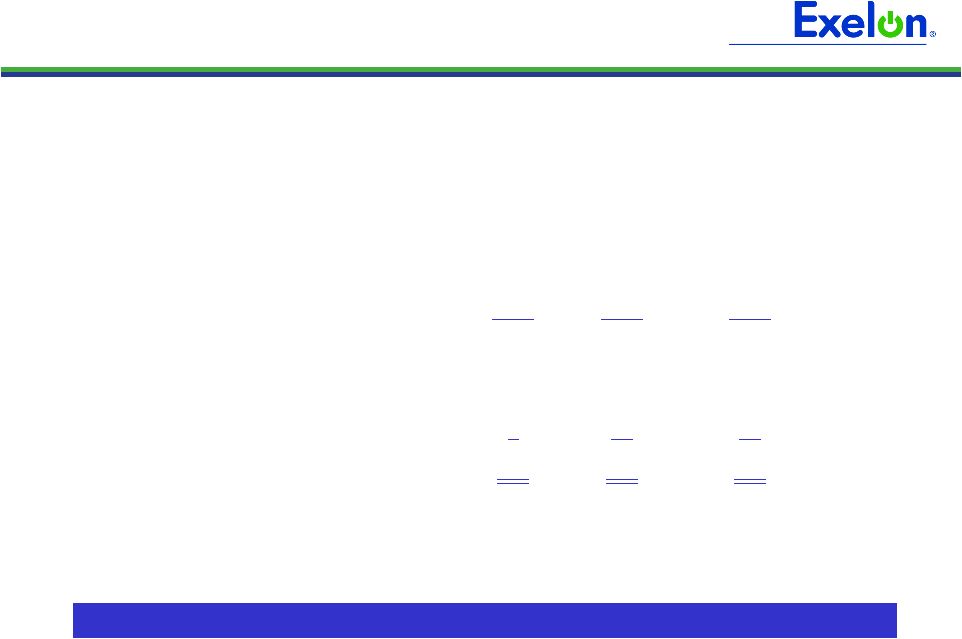

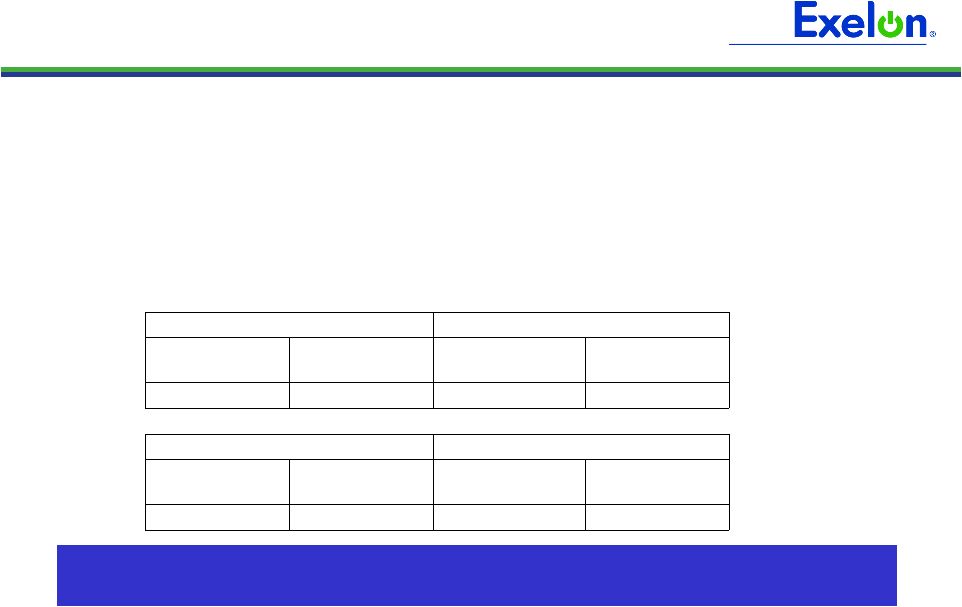

6 Portfolio Implications • Cromby and Eddystone have not cleared in the past two RPM capacity auctions (2011/12 and 2012/13) • May 31, 2011 is the end of RPM capacity obligation for Cromby station and Eddystone coal units • Units will not be bid into RPM auction for 2013/2014 in May 2010 • Impact on Hedging Disclosures (as of 9/30/09): – No impact on 2010 due to May 2011 retirement date – Mid-Atlantic Expected Generation (GWh) (1) – Open Gross Margin ($ millions) (2) 59,800 With Cromby/Eddystone 59,100 With Cromby/Eddystone 56,700 57,200 Without Cromby/Eddystone Without Cromby/Eddystone 2012 2011 Retirements do not impact our ability to meet current obligations or our continued participation in future load-following opportunities Without Cromby/Eddystone $5,850 With Cromby/Eddystone $5,950 With Cromby/Eddystone $5,750 $5,900 Without Cromby/Eddystone 2012 2011 (1) Expected generation represents the amount of energy estimated to be generated or purchased through owned or contracted for capacity. Expected generation is based upon a simulated dispatch model that makes assumptions regarding future market conditions, which are calibrated to market quotes for power, fuel, load following products, and options. Expected generation assumes 10 refueling outages in 2010 and 11 refueling outages in 2011 and 2012 at Exelon-operated nuclear plants and Salem. Expected generation assumes capacity factors of 93.5%, 92.8% and 92.8% in 2010, 2011 and 2012 at Exelon-operated nuclear plants. These estimates of expected generation in 2011 and 2012 do not represent guidance or a forecast of future results as Exelon has not completed its planning or optimization processes for those years. (2) Gross margin is defined as operating revenues less fuel expense and purchased power expense, excluding the impact of decommissioning and other incidental revenues. Open gross margin is estimated based upon an internal model that is developed by dispatching our expected generation to current market power and fossil fuel prices. Open gross margin assumes there is no hedging in place other than fixed assumptions for capacity cleared in the RPM auctions and uranium costs for nuclear power plants. Open gross margin contains assumptions for other gross margin line items such as various ISO bill and ancillary revenues and costs and PPA capacity payments. The estimation of open gross margin incorporates management discretion and modeling assumptions that are subject to change. |