Exhibit 99.1

Welcome and Agenda Dan Eggers Senior Vice President, Investor Relations

Cautionary Statements Regarding Forward-Looking Information This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, that are subject to risks and uncertainties. The factors that could cause actual results to differ materially from the forward-looking statements made by Exelon Corporation, Exelon Generation Company, LLC, Commonwealth Edison Company, PECO Energy Company, Baltimore Gas and Electric Company, Pepco Holdings LLC (PHI), Potomac Electric Power Company, Delmarva Power & Light Company, and Atlantic City Electric Company (Registrants) include those factors discussed herein, as well as the items discussed in (1) Exelon’s 2015 Annual Report on Form 10-K in (a) ITEM 1A. Risk Factors, (b) ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and (c) ITEM 8. Financial Statements and Supplementary Data: Note 23; (2) PHI’s 2015 Annual Report on Form 10-K in (a) ITEM 1A. Risk Factors, (b) ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and (c) ITEM 8. Financial Statements and Supplementary Data: Note 16; (3) Exelon’s Second Quarter 2016 Quarterly Report on Form 10-Q in (a) Part II, Other Information, ITEM 1A. Risk Factors; (b) Part 1, Financial Information, ITEM 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations and (c) Part I, Financial Information, ITEM 1. Financial Statements: Note 18; and (4) other factors discussed in filings with the SEC by the Registrants. Readers are cautioned not to place undue reliance on these forward-looking statements, which apply only as of the date of this presentation. None of the Registrants undertakes any obligation to publicly release any revision to its forward-looking statements to reflect events or circumstances after the date of this presentation.

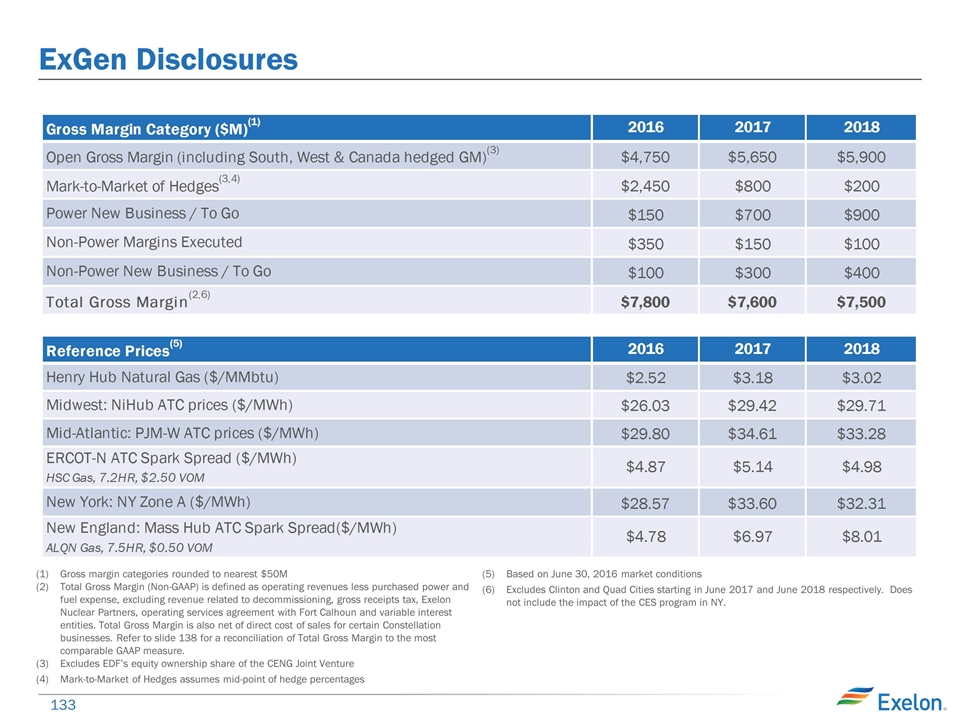

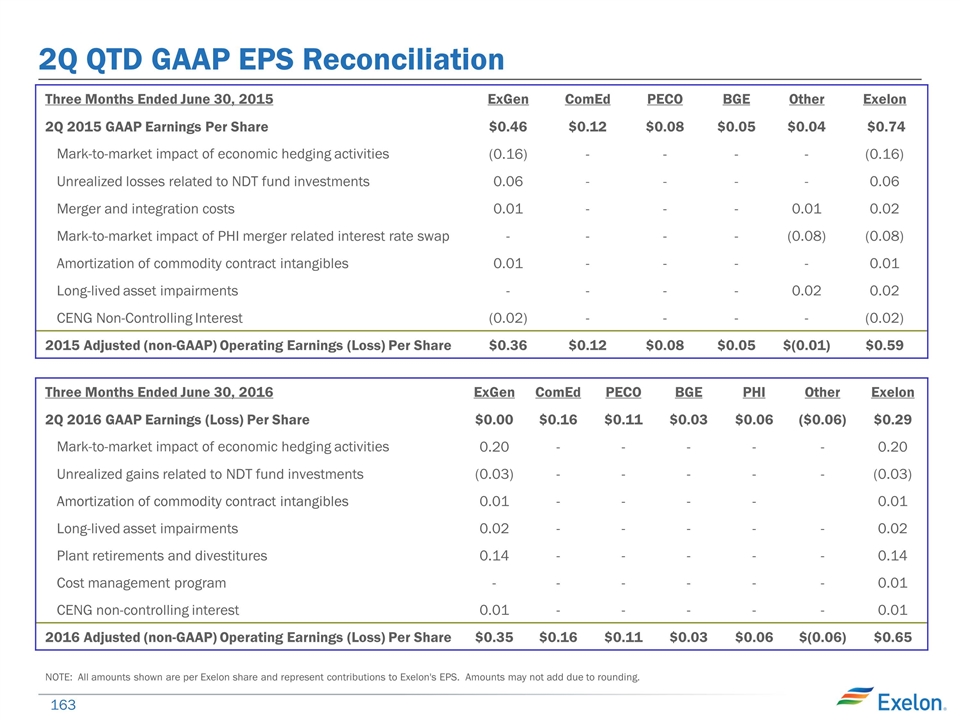

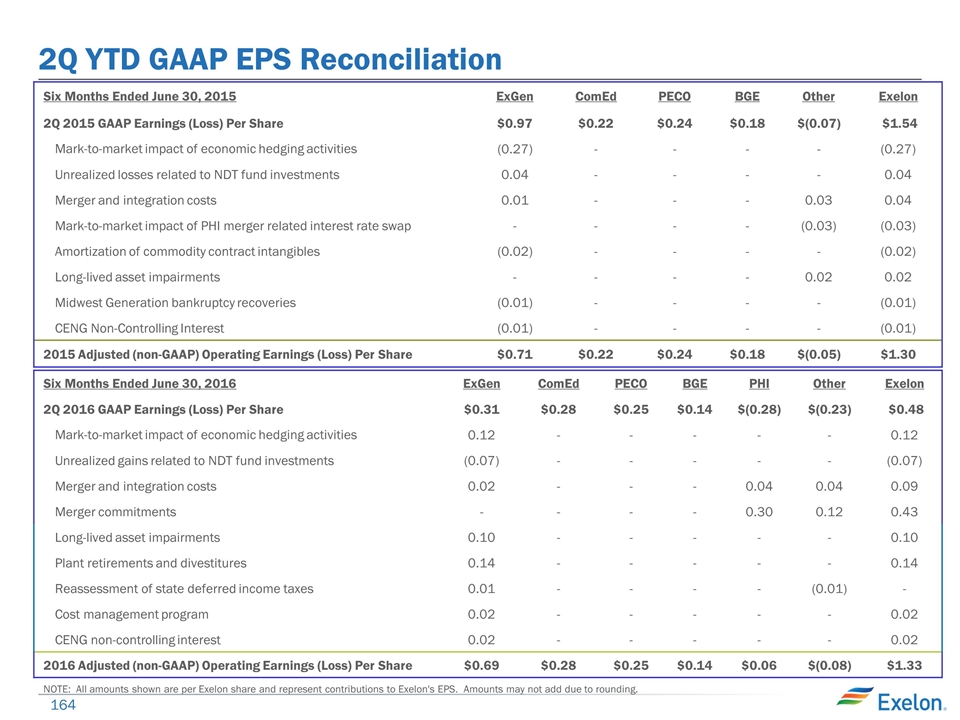

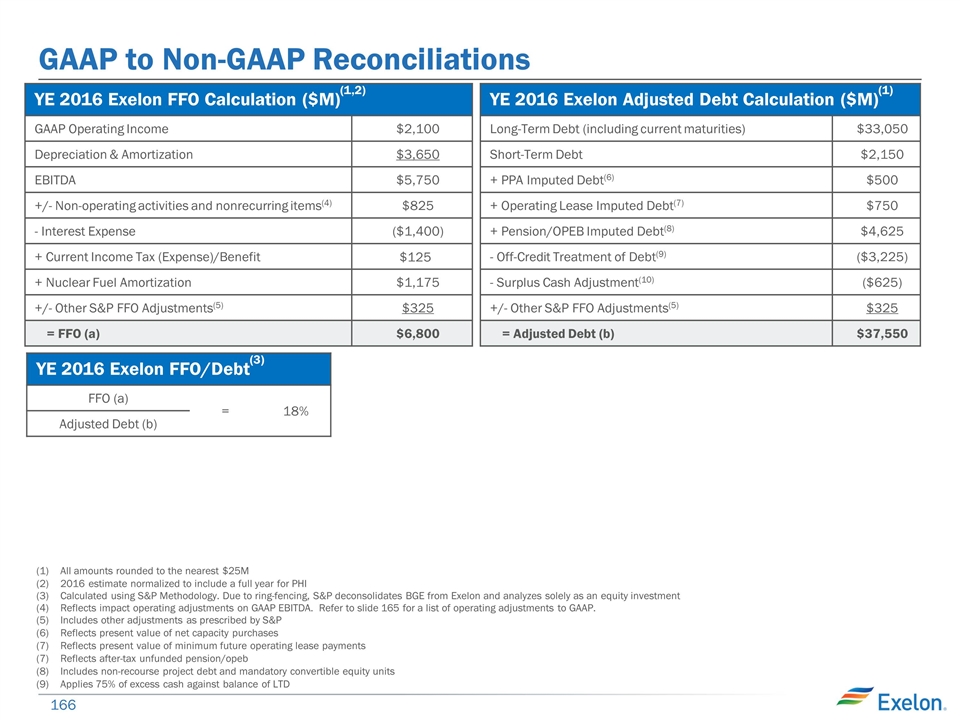

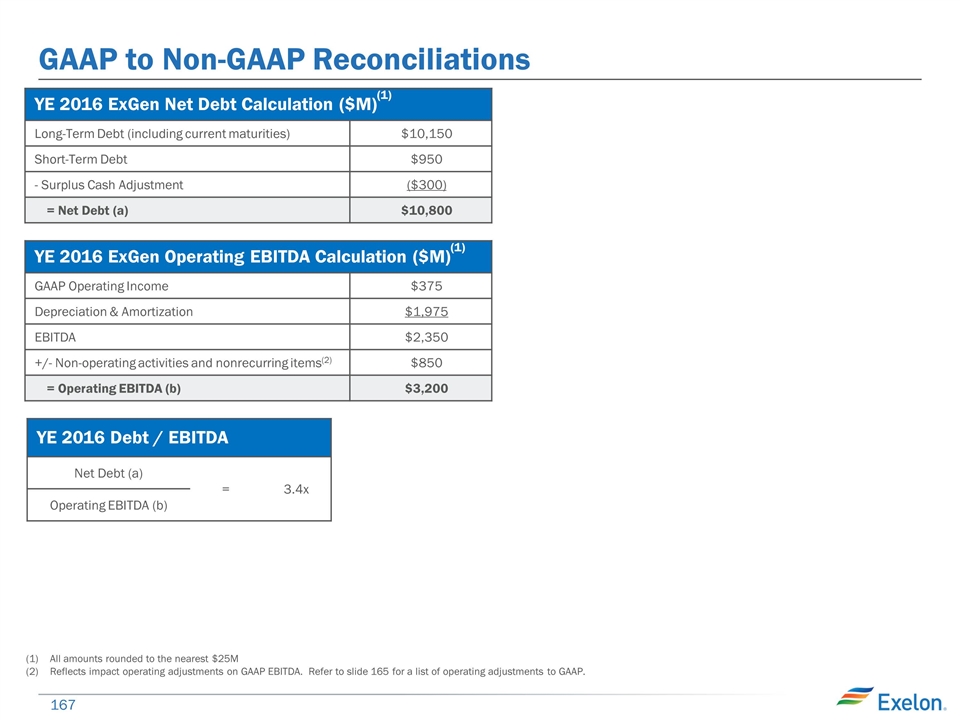

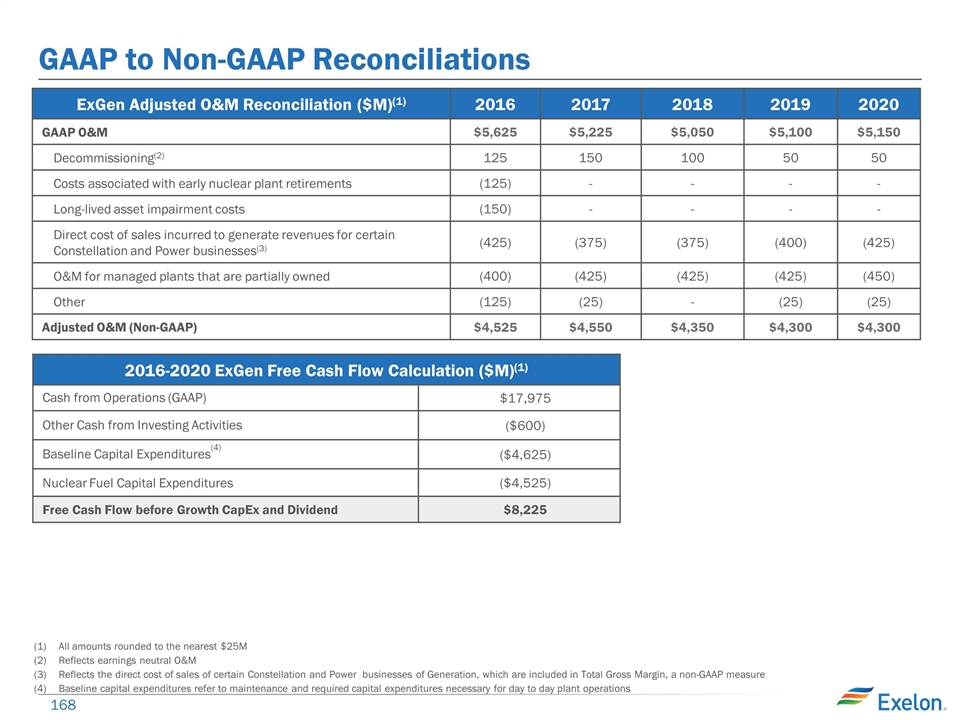

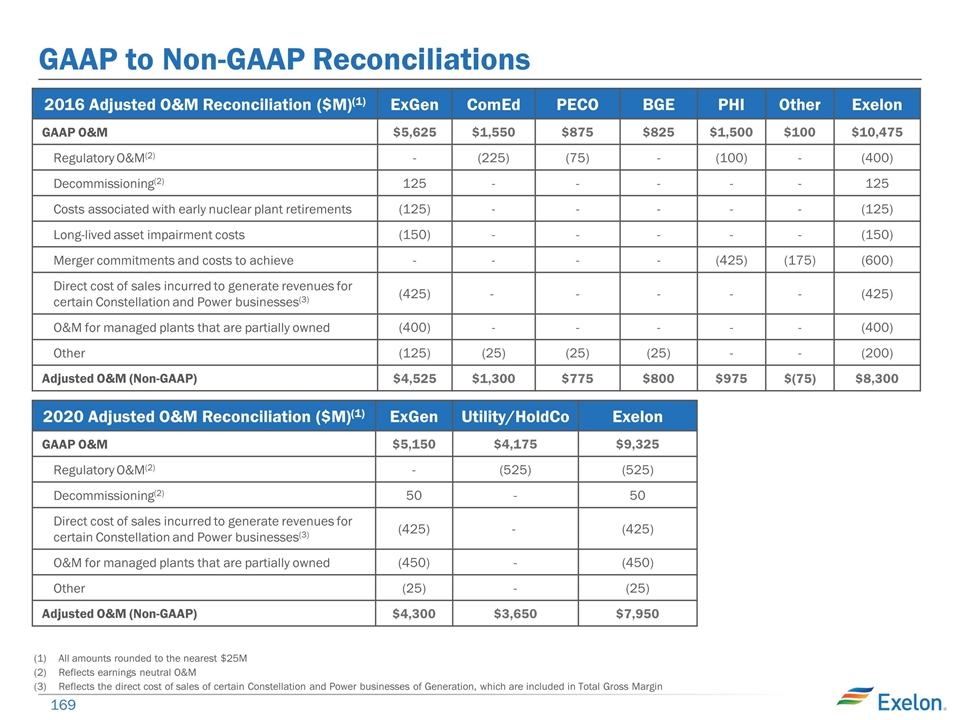

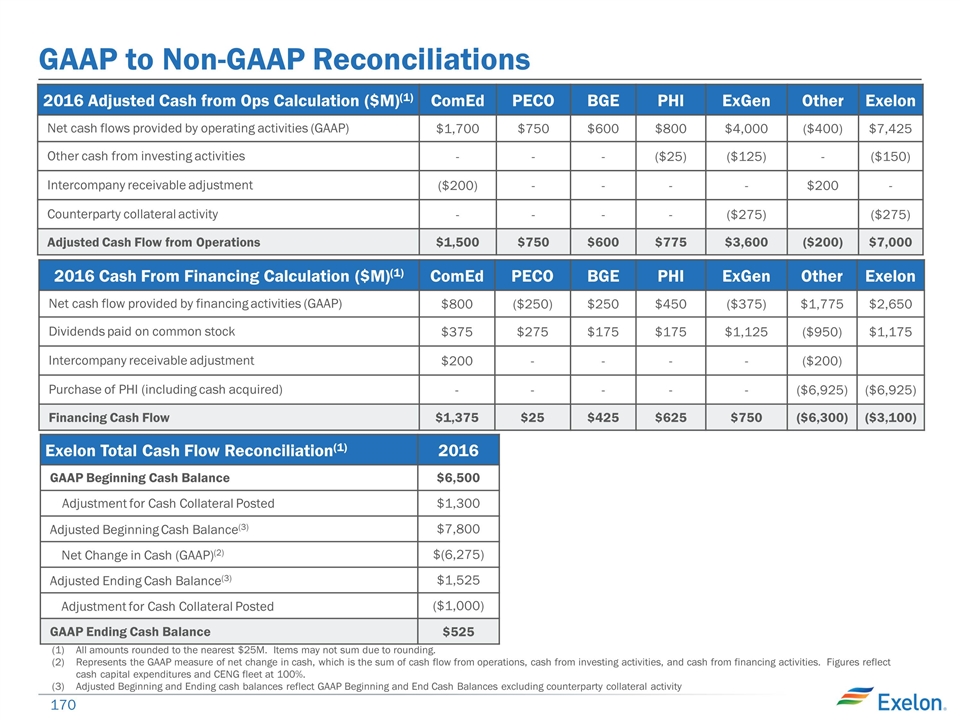

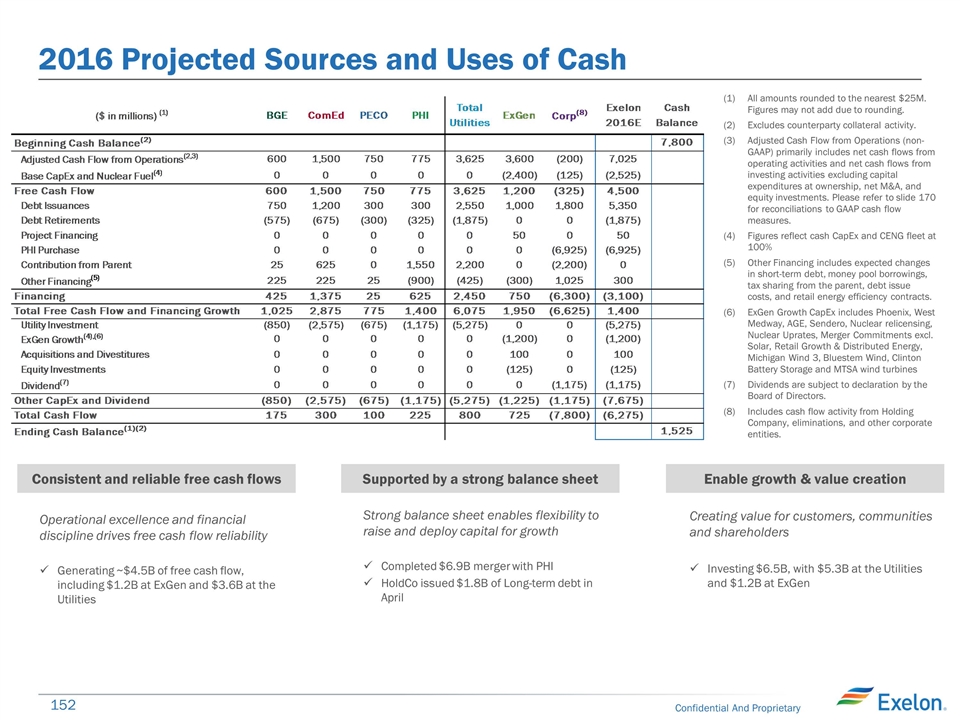

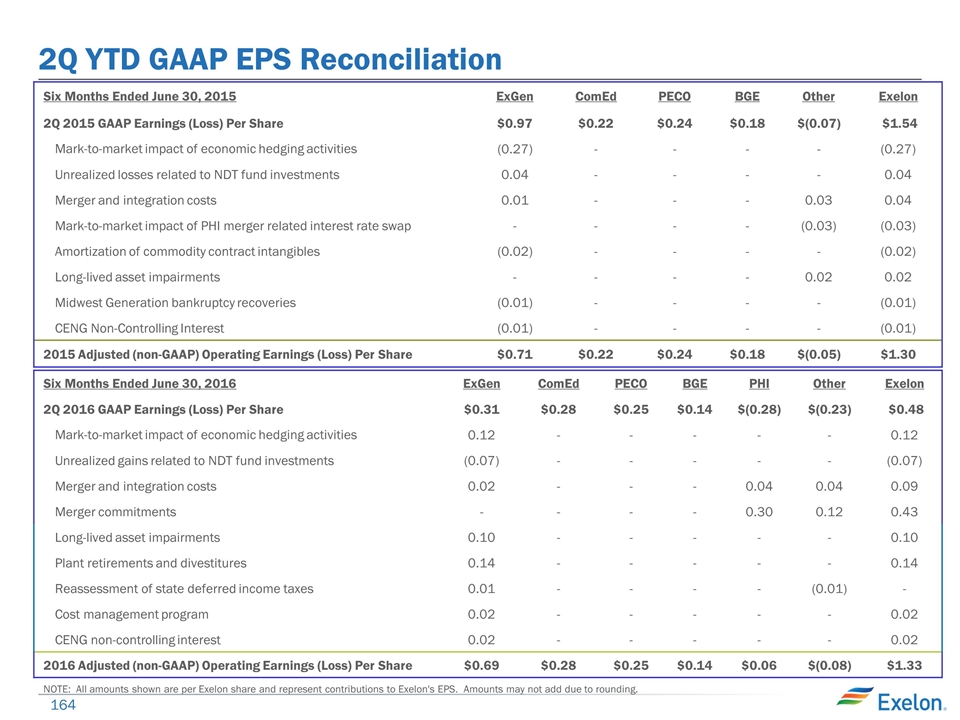

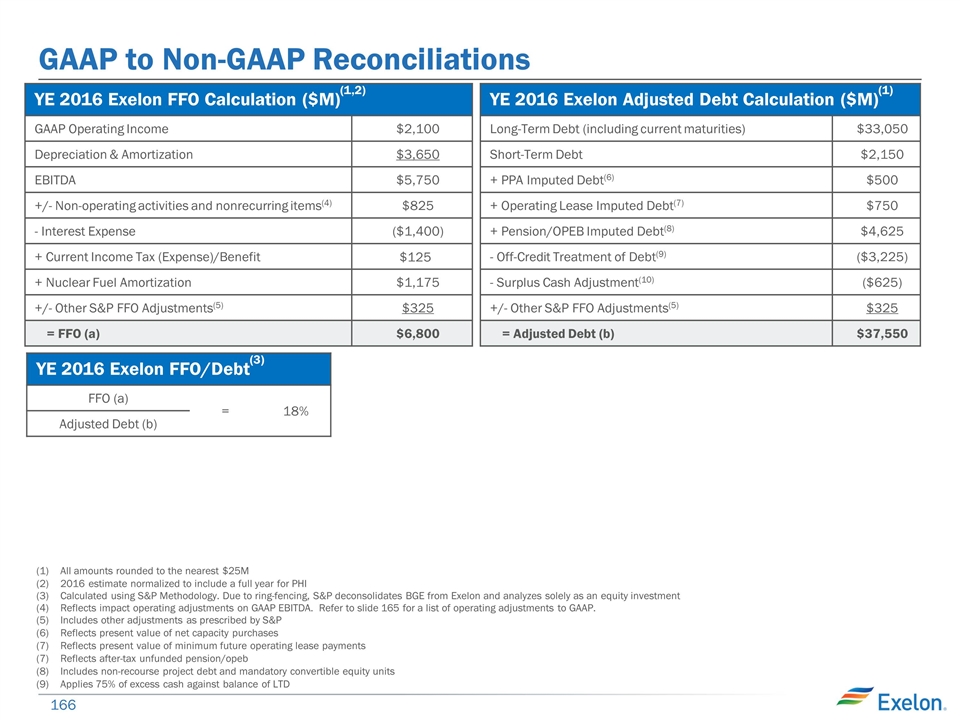

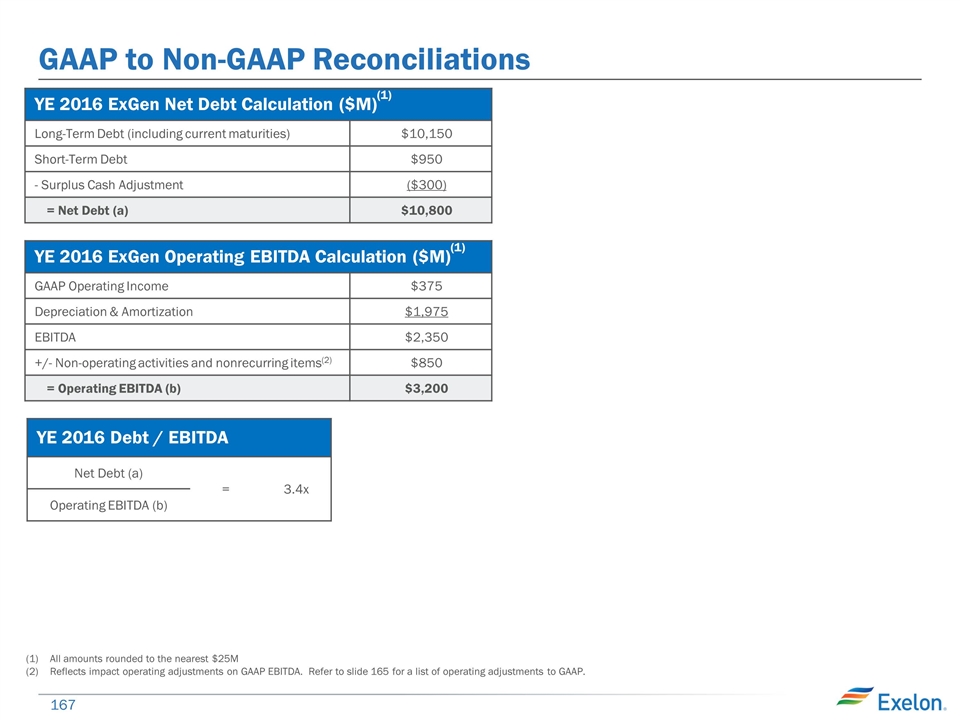

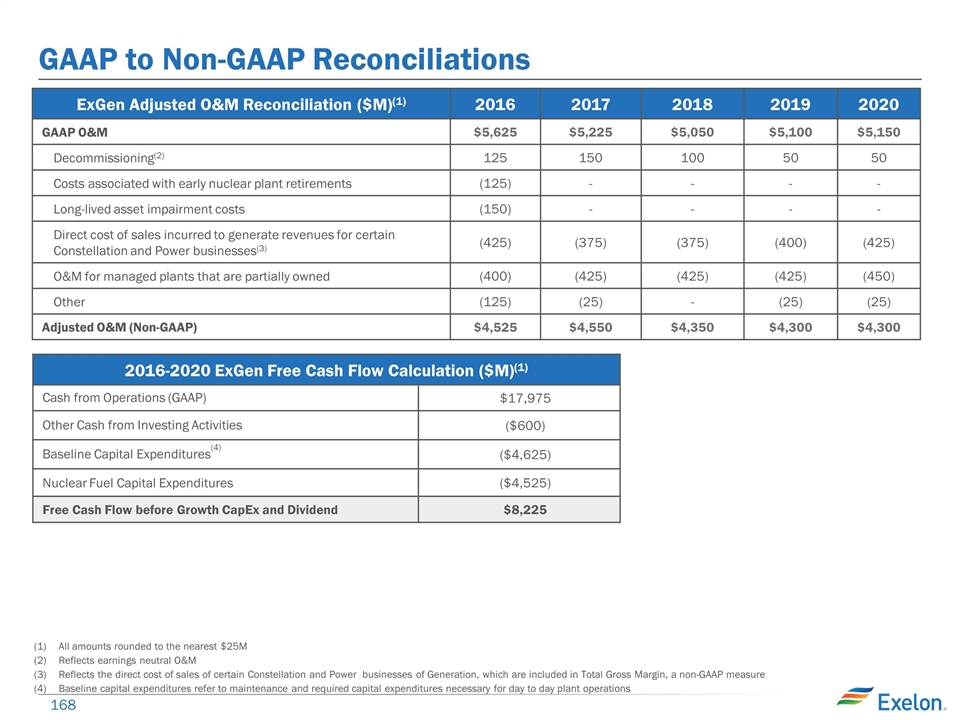

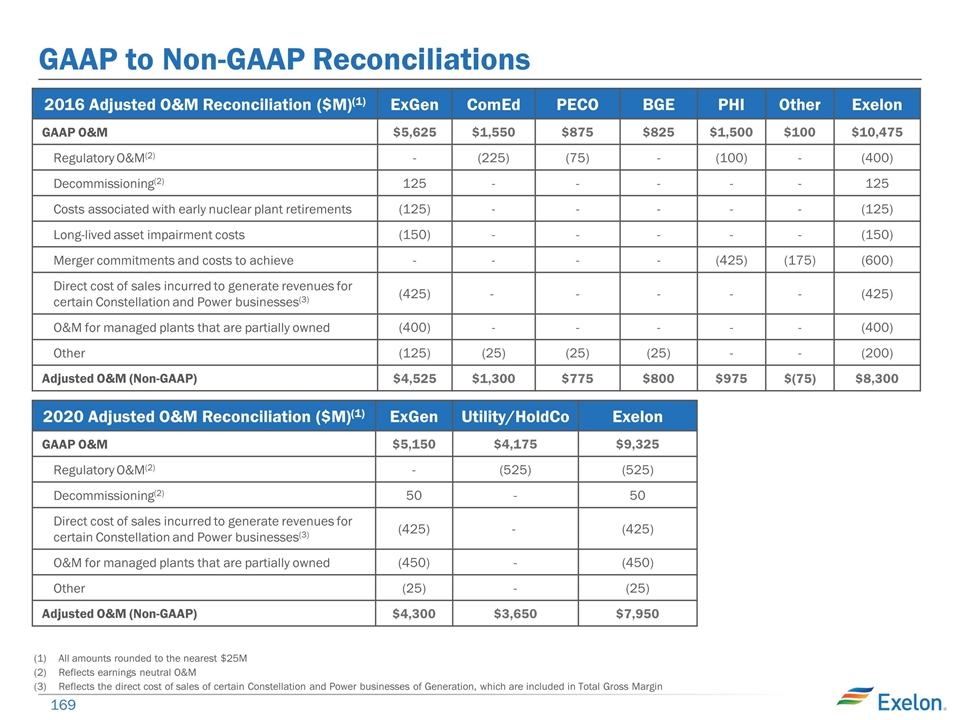

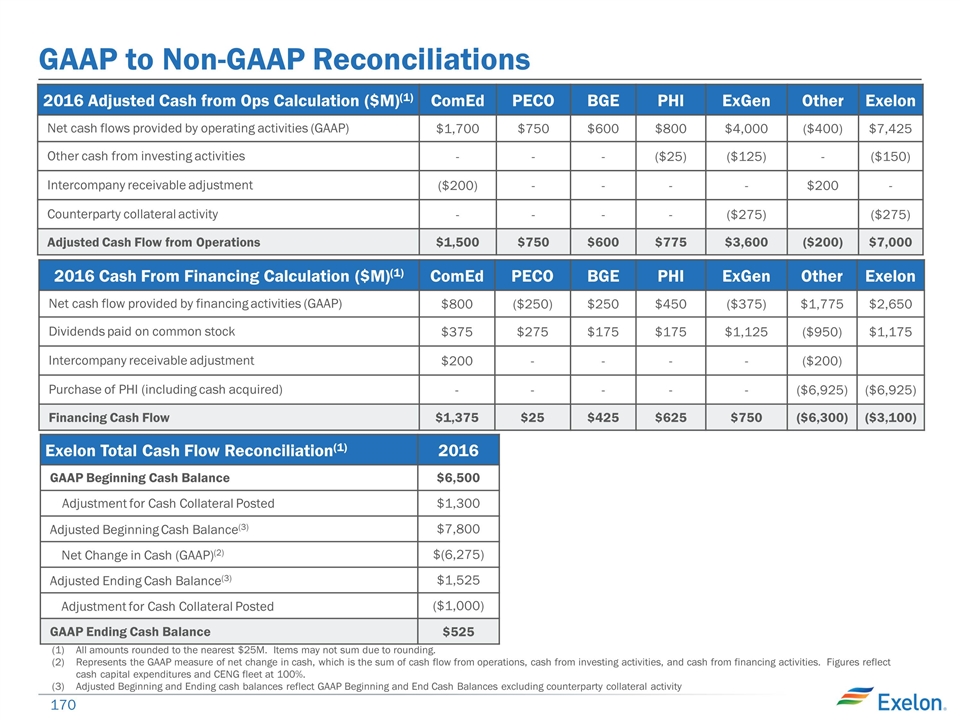

Non-GAAP Financial Measures Exelon reports its financial results in accordance with accounting principles generally accepted in the United States (GAAP). Exelon supplements the reporting of financial information determined in accordance with GAAP with certain non-GAAP financial measures, including adjusted (non-GAAP) operating earnings, adjusted (non-GAAP) operating and maintenance expense, total gross margin, earnings before interest, taxes, depreciation and amortization (EBITDA), and adjusted cash flow from operations (non-GAAP) or free cash flow. Adjusted (non-GAAP) operating earnings exclude certain costs, expenses, gains and losses and other specified items, including mark-to-market adjustments from economic hedging activities, unrealized gains and losses from nuclear decommissioning trust fund investments merger and integration costs, certain costs incurred associated with the PHI acquisition, merger commitments related to the settlement of the PHI acquisition, the impairment of certain long-lived assets, plant retirements and divestitures, costs related to the cost management program, and the non-controlling interest in CENG. Adjusted (non-GAAP) operating and maintenance expense excludes regulatory operating and maintenance costs for the utility businesses and direct cost of sales for certain Constellation businesses, decommissioning costs that do not affect profit and loss, and the impact from operating and maintenance expense related to variable interest entities at Generation. Total gross margin (non-GAAP) is defined as operating revenues less purchased power and fuel expense, excluding revenue related to decommissioning, gross receipts tax, Exelon Nuclear Partners, the operating services agreement with Fort Calhoun, variable interest entities and net of direct cost of sales for certain Constellation businesses. EBITDA is defined as earnings before interest, taxes, depreciation and amortization, including nuclear fuel amortization expense. Adjusted cash flow from operations (non-GAAP) or free cash flow primarily includes net cash flows from operating activities and net cash flows from investing activities excluding capital expenditures at ownership and nuclear fuel expense. Due to the forward-looking nature of any forecasted non-GAAP measures, information to reconcile the forecast adjusted (non-GAAP) measures to the most directly comparable GAAP measure is not currently available, as management is unable to project all of these items for future periods.

Non-GAAP Financial Measures Continued This information is intended to enhance an investor’s overall understanding of period over period financial results and provide an indication of Exelon’s baseline operating performance by excluding items that are considered by management to be not directly related to the ongoing operations of the business. In addition, this information is among the primary indicators management uses as a basis for evaluating performance, allocating resources, setting incentive compensation targets and planning and forecasting of future periods. These non-GAAP financial measures are not a presentation defined under GAAP and may not be comparable to other companies’ presentation. Exelon has provided these non-GAAP financial measure as supplemental information and in addition to the financial measures that are calculated and presented in accordance with GAAP. These non-GAAP measures should not be deemed more useful than, a substitute for, or an alternative to the most comparable GAAP measures provided in the materials presented. Reconciliations of these non-GAAP measures to the most comparable GAAP measures are provided in the footnotes, appendices and attachments to this presentation.

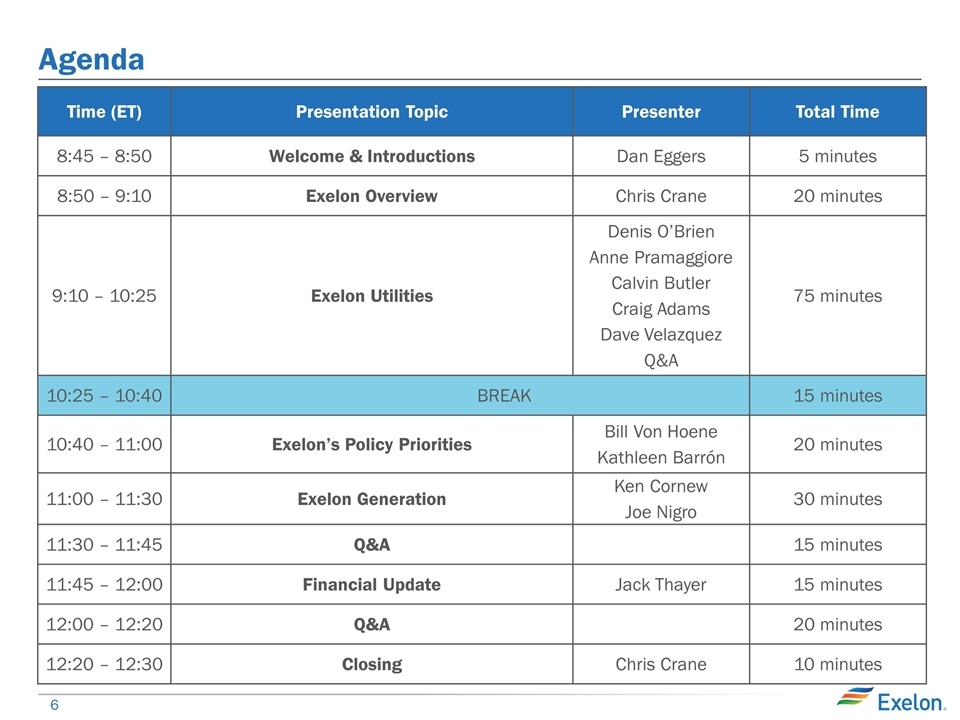

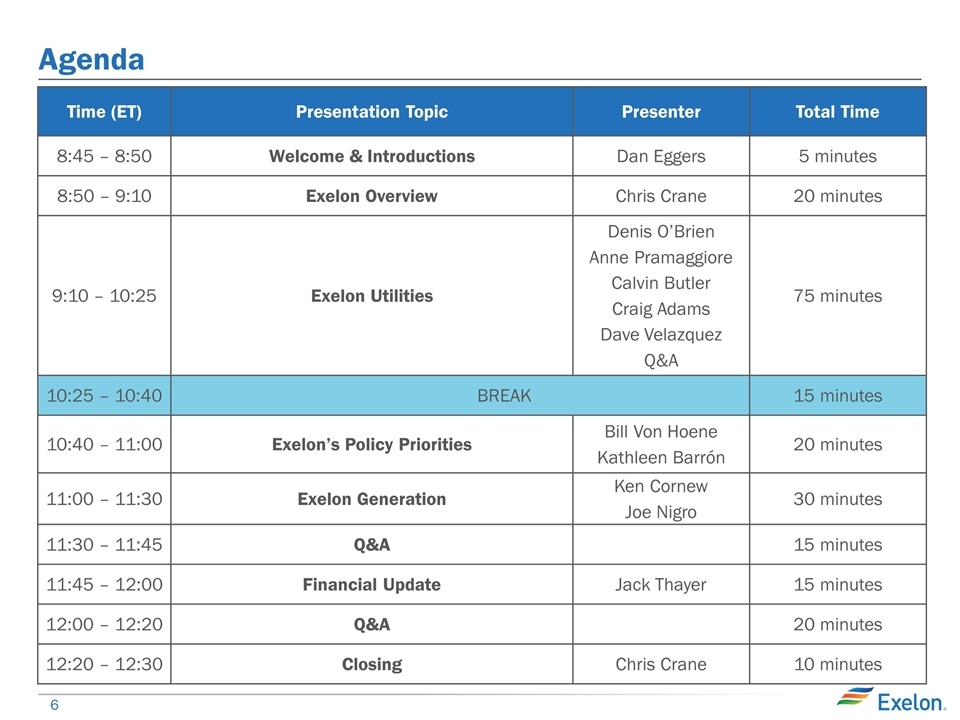

Agenda Time (ET) Presentation Topic Presenter Total Time 8:45 – 8:50 Welcome & Introductions Dan Eggers 5 minutes 8:50 – 9:10 Exelon Overview Chris Crane 20 minutes 9:10 – 10:25 Exelon Utilities Denis O’Brien Anne Pramaggiore Calvin Butler Craig Adams Dave Velazquez Q&A 75 minutes 10:25 – 10:40 BREAK 15 minutes 10:40 – 11:00 Exelon’s Policy Priorities Bill Von Hoene Kathleen Barrón 20 minutes 11:00 – 11:30 Exelon Generation Ken Cornew Joe Nigro 30 minutes 11:30 – 11:45 Q&A 15 minutes 11:45 – 12:00 Financial Update Jack Thayer 15 minutes 12:00 – 12:20 Q&A 20 minutes 12:20 – 12:30 Closing Chris Crane 10 minutes

Exelon Overview Chris Crane President & Chief Executive Officer

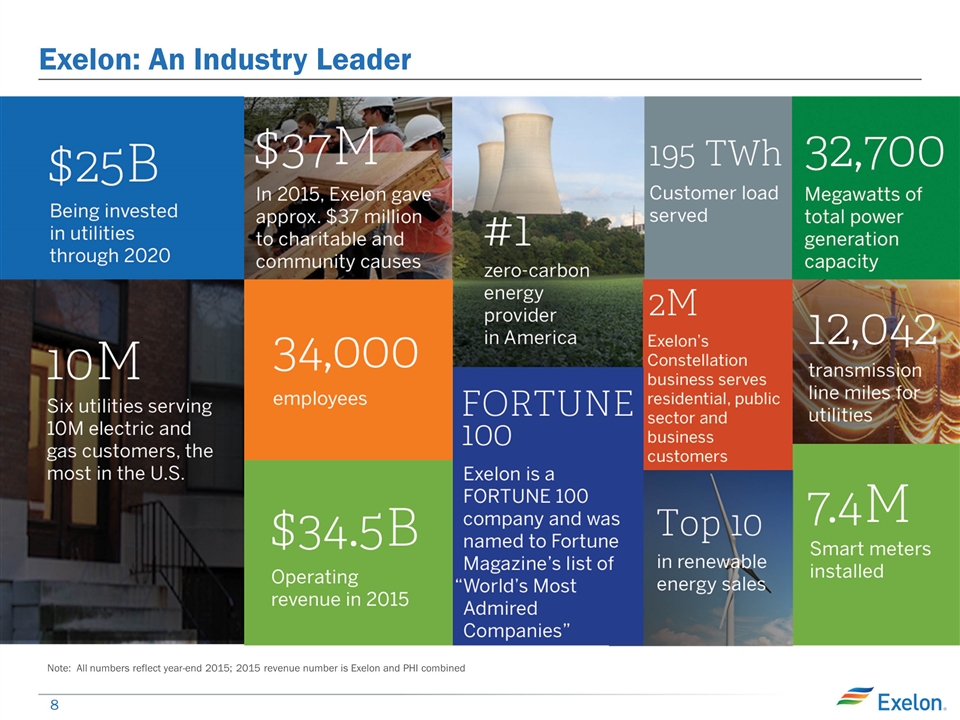

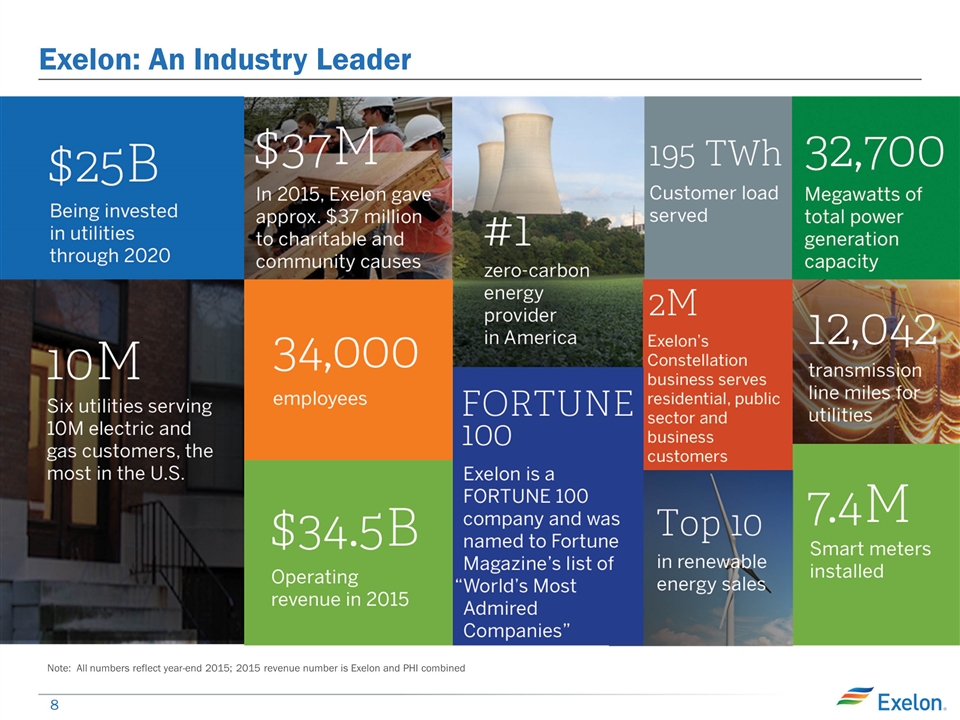

Exelon: An Industry Leader Note: All numbers reflect year-end 2015; 2015 revenue number is Exelon and PHI combined

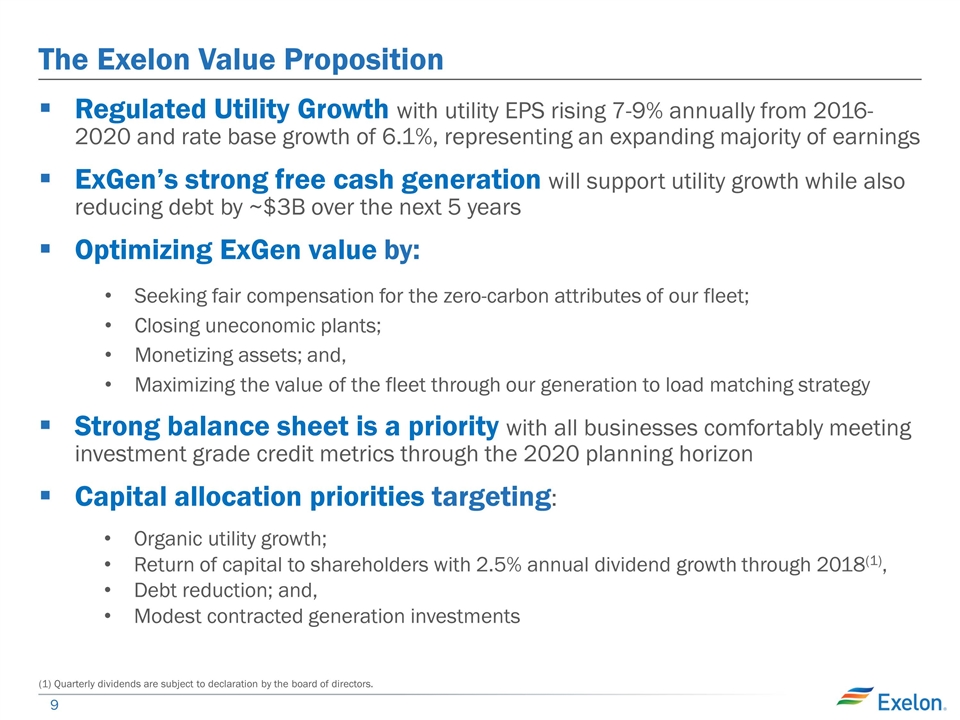

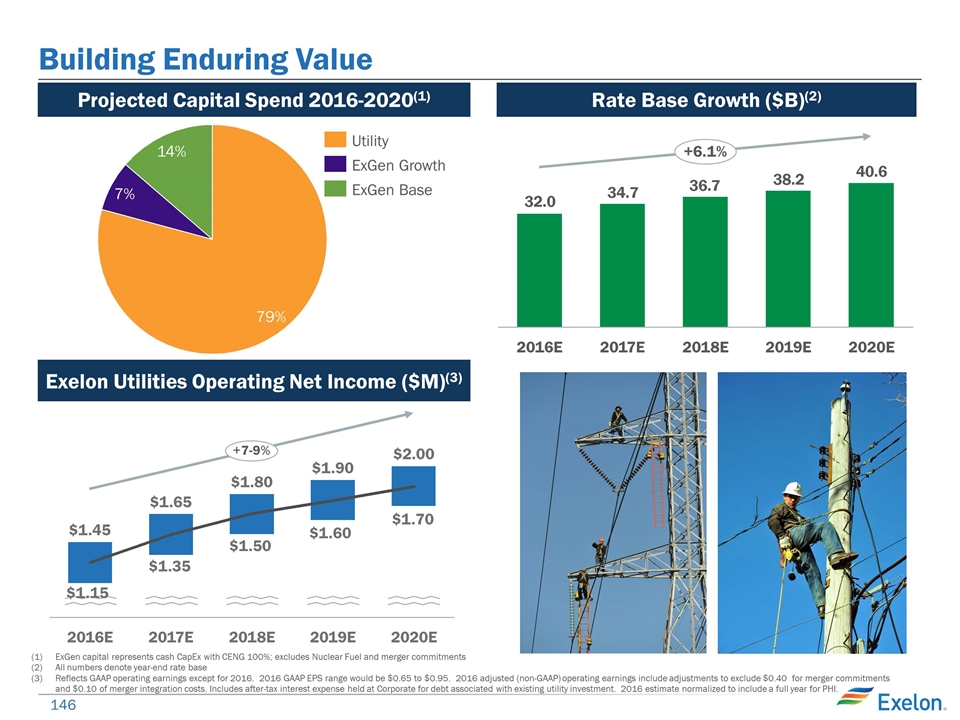

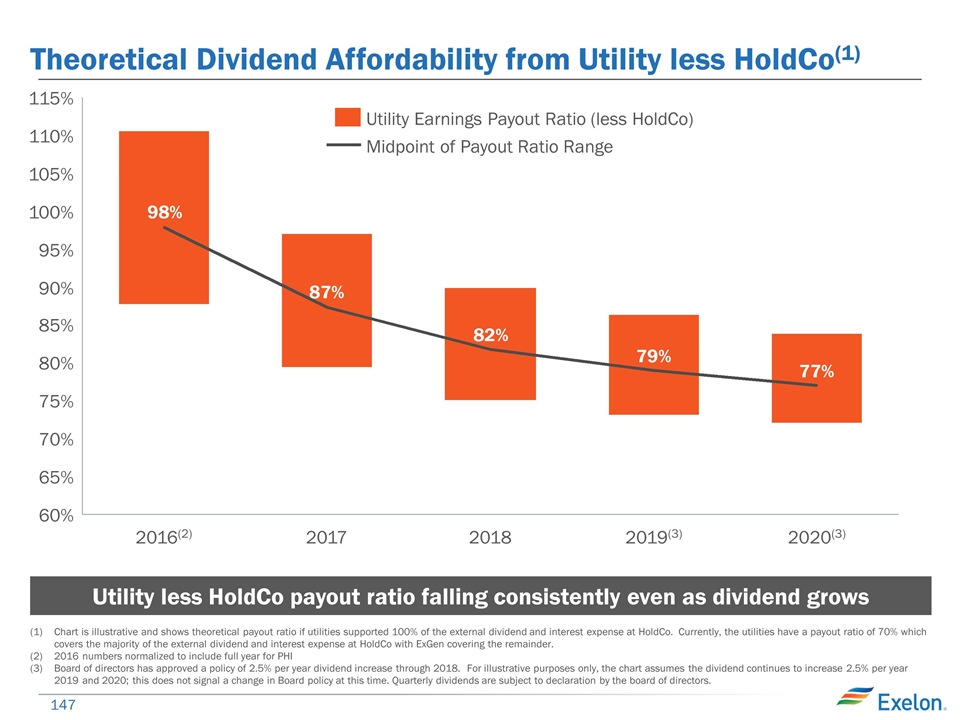

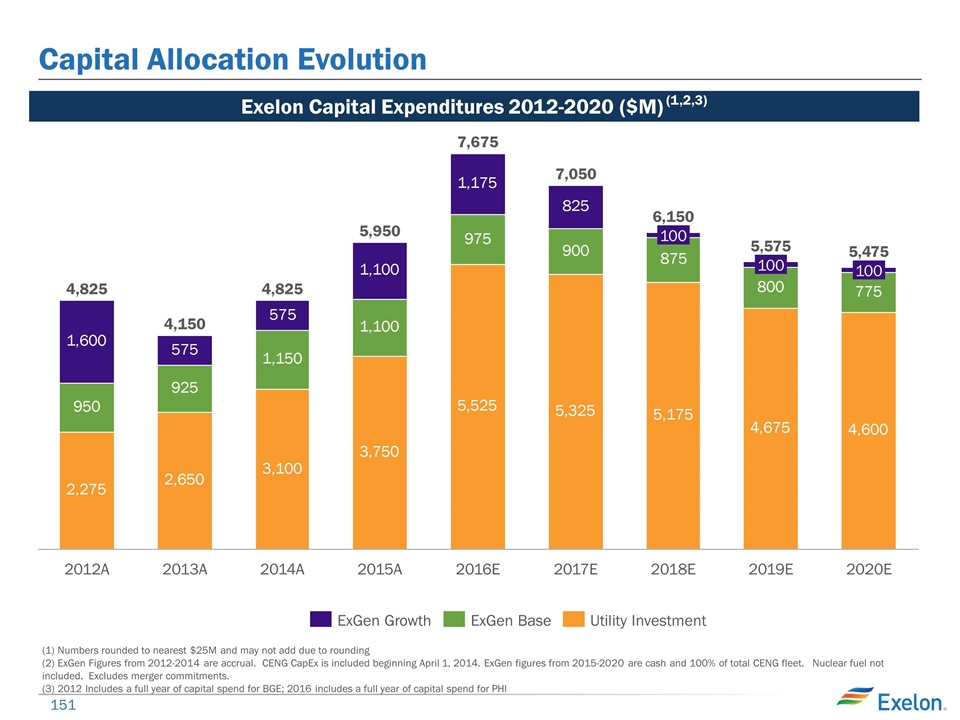

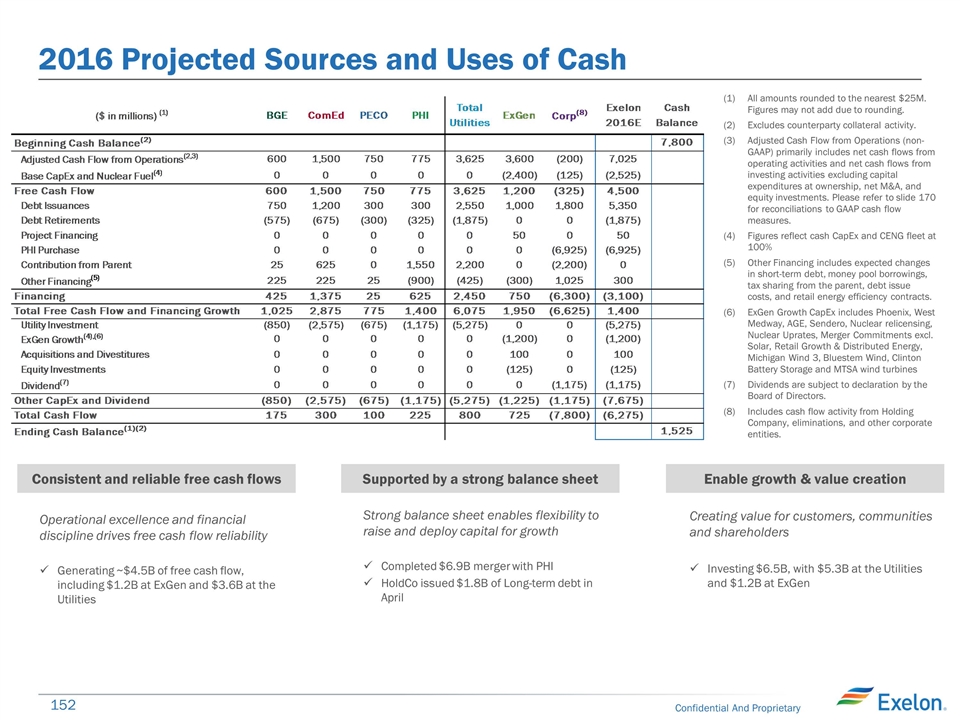

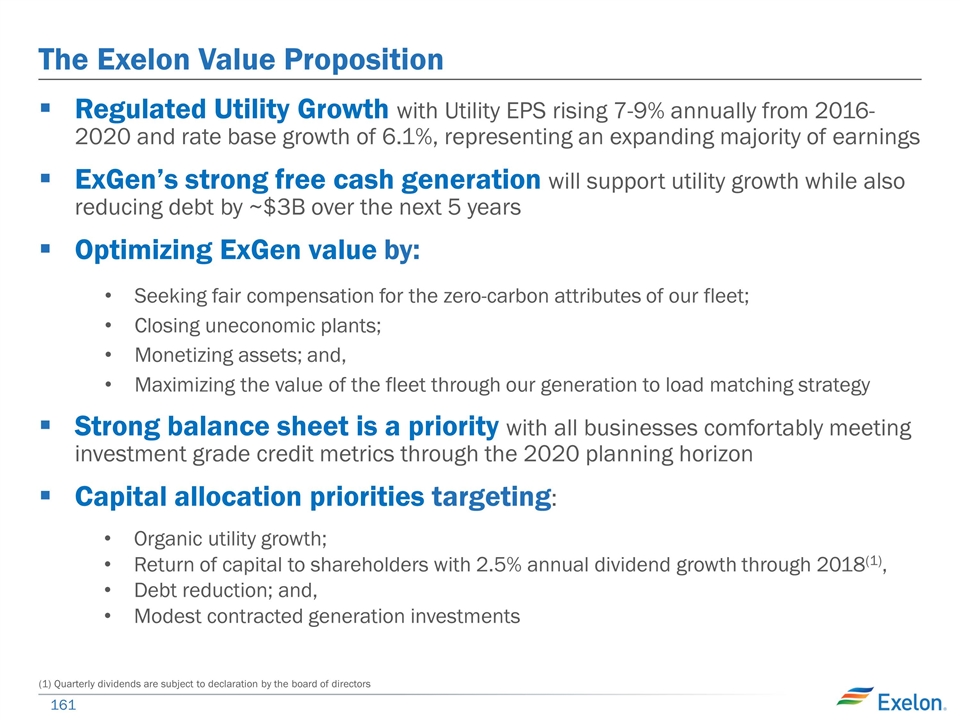

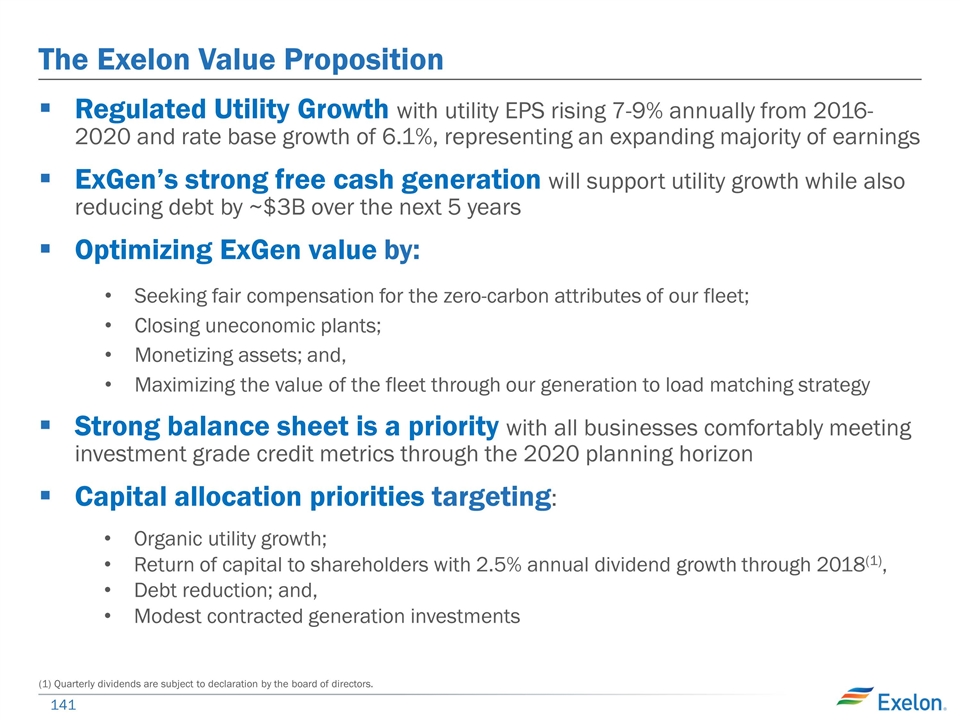

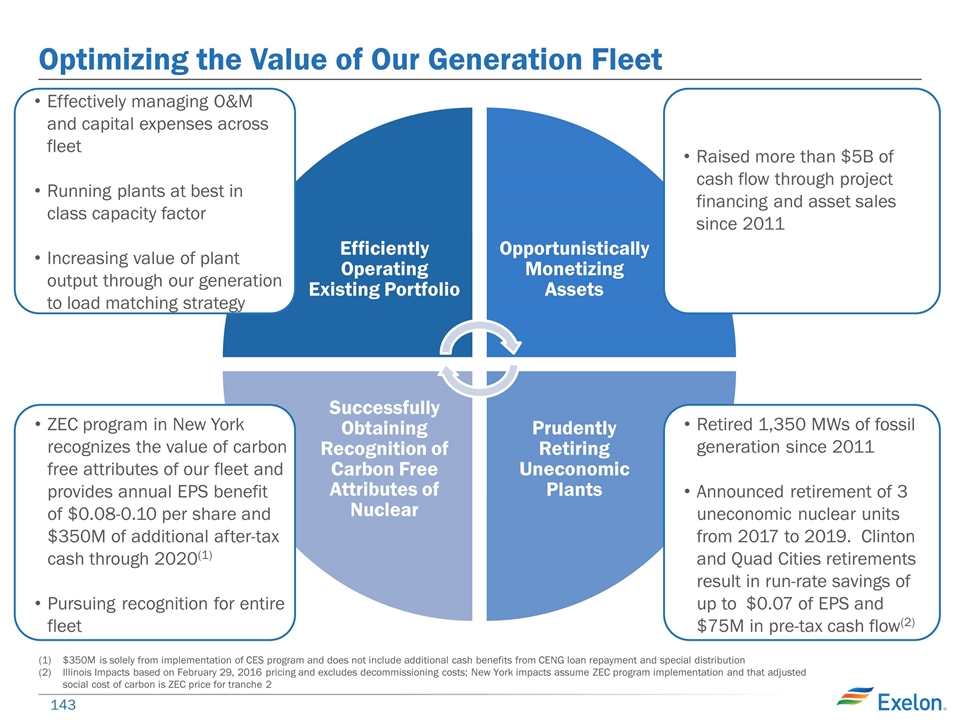

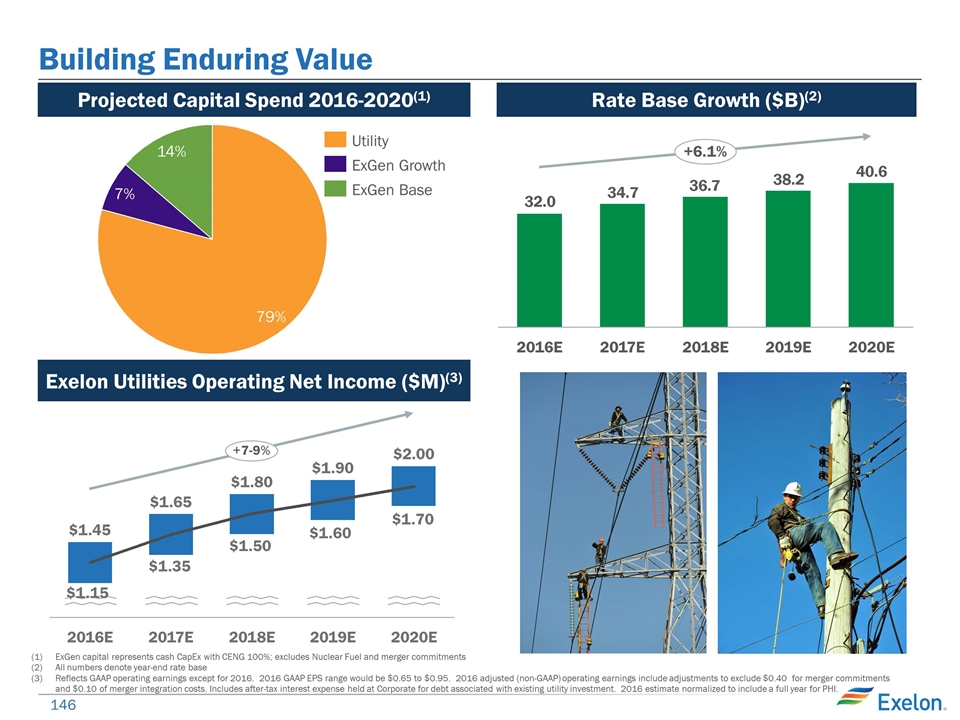

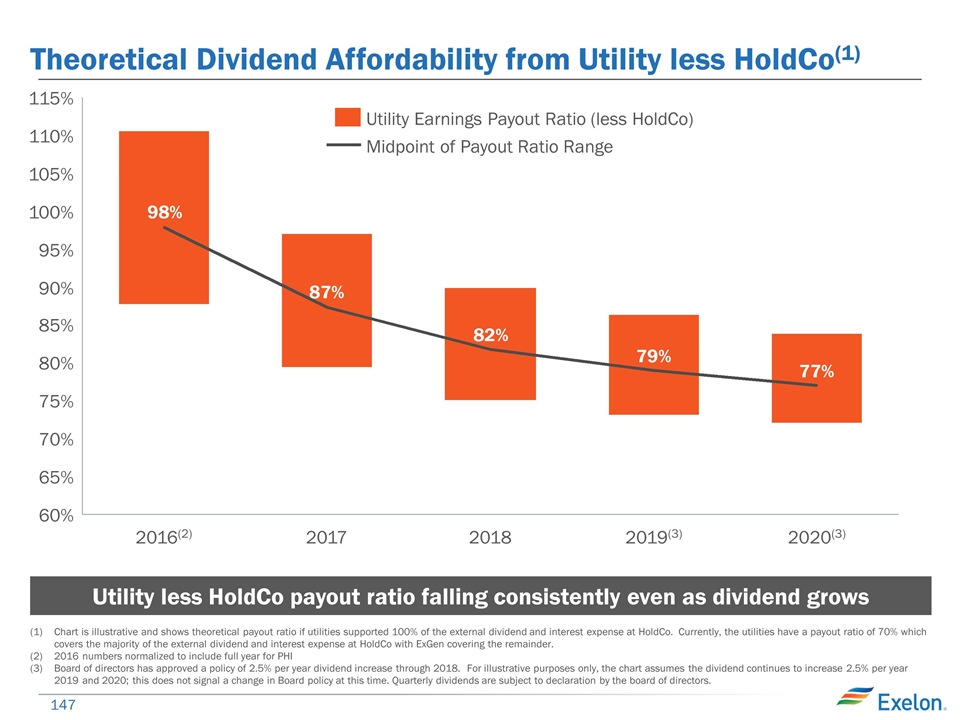

The Exelon Value Proposition Regulated Utility Growth with utility EPS rising 7-9% annually from 2016-2020 and rate base growth of 6.1%, representing an expanding majority of earnings ExGen’s strong free cash generation will support utility growth while also reducing debt by ~$3B over the next 5 years Optimizing ExGen value by: Seeking fair compensation for the zero-carbon attributes of our fleet; Closing uneconomic plants; Monetizing assets; and, Maximizing the value of the fleet through our generation to load matching strategy Strong balance sheet is a priority with all businesses comfortably meeting investment grade credit metrics through the 2020 planning horizon Capital allocation priorities targeting: Organic utility growth; Return of capital to shareholders with 2.5% annual dividend growth through 2018(1), Debt reduction; and, Modest contracted generation investments (1) Quarterly dividends are subject to declaration by the board of directors.

