Exhibit 99.2 Earnings Conference Call 4th Quarter 2008 January 22, 2009 |

2 Forward-Looking Statements This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, that are subject to risks and uncertainties. The factors that could cause actual results to differ materially from these forward-looking statements include those discussed herein as well as those discussed in (1) Exelon’s 2007 Annual Report on Form 10-K in (a) ITEM 1A. Risk Factors, (b) ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and (c) ITEM 8. Financial Statements and Supplementary Data: Note 19; (2) Exelon’s Third Quarter 2008 Quarterly Report on Form 10-Q in (a) Part II, Other Information, ITEM 1A. Risk Factors and (b) Part I, Financial Information, ITEM 1. Financial Statements: Note 12; and (3) other factors discussed in filings with the Securities and Exchange Commission by Exelon Corporation, Exelon Generation Company, LLC, Commonwealth Edison Company, and PECO Energy Company (Companies). Readers are cautioned not to place undue reliance on these forward-looking statements, which apply only as of the date of this presentation. None of the Companies undertakes any obligation to publicly release any revision to its forward-looking statements to reflect events or circumstances after the date of this presentation. This presentation includes references to adjusted (non-GAAP) operating earnings and non- GAAP cash flows that exclude the impact of certain factors. We believe that these adjusted operating earnings and cash flows are representative of the underlying operational results of the Companies. Please refer to the attachments to the earnings release and the appendix to this presentation for a reconciliation of adjusted (non-GAAP) operating earnings to GAAP earnings and non-GAAP cash flows to GAAP cash flows. |

3 Key Financial Messages Q4 operating results of $1.07/share powered by strong Generation performance: 4Q08 nuclear capacity factor of 93.7% 7% increase in average realized energy margins in 4Q08 compared to 4Q07 Reaffirming 2009 operating earnings guidance of $4.00-$4.30/share Challenged by higher pension and OPEB expense and lower load growth Committed to cost reduction initiatives Well-positioned in these challenging times Strong cash flow from operations – forecasted at $4.75 billion in 2009 (1) Sufficient liquidity – $6.9 billion available under credit facilities as of January 16 th Minimal near-term debt maturities – $29 million in total in 2009 (2) Refer to Earnings Release Attachments for additional details and to the Appendix for a reconciliation of adjusted (non-GAAP) operating EPS to GAAP EPS. (1) Primarily includes net cash flows provided by operating activities, excluding counterparty collateral activity, and including net cash flows used in investing activities other than capital expenditures. (2) Excludes securitization debt and includes capital leases. |

