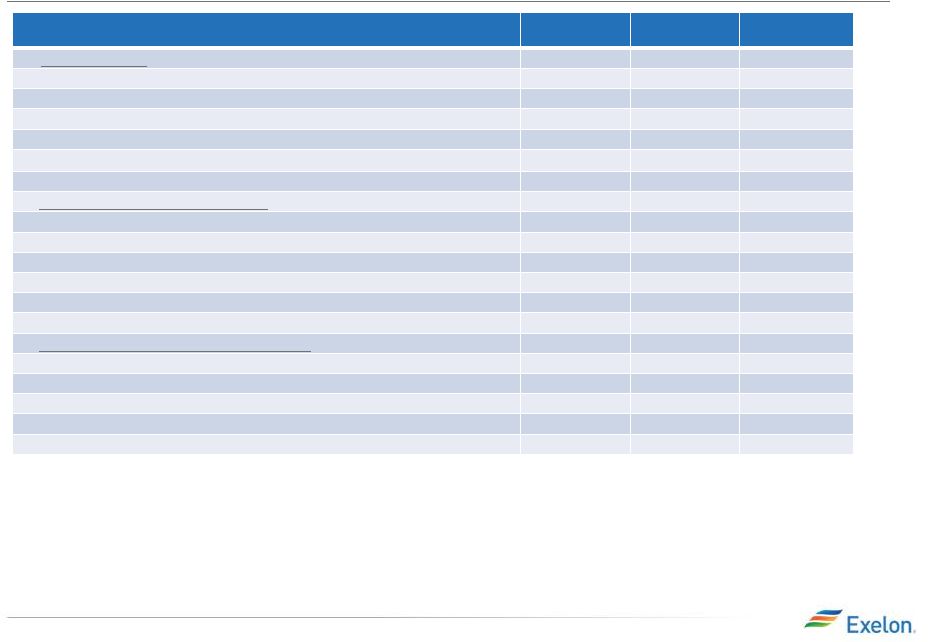

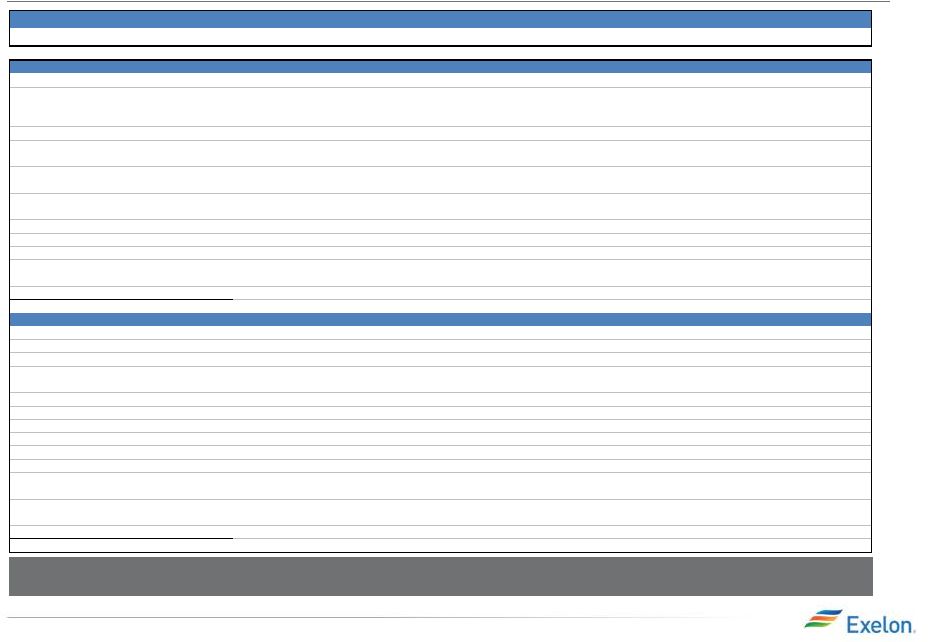

Moody’s Credit Metric Ratios 2013 1Q Earnings Release Slides 22 Note: See Moody’s publications for official guidelines, criteria and methodology Note: Moody’s Approach to Global Standard Adjustments for Non-Financial Corporations allows for Analyst discretion whether to incorporate imputed debt (and other associated adjustments) for PPAs/tolls. Moody’s official methodology for Exelon and subs does not include PPAs/tolls; however they view credit metrics both with and without Reflects key credit ratio calculations and adjustments per Moody’s guidelines Moody's Metrics Cash From Ops (pre w/c) / Debt Cash From Ops (pre w/c) / Adjusted Debt Retained Cash Flow / Debt (Adjusted FFO - Adjusted Dividend) / Adjusted Debt Free Cash Flow Credit Adjustments - Cash from Operations: Source (2012 10K): Methodology: Cash From Operations Stmt. of Cash Flows Start with net cash flows provided by operating activities (+/-) Working Capital Adjustments and changes in short- terms assets and liabilities Stmt. of Cash Flows and Supplemental Cash Flow Information Includes changes in A/R, Inventories, A/P and other accrued expenses, counterparty collateral, income taxes, under/over-recovered energy and transmission costs, other current assets. Impact is opposite of impact to cash flow Moody's Cash From Ops Adjustments: (+) Operating Lease Depreciation Adjustment FN 19 - Commitments & Contingencies - Rental Expense Equals annual rent expense x 2/3 (remaining 1/3 is allocated to interest) (+) Normalize Pension/OPEB Contribution FN 14 - Retirement Benefits - Contributions, Service Costs Reflects employer contributions – service costs, if > $0, otherwise $0 (-) Interest Capitalized / AFUDC FN 1 - Accounting Policies - Capitalized Interest and AFUDC Reclass activity classified as Investing to Cash from Operations (+/-) Interest or Dividend on Hybrid Securities FN 11 - Debt and Credit Agreements Remove/add interest expense/dividend payments associated with instruments that qualify as hybrid securites (treated all or partially as debt or equity) (+/-) Other Adjustments N/A One-time or non-standard adjustments at discretion of rating agency = Cash from Ops (pre w/c) Credit Adjustments - FFO: Source (2012 10K): Methodology: Net Income Stmt. of Cash