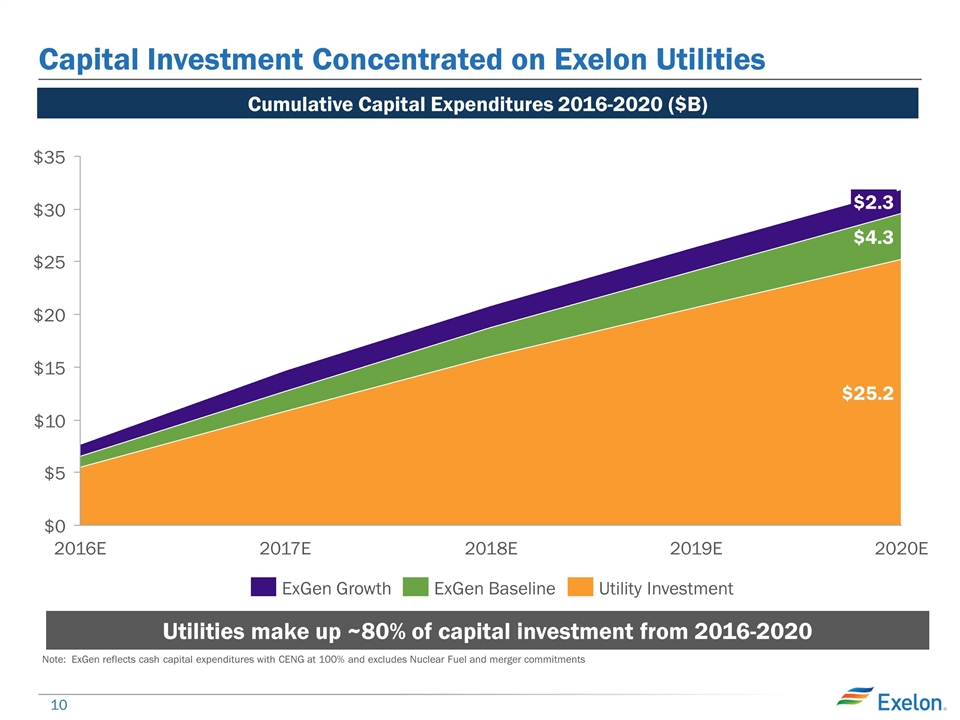

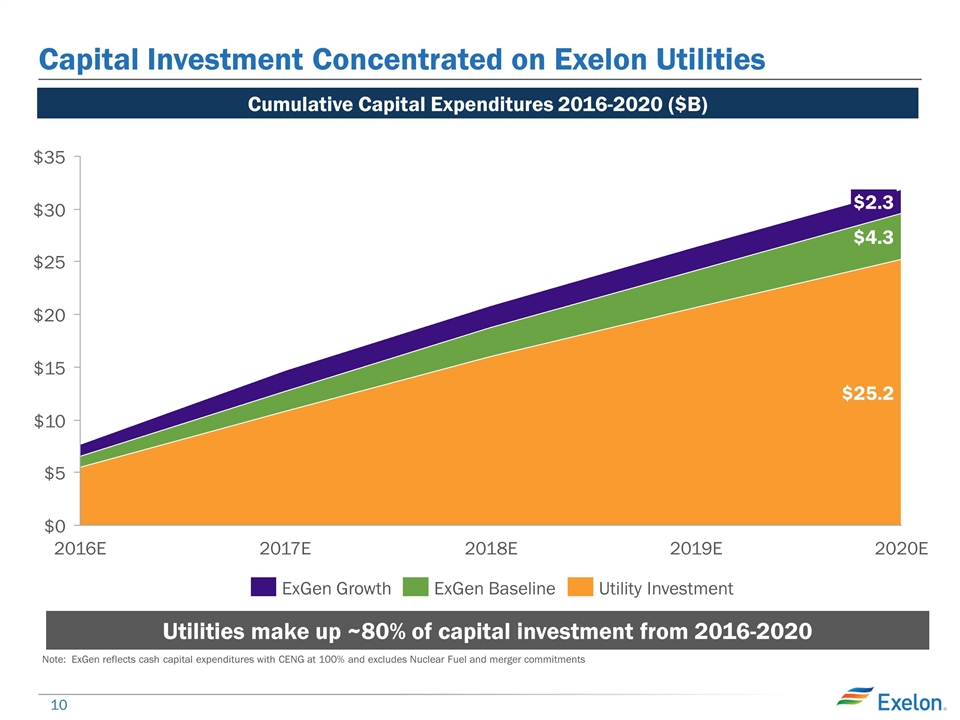

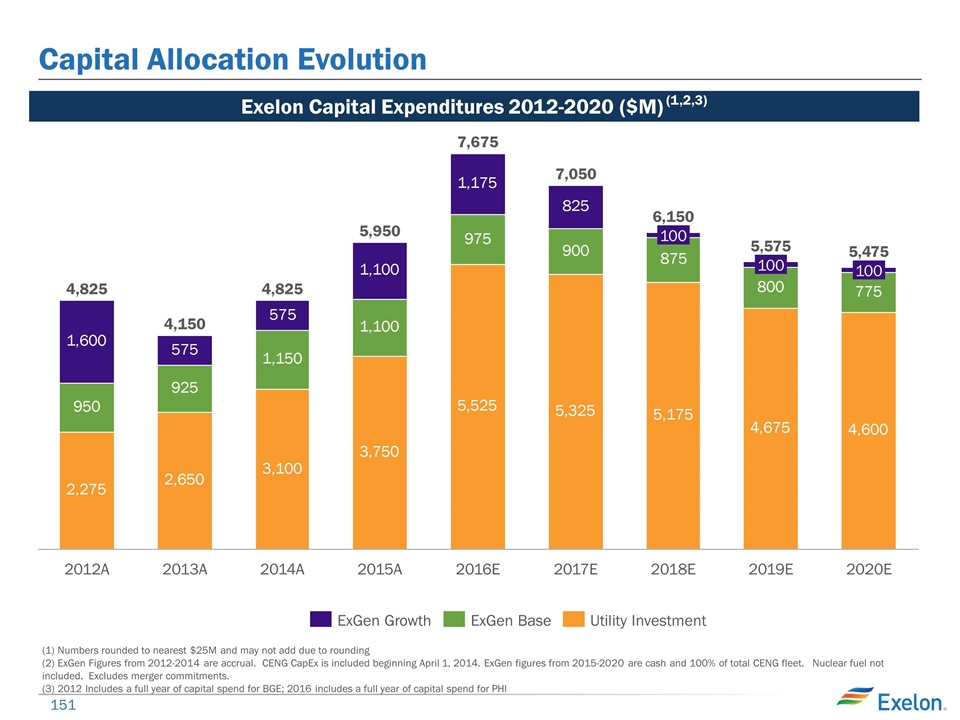

Capital Investment Concentrated on Exelon Utilities Note: ExGen reflects cash capital expenditures with CENG at 100% and excludes Nuclear Fuel and merger commitments Cumulative Capital Expenditures 2016-2020 ($B) Utilities make up ~80% of capital investment from 2016-2020

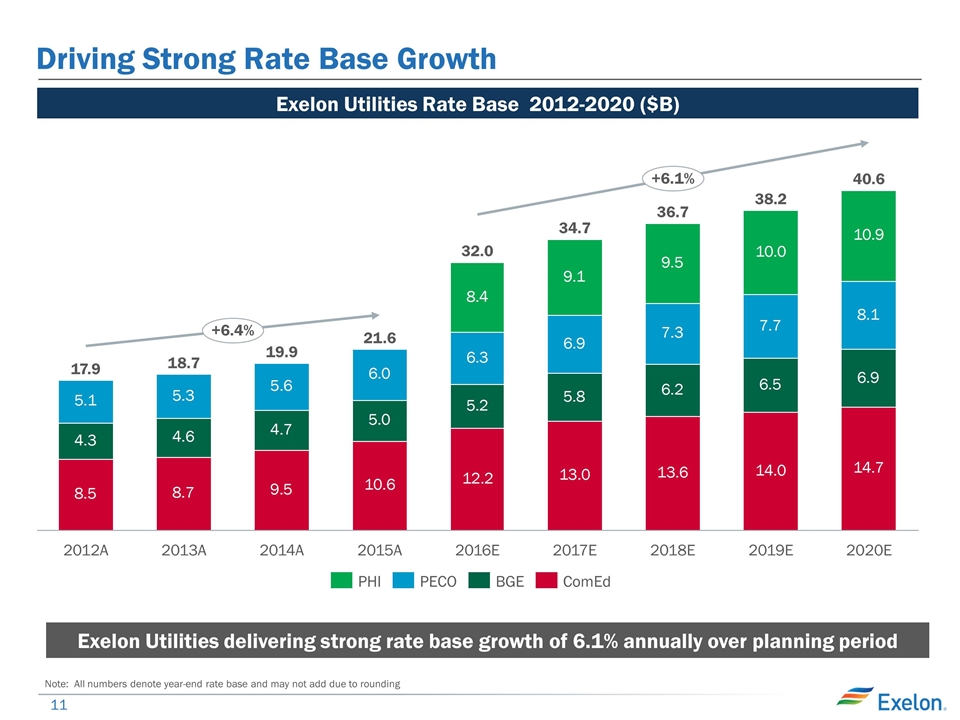

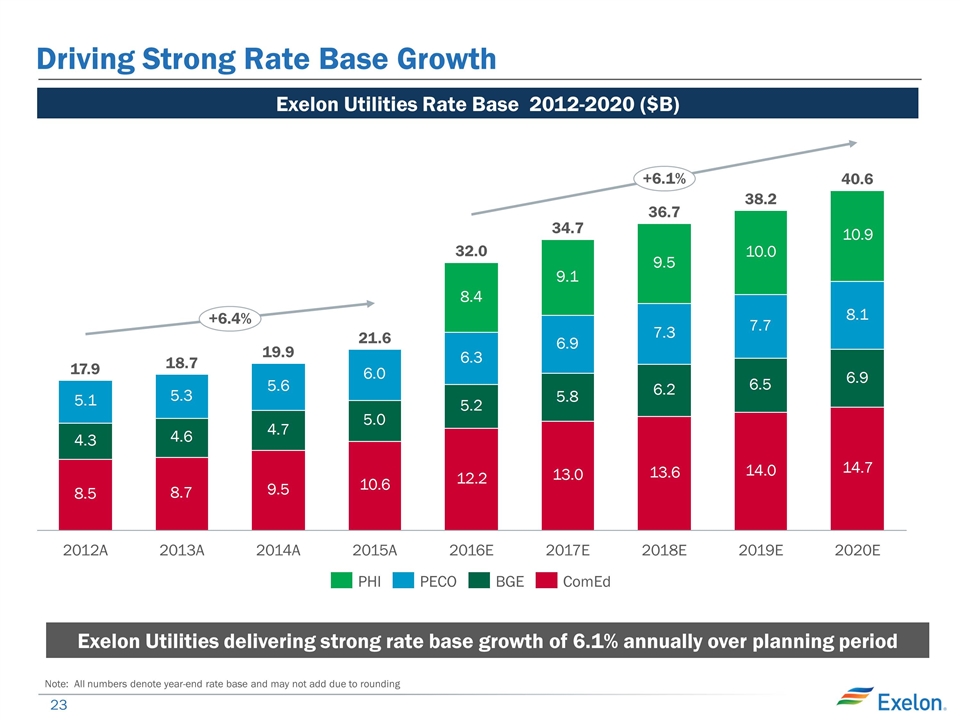

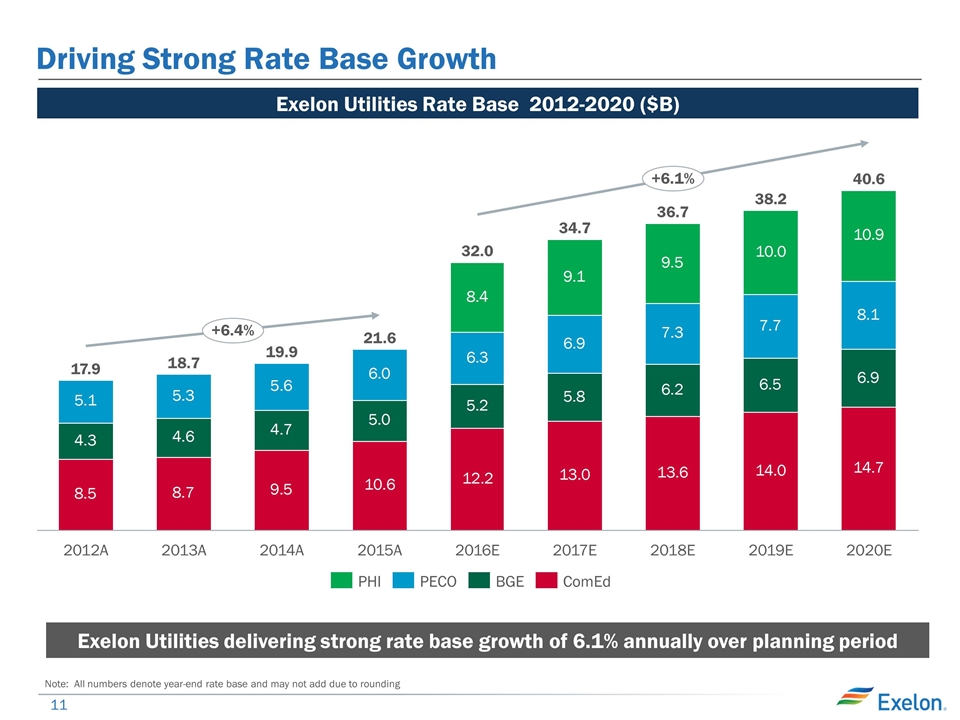

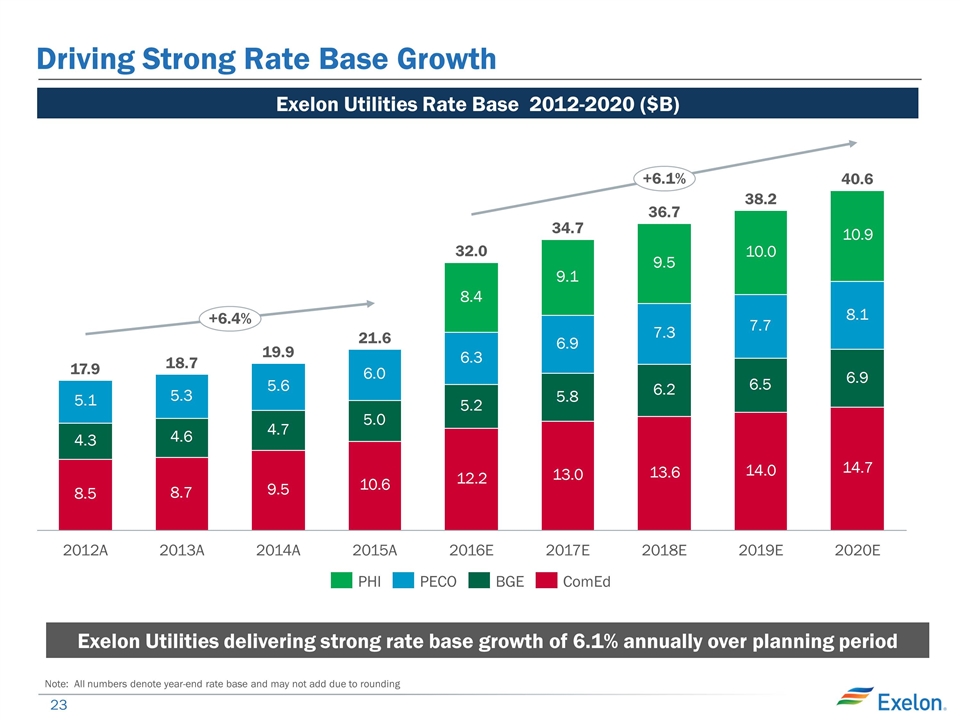

Driving Strong Rate Base Growth Exelon Utilities Rate Base 2012-2020 ($B) Exelon Utilities delivering strong rate base growth of 6.1% annually over planning period Note: All numbers denote year-end rate base and may not add due to rounding

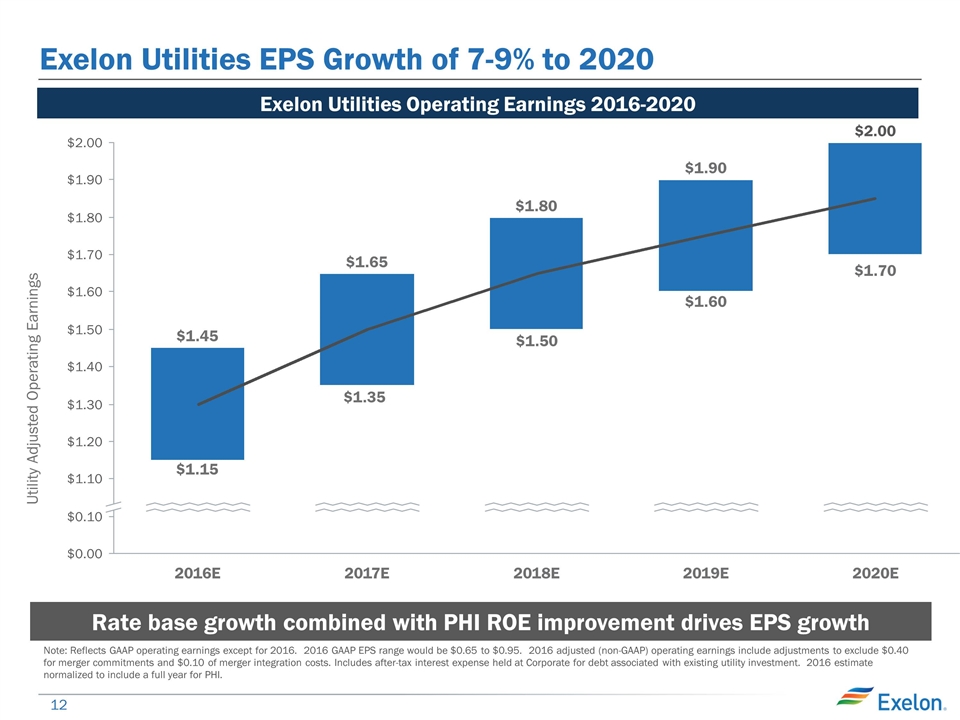

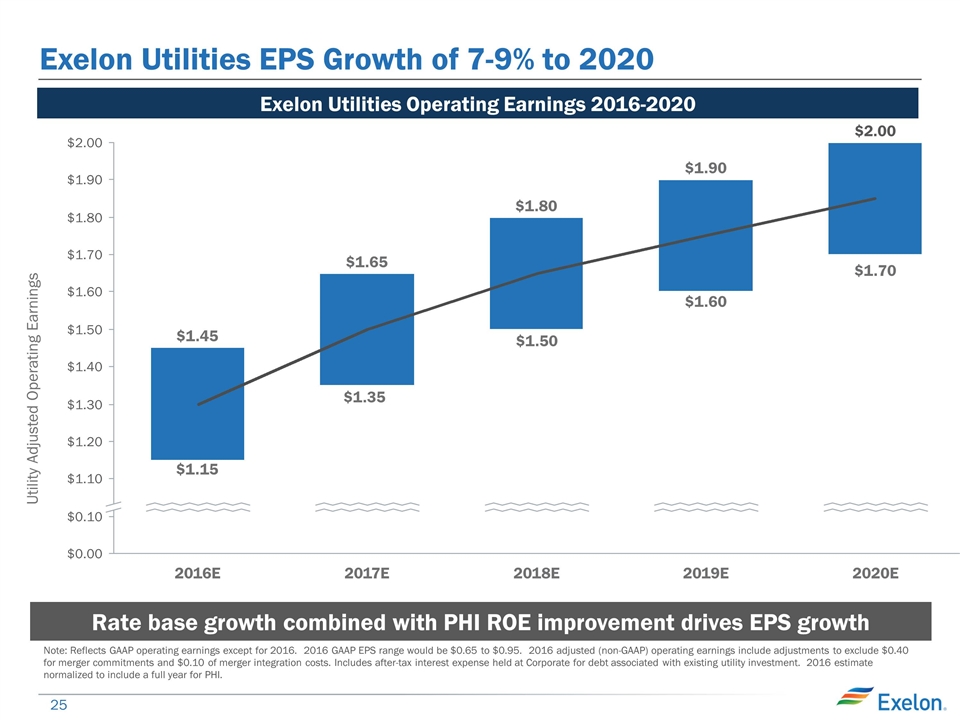

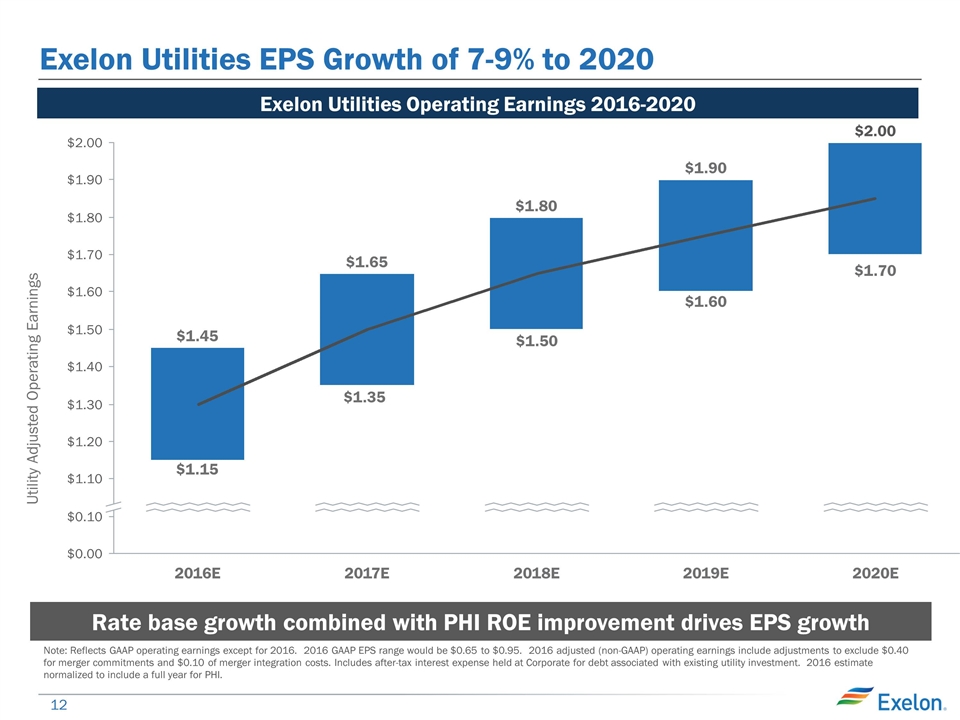

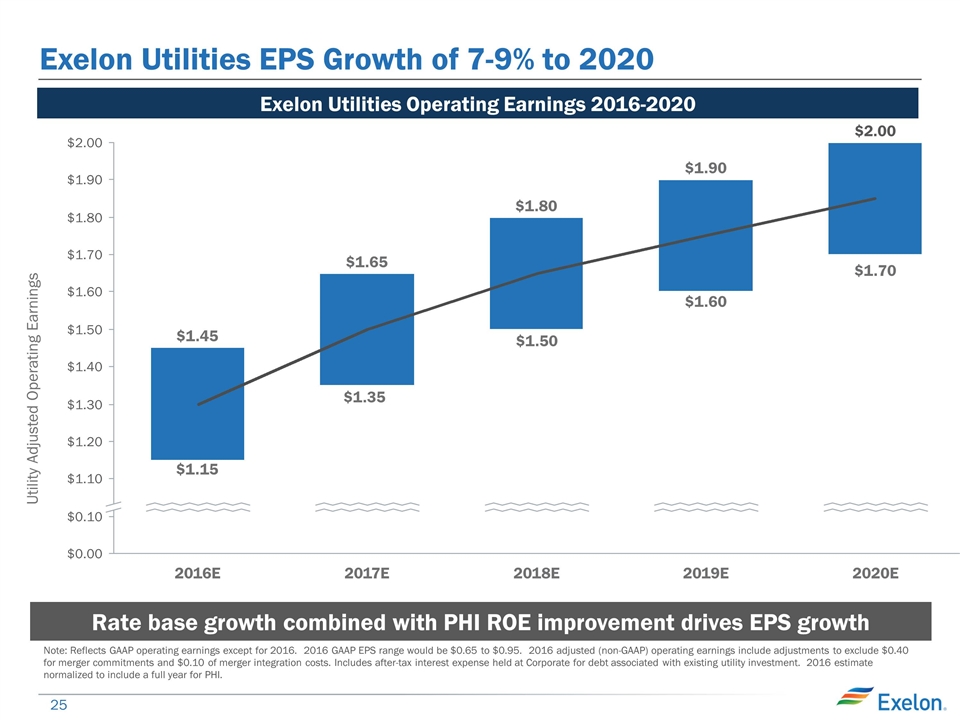

Exelon Utilities EPS Growth of 7-9% to 2020 $1.60 $1.50 $1.15 Utility Adjusted Operating Earnings Rate base growth combined with PHI ROE improvement drives EPS growth $1.35 Note: Reflects GAAP operating earnings except for 2016. 2016 GAAP EPS range would be $0.65 to $0.95. 2016 adjusted (non-GAAP) operating earnings include adjustments to exclude $0.40 for merger commitments and $0.10 of merger integration costs. Includes after-tax interest expense held at Corporate for debt associated with existing utility investment. 2016 estimate normalized to include a full year for PHI. $1.70 Exelon Utilities Operating Earnings 2016-2020

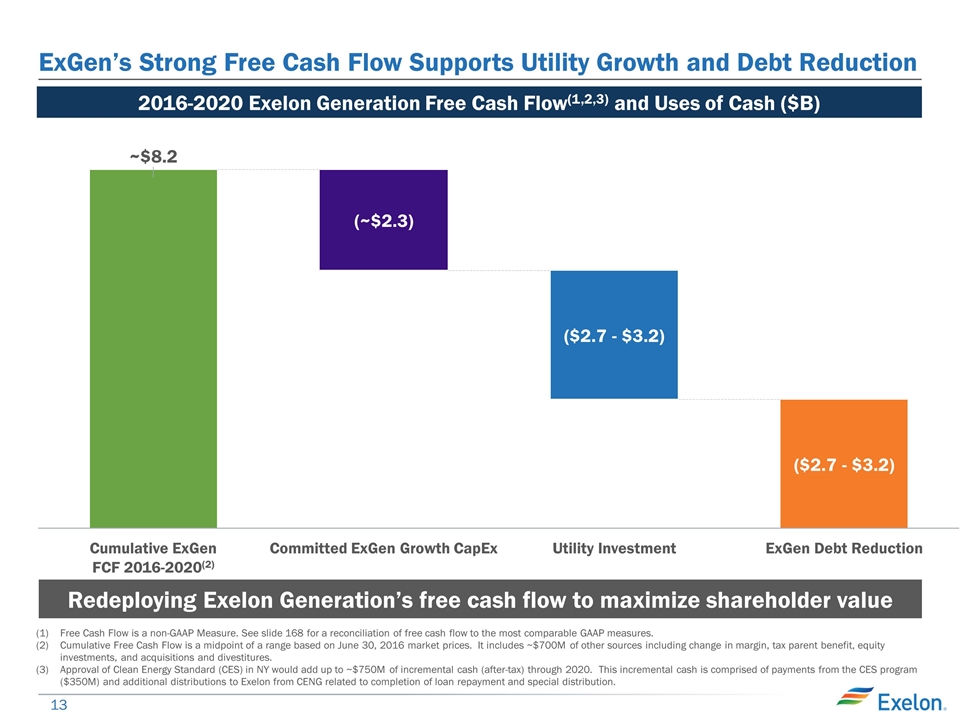

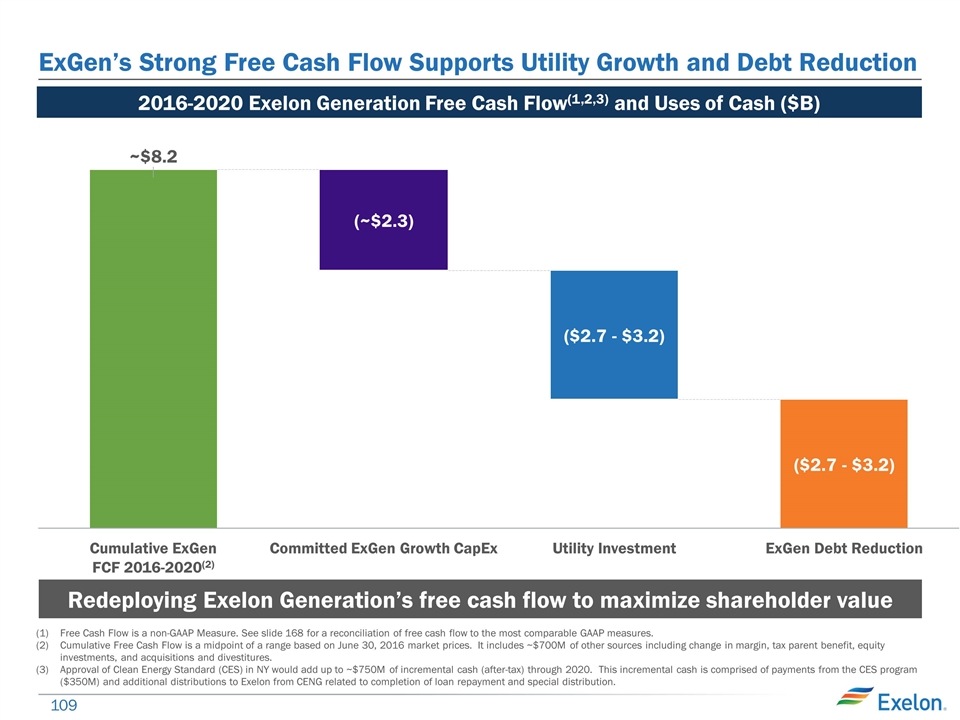

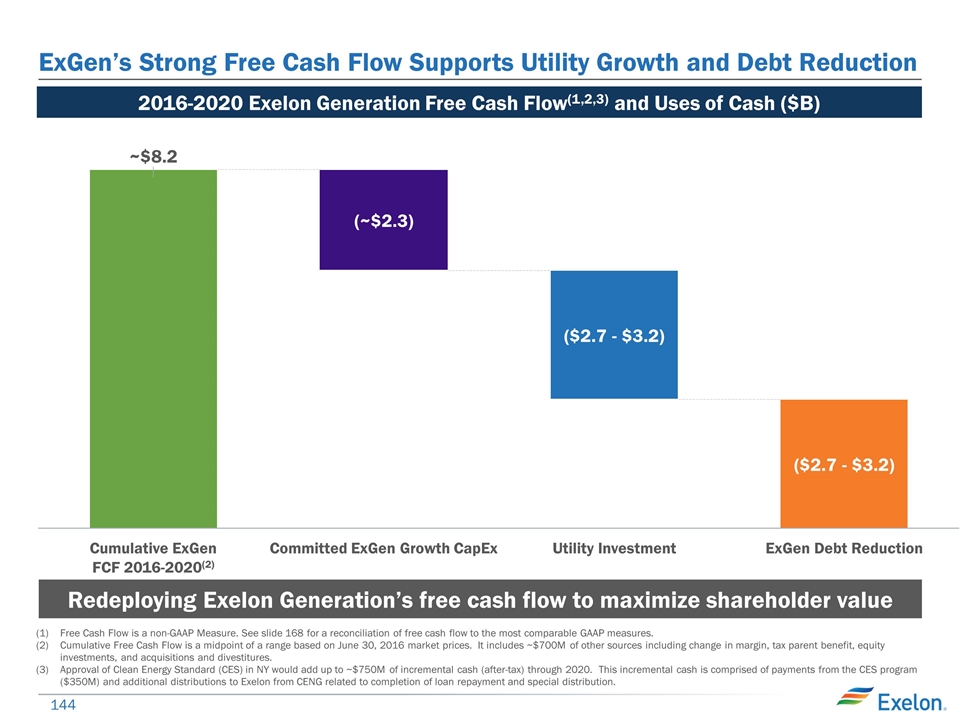

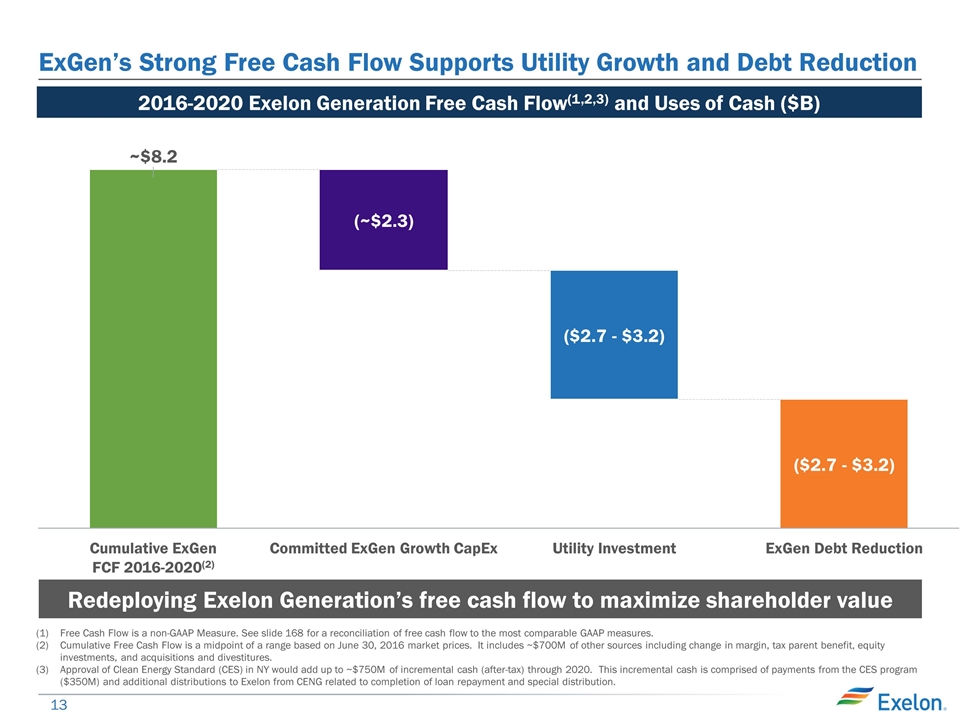

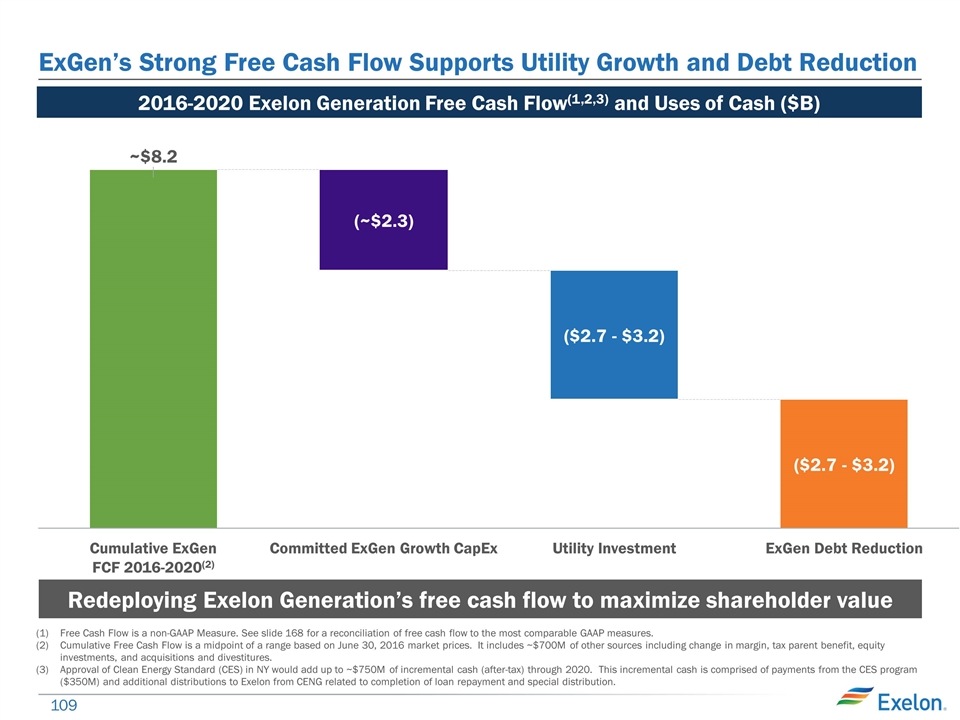

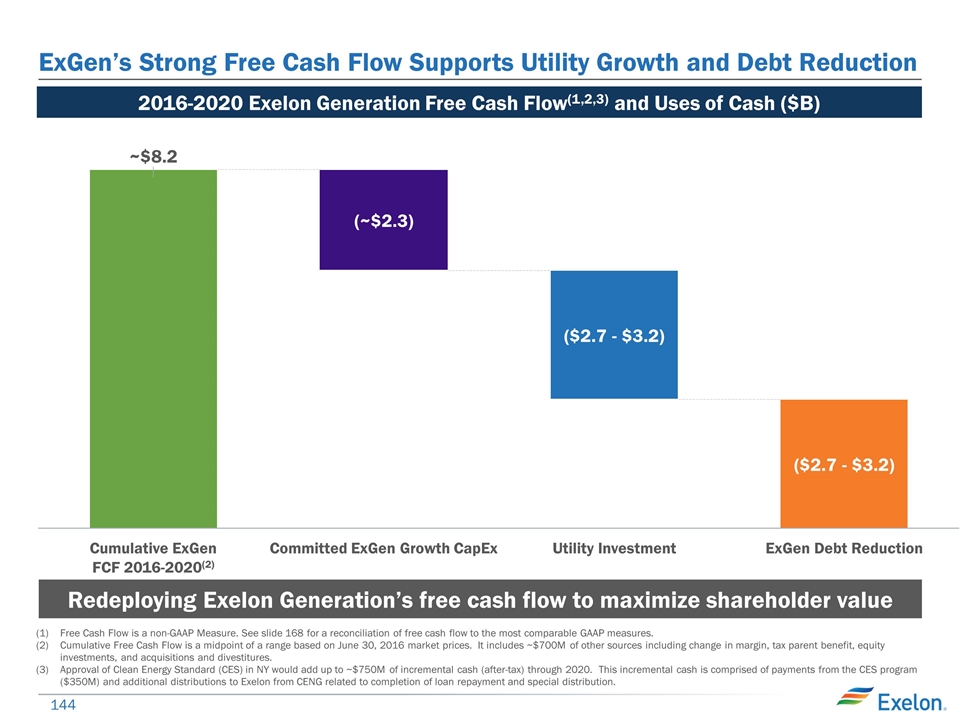

ExGen’s Strong Free Cash Flow Supports Utility Growth and Debt Reduction 2016-2020 Exelon Generation Free Cash Flow(1,2,3) and Uses of Cash ($B) Free Cash Flow is a non-GAAP Measure. See slide 168 for a reconciliation of free cash flow to the most comparable GAAP measures. Cumulative Free Cash Flow is a midpoint of a range based on June 30, 2016 market prices. It includes ~$700M of other sources including change in margin, tax parent benefit, equity investments, and acquisitions and divestitures. Approval of Clean Energy Standard (CES) in NY would add up to ~$750M of incremental cash (after-tax) through 2020. This incremental cash is comprised of payments from the CES program ($350M) and additional distributions to Exelon from CENG related to completion of loan repayment and special distribution. ($2.7 - $3.2) (2) (~$2.3) ($2.7 - $3.2) ~$8.2 Redeploying Exelon Generation’s free cash flow to maximize shareholder value

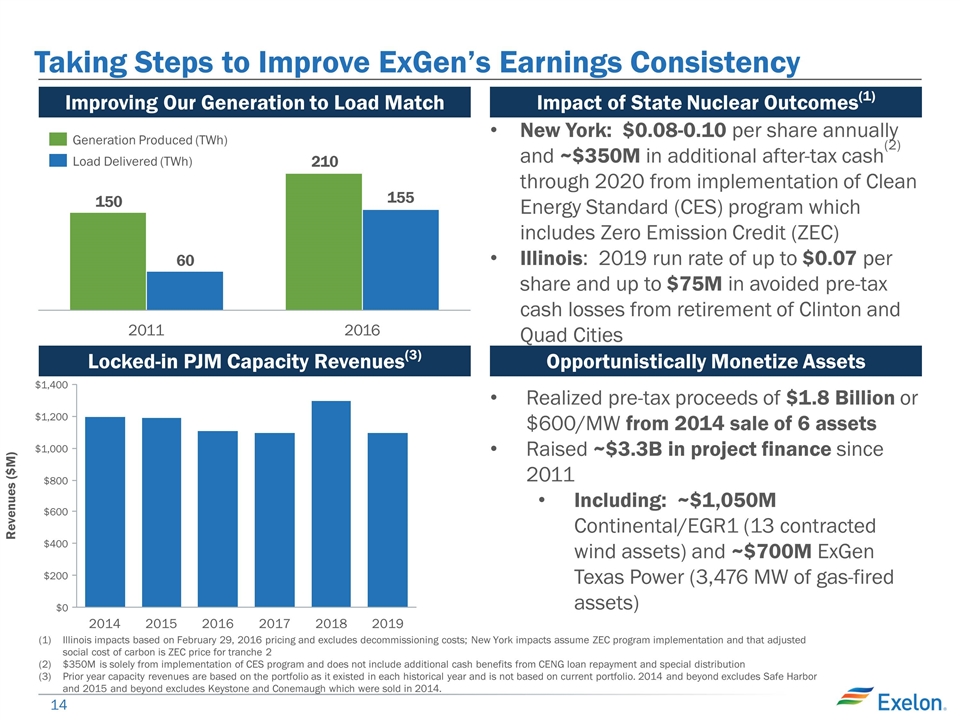

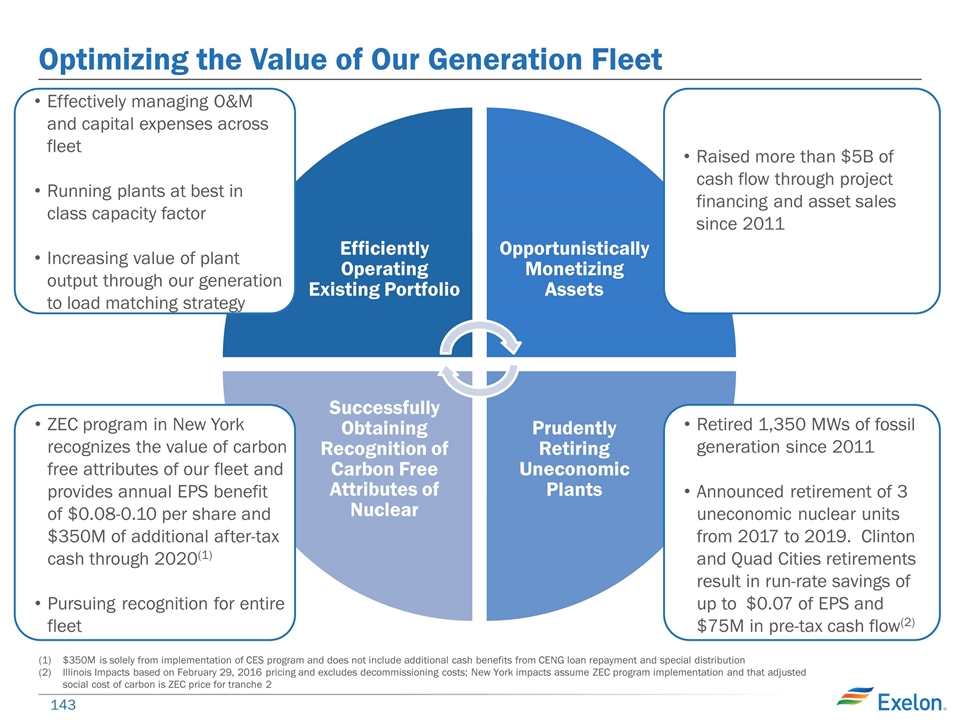

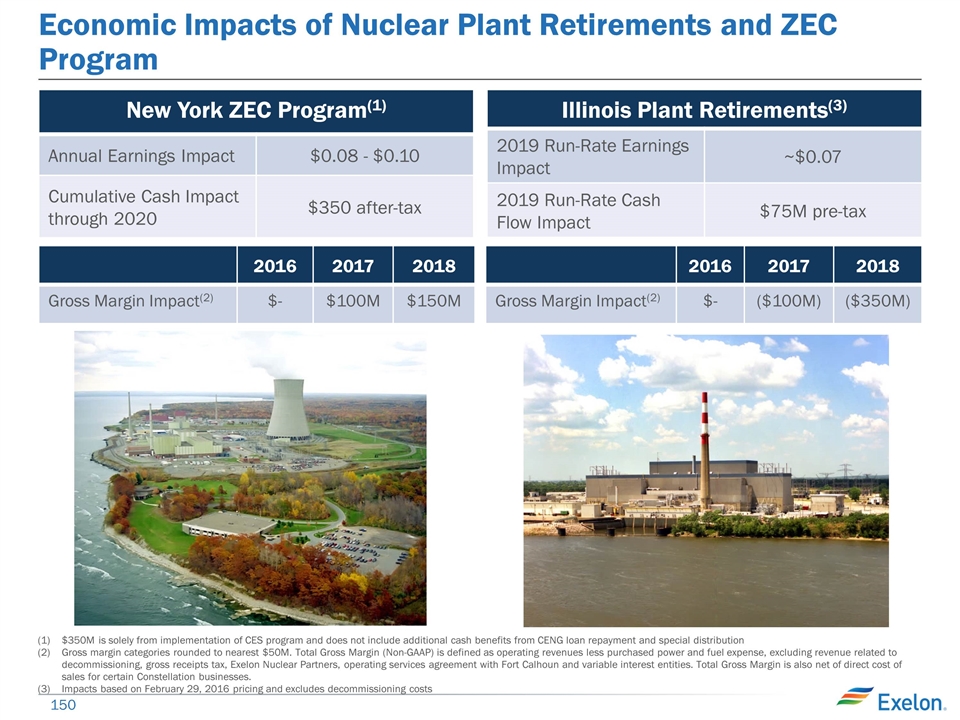

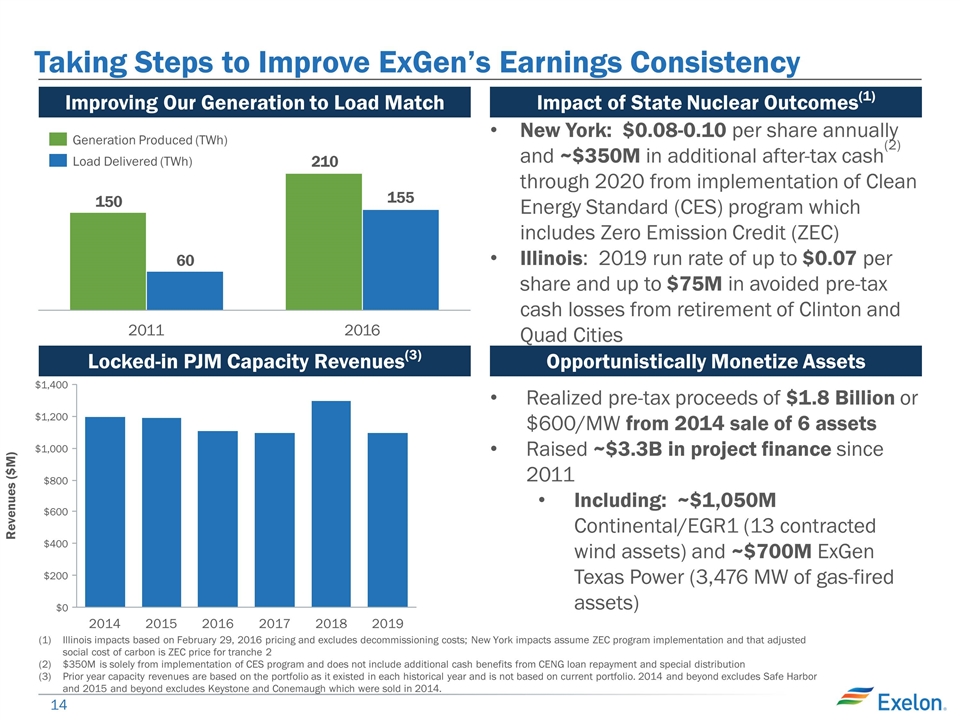

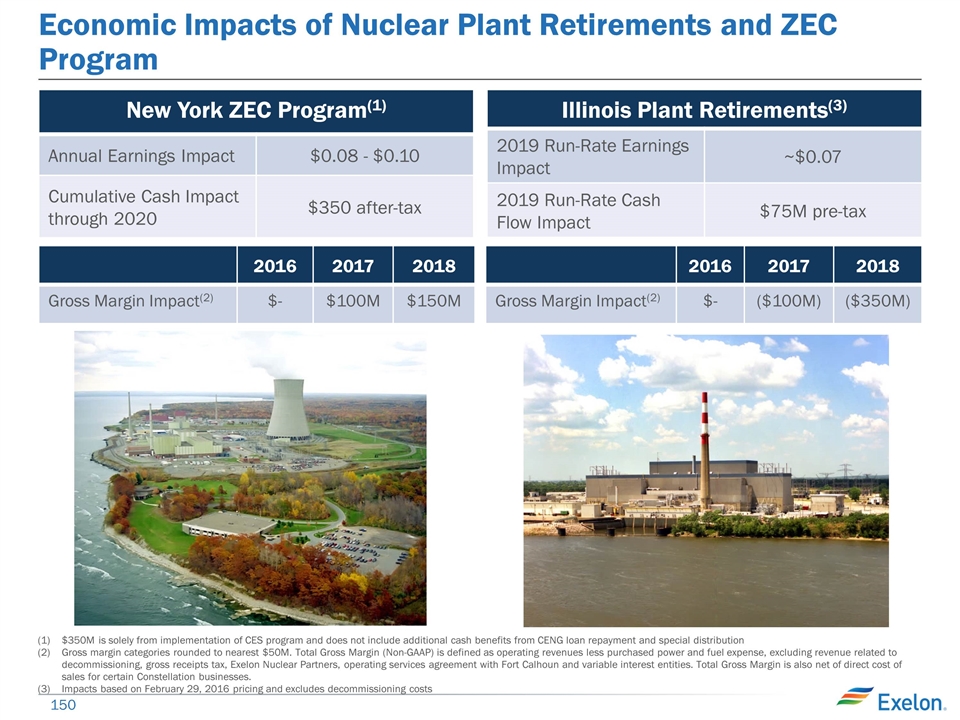

Taking Steps to Improve ExGen’s Earnings Consistency Improving Our Generation to Load Match Impact of State Nuclear Outcomes(1) Locked-in PJM Capacity Revenues(3) Opportunistically Monetize Assets New York: $0.08-0.10 per share annually and ~$350M in additional after-tax cash(2) through 2020 from implementation of Clean Energy Standard (CES) program which includes Zero Emission Credit (ZEC) Illinois: 2019 run rate of up to $0.07 per share and up to $75M in avoided pre-tax cash losses from retirement of Clinton and Quad Cities Realized pre-tax proceeds of $1.8 Billion or $600/MW from 2014 sale of 6 assets Raised ~$3.3B in project finance since 2011 Including: ~$1,050M Continental/EGR1 (13 contracted wind assets) and ~$700M ExGen Texas Power (3,476 MW of gas-fired assets) Revenues ($M) Illinois impacts based on February 29, 2016 pricing and excludes decommissioning costs; New York impacts assume ZEC program implementation and that adjusted social cost of carbon is ZEC price for tranche 2 $350M is solely from implementation of CES program and does not include additional cash benefits from CENG loan repayment and special distribution Prior year capacity revenues are based on the portfolio as it existed in each historical year and is not based on current portfolio. 2014 and beyond excludes Safe Harbor and 2015 and beyond excludes Keystone and Conemaugh which were sold in 2014.

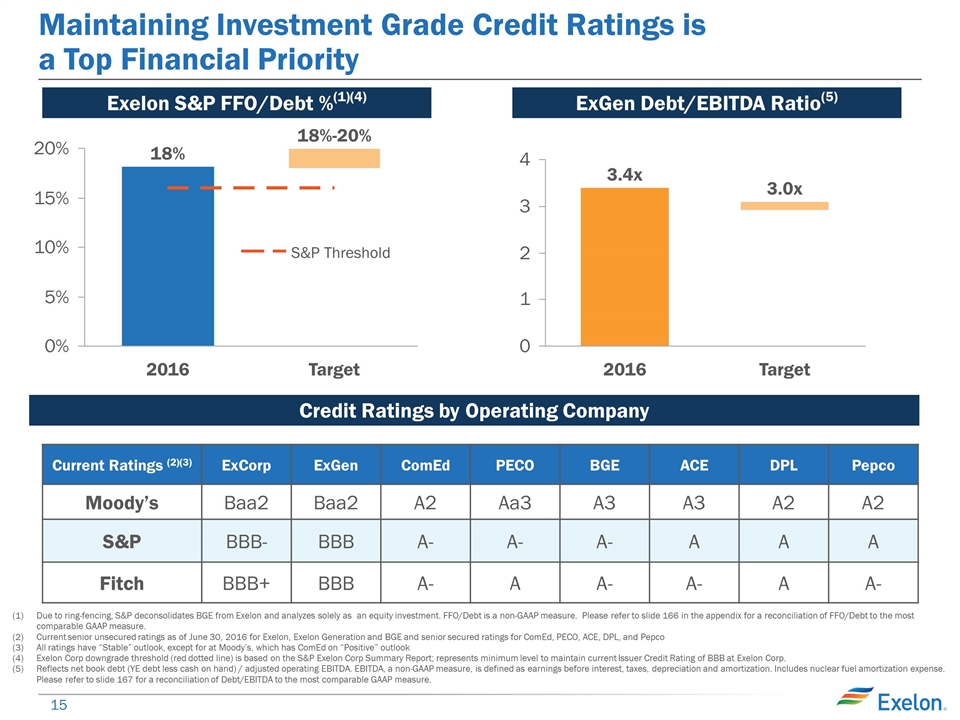

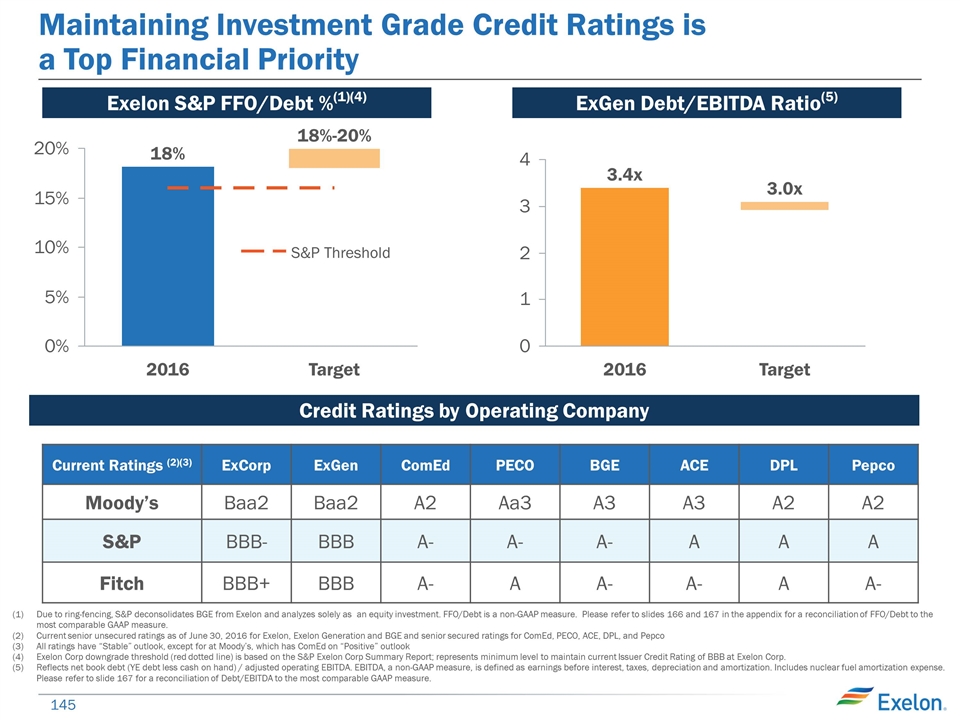

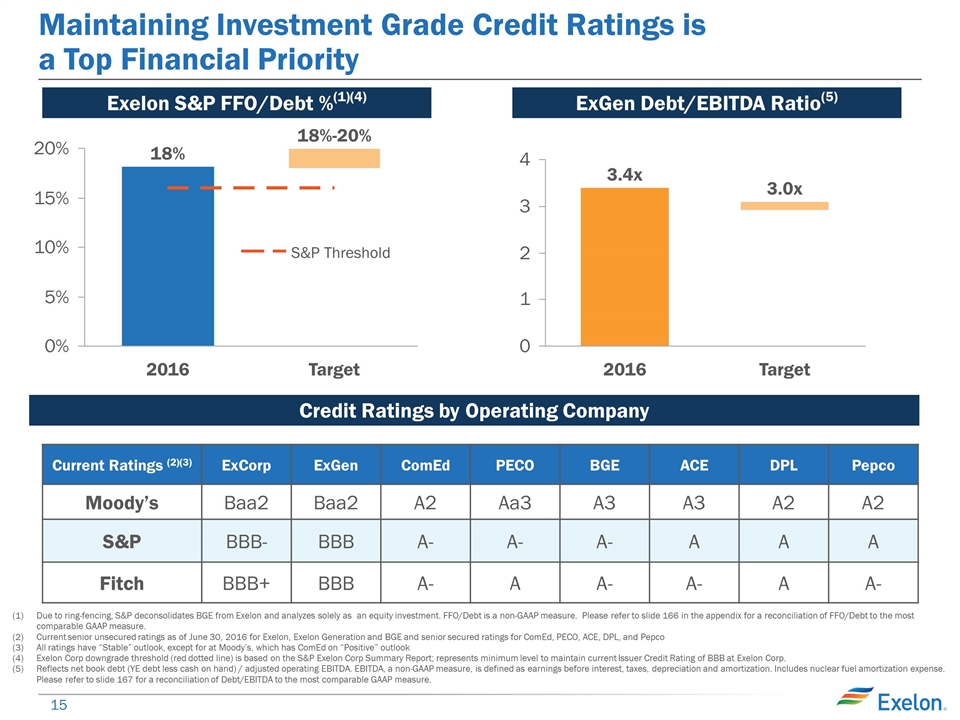

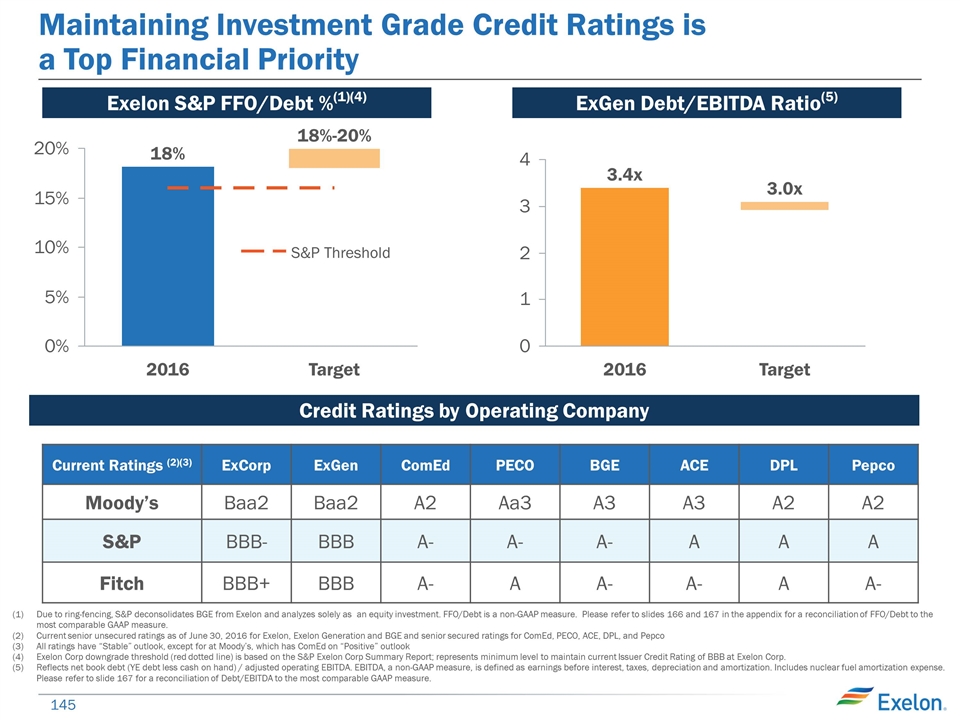

Maintaining Investment Grade Credit Ratings is a Top Financial Priority Current Ratings (2)(3) ExCorp ExGen ComEd PECO BGE ACE DPL Pepco Moody’s Baa2 Baa2 A2 Aa3 A3 A3 A2 A2 S&P BBB- BBB A- A- A- A A A Fitch BBB+ BBB A- A A- A- A A- Due to ring-fencing, S&P deconsolidates BGE from Exelon and analyzes solely as an equity investment. FFO/Debt is a non-GAAP measure. Please refer to slide 166 in the appendix for a reconciliation of FFO/Debt to the most comparable GAAP measure. Current senior unsecured ratings as of June 30, 2016 for Exelon, Exelon Generation and BGE and senior secured ratings for ComEd, PECO, ACE, DPL, and Pepco All ratings have “Stable” outlook, except for at Moody’s, which has ComEd on “Positive” outlook Exelon Corp downgrade threshold (red dotted line) is based on the S&P Exelon Corp Summary Report; represents minimum level to maintain current Issuer Credit Rating of BBB at Exelon Corp. Reflects net book debt (YE debt less cash on hand) / adjusted operating EBITDA. EBITDA, a non-GAAP measure, is defined as earnings before interest, taxes, depreciation and amortization. Includes nuclear fuel amortization expense. Please refer to slide 167 for a reconciliation of Debt/EBITDA to the most comparable GAAP measure. ExGen Debt/EBITDA Ratio(5) Exelon S&P FFO/Debt %(1)(4) Credit Ratings by Operating Company 18%-20% 18% 3.0x x

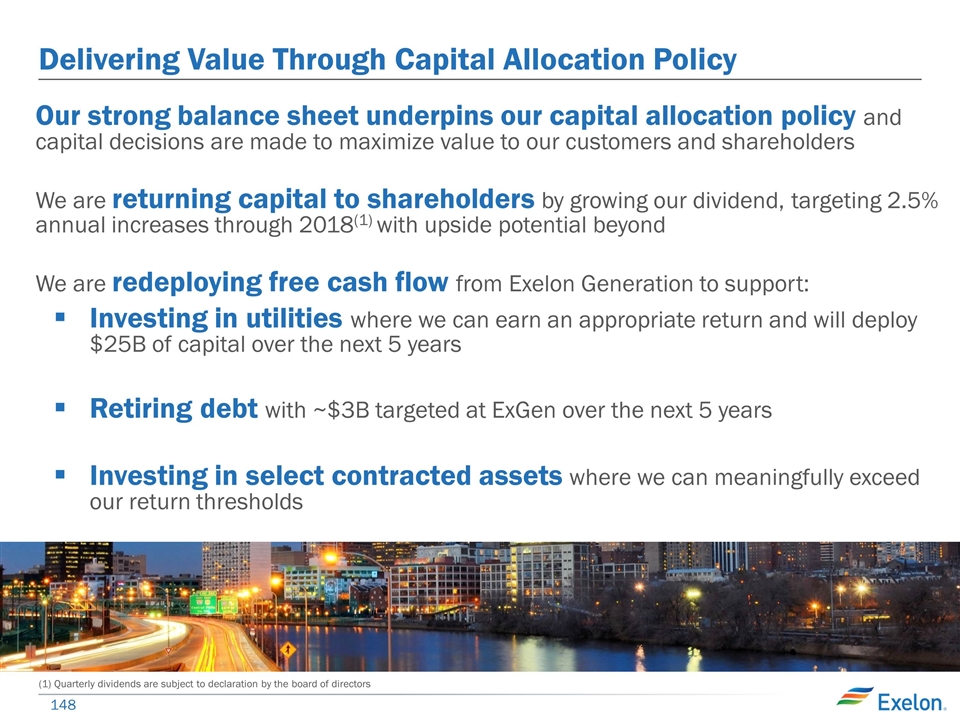

Delivering Value Through Capital Allocation Policy Our strong balance sheet underpins our capital allocation policy and capital decisions are made to maximize value to our customers and shareholders We are returning capital to shareholders by growing our dividend, targeting 2.5% annual increases through 2018(1) with upside potential beyond We are redeploying free cash flow from Exelon Generation to support: Investing in utilities where we can earn an appropriate return and will deploy $25B of capital over the next 5 years Retiring debt with ~$3B targeted at ExGen over the next 5 years Investing in select contracted assets where we can meaningfully exceed our return thresholds (1) Quarterly dividends are subject to declaration by the board of directors