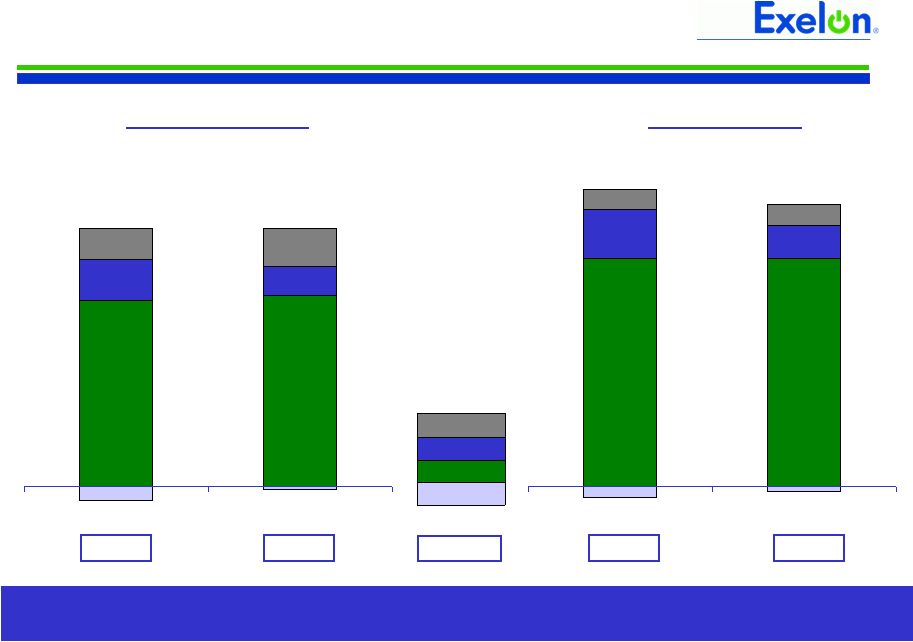

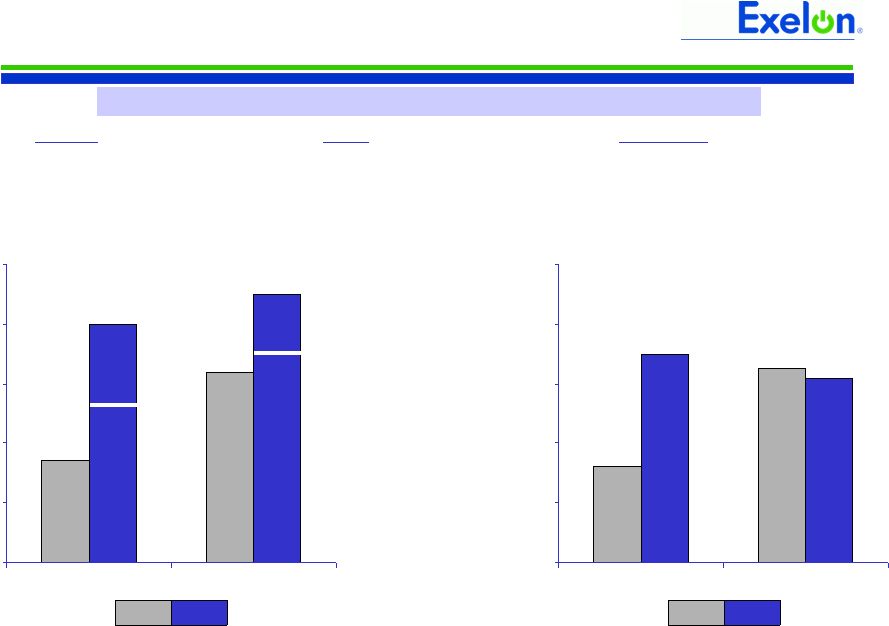

4 $3.45 $3.46 $0.75 $0.49 $0.30 $0.33 2007 2008 $0.78 $0.80 $0.17 $0.12 $0.16 $0.13 2007 2008 Exelon Operating EPS $1.07 HoldCo/Other ExGen PECO ComEd 4th Quarter (Q4) $4.20 $1.02 Full Year (FY) ExGen and ComEd reported higher quarter-over-quarter earnings, partially offset by lower earnings at PECO, as expected Refer to Earnings Release Attachments for additional details and to the Appendix for a reconciliation of adjusted (non-GAAP) operating EPS to GAAP EPS. $0.84 $1.07 $4.05 $4.13 $4.32 GAAP EPS |

5 Exelon Generation Operating EPS Contribution 4Q YTD $0.78 $0.80 $3.46 $3.45 2008 2007 Key Drivers – Q4 ’08 vs. Q4 ’07* Favorable portfolio/market conditions: +$0.02 Nuclear volume: +$0.02 Costs associated with possible nuclear construction project: +$0.04 Higher nuclear fuel costs: ($0.02) Higher O&M costs, reflecting both inflationary pressures and other O&M costs: ($0.05) ’07 rebalancing of nuclear decommissioning trust funds: ($0.06) ’07 tax method change: +$0.06 *Refer to the Earnings Release Attachments for additional details and to the Appendix for a reconciliation of adjusted (non-GAAP) operating EPS to GAAP EPS 241 80 195 91 Refueling 59 22 59 27 Non-refueling YTD 4Q YTD 4Q 2008 2007 Outage Days |

6 4Q YTD Key Drivers – Q4 ’08 vs. Q4 ’07* Distribution rates: +$0.06 ’08 tax method change: +$0.02 ’07 tax method change: ($0.06) ComEd Operating EPS Contribution 2008 2007 *Refer to the Earnings Release Attachments for additional details and to the Appendix for a reconciliation of adjusted (non-GAAP) operating EPS to GAAP EPS $0.13 $0.16 $0.30 $0.33 |

7 ComEd Load Growth Trends Weather-Normalized Load Growth Q4 2008 FY 2008 2009e Customer Growth 0.1% 0.5% 0.3% Average Use-Per-Customer (0.6%) 0.0% (0.9%) Total Residential (0.5%) 0.5% (0.6%) Small C&I (2.9%) (0.3%) (0.9%) Large C&I (1.0%) (0.4%) (2.1%) All Customer Classes (1.6%) (0.1%) (1.1%) ComEd Customer Usage by Revenue Class Chicago US Unemployment rate 6.7% 7.2% 4 th Qtr ‘08 annualized growth in gross domestic/metro product (6.8%) (4.5%) 10/08 Home price index (10.8%) (18.0%) Key Economic Indicators Other 2% Other Large C&I 13% 380 Large C&I 18% Small C&I 36% Residential 31% Top 380 Customer Usage by Segment 3% Leisure & Hospitality 9% Trade, Transportation & Utilities 10% Finance, Professional & Business Services 12% Health & Educational Services 13% Government 53% Manufacturing (1) Source: Illinois Department of Employment Security and U.S. Department of Labor (2) Source: Moody’s Economy.com (3) Source: S&P Case-Shiller index (2) (1) (3) |

8 4Q YTD PECO Operating EPS Contribution Key Drivers – Q4 ’08 vs. Q4 ’07* CTC amortization: ($0.02) Weather: ($0.01) Bad debt expense: +$0.01 ’07 tax method change: ($0.05) 2008 2007 *Refer to the Earnings Release Attachments for additional details and to the Appendix for a reconciliation of adjusted (non-GAAP) operating EPS to GAAP EPS $0.17 $0.12 $0.49 $0.75 |

