Exhibit 99.2

Table of Contents

| | |

Introduction | | 1 |

| |

Exelon at a Glance | | |

Profile, Vision and Quick Facts | | 2 |

| |

Company Overview | | |

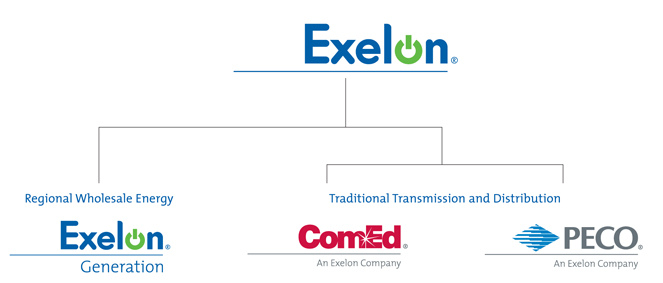

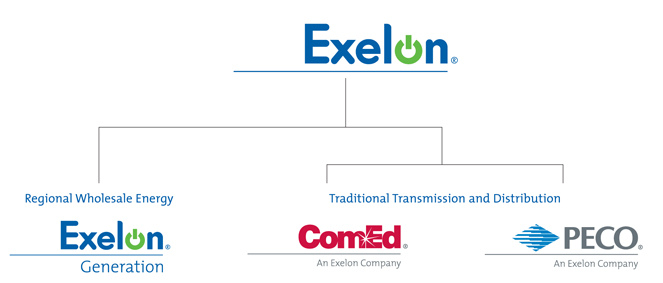

Corporate Structure and Operating Company Summary | | 3 |

| |

State Regulation | | |

Illinois Commerce Commission and ComEd Electric Distribution Rate Case | | 4 |

Pennsylvania Public Utility Commission, PECO Electric Transition Plan and System Average Electric Rates | | 5 |

| |

Federal Regulation | | |

Federal Energy Regulatory Commission and ComEd Electric Transmission Rate Case | | 6 |

| |

Exelon – Financial and Operating Highlights | | 7 |

| |

Reconciliation of Adjusted (non-GAAP) Operating Earnings to GAAP | | |

Consolidated Statements of Operations | | |

Exelon Corporation | | 8 |

Exelon Generation Company | | 10 |

Commonwealth Edison Company (ComEd) | | 11 |

PECO Energy Company (PECO) | | 12 |

| |

Exelon and Operating Companies | | |

Capital Structure, Capitalization Ratios and Credit Ratings | | 13 |

| |

Long-Term Debt Outstanding | | |

Exelon Corporation | | 14 |

Exelon Generation | | 14 |

ComEd | | 15 |

PECO | | 16 |

| |

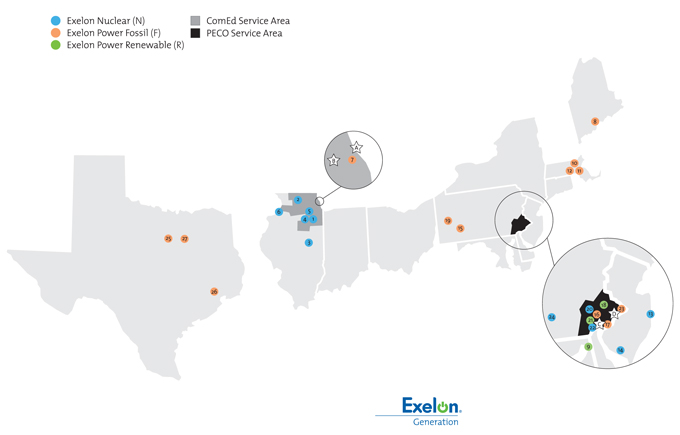

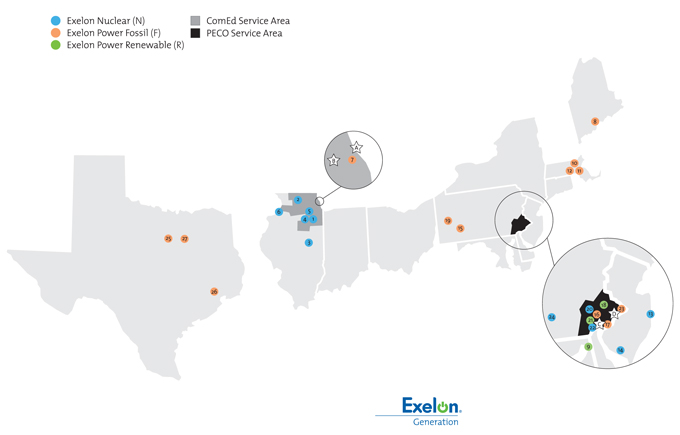

Map of Exelon Service Area and Selected Generating Assets | | 17 |

| |

Exelon Generation | | |

Generating Resources – Sources of Electric Supply, Type of Capacity and Long-Term Contracts | | 18 |

Nuclear Generating Capacity | | 19 |

Total Electric Generating Capacity | | 20 |

Fossil Emissions Reduction Summary | | 22 |

Annual Electric Supply and Sales Statistics | | 24 |

Electric Supply and Sales Statistics by Quarter | | 25 |

| |

Electric Sales Statistics, Revenue and Customer Detail | | |

ComEd | | 26 |

PECO | | 28 |

| |

Gas Sales Statistics, Revenue and Customer Detail – PECO | | 30 |

To the Financial Community,

The Exelon Fact Book is intended to provide historical financial and operating information to assist in the analysis of Exelon and its operating companies. Please refer to the SEC filings of Exelon and its subsidiaries, including the annual Form 10-K and quarterly Form 10-Q, for more comprehensive financial statements and information.

For more information about Exelon and to send e-mail inquiries, visit our website at www.exeloncorp.com.

| | |

| Investor Information | | Stock Symbol: EXC |

| Exelon Corporation | | Common stock is listed on the |

| Investor Relations | | New York, Chicago and Philadelphia stock exchanges. |

| 10 South Dearborn Street | | |

| Chicago, IL 60603 | | |

| 312.394.2345 | | |

| 312.394.4082 (fax) | | |

Information in this Fact Book is current as of August 31, 2007 unless otherwise noted.

This publication includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, that are subject to risks and uncertainties. The factors that could cause actual results to differ materially from these forward-looking statements include those discussed herein as well as those discussed in (1) Exelon’s 2006 Annual Report on Form 10-K in (a) ITEM 1A. Risk Factors, (b) ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and (c) ITEM 8. Financial Statements and Supplementary Data: Note 18; (2) Exelon’s Second Quarter 2007 Quarterly Report on Form 10-Q in (a) Part II, Other Information, ITEM 1A. Risk Factors and (b) Part I, Financial Information, ITEM 1. Financial Statements: Note 13; and (3) other factors discussed in filings with the Securities and Exchange Commission (SEC) by Exelon Corporation, Exelon Generation Company LLC, Commonwealth Edison Company, and PECO Energy Company (Companies). Readers are cautioned not to place undue reliance on these forward-looking statements, which apply only as of the date of this publication. None of the Companies undertakes any obligation to publicly release any revision to its forward-looking statements to reflect events or circumstances after the date of this publication.

Exelon at a Glance

Company Profile

Exelon Corporation, headquartered in Chicago, Illinois, is one of the largest electric utilities in the U.S. with approximately 5.4 million customers and more than $15 billion in annual revenues. The company has one of the largest portfolios of electricity generation capacity, with a nationwide reach and strong positions in the Midwest and Mid-Atlantic.

Our Vision

Exelon will be the best group of electric generation and electric and gas delivery companies in the United States – providing superior value for our customers, employees, investors and the communities we serve.

Our Goals

| • | | Keep the lights on and the gas flowing |

| • | | Run the nuclear fleet at world-class levels |

| • | | Capitalize on environmental leadership and clean nuclear energy |

| • | | Create a challenging and rewarding workplace |

| • | | Enhance the value of our generation |

| • | | Build value through disciplined financial management |

Our Values

Safety – for our employees, our customers and our communities

Integrity – the highest ethical standards in what we say and what we do

Diversity – in ethnicity, gender, experience and thought

Respect – trust and teamwork through open and honest communication

Accountability – for our commitments, actions and results

Continuous improvement – stretch goals and measured results

| | | | |

| Exelon Quick Facts at year-end 2006 | | | | Market Highlights |

| | |

| $15.7 | | 6,765 | | 670 million |

| billion in revenues | | circuit miles of electric transmission lines | | common shares outstanding |

| | |

| $44.3 | | 12,052 | | $1.76 |

| billion in assets | | miles of gas pipelines | | current annual dividend rate per share(a) |

| | |

| 5.4 | | 33,234 | | 50% |

| million electric customers | | MWs total U.S. generating resources | | 2006 dividend payout ratio(b) |

| | |

| 0.5 | | 17,200 | | 2.8% |

| million gas customers | | employees | | dividend yield |

| | |

| 106,149 | | | | |

| circuit miles of electric distribution lines | | | | |

| (a) | Dividend rate increased in December 2006. Dividends are subject to declaration by the board of directors each quarter. |

| (b) | Based on $1.60 dividend per share paid in 2006. |

2

Company Overview

| | | | |

| Nuclear Generation | | Illinois Utility | | Pennsylvania Utility |

| Fossil Generation | | 2006 | | 2006 |

| Renewable/Hydro Generation | | (in millions) | | (in millions) |

| Power Marketing | | Revenues: $6,101 | | Revenues: $5,168 |

2006 | | Assets: $17,774 | | Assets: $9,773 |

| (in millions) | | | | |

| Revenues: $9,143 | | | | |

| Assets: $18,909 | | | | |

| | |

Operating Companies | | | | |

| | |

Exelon Generation | | Commonwealth Edison Company | | PECO Energy Company |

| | |

| Exelon Generation engages in competitive electric generation operations, including owned and contracted-for generating facilities, and power marketing activities through Power Team. | | Commonwealth Edison (ComEd) is a regulated electricity transmission and distribution company with a service area in northern Illinois, including the City of Chicago, of approximately 11,300 square miles and an estimated population of 8 million. ComEd has approximately 3.8 million customers. | | PECO Energy (PECO) is a regulated electricity transmission and distribution company and natural gas distribution company with a service area in southeastern Pennsylvania, including the City of Philadelphia, of approximately 2,100 square miles and an estimated population of 3.8 million. PECO has approximately 1.6 million electric customers and 480,000 natural gas customers. |

3

State Regulation

Illinois Commerce Commission (ICC)

(www.icc.illinois.gov)

The ICC has five full-time members, each appointed by the Governor (Rod Blagojevich, Democrat; term began in January 2003 and ends in January 2011) and confirmed by the Illinois State Senate. The Commissioners serve for five-year, staggered terms. Under Illinois law, no more than three Commissioners may belong to the same political party. The Chairman is designated by the Governor.

| | | | | | | | |

Commissioner | | Party Affiliation | | Service Began | | Term Ends | | Professional Experience |

