U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended January 31, 2009

Commission file number: 0--49996

AMERICAN GOLDFIELDS INC.

(Exact name of registrant as specified in its charter)

| Nevada | | 71-0867612 |

| (State of incorporation) | | (I.R.S. Employer Identification No.) |

5836 South Pecos Road

Las Vegas, Nevada 89120

(Address of principal executive offices)

800-942-2201

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Exchange Act:

None

Securities registered pursuant to Section 12(g) of the Exchange Act:

Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer ¨

Non-accelerated filer ¨ (Do not check if a smaller reporting company) Smaller Reporting Company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The issuer’s revenues for its most recent fiscal year were $Nil

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the average bid and asked price of such common equity as July 31, 2008 was approximately $1,703,430.

The number of shares of the issuer’s common stock issued and outstanding as of April 29, 2009 was 21,292,878 shares.

Documents Incorporated By Reference: None

TABLE OF CONTENTS

| | | Page |

PART I | | |

| Item 1 | Business | 4 |

| Item 1A | Risk Factors | 8 |

| Item 1B | Unresolved Staff Comments | 11 |

| Item 2 | Properties | 11 |

| Item 3 | Legal Proceedings | 31 |

| Item 4 | Submission of Matters to a Vote of Security Holders | 32 |

| | | |

| PART II | | |

| Item 5 | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 32 |

| Item 6 | Selected Financial Data | 34 |

| Item 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operation | 35 |

| Item 7A | Quantitative and Qualitative Disclosures About Market Risk. | 37 |

| Item 8 | Financial Statements and Supplementary Data. | 37 |

| Item 9 | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 60 |

| Item 9A | Controls and Procedures | 60 |

| Item 9B | Other Information | 60 |

| | | |

| PART III | | |

| Item 10 | Directors, Executive Officers and Corporate Governance | 61 |

| Item 11 | Executive Compensation | 63 |

| Item 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 65 |

| Item 13 | Certain Relationships and Related Transactions, and Director Independence | 66 |

| Item 14 | Principal Accountant Fees and Services | 70 |

| | | |

| PART IV | | |

| Item 15 | Exhibits, Financial Statement Schedules | 71 |

| | | |

| SIGNATURES | | 72 |

| | | |

PART I

ITEM 1. DESCRIPTION OF BUSINESS

General

American Goldfields Inc. (the “Company” or “we”), f/k/a Baymont Corporation, is a natural resource exploration stage company engaged in the acquisition and exploration of properties for deposits of gold or silver. We were incorporated on December 21, 2001 under the laws of the State of Nevada. Since then, we have engaged primarily in the acquisition and exploration of mining interests in properties that may potentially have deposits of gold and silver. To date, we have not earned any revenues.

In December 2001, we caused the incorporation of our wholly owned subsidiary, Baymont Explorations Inc., under the laws of British Columbia. Through this subsidiary we acquired a 75% undivided interest in a group of mineral claims known as the Bor Claims, being four mineral claims covering a total area of 247 acres located in the Omineca Mining Division of the Province of British Columbia, Canada. The interest was purchased from Lorne B. Warren of Smithers, British Columbia, the beneficial owner of the claims, for US$2,500. In April 2004 we terminated our interest in this property.

On various dates in 2004 and 2005, we entered into separate agreements with MinQuest Inc. (“MinQuest”) granting us an option to purchase 100% of MinQuest’s mining interests in six different properties located in various parts of the State of Nevada, which we plan to explore for the purpose of determining whether there are any commercially exploitable deposits of gold or silver. None of the properties presently has any mineral deposits. The properties are undeveloped and do not contain any open-pit or underground mines. There is no mining plant or equipment located on the properties, and there is no power supply to the properties. Our planned exploration program is exploratory in nature and no mineral reserves may ever be found.

On May 30, 2008, the Company entered into an Assignment and Assumption Agreement (the “Agreement”) with Patriot Gold Corp., a Nevada corporation (“Patriot”), to assign the exclusive option to an undivided right, title and interest in the Imperial Property to Patriot. Pursuant to the Agreement, Patriot assumed the rights, and agreed to perform all of the duties and obligations, of the Company arising under the Imperial Property Option Agreement.

Further exploration of all of our mineral claims is required before a final determination as to their viability can be made. No commercially viable mineral deposit may exist on our mineral claims. Our plan of operations is to carry out exploration work on these claims in order to ascertain whether they possess deposits of gold or silver. We can provide no assurance to investors that our mineral claims contain a commercially viable mineral deposit until appropriate exploratory work is done and an evaluation based on that work concludes further work programs are justified. At this time, we definitely have no reserves on our mineral claims.

Corporate History

From the date of its incorporation until February 5, 2004, the Company was controlled by Mr. Alfredo De Lucrezia, who was its sole officer and director and had legal and beneficial ownership of 6,000,000 (pre-forward split) shares of the Company’s common stock, or 66.8% of the issued and outstanding share capital of the Company. On February 5, 2004 Mr. Lucrezia appointed Donald Neal and Gregory Crowe to the Board and resigned as the Company’s sole officer. Mr. Neal was duly appointed as the Chief Executive Officer, Chief Financial Officer, Treasurer and Secretary of the Company. Mr. Neal’s appointment to the Board became effective on February 5, 2004, and Mr. Crowe became a member of the Board on February 23, 2004, ten days after the mailing of the Information Statement regarding such changes. On such date, Mr. Lucrezia resigned as a director of the Company.

On February 10, 2004, Mr. Lucrezia sold 3,000,000 shares of Common Stock to each of Donald Neal and Gregory Crowe pursuant to a Purchase and Sale Agreement dated as of such date. The purchase price for each share of common stock was $0.035, amounting in the aggregate to $105,000 for each of Messrs. Crowe and Neal. Immediately subsequent to this sale Mr. Lucrezia no longer held any shares of capital stock or other equity in the Company.

On February 10, 2004, Messrs. Neal and Crowe entered into a Shareholders’ Agreement dated as of such date. The agreement provided that for so long as the person holds any of the 3,000,000 shares which he received from Alfredo De Lucrezia, the directors shall vote such shares to maintain two persons on our board, or such number as the shareholders agree. Upon any vote to appoint representatives to the Board, each shareholder agreed that he shall vote his shares for the other shareholder. If one of the shareholders is no longer a shareholder, or if the Board or our shareholders decided to remove one of the Board members, or the shareholder no longer holds any of the 3,000,000 shares which he received from Mr. Lucrezia, then the other shareholder agreed to vote his shares to either maintain the number of Board members as one or to nominate a second Board member. The agreement also provided that for all other matters in which shares are voted, the two shareholders shall vote their 3,000,000 shares together as determined by the unanimous decision of the shareholders. Each of the shareholders also agreed that he would not, directly or indirectly, sell, pledge, gift or in any other way dispose of any of the 3,000,000 shares which he received from Mr. Lucrezia. This transfer restriction shall apply to such shares in all situations during all times that such individual holds any of the 3,000,000 shares.

On February 23, 2004, the Company approved a 6:1 forward stock split. As a result of the stock split, an additional 44,928,565 shares of common stock were issued. The par value of the common stock remained unchanged at $0.001 per common share but the authorized number of common stock increased to 600,000,000 from 100,000,000.

On February 24, 2004, the Company and a majority of the Company’s stockholders authorized the changing of the Company’s name to American Goldfields Inc. The name change became effective March 31, 2004.

On March 31, 2004, each of Messrs. Neal and Crowe returned 15,000,000 shares (such number reflects the 6:1 stock split) of common stock to treasury for no proceeds. The Company did not record a gain or loss as a result of this transaction. Since it is customary for a mining exploration company to acquire properties with the issuance of stock, this is an option which Messrs. Neal and Crowe considered not only feasible and reasonable, but the only practicable method for the company to acquire property in light of the Company’s current financial condition. The stockholders/directors determined that they would prefer to dilute their personal equity interests in the Company now rather than have the stockholders incur significant dilution in the future when, and if, a potential seller feels that the directors of the company have too significant of an equity interest.