9 PECO Load Growth Trends Other 2% Other Large C&I 21% 150 Large C&I 21% Small C&I 22% Residential 34% Weather-Normalized Electric Load Growth Q4 2008 FY 2008 2009e Customer Growth 0.5% 0.7% 0.1% Average Use-Per-Customer (0.9%) 1.1% (0.6%) Total Residential (0.4%) 1.8% (0.5%) Small C&I (0.2%) (0.8%) Large C&I (2.4%) 0.1% (1.9%) All Customer Classes (1.1%) 0.6% (1.1%) PECO Customer Usage by Revenue Class Philadelphia US 12/08 Unemployment rate (1) 6.3% 7.2% 4 Qtr ‘08 annualized growth in gross domestic/metro product (2) (4.0%) (4.5%) Key Economic Indicators Top 150 Customer Usage by Segment 18% Health & Educational Services 19% Manufacturing 21% Petroleum 3% Retail Trade 4% Other 9% Transportation, Communication & Utilities 13% Finance, Insurance & Real Estate 13% Pharmaceuticals (1) Source: Moody’s Economy.com and U.S. Department of Labor (2) Source: Moody’s Economy.com th |

10 2009 Operating Earnings Guidance 2009E 2008A $0.49 $3.46 $4.20 ComEd PECO Exelon Generation ComEd distribution revenue PECO gas revenue O&M and other Pension/OPEB Inflation Cost reduction initiatives Bad debt expense Nuclear fuel costs Depreciation and amortization PECO CTC 2009 Earnings Drivers ComEd PECO Exelon Generation Holdco Holdco Exelon $0.33 Exelon $4.00 - $4.30 (1) $0.45 - $0.55 $0.45 - $0.55 $3.10 - $3.35 (1) Operating Earnings Guidance. Excludes the earnings impact of certain items as disclosed in the Appendix. Reaffirming 2009 operating earnings guidance of $4.00-$4.30/share (1) – expect 1Q09 results between $1.10 to $1.20/share |

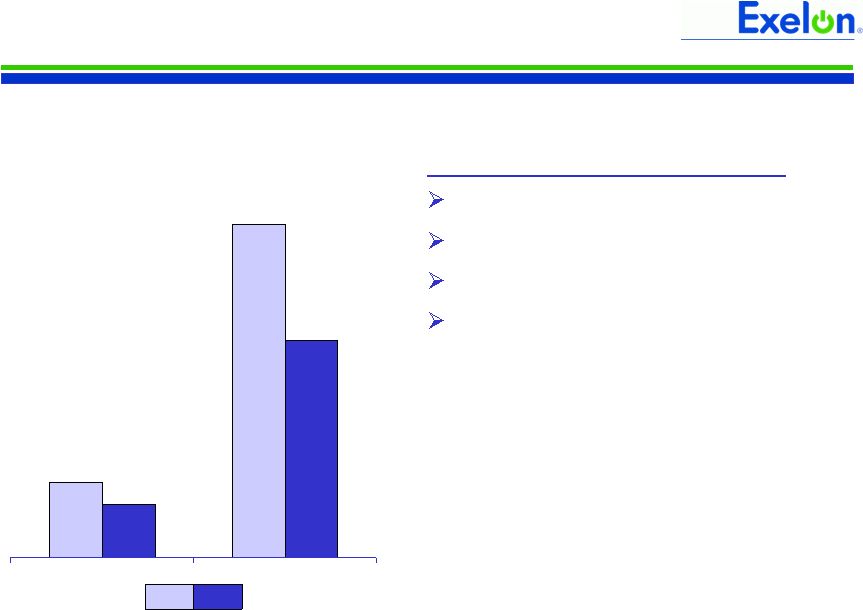

11 Cash Contributions $0 $50 $100 $150 $200 $250 Pension OPEB Pre-Tax Expense $0 $50 $100 $150 $200 $250 Pension OPEB 2009 Pension and OPEB Expense and Contributions Pension and OPEB Plans Key Metrics – 12/31/08e (in millions) Pension Assets $6,650 Obligations $10,800 2009e 2008 Estimate as of 11/08 Estimate as of 11/08 $85 $200 $160 $225 $80 $175 $163 $155 2009e 2008 1 2 3 OPEB Assets $1,200 Obligations $3,500 Key Metrics 2008 asset return -26% 12/31/08 discount rate 6.09% 2009 L-T EROA 8.50% (1) Excludes settlement charges. (2) Management has not yet made a definitive decision regarding its 2009 pension contributions and may make additional discretionary contributions based upon final interpretations of the Worker, Retiree and Employer Recovery Act of 2008. (3) Management has not yet made a definitive decision regarding its 2009 OPEB contributions. Approximately $100 million of the estimated 2009 OPEB contributions is discretionary. |

