Exelon Corporation Christopher Crane President and Chief Operating Officer Edison Electric Institute Financial Conference November 10-12, 2008 EXHIBIT 99.1 |

2 Forward-Looking Statements This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, for example, statements regarding benefits of the proposed merger, integration plans and expected synergies. There are a number of risks and uncertainties that could cause actual results to differ materially from the forward- looking statements made herein. The factors that could cause actual results to differ materially from these forward-looking statements include Exelon’s ability to achieve the synergies contemplated by the proposed transaction, Exelon’s ability to promptly and effectively integrate the businesses of NRG and Exelon, and the timing to consummate the proposed transaction and obtain required regulatory approvals as well as those discussed in (1) Exelon’s 2007 Annual Report on Form 10-K in (a) ITEM 1A. Risk Factors, (b) ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and (c) ITEM 8. Financial Statements and Supplementary Data: Note 19; (2) Exelon’s Third Quarter 2008 Quarterly Report on Form 10-Q in (a) Part II, Other Information, ITEM 1A. Risk Factors and (b) Part I, Financial Information, ITEM 1. Financial Statements: Note 12; and (3) other factors discussed in Exelon’s filings with the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements, which apply only as of the date of this filing. Exelon does not undertake any obligation to publicly release any revision to its forward-looking statements to reflect events or circumstances after the date of this filing. All information in this presentation concerning NRG, including its business, operations, and financial results, was obtained from public sources. While Exelon has no knowledge that any such information is inaccurate or incomplete, Exelon has not had the opportunity to verify any of that information. |

3 Important Additional Information This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. This presentation relates to a transaction with NRG proposed by Exelon, which may become the subject of a registration statement filed with the Securities and Exchange Commission (the “SEC”). This material is not a substitute for the prospectus/proxy statement Exelon intends to file with the SEC regarding the proposed transaction or for any other document which Exelon may file with the SEC and send to Exelon or NRG stockholders in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF EXELON AND NRG ARE URGED TO READ ANY SUCH DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Exelon and its directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding Exelon’s directors and executive officers is available in its Annual Report on Form 10-K for the year ended December 31, 2007, which was filed with the SEC on February 7, 2008, and its proxy statement for its 2008 Annual Meeting of Shareholders, which was filed with the SEC on March 20, 2008. Other information regarding the participants in a proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in a proxy statement filed in connection with the proposed transaction. |

4 Exelon Key Messages • Consistent with Exelon Protect and Grow Strategy • Earnings and cash accretion • Clear value creation • Meets NRG’s “Five Imperatives” Exelon Financial Outlook • 2009 operating guidance of $4.00 - $4.30/share • Managing costs and driving productivity • Significant uplift in 2011 - operating earnings of ~$5.00-$6.00/share (1) (1) Illustrative. Provided solely to illustrate possible future outcomes that are based on a number of different assumptions, all of which are subject to uncertainties and should not be relied upon as earnings guidance or a forecast of future results. Compelling Offer for NRG |

5 A Compelling Opportunity for Value Creation • Exelon offered to acquire all outstanding common shares of NRG in an all stock transaction – Fixed exchange ratio of 0.485 Exelon share for each NRG common share – Offer represents a 37% premium to October 17th closing price for NRG • Combined Entity Creates Value By: – Providing earnings and cash accretion – Creating an exceptional growth platform – Operating in the most attractive markets – Utilizing a premier balance sheet – Allowing Exelon to unlock NRG’s value – Giving NRG’s shareholders the opportunity to participate in future value – Presenting manageable regulatory hurdles to close |

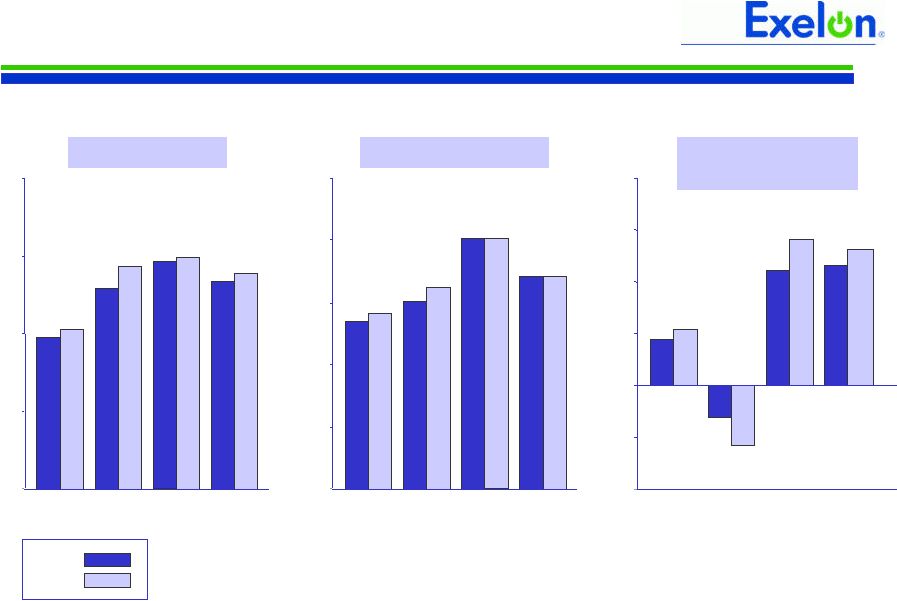

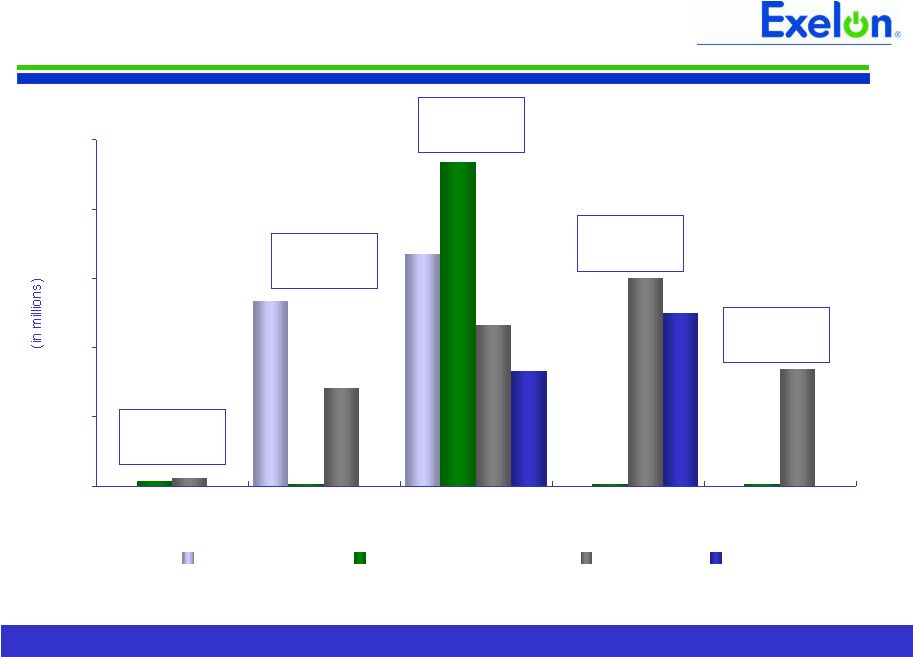

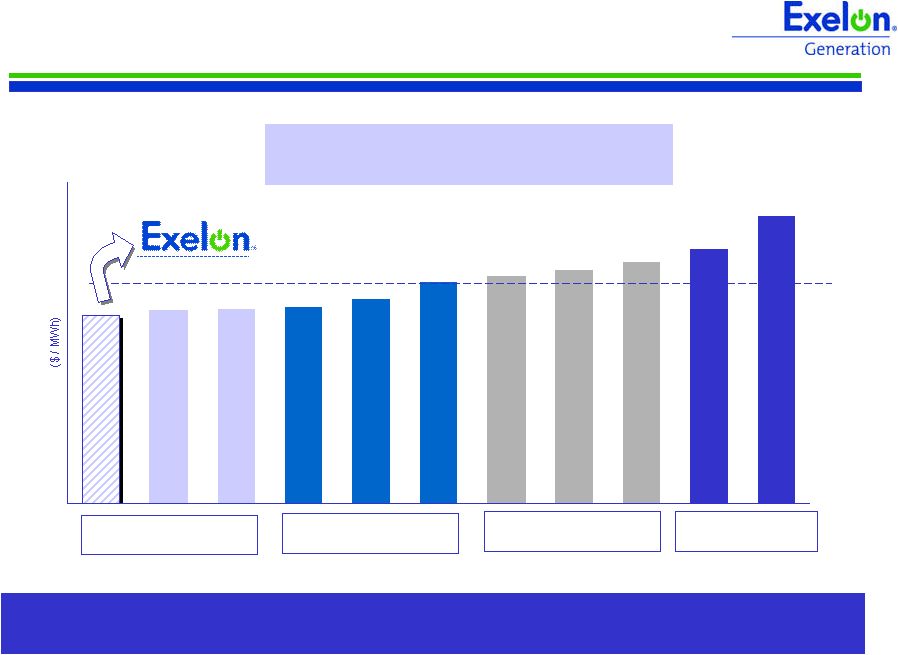

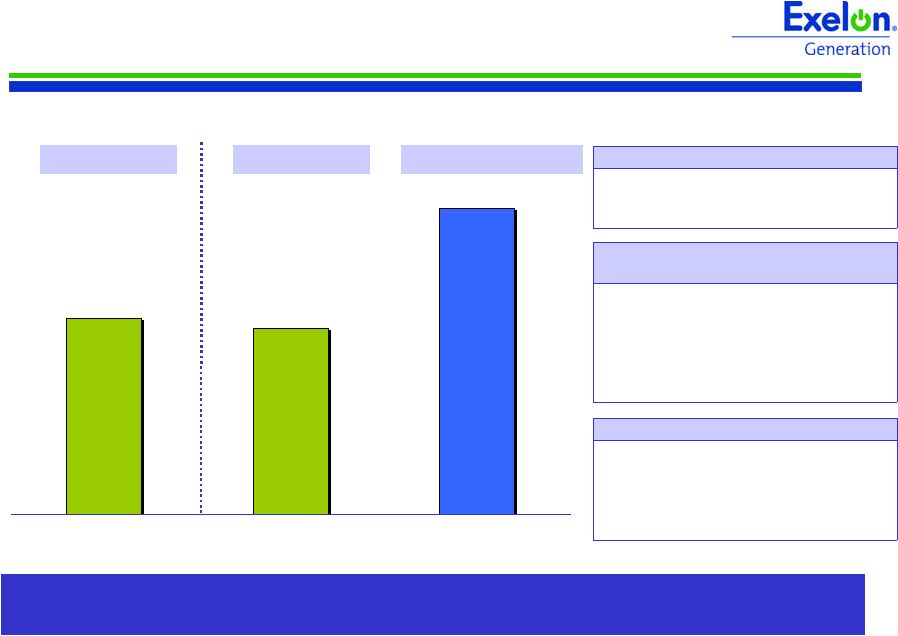

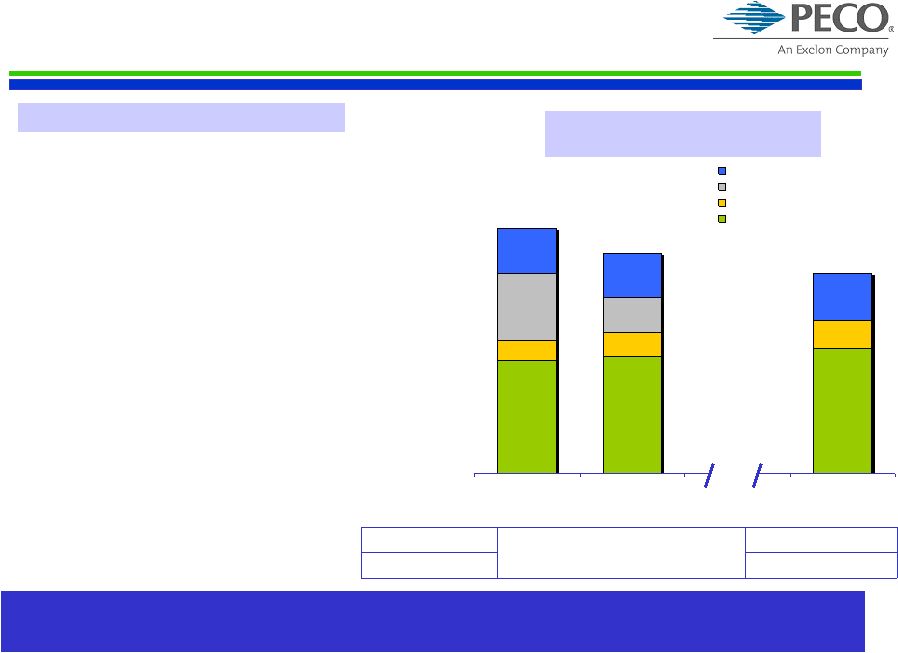

6 Transaction Is Accretive (1) Does not include purchase accounting. One-time cost to achieve of ~$100 million (pre-tax) and transaction and other costs of $654 million excluded. (2) Free cash flow defined as cash flow from operations less capital expenditures. (3) Based solely on I/B/E/S estimates for Exelon and NRG as of 10/31/08. Not necessarily representative of either company’s internal forecasts. Provided for illustration only. Not intended as earnings guidance or as a forecast of expected results. (4) Assumes refinancing of ~$8 billion of NRG debt at an interest rate of 10%. (5) Pro forma numbers in Exelon’s internal forecasts are somewhat lower and accretion is approximately breakeven in 2011. Operating Earnings per share 1 Free cash flow 2 per share $3.82 $4.29 $4.69 2010E 2011E 2012E $2.83 $2.91 $3.70 2010E 2011E 2012E $3.04 N/A N/A 2010E 2011E 2012E $4.42 $5.86 $6.16 2010E 2011E 2012E $4.03 N/A N/A 2010E 2011E 2012E 32.5% $4.83 $6.01 $6.43 2010E 2011E 2012E 9.4% 2.5% 4.3% Based on analyst consensus estimates for both companies, the deal will be accretive in the first full year following closing Exelon NRG Pro forma 5 • Synergies • Increased interest expense (4) • Synergies • Increased interest expense (4) 3 3 1 2 |

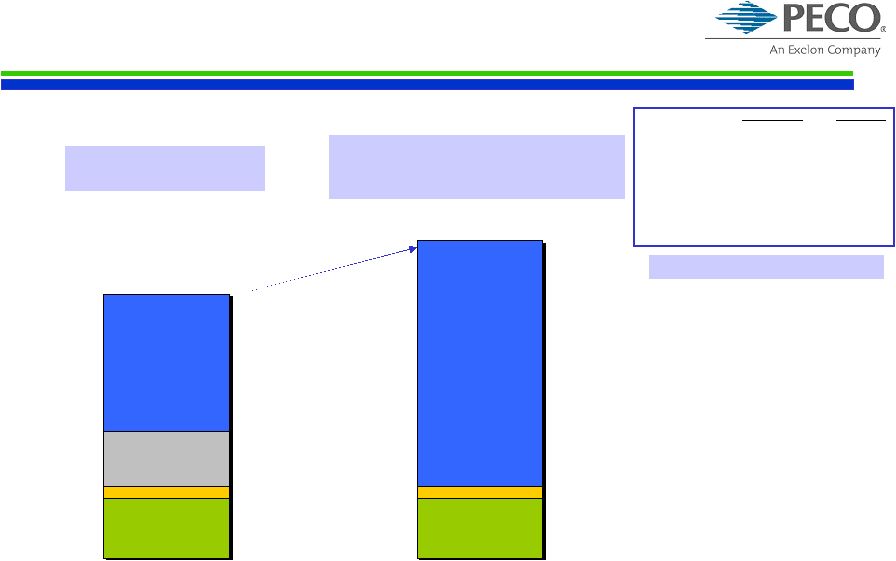

7 Combination Creates Substantial Synergies Exelon Operations & Maintenance: $4,289 NRG Maintenance & Other Opex: $950 General & Admin Expenses: $309 Other COGS: $454 Pro Forma Combined Non-fuel Expenses: $6,002 Estimated Annual Cost Savings: $180 - $300 2 % of Combined Expenses: 3%-5% Costs to Achieve $100 NPV of Synergies: $1,500-$3,000 ($ in Millions) Reflects no revenue or fuel cost synergies. Excludes transaction and other costs of $654 million and excludes increased interest expense related to refinancing of NRG debt. (1) Company 10-K for 2007 and investor presentations. (2) Based on a preliminary analysis of publicly available information. Subject to due diligence investigation. 1 Transaction creates $1.5 – $3 billion of value through synergies – with opportunity for more 1 |