Flows Start with net income (+/-) Non-cash adjustments to cash flows Stmt. of Cash Flows Includes depreciation and amortization, deferred income taxes, net fair value change in derivatives, net realized/unrealized gains/losses on decom funds, other non-cash operating activities Moody's FFO Adjustments: *** same as Cash from Ops Adjustments listed above *** = Adjusted FFO Credit Adjustments - CapEx: Source (2012 10K): Methodology: Capital Expenditures Stmt. of Cash Flows Start with capital expenditures Moody's CapEx Adjustments: (+) Operating Leases CapEx FN 19 - Commitments & Contingencies - Rental Expense Reclass of operatng spend to capital; equal to operating lease deprecation adjustment (-) Interest Capitalized / AFUDC FN 1 - Accounting Policies - Capitalized Interest and AFUDC Reclass activity classified as Investing to Cash from Operations = Adjusted CapEx Credit Adjustments - Debt: Source (2012 10K): Methodology: Total Long-term Debt (incl. current maturities) Balance Sheet Start with long-term debt outstanding (+) Short-term Borrowings Balance Sheet Reflects short-terms borrowings (commerical paper, notes payable etc.) Moody's Debt Adjustments: (+) Unfunded Pension FN 14 - Retirement Benefits - Unfunded Status Reflects unfunded status (pension only) (+/-) Hybrid Securities FN 11 - Debt and Credit Agreements Reclassify instruments that qualify as hybrid securites between debt and equity (treated all or partially as debt or equity) (+) Operating Leases FN 19 - Commitments & Contingencies - Minimum Future Lease Payments Annual rent expense x multiple between 4 and 10 (currently 8 for ExGen/Corp and 6 for utilities) (+/-) Other Adjustments N/A One-time or non-standard adjustments at discretion of rating agency = Adjusted Debt Credit Adjustments - Dividend: Source (2012 10K): Methodology: Common Dividends Stmt. of Cash Flows Start with common dividends (+) Preferred Dividends Stmt. of Cash Flows Reflects dividends on preferred securities Moody's Dividend Adjustments: (+) Hybrid Securities FN 11 - Debt and Credit Agreements Remove/add dividend payments/interest expense associated with instruments that qualify as hybrid securites (treated all or partially as equity or debt) = Adjusted Dividend Cash From Operations + Moody's Cash From Ops Adjustments - Adjusted Dividend - Adjusted CapEx Calculation |