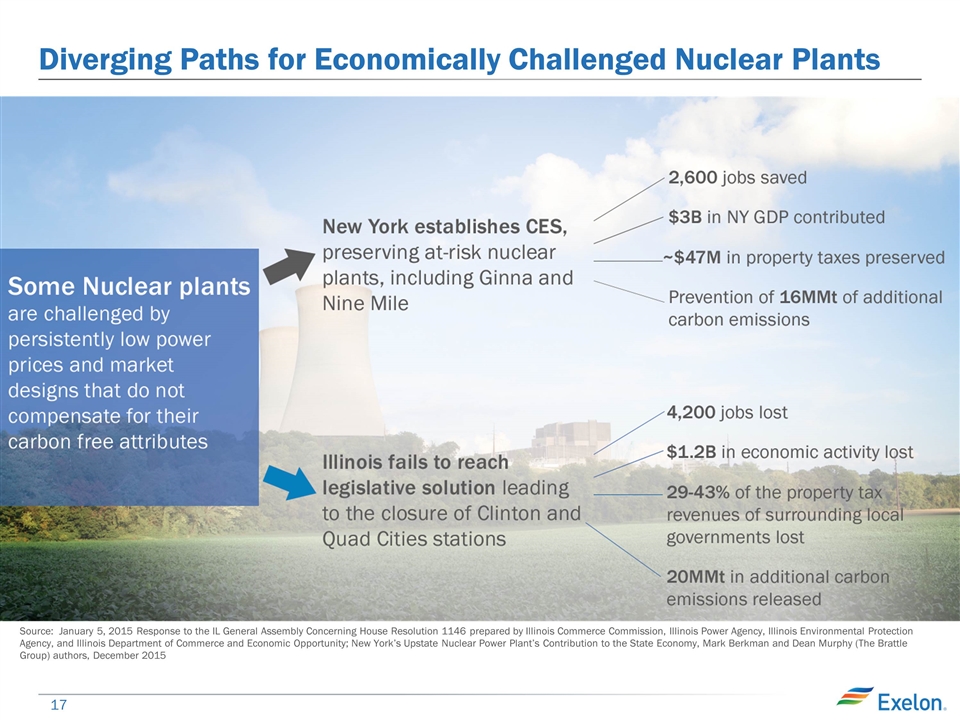

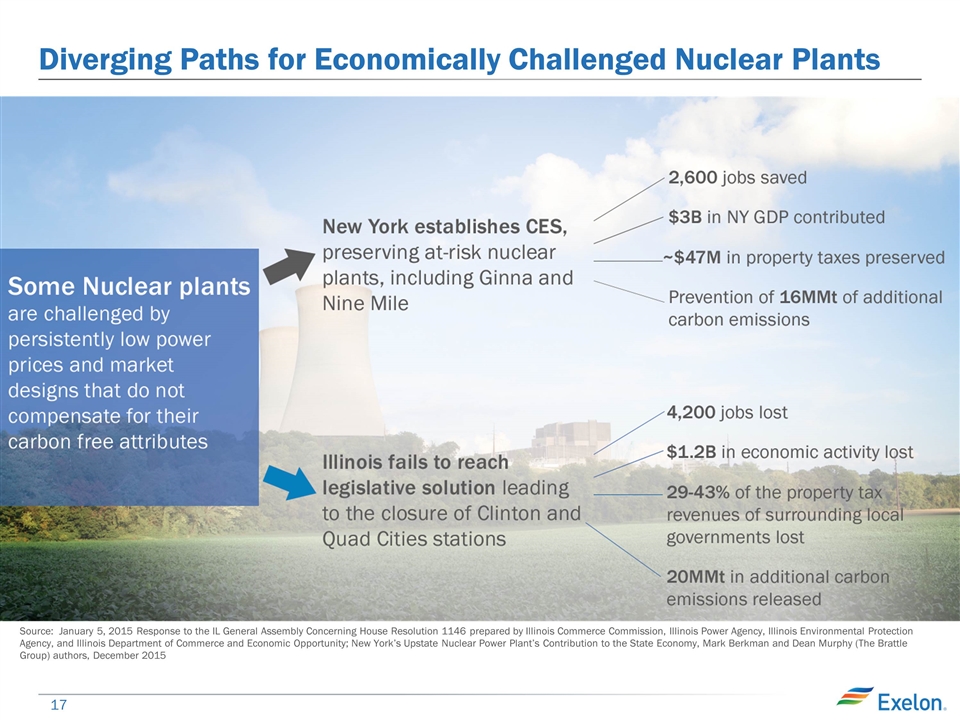

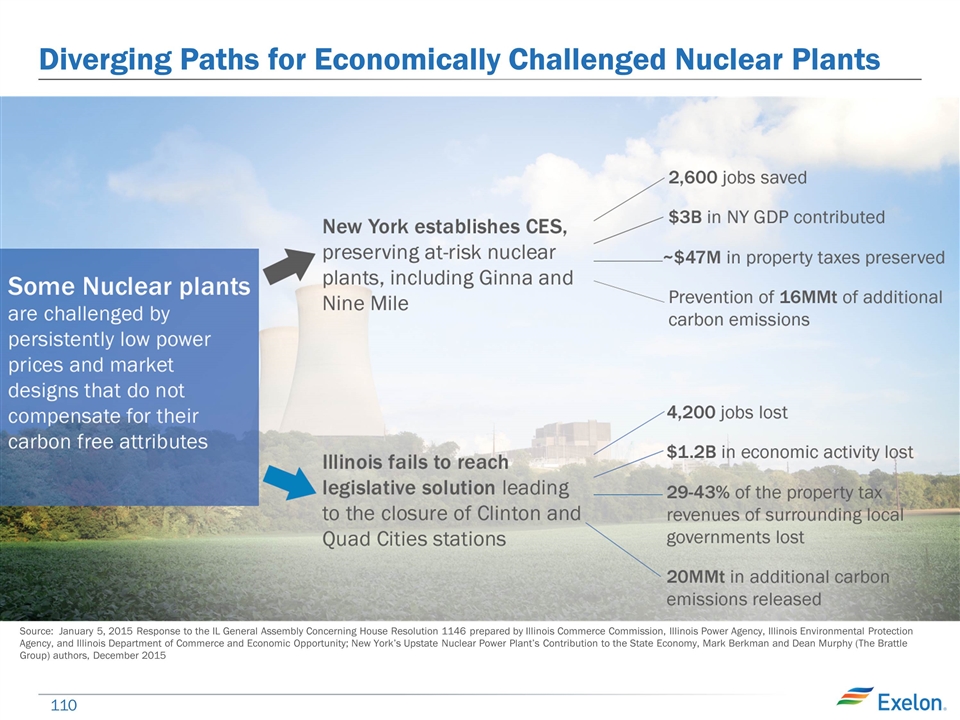

Diverging Paths for Economically Challenged Nuclear Plants Source: January 5, 2015 Response to the IL General Assembly Concerning House Resolution 1146 prepared by Illinois Commerce Commission, Illinois Power Agency, Illinois Environmental Protection Agency, and Illinois Department of Commerce and Economic Opportunity; New York’s Upstate Nuclear Power Plant’s Contribution to the State Economy, Mark Berkman and Dean Murphy (The Brattle Group) authors, December 2015

Fostering a Culture of Innovation

Exelon Utilities Denis O’Brien Chief Executive Officer, Exelon Utilities

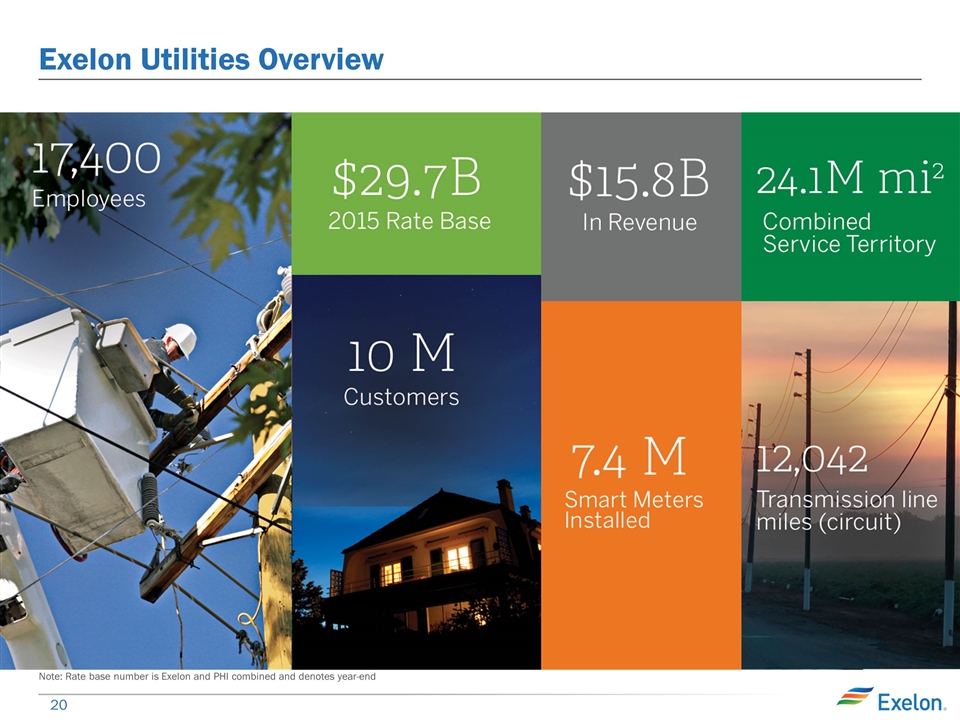

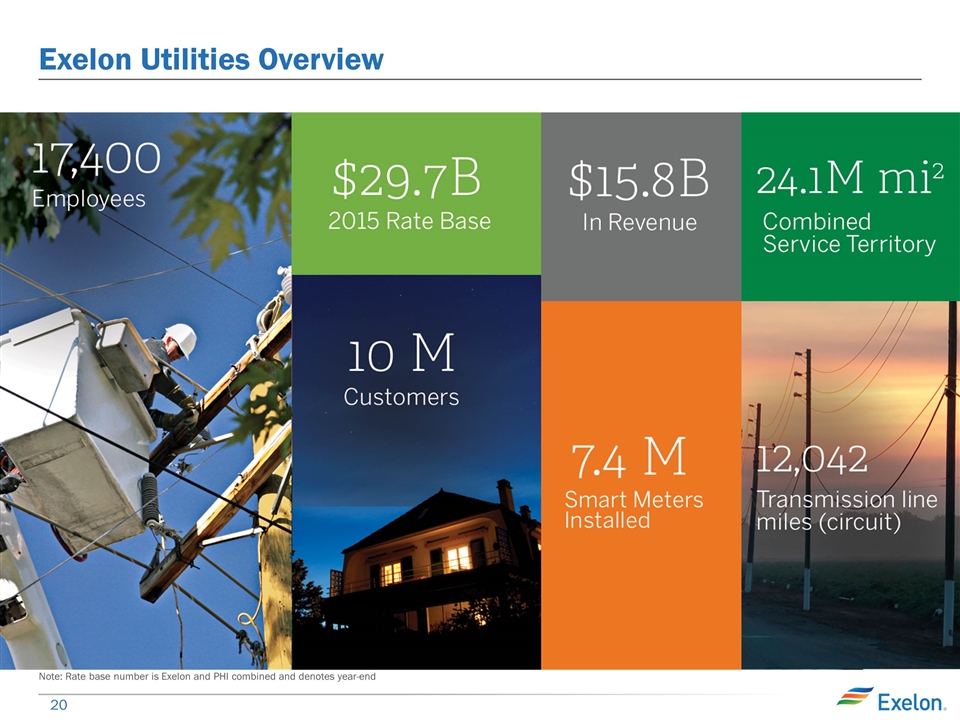

Exelon Utilities Overview Note: Rate base number is Exelon and PHI combined and denotes year-end

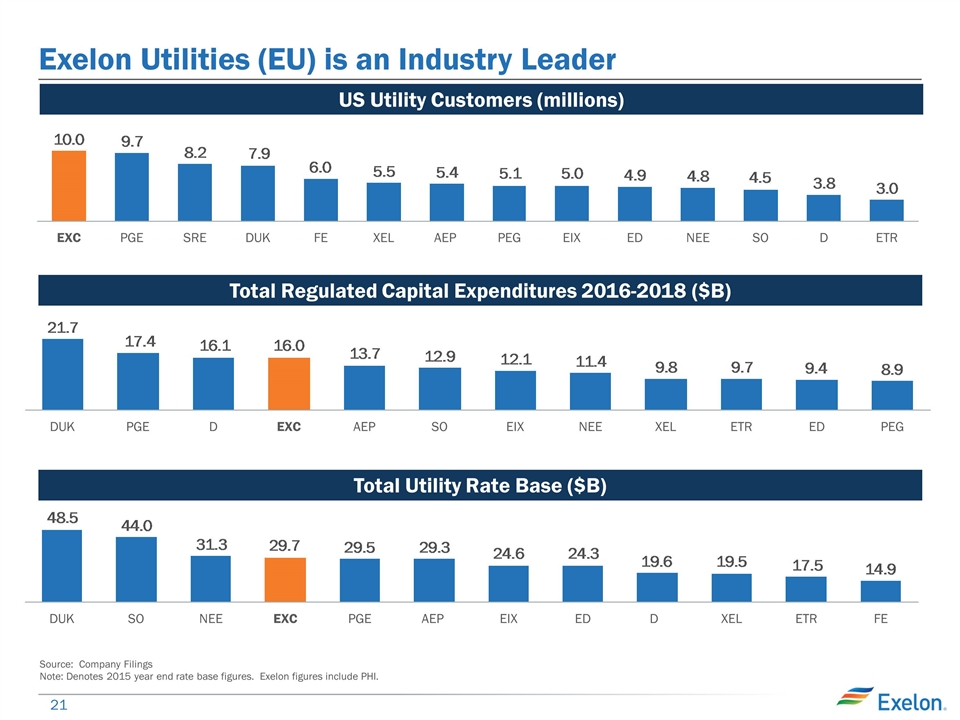

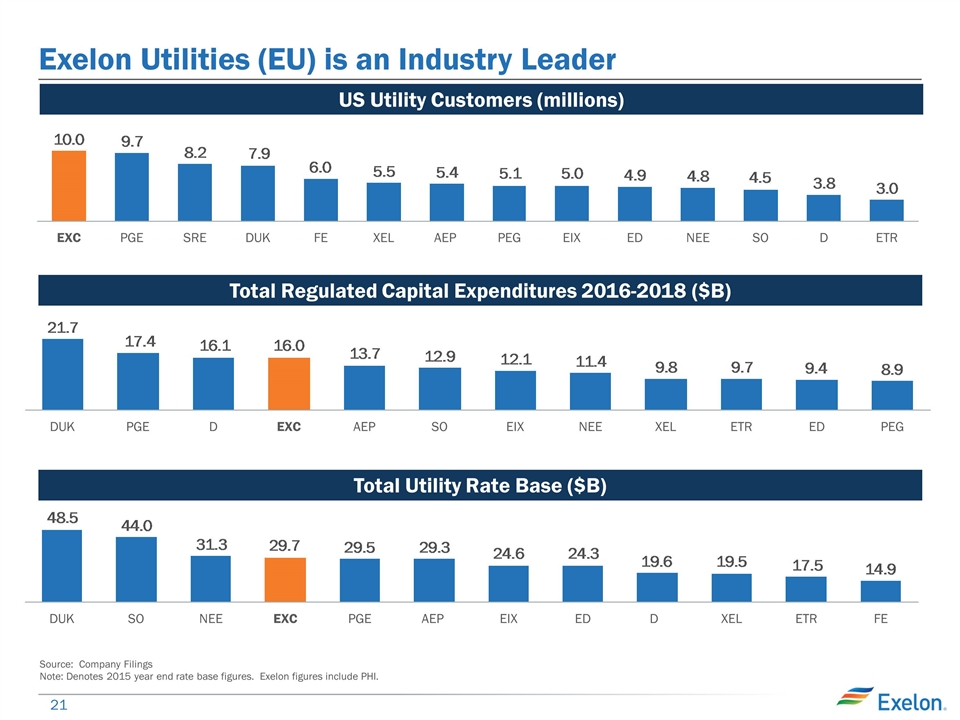

Exelon Utilities (EU) is an Industry Leader Total Utility Rate Base ($B) Total Regulated Capital Expenditures 2016-2018 ($B) US Utility Customers (millions) Source: Company Filings Note: Denotes 2015 year end rate base figures. Exelon figures include PHI.

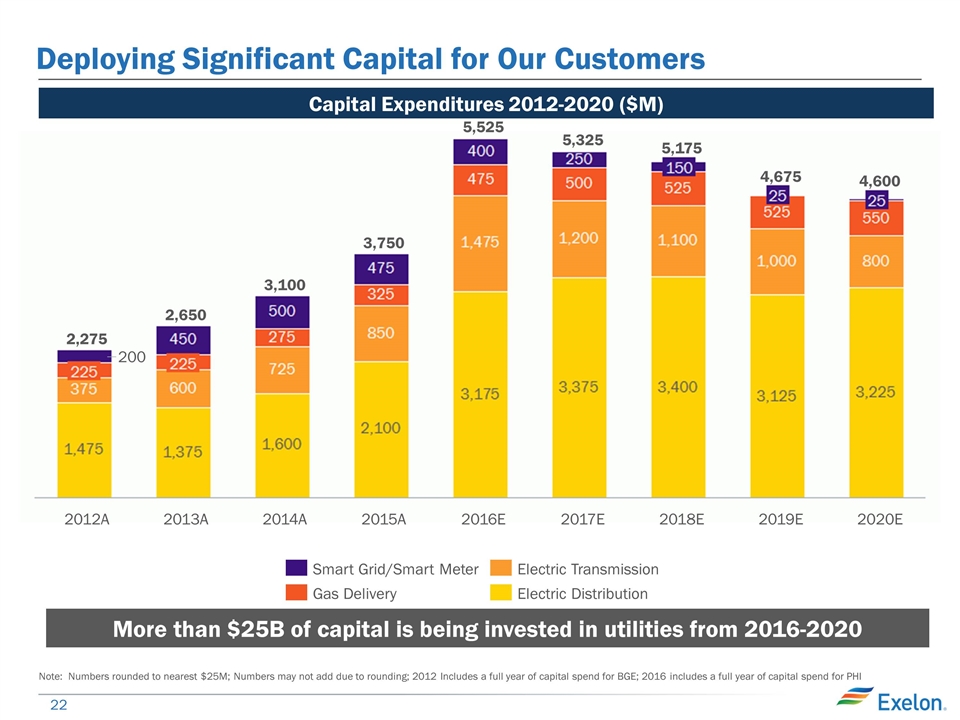

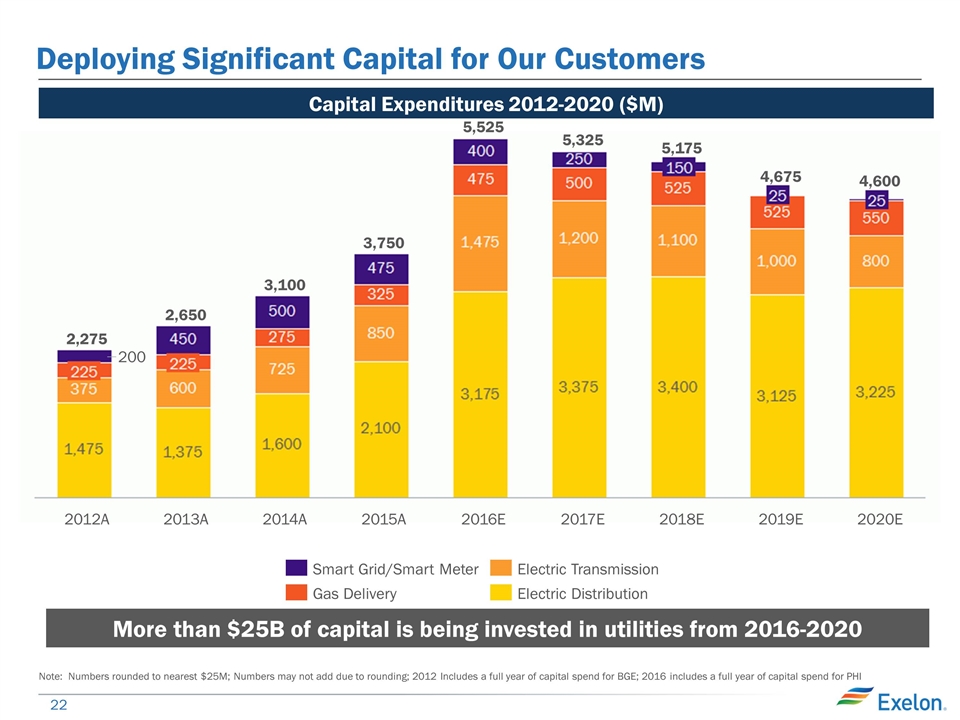

Deploying Significant Capital for Our Customers Capital Expenditures 2012-2020 ($M) More than $25B of capital is being invested in utilities from 2016-2020 Note: Numbers rounded to nearest $25M; Numbers may not add due to rounding; 2012 Includes a full year of capital spend for BGE; 2016 includes a full year of capital spend for PHI 200

Driving Strong Rate Base Growth Exelon Utilities Rate Base 2012-2020 ($B) Exelon Utilities delivering strong rate base growth of 6.1% annually over planning period Note: All numbers denote year-end rate base and may not add due to rounding

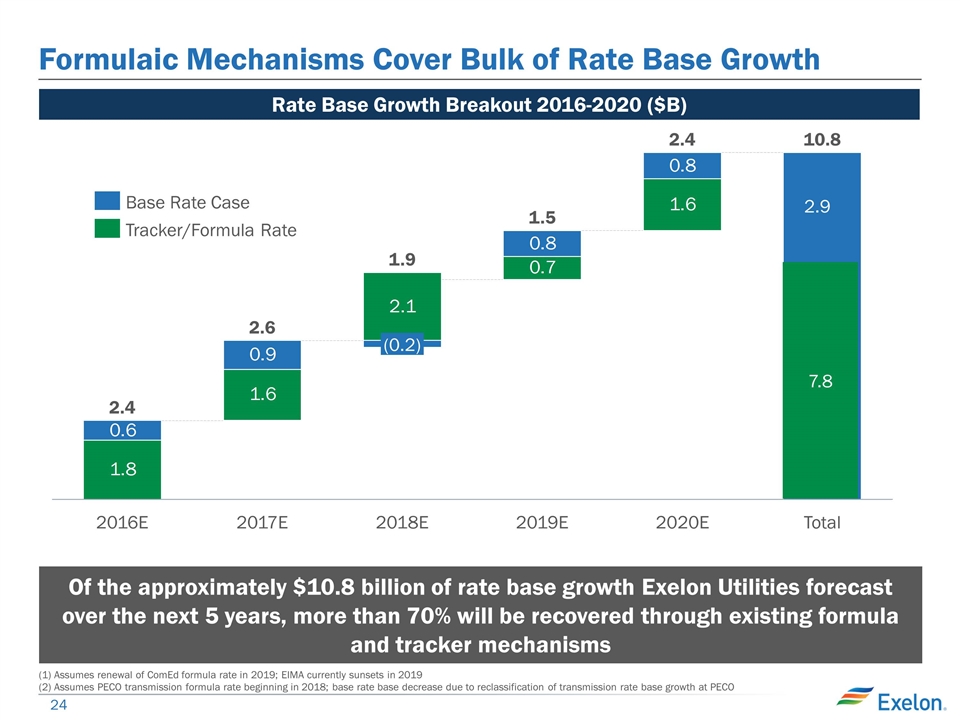

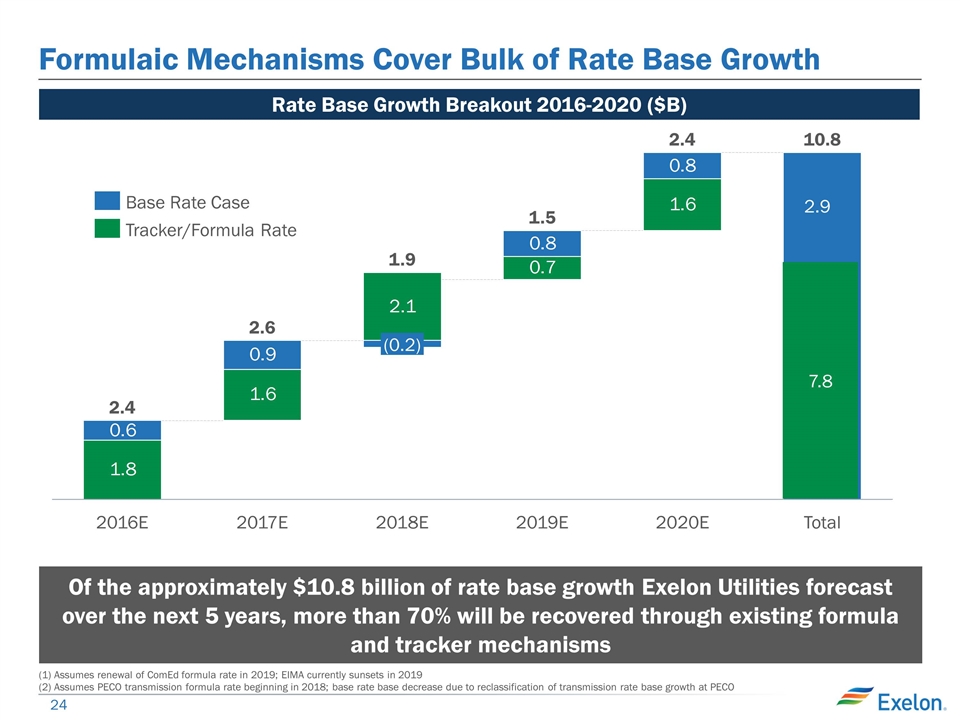

Formulaic Mechanisms Cover Bulk of Rate Base Growth 10.8 2.6 Of the approximately $10.8 billion of rate base growth Exelon Utilities forecast over the next 5 years, more than 70% will be recovered through existing formula and tracker mechanisms Rate Base Growth Breakout 2016-2020 ($B) 7.8 2.9 (1) Assumes renewal of ComEd formula rate in 2019; EIMA currently sunsets in 2019 (2) Assumes PECO transmission formula rate beginning in 2018; base rate base decrease due to reclassification of transmission rate base growth at PECO

Exelon Utilities EPS Growth of 7-9% to 2020 $1.60 $1.50 $1.15 Utility Adjusted Operating Earnings Rate base growth combined with PHI ROE improvement drives EPS growth $1.35 Note: Reflects GAAP operating earnings except for 2016. 2016 GAAP EPS range would be $0.65 to $0.95. 2016 adjusted (non-GAAP) operating earnings include adjustments to exclude $0.40 for merger commitments and $0.10 of merger integration costs. Includes after-tax interest expense held at Corporate for debt associated with existing utility investment. 2016 estimate normalized to include a full year for PHI. $1.70 Exelon Utilities Operating Earnings 2016-2020

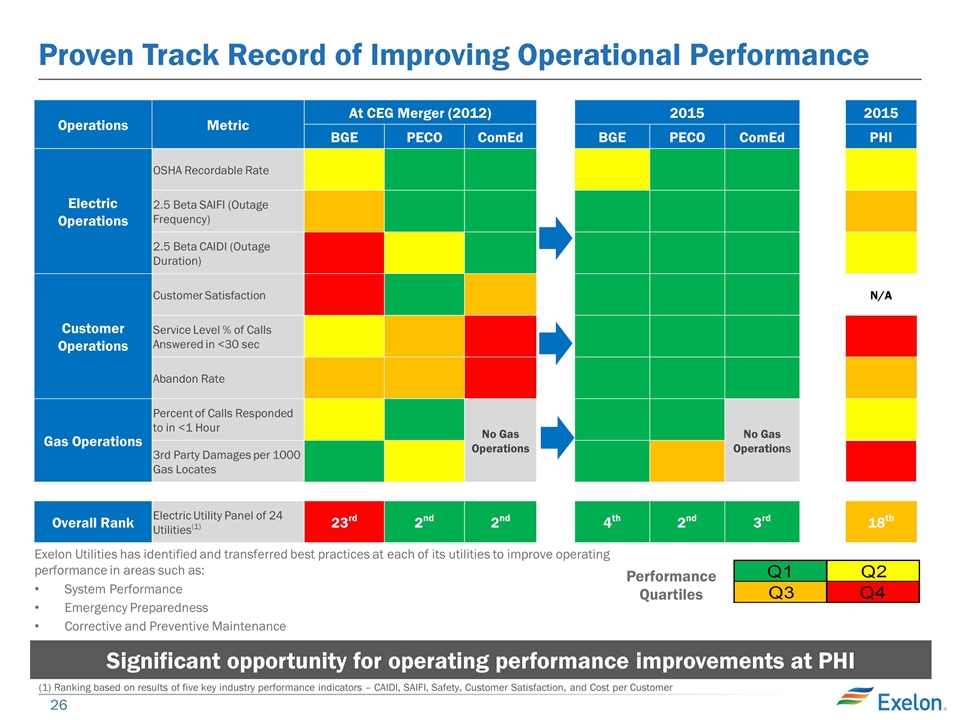

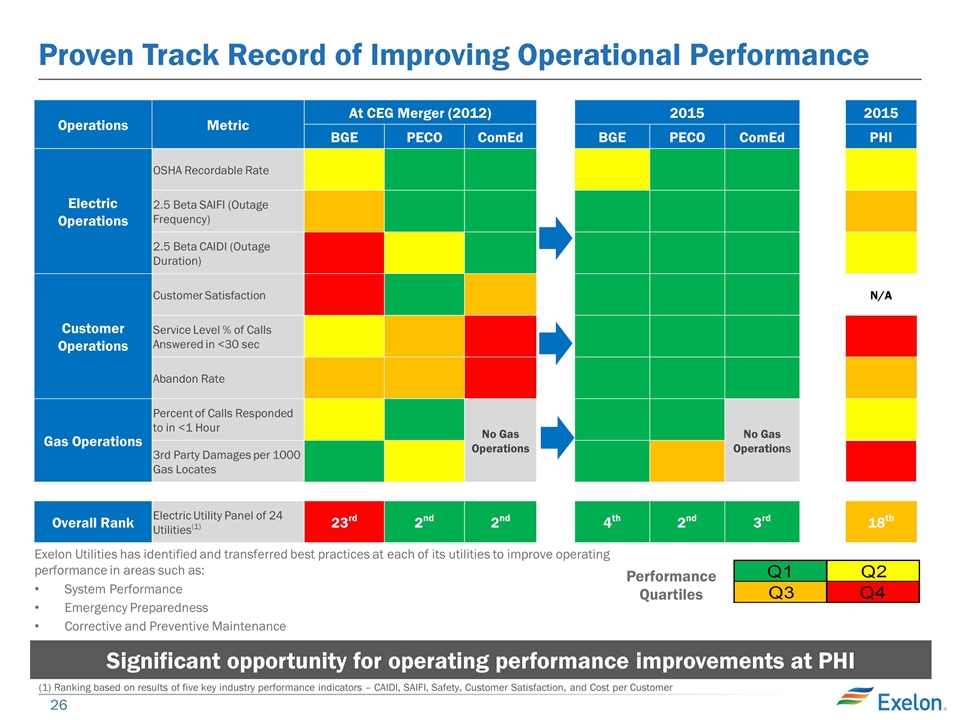

Proven Track Record of Improving Operational Performance Operations Metric At CEG Merger (2012) 2015 2015 BGE PECO ComEd BGE PECO ComEd PHI Electric Operations OSHA Recordable Rate 2.5 Beta SAIFI (Outage Frequency) 2.5 Beta CAIDI (Outage Duration) Customer Operations Customer Satisfaction N/A Service Level % of Calls Answered in <30 sec Abandon Rate Gas Operations Percent of Calls Responded to in <1 Hour No Gas Operations No Gas Operations 3rd Party Damages per 1000 Gas Locates Overall Rank Electric Utility Panel of 24 Utilities(1) 23rd 2nd 2nd 4th 2nd 3rd 18th Performance Quartiles Exelon Utilities has identified and transferred best practices at each of its utilities to improve operating performance in areas such as: System Performance Emergency Preparedness Corrective and Preventive Maintenance Significant opportunity for operating performance improvements at PHI (1) Ranking based on results of five key industry performance indicators – CAIDI, SAIFI, Safety, Customer Satisfaction, and Cost per Customer Quartiles Q1 Q2 Q3 Q4

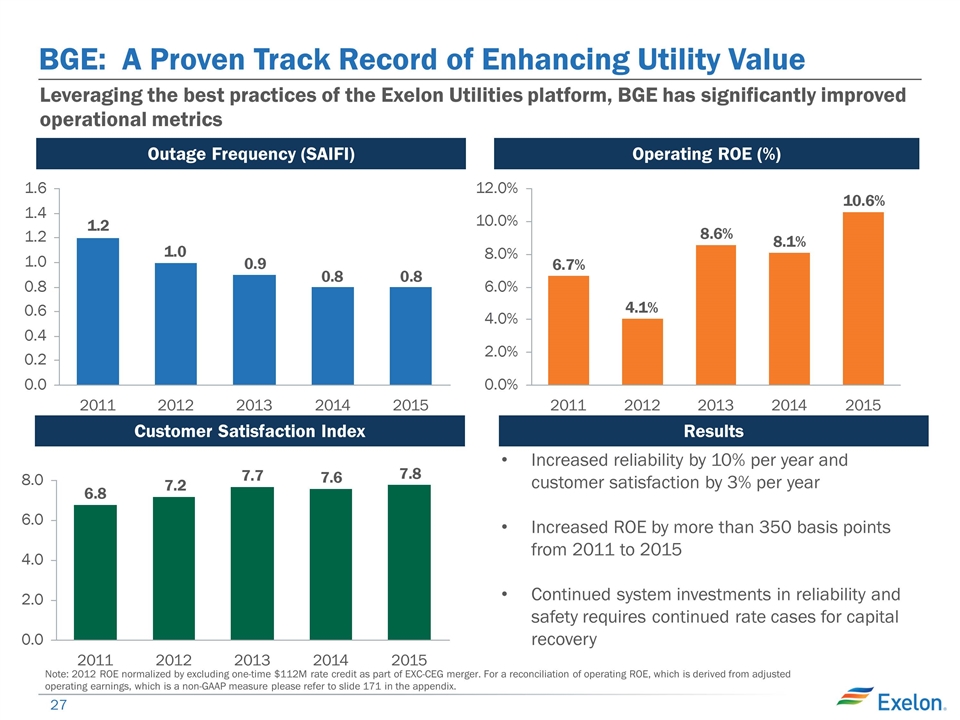

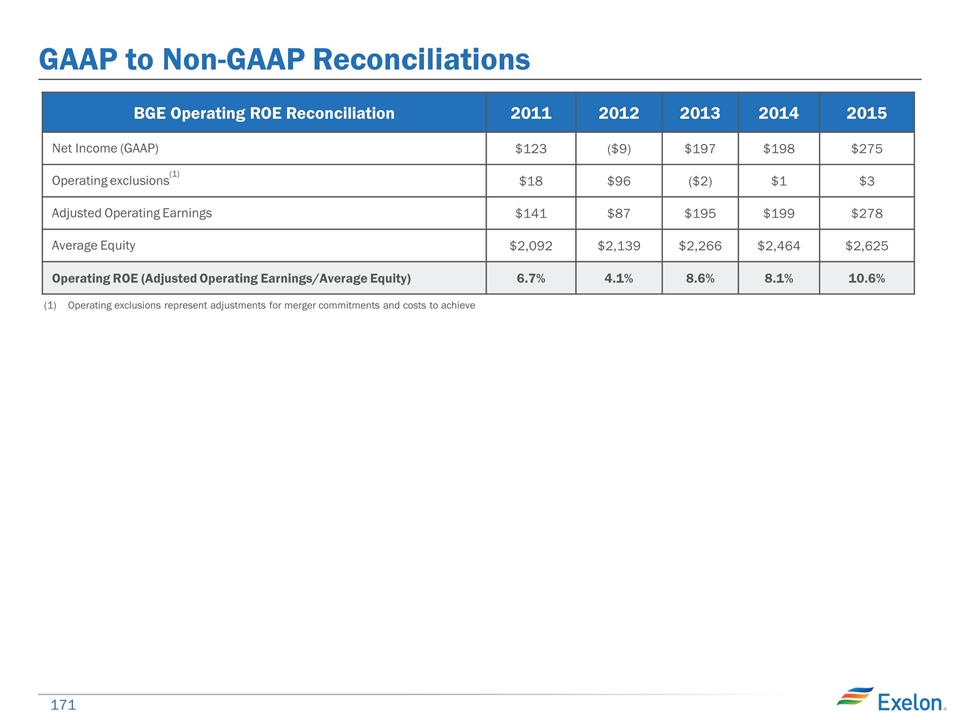

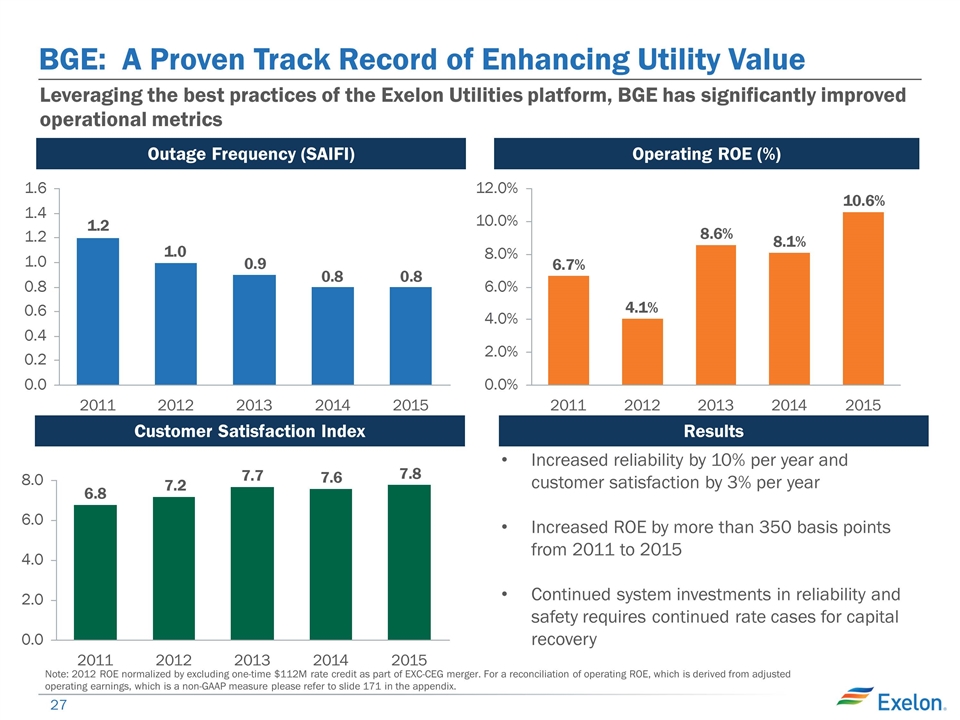

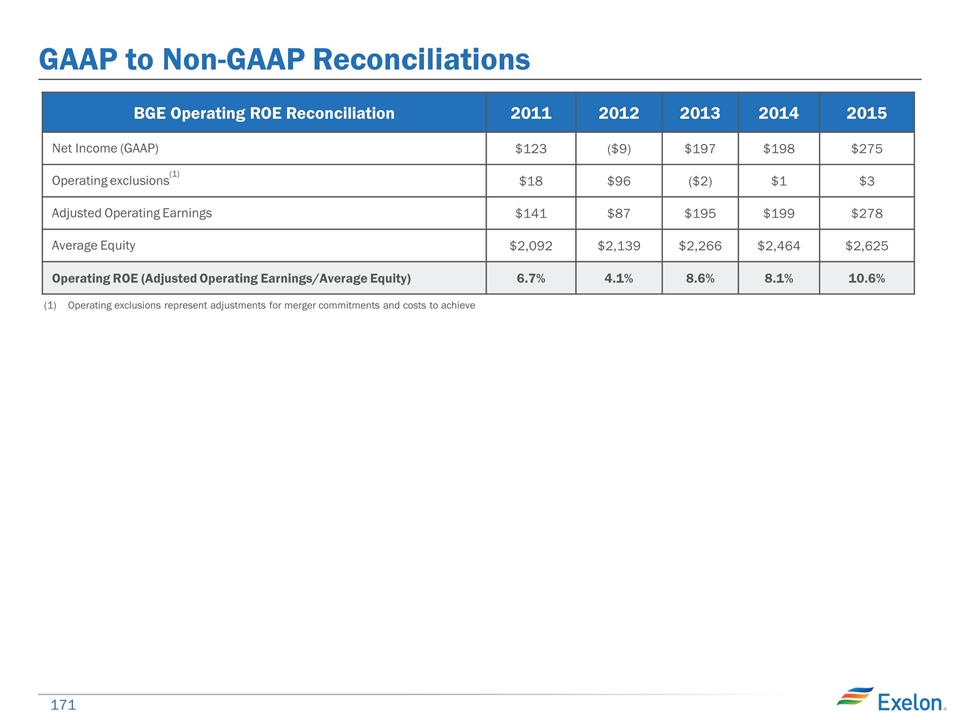

BGE: A Proven Track Record of Enhancing Utility Value Note: 2012 ROE normalized by excluding one-time $112M rate credit as part of EXC-CEG merger. For a reconciliation of operating ROE, which is derived from adjusted operating earnings, which is a non-GAAP measure please refer to slide 171 in the appendix. Increased reliability by 10% per year and customer satisfaction by 3% per year Increased ROE by more than 350 basis points from 2011 to 2015 Continued system investments in reliability and safety requires continued rate cases for capital recovery Leveraging the best practices of the Exelon Utilities platform, BGE has significantly improved operational metrics Outage Frequency (SAIFI) Operating ROE (%) Customer Satisfaction Index Results

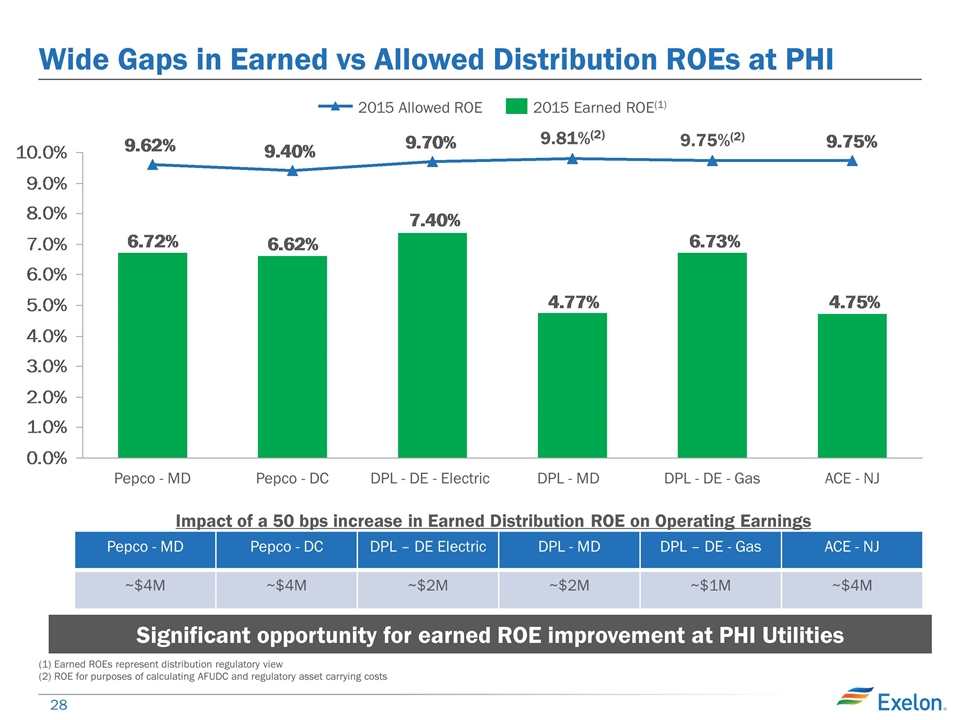

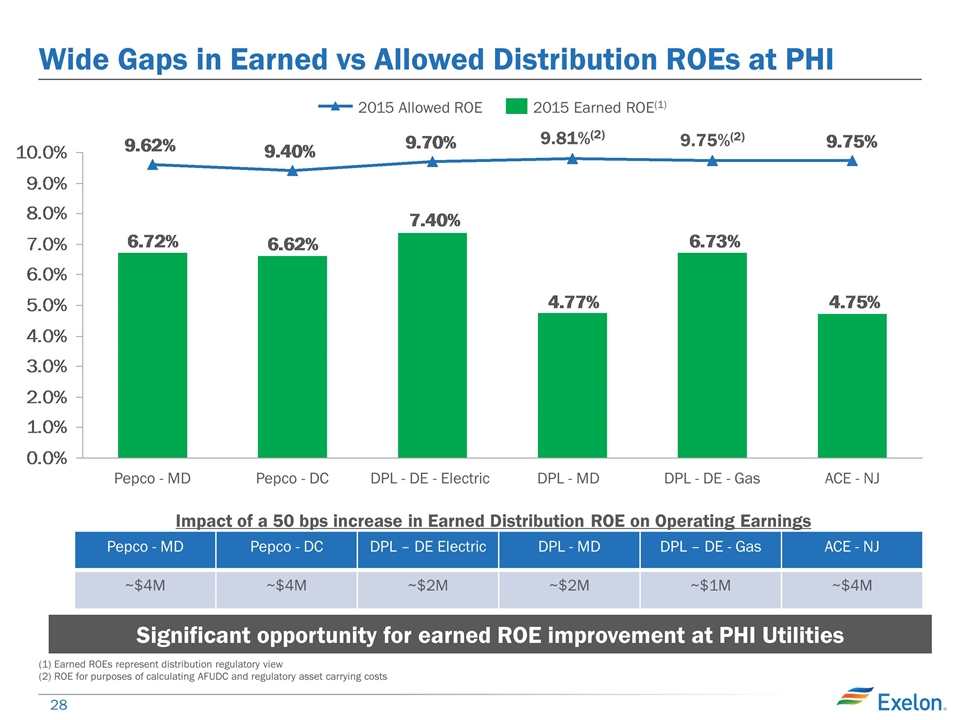

Wide Gaps in Earned vs Allowed Distribution ROEs at PHI (2) (2) 2015 Earned ROE(1) Significant opportunity for earned ROE improvement at PHI Utilities Impact of a 50 bps increase in Earned Distribution ROE on Operating Earnings Pepco - MD Pepco - DC DPL – DE Electric DPL - MD DPL – DE - Gas ACE - NJ ~$4M ~$4M ~$2M ~$2M ~$1M ~$4M (1) Earned ROEs represent distribution regulatory view (2) ROE for purposes of calculating AFUDC and regulatory asset carrying costs

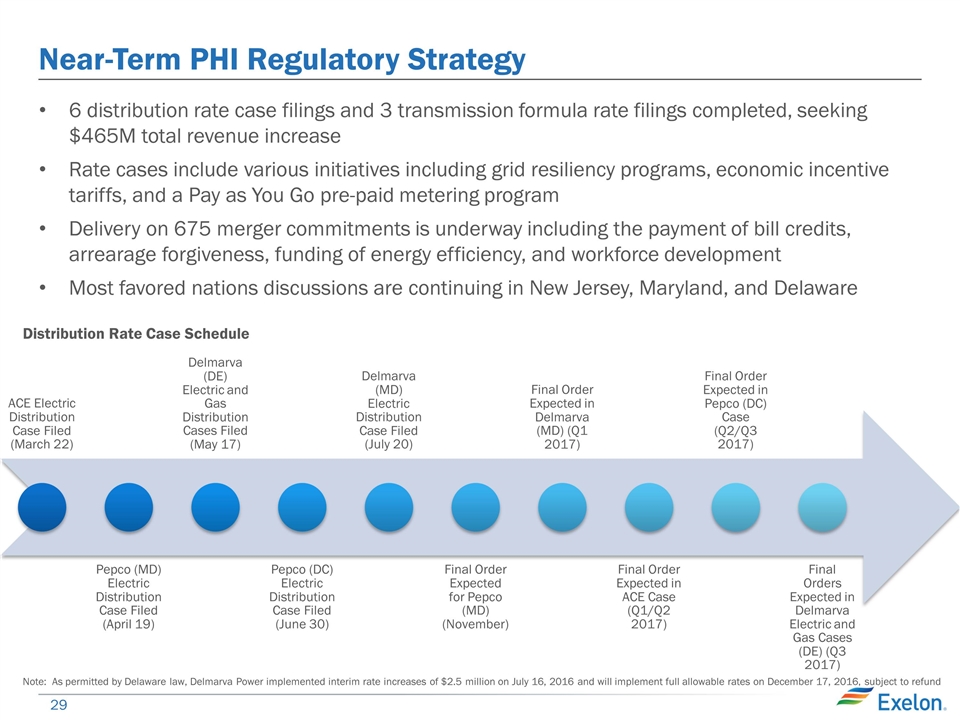

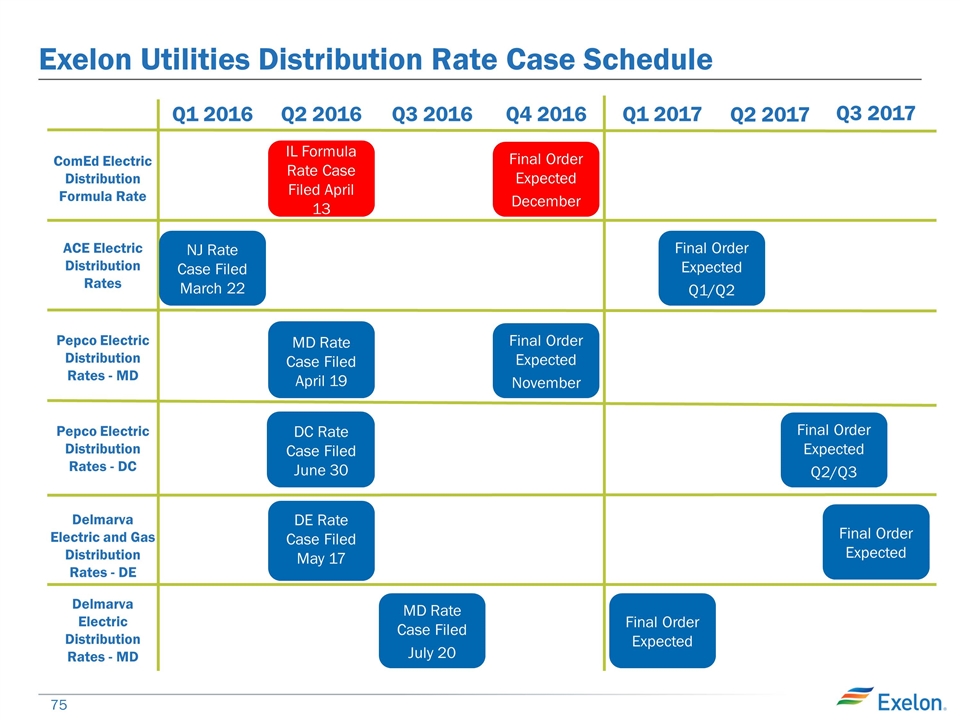

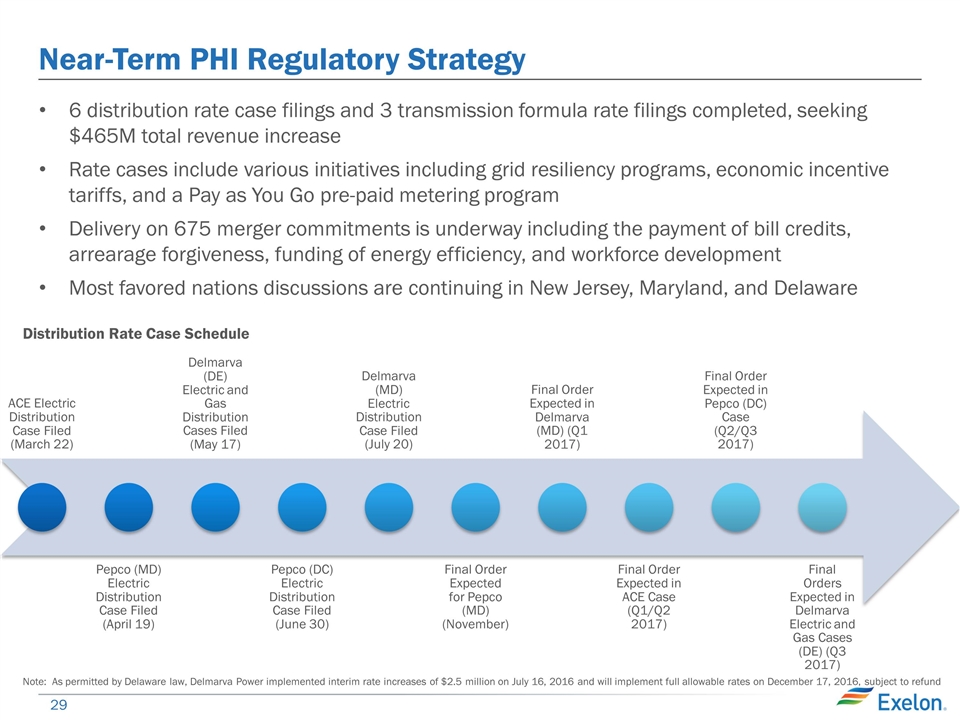

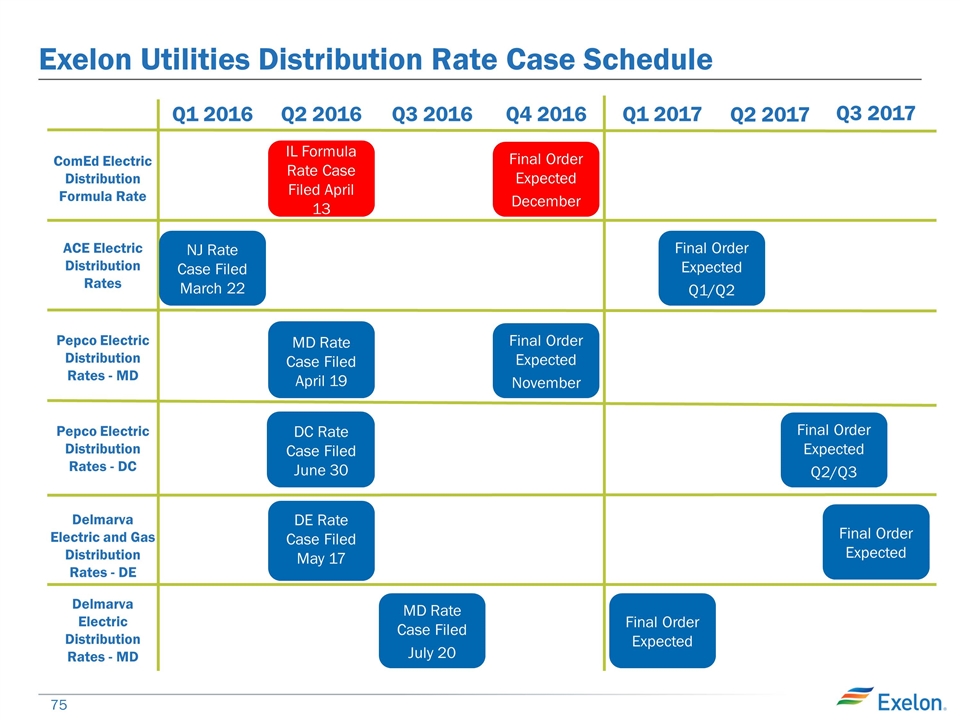

Near-Term PHI Regulatory Strategy 6 distribution rate case filings and 3 transmission formula rate filings completed, seeking $465M total revenue increase Rate cases include various initiatives including grid resiliency programs, economic incentive tariffs, and a Pay as You Go pre-paid metering program Delivery on 675 merger commitments is underway including the payment of bill credits, arrearage forgiveness, funding of energy efficiency, and workforce development Most favored nations discussions are continuing in New Jersey, Maryland, and Delaware Note: As permitted by Delaware law, Delmarva Power implemented interim rate increases of $2.5 million on July 16, 2016 and will implement full allowable rates on December 17, 2016, subject to refund Distribution Rate Case Schedule ACE Electric Distribution Case Filed (March 22) Pepco (MD) Electric Distribution Case Filed (April 19) Delmarva (DE) Electric and Gas Distribution Cases Filed (May 17) Pepco (DC) Electric Distribution Case Filed (June 30) Delmarva (MD) Electric Distribution Case Filed (July 20) Final Order Expected for Pepco (MD) (November) Final Order Expected in ACE Case (Q1/Q2 2017) Final Order Expected in Pepco (DC) Case (Q2/Q3 2017) Final Order Expected in Delmarva (MD) (Q1 2017) Final Orders Expected in Delmarva Electric and Gas Cases (DE) (Q3 2017)

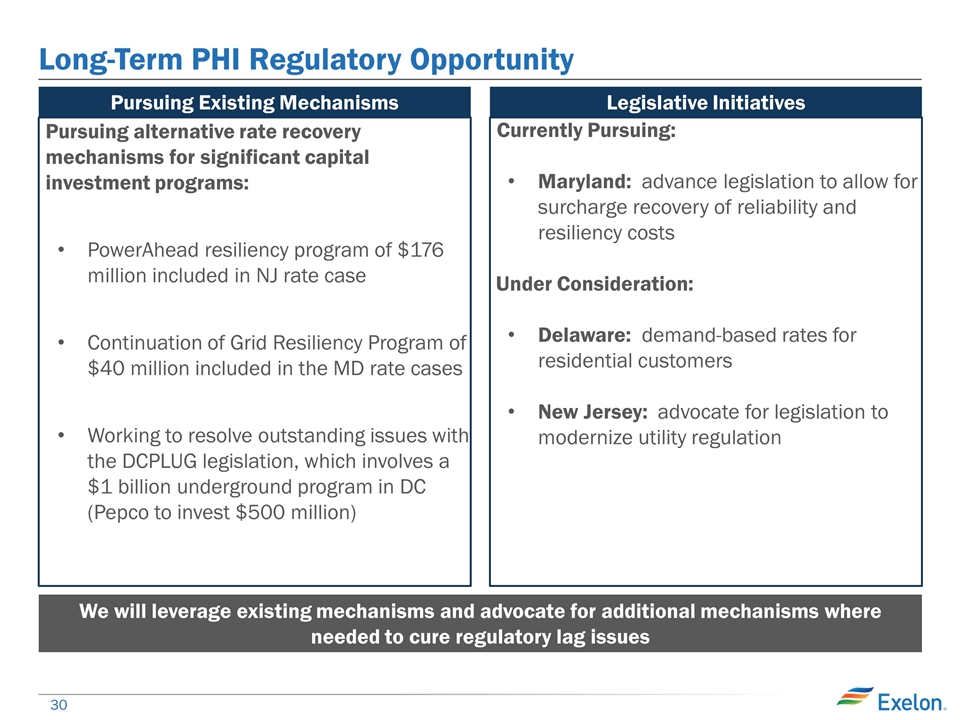

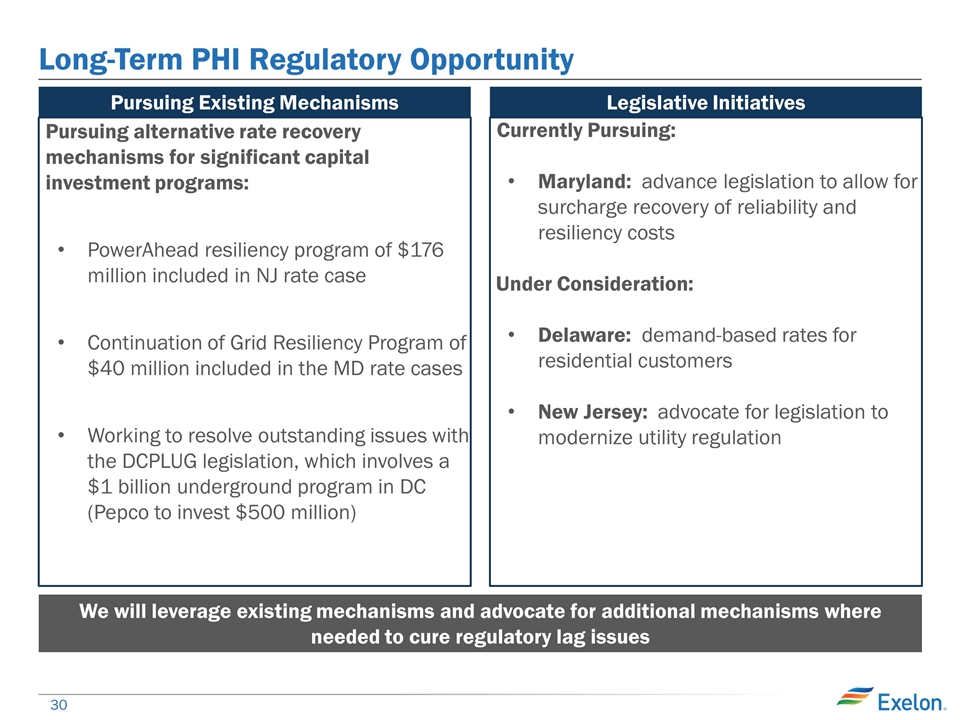

Long-Term PHI Regulatory Opportunity Pursuing Existing Mechanisms Legislative Initiatives Pursuing alternative rate recovery mechanisms for significant capital investment programs: PowerAhead resiliency program of $176 million included in NJ rate case Continuation of Grid Resiliency Program of $40 million included in the MD rate cases Working to resolve outstanding issues with the DCPLUG legislation, which involves a $1 billion underground program in DC (Pepco to invest $500 million) Currently Pursuing: Maryland: advance legislation to allow for surcharge recovery of reliability and resiliency costs Under Consideration: Delaware: demand-based rates for residential customers New Jersey: advocate for legislation to modernize utility regulation We will leverage existing mechanisms and advocate for additional mechanisms where needed to cure regulatory lag issues

Exelon Employees Support Their Communities Note: Legacy Exelon data only

ComEd Anne Pramaggiore President & Chief Executive Officer, ComEd

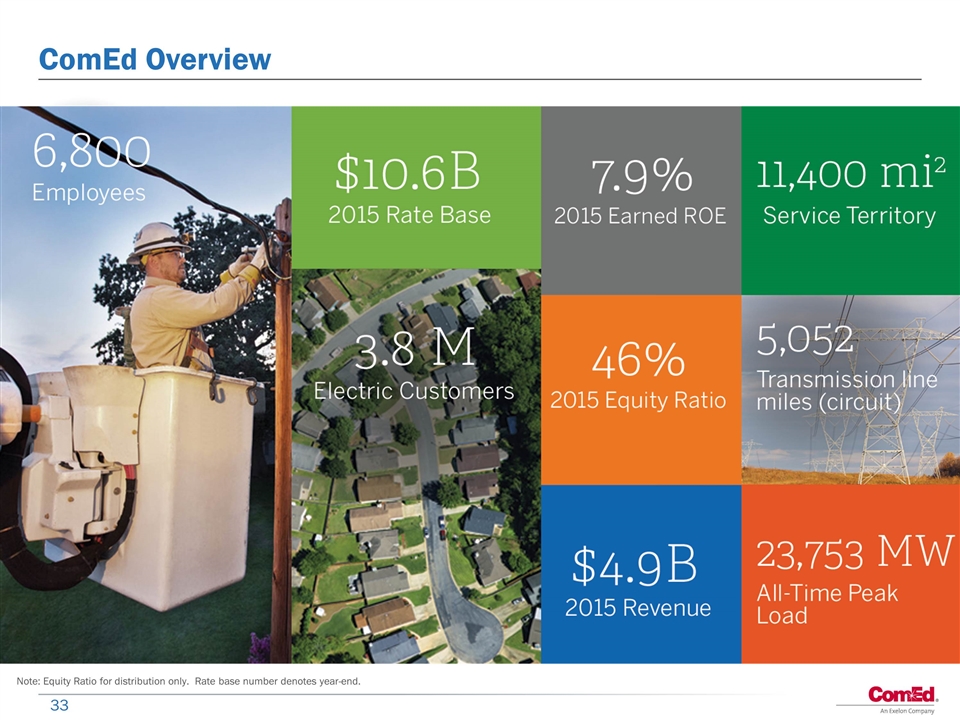

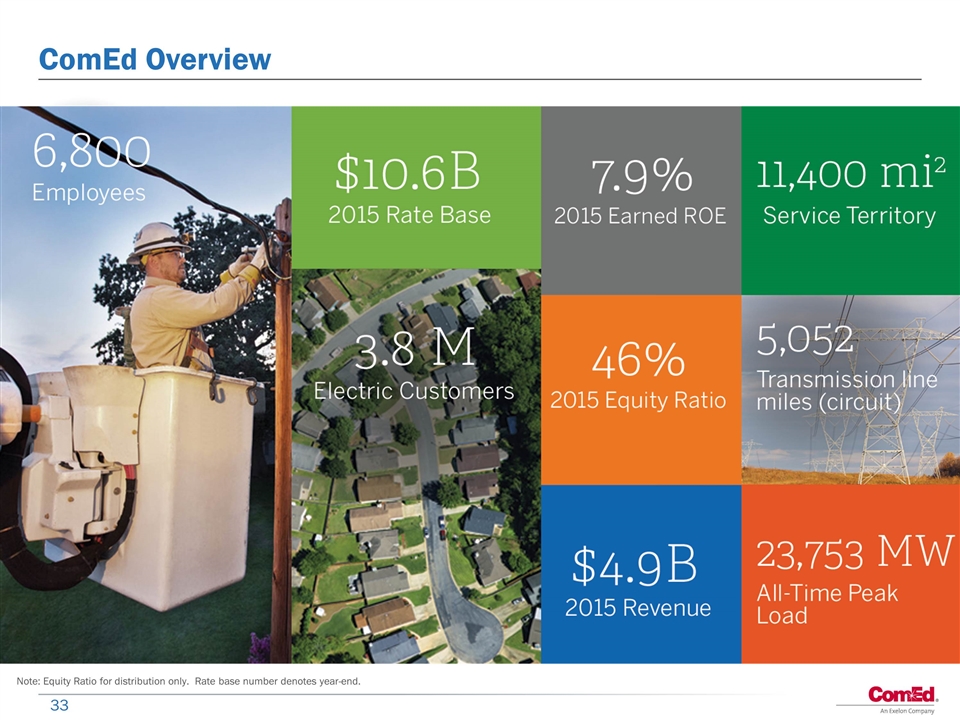

ComEd Overview Note: Equity Ratio for distribution only. Rate base number denotes year-end.