Clear Value under Multiple Scenarios Gas price is long-term price in 2008 $/MMBtu; coal price is long-term price in 2008 $/ton for PRB8800 excluding transportation; new build cost is long-term combined cycle cost in PJM in 2008 overnight $/kW; carbon year is year in which national cap and trade starts; carbon price is in 2012 $/tonne assuming 7% escalation; moderate recession assumes conditions consistent with current forward prices; and severe recession assumes five years of no load growth. 8 Gas Prices New Build Costs Carbon Year/Price Recession $0 $6.50 $1,300 Moderate 2014/$22 $7.30 $1,100 Moderate 2020/$22 $7.10 $1,100 Severe 2014/$22 $7.30 $1,500 Moderate 2012/$12 $8.60 $1,500 Moderate We look at fundamental value creation under a wide range of future commodity price scenarios and our analysis suggests $1-3 billion, possibly more Coal Prices $11.00 $20.00 $20.00 $20.00 $11.00 |

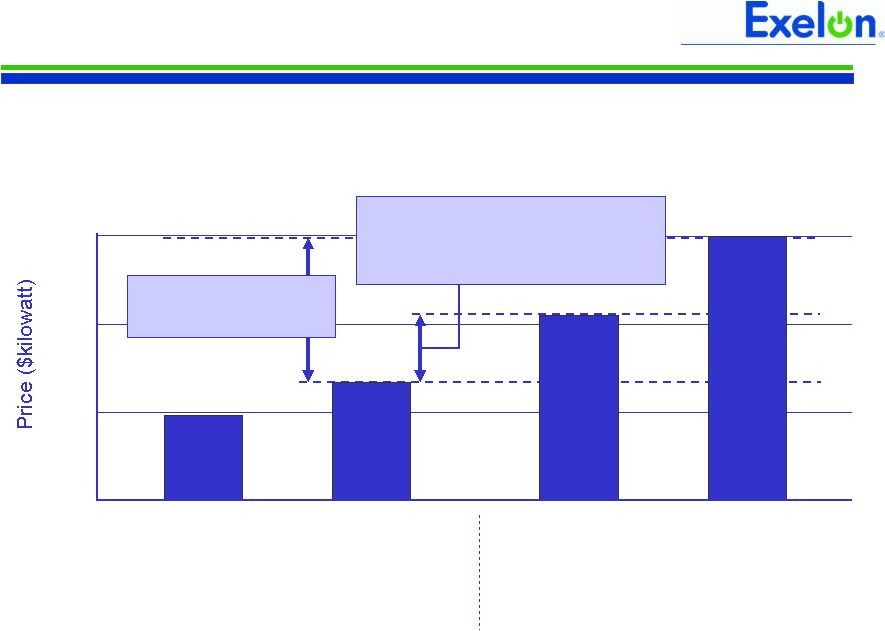

9 Without Premium 0 1,000 3,000 2,000 With Premium Conservative DCF Estimate Replacement Costs NRG Stock Value NRG Long-Term Value 975 1,350 2,050 3,000+ Price per Kilowatt Comparison for Texas Baseload Generation Exelon Unlocks NRG Value Less than 45% of replacement value Even with premium, purchase price is 66% of conservative long-term DCF value subtracting value of other NRG assets from NRG enterprise value based on October 17 th close. $/KW values are for 5,325 MW of Texas baseload which includes Parish coal, Limestone, and STP; values implied by NRG stock price are determined by |

10 World Class Nuclear & Fossil Operations High performing nuclear plant • Top quartile capacity factor – 94.9% • Large, well-maintained, relatively young units Fossil fleet • Half of >500 MW coal units are top quartile capacity factor • 90% of coal fleet lower-cost PRB and lignite NRG Premier U.S. nuclear fleet • Best fleet capacity factor ~ 94% • Lowest fleet production costs ~ $15 /MWh • Shortest fleet average refueling outage duration – 24 days • Strong reputation for performance Exelon |

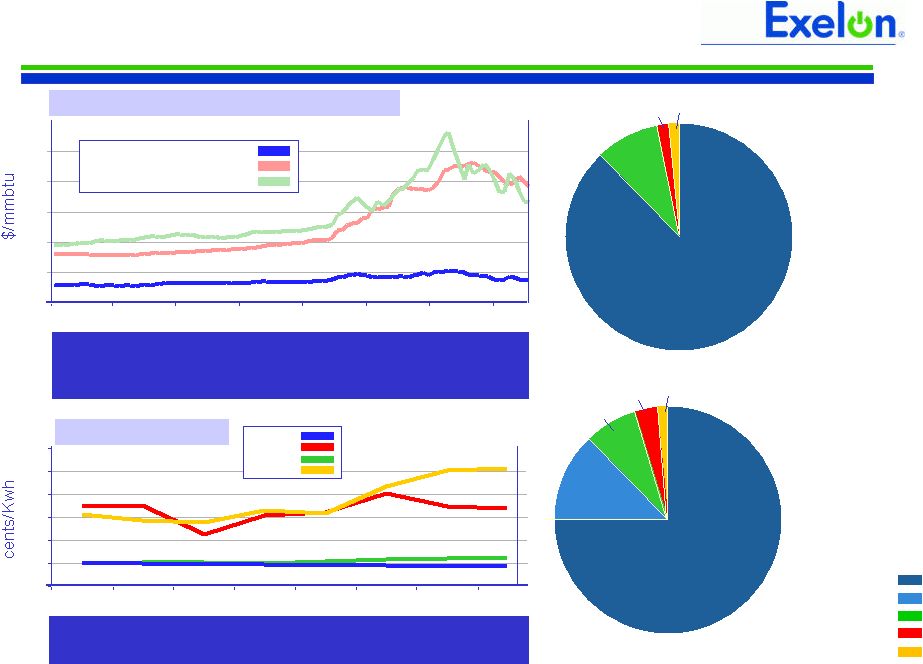

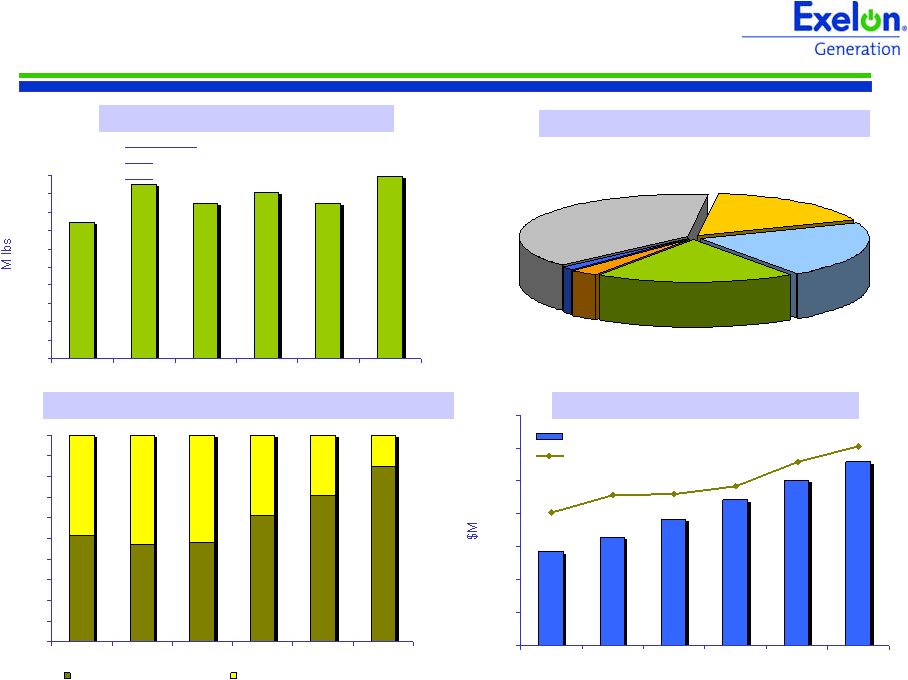

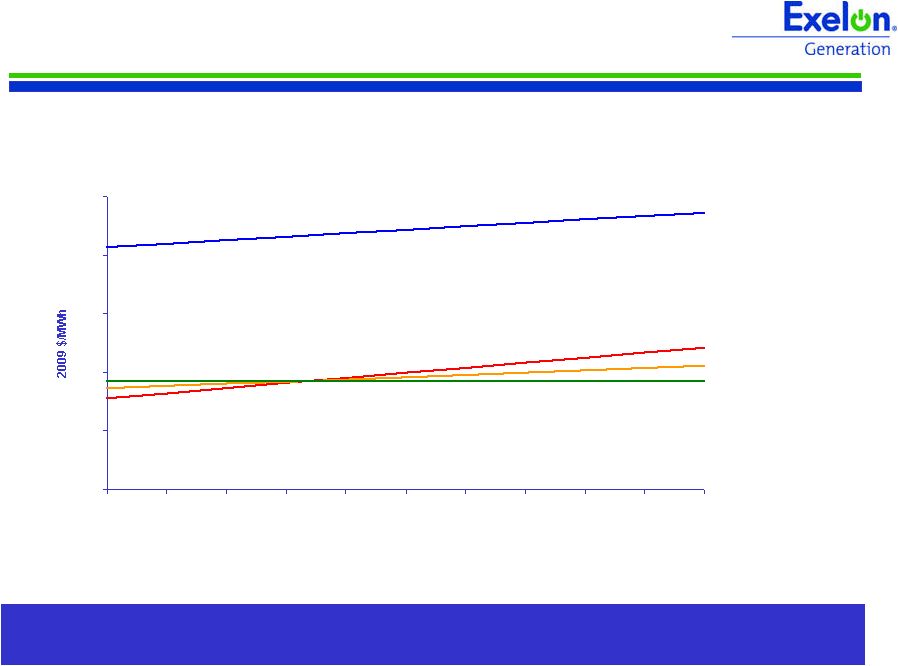

11 <1% <1% 6% Coal Exelon ~150,000 GWh Pro Forma Exelon ~198,000 GWh Nuclear PRB & Lignite Coal Other Coal Gas/Oil Hydro/Other 2009 Historical Forward Coal Prices Combined Entity Will Continue to Benefit from Low Cost, Low Volatility Fuel Sources 0.00 1.00 2.00 3.00 4.00 5.00 6.00 Powder River Basin Northern Appalachian Central Appalachian Production Costs 0 2 4 6 8 10 12 2000 2001 2002 2003 2004 2005 2006 2007 Nuclear Gas Coal Petroleum 93% Nuclear 1% 3% 75% Nuclear 15% PRB & Lignite Coal 6% Other Coal (1) Based on 2007 data, does not include ~38,000 GWh of Exelon Purchased Power. Q1 2007 Q2 2007 Q3 2007 Q4 2007 Q1 2008 Q2 2008 Q3 2008 Powder River Basin and lignite coal supply (90% of NRG’s coal) provides low-sulfur at a relatively stable price as compared to northern and central Appalachian coal mines. Combined fleet will continue to be predominantly low-cost fuel. 1 1 |

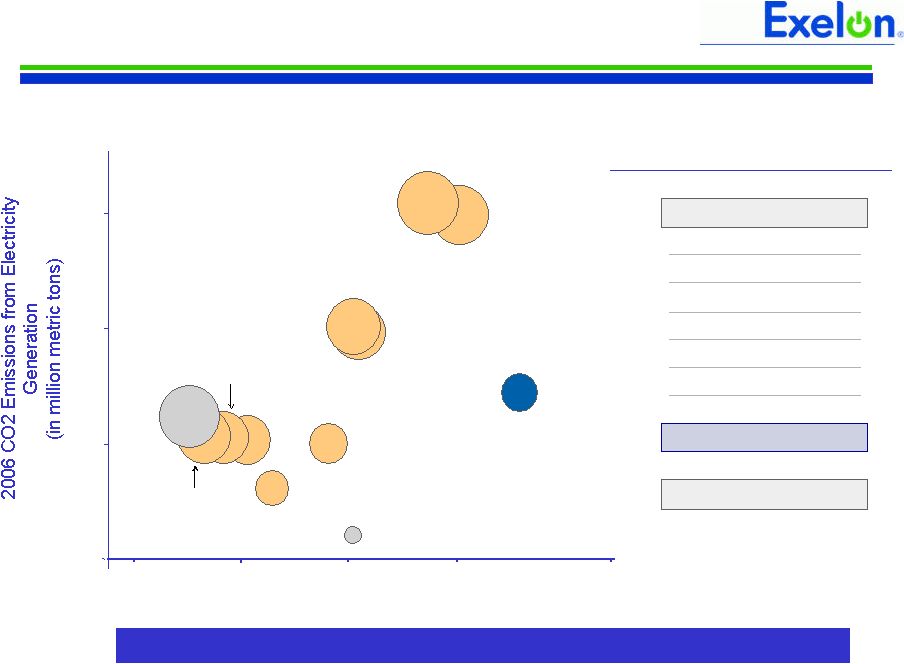

0 50 100 150 50 100 150 200 250 2006 Electricity Generated (GWh, in thousands) NRG TVA AEP Duke FPL Southern Exelon + NRG Entergy Exelon Dominion Progress FirstEnergy Bubble size represents carbon intensity, expressed in terms of metric tons of CO2 per MWh generated SOURCE: EIA and EPA data as compiled by NRDC CO2 Emissions of Largest US Electricity Generators Largest Fleet, 2nd Lowest Carbon Intensity Top Generators by CO2 Intensity 10 9 8 7 6 5 4 3 2 1 12 Exelon 2020 principles will be applied to the combined fleet AEP NRG Southern Duke FirstEnergy TVA Progress Dominion FPL Exelon + NRG Entergy Exelon 0.83 0.80 0.74 0.66 0.64 0.64 0.57 0.50 0.35 0.31 0.26 0.07 |

Financing Plan Considerations • Negotiated acquisition of NRG would require refinancing of only ~$4B of NRG debt and other credit facilities – Under a negotiated deal with NRG, $4.7B of NRG bonds could remain in place with no change in terms, but with substantially improved credit metrics for those bondholders – Exelon's relationships with many of NRG's banks should facilitate arrangements for new credit facilities – Financing commitments are well underway for refinancing • The NRG direct lien program for power marketing could be left in place 13 |

14 Premier Balance Sheet and Credit Metrics Committed to returning Exelon Generation’s senior unsecured debt to strong investment grade within the next 3 years Targeting stronger credit metrics for the combined entity -- 25 - 30% FFO/debt Pay down debt plan will include: NRG balance sheet cash, asset sale proceeds, free cash flow Exelon NRG Today 2011 Credit Rating: BBB FFO / Debt: 25-30% Combined Entity Targets Credit Rating: BBB- FFO / Debt: 26% Credit Rating: B+ FFO / Debt: 18% 2 3 1 (1) Ratios exclude securitized debt. (2) Senior unsecured credit rating and FFO/Debt as of 10/31/08. Reflects S&P updated guidelines, which include imputed debt and interest related to purchase power agreements, unfunded pension and other postretirement benefits obligations, capital adequacy for energy trading, operating lease obligations and other off-balance sheet data. (3) From Standard & Poor’s 8/28/08 CreditStats: Independent Power Producers & Energy Traders – U.S. |

15 Principal Regulatory Approvals and Expected Divestitures • Principal regulatory approvals: – Texas, New York, Pennsylvania, California state regulatory commissions – Hart-Scott-Rodino (DOJ/FTC) – FERC – NRC – Notice filing in Illinois • Limited market power issues – not expected to challenge transaction closing – Divestitures anticipated only in PJM and ERCOT – ~3,200 MWs of high heat rate gas and baseload coal plants and ~1,200 MWs under contract – Model assumes $1 billion of proceeds from divestitures (after-tax) Regulatory hurdles are manageable 1 (1) Plants subject to divestiture are de minimus contributors to revenue and earnings. |

16 Exelon More Than Meets the “Five Imperatives” Outlined by NRG on May 28, 2008 1. 1. 2. 2. 3. 3. 4. 4. 5. 5. NRG’s Stated Imperatives MUST accumulate generation at competitive cost This transaction accomplishes in one step what several transactions might have accomplished for NRG in these regards. Given the current difficulty in accessing capital markets, it is unclear whether NRG would have the ability to meet this objective without Exelon. Exelon provides NRG stakeholders with broad trading expertise and sound power marketing and risk management practices. Exelon’s significant experience in markets with locational prices is particularly relevant since ERCOT is moving to a PJM-type structure. Exelon’s breadth of operations and depth of service allows unparalleled access to customers, retail providers, and other sales channels. NRG stakeholders become part of the most diversified and competitive generation portfolio operating in 12 different states and 6 different regional transmission organizations. Deal provides NRG stakeholders with significant value and upside and a share of the largest unregulated generation fleet in the United States. MUST be geographically diversified in multiple markets MUST develop and expand our route to market through contracting with retail load providers, trading, direct sales, etc MUST have sophisticated ability to trade, procure, hedge, and originate for electricity and input fuels MUST develop depth and breadth in key markets, particularly across fuel types, transmission constraints and merit order Exelon Combination More than Meets These Imperatives |

