Earnings Conference Call 1st Quarter 2017 May 3, 2017 Exhibit 99.2

Cautionary Statements Regarding Forward-Looking Information This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, that are subject to risks and uncertainties. The factors that could cause actual results to differ materially from the forward-looking statements made by Exelon Corporation, Exelon Generation Company, LLC, Commonwealth Edison Company, PECO Energy Company, Baltimore Gas and Electric Company, Pepco Holdings LLC, Potomac Electric Power Company, Delmarva Power & Light Company, and Atlantic City Electric Company (Registrants) include those factors discussed herein, as well as the items discussed in (1) Exelon’s 2016 Annual Report on Form 10-K in (a) ITEM 1A. Risk Factors, (b) ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and (c) ITEM 8. Financial Statements and Supplementary Data: Note 24, Commitments and Contingencies; (2) Exelon’s First Quarter 2017 Quarterly Report on Form 10-Q (to be filed on May 3, 2017) in (a) Part II, Other Information, ITEM 1A. Risk Factors; (b) Part 1, Financial Information, ITEM 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations and (c) Part I, Financial Information, ITEM 1. Financial Statements: Note 17; and (2) other factors discussed in filings with the SEC by the Registrants. Readers are cautioned not to place undue reliance on these forward-looking statements, which apply only as of the date of this press release. None of the Registrants undertakes any obligation to publicly release any revision to its forward-looking statements to reflect events or circumstances after the date of this presentation.

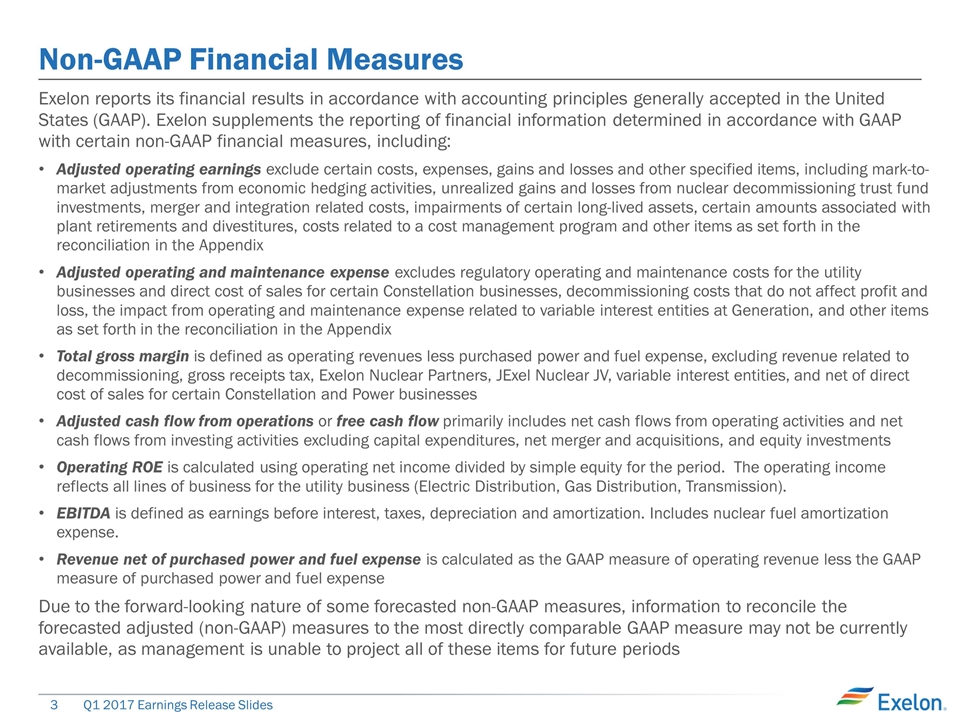

Non-GAAP Financial Measures Exelon reports its financial results in accordance with accounting principles generally accepted in the United States (GAAP). Exelon supplements the reporting of financial information determined in accordance with GAAP with certain non-GAAP financial measures, including: Adjusted operating earnings exclude certain costs, expenses, gains and losses and other specified items, including mark-to-market adjustments from economic hedging activities, unrealized gains and losses from nuclear decommissioning trust fund investments, merger and integration related costs, impairments of certain long-lived assets, certain amounts associated with plant retirements and divestitures, costs related to a cost management program and other items as set forth in the reconciliation in the Appendix Adjusted operating and maintenance expense excludes regulatory operating and maintenance costs for the utility businesses and direct cost of sales for certain Constellation businesses, decommissioning costs that do not affect profit and loss, the impact from operating and maintenance expense related to variable interest entities at Generation, and other items as set forth in the reconciliation in the Appendix Total gross margin is defined as operating revenues less purchased power and fuel expense, excluding revenue related to decommissioning, gross receipts tax, Exelon Nuclear Partners, JExel Nuclear JV, variable interest entities, and net of direct cost of sales for certain Constellation and Power businesses Adjusted cash flow from operations or free cash flow primarily includes net cash flows from operating activities and net cash flows from investing activities excluding capital expenditures, net merger and acquisitions, and equity investments Operating ROE is calculated using operating net income divided by simple equity for the period. The operating income reflects all lines of business for the utility business (Electric Distribution, Gas Distribution, Transmission). EBITDA is defined as earnings before interest, taxes, depreciation and amortization. Includes nuclear fuel amortization expense. Revenue net of purchased power and fuel expense is calculated as the GAAP measure of operating revenue less the GAAP measure of purchased power and fuel expense Due to the forward-looking nature of some forecasted non-GAAP measures, information to reconcile the forecasted adjusted (non-GAAP) measures to the most directly comparable GAAP measure may not be currently available, as management is unable to project all of these items for future periods

Non-GAAP Financial Measures Continued This information is intended to enhance an investor’s overall understanding of period over period financial results and provide an indication of Exelon’s baseline operating performance by excluding items that are considered by management to be not directly related to the ongoing operations of the business. In addition, this information is among the primary indicators management uses as a basis for evaluating performance, allocating resources, setting incentive compensation targets and planning and forecasting of future periods. These non-GAAP financial measures are not a presentation defined under GAAP and may not be comparable to other companies’ presentation. Exelon has provided these non-GAAP financial measure as supplemental information and in addition to the financial measures that are calculated and presented in accordance with GAAP. These non-GAAP measures should not be deemed more useful than, a substitute for, or an alternative to the most comparable GAAP measures provided in the materials presented. Non-GAAP financial measures are identified by the phrase “non-GAAP” or an asterisk. Reconciliations of these non-GAAP measures to the most comparable GAAP measures are provided in the appendices and attachments to this presentation, except for the reconciliation for total gross margin, which appears on slide 27 of this presentation.

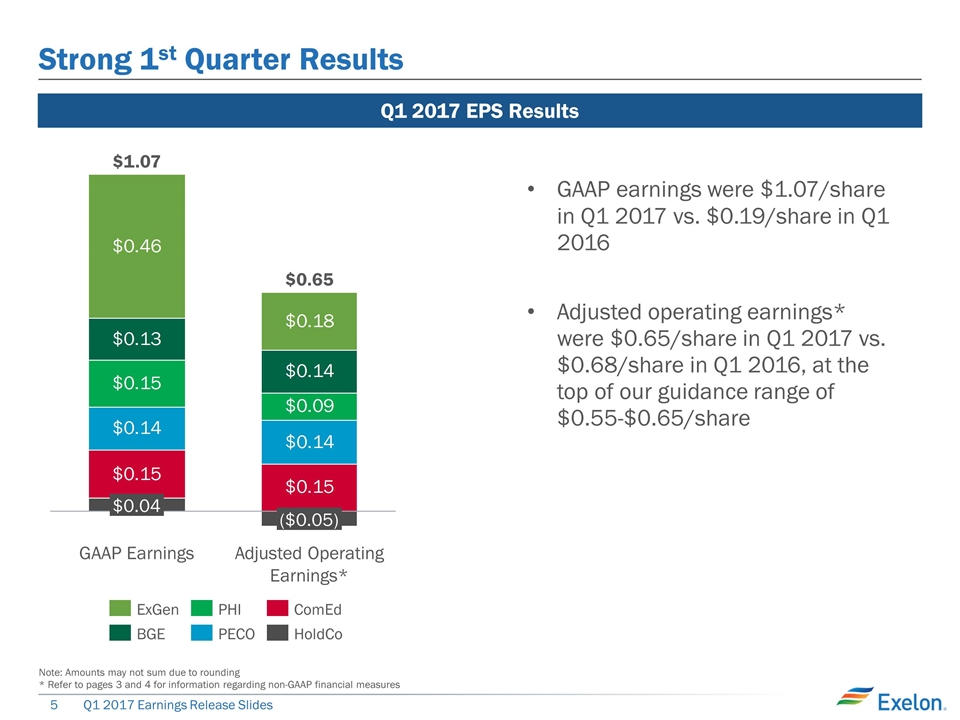

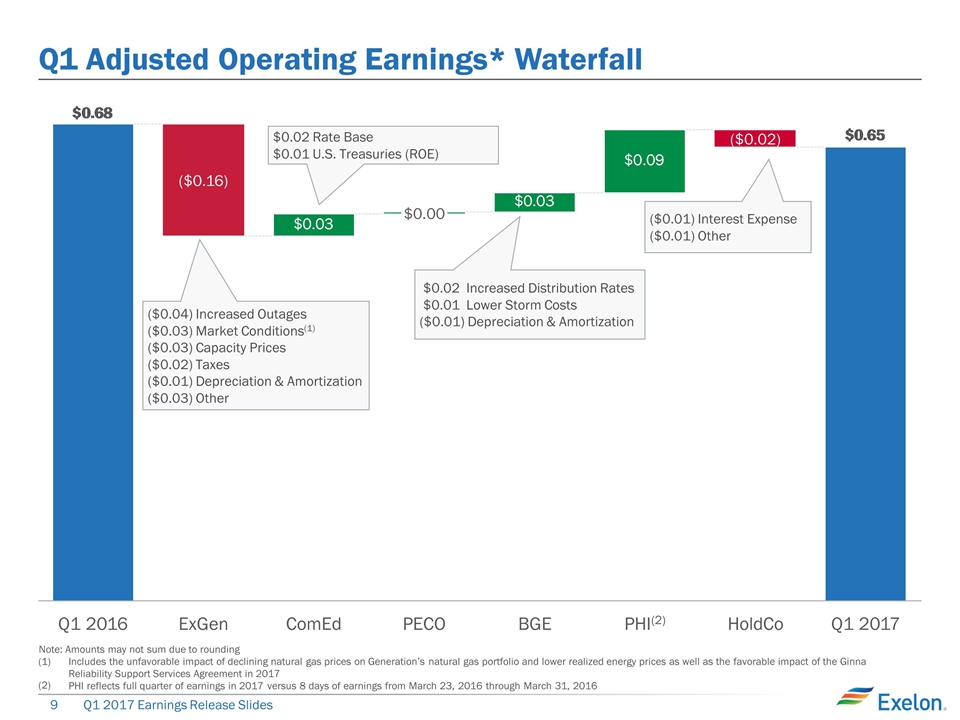

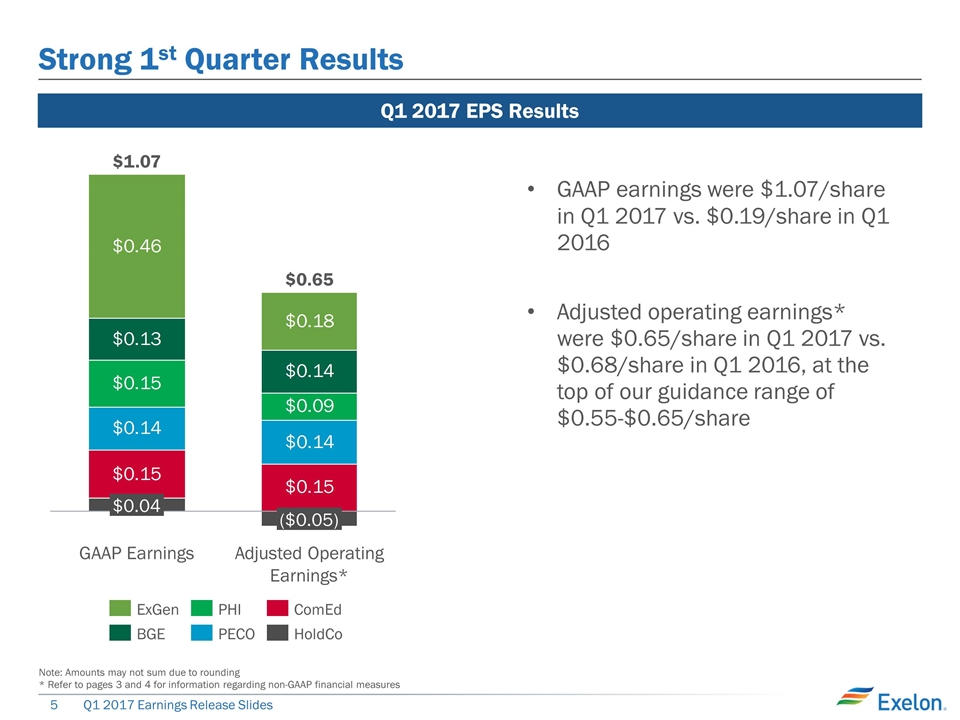

Note: Amounts may not sum due to rounding * Refer to pages 3 and 4 for information regarding non-GAAP financial measures Strong 1st Quarter Results * Q1 2017 EPS Results GAAP earnings were $1.07/share in Q1 2017 vs. $0.19/share in Q1 2016 Adjusted operating earnings* were $0.65/share in Q1 2017 vs. $0.68/share in Q1 2016, at the top of our guidance range of $0.55-$0.65/share

