Note 2 - Basis of presentation, summary of significant accounting policies and recent accounting pronouncements - Digital Currencies Translations and Remeasurements (Page 9).

“The Company originally adopted an accounting policy regarding digital currencies transactions and remeasurement that stated:

‘Digital currencies are recorded at their fair value on the date they are received as revenues, and are revalued to their current market value at each reporting date. Fair value is determined by taking the spot rate from the most liquid exchanges.’

Based on reviews of the available accounting guidance, the Company has concluded that its originally adopted accounting policy was in error and the digital currencies should have been recorded at cost less impairment. The change in this accounting policy did not have a material impact of the Company’s previously reported condensed interim consolidated financial statements.” (Emphasis Added).

| 13. | In order to help us evaluate your assertion that the bitcoin mining you do is within the scope of ASC 606, please address the following: |

| · | Describe for us the nature of the mining activities you perform, including a discussion of 1) any arrangements (explicit or implied) related to these activities and counterparties involved with these activities and 2) any cash or non-cash consideration received by the company in connection with the mining activities; |

| · | Provide to us both your ASC 606-10-15 scoping analysis and your “Step 1: Identify the contract with the customer” analysis that identifies your customer and how you meet the criteria of ASC 606-10-25-1; and |

| · | Tell us the accounting alternatives you considered and rejected, and the reasons why, in arriving at your conclusion that your bitcoin mining is within the scope of ASC 606. |

Response

The Company, in various annual, quarterly, and periodic report filings between June 15, 2018 and most recently, Q3 2018 Report, has made disclosure of its accounting practices and revenue recognition from its bitcoin mining activities; including extensive discussion of its ASC 606-10-15 scoping analysis and its determination that bitcoin mining is within the scope of ASC 606. Additionally, in response to the Staff’s comment, the Company has previously provided supplemental information to the Staff, which is also attached hereto as Exhibit A.

Additionally, in response to the Staff’s comment, the Company has made the following disclosure regarding its treatment of bitcoin mining:

United States Securities and Exchange Commission

November 23, 2018

Page 3

Form 10-Q, Part I, Note 2 - Basis of presentation, summary of significant accounting policies and recent

accounting pronouncements - Revenue Recognition (Cryptocurrency Mining) (Pages 10 and 11).

“The Company recognizes revenue when it is realized or realizable and earned. The Company considers revenue realized or realizable and earned when there is persuasive evidence of an arrangement and that the product has been shipped or the services have been provided to the customer, the sales price is fixed or determinable and collectability is probable. The Company’s material revenue stream is related to the mining of digital currencies. The Company derives its revenue by providing transaction verification services within the digital currency networks of cryptocurrencies, such as bitcoin, bitcoin cash and litecoin, commonly termed "cryptocurrency mining." In consideration for these services, the Company receives digital currencies which are recorded as revenue, using the average U. S. dollar spot price of the related cryptocurrency on the date of receipt. The coins are recorded on the balance sheet at their fair value. Gains or losses on sale of digital currencies are recorded at the time of the transaction in the statement of operations. Expenses associated with running the cryptocurrency mining business, such as equipment depreciation, rent and electricity costs are also recorded as cost and expenses.

There is currently no specific definitive guidance in GAAP or alternative accounting frameworks for the accounting for the production and mining of digital currencies exists, and management has exercised its best judgment in determining appropriate accounting treatment for the recognition of revenue for mining of digital currencies. Management has examined various factors surrounding the substance of the Company's operations and the guidance in Accounting Standards Codification (“ASC”) 606, Revenue from Contracts with Customers, including the stage of completion being the completion and addition of a block to a blockchain and the reliability of the measurement of the digital currency received. Management has consulted with an outside public accounting firm, auditors, and legal counsel to arrive at this conclusion. In the event authoritative guidance is enacted by the Financial Accounting Standards Board (“FASB”), the Company may be required to change its policies which could result in a change in the Company's financial statements.