17 Exelon Key Messages Compelling Offer for NRG • Consistent with Exelon Protect and Grow Strategy • Earnings and cash accretion • Clear value creation • Meets NRG’s “Five Imperatives” Exelon Financial Outlook • 2009 operating guidance of $4.00 - $4.30/share • Managing costs and driving productivity • Significant uplift in 2011 - operating earnings of ~$5.00-$6.00/share (1) (1) Illustrative. Provided solely to illustrate possible future outcomes that are based on a number of different assumptions, all of which are subject to uncertainties and should not be relied upon as earnings guidance or a forecast of future results. |

18 Well-Positioned in Near-Term Macroeconomic Uncertainty • Hedging strategy provides near-term earnings and cash flow stability • Over 90% and 80% financially hedged in 2009 and 2010, respectively Risk management • Proven management team • Lowest-cost nuclear fleet operator with ~94% capacity factor Best-in-class management / operations • Nuclear remains a low-cost generation source • Improving utilities’ performance and regulatory environment Basics of business unchanged • Nation’s largest nuclear fleet ~140,000 GWhs of annual production Market leader • Progress made on transition to competitive markets in PA • ComEd on path to regulatory recovery • Positively levered to long-term fundamentals Long-term value in place • Strong and consistent cash flows from operations – ~$4.75 billion estimated in 2009 • Over 12% annual growth rate in dividend since 2001 Stable cash flows and commitment to value return • ~$6.8 billion of available credit facilities as of 10/31/2008 • Debt maturities of $29 million (1) , in total, through 12/31/2009 Sufficient liquidity Investment Criteria Exelon Profile (1) Excludes securitization debt. |

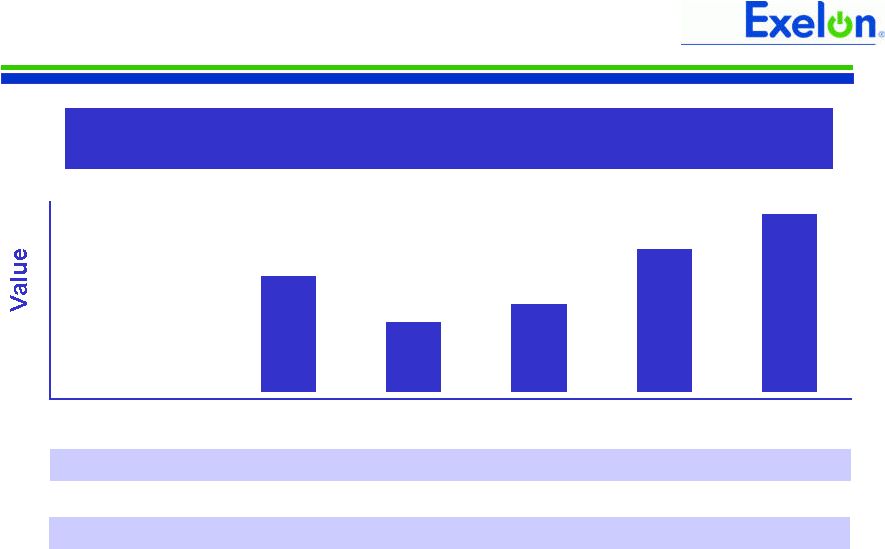

19 O&M and other Inflation Pension/OPEB Cost initiatives Bad debt expense 2009 Operating Earnings Guidance 2009E 2008E $0.45 - $0.50 $3.45 - $3.55 $4.15 - $4.30 (1) ComEd PECO Exelon Generation 2009 Earnings Drivers ComEd PECO Exelon Generation Holdco Holdco Exelon $0.30 - $0.35 Exelon $4.00 - $4.30 (1) $0.45 - $0.55 $0.45 - $0.55 $3.10 - $3.35 NOTE: See “Key Assumptions” slide in Appendix (1) Operating Earnings Guidance. Excludes the earnings impact of certain items as disclosed in the Appendix. (2) Primarily reflects 2008 option and uranium settlement gains at Exelon Generation. Issuing 2009 operating earnings guidance of $4.00-$4.30/share (1) ComEd distribution revenue PECO gas revenue Nuclear fuel costs Depreciation and amortization PECO CTC Discrete 2008 ExGen gains (2) |

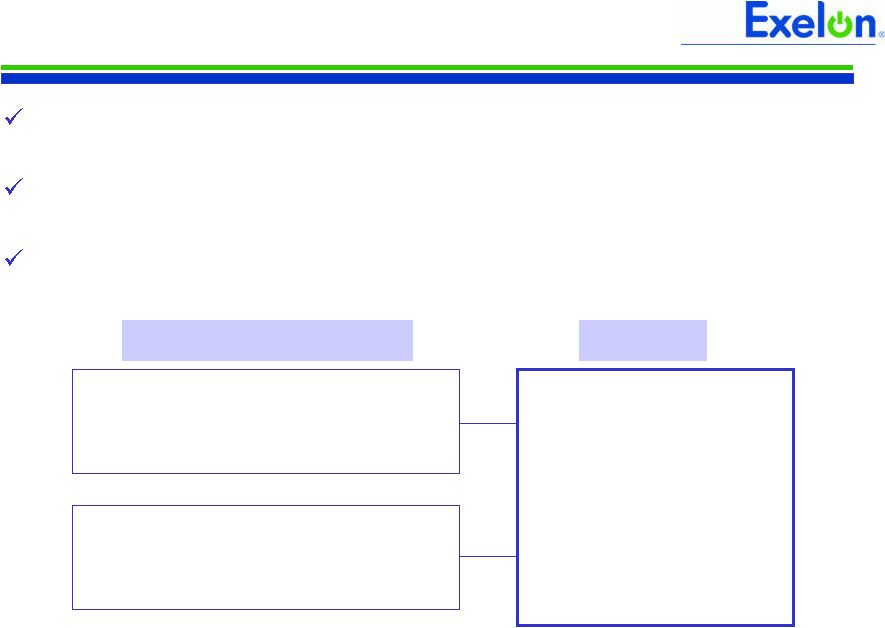

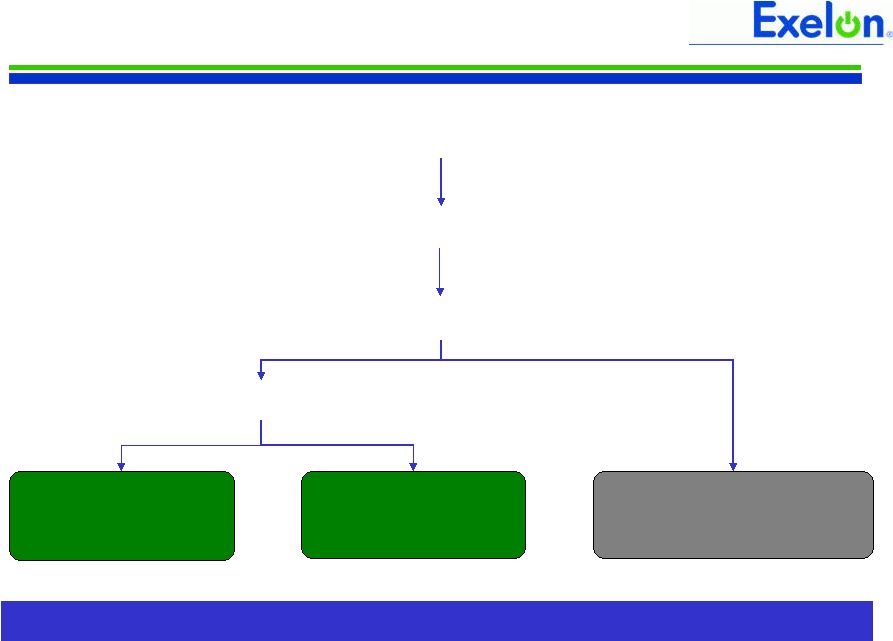

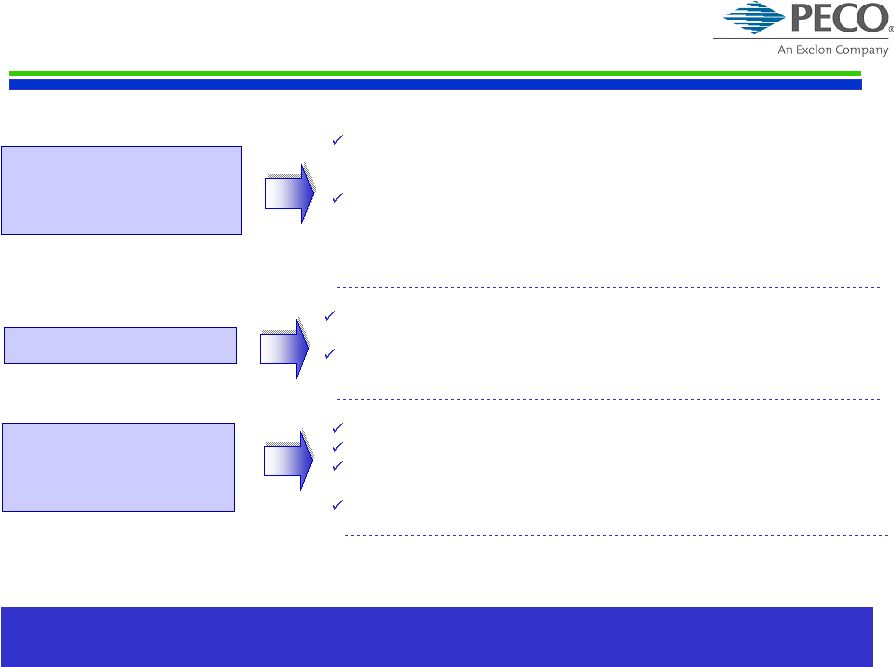

20 Exelon Cost and Capital Management Initiative • Clearly define governance and oversight model • Optimize the Exelon operational structure to drive efficiency and accountability, reducing complexity and cost • Provide better visibility on cost drivers and productivity • Process improvement and elimination of low value work • Drive productivity focus in business planning process Define and implement appropriate governance and oversight model Identify cost reduction opportunities Focus 1: Cost Break-through Drive focus on productivity initiatives Identify additional needs and opportunities Focus 2: Business Unit Cost Productivity Process redesign Systems investment Focus 3: Sustainable Productivity Drive productivity and cost reduction (with continued superior operations) Cost and capital management initiatives support earnings expectations |

21 Exelon Key Messages • Consistent with Exelon Protect and Grow Strategy • Earnings and cash accretion • Clear value creation • Meets NRG’s “Five Imperatives” Exelon Financial Outlook • 2009 operating guidance of $4.00 - $4.30/share • Managing costs and driving productivity • Significant uplift in 2011 - operating earnings of ~$5.00-$6.00/share (1) (1) Illustrative. Provided solely to illustrate possible future outcomes that are based on a number of different assumptions, all of which are subject to uncertainties and should not be relied upon as earnings guidance or a forecast of future results. Compelling Offer for NRG |

22 Appendix Additional Information regarding Offer for NRG |

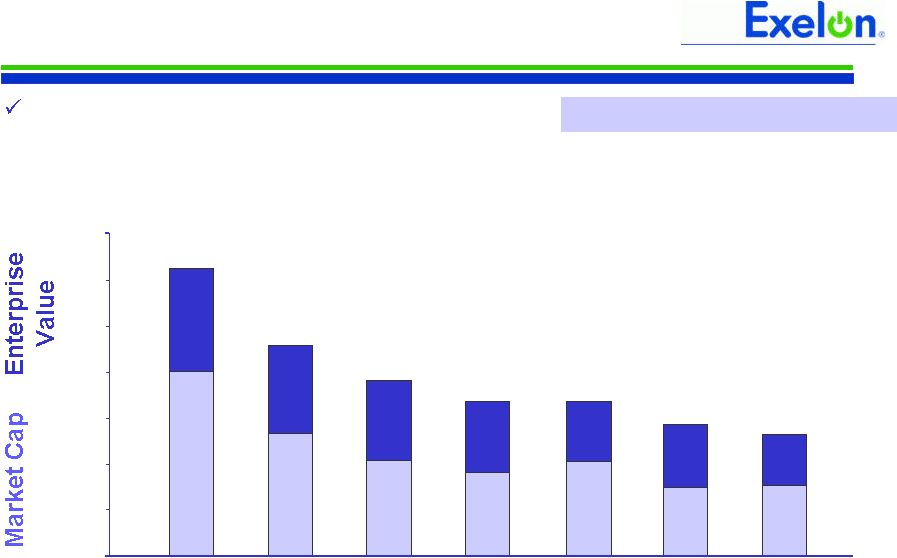

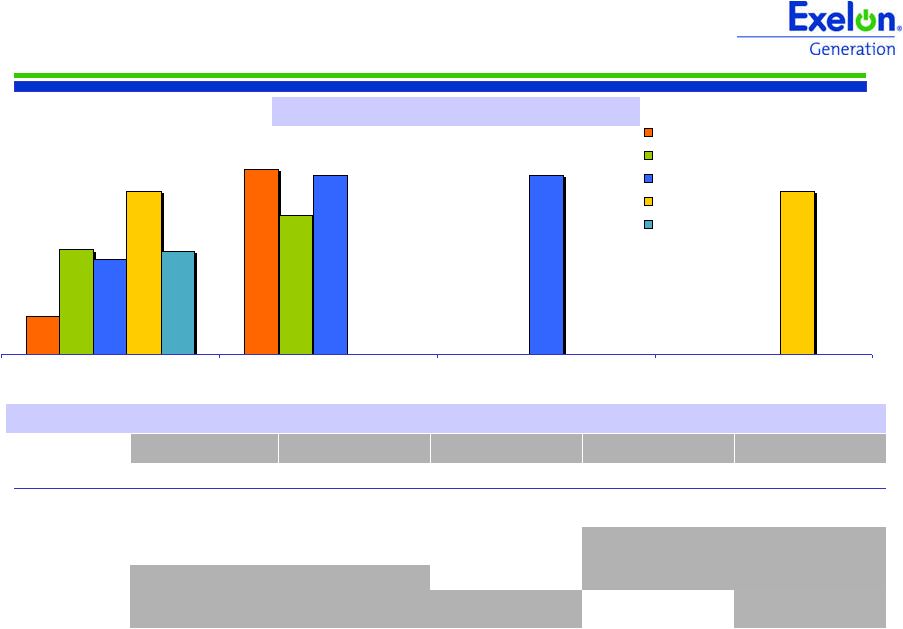

23 Pro Forma Exelon Combined company will have requisite scope, scale and financial strength to succeed in an increasingly volatile energy market Combination Will Result in Scope, Scale and Financial Strength (1) Reflects total assets (under GAAP) with no adjustments. Based upon 9/30/08 Form 10-Q. (2) Reflects Last Twelve Months EBITDA (Earnings before Income Taxes, Depreciation and Amortization) as of 9/30/08 with no adjustments. (3) Calculation of Enterprise Value = Market Capitalization (as of 10/31/08) + Total Debt (as of 6/30/08) + Preferred Securities (as of 6/30/08) + Minority Interest (as of 6/30/08) – Cash & Cash Equivalents (as of 6/30/08). Debt, Preferred Securities, Minority Interest and Cash & Cash Equivalents based upon 6/30/08 Form 10-Q. (4) Includes owned-and-contracted capacity after giving effect to planned divestitures after regulatory approvals. $0 $30 $50 $60 $40 $20 $70 $10 Southern Dominion FPL Duke First Energy Entergy $68,900 Combined assets (1) $9,400 LTM EBITDA (2) ($ in millions) $63,000 Enterprise value (3) ~51,000MWs Generating capacity (4) Pro Forma Quick Stats Market cap (as of 10/31/08) $41,200 |