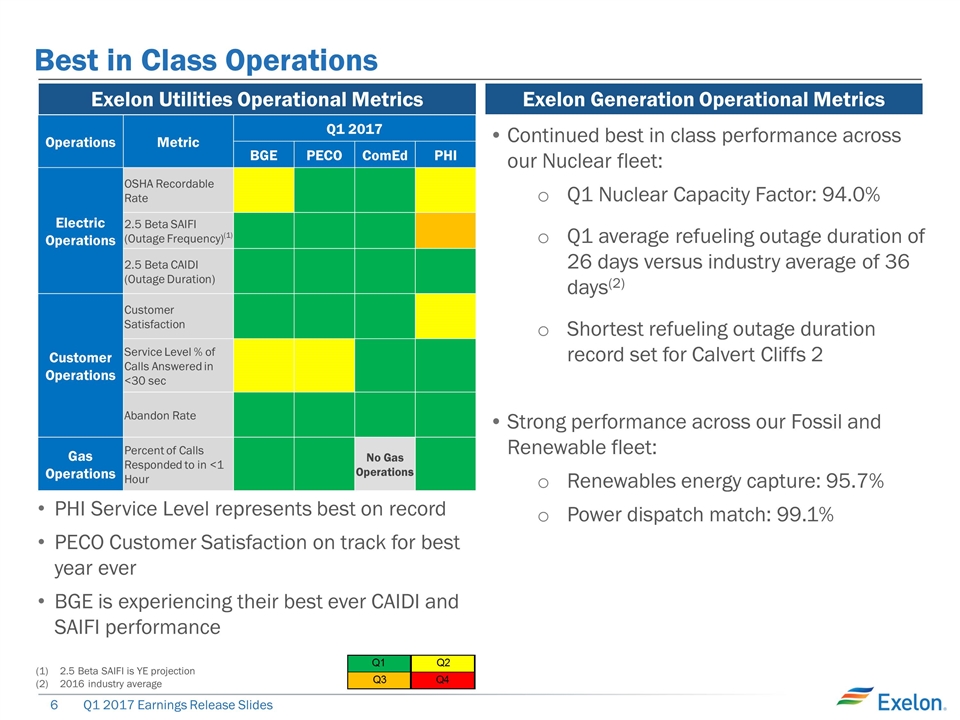

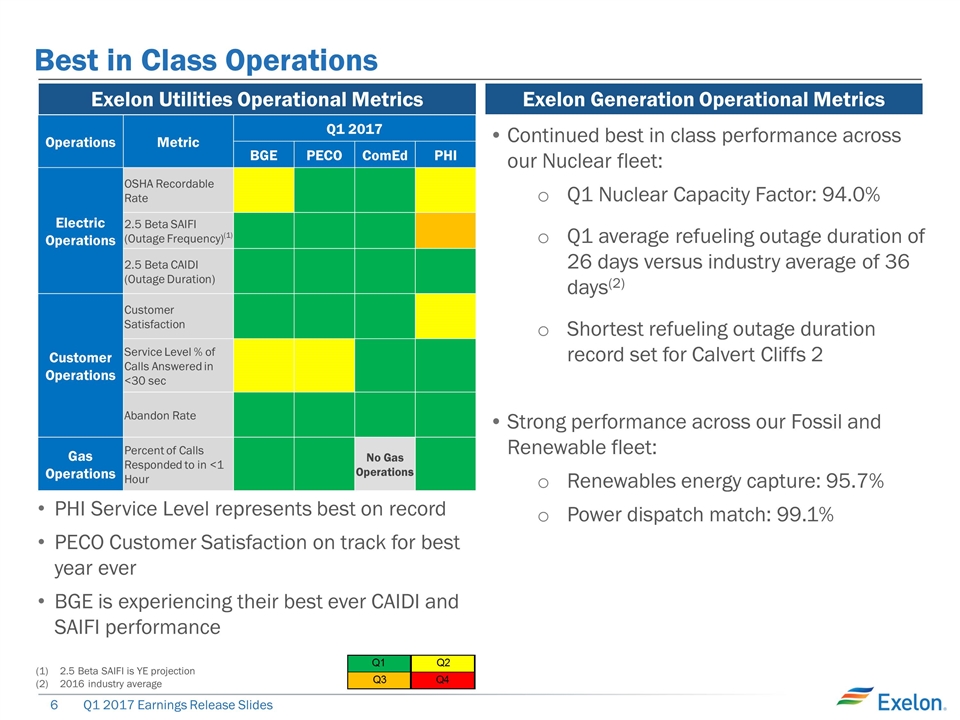

Best in Class Operations Operations Metric Q1 2017 BGE PECO ComEd PHI Electric Operations OSHA Recordable Rate 2.5 Beta SAIFI (Outage Frequency)(1) 2.5 Beta CAIDI (Outage Duration) Customer Operations Customer Satisfaction Service Level % of Calls Answered in <30 sec Abandon Rate Gas Operations Percent of Calls Responded to in <1 Hour No Gas Operations 2.5 Beta SAIFI is YE projection 2016 industry average Exelon Utilities Operational Metrics Exelon Generation Operational Metrics Continued best in class performance across our Nuclear fleet: Q1 Nuclear Capacity Factor: 94.0% Q1 average refueling outage duration of 26 days versus industry average of 36 days(2) Shortest refueling outage duration record set for Calvert Cliffs 2 Strong performance across our Fossil and Renewable fleet: Renewables energy capture: 95.7% Power dispatch match: 99.1% PHI Service Level represents best on record PECO Customer Satisfaction on track for best year ever BGE is experiencing their best ever CAIDI and SAIFI performance Quartiles Q1 Q2 Q3 Q4

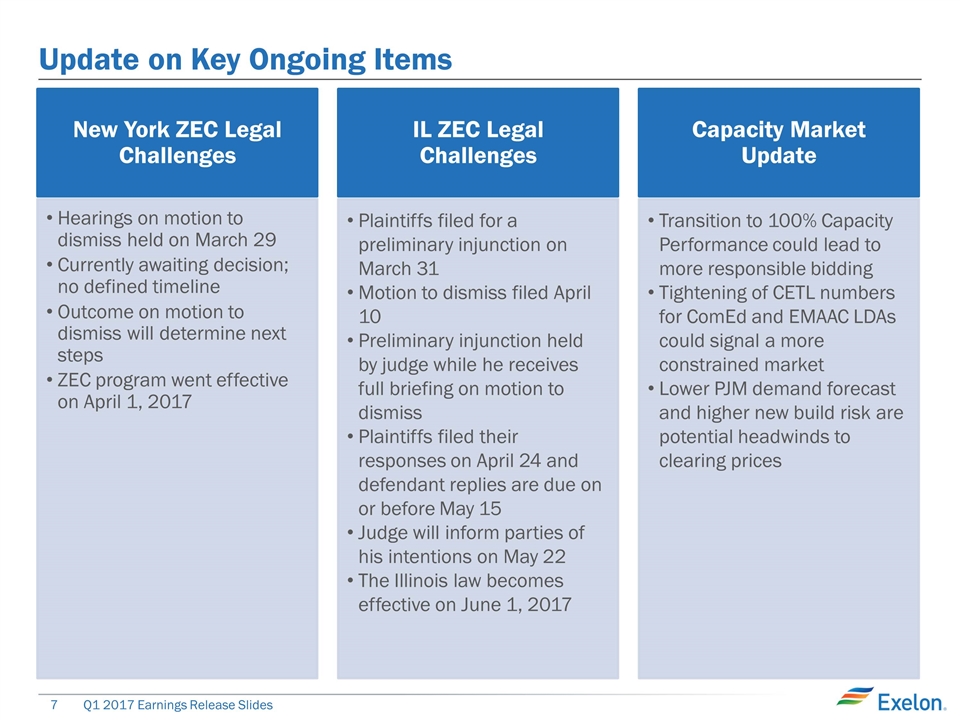

Update on Key Ongoing Items New York ZEC Legal Challenges Capacity Market Update IL ZEC Legal Challenges Hearings on motion to dismiss held on March 29 Currently awaiting decision; no defined timeline Outcome on motion to dismiss will determine next steps ZEC program went effective on April 1, 2017 Plaintiffs filed for a preliminary injunction on March 31 Motion to dismiss filed April 10 Preliminary injunction held by judge while he receives full briefing on motion to dismiss Plaintiffs filed their responses on April 24 and defendant replies are due on or before May 15 Judge will inform parties of his intentions on May 22 The Illinois law becomes effective on June 1, 2017 Transition to 100% Capacity Performance could lead to more responsible bidding Tightening of CETL numbers for ComEd and EMAAC LDAs could signal a more constrained market Lower PJM demand forecast and higher new build risk are potential headwinds to clearing prices

Note: Amounts may not sum due to rounding $(0.05) Q1 2017 Adjusted Operating EPS* Results Exelon Utilities Timing of O&M Unfavorable weather Exelon Generation Generation performance Timing of O&M 1st Quarter Adjusted Operating Earnings* Drivers Q1 2017 vs. Guidance of $0.55 - $0.65 $0.47

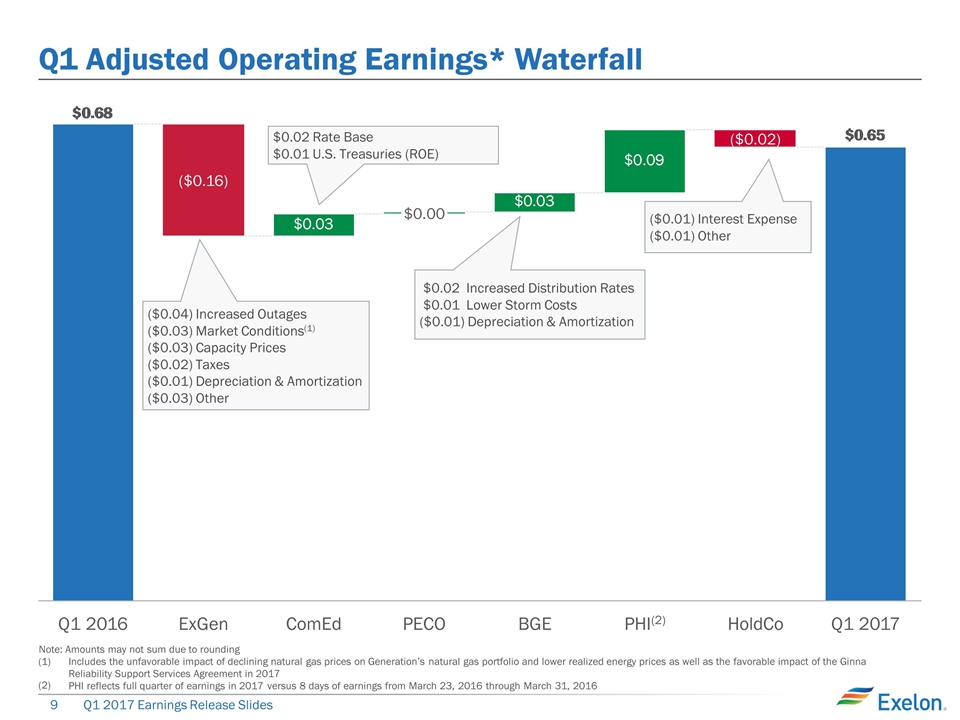

Q1 Adjusted Operating Earnings* Waterfall HoldCo (2) ($0.04) Increased Outages ($0.03) Market Conditions(1) ($0.03) Capacity Prices ($0.02) Taxes ($0.01) Depreciation & Amortization ($0.03) Other Note: Amounts may not sum due to rounding Includes the unfavorable impact of declining natural gas prices on Generation’s natural gas portfolio and lower realized energy prices as well as the favorable impact of the Ginna Reliability Support Services Agreement in 2017 PHI reflects full quarter of earnings in 2017 versus 8 days of earnings from March 23, 2016 through March 31, 2016 $0.02 Rate Base $0.01 U.S. Treasuries (ROE) $0.02 Increased Distribution Rates $0.01 Lower Storm Costs ($0.01) Depreciation & Amortization ($0.01) Interest Expense ($0.01) Other (1) (2)

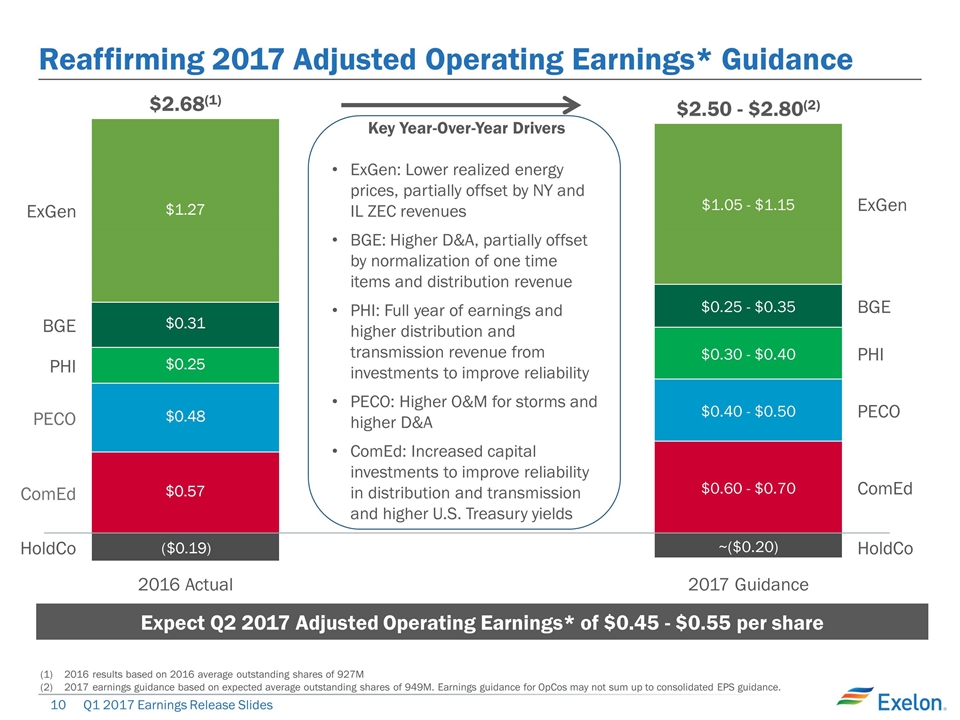

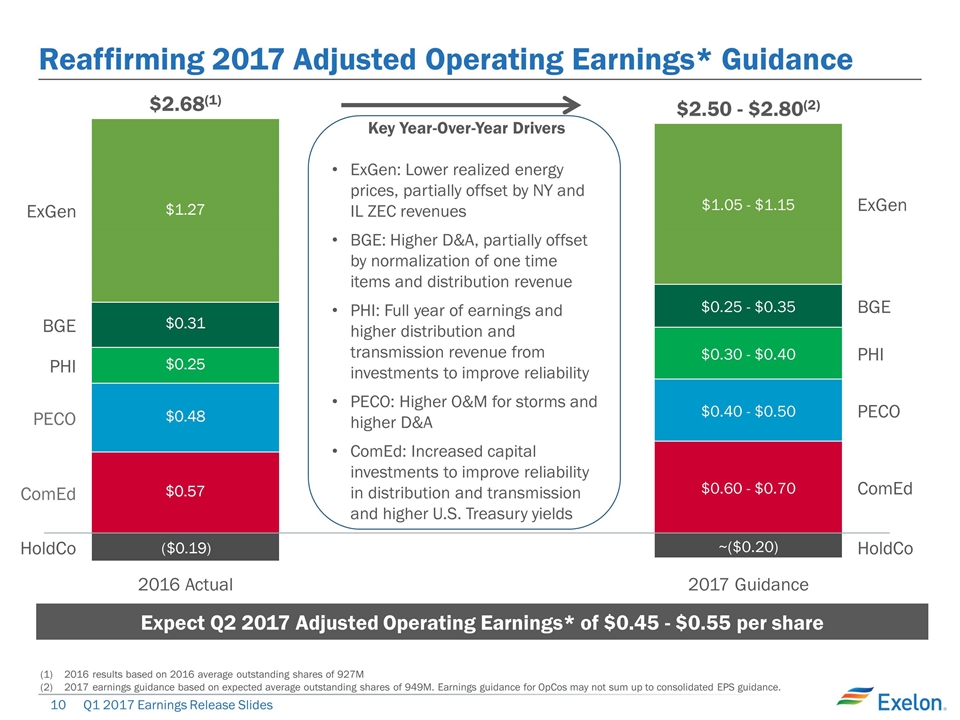

$2.50 - $2.80(2) ~($0.20) $0.60 - $0.70 $0.40 - $0.50 $0.30 - $0.40 $0.25 - $0.35 $1.05 - $1.15 $2.68(1) Reaffirming 2017 Adjusted Operating Earnings* Guidance 2016 results based on 2016 average outstanding shares of 927M 2017 earnings guidance based on expected average outstanding shares of 949M. Earnings guidance for OpCos may not sum up to consolidated EPS guidance. Expect Q2 2017 Adjusted Operating Earnings* of $0.45 - $0.55 per share Key Year-Over-Year Drivers ExGen: Lower realized energy prices, partially offset by NY and IL ZEC revenues BGE: Higher D&A, partially offset by normalization of one time items and distribution revenue PHI: Full year of earnings and higher distribution and transmission revenue from investments to improve reliability PECO: Higher O&M for storms and higher D&A ComEd: Increased capital investments to improve reliability in distribution and transmission and higher U.S. Treasury yields

