Amincor, Inc.

1350 Avenue of the Americas, 24th Floor

New York, New York 10019

Tel. # 347-821-3452

May 18, 2011

United States Securities and Exchange Commission

Division of Corporate Finance

100 F Street NE

Washington, DC 20549

Attn: Caroline Kim

| Re: | Amincor, Inc. |

| | Amendment No. 2 Registration Statement on Form 10 |

| | Filed January 7, 2011 |

| | Form 10-Q for the Quarter Ended September 30, 2010 |

| | Filed November 30, 2010 |

| | Current Reports on Amended Form 8-K |

| | Filed October 19, 2010, January 26, 2011, and March 2, 2011 |

| | File No. 0-49669 |

Dear Ms. Kim:

We have submitted today for filing amendment No. 3 to the Registration Statement on Form 10 for Amincor, Inc. as referenced above in response to the Securities Act and Exchange Commission letter dated April 18, 2011.

Amendment No. 2 to Registration Statement on Form 10. filed January 7, 2011

General

| 1. | We remind you of prior comments 1 and 2 from our letter to you dated November 3, 2010. |

ANSWER

We have complied with these comments.

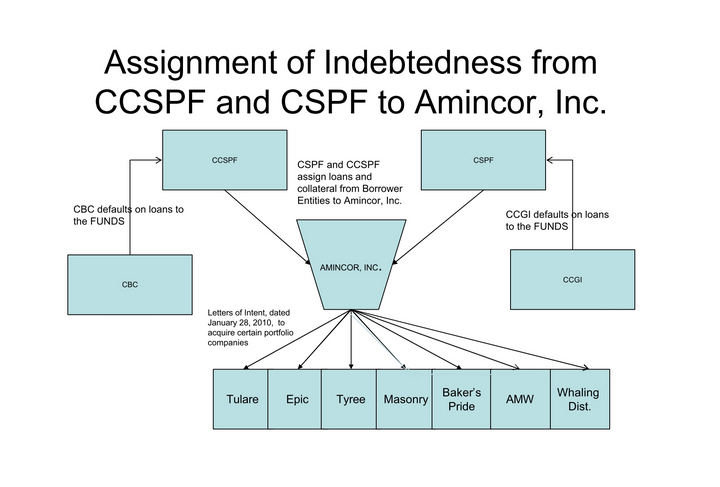

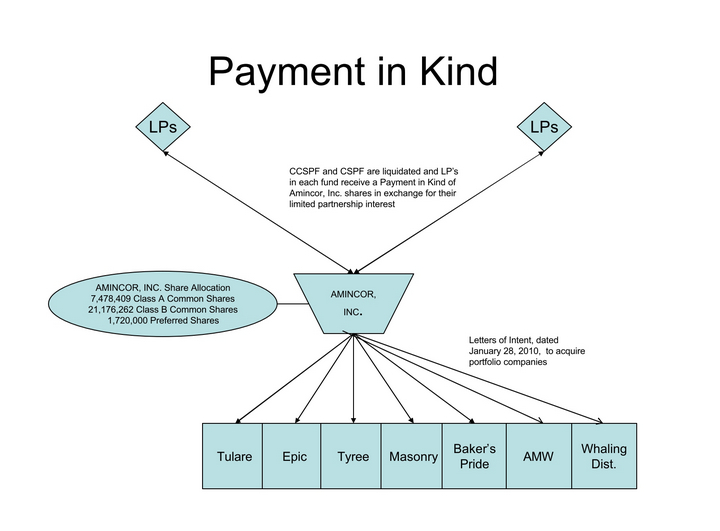

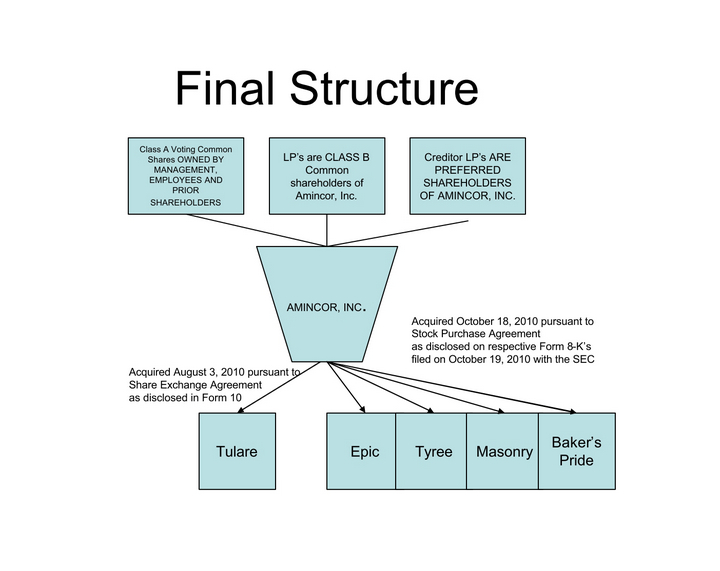

| 2. | We refer you to prior comment 7 from our letter to you dated November 3, 2010. Rather than requiring the reader to refer to exhibits for the information, please include in the main text of the filing the diagrams and explanatory text which appear in exhibits 99.5 and 99.6. Also, be sure to identify in the text and diagrams any material limited partner investors, as we requested in prior comment 7. |

| | We have included at pages 5-8 and 13-15 in the main text of the filing the diagrams and explanatory text which appears in Exhibits 99.5 and 99.6 as follows: |

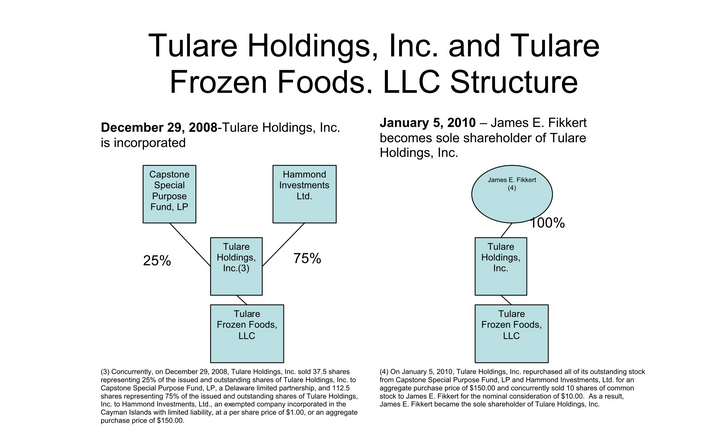

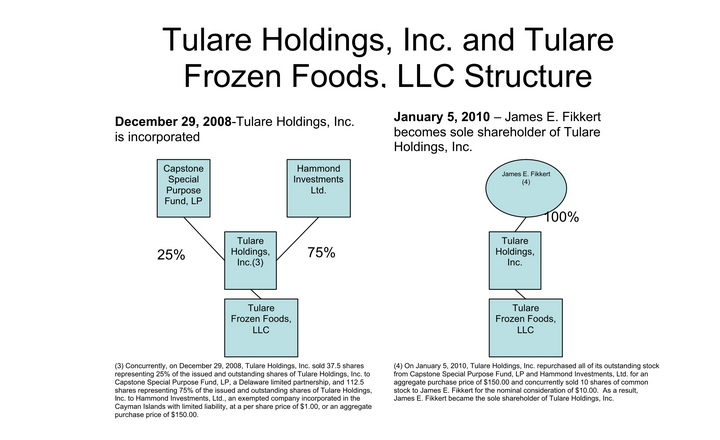

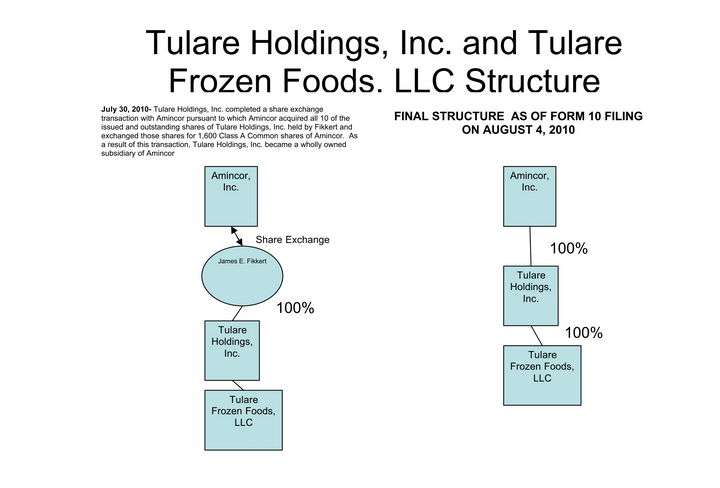

The diagrams below and the accompanying text show how Tulare Holdings, Inc. and Tulare Frozen Foods, LLC became a wholly owned subsidiary of the Company and should be read in conjunction with the “Item 1. Business – Background” section above.