Charles E. Box (Chairman) | | Democrat | | 1/06 | | 1/09 | | Attorney; mayor of Rockford, IL; city administrator and legal director |

| | | | |

Lula M. Ford | | Democrat | | 1/03 | | 1/08 | | Assistant superintendent, Chicago Public Schools; teacher; assistant director, Central Management Service |

| | | | |

Erin O’Connell-Diaz | | Republican | | 4/03 | | 1/08 | | Attorney; ICC Administrative Law Judge; assistant attorney general |

| | | | |

Robert F. Lieberman | | Democrat | | 2/05 | | 1/10 | | CEO, Center for Neighborhood Technology; positions at Illinois Department of Natural Resources and Office of Coal Development |

| | | | |

Vacant | | | | | | | | |

ComEd Electric Distribution Rate Case

| | | | | | | | | | | | | | | | | | | |

($ in millions) | | Date | | Revenue

Increase | | Test Year | | Rate Base | | Overall Rate

of Return | | | Return on

Equity | | | Equity Ratio | |

ComEd Request | | 8/31/05 | | $ | 317 | | 2004 | | $ | 6,187 | | 8.94 | % | | 11.00 | % | | 54.20 | % |

ICC Order(a) | | 12/20/06 | | $ | 83 | | 2004 | | $ | 5,521 | | 8.01 | % | | 10.045 | % | | 42.86 | % |

| (a) | The ICC issued an order on rehearing that increased the amount previously approved on July 26, 2006 by approximately $74 million. ComEd and other parties appealed the rate order; the timing of a court ruling is uncertain. |

4

State Regulation

Pennsylvania Public Utility Commission (PUC)

(www.puc.state.pa.us)

The PUC has five full-time members, each appointed by the Governor (Ed Rendell, Democrat; term began in January 2003 and ends in January 2011) and confirmed by the Pennsylvania State Senate. The Commissioners serve for five-year, staggered terms. Under Pennsylvania law, no more than three Commissioners may belong to the same political party as the Governor. The Chairman and Vice Chairman are designated by the Governor.

| | | | | | | | |

Commissioner | | Party Affiliation | | Service Began | | Term Ends | | Professional Experience |

Wendell F. Holland (Chairman) | | Democrat | | 9/03 | | 4/08 | | Attorney; retired judge; executive at American Water Works Company |

| | | | |

James H. Cawley (Vice Chairman) | | Democrat | | 6/05 | | 4/10 | | Attorney; majority counsel to the Pennsylvania Senate Consumer Affairs Committee |

| | | | |

Kim Pizzingrilli | | Republican | | 2/02 | | 4/12 | | Secretary of the Commonwealth; positions at the Department of State and Treasury Department |

| | | | |

Terrance J. Fitzpatrick | | Republican | | 6/05 | | 4/09 | | Attorney; PUC Commissioner 1999–2004 and former Chairman; PUC assistant counsel; member of the state Environmental Hearing Board |

| | | | |

Tyrone Christy | | Democrat | | 7/07 | | 4/11 | | Executive at Americas Power Partners/ Armstrong Services; board member of Pennsylvania Energy Development Authority; vice chairman of PUC’s Independent Power Committee |

PECO Energy – Electric Transition Plan

The PUC authorized recovery in PECO’s 1998 settlement of $5.3 billion of stranded costs, or competitive transition charges (CTC) regulatory asset, with a return on the unamortized balance of 10.75%, through 2010. The PUC authorized amortization of the regulatory asset through 2010.

| | | | | | |

($ in millions) Year | | Estimated CTC Revenue | | Estimated Stranded

Cost Amortization |

2007 | | $ | 910 | | $ | 619 |

2008 | | | 917 | | | 697 |

2009 | | | 924 | | | 783 |

2010 | | | 932 | | | 883 |

PECO Energy – Schedule of System Average Electric Rates

Transmission rates are regulated by the Federal Energy Regulatory Commission. The CTC rate is subject to annual reconciliation for actual retail sales. Rates increased from the original PUC settlement to reflect the roll-in of increased gross receipts tax and Universal Service Fund charge and nuclear decommissioning cost adjustment.

| | | | | | | | | | |

(¢/kWh) Effective Date | | Transmission | | Distribution | | CTC | | Energy and

Capacity | | Total |

1/1/2006 | | 0.46 | | 2.59 | | 2.70 | | 4.92 | | 10.67 |

1/1/2007 | | 0.46 | | 2.59 | | 2.70 | | 5.43 | | 11.18 |

1/1/2008 | | 0.46 | | 2.59 | | 2.70 | | 5.43 | | 11.18 |

1/1/2009 | | 0.46 | | 2.59 | | 2.70 | | 5.43 | | 11.18 |

1/1/2010 | | 0.46 | | 2.59 | | 2.70 | | 5.43 | | 11.18 |

5

Federal Regulation

Federal Energy Regulatory Commission (FERC)

(www.ferc.gov)

The FERC has five full-time members, each appointed by the President of the United States and confirmed by the U.S. Senate. The Commissioners serve for five-year, staggered terms. No more than three Commissioners may belong to the same political party. The Chairman is designated by the President.

| | | | | | | | |

Commissioner | | Party Affiliation | | Service Began | | Term Ends | | Professional Experience |

Joseph T. Kelliher (Chairman) | | Republican | | 11/03 | | 6/07(a) | | Attorney; senior policy advisor to Secretary of Energy; majority counsel to House Committee on Commerce for energy legislation |

| | | | |

Suedeen G. Kelly | | Democrat | | 11/03 | | 6/09 | | Attorney; professor of law; Chair of the New Mexico Public Service Commission; counsel to the California Independent System Operator |

| | | | |

Philip D. Moeller | | Republican | | 7/06 | | 6/10 | | Energy policy advisor to former U.S. Senator Slade Gorton (WA); staff coordinator for the WA State Senate Committee on Energy, Utilities and Telecommunications; Alliant Energy Corporation |

| | | | |

Marc Spitzer | | Republican | | 7/06 | | 6/11 | | Attorney; Chair of the Arizona Corporation Commission; Arizona State Senator and Chair of the Judiciary and Finance Committees |

| | | | |

Jon Wellinghoff | | Democrat | | 7/06 | | 6/08 | | Attorney, practice focused on energy law and utility regulation; staff advisor to several state utility commissions; Nevada State Consumer Advocate |

| (a) | Chairman Kelliher has been renominated by the President for a new term, subject to Senate confirmation. |

ComEd Electric Transmission Rate Case

| | | | | | | | | | | | | | | | | | | |

($ in millions) | | Date | | Revenue

Increase | | Test Year | | Rate Base | | Overall Rate

of Return | | | Return on

Equity | | | Equity Ratio | |

ComEd Request | | 3/1/07 | | $ | 147 | | 2005

pro forma | | $ | 1,898 | | 9.87 | % | | 12.20 | %(a) | | 58.3 | % |

FERC Order(b) | | 6/5/07 | | $ | 116 | | 2005 | | $ | 1,745 | | 9.87 | % | | 12.20 | %(c) | | 58.3 | % |

| (a) | Reflects base ROE of 11.70% plus requested 0.50% adder for participation in a Regional Transmission Organization (RTO). Additionally, an incentive adder of 1.50% on major new projects was requested. |

| (b) | FERC issued an order that conditionally approved ComEd’s proposal to implement a formula-based transmission rate, effective May 1, 2007, subject to refund. FERC denied ComEd’s request for incentives on major projects. The FERC order provides that further hearing and settlement procedures be conducted on certain issues; the timing of completion is uncertain. Revenue requirement aspects of the order are subject to change pending these procedures. |

| (c) | FERC approved the 0.50% RTO adder; the base ROE and other items were set for hearing. |

6

Exelon Corporation – Financial and Operating Highlights

| | | | | | | | | | | | |

| | | For the Years ended December 31, | |

(in millions, except per share data and where indicated) | | 2006 | | | 2005 | | | 2004 | |

Operating revenues | | $ | 15,655 | | | $ | 15,357 | | | $ | 14,133 | |

Net income | | $ | 1,592 | | | $ | 923 | | | $ | 1,864 | |

Electric deliveries (in GWhs)(a) | | | 128,748 | | | | 131,021 | | | | 124,861 | |

Gas deliveries (in million cubic feet (mmcf)) | | | 76,105 | | | | 85,061 | | | | 87,097 | |

Total available electric supply resources (MWs) | | | 33,464 | | | | 33,520 | | | | 34,687 | |

Capital expenditures | | $ | 2,418 | | | $ | 2,165 | | | $ | 1,921 | |

Common Stock Data | | | | | | | | | | | | |

Average common shares outstanding – diluted (in millions) | | | 676 | | | | 676 | | | | 669 | |

GAAP earnings per share (diluted) | | $ | 2.35 | | | $ | 1.36 | | | $ | 2.78 | |

Adjusted (non-GAAP) operating earnings per share (diluted) | | $ | 3.22 | | | $ | 3.10 | | | $ | 2.78 | |

Dividends paid per common share | | $ | 1.60 | | | $ | 1.60 | | | $ | 1.26 | |

New York Stock Exchange common stock price(per share) | | | | | | | | | | | | |

High | | $ | 63.62 | | | $ | 57.46 | | | $ | 44.90 | |

Low | | $ | 51.13 | | | $ | 41.77 | | | $ | 30.92 | |

Year end | | $ | 61.89 | | | $ | 53.14 | | | $ | 44.07 | |

Book value per share | | $ | 14.89 | | | $ | 13.69 | | | $ | 14.29 | |

Total market capitalization (year end) | | $ | 41,460 | | | $ | 35,412 | | | $ | 29,271 | |

Common shares outstanding (year end) | | | 669.9 | | | | 666.4 | | | | 664.2 | |

| | | |

(a) One GWh is the equivalent of one million kilowatthours (kWh). | | | | | | | | | | | | |

| | | |

| Reconciliation of Adjusted (non-GAAP) Operating Earnings Per Share to GAAP | | | | | | | | | | | | |

| | | |

| | | 2006 | | | 2005 | | | 2004 | |

GAAP Earnings per Diluted Share | | $ | 2.35 | | | $ | 1.36 | | | $ | 2.78 | |

Impairment of ComEd’s goodwill | | | 1.15 | | | | 1.78 | | | | | |

Investments in synthetic fuel-producing facilities | | | 0.04 | | | | (0.10 | ) | | | (0.10 | ) |

Mark-to-market adjustments from economic hedging activities | | | (0.09 | ) | | | | | | | | |

Nuclear decommissioning obligation reduction | | | (0.13 | ) | | | | | | | | |

Recovery of debt costs at ComEd | | | (0.08 | ) | | | | | | | | |

Recovery of severance costs at ComEd | | | (0.14 | ) | | | | | | | | |

Cumulative effect of adopting FIN 47 | | | | | | | 0.06 | | | | | |

Charges related to the now-terminated merger with Public Service Enterprise Group Incorporated (PSEG) | | | 0.09 | | | | 0.03 | | | | 0.01 | |

Financial impact of Generation’s investment in Sithe Energies, Inc. (Sithe) | | | | | | | (0.03 | ) | | | 0.02 | |

Charges associated with debt repurchases | | | | | | | | | | | 0.12 | |

Severance charges | | | 0.03 | | | | | | | | 0.07 | |

Cumulative effect of adopting FIN 46-R | | | | | | | | | | | (0.05 | ) |

Settlement associated with the storage of spent nuclear fuel | | | | | | | | | | | (0.04 | ) |

Financial impact of Boston Generating investment | | | | | | | | | | | (0.03 | ) |

| | | | | | | | | | | | |

Adjusted (non-GAAP) Operating Earnings per Diluted Share | | $ | 3.22 | | | $ | 3.10 | | | $ | 2.78 | |

7

Exelon Corporation – Reconciliation of Adjusted (non-GAAP) Operating Earnings

to GAAP Consolidated Statements of Operations (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Twelve Months Ended December 31, 2006 | | | Twelve Months Ended December 31, 2005 | |