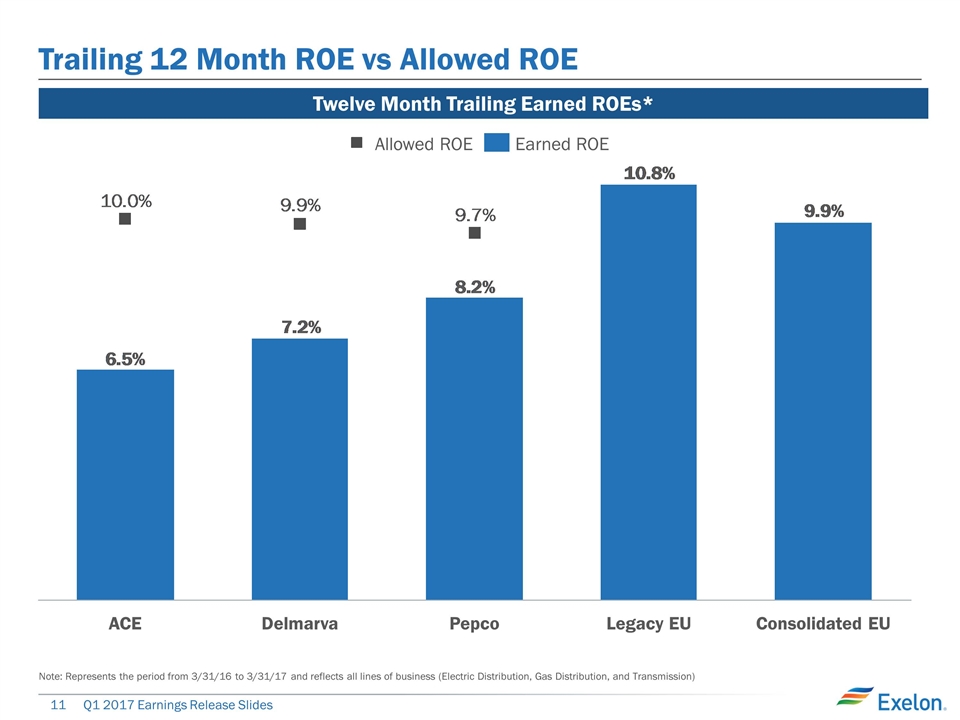

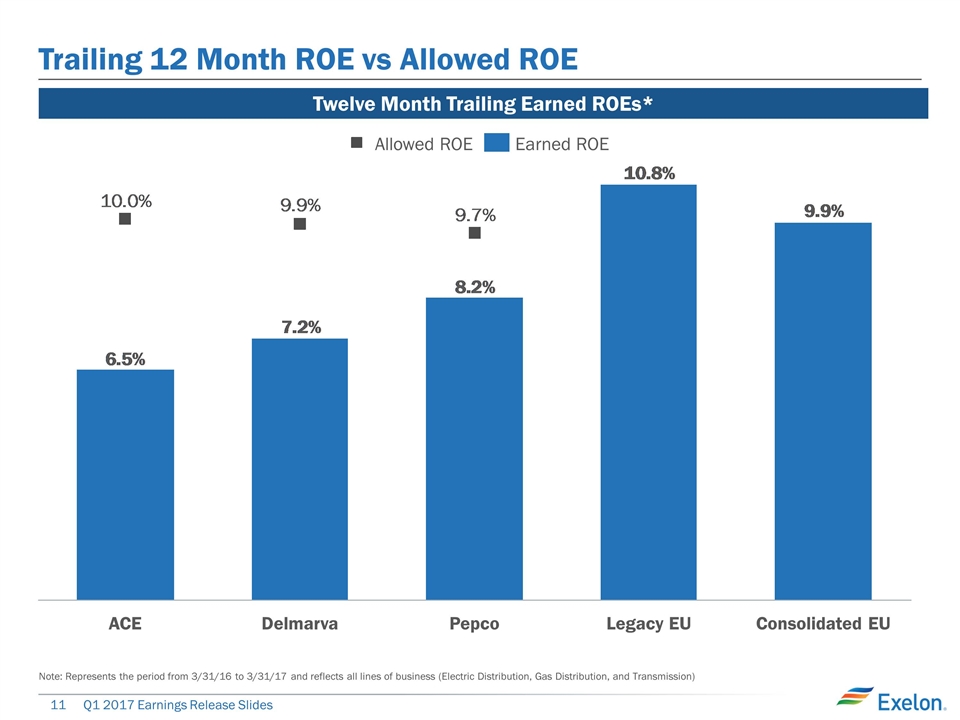

Trailing 12 Month ROE vs Allowed ROE Twelve Month Trailing Earned ROEs* Note: Represents the period from 3/31/16 to 3/31/17 and reflects all lines of business (Electric Distribution, Gas Distribution, and Transmission)

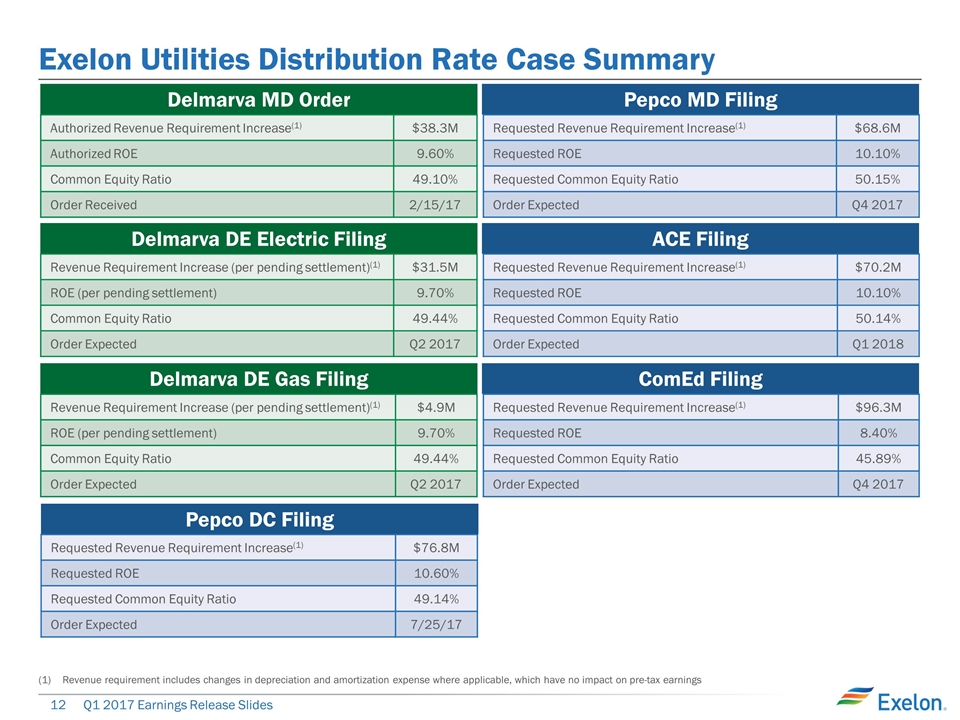

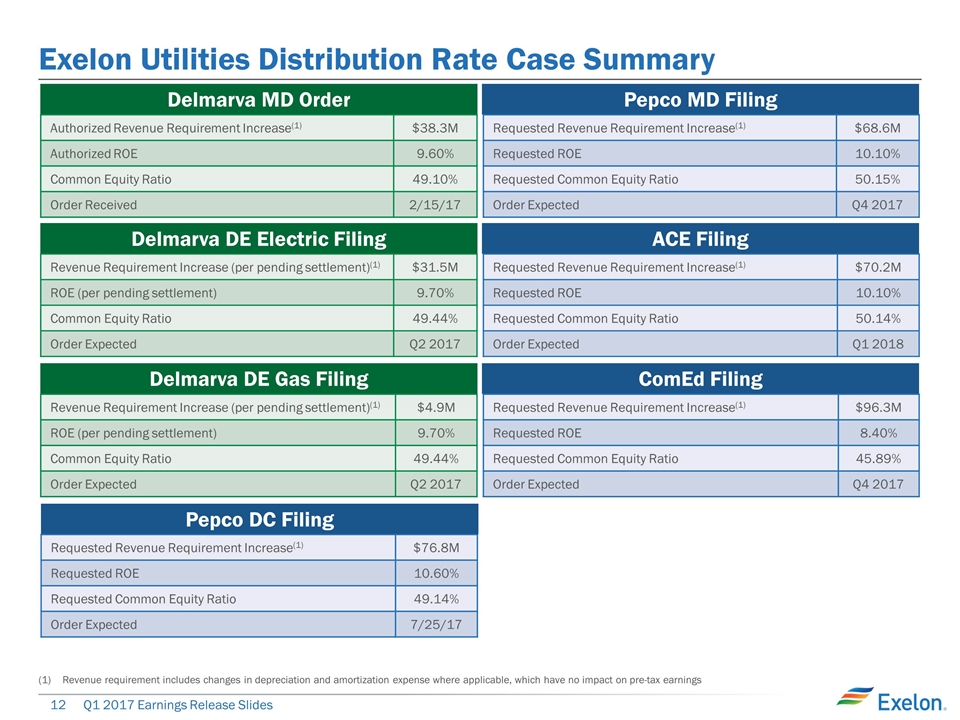

Exelon Utilities Distribution Rate Case Summary Delmarva DE Electric Filing Revenue Requirement Increase (per pending settlement)(1) $31.5M ROE (per pending settlement) 9.70% Common Equity Ratio 49.44% Order Expected Q2 2017 Delmarva DE Gas Filing Revenue Requirement Increase (per pending settlement)(1) $4.9M ROE (per pending settlement) 9.70% Common Equity Ratio 49.44% Order Expected Q2 2017 Delmarva MD Order Authorized Revenue Requirement Increase(1) $38.3M Authorized ROE 9.60% Common Equity Ratio 49.10% Order Received 2/15/17 Pepco DC Filing Requested Revenue Requirement Increase(1) $76.8M Requested ROE 10.60% Requested Common Equity Ratio 49.14% Order Expected 7/25/17 Revenue requirement includes changes in depreciation and amortization expense where applicable, which have no impact on pre-tax earnings Pepco MD Filing Requested Revenue Requirement Increase(1) $68.6M Requested ROE 10.10% Requested Common Equity Ratio 50.15% Order Expected Q4 2017 ACE Filing Requested Revenue Requirement Increase(1) $70.2M Requested ROE 10.10% Requested Common Equity Ratio 50.14% Order Expected Q1 2018 ComEd Filing Requested Revenue Requirement Increase(1) $96.3M Requested ROE 8.40% Requested Common Equity Ratio 45.89% Order Expected Q4 2017