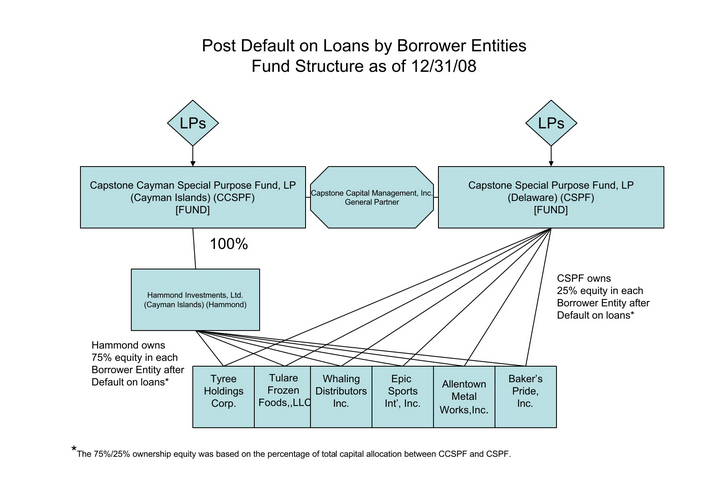

The Charts below show the relationships between the Registrant and the Capstone “group of companies”. These charts should be read in conjunction with the text above under “History of the Company”.

There are no material limited partner investors as no limited partner was a 10% percent or greater investor in the Funds.

| 3. | We re-issue prior comment 12 from our letter to you dated November 3, 2010. Please make the changes needed to clarify the notes to your financial statements accordingly. |

| | We have revised the filing throughout to eliminate the generic labels and replaced with specific named parties throughout the document. We have also added a Glossary defining such generic terms on pages 35-36 of the Amended filing. |

| 4. | Notwithstanding your response to prior comment 13 from our letter to you dated November 3, 2010, it appears that a reasonably detailed description of the “winding up petition” is required, due to the positions that members of your management held or hold with the Capstone companies. Please provide appropriate disclosure to disclose the matters involved, the pertinent dates, and the status of the petition currently. |

ANSWER

We respectfully disagree with the comment that further disclosure regarding the “winding up petition” is required in the amended Form 10 since as previously stated neither Registrant nor any of its officers or directors or any of the related Capstone entities are named in the proceeding and a detailed explanation of the “winding-up petition” in the Form 10 will be confusing and potentially misleading to investors. Further, all of the Class B and Preferred Shareholders are aware of the proceeding. For the purposes of clarification, the parties recently agreed upon the appointment of Deloitte and Touche as Liquidators and an engagement fee was paid to them. The Liquidators have yet to make even a provisional finding and we are advised that no formal position is likely to be taken by the Liquidators until they make their report to the Court. The Company’s position is that the Funds’ actions were proper and no further action will be recommended by the Liquidators.

Business, page 4

General

| 5. | We note your reference at page 4 to the Forms 8-K filed on October 19, 2010. Revise to disclose in this section the current operating status and business of each acquired entity. In the alternative, provide a cross reference to the more detailed disclosure of this information that you revise to provide elsewhere in the filing. |

| | We have responded to this comment on page 12 as follows: |

Baker’s Pride, Inc. is an operating business engaged in the production of sliced and packaged private label brand bread and bakery goods. Epic Sports International, Inc. is an operating business and is the worldwide licensee for Volkl and Boris Becker Tennis and the exclusive U.S. North American distributor for the Australian Klipspringer brand of racquet strings and accessories. Masonry Supply Holding Corp., through its wholly owned subsidiary Imperia Masonry Supply Corp., is an operating business engaged in the production of concrete, lightweight and split face block manufacturing and wholesaling a wide array of other masonry and building material products. Tyree Holdings Corp. is an operating business engaged in providing retail petroleum and environmental services.

| 6. | Rather than merely describing this information in the letter of response, please provide all the disclosure that prior comment 10 from our letter to you dated November 3, 2010, required. If true, also disclose explicitly that Messrs. Rice and Ingrassia are no longer officers or directors of any of the Target Companies. Please note that when our comments request you to “disclose” certain information, we are asking for disclosure in your filing rather than in the letter of response. |

| | We have responded to this comment at page 12 of the Amended Form 10 as follows: |