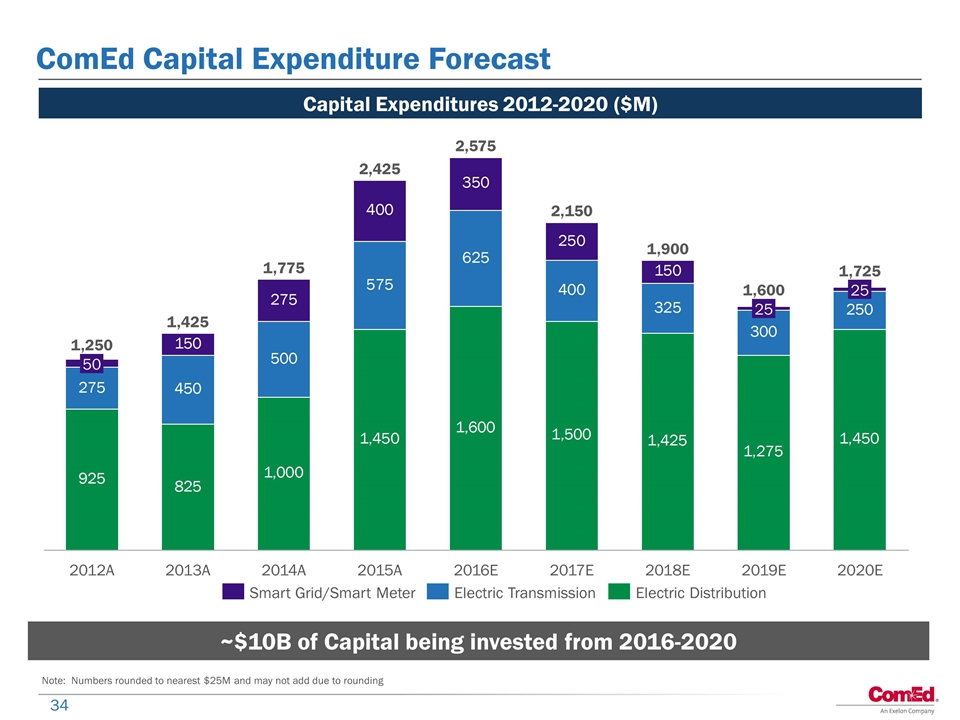

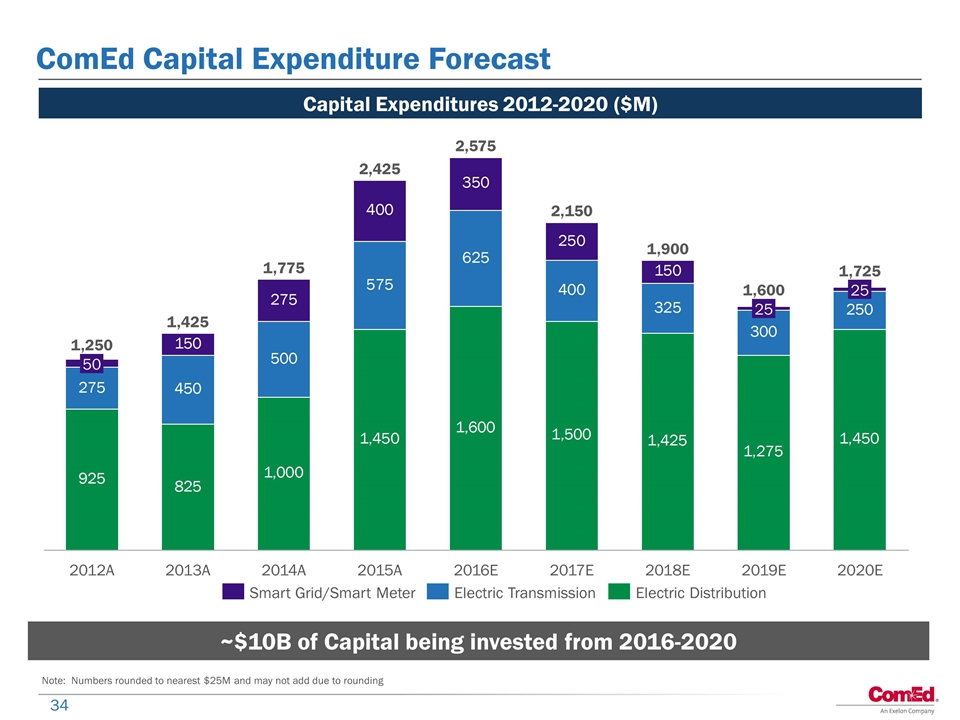

Note: Numbers rounded to nearest $25M and may not add due to rounding ComEd Capital Expenditure Forecast Capital Expenditures 2012-2020 ($M) ~$10B of Capital being invested from 2016-2020

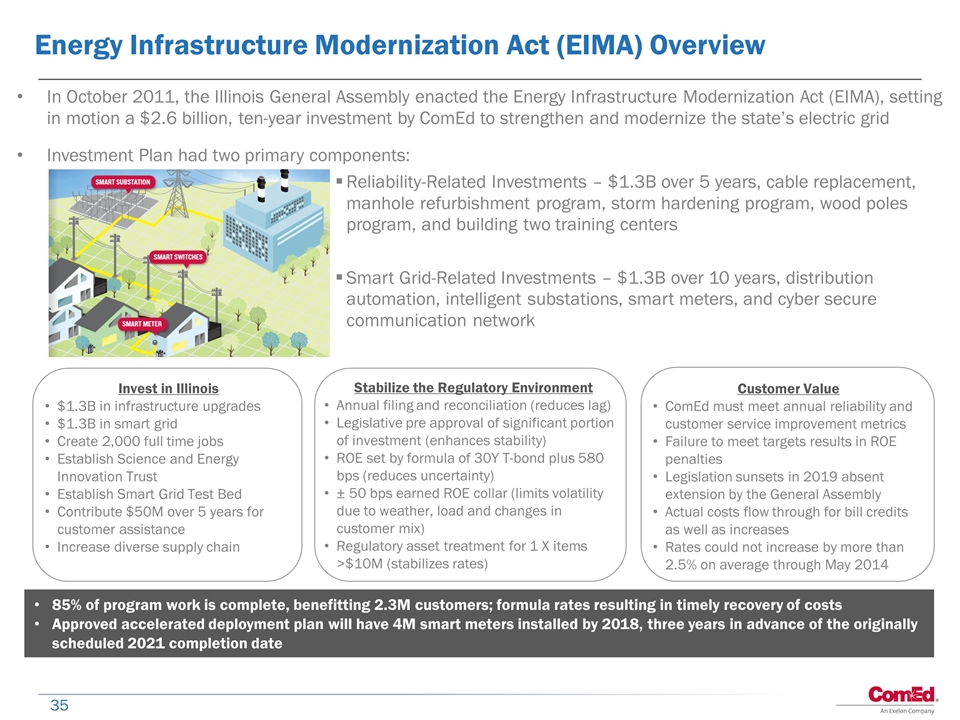

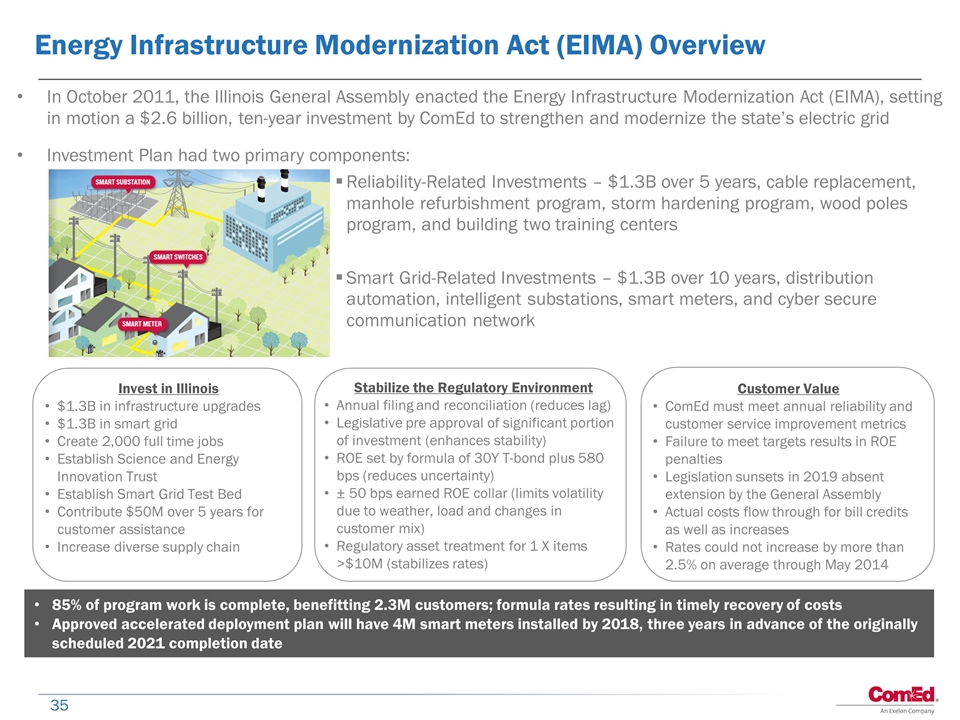

In October 2011, the Illinois General Assembly enacted the Energy Infrastructure Modernization Act (EIMA), setting in motion a $2.6 billion, ten-year investment by ComEd to strengthen and modernize the state’s electric grid Investment Plan had two primary components: Reliability-Related Investments – $1.3B over 5 years, cable replacement, manhole refurbishment program, storm hardening program, wood poles program, and building two training centers Smart Grid-Related Investments – $1.3B over 10 years, distribution automation, intelligent substations, smart meters, and cyber secure communication network Energy Infrastructure Modernization Act (EIMA) Overview 85% of program work is complete, benefitting 2.3M customers; formula rates resulting in timely recovery of costs Approved accelerated deployment plan will have 4M smart meters installed by 2018, three years in advance of the originally scheduled 2021 completion date Invest in Illinois $1.3B in infrastructure upgrades $1.3B in smart grid Create 2,000 full time jobs Establish Science and Energy Innovation Trust Establish Smart Grid Test Bed Contribute $50M over 5 years for customer assistance Increase diverse supply chain Stabilize the Regulatory Environment Annual filing and reconciliation (reduces lag) Legislative pre approval of significant portion of investment (enhances stability) ROE set by formula of 30Y T-bond plus 580 bps (reduces uncertainty) ± 50 bps earned ROE collar (limits volatility due to weather, load and changes in customer mix) Regulatory asset treatment for 1 X items >$10M (stabilizes rates) Customer Value ComEd must meet annual reliability and customer service improvement metrics Failure to meet targets results in ROE penalties Legislation sunsets in 2019 absent extension by the General Assembly Actual costs flow through for bill credits as well as increases Rates could not increase by more than 2.5% on average through May 2014

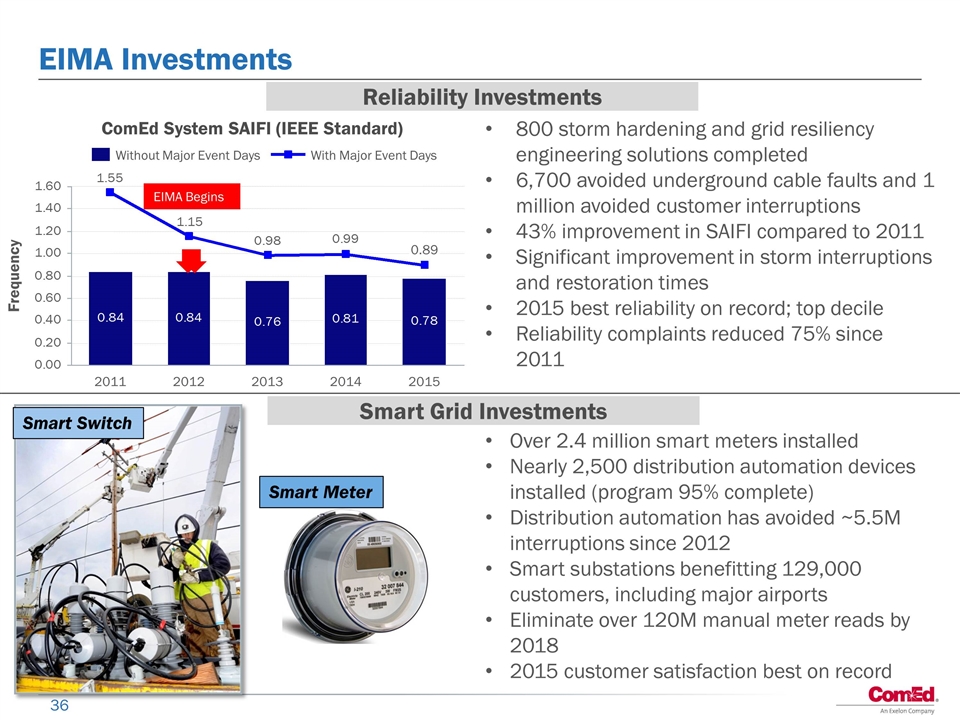

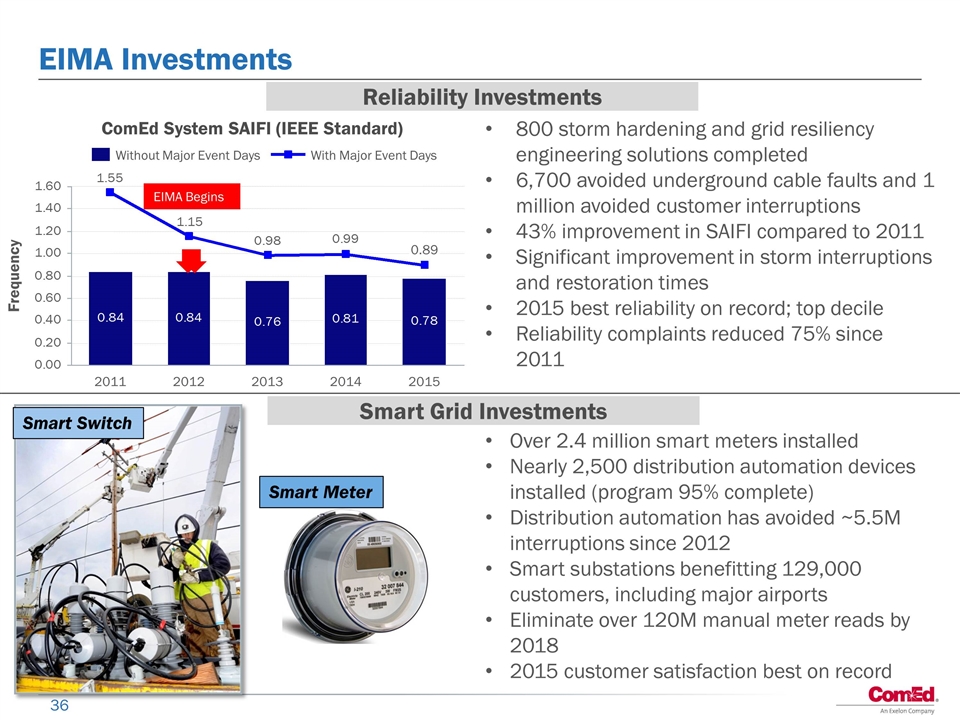

EIMA Investments ComEd System SAIFI (IEEE Standard) Frequency EIMA Begins 800 storm hardening and grid resiliency engineering solutions completed 6,700 avoided underground cable faults and 1 million avoided customer interruptions 43% improvement in SAIFI compared to 2011 Significant improvement in storm interruptions and restoration times 2015 best reliability on record; top decile Reliability complaints reduced 75% since 2011 Reliability Investments EIMA Begins Smart Grid Investments Smart Meter Smart Switch Over 2.4 million smart meters installed Nearly 2,500 distribution automation devices installed (program 95% complete) Distribution automation has avoided ~5.5M interruptions since 2012 Smart substations benefitting 129,000 customers, including major airports Eliminate over 120M manual meter reads by 2018 2015 customer satisfaction best on record

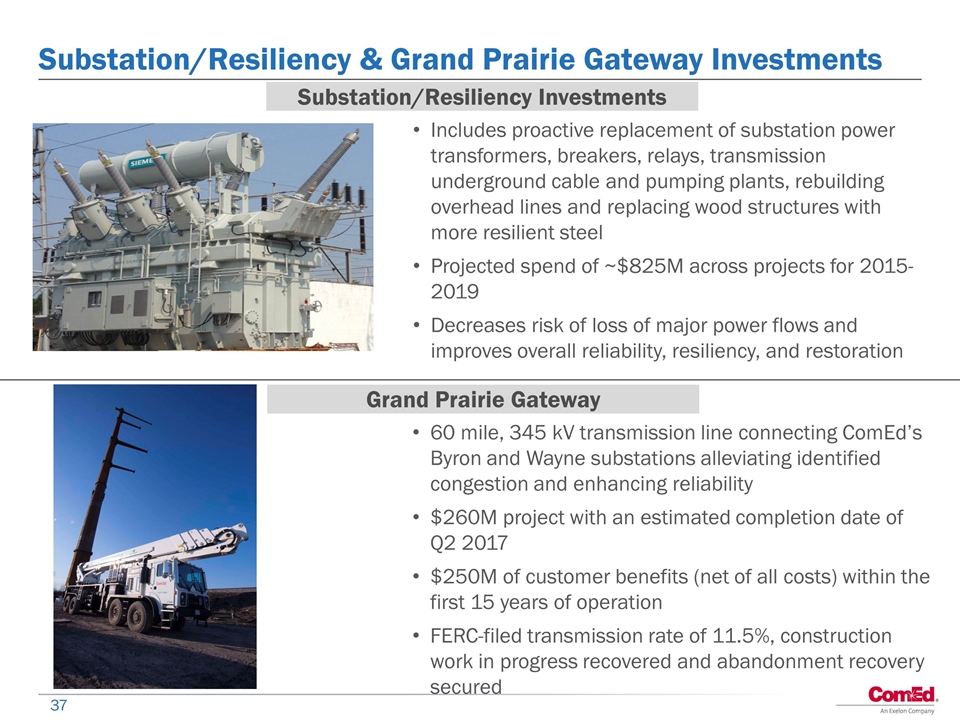

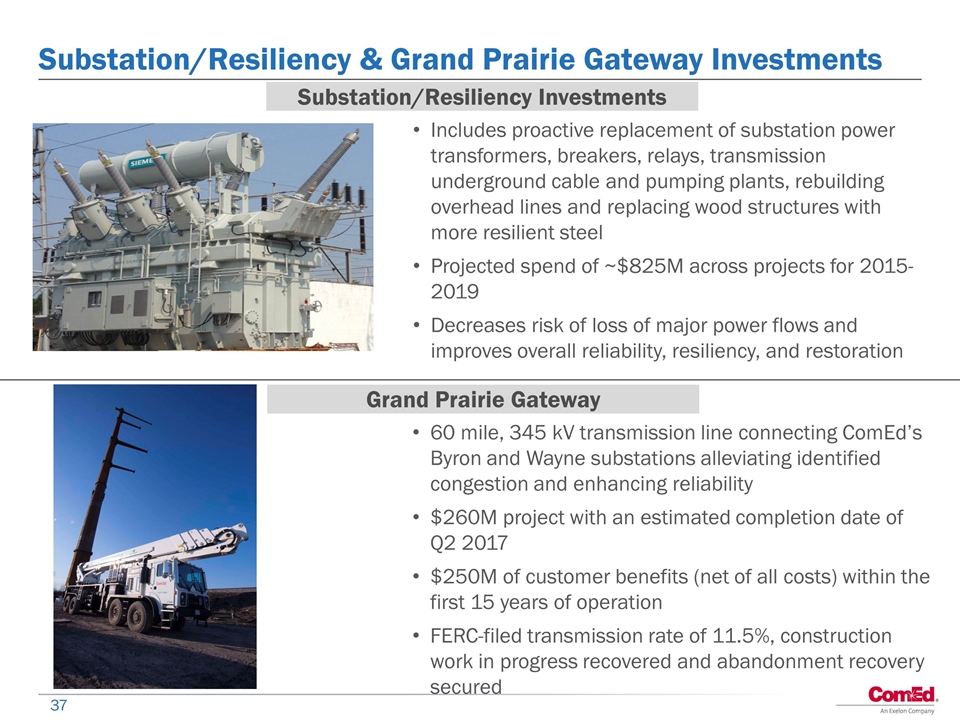

Substation/Resiliency & Grand Prairie Gateway Investments Includes proactive replacement of substation power transformers, breakers, relays, transmission underground cable and pumping plants, rebuilding overhead lines and replacing wood structures with more resilient steel Projected spend of ~$825M across projects for 2015-2019 Decreases risk of loss of major power flows and improves overall reliability, resiliency, and restoration Substation/Resiliency Investments Grand Prairie Gateway 60 mile, 345 kV transmission line connecting ComEd’s Byron and Wayne substations alleviating identified congestion and enhancing reliability $260M project with an estimated completion date of Q2 2017 $250M of customer benefits (net of all costs) within the first 15 years of operation FERC-filed transmission rate of 11.5%, construction work in progress recovered and abandonment recovery secured

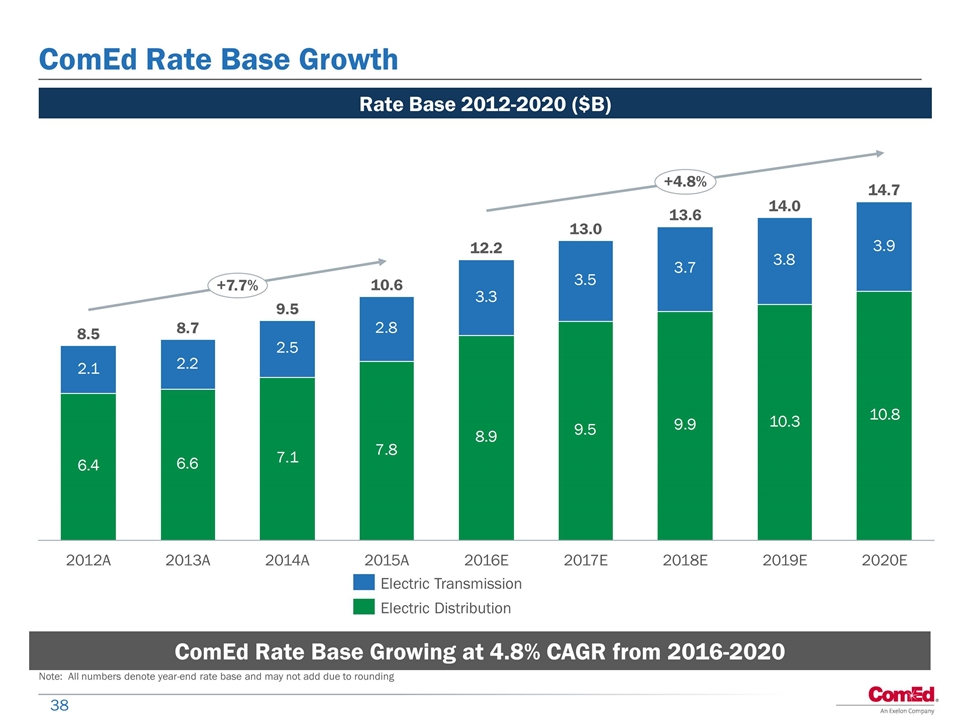

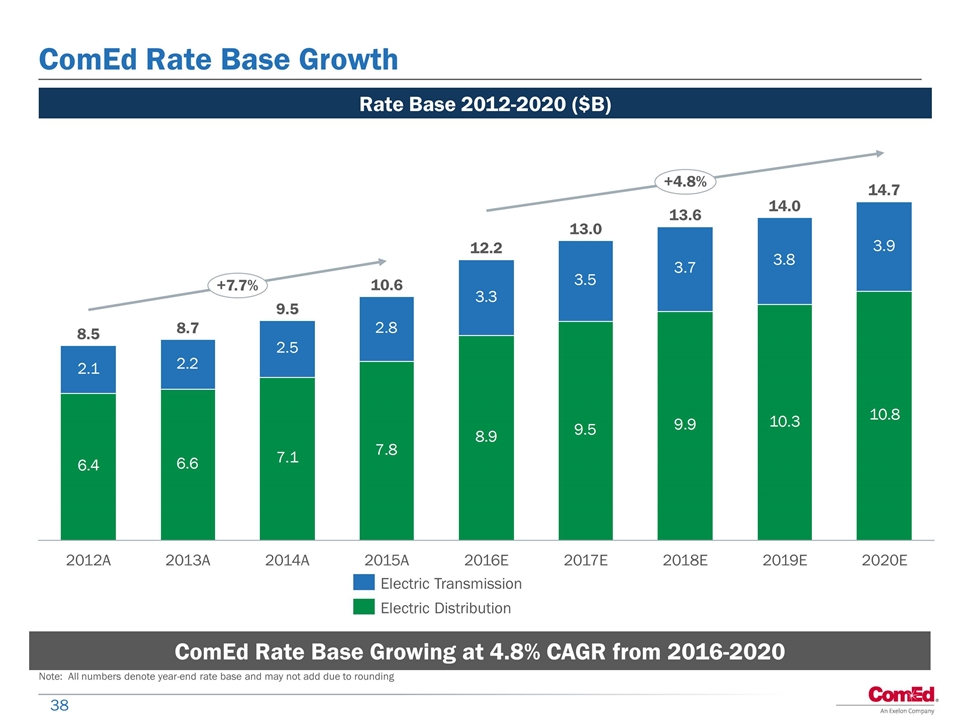

ComEd Rate Base Growth Rate Base 2012-2020 ($B) ComEd Rate Base Growing at 4.8% CAGR from 2016-2020 Note: All numbers denote year-end rate base and may not add due to rounding

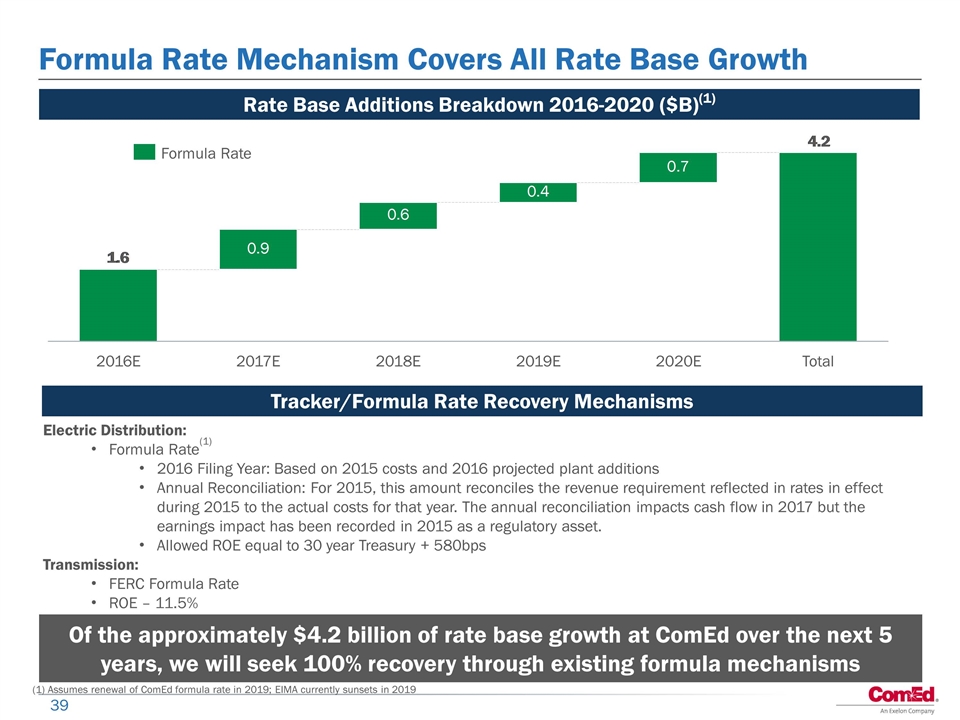

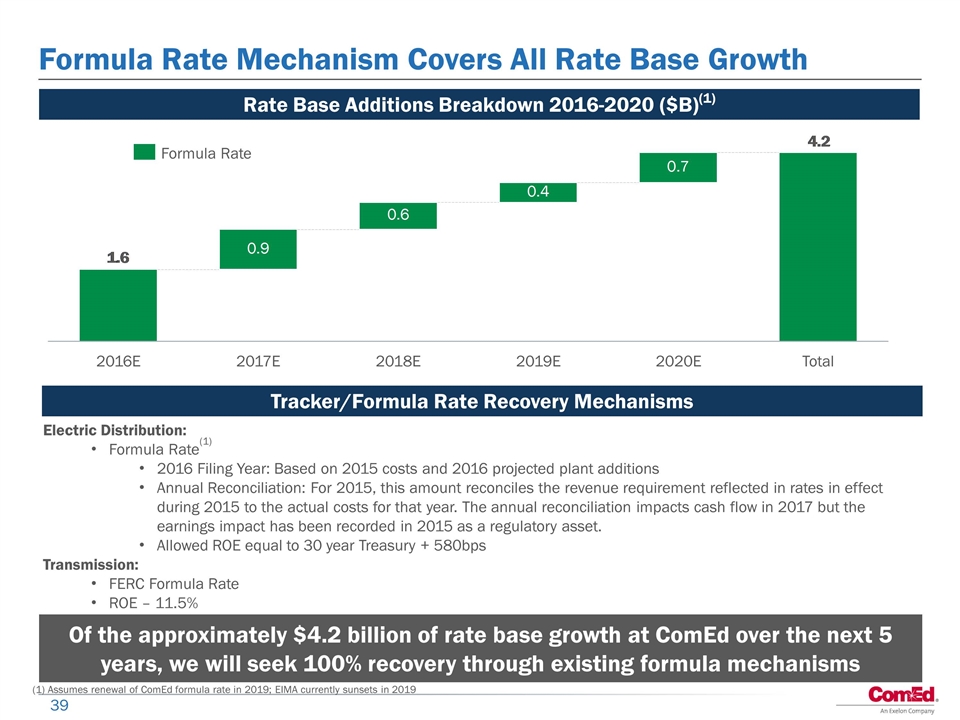

Formula Rate Mechanism Covers All Rate Base Growth Of the approximately $4.2 billion of rate base growth at ComEd over the next 5 years, we will seek 100% recovery through existing formula mechanisms Rate Base Additions Breakdown 2016-2020 ($B)(1) Tracker/Formula Rate Recovery Mechanisms Electric Distribution: Formula Rate(1) 2016 Filing Year: Based on 2015 costs and 2016 projected plant additions Annual Reconciliation: For 2015, this amount reconciles the revenue requirement reflected in rates in effect during 2015 to the actual costs for that year. The annual reconciliation impacts cash flow in 2017 but the earnings impact has been recorded in 2015 as a regulatory asset. Allowed ROE equal to 30 year Treasury + 580bps Transmission: FERC Formula Rate ROE – 11.5% (1) Assumes renewal of ComEd formula rate in 2019; EIMA currently sunsets in 2019

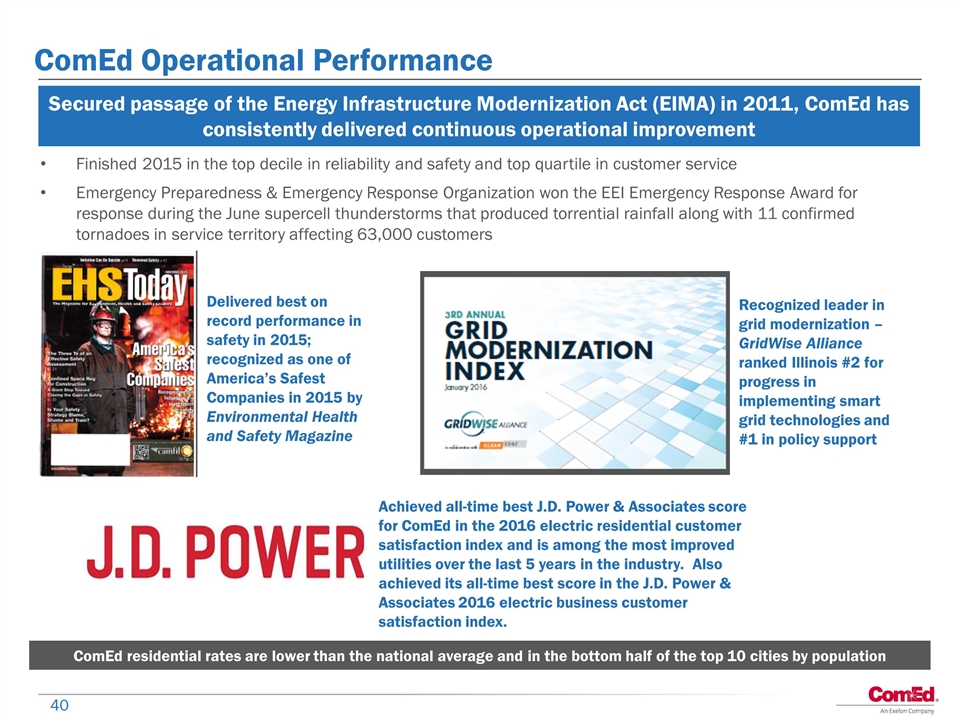

ComEd Operational Performance Secured passage of the Energy Infrastructure Modernization Act (EIMA) in 2011, ComEd has consistently delivered continuous operational improvement Delivered best on record performance in safety in 2015; recognized as one of America’s Safest Companies in 2015 by Environmental Health and Safety Magazine Recognized leader in grid modernization – GridWise Alliance ranked Illinois #2 for progress in implementing smart grid technologies and #1 in policy support Achieved all-time best J.D. Power & Associates score for ComEd in the 2016 electric residential customer satisfaction index and is among the most improved utilities over the last 5 years in the industry. Also achieved its all-time best score in the J.D. Power & Associates 2016 electric business customer satisfaction index. Achieved best-on-record municipal and large customer Finished 2015 in the top decile in reliability and safety and top quartile in customer service Emergency Preparedness & Emergency Response Organization won the EEI Emergency Response Award for response during the June supercell thunderstorms that produced torrential rainfall along with 11 confirmed tornadoes in service territory affecting 63,000 customers ComEd residential rates are lower than the national average and in the bottom half of the top 10 cities by population

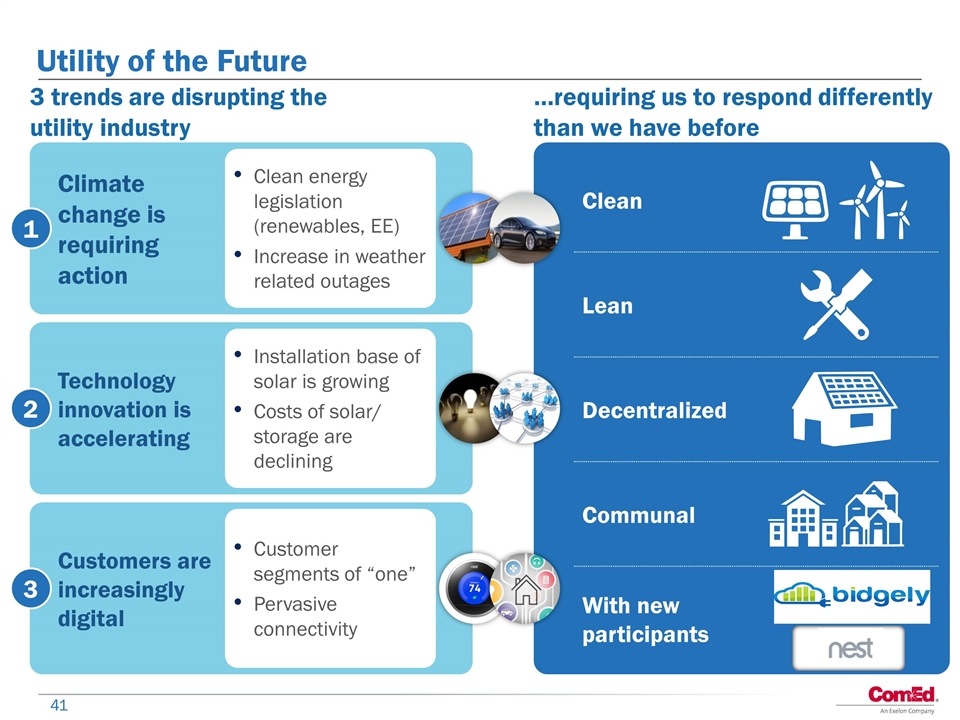

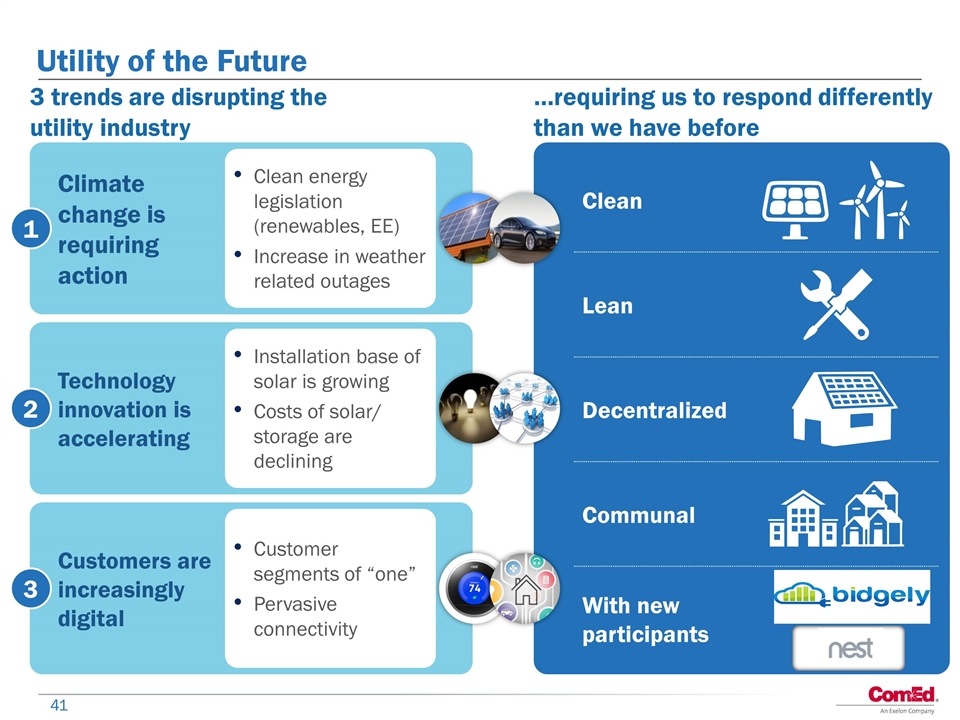

Utility of the Future 1 2 3 Customers are increasingly digital Climate change is requiring action Technology innovation is accelerating Customer segments of “one” Pervasive connectivity Installation base of solar is growing Costs of solar/ storage are declining Clean energy legislation (renewables, EE) Increase in weather related outages 3 trends are disrupting the utility industry …requiring us to respond differently than we have before Lean Decentralized Communal With new participants Clean

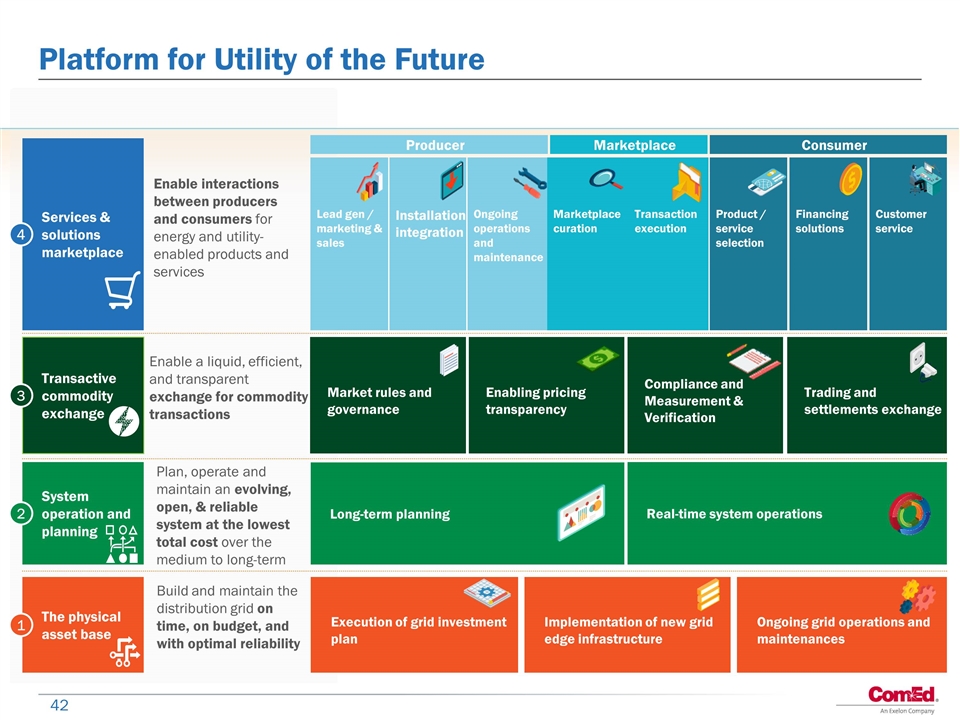

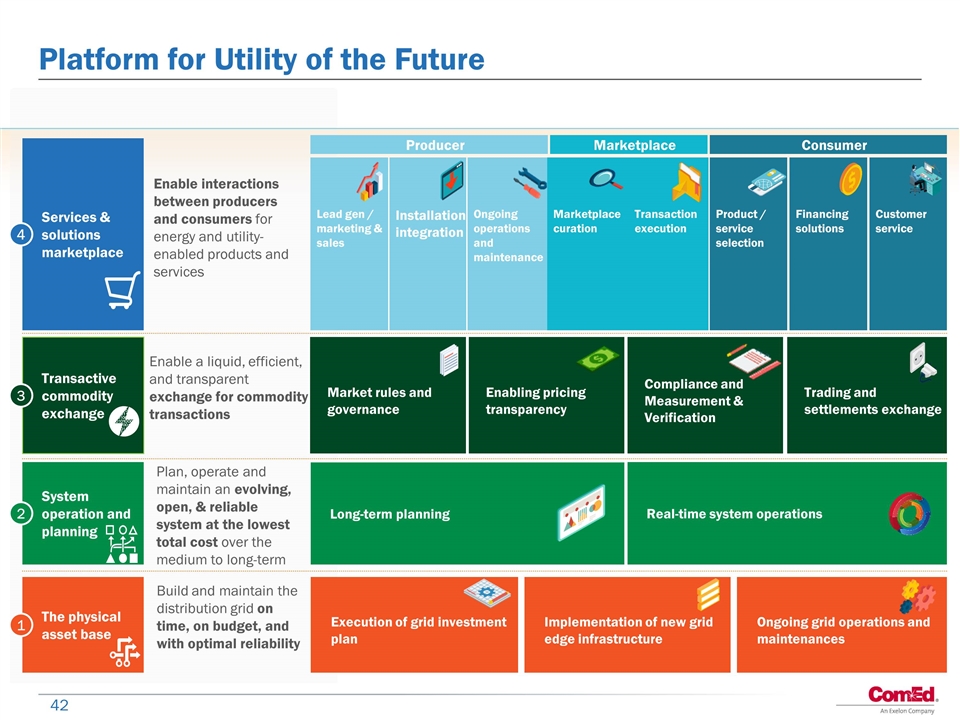

Build and maintain the distribution grid on time, on budget, and with optimal reliability Enable a liquid, efficient, and transparent exchange for commodity transactions Transactive commodity exchange Plan, operate and maintain an evolving, open, & reliable system at the lowest total cost over the medium to long-term System operation and planning Enable interactions between producers and consumers for energy and utility-enabled products and services Services & solutions marketplace The physical asset base 1 3 2 4 Installation integration Ongoing operations and maintenance Marketplace curation Transaction execution Product / service selection Financing solutions Customer service Lead gen / marketing & sales Producer Marketplace Consumer Enabling pricing transparency Compliance and Measurement & Verification Market rules and governance Trading and settlements exchange Long-term planning Real-time system operations Execution of grid investment plan Implementation of new grid edge infrastructure Ongoing grid operations and maintenances Platform for Utility of the Future

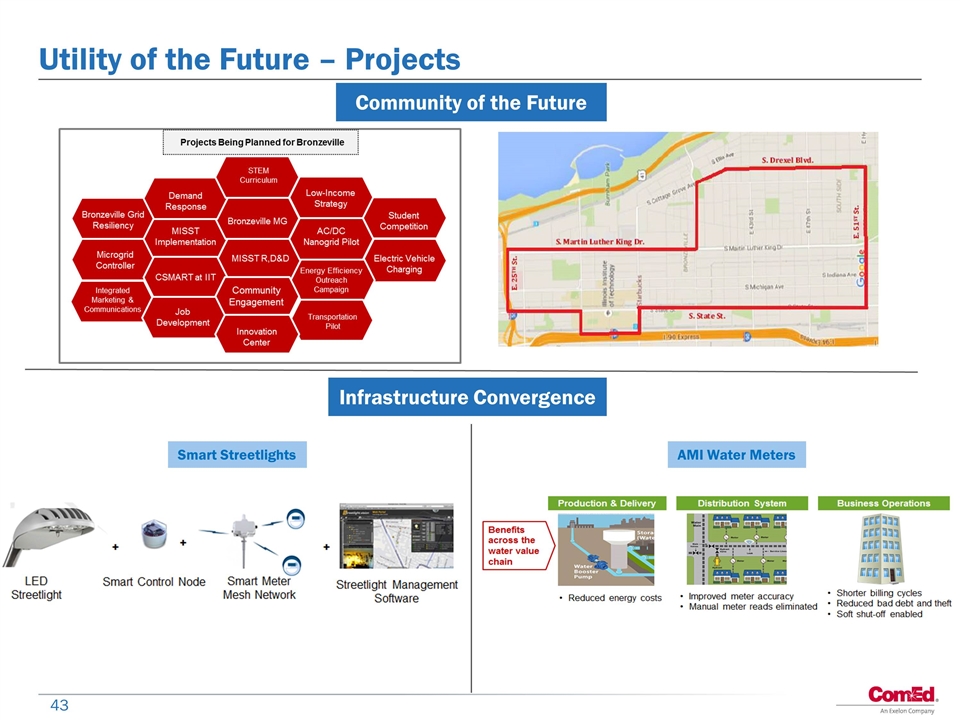

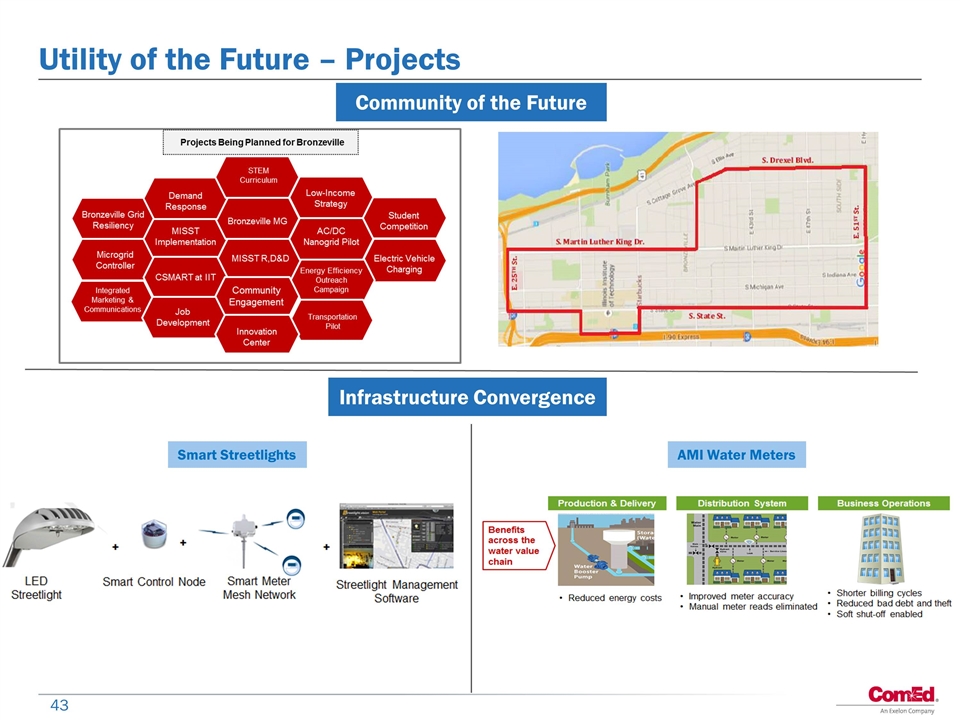

Utility of the Future – Projects Community of the Future Infrastructure Convergence AMI Water Meters Smart Streetlights

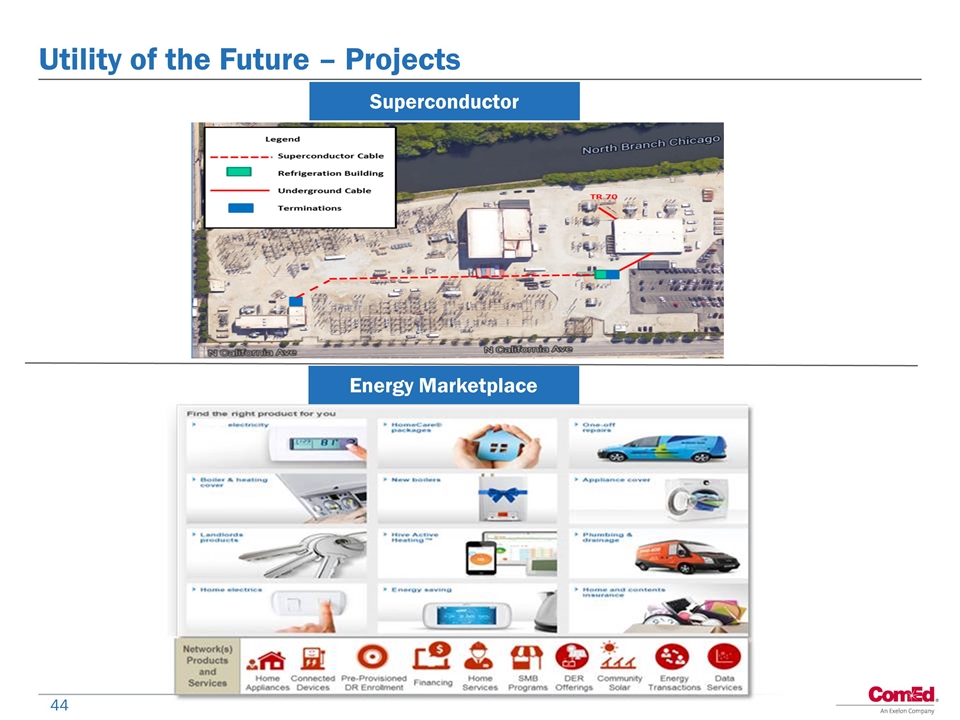

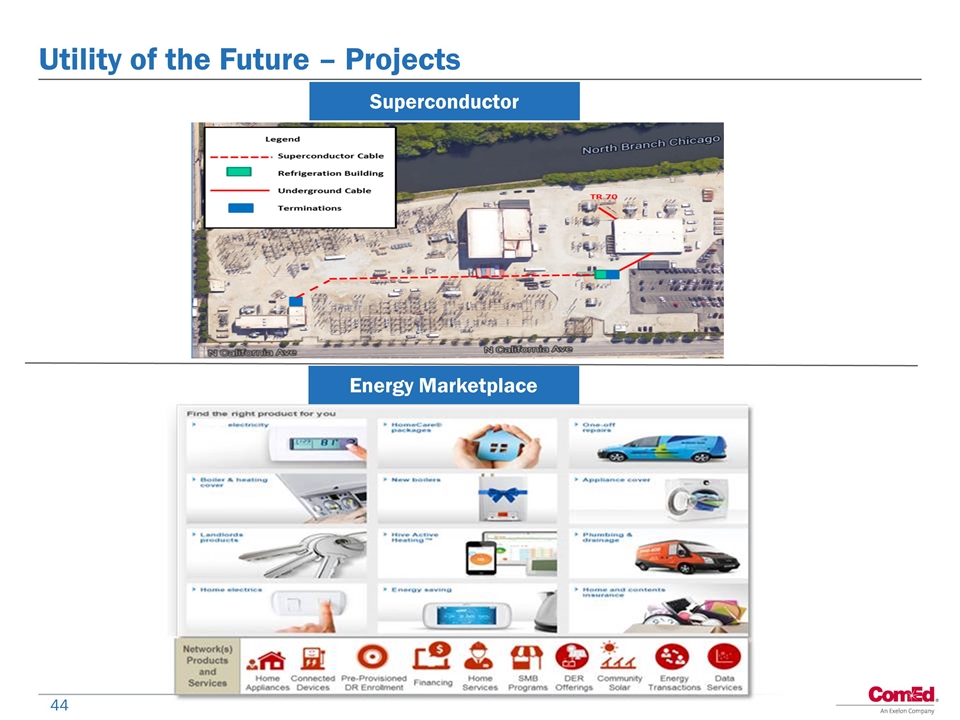

Utility of the Future – Projects Superconductor Energy Marketplace

BGE Calvin Butler Chief Executive Officer, BGE

BGE Overview Note: Rate base number denotes year-end

BGE celebrated its 200th anniversary as the first gas utility in the country and our continued position as an innovator and regional force

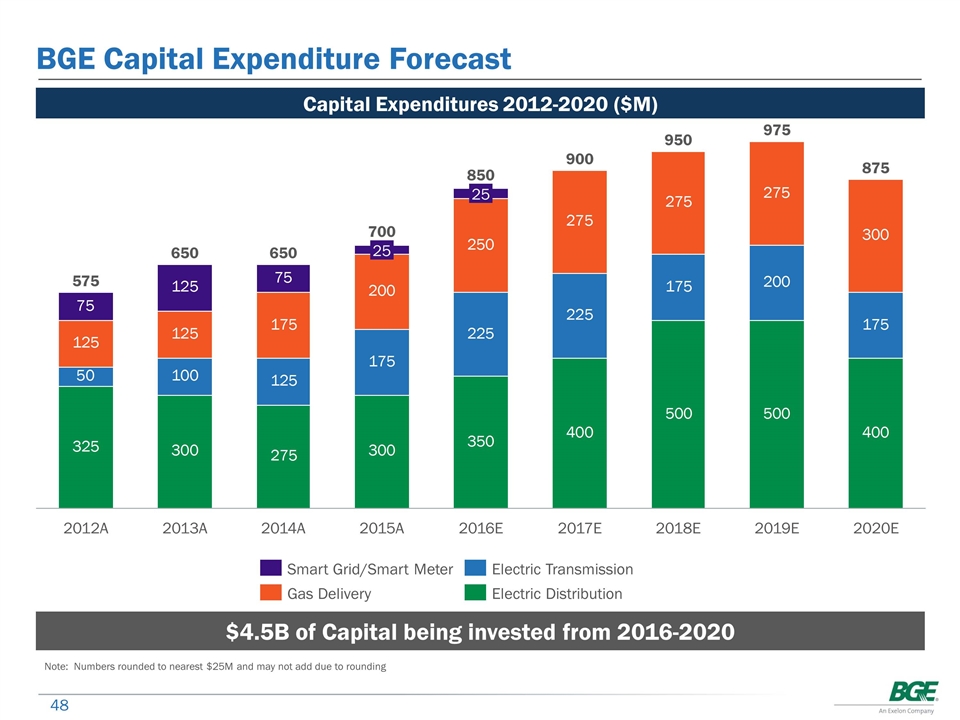

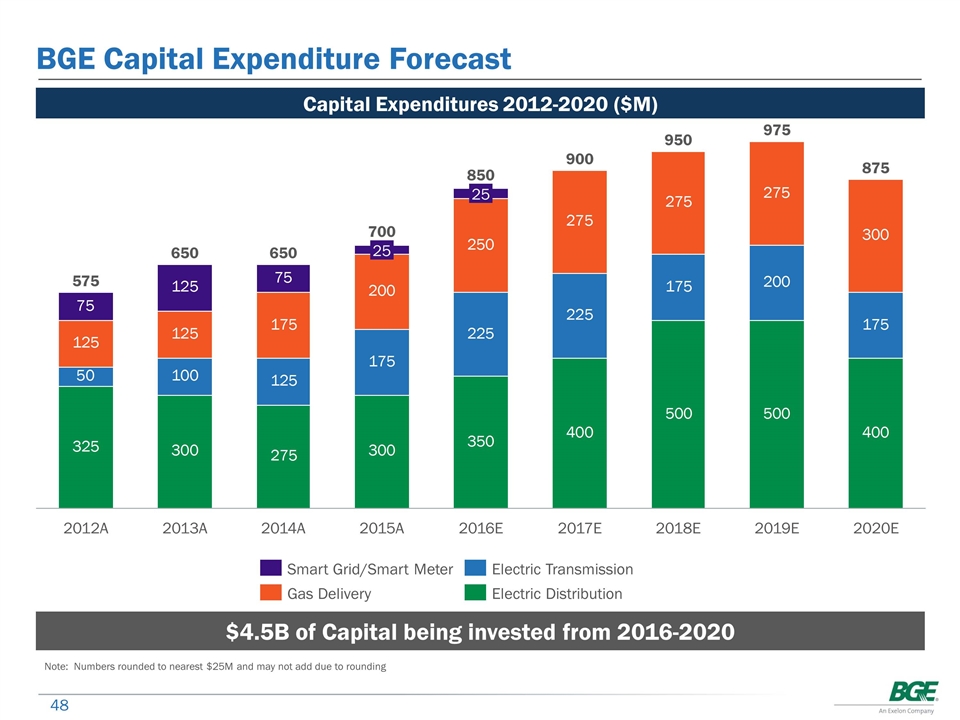

Note: Numbers rounded to nearest $25M and may not add due to rounding BGE Capital Expenditure Forecast Capital Expenditures 2012-2020 ($M) $4.5B of Capital being invested from 2016-2020

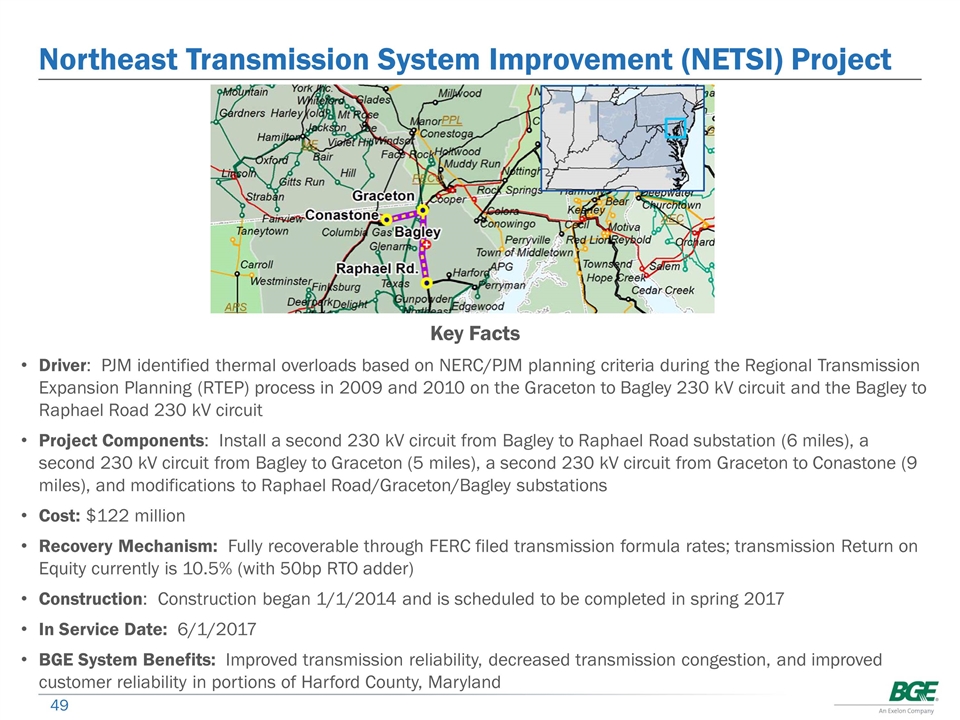

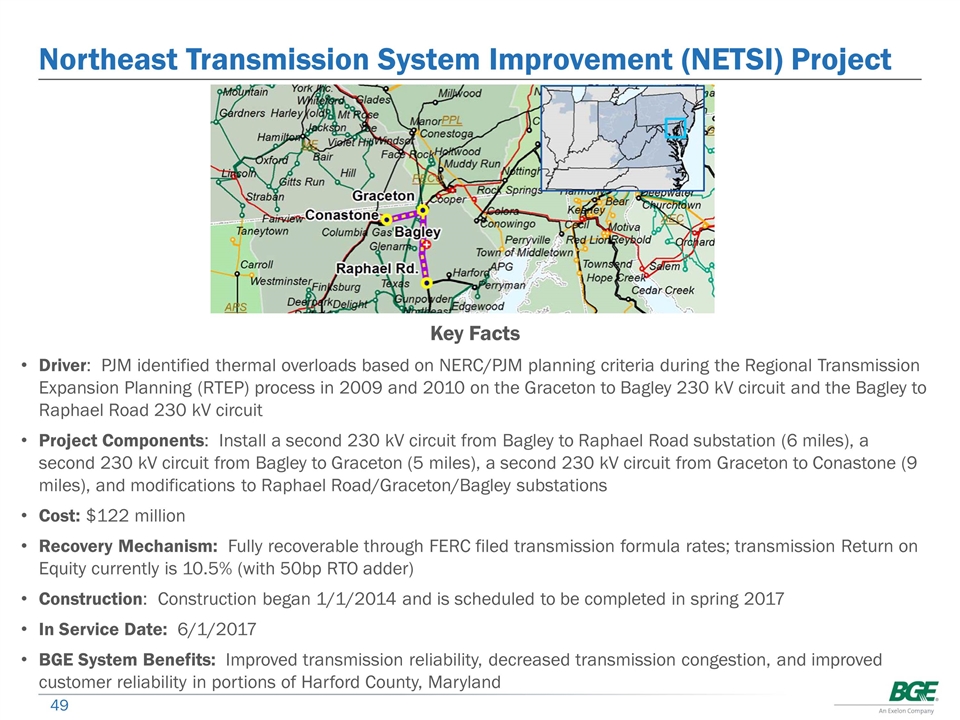

Northeast Transmission System Improvement (NETSI) Project Key Facts Driver: PJM identified thermal overloads based on NERC/PJM planning criteria during the Regional Transmission Expansion Planning (RTEP) process in 2009 and 2010 on the Graceton to Bagley 230 kV circuit and the Bagley to Raphael Road 230 kV circuit Project Components: Install a second 230 kV circuit from Bagley to Raphael Road substation (6 miles), a second 230 kV circuit from Bagley to Graceton (5 miles), a second 230 kV circuit from Graceton to Conastone (9 miles), and modifications to Raphael Road/Graceton/Bagley substations Cost: $122 million Recovery Mechanism: Fully recoverable through FERC filed transmission formula rates; transmission Return on Equity currently is 10.5% (with 50bp RTO adder) Construction: Construction began 1/1/2014 and is scheduled to be completed in spring 2017 In Service Date: 6/1/2017 BGE System Benefits: Improved transmission reliability, decreased transmission congestion, and improved customer reliability in portions of Harford County, Maryland

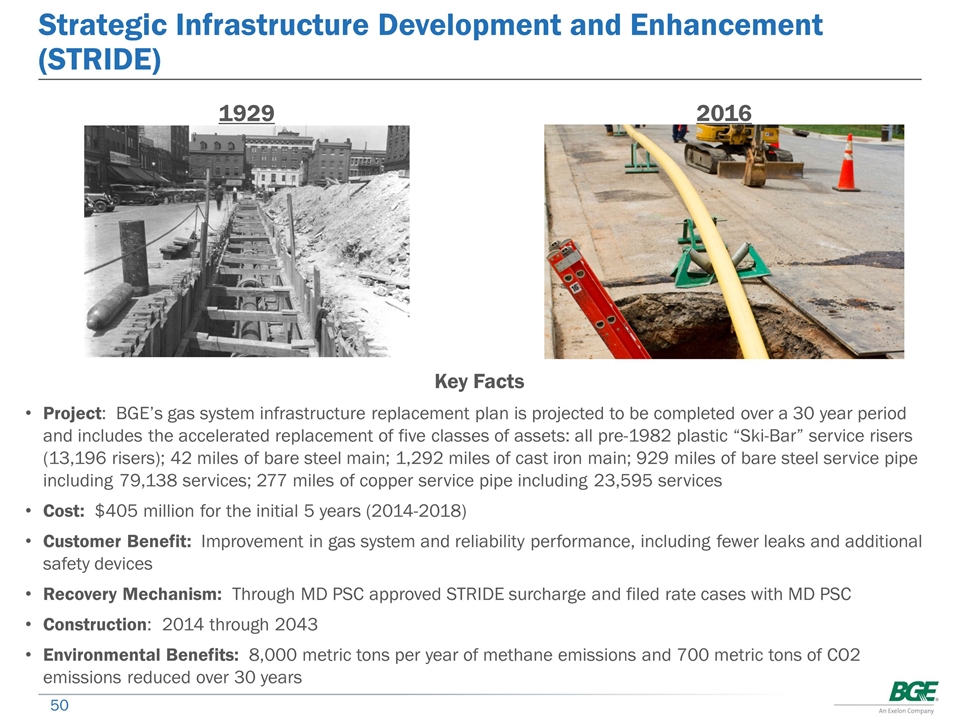

Strategic Infrastructure Development and Enhancement (STRIDE) Key Facts Project: BGE’s gas system infrastructure replacement plan is projected to be completed over a 30 year period and includes the accelerated replacement of five classes of assets: all pre-1982 plastic “Ski-Bar” service risers (13,196 risers); 42 miles of bare steel main; 1,292 miles of cast iron main; 929 miles of bare steel service pipe including 79,138 services; 277 miles of copper service pipe including 23,595 services Cost: $405 million for the initial 5 years (2014-2018) Customer Benefit: Improvement in gas system and reliability performance, including fewer leaks and additional safety devices Recovery Mechanism: Through MD PSC approved STRIDE surcharge and filed rate cases with MD PSC Construction: 2014 through 2043 Environmental Benefits: 8,000 metric tons per year of methane emissions and 700 metric tons of CO2 emissions reduced over 30 years 1929 2016

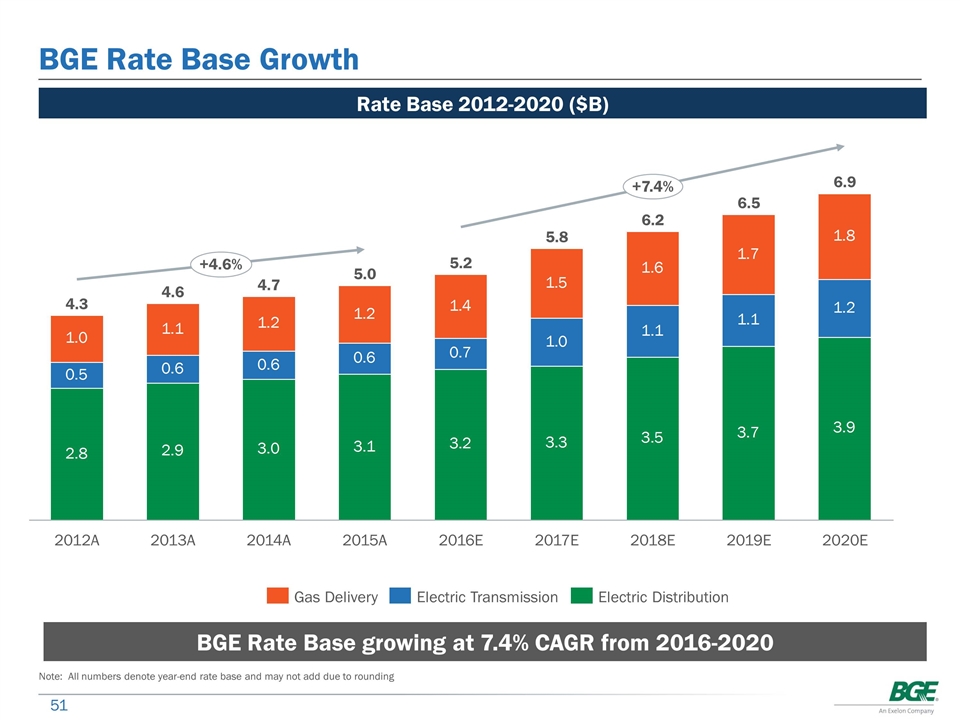

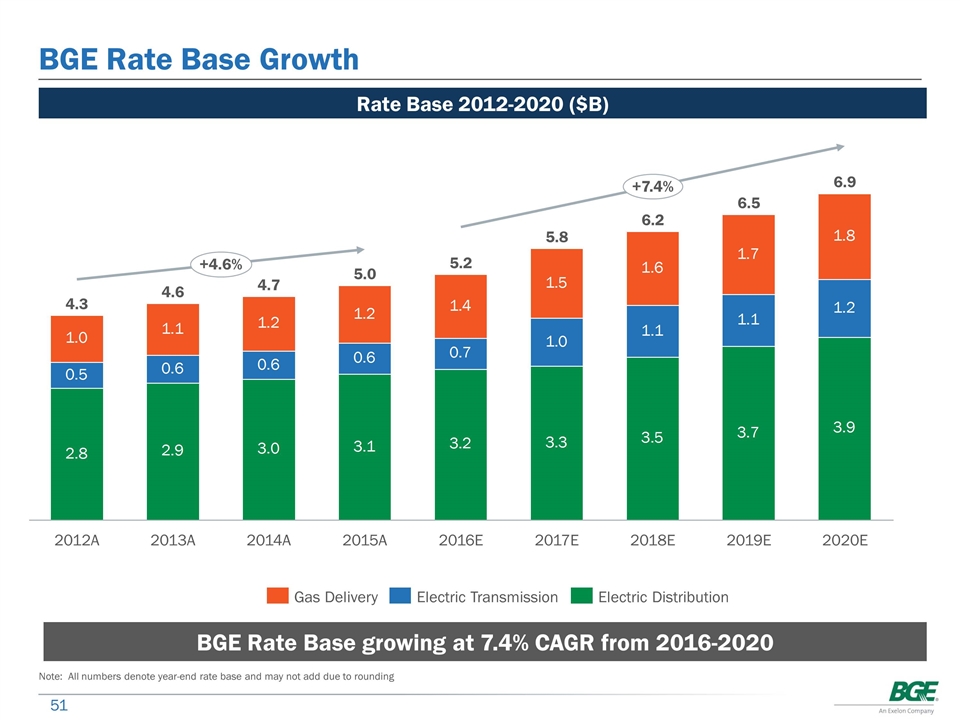

BGE Rate Base Growth Rate Base 2012-2020 ($B) BGE Rate Base growing at 7.4% CAGR from 2016-2020 6.2 Note: All numbers denote year-end rate base and may not add due to rounding