On May 26, 2004, Mr. Richard Kern joined the Board of Directors of the Company. Mr. Kern is also the President of MinQuest Inc. All of the Company’s current mineral properties have been optioned from MinQuest. In addition, MinQuest has been engaged by the Company as its principal exploration contractor for all exploration performed on the Company’s current properties. As a result, a significant portion of the Company’s expenses have been the result of activities performed directly by Mr. Kern or by subcontractors managed by Mr. Kern or MinQuest.

On January 11, 2006 the Company's Board of Directors elected Dr. David Gladwell as a member of the Board of Directors of the Company.

On July 12, 2006, the Company granted stock options to Mr. Neal. Pursuant to such agreement, Mr. Neal was granted 200,000 options, with each option entitling him to purchase one share of common stock at a price of $1.00 until July 12, 2016.

On July 12, 2006, the Company and Mr. Neal entered into an Agreement, pursuant to which the Company acquired 3,000,000 common shares of the Company’s stock owned by Mr. Neal for a purchase price of $0.01 per share. The payment of the $30,000 purchase price was made on April 30, 2007.

On July 14, 2006 Mr. Crowe resigned as a Director of the Company. In connection with his resignation, the Company and Mr. Crowe entered into a Redemption Agreement, dated July 14, 2006, pursuant to which Mr. Crowe agreed to sell the 3,000,000 common shares of the Company owned by Mr. Crowe to the Company at a price of $0.01 per share. The Company paid Mr. Crowe $30,000 and returned the shares to treasury for cancellation.

On September 15, 2006, the Company's Board of Directors elected Mr. Jared Beebe as a member of the Board of Directors of the Company.

On September 12, 2008, Mr. Neal resigned from his positions as President, Chief Executive Officer, Secretary, Treasurer, and Director of the Company.

On September 12, 2008, the Board of Directors of the Company appointed Richard Kern as President, Chief Executive Officer, Secretary, and Treasurer of the Company.

Since May 2004, the Company has focused its exploration activity in the State of Nevada and the Company’s subsidiary, Baymont Explorations Inc. has been inactive. As a result, during the year ended January 31, 2007, Baymont Exploration Inc. was dissolved for failure to file Annual Reports with the Registrar of Companies in British Columbia. Baymont Explorations Inc. had no assets and its sole liability was to its Parent Company.

Competition

The mineral exploration industry, in general, is intensively competitive and even if commercial quantities of ore are discovered, a ready market may not exist for sale of same. Numerous factors beyond our control may affect the marketability of any substances discovered. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in our not receiving an adequate return on invested capital.

Compliance with Government Regulation

We are required to comply with all regulations, rules and directives of governmental authorities and agencies applicable to the exploration of minerals in the United States. The federal government and various state and local governments have adopted laws and regulations regarding the protection of natural resources, human health and the environment. We will be required to conduct all exploration activities in accordance with all applicable laws and regulations. These may include requiring working permits for any exploration work that results in physical disturbances to the land and locating claims, posting claims and reporting work performed on the mineral claims. The laws and regulations may tell us how and where we can explore for natural resources, as well as environmental matters relating to exploration and development. Because these laws and regulations change frequently, the costs of compliance with existing and future environmental regulations cannot be predicted with certainty.

Any exploration or production on United States Federal land will have to comply with the Federal Land Management Planning Act which has the effect generally of protecting the environment. Any exploration or production on private property, whether owned or leased, will have to comply with the Endangered Species Act and the Clean Water Act. The costs of complying with environmental concerns under any of these acts vary on a case by case basis. In many instances the cost can be prohibitive to development. Environmental costs associated with a particular project must be factored into the overall cost evaluation of whether to proceed with the project.

There are no costs to us at the present time in connection with compliance with environmental laws other than the reclamation bonding requirements of the Bureau of Land Management. However, since we do anticipate engaging in natural resource projects, these costs could occur at any time. Costs could extend into the millions of dollars for which we could be liable. In the event of liability, we would be entitled to contribution from other owners so that our percentage share of a particular project would be the percentage share of our liability on that project. However, other owners may not be willing or able to share in the cost of the liability. Even if liability is limited to our percentage share, any significant liability would wipe out our assets and resources.

Employees

We have no employees as of the date of this report other than Mr. Kern, our sole officer. Our sole officer and three directors (one of which is Mr. Kern) provide planning and organizational services for us on a part-time basis.

Any other services required will be conducted largely through consultants and other third parties.

Research and Development Expenditures

We have not incurred any research or development expenditures since our incorporation.

Subsidiaries

We previously incorporated a wholly-owned British Columbia subsidiary, Baymont Explorations Inc. Since May 2004, the Company has focused its exploration activity in the State of Nevada and the Company’s subsidiary, Baymont Explorations Inc. has been inactive. As a result, during the year ended January 31, 2007, Baymont Exploration Inc. was dissolved for failure to file Annual Reports with the Registrar of Companies in British Columbia. Baymont Explorations Inc. had no assets and its sole liability was to its Parent Company.

Patents and Trademarks

We do not own any patents or trademarks.

ITEM 1A. RISK FACTORS

Factors that May Affect Future Results

1. We will require additional funds to achieve our current business strategy and our inability to obtain funding will cause our business to fail.

Based upon current plans, we expect to incur operating losses in future periods. This will happen because there are expenses associated with the acquisition and exploration of natural resource properties. We will need to raise additional funds through public or private debt or equity sales in order to fund our operations and fulfill our contractual obligations. These financings may not be available when needed. Even if these financings are available, it may be on terms that we deem unacceptable or are materially adverse to your interests with respect to dilution of book value, dividend preferences, liquidation preferences, or other terms. Our inability to obtain financing would have an adverse effect on our ability to implement our current exploration in Nevada, and as a result, could require us to diminish or suspend our operations and possibly cease our existence. Obtaining additional financing would be subject to a number of factors, including the market prices for the mineral property and silver and copper. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us.

2. If we do not complete the required option payments and capital expenditure requirements mandated in our respective agreements with MinQuest, we will lose our interest in that respective property and our business may fail.

If we do not make all of the property payments to MinQuest or incur the required expenditures in accordance with the respective property option agreements we will lose our option to purchase the respective property for which we have not made the payments and may not be able to continue to execute our business objectives if we are unable to find an alternate exploration interest. Since our payment obligations are non-refundable, if we do not make any payments, we will lose any payments previously made and all our rights to the properties.

3. Because all of our mineral properties have been optioned from MinQuest and our sole Officer is also an Officer and Director of MinQuest, potential conflicts of interest could impact our business.

Mr. Kern joined the Board of Directors of the Company on May 26, 2004 and on September 12, 2008 he was appointed the Company’s President, Chief Executive Officer, Secretary, and Treasurer of the Company. Mr. Kern is also the president of MinQuest. All of the Company’s mineral properties have been optioned from MinQuest. As a result, MinQuest and Mr. Kern are related parties to the Company and both MinQuest and Mr. Kern receive substantial payments from the Company. In addition, the Company has agreed to use Mr. Kern as the primary contractor on exploration undertaken to date on all of its properties. The potential exists for conflicts of interest to occur from time to time that could adversely affect the Company’s ability conduct its business. Also, Mr. Kern is the most knowledgeable person regarding the historical and current state of exploration on the mineral properties currently optioned by the Company. If Mr. Kern were to terminate his relationship with the Company, the Company would be adversely affected while we found a suitable replacement. To date, there have not been any conflicts of interest between the Company and MinQuest or Mr. Kern.

4. Because our Directors serve as Officers and Directors of other companies engaged in mineral exploration, a potential conflict of interest could negatively impact our ability to acquire properties to explore and to run our business.

All of our Directors and Officers work for other mining and mineral exploration companies. Due to time demands placed on our Directors and Officers, and due to the competitive nature of the exploration business, the potential exists for conflicts of interest to occur from time to time that could adversely affect our ability to conduct our business. The Officers and Directors’ full-time employment with other entities limits the amount of time they can dedicate to us as a director or officer. Also, our Directors and Officers may have a conflict of interest in helping us identify and obtain the rights to mineral properties because they may also be considering the same properties. To mitigate these risks, we contract several geologists in order to ensure that we are not overly reliant on any one of our Directors to provide us with geological services. However, we cannot be certain that a conflict of interest will not arise in the future. To date, there have not been any conflicts of interest between any of our Directors or Officers and the Company.