12 Exelon Cost and Capital Management • Clearly define governance and oversight model • Optimize the Exelon operational structure to drive efficiency and accountability, reducing complexity and cost • Provide better visibility on cost drivers and productivity • Process improvement and elimination of low value work • Drive productivity focus in business planning process • Continue to manage capital spending Exelon’s 2009 earnings guidance contemplates over $100 million of forecasted O&M reductions due to cost management Drive productivity and cost reduction (with continued superior operations) Continue to align spending plans with market conditions $4,500 (2) $4,500 Exelon Consolidated $700 $750 PECO $1,100 $1,100 ComEd $2,750 $2,700 Exelon Generation 2009e 2008a O&M Expense (1) (in millions) $3,400 $3,200 Exelon Consolidated $400 $400 PECO $1,000 $950 ComEd $1,950 $1,750 Exelon Generation 2009e 2008a CapEx (in millions) (1) Reflects Operating O&M data and excludes Decommissioning impact. (2) Reflects ~$180 million increase in O&M expense from 2008a to 2009e due to higher pension and OPEB expense. |

13 Well-Positioned in These Challenging Times Nuclear remains a low-cost generation source and Exelon Generation is the lowest-cost nuclear fleet operator in the US Hedging program largely protects against commodity movements in the near term – over 90% financially hedged in 2009 and ~90% financially hedged in 2010 Hedged Against Short-Term Volatility in Commodities $7.3 billion in aggregate credit facility commitments that extend largely through 2012 – $6.9 billion available as of 1/16/09 23 banks committed to the facility – with each bank having less than 10% of the aggregate commitments at Exelon $29 million of debt maturities, in total, in FY2009 (1) Sufficient Liquidity Power marketing activities are governed by tight risk management policies – proprietary trading activities are minimal Diversified, high quality counterparties Daily monitoring of positions, exposure and financial condition of counterparties Collateral required from non-investment grade counterparties Financially Disciplined World-class nuclear operations – 93.9% capacity factor FY 2008 with 10 refueling outages at Exelon-operated units and 2 outages at Salem Constructive rate cases at ComEd and PECO Final ComEd rate order provides for $273.6 million increase in annual distribution revenues PAPUC approval of PECO gas rate agreement provides for $76.5 million increase in annual gas revenues Strong Operations Exelon Position (1) Excludes securitization debt, which is repaid through customer-collected revenues, and includes capital leases. |