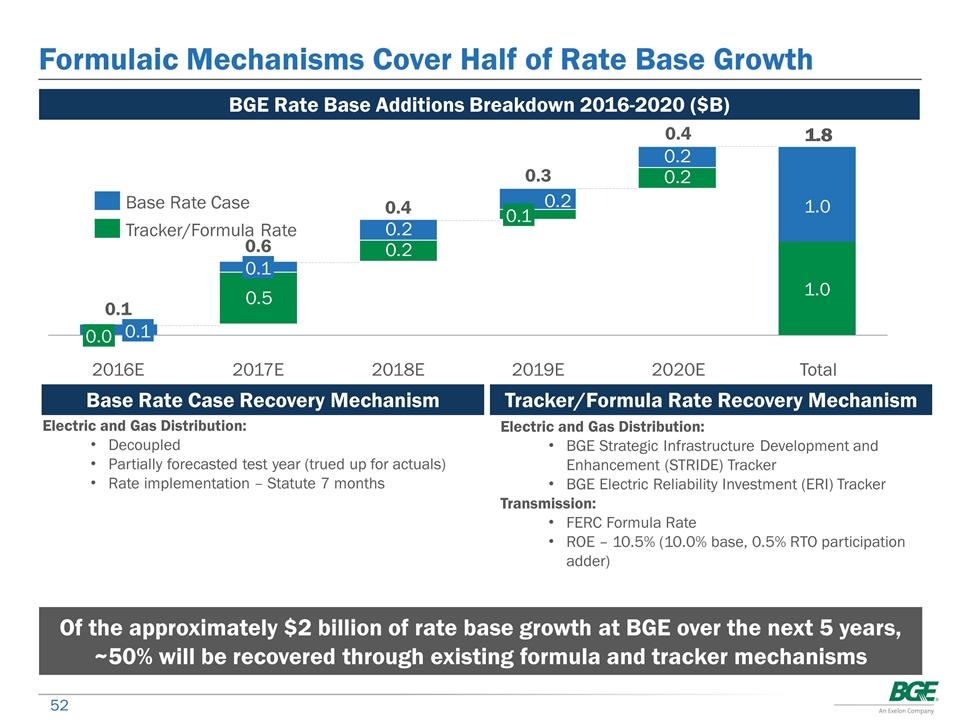

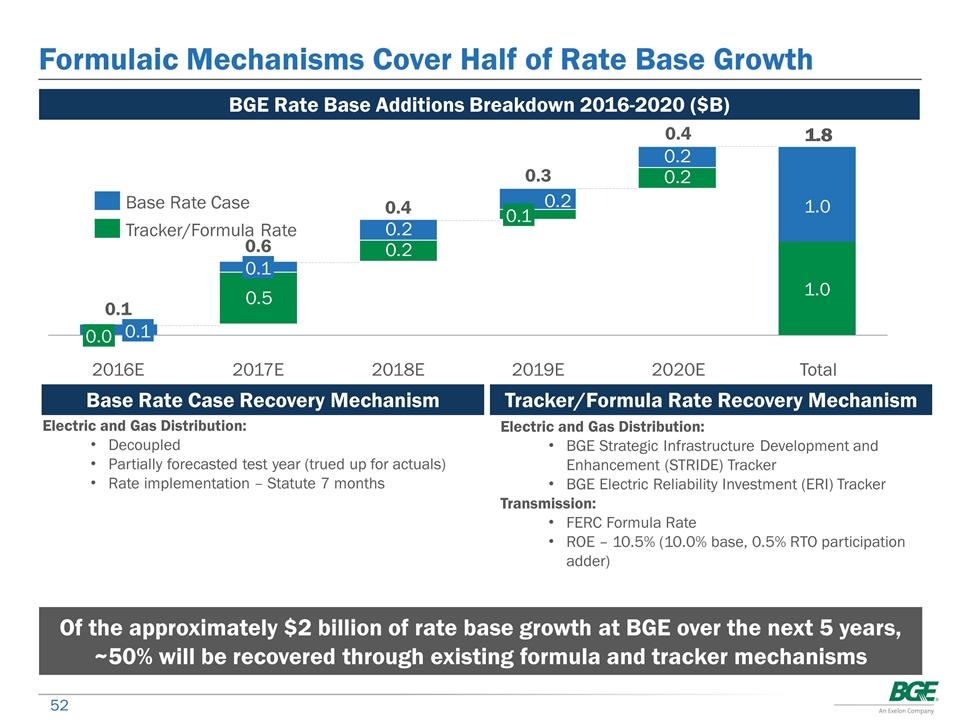

Formulaic Mechanisms Cover Half of Rate Base Growth Of the approximately $2 billion of rate base growth at BGE over the next 5 years, ~50% will be recovered through existing formula and tracker mechanisms BGE Rate Base Additions Breakdown 2016-2020 ($B) 1.0 1.0 Base Rate Case Recovery Mechanism Electric and Gas Distribution: Decoupled Partially forecasted test year (trued up for actuals) Rate implementation – Statute 7 months Electric and Gas Distribution: BGE Strategic Infrastructure Development and Enhancement (STRIDE) Tracker BGE Electric Reliability Investment (ERI) Tracker Transmission: FERC Formula Rate ROE – 10.5% (10.0% base, 0.5% RTO participation adder) Tracker/Formula Rate Recovery Mechanism

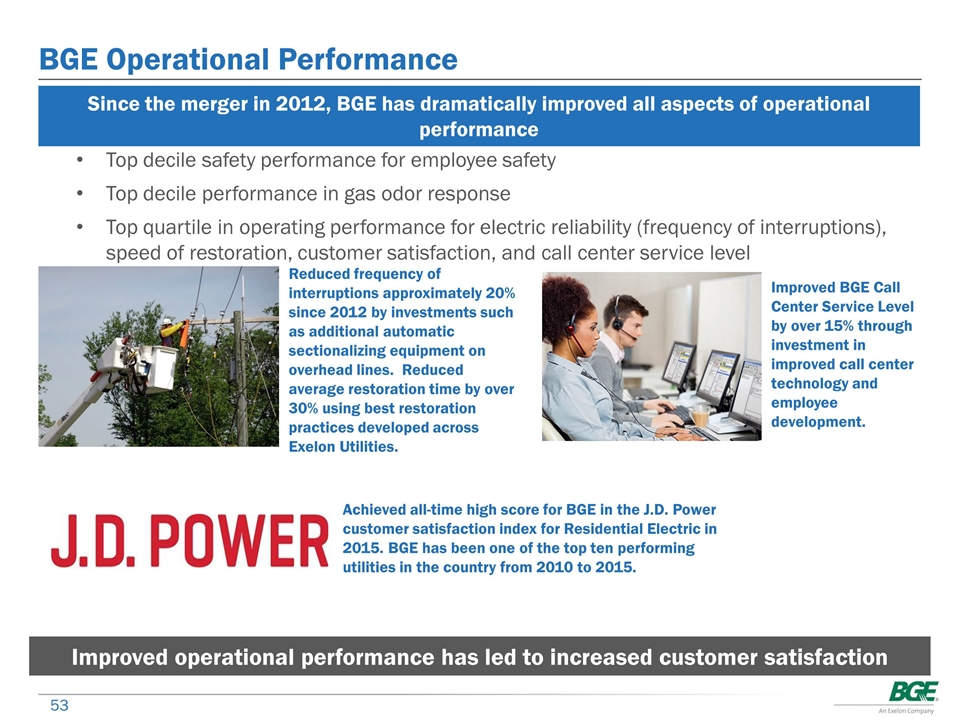

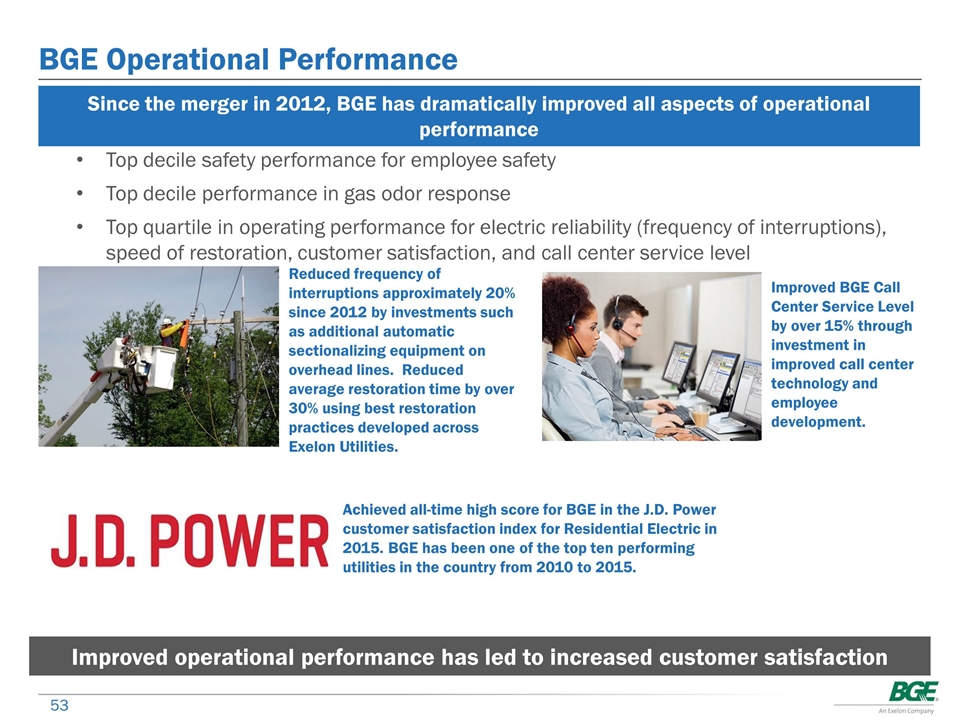

BGE Operational Performance Since the merger in 2012, BGE has dramatically improved all aspects of operational performance Top decile safety performance for employee safety Top decile performance in gas odor response Top quartile in operating performance for electric reliability (frequency of interruptions), speed of restoration, customer satisfaction, and call center service level Achieved all-time high score for BGE in the J.D. Power customer satisfaction index for Residential Electric in 2015. BGE has been one of the top ten performing utilities in the country from 2010 to 2015. Reduced frequency of interruptions approximately 20% since 2012 by investments such as additional automatic sectionalizing equipment on overhead lines. Reduced average restoration time by over 30% using best restoration practices developed across Exelon Utilities. Improved BGE Call Center Service Level by over 15% through investment in improved call center technology and employee development. Improved operational performance has led to increased customer satisfaction

PECO Craig Adams President & Chief Executive Officer, PECO

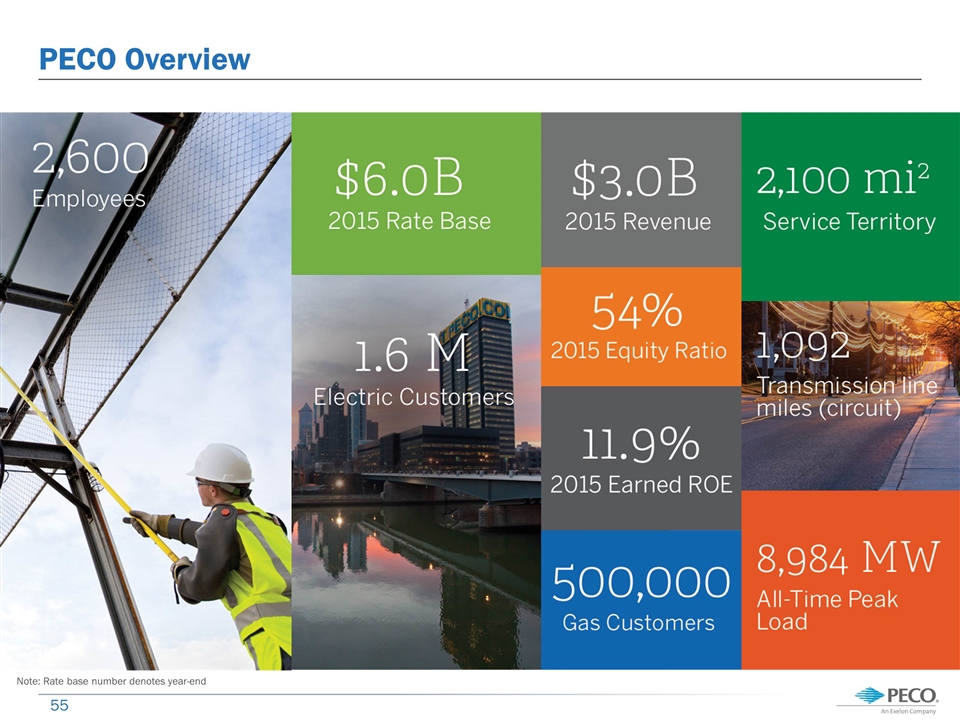

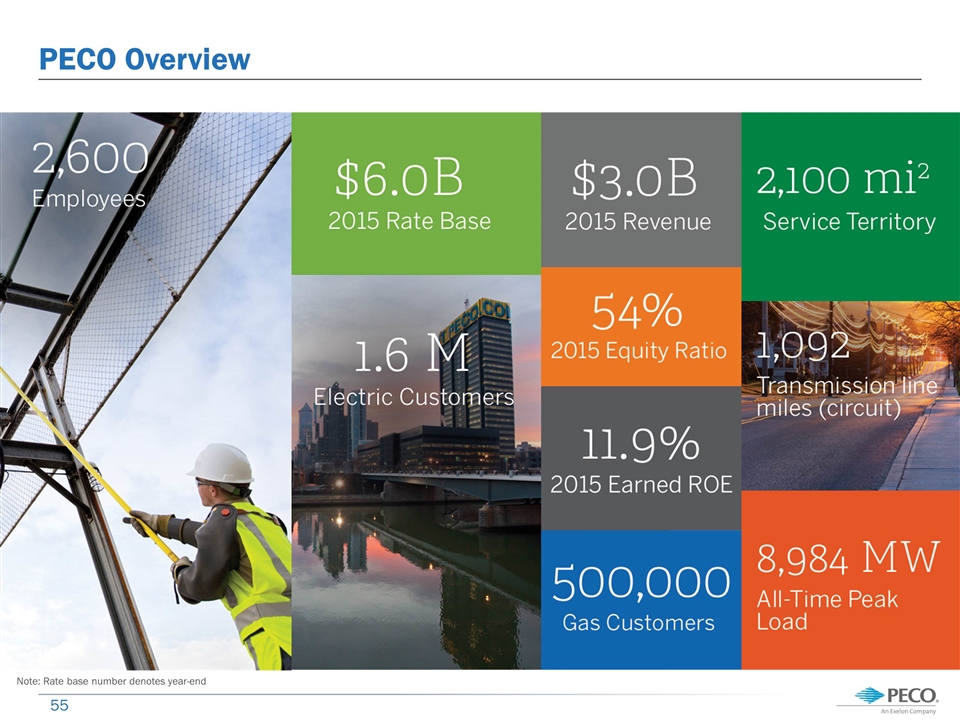

PECO Overview Note: Rate base number denotes year-end

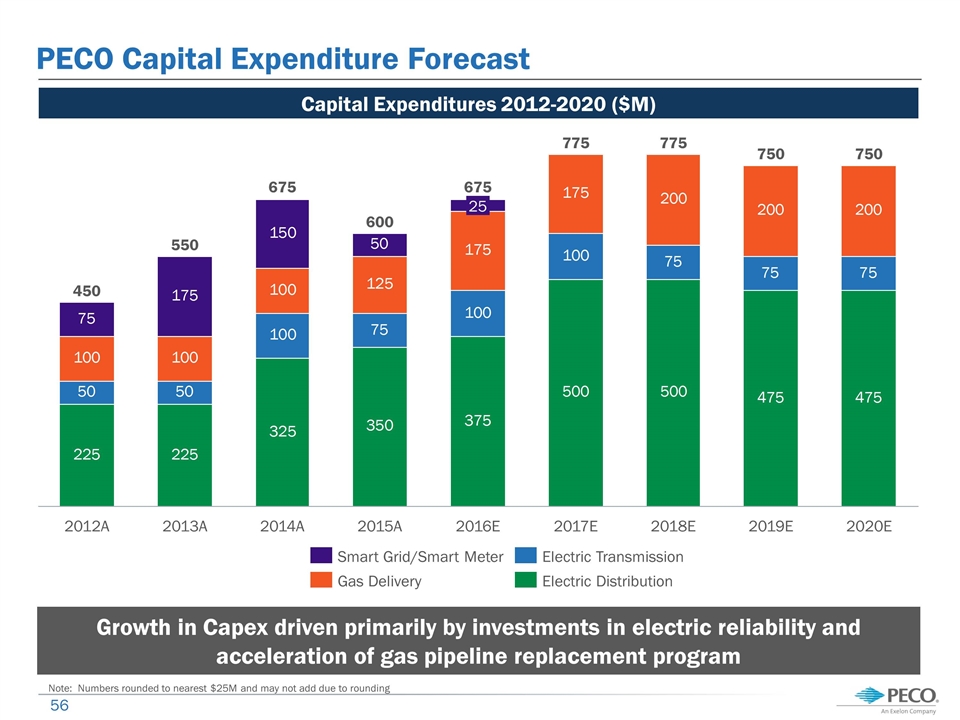

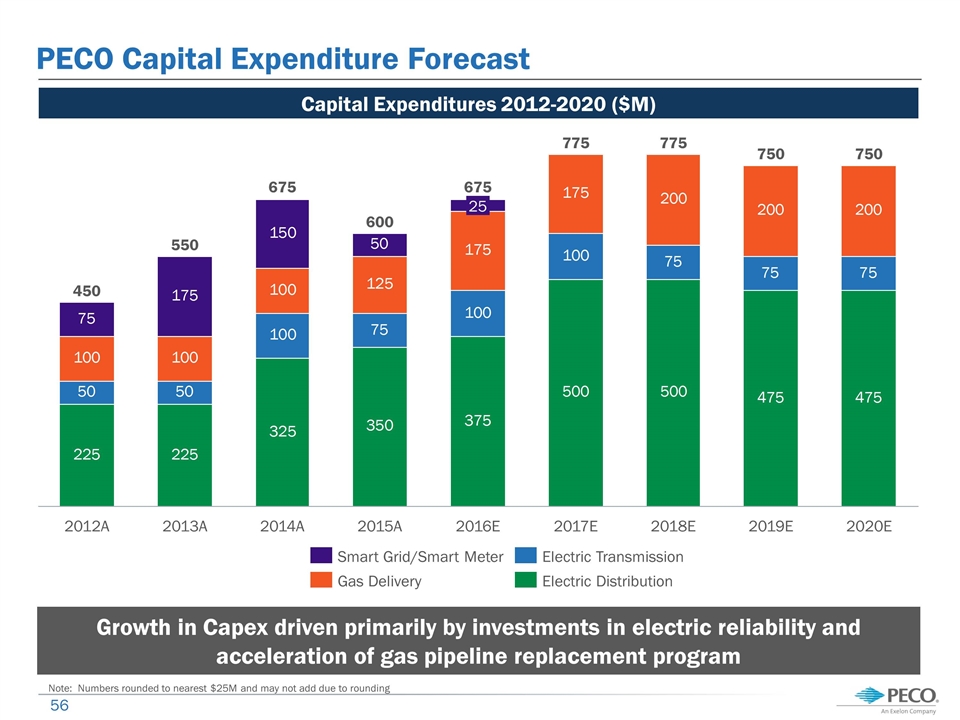

Note: Numbers rounded to nearest $25M PECO Capital Expenditure Forecast Capital Expenditures 2012-2020 ($M) Growth in Capex driven primarily by investments in electric reliability and acceleration of gas pipeline replacement program Note: Numbers rounded to nearest $25M and may not add due to rounding

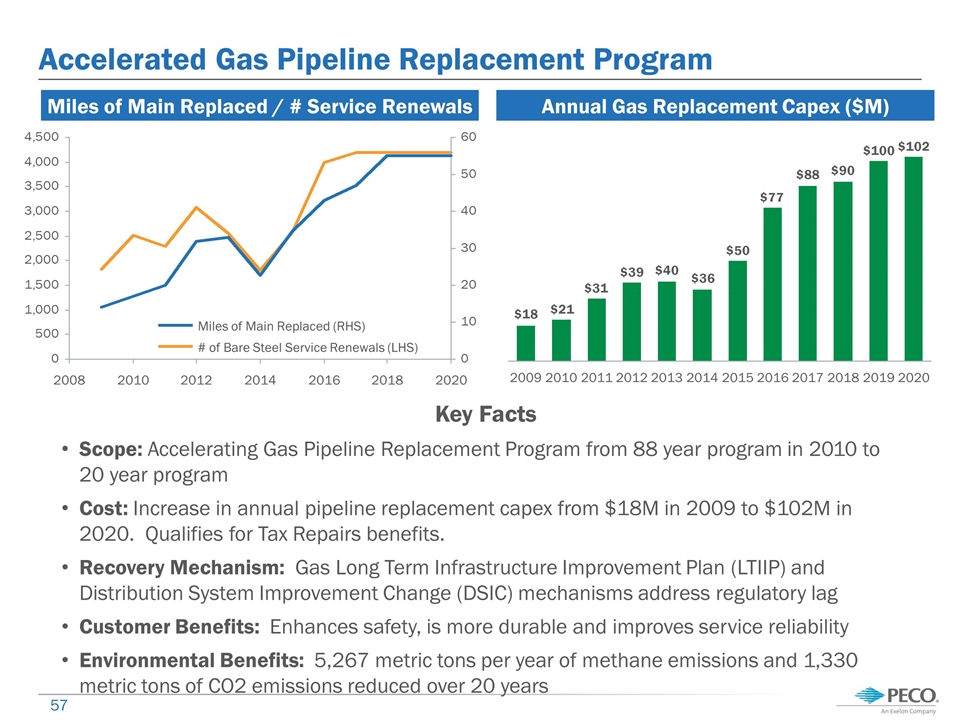

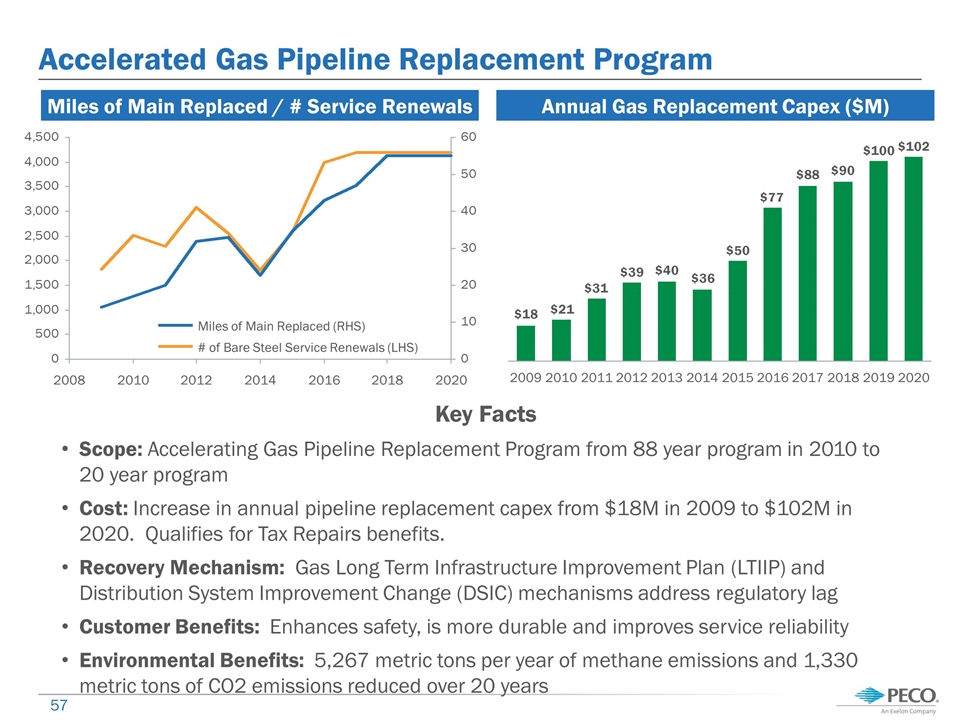

Accelerated Gas Pipeline Replacement Program Key Facts Scope: Accelerating Gas Pipeline Replacement Program from 88 year program in 2010 to 20 year program Cost: Increase in annual pipeline replacement capex from $18M in 2009 to $102M in 2020. Qualifies for Tax Repairs benefits. Recovery Mechanism: Gas Long Term Infrastructure Improvement Plan (LTIIP) and Distribution System Improvement Change (DSIC) mechanisms address regulatory lag Customer Benefits: Enhances safety, is more durable and improves service reliability Environmental Benefits: 5,267 metric tons per year of methane emissions and 1,330 metric tons of CO2 emissions reduced over 20 years Miles of Main Replaced / # Service Renewals Annual Gas Replacement Capex ($M)

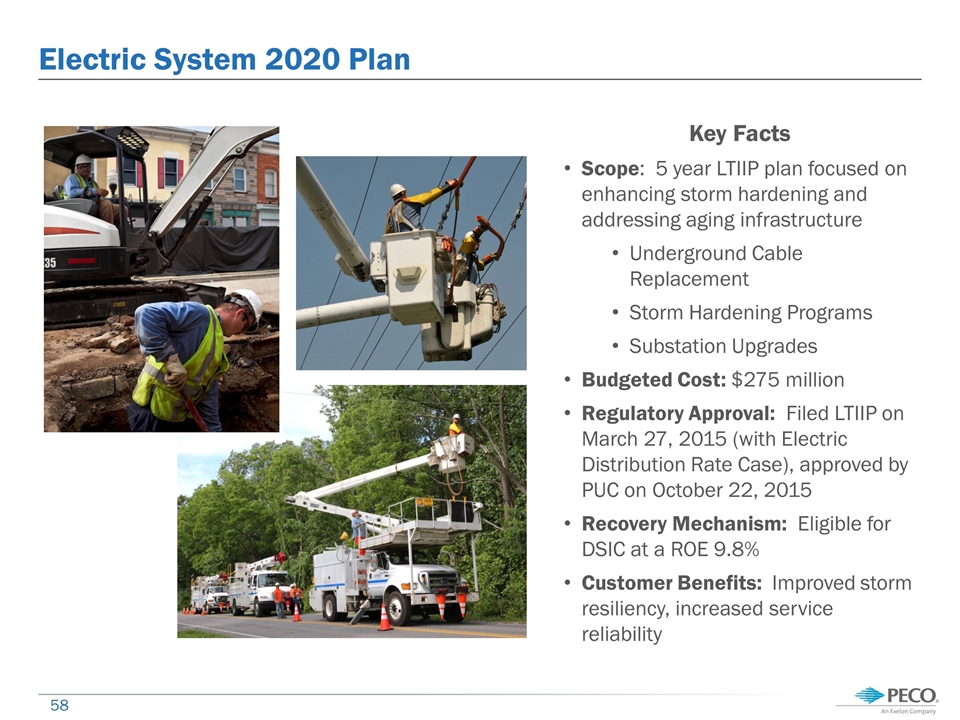

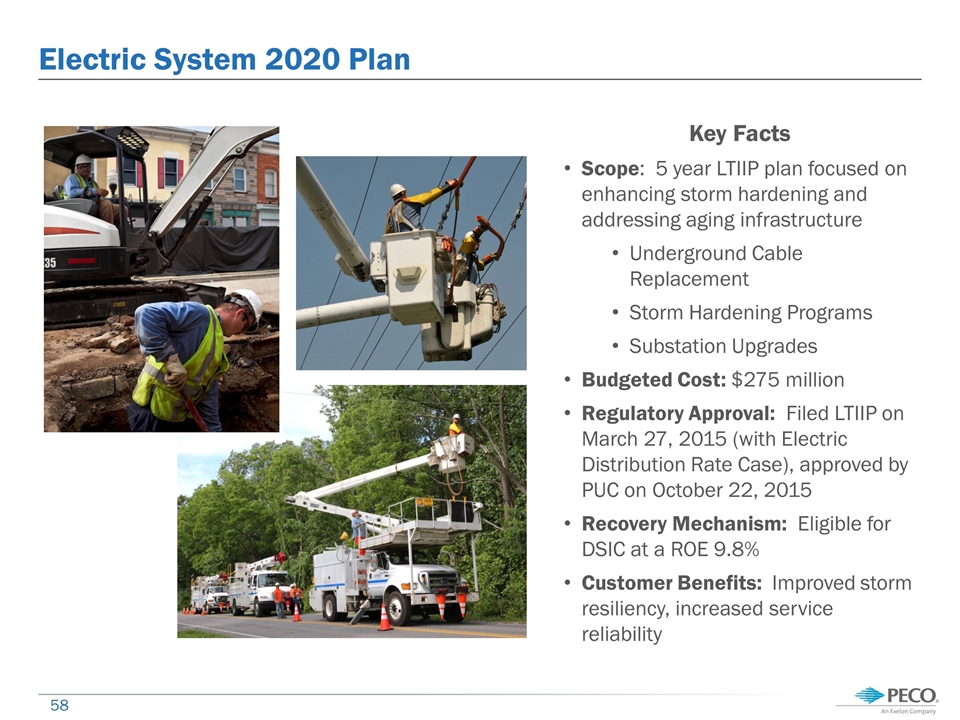

Electric System 2020 Plan Key Facts Scope: 5 year LTIIP plan focused on enhancing storm hardening and addressing aging infrastructure Underground Cable Replacement Storm Hardening Programs Substation Upgrades Budgeted Cost: $275 million Regulatory Approval: Filed LTIIP on March 27, 2015 (with Electric Distribution Rate Case), approved by PUC on October 22, 2015 Recovery Mechanism: Eligible for DSIC at a ROE 9.8% Customer Benefits: Improved storm resiliency, increased service reliability

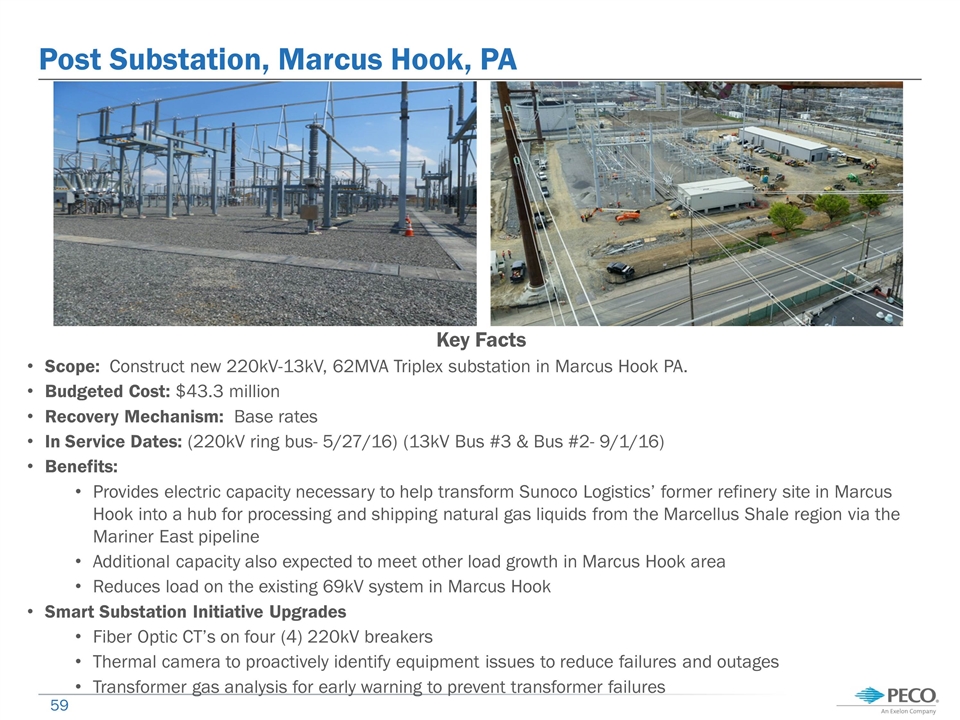

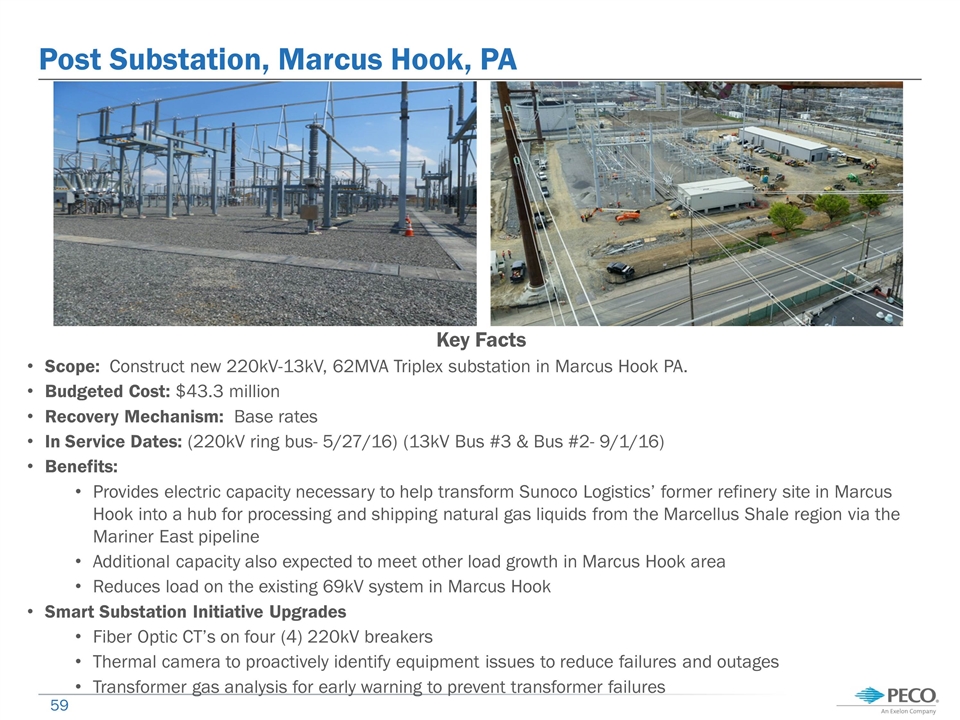

Post Substation, Marcus Hook, PA Key Facts Scope: Construct new 220kV-13kV, 62MVA Triplex substation in Marcus Hook PA. Budgeted Cost: $43.3 million Recovery Mechanism: Base rates In Service Dates: (220kV ring bus- 5/27/16) (13kV Bus #3 & Bus #2- 9/1/16) Benefits: Provides electric capacity necessary to help transform Sunoco Logistics’ former refinery site in Marcus Hook into a hub for processing and shipping natural gas liquids from the Marcellus Shale region via the Mariner East pipeline Additional capacity also expected to meet other load growth in Marcus Hook area Reduces load on the existing 69kV system in Marcus Hook Smart Substation Initiative Upgrades Fiber Optic CT’s on four (4) 220kV breakers Thermal camera to proactively identify equipment issues to reduce failures and outages Transformer gas analysis for early warning to prevent transformer failures

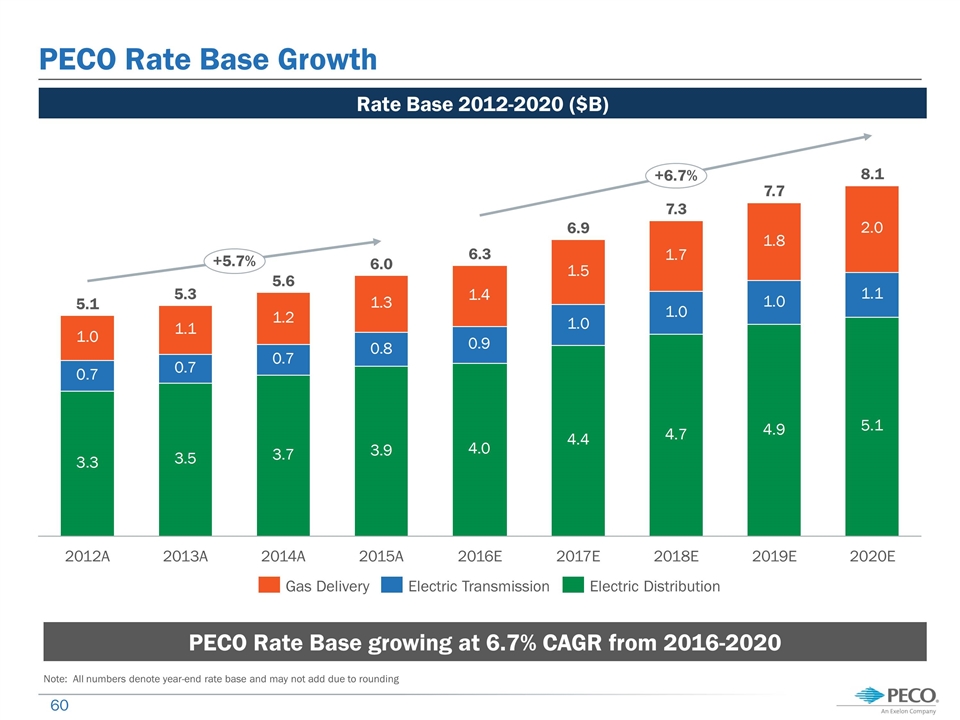

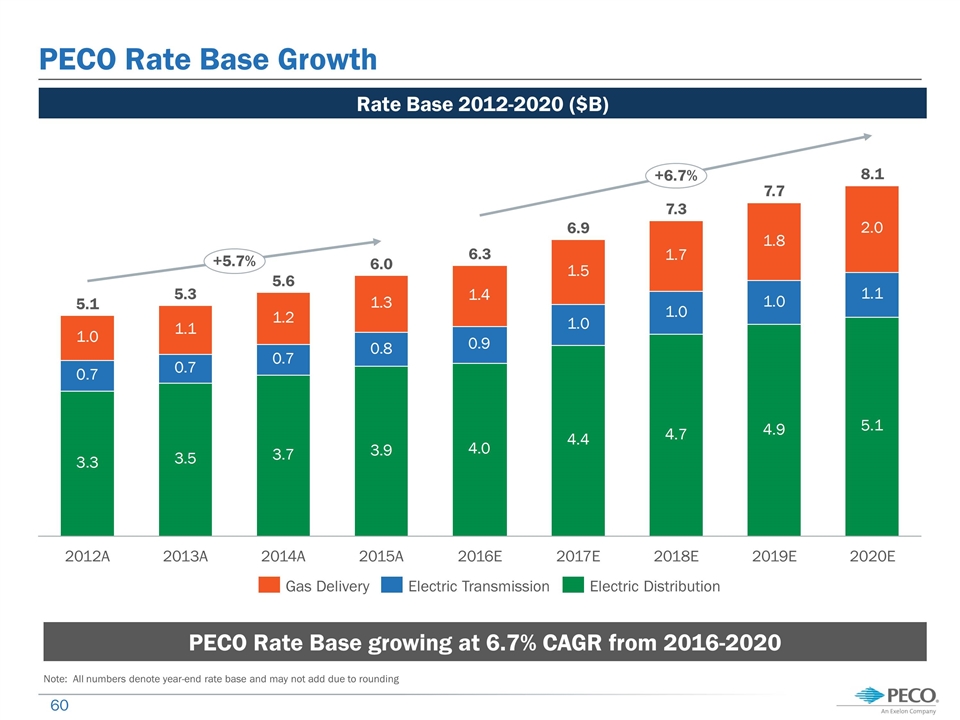

PECO Rate Base Growth Rate Base 2012-2020 ($B) PECO Rate Base growing at 6.7% CAGR from 2016-2020 Note: All numbers denote year-end rate base and may not add due to rounding

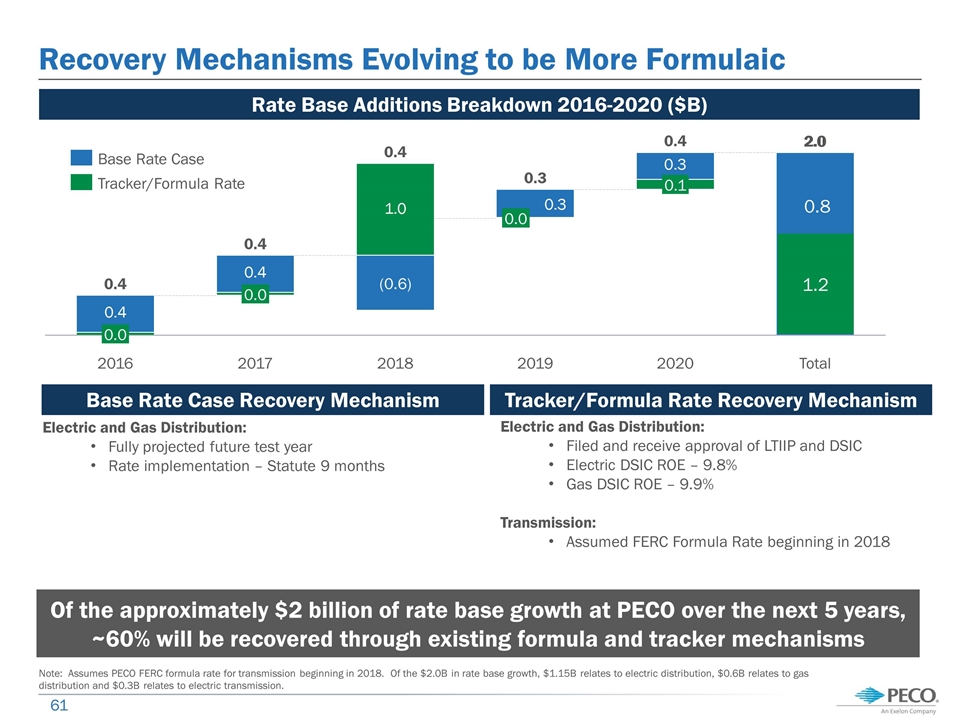

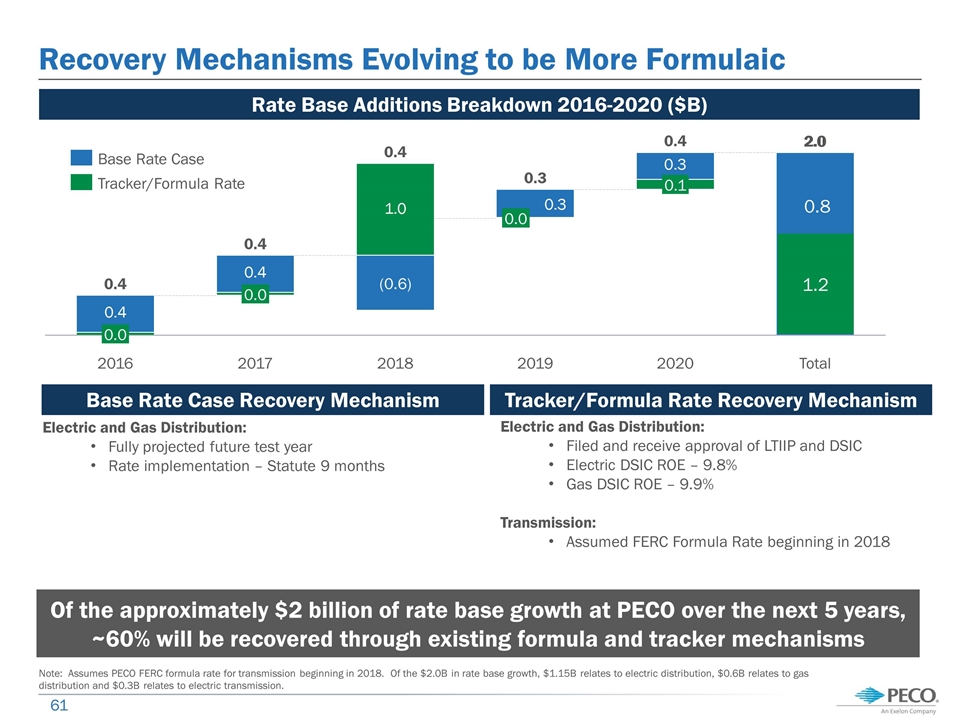

Recovery Mechanisms Evolving to be More Formulaic Of the approximately $2 billion of rate base growth at PECO over the next 5 years, ~60% will be recovered through existing formula and tracker mechanisms Rate Base Additions Breakdown 2016-2020 ($B) 1.2 0.8 Base Rate Case Recovery Mechanism Electric and Gas Distribution: Fully projected future test year Rate implementation – Statute 9 months Electric and Gas Distribution: Filed and receive approval of LTIIP and DSIC Electric DSIC ROE – 9.8% Gas DSIC ROE – 9.9% Transmission: Assumed FERC Formula Rate beginning in 2018 Tracker/Formula Rate Recovery Mechanism Note: Assumes PECO FERC formula rate for transmission beginning in 2018. Of the $2.0B in rate base growth, $1.15B relates to electric distribution, $0.6B relates to gas distribution and $0.3B relates to electric transmission.

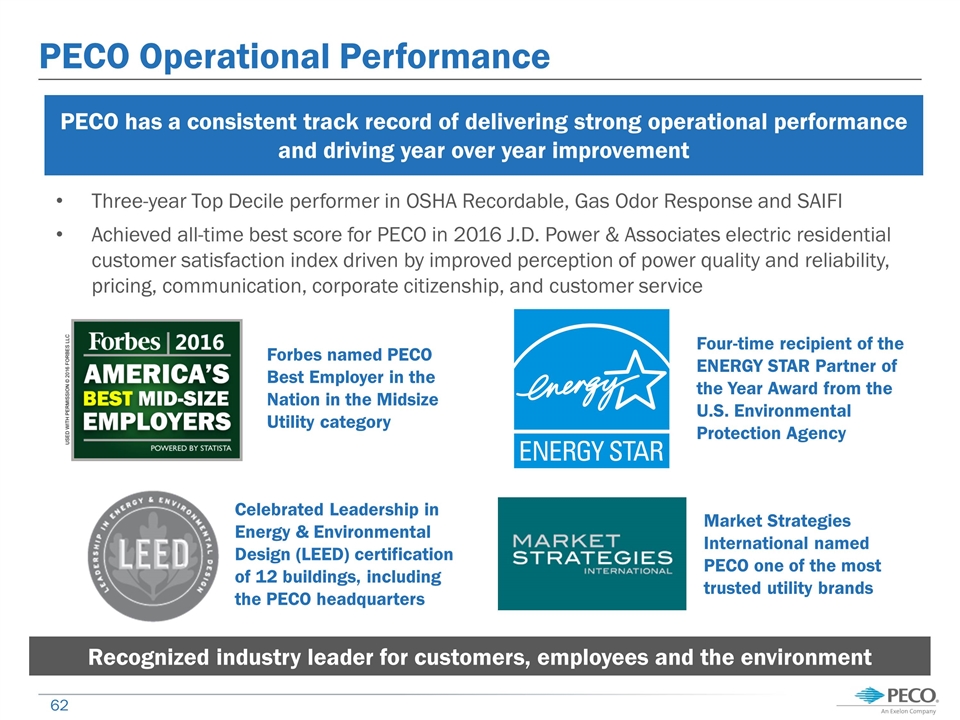

PECO Operational Performance Forbes named PECO Best Employer in the Nation in the Midsize Utility category Four-time recipient of the ENERGY STAR Partner of the Year Award from the U.S. Environmental Protection Agency Celebrated Leadership in Energy & Environmental Design (LEED) certification of 12 buildings, including the PECO headquarters Market Strategies International named PECO one of the most trusted utility brands PECO has a consistent track record of delivering strong operational performance and driving year over year improvement Three-year Top Decile performer in OSHA Recordable, Gas Odor Response and SAIFI Achieved all-time best score for PECO in 2016 J.D. Power & Associates electric residential customer satisfaction index driven by improved perception of power quality and reliability, pricing, communication, corporate citizenship, and customer service Recognized industry leader for customers, employees and the environment

Pepco Holdings Dave Velazquez President & Chief Executive Officer, Pepco Holdings

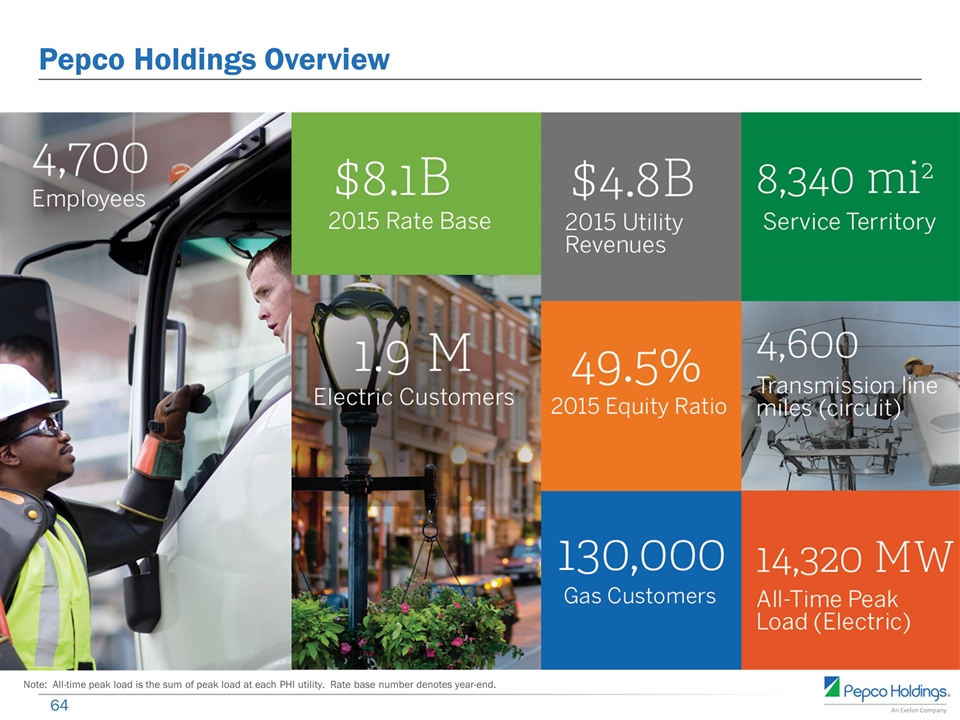

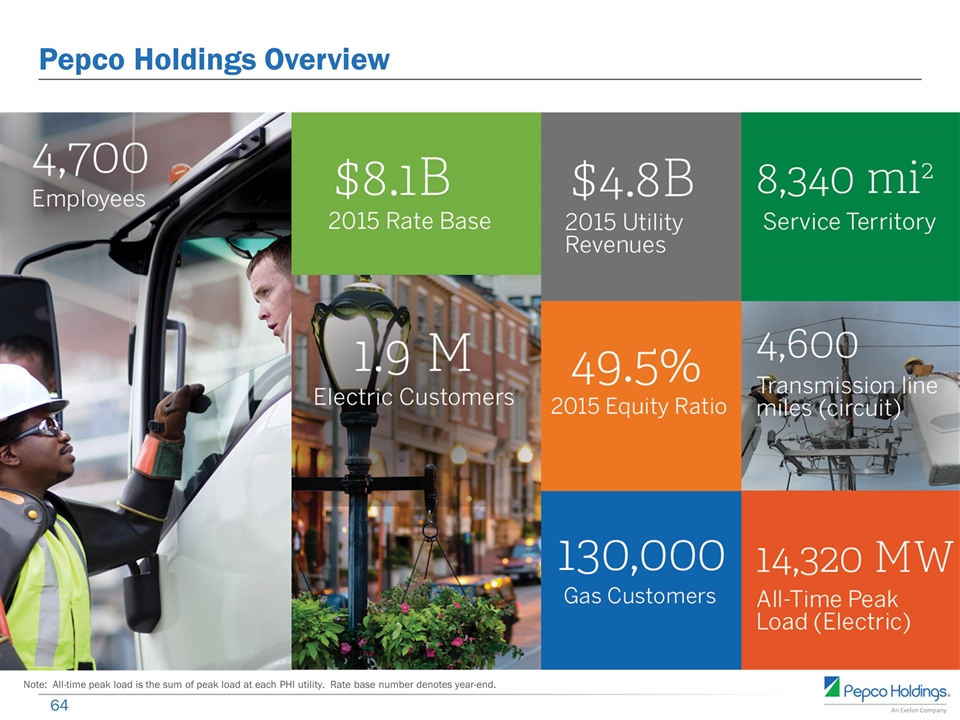

Pepco Holdings Overview Note: All-time peak load is the sum of peak load at each PHI utility. Rate base number denotes year-end.

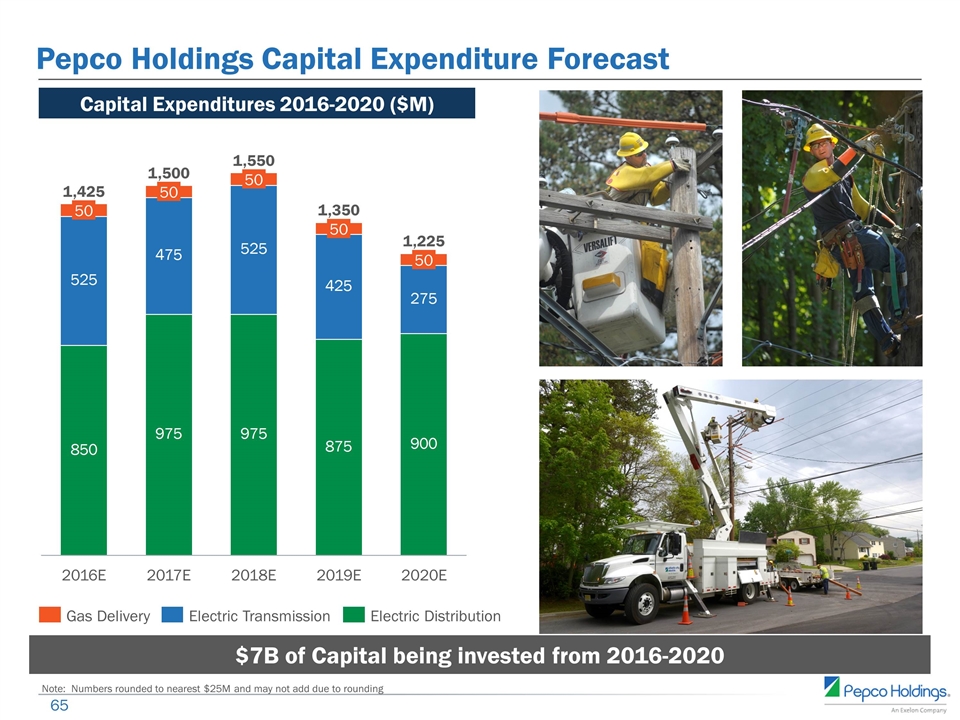

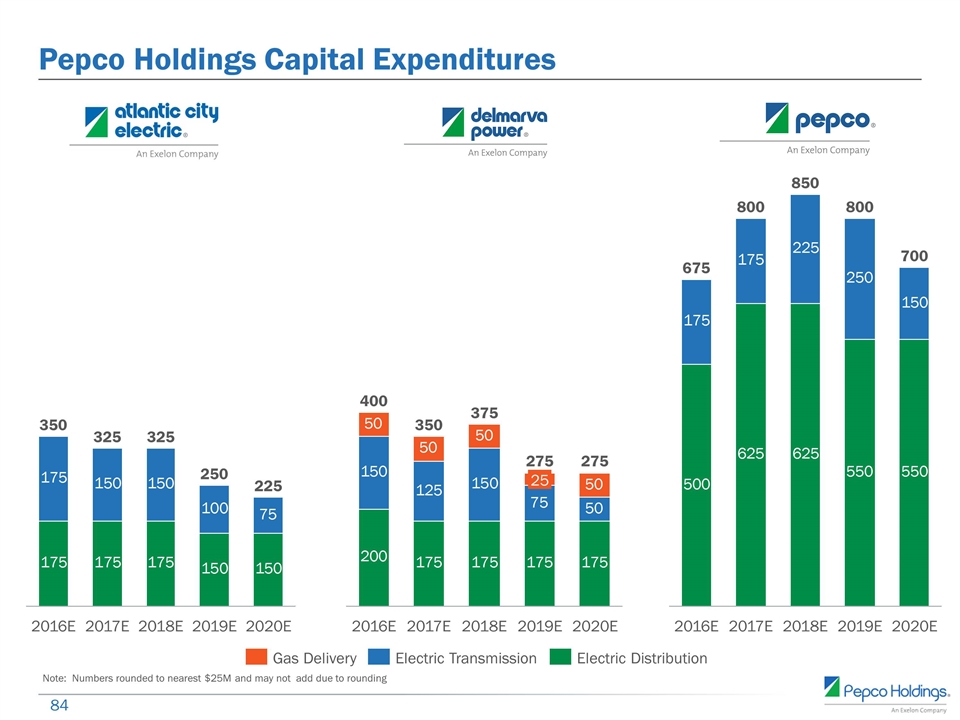

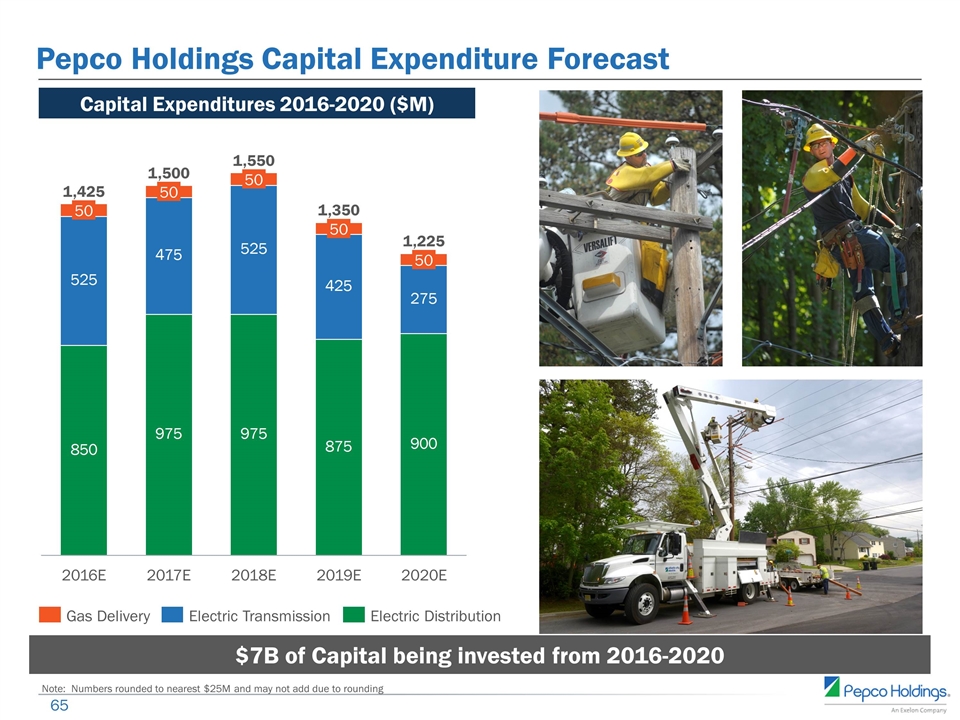

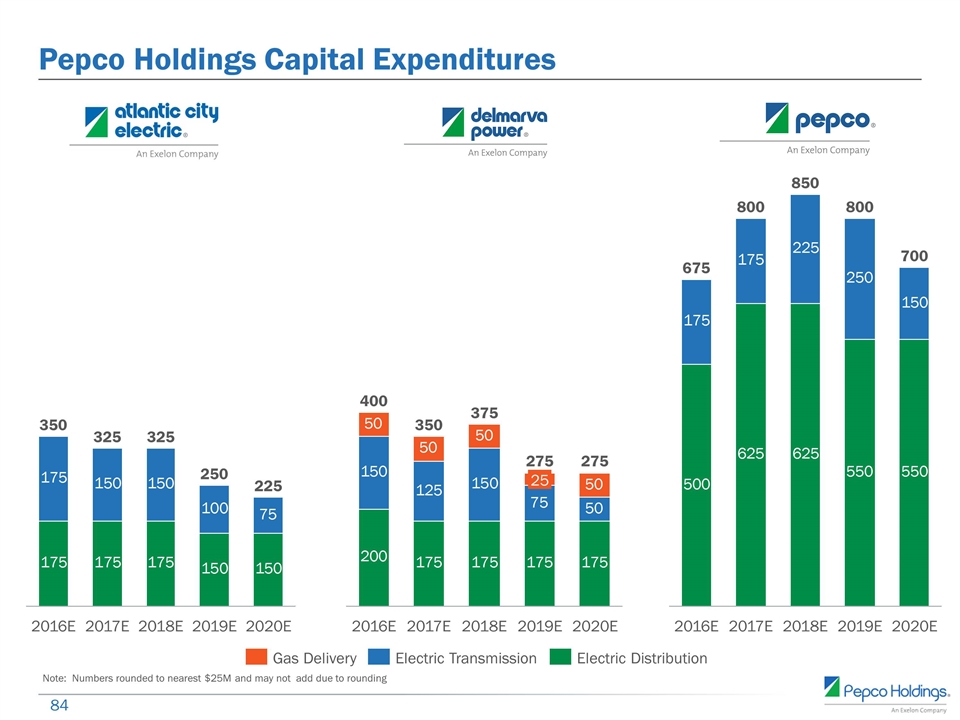

Note: Numbers rounded to nearest $25M and may not add due to rounding Pepco Holdings Capital Expenditure Forecast Capital Expenditures 2016-2020 ($M) $7B of Capital being invested from 2016-2020

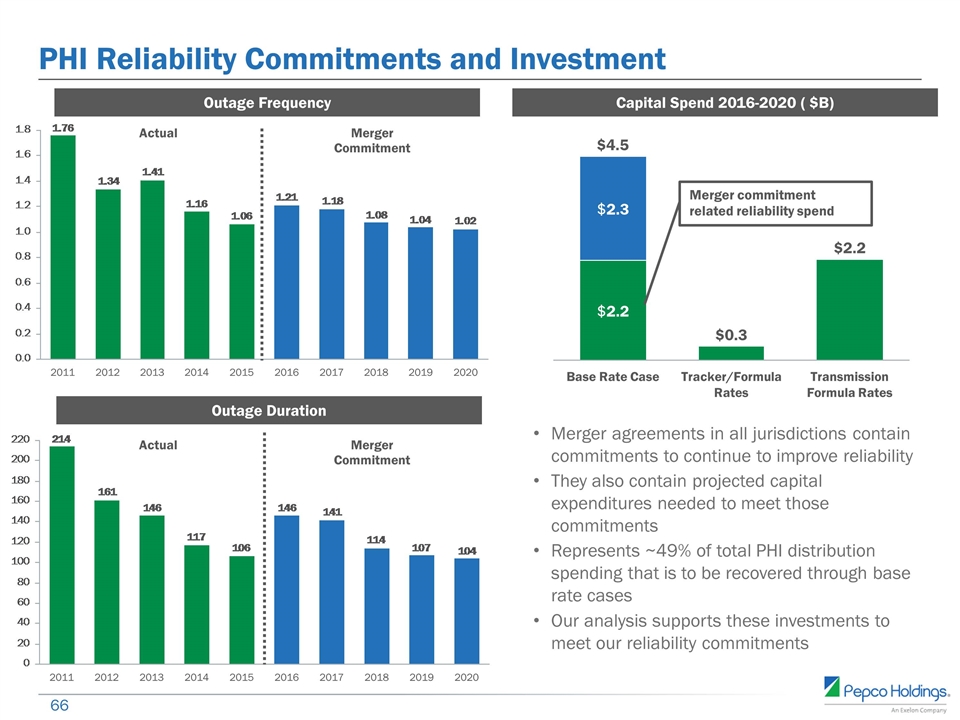

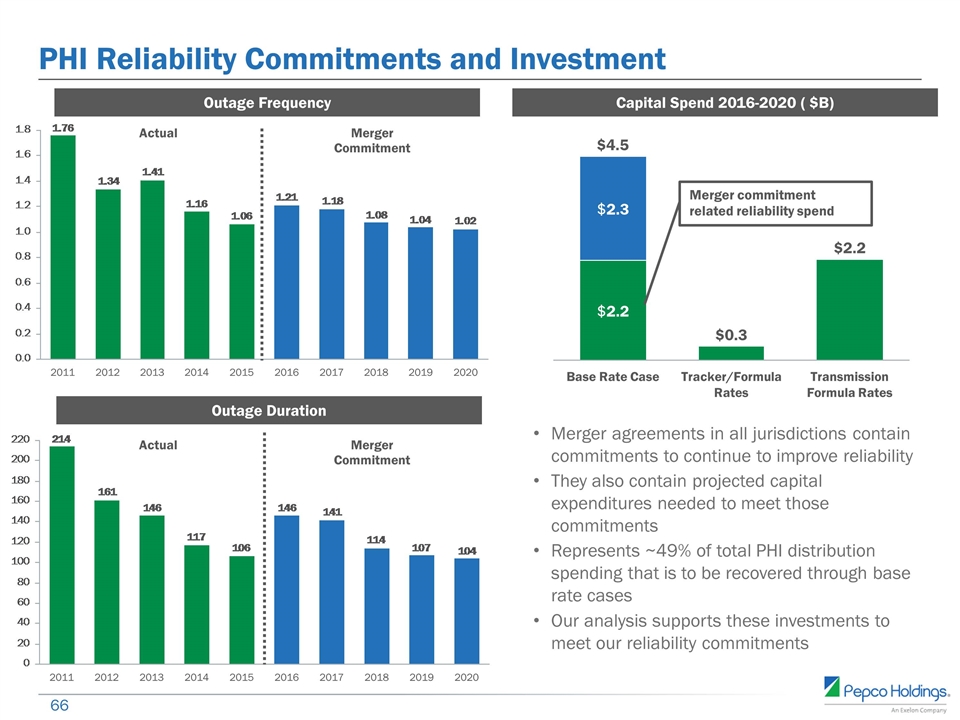

PHI Reliability Commitments and Investment Merger agreements in all jurisdictions contain commitments to continue to improve reliability They also contain projected capital expenditures needed to meet those commitments Represents ~49% of total PHI distribution spending that is to be recovered through base rate cases Our analysis supports these investments to meet our reliability commitments Outage Frequency Outage Duration Capital Spend 2016-2020 ( $B) Actual Merger Commitment Actual Merger Commitment $ $ $ $ $ Merger commitment related reliability spend

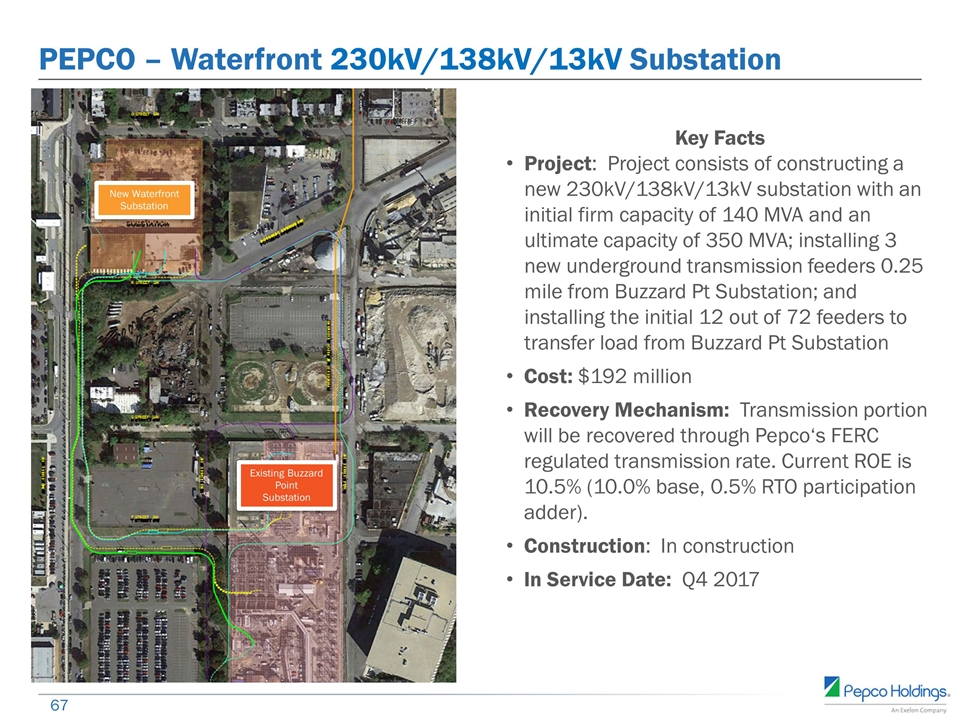

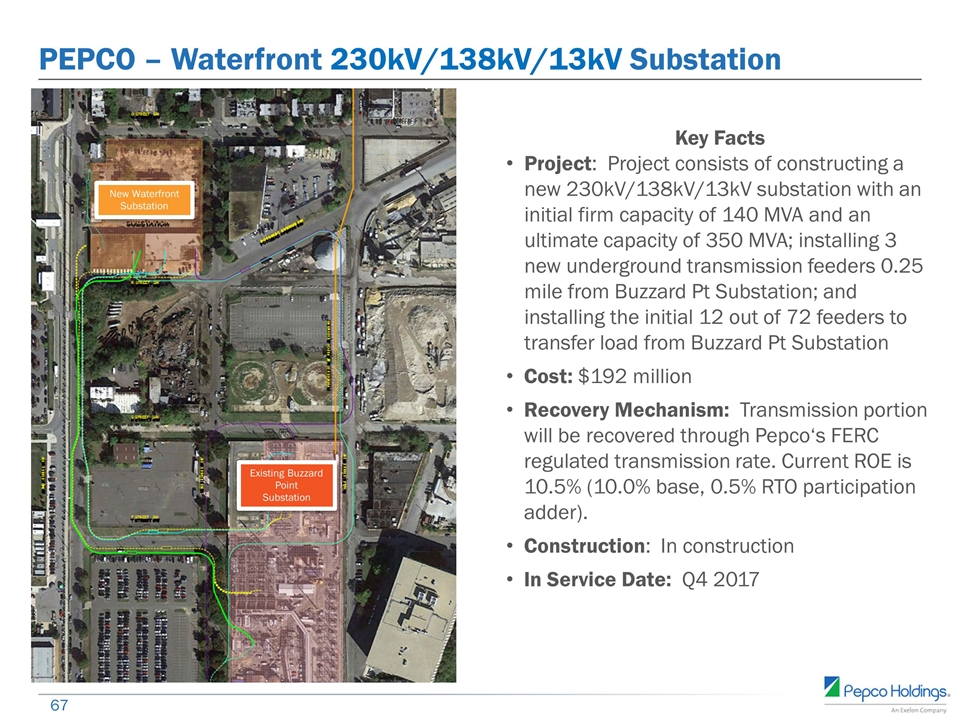

Key Facts Project: Project consists of constructing a new 230kV/138kV/13kV substation with an initial firm capacity of 140 MVA and an ultimate capacity of 350 MVA; installing 3 new underground transmission feeders 0.25 mile from Buzzard Pt Substation; and installing the initial 12 out of 72 feeders to transfer load from Buzzard Pt Substation Cost: $192 million Recovery Mechanism: Transmission portion will be recovered through Pepco‘s FERC regulated transmission rate. Current ROE is 10.5% (10.0% base, 0.5% RTO participation adder). Construction: In construction In Service Date: Q4 2017 PEPCO – Waterfront 230kV/138kV/13kV Substation New Waterfront Substation Existing Buzzard Point Substation