5. Because of the speculative nature of exploration and development, there is a substantial risk that our business will fail.

The search for valuable natural resources as a business is extremely risky. We can provide investors with no assurance that the properties we have optioned in Nevada contain commercially exploitable reserves. Exploration for natural reserves is a speculative venture involving substantial risk. Few properties that are explored are ultimately developed into producing commercially feasible reserves. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to complete our business plan.

6. Because we have not commenced business operations, we face a high risk of business failure due to our inability to predict the success of our business

We are in the initial stages of exploration of our mineral claims, and thus have no way to evaluate the likelihood that we will be able to operate the business successfully. We were incorporated on December 21, 2001 and to date have been involved primarily in organizational activities, and the acquisition and exploration of the mineral claims. We have not earned any revenues as of the date of this report.

7. Because of the unique difficulties and uncertainties inherent in mineral exploration and the mining business, we face a high risk of business failure

Potential investors should be aware of the difficulties normally encountered by early-stage mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates.

8. Because we anticipate our operating expenses will increase prior to our earning revenues, we may never achieve profitability

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from the exploration of our mineral claims, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

9. Because of the speculative nature of exploration of mineral properties, there is substantial risk that no mineral deposits will be found and this business will fail

The search for valuable minerals as a business is extremely risky. Exploration for minerals is a speculative venture necessarily involving substantial risk. The expenditures to be made by us in the exploration of the mineral claims may not result in the discovery of mineral deposits. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to complete our business plan.

10. Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business

The search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. The payment of such liabilities may have a material adverse effect on our financial position.

11. Because access to our mineral claims may be restricted by inclement weather, we may be delayed in our exploration

Access to our mineral properties may be restricted through some of the year due to weather in the area. As a result, any attempt to test or explore the property is largely limited to the times when weather permits such activities. These limitations can result in significant delays in exploration efforts. Such delays can have a significant negative effect on our results of operations.

12. Because our President has only agreed to provide his services on a part-time basis, he may not be able or willing to devote a sufficient amount of time to our business operations, causing our business to fail

Mr. Kern, our sole officer, provides his management services to a number of companies. Because we are in the early stages of our business, Mr. Kern will not be spending all of his time working for the Company. Mr. Kern expects to expend approximately one day per week on our business. Later, if the demands of our business require the full business time of Mr. Kern, he is prepared to adjust his timetable to devote more time to our business. However, it still may not be possible for Mr. Kern to devote sufficient time to the management of our business, as and when needed, especially if the demands of Mr. Kern’s other interests increase. Competing demands on Mr. Kern’s time may lead to a divergence between his interests and the interests of other shareholders.

Risks Related To Legal Uncertainty and Regulations

13. As we undertake exploration of our mineral claims, we will be subject to compliance with government regulation that may increase the anticipated cost of our exploration program

There are several governmental regulations that materially restrict mineral exploration. We will be subject to the federal, state and local laws of the United States and Nevada as we carry out our exploration program. We may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these laws. While our planned exploration program budgets for regulatory compliance, there is a risk that new regulations could increase our costs of doing business and prevent us from carrying out exploration program.

ITEM 1B UNRESOLVED STAFF COMMENTS

There are no unresolved staff comments.

ITEM 2. DESCRIPTION OF PROPERTIES

We currently maintain our corporate office at 5836 South Pecos Road, Las Vegas, Nevada at a cost of approximately $100 per month. This rental is on a month-to-month basis.

We have interests in the following real properties:

GILMAN PROPERTY

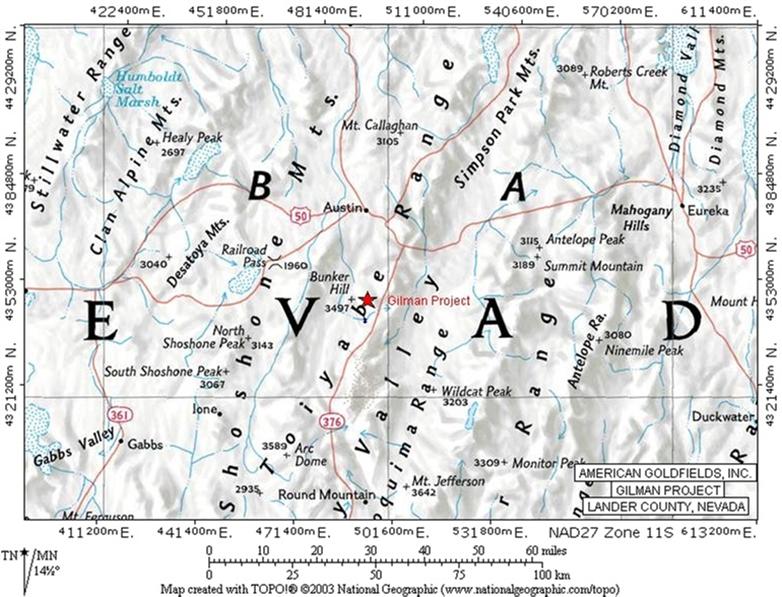

Map of Gilman Property located in western Nevada.

On May 7, 2004, the Company completed the formal agreement with MinQuest for an option to acquire a 100% interest in a property known as the Gilman Property. The agreement requires minimum annual property option payments with a total of $85,000 required to be paid by May 15, 2009. The agreement also requires minimum annual exploration expenditures with a grand total of $450,000 in expenditures required to be incurred on the property by May 15, 2009. The agreement is subject to a 3% royalty payable to MinQuest with the Company being able to repurchase up to two-thirds of the royalty for $1,000,000 for each 1% repurchased. The Company is not required to use MinQuest for exploration undertaken on the Gilman Property. However, at its discretion, the Company has engaged MinQuest as the principal contractor for exploration performed to date.

On March 22, 2005, the Company executed an amendment to the Gilman Property Option Agreement. As a result of the amendment, the Company’s obligation to incur $50,000 in exploration expenditures on the Gilman Property by May 2005 was moved to May 2009. On May 29, 2006 by way of a letter agreement the Company and MinQuest agreed to adjust the exploration expenditure commitments such that the amount due to be spent by May 15, 2006 was moved to May 15, 2007. On April 21, 2009 MinQuest granted the Company a one year extension on its Gilman property obligations. The result is that the final property option payment of $15,000 and the property expenditure requirement of $175,000 due May 15, 2009 are now due May 15, 2010. All other terms and commitments of the original agreement remain unchanged.

To January 31, 2009, the Company had made the initial option payment of $10,000 due on signing as well as the $15,000 annual option payments due in May 2008, 2007, 2006 and 2005. In addition the Company has incurred approximately $154,000 in exploration expenditures on the property. At January 31, 2009 the Company had a shortfall in property expenditures of approximately $121,000. As a result of the extension granted by MinQuest, this amount is now due to be incurred by May 15, 2010. In the event the Company does not make the indicated option payments and incur the exploration expenditures, when demanded, the Company will lose its interest in the property.

Description and Location of the Gilman Property

The Gilman Property is located in Lander County, Nevada approximately 28 kilometers south of the town of Austin, 282 kilometers east of Reno. The property currently consists of 61 contiguous, unpatented mineral claims over the eastern flank of the Toiyabe Range on the North Toiyabe Peak and Kingston US Geological Survey 7 ½’ quadrangle mapsheets. The property is accessed from Austin by following State Highway 376 for 16 kilometers. A gravel road leads west 3.5 kilometers to the main area of interest on the property.

Land claims in the district are administered under Department of Interior, Bureau of Land Management (“BLM”) and Department of Agriculture, Forest Service (“USFS”) under the Federal Land Policy and Management Act of 1976. The Gilman claims cover portions of Sections 7, 8, 17, and 18 in Township 16 North, Range 44 East in Lander County, Nevada. None of the claims have been legally surveyed. All of the claims are on USFS administered lands, while the access to the property is across BLM land.