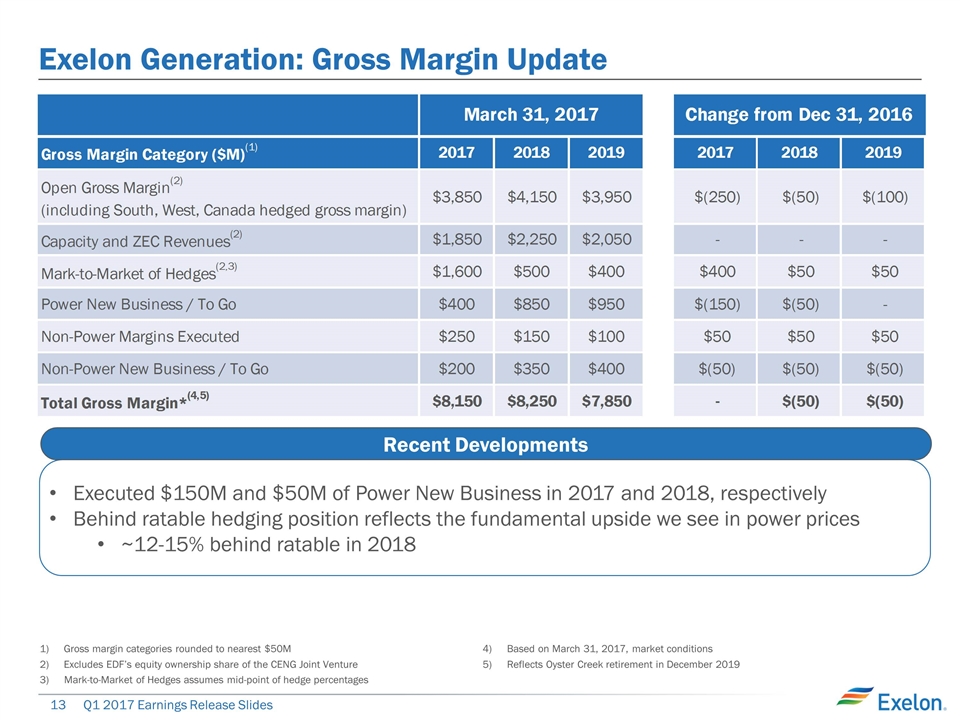

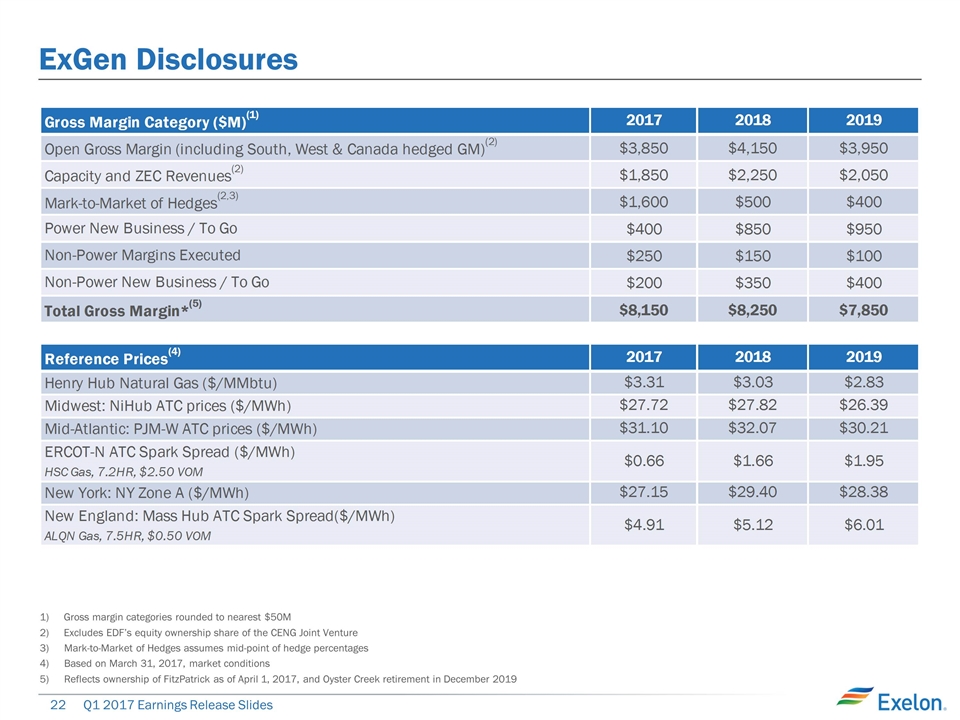

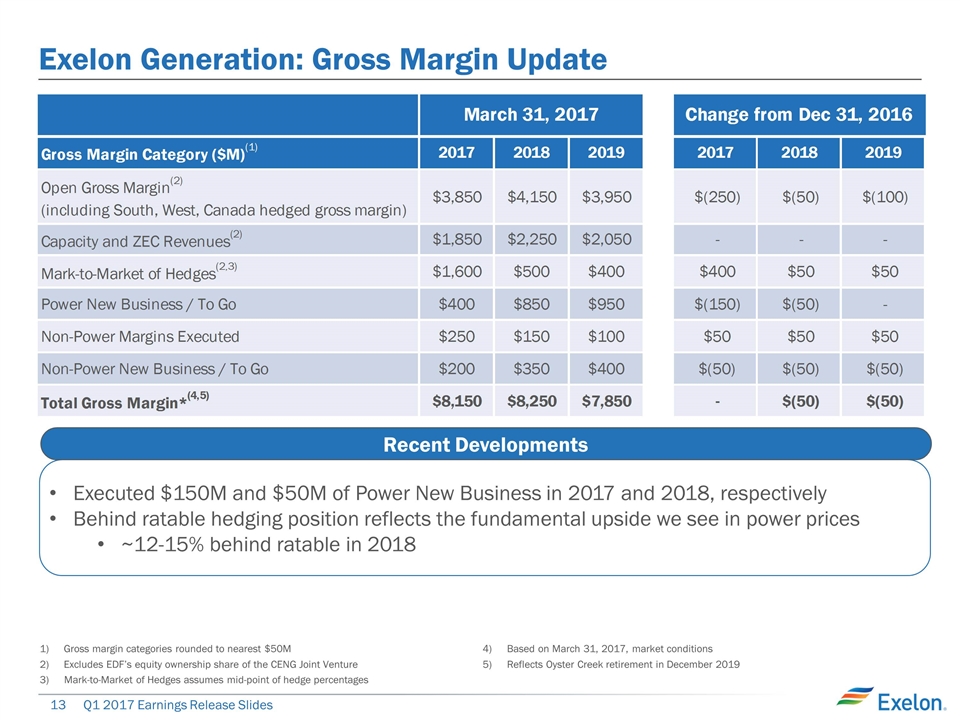

Exelon Generation: Gross Margin Update Gross margin categories rounded to nearest $50M Excludes EDF’s equity ownership share of the CENG Joint Venture Mark-to-Market of Hedges assumes mid-point of hedge percentages Based on March 31, 2017, market conditions Reflects Oyster Creek retirement in December 2019 Executed $150M and $50M of Power New Business in 2017 and 2018, respectively Behind ratable hedging position reflects the fundamental upside we see in power prices ~12-15% behind ratable in 2018 Recent Developments

Summary of Recent Key Transactions Exelon Generation Renewables JV FitzPatrick Nuclear Station ExGen Texas Power • 3,476 MW ERCOT conventional power portfolio consisting of CCGTs and Simple Cycles • Plants economically challenged due to downturn in ERCOT power prices • Reached agreement with lenders to pursue a potential sale of the assets Mystic 8 & 9 • No longer pursuing sale of assets • No impact to our commitments on Debt/EBITDA and debt reduction Acquisition completed on March 31, 2017 $400M of pre-tax proceeds from Hancock, representing an EV/EBITDA multiple 10x 1,296 MW of renewable generation capacity Option to drop additional projects into the JV Proceeds will be used to accelerate debt reduction strategy Part of NY ZEC Program and started realizing benefit of ZEC payments on April 1, 2017 Adds 838 MW of nuclear capacity to the portfolio

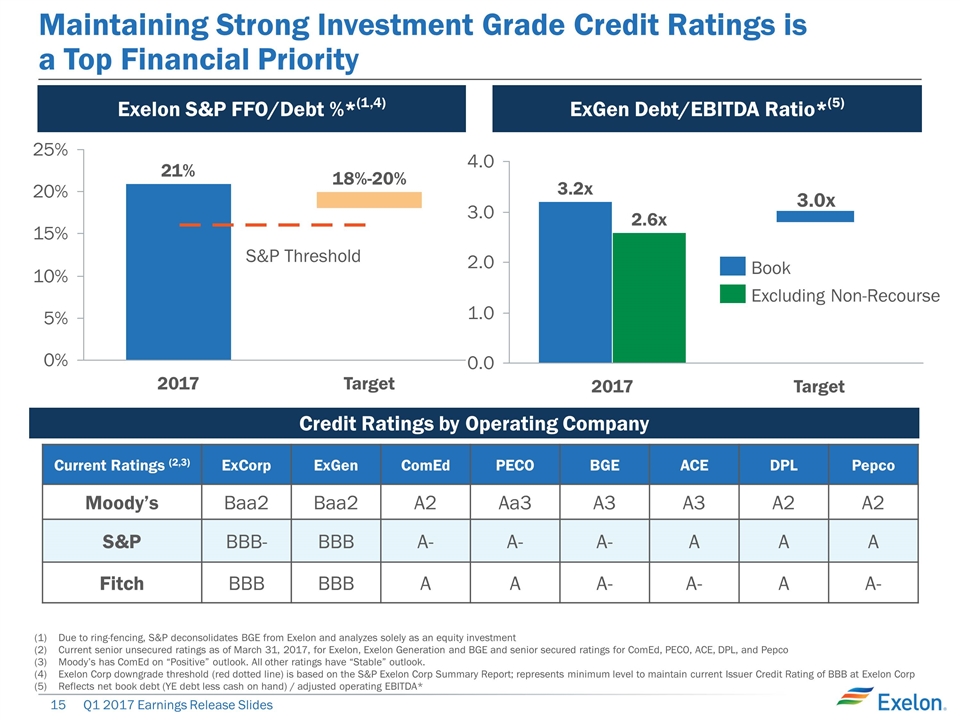

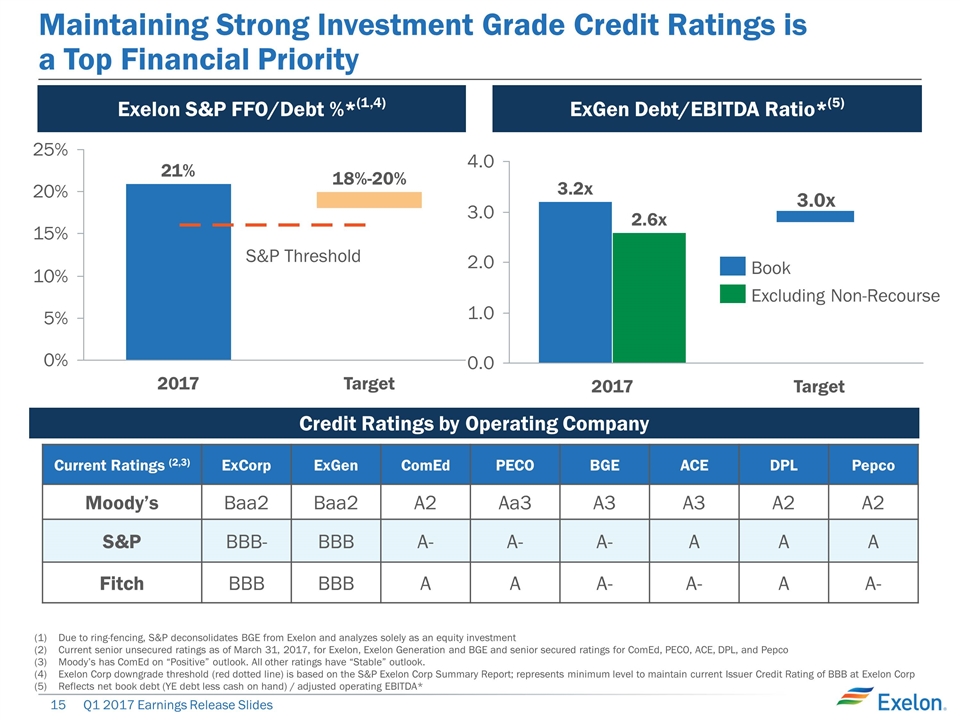

Maintaining Strong Investment Grade Credit Ratings is a Top Financial Priority Current Ratings (2,3) ExCorp ExGen ComEd PECO BGE ACE DPL Pepco Moody’s Baa2 Baa2 A2 Aa3 A3 A3 A2 A2 S&P BBB- BBB A- A- A- A A A Fitch BBB BBB A A A- A- A A- Due to ring-fencing, S&P deconsolidates BGE from Exelon and analyzes solely as an equity investment Current senior unsecured ratings as of March 31, 2017, for Exelon, Exelon Generation and BGE and senior secured ratings for ComEd, PECO, ACE, DPL, and Pepco Moody’s has ComEd on “Positive” outlook. All other ratings have “Stable” outlook. Exelon Corp downgrade threshold (red dotted line) is based on the S&P Exelon Corp Summary Report; represents minimum level to maintain current Issuer Credit Rating of BBB at Exelon Corp Reflects net book debt (YE debt less cash on hand) / adjusted operating EBITDA* ExGen Debt/EBITDA Ratio*(5) Exelon S&P FFO/Debt %*(1,4) Credit Ratings by Operating Company 18%-20% x x 3.0x Excluding Non-Recourse Book S&P Threshold

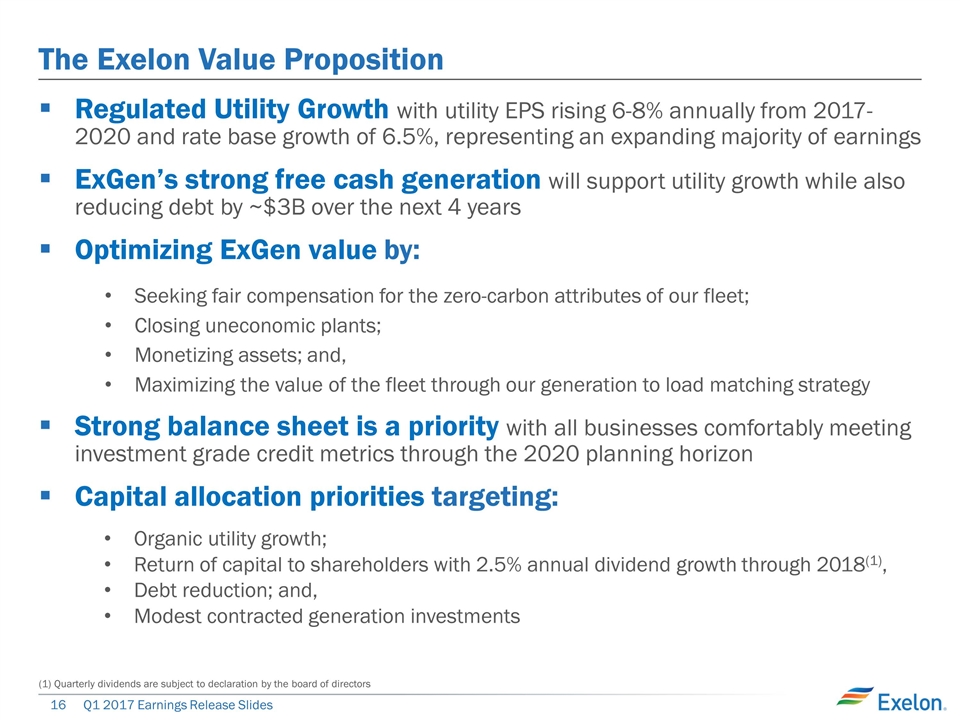

The Exelon Value Proposition Regulated Utility Growth with utility EPS rising 6-8% annually from 2017-2020 and rate base growth of 6.5%, representing an expanding majority of earnings ExGen’s strong free cash generation will support utility growth while also reducing debt by ~$3B over the next 4 years Optimizing ExGen value by: Seeking fair compensation for the zero-carbon attributes of our fleet; Closing uneconomic plants; Monetizing assets; and, Maximizing the value of the fleet through our generation to load matching strategy Strong balance sheet is a priority with all businesses comfortably meeting investment grade credit metrics through the 2020 planning horizon Capital allocation priorities targeting: Organic utility growth; Return of capital to shareholders with 2.5% annual dividend growth through 2018(1), Debt reduction; and, Modest contracted generation investments (1) Quarterly dividends are subject to declaration by the board of directors