As officers and directors of the General Partner to the Capstone Funds, John R. Rice, III and Joseph F. Ingrassia had to exercise a certain level of control over the Target Companies after such companies defaulted on their loans to the Lenders. Messrs Rice and Ingrassia were the President and Vice-President, respectively, as well as controlling members of the Board of Directors of each of the Target Companies. By holding these management and director positions, Messrs. Rice and Ingrassia were able to install new management, restructure or liquidate various investments and consolidate operations of the Target Companies. Messrs. Rice and Ingrassia received no salary or benefits from acting in these capacities on behalf of the Target Companies and undertook such duties to attempt to create value for the investors in the Capstone Funds who subsequently became the shareholders of Amincor, Inc. In addition to being officers and directors of Amincor, Messrs. Rice and Ingrassia are also officers and directors of each of the Target Companies, which are now subsidiaries of Amincor as follows: Both Mr. Rice and Mr. Ingrassia are directors of each of the subsidiary companies. In addition, they hold the following offices: Mr. Rice is the Chief Executive Officer and Mr. Ingrassia is the Vice President of Imperia Masonry Supply Corp. Both Mr. Rice and Mr. Ingrassia are Vice-Presidents of Tyree Holdings, Inc. and Mr. Ingrassia is Vice President of Baker’s Pride Inc. and Epic Sports International, Inc. Capstone Business Credit, LLC and Capstone Capital Group I, LLC, as asset based lenders, had a debtor/collector relationship with each of the Target Companies. Messrs. Rice and Ingrassia are the managing members of Capstone Business Credit, LLC and Capstone Capital Group I, LLC.

History of the Company, page 6

| 7. | We note your response to prior comment 6 from our letter to you dated November 3, 2010. Please expand your disclosures to explain the reasons behind the December 2009 transfer of Amincor to the limited partners and creditors of the Capstone Funds. Also explain further the assignment to Amincor of all of the right, title, and interest of the debt owed to the Capstone Funds. |

| | We have answered the comment at page 11 as follows: |

The “restructuring” described above was undertaken after substantial consultation with an independent third party consultant, Houlihan Smith & Company Inc. (“Houlihan”). which was engaged at the request of several of the limited partners of the Capstone Funds. Houlihan’s initial engagement was to provide a valuation of the assets that remained in the Capstone Funds. During the initial engagement, the Capstone Funds’ investors requested that Houlihan also be engaged to assist in the development of a liquidity plan for the remaining assets of the Capstone Funds. Houlihan was further engaged to provide investment banking services to raise debt and/or equity for the Borrower Entities. However, this engagement was subsequently terminated because Houlihan was unsuccessful in its endeavor to raise debt and/or equity for the Borrower Entities due to the global financial crisis and the state of the economy in 2008 and early 2009.

In addition, Houlihan was also engaged at the request of the Capstone Funds’ investors, to oversee the activities of the General Partner during the implementation of the liquidity plan. This was done by the establishment of an investor advisory committee (the “Advisory Committee”). The Advisory Committee was comprised of six (6) representative investors of the Capstone Funds. The Advisory Committee met via conference call every four to six (4-6) weeks throughout 2010. Recordings of all conference calls and copies of all related meeting materials were distributed to all Class B common and Preferred shareholders of Amincor. The last Advisory Committee meeting was held on November 4, 2010. No additional Advisory Committee meetings are scheduled as the Company is now reporting under the Securities and Exchange Act of 1934, as amended. In connection with the restructuring all of the right title and interest in the debt owed to the Capstone Funds was assigned to Amincor

| | As noted above the transfer of Amincor to the limited partners and creditors of the Funds was undertaken on the recommendation of a third party financial advisor recommended by the limited partners and creditors of the Funds. Their recommendation was that a public shell shall be acquired and the debt related to the Funds be converted to equity in the “public company” by the distribution of shares as payment-in-kind to the limited partners and creditors of the Funds pursuant to applicable Cayman and Delaware limited partnership law. |

| 8. | In your response to prior comment 18 from our letter to you dated November 3, 2010, you disclose the change of control of Amincor (formerly Joning) in September 2005. Please disclose the circumstances of this change of control, and provide explanatory text along with the diagrams that previously appeared in exhibits 99.5 and 99.6. |

| | Please see the chart at pages 6-8 set forth above in response to Comment 2. We have responded to the comment at page 10 by modifying the first paragraph of the History of the Company section to read as follows: |