(in millions, except per share date) | | GAAP(a) | | | Adjustments | | | Adjusted

Non-GAAP | | | GAAP(a) | | | Adjustments | | | Adjusted

Non-GAAP | |

Operating revenues | | $ | 15,655 | | | $ | 5 | (b) | | $ | 15,660 | | | $ | 15,357 | | | $ | — | | | $ | 15,357 | |

Operating expenses | | | | | | | | | | | | | | | | | | | | | | | | |

Purchased power | | | 2,683 | | | | 179 | (b) | | | 2,862 | | | | 3,162 | | | | (12 | )(b) | | | 3,150 | |

Fuel | | | 2,549 | | | | (77 | )(b) | | | 2,472 | | | | 2,508 | | | | (4 | )(b) | | | 2,504 | |

Operating and maintenance | | | 3,868 | | | | 23 | (b),(c),(d),(e),(f),(g) | | | 3,891 | | | | 3,694 | | | | (82 | )(c),(d),(f) | | | 3,612 | |

Impairment of goodwill | | | 776 | | | | (776 | )(j) | | | — | | | | 1,207 | | | | (1,207 | )(j) | | | — | |

Depreciation and amortization | | | 1,487 | | | | (37 | )(c),(d) | | | 1,450 | | | | 1,334 | | | | (77 | )(c),(d) | | | 1,257 | |

Taxes other than income | | | 771 | | | | — | | | | 771 | | | | 728 | | | | — | | | | 728 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total operating expenses | | | 12,134 | | | | (688 | ) | | | 11,446 | | | | 12,633 | | | | (1,382 | ) | | | 11,251 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operating income | | | 3,521 | | | | 693 | | | | 4,214 | | | | 2,724 | | | | 1,382 | | | | 4,106 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Other income and deductions | | | | | | | | | | | | | | | | | | | | | | | | |

Interest expense, net | | | (880 | ) | | | 16 | (c),(m) | | | (864 | ) | | | (829 | ) | | | 14 | (c) | | | (815 | ) |

Equity in losses of unconsolidated affiliates | | | (111 | ) | | | 83 | (c) | | | (28 | ) | | | (134 | ) | | | 104 | (c) | | | (30 | ) |

Other, net | | | 266 | | | | (151 | )(b),(c),(d),(i),(l) | | | 115 | | | | 134 | | | | — | | | | 134 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total other income and deductions | | | (725 | ) | | | (52 | ) | | | (777 | ) | | | (829 | ) | | | 118 | | | | (711 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income from continuing operations before income taxes | | | 2,796 | | | | 641 | | | | 3,437 | | | | 1,895 | | | | 1,500 | | | | 3,395 | |

Income taxes | | | 1,206 | | | | 54 | (b),(c),(d),(e),(f),(g),(i),(l),(m) | | | 1,260 | | | | 944 | | | | 350 | (b),(c),(d),(f) | | | 1,294 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income from continuing operations | | | 1,590 | | | | 587 | | | | 2,177 | | | | 951 | | | | 1,150 | | | | 2,101 | |

Income (loss) from discontinued operations | | | 2 | | | | (4 | )(h) | | | (2 | ) | | | 14 | | | | (18 | )(h) | | | (4 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income before cumulative effect of changes in accounting principles | | | 1,592 | | | | 583 | | | | 2,175 | | | | 965 | | | | 1,132 | | | | 2,097 | |

Cumulative effect of changes in accounting principles, net of | | | — | | | | — | | | | — | | | | (42 | ) | | | 42 | (k) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | $ | 1,592 | | | $ | 583 | | | $ | 2,175 | | | $ | 923 | | | $ | 1,174 | | | $ | 2,097 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (a) | Results reported in accordance with accounting principles generally accepted in the United States (GAAP). |

| (b) | Adjustment to exclude the mark-to-market impact of Exelon’s economic hedging activities. |

| (c) | Adjustment to exclude the financial impact of Exelon’s investments in synthetic fuel-producing facilities, including the impact of mark-to-market gains (losses) associated with the related derivatives. |

| (d) | Adjustment to exclude certain costs associated with Exelon’s merger with PSEG which was terminated in September 2006. |

| (e) | Adjustment to exclude the decrease in Generation’s nuclear decommissioning obligation liability related to the AmerGen Energy Company, LLC nuclear plants. |

| (f) | Adjustment to exclude severance charges. |

| (g) | Adjustment to exclude a one-time benefit to recover previously incurred severance costs approved by the December 2006 amended ICC rate order. |

| (h) | Adjustment to exclude the financial impact of Generation’s prior investment in Sithe (sold in January 2005). |

| (i) | Adjustment to exclude a one-time benefit to recover previously incurred debt costs approved by the July 2006 ICC rate order. |

| (j) | Adjustment to exclude the impairments of ComEd’s goodwill. |

| (k) | Adjustment for the cumulative effect of adopting FIN 47. |

| (l) | Adjustment to exclude an impairment charge related to Generation’s investments in Termoeléctrica del Golfo (TEG) and Termoeléctrica Peñoles (TEP), the sale of which closed on February 9, 2007. |

| (m) | Adjustment to exclude the settlement of a tax matter at Generation related to Sithe. |

8

Exelon Corporation – Reconciliation of Adjusted (non-GAAP) Operating Earnings

to GAAP Consolidated Statements of Operations (unaudited)

| | | | | | | | | | | | | | | | | | | | | |

| | | Twelve Months Ended December 31, 2006 | | Twelve Months Ended December 31, 2005 | |

(in millions, except per share date) | | GAAP(a) | | Adjustments | | Adjusted

Non-GAAP | | GAAP(a) | | | Adjustments | | | Adjusted

Non-GAAP | |

Earnings per average common share | | | | | | | | | | | | | | | | | | | | | |

Basic: | | | | | | | | | | | | | | | | | | | | | |

Income from continuing operations | | $ | 2.37 | | $ | 0.88 | | $ | 3.25 | | $ | 1.42 | | | $ | 1.73 | | | $ | 3.15 | |

Income (loss) from discontinued operations | | | — | | | — | | | — | | | 0.02 | | | | (0.03 | ) | | | (0.01 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Income before cumulative effect of changes in accounting principles | | $ | 2.37 | | $ | 0.88 | | $ | 3.25 | | $ | 1.44 | | | $ | 1.70 | | | $ | 3.14 | |

Cumulative effect of changes in accounting principles, net of income taxes | | | — | | | — | | | — | | | (0.06 | ) | | | 0.06 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | |

Net income | | $ | 2.37 | | $ | 0.88 | | $ | 3.25 | | $ | 1.38 | | | $ | 1.76 | | | $ | 3.14 | |

| | | | | | | | | | | | | | | | | | | | | |

Diluted: | | | | | | | | | | | | | | | | | | | | | |

Income from continuing operations | | $ | 2.35 | | $ | 0.87 | | $ | 3.22 | | $ | 1.40 | | | $ | 1.71 | | | $ | 3.11 | |

Income (loss) from discontinued operations | | | — | | | — | | | — | | | 0.02 | | | | (0.03 | ) | | | (0.01 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Income before cumulative effect of changes in accounting principles | | | 2.35 | | | 0.87 | | | 3.22 | | | 1.42 | | | | 1.68 | | | | 3.10 | |

Cumulative effect of changes in accounting principles, net of income taxes | | | — | | | — | | | — | | | (0.06 | ) | | | 0.06 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | |

Net income | | $ | 2.35 | | $ | 0.87 | | $ | 3.22 | | $ | 1.36 | | | $ | 1.74 | | | $ | 3.10 | |

| | | | | | | | | | | | | | | | | | | | | |

Average common shares outstanding | | | | | | | | | | | | | | | | | | | | | |

Basic | | | 670 | | | | | | 670 | | | 669 | | | | | | | | 669 | |

Diluted | | | 676 | | | | | | 676 | | | 676 | | | | | | | | 676 | |

| (a) | Results reported in accordance with GAAP. |

9

Exelon Generation Company – Reconciliation of Adjusted (non-GAAP) Operating

Earnings to GAAP Consolidated Statements of Operations (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Twelve Months Ended December 31, 2006 | | | Twelve Months Ended December 31, 2005 | |

(in millions) | | GAAP(a) | | | Adjustments | | | Adjusted

Non-GAAP | | | GAAP(a) | | | Adjustments | | | Adjusted

Non-GAAP | |

Operating revenues | | $ | 9,143 | | | $ | — | | | $ | 9,143 | | | $ | 9,046 | | | $ | — | | | $ | 9,046 | |

Operating expenses | | | | | | | | | | | | | | | | | | | | | | | | |

Purchased power | | | 2,027 | | | | 179 | (b) | | | 2,206 | | | | 2,569 | | | | (12 | )(b) | | | 2,557 | |

Fuel | | | 1,951 | | | | (77 | )(b) | | | 1,874 | | | | 1,913 | | | | (4 | )(b) | | | 1,909 | |

Operating and maintenance | | | 2,305 | | | | 121 | (b),(c),(d),(h) | | | 2,426 | | | | 2,288 | | | | (9 | )(c),(d) | | | 2,279 | |

Depreciation and amortization | | | 279 | | | | — | | | | 279 | | | | 254 | | | | — | | | | 254 | |

Taxes other than income | | | 185 | | | | — | | | | 185 | | | | 170 | | | | — | | | | 170 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total operating expenses | | | 6,747 | | | | 223 | | | | 6,970 | | | | 7,194 | | | | (25 | ) | | | 7,169 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operating income | | | 2,396 | | | | (223 | ) | | | 2,173 | | | | 1,852 | | | | 25 | | | | 1,877 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Other income and deductions | | | | | | | | | | | | | | | | | | | | | | | | |

Interest expense, net | | | (159 | ) | | | 7 | (i) | | | (152 | ) | | | (128 | ) | | | — | | | | (128 | ) |

Equity in losses of unconsolidated affiliates | | | (9 | ) | | | — | | | | (9 | ) | | | (1 | ) | | | — | | | | (1 | ) |

Other, net | | | 41 | | | | 9 | (b),(c),(g) | | | 50 | | | | 95 | | | | — | | | | 95 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total other income and deductions | | | (127 | ) | | | 16 | | | | (111 | ) | | | (34 | ) | | | — | | | | (34 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income from continuing operations before income taxes | | | 2,269 | | | | (207 | ) | | | 2,062 | | | | 1,818 | | | | 25 | | | | 1,843 | |

Income taxes | | | 866 | | | | (79 | )(b),(c),(d),(e),(f),(g),(h) | | | 787 | | | | 709 | | | | 10 | (b),(c),(d) | | | 719 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income from continuing operations | | | 1,403 | | | | (128 | ) | | | 1,275 | | | | 1,109 | | | | 15 | | | | 1,124 | |

Income from discontinued operations | | | 4 | | | | (4 | )(f) | | | — | | | | 19 | | | | (18 | )(f) | | | 1 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income before cumulative effect of a change in accounting principle | | | 1,407 | | | | (132 | ) | | | 1,275 | | | | 1,128 | | | | (3 | ) | | | 1,125 | |