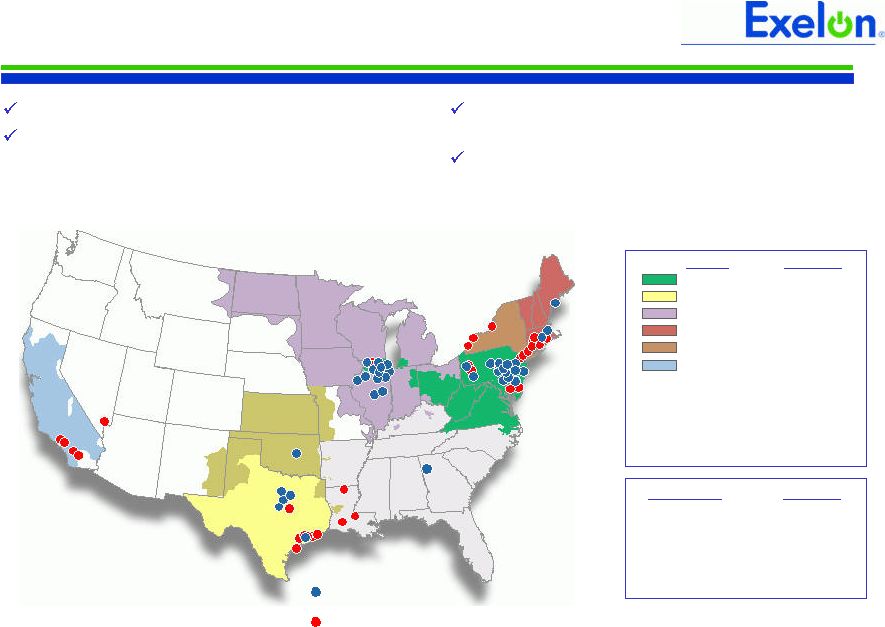

Combination Enables Access to Attractive New Markets By RTO Combined PJM 22,812 ERCOT 13,027 MISO 1,065 ISO NE 2,174 NYISO 3,960 CAL ISO 2,085 Contracted* 6,280 51,403 SERC 2,405 WECC 45 Total 53,853 By Fuel Type Combined Nuclear 18,144 Coal 8,986 Gas/Oil 18,801 Other 1,642 Contracted 6,280 *Contracted in various RTOs, mainly in PJM and ERCOT (1) Excludes international assets. Before any divestitures. 24 Geographically complementary asset base Attractive new markets for Exelon (NY, NE, CA): declining reserve margins, supportive regulatory structures Predominantly located in competitive markets ERCOT portfolio will position Exelon to offer an array of products, capture value, and efficiently utilize credit 1 1 Exelon NRG |

25 Nuclear Growth Opportunities • Texas offers nuclear growth platform • Potential for stretch power uprate (5-7%) on South Texas Project units 1 and 2 • Construction & Operating License and Loan Guarantee applications filed for both STP 3 and 4 and Victoria County • Exelon has the financial strength and discipline to investigate these opportunities • Strong balance sheet and credit metrics • Demonstrated track record of financial rigor • Nuclear depth and expertise • Options to build remain under evaluation; no commitment has yet been made |

26 Exelon 2020 and NRG • Expand internal energy efficiency, SF6, vehicle, and supply chain initiatives to NRG portfolio • Offset a portion of NRG’s GHG emissions • Expand energy efficiency program offerings • Add capacity to existing nuclear units through uprates • Add new renewable generation • Add new gas-fired capacity • Continue to explore new nuclear • Address older/higher emitting coal and oil units • Invest in clean coal technology R&D Options to Evaluate: Taking the next step in Exelon’s commitment to address climate change Offer more low carbon electricity in the marketplace Reduce emissions from coal/oil fired generation Help our customers and the communities we serve reduce their GHG emissions Reduce or offset our footprint by greening our operations Apply Elements of Exelon 2020 to NRG Expand the 2020 Plan |

27 NRG is Best Investment Available 0% 4.0% 8.0% 12.0% 16.0% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% (10.0%) 0% 5.0% 20.0% EBITDA / EV Yield Earnings Yield Free Cash Flow Yield EXC Illustrative Utilities NRG at Offer 2009E 2010E 7.9 10.2 11.8 10.6 8.1 11.4 11.9 10.7 IPPs EXC Illustrative Utilities NRG at Offer IPPs EXC Illustrative Utilities NRG at Offer IPPs 13.7 15.4 20.1 16.7 14.4 16.1 20.1 17.1 Source: FactSet. Prices as of 10/17/08, I/B/E/S estimates as of 10/31/08. EV = Enterprise Value (1) Illustrative Utilities include CMS, CNL, DPL, TE, WEC, WR. (2) IPPs include CPN, DYN, MIR, RRI. 4.3 (3.1) 11.2 11.6 5.2 (6.2) 14.2 12.3 15.0% 10.0% (5.0%) 1 2 2 2 1 1 |

28 2009 Financial Outlook and Operating Data |

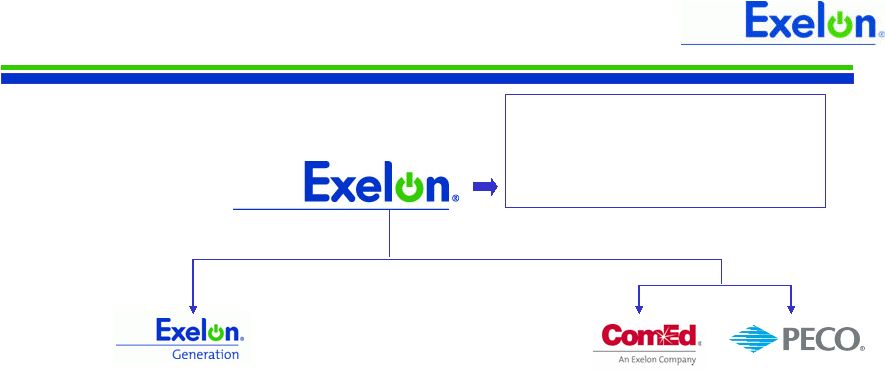

29 The Exelon Companies ’07 Earnings: $2,331M ’07 EPS: $3.45 Total Debt (1) : $2.5B Credit Rating (2) : BBB Nuclear, Fossil, Hydro & Renewable Generation Power Marketing ‘07 Operating Earnings: $2.9B ‘07 EPS: $4.32 Assets (1) : $45.2B Total Debt (1) : $13.0B Credit Rating (2) : BBB- Note: All ’07 income numbers represent adjusted (Non-GAAP) Operating Earnings and EPS. Refer to Appendix for reconciliation of adjusted (non-GAAP) operating EPS to GAAP EPS. (1) As of 9/30/08. (2) Standard & Poor’s senior unsecured debt ratings for Exelon and Generation and senior secured debt ratings for ComEd and PECO as of 10/31/08. Pennsylvania Utility Illinois Utility ’07 Earnings: $200M $507M ’07 EPS: $0.30 $0.75 Total Debt (1) : $5.1B $3.5B Credit Ratings (2) : BBB+ A- |

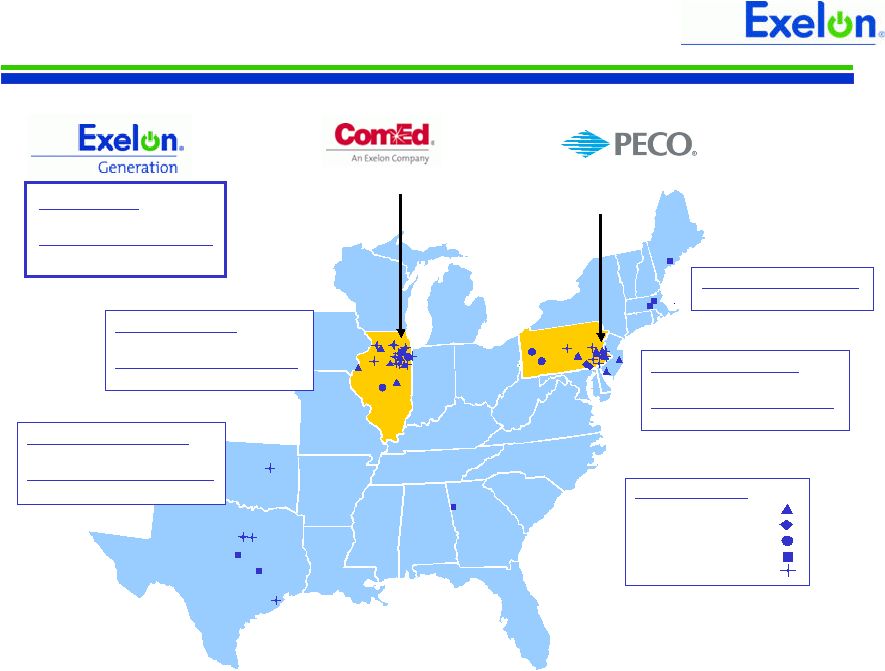

30 Multi-Regional, Diverse Company Note: Owned megawatts based on Generation’s ownership, using annual mean ratings for nuclear units (excluding Salem) and summer ratings for Salem and the fossil and hydro units. Midwest Capacity Owned: 11,388 MW Contracted: 3,230 MW Total: 14,618 MW ERCOT/South Capacity Owned: 2,222 MW Contracted: 2,917 MW Total: 5,139 MW New England Capacity Owned: 194 MW Total Capacity Owned: 24,821 MW Contracted: 6,483 MW Total: 31,304 MW Electricity Customers: 1.6M Gas Customers: 0.5M Electricity Customers: 3.8M Generating Plants Nuclear Hydro Coal/Oil/Gas Base-load Intermediate Peaker Mid-Atlantic Capacity Owned: 11,017 MW Contracted: 336 MW Total: 11,353 MW |

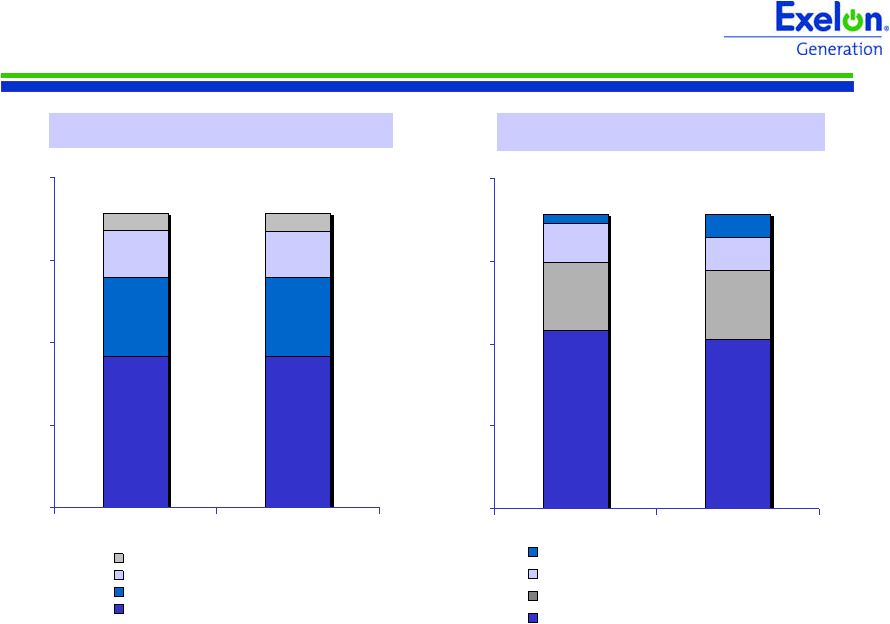

31 ~4% (2) $1,050 $1,100 ~3% (2) $700 $750 ~4% ~4% 2009-2013 CAGR $4,400 $2,650 2009E $4,500 $2,700 2008E Exelon (3) O&M Expense (1) ($ in Millions) O&M and CapEx Expectations ($ in Millions) ~5% $1,000 $950 ~6% $400 $400 Exelon (3) ~4% ~8% ~3% 2009-2013 CAGR (4) $3,400 $950 $1,000 2009E $3,300 $850 $950 2008E Nuclear Fuel Plant & Other CapEx A combination of company-wide cost-savings initiatives and controlled spending will offset inflationary pressures and rising pension and retiree health and welfare costs (1) Reflects Operating O&M data and excludes Decommissioning impact. (2) For ComEd and PECO, O&M excludes energy efficiency spend recoverable under a rider. 2009-2013 Compound Annual Growth Rate (CAGR) would be ~6% for ComEd and ~4% for PECO if spend was included. (3) Includes eliminations and other corporate entities. (4) Subject to change based upon proposed NRG acquisition. NOTE: CapEx expectations for ComEd exclude potential investment in automated meter technology that is subject to approval by the Illinois Commerce Commission. |

32 2009 Projected Sources and Uses of Cash 150 0 300 50 Other (4) 150 350 (250) 250 Net Financing (excluding Dividend): (2) 750 350 200 200 Planned Debt Issuances Net Financing (excluding Dividend): (2) (750) 0 (750) 0 Planned Debt Retirements (3) $4,750 $2,800 $950 $1,000 Cash Flow from Operations (1) (3,400) (1,950) (400) (1,000) Capital Expenditures $1,500 $1,200 $300 $250 Cash Available before Dividend (1,400) Dividend (5) $100 Cash Available after Dividend Exelon (6) ($ in Millions) Numbers are rounded and may not add. (1) Cash Flow from Operations = Primarily includes net cash flows provided by operating activities, excluding counterparty collateral activity, and including net cash flows used in investing activities other than capital expenditures. (2) Net Financing (excluding Dividend) = Net cash flows used in financing activities excluding dividends paid on common and preferred stock. (3) Planned Debt Retirements are $17M, $728M, and $11M for ComEd, PECO, and ExGen, respectively. Includes securitized debt. (4) Other financing includes ComEd recovery of excess payments to ComEd Transitional Funding Trust. For PECO it represents the Parent Receivable and expected changes in short-term debt. (5) Assumes 2009 Dividend of $2.10 per share. Dividends are subject to declaration by the board of directors. (6) Includes cash flow activity from Holding Company, eliminations, and other corporate entities. |

33 Pension Benefit Expense Service Amortization Interest Expected Return on Assets Total Service 50 bps ~$40M Long-Term Expected Return on Plan Assets (EROA) 50 bps ~$37M 100 bps ~$2.5M Sensitivity of 2009 pre-tax pension expense 12/31/08 Discount Rate FY08 Asset Returns Impact on 2009 estimated expense Input Pension Plan Key Metrics – 12/31/07 (in millions) Assets $9,634 Obligations $10,427 Discount rate 6.20% 2008 L-T EROA 8.75% $130 $83 ($668) $113 $508 $0 $200 $400 $600 $800 Note: Excludes settlement charges. |

34 Other Postretirement Benefits (OPEB) 2009 Expense: Exelon estimates pre-tax 2009 OPEB expense of ~$175 million under Scenarios 1-3 and $225 million under Scenario 4 as compared to $160 million in 2008. 2009 Contributions: Exelon estimates roughly $150 million of contributions to its OPEB plans in 2009, which is subject to change. Potential Variability in Future Pension Expense and Contributions Required contribution Pre-tax expense Required contribution Pre-tax expense Required contribution Pre-tax expense Discount Rate Actual Asset Returns $1,375 $300 $825 $250 $175 $150 6.70% as of 1/1/09, increasing to 6.90% as of 1/1/11 -27% in 2008 -15% in 2009 -3% in 2010 8.5%in 2011 4 $775 $275 $225 $200 $125 $75 7.90% as of 1/1/09, increasing to 8.10% as of 1/1/11 -27% in 2008 -15% in 2009 -3% in 2010 8.5%in 2011 3 $675 $250 $200 $175 $125 $75 7.90% as of 1/1/09, increasing to 8.10% as of 1/1/11 -27% in 2008 -9% in 2009 8.5% in 2010- 2011 2 $100 $225 $100 $150 $125 $75 7.90% as of 1/1/09, increasing to 8.10% as of 1/1/11 -27% in 2008 8.50% in 2009- 2011 1 2011 2010 2009 Assumptions Illustrative Scenario NOTE: Slide provided for illustrative purposes and not intended to represent a forecast of future outcomes. Assumes 20% overall capitalization rate of pension and OPEB costs. |

35 Sufficient Liquidity (1) Excludes previous commitment from Lehman Brothers Bank. (2) Available Capacity Under Facility represents the unused bank commitments under the borrower’s credit agreements net of outstanding letters of credit. The amount of commercial paper outstanding does not reduce the available capacity under the credit agreements. (3) Includes cash flow activity from Holding Company, eliminations, and other corporate entities. (90) -- -- (90) Outstanding Facility Draws (416) (155) (90) (166) Outstanding Letters of Credit $7,317 $4,834 $574 $952 Aggregate Bank Commitments (1) 6,811 4,679 484 696 Available Capacity Under Facility (2) -- -- -- -- Outstanding Commercial Paper $6,811 $4,679 $484 $696 Available Capacity Less Outstanding Commercial Paper Exelon (3) ($ in Millions) We have no commercial paper outstanding and our bank facility is largely untapped Available Capacity Under Bank Facility as of October 31, 2008 |