Amincor, Inc. was incorporated under the laws of the state of Nevada on October 8, 1997 under the name GSE Group, Inc. GSE Group, Inc. was originally formed to provide consulting services for reverse mergers to public shell corporations and private companies seeking to gain access to the public markets. On October 20, 1997, GSE Group, Inc. changed its name to Global Stock Exchange Corp. and on April 28, 2000, Global Stock Exchange Corp. changed its name to Joning Corp (“Joning”). In July 2000, Joning ceased its business activities. On March 8, 2002, Joning filed a Registration Statement on Form 10-SB under the Securities Exchange Act of 1934 (the “Exchange Act”) as a shell company with the purpose of finding a suitable company for a reverse merger transaction. Joning ceased filing periodic reports subsequent to its filing of its Form 10-QSB on October 24, 2004 as it did not have the personnel or resources to continue the filings and there was no operating business or pending business transactions. In September 2005, Capstone Trade Partners, Ltd. paid $18,500 for a controlling interest in Joning. Simultaneously, therewith certain Joning shareholders delivered their shares in transferrable form to Capstone Trade Partners, Ltd., which then assigned the right, title and interest to those shares to Messrs John R. Rice, III and Joseph F. Ingrassia, the principals of Capstone Trade Partners, Ltd. As a result of this transaction, Messrs. Rice and Ingrassia became the controlling shareholders of Joning. When Capstone Trade Partners, Ltd. acquired control of the Company several of the Joning “selling shareholders” delivered all of their shares to the Purchasers’ counsel but were entitled to the return of a certain portion of their shares upon transfer. However, the transaction which Purchaser contemplated entering at this time of acquisition of control of the Company did not occur. As a result, the shares that were delivered to the Purchasers’ counsel were held in counsel’s files and were inadvertently not transferred from the original owners’ to the Purchaser. Subsequently, when the Amincor transaction proceeded, the shares were forwarded to the Company’s Transfer Agent for cancellation. Due to the lapse of time since the shares had been acquired, the fact that some shareholders had not sold all of their shares and therefore were entitled to the return of some shares was overlooked. Upon discovery of the oversight, the Company issued 413,249 new shares to those shareholders to restore their correct share position. All of such 413,249 shares were Class A common shares.

| 9. | We re-issue prior to comment 19 from our letter to you dated November 3, 2010. In the new disclosure, be sure to indicate that Joning filed a Form 15-12G on June 2, 2008, to terminate its registration, prior to filing anew as Amincor. |

ANSWER

We have responded to this comment in the second paragraph of History of the Company on page 10 as follows:

Amincor (formerly Joning) ceased filing required periodic reports under the Securities and Exchange Act of 1934 subsequent to its filing of Form 10-Q for the quarter ended May 31, 2004 on October 24, 2004. On June 2, 2008, Joning filed a Form 15-12G to terminate its registration. Please see charts set forth in the answer to Comment 2 above.

Amount Due from Factor and Inventory, page 12

| 10. | Based on your response to prior comment 24 from our letter to you dated November 3, 2010, it appears that the Discount Factoring Agreement and Purchase Order Financing Agreement have been terminated by Amincor and replaced by a capital allocation agreement with similar terms. Please file this agreement and disclose all the material details. See Item 601(b)(10) of Regulation S-K. |

| | The Loan and Security Agreement dated as of January 1, 2010 between Tulare Frozen Foods, LLC and Amincor and the Amended Loan and Security Agreement dated as of October 31, 2010 have been filed as Exhibits 10.9 and 10.10 to the Amended Form 10. We have disclosed the material details at page 23 of the Amended Form 10 as follows: |

At the end of 2009, the Lender assigned all of its right, title and interest in the Discount Factoring Agreement to Amincor. On December 31, 2009 Amincor terminated the Discount Factoring Agreement. Since January 1, 2010 Tulare’s operations have been financed by allocation of capital from Amincor, pursuant to a Loan and Security Agreement dated January 1, 2010 as amended by agreement dated October 31, 2010. The Agreement is for a period of three years and provides that Amincor will make advances of 70% against Tulare’s Eligible Accounts and 50% of the value (determined at the lower of cost or market) of Tulare’s Eligible Inventory to be secured by collateral as defined said agreement. Amincor initially received interest at the rate of 16% per annum. The interest rate was reduced to 8.35% per annum by the Amended Loan and Security Agreement dated as of October 31, 2010. Amincor also receives a Collateral Management fee of $50,000 per month.

Directors and Executive Officers, page 18

| 11. | Please disclose in the filing the tabular information you provided in your response to prior comment 11 from our letter to you dated November 3, 2010. |

| | We have disclosed the requested information on page 28 of the amended Form 10 as follows: |

A list of Amincor and the Capstone entities and the positions held by each of John R. Rice III, Joseph F. Ingrassia and Robert Olson in each of them is set forth below. No individual receives compensation from any entity listed below.