Cumulative effect of a change in accounting principle, net of income taxes | | | — | | | | — | | | | — | | | | (30 | ) | | | 30 | (e) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | $ | 1,407 | | | $ | (132 | ) | | $ | 1,275 | | | $ | 1,098 | | | $ | 27 | | | $ | 1,125 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (a) | Results reported in accordance with GAAP. |

| (b) | Adjustment to exclude the mark-to-market impact of Generation’s economic hedging activities. |

| (c) | Adjustment to exclude certain costs associated with Exelon’s merger with PSEG, which was terminated in September 2006. |

| (d) | Adjustment to exclude severance charges. |

| (e) | Adjustment for the cumulative effect of adopting FIN 47. |

| (f) | Adjustment to exclude the financial impact of Generation’s investment in Sithe (sold in January 2005). |

| (g) | Reflects an impairment charge related to Generation’s investments in TEG and TEP, the sale of which closed on February 9, 2007. |

| (h) | Adjustment to exclude the decrease in Generation’s nuclear decommissioning obligation liability related to the AmerGen nuclear plants. |

| (i) | Adjustment to exclude the settlement of a tax matter at Generation related to Sithe. |

10

Commonwealth Edison Company – Reconciliation of Adjusted (non-GAAP) Operating Earnings

to GAAP Consolidated Statements of Operations (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Twelve Months Ended December 31, 2006 | | | Twelve Months Ended December 31, 2005 | |

(in millions) | | GAAP(a) | | | Adjustments | | | Adjusted

Non-GAAP | | | GAAP(a) | | | Adjustments | | | Adjusted

Non-GAAP | |

| Operating revenues | | $ | 6,101 | | | | 5 | (f) | | $ | 6,106 | | | $ | 6,264 | | | $ | — | | | $ | 6,264 | |

| Operating expenses | | | | | | | | | | | | | | | | | | | | | | | | |

Purchased power | | | 3,292 | | | | — | | | | 3,292 | | | | 3,520 | | | | — | | | | 3,520 | |

Operating and maintenance | | | 745 | | | | 145 | (b),(c),(h) | | | 890 | | | | 833 | | | | 6 | (b),(c) | | | 839 | |

Impairment of goodwill | | | 776 | | | | (776 | )(d) | | | — | | | | 1,207 | | | | (1,207 | )(d) | | | — | |

Depreciation and amortization | | | 430 | | | | — | | | | 430 | | | | 413 | | | | — | | | | 413 | |

Taxes other than income | | | 303 | | | | — | | | | 303 | | | | 303 | | | | — | | | | 303 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total operating expenses | | | 5,546 | | | | (631 | ) | | | 4,915 | | | | 6,276 | | | | (1,201 | ) | | | 5,075 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Operating income (loss) | | | 555 | | | | 636 | | | | 1,191 | | | | (12 | ) | | | 1,201 | | | | 1,189 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Other income and deductions | | | | | | | | | | | | | | | | | | | | | | | | |

Interest expense, net | | | (308 | ) | | | — | | | | (308 | ) | | | (291 | ) | | | — | | | | (291 | ) |

Equity in losses of unconsolidated affiliates | | | (10 | ) | | | — | | | | (10 | ) | | | (14 | ) | | | — | | | | (14 | ) |

Other, net | | | 96 | | | | (87 | )(g) | | | 9 | | | | 4 | | | | — | | | | 4 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total other income and deductions | | | (222 | ) | | | (87 | ) | | | (309 | ) | | | (301 | ) | | | — | | | | (301 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Income (loss) before income taxes | | | 333 | | | | 549 | | | | 882 | | | | (313 | ) | | | 1,201 | | | | 888 | |

| Income taxes | | | 445 | | | | (91 | )(b),(c),(f),(g),(h) | | | 354 | | | | 363 | | | | (2 | )(b),(c) | | | 361 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Income (loss) before cumulative effect of a change in accounting principle | | | (112 | ) | | | 640 | | | | 528 | | | | (676 | ) | | | 1,203 | | | | 527 | |

| Cumulative effect of a change in accounting principle, net of income taxes | | | — | | | | — | | | | — | | | | (9 | ) | | | 9 | (e) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Net income (loss) | | $ | (112 | ) | | $ | 640 | | | $ | 528 | | | $ | (685 | ) | | $ | 1,212 | | | $ | 527 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (a) | Results reported in accordance with GAAP. |

| (b) | Adjustment to exclude certain costs associated with Exelon’s merger with PSEG, which was terminated in September 2006. |

| (c) | Adjustment to exclude severance charges. |

| (d) | Adjustment to exclude the impairment of ComEd’s goodwill. |

| (e) | Adjustment for the cumulative effect of adopting FIN 47. |

| (f) | Adjustment to exclude the mark-to-market impact of one wholesale contract at ComEd. |

| (g) | Adjustment to exclude a one-time benefit approved by the July 2006 ICC rate order to recover previously incurred debt expenses to retire debt early. |

| (h) | Adjustment to exclude a one-time benefit approved by the December 2006 amended ICC rate order to recover previously incurred severance costs. |

11

PECO Energy Company – Reconciliation of Adjusted (non-GAAP) Operating Earnings

to GAAP Consolidated Statements of Operations (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Twelve Months Ended December 31, 2006 | | | Twelve Months Ended December 31, 2005 | |

(in millions) | | GAAP(a) | | | Adjustments | | | Adjusted

Non-GAAP | | | GAAP(a) | | | Adjustments | | | Adjusted

Non-GAAP | |

| Operating revenues | | $ | 5,168 | | | $ | — | | | $ | 5,168 | | | $ | 4,910 | | | $ | — | | | $ | 4,910 | |

| Operating expenses | | | | | | | | | | | | | | | | | | | | | | | | |

Purchased power | | | 2,104 | | | | — | | | | 2,104 | | | | 1,918 | | | | — | | | | 1,918 | |

Fuel | | | 598 | | | | — | | | | 598 | | | | 597 | | | | | | | | 597 | |

Operating and maintenance | | | 628 | | | | (13 | )(b),(c) | | | 615 | | | | 549 | | | | (7 | )(b),(c) | | | 542 | |

Depreciation and amortization | | | 710 | | | | (9 | )(b) | | | 701 | | | | 566 | | | | (13 | )(b) | | | 553 | |

Taxes other than income | | | 262 | | | | — | | | | 262 | | | | 231 | | | | — | | | | 231 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total operating expenses | | | 4,302 | | | | (22 | ) | | | 4,280 | | | | 3,861 | | | | (20 | ) | | | 3,841 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Operating income | | | 866 | | | | 22 | | | | 888 | | | | 1,049 | | | | 20 | | | | 1,069 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Other income and deductions | | | | | | | | | | | | | | | | | | | | | | | | |

Interest expense, net | | | (266 | ) | | | — | | | | (266 | ) | | | (279 | ) | | | — | | | | (279 | ) |

Equity in losses of unconsolidated affiliates | | | (9 | ) | | | — | | | | (9 | ) | | | (16 | ) | | | — | | | | (16 | ) |

Other, net | | | 30 | | | | — | | | | 30 | | | | 13 | | | | — | | | | 13 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total other income and deductions | | | (245 | ) | | | — | | | | (245 | ) | | | (282 | ) | | | — | | | | (282 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Income before income taxes | | | 621 | | | | 22 | | | | 643 | | | | 767 | | | | 20 | | | | 787 | |

| Income taxes | | | 180 | | | | 8 | (b),(c) | | | 188 | | | | 247 | | | | 7 | (b),(c) | | | 254 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Income before cumulative effect of a change in accounting principle | | | 441 | | | | 14 | | | | 455 | | | | 520 | | | | 13 | | | | 533 | |

| Cumulative effect of a change in accounting principle, net of income taxes | | | — | | | | — | | | | — | | | | (3 | ) | | | 3 | (d) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Net income | | $ | 441 | | | $ | 14 | | | $ | 455 | | | $ | 517 | | | $ | 16 | | | $ | 533 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (a) | Results reported in accordance with GAAP. |

| (b) | Adjustment to exclude certain costs associated with Exelon’s merger with PSEG, which was terminated in September 2006. |

| (c) | Adjustment to exclude severance charges. |

| (d) | Adjustment for the cumulative effect of adopting FIN 47. |

12

Exelon and Operating Companies – Capital Structure and Capitalization Ratios

| | | | | | | | | | | | | | | | | | | | | | | |

(at December 31) | | 2006 | | 2005 | | 2004 |

| | | (in millions) | | | (in percent) | | (in percent)(a) | | (in millions) | | | (in percent) | | (in percent)(a) | | (in millions) | | (in percent) | | (in percent)(a) |

Exelon (consolidated) | | | | | | | | | | | | | | | | | | | | | | | |

Total Debt | | $ | 13,045 | | | 56.5 | | 49.8 | | $ | 13,964 | | | 60.3 | | 52.1 | | $ | 13,551 | | 58.6 | | 47.8 |

Preferred Securities of Subsidiaries | | | 87 | | | 0.4 | | 0.4 | | | 87 | | | 0.4 | | 0.5 | | | 87 | | 0.4 | | 0.5 |

Total Shareholders’ Equity | | | 9,973 | (d) | | 43.2 | | 49.7 | | | 9,125 | (c) | | 39.4 | | 47.5 | | | 9,489 | | 41.0 | | 51.8 |

| | | | | | | | | | | | | | | | | | | | | | | |

Total Capitalization | | | 23,105 | | | | | | | | 23,176 | | | | | | | | 23,127 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Transition Debt | | $ | 3,051 | | | | | | | $ | 3,963 | | | | | | | $ | 4,797 | | | | |

Exelon Generation | | | | | | | | | | | | | | | | | | | | | | | |

Total Debt(b) | | $ | 1,790 | | | 24.6 | | | | $ | 2,203 | | | 35.6 | | | | $ | 2,913 | | 48.9 | | |

Total Members’ Equity | | | 5,480 | | | 75.4 | | | | | 3,980 | | | 64.4 | | | | | 3,039 | | 51.1 | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Total Capitalization | | $ | 7,270 | | | | | | | $ | 6,183 | | | | | | | $ | 5,952 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

ComEd | | | | | | | | | | | | | | | | | | | | | | | |

Total Debt(b) | | $ | 4,648 | | | 42.5 | | 38.8 | | $ | 4,775 | | | 42.7 | | 37.2 | | $ | 4,875 | | 42.0 | | 34.4 |

Total Shareholders’ Equity | | | 6,298 | (d) | | 57.5 | | 61.2 | | | 6,396 | (c) | | 57.3 | | 62.8 | | | 6,740 | | 58.0 | | 65.6 |

| | | | | | | | | | | | | | | | | | | | | | | |

Total Capitalization | | | 10,946 | | | | | | | | 11,171 | | | | | | | | 11,615 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Transition Debt(e) | | $ | 648 | | | | | | | $ | 987 | | | | | | | $ | 1,341 | | | | |

PECO Energy | | | | | | | | | | | | | | | | | | | | | | | |

Total Debt(b) | | $ | 4,197 | | | 69.9 | | 49.8 | | $ | 4,562 | | | 72.8 | | 48.2 | | $ | 4,839 | | 77.6 | | 49.7 |

