Interim Value. For each Shield Option, the value we assign on any Business Day prior to the Term End Date. During the Transfer Period, the Interim Value of each Shield Option will equal the Investment Amount in that Shield Option. After the Transfer Period, the Interim Value of that Shield Option is equal to the Investment Amount in the Shield Option, adjusted for the Index Performance of the associated Index and subject to the applicable Accrued Shield Rate, Accrued Cap Rate or Accrued Step Rate. The Interim Value is the amount that is available for annuitization, death benefits, withdrawals and Surrenders.

Investment Amount. The Investment Amount, for each Shield Option, is the amount that is allocated to the Shield Option and subsequently reflects all withdrawals and adjustments at the Term End Date. The Investment Amount will be reduced for any withdrawal by the same percentage that the withdrawal reduces the Interim Value attributable to that Shield Option.

Issue Date. The date the Contract is issued.

Joint Annuitant. If there is more than one Annuitant, each Annuitant will be a Joint Annuitant of the Contract.

Joint Owner. If there is more than one Owner, each Owner will be a Joint Owner of the Contract. Joint Owners are limited to natural persons.

Maturity Date. The Maturity Date is specified in your Contract and is the first day of the calendar month following the Annuitant’s 90th birthday or 10 years from the date we issue your Contract, whichever is later. The Contract will be annuitized at the Maturity Date.

Minimum Account Value. $2,000. If your Account Value falls below the Minimum Account Value as a result of a withdrawal we will treat the withdrawal request as a request for a full withdrawal.

Minimum Guaranteed Cap Rate. The actual Minimum Guaranteed Cap Rate for your Contract is the amount shown on your Contract Schedule but will not be less than 2% for Shield Options with a 1-Year Term, 6% for Shield Options with a 3-Year Term and 8% for Shield Options with a 6-Year Term.

Minimum Guaranteed Interest Rate. The current Minimum Guaranteed Interest Rate will not be less than 1%. This interest rate is guaranteed to be a rate not less than the minimum interest rate allowed by state law—see Appendix D. The actual Minimum Guaranteed Interest Rate for your Contract is the amount shown on your Contract Schedule and applies only to amounts in the Fixed Account.

Minimum Guaranteed Step Rate. The actual Minimum Guaranteed Step Rate for your Contract is the amount shown on your Contract Schedule but will not be less than 1.5%.

Notice. Any form of communication providing information we need, either in a signed writing or another manner that we approve in advance. All Notices to us must be sent to our Annuity Service Office and received in Good Order. To be effective for a Business Day, a Notice must be received in Good Order prior to the end of that Business Day.

NYSE. New York Stock Exchange.

Owner (“you”, “yours”). The person(s) entitled to the ownership rights under the Contract. Subject to our administrative procedures, we may also permit ownership by a corporation (a type of non-natural person) or certain other legal entities. If Joint Owners are named, all references to Owner shall mean Joint Owners.

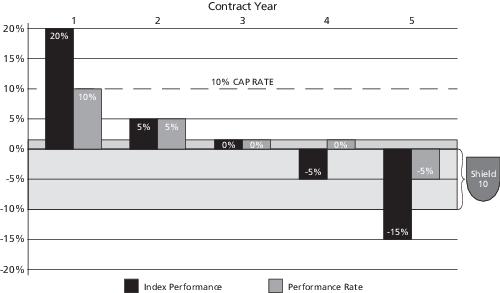

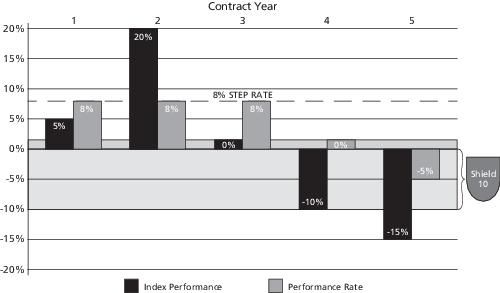

Performance Rate. The rate credited at the Term End Date. The Performance Rate is based on the Index Performance, adjusted for the applicable Shield Rate, Cap Rate or Step Rate. The Performance Rate can be positive, zero or negative. At the end of the Term, any increase or reduction in the Investment Amount in a particular Shield Option is determined by multiplying the Performance Rate by the Investment Amount of the Shield Option on the last day of the Term.

Performance Rate Adjustment. The adjustment made to the Investment Amount for each Shield Option on any day during the Term, up to, and including, the Term End Date. Prior to the Term End Date, this adjustment is based on the Index Performance of the associated Index for a particular Term, subject to any applicable Accrued Shield Rate, Accrued Cap Rate or Accrued Step Rate. On the Term End Date, this adjustment is based on the Performance Rate. This adjustment can be positive, zero or negative. When the Performance Rate Adjustment is positive we may also refer to this adjustment as “earnings.” When the Performance Rate Adjustment is negative we may also refer to this adjustment as “losses.”

Premium Tax. The amount of tax, if any, charged by the state or municipality. New York state does not currently assess Premium Taxes on Purchase Payments.

Purchase Payment. The amount paid to us under the Contract as consideration for the benefits it provides.

Rate Crediting Type. Either the Cap Rate or the Step Rate.

RMD. Required Minimum Distribution.