| Name | | Amincor, Inc. | | Capstone Capital Management, Inc. | | Capstone Business Credit, LLC | | Capstone Capital Group I, LLC |

| | | | | | | | | |

| John R. Rice, III | | President / CEO / Director | | President | | Managing Member | | Managing Member |

| Joseph F. Ingrassia | | Vice-President / Director | | Vice-President | | Managing Member | | Managing Member |

| Robert L. Olson | | Chief Financial Officer / Director | | Chief Financial Officer | | Chief Financial Officer | | Chief Financial Officer |

| 12. | Revise the biographical sketches to eliminate any gaps or ambiguities as to them within the five year description Item 401 of Regulation S-K requires you to provide. For example, provide the month and year each listed office or position began and ended with each listed employer during that period. We refer you in particular to the sketches for Messrs. Fikkert and Hagin. |

ANSWER

We have revised the biographical sketches for Messrs. Fikkert and Hagin as on pages 28, 29 of the Amended Form 10 as follows:

The business of our operating subsidiary, Tulare Holdings, Inc. (“Holdings”), will be managed by its officers:

James E. Fikkert, President, 58

Mr. Fikkert has been President of Tulare Frozen Foods, LLC since January, 2008 and of Holdings since December 30, 2008. Mr. Fikkert has an extensive background in the frozen food business with over 25 years of experience. Mr. Fikkert has a strong background in corporate, plant and field operations, planning, team building, supply chain management, and project management. Prior to his position at Tulare, Mr. Fikkert held various managerial positions at various companies which eventually became Birds Eye Foods Inc. from 1974 until October 2004 and at Flexo Solutions, LLC from March 2005 until March 2007. Mr. Fikkert joined Tulare on October 4, 2007. Mr. Fikkert received his Bachelors of Science from the University of Wisconsin in 1974.

Douglas Hagin, Chief Financial Officer, 63

Mr. Hagin was the acting CFO of Tulare on a consulting basis from October 2008 to March 1, 2010 at which time he became Tulare’s fulltime CFO. Prior thereto from January 2006 until joining Tulare on a full time basis, Mr. Hagin was an independent business and financing consultant. Mr. Hagin is responsible for all financial projections and assists in completing the company’s monthly financial reports. In addition, Mr. Hagin is responsible for assisting the Tulare’s President in the company’s strategic planning. Prior to his position at Tulare, Mr. Hagin spent 25 years working in the frozen vegetable industry in various roles from the vice president of sales at Bellingham Frozen Foods to a logistics manager at Birds Eye Frozen Foods, Inc. Mr. Hagin received his Bachelors of Science in Business Administration from the University of Puget Sound in 1969.

Recent Sales of Unregistered Securities, Page 23

| 13. | Please disclose why you created a second class of common stock and a convertible preferred class, and briefly discuss how you determined the manner by which the different shares were to be allocated among the Capstone investors. |

ANSWER

We do not believe that this decision by Management is required to be disclosed. However, the reason that the second class of common stock and convertible preferred class were created was because current management felt that they were (and are) intimately familiar with the operating companies that represent the Company’s primary assets, and any change in management in the near term might result in a substantial devaluation of the underlying assets of the Company and accordingly determined that it was (and is) in the best interests of all of the shareholders for Class A stock to be the only voting stock for the near future.

We have otherwise responded to this comment on page 33 as follows:

On March 2, 2010, we issued 21,176,262 restricted shares of Class B non-voting common stock to 68 accredited institutional investors, who had placed redemption requests with trade dates subsequent to December 31, 2008 (the date on which redemption on the Capstone Funds was suspended) or that had not made redemption requests, as payment-in-kind for their interests in the Capstone Funds. On March 2, 2010, we issued 1,752,823 shares of Preferred Stock to 36 accredited institutional investors, who became creditors of the Capstone Funds because they had placed redemption requests with trade dates prior to December 31, 2008, as payment-in-kind for their interests in Capstone Funds. We issued the Class B common shares to investors who were not creditors of the Funds as determined by Delaware and Cayman Island limited partnership law and issued the convertible preferred shares to investors who were creditors of the Funds as determined by Delaware and Cayman Island limited partnership law in order to preserve their relative rights and preferences.

| 14. | Disclose the information you provided in response to prior comments 30 and 31 from our letter to you dated November 3, 2010. |

ANSWER

We have disclosed the information requested in response to this comment on page 10 of the Amended Form 10 as follows:

In 2005, when Capstone Trade Partners, Ltd. (the “Purchaser”) acquired control of the Company several of the Joning “selling shareholders” delivered all of their shares to the Purchasers’ counsel but were entitled to the return of a certain portion of their shares upon transfer. However, the transaction which Purchaser contemplated entering at this time of acquisition of control of the Company did not occur. As a result, the shares that were delivered to the Purchasers’ counsel were held in counsel’s files and were inadvertently not transferred from the original owners’ to the Purchaser. Subsequently, when the Amincor transaction proceeded, the shares were forwarded to the Company’s Transfer Agent for cancellation. Due to the lapse of time since the shares had been acquired, the fact that some shareholders had not sold all of their shares and therefore were entitled to the return of some shares was overlooked. Upon discovery of the oversight, the Company issued 413,249 new shares to those shareholders to restore their correct share position. All of such 413,249 shares were Class A common shares.