Three of the claims on the Gilman Property are registered in the name of Mr. Herb Duerr. Under a Letter Agreement dated July 25, 2002, MinQuest leased the three claims. The Letter Agreement permits MinQuest to assign the property and terms of the agreement to third parties. This agreement covers an approximate 1.6 kilometer area. MinQuest located an additional 16 claims which all fall within the area of interest covered by the agreement MinQuest has with Mr. Duerr. Mr. Duerr subsequently granted to MinQuest the rights necessary to allow MinQuest to enter into agreements with third parties for the additional 16 claims. To maintain the claims in good standing, maintenance fees totaling $135 per claim are payable to the BLM on or before September 1 of each year. Recording fees of approximately $15 per claim are required by Lander County each year.

All of the Gilman Property is within the Toiyabe National Forest, administered by the USFS. Exploration within national forest lands must be permitted by the USFS. Prior to undertaking exploration activities a Plan of Operations must be submitted to the USFS for review. An environmental assessment and public input is required necessitating an approximate four month lead time before undertaking any disturbance. A reclamation bond to cover costs of such disturbances is required to be posted with the USFS. Access to the Gilman Property is across BLM administered land. As there are existing roads and tracks in place, no permit is required to cross these lands. No permits have been applied for or are currently issued for the Gilman Property.

Exploration History of the Gilman Property

There is no known production or history data from the Gilman Property, but several pits and two adits are evidence of prior exploration activities. Numerous companies conducted property reviews and sampled the showings in the area, which have locally returned high concentrations of gold.

Geology of the Gilman Mineral Claims

The geology of the property is described in a December, 2002 report by Geoffrey N. Goodall, President of Global Geological Consultants Ltd., a private consulting firm. Mineralization on the Gilman Property is associated with a steep, easterly dipping and northerly trending range front fault. Jasperoid and massive quartz veining have developed along the fault zone and local east trending faults offset the jasperoid. Sulphide rich quartz veining occurs at the base of the silicified fault zone. Sulphides identified at Gilman include pyrite, arsenopyrite, galena, chalcopyrite and sphalerite. The primary focus of exploration at the Gilman Property is for structurally hosted high-grade gold/silver mineralization. Mineralization at Gilman consists of a gossanous shear zone and quartz veins along the base of a range front fault zone. Gold, silver, and copper associated with the fault system have been located in the area.

Current State of Exploration

The Gilman claims presently do not have any mineral reserves. The property that is the subject to our mineral claims is undeveloped and does not contain any open-pit or underground mines. There is no mining plant or equipment located on the property that is the subject of the mineral claim. Currently, there is no power supply to the mineral claim. Our planned exploration program is exploratory in nature and no mineral reserves may ever be found.

Geological Exploration Program

Evaluation of the Gilman claims to January 31, 2007 had consisted of the preparation of a topographic base map, and surface and underground geochemical sampling. In addition, as part of the permitting process the Company undertook an archeological review of the property. During 2008, the Company received a permit to drill on the Gilman Property. The Board of Directors approved an $112,500 (excluding reclamation bond and claim filing fees) drilling budget that includes three reverse circulation holes for a total of 3,000 feet of drilling. The program began in January 2008 with the goal of testing a previously untested range front fault hosted quartz vein system. Testing has been initiated at the northern end of a mile-long target zone. Due to heavy snowfall only one hole was drilled in January 2008 before the rig had to be removed from the property. It is hoped that drilling will be restarted in 2009.

IMPERIAL PROPERTY

Map of Imperial Property located in western Nevada.

On June 30, 2004, the Company entered into an agreement with MinQuest for an option to acquire a 100% interest in a property known as the “Imperial Property.” The Company made the first scheduled option payment of $60,000 upon signing the agreement. The agreement requires certain additional minimum annual property option payments with a total of $80,000 required to be paid by July 1, 2008. The agreement also requires minimum annual exploration expenditures with a grand total of $500,000 in expenditures required to be incurred on the property by July 1, 2009. The property option agreement is subject to a 3% royalty payable to MinQuest. The Company is required to use MinQuest for exploration conducted on the Imperial Property.

To January 31, 2008, the Company had made the initial option payment of $60,000 upon signing the agreement as well as the $20,000 option payments due in July 2007, 2006 and 2005. In addition the Company has incurred approximately $277,000 in exploration expenditures on the property.

On May 30, 2008, the Company entered into an Assignment and Assumption Agreement (the “Agreement”) with Patriot Gold Corp., a Nevada corporation (“Patriot”), to assign the exclusive option to an undivided right, title and interest in the Imperial Property to Patriot. Pursuant to the Agreement, Patriot assumed the rights, and agreed to perform all of the duties and obligations, of the Company arising under the Imperial Property Option Agreement. Simultaneous with the execution and delivery of the Agreement, the Company received $250,000 from Patriot, which amount represents the full payment and satisfaction for the assignment by the Company to Patriot of the Imperial Property Option Agreement and all rights and obligations with respect thereto. Included in the assignment were, without limitation, all sums incurred by the Company in connection with the Imperial Property, specifically (i) the refunding of the reclamation bond previously paid by the Company to the Bureau of Land Management in Nevada in the amount of $13,255; (ii) the approximately $277,000 of expenditures incurred by the Company prior to the Agreement; and (iii) the $120,000 paid to MinQuest Inc. by the Company as option payments under the Imperial Property Option Agreement.

HERCULES PROPERTY

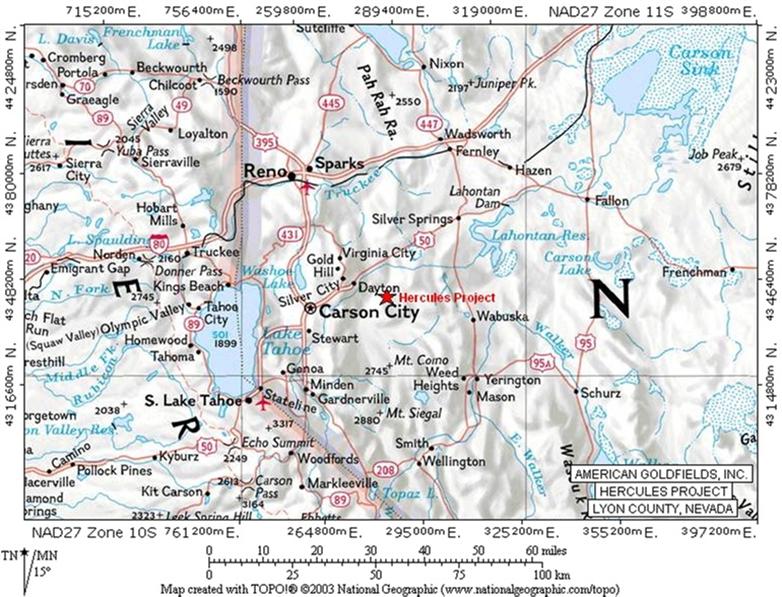

Map of Hercules Property located in western Nevada.

On October 22, 2004, the Company entered into an agreement with MinQuest for an option to acquire a 100% interest in a property known as the “Hercules Property.” Concurrent with the signing of the agreement, the Company made the first property option payment of $20,000. The agreement requires certain additional minimum annual property option payments totaling $200,000 and minimum annual exploration expenditures totaling $4,050,000 to be paid or incurred by November 25, 2014. The agreement is subject to a 3% royalty payable to MinQuest with the Company being able to repurchase up to two-thirds of the royalty for $3,000,000. On May 29, 2006 by way of a letter agreement, the Company and MinQuest agreed to adjust the timing of exploration expenditures such that an aggregate amount of approximately $300,000 was to be spent by September 1, 2006. On April 21, 2009 MinQuest granted the Company a one year extension on its Hercules property obligations. The result is that the $20,000 property option payments due annually on November 25, 2008 through 2014 inclusive are now due on November 25, 2009 through 2015 inclusive. The annual property expenditure requirements of $500,000 required to be incurred annually by November 25, 2009 through 2014 respectively are now due to be incurred by November 25, 2010 through November 25, 2015.

To January 31, 2009, the Company had made the initial option payment of $20,000 due on signing as well as the $20,000 option payments due in November 2007, 2006 and 2005. In addition the Company has incurred approximately $792,200 in exploration expenditures on the property. At January 31, 2009 the Company had a shortfall in property expenditures of approximately $257,800. As a result of the extension granted by MinQuest, this amount is now due to be incurred by November 25, 2009. In the event the Company does not make the indicated option payments and incur the exploration expenditures, when demanded, the Company will lose its interest in the property.