Total Shareholders’ Equity | | | 1,809 | | | 30.1 | | 50.2 | | | 1,704 | | | 27.2 | | 51.8 | | | 1,398 | | 22.4 | | 50.3 |

| | | | | | | | | | | | | | | | | | | | | | | |

Total Capitalization | | | 6,006 | | | | | | | | 6,266 | | | | | | | | 6,237 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Transition Debt(f) | | $ | 2,404 | | | | | | | $ | 2,975 | | | | | | | $ | 3,456 | | | | |

| (a) | Excluding ComEd and PECO transition debt. |

| (b) | Debt includes borrowings from intercompany money pool; as of January 10, 2006, ComEd suspended participation in the intercompany money pool. |

| (c) | Reflects $1,207 million charge related to the impairment of ComEd’s goodwill in 2005; goodwill balance totaled $3,475 million at December 31, 2005. |

| (d) | Reflects $776 million charge related to the impairment of ComEd’s goodwill in 2006; goodwill balance totaled $2,694 million at December 31, 2006. |

| (e) | ComEd transition debt maturities (in millions): 2007 - $308, 2008 - $340. |

| (f) | PECO transition debt maturities (in millions): 2007 - $273, 2008 - $625, 2009 - $700, 2010 - $806. |

| | Note: | Numbers may not add due to rounding. |

Credit Ratings as of August 31, 2007

| | | | | | |

| | | Moody’s Investors

Service(a) | | Standard & Poor’s

Corporation(b) | | Fitch Ratings(c) |

Exelon Corporation | | | | | | |

Senior Unsecured Debt | | Baa2 | | BBB | | BBB+ |

Commercial Paper | | P2 | | A2 | | F2 |

| | | |

Exelon Generation | | | | | | |

Senior Unsecured Debt | | Baa1 | | BBB+ | | BBB+ |

Commercial Paper | | P2 | | A2 | | F2 |

| | | |

ComEd | | | | | | |

Senior Secured Debt | | Baa2 | | BBB- | | BBB |

Senior Unsecured Debt | | Ba1 | | B+ | | BBB- |

Commercial Paper | | Not Prime | | B | | B |

| | | |

PECO Energy | | | | | | |

Senior Secured Debt | | A2 | | A- | | A |

Senior Unsecured Debt | | A3 | | BBB | | A- |

Commercial Paper | | P1 | | A2 | | F2 |

| (a) | ComEd and PECO ratings outlooks are stable; Exelon, and Generation ratings are under review for possible upgrade. |

| (b) | Exelon, PECO and Generation ratings outlooks are stable; ComEd ratings outlook is positive. |

| (c) | Exelon, ComEd, PECO and Generation ratings outlooks are stable. |

13

Exelon Corporation – Long-Term Debt Outstanding as of December 31, 2006

| | | | | | | | | | | | | | | | | | |

Series | | Interest

Rate | | | Date

Issued | | Maturity

Date | | Total Debt

Outstanding | | | Current

Portion | | Long-Term

Debt | |

| (in millions) | | | | | | | | | | | | | | | |

| Senior Notes Payable | | | | | | | | | | | | | | | | | | |

2005 Senior Notes Payable | | 4.45 | % | | 6/9/05 | | 6/15/10 | | $ | 400 | | | $ | 0 | | $ | 400 | |

2005 Senior Notes Payable | | 4.90 | % | | 6/9/05 | | 6/15/15 | | | 800 | | | | 0 | | | 800 | |

2005 Senior Notes Payable | | 5.625 | % | | 6/9/05 | | 6/15/35 | | | 500 | | | | 0 | | | 500 | |

2001 Senior Notes Payable | | 6.75 | % | | 5/8/01 | | 5/1/11 | | | 500 | | | | 0 | | | 500 | |

| | | | | | | | | | | | | | | | | | |

Total Senior Notes Payable | | | | | | | | | $ | 2,200 | | | $ | 0 | | $ | 2,200 | |

| | | | | | | | | | | | | | | | | | |

Unamortized Debt Discount | | | | | | | | | $ | (3 | ) | | $ | 0 | | $ | (3 | ) |

| | | | | | | | | | | | | | | | | | |

Total Long-Term Debt | | | | | | | | | $ | 2,197 | | | $ | 0 | | $ | 2,197 | |

| | | | | | | | | | | | | | | | | | |

| | | |

Maturities | | |

2007 | | $ | 0 |

2008 | | | 0 |

2009 | | | 0 |

2010 | | | 400 |

2011 | | $ | 500 |

Exelon Generation – Long-Term Debt Outstanding as of December 31, 2006

| | | | | | | | | | | | | | | | | | |

Series | | Interest

Rate | | | Date

Issued | | Maturity

Date | | Total Debt

Outstanding | | | Current

Portion | | Long-Term

Debt | |

| (in millions) | | | | | | | | | | | | | | | |

| Senior Notes | | | | | | | | | | | | | | | | | | |

2001 Senior Unsecured Notes | | 6.95 | % | | 6/14/01 | | 6/15/11 | | $ | 700 | | | $ | 0 | | $ | 700 | |

2003 Senior Unsecured Notes | | 5.35 | % | | 12/16/03 | | 1/15/14 | | | 500 | | | | 0 | | | 500 | |

| | | | | | | | | | | | | | | | | | |

Total Senior Unsecured Notes | | | | | | | | | $ | 1,200 | | | $ | 0 | | $ | 1,200 | |

| | | | | | | | | | | | | | | | | | |

| Unsecured Pollution Control Notes | | | | | | | | | | | | | | | | | | |

Montgomery Co. 2001 Ser. B | | var. rate | | | 9/5/01 | | 10/1/30 | | | 69 | | | | 0 | | | 69 | |

Delaware Co. 2001 Ser. A | | var. rate | | | 4/25/01 | | 4/1/21 | | | 39 | | | | 0 | | | 39 | |

Montgomery Co. 2001 Ser. A | | var. rate | | | 4/25/01 | | 10/1/34 | | | 13 | | | | 0 | | | 13 | |

Delaware Co. 1993 Ser. A | | var. rate | | | 8/24/93 | | 8/1/16 | | | 24 | | | | 0 | | | 24 | |

Salem Co. 1993 Ser. A | | var. rate | | | 9/9/93 | | 3/1/25 | | | 23 | | | | 0 | | | 23 | |

Montgomery Co. 1994 Ser. A | | var. rate | | | 2/14/95 | | 6/1/29 | | | 83 | | | | 0 | | | 83 | |

Montgomery Co. 1994 Ser. B | | var. rate | | | 7/2/95 | | 6/1/29 | | | 13 | | | | 0 | | | 13 | |

York County 1993 Ser. A | | var. rate | | | 8/24/93 | | 8/1/16 | | | 18 | | | | 0 | | | 18 | |

Montgomery Co. 1996 Ser. A | | var. rate | | | 3/27/96 | | 3/1/34 | | | 34 | | | | 0 | | | 34 | |

Montgomery Co. 2002 Ser. A | | var. rate | | | 7/24/02 | | 12/1/29 | | | 30 | | | | 0 | | | 30 | |

Indiana Co. 2003 A | | var. rate | | | 6/3/03 | | 6/1/27 | | | 17 | | | | 0 | | | 17 | |

Delaware Co. 1999 Ser. A | | var. rate | | | 10/1/04 | | 4/1/21 | | | 51 | | | | 0 | | | 51 | |

Montgomery Co. 1999 Ser. A | | var. rate | | | 10/1/04 | | 10/1/30 | | | 92 | | | | 0 | | | 92 | |

Montgomery Co. 1999 Ser. B | | var. rate | | | 10/1/04 | | 10/1/34 | | | 14 | | | | 0 | | | 14 | |

| | | | | | | | | | | | | | | | | | |

Total Unsec. Pollution Control Notes | | | | | | | | | $ | 520 | | | $ | 0 | | $ | 520 | |

| | | | | | | | | | | | | | | | | | |

| AmerGen Notes Payable - Oyster Creek | | 6.33 | % | | | | 8/8/09 | | $ | 29 | | | $ | 10 | | $ | 19 | |

| Capital Leases | | | | | | | | | $ | 44 | | | $ | 2 | | $ | 42 | |

| | | | | | | | | | | | | | | | | | |

Unamortized Debt Discount | | | | | | | | | $ | (3 | ) | | $ | 0 | | $ | (3 | ) |

| | | | | | | | | | | | | | | | | | |

Total Long-Term Debt | | | | | | | | | $ | 1,790 | | | $ | 12 | | $ | 1,778 | |

| | | | | | | | | | | | | | | | | | |

| | | |

Maturities | | |

2007 | | $ | 12 |

2008 | | | 12 |

2009 | | | 11 |

2010 | | | 2 |

2011 | | $ | 702 |

14

ComEd – Long-Term Debt Outstanding as of December 31, 2006

| | | | | | | | | | | | | | | | | | |

Series | | Interest

Rate | | | Date

Issued | | Maturity

Date | | Total Debt

Outstanding | | | Current

Portion | | Long-Term

Debt | |

| (in millions) | | | | | | | | | | | | | | | |

First Mortgage Bonds | | | | | | | | | | | | | | | | | | |

99 | | 3.70 | % | | 1/22/03 | | 2/1/08 | | $ | 295 | | | $ | 0 | | $ | 295 | |

83 | | 8.00 | % | | 5/15/92 | | 5/15/08 | | | 120 | | | | 0 | | | 120 | |

Pollution Control-1994B | | 5.70 | % | | 1/15/94 | | 1/15/09 | | | 16 | | | | 0 | | | 16 | |

102 | | 4.74 | % | | 8/25/03 | | 8/15/10 | | | 212 | | | | 0 | | | 212 | |

105 | | 5.40 | % | | 12/19/06 | | 12/15/11 | | | 345 | | | | 0 | | | 345 | |

98 | | 6.15 | % | | 3/13/02 | | 3/15/12 | | | 450 | | | | 0 | | | 450 | |

92 | | 7.625 | % | | 4/15/93 | | 4/15/13 | | | 125 | | | | 0 | | | 125 | |

IL Dev. Fin. Authority-2002 A | | var. rate | | | 6/4/02 | | 4/15/13 | | | 100 | | | | 0 | | | 100 | |

94 | | 7.50 | % | | 7/1/93 | | 7/1/13 | | | 127 | | | | 0 | | | 127 | |

IL Dev. Fin. Authority-2003 D | | var. rate | | | 12/23/03 | | 1/15/14 | | | 20 | | | | 0 | | | 20 | |

Pollution Control-1994C | | 5.85 | % | | 1/15/94 | | 1/15/14 | | | 17 | | | | 0 | | | 17 | |

101 | | 4.70 | % | | 4/7/03 | | 4/15/15 | | | 260 | | | | 0 | | | 260 | |

104 | | 5.95 | % | | 8/28/06 | | 8/15/16 | | | 415 | | | | 0 | | | 415 | |

IL Fin. Authority-2005 | | var. rate | | | 3/17/05 | | 3/1/17 | | | 91 | | | | 0 | | | 91 | |

IL Dev. Fin. Authority-2003 A | | var. rate | | | 5/8/03 | | 5/15/17 | | | 40 | | | | 0 | | | 40 | |

IL Dev. Fin. Authority-2003 B | | var. rate | | | 9/24/03 | | 11/1/19 | | | 42 | | | | 0 | | | 42 | |

IL Dev. Fin. Authority-2003 C | | var. rate | | | 11/19/03 | | 3/1/20 | | | 50 | | | | 0 | | | 50 | |

100 | | 5.875 | % | | 1/22/03 | | 2/1/33 | | | 254 | | | | 0 | | | 254 | |

103 | | 5.90 | % | | 3/6/06 | | 3/15/36 | | | 325 | | | | 0 | | | 325 | |

| | | | | | | | | | | | | | | | | | |

Total First Mortgage Bonds | | | | | | | | | $ | 3,304 | | | $ | 0 | | $ | 3,304 | |

| | | | | | | | | | | | | | | | | | |

Sinking Fund Debentures | | | | | | | | | | | | | | | | | | |

Sinking Fund Debenture | | 3.875 | % | | 1/1/58 | | 1/1/08 | | | 2 | | | | 1 | | | 1 | |