Messrs Rice and Ingrassia acquired their shares via assignment from Capstone Trade Partners, Ltd. Mr. Olson received his shares from Messrs Rice and Ingrassia on August 2, 2010.

Financial Statement

Note 6 – Subsequent Events, page F-12

| 15. | We have read your response to prior comment 35 and see that you identified the “two related entities,” their relationship with Amincor, Inc. and their ownership interests in the debt. However, you have not amended the disclosures in your financial statements as requested in our comment. Please include these revised disclosures in your next amendment. |

ANSWER

We believe we have fully answered this comment and note that it did not request amendment to the disclosure in our financial statement.

| 16. | Your response to the third bullet point to prior comment 35 indicated that the equity holders of the two related entities received no shares in Amincor in exchange for the promissory notes. However, at page F-12 you state that “In exchange for the debt, the Company issued shares to the equity holders of the related entities.” Please resolve this inconsistency in your disclosure. |

| | We do not believe that these items are inconsistent. The note at page F-12 explains that the related entities that owned Tulare’s defaulted debt returned their shares in Tulare in conjunction with the exchange of their interest in Tulare’s debt. |

| 17. | We note your response to prior comment 36, identifying the “certain shareholders” as Mr. Ingrassia and Mr. Rice. Please modify your disclosures to clarify that these individuals are the “certain shareholders”. |

| | We have modified the disclosure on page F-12 of the Notes to Financial Statements of the Amended Form 10 to clarify that Capstone Trade Partners Ltd are the “certain shareholders” as follows: |

On August 2, 2010, 7,056,856 shares of Class A Common Stock owned by Capstone Trade Partners, Ltd were retired. Messrs John R. Rice III and Joseph F. Ingrassia, the President and Vice-President respectively and Directors of the Company are the sole shareholders of Capstone Trade Partners Ltd.

| 18. | We have read your response to prior comment 37 regarding the ownership of Amincor Inc. and Tulare Frozen Foods LLC prior to the reorganization and see that you have provided some of the information requested in our comment but have not amended the disclosures in your financial statements. Please include these revised disclosures in your next amendment. It should be clear from your disclosure how you conclude that these entities were under common control. |

| | Please refer to the organizational chart for Tulare Holdings Inc. set forth in the response to comment 2 hereof. |

| 19. | We have read your response to the last bullet point in prior comment 37, indicating that you believe you have met the reporting requirements of Rule 8-05 of regulation S-X in presenting pro forma financial statements for the acquisition of Tulare Holdings, Inc. However, we do not see any pro forma financial information in the Form 10 or any subsequent amendments. Please provide this disclosure to comply with your reporting obligations. |

ANSWER

Please refer to the audited financial statements for the years ended December 31, 2009 and 2008 and the June 30, 2010 amended consolidated financial statements previously filed with the initial Form 10 filing on August 4, 2010.

Form 10-Q for the Quarter Ended September 30, 2010

| 20. | We note that you have labeled your financial statements including activity of Tulare Holdings, Inc. prior to your common control merger with that entity on August 3, 2010 as consolidated, while at page 9 you indicate that you are reporting combined financial statements. Please revise your presentation and all labeling and applicable narratives as necessary to comply with FASB ASC paragraph 805-50-45-5. Please confirm that your historical financial statements include activity of both entities only for periods when these entities were under common control; and ensure that the changes you make to the labeling and narratives clarify that your financial statements are shown on a combined basis prior to the merger and on a consolidated basis subsequent to the merger. |

ANSWER

The Company is unable to adequately respond to this comment at this time and is working with its auditors to prepare a response and will file an amended answer to the Commission’s April 12, 2011 comment letter as promptly as possible.

Balance Sheet, page 3

| 21. | Please present a balance sheet as of the end of the preceding fiscal year-end to comply with Rule 8-03 of regulation S-X. |

ANSWER

The Company is unable to adequately respond to this comment at this time and is working with its auditors to prepare a response and will file an amended answer to the Commission’s April 12, 2011 comment letter as promptly as possible.