Description and Location of the Hercules Property

The Hercules Property is located in Lyon County, Nevada, approximately 40 kilometers southwest of Reno. Access is via 11 kilometers of paved and dirt road from Dayton. The property consists of 40 unpatented claims. Land claims in the district are administered under Department of Interior, Bureau of Land Management (“BLM”) under the Federal Land Policy and Management Act of 1976. MinQuest holds a 100% interest in these claims via unpatented mining claims.

Exploration History of the Hercules Property

The Hercules Property was first discovered in 1860 by pioneers during the famous “Washoe Rush”. Production from high grade veins started as early as 1870 and occurred as late as 1956. The Hercules Mine, located on the property, had production of 5,000 ounces of gold and 20,000 ounces of silver as indicated from stoping. Recent exploration efforts began in the early 1980’s when placer mining was attempted on the eastern portion of the property, below the Hercules Mine. Since then, Asamera, St. Joe, Horizon Gold, Phelps Dodge and Adamas\GSL have conducted exploration efforts totaling over US$2,000,000 in expenditures. Drilling undertaken by predecessor companies are as follows:

| | St. Joe | 1985 | 11 RC holes for 2,715 feet (882 m) |

| | Asamera | 1985 | 10 Core holes for 4,314 feet (1,400 m) |

| | Horizon Gold | 1986-90 | 138 RC holes for 18,091 feet (5,874 m) |

| | Phelps-Dodge | 1995-97 | 17 RC holes for a total of 8,805 feet (2,859 m) |

A total of 33,925 feet (11,015 m) in 176 holes have been completed on the property. The vast majority of the drilling targeted shallow open pit heap-leachable gold mineralization. No systematic exploration of the high-grade vein targets has been completed.

Geology of the Hercules Mineral Claims

The property lies within the Walker Lane structural corridor. The Walker Lane is characterized by a strong northwesterly structural fabric causing easterly rifting. As with much of the Walker Lane rocks at Hercules consist dominantly of Tertiary age pyroclastic volcanics and volcaniclastic sediments cover the entire property. The pyroclastic rocks have been intruded by several volcanic vents and plugs. Thin post-mineral basalt and rhyodacite of Pliocene age cover mineralization on the northern and western sides of the property.

The Hercules Property contains one of the most significant untested Comstock-type vein systems in the Western U.S. The depth of erosion of the Hercules vein system is evidenced by the following:

| 1. | Multiple parallel veins that should merge at depth. |

| 2. | Presence of low-temperature alteration minerals such as chalcedony, calcite, and kaolinite in exist in veins at current surface. |

| 3. | Presence of low temperature elements such as mercury, arsenic and antimony. |

| 4. | A low silver to gold ratio relative to bonanza horizon. |

| 5. | Low base metal content (lead, zinc) relative to bonanza horizon. |

| 6. | Localized high-grade gold (+0.5 oz/ton) in veins at current erosion surface. |

The Hercules mineralization is largely localized along two parallel dip-slip multi-vein structures which trend north-northeast. The structures have near-vertical dips and have been offset by two east-west faults. Gold/silver is hosted by permeable volcanics/volcaniclastics as well as by the high-angle structures. The highest grade mineralization occurs in quartz veins within the faults. Silicification and banded quartz-adularia veins are surrounded by intense clay alteration grading to weak propylitic alteration.

The second target type at Hercules is bulk-minable, heap-leachable gold/silver.This area contains the following individual target areas:

| • | Zones C/D/E contain significant mineralization.within three separate pods. Drilling is wide spaced and incomplete between the three pods. The pods remain open ended along strike and down dip. These pods may join along strike. Two claims not owned by MinQuest cover part of this resource. In the past, these claims were leased for reasonable terms. |

| • | Zone A/B is an extension of the C/D/E/ zone. The A/B zone contains additional mineralization of gold and silver. |

| • | The West Cliff Zone also contains additional mineralization as indicated in widely spaced drilling and surface sampling results. Untested mineralization occurs north of the West Cliff resource. This area has a 5,000 feet (1620 m) strike length. |

| • | The Loaves Zone is the last target in this area. |

All of these areas remain open along strike and at depth.

St. Joe and Horizon Gold performed bulk tests from drill cuttings and surface samples. The average recovery for gold was 88%. The process involved crushing and pulverizing the sample and completing a bottle roll using over 50 separate samples. Although the tests are encouraging, further metallurgy is needed to determine recoveries of various size fractions.

A bonanza grade gold/silver deposit is the primary target at Hercules. All of the mineralized vein structures listed previously are targets. Exploration should begin in areas with higher-grade gold values at surface, with higher silver/gold ratios, more base metals, higher temperature alteration suites and where multiple veins occur. This will ensure the shallowest targets will be tested first. The most likely site to start as indicated by initial study is area D and E of the Hercules Mine target. Accurate drilling down dip in 100 m steps will allow spot coring of the target horizon at 300-400 m beneath the surface.

The secondary target is open pit bulk-minable heap leachable gold/silver for which some resources have already been established. The size and grade of these resources could be increased by drilling across their feeder structures and by drilling possible extensions.

The West Cliff target is located in the southwest portion of the property. This area is defined by 17 widely spaced drill holes and underground and surface channel sampling results. Soil sampling and drilling suggests a second en-echelon zone occurs 300 feet (100 m) east of the main zone. The area is open ended for 1000 feet (305m) north, 600 feet (180 m) south and down dip to the west. Only two holes have tested the parallel zone.

The Loaves target consists of a zone of silicified volcanics containing banded quartz veins. The zone has a strike length of over 5,000 feet (1520 m) and extends under cover to the northwest. This zone is probably the offset extension of the West Cliffs resource. Only two of ten holes drilled to date have tested the structure. Previous drilling has targeted the footwall side of the fault. Even so, long intervals of anomalous gold with occasional short intervals of higher grade were encountered. This target requires angle drilling to test the hanging wall side of the structure to penetrate the fault zone at depth and along strike.

The Hercules Mine and Extensions (C\D\E) targets cover the main Hercules structure and parallel fault zones. Drilling and sampling from underground and outcrop areas have encountered relatively thick intercepts of gold and silver. This wide spaced drilling (both core and RC) and underground sampling indicate multiple mineralized structures with associated disseminated mineralization. The core samples were only partially assayed and may contain more gold than is displayed on the cross sections. The zone remains open for at least 1000 feet (300 m) north, over 1000 feet (300 m) south. Parallel mineralized structures are known to exist further to the east within the claim block.

The southern of the three Loaves targets contains 3 holes and surface panel sampling. Soil sampling suggests a minimum of 1700 feet (515 m) of strike length that remains untested.

Current State of Exploration

The Hercules claims have had a significant amount of exploration undertaken in their history. However, they do not currently have any mineral reserves. The property that is the subject to our mineral claims is undeveloped. There is no mining plant or equipment located on the property that is the subject of the mineral claim. Currently, there is no power supply to the mineral claim. Our planned exploration program is exploratory in nature and no mineral reserves may ever be found.

Geological Exploration Program

The exploration potential at the Hercules Property is considered excellent. Several of the near-surface targets were poorly tested and are open between the current targets. Obvious extensions of drilling, soil and rock gold anomalies and high grade veins in old workings suggest not only an excellent chance of increasing the known resource of open pit mineralization but of finding a world class bonanza gold/silver deposit at depth. The vast majority of the previous resource drilling was vertical and did not test for these potentially higher grade fault zones.

During 2005 the Company undertook an exploration program on the Hercules Property. The program consisted of geologic mapping, geochemical sampling, compilation of previous drilling data, and a re-evaluation of geophysical surveys. Also, a total of 105 soil samples were collected on the north end of the property. The geophysical targets on the northern portion of the claim block were reviewed and evaluated. The information developed from previous exploration groups was combined with new information from the geophysical surveys and recent mapping to place 7 reverse circulation holes to determine strike, dip and stratigraphy within the A, B, C, West Cliffs and Bread Loaves mineralized zones. The structures believed to be present in these areas would provide a pathway for mineral rich fluids. The fluids should pond within certain porous rock types below impermeable stratigraphy.