The Company recognizes revenue under ASC 606, Revenue from Contracts with Customers. The core principle of the new revenue standard is that a company should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the company expects to be entitled in exchange for those goods or services. The following five steps are applied to achieve that core principle:

| | | Step 1: Identify the contract with the customer |

| | | Step 2: Identify the performance obligations in the contract |

| | | Step 3: Determine the transaction price |

| | | Step 4: Allocate the transaction price to the performance obligations in the contract |

| | | Step 5: Recognize revenue when the company satisfies a performance obligation |

In order to identify the performance obligations in a contract with a customer, a company must assess the promised goods or services in the contract and identify each promised good or service that is distinct. A performance obligation meets ASC 606’s definition of a “distinct” good or service (or bundle of goods or services) if both of the following criteria are met:

| | • | The customer can benefit from the good or service either on its own or together with other resources that are readily available to the customer (i.e., the good or service is capable of being distinct). |

United States Securities and Exchange Commission

November 23, 2018

Page 4

| | • | The entity’s promise to transfer the good or service to the customer is separately identifiable from other promises in the contract (i.e., the promise to transfer the good or service is distinct within the context of the contract). |

If a good or service is not distinct, the good or service is combined with other promised goods or services until a bundle of goods or services is identified that is distinct.

The transaction price is the amount of consideration to which an entity expects to be entitled in exchange for transferring promised goods or services to a customer. The consideration promised in a contract with a customer may include fixed amounts, variable amounts, or both. When determining the transaction price, an entity must consider the effects of all of the following:

| | | Constraining estimates of variable consideration |

| | | The existence of a significant financing component in the contract |

| | | Consideration payable to a customer |

Variable consideration is included in the transaction price only to the extent that it is probable that a significant reversal in the amount of cumulative revenue recognized will not occur when the uncertainty associated with the variable consideration is subsequently resolved.

The transaction price is allocated to each performance obligation on a relative standalone selling price basis.

The transaction price allocated to each performance obligation is recognized when that performance obligation is satisfied, at a point in time or over time as appropriate.

There is only one performance obligation in each digital currency transaction (transfer of a verified transaction to the Blockchain). If the Company either directly or as part of a group of other miners operating as part of a mining pool, is successful in adding a block to the Blockchain (by verifying an individual transaction), the Company is automatically awarded a fixed number of digital currency tokens for their effort. At the time the contract with the customer arises (upon being the first to solve the algorithm and transferring a verified transaction to the Blockchain), the consideration receivable is fixed. As such, the Company concluded that there was no variable consideration. There is no significant financing component or consideration payable to the customer in these transactions.

Digital currencies are non-cash consideration and thus must be included in the transaction price at fair value at the inception of the contract, which is when the algorithm is solved and a verified transaction is transferred to the Blockchain. Fair value is determined using the average U.S. dollar spot rate of the related digital currency.

Expenses associated with running the digital currency mining business, such as rent and electricity cost are also recorded as cost of revenues. Depreciation on digital currency mining equipment is recorded as a component of costs and expenses.”

United States Securities and Exchange Commission

November 23, 2018

Page 5

| 14. | We note your policy that bitcoin mined is non-cash consideration and thus must be included in the transaction price at fair value at the inception of the contract. Please provide your analysis, with specific citation to authoritative accounting literature, that clarifies how your use of the average U.S. dollar spot price of the related cryptocurrency on the date of receipt complies with ASC 820. In your analysis, please identify how you determined your principal or most advantageous market and whether the price in that market required adjustment to arrive at ASC 820 fair value, and the reasons why or why not. |

Response

As discussed in the Company’s response to the Staff’s comment 2, above, the Company has noted its previous accounting practices regarding its treatment of digital currency assets by assessing their value at fair value under ASC 820 was made in error. Accordingly, the Company has adopted a costless impairment valuation of its digital currency. Sec Form 10-Q, Part I, Note 2-Basis of presentation, summary of significant accounting policies and recent accounting pronouncements.