Form 8-K/As filed March 2, 2011

General

| 22. | We have read your responses to prior comments 43, 46, 48 and 50 and understand that the sequential chain of events leading to the respective acquisitions can be summarized as follows. Capstone Capital Group I, LLC and Capstone Business Credit, LLC (the “Capstone Lenders”) foreclosed on the assets of the businesses that were in default on their debts (Imperia Bros, Inc., The Baking Company of Burlington, LLC, Klip America, Inc. and the Tyree Organization, Ltd., or the “foreclosed entities”). The assets of the foreclosed entities were contributed to companies (Masonry Supply Holdings Corp., Universal Apparel Holdings, Inc. and Tyree Holdings Corp., the “holding companies”) created and controlled by Capstone Capital Group I, LLC and Capstone Business Credit, LLC. These holding companies were solely created to continue the operations of the foreclosed entities. Please address the following points: |

• Confirm that the facts and chain of events summarized above is correct.

| | • | Describe the manner by and extent to which Capstone Lenders or Messrs. Rice and Ingrassia’s were able to direct the activities of the foreclosed entities prior to foreclosure, including details sufficient to understand their ability to elect or nominate members to the board of directors or influence future economic performance of the foreclosed entities. |

| | • | Quantify the equity interests held by the related parties controlled by Messrs. Rice and Ingrassia in the foreclosed entities prior to foreclosure. |

ANSWER

| | • | The facts and chain of events described above is correct except for the following: The assets of the foreclosed entities were contributed to Masonry Supply Holdings Corp., Universal Apparel Holdings, Inc. and Tyree Holdings Corp., (the “holding companies”) created and controlled by Capstone Capital Management, Inc. the General Partner of the Funds on behalf of the limited partners of the Funds. These holding companies were created solely to continue the operations of the foreclosed entities in an attempt to recover losses incurred by the Funds. |

| | • | Neither the Capstone Lenders nor Messrs. Rice and Ingrassia were able to direct the activities of the foreclosed entities prior to foreclosure. |

| | • | The related parties controlled by Messrs Rice and Ingrassia did not hold any equity interest in the foreclosed entities prior to the foreclosure. |

| 23. | It appears that you have accounted for the foreclosures as business combinations, recording the net assets at fair value in the financial statements of the holding companies. However, your response to prior comment 44 indicates that you view the foreclosures as troubled debt restructurings. Please explain your rationale in accounting for the foreclosures as business combinations rather than troubled debt restructurings, specifically addressing how your accounting complies with FASB ASC Section 310-40-40. |

ANSWER

The Company is unable to adequately respond to this comment at this time and is working with its auditors to prepare a response and will file an amended answer to the Commission’s April 12, 2011 comment letter as promptly as possible.

| 24. | In your responses to prior comments 43 and 46, your represent that the losses resulting from the foreclosures on outstanding debts of the Imperia Bros., Inc. (“Imperia”) and The Baking Company of Burlington, LLC (“TBC”) have been recognized by former creditors of Imperia and TBC in accordance with FASB ASC paragraphs 810-10-55-20 through 21. Please explain why you refer to the accounting of the former creditors of Imperia and TBC in your response and tell us how you have applied FASB ASC paragraphs 810-10-55-20 through 21 in determining any gain or loss should be recognized in your financial statements. |

ANSWER

The Company is unable to adequately respond to this comment at this time and is working with its auditors to prepare a response and will file an amended answer to the Commission’s April 12, 2011 comment letter as promptly as possible.

Form 8-K/A filed October 19, 2010

Acquisition of Baker’s Pride, Inc.

General

| 25. | We note your response to prior comment 44 related to the omission of predecessor financial statements for The Baking Company of Burlington, LLC. We are considering your response to this comment. |

ANSWER

No response to the comment is required.

Financial Statements

Note 3 – Acquisition

| 26. | We have read your response to prior comment 45 related to the acquisition of Baker’s Pride, Inc. and see that you have specifically identified the related party lenders involved in the transaction as well as the amount of debt that was in default when the acquisition took place. However, we note that you have not filed an amended Form 8-K to provide this disclosure in your filing. Please include the revised disclosures in your next amendments. |

ANSWER

We do not believe that an amended 8-K filing is required in response to this comment and believe that this information is not required for investors to understand the structure or operation of the Registrant.

The Company hereby acknowledges that:

| · | The Company is responsible for the adequacy and accuracy of the disclosure in the filing; |

| · | Staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| · | The Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

| | | Very truly yours, |

| | | |

| | | Amincor, Inc. |

| | | |

| | | |

| | By: | /s/ John R. Rice, III |

| | | John R. Rice, III President |