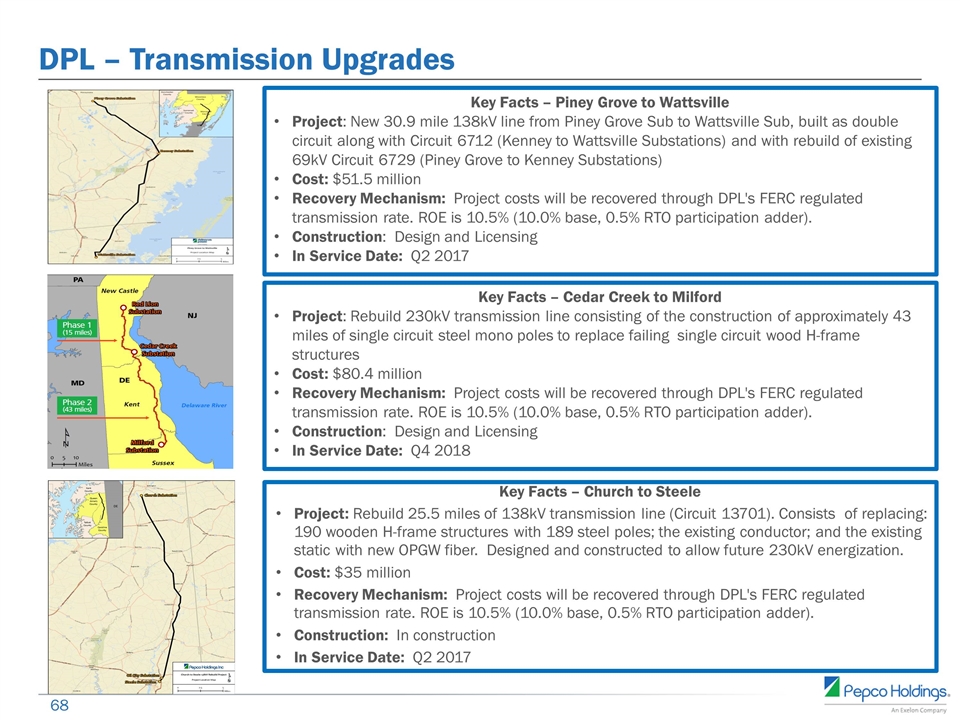

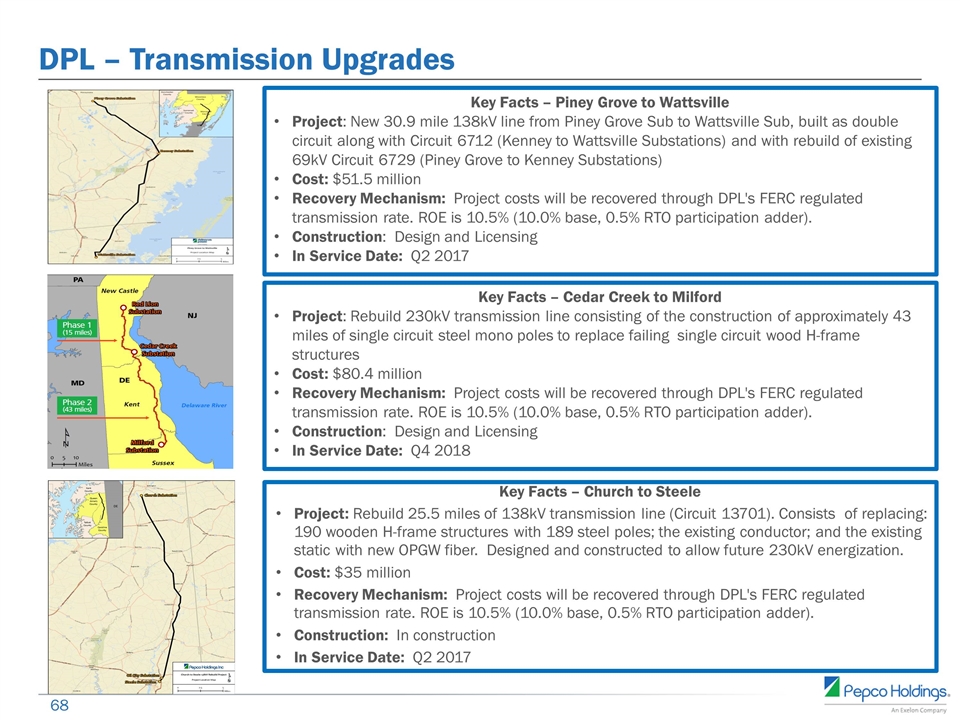

DPL – Transmission Upgrades Key Facts – Piney Grove to Wattsville Project: New 30.9 mile 138kV line from Piney Grove Sub to Wattsville Sub, built as double circuit along with Circuit 6712 (Kenney to Wattsville Substations) and with rebuild of existing 69kV Circuit 6729 (Piney Grove to Kenney Substations) Cost: $51.5 million Recovery Mechanism: Project costs will be recovered through DPL's FERC regulated transmission rate. ROE is 10.5% (10.0% base, 0.5% RTO participation adder). Construction: Design and Licensing In Service Date: Q2 2017 Key Facts – Church to Steele Project: Rebuild 25.5 miles of 138kV transmission line (Circuit 13701). Consists of replacing: 190 wooden H-frame structures with 189 steel poles; the existing conductor; and the existing static with new OPGW fiber. Designed and constructed to allow future 230kV energization. Cost: $35 million Recovery Mechanism: Project costs will be recovered through DPL's FERC regulated transmission rate. ROE is 10.5% (10.0% base, 0.5% RTO participation adder). Construction: In construction In Service Date: Q2 2017 Key Facts – Cedar Creek to Milford Project: Rebuild 230kV transmission line consisting of the construction of approximately 43 miles of single circuit steel mono poles to replace failing single circuit wood H-frame structures Cost: $80.4 million Recovery Mechanism: Project costs will be recovered through DPL's FERC regulated transmission rate. ROE is 10.5% (10.0% base, 0.5% RTO participation adder). Construction: Design and Licensing In Service Date: Q4 2018

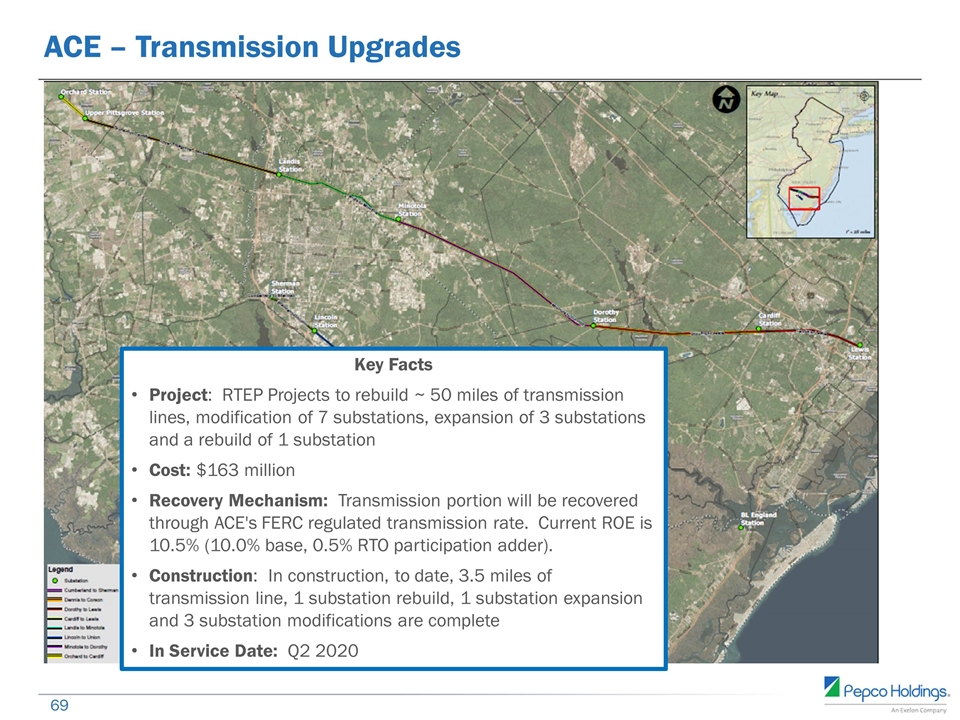

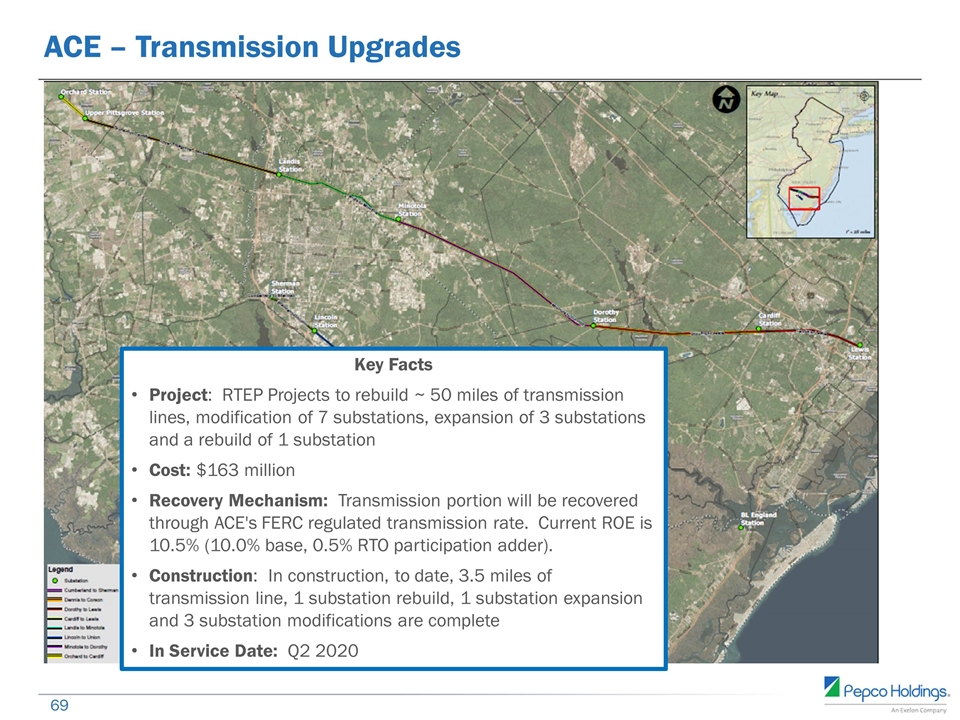

Key Facts Project: RTEP Projects to rebuild ~ 50 miles of transmission lines, modification of 7 substations, expansion of 3 substations and a rebuild of 1 substation Cost: $163 million Recovery Mechanism: Transmission portion will be recovered through ACE's FERC regulated transmission rate. Current ROE is 10.5% (10.0% base, 0.5% RTO participation adder). Construction: In construction, to date, 3.5 miles of transmission line, 1 substation rebuild, 1 substation expansion and 3 substation modifications are complete In Service Date: Q2 2020 ACE – Transmission Upgrades

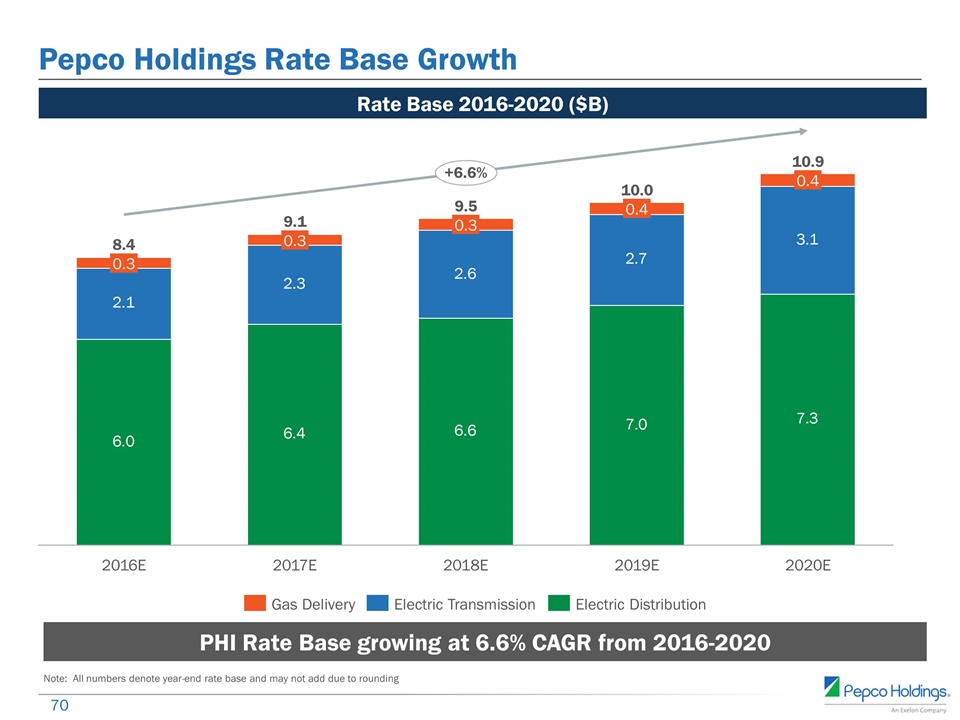

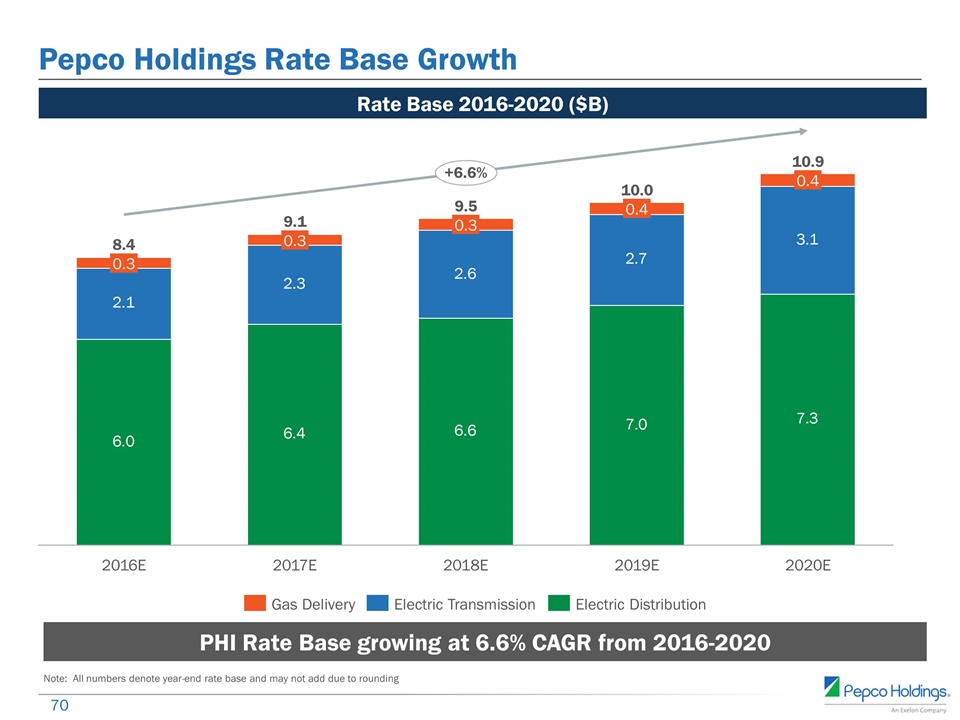

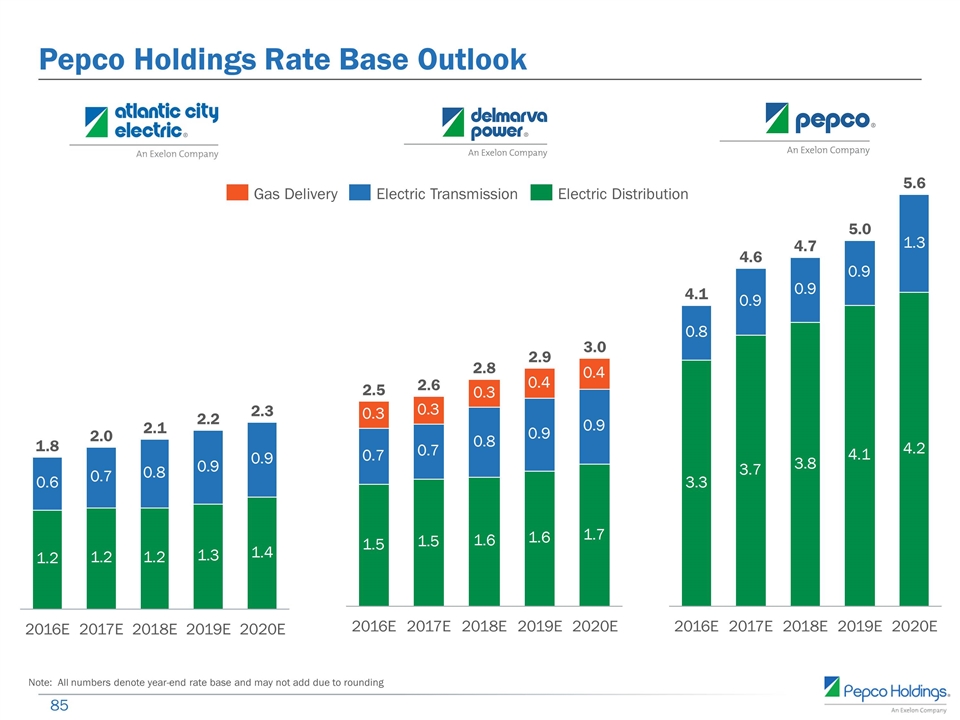

Pepco Holdings Rate Base Growth PHI Rate Base growing at 6.6% CAGR from 2016-2020 Rate Base 2016-2020 ($B) Note: All numbers denote year-end rate base and may not add due to rounding

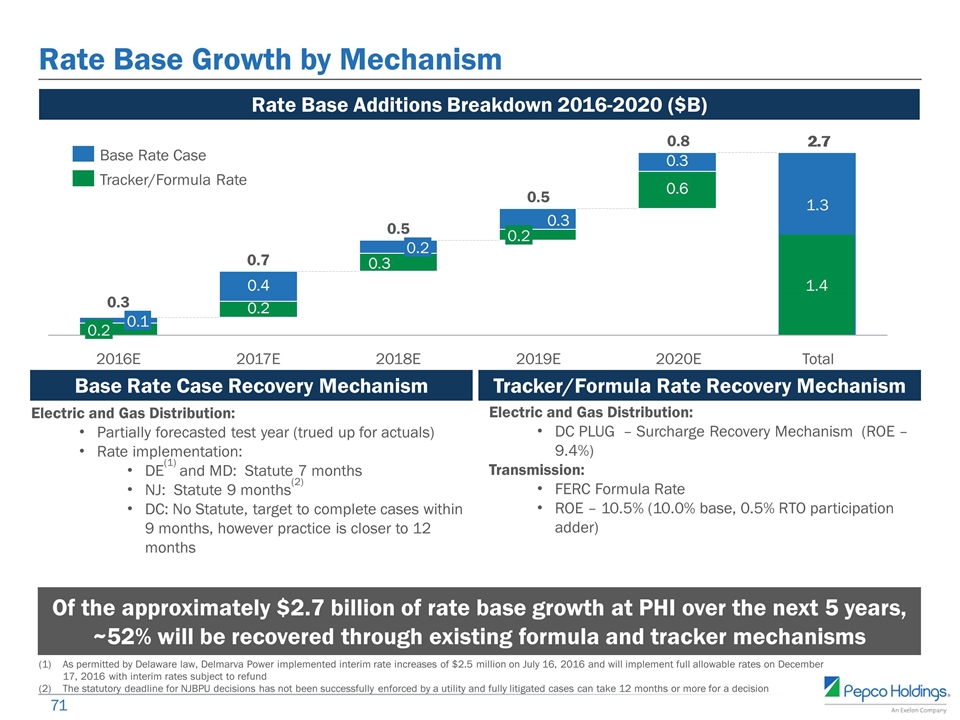

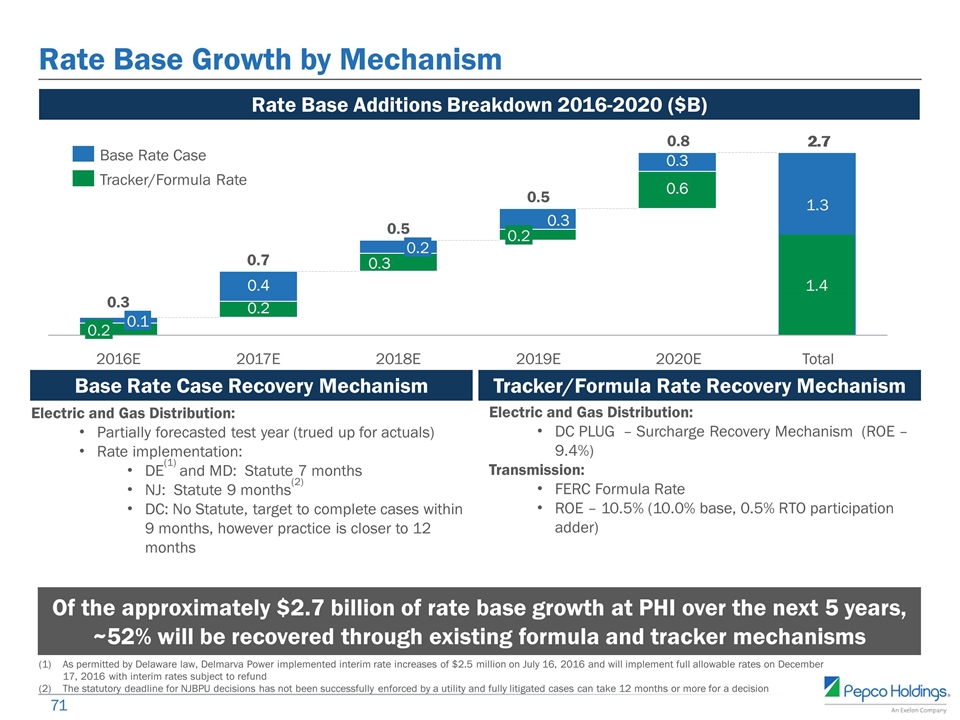

Rate Base Growth by Mechanism Of the approximately $2.7 billion of rate base growth at PHI over the next 5 years, ~52% will be recovered through existing formula and tracker mechanisms Rate Base Additions Breakdown 2016-2020 ($B) 1.4 1.3 Base Rate Case Recovery Mechanism Electric and Gas Distribution: Partially forecasted test year (trued up for actuals) Rate implementation: DE(1) and MD: Statute 7 months NJ: Statute 9 months(2) DC: No Statute, target to complete cases within 9 months, however practice is closer to 12 months Electric and Gas Distribution: DC PLUG – Surcharge Recovery Mechanism (ROE – 9.4%) Transmission: FERC Formula Rate ROE – 10.5% (10.0% base, 0.5% RTO participation adder) Tracker/Formula Rate Recovery Mechanism As permitted by Delaware law, Delmarva Power implemented interim rate increases of $2.5 million on July 16, 2016 and will implement full allowable rates on December 17, 2016 with interim rates subject to refund The statutory deadline for NJBPU decisions has not been successfully enforced by a utility and fully litigated cases can take 12 months or more for a decision

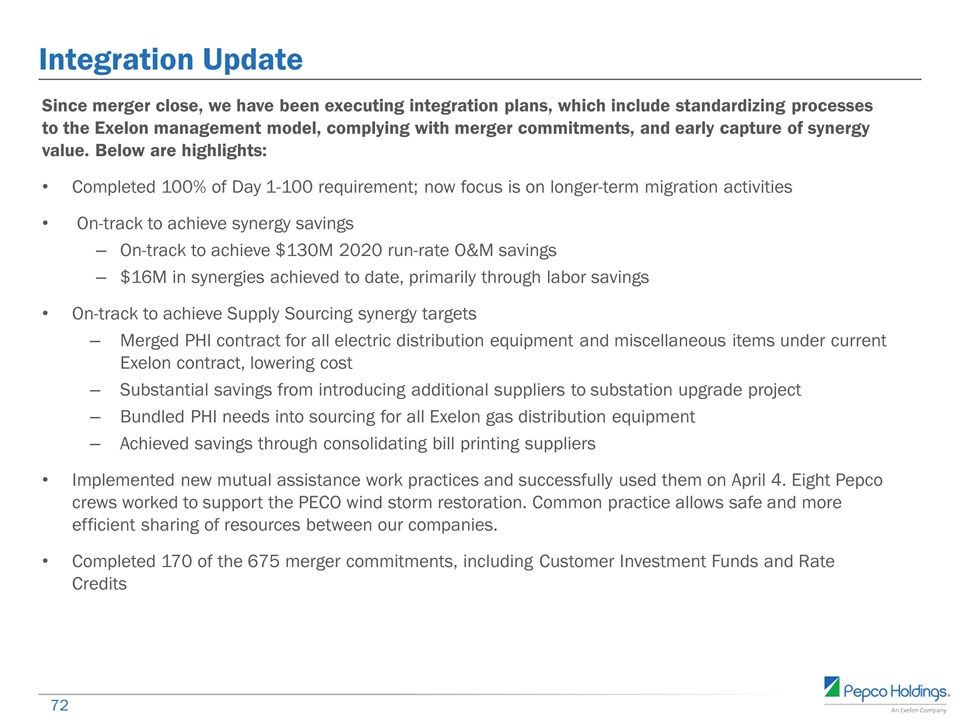

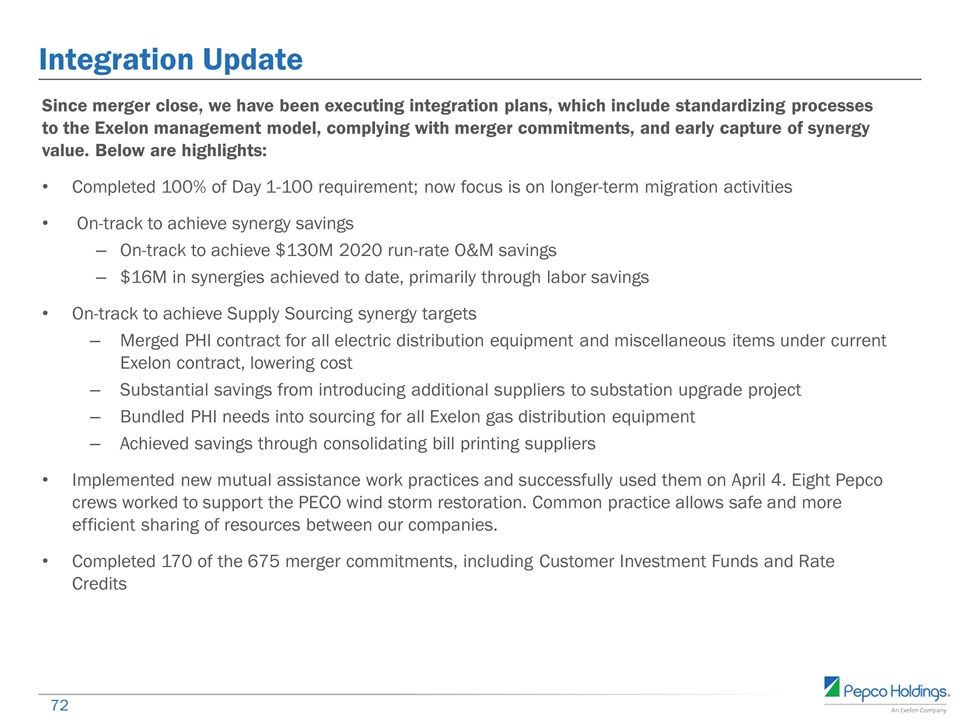

Integration Update Since merger close, we have been executing integration plans, which include standardizing processes to the Exelon management model, complying with merger commitments, and early capture of synergy value. Below are highlights: Completed 100% of Day 1-100 requirement; now focus is on longer-term migration activities On-track to achieve synergy savings On-track to achieve $130M 2020 run-rate O&M savings $16M in synergies achieved to date, primarily through labor savings On-track to achieve Supply Sourcing synergy targets Merged PHI contract for all electric distribution equipment and miscellaneous items under current Exelon contract, lowering cost Substantial savings from introducing additional suppliers to substation upgrade project Bundled PHI needs into sourcing for all Exelon gas distribution equipment Achieved savings through consolidating bill printing suppliers Implemented new mutual assistance work practices and successfully used them on April 4. Eight Pepco crews worked to support the PECO wind storm restoration. Common practice allows safe and more efficient sharing of resources between our companies. Completed 170 of the 675 merger commitments, including Customer Investment Funds and Rate Credits

Utility Appendix

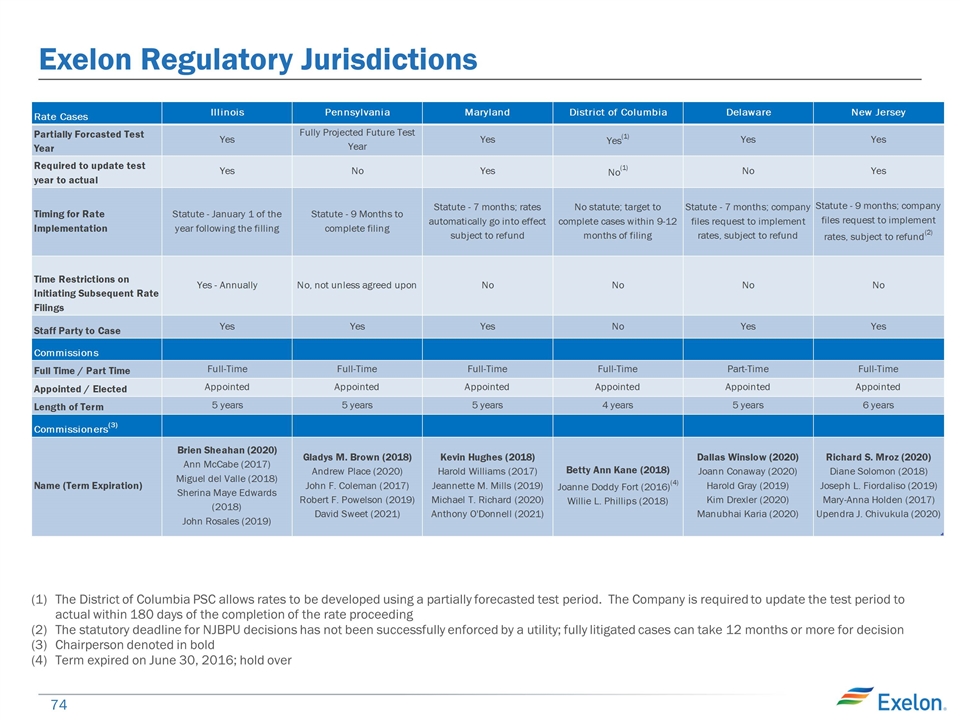

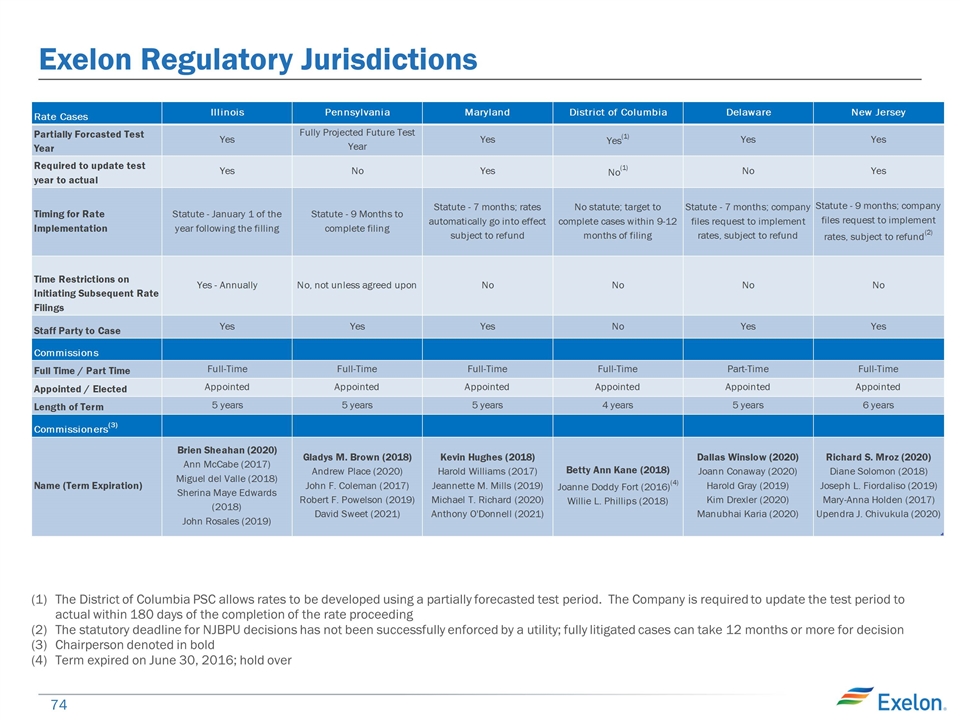

Exelon Regulatory Jurisdictions The District of Columbia PSC allows rates to be developed using a partially forecasted test period. The Company is required to update the test period to actual within 180 days of the completion of the rate proceeding The statutory deadline for NJBPU decisions has not been successfully enforced by a utility; fully litigated cases can take 12 months or more for decision Chairperson denoted in bold Term expired on June 30, 2016; hold over

Q1 2016 Q2 2016 Q3 2016 ACE Electric Distribution Rates ComEd Electric Distribution Formula Rate Q4 2016 Pepco Electric Distribution Rates - DC Delmarva Electric and Gas Distribution Rates - DE Delmarva Electric Distribution Rates - MD Pepco Electric Distribution Rates - MD Exelon Utilities Distribution Rate Case Schedule NJ Rate Case Filed March 22 Q1 2017 Final Order Expected Q1/Q2 IL Formula Rate Case Filed April 13 Final Order Expected December MD Rate Case Filed April 19 Final Order Expected November DC Rate Case Filed June 30 DE Rate Case Filed May 17 Final Order Expected MD Rate Case Filed July 20 Final Order Expected Q2 2017 Final Order Expected Q2/Q3 Q3 2017 IL Formula Rate Case Filed April 13 MD Rate Case Filed April 19 DC Rate Case Filed June 30 DE Rate Case Filed May 17

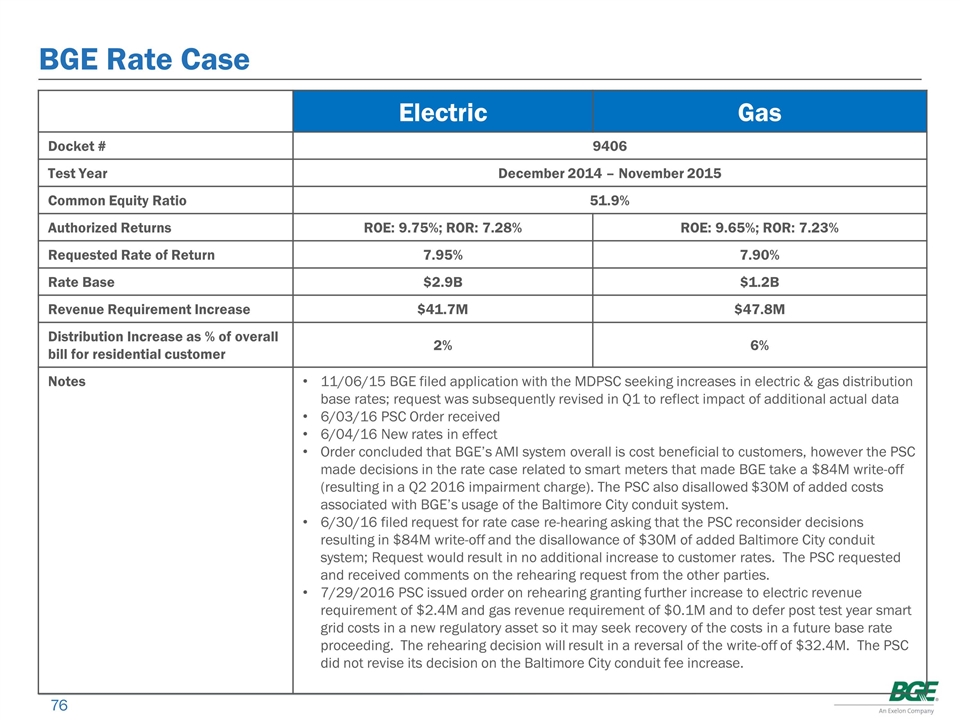

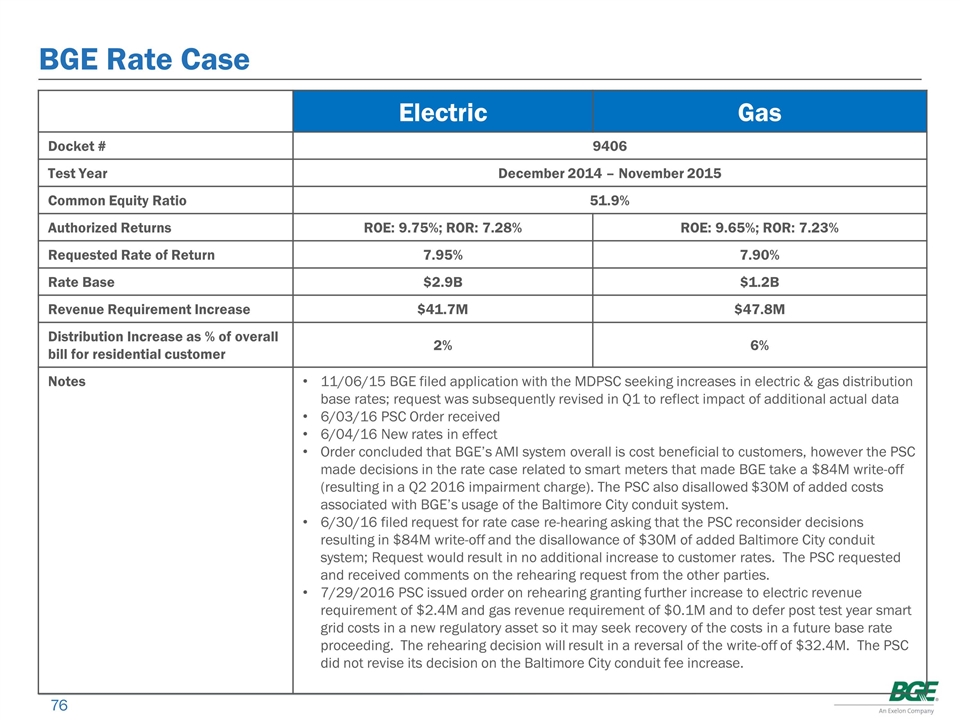

BGE Rate Case Electric Gas Docket # 9406 Test Year December 2014 – November 2015 Common Equity Ratio 51.9% Authorized Returns ROE: 9.75%; ROR: 7.28% ROE: 9.65%; ROR: 7.23% Requested Rate of Return 7.95% 7.90% Rate Base $2.9B $1.2B Revenue Requirement Increase $41.7M $47.8M Distribution Increase as % of overall bill for residential customer 2% 6% Notes 11/06/15 BGE filed application with the MDPSC seeking increases in electric & gas distribution base rates; request was subsequently revised in Q1 to reflect impact of additional actual data 6/03/16 PSC Order received 6/04/16 New rates in effect Order concluded that BGE’s AMI system overall is cost beneficial to customers, however the PSC made decisions in the rate case related to smart meters that made BGE take a $84M write-off (resulting in a Q2 2016 impairment charge). The PSC also disallowed $30M of added costs associated with BGE’s usage of the Baltimore City conduit system. 6/30/16 filed request for rate case re-hearing asking that the PSC reconsider decisions resulting in $84M write-off and the disallowance of $30M of added Baltimore City conduit system; Request would result in no additional increase to customer rates. The PSC requested and received comments on the rehearing request from the other parties. 7/29/2016 PSC issued order on rehearing granting further increase to electric revenue requirement of $2.4M and gas revenue requirement of $0.1M and to defer post test year smart grid costs in a new regulatory asset so it may seek recovery of the costs in a future base rate proceeding. The rehearing decision will result in a reversal of the write-off of $32.4M. The PSC did not revise its decision on the Baltimore City conduit fee increase.

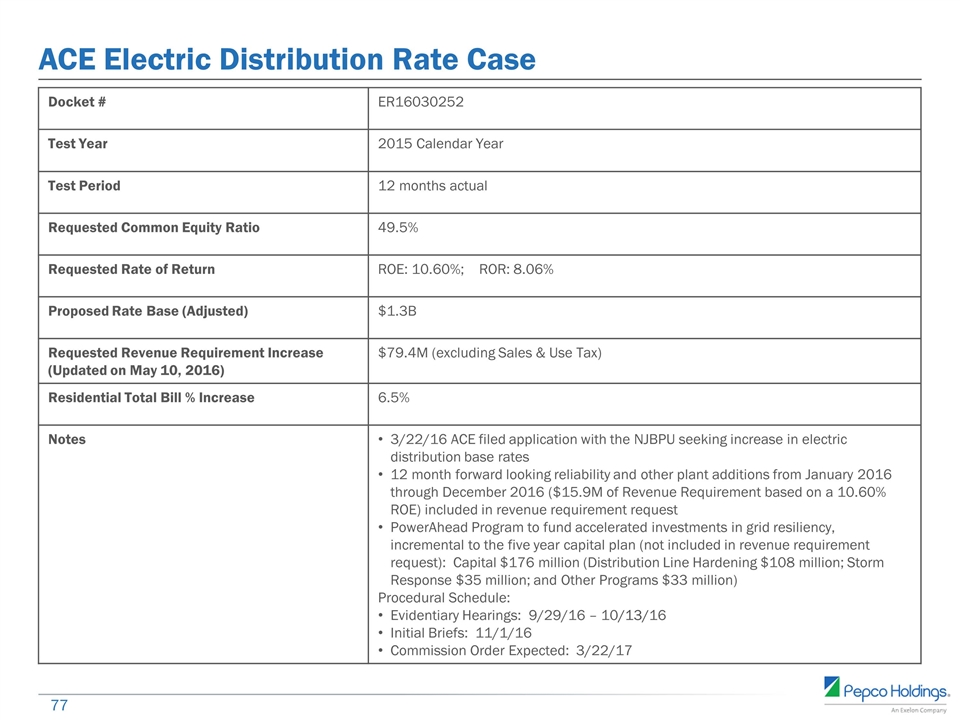

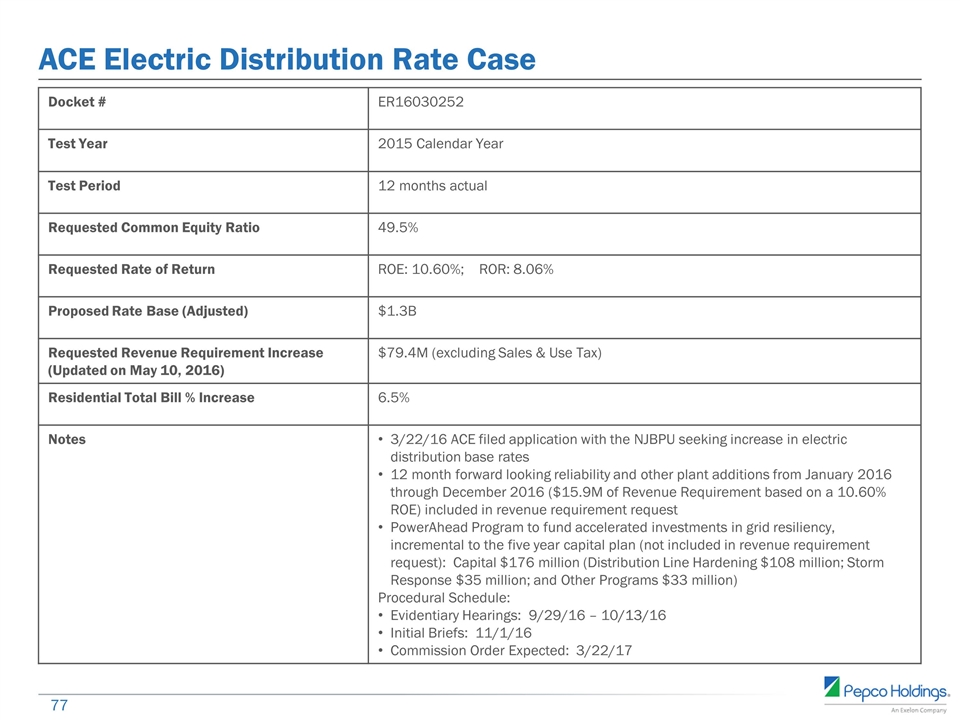

ACE Electric Distribution Rate Case Docket # ER16030252 Test Year 2015 Calendar Year Test Period 12 months actual Requested Common Equity Ratio 49.5% Requested Rate of Return ROE: 10.60%; ROR: 8.06% Proposed Rate Base (Adjusted) $1.3B Requested Revenue Requirement Increase (Updated on May 10, 2016) $79.4M (excluding Sales & Use Tax) Residential Total Bill % Increase 6.5% Notes 3/22/16 ACE filed application with the NJBPU seeking increase in electric distribution base rates 12 month forward looking reliability and other plant additions from January 2016 through December 2016 ($15.9M of Revenue Requirement based on a 10.60% ROE) included in revenue requirement request PowerAhead Program to fund accelerated investments in grid resiliency, incremental to the five year capital plan (not included in revenue requirement request): Capital $176 million (Distribution Line Hardening $108 million; Storm Response $35 million; and Other Programs $33 million) Procedural Schedule: Evidentiary Hearings: 9/29/16 – 10/13/16 Initial Briefs: 11/1/16 Commission Order Expected: 3/22/17

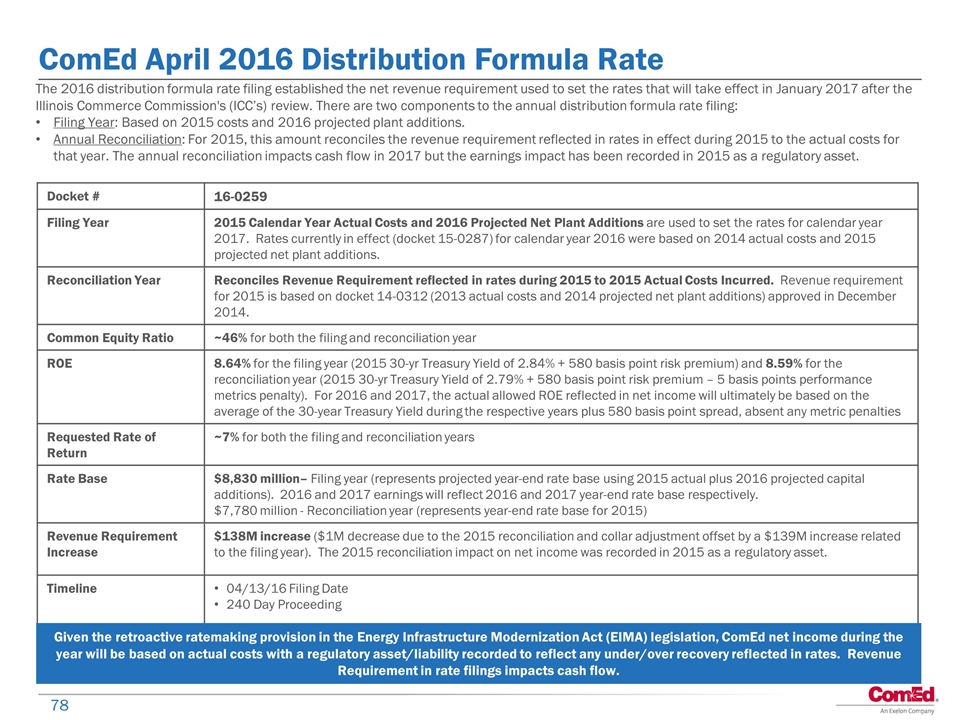

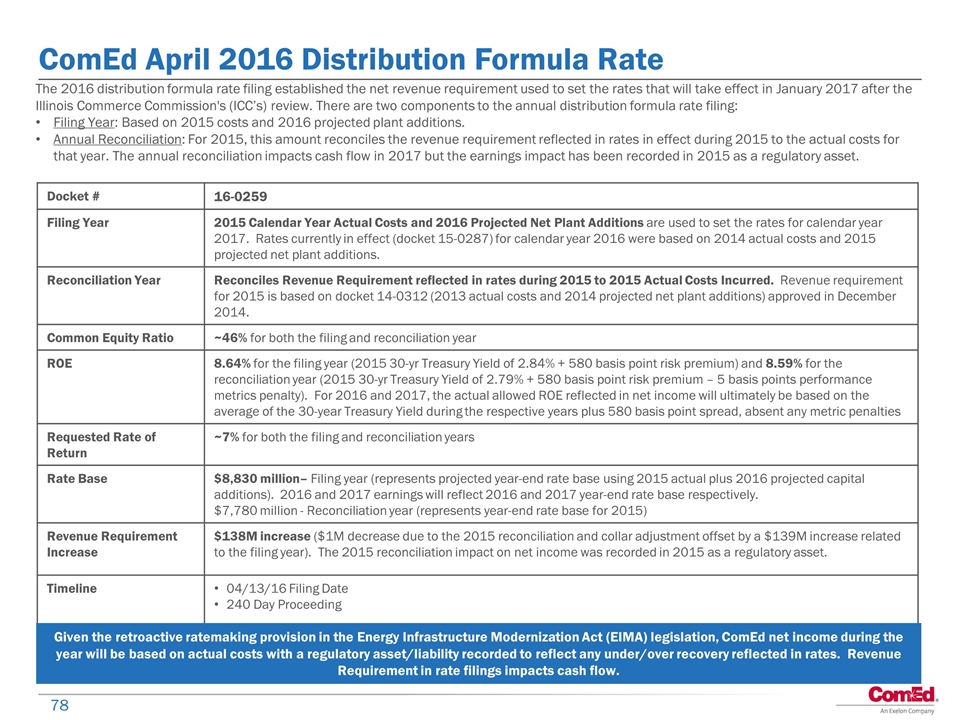

ComEd April 2016 Distribution Formula Rate Docket # 16-0259 Filing Year 2015 Calendar Year Actual Costs and 2016 Projected Net Plant Additions are used to set the rates for calendar year 2017. Rates currently in effect (docket 15-0287) for calendar year 2016 were based on 2014 actual costs and 2015 projected net plant additions. Reconciliation Year Reconciles Revenue Requirement reflected in rates during 2015 to 2015 Actual Costs Incurred. Revenue requirement for 2015 is based on docket 14-0312 (2013 actual costs and 2014 projected net plant additions) approved in December 2014. Common Equity Ratio ~46% for both the filing and reconciliation year ROE 8.64% for the filing year (2015 30-yr Treasury Yield of 2.84% + 580 basis point risk premium) and 8.59% for the reconciliation year (2015 30-yr Treasury Yield of 2.79% + 580 basis point risk premium – 5 basis points performance metrics penalty). For 2016 and 2017, the actual allowed ROE reflected in net income will ultimately be based on the average of the 30-year Treasury Yield during the respective years plus 580 basis point spread, absent any metric penalties Requested Rate of Return ~7% for both the filing and reconciliation years Rate Base $8,830 million– Filing year (represents projected year-end rate base using 2015 actual plus 2016 projected capital additions). 2016 and 2017 earnings will reflect 2016 and 2017 year-end rate base respectively. $7,780 million - Reconciliation year (represents year-end rate base for 2015) Revenue Requirement Increase $138M increase ($1M decrease due to the 2015 reconciliation and collar adjustment offset by a $139M increase related to the filing year). The 2015 reconciliation impact on net income was recorded in 2015 as a regulatory asset. Timeline 04/13/16 Filing Date 240 Day Proceeding The 2016 distribution formula rate filing established the net revenue requirement used to set the rates that will take effect in January 2017 after the Illinois Commerce Commission's (ICC’s) review. There are two components to the annual distribution formula rate filing: Filing Year: Based on 2015 costs and 2016 projected plant additions. Annual Reconciliation: For 2015, this amount reconciles the revenue requirement reflected in rates in effect during 2015 to the actual costs for that year. The annual reconciliation impacts cash flow in 2017 but the earnings impact has been recorded in 2015 as a regulatory asset. Given the retroactive ratemaking provision in the Energy Infrastructure Modernization Act (EIMA) legislation, ComEd net income during the year will be based on actual costs with a regulatory asset/liability recorded to reflect any under/over recovery reflected in rates. Revenue Requirement in rate filings impacts cash flow.

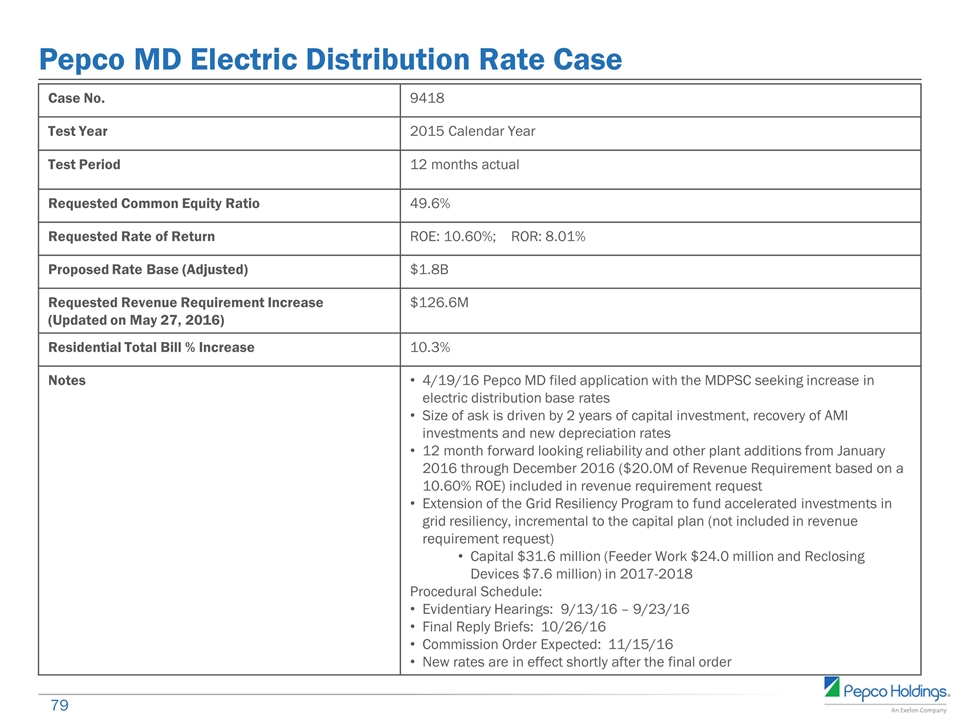

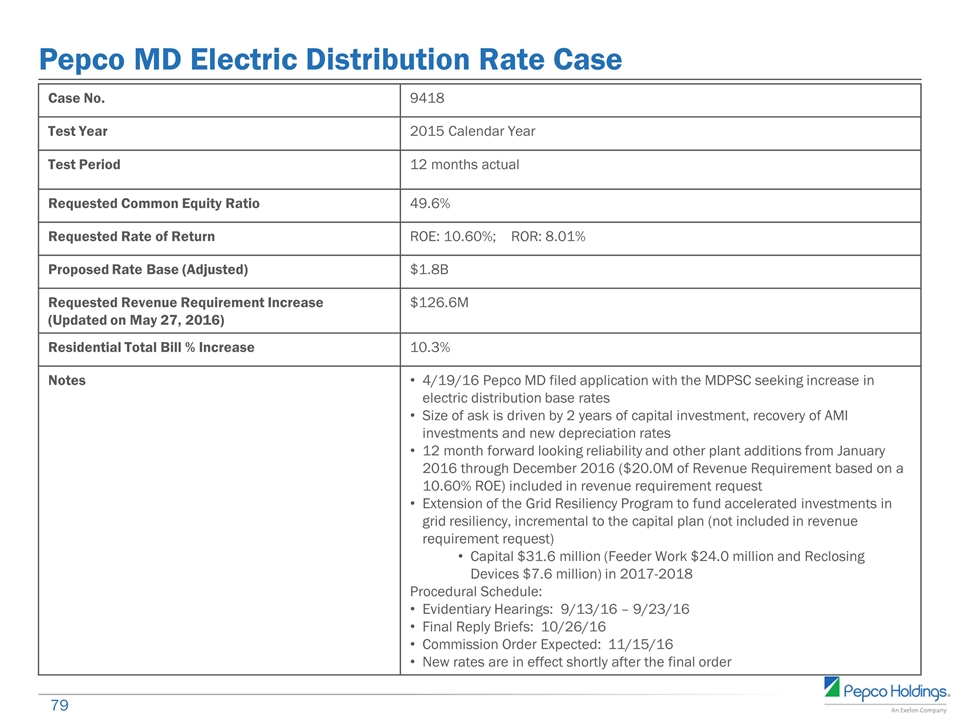

Pepco MD Electric Distribution Rate Case Case No. 9418 Test Year 2015 Calendar Year Test Period 12 months actual Requested Common Equity Ratio 49.6% Requested Rate of Return ROE: 10.60%; ROR: 8.01% Proposed Rate Base (Adjusted) $1.8B Requested Revenue Requirement Increase (Updated on May 27, 2016) $126.6M Residential Total Bill % Increase 10.3% Notes 4/19/16 Pepco MD filed application with the MDPSC seeking increase in electric distribution base rates Size of ask is driven by 2 years of capital investment, recovery of AMI investments and new depreciation rates 12 month forward looking reliability and other plant additions from January 2016 through December 2016 ($20.0M of Revenue Requirement based on a 10.60% ROE) included in revenue requirement request Extension of the Grid Resiliency Program to fund accelerated investments in grid resiliency, incremental to the capital plan (not included in revenue requirement request) Capital $31.6 million (Feeder Work $24.0 million and Reclosing Devices $7.6 million) in 2017-2018 Procedural Schedule: Evidentiary Hearings: 9/13/16 – 9/23/16 Final Reply Briefs: 10/26/16 Commission Order Expected: 11/15/16 New rates are in effect shortly after the final order

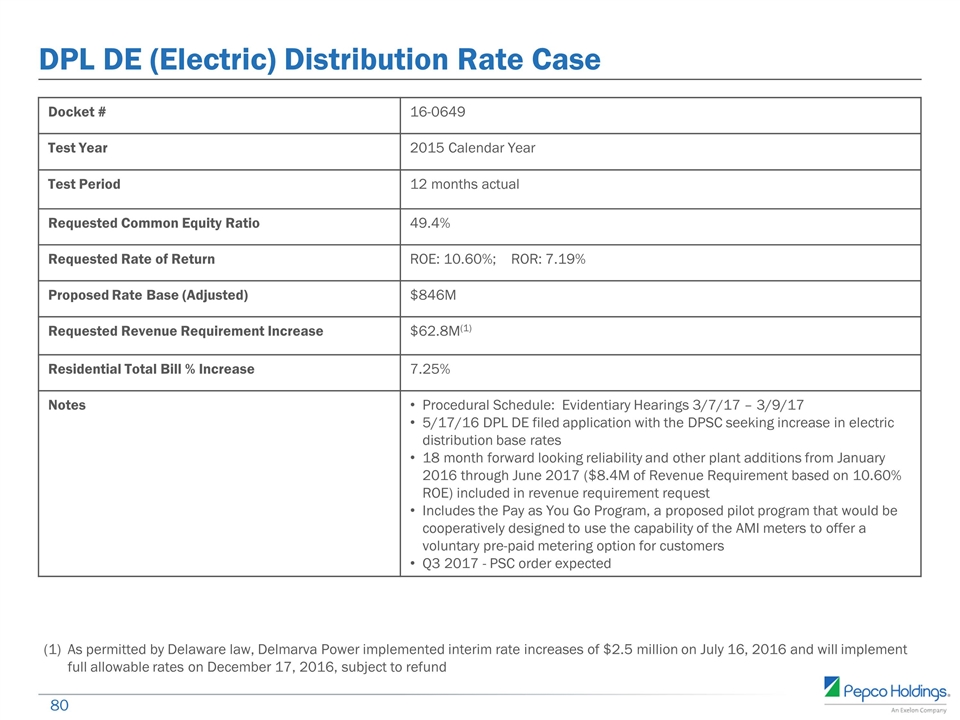

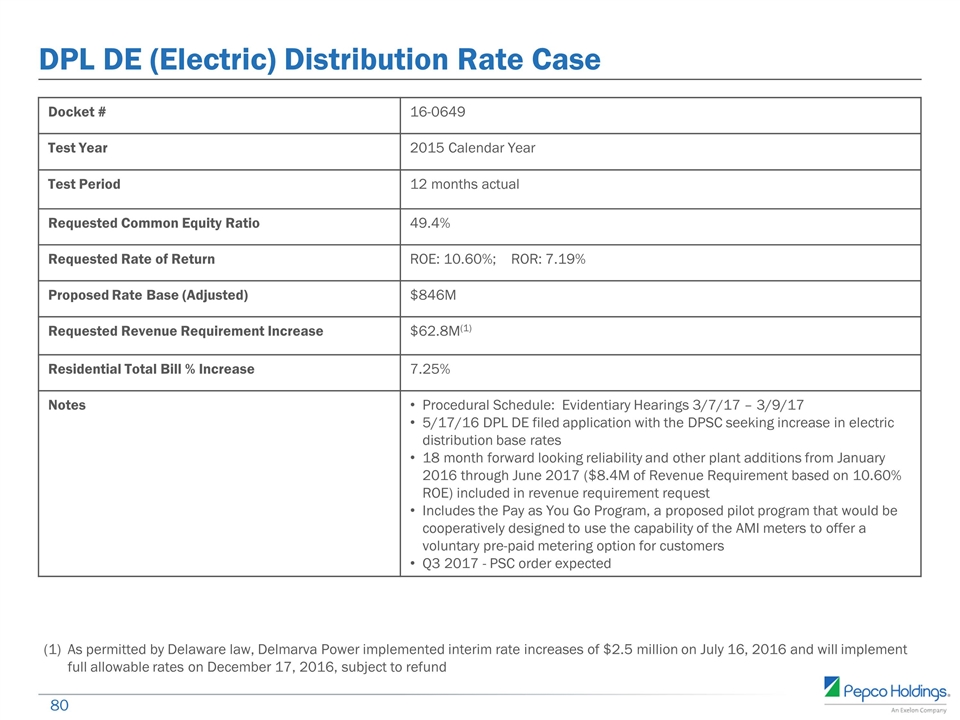

DPL DE (Electric) Distribution Rate Case Docket # 16-0649 Test Year 2015 Calendar Year Test Period 12 months actual Requested Common Equity Ratio 49.4% Requested Rate of Return ROE: 10.60%; ROR: 7.19% Proposed Rate Base (Adjusted) $846M Requested Revenue Requirement Increase $62.8M(1) Residential Total Bill % Increase 7.25% Notes Procedural Schedule: Evidentiary Hearings 3/7/17 – 3/9/17 5/17/16 DPL DE filed application with the DPSC seeking increase in electric distribution base rates 18 month forward looking reliability and other plant additions from January 2016 through June 2017 ($8.4M of Revenue Requirement based on 10.60% ROE) included in revenue requirement request Includes the Pay as You Go Program, a proposed pilot program that would be cooperatively designed to use the capability of the AMI meters to offer a voluntary pre-paid metering option for customers Q3 2017 - PSC order expected As permitted by Delaware law, Delmarva Power implemented interim rate increases of $2.5 million on July 16, 2016 and will implement full allowable rates on December 17, 2016, subject to refund

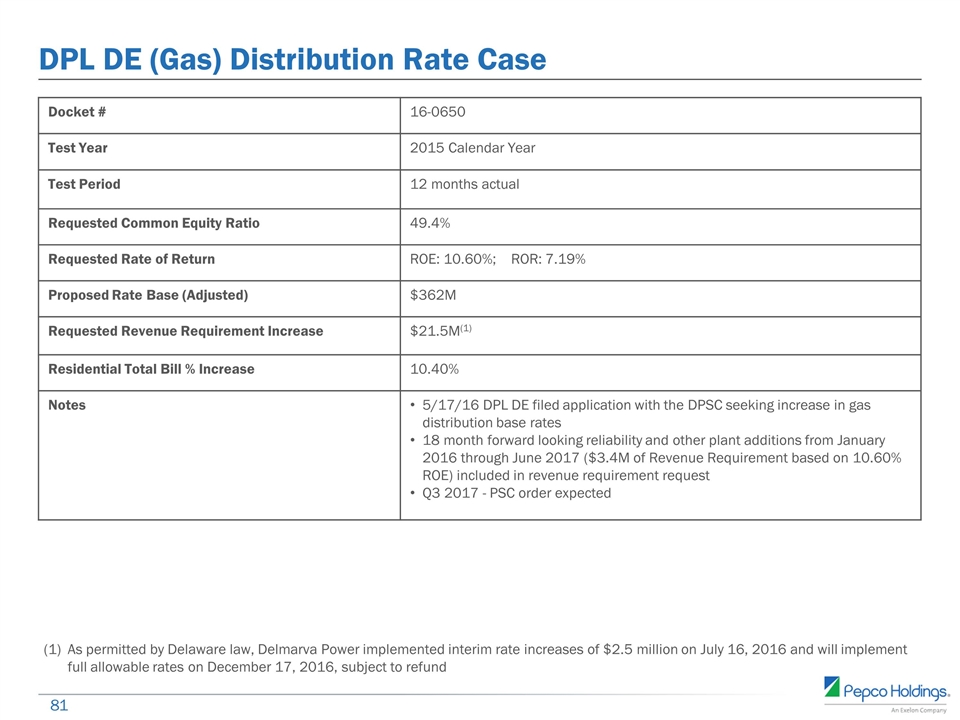

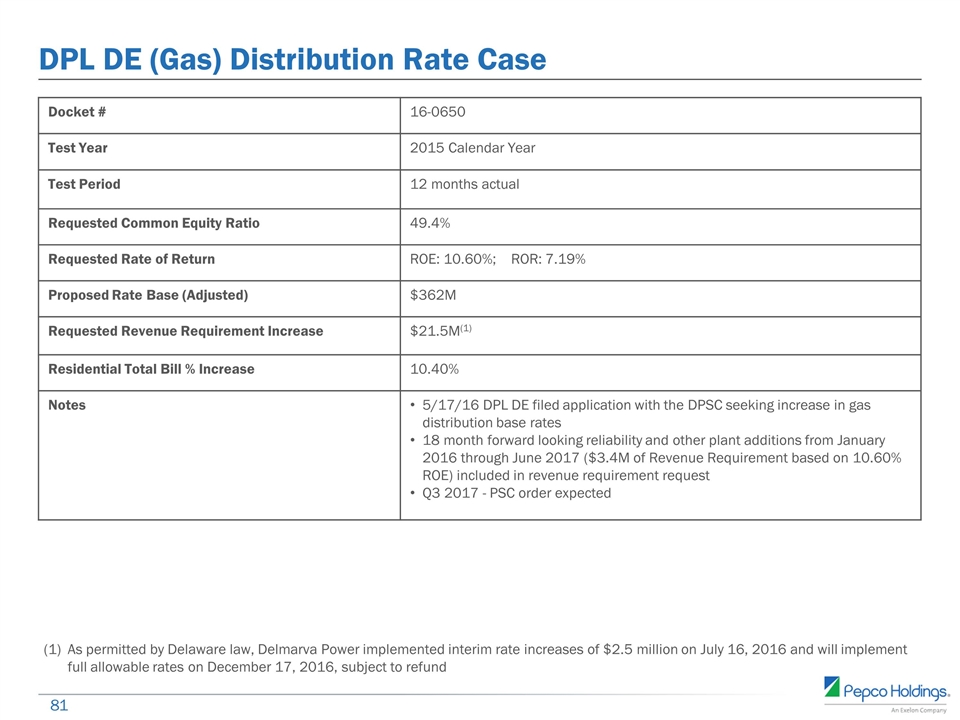

DPL DE (Gas) Distribution Rate Case Docket # 16-0650 Test Year 2015 Calendar Year Test Period 12 months actual Requested Common Equity Ratio 49.4% Requested Rate of Return ROE: 10.60%; ROR: 7.19% Proposed Rate Base (Adjusted) $362M Requested Revenue Requirement Increase $21.5M(1) Residential Total Bill % Increase 10.40% Notes 5/17/16 DPL DE filed application with the DPSC seeking increase in gas distribution base rates 18 month forward looking reliability and other plant additions from January 2016 through June 2017 ($3.4M of Revenue Requirement based on 10.60% ROE) included in revenue requirement request Q3 2017 - PSC order expected As permitted by Delaware law, Delmarva Power implemented interim rate increases of $2.5 million on July 16, 2016 and will implement full allowable rates on December 17, 2016, subject to refund

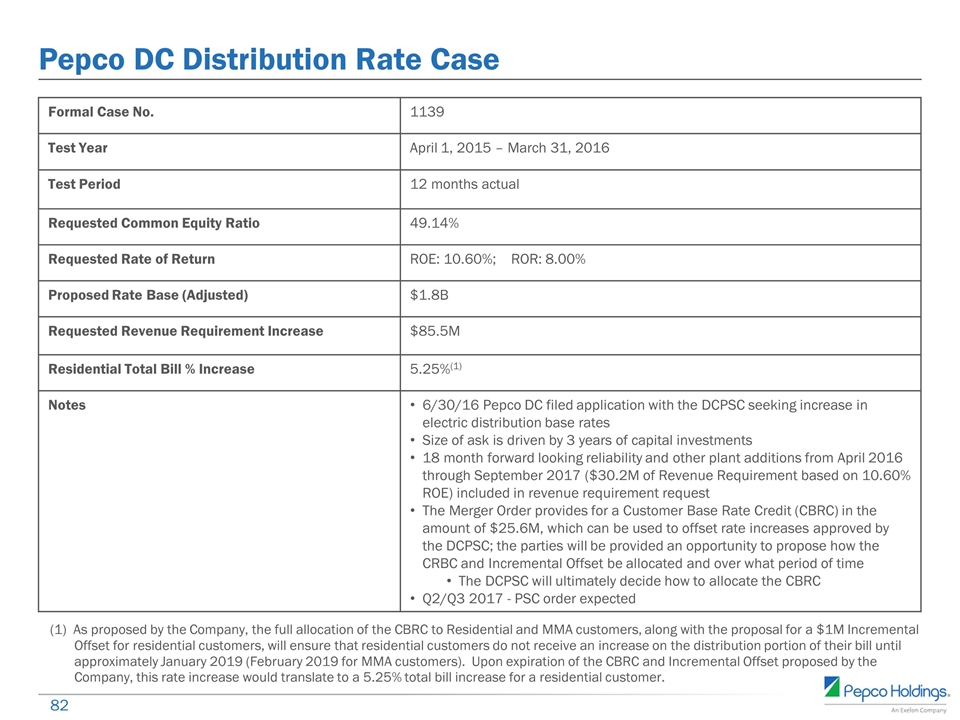

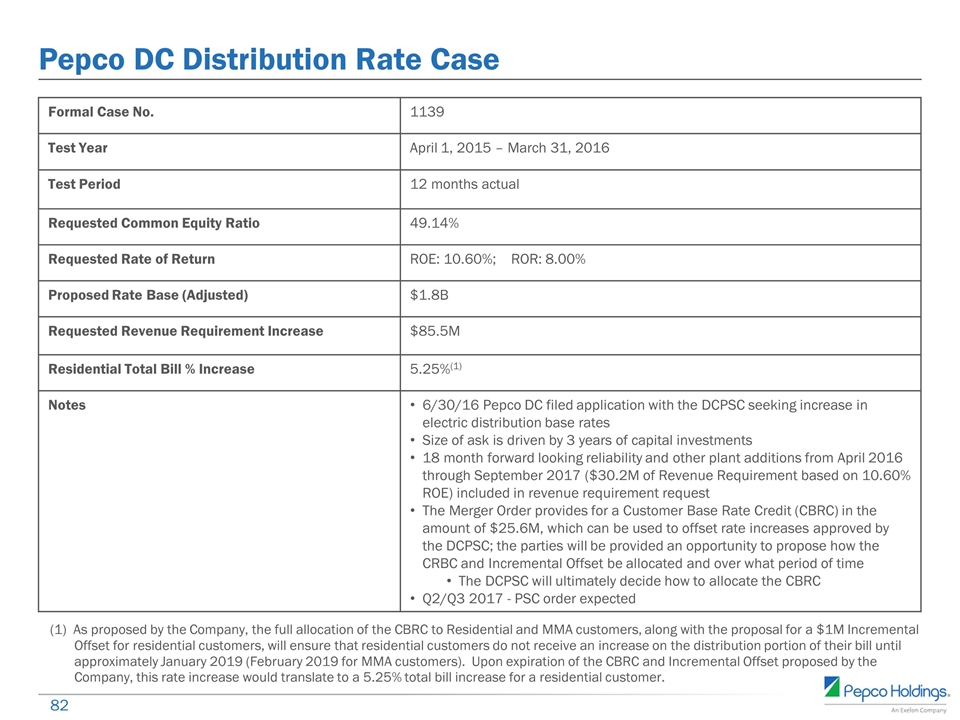

Pepco DC Distribution Rate Case Formal Case No. 1139 Test Year April 1, 2015 – March 31, 2016 Test Period 12 months actual Requested Common Equity Ratio 49.14% Requested Rate of Return ROE: 10.60%; ROR: 8.00% Proposed Rate Base (Adjusted) $1.8B Requested Revenue Requirement Increase $85.5M Residential Total Bill % Increase 5.25%(1) Notes 6/30/16 Pepco DC filed application with the DCPSC seeking increase in electric distribution base rates Size of ask is driven by 3 years of capital investments 18 month forward looking reliability and other plant additions from April 2016 through September 2017 ($30.2M of Revenue Requirement based on 10.60% ROE) included in revenue requirement request The Merger Order provides for a Customer Base Rate Credit (CBRC) in the amount of $25.6M, which can be used to offset rate increases approved by the DCPSC; the parties will be provided an opportunity to propose how the CRBC and Incremental Offset be allocated and over what period of time The DCPSC will ultimately decide how to allocate the CBRC Q2/Q3 2017 - PSC order expected (1) As proposed by the Company, the full allocation of the CBRC to Residential and MMA customers, along with the proposal for a $1M Incremental Offset for residential customers, will ensure that residential customers do not receive an increase on the distribution portion of their bill until approximately January 2019 (February 2019 for MMA customers). Upon expiration of the CBRC and Incremental Offset proposed by the Company, this rate increase would translate to a 5.25% total bill increase for a residential customer.