***

If you have any questions or request any further information, please do not hesitate to call the undersigned at (303) 794 – 2000 or contact our counsel, William R. Jackman of Rogers Towers, P.A. at (904) 398-3911.

Very truly yours,

/s/ Robby Chang

Chief Financial Officer

EXHIBIT A

Riot Blockchain, Inc.

Supplemental Responses to the Securities and Exchange Commission Staff Following Calls on October 16 and 19, 2018

On October 16 and 19, 2018, the Securities and Exchange Commission (the “SEC”) staff and representatives of Riot Blockchain, Inc. (“Riot”) participated in telephone conferences to discuss Riot’s operations and accounting practices. The following discussion is intended to supplement certain questions raised by the SEC staff during those calls with respect to Riot’s digital currency1 mining revenue stream and accounting practices.

Background of Digital Currency Mining Operations

A mining operator (a “Miner”) can choose to mine independently or register to mine as part of a pool with other Miners joining forces in a mining pool organized and operated by a pool operator (“Operator”). Mining individually or as part of a pool run by an Operator is elective for each Miner and can be changed any time at will. Mining for digital currency involves solving mathematical algorithms for digital currency rewards. Digital currency rewards are given to reward Miners for solving algorithms which are used to verify immutable Blocks in the Blockchain. These immutable Blocks are generated in response to transactions “on the Blockchain” and must be verified algorithmically in order to ensure their validity and be added to the Blockchain.

In the current model, the first Miner to complete a given algorithm is awarded with a reward of a block of digital currency (“Reward”).2 This first to finish system encourages competition between Miners and requires increasingly powerful computation systems to solve algorithms at an ever-faster pace. 3 The drive to increase Hash Rates by employing more and more computing power requires the expenditure of tremendous amounts of energy at great expense to the Miners. Accordingly, Miners have banded together in pools to solve algorithms collectively, whereby the systemic costs of mining operations and the risk of losing out on solving the algorithm first are distributed across the pool.

Historically, Riot, as a Miner, has joined as part of a pool or pools to enhance its mining effectiveness. Whereas an individual Miner must approach solutions to a given algorithm sequentially, operating as a part of a pool of Miners enables Riot to focus on a single solution to a given algorithm, while hedging against the risk posed by other Miners approaching the solution to the algorithm differently, by sharing in the success of mining operations across the pool according to pre-agreed upon parameters. Miners “sign-up” with a pool Operator on-line according to pre-arranged parameters whereby their individual Hash Rates are added to the pool in exchange for a ratable share of the pool’s Rewards based on the Hash Rate contributed by the Miner. Pool operators are able to marshal higher Hash Rates to solve algorithms by utilizing the computing power offered by a distributed net of Miners whereby they are more likely to receive a Reward which is shared with the Miners.

1 Responses and examples are based upon the Bitcoin currency, as that is the dominant currency production by Riot as a Miner Production and flow of other currencies are generally equivalent to the facts and processes as described below. For Riot, the value of Bitcoin production in 2018 has represented approximately 88.4% of total currencies mined.

2 A Reward is currently approximately 12.5 coins (“Block”).

3 The higher the computing power being employed (“Hash Rate”), the better the chances for a successful Reward of a Block.

Accounting for Revenue from Mining Operations

The transfer of Rewards to Riot is done automatically following a successful reward. The only consideration received by Riot relating to the mining process is the allocation of Rewards from the pool operator, or should Riot be operating directly and successfully, the award of the Block Reward. Upon signing up with the pool Operator, Riot provides applicable digital “wallet” identification and instructions. Transfers are made in a regular basis once the Reward Block has been confirmed and verified via solved algorithm. Such transfers are made within hours of the Reward posting, after validation, which typically occurs upon the subsequent completion of approximately a dozen new Reward Blocks. Riot verifies the transfer of each award to its wallet, using the Blockchain data and reviews Operator allocations for reasonableness. When Riot or the pool Operator is unsuccessful in discovering a Block, there are no Rewards awarded to the pool, and no payout is made to the Miners.4