Additional Disclosures

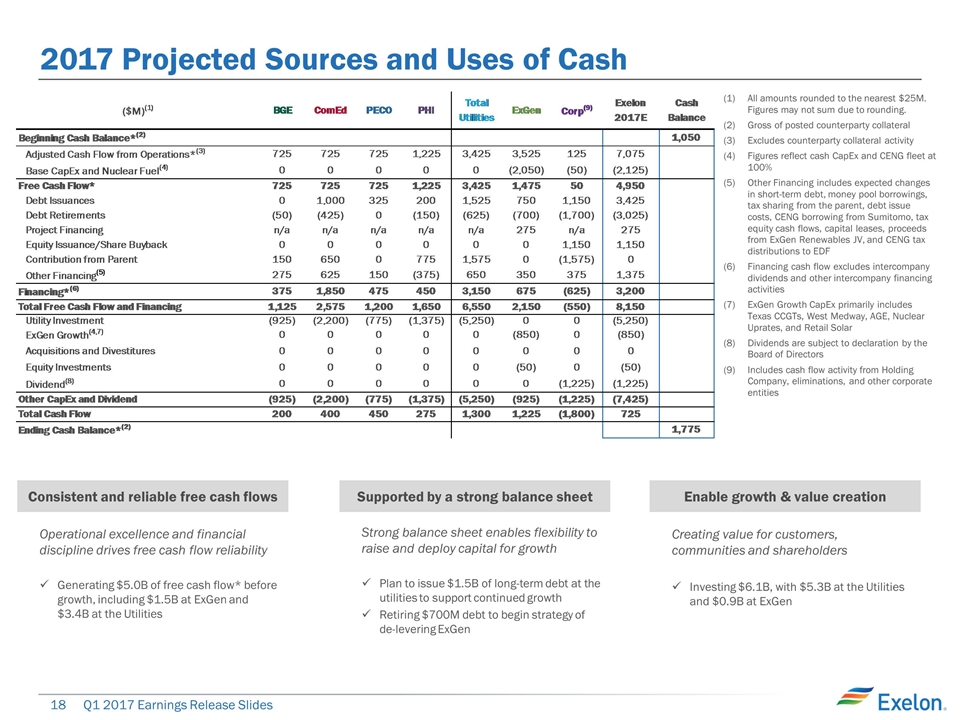

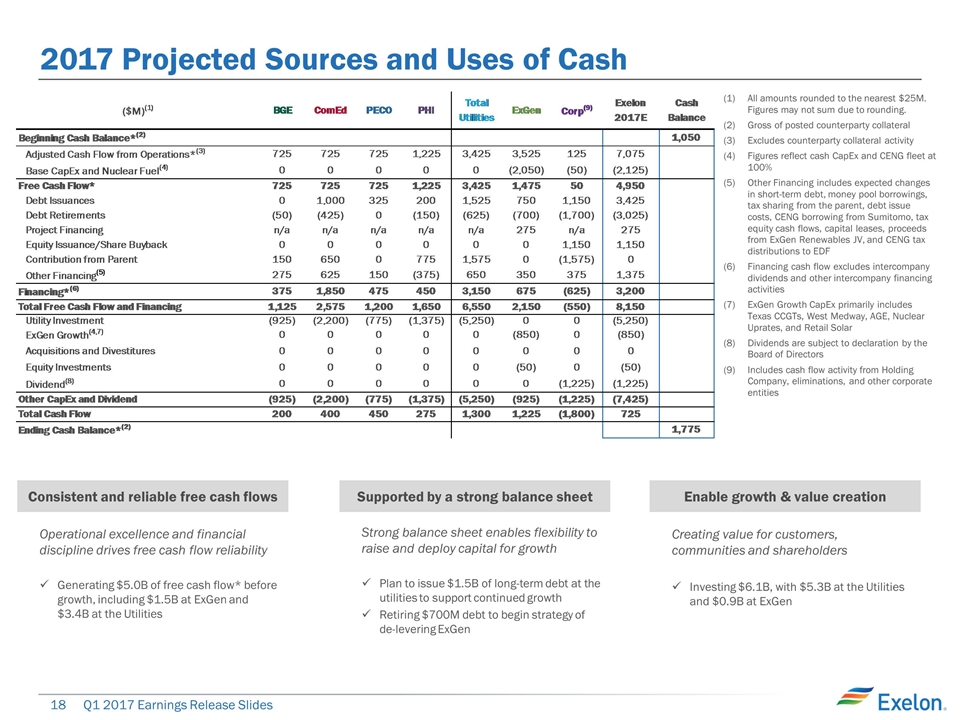

2017 Projected Sources and Uses of Cash Consistent and reliable free cash flows Enable growth & value creation Supported by a strong balance sheet Strong balance sheet enables flexibility to raise and deploy capital for growth Plan to issue $1.5B of long-term debt at the utilities to support continued growth Retiring $700M debt to begin strategy of de-levering ExGen Operational excellence and financial discipline drives free cash flow reliability Generating $5.0B of free cash flow* before growth, including $1.5B at ExGen and $3.4B at the Utilities Creating value for customers, communities and shareholders Investing $6.1B, with $5.3B at the Utilities and $0.9B at ExGen All amounts rounded to the nearest $25M. Figures may not sum due to rounding. Gross of posted counterparty collateral Excludes counterparty collateral activity Figures reflect cash CapEx and CENG fleet at 100% Other Financing includes expected changes in short-term debt, money pool borrowings, tax sharing from the parent, debt issue costs, CENG borrowing from Sumitomo, tax equity cash flows, capital leases, proceeds from ExGen Renewables JV, and CENG tax distributions to EDF Financing cash flow excludes intercompany dividends and other intercompany financing activities ExGen Growth CapEx primarily includes Texas CCGTs, West Medway, AGE, Nuclear Uprates, and Retail Solar Dividends are subject to declaration by the Board of Directors Includes cash flow activity from Holding Company, eliminations, and other corporate entities

Exelon Generation Disclosures March 31, 2017

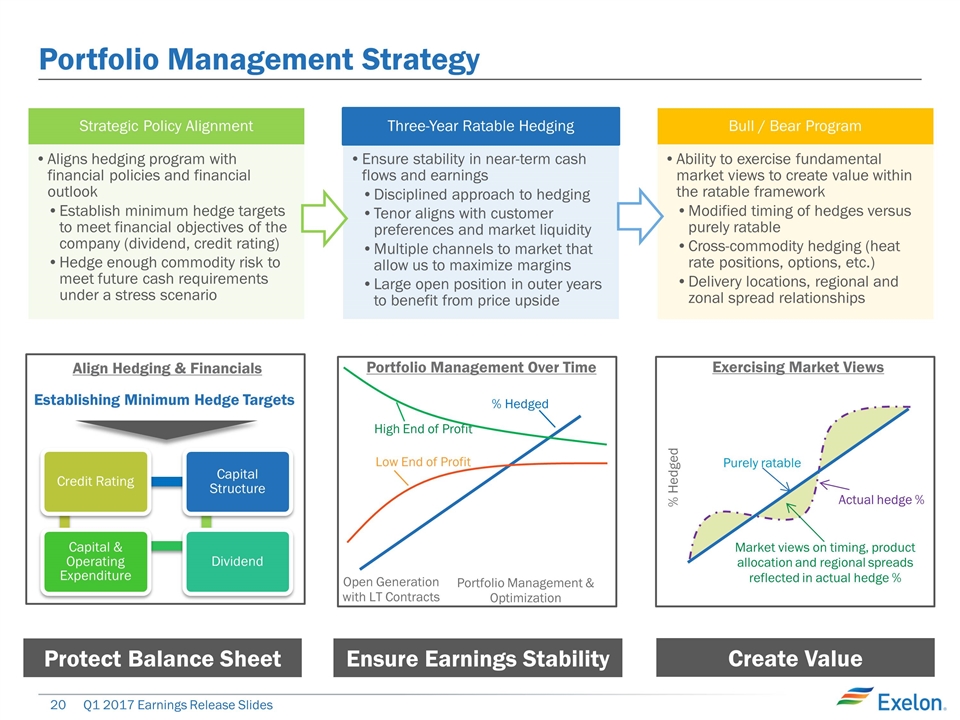

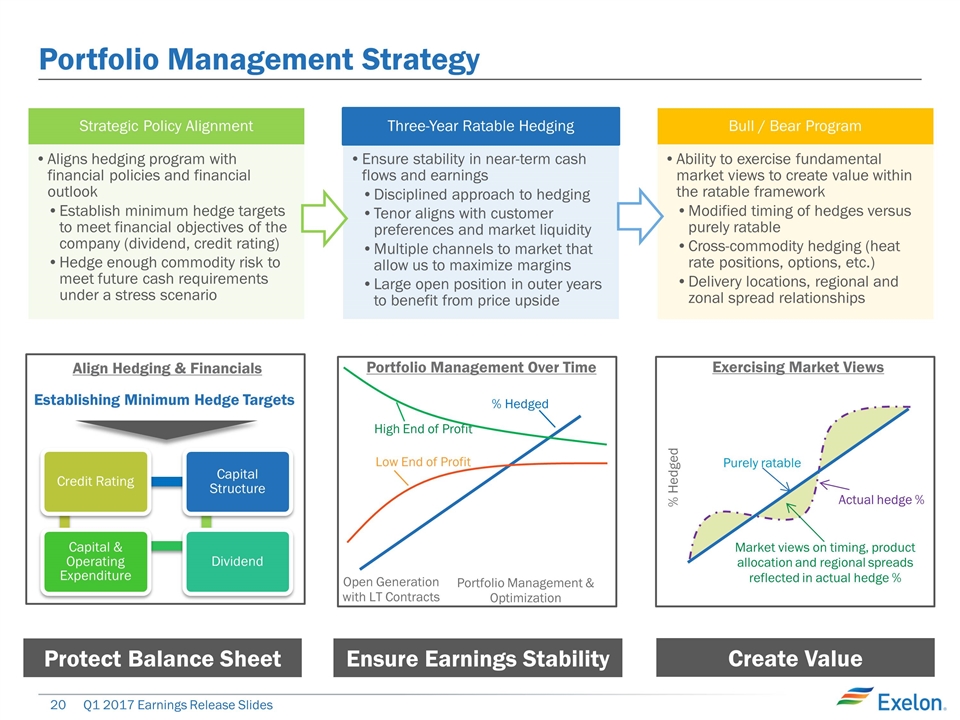

Portfolio Management Strategy Protect Balance Sheet Ensure Earnings Stability Create Value Exercising Market Views % Hedged Purely ratable Actual hedge % Market views on timing, product allocation and regional spreads reflected in actual hedge % High End of Profit Low End of Profit % Hedged Open Generation with LT Contracts Portfolio Management & Optimization Portfolio Management Over Time Align Hedging & Financials Establishing Minimum Hedge Targets Strategic Policy Alignment Three-Year Ratable Hedging Ensure stability in near-term cash flows and earnings Bull / Bear Program Ability to exercise fundamental market views to create value within the ratable framework Hedge enough commodity risk to meet future cash requirements under a stress scenario Tenor aligns with customer preferences and market liquidity Multiple channels to market that allow us to maximize margins Cross-commodity hedging (heat rate positions, options, etc.) Delivery locations, regional and zonal spread relationships Aligns hedging program with financial policies and financial outlook Disciplined approach to hedging Large open position in outer years to benefit from price upside Modified timing of hedges versus purely ratable Establish minimum hedge targets to meet financial objectives of the company (dividend, credit rating) Credit Rating Capital & Operating Expenditure Dividend Capital Structure

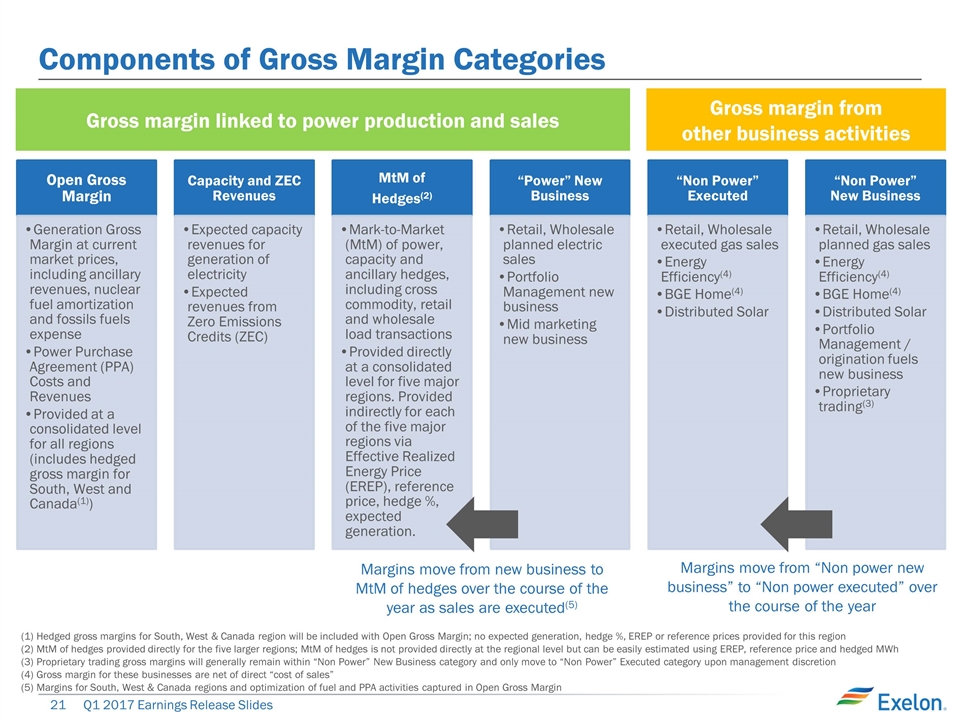

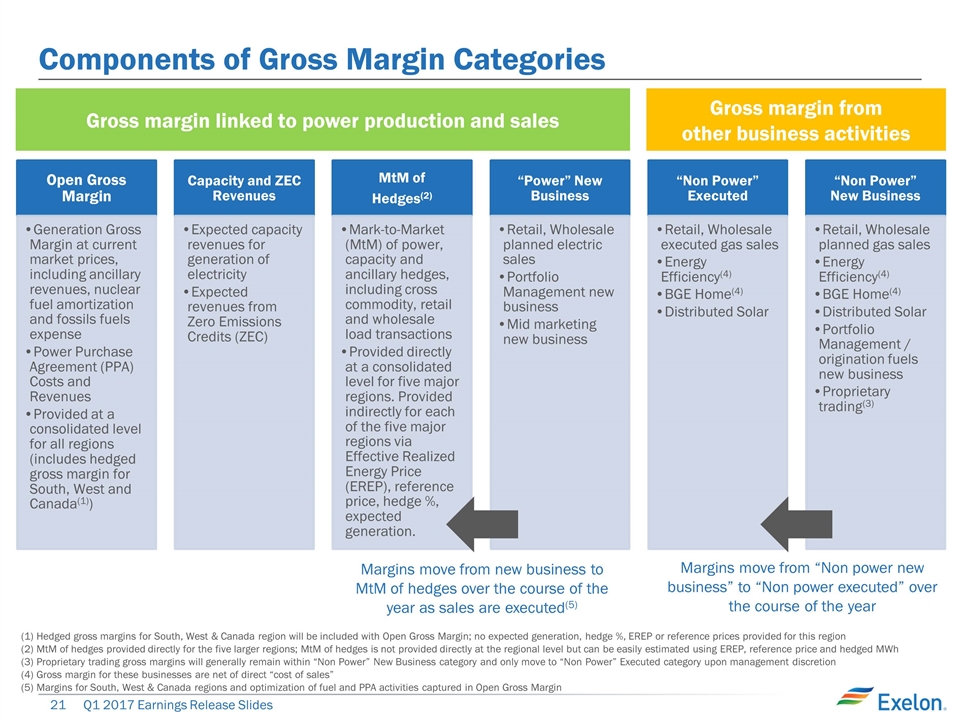

Components of Gross Margin Categories Margins move from new business to MtM of hedges over the course of the year as sales are executed(5) Margins move from “Non power new business” to “Non power executed” over the course of the year Gross margin linked to power production and sales Gross margin from other business activities (1) Hedged gross margins for South, West & Canada region will be included with Open Gross Margin; no expected generation, hedge %, EREP or reference prices provided for this region (2) MtM of hedges provided directly for the five larger regions; MtM of hedges is not provided directly at the regional level but can be easily estimated using EREP, reference price and hedged MWh (3) Proprietary trading gross margins will generally remain within “Non Power” New Business category and only move to “Non Power” Executed category upon management discretion (4) Gross margin for these businesses are net of direct “cost of sales” (5) Margins for South, West & Canada regions and optimization of fuel and PPA activities captured in Open Gross Margin Open Gross Margin Generation Gross Margin at current market prices, including ancillary revenues, nuclear fuel amortization and fossils fuels expense MtM of Hedges (2) Mark-to-Market ( MtM ) of power, capacity and ancillary hedges, including cross commodity, retail and wholesale load transactions “Power” New Business Retail, Wholesale planned electric sales “Non Power” Executed “Non Power” New Business Power Purchase Agreement (PPA) Costs and Revenues Provided at a consolidated level for all regions (includes hedged gross margin for South, West and Canada (1) ) Provided directly at a consolidated level for five major regions. Provided indirectly for each of the five major regions via Effective Realized Energy Price (EREP), reference price, hedge %, expected generation. Portfolio Management new business Mid marketing new business Retail, Wholesale executed gas sales Energy Efficiency (4) BGE Home (4) Distributed Solar Retail, Wholesale planned gas sales Energy Efficiency (4) BGE Home (4) Distributed Solar Portfolio Management / origination fuels new business Proprietary trading (3) Capacity and ZEC Revenues Expected capacity revenues for generation of electricity Expected revenues from Zero Emissions Credits (ZEC)