Sinking Fund Debenture | | 4.625 | % | | 1/1/59 | | 1/1/09 | | | 1 | | | | 0 | | | 1 | |

Sinking Fund Debenture | | 4.75 | % | | 12/1/61 | | 12/1/11 | | | 5 | | | | 1 | | | 4 | |

| | | | | | | | | | | | | | | | | | |

Total Sinking Fund Debentures | | | | | | | | | $ | 8 | | | $ | 2 | | $ | 6 | |

| | | | | | | | | | | | | | | | | | |

Notes Payable | | | | | | | | | | | | | | | | | | |

Notes Payable | | 7.625 | % | | 1/9/97 | | 1/15/07 | | | 145 | | | | 145 | | | 0 | |

Notes Payable | | 6.95 | % | | 7/16/98 | | 7/15/18 | | | 140 | | | | 0 | | | 140 | |

| | | | | | | | | | | | | | | | | | |

Total Notes Payable | | | | | | | | | $ | 285 | | | $ | 145 | | $ | 140 | |

| | | | | | | | | | | | | | | | | | |

Long-Term Debt To Financing Trusts | | | | | | | | | | | | | | | | | | |

Class A-6 Transitional Funding Trust Notes, Series 1998 | | 5.63 | % | | 12/16/98 | | 6/25/07 | | | 138 | | | | 138 | | | 0 | |

Class A-7 Transitional Funding Trust Notes, Series 1998 | | 5.74 | % | | 12/16/98 | | 12/25/08 | | | 510 | | | | 170 | | | 340 | |

Subordinated Debentures to ComEd Financing II | | 6.35 | % | | 3/17/03 | | 3/15/33 | | | 206 | | | | 0 | | | 206 | |

Subordinated Debentures to ComEd Financing III | | 8.50 | % | | 1/24/97 | | 1/15/27 | | | 155 | | | | 0 | | | 155 | |

| | | | | | | | | | | | | | | | | | |

Total Long-Term Debt to Financing Trusts | | | | | | | | | $ | 1,009 | | | $ | 308 | | $ | 701 | |

| | | | | | | | | | | | | | | | | | |

Unamortized Debt Discount | | | | | | | | | $ | (17 | ) | | $ | 0 | | $ | (17 | ) |

| | | | | | | | | | | | | | | | | | |

Total Long-Term Debt | | | | | | | | | $ | 4,588 | | | $ | 455 | | $ | 4,133 | |

| | | | | | | | | | | | | | | | | | |

| | | |

Maturities | | |

2007 | | $ | 455 |

2008 | | | 757 |

2009 | | | 17 |

2010 | | | 213 |

2011 | | $ | 347 |

15

PECO Energy – Long-Term Debt Outstanding as of December 31, 2006

| | | | | | | | | | | | | | | | | | |

Series | | Interest

Rate | | | Date

Issued | | Maturity

Date | | Total Debt

Outstanding | | | Current

Portion | | Long-Term

Debt | |

| (in millions) | | | | | | | | | | | | | | | |

First Mortgage Bonds | | | | | | | | | | | | | | | | | | |

FMB | | 5.90 | % | | 4/23/04 | | 5/1/34 | | $ | 75 | | | $ | 0 | | $ | 75 | |

FMB | | 3.50 | % | | 4/28/03 | | 5/1/08 | | | 450 | | | | 0 | | | 450 | |

FMB | | 5.95 | % | | 11/1/01 | | 11/1/11 | | | 250 | | | | 0 | | | 250 | |

FMB | | 4.75 | % | | 9/23/02 | | 10/1/12 | | | 225 | | | | 0 | | | 225 | |

FMB | | 5.95 | % | | 9/25/06 | | 10/1/36 | | | 300 | | | | 0 | | | 300 | |

| | | | | | | | | | | | | | | | | | |

Total First Mortgage Bonds | | | | | | | | | $ | 1,300 | | | $ | 0 | | $ | 1,300 | |

| | | | | | | | | | | | | | | | | | |

Mortgage-Backed Pollution Control Notes | | | | | | | | | | | | | | | | | | |

Delaware Co. 1988 Ser. A | | var. rate | | | 4/1/93 | | 12/1/12 | | | 50 | | | | 0 | | | 50 | |

Delaware Co. 1988 Ser. B | | var. rate | | | 4/1/93 | | 12/1/12 | | | 50 | | | | 0 | | | 50 | |

Delaware Co. 1988 Ser. C | | var. rate | | | 4/1/93 | | 12/1/12 | | | 50 | | | | 0 | | | 50 | |

Salem Co. 1988 Ser. A | | var. rate | | | 4/1/93 | | 12/1/12 | | | 4 | | | | 0 | | | 4 | |

| | | | | | | | | | | | | | | | | | |

Total Mortgage-Backed Pollution Control Notes | | | | | | | | | $ | 154 | | | $ | 0 | | $ | 154 | |

| | | | | | | | | | | | | | | | | | |

Notes Payable - Accounts Receivable Agreement | | variable | | | | | 11/12/10 | | $ | 17 | | | $ | 0 | | $ | 17 | |

| | | | | | | | | | | | | | | | | | |

Long-Term Debt to PETT(a) and Other Financing Trusts | | | | | | | | | | | | | | | | | | |

1999 A-7 | | 6.13 | % | | 3/26/99 | | 9/1/08 | | | 848 | | | | 273 | | | 575 | |

2000 A-3 | | 7.625 | % | | 5/2/00 | | 3/1/09 | | | 399 | | | | 0 | | | 399 | |

2000 A-4 | | 7.65 | % | | 5/2/00 | | 9/1/09 | | | 351 | | | | 0 | | | 351 | |

2001 A-1 | | 6.52 | % | | 3/1/01 | | 9/1/10 | | | 805 | | | | 0 | | | 805 | |

PECO Energy Capital Trust III | | 7.38 | % | | 4/6/98 | | 4/6/28 | | | 81 | | | | 0 | | | 81 | |

PECO Energy Capital Trust IV | | 5.75 | % | | 6/24/03 | | 6/15/33 | | | 103 | | | | 0 | | | 103 | |

| | | | | | | | | | | | | | | | | | |

Total Long-Term Debt to PETT and Other Financing Trusts | | | | | | | | | $ | 2,588 | | | $ | 273 | | $ | 2,315 | |

| | | | | | | | | | | | | | | | | | |

Unamortized Debt Discount | | | | | | | | | $ | (2 | ) | | $ | 0 | | $ | (2 | ) |

| | | | | | | | | | | | | | | | | | |

Total Long-Term Debt | | | | | | | | | $ | 4,057 | | | $ | 273 | | $ | 3,784 | |

| | | | | | | | | | | | | | | | | | |

| (a) | PETT = PECO Energy Transition Trust |

| | | |

Maturities | | |

2007 | | $ | 273 |

2008 | | | 1,075 |

2009 | | | 700 |

2010 | | | 823 |

2011 | | $ | 250 |

16

Exelon Service Area and Selected Generating Assets*

Illinois

Maine

Maryland

Massachusetts

New Jersey

Pennsylvania

Texas

2006 Exelon Generation – Ownership Equity

| | | | | | |

| | | Output Mix

in Megawatt

Hours (MWh) | | | Capacity in

Megawatts (MW) | |

Nuclear | | 92 | % | | 66 | % |

Coal | | 6 | % | | 6 | % |

Oil | | <1 | % | | 10 | % |

Gas | | <1 | % | | 12 | % |

Renewables | | 1 | % | | 6 | % |

| * | Map does not show 8 sites in the Philadelphia area where Exelon has peaking combustion turbines. |

17

Exelon Generation – Generating Resources

Sources of Electric Supply

| | | | | | |

(GWhs) | | 2006 | | 2005 | | 2004 |

Nuclear units | | 139,610 | | 137,936 | | 136,621 |

Purchases – non-trading portfolio | | 38,297 | | 42,623 | | 48,968 |

Fossil and hydroelectric units | | 12,773 | | 13,778 | | 17,010 |

| | | | | | |

Total supply | | 190,680 | | 194,337 | | 202,599 |

| | | |

| Type of Capacity | | | | | | |

| | | |

(MWs) At December 31, | | 2006 | | 2005 | | 2004 |

Owned generation assets | | | | | | |

Nuclear | | 16,945 | | 16,856 | | 16,751 |

Fossil | | 6,992 | | 6,636 | | 6,709 |

Hydroelectric | | 1,606 | | 1,607 | | 1,633 |

| | | | | | |

Owned generation assets | | 25,543 | | 25,099 | | 25,093 |

Long-term contracts | | 7,691 | | 8,191 | | 8,701 |

TEG and TEP(a) | | 230 | | 230 | | 230 |

Sithe(b) | | — | | — | | 663 |

| | | | | | |

Total generating resources | | 33,464 | | 33,520 | | 34,687 |

| (a) | Generation, through its investments in Termoeléctrica del Golfo (TEG) and Termoeléctrica Peñoles (TEP), owned a 49.5% interest in two facilities in Mexico, each with a capacity of 230 MWs. On February 9, 2007, Generation sold its ownership interests in TEG and TEP. |

| (b) | Based on Generation’s 50% ownership of Sithe Energies, Inc; Sithe investment was sold on January 31, 2005. |

Long-Term Contracts

(At August 31, 2007)

| | | | | | | | | | | | |

ISO Region | | Dispatch Type | | Location | | Seller | | Fuel Type | | Delivery Term | | Capacity (MW) |

| PJM | | Base-load | | Kincaid, IL | | Kincaid Generation, LLC | | Coal | | 1998 – 2013 | | 1,108 |

| SERC | | Peaking | | Franklin, GA | | Tenaska Georgia Partners, LP(a) | | Oil/Gas | | 2001 – 2030 | | 925 |

| ERCOT | | Base-load | | Shiro, TX | | Tenaska Frontier Partners, LLP | | Oil/Gas | | 2000 – 2020 | | 830 |

| SPP | | Peaking | | Jenks, OK | | Green Country Energy, LLC | | Oil/Gas | | 2002 – 2022 | | 795 |

| PJM | | Peaking | | Elwood, IL | | Elwood Energy, LLC | | Oil/Gas | | 2001 – 2012 | | 775 |

| PJM | | Peaking | | Manhattan, IL | | Lincoln Generating Facility, LLC | | Oil/Gas | | 2003 – 2011 | | 664 |

| PJM | | Peaking | | Aurora, IL | | Reliant Energy Wholesale Generation, LLC | | Oil/Gas | | 2003 – 2008 | | 600 |

| PJM | | Base-load | | Hammond, IN | | State Line Energy, LLC | | Coal | | 1997 – 2012 | | 515 |

| ERCOT | | Intermediate | | Granbury, TX | | Wolf Hollow, LP | | Oil/Gas | | 2003 – 2023 | | 350 |

| PJM | | Peaking | | Lee County, IL | | Duke Energy Trading Inc. | | Oil/Gas | | 2001 – 2008 | | 344 |

| PJM | | Peaking | | East Dundee, IL | | Dynegy Inc. (Rocky Road Plant) | | Oil/Gas | | 2001 – 2009 | | 330 |

| PJM | | Peaking | | Crete, IL | | DTE Energy Trading and Marketing, LLC | | Oil/Gas | | 2003 – 2008 | | 294 |

| PJM | | Peaking | | Morris, IL | | Morris Cogeneration, LLC | | Oil/Gas | | 2001 – 2011 | | 100 |

| PJM | | Peaking | | Kincaid, IL | | Kincaid Generation, LLC | | Coal | | 2001 – 2013 | | 50 |

| | | | | | | | | | | | |

| Total | | | | | | | | | | | | 7,680 |

| | | | | | | | | | | | |

ISO = Independent System Operator

| (a) | On April 4, 2007, Exelon Generation agreed to sell its rights to all of the capacity, energy and ancillary services supplied from this contract through a tolling agreement with Georgia Power, commencing June 1, 2010 and lasting for 15–20 years, subject to regulatory approval. |