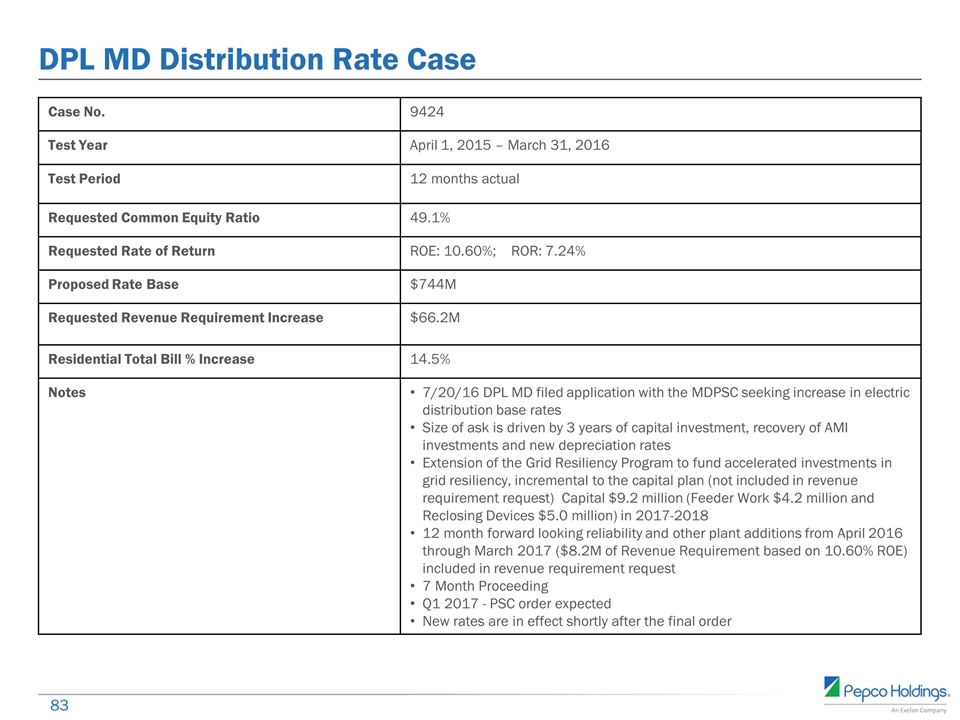

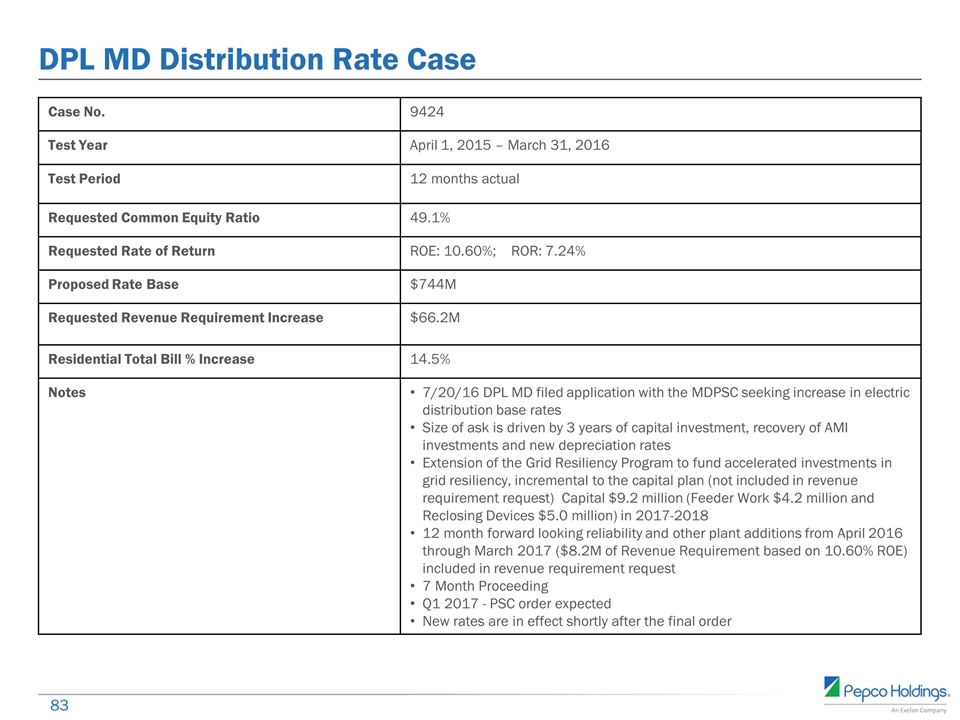

DPL MD Distribution Rate Case Case No. 9424 Test Year April 1, 2015 – March 31, 2016 Test Period 12 months actual Requested Common Equity Ratio 49.1% Requested Rate of Return ROE: 10.60%; ROR: 7.24% Proposed Rate Base $744M Requested Revenue Requirement Increase $66.2M Residential Total Bill % Increase 14.5% Notes 7/20/16 DPL MD filed application with the MDPSC seeking increase in electric distribution base rates Size of ask is driven by 3 years of capital investment, recovery of AMI investments and new depreciation rates Extension of the Grid Resiliency Program to fund accelerated investments in grid resiliency, incremental to the capital plan (not included in revenue requirement request) Capital $9.2 million (Feeder Work $4.2 million and Reclosing Devices $5.0 million) in 2017-2018 12 month forward looking reliability and other plant additions from April 2016 through March 2017 ($8.2M of Revenue Requirement based on 10.60% ROE) included in revenue requirement request 7 Month Proceeding Q1 2017 - PSC order expected New rates are in effect shortly after the final order

Pepco Holdings Capital Expenditures Note: Numbers rounded to nearest $25M and may not add due to rounding

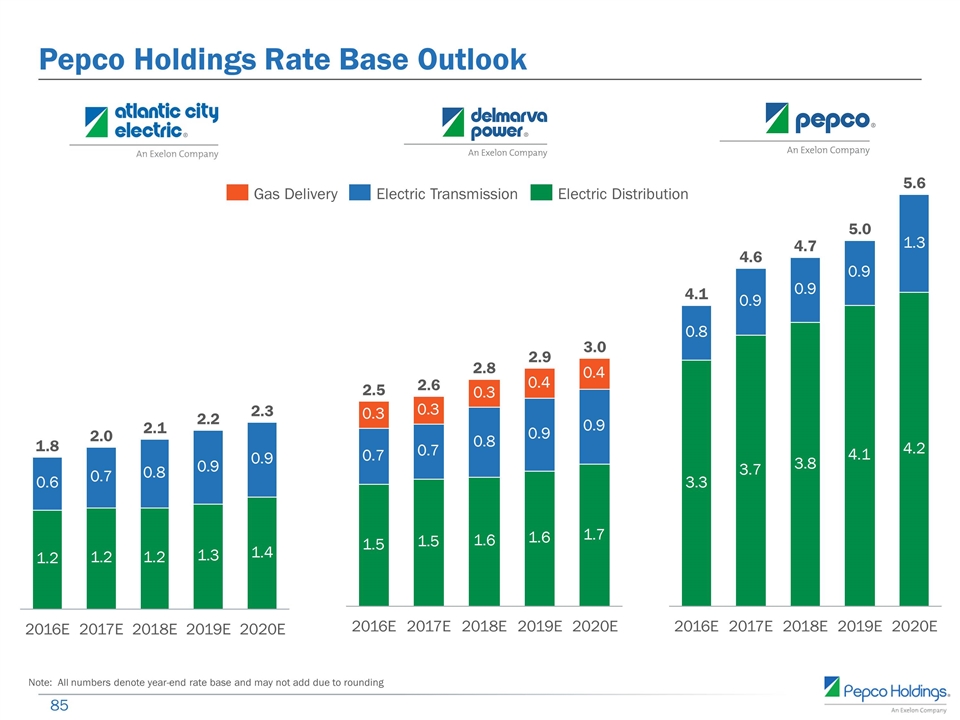

Note: All numbers denote year-end rate base and may not add due to rounding Pepco Holdings Rate Base Outlook Electric Distribution Electric Transmission Gas Delivery

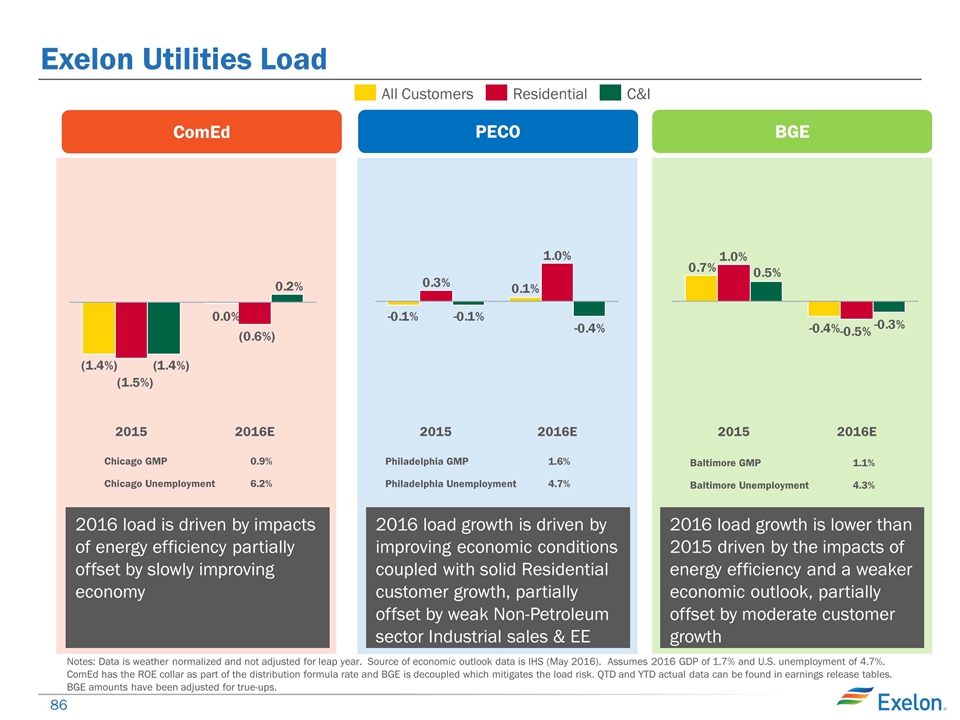

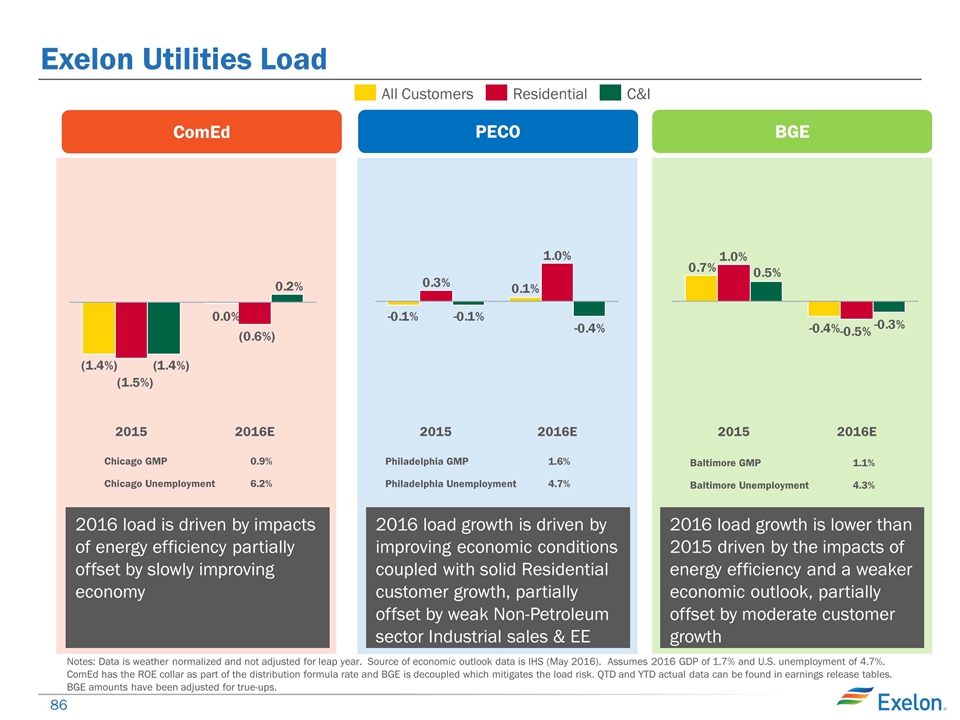

BGE Exelon Utilities Load ComEd Baltimore GMP 1.1% Baltimore Unemployment 4.3% PECO 2016 load growth is driven by improving economic conditions coupled with solid Residential customer growth, partially offset by weak Non-Petroleum sector Industrial sales & EE Philadelphia GMP 1.6% Philadelphia Unemployment 4.7% Chicago GMP 0.9% Chicago Unemployment 6.2% 2016 load is driven by impacts of energy efficiency partially offset by slowly improving economy Notes: Data is weather normalized and not adjusted for leap year. Source of economic outlook data is IHS (May 2016). Assumes 2016 GDP of 1.7% and U.S. unemployment of 4.7%. ComEd has the ROE collar as part of the distribution formula rate and BGE is decoupled which mitigates the load risk. QTD and YTD actual data can be found in earnings release tables. BGE amounts have been adjusted for true-ups. 2015 2016E 2016 load growth is lower than 2015 driven by the impacts of energy efficiency and a weaker economic outlook, partially offset by moderate customer growth 2016E 2015

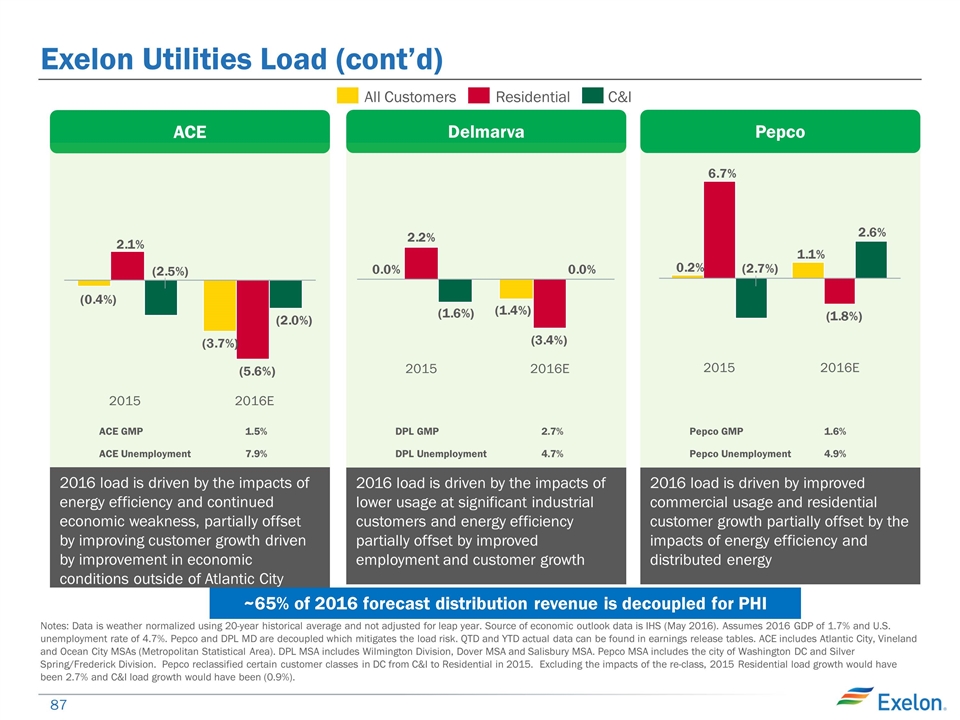

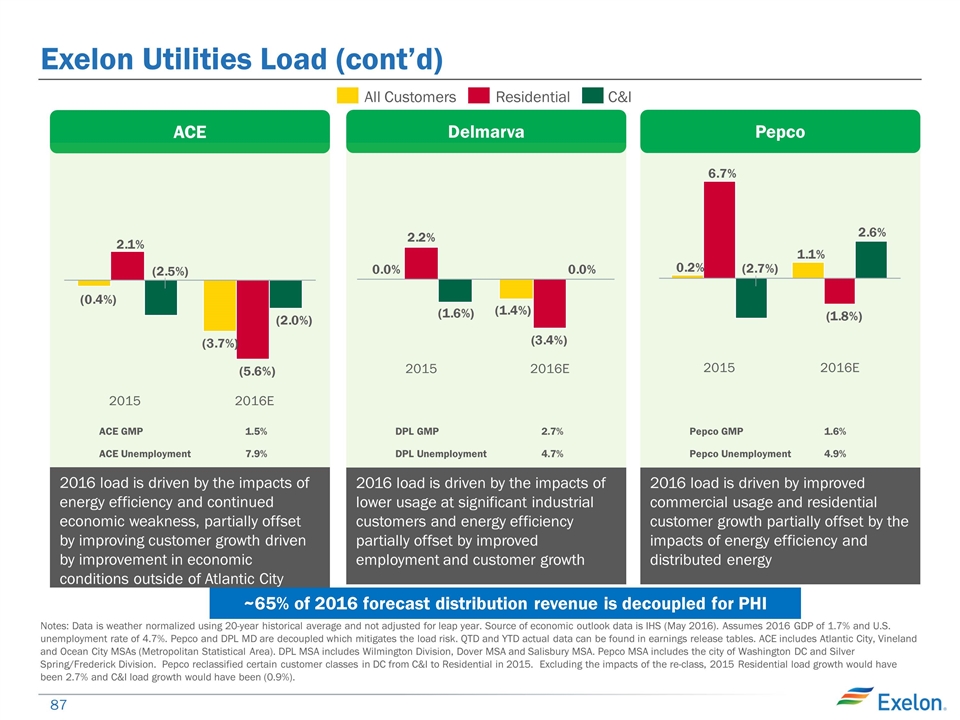

Pepco Exelon Utilities Load (cont’d) Delmarva C&I ACE 2016E 2015 2016 load is driven by the impacts of energy efficiency and continued economic weakness, partially offset by improving customer growth driven by improvement in economic conditions outside of Atlantic City 2016 load is driven by the impacts of lower usage at significant industrial customers and energy efficiency partially offset by improved employment and customer growth 2016 load is driven by improved commercial usage and residential customer growth partially offset by the impacts of energy efficiency and distributed energy ACE GMP 1.5% ACE Unemployment 7.9% DPL GMP 2.7% DPL Unemployment 4.7% Pepco GMP 1.6% Pepco Unemployment 4.9% Notes: Data is weather normalized using 20-year historical average and not adjusted for leap year. Source of economic outlook data is IHS (May 2016). Assumes 2016 GDP of 1.7% and U.S. unemployment rate of 4.7%. Pepco and DPL MD are decoupled which mitigates the load risk. QTD and YTD actual data can be found in earnings release tables. ACE includes Atlantic City, Vineland and Ocean City MSAs (Metropolitan Statistical Area). DPL MSA includes Wilmington Division, Dover MSA and Salisbury MSA. Pepco MSA includes the city of Washington DC and Silver Spring/Frederick Division. Pepco reclassified certain customer classes in DC from C&I to Residential in 2015. Excluding the impacts of the re-class, 2015 Residential load growth would have been 2.7% and C&I load growth would have been (0.9%). ~65% of 2016 forecast distribution revenue is decoupled for PHI

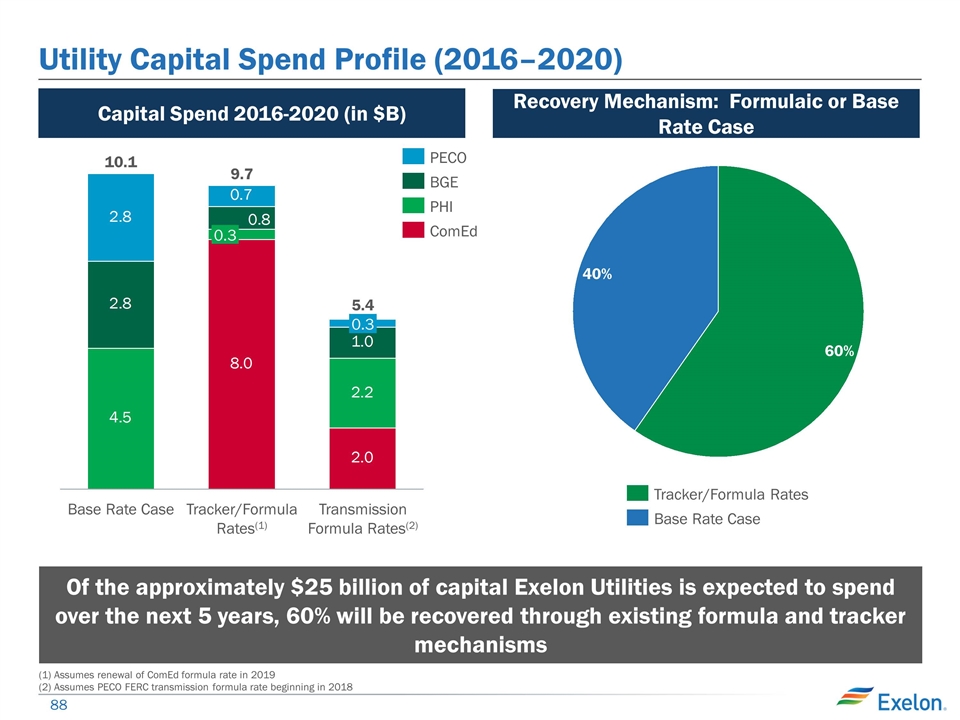

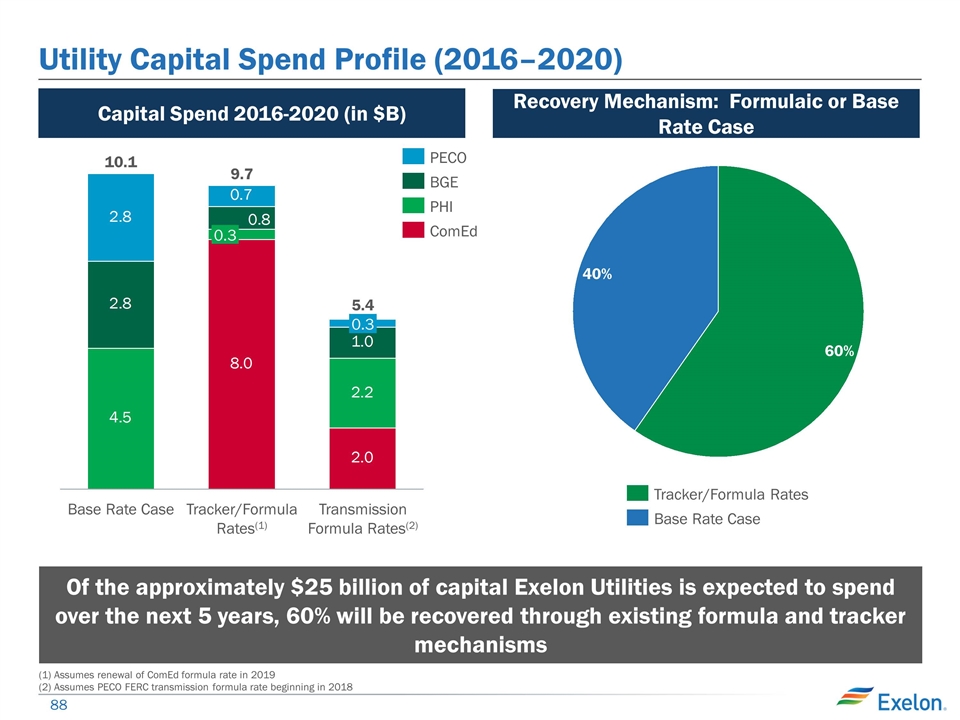

Utility Capital Spend Profile (2016–2020) (1) Assumes renewal of ComEd formula rate in 2019 (2) Assumes PECO FERC transmission formula rate beginning in 2018 Of the approximately $25 billion of capital Exelon Utilities is expected to spend over the next 5 years, 60% will be recovered through existing formula and tracker mechanisms Capital Spend 2016-2020 (in $B) (2) (1) Recovery Mechanism: Formulaic or Base Rate Case

Exelon’s Policy Priorities Bill Von Hoene Senior Executive Vice President & Chief Strategy Officer Kathleen Barrón Senior Vice President Federal Regulatory Affairs and Wholesale Market Policy

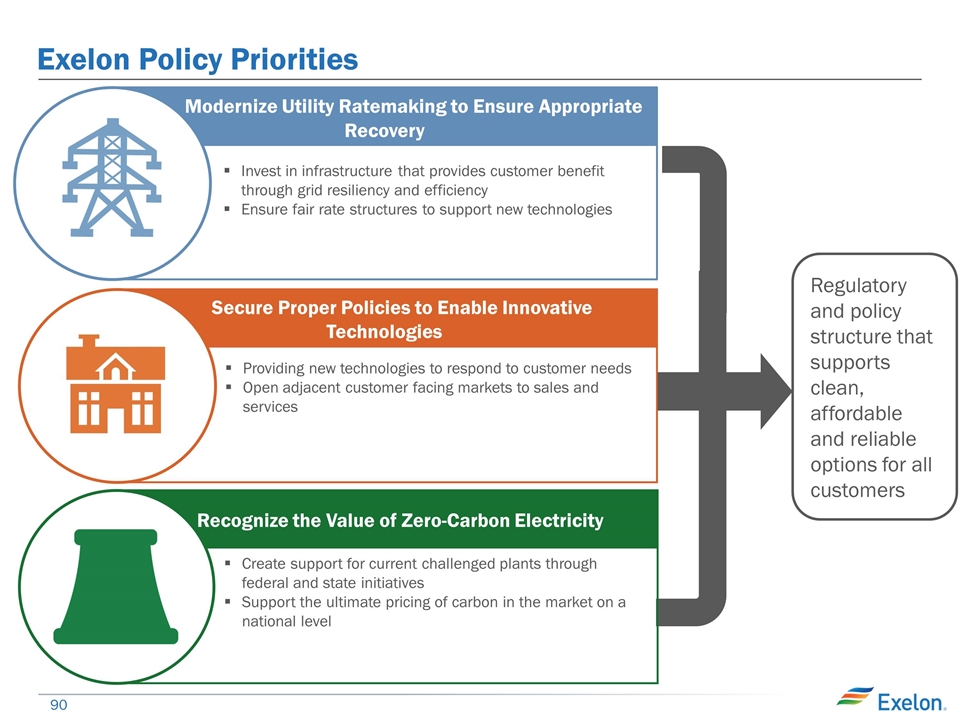

Exelon Policy Priorities Create support for current challenged plants through federal and state initiatives Support the ultimate pricing of carbon in the market on a national level Modernize Utility Ratemaking to Ensure Appropriate Recovery Secure Proper Policies to Enable Innovative Technologies Recognize the Value of Zero-Carbon Electricity Regulatory and policy structure that supports clean, affordable and reliable options for all customers Invest in infrastructure that provides customer benefit through grid resiliency and efficiency Ensure fair rate structures to support new technologies Providing new technologies to respond to customer needs Open adjacent customer facing markets to sales and services

Our Carbon Policy Principles Exelon believes in our nation’s ability to transition the generation fleet to a zero-carbon future while maintaining affordable and reliable electric service for consumers For the foreseeable future, the most cost-effective carbon solution for our customers will be the continued operation of our nation’s nuclear fleet Exelon believes competitive markets produce superior results for consumers and drive innovation. However, those markets do not currently incorporate appropriate pricing for environmental attributes. Exelon is pursuing a two-part strategy for moving toward a more competitive treatment of CO2 emissions: First, we must maintain nuclear units that provide a cost effective form of CO2 abatement. The New York ZEC program demonstrates that as long as the clean energy payment required to maintain operations at existing nuclear units is lower than the social cost of CO2 emissions and the cost of CO2 abatement being paid to other zero carbon resources, maintaining nuclear capacity should be selected as the most competitive source of CO2 abatement. Second, we must continue to work toward a technology neutral price of CO2 abatement. Exelon is pursuing approaches to reflect a uniform price on CO2 in wholesale markets as an eventual substitute for technology-specific subsidies. As these approaches are phased in, the ZEC programs have been designed to automatically reduce ZEC payments in response to higher energy prices.

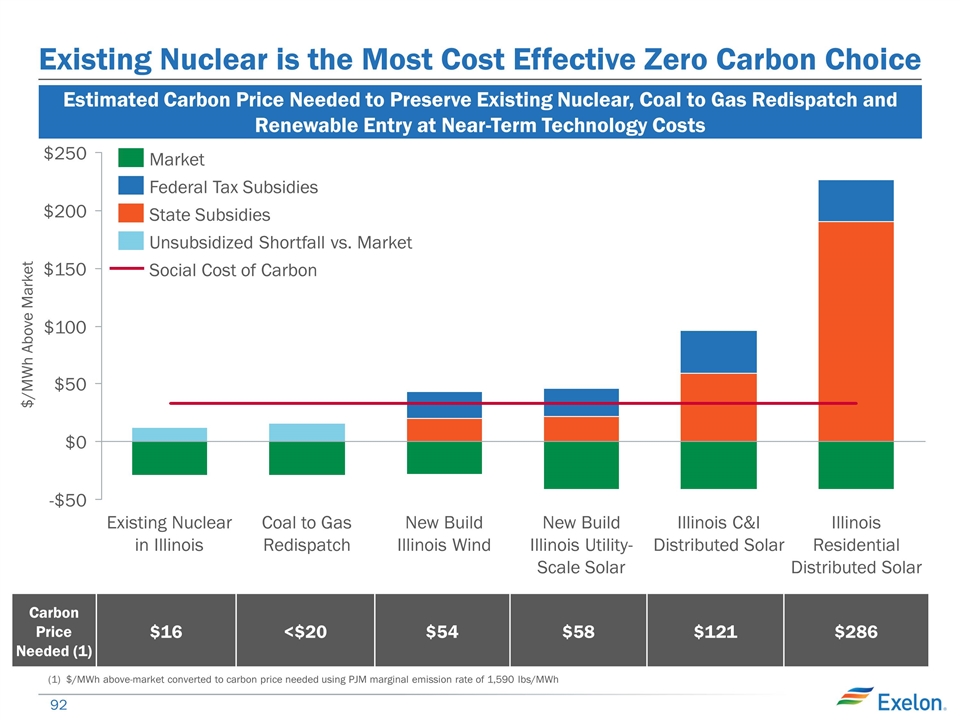

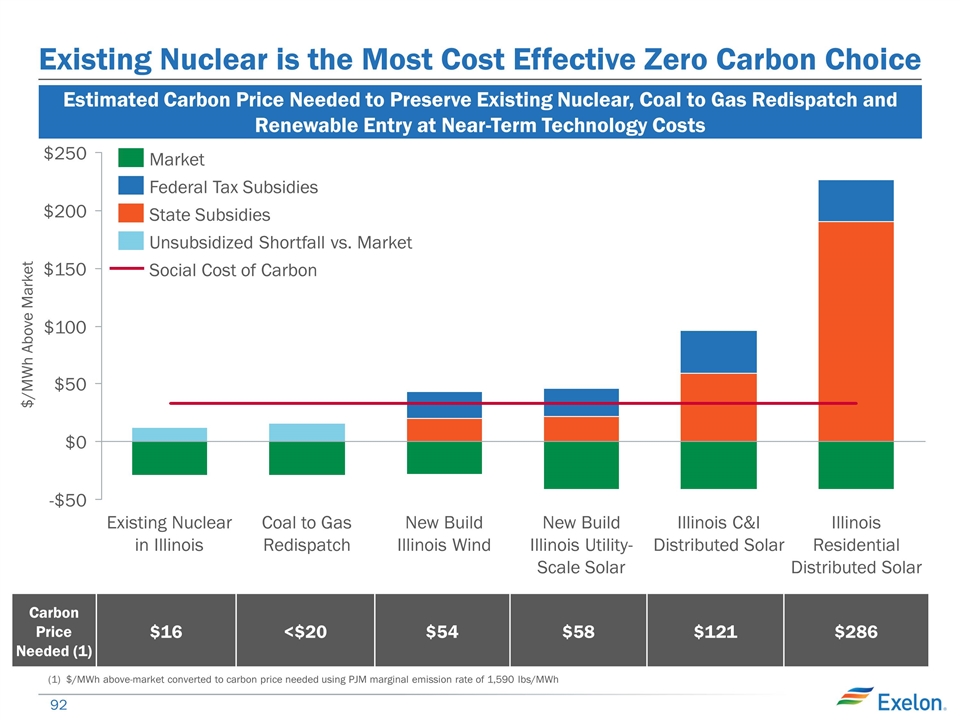

Existing Nuclear is the Most Cost Effective Zero Carbon Choice Carbon Price Needed (1) $16 <$20 $54 $58 $121 $286 (1) $/MWh above-market converted to carbon price needed using PJM marginal emission rate of 1,590 lbs/MWh Estimated Carbon Price Needed to Preserve Existing Nuclear, Coal to Gas Redispatch and Renewable Entry at Near-Term Technology Costs $/MWh Above Market

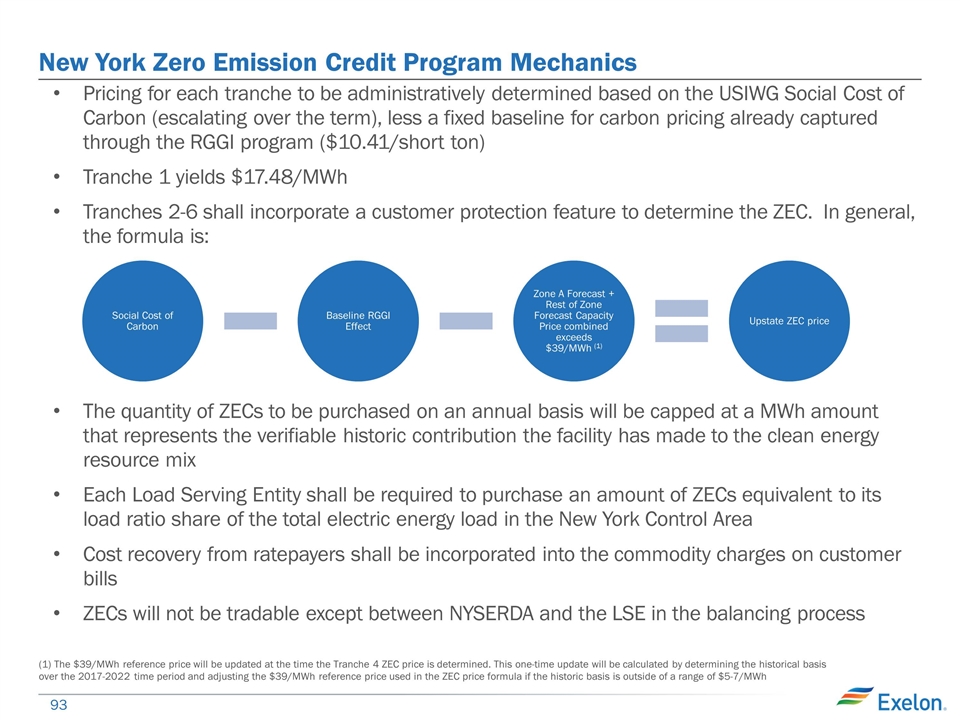

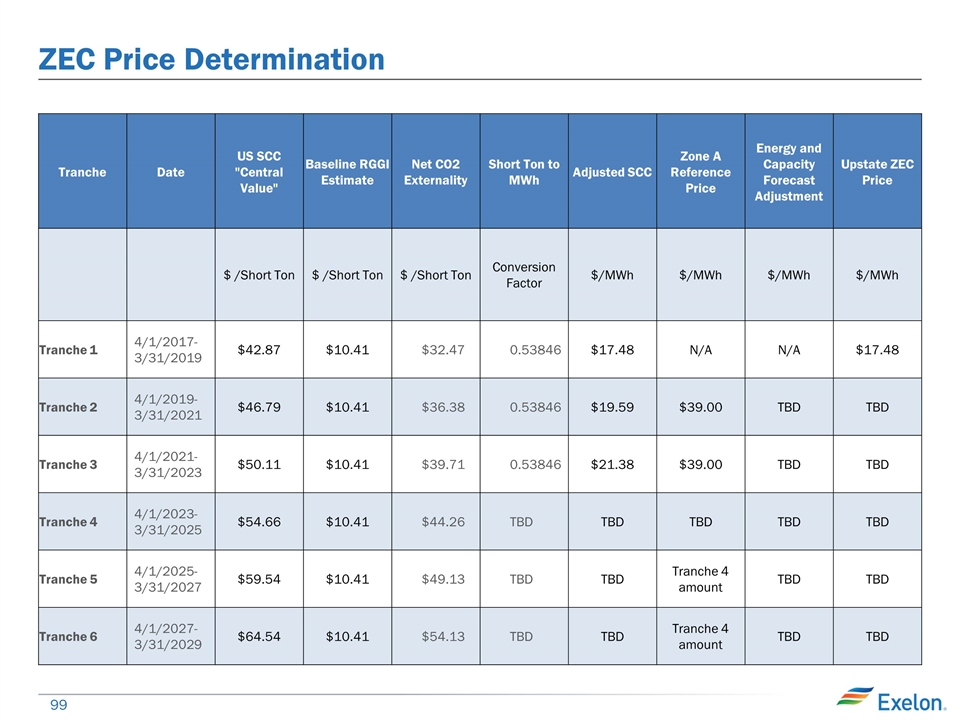

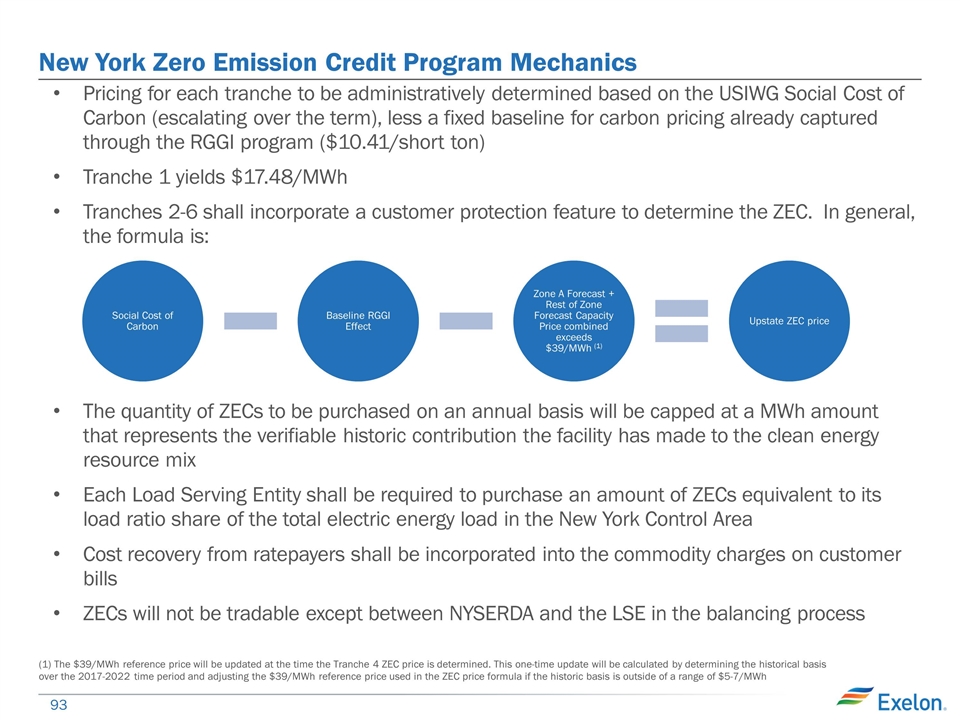

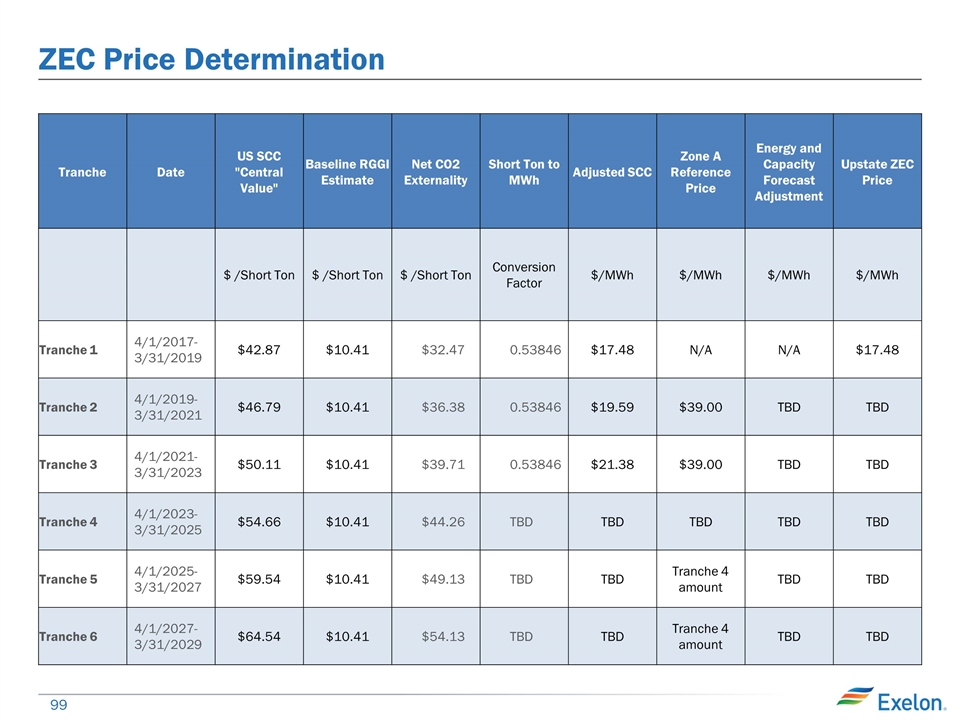

New York Zero Emission Credit Program Mechanics Pricing for each tranche to be administratively determined based on the USIWG Social Cost of Carbon (escalating over the term), less a fixed baseline for carbon pricing already captured through the RGGI program ($10.41/short ton) Tranche 1 yields $17.48/MWh Tranches 2-6 shall incorporate a customer protection feature to determine the ZEC. In general, the formula is: The quantity of ZECs to be purchased on an annual basis will be capped at a MWh amount that represents the verifiable historic contribution the facility has made to the clean energy resource mix Each Load Serving Entity shall be required to purchase an amount of ZECs equivalent to its load ratio share of the total electric energy load in the New York Control Area Cost recovery from ratepayers shall be incorporated into the commodity charges on customer bills ZECs will not be tradable except between NYSERDA and the LSE in the balancing process (1) The $39/MWh reference price will be updated at the time the Tranche 4 ZEC price is determined. This one-time update will be calculated by determining the historical basis over the 2017-2022 time period and adjusting the $39/MWh reference price used in the ZEC price formula if the historic basis is outside of a range of $5-7/MWh Social Cost of Carbon Baseline RGGI Effect Upstate ZEC price Zone A Forecast + Rest of Zone Forecast Capacity Price combined exceeds $39/ MWh (1)

Zero Emission Credits (ZECs) are Like Renewable Energy Credits (RECs) Both credits are for environmental attributes to meet a state environmental goal While legal challenges are likely, we believe that ZECs, like RECs, will withstand legal challenge: No affiliate contracts (Ohio) No attempt to alter FERC wholesale rate (NJ/MD) FERC has never applied the Minimum Offer Price Rule (MOPR) to existing resources; it has always been a tool to address state support for new entry Payment for ZECs is not “tethered” to action in a FERC jurisdictional market

Presidential Politics Policy Outlook: Key Issues Facing the Next President Climate Change including Clean Power Plan Implementation Budget & Entitlement Reform Comprehensive Tax Reform Appointees to Supreme Court, DOE, EPA, FERC and NRC Federal Nuclear Waste Policy TRUMP CLINTON

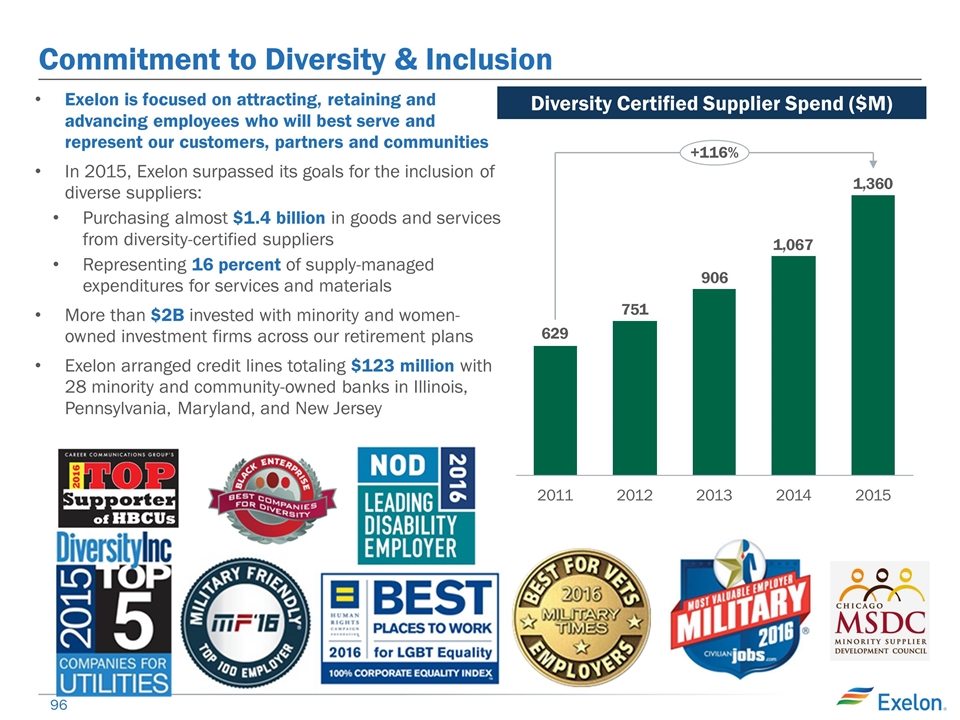

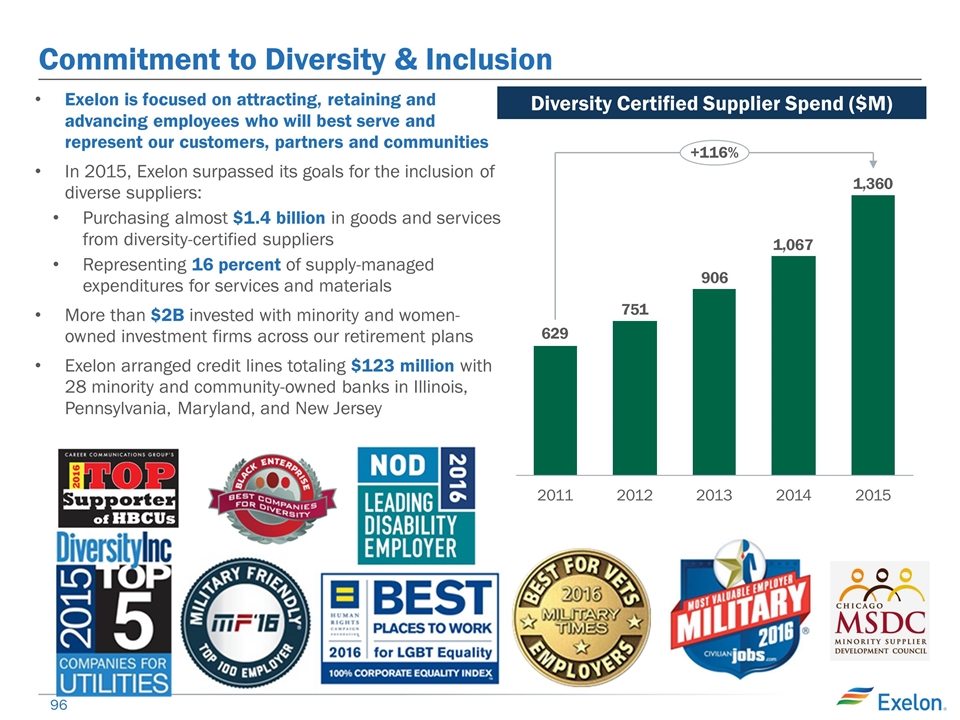

Commitment to Diversity & Inclusion Exelon is focused on attracting, retaining and advancing employees who will best serve and represent our customers, partners and communities In 2015, Exelon surpassed its goals for the inclusion of diverse suppliers: Purchasing almost $1.4 billion in goods and services from diversity-certified suppliers Representing 16 percent of supply-managed expenditures for services and materials More than $2B invested with minority and women-owned investment firms across our retirement plans Exelon arranged credit lines totaling $123 million with 28 minority and community-owned banks in Illinois, Pennsylvania, Maryland, and New Jersey Diversity Certified Supplier Spend ($M)

Exelon’s Policies Priorities Appendix

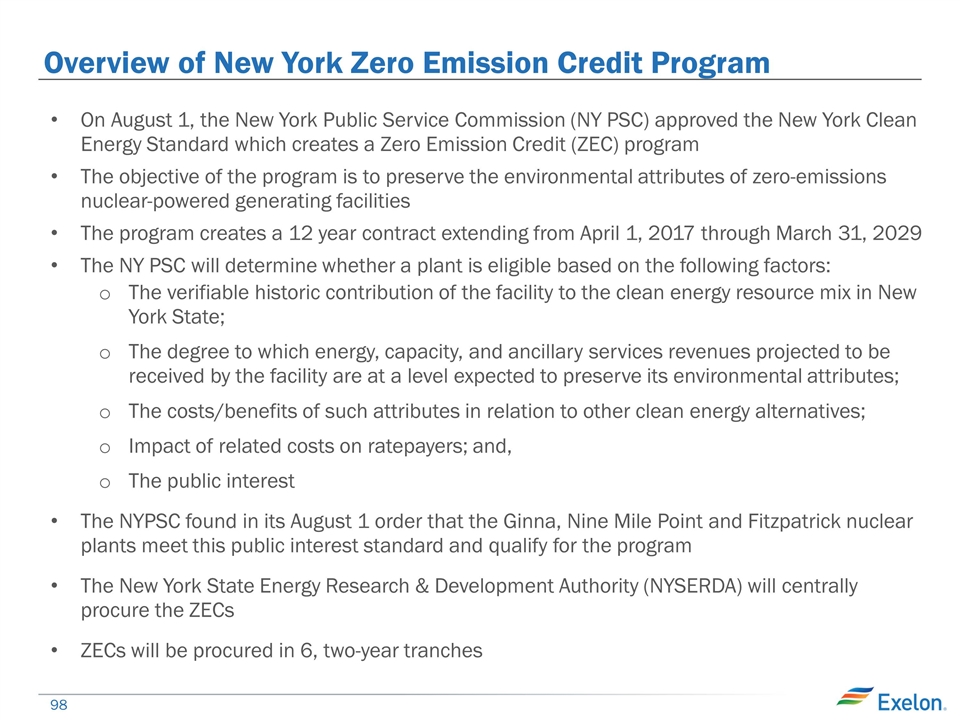

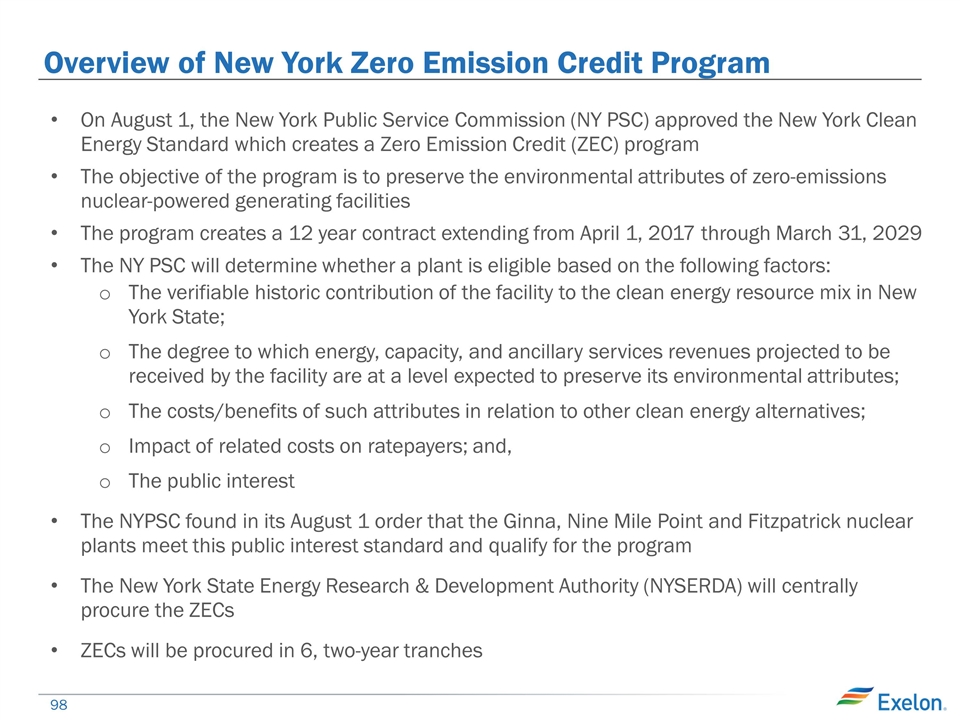

Overview of New York Zero Emission Credit Program On August 1, the New York Public Service Commission (NY PSC) approved the New York Clean Energy Standard which creates a Zero Emission Credit (ZEC) program The objective of the program is to preserve the environmental attributes of zero-emissions nuclear-powered generating facilities The program creates a 12 year contract extending from April 1, 2017 through March 31, 2029 The NY PSC will determine whether a plant is eligible based on the following factors: The verifiable historic contribution of the facility to the clean energy resource mix in New York State; The degree to which energy, capacity, and ancillary services revenues projected to be received by the facility are at a level expected to preserve its environmental attributes; The costs/benefits of such attributes in relation to other clean energy alternatives; Impact of related costs on ratepayers; and, The public interest The NYPSC found in its August 1 order that the Ginna, Nine Mile Point and Fitzpatrick nuclear plants meet this public interest standard and qualify for the program The New York State Energy Research & Development Authority (NYSERDA) will centrally procure the ZECs ZECs will be procured in 6, two-year tranches

ZEC Price Determination Tranche Date US SCC "Central Value" Baseline RGGI Estimate Net CO2 Externality Short Ton to MWh Adjusted SCC Zone A Reference Price Energy and Capacity Forecast Adjustment Upstate ZEC Price $ /Short Ton $ /Short Ton $ /Short Ton Conversion Factor $/MWh $/MWh $/MWh $/MWh Tranche 1 4/1/2017-3/31/2019 $42.87 $10.41 $32.47 0.53846 $17.48 N/A N/A $17.48 Tranche 2 4/1/2019-3/31/2021 $46.79 $10.41 $36.38 0.53846 $19.59 $39.00 TBD TBD Tranche 3 4/1/2021-3/31/2023 $50.11 $10.41 $39.71 0.53846 $21.38 $39.00 TBD TBD Tranche 4 4/1/2023-3/31/2025 $54.66 $10.41 $44.26 TBD TBD TBD TBD TBD Tranche 5 4/1/2025-3/31/2027 $59.54 $10.41 $49.13 TBD TBD Tranche 4 amount TBD TBD Tranche 6 4/1/2027-3/31/2029 $64.54 $10.41 $54.13 TBD TBD Tranche 4 amount TBD TBD

Exelon Generation Overview Ken Cornew President & Chief Executive Officer, Exelon Generation

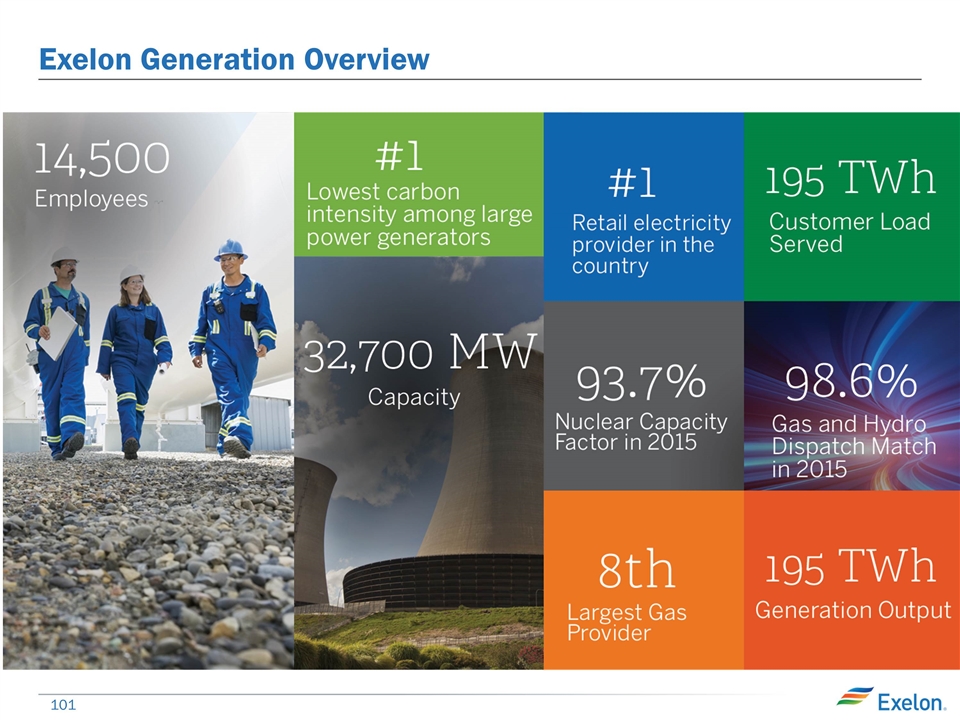

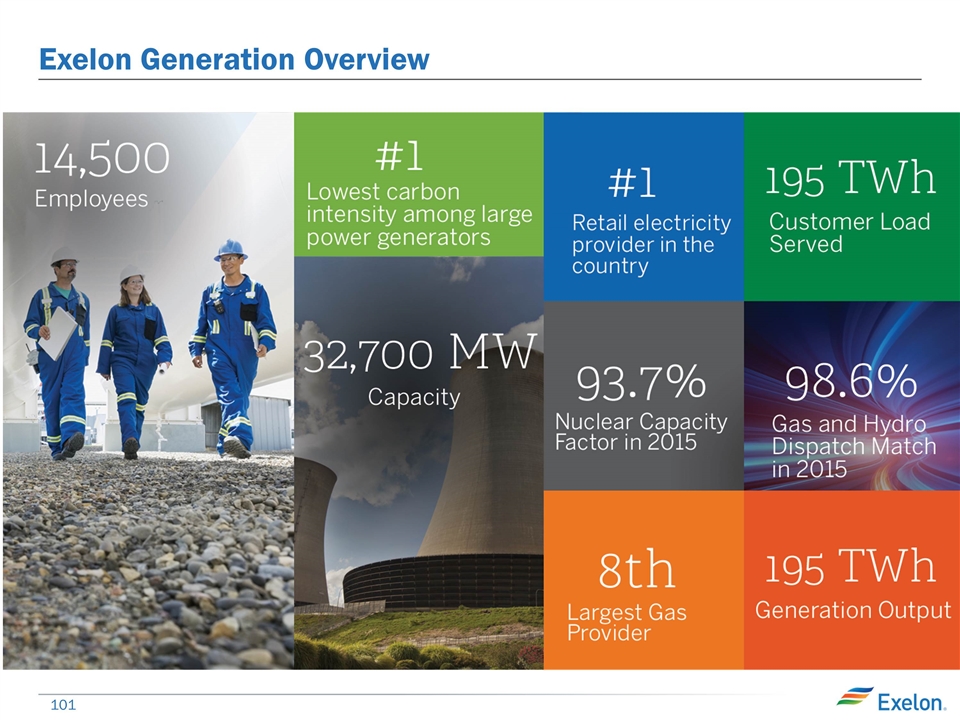

Exelon Generation Overview

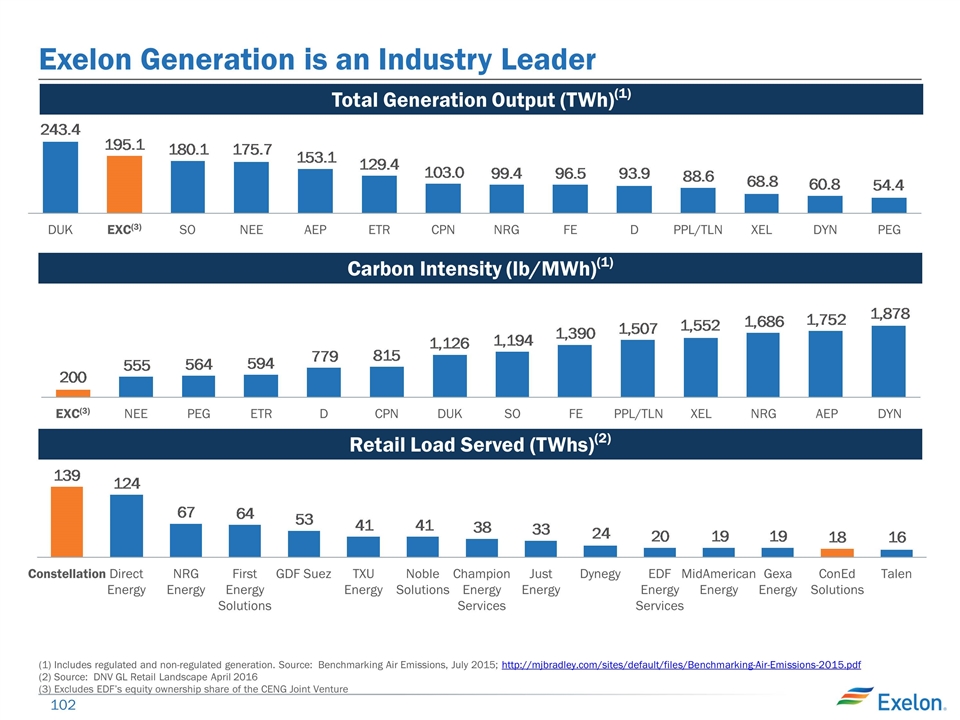

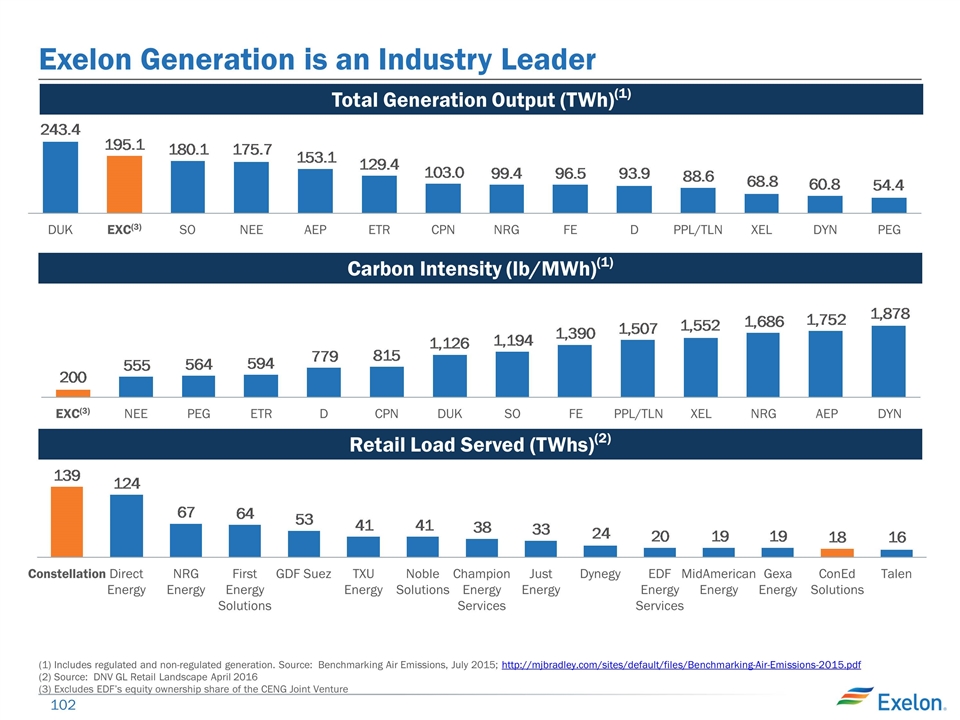

Exelon Generation is an Industry Leader Retail Load Served (TWhs)(2) Carbon Intensity (lb/MWh)(1) (3) Total Generation Output (TWh)(1) (1) Includes regulated and non-regulated generation. Source: Benchmarking Air Emissions, July 2015; http://mjbradley.com/sites/default/files/Benchmarking-Air-Emissions-2015.pdf (2) Source: DNV GL Retail Landscape April 2016 (3) Excludes EDF’s equity ownership share of the CENG Joint Venture (3)