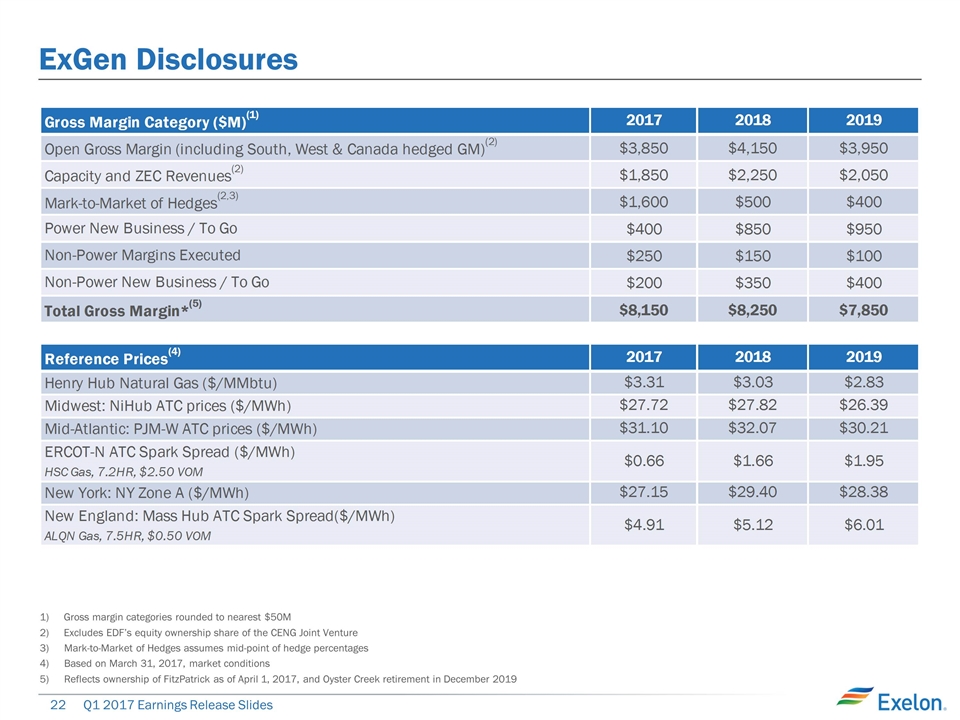

ExGen Disclosures Gross margin categories rounded to nearest $50M Excludes EDF’s equity ownership share of the CENG Joint Venture Mark-to-Market of Hedges assumes mid-point of hedge percentages Based on March 31, 2017, market conditions Reflects ownership of FitzPatrick as of April 1, 2017, and Oyster Creek retirement in December 2019

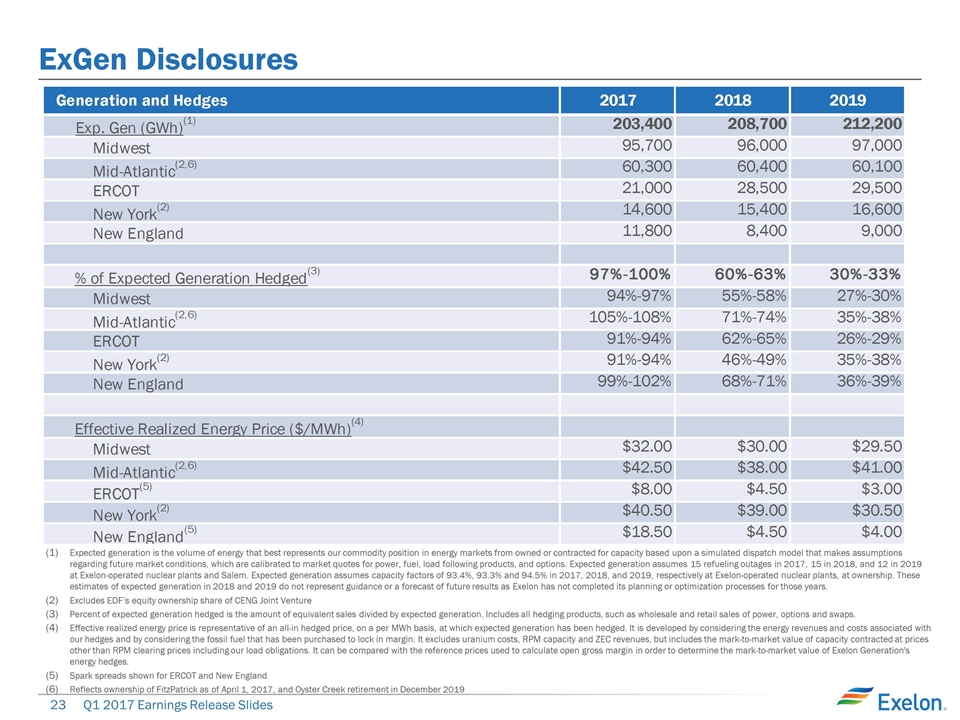

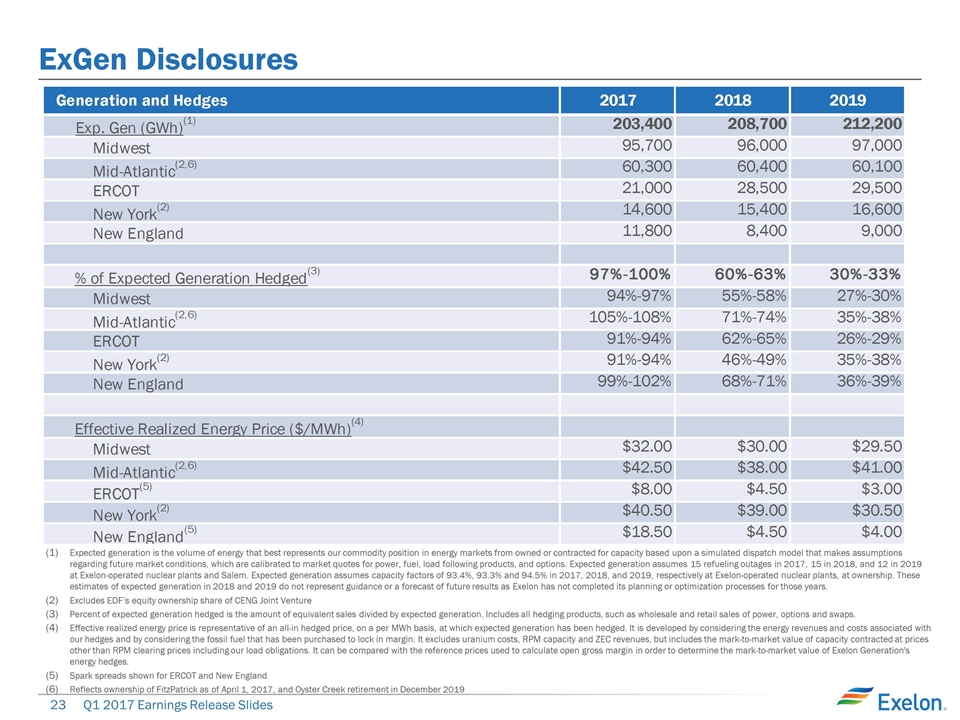

ExGen Disclosures Expected generation is the volume of energy that best represents our commodity position in energy markets from owned or contracted for capacity based upon a simulated dispatch model that makes assumptions regarding future market conditions, which are calibrated to market quotes for power, fuel, load following products, and options. Expected generation assumes 15 refueling outages in 2017, 15 in 2018, and 12 in 2019 at Exelon-operated nuclear plants and Salem. Expected generation assumes capacity factors of 93.4%, 93.3% and 94.5% in 2017, 2018, and 2019, respectively at Exelon-operated nuclear plants, at ownership. These estimates of expected generation in 2018 and 2019 do not represent guidance or a forecast of future results as Exelon has not completed its planning or optimization processes for those years. Excludes EDF’s equity ownership share of CENG Joint Venture Percent of expected generation hedged is the amount of equivalent sales divided by expected generation. Includes all hedging products, such as wholesale and retail sales of power, options and swaps. Effective realized energy price is representative of an all-in hedged price, on a per MWh basis, at which expected generation has been hedged. It is developed by considering the energy revenues and costs associated with our hedges and by considering the fossil fuel that has been purchased to lock in margin. It excludes uranium costs, RPM capacity and ZEC revenues, but includes the mark-to-market value of capacity contracted at prices other than RPM clearing prices including our load obligations. It can be compared with the reference prices used to calculate open gross margin in order to determine the mark-to-market value of Exelon Generation's energy hedges. Spark spreads shown for ERCOT and New England Reflects ownership of FitzPatrick as of April 1, 2017, and Oyster Creek retirement in December 2019

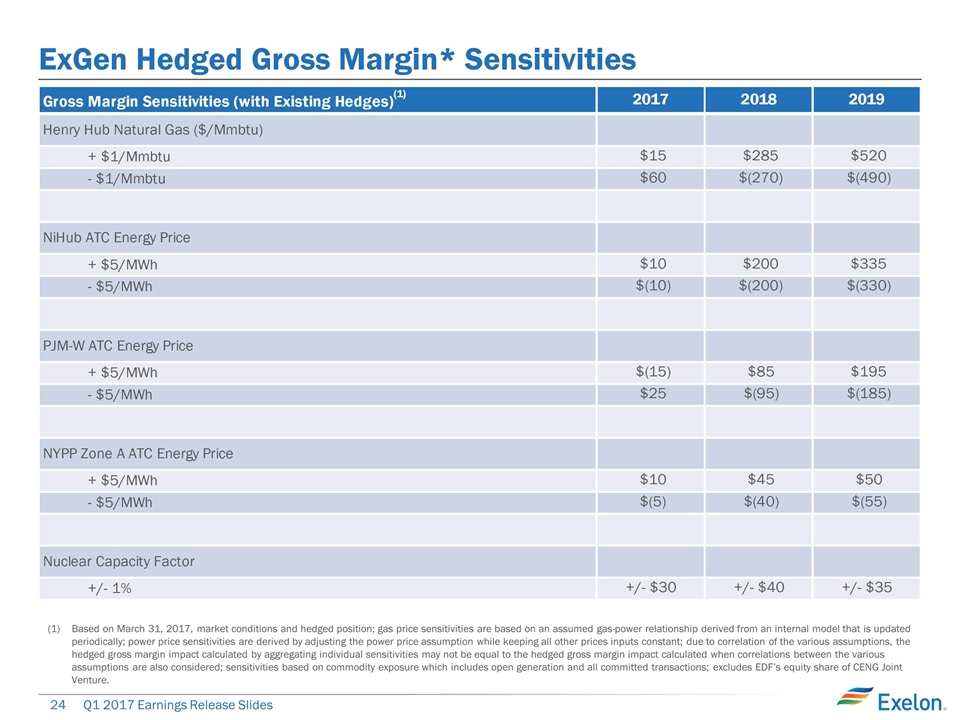

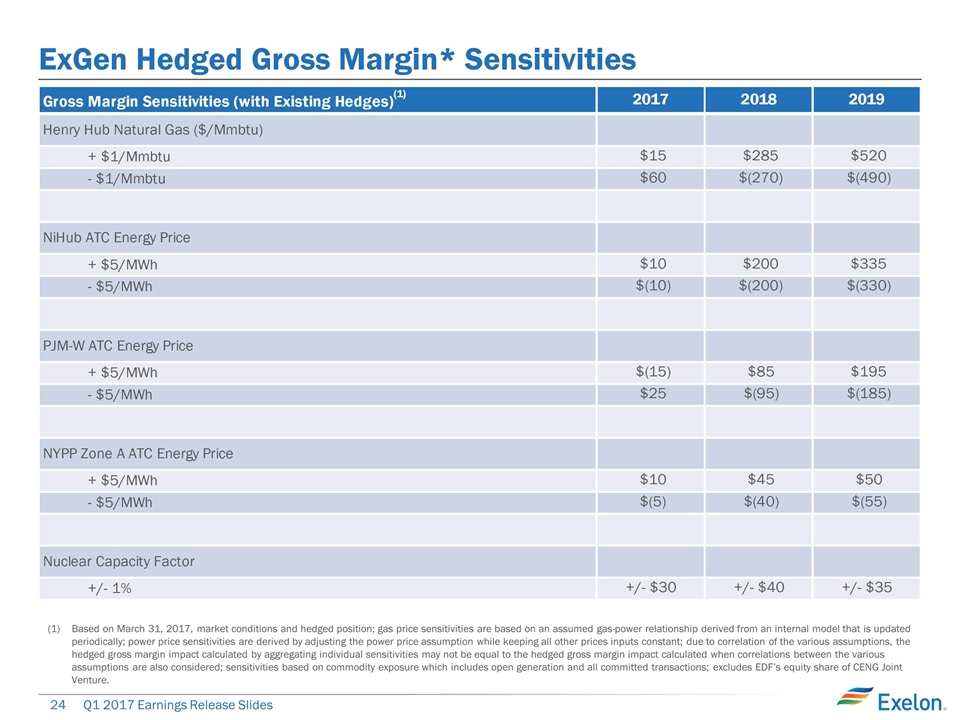

ExGen Hedged Gross Margin* Sensitivities Based on March 31, 2017, market conditions and hedged position; gas price sensitivities are based on an assumed gas-power relationship derived from an internal model that is updated periodically; power price sensitivities are derived by adjusting the power price assumption while keeping all other prices inputs constant; due to correlation of the various assumptions, the hedged gross margin impact calculated by aggregating individual sensitivities may not be equal to the hedged gross margin impact calculated when correlations between the various assumptions are also considered; sensitivities based on commodity exposure which includes open generation and all committed transactions; excludes EDF’s equity share of CENG Joint Venture.

