Maximum Amount Condition will be tested at the Expiration Time for each series in order of Acceptance Priority Level. If any series of Old Notes is accepted for exchange, all Old Notes of that series that are validly tendered and not validly withdrawn will be accepted for exchange. Accordingly, no series of Old Notes will be subject to proration pursuant to the Exchange Offers.

It is possible that any series of Old Notes with Acceptance Priority Level 10 or lower will fail to meet the Maximum Amount Condition and therefore will not be accepted for exchange even if one or more series with a lower Acceptance Priority Level is accepted for exchange.

In exchange for each $1,000 principal amount of Old Notes that is validly tendered prior to 5:00 p.m., New York City time, on November 28, 2018 (the “Early Participation Deadline”) and not validly withdrawn (subject to the Acceptance Priority Levels and the conditions described herein, including the applicable Minimum Size Condition and the Maximum Amount Condition), holders will receive the total consideration set out in the table above (the “Total Consideration”), which consists of $1,000 principal amount of New Notes and a cash amount of $1 (such cash amount, the “Cash Component”).

The Total Consideration includes an early participation premium set out in the table above (the “Early Participation Premium”), which consists of $30 principal amount of New Notes.

In exchange for $1,000 principal amount of Old Notes that is validly tendered after the Early Participation Deadline but prior to the Expiration Time (as defined below) and not validly withdrawn (subject to the Acceptance Priority Levels and the conditions described herein, including the applicable Minimum Size Condition and the Maximum Amount Condition), holders will receive only the exchange consideration set out in the table above (the “Exchange Consideration”), which is equal to the Total Consideration less the Early Participation Premium and so consists of $970 principal amount of New Notes and a cash amount of $1.

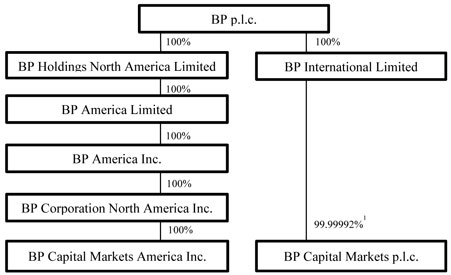

Other than the identity of the Issuer, the terms of each series of the New Notes are identical in all material respects to the corresponding series of Old Notes, with minor exceptions as discussed in “Description of Differences Between the New Notes and the Old Notes.” The Old Notes are, and each series of the New Notes will be, fully and unconditionally guaranteed by BP. Each series of the New Notes will have the same financial terms and covenants as the corresponding series of Old Notes, and are subject to the same business and financial risks. The Old Notes were issued pursuant to supplemental indentures to an indenture, dated March 8, 2002, amongst BP Capital U.K., BP and The Bank of New York Mellon Trust Company, N.A. (as successor to JPMorgan Chase Bank, N.A.), as trustee (the “Trustee”) (such indenture, as supplemented, the “Old Indenture”). The New Notes will be issued pursuant to a supplemental indenture to an indenture dated June 4, 2003, among BP Capital America, BP and the Trustee (such indenture, as will be supplemented, the “New Indenture” and together with the Old Indenture, the “Indentures”).

Subject to the rounding described below, no accrued but unpaid interest will be paid on the Old Notes in connection with the Exchange Offers. However, interest on the applicable New Note will accrue from and including the most recent interest payment date of the tendered Old Note. The principal amount of each New Note will be rounded down, if necessary, to the nearest whole multiple of $1,000, and we will pay cash equal to the remaining portion (plus accrued interest thereon), if any, of the exchange price of such Old Note. The Exchange Offers will expire at 11:59 p.m., New York City time, on December 12, 2018, unless extended (the “Expiration Time”). You may withdraw tendered Old Notes at any time prior to the Expiration Time. As of the date of this prospectus, there was $23,750,000,000 aggregate principal amount of outstanding Old Notes.

The consummation of each Exchange Offer is subject to, and conditional upon, the satisfaction or waiver, where permitted, of the conditions discussed under “The Exchange Offers—Terms of the Exchange Offers” and “The Exchange Offers—Conditions to the Exchange Offers,” including, among other things, the Minimum Size Condition and the Maximum Amount Condition. Subject to applicable law and as described under “The Exchange Offers—Extensions; Amendments; Waiver; Termination,” we may, at our option and sole discretion, waive any such conditions with respect to any of the Exchange Offers, except the condition that the registration statement of which this prospectus forms a part has been declared effective by the U.S. Securities and Exchange Commission. All conditions to the Exchange Offers must be satisfied or, where permitted, waived, at or by the Expiration Time.

We plan to issue the New Notes promptly on or about the second business day following the Expiration Time (the “Settlement Date”). The Old Notes are currently, and we intend will remain, listed on the New York Stock Exchange (“NYSE”), and we intend to list the New Notes on the NYSE. We expect trading in the New Notes on the NYSE to begin within 30 days of the Settlement Date.

This investment involves risks. Prior to participating in any of the Exchange Offers, please see the section entitled “Risk Factors” beginning on page 11 of this prospectus for a discussion of the risks that you should consider.Additionally, see the sections entitled “Risk Factors” in our 2017 Annual Report on Form 20-F for the fiscal year ended December 31, 2017 and “Principal risks and uncertainties” in our Report on Form 6-K filed with the SEC on July 31, 2018, which are incorporated by reference herein, to read about factors you should consider before investing in the New Notes.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.