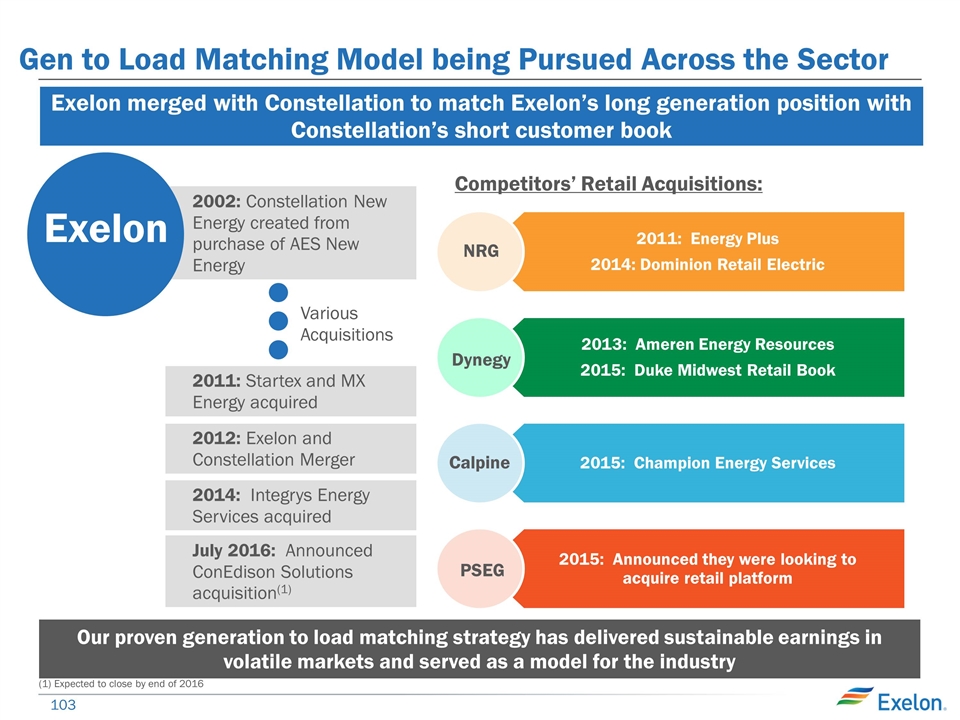

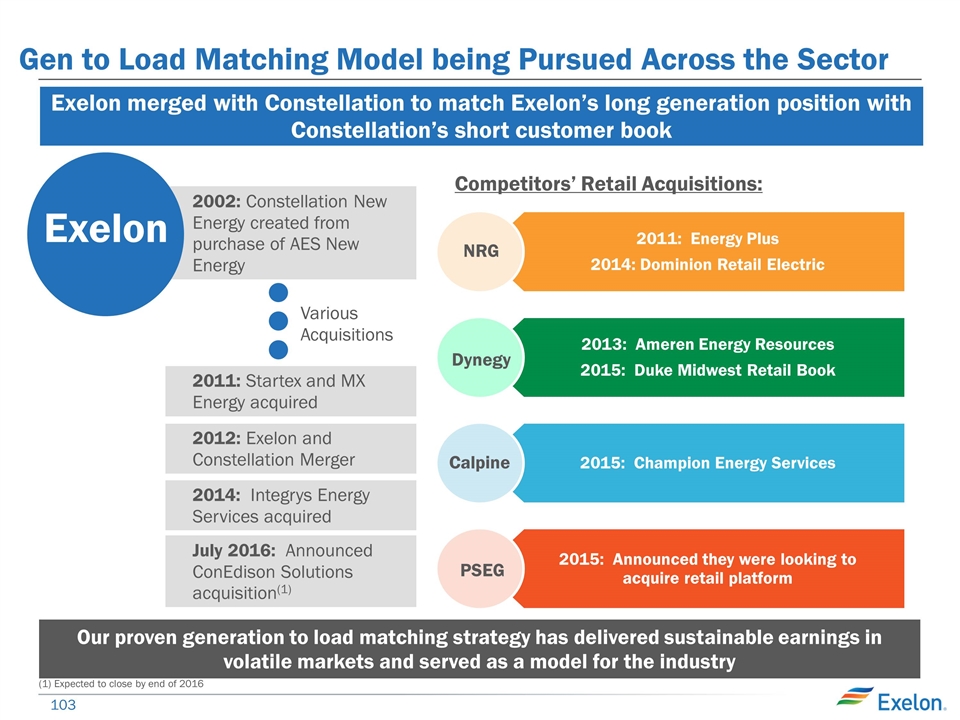

2012: Exelon and Constellation Merger 2002: Constellation New Energy created from purchase of AES New Energy Gen to Load Matching Model being Pursued Across the Sector 2011: Energy Plus 2014: Dominion Retail Electric 2013: Ameren Energy Resources 2015: Duke Midwest Retail Book 2015: Champion Energy Services 2015: Announced they were looking to acquire retail platform NRG Dynegy Calpine PSEG Our proven generation to load matching strategy has delivered sustainable earnings in volatile markets and served as a model for the industry Exelon merged with Constellation to match Exelon’s long generation position with Constellation’s short customer book Competitors’ Retail Acquisitions: Exelon July 2016: Announced ConEdison Solutions acquisition(1) 2014: Integrys Energy Services acquired 2011: Startex and MX Energy acquired (1) Expected to close by end of 2016 Various Acquisitions

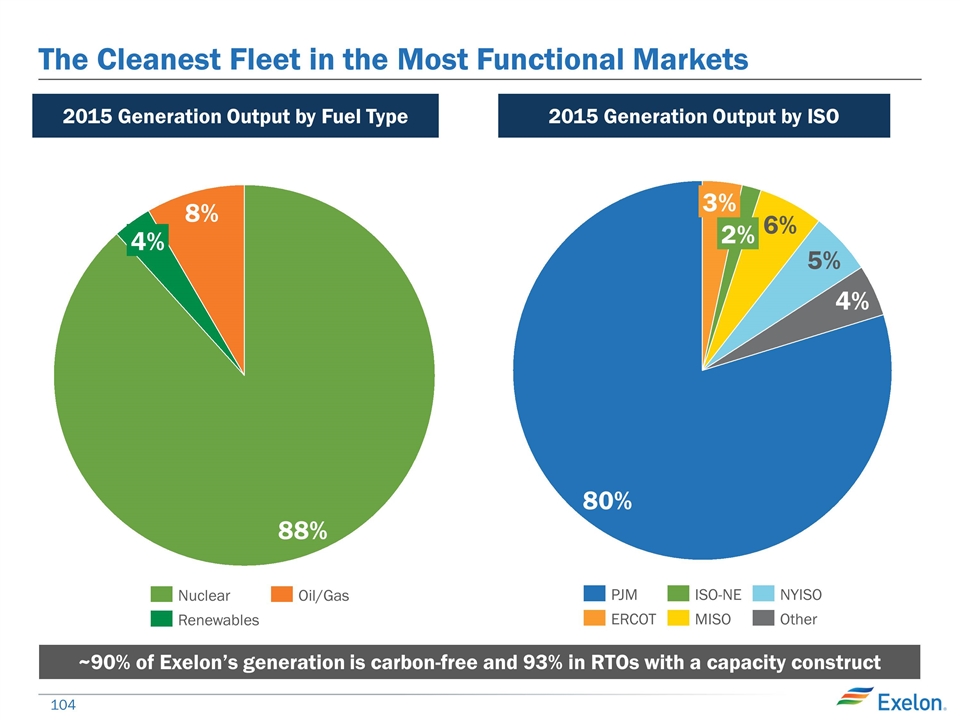

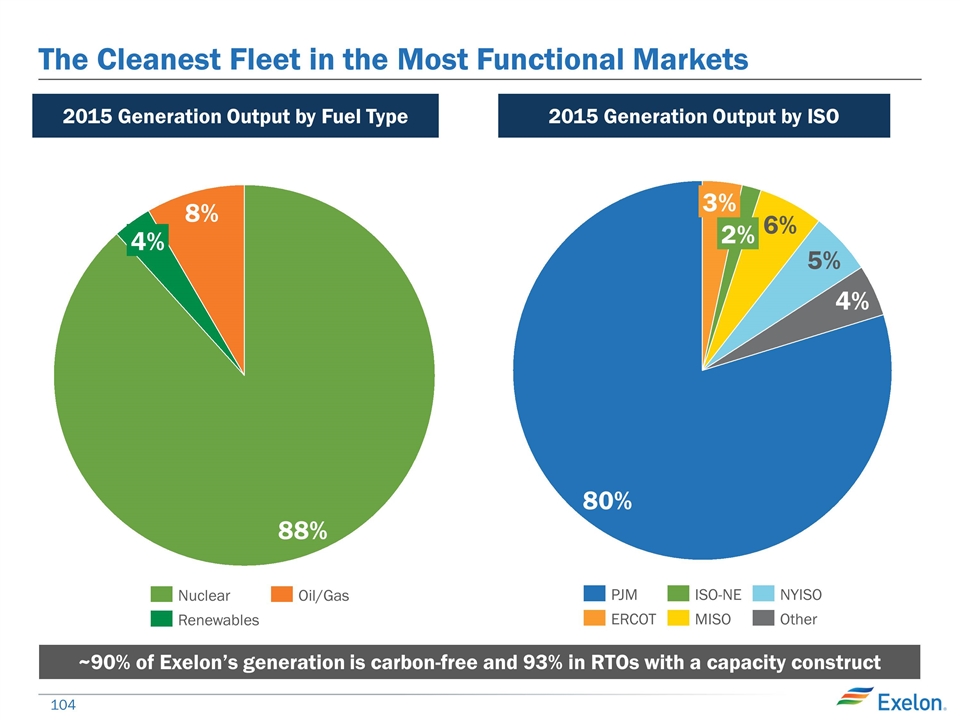

The Cleanest Fleet in the Most Functional Markets 2015 Generation Output by Fuel Type 2015 Generation Output by ISO ~90% of Exelon’s generation is carbon-free and 93% in RTOs with a capacity construct

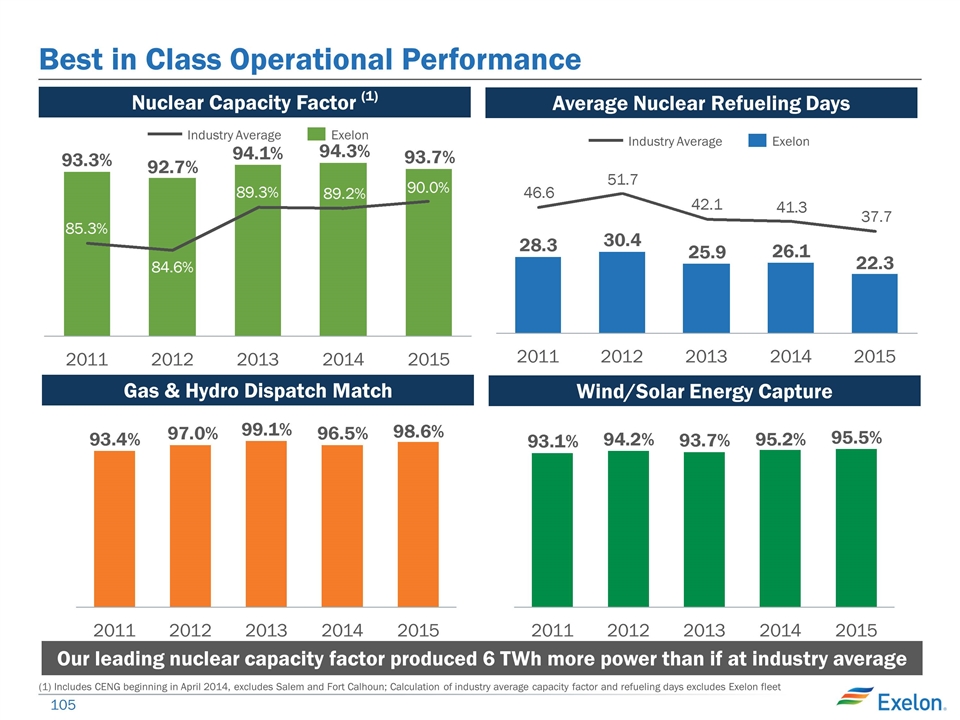

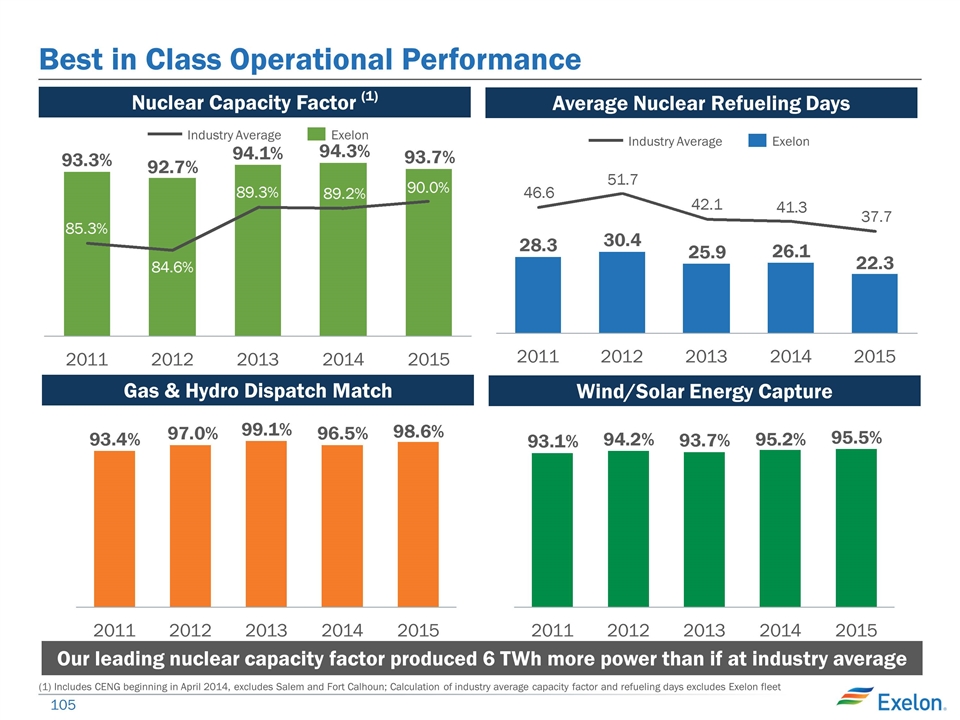

Best in Class Operational Performance Nuclear Capacity Factor (1) Gas & Hydro Dispatch Match Our leading nuclear capacity factor produced 6 TWh more power than if at industry average Average Nuclear Refueling Days Wind/Solar Energy Capture (1) Includes CENG beginning in April 2014, excludes Salem and Fort Calhoun; Calculation of industry average capacity factor and refueling days excludes Exelon fleet

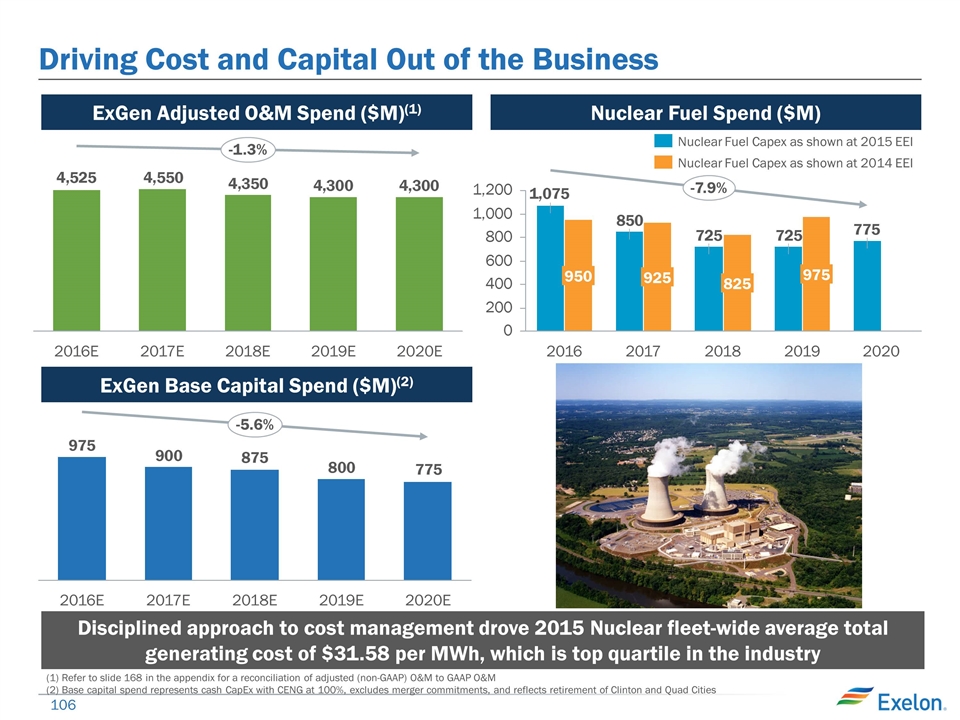

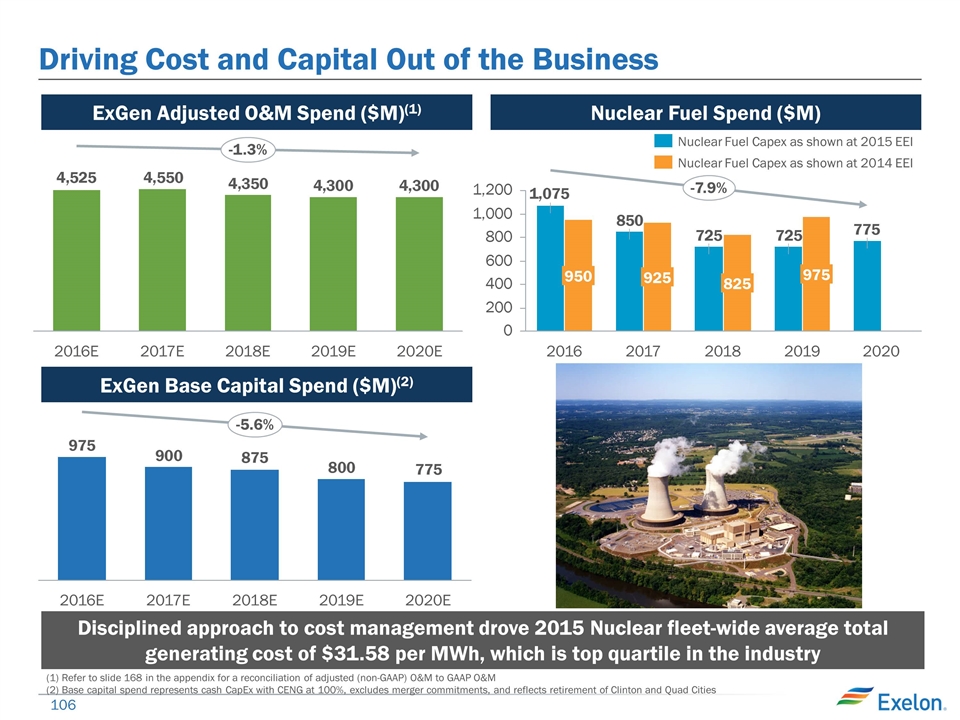

Driving Cost and Capital Out of the Business ExGen Base Capital Spend ($M)(2) ExGen Adjusted O&M Spend ($M)(1) Disciplined approach to cost management drove 2015 Nuclear fleet-wide average total generating cost of $31.58 per MWh, which is top quartile in the industry Nuclear Fuel Spend ($M) (1) Refer to slide 168 in the appendix for a reconciliation of adjusted (non-GAAP) O&M to GAAP O&M (2) Base capital spend represents cash CapEx with CENG at 100%, excludes merger commitments, and reflects retirement of Clinton and Quad Cities

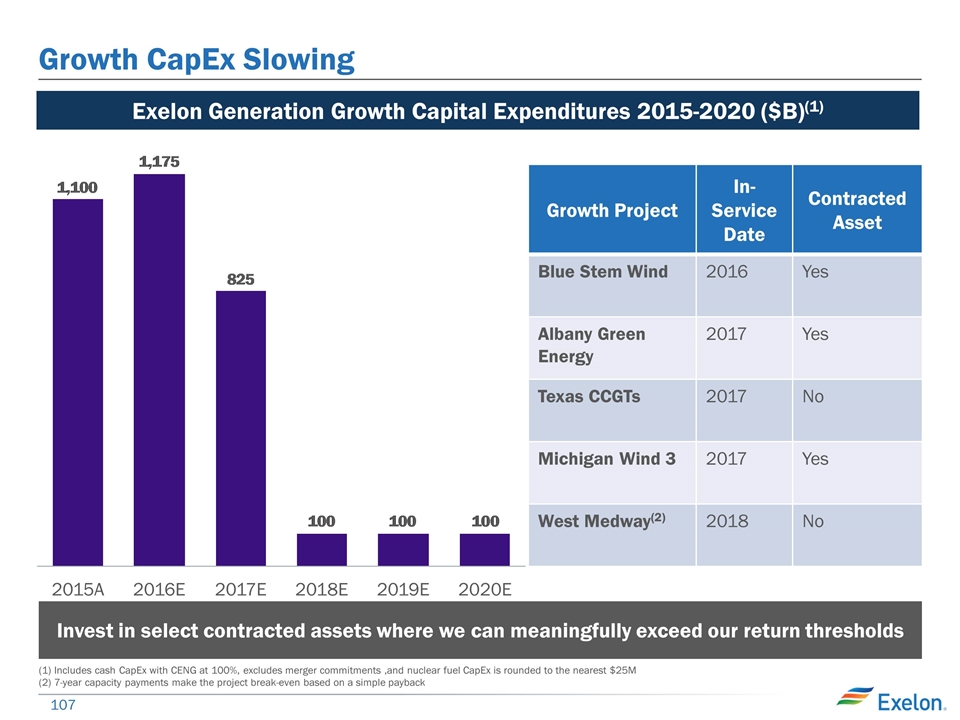

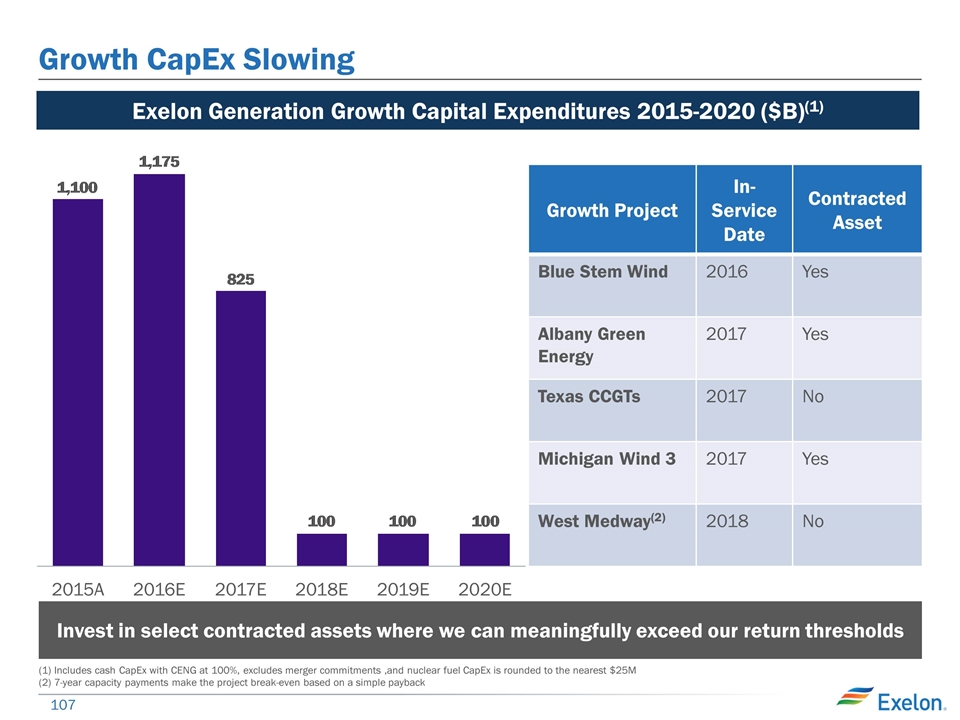

Growth CapEx Slowing Growth Project In-Service Date Contracted Asset Blue Stem Wind 2016 Yes Albany Green Energy 2017 Yes Texas CCGTs 2017 No Michigan Wind 3 2017 Yes West Medway(2) 2018 No Exelon Generation Growth Capital Expenditures 2015-2020 ($B)(1) (1) Includes cash CapEx with CENG at 100%, excludes merger commitments ,and nuclear fuel CapEx is rounded to the nearest $25M (2) 7-year capacity payments make the project break-even based on a simple payback Invest in select contracted assets where we can meaningfully exceed our return thresholds

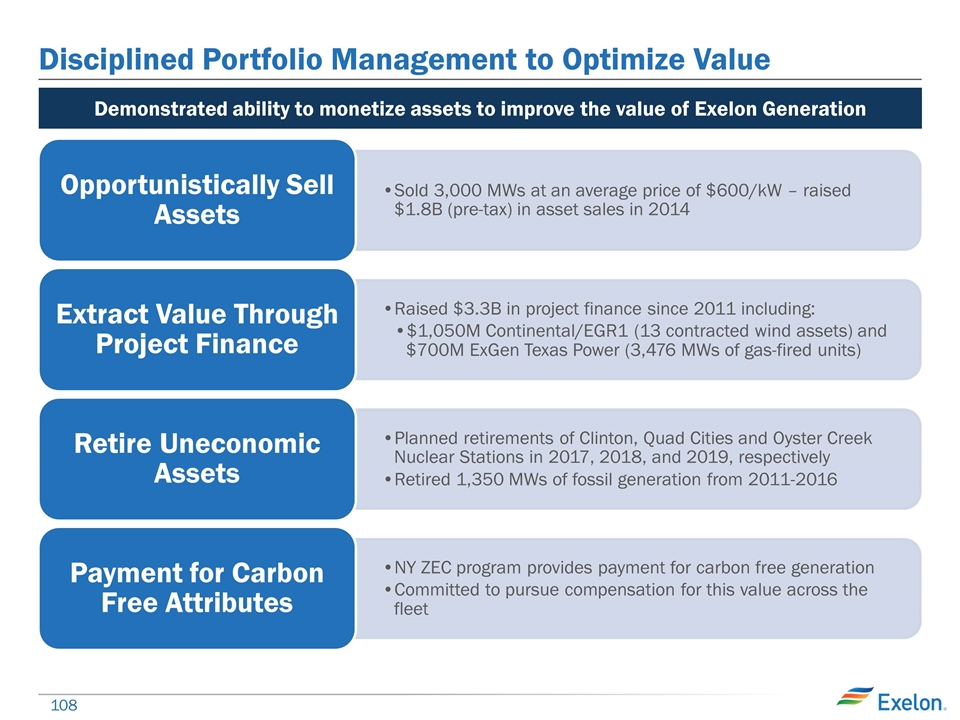

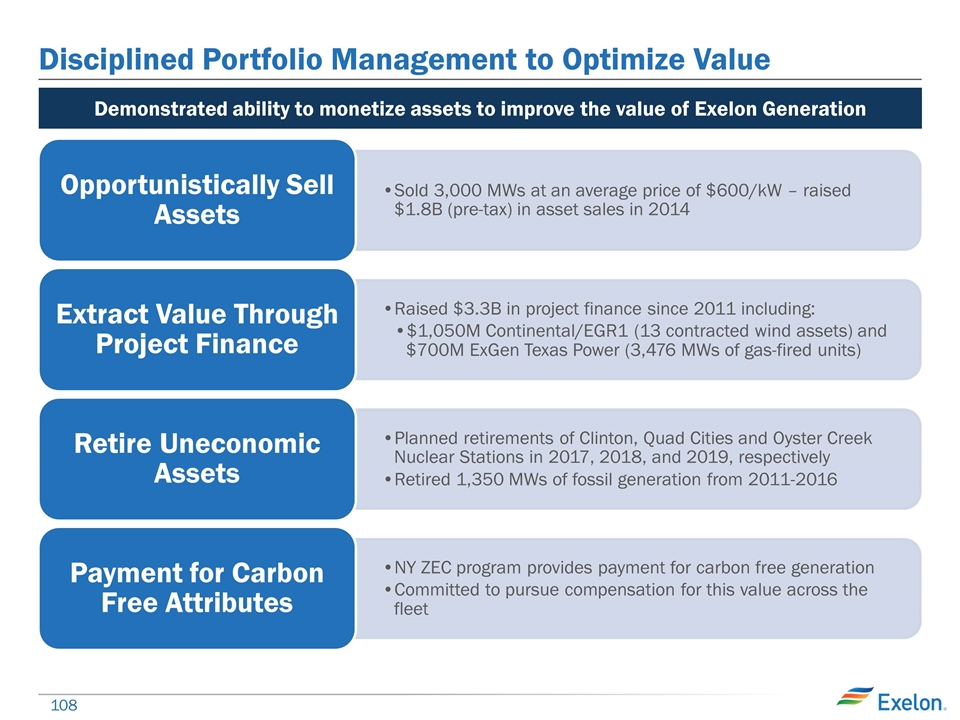

Disciplined Portfolio Management to Optimize Value Demonstrated ability to monetize assets to improve the value of Exelon Generation Opportunistically Sell Assets Sold 3,000 MWs at an average price of $600/kW – raised $1.8B (pre-tax) in asset sales in 2014 Extract Value Through Project Finance Raised $3.3B in project finance since 2011 including: Retire Uneconomic Assets Planned retirements of Clinton, Quad Cities and Oyster Creek Nuclear Stations in 2017, 2018, and 2019, respectively Retired 1,350 MWs of fossil generation from 2011-2016 Payment for Carbon Free Attributes NY ZEC program provides payment for carbon free generation $1,050M Continental/EGR1 (13 contracted wind assets) and $700M ExGen Texas Power (3,476 MWs of gas-fired units) Committed to pursue compensation for this value across the fleet

ExGen’s Strong Free Cash Flow Supports Utility Growth and Debt Reduction 2016-2020 Exelon Generation Free Cash Flow(1,2,3) and Uses of Cash ($B) Free Cash Flow is a non-GAAP Measure. See slide 168 for a reconciliation of free cash flow to the most comparable GAAP measures. Cumulative Free Cash Flow is a midpoint of a range based on June 30, 2016 market prices. It includes ~$700M of other sources including change in margin, tax parent benefit, equity investments, and acquisitions and divestitures. Approval of Clean Energy Standard (CES) in NY would add up to ~$750M of incremental cash (after-tax) through 2020. This incremental cash is comprised of payments from the CES program ($350M) and additional distributions to Exelon from CENG related to completion of loan repayment and special distribution. ($2.7 - $3.2) (2) (~$2.3) ($2.7 - $3.2) ~$8.2 Redeploying Exelon Generation’s free cash flow to maximize shareholder value

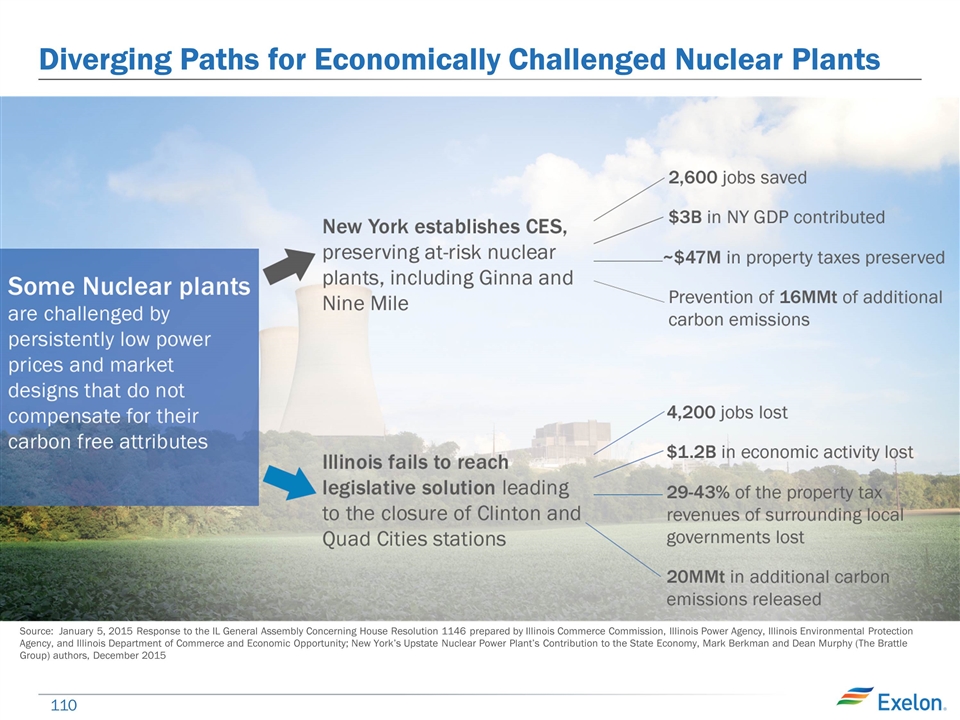

Diverging Paths for Economically Challenged Nuclear Plants Source: January 5, 2015 Response to the IL General Assembly Concerning House Resolution 1146 prepared by Illinois Commerce Commission, Illinois Power Agency, Illinois Environmental Protection Agency, and Illinois Department of Commerce and Economic Opportunity; New York’s Upstate Nuclear Power Plant’s Contribution to the State Economy, Mark Berkman and Dean Murphy (The Brattle Group) authors, December 2015

Investing in Our Future Employees through STEM Education Exelon is making significant investments in science, technology, engineering and math (STEM) education because it is key to the success of our businesses and communities $8M to support STEM education programs in 2015 Reaching more than 150,000 students at hundreds of schools

Constellation Joe Nigro Chief Executive Officer, Constellation

Constellation Overview (1) As calculated based on the same generation supply mix used in EPA eGRID 2012

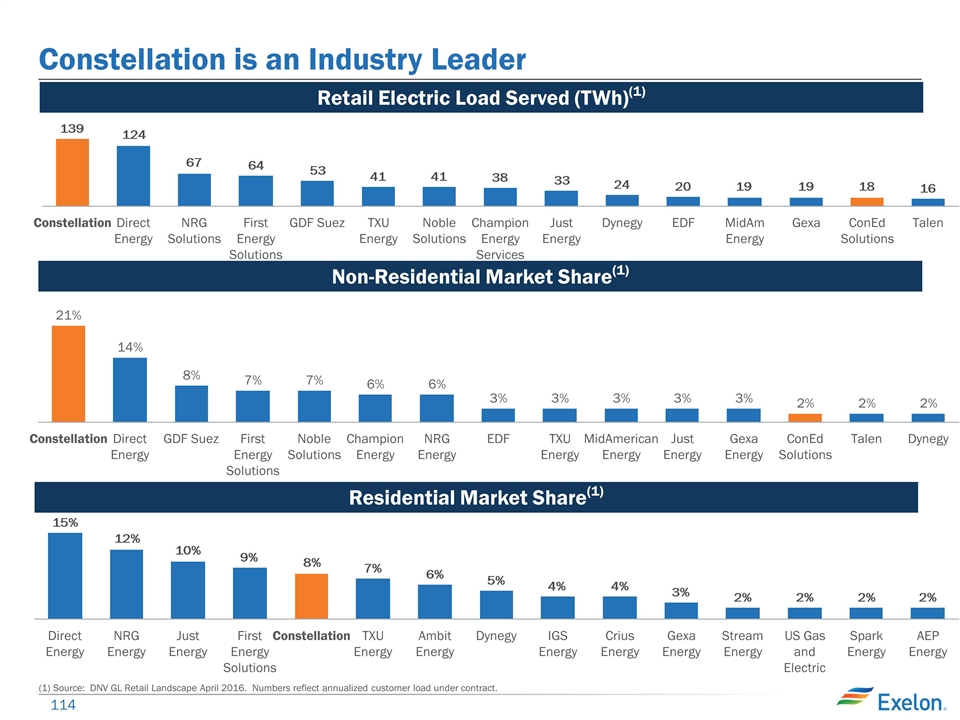

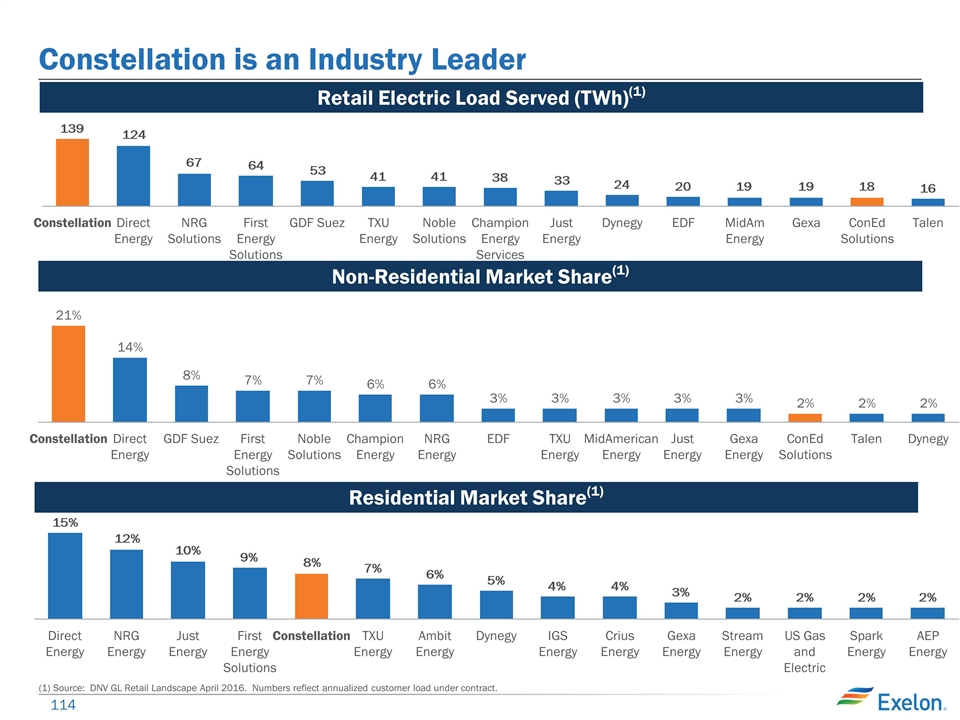

Constellation is an Industry Leader Non-Residential Market Share(1) Retail Electric Load Served (TWh)(1) (1) Source: DNV GL Retail Landscape April 2016. Numbers reflect annualized customer load under contract. Residential Market Share(1)

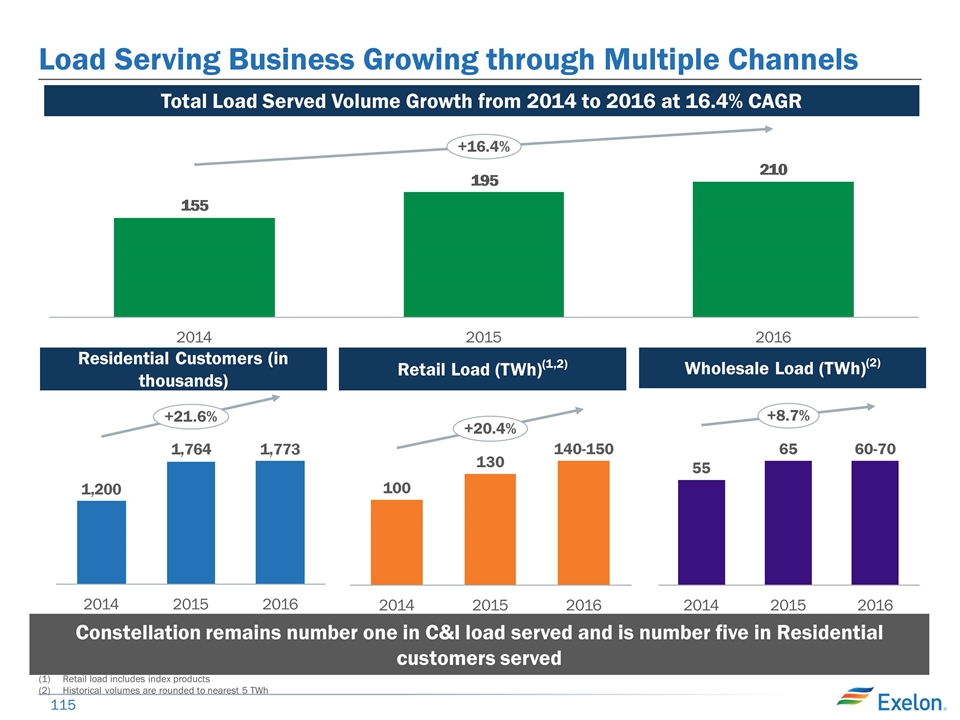

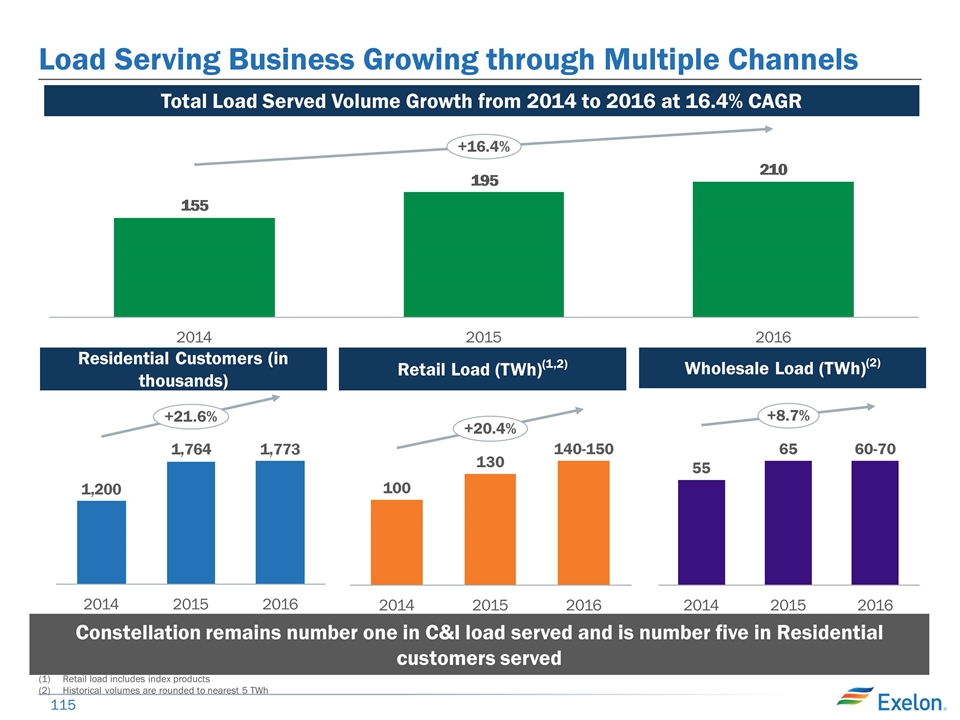

Load Serving Business Growing through Multiple Channels Constellation remains number one in C&I load served and is number five in Residential customers served Total Load Served Volume Growth from 2014 to 2016 at 16.4% CAGR 140-150 130 100 60-70 65 55 Wholesale Load (TWh)(2) Residential Customers (in thousands) Retail Load (TWh)(1,2) Retail load includes index products Historical volumes are rounded to nearest 5 TWh

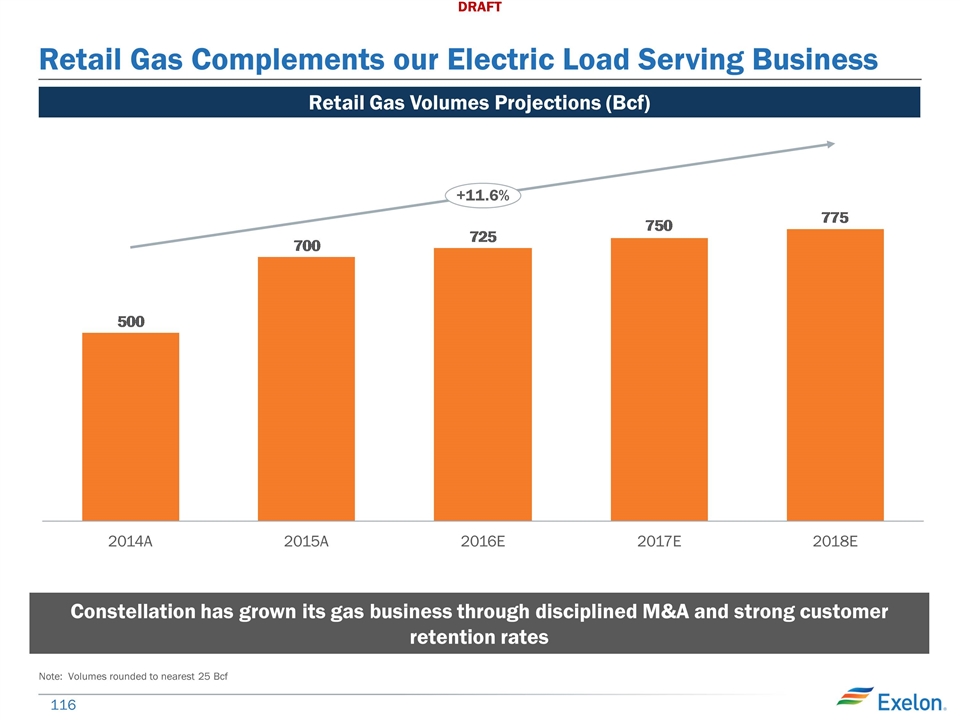

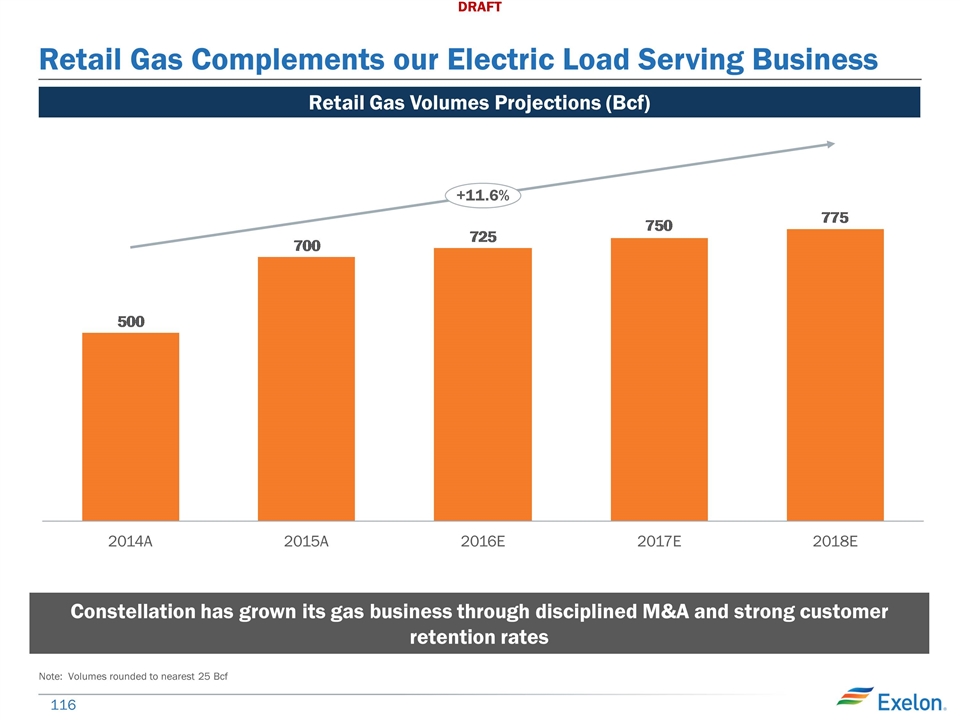

Retail Gas Complements our Electric Load Serving Business Retail Gas Volumes Projections (Bcf) Constellation has grown its gas business through disciplined M&A and strong customer retention rates Note: Volumes rounded to nearest 25 Bcf

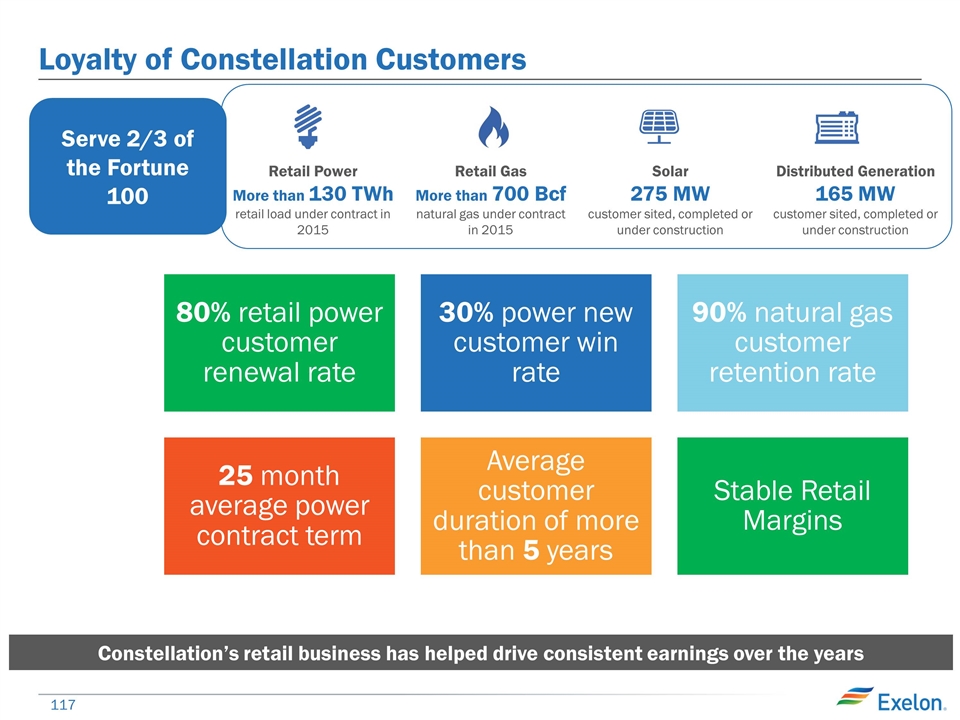

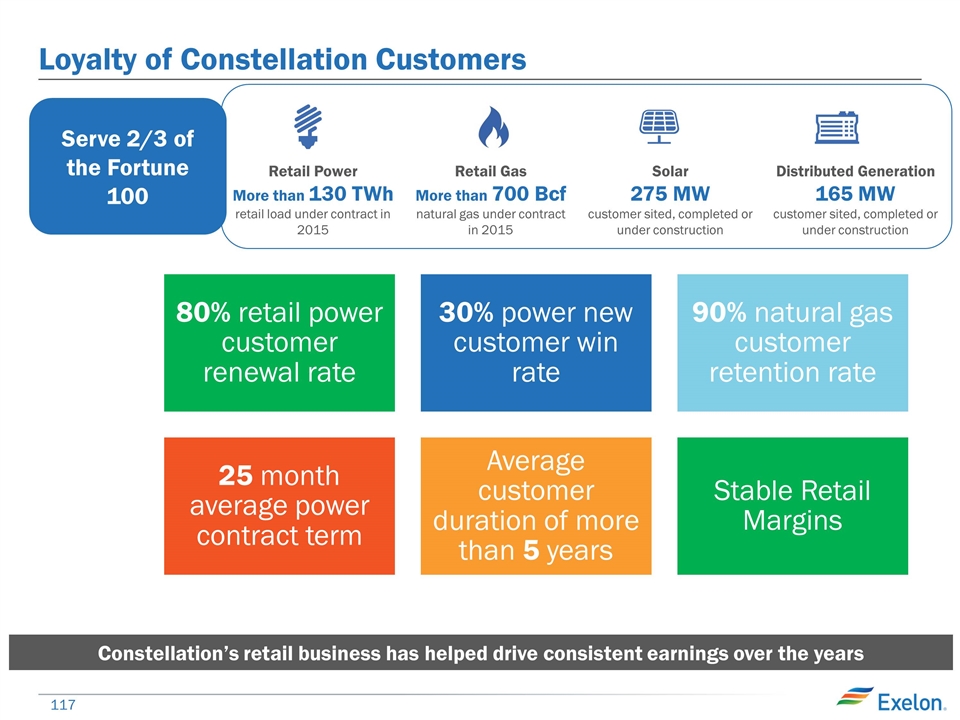

Loyalty of Constellation Customers Constellation’s retail business has helped drive consistent earnings over the years Retail Power More than 130 TWh retail load under contract in 2015 Retail Gas More than 700 Bcf natural gas under contract in 2015 Solar 275 MW customer sited, completed or under construction Distributed Generation 165 MW customer sited, completed or under construction Serve 2/3 of the Fortune 100 80% retail power customer renewal rate 30% power new customer win rate 25 month average power contract term Average customer duration of more than 5 years Stable Retail Margins 90% natural gas customer retention rate

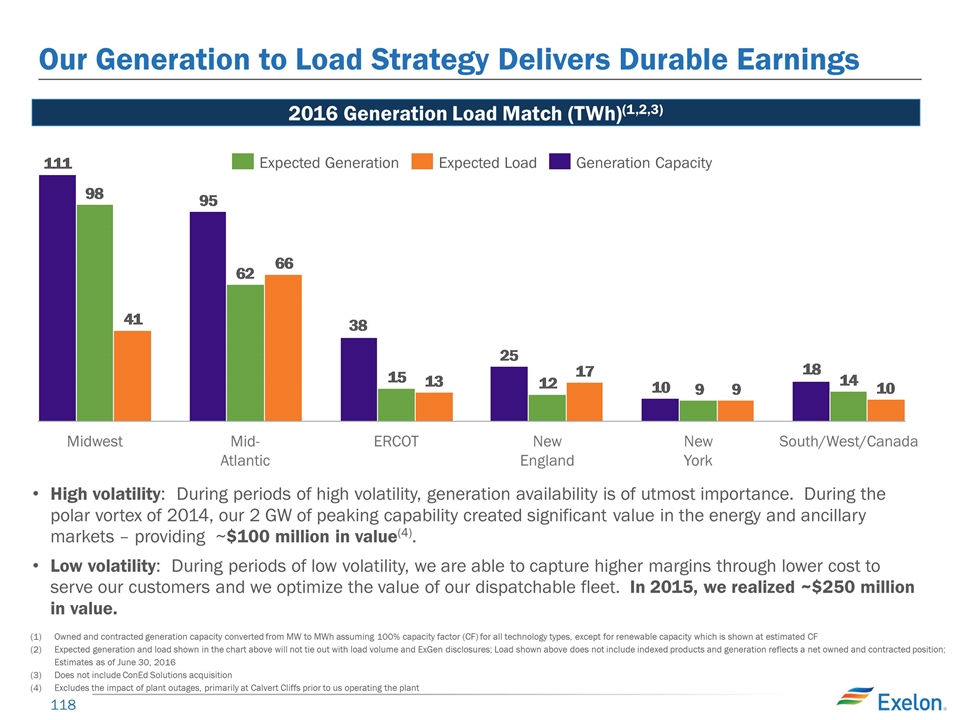

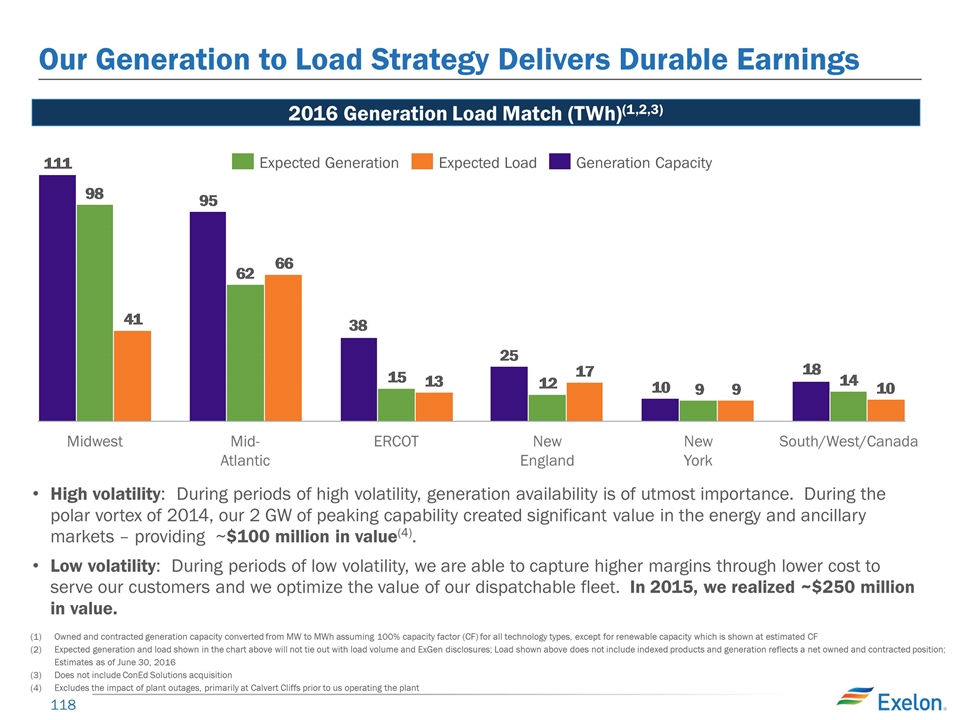

Our Generation to Load Strategy Delivers Durable Earnings 2016 Generation Load Match (TWh)(1,2,3) High volatility: During periods of high volatility, generation availability is of utmost importance. During the polar vortex of 2014, our 2 GW of peaking capability created significant value in the energy and ancillary markets – providing ~$100 million in value(4). Low volatility: During periods of low volatility, we are able to capture higher margins through lower cost to serve our customers and we optimize the value of our dispatchable fleet. In 2015, we realized ~$250 million in value. Owned and contracted generation capacity converted from MW to MWh assuming 100% capacity factor (CF) for all technology types, except for renewable capacity which is shown at estimated CF Expected generation and load shown in the chart above will not tie out with load volume and ExGen disclosures; Load shown above does not include indexed products and generation reflects a net owned and contracted position; Estimates as of June 30, 2016 Does not include ConEd Solutions acquisition Excludes the impact of plant outages, primarily at Calvert Cliffs prior to us operating the plant

Exelon Generation Appendix

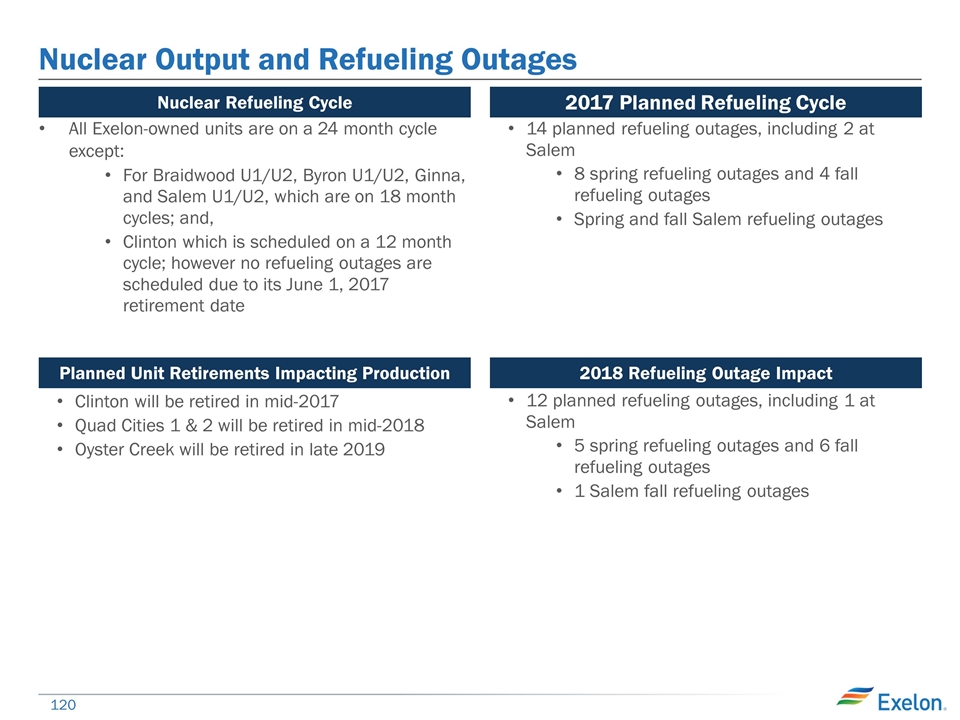

Nuclear Output and Refueling Outages Nuclear Refueling Cycle 2017 Planned Refueling Cycle Planned Unit Retirements Impacting Production 2018 Refueling Outage Impact All Exelon-owned units are on a 24 month cycle except: For Braidwood U1/U2, Byron U1/U2, Ginna, and Salem U1/U2, which are on 18 month cycles; and, Clinton which is scheduled on a 12 month cycle; however no refueling outages are scheduled due to its June 1, 2017 retirement date 14 planned refueling outages, including 2 at Salem 8 spring refueling outages and 4 fall refueling outages Spring and fall Salem refueling outages Clinton will be retired in mid-2017 Quad Cities 1 & 2 will be retired in mid-2018 Oyster Creek will be retired in late 2019 12 planned refueling outages, including 1 at Salem 5 spring refueling outages and 6 fall refueling outages 1 Salem fall refueling outages

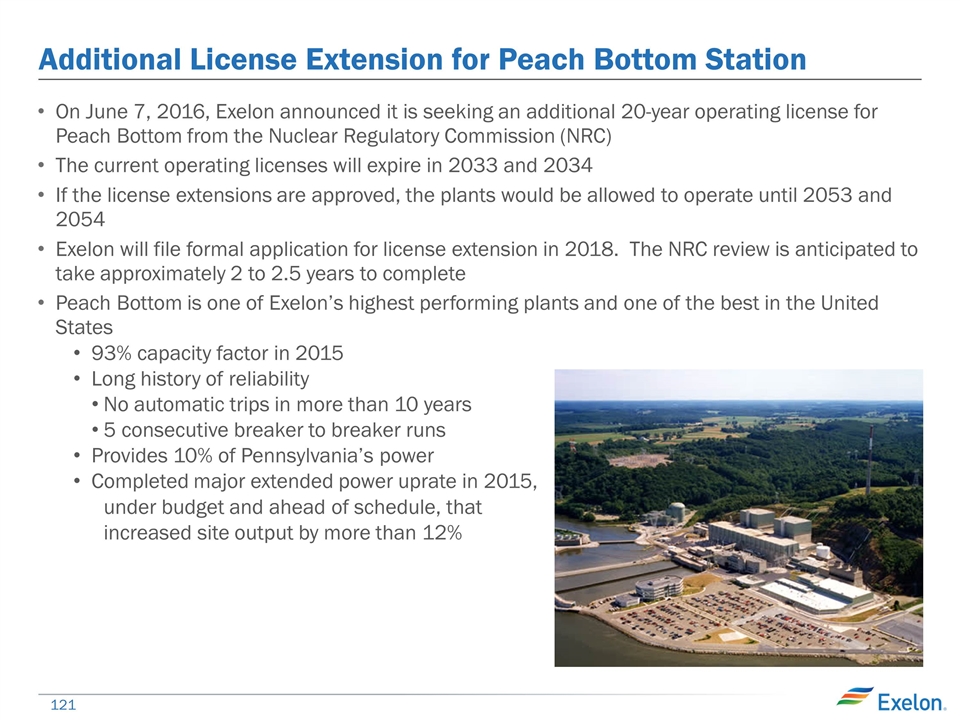

Additional License Extension for Peach Bottom Station On June 7, 2016, Exelon announced it is seeking an additional 20-year operating license for Peach Bottom from the Nuclear Regulatory Commission (NRC) The current operating licenses will expire in 2033 and 2034 If the license extensions are approved, the plants would be allowed to operate until 2053 and 2054 Exelon will file formal application for license extension in 2018. The NRC review is anticipated to take approximately 2 to 2.5 years to complete Peach Bottom is one of Exelon’s highest performing plants and one of the best in the United States 93% capacity factor in 2015 Long history of reliability No automatic trips in more than 10 years 5 consecutive breaker to breaker runs Provides 10% of Pennsylvania’s power Completed major extended power uprate in 2015, under budget and ahead of schedule, that increased site output by more than 12%