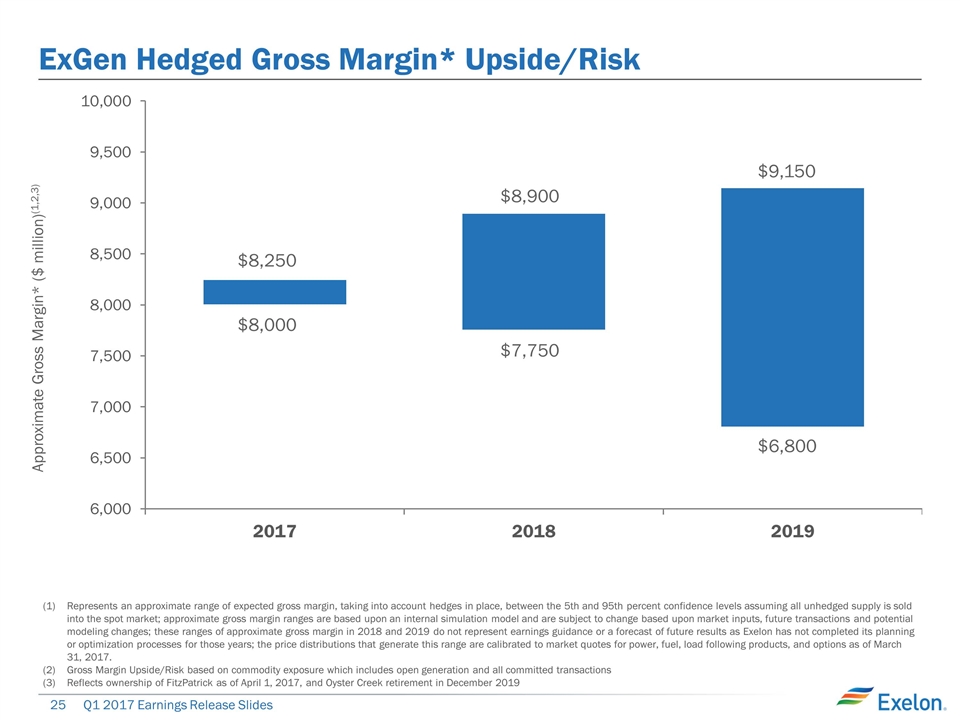

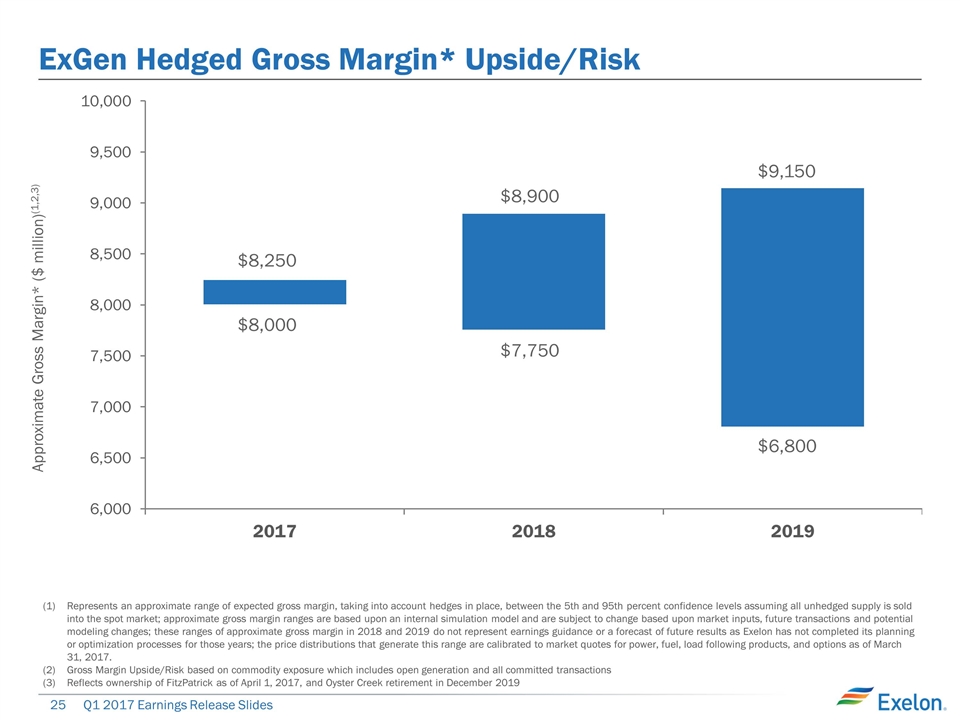

ExGen Hedged Gross Margin* Upside/Risk Approximate Gross Margin* ($ million)(1,2,3) $8,250 $8,000 $8,900 $7,750 Represents an approximate range of expected gross margin, taking into account hedges in place, between the 5th and 95th percent confidence levels assuming all unhedged supply is sold into the spot market; approximate gross margin ranges are based upon an internal simulation model and are subject to change based upon market inputs, future transactions and potential modeling changes; these ranges of approximate gross margin in 2018 and 2019 do not represent earnings guidance or a forecast of future results as Exelon has not completed its planning or optimization processes for those years; the price distributions that generate this range are calibrated to market quotes for power, fuel, load following products, and options as of March 31, 2017. Gross Margin Upside/Risk based on commodity exposure which includes open generation and all committed transactions Reflects ownership of FitzPatrick as of April 1, 2017, and Oyster Creek retirement in December 2019 $6,800 $9,150

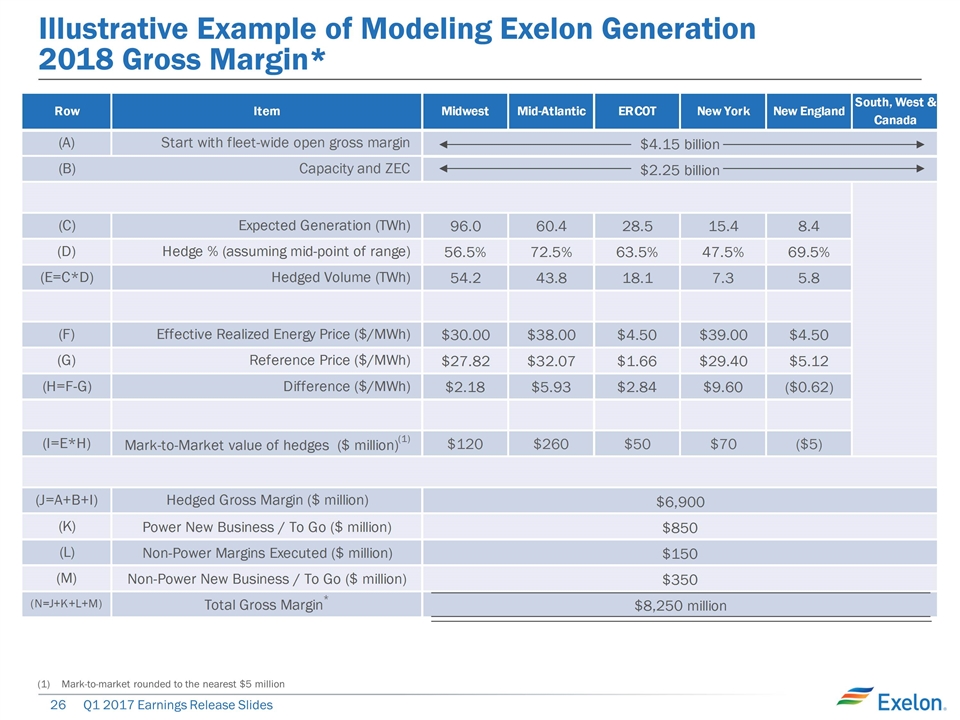

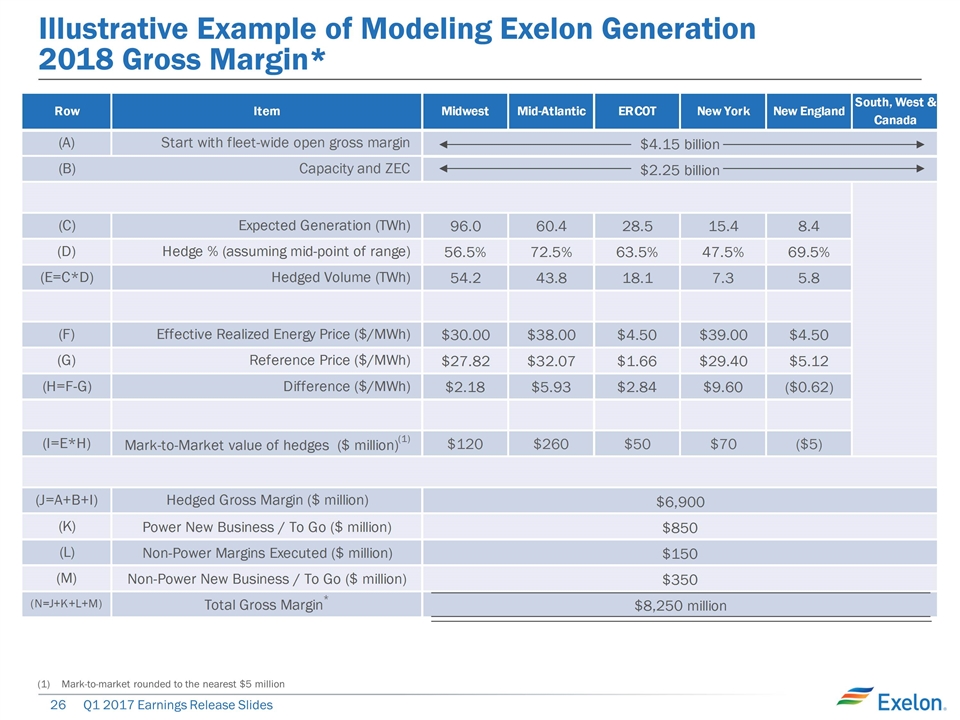

Illustrative Example of Modeling Exelon Generation 2018 Gross Margin* Mark-to-market rounded to the nearest $5 million

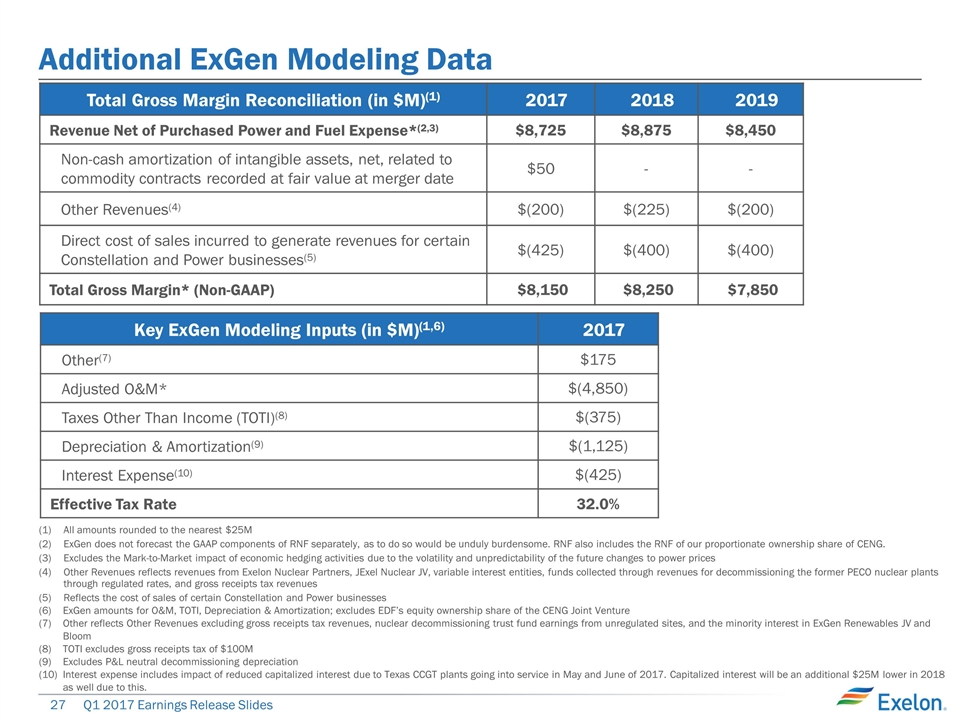

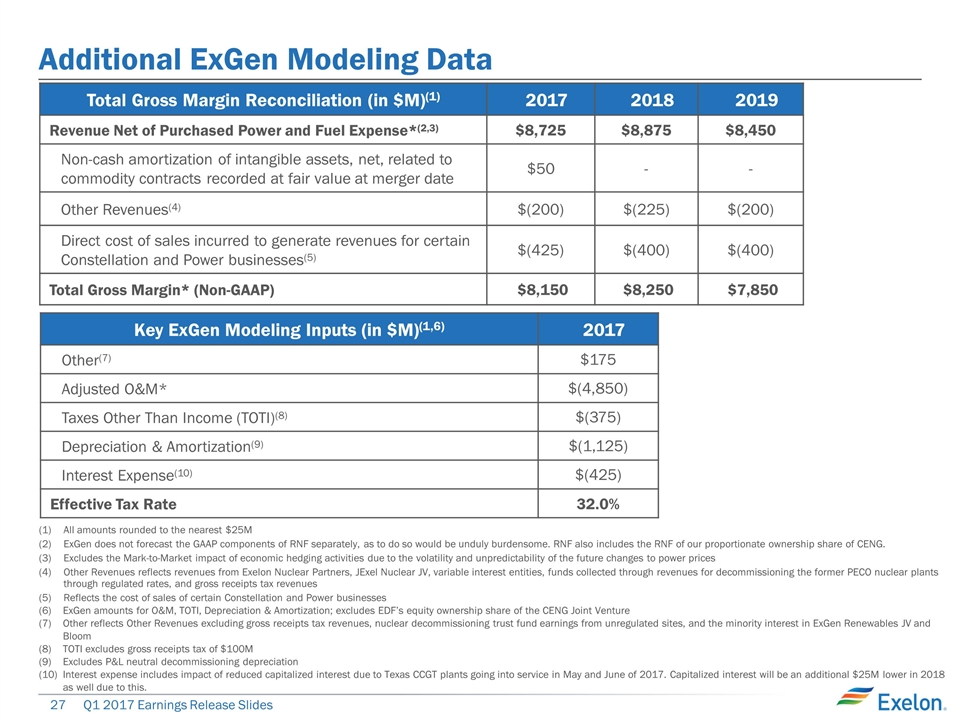

Additional ExGen Modeling Data Total Gross Margin Reconciliation (in $M)(1) 2017 2018 2019 Revenue Net of Purchased Power and Fuel Expense*(2,3) $8,725 $8,875 $8,450 Non-cash amortization of intangible assets, net, related to commodity contracts recorded at fair value at merger date $50 - - Other Revenues(4) $(200) $(225) $(200) Direct cost of sales incurred to generate revenues for certain Constellation and Power businesses(5) $(425) $(400) $(400) Total Gross Margin* (Non-GAAP) $8,150 $8,250 $7,850 All amounts rounded to the nearest $25M ExGen does not forecast the GAAP components of RNF separately, as to do so would be unduly burdensome. RNF also includes the RNF of our proportionate ownership share of CENG. Excludes the Mark-to-Market impact of economic hedging activities due to the volatility and unpredictability of the future changes to power prices Other Revenues reflects revenues from Exelon Nuclear Partners, JExel Nuclear JV, variable interest entities, funds collected through revenues for decommissioning the former PECO nuclear plants through regulated rates, and gross receipts tax revenues Reflects the cost of sales of certain Constellation and Power businesses ExGen amounts for O&M, TOTI, Depreciation & Amortization; excludes EDF’s equity ownership share of the CENG Joint Venture Other reflects Other Revenues excluding gross receipts tax revenues, nuclear decommissioning trust fund earnings from unregulated sites, and the minority interest in ExGen Renewables JV and Bloom TOTI excludes gross receipts tax of $100M Excludes P&L neutral decommissioning depreciation Interest expense includes impact of reduced capitalized interest due to Texas CCGT plants going into service in May and June of 2017. Capitalized interest will be an additional $25M lower in 2018 as well due to this. Key ExGen Modeling Inputs (in $M)(1,6) 2017 Other(7) $175 Adjusted O&M* $(4,850) Taxes Other Than Income (TOTI)(8) $(375) Depreciation & Amortization(9) $(1,125) Interest Expense(10) $(425) Effective Tax Rate 32.0%