14 Appendix |

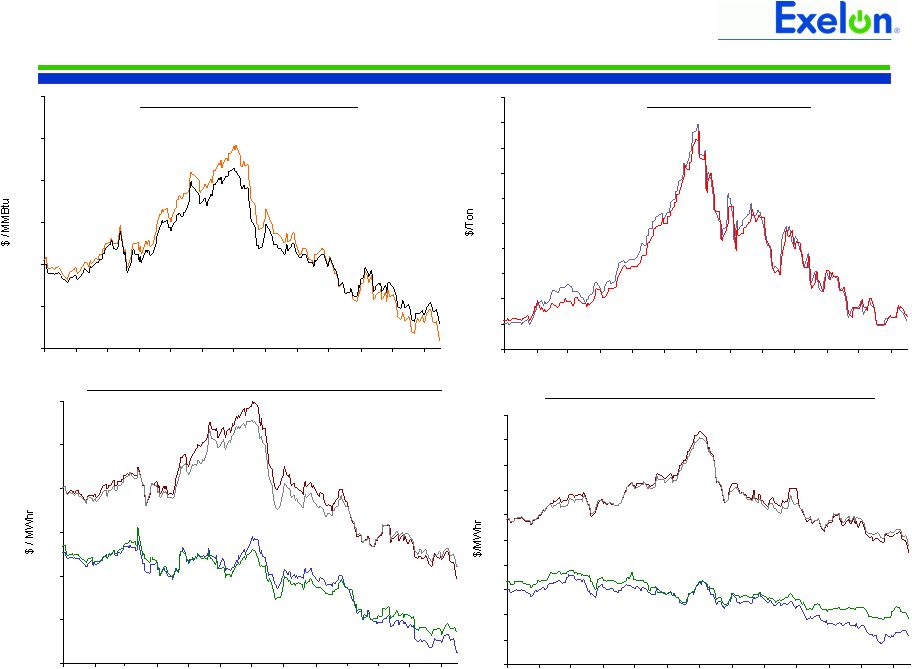

45 55 65 75 85 95 105 1/08 2/08 3/08 4/08 5/08 6/08 7/08 8/08 9/08 10/08 11/08 12/08 1/09 50 60 70 80 90 100 110 120 130 140 150 1/08 2/08 3/08 4/08 5/08 6/08 7/08 8/08 9/08 10/08 11/08 12/08 1/09 6.5 7.5 8.5 9.5 10.5 11.5 12.5 1/08 2/08 3/08 4/08 5/08 6/08 7/08 8/08 9/08 10/08 11/08 12/08 1/09 Forward NYMEX Natural Gas PJM-West and Ni-Hub On-Peak Forward Prices PJM-West and Ni-Hub Wrap Forward Prices 2010 2011 Market Price Snapshot Rolling 12 months, as of January 16, 2009. Source: OTC quotes and electronic trading system. Quotes are daily. Forward NYMEX Coal $6.70 $7.12 2010 2011 $61.38 $62.50 15 2010 Ni-Hub 2011 Ni-Hub 2011 PJM-West 2010 PJM-West 2010 Ni-Hub 2011 Ni-Hub 2011 PJM-West 2010 PJM-West $64.43 $67.15 $47.38 $34.00 $47.54 $49.00 $30.74 $52.00 25 30 35 40 45 50 55 60 65 70 75 1/08 2/08 3/08 4/08 5/08 6/08 7/08 8/08 9/08 10/08 11/08 12/08 1/09 |

7.5 8.5 9.5 10.5 11.5 12.5 13.5 14.5 15.5 16.5 1/08 2/08 3/08 4/08 5/08 6/08 7/08 8/08 9/08 10/08 11/08 12/08 1/09 8 8.2 8.4 8.6 8.8 9 9.2 9.4 9.6 9.8 10 1/08 2/08 3/08 4/08 5/08 6/08 7/08 8/08 9/08 10/08 11/08 12/08 1/09 55 60 65 70 75 80 85 90 95 1/08 2/08 3/08 4/08 5/08 6/08 7/08 8/08 9/08 10/08 11/08 12/08 1/09 6 7 8 9 10 11 1/08 2/08 3/08 4/08 5/08 6/08 7/08 8/08 9/08 10/08 11/08 12/08 1/09 16 2011 2010 2010 2011 2010 2011 Houston Ship Channel Natural Gas Forward Prices ERCOT North On-Peak Forward Prices ERCOT North On-Peak v. Houston Ship Channel Implied Heat Rate 2010 2011 ERCOT North On Peak Spark Spread Assumes a 7.2 Heat Rate, $1.50 O&M, and $.15 adder Market Price Snapshot Rolling 12 months, as of January 16, 2009. Source: OTC quotes and electronic trading system. Quotes are daily. $6.37 $6.80 $60.98 $56.52 $8.88 $8.96 $8.09 $9.43 |

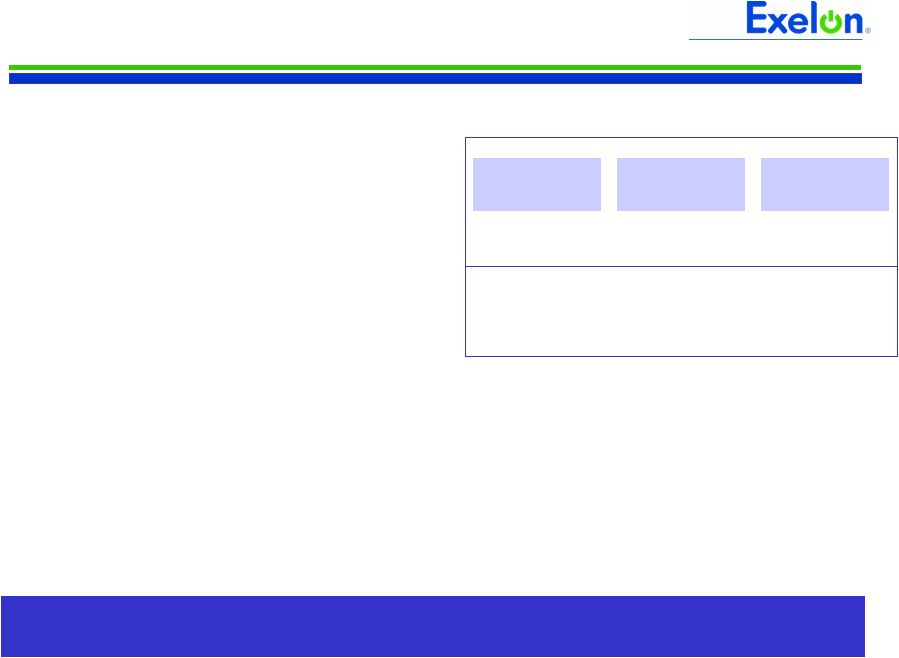

17 Hedging Targets (1) Percent financially hedged is our estimate of the gross margin that is hedged at a 95% confidence level given the current assessment of market volatility. The formula is the gross margin at the 5 percentile / expected gross margin. Power Team utilizes various products and channels to market in order to optimize Exelon Generation’s earnings: • Block product sales in power • Options in power and natural gas • Full requirements sales via retail channel and wholesale load procurement processes • Supplement the portfolio with structured transactions • Use physical and financial fuel products to manage variability in fossil generation output Target Ranges 90% - 98% 70% - 90% 60% - 80% >90% Current Position ~90% Near top end of range Prompt Year (2009) Second Year (2010) Third Year (2011) Financial Hedging Range (1) Flexibility in our targeted financial hedge ranges allows us to be opportunistic while mitigating downside risk Financial hedge ratios reflect a range of revenue net fuel based on observed market prices and volatility • Generally, hedges are executed on a ratable basis over a three-year window; therefore, the position is well hedged in the front year and significantly open in the outer years • Utilize options to hedge risk and preserve upside th |