18

Exelon Generation – Nuclear Generating Capacity

Exelon Nuclear Fleet(a)

(At December 31, 2006)

| | | | | | | | | | | | | | | | | | |

Station | | Number

of Units | | Plant

Type | | NSSS

Vendor | | Net Annual

Mean Rating (MW) | | Start Date | | License

Expires | | Ownership | | Last Refueling

Completed by Unit | | Refueling

Cycle |

| Braidwood | | 2 | | PWR | | W | | 1,194/1,166 | | 1988 | | 2026/2027 | | 100% | | May-06/Nov-06 | | 18 mos. |

| Byron | | 2 | | PWR | | W | | 1,183/1,153 | | 1985/1987 | | 2024/2026 | | 100% | | Oct-06/May-07 | | 18 mos. |

| Clinton | | 1 | | BWR | | GE | | 1,048 | | 1987 | | 2026 | | 100%(b) | | Feb-06 | | 24 mos. |

| Dresden | | 2 | | BWR | | GE | | 871/871 | | 1970/1971 | | 2029/2031 | | 100% | | Nov-05/Nov-06 | | 24 mos. |

| LaSalle | | 2 | | BWR | | GE | | 1,138/1,150 | | 1984 | | 2022/2023 | | 100% | | Mar-06/Mar-07 | | 24 mos. |

| Limerick | | 2 | | BWR | | GE | | 1,151/1,151 | | 1986/1990 | | 2024/2029 | | 100% | | Mar-06/Apr-07 | | 24 mos. |

| Oyster Creek | | 1 | | BWR | | GE | | 625 | | 1969 | | 2009(c) | | 100%(b) | | Nov-06 | | 24 mos. |

| Peach Bottom | | 2 | | BWR | | GE | | 1,138/1,131 | | 1974 | | 2033/2034 | | 50% Exelon, | | Oct-06/Oct-05 | | 24 mos. |

| | | | | | | | | | | | | | 50% PSEG Nuclear | | | | |

| Quad Cities | | 2 | | BWR | | GE | | 866/871 | | 1973 | | 2032/2032 | | 75% Exelon, | | May-07/Apr-06 | | 24 mos. |

| | | | | | | | | | | | | | 25% Mid-American | | | | |

| | | | | | | | | | | | | | Energy Holdings | | | | |

| Three Mile Island | | 1 | | PWR | | B&W | | 837 | | 1974 | | 2014 | | 100%(b) | | Nov-05 | | 24 mos. |

| | | | | | | | | | | | | | | | | | |

Total | | 17 | | | | | | 17,544 | | | | | | 15,976 MW owned | | | | |

| | | | | | | | | | | | | | | | | | |

| (a) | Does not include Exelon Generation’s 42.59%, 969 MW, interest in Salem Units 1 and 2 (PWRs). Last refueling outages: Salem Unit 1 completed April 2007 and Unit 2 completed November 2006. |

| (b) | Clinton, Oyster Creek and Three Mile Island are operated by AmerGen, wholly owned by Generation. |

| (c) | A December 2004 order permits Oyster Creek to operate beyond its license expiration if the NRC has not completed its renewal application review. |

| Notes: | PWR = pressurized water reactor; BWR = boiling water reactor |

NSSS Vendor = Nuclear Steam Supply System Vendor

Nuclear Operating Data

| | | | | | | | | | | | |

| | | 2006 | | | 2005 | | | 2004 | |

Fleet capacity factor(a) | | | 93.9 | %(b) | | | 93.5 | % | | | 93.5 | % |

Fleet production cost per MWh(a) | | $ | 13.85 | | | $ | 13.03 | | | $ | 12.43 | |

Refueling Outage Days(a)– 2006

– Conducted ten refueling outages

– Average refueling outage duration: 24 days

– U.S. average refueling duration: ~39 days

Net Generation – 2006

– 131,385 GWhs, excluding Salem

– 139,610 GWhs, including Salem

Refueling Outages (including Salem)

2006: 11 actual

2007: 9 planned

2008: 12 planned

| (a) | Excludes Salem; Salem Unit 1 and Unit 2 capacity factors in 2006 were 100.7% and 93.6%, respectively. |

| (b) | vs. industry average of 89.3%. |

Source for industry averages: Exelon Nuclear 2007 Benchmarking Report

19

Exelon Generation – Total Electric Generating Capacity

Owned net electric generating capacity by station at December 31, 2006; does not include properties held by equity method investments:

Base-load units are plants that normally operate to take all or part of the minimum continuous load of a system, and consequently produce electricity at an essentially constant rate. Intermediate units are plants that normally operate to take load of a system during the daytime higher load hours, and consequently produce electricity by cycling on and off daily. Peaking units are plants that usually house low-efficiency, quick response steam units, gas turbines, diesels, or pumped-storage hydroelectric equipment normally used during the maximum load periods.

| | | | | | | | | | | | | |

Station | | Location | | Number

of Units | | Percent

Owned(a) | | Primary

Fuel Type | | Primary

Dispatch

Type | | Net

Generation

Capacity(b)

(MW) | |

Nuclear(c) | | | | | | | | | | | | | |

Braidwood | | Braidwood, IL | | 2 | | | | Uranium | | Base-load | | 2,360 | |

Byron | | Byron, IL | | 2 | | | | Uranium | | Base-load | | 2,336 | |

Clinton | | Clinton, IL | | 1 | | | | Uranium | | Base-load | | 1,048 | |

Dresden | | Morris, IL | | 2 | | | | Uranium | | Base-load | | 1,742 | |

LaSalle | | Seneca, IL | | 2 | | | | Uranium | | Base-load | | 2,288 | |

Limerick | | Limerick Twp., PA | | 2 | | | | Uranium | | Base-load | | 2,302 | |

Oyster Creek | | Forked River, NJ | | 1 | | | | Uranium | | Base-load | | 625 | |

Peach Bottom | | Peach Bottom Twp., PA | | 2 | | 50.00 | | Uranium | | Base-load | | 1,135 | (d) |

Quad Cities | | Cordova, IL | | 2 | | 75.00 | | Uranium | | Base-load | | 1,303 | (d) |

Salem | | Hancock’s Bridge, NJ | | 2 | | 42.59 | | Uranium | | Base-load | | 969 | (d) |

Three Mile Island | | Londonderry Twp, PA | | 1 | | | | Uranium | | Base-load | | 837 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 16,945 | |

Fossil (Steam Turbines) | | | | | | | | | | | | | |

Conemaugh | | New Florence, PA | | 2 | | 20.72 | | Coal | | Base-load | | 352 | (d) |

Cromby 1 | | Phoenixville, PA | | 1 | | | | Coal | | Intermediate | | 147 | |

Cromby 2 | | Phoenixville, PA | | 1 | | | | Oil/Gas | | Intermediate | | 211 | |

Eddystone 1, 2 | | Eddystone, PA | | 2 | | | | Coal | | Intermediate | | 599 | |

Eddystone 3, 4 | | Eddystone, PA | | 2 | | | | Oil/Gas | | Intermediate | | 760 | |

Fairless Hills | | Falls Twp, PA | | 2 | | | | Landfill Gas | | Peaking | | 60 | |

Handley 4, 5 | | Fort Worth, TX | | 2 | | | | Gas | | Peaking | | 916 | |

Handley 3 | | Fort Worth, TX | | 1 | | | | Gas | | Intermediate | | 400 | |

Keystone | | Shelocta, PA | | 2 | | 20.99 | | Coal | | Base-load | | 357 | (d) |

Mountain Creek 2, 6, 7 | | Dallas, TX | | 3 | | | | Gas | | Peaking | | 273 | |

Mountain Creek 8 | | Dallas, TX | | 1 | | | | Gas | | Intermediate | | 550 | |

New Boston 1 | | South Boston, MA | | 1 | | | | Gas | | Intermediate | | 355 | |

Schuylkill | | Philadelphia, PA | | 1 | | | | Oil | | Peaking | | 175 | |

Wyman | | Yarmouth, ME | | 1 | | 5.89 | | Oil | | Intermediate | | 36 | (d) |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 5,191 | |

Fossil (Combustion Turbines) | | | | | | | | | | | | | |

Chester | | Chester, PA | | 3 | | | | Oil | | Peaking | | 54 | |

Croydon | | Bristol Twp., PA | | 8 | | | | Oil | | Peaking | | 497 | |

Delaware | | Philadelphia, PA | | 4 | | | | Oil | | Peaking | | 74 | |

Eddystone | | Eddystone, PA | | 4 | | | | Oil | | Peaking | | 76 | |

Falls | | Falls Twp., PA | | 3 | | | | Oil | | Peaking | | 60 | |

Framingham | | Framingham, MA | | 3 | | | | Oil | | Peaking | | 41 | |

LaPorte | | Laporte, TX | | 4 | | | | Gas | | Peaking | | 160 | |

Medway | | West Medway, MA | | 3 | | | | Oil | | Peaking | | 172 | |

Moser | | Lower Pottsgrove Twp., PA | | 3 | | | | Oil | | Peaking | | 60 | |

New Boston | | South Boston, MA | | 1 | | | | Gas | | Peaking | | 18 | |

Pennsbury | | Falls Twp., PA | | 2 | | | | Landfill Gas | | Peaking | | 6 | |

Richmond | | Philadelphia, PA | | 2 | | | | Oil | | Peaking | | 132 | |

Salem | | Hancock’s Bridge, NJ | | 1 | | 42.59 | | Oil | | Peaking | | 16 | (d) |

Schuylkill | | Philadelphia, PA | | 2 | | | | Oil | | Peaking | | 38 | |

Southeast Chicago | | Chicago, IL | | 8 | | | | Gas | | Peaking | | 312 | |

Southwark | | Philadelphia, PA | | 4 | | | | Oil | | Peaking | | 72 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 1,788 | |

20

Exelon Generation – Total Electric Generating Supply

(continued)

Owned net electric generating capacity by station at December 31, 2005; does not include properties held by equity method investments:

| | | | | | | | | | | | | |

Station | | Location | | Number

of Units | | Percent

Owned(a) | | Primary

Fuel Type | | Primary

Dispatch

Type | | Net

Generation

Capacity(b)

(MW) | |

Fossil (Internal Combustion/Diesel) | | | | | | | | | | | | | |

Conemaugh | | New Florence, PA | | 4 | | 20.72 | | Oil | | Peaking | | 2 | (d) |

Cromby | | Phoenixville, PA | | 1 | | | | Oil | | Peaking | | 3 | |

Delaware | | Philadelphia, PA | | 1 | | | | Oil | | Peaking | | 3 | |

Keystone | | Shelocta, PA | | 4 | | 20.99 | | Oil | | Peaking | | 2 | (d) |

Schuylkill | | Philadelphia, PA | | 1 | | | | Oil | | Peaking | | 3 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 13 | |