36 Large and Diverse Bank Group Exelon has a large and diverse bank group with over $7.3 billion in aggregate credit facility commitments – 24 banks committed to the facility with each bank having less than 10% of the aggregate commitments at Exelon • Bank of America, N.A. / Merrill Lynch USA (2) • The Royal Bank of Scotland PLC (RBS) • Barclays Bank PLC • JP Morgan Chase Bank, N.A. • The Bank of Nova Scotia (Scotia) • Wachovia Bank, N.A. • Citibank, N.A. • Commerzbank AG • BNP Paribas • Deutsche Bank AG, New York Branch • Credit Suisse, Cayman Islands Branch • Morgan Stanley Bank • UBS Loan Finance LLC • The Bank of New York / Mellon Bank, N.A. • Mizuho Corporate Bank, LTD • Goldman Sachs (3) • The Bank of Tokyo-Mitsubishi UFJ, LTD • KeyBank N.A. • U.S. Bank, N.A. • SunTrust Bank • Union Bank of California, N.A. • The Northern Trust Company • Malayan Banking Berhad (May Bank) • National City Bank (1) As of October 31, 2008. (2) Assumes that Bank of America assumes Merrill Lynch’s previous commitment. (3) Includes funding commitments by Williams Street Commitment Corporation, Williams Street Credit Corporation, Goldman Sachs Credit Partners, L.P. Banks Committed to Exelon’s Facilities (1) |

37 $0 $150 $300 $450 $600 $750 2009 2010 2011 2012 2013 Exelon Corp Exelon Generation ComEd PECO 2009-2013 Debt Maturities Note: Balances shown exclude securitized debt Minimal debt maturities before 2011 $29 M Total $615 M Total $1,799 M Total $828 M Total $255 M Total |

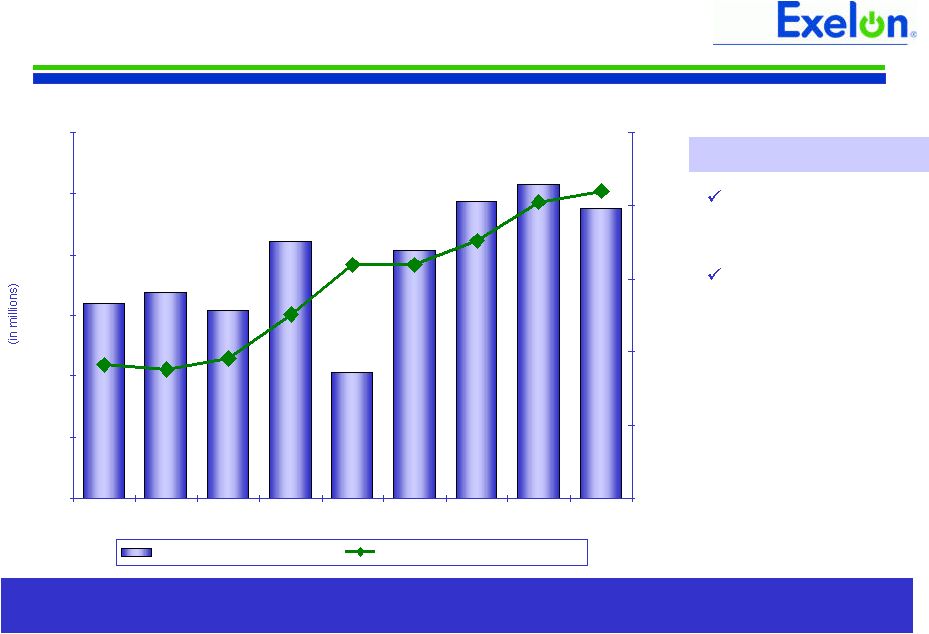

38 Stable Cash Flows and Commitment to Value Return (1) Cash Flows from Operations primarily include net cash flows provided by operating activities, excluding counterparty collateral activity, and including net cash flows used in investing activities other than capital expenditures. Cash Flows from Operations in 2005 reflect discretionary aggregate pension contributions of $2 billion. Exelon produces strong and consistent cash flows and continues to honor its commitment to return value to shareholders Strong and consistent cash flows from operations (1) Over 12% compound annual dividend growth rate since 2001 Sustainable Value $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 2001 2002 2003 2004 2005 2006 2007 2008E 2009E $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 Cash flow from operations Annual cash dividend / share |

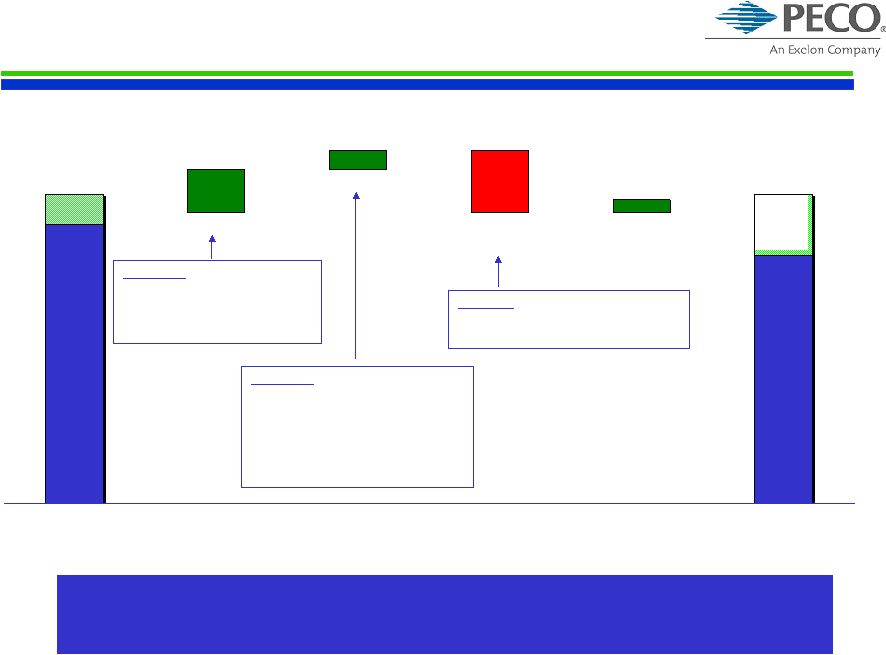

39 Value Return Framework Less Equals Maintenance Capital and Committed Dividends Free Cash Flow before Dividends and CapEx Strengthen Balance Sheet / Increase Financial Flexibility Invest in Growth Available Cash and Balance Sheet Capacity (1) Return Value via Share Repurchases, Increased Dividends Monetize We evaluate value return on an annual basis (1) Exelon on a stand alone basis targets a FFO/Debt Ratio of 20-30%. |

40 Protect Today’s Value • Deliver superior operating performance • Advance competitive markets • Protect the value of our generation • Build healthy, self-sustaining delivery companies Grow Long-Term Value • Drive the organization to the next level of performance • Set the industry standard for low carbon energy generation and delivery through reductions, displacement and offsets • Rigorously evaluate and pursue new growth opportunities + Strategic Direction |

41 |

42 Exelon Generation 2009 EPS Contribution Generation’s 2009 earnings will be impacted by higher nuclear fuel expense and the absence of discrete gains reported in 2008 – cost savings initiatives will partially offset inflationary pressures and rising pension and retiree health and welfare costs (1) Estimated contribution to Exelon’s operating earnings guidance. (2) Primarily reflects uranium settlements and option gains reported in 2Q08. ($0.18) $0.02 ($0.01) RNF O&M Other Depreciation ($0.06) $ / Share Key Items: Cost Efficiency Initiative Nuclear Outages Inflation Pension & OPEB 2008e (1) 2009e (1) $3.10 – $3.35 $3.45 – $3.55 Key Items: Discrete 2008 Gains (2) ($0.14) Nuclear Fuel Expense ($0.08) $0.06 $0.03 ($0.07) ($0.04) |

43 • Large, low-cost, low-emissions, exceptionally well-run nuclear fleet • Complementary and flexible fossil and hydro fleet • Improving power market fundamentals (commodity prices, heat rates, and capacity values) • End of below-market contract in Pennsylvania beginning 2011 • Potential carbon restrictions Value Proposition Exelon Generation • Continue to focus on operating excellence, cost management, and market discipline • Execute on power and fuel hedging programs • Support competitive markets • Pursue nuclear & hydro plant relicensing and strategic investment in material condition • Maintain industry-leading talent Protect Value • Pursue potential for nuclear plant uprates and investigate potential for more • Rigorously evaluate generation development opportunities, including new nuclear and combined cycle gas turbine • Capture increased value of low-carbon generation portfolio Grow Value Exelon Generation is the premier unregulated generation company – positioned to capture market opportunities and manage risk |

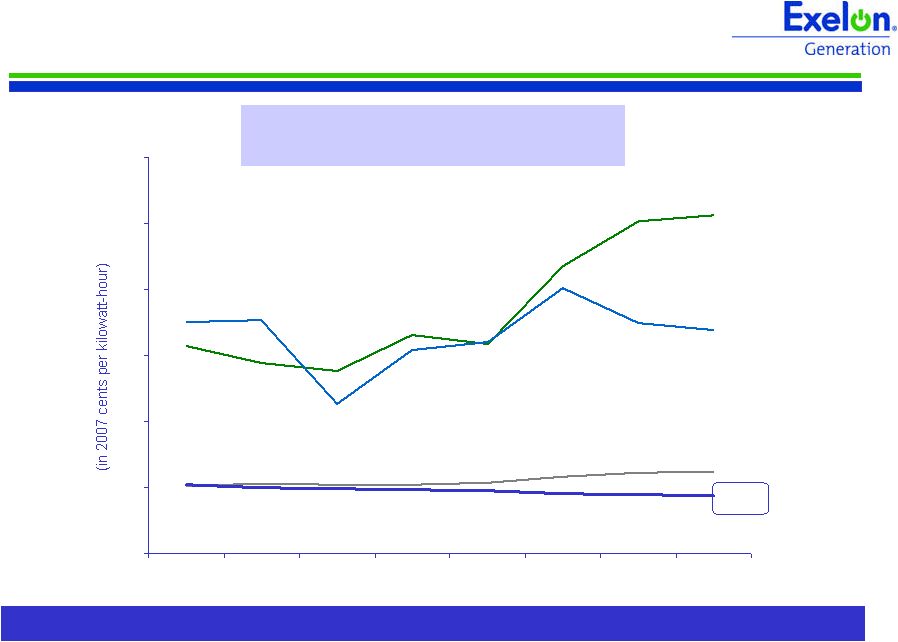

44 Basics of Business Unchanged Nuclear remains one of the lowest cost options for electricity production 10.26 6.78 2.47 1.76 0.0 2.0 4.0 6.0 8.0 10.0 12.0 2000 2001 2002 2003 2004 2005 2006 2007 Petroleum Gas Coal Nuclear U.S. Electricity Production Costs (2000-2007) (1) (1) In 2007 Cents/kWh. Source Global Energy Decisions May 2008; Production Costs = Operations and Maintenance + Fuel Costs |

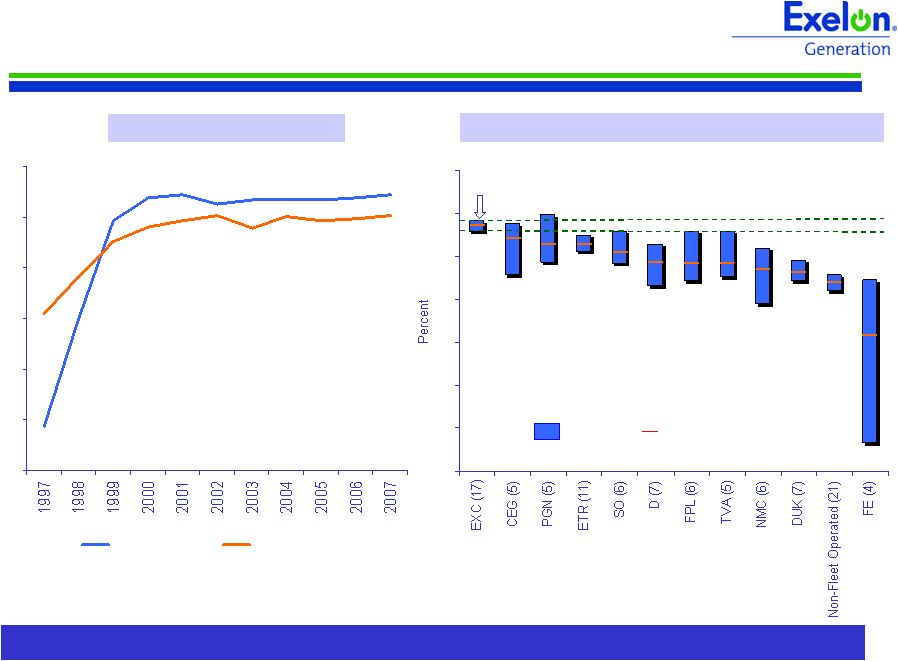

45 Lowest Cost Nuclear Fleet Operator Among major nuclear plant fleet operators, Exelon is consistently the lowest-cost producer of electricity in the nation 1 st Quartile 2 nd Quartile 3 rd Quartile 4 th Quartile 2006-2007 Average Production Cost for Major Nuclear Operators (1) Average (1) Source: 2007 Electric Utility Cost Group (EUCG) survey. Includes Fuel Cost plus Direct O&M divided by net generation. |

46 Effectively Managing Nuclear Fuel Costs Components of Fuel Expense in 2008 Projected Total Nuclear Fuel Spend Projected Exelon Average Uranium Cost vs. Market Projected Exelon Uranium Demand Note: Excludes costs reimbursed under the settlement agreement with the DOE. Market source: UxC composite forecasts. 2008 – 2011: 100% hedged in volume 2012: ~80% hedged in volume 2013: ~70% hedged in volume All charts exclude Salem 0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 9.0 10.0 2008 2009 2010 2011 2012 2013 0 200 400 600 800 1,000 1,200 1,400 2008 2009 2010 2011 2012 2013 Nuclear Fuel Expense (Amortization + Spent Fuel) Nuclear Fuel Capex 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2008 2009 2010 2011 2012 2013 Exelon Average Reload Price Projected Market Price (Term) Enrichment 38% Fabrication 17% Nuclear Waste Fund 22% Tax/Interest 1% Conversion 3% Uranium 19% |

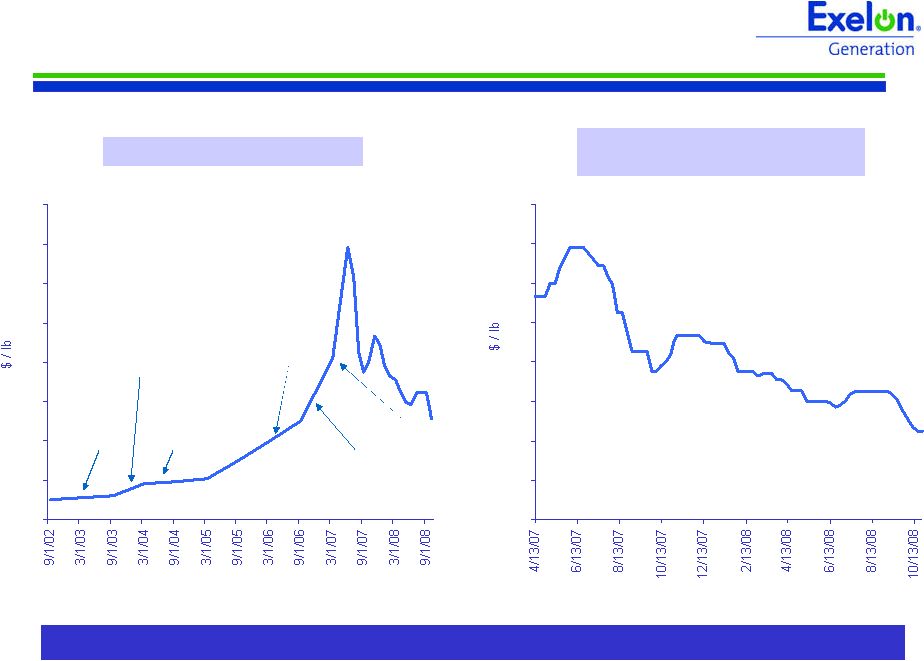

47 Uranium Price Volatility Long-term Uranium Price Trend Long-term equilibrium price expected to be $40-$60/lb Eighteen-Month Uranium Price Trend Long-term Uranium Price Trend Spring 2003 McArthur River flood December 2003 GNSS/Tenex termination; ConverDyn UF6 release and shutdown Early 2004 ERA / Ranger water problems Early 2006 First Cigar Lake flood; Cyclone Monica halts ERA / Ranger operations for approximately two weeks October 2006 Second Cigar Lake flood March 2007 ERA / Ranger flooding (cyclone George) 0 20 40 60 80 100 120 140 160 0 20 40 60 80 100 120 140 160 |

48 World-Class Nuclear Operator Average Capacity Factor Note: Exelon data prior to 2000 represent ComEd-only nuclear fleet. Sources: Platt’s, Nuclear News, Nuclear Energy Institute and Energy Information Administration (Department of Energy). 65 70 75 80 85 90 95 100 Operator (# of Reactors) Range 5-Year Average Range of Fleet 2-Yr Avg Capacity Factor (2003-2007) EXC 93.5% Sustained production excellence 40% 50% 60% 70% 80% 90% 100% Exelon Industry |