Six drill holes were located on the margins of the previously defined mineralized zones. The seventh hole tested a parallel alteration zone to the west of any previous drilling. Seven drill holes were completed for 2,470 feet (753 m). The drilling extended the known precious metals mineralization near surface and between pods A-C. The holes also defined several fault zones that fed these mineralized areas. Generally, the fault zones were encountered within an impermeable mudstone unit. The faults were represented by bleaching, iron oxide and clay alteration within the mudstone. The faults were 3 to 8 meters wide and contained anomalous gold values in the 0.01 to 0.05 g/t range. It is believed that this mudstone unit restricted the flow of mineralizing fluids and may have caused ponding of the fluids at its base.

The following table lists the intercepts in each drill hole:

| Drill Hole # | Gold Eq g/t | Thickness (m) | From (m) | To (m) |

| HY 05-01 | 0.95 | 12.2 | 6.1 | 18.3 |

| HY 05-02 | 0.379 | 1.5 | 32.0 | 33.5 |

| | 0.33 | 10.7 | 44.2 | 54.9 |

| | 0.83 | 3.0 | 65.5 | 68.5 |

| HY 05-03 | 0.58 | 3.0 | 32.0 | 35.0 |

| | 0.32 | 4.5 | 41.2 | 45.7 |

| | 0.54 | 3.0 | 51.8 | 54.8 |

| | 0.59 | 6.1 | 83.8 | 89.9 |

| HY 05-04 | 0.38 | 6.1 | 3.0 | 9.1 |

| | 0.61 | 1.5 | 10.7 | 12.2 |

| | 0.45 | 1.5 | 42.7 | 44.2 |

| | 0.42 | 1.5 | 54.9 | 56.4 |

| HY 05-05 | NSV | | | |

| HY 05-06 | 0.55 | 1.5 | 51.8 | 53.3 |

| HY 05-07 | NSV | | | |

NSV = no significant values found

All holes successfully identified altered and mineralized structures. Holes 05-01 through 05-04 extended the known ore zones of A through C east and north. It appears that drill hole 05-05 may have missed the West Cliffs vein due to thicker alluvial cover than anticipated. Hole 05-07 was the only hole that tested outside of the known mineralization. The hole intersected an opaline rich structure hosted within basalt and andesite west of any previous drilling. The structure contained sulfide minerals (mainly pyrite) and low temperature quartz, but did not contain any significant precious metal values. The cuttings were not assayed for trace elements. This structure is along strike of an interpreted fault defined by an IP geophysical survey to the north.

During 2006 the Company completed a drill program consisting of 10 holes for a total of 4,805 feet which was completed in March 2007.

Hole H0601 - tested altered volcanic rock on the west side of the property. This hole was angled at -45 degrees N25E to test a fault zone containing silicified and pyritic mudstone and tuff at surface. This near surface zone of alteration was encountered from surface to 45 feet. The hole passed through clay altered volcanic tuff and remained in unaltered mudstone from 140 feet to 480 feet. The last 20 feet of the drill hole from 480 to 500 feet contained unaltered latite. In other areas of the property the mudstone unit varies from 140 to 210 feet in thick. Given the angle of the drill hole and the possibility of relatively flat bedding, the true thickness of the mudstone in H0601 is probably 230 to 240 feet. This is consistent although a little thicker than the suggested thickness from elsewhere on the property.

Holes H0602 to H0605 - targeted the eastern structural trend. H0602, H0602A and H0603 were step offs of the 2005 drilling efforts. This year’s drill holes were drilled at steeper angles from -60o to - -70o and to depths of 500 to 600 feet to provide deeper penetration of the mudstone unit in resource area “A”. The holes were stepped back east from the 2005 drill holes by 100 feet. No faults were apparent in the mudstone, although the faulting projected from the 2005 drilling suggested a 60 to 65 degree dip to the east.

Hole H0602 was drilled 100 feet east of H0501 N60W at an angle of -70. The hole penetrated 65 feet of post mineral dacite then encountered silicified and clay altered volcanic agglomerate to 120 feet. At this point the hole was lost due to caving. A five foot intercept of 2.32 ppm gold within a broader 20 feet zone of .89 ppm gold was encountered immediately below the dacite cap.

Hole H0602A was drilled 20 feet northeast of 0602 due east at an angle of -60. This hole encountered 10 feet of 0.2 ppm gold from 75 to 85 feet and at least one five foot sample that was a void (no sample collected). The alteration was similar to H0602 just below the dacite. H0602A contained 260 feet of mudstone before encountering an unaltered crystal tuff to volcanic agglomerate at 490 feet. No alteration or elevated gold values were encountered below the initial gold values described above.

Hole H0603 was drilled 400 feet north of H0602 on the northern margin of the “A” resource described in previous reports. H0603 offset H0503 by 125 feet east. Hole H0603 was set up to intersect the projected “A” structure perpendicularly. The hole was angled N60W at -70 degrees. It entered the mudstone unit at 30 feet and remained in mudstone for its entire length. Clay alteration of the mudstone was noted between 30 and 125 feet, but no significant gold values or silica were present within this zone. It is assumed that a fault zone down dropping the mudstone to the west, artificially thickening the unit by repeating the sequence.

Holes H0604 and H0605 were drilled to the west of resource area “C”. Hole H0604 was drilled due east at -45o. Hole H0605 was drilled S80E at -45o. The “C” resource area is poorly defined by drilling. Only 2 holes were previously drilled on the western side of the “C” resource fault zone. Only one of those contained ore grade values and that hole was positioned on top of the fault. The 2006 drill program stepped back 100 to 200 feet from the fault to determine if the fault rolled back to the west. Both holes encountered significant near surface alteration and mineralization from 40 feet to depth.

Hole H0604 was drilled furthest south and encountered 50 feet of 0.45 ppm gold from 70 feet to 120 feet. An additional five feet assayed 0.42 ppm at 250 feet. Both mineralized zones contained significant quartz veining, silicification and argillization. The second area of deeper mineralization may be related to high-angle faulting. Drill hole H0605 was positioned 300 feet northwest of H0604. H0605 penetrated 105 feet of alluvium before encountering 60 feet of 0.49 ppm gold. Within this mineralized interval, 25 feet of 0.71 ppm was intercepted with a best of 1.345 ppm over five feet. These intercepts have significantly increased the area of the “C” resource and provided excellent potential for discovery of additional resources to the west of the known mineralization.

Holes H0606 to 0608 – were all drilled in the West Ridge resource area. The holes offset known mineralization in the pediment and were projected to encounter vein mineralization at depth. All of the drill holes encountered significant alteration with anomalous gold and silver values over widths of 25 to 80 feet thick. Generally, these altered zones start immediately below alluvial cover. The alteration consists of stockwork quartz-calcite veining and silicification within a crystal tuff to tuff breccia.

H0606 was the furthest south drill hole in the 2006 drill program. It offset Phelps Dodge drill holes with significant mineralization in alluvium cover. Hole 0606 intersected the best overall gold and silver values of the three holes drilled in this area. The mineralization started at the base of the alluvium (140 feet) and continued over a width of 55 feet. The best interval averaged 0.47 ppm gold and 11 ppm silver over 40 feet or 10 feet of 0.72 ppm gold and 13 ppm silver. Although these values are not stunning, this hole extends mineralization from the Phelps Dodge drilling. It is the furthest west hole drilled to date and indicates the mineralization continues to get better further to the west.

H0607 was drilled about 400 feet northeast of H0606. This hole contained approximately 50 feet with an average of 0.1 ppm gold and 1 ppm silver. Although this is not ore grade, the zone is definitely significant. It suggests a rather large area of alteration which is totally blind and open to the north, west and south in relatively flat landscape which would be easy to explore. Weak alteration and mineralization continues in H0607 to 480 feet. The drilling continued to 530 feet, but alteration tapers off dramatically.

H0608 was drilled about 300 feet further to the northeast to offset a Phelps Dodge drill hole. The PD hole encountered 20 feet of 0.23 opt gold (about 7.5 ppm gold). In H0608 the entire hole contained moderately altered volcanic breccias with minor quartz stockworks and moderate bleaching of mafic minerals. The entire hole was anomalous in gold (0.0X ppm). Several individual zones contained 15 to 20 feet thick intercepts of mineralized quartz veining. The gold and silver values remained weak compared to the previous drilling by Phelps Dodge. However, the discreet zones of mineralization generally averaged 0.2 ppm gold and 12 ppm silver within thicker intercepts of 0.0X ppm. Individual five feet samples assayed 0.3 to 0.45 ppm gold and up to 30 ppm silver.