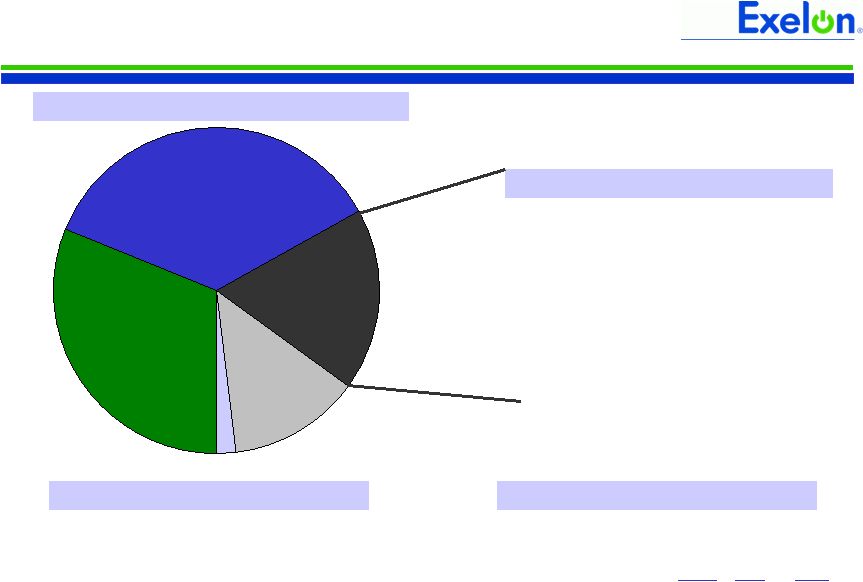

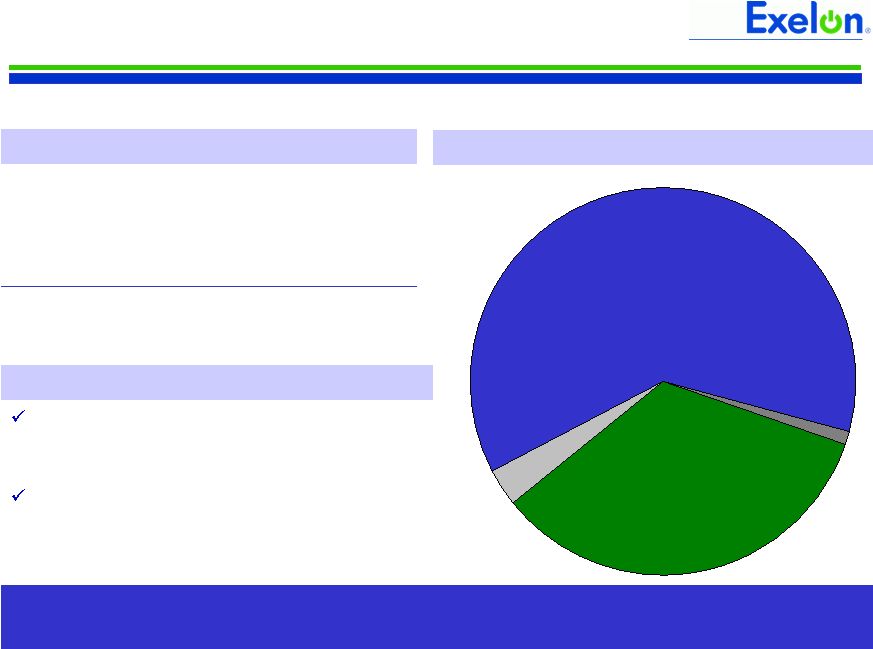

18 Exelon Generation Has Limited Counterparty Exposure Net Exposure After Credit Collateral (1) (in millions) Investment grade $1,113 Non-investment grade 3 No external ratings 27 Total $1,143 (1) As of December 31, 2008. Does not include credit risk exposure from uranium procurement contracts or exposure through Regional Transmission Organizations, Independent System Operators and New York Mercantile Exchange and Intercontinental Exchange commodity exchanges. Additionally, does not include receivables related to the supplier forward agreements with ComEd and the PPA with PECO. Exelon Generation transacts with a diverse group of counterparties, predominantly all investment grade, and has ample liquidity to support its operations Exelon Generation – Sufficient Liquidity Aggregate credit facility commitments of $4.8 billion that extend through 2012 – $4.7 billion available as of 1/16/09 Strong balance sheet – A3/BBB/BBB+ Senior Unsecured Rating Net Exposure by Type of Counterparty (1) Coal Producers 1% Financial Institutions 34% Investor-Owned Utilities, Marketers, and Power Producers 62% Other 3% |