Hydroelectric | | | | | | | | | | | | | |

Conowingo | | Harford Co. MD | | 11 | | | | Hydroelectric | | Base-load | | 536 | |

Muddy Run | | Lancaster, PA | | 8 | | | | Hydroelectric | | Intermediate | | 1,070 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 1,606 | |

| | | | | | | | | | | | | |

Total | | | | 126 | | | | | | | | 25,543 | |

| | | | | | | | | | | | | |

| (a) | 100%, unless otherwise indicated. |

| (b) | For nuclear stations, except Salem, capacity reflects the annual mean rating. All other stations, including Salem, reflect a summer rating. |

| (c) | All nuclear stations are boiling water reactors except Braidwood, Byron, Salem and Three Mile Island, which are pressurized water reactors. |

| (d) | Net generation capacity is stated at proportionate ownership share. |

21

Fossil Emissions Reduction Summary

Owned generation as of December 31, 2006. Table does not include station auxiliary equipment, peaking combustion turbines or plants where Exelon owns less than 100 MW.

| | | | | | | | |

| | | | | Net Generation Available for Sale (MWh) |

Fossil Station | | Capacity

(MW, Summer Rating) | | 2006 | | 2005 | | 2004 |

| Conemaugh (New Florence, PA) | | 352 | | 2,960,319 | | 2,681,176 | | 2,698,520 |

Units: 2 coal units (baseload) | | | | | | | | |

Reduction Technology: SO2 scrubbed | | | | | | | | |

Data reflects Exelon Generation’s 20.72% plant ownership. | | | | | | | | |

| | | | |

| Cromby (Phoenixville, PA) | | 358 | | 733,272 | | 1,010,799 | | 928,105 |

Units: 1 coal unit (intermediate), 1 oil/gas steam unit (intermediate) | | | | | | | | |

Reduction Technology: SO2 scrubbed (coal unit) and SNCR NOx | | | | | | | | |

| | | | |

| Eddystone (Eddystone, PA) | | 1,359 | | 2,925,962 | | 3,748,334 | | 3,205,674 |

Units: 2 coal units (intermediate), 2 oil/gas steam units (intermediate) | | | | | | | | |

Reduction Technology: SO2 scrubbed (coal units), SNCR NOx, and low NOx burners with separate overfire air | | | | | | | | |

| | | | |

| Handley(a)(Ft. Worth, TX) | | 1,316 | | 715,028 | | 803,986 | | 1,017,590 |

Units: 3 gas steam units (peaking/intermediate) | | | | | | | | |

Reduction Technology: SCR NOx (Units 3,4, and 5) | | | | | | | | |

| | | | |

| Keystone (Shelocta, PA) | | 357 | | 2,671,192 | | 2,827,950 | | 2,578,620 |

Units: 2 coal units (baseload) | | | | | | | | |

Reduction Technology: SCR NOx | | | | | | | | |

Data reflects Exelon Generation’s 20.99% plant ownership. | | | | | | | | |

SO2 scrubbers planned for 2009. | | | | | | | | |

| | | | |

| Mountain Creek(a)(Dallas, TX) | | 823 | | 530,147 | | 660,123 | | 459,909 |

Units: 4 gas steam units (peaking/intermediate) | | | | | | | | |

Reduction Technology: Induced flue gas recirculation (Units 6 and 7) and SCR NOx (Unit 8) | | | | | | | | |

| | | | |

| New Boston (South Boston, MA) | | 355 | | 211,461 | | 246,860 | | 160,563 |

Units: 1 gas steam unit (intermediate) | | | | | | | | |

Reduction Technology: None | | | | | | | | |

| | | | |

| Schuylkill (Philadelphia, PA) | | 175 | | 27,204 | | 129,260 | | 70,782 |

Units: 1 oil steam unit (peaking) | | | | | | | | |

Reduction Technology: None | | | | | | | | |

| (a) | Handley Units 1 and 2 and Mountain Creek Unit 3 were removed from service in 2005. These units represented a combined 195 MW of capacity. |

22

Fossil Emissions Reduction Summary

| | | | | | | | | | | | | | |

Emissions (tons) | | Reduction Technology |

Type | | 2006 | | 2005 | | 2004 | | SO2

Scrubbed | | SCR/SNCR

NOx | | Low NOx

burners with

separate

overfire air | | Induced

flue gas

recirculation |

| Conemaugh | | | | | | | | | | | | | | |

| SO2 | | 1,665 | | 1,487 | | 1,493 | | X | | | | | | |

| NOx | | 4,842 | | 4,074 | | 4,091 | | | | | | | | |

| CO2 | | 2,898,948 | | 2,612,601 | | 2,556,113 | | | | | | | | |

| | | | | | | |

| Cromby | | | | | | | | | | | | | | |

| SO2 | | 3,613 | | 4,990 | | 6,873 | | X (Coal Unit) | | | | | | |

| NOx | | 1,693 | | 2,105 | | 2,057 | | | | X | | | | |

| CO2 | | 970,953 | | 1,221,416 | | 1,249,773 | | | | | | | | |

| | | | | | | |

| Eddystone | | | | | | | | | | | | | | |

| SO2 | | 6,494 | | 8,675 | | 8,242 | | X (Coal Units) | | | | | | |

| NOx | | 5,409 | | 6,378 | | 5,276 | | | | X | | X | | |

| CO2 | | 3,720,295 | | 4,617,722 | | 4,172,765 | | | | | | | | |

| | | | | | | |

| Handley | | | | | | | | | | | | | | |

| SO2 | | 3 | | 3 | | 4 | | | | | | | | |

| NOx | | 57 | | 56 | | 206 | | | | X (Units 3, 4, 5) | | | | |

| CO2 | | 564,301 | | 654,284 | | 825,199 | | | | | | | | |

| | | | | | | |

| Keystone | | | | | | | | | | | | | | |

| SO2 | | 34,497 | | 37,523 | | 35,958 | | | | | | | | |

| NOx | | 2,684 | | 2,938 | | 2,850 | | | | X | | | | |

| CO2 | | 2,575,707 | | 2,718,347 | | 2,467,692 | | | | | | | | |

| | | | | | | |

| Mountain Creek | | | | | | | | | | | | | | |

| SO2 | | 2 | | 2 | | 4 | | | | | | | | |

| NOx | | 82 | | 97 | | 78 | | | | X (Unit 8) | | | | X (Units 6, 7) |

| CO2 | | 377,003 | | 489,586 | | 353,462 | | | | | | | | |

| | | | | | | |

| New Boston | | | | | | | | | | | | | | |

| SO2 | | 1 | | 1 | | 1 | | | | | | | | |

| NOx | | 115 | | 132 | | 93 | | | | | | | | |

| CO2 | | 138,129 | | 163,798 | | 110,507 | | | | | | | | |

| | | | | | | |

| Schuylkill | | | | | | | | | | | | | | |

| SO2 | | 95 | | 359 | | 407 | | | | | | | | |

| NOx | | 43 | | 180 | | 82 | | | | | | | | |

| CO2 | | 32,445 | | 140,475 | | 74,517 | | | | | | | | |

23

Exelon Generation – Annual Electric Supply and Sales Statistics

| | | | | | | | | | | | |

| | | Twelve Months Ended December 31, | |

(in GWhs) | | 2006 | | | 2005 | | | 2004 | |

Supply | | | | | | | | | | | | |

Nuclear | | | 139,610 | | | | 137,936 | | | | 136,621 | |

Purchased Power - Generation(a) | | | 38,297 | | | | 42,623 | | | | 48,968 | |

Fossil and Hydro | | | 12,773 | | | | 13,778 | | | | 17,010 | |

| | | | | | | | | | | | |

Power Team Supply | | | 190,680 | | | | 194,337 | | | | 202,599 | |

Purchased Power - Other | | | 1,413 | | | | 878 | | | | 585 | |

| | | | | | | | | | | | |

Total Electric Supply Available for Sale | | | 192,093 | | | | 195,215 | | | | 203,184 | |

Less: Line Loss and Company Use | | | (10,300 | ) | | | (10,368 | ) | | | (9,264 | ) |

| | | | | | | | | | | | |

Total Supply | | | 181,793 | | | | 184,847 | | | | 193,920 | |

Energy Sales | | | | | | | | | | | | |

Retail Sales | | | 135,273 | | | | 137,348 | | | | 130,945 | |

Power Team Market Sales(a) | | | 64,800 | | | | 66,049 | | | | 86,049 | |

Interchange Sales and Sales to Other Utilities | | | 3,274 | | | | 2,854 | | | | 2,470 | |

| | | | | | | | | | | | |

| | | 203,347 | | | | 206,251 | | | | 219,464 | |

Less: Delivery Only Sales | | | (21,554 | ) | | | (21,404 | ) | | | (25,544 | ) |

| | | | | | | | | | | | |

Total Energy Sales | | | 181,793 | | | | 184,847 | | | | 193,920 | |

|

(a) Purchased power and market sales do not include trading volume of 31,692 GWhs, 26,924 GWhs and 24,001 GWhs for the twelve months ended December 31, 2006, 2005 and 2004, respectively. | |

| |

| | | Twelve Months Ended December 31, | |

(in GWhs) | | 2006 | | | 2005 | | | 2004 | |

Electric Sales | | | | | | | | | | | | |

ComEd | | | 79,733 | | | | 82,798 | | | | 75,092 | |

PECO | | | 39,621 | | | | 39,163 | | | | 35,373 | |

Market(a) | | | 71,326 | | | | 72,376 | | | | 92,134 | |

| | | | | | | | | | | | |

Total Electric Sales(b),(c) | | | 190,680 | | | | 194,337 | | | | 202,599 | |

| | | | | | | | | | | | |

Average Margin ($/MWh) | | | | | | | | | | | | |

Average Realized Revenue | | | | | | | | | | | | |

ComEd | | $ | 35.89 | | | $ | 37.50 | | | $ | 30.66 | |

PECO | | | 45.73 | | | | 42.64 | | | | 40.91 | |

Market(d) | | | 51.03 | | | | 46.16 | | | | 35.03 | |

Total Electric Sales | | | 43.60 | | | | 41.76 | | | | 34.43 | |

Average Purchased Power and Fuel Cost(e) | | $ | 18.02 | | | $ | 20.11 | | | $ | 17.60 | |

Average Margin(e) | | $ | 25.58 | | | $ | 21.65 | | | $ | 16.83 | |

Around-the-clock Market Prices ($/MWh)(f) | | | | | | | | | | | | |

PJM West Hub | | $ | 51.07 | | | $ | 60.92 | | | $ | 42.34 | |

NIHUB | | | 41.42 | | | | 46.39 | | | | 31.15 | |

| (a) | Represents wholesale and retail sales. |

| (b) | Excludes retail gas sales, trading portfolio and other operating revenue. |

| (c) | Total sales do not include trading volume of 31,692 GWhs, 26,924 GWhs and 24,001 GWhs for the twelve months ended December 31, 2006, 2005 and 2004, respectively. |

| (d) | Market and retail sales exclude revenues related to tolling agreements of $86 million, $86 million and $97 million for the twelve months ended December 31, 2006, 2005 and 2004, respectively. |

| (e) | Excludes the mark-to-market impact of Generation’s economic hedging activities. |

| (f) | Represents the average for the year. |

24

Exelon Generation – Electric Supply and Sales Statistics by Quarter

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended |

(in GWhs) | | June 30,

2007 | | March 31,

2007 | | December 31,

2006 | | September 30,

2006 | | June 30,

2006 | | March 31,

2006 | | December 31,