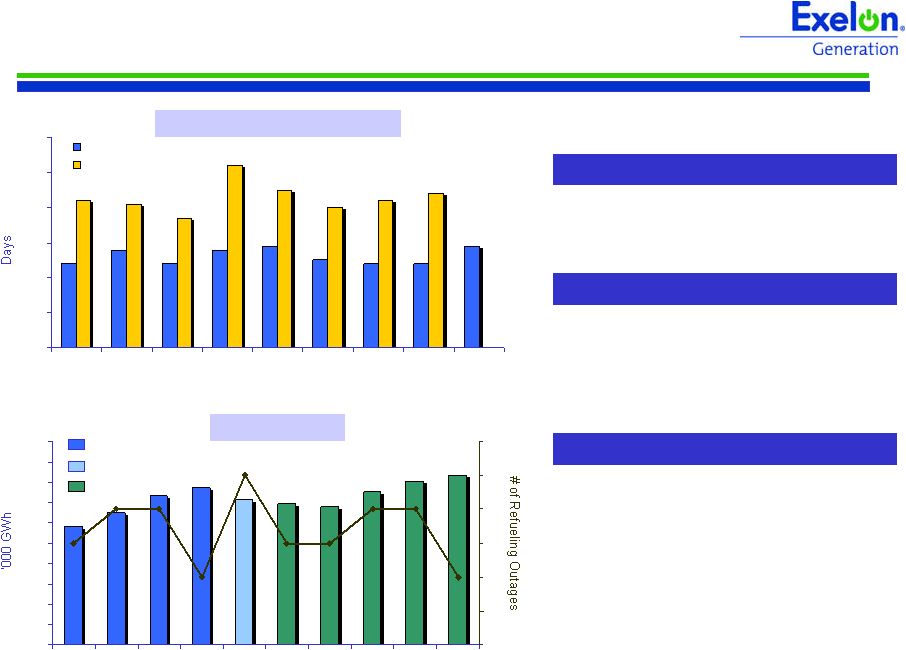

49 Impact of Refueling Outages 125 127 129 131 133 135 137 139 141 143 145 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 7 8 9 10 11 12 13 Note: Data includes Salem. Net nuclear generation data based on ownership interest • 18 or 24 months • Duration: ~24 days Nuclear Refueling Cycle • Reflects extended steam generator replacement outage • Based on the refueling cycle, we will conduct 10 refueling outages in 2009, versus 12 in 2008 2009 Refueling Outage Impact Refueling Outage Duration Nuclear Output 0 10 20 30 40 50 60 2000 2001 2002 2003 2004 2005 2006 2007 2008 YTD Exelon Industry (w/o Exelon) Actual Target Estimate • 2008 reflects Salem’s extended steam generator replacement outage. • 2008 YTD average outage duration is 24 days without Salem 2008 Refueling Outage Impact |

50 108,300 102,900 23,700 19,500 13,900 41,800 41,100 5,200 0 50,000 100,000 150,000 200,000 2008 2009 ComEd Swap IL Auction PECO Load Actual Forward Hedges & Open Position Total Portfolio Characteristics Expected Total Supply (GWh) Expected Total Sales (GWh) 91,500 91,300 47,700 47,600 28,600 10,200 10,600 28,900 0 50,000 100,000 150,000 200,000 2008 2009 Forward / Spot Purchases Fossil & Hydro Mid-Atlantic Nuclear Midwest Nuclear 178,300 178,300 178,100 178,100 |

51 Hedging Targets (1) Percent financially hedged is our estimate of the gross margin that is hedged at a 95% confidence level given the current assessment of market volatility. The formula is the gross margin at the 5th percentile / expected gross margin. Power Team utilizes various products and channels to market in order to optimize Exelon Generation’s earnings: • Block product sales in power • Options in power and natural gas • Full requirements sales via retail channel and wholesale load procurement processes • Supplement the portfolio with structured transactions • Use physical and financial fuel products to manage variability in fossil generation output Target Ranges 90% - 98% 70% - 90% 60% - 80% >90% Current Position >80% Near top end of range Prompt Year (2009) Second Year (2010) Third Year (2011) Financial Hedging Range (1) Flexibility in our targeted financial hedge ranges allows us to be opportunistic while mitigating downside risk Financial hedge ratios reflect a range of revenue net fuel based on observed market prices and volatility • Generally, hedges are executed on a ratable basis over a three-year window; therefore, the position is well hedged in the front year and significantly open in the outer years • Utilize options to hedge risk and preserve upside |

52 Financial Swap Agreement with ComEd 3,000 $53.48 January 1, 2013 - May 31, 2013 3,000 $52.37 January 1, 2012 - December 31, 2012 3,000 $51.26 January 1, 2011 - December 31, 2011 3,000 $50.15 June 1, 2010 - December 31, 2010 2,000 $50.15 January 1, 2010 - May 31, 2010 2,000 $49.04 June 1, 2009 - December 31, 2009 1,000 $49.04 January 1, 2009 - May 31, 2009 1,000 $47.93 June 1, 2008 - December 31, 2008 Notional Quantity (MW) Fixed Price ($/MWH) Portion of Term • Market-based contract for ATC baseload energy only – Does not include capacity, ancillary services or congestion • Preserves competitive markets • Fits with Exelon Generation’s hedging policy and strategy • Small portion of Exelon Generation’s supply |

53 Exelon Generation Has Limited Counterparty Exposure Net Exposure After Credit Collateral (1) (in millions) Investment grade $582 Non-investment grade 59 No external ratings 42 Total $683 (1) As of September 30, 2008. Does not include credit risk exposure from uranium procurement contracts or exposure through Regional Transmission Organizations, Independent System Operators and New York Mercantile Exchange and Intercontinental Exchange commodity exchanges. Additionally, does not include receivables related to the supplier forward agreements with ComEd and the PPA with PECO. As of September 30 th , no one counterparty represented more than 10% of Exelon Generation’s net exposure from power marketing activities Exelon Generation – Sufficient Liquidity Aggregate credit facility commitments of $4.8 billion that extend through 2012 – $4.7 billion available as of 10/31/08 Strong balance sheet – A3/BBB/BBB+ Senior Unsecured Rating Net Exposure by Type of Counterparty (1) Coal Producers 13% Financial Institutions 45% Investor-Owned Utilities, Marketers, and Power Producers 38% Other 4% |

54 Long-Term Investment Thesis Power Market Fundamentals Reserve Margins Capacity Prices Construction Costs Commodities Natural Gas Coal Environmental Position Carbon SO-2, NOX Mercury Lowest-cost, low-emissions nuclear fleet Demand Trends Demand Profile Changes Off-Peak Usage |

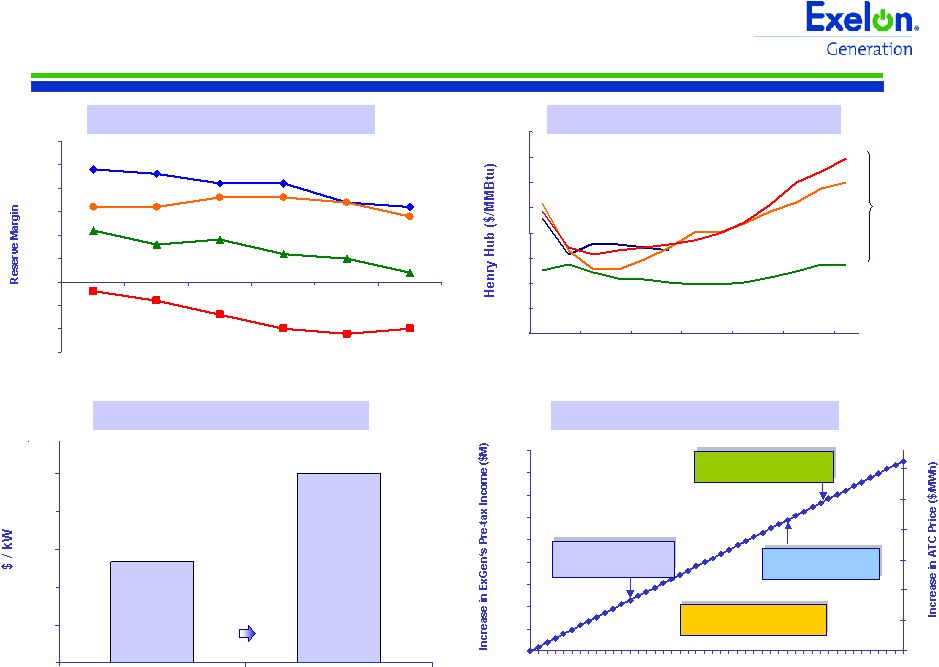

55 -15% -10% -5% 0% 5% 10% 15% 20% 25% 30% 2008 2009 2010 2011 2012 2013 Reserve Margins Declining Natural Gas Prices Remaining High PJM-East ERCOT NI-Hub PJM West Positively Exposed to Market Dynamics NYMEX (1) $5 $6 $7 $8 $9 $10 $11 $12 $13 2008 2010 2012 2014 2016 2018 2020 (1) As of 09/30/08 Various 3 rd party estimates 2,000 2,500 3,000 3,500 4,000 4,500 2007 2008 Note: Illustrative estimate. Overnight, all-in capital cost without interest during construction. Carbon Legislation Progressing Construction Costs Escalating New Nuclear Installed Cost 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 0 5 10 15 20 25 30 35 40 45 0 5 10 15 20 25 30 Carbon Credit ($/Tonne) Bingaman-Specter 2012: $12/tonne Europe Carbon-Trading 2012: $35.50/tonne EIA Carbon Case 2010: $31/tonne Lieberman-Warner Possible $20 to $40/tonne |

56 Reliability Pricing Model Auction PJM RPM Auction ($/MW-day) (1) All values are approximate and not inclusive of wholesale transactions. (2) All capacity values are in installed capacity terms (summer ratings) located in the areas. (3) EMAAC obligation consists of load obligations from PECO and BGS. The PPL obligation begins January 2010 and ends December 2010. (4) Removing State Line from the supply in October 2007 reduces this by 515 MW. (5) 08/09 Capacity supply decreased due to roll-off of several purchase power agreements (PPAs). (6) In 09/10, obligation is reduced due to roll-off of part of ComEd auction load obligation in May 2009. (7) MAAC = Mid-Atlantic Area Council; APS = Allegheny Power System. (8) PECO PPA expires December 2010. 2007 / 2008 2008 / 2009 2009 / 2010 2010 / 2011 2011 / 2012 in MW Capacity (2) Obligation Capacity (2) Obligation Capacity (2) Obligation Capacity (2) Obligation Capacity (2) Obligation RTO 16,000 (4) 6,600- 6,800 14,500 (5) 6,600- 6,800 12,700 4,750- 4,950 (6) 12,700 0 23,200 0 Eastern MAAC 9,500 9,500- 9,800 (3) 9,500 9,550- 9,850 (3) 9,500 9,750- 9,950 (3) MAAC + APS (7) 1,500 0 MAAC 11,000 9,300- 9,500 (3)(8) Exelon Generation Participation within PJM Reliability Pricing Model (1) 197.67 174.29 40.80 111.92 148.80 102.04 191.32 191.32 174.29 110.00 RTO Eastern MAAC MAAC + APS MAAC 2007/2008 2008/2009 2009/2010 2010/2011 2011/2012 |

57 Long-Run Marginal Cost of Electricity 0 50 100 150 200 250 0 5 10 15 20 25 30 35 40 45 50 CO2 Price ($/Metric Ton) Combustion Turbine Pulverized Coal CCGT Nuclear Note: CCGT = Combined Cycle Gas Turbine Excluding energy efficiency, Nuclear is the least expensive generation option in a carbon- constrained environment |

58 Exelon Generation Operating EBITDA 2009 EBITDA 2009 Open EBITDA (No Carbon) $ Millions ~$4,100 ~$3,900 2008 EBITDA (2) (1) Open EBITDA assumes that existing hedges (including the PECO load, Illinois auction load, ComEd financial swap, nuclear fuel, and other sales) are priced at market prices as of 7/31/08. (2) EBITDA data is operating-based. Refer to the Appendix for a reconciliation of Operating Net Income to EBITDA. (3) Sensitivities are derived by changing one assumption at a time while holding all else constant. Due to correlation of the various assumptions, the pre-tax earnings impact calculated by aggregating individual sensitivities may not be equal to the pre-tax earnings impact calculated when correlations between the various assumptions are also considered. ~$6,400 2009 Open – 2009 (1) 2008 (at 90%+ financially hedged) (at ~95% financially hedged) Open EBITDA plus upside from energy, capacity, and carbon drives Exelon Generation’s value 52.50 76.00 125.00 131.50 9.75 2009 Open EBITDA (1) Assumptions 10/31/08 Prices 98.00 NAAP Coal Price ($/ton) 72.00 WTI Oil ($/barrel) 42.00 NI-Hub ATC Price ($/MWh) 59.30 PJM W-Hub ATC Price ($/MWh) 7.30 Henry Hub Gas Price ($/mmBtu) ~$100M +/- $1/MWh Ni-Hub ATC Price See following slide for fuel sensitivities Power Price Revenue Sensitivities: ~$60M +/- $1/MWh PJM W-Hub ATC Price (Pre-Tax Impact) 2009 Open EBITDA (1) Sensitivities (3) ~$4M +/- $1/MWh PJM W-Hub ATC Price ~$5M +/- $1/MWh Ni-Hub ATC Price (Pre-Tax Impact) 2009 EBITDA Sensitivities |

59 Current Market Prices Units 2005 ¹ 2006 1 2007 ¹ 2008 5 2009 6 2010 6 2011 6 PRICES (as of October 31, 2008) PJM West Hub ATC ($/MWh) 60.92 ² 51.07 ² 59.76 ² 68.77 59.32 62.88 63.21 PJM NiHub ATC ($/MWh) 46.39 ² 41.42 ² 45.47 ² 48.98 42.04 43.10 45.26 NEPOOL MASS Hub ATC ($/MWh) 76.65 ² 59.68 2 66.72 ² 81.38 68.97 73.67 74.28 ERCOT North On-Peak ($/MWh) 76.90 ³ 60.87 ³ 59.44 ³ 72.58 58.93 66.83 67.88 Henry Hub Natural Gas ($/MMBTU) 8.85 4 6.74 4 6.74 4 8.92 7.33 8.03 8.15 WTI Crude Oil ($/bbl) 56.62 4 66.38 4 69.72 4 106.51 71.88 78.19 83.18 PRB 8800 ($/Ton) 8.06 13.04 9.67 11.83 14.03 15.45 16.75 NAPP 3.0 ($/Ton) 52.42 43.87 47.54 105.93 98.00 97.50 96.50 ATC HEAT RATES (as of October 31, 2008) PJM West Hub / Tetco M3 (MMBTU/MWh) 6.30 6.98 7.68 6.98 7.13 6.88 6.83 PJM NiHub / Chicago City Gate (MMBTU/MWh) 5.52 6.32 6.65 5.54 5.78 5.36 5.55 ERCOT North / Houston Ship Channel (MMBTU/MWh) 8.21 8.28 7.80 7.32 7.04 7.19 7.26 (1) 2005, 2006 and 2007 are actual settled prices. (2) Real Time LMP (Locational Marginal Price). (3) Next day over-the-counter market. (4) Average NYMEX settled prices. (5) 2008 information is a combination of actual prices through October 31, 2008 and market prices for the balance of the year. (6) 2009, 2010 and 2011 are forward market prices as of October 31, 2008. ~$12 - $25/barrel WTI Oil Price ~($5) + $25/barrel WTI Oil Price ~$25 - $15/ton NAAP Coal Price ~($12) + $15/ton NAAP Coal Price ~$70 - $1/mmBtu Henry Hub Gas Price ~($45) + $1/mmBtu Henry Hub Gas Price (Pre-Tax Impact) 2009 Open EBITDA Fuel Price Cost Sensitivities |