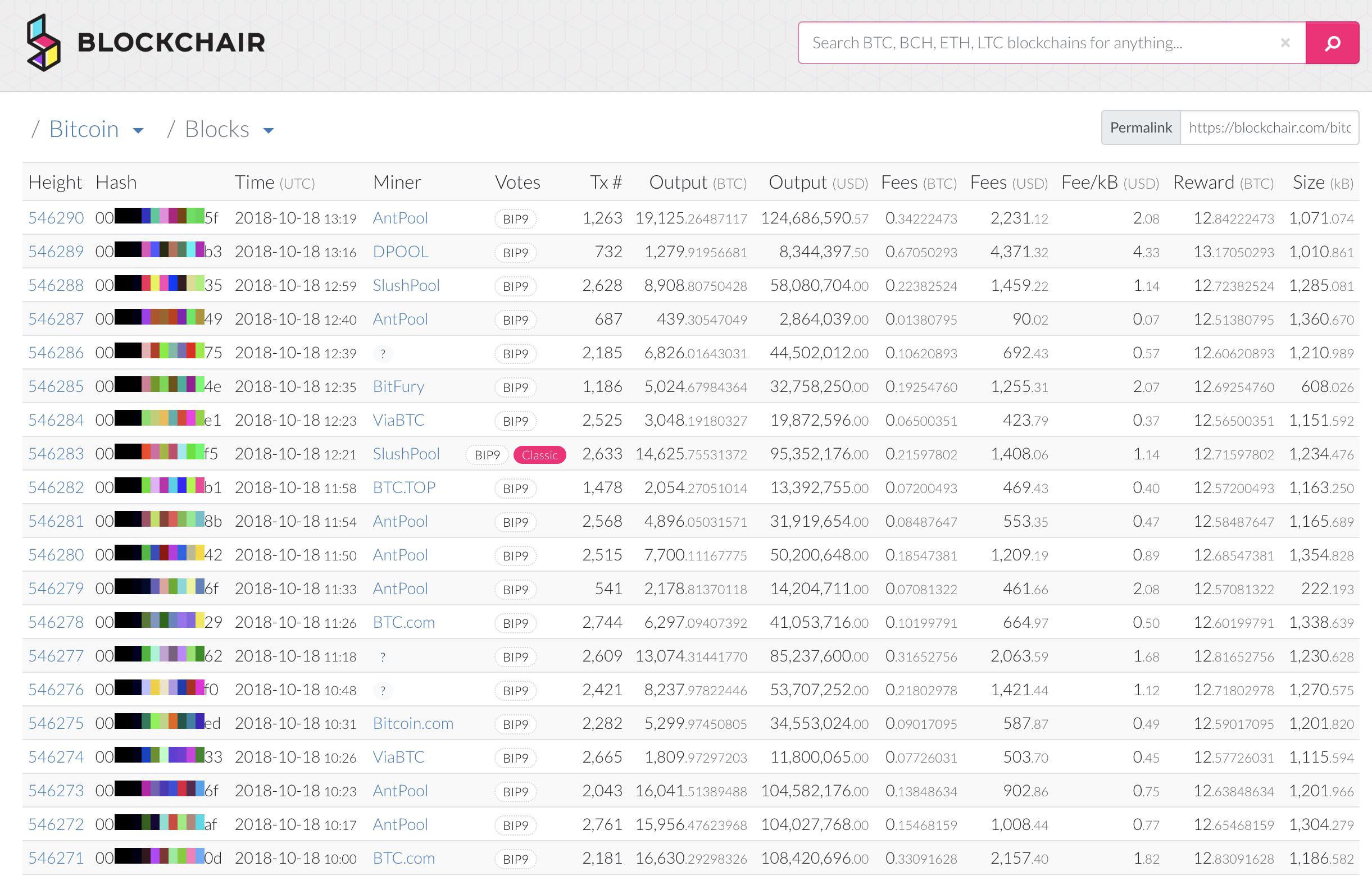

Attached at Exhibit A, is a digital screen shot from Blockchair Tracker as an example of a series of successful Block Rewards for October 18, 2018. Each row is a successful Block and reports the data about the award, including the reference number (“Height”), who the Miner was or the name of the Operator if in a pool, the transactions in the Block (“Tx#”), the fees charged and the Reward quantity. The miner who discovers this block is given the entire mining reward for their work. In the attached example, you can see “AntPool” listed for block 546290 – there were 1,263 transactions in the block and 0.342 BTC in fees paid. The total reward is 12.8422 paid to the mining pool operator. This reward will be distributed to the miners that supported the discovery of that block in an amount equal to their contribution of work. The transaction fees are deducted (retained) by the pool Operator resulting in a net settlement in Bitcoin to each Miner participating in the pool.