19 2009 Projected Sources and Uses of Cash 150 0 300 50 Other 150 350 (250) 250 Net Financing (excluding Dividend): (2) 750 350 200 200 Planned Debt Issuances Net Financing (excluding Dividend): (2) (750) 0 (750) 0 Planned Debt Retirements (3) $4,750 $2,800 $950 $1,000 Cash Flow from Operations (1) (3,400) (1,950) (400) (1,000) Capital Expenditures $1,500 $1,200 $300 $250 Cash Available before Dividend (1,400) Dividend (4) $100 Cash Available after Dividend Exelon (5) ($ in Millions) Numbers are rounded and may not add. (1) Cash Flow from Operations = Primarily includes net cash flows provided by operating activities, excluding counterparty collateral activity, and including net cash flows used in investing activities other than capital expenditures. (2) Net Financing (excluding Dividend) = Net cash flows used in financing activities excluding dividends paid on common and preferred stock. (3) Planned Debt Retirements are $17M, $728M, and $12M for ComEd, PECO, and ExGen, respectively. Includes securitized debt. (4) Assumes 2009 Dividend of $2.10 per share. Dividends are subject to declaration by the board of directors. (5) Includes cash flow activity from Holding Company, eliminations, and other corporate entities. |

20 Sufficient Liquidity (1) Excludes previous commitment from Lehman Brothers Bank. (2) Available Capacity Under Facility represents the unused bank commitments under the borrower’s credit agreements net of outstanding letters of credit. The amount of commercial paper outstanding does not reduce the available capacity under the credit agreements. (3) Includes cash flow activity from Holding Company, eliminations, and other corporate entities. -- -- -- -- Outstanding Facility Draws (396) (157) (93) (141) Outstanding Letters of Credit $7,317 $4,834 $574 $952 Aggregate Bank Commitments (1) 6,921 4,677 481 811 Available Capacity Under Facility (2) (140) -- (125) -- Outstanding Commercial Paper $6,781 $4,677 $356 $811 Available Capacity Less Outstanding Commercial Paper Exelon (3) ($ in Millions) We have minimal commercial paper outstanding and our bank facility is largely untapped Available Capacity Under Bank Facility as of January 16, 2009 |

21 Projected 2009 Key Credit Measures BBB A- BBB+ BBB- S&P Credit Ratings (3) BBB+ A BBB BBB+ Fitch Credit Ratings (3) A3 A2 Baa2 Baa1 Moody’s Credit Ratings (3) 3.6x 3.8x FFO / Interest ComEd: 18% 14% FFO / Debt 55% 62% Rating Agency Debt Ratio 6.3x 3.0x FFO / Interest PECO: 36% 10% FFO / Debt 52% 54% Rating Agency Debt Ratio 30% 51% Rating Agency Debt Ratio 108% 46% FFO / Debt 21.3x 8.6x FFO / Interest Exelon Generation: 54% 39% 7.0x Without PPA & Pension / OPEB (2) 64% Rating Agency Debt Ratio 23% FFO / Debt 5.2x FFO / Interest Exelon Consolidated: With PPA & Pension / OPEB (1) Notes: Projected credit measures reflect impact of Illinois electric rates and policy settlement. Exelon, ComEd and PECO metrics exclude securitization debt. See following slide for FFO (Funds from Operations)/Interest, FFO/Debt and Adjusted Book Debt Ratio reconciliations to GAAP. (1) Reflects S&P updated guidelines, which include imputed debt and interest related to purchased power agreements (PPA), unfunded pension and other postretirement benefits (OPEB) obligations, capital adequacy for energy trading, operating lease obligations, and other off-balance sheet debt. Debt is imputed for estimated pension and OPEB obligations by operating company. (2) Excludes items listed in note (1) above. (3) Current senior unsecured ratings for Exelon and Generation and senior secured ratings for ComEd and PECO as of January 16, 2009. On October 21, 2008, S&P put Exelon, ComEd, PECO and Exelon Generation on Credit Watch with negative implications. On November 12, 2008, Moody’s placed the ratings of Exelon, Exelon Generation and PECO under review for possible downgrade. |