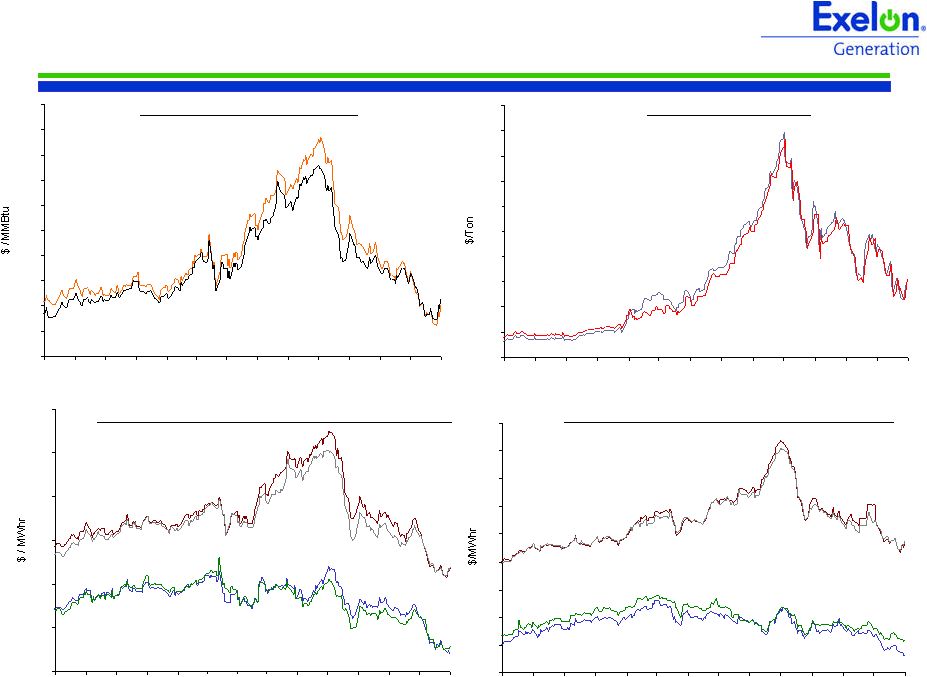

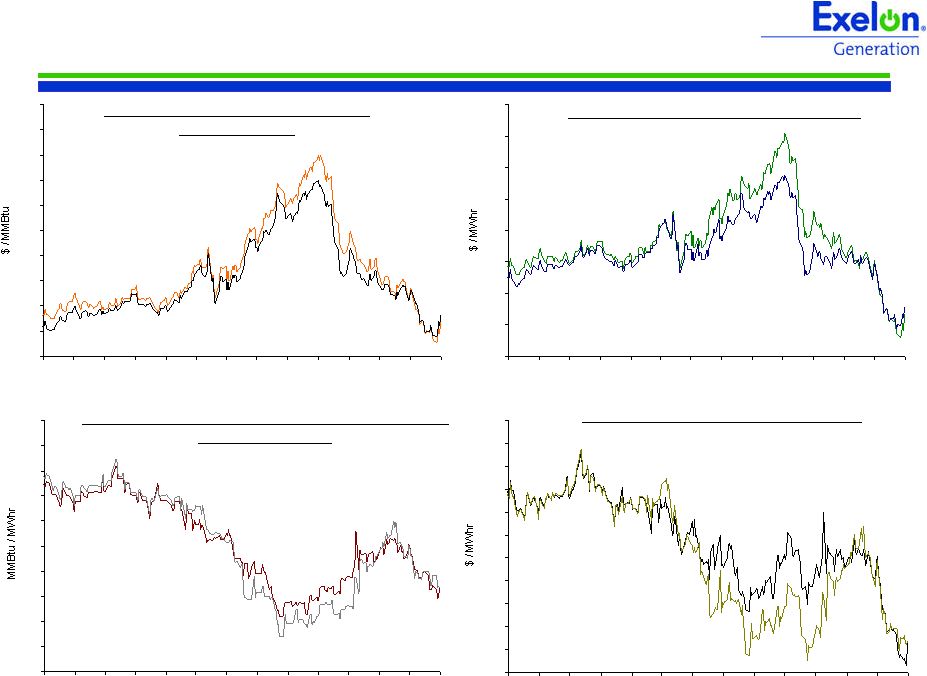

60 50 60 70 80 90 100 110 10/07 11/07 12/07 1/08 2/08 3/08 4/08 5/08 6/08 7/08 8/08 9/08 10/08 50 60 70 80 90 100 110 120 130 140 150 10/07 11/07 12/07 1/08 2/08 3/08 4/08 5/08 6/08 7/08 8/08 9/08 10/08 7 7.5 8 8.5 9 9.5 10 10.5 11 11.5 12 10/07 11/07 12/07 1/08 2/08 3/08 4/08 5/08 6/08 7/08 8/08 9/08 10/08 30 35 40 45 50 55 60 65 70 75 10/07 11/07 12/07 1/08 2/08 3/08 4/08 5/08 6/08 7/08 8/08 9/08 10/08 Forward NYMEX Natural Gas PJM-West and Ni-Hub On-Peak Forward Prices PJM-West and Ni-Hub Wrap Forward Prices 2010 Ni-Hub 2011 Ni-Hub 2011 PJM-West 2010 PJM-West 2010 2011 Market Price Snapshot Rolling 12 months, as of October 31, 2008. Source: OTC quotes and electronic trading system. Quotes are daily. 2010 Ni-Hub 2011 Ni-Hub 2011 PJM-West 2010 PJM-West Forward NYMEX Coal 2010 2011 $8.03 $8.15 $81.15 $81.30 $73.65 $73.90 $54.37 $36.00 $53.42 $53.90 $33.20 $55.87 |

61 7.5 8.5 9.5 10.5 11.5 12.5 13.5 14.5 15.5 16.5 17.5 18.5 10/07 11/07 12/07 1/08 2/08 3/08 4/08 5/08 6/08 7/08 8/08 9/08 10/08 8 8.2 8.4 8.6 8.8 9 9.2 9.4 9.6 9.8 10 10/07 11/07 12/07 1/08 2/08 3/08 4/08 5/08 6/08 7/08 8/08 9/08 10/08 7 7.5 8 8.5 9 9.5 10 10.5 11 11.5 12 10/07 11/07 12/07 1/08 2/08 3/08 4/08 5/08 6/08 7/08 8/08 9/08 10/08 60 65 70 75 80 85 90 95 100 10/07 11/07 12/07 1/08 2/08 3/08 4/08 5/08 6/08 7/08 8/08 9/08 10/08 2011 2010 2010 2011 2010 2011 Houston Ship Channel Natural Gas Forward Prices ERCOT North On-Peak Forward Prices ERCOT North On-Peak v. Houston Ship Channel Implied Heat Rate 2010 2011 ERCOT North On Peak Spark Spread Assumes a 7.2 Heat Rate, $1.50 O&M, and $.15 adder Market Price Snapshot Rolling 12 months, as of October 31, 2008. Source: OTC quotes and electronic trading system. Quotes are daily. $7.70 $7.84 $67.88 $66.83 $8.68 $8.66 $8.79 $8.89 |

62 Exelon Nuclear Fleet Overview Fleet also includes 4 shutdown units: Peach Bottom 1, Dresden 1, Zion 1 & 2. (1) Capacity based on ownership interest. Average in-service time = 27 years 2011 42.6% Exelon, 56.4% PSEG 2016, 2020 503, 491 (1) W PWR 2 Salem, NJ Life of plant capacity 100% AmerGen 2014; renewal filed 2008 837 B&W PWR 1 TMI-1, PA Dry cask 100% AmerGen 2009; renewal filed 2005 625 GE BWR 1 Oyster Creek, NJ Dry cask 50% Exelon, 50% PSEG Renewed: 2033, 2034 570, 570 (1) GE BWR 2 Peach Bottom, PA Dry cask 75% Exelon, 25% Mid- American Holdings Renewed: 2032 650, 653 (1) GE BWR 2 Quad Cities, IL Dry cask 100% Renewed: 2029, 2031 869, 871 GE BWR 2 Dresden, IL 2010 100% 2022, 2023 1138, 1150 GE BWR 2 LaSalle, IL Dry cask 100% 2024, 2029 1149, 1146 GE BWR 2 Limerick, PA Re-rack completed 2011 2013 Spent Fuel Storage/ Date to lose full core discharge capacity GE W W Vendor BWR PWR PWR Type 1 2 2 Units 100% AmerGen 2026 1065 Clinton, IL 100% 2024, 2026 1183, 1153 Byron, IL 100% 2026, 2027 1194, 1166 Braidwood, IL Ownership License Expiration / Status Net Annual Mean Rating MW 2008 Plant, Location |

63 |

64 ComEd 2009 EPS Contribution (1) Estimated contribution to Exelon’s operating earnings guidance. (2) Disallowances recorded in September 2008 in connection with the ICC order in ComEd’s distribution rate case. ComEd’s operating earnings are expected to increase in 2009 primarily due to continued execution of its Regulatory Recovery Plan 2008e (1) RNF O&M Depreciation / Amortization Interest Expense $0.45 - $0.55 $0.30 – $0.35 $0.25 $0.01 ($0.06) 2009e (1) Key Items: Cost Efficiency Initiative Rate Case Disallowance (2) Storms Energy Efficiency Inflation Pension & OPEB $ / Share Key Items: Distribution Rates Energy Efficiency Weather $0.01 $0.05 $0.02 $0.01 ($0.04) ($0.03) ($0.01) $0.18 $0.04 $0.01 |

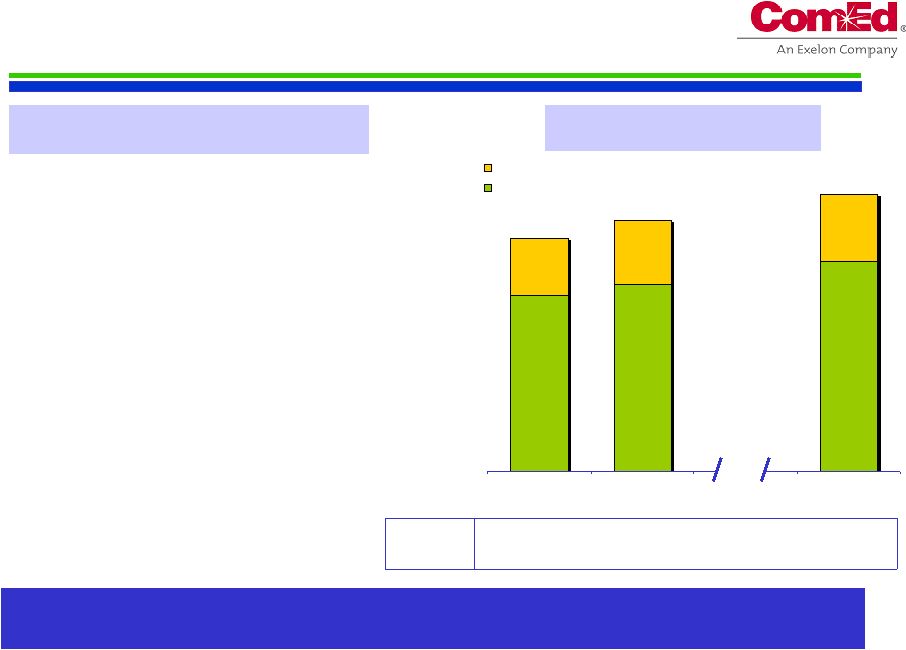

65 6.1 2.0 7.3 6.5 2.1 2.3 Transmission Distribution ComEd – Moving Forward Executing Regulatory Recovery Plan ~9 – 10% ~ 45% ~7.3 – 8.8% ~ 45% ROE Equity (1) ~5.0 – 6.0% ~ 45% • Constructive ComEd rate cases including the recent final rate order that provides for $273.6 million increase in annual distribution revenues • Illinois Power Agency proposed procurement plan for ComEd - first procurement in Spring 2009 • Actively promoting/implementing efficiency, renewable energy, and demand-side management programs • Studying innovative future test year approach for distribution rate filing in 2009 8.1 8.6 9.6 2008e 2009e 2011 (Illustrative) (2) Average Annual Rate Base (1) ($ in Billions) ComEd’s earnings are expected to increase as regulatory lag is reduced over time through regular rate requests, putting ComEd on a path toward appropriate returns (1) Equity based on definition provided in most recent ICC distribution rate case order (book equity less goodwill). Projected book equity ratio in 2008 is 58%. (2) Provided solely to illustrate possible future outcomes that are based on a number of different assumptions, all of which are subject to uncertainties and should not be relied upon as a forecast of future results. |

66 ComEd Executing on Regulatory Recovery Plan The ICC issued a final Order in ComEd’s distribution rate case – granting a revenue increase of $273.6 million to take effect on September 16, 2008: (14) 345 359 Depreciation and Amortization $(87) 274 361 Total Revenue Increase 3 129 132 Other Revenues (11) 987 998 O&M Expenses (22) 10.30% ROE / 45.04% Equity 10.75% ROE / 45.11% Equity ROE / Cap Structure $(43) $6,694 $7,071 Rate Base Impact on Revenue Increase ICC Order ComEd Original Request ($ in millions) |

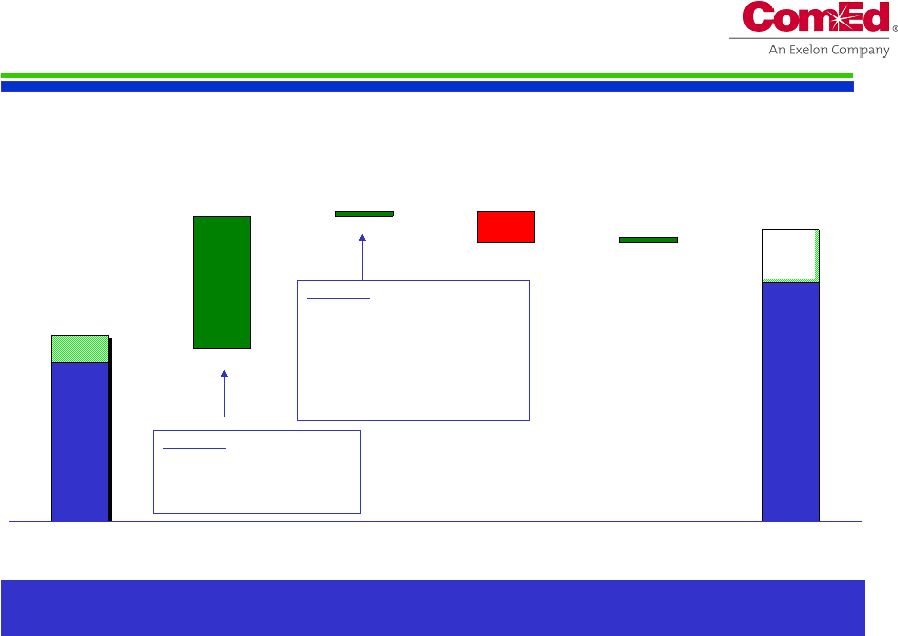

67 Illinois Power Agency Proposes ComEd Procurement Plan In September 2008, the Illinois Power Agency proposed its first ComEd procurement plan, which will provide for energy procurement for up to a three-year period Auction Contracts Financial Swap 3/08 RFP Jun 2007 Jun 2008 Jun 2009 Jun 2010 Jun 2011 Jun 2012 Jun 2013 NOTE: For illustrative purposes only. Assumes constant load profile each year. 2009 2009 Future Procurement by Illinois Power Agency 2010 2010 2011 2012 2011 |

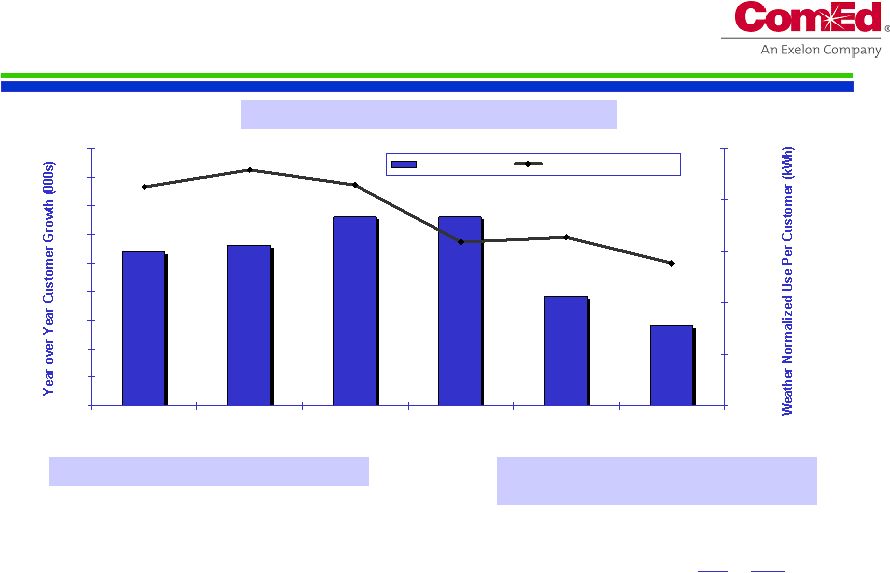

68 ComEd Load Growth Trends Key Economic Indicators Estimated Weather-Normalized Residential Load Growth Chicago US 9/08 Unemployment rate 6.6% 6.1% 3rd Qtr ‘08 annualized growth in gross domestic/metro product (0.1%) (0.3%) 8/08 Home price index (9.8%) (16.6%) 2008 2009 Customer Growth 0.7% 0.6% Average Use-Per-Customer 0.1% (0.6%) Total Residential 0.8% 0.0% Small C&I 0.4% 0.4% Large C&I 0.1% (1.0%) All Customer Classes 0.4% (0.1%) 32 33 38 38 24 19 5 10 15 20 25 30 35 40 45 50 2004 2005 2006 2007 2008E 2009E 8,000 8,100 8,200 8,300 8,400 8,500 New Customers Avg. Use Per Customer ComEd Residential Load Growth Statistics |