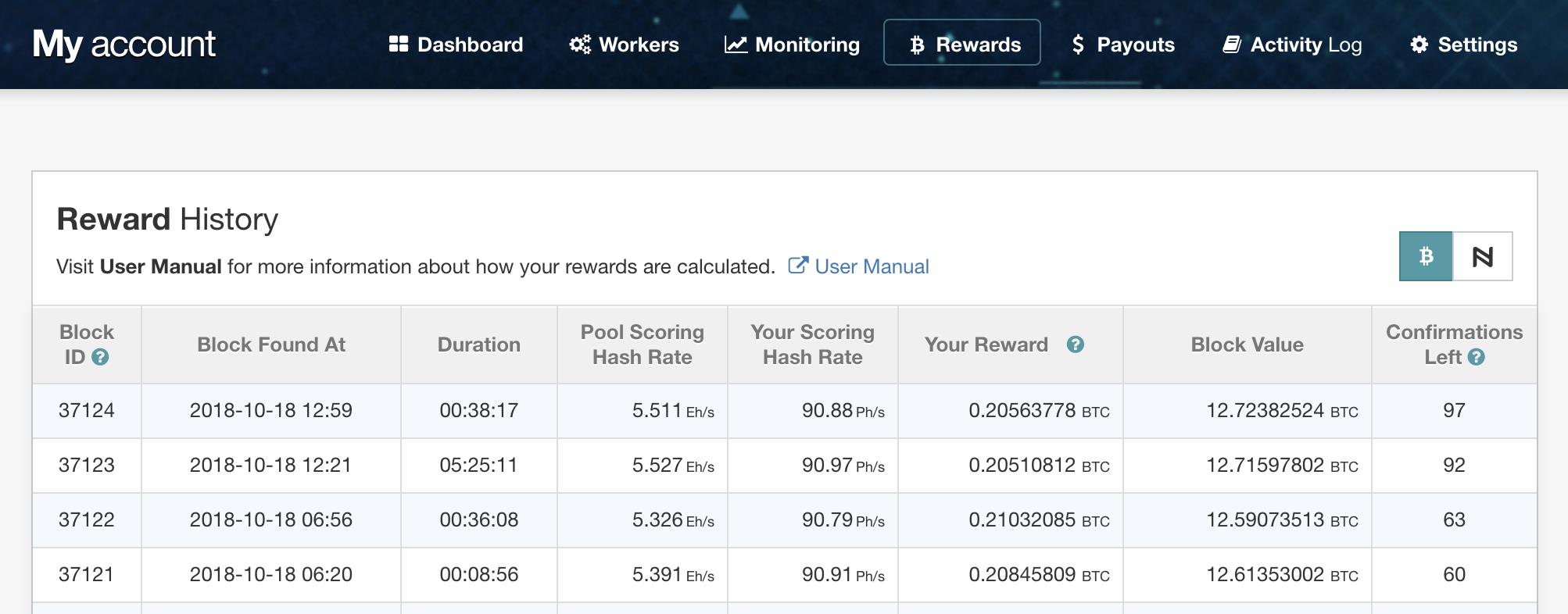

Attached at Exhibit B, is a digital screen shot example of the report posted by the pool Operator (SlushPool) showing the allocation to each user (in this case Riot), for each successful Reward. In this example, SlushPool discovered block 546288. Riot worked on this block as a Miner in their pool. The total Reward received by SlushPool was equal to 12.7238 BTC. Riot’s allocation of Reward from SlushPool showing the Block processed by the pool Operator, Block ID 37124 represents the Block number 546288 on the public Bitcoin blockchain from Exhibit A. Riot was rewarded with .2056 BTC for our work on this Block. The total Hash Rate for the pool at that time is displayed along with Riot’s Hash Rate, the relationship between them represents Riot’s proportional share of the Reward.

The data source where daily currency values are obtained to compute the quarterly currency revenues and period end values. Riot has used data related to historical BTC pricing from Coindesk.com.5 This has been the consistent market pricing source for our accounting periods.

Allocation of Rewards

User participation to pool’s mining power is measured by scoring Hash Rate.6 Hash Rate reflects how much computing power a given Miner expended in in relation to a given algorithm. Miners are awarded a share of the pool’s Reward based on their individual Hash Rate. Hash Rate can be understood as an exponential moving average from hash rate of all user mining devices connected to the pool.7 The averaging controls for short term Hash Rate drops or increases caused by power fluctuations and other external stimuli, and makes rewards calculation more stable and fair.8 For example, if a Miner’s scoring Hash Rate is 1% of the whole pool, the Miner receives 1% of the block rewards. If you own 0.031% of Hash Rate, the Miner receives 0.031% of the Rewards for the Block.

_________________________

4 Tracking of successful Block Rewards is reported by Blockchair Tracker: https://blockchair.com/bitcoin/blocks.

5 See https://www.coindesk.com/price/

6 The payout details are presented at: https://slushpool.com/help/manual/rewards

7 See EMA definition.

The pool calculates a Miner’s reward for every found block as follows:

| ● | A block value is typically 12.5 BTC + fees from Bitcoin transactions contained in the block. |

| ● | Scoring hash rates used for the calculation are hash rates from time when a particular block was found. They reflect some mining history before the actual block finding. |

| ● | A pool fee is currently 2% of the proportional Reward per Miner. |

When the pool or the Miner is unsuccessful in uncovering a Block for a given algorithm, no Reward is given to the pool or the Miners participating in the pool. In these situations, the Miners receive no compensation for their efforts. Riot has not entered into any separate agreements for compensation in these “no-Reward” situations, and accounts for its expenses in its operating costs. Accordingly, Riot’s sole compensation for its Mining operations is limited to Rewards and/or its share of Rewards based on its pool participation.

Payout Timing

Riot’s wallet will receive payouts twice per day or whenever the total reward amount surpasses 1 BTC. As it relates to a given contract between the system and a Miner, payouts in the form of Rewards are distributed to each Miner’s account upon completion of the contract, which is consummated and completed simultaneously upon delivery of a verified Block to the system. As discussed herein, Block verification by algorithm is the principle service provided by Miners to the system.

Contract Rights and Obligations

Pool participants have limited rights under the pool Operators terms of service. Participants are also subject to the terms and conditions disclosed on each Operators web site and agreed to by Miners when signing up. The term and conditions are fairly general and limit the liability to the pool Operator. Conditions include requirements to follow the Operators restrictions on use of content and software, and the Operators rights to modify and terminate services. Miners have the right to terminate using the services of the Operator at any time.

The following links are provided by the pool operators describing the terms and conditions of each service:

| ● | Antpool Terms of Service: https://account.bitmain.com/terms_service |

| ● | Slushpool Terms of Service: https://slushpool.com/terms-of-service |

_________________________

8 The mathematical definition is provided further below in this section.

Exhibit A

Exhibit B