Holes H0609 and H0610 - targeted two altered structures within a crystal tuff unit. The mineralized area is 800 feet west of the western margin of resource “A”. Both drill holes were located to intersect apparent mineralized structures observed on surface. Drill hole H0609 was drilled due east at -60 degrees. It intersected 15 feet of gold mineralization (0.66 ppm) from 65 to 80 feet. This zone may be related to bedding replacement of a volcanic tuff.

Hole H0610 encountered 15 feet of 0.24 ppm gold and 3 ppm silver in a near surface zone of silicified volcanic material between 55 and 70 feet. An additional zone of silicified and mineralized material was encountered between 180 and 200 feet. This zone included an average of 0.2 ppm gold and 2 ppm silver which is likely coincident with the obvious structure on surface. Both drill holes encountered blind near surface mineralization adjacent to structures that had been previously recognized and drilled.

The 2006 drilling program was successful in expanding the known target areas and finding new areas of near-surface, low grade gold and silver. The new intercepts in the “C” resource area (H0604 and H0605), and the West Cliffs zone (H0606 through 0608) combined with the intercepts from the 2005 drilling program in the “A” area indicate potential for an increase in the historic target zones. Drilling in the north central area also provided new evidence for increasing targets (H0609 and 0610). The interpretation of the 2006 drilling results also suggests faults previously believed to dip to the east may roll to the west at relatively shallow depth. This finding coupled with the potential for increase of near-surface resources indicates changes are necessary to the exploration philosophy at Hercules.

Future drill programs will be concentrated on further developing the shallow targets on both the east and west sides of the known structures. Previously, the historic drilling had concentrated on the east side of the structures, defining the shallow resources in “A” through “C”. The recent holes drilled in the 2005 and 2006 exploration programs suggest further near-surface targets are likely to be developed within the “A” through “C” areas, the West Cliffs hanging wall and the central core between these two areas. The topography is relatively flat allowing for an inexpensive, shallow drilling program.

Drilling to depth on the structural zones remains a significant target for developing high grade resources at depth. Because of the interpretation of the deeper drill holes completed during this program, it is recommended that the next set of deep holes on the property should be drilled from west to east on the northeastern veins within the “B” to “C” resource areas. The interpretation of the recent drilling suggests that the veins may roll over developing dips of near vertical to westerly at depths of less than 500 feet.

During 2007 the Company conducted a drill program that was completed in March 2008. The program included the drilling of 24 holes for a total 7,415 feet. The budget for the program approved by the Board of Directors was $275,000. The Company is awaiting the final assay and report results.

CORTEZ PROPERTY

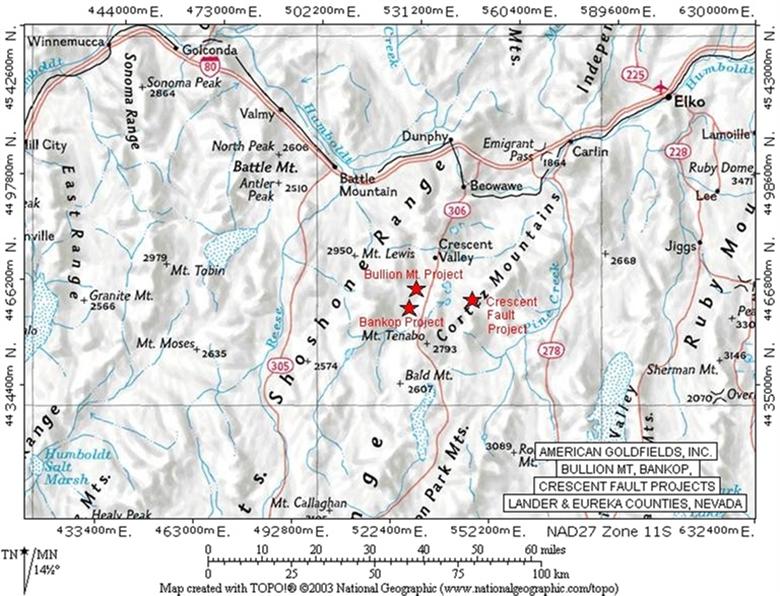

Map of the Cortez Properties located in western Nevada.

On February 28, 2005, the Company entered into an agreement with MinQuest for an option to acquire a 100% interest in properties known as the “Crescent Fault Property,” the “Bankop Property,” and the “Bullion Mountain Property” (collectively, the “Cortez Property”). Concurrent with the signing of the agreement, the Company made the first property option payment of $65,000. The agreement requires certain additional minimum annual property option payments totaling $445,000 and minimum annual exploration expenditures totaling $1,150,000 to be paid or incurred by February 15, 2010. The agreement is subject to a 3% royalty payable to MinQuest. In addition, the Company is required to use MinQuest for exploration activities undertaken on the properties. On May 29, 2006 by way of a letter agreement, the Company and MinQuest agreed to adjust the timing of exploration expenditures such that an aggregate amount of approximately $250,000 was to be spent by September 1, 2006. On April 21, 2009 MinQuest granted the Company a one year extension on its Cortez property obligations. The result is that the $75,000 property option payments due on February 26, 2009 is now due February 26, 2010 and the $250,000 due on February 26, 2010 is now due February 26, 2011. The annual property expenditure requirement of $300,000 required to be incurred by February 26, 2009 is now due to be incurred by February 26, 2010 and the $250,000 due February 26, 2010 is now due to be incurred by February 26, 2011.

To January 31, 2009, the Company had made the initial option payment of $65,000 due on signing as well as the $50,000, $40,000 and the $30,000 option payments due in February of 2008, 2007, and 2006 respectively. In addition the Company has incurred approximately $242,900 in exploration expenditures on the property. At January 31, 2009 the Company had a shortfall in property expenditures of approximately $207,100. As a result of the extension granted by MinQuest, this amount is now due to be incurred by February 26, 2010. In the event the Company does not make the indicated option payments and incur the exploration expenditures, when demanded, the Company will lose its interest in the property.

CRESCENT FAULT PROPERTY

Description and Location of the Crescent Fault Property

The Crescent Fault Property is located in Eureka County, Nevada and consists of 33 unpatented claims. Access to the property is via paved highway and graded gravel road. Land claims in the district are administered under Department of Interior, Bureau of Land Management (“BLM”) under the Federal Land Policy and Management Act of 1976. All claims are held by Desert Pacific Exploration (‘DPE’) and under a Letter Agreement dated February 26, 2005 MinQuest acquired the rights to the claims comprising the Crescent Fault Property from DPE. The Letter Agreement allows MinQuest to assign its interest to third parties.

Exploration History of the Crescent Fault Property

The Crescent Fault Property was explored by Homestake from 1983 to 1986, Noranda from 1992 to 1994, and North Mining from 1995 to 1996. Past exploration includes considerable rock chip sampling, geologic mapping, and drilling. Clastic sediments have been silicified and argillized along a range front fault zone. Drilling has tested part of the range front and some of the down dropped section. Drilling on the property is summarized as follows:

| Homestake | 1985-1986 | 2 holes drilled for 1,855 feet |

| Noranda | 1992-1993 | 8 holes drilled for 4,436 feet |

| North | 1995 | 8 holes drilled for 3,930 feet |

Drilling has intersected significant sphalerite and galena. The lead-zinc mineralization appears to be related to epidote-chlorite skarn. The drilling has focused on testing the surface expression of pyritic jasperoid and quartz veining developed within parallel to sub-parallel faults to the range front. Potential down dropped sections of mineralization may exist under alluvial cover. Outcrops of jasperoid are developed along low angle thrust faults and high angle shear zones. Tertiary age dikes have been noted along high angle faults trending northwesterly.

Geology of the Crescent Fault Property Mineral Claims

The property was discovered while prospecting along the Crescent fault. One short adit and a few small prospect pits were the only evidence of previous exploration efforts prior to the first drill holes. The drilling has focused along the range front, intersecting significant alteration and mineralization.