Exelon Utilities Rate Case Filing Summaries

3/17 4/17 5/17 6/17 Pepco Electric Distribution Rates - DC Delmarva Electric Distribution Rates - DE Pepco Electric Distribution Rates - MD Exelon Utilities Distribution Rate Case Schedule 7/17 8/17 Note: Based on current schedules of Illinois Commerce Commission, Maryland Public Service Commission, DC Public Service Commission and Delaware Public Service Commission and are subject to change Delmarva Gas Distribution Rates - DE Settlement Filed Mar 8 Settlement Filed April 6 Rate Case Filed Mar 24 Evidentiary Hearings Mar 15-21 Final Reply Briefs April 24 9/17 Commission Order Expected July 25 ACE Electric Distribution Rates - NJ Rate Case Filed Mar 30 ComEd Electric Distribution Formula Rate 2017 FRU Filing April 13 Rebuttal Testimony Mid-July Intervenor Direct Testimony June 30 Rebuttal Testimony Aug 1 Evidentiary Hearings Sep 5-15

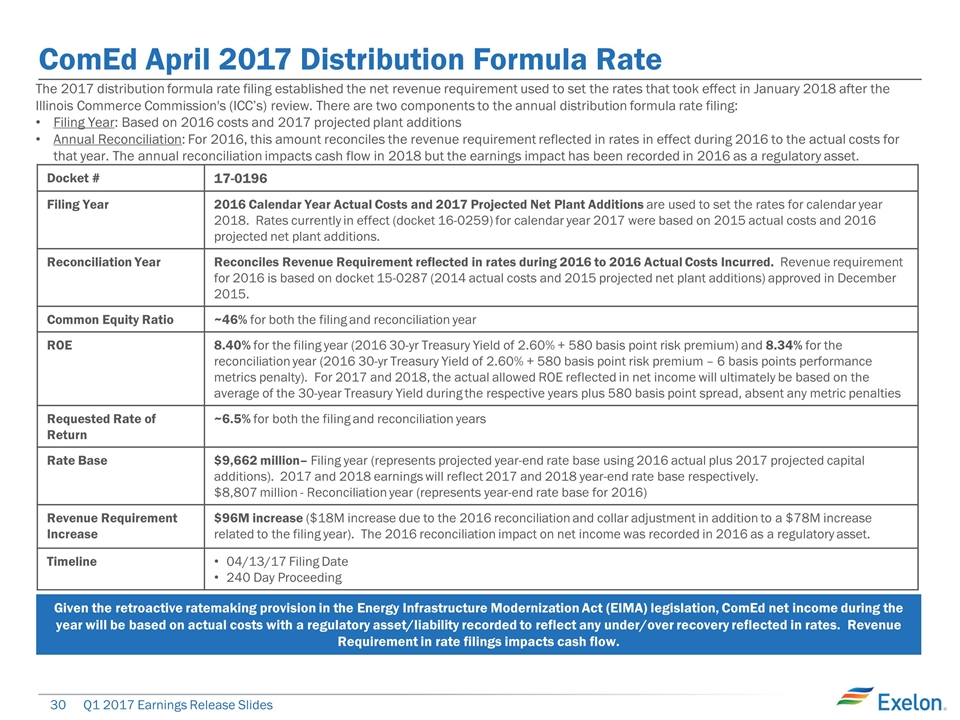

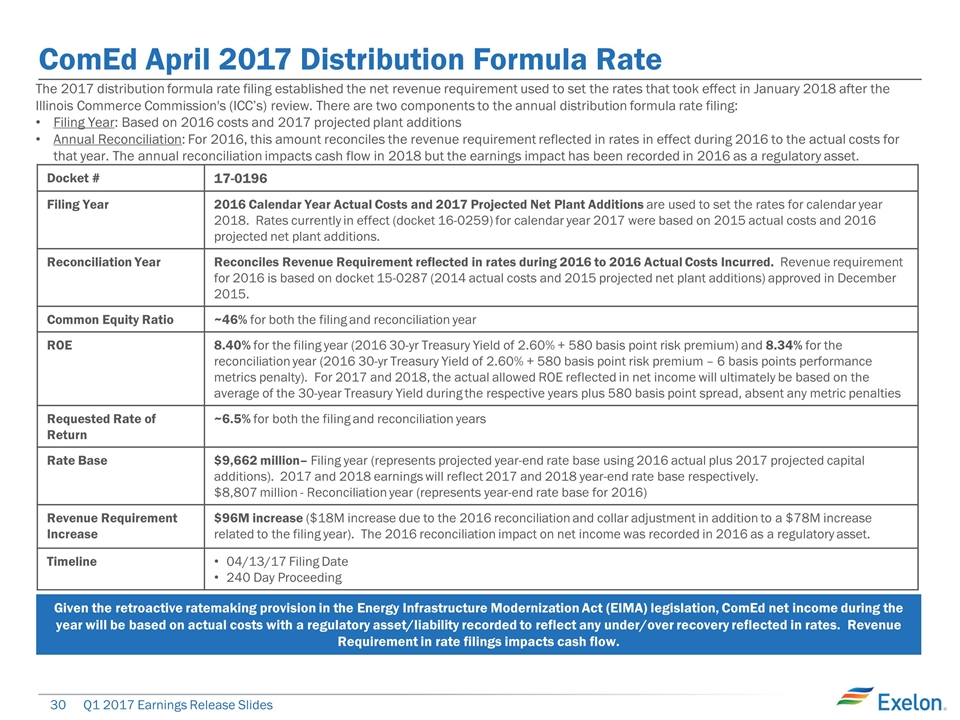

ComEd April 2017 Distribution Formula Rate Docket # 17-0196 Filing Year 2016 Calendar Year Actual Costs and 2017 Projected Net Plant Additions are used to set the rates for calendar year 2018. Rates currently in effect (docket 16-0259) for calendar year 2017 were based on 2015 actual costs and 2016 projected net plant additions. Reconciliation Year Reconciles Revenue Requirement reflected in rates during 2016 to 2016 Actual Costs Incurred. Revenue requirement for 2016 is based on docket 15-0287 (2014 actual costs and 2015 projected net plant additions) approved in December 2015. Common Equity Ratio ~46% for both the filing and reconciliation year ROE 8.40% for the filing year (2016 30-yr Treasury Yield of 2.60% + 580 basis point risk premium) and 8.34% for the reconciliation year (2016 30-yr Treasury Yield of 2.60% + 580 basis point risk premium – 6 basis points performance metrics penalty). For 2017 and 2018, the actual allowed ROE reflected in net income will ultimately be based on the average of the 30-year Treasury Yield during the respective years plus 580 basis point spread, absent any metric penalties Requested Rate of Return ~6.5% for both the filing and reconciliation years Rate Base $9,662 million– Filing year (represents projected year-end rate base using 2016 actual plus 2017 projected capital additions). 2017 and 2018 earnings will reflect 2017 and 2018 year-end rate base respectively. $8,807 million - Reconciliation year (represents year-end rate base for 2016) Revenue Requirement Increase $96M increase ($18M increase due to the 2016 reconciliation and collar adjustment in addition to a $78M increase related to the filing year). The 2016 reconciliation impact on net income was recorded in 2016 as a regulatory asset. Timeline 04/13/17 Filing Date 240 Day Proceeding The 2017 distribution formula rate filing established the net revenue requirement used to set the rates that took effect in January 2018 after the Illinois Commerce Commission's (ICC’s) review. There are two components to the annual distribution formula rate filing: Filing Year: Based on 2016 costs and 2017 projected plant additions Annual Reconciliation: For 2016, this amount reconciles the revenue requirement reflected in rates in effect during 2016 to the actual costs for that year. The annual reconciliation impacts cash flow in 2018 but the earnings impact has been recorded in 2016 as a regulatory asset. Given the retroactive ratemaking provision in the Energy Infrastructure Modernization Act (EIMA) legislation, ComEd net income during the year will be based on actual costs with a regulatory asset/liability recorded to reflect any under/over recovery reflected in rates. Revenue Requirement in rate filings impacts cash flow.

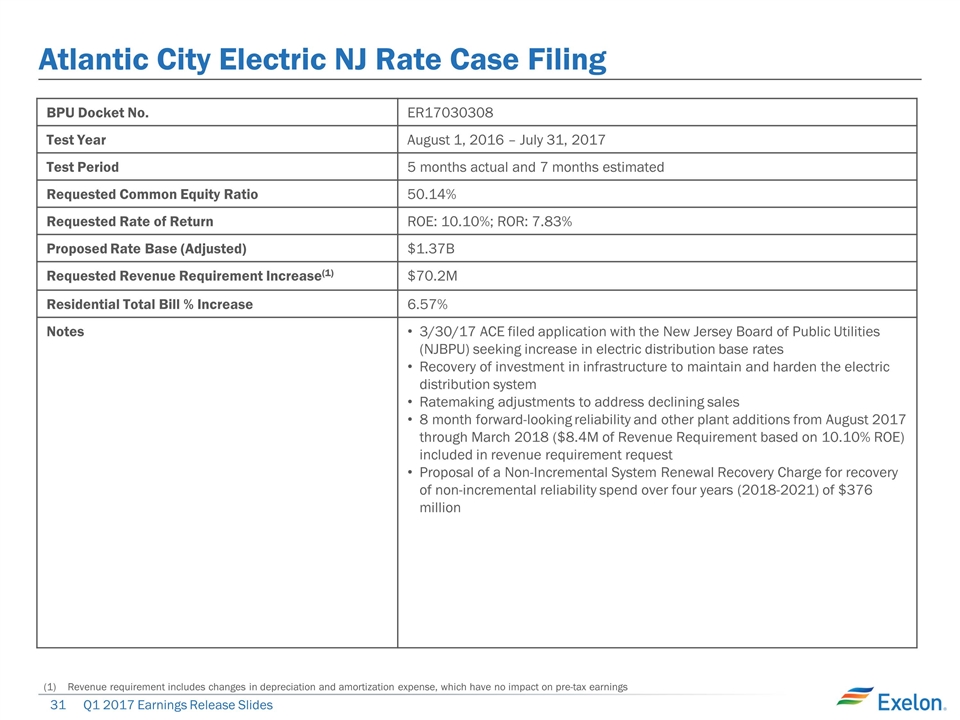

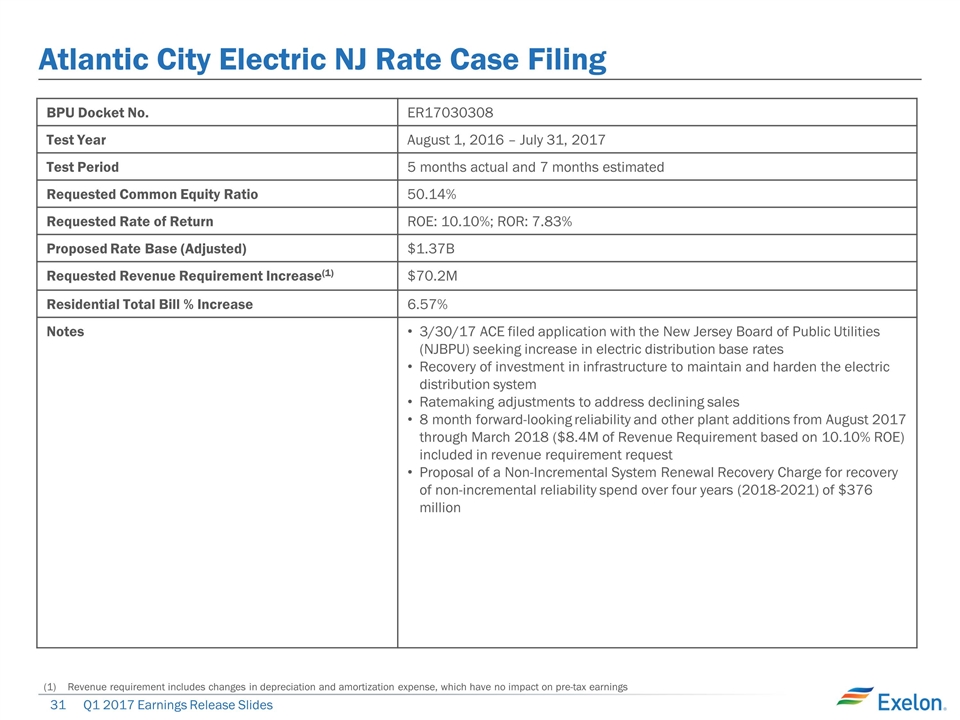

Atlantic City Electric NJ Rate Case Filing BPU Docket No. ER17030308 Test Year August 1, 2016 – July 31, 2017 Test Period 5 months actual and 7 months estimated Requested Common Equity Ratio 50.14% Requested Rate of Return ROE: 10.10%; ROR: 7.83% Proposed Rate Base (Adjusted) $1.37B Requested Revenue Requirement Increase(1) $70.2M Residential Total Bill % Increase 6.57% Notes 3/30/17 ACE filed application with the New Jersey Board of Public Utilities (NJBPU) seeking increase in electric distribution base rates Recovery of investment in infrastructure to maintain and harden the electric distribution system Ratemaking adjustments to address declining sales 8 month forward-looking reliability and other plant additions from August 2017 through March 2018 ($8.4M of Revenue Requirement based on 10.10% ROE) included in revenue requirement request Proposal of a Non-Incremental System Renewal Recovery Charge for recovery of non-incremental reliability spend over four years (2018-2021) of $376 million Revenue requirement includes changes in depreciation and amortization expense, which have no impact on pre-tax earnings

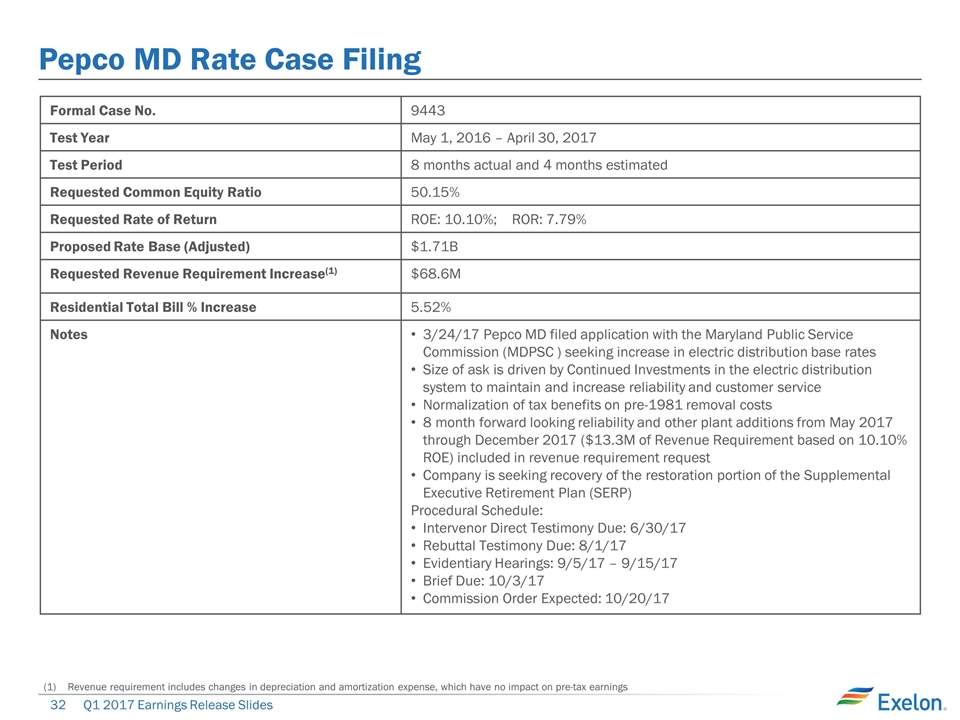