69 |

70 PECO 2009 EPS Contribution (1) Estimated contribution to Exelon’s operating earnings guidance. PECO’s 2009 operating earnings are expected to be comparable to 2008 due to the gas distribution rate increase and lower bad debt expense, partially offset by higher CTC amortization $ / Share RNF O&M Interest Expense $0.45 - $0.55 $0.45 – $0.50 $0.07 $0.04 $0.02 ($0.10) Amortization / Depreciation 2008e (1) 2009e (1) Key Items: Gas Rate Case $0.07 Weather $0.03 Pricing/Customer Mix ($0.02) Key Items: Bad Debt Cost Efficiency Initiative Inflation Pension & OPEB Regulatory / Post 2010 Key Item: Competitive Transition Charge (CTC) Amortization ($0.09) $0.06 $0.02 ($0.02) ($0.01) ($0.01) |

71 2.8 2.9 3.1 0.5 0.6 1.7 0.9 1.1 1.1 1.2 0.7 Gas CTC Electric Transmission Electric Distribution PECO – Moving Forward Actively Engaged in Transition • Positive outcome of 2008 gas rate case provides for increased gas revenues of $76.5 million • Developing plans and programs to implement energy efficiency, demand response and smart meter provisions of Act 129 (HB2200) • Transitioning through an orderly structure to market-based rates – Working with the Governor, Legislature, and PAPUC for post-transition rates and structure – Power Procurement Plan filed 9/10/08 to address post-transition plan beginning in 2011 along with mitigation alternatives ~9 – 11% (3) Not applicable due to transition rate structure Rate Making ROE Equity ~50-52% 6.1 5.5 5.0 Average Annual Rate Base (1) ($ in Billions) 2008e 2009e 2011 (Illustrative) (2) PECO provides a predictable but declining source of earnings to Exelon through the remainder of the transition period (1) Rate base as determined for rate-making purposes. (2) Provided solely to illustrate possible future outcomes that are based on a number of different assumptions, all of which are subject to uncertainties and should not be relied upon as a forecast of future results. (3) Assumes PECO is awarded 100% of potential requested revenue increases for rate cases filed during the planning period. |

72 PECO Pursuing Regulatory Path PECO’s procurement plan for obtaining default service Post 2010 includes a portfolio of full requirements and spot products competitively procured through multiple RFP solicitations Mitigation plan includes early staggered procurement, voluntary post-rate cap phase-in, gradual phase-out of declining block rate design, customer education, enhanced retail choice program, and low-income rate design changes A Compact Fluorescent Light bulb rebate program for over 3 million bulbs An enhanced web-based energy audit / bill analyzer program Voluntary Residential Direct Load Control (air conditioning cycling) program for 75,000 customers Full and current cost recovery for the 3 programs Default Service Procurement and Mitigation Filing Early Phase-in Filing Energy Efficiency and Demand Side Response Filing Early phase-in proposal provides a voluntary opt-in program for customers to pre-pay towards 2011 prices Requested expedited PAPUC approval to allow for implementation July 1, 2009 PECO’s third quarter 2008 regulatory filings address procurement, rate mitigation, and energy efficiency – allowing PECO to execute on its regulatory strategy |

73 $107.89 $107.04 2.63 2.63 0.48 0.48 2.41 6.00 10.75 PECO Average Electric Rates (1) System Average Rates based upon Restructuring Settlement Rate Caps on Energy and Capacity increased from original settlement by 1.6% to reflect the roll-in of increased Gross Receipts Tax and $0.02/kWh for Universal Service Fund Charge and Nuclear Decommissioning Cost Adjustment. System Average Rates also adjusted for sales mix based on current sales forecast. Assumes continuation of current Transmission and Distribution Rates. 2011 2008 – 2010 Energy / Capacity Competitive Transition Charge (CTC) Transmission Distribution 11.52¢ (1) Unit Rates (¢/kWh) Electric Restructuring Settlement ~20% 13.86¢ Assumptions Projected Rate Increase Based on Average PPL Procurement Results (Illustrative) • 2011 default service rate will reflect associated full requirements costs and be acquired through multiple procurements • Using the average results of completed PPL procurements for 2010 and assuming a 50/50 weighting of Residential and Small C&I customers produces a proxy of 10.75¢/kWh. This will result in a system average rate increase of ~20% • PECO’s 2011 full requirements price expected to differ from PPL due, in part, to the timing of the procurement (2011 vs. 2010) and locational differences • Rates will vary by customer class and may be impacted by legislation and procurement model Residential Small C&I Round 1, 7/2007 $101.77 $105.11 Round 2, 10/2007 $105.08 $105.75 Round 3, 3/2008 $108.80 $108.76 Average PPL Procurement Results Round 4, 10/2008 $112.51 $111.94 |

74 Pennsylvania Snapshot • Governor Rendell’s “Energy Independence Strategy”, introduced in February 2007, spurred legislative activity. – Legislation Act 129 (HB 2200) dealing with energy efficiency/ demand response, procurement and smart meters passed by General Assembly on October 8th and signed onto law by Governor on October 15th – Energy Fund Bill and Alternative Fuel Bill passed in Spring 2008 session – Rate mitigation expected to be taken up in next legislative session beginning January 2009 Current Status • Energy Efficiency(EE) and Demand Response (DR) – EE Targets of 1% reduction in consumption by 2011, 3% reduction by 2013 – DR target of 4.5% reduction in peak demand by 2013 – Up to $20 million in penalties for failure to achieve targets – Full and current program cost recovery through surcharge mechanism – Reduced consumption reflected in future rate base proceedings – Spending cap equal to 2% of revenue – Procurement – Competitive procurement using auctions, RFPs or bilateral agreements – Prudent mix of spot, short term or long term (defined as 4-20 years) contracts • Smart Meters – Utilities must file smart meter file plan with PAPUC by August 2009 – Required to furnish meters upon 1) customer request, 2) for new construction, and 3) on a depreciation schedule not to exceed 15 years – Base rate or surcharge recovery Act 129 (HB 2200) Highlights |

75 PECO Load Growth Trends 4.8 6.3 8.4 7.7 5.5 4.6 0 1 2 3 4 5 6 7 8 9 10 2004 2005 2006 2007 2008E 2009E 9,000 9,100 9,200 9,300 9,400 9,500 9,600 9,700 9,800 9,900 10,000 New Customers Avg. Use Per Customer PECO Residential Load Growth Statistics Philadelphia US 9/08 Unemployment rate 6.1% 6.1% 3rd Qtr ‘08 annualized growth in gross domestic/metro product 0.3% (0.3%) Key Economic Indicators 2008 2009 Customer Growth 0.4% 0.3% Average Use-Per-Customer 1.9% 0.1% Total Residential 2.3% 0.4% Small C&I (0.6%) 0.1% Large C&I 1.0% 0.0% All Customer Classes 1.1% 0.2% Estimated Weather-Normalized Residential Load Growth |

76 Key Assumptions, Projected 2009 Credit Measures & GAAP Reconciliation |

77 Key Assumptions 37.3 1.2 2.6 23.86 115.37 6.65 6.84 45.47 7.68 7.78 59.76 6.74 148,307 41,343 189,650 94.5 2007 Actual 37.2 0.4 1.1 82.39 169.09 5.50 9.00 50.00 6.95 10.00 70.00 9.00 137,200 41,100 178,300 93.8 2008 Est. 9.75 Chicago City Gate Gas Price ($/mmBtu) 11.00 Tetco M3 Gas Price ($/mmBtu) 37.2 Effective Tax Rate (%) (4) (0.1) ComEd 0.2 PECO Electric Delivery Growth (%) (3) 106.13 PJM West Capacity Price ($/MW-day) 173.73 PJM East Capacity Price ($/MW-day) 5.40 NI Hub Implied ATC Heat Rate (mmbtu/MWh) 52.50 NI Hub ATC Price ($/MWh) 6.95 PJM West Hub Implied ATC Heat Rate (mmbtu/MWh) 76.00 PJM West Hub ATC Price ($/MWh) 9.75 Henry Hub Gas Price ($/mmBtu) 136,300 Total Genco Market and Retail Sales (GWhs) (2) 41,800 Total Genco Sales to PECO (GWhs) 178,100 Total Genco Sales Excluding Trading (GWhs) 93.1 Nuclear Capacity Factor (%) (1) 2009 Est. (1) Excludes Salem . (2) Includes Illinois Auction sales and ComEd swap. (3) Weather-normalized retail load growth. (4) Excludes results related to investments in synthetic fuel-producing facilities. |

78 Projected 2009 Key Credit Measures BBB A- BBB+ BBB- S&P Credit Ratings (3) BBB+ A BBB BBB+ Fitch Credit Ratings (3) A3 A2 Baa2 Baa1 Moody’s Credit Ratings (3) 3.6x 3.8x FFO / Interest ComEd: 18% 16% FFO / Debt 55% 59% Rating Agency Debt Ratio 6.3x 3.0x FFO / Interest PECO: 36% 10% FFO / Debt 52% 53% Rating Agency Debt Ratio 30% 49% Rating Agency Debt Ratio 108% 50% FFO / Debt 21.3x 8.6x FFO / Interest Exelon Generation: 54% 39% 7.0x Without PPA & Pension / OPEB (2) 62% Rating Agency Debt Ratio 25% FFO / Debt 5.2x FFO / Interest Exelon Consolidated: With PPA & Pension / OPEB (1) Notes: Projected credit measures reflect impact of Illinois electric rates and policy settlement. Exelon, ComEd and PECO metrics exclude securitization debt. See following slide for FFO (Funds from Operations)/Interest, FFO/Debt and Adjusted Book Debt Ratio reconciliations to GAAP. (1) Reflects S&P updated guidelines, which include imputed debt and interest related to purchased power agreements (PPA), unfunded pension and other postretirement benefits (OPEB) obligations, capital adequacy for energy trading, operating lease obligations, and other off-balance sheet debt. Debt is imputed for estimated pension and OPEB obligations by operating company. (2) Excludes items listed in note (1) above. (3) Current senior unsecured ratings for Exelon and Generation and senior secured ratings for ComEd and PECO as of 10/31/08. On October 21, 2008, S&P put Exelon, ComEd, PECO and Exelon Generation on Credit Watch with negative implications. |

79 FFO Calculation and Ratios FFO Calculation = FFO - PECO Transition Bond Principal Paydown + Gain on Sale, Extraordinary Items and Other Non-Cash Items (3) + Change in Deferred Taxes + Depreciation, amortization (including nucl fuel amortization), AFUDC/Cap. Interest Add back non-cash items: Net Income Adjusted Interest FFO + Adjusted Interest = Adjusted Interest + 7% of Present Value (PV) of Operating Leases + Interest on imputed debt related to PV of Purchased Power Agreements (PPA), unfunded Pension and Other Postretirement Benefits (OPEB) obligations, and Capital Adequacy for Energy Trading (2) , as applicable - PECO Transition Bond Interest Expense Net Interest Expense (Before AFUDC & Cap. Interest) FFO Interest Coverage + Capital Adequacy for Energy Trading (2) FFO = Adjusted Debt + PV of Operating Leases + 100% of PV of Purchased Power Agreements (2) + Unfunded Pension and OPEB obligations (2) + A/R Financing Add off-balance sheet debt equivalents: - PECO Transition Bond Principal Balance + STD + LTD Debt: Adjusted Debt (1) FFO Debt Coverage Rating Agency Capitalization Rating Agency Debt Total Adjusted Capitalization Adjusted Book Debt = Total Rating Agency Capitalization + Off-balance sheet debt equivalents (2) - Goodwill Total Adjusted Capitalization = Rating Agency Debt + ComEd Transition Bond Principal Balance + Off-balance sheet debt equivalents (2) Adjusted Book Debt = Total Adjusted Capitalization + Adjusted Book Debt + Preferred Securities of Subsidiaries + Total Shareholders' Equity Capitalization: = Adjusted Book Debt - Transition Bond Principal Balance + STD + LTD Debt: Debt to Total Cap Note: Reflects S&P guidelines and company forecast. FFO and Debt related to non-recourse debt are excluded from the calculations. (1) Uses current year-end adjusted debt balance. (2) Metrics are calculated in presentation unadjusted and adjusted for debt equivalents and related interest for PPAs, unfunded Pension and OPEB obligations, and Capital Adequacy for Energy Trading. (3) Reflects depreciation adjustment for PPAs and decommissioning interest income and contributions. |

80 GAAP Earnings Reconciliation Year Ended December 31, 2007 (18) - - - (18) Nuclear Decommissioning obligation reduction (11) - - - (11) Sale of Genco’s investments in TEG and TEP 72 - - - 72 Georgia Power tolling agreement (130) - - - (130) Termination of Stateline PPA (5) - - - (5) Settlement of a tax matter at Generation related to Sithe $(115) (63) - - (87) - $35 Other $2,923 (29) 14 280 (87) 101 $2,736 Exelon $507 - - - - - $507 PECO $200 - 14 24 - (3) $165 ComEd ExGen (in millions) - City of Chicago settlement 256 2007 Illinois electric rate settlement $2,331 2007 Adjusted (non-GAAP) Operating Earnings / (Loss) 34 Non-cash deferred tax items - Investments in synthetic fuel-producing facilities 104 Mark-to-market adjustments from economic hedging activities $2,029 2007 GAAP Reported Earnings Note: Amounts may not add due to rounding. |

81 (1) Amounts shown per Exelon share and represent contributions to Exelon's EPS. (0.01) - - - (0.01) Settlement of a tax matter at Generation related to Sithe (0.04) (0.08) - - 0.04 Non-cash deferred tax items (0.14) (0.14) - - - Investments in synthetic fuel-producing facilities 0.41 - - 0.03 0.38 2007 Illinois electric rate settlement (0.19) - - - (0.19) Termination of State Line PPA 0.11 - - - 0.11 Georgia Power tolling agreement Exelon Other (1) PECO (1) ComEd (1) ExGen (1) $4.32 $(0.18) $0.75 $0.30 $3.45 2007 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share (0.01) - - - (0.01) Sale of Generation's investments in TEG and TEP 0.02 - - 0.02 - City of Chicago settlement (0.03) - - - (0.03) Nuclear decommissioning obligation reduction 0.15 - - - 0.15 Mark-to-market adjustments from economic hedging activities $4.05 $0.04 $0.75 $0.25 $3.01 2007 GAAP Earnings Per Share GAAP EPS Reconciliation Year Ended December 31, 2007 |

82 2008/2009 Earnings Outlook • Exelon’s outlook for 2008/2009 adjusted (non-GAAP) operating earnings excludes the earnings impacts of the following: • Mark-to-market adjustments from economic hedging activities • Unrealized gains and losses from nuclear decommissioning trust fund investments primarily related to the AmerGen nuclear plants • Significant impairments of assets, including goodwill • Changes in decommissioning obligation estimates • Costs associated with the 2007 Illinois electric rate settlement agreement, including ComEd’s previously announced customer rate relief programs • Costs associated with ComEd’s settlement with the City of Chicago • Certain costs associated with the proposed offer to acquire NRG Energy Inc. • Other unusual items • Significant future changes to GAAP • Both our operating earnings and GAAP earnings guidance are based on the assumption of normal weather |

83 Operating net income (loss) +/- Cumulative effect of changes in accounting principle +/- Discontinued operations +/- Minority interest + Income taxes Income (loss) from continuing operations before income taxes and minority interest +/- Total other income and deductions (interest expense; equity in (losses) earnings of investments; and other, net) + Depreciation and amortization Earnings before interest, taxes, depreciation and amortization (EBITDA) Reconciliation of Net Income to EBITDA |

84 Exelon Investor Relations Contacts Inquiries concerning this presentation should be directed to: Exelon Investor Relations 10 South Dearborn Street Chicago, Illinois 60603 312-394-2345 For copies of other presentations, annual/quarterly reports, or to be added to our email distribution list please contact: Martha Chavez Executive Admin Coordinator 312-394-4069 Martha.Chavez@ExelonCorp.com Investor Relations Contacts: Chaka Patterson, Vice President 312-394-7234 Chaka.Patterson@ExelonCorp.com Karie Anderson, Director 312-394-4255 Karie.Anderson@ExelonCorp.com Marybeth Flater, Manager 312-394-8354 Marybeth.Flater@ExelonCorp.com |