22 FFO Calculation and Ratios FFO Calculation = FFO - PECO Transition Bond Principal Paydown + Gain on Sale, Extraordinary Items and Other Non-Cash Items + Change in Deferred Taxes + Depreciation, amortization (including nucl fuel amortization), AFUDC/Cap. Interest Add back non-cash items: Net Income Adjusted Interest FFO + Adjusted Interest = Adjusted Interest + 7% of Present Value (PV) of Operating Leases + Interest on imputed debt related to PV of Purchased Power Agreements (PPA), unfunded Pension and Other Postretirement Benefits (OPEB) obligations, and Capital Adequacy for Energy Trading , as applicable - PECO Transition Bond Interest Expense Net Interest Expense (Before AFUDC & Cap. Interest) FFO Interest Coverage + Capital Adequacy for Energy Trading (2) FFO = Adjusted Debt + PV of Operating Leases + 100% of PV of Purchased Power Agreements + Unfunded Pension and OPEB obligations + A/R Financing Add off-balance sheet debt equivalents: - PECO Transition Bond Principal Balance + STD + LTD Debt: Adjusted Debt (1) FFO Debt Coverage Rating Agency Capitalization Rating Agency Debt Total Adjusted Capitalization Adjusted Book Debt = Total Rating Agency Capitalization + Off-balance sheet debt equivalents (2) - Goodwill Total Adjusted Capitalization = Rating Agency Debt + ComEd Transition Bond Principal Balance + Off-balance sheet debt equivalents (2) Adjusted Book Debt = Total Adjusted Capitalization + Adjusted Book Debt + Preferred Securities of Subsidiaries + Total Shareholders' Equity Capitalization: = Adjusted Book Debt - Transition Bond Principal Balance + STD + LTD Debt: Debt to Total Cap Note: Reflects S&P guidelines and company forecast. FFO and Debt related to non-recourse debt are excluded from the calculations. (1) Uses current year-end adjusted debt balance. (2) Metrics are calculated in presentation unadjusted and adjusted for debt equivalents and related interest for PPAs, unfunded Pension and OPEB obligations, and Capital Adequacy for Energy Trading. (3) Reflects depreciation adjustment for PPAs and decommissioning interest income and contributions. (2) (2) (2) (2) |

23 Q4 GAAP EPS Reconciliation (0.11) - - - (0.11) Georgia Power tolling agreement 0.19 - - - 0.19 Termination of State Line PPA 0.03 0.03 - - - Investments in synthetic fuel-producing facilities (0.03) - - - (0.03) Mark-to-market adjustments from economic hedging activities (0.28) - - (0.01) (0.27) 2007 Illinois Electric Rate Settlement (0.02) - - (0.02) - City of Chicago settlement with ComEd 0.04 0.08 - - (0.04) Non-cash deferred tax items $0.84 $0.05 $0.17 $0.10 $0.52 Q4 2007 GAAP Earnings Per Share $1.02 ($0.06) $0.17 $0.13 $0.78 2007 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share Exelon Other PECO ComEd ExGen Three Months Ended December 31, 2007 NOTE: All amounts shown are per Exelon share and represent contributions to Exelon's EPS. (0.10) - - - (0.10) Unrealized gains and losses related to nuclear decommissioning trust funds 0.15 - - - 0.15 Mark-to-market adjustments from economic hedging activities 0.03 0.03 Settlement of tax matter at Generation related to Sithe (0.02) (0.02) - - - NRG acquisition costs $1.07 ($0.03) $0.12 $0.14 $0.84 Q4 2008 GAAP Earnings (Loss) Per Share $1.07 ($0.01) $0.12 $0.16 $0.80 2008 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share (0.04) - - - (0.04) 2007 Illinois Electric Rate Settlement (0.02) - - (0.02) - City of Chicago settlement with ComEd Exelon Other PECO ComEd ExGen Three Months Ended December 31, 2008 |

24 YTD GAAP EPS Reconciliation 0.04 0.08 - - (0.04) Non-cash deferred tax items (0.11) - - - (0.11) Georgia Power tolling agreement 0.19 - - - 0.19 Termination of State Line PPA 0.14 0.14 - - - Investments in synthetic fuel-producing facilities (0.15) - - - (0.15) Mark-to-market adjustments from economic hedging activities 0.01 - - - 0.01 Settlement of a tax matter at Generation related to Sithe 0.01 - - - 0.01 Sale of Generation's investments in TEG and TEP (0.02) - - (0.02) - City of Chicago settlement with ComEd $4.05 $0.04 $0.75 $0.25 $3.01 YTD 2007 GAAP Earnings Per Share $4.32 ($0.18) $0.75 $0.30 $3.45 2007 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share 0.03 - - - 0.03 Decommissioning obligation reduction (0.41) - - (0.03) (0.38) 2007 Illinois Electric Rate Settlement Exelon Other PECO ComEd ExGen Twelve Months Ended December 31, 2007 (0.02) (0.02) - - - NRG acquisition costs (0.27) - - - (0.27) Unrealized gains & losses related to nuclear decommissioning trust funds (0.22) - - (0.01) (0.21) 2007 Illinois Electric Rate Settlement 0.03 0.03 Settlement of tax matter at Generation related to Sithe (0.02) - - (0.02) - City of Chicago settlement with ComEd $4.13 ($0.10) $0.49 $0.30 $3.44 YTD 2008 GAAP Earnings (Loss) Per Share $4.20 ($0.08) $0.49 $0.33 $3.46 2008 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share 0.41 - - - 0.41 Mark-to-market adjustments from economic hedging activities 0.02 - - - 0.02 Decommissioning obligation reduction Exelon Other PECO ComEd ExGen Twelve Months Ended December 31, 2008 NOTE: All amounts shown are per Exelon share and represent contributions to Exelon's EPS. |