The regional geology consists of a package of Pennsylvanian to Permian carbonate to siliciclastic sediments. This sediment package has been intruded by a possible Cretaceous granodiorite to porphyry rhyolite. The range front has had both strike-slip and dip-slip movement, down dropped along the Crescent fault. Placer Dome has determined the strike-slip movement to be up to 1 mile in an east-northeasterly direction. Many parts of the Crescent fault have been down dropped over 1000 feet under alluvial cover. In the vicinity of the property, drilling and geophysical data indicate a shelf of bedrock has been preserved at depths ranging from 250 to 400 feet deep for up to 1000 feet from the fault zone. Potential for a preserved portion of mineralized bed rock at reasonable depth is very good.

Tertiary volcanoclastics on the eastern part of the property are altered and quartz veined along strike of the fault. Jasperoid shows slickensides indicating two movements, one down dropped and one left lateral. Low angle faulting was noted near the top of the ridge and has been down faulted along the range front, in the next section west. The low angle faulting is represented by Ordovician chert and quartzite thrust over Pennsylvanian carbonate. North to northwest trending faults bisect the range front fault zone, down dropping and offsetting mineralization in several areas. Possible Tertiary age dikes and sills have intruded and healed several northwesterly faults and the crescent fault zone. These dikes are argillized, iron stained and in a few places, quartz veined.

The property covers a well defined zone of alteration exposed along the range front fault zone bounding the southeast portion of Crescent Valley. The alteration is composed of jasperoid, decalcified limestone, silicified shale, and quartz veining filling faults and fractures in intrusive rocks and siliciclastic sediments. Tertiary age dikes have intruded the sediments and older intrusive rocks, generally following a northwesterly trend. Alteration zones carry low values in gold, silver and copper along with minor elevations of trace elements typically identified in other disseminated gold deposits of the area. The jasperoid is vuggy with weak, erratic gold and anomalous arsenic, mercury and antimony on the surface.

The Jasperoid target dips northwesterly under alluvium, paralleling the Crescent Fault. Drilling has intercepted relatively shallow bedrock under the alluvium, but no gold has been encountered to date. Extensions of the zone will be mapped and sampled to further define this target area.

Skarn mineralization is hidden. Skarn is weakly developed and spotty throughout the area. Drilling has encountered high grade gold and base metals in carbonate rocks. Mapping of alteration phases may better define the Skarn target. At present, the best potential target is a blind skarn zone with high-grade gold potential.

Current State of Exploration

The Crescent Fault claims presently do not have any mineral reserves. The property that is the subject to our mineral claims is undeveloped and does not contain any open-pit or underground mines. There is no mining plant or equipment located on the property that is the subject of the mineral claim. Currently, there is no power supply to the mineral claim. Our planned exploration program is exploratory in nature and no mineral reserves may ever be found.

Paved roads come within 5 miles of the property and well maintained gravel roads provide access within 1,000 feet of the property boundary. A dirt road is in place and provides adequate access throughout the property. All currently proposed drilling can be done without further road building.

Geological Exploration Program

Potential exists for the existence of relatively high-grade gold. The exploration completed to date has identified mineralization within fault zones parallel to the range front fault. Sampling has indicated weakly anomalous gold values exist over 12,000 feet of strike length. In 2005 the Company initiated a program of geophysical and geochemical surveys over the pediment area along strike of the mineralization. The surveys were following up on the observations of previous geophysicists and drill-hole data from former property owners suggesting shallow pediment. Five CSMT (Controlled Source Magneto Telluric) survey lines were collected to determine changes in lithology and potential parallel faulting to the main Crescent Fault.

Also in 2005 a reconnaissance auger sampling program was designed to test for concealed gold mineralization in pediment cover. The auger holes were positioned 30 meters apart along each line and the lines were separated about 300 meters apart, perpendicular to the range front. The holes tested the caliche layer developed within transported material. Gold mineralization is known to leak from sources below and become entrapped in the caliche layer. This system is not widely used but is proven technology in finding buried gold deposits in desert environments in both Nevada and Australia. It has been successful in finding at least two gold deposits in the Battle Mountain area.

A total of 175 samples were collected along 9 widely separated lines. The samples were tested for calcium carbonate on site and 31 elements in the ALS/Chemex lab. No gold was identified in any of the samples.

The 2005 program of CSMT and auger drilling did not identify any significant drill targets within the pediment zone. The topography is too steep to effectively conduct geophysical surveys to identify new drill targets on the rest of the property. However, the original drill targets still remain.

The exploration contractor has made several recommendations to the Company. Amongst the recommendations are that at least one drill hole should be spotted to intersect the favorable host rocks at a depth of 300 meters and a second hole should be placed to twin the original drill hole that intersected 4 g/t gold. This hole would determine the alteration type and structural control of the mineralization. It has also been recommended that 5 additional drill holes be targeted at areas of gold in rock chip that have yet to be drill tested. Offsetting known mineralization in previous drilling is also highly recommended.

The Crescent Fault Property forms part of the Cortez Property and as such is covered by the Cortez Property Option Agreement such that annual minimum property expenditures can be incurred on any of the three properties making up the Cortez Property. Based on an evaluation of the previous work undertaken on the Cortez Property and based upon recommendations from MinQuest, the Company elected to conduct a drill exploration program on the Bankop Property in 2006 in order to meet the Company’s exploration expenditure commitments under the Cortez Property Option Agreement. As a result, the Company did not undertake an exploration program on the Crescent Fault claims in 2006.

For 2007 the Board of Directors has approved a budget of $150,000 for the Crescent Fault Property. The exploration plan includes drilling three or four holes for a total of 2,000 feet. The work has not yet been completed but it is hoped that it will be undertaken in May or June 2009 but the Company has not yet made its determination on its 2009 exploration programs.

BANKOP PROPERTY

Description and Location of the Bankop Property

The Bankop Property is located in eastern Lander County, Nevada, approximately 40 kilometers (25 miles) southeast of Battle Mountain and six kilometers (4 miles) northwest of the Pipeline Mine. The property consists of 24 unpatented mining claims. Land claims in the district are administered under Department of Interior, Bureau of Land Management (“BLM”) under the Federal Land Policy and Management Act of 1976. All claims are held by Desert Pacific Exploration (‘DPE’) and under a Letter Agreement dated February 26, 2005 MinQuest acquired the rights to the claims comprising the Bankop Property from DPE. The Letter Agreement allows MinQuest to assign its interest to third parties.

Exploration History of the Bankop Property

There has been no production from the Bankop claims.

Historic prospect pits, adits, and shafts occur throughout the low lying hills of the area. The property has seen recent exploration efforts beginning as early as 1965. Exploration companies involved included U.S Mining and Exploration Company, Inc., Phelps Dodge, Inc., Placer Amex, Inc., Cyprus Exploration Company, Homestake Mining Company, U.S Borax, Placer Dome U.S. Inc., Noranda Exploration, Inc. (Hemlo Gold, Inc.), Uranerz U.S.A., Inc. and Minorca Resources Inc. This very large volume of geologic information is an extremely valuable tool for further study of the property.

Geology of the Bankop Mineral Claims

Regionally, the Utah Camp property is situated within the Battle Mountain-Eureka Trend, a northwest striking 30 to 40 mile wide (45 to 60 km) belt of mostly Paleozoic rocks which are intruded by numerous Cretaceous to Tertiary age intrusives. All bedrock mapped to date on the Bankop property is Upper Plate fine-grained clastic rocks. Although these rocks are dominated by siliceous lithologies, they do contain an appreciable thickness of carbonate-rich rocks. Deep drilling by Uranerz contains thick sections of calcareous siltstone within the Valmy. Calcareous sandstones make up a significant portion of the middle Elder Formation. Both of these rock types are good host rocks for Carlin style mineralization.

A significant portion of the property is covered by Quaternary alluvium. Outcrop is normally sparse, except where thick sections of quartzite occur. Colluvial cover is relatively thick once the break in slope is reached traversing from ridge top to valley.

Besides the bedding plane faults associated with thrust slices, several high angle faults have been mapped. The dominant trend is northeast and the next most abundant trend is northwest. East-west high angle structures are most common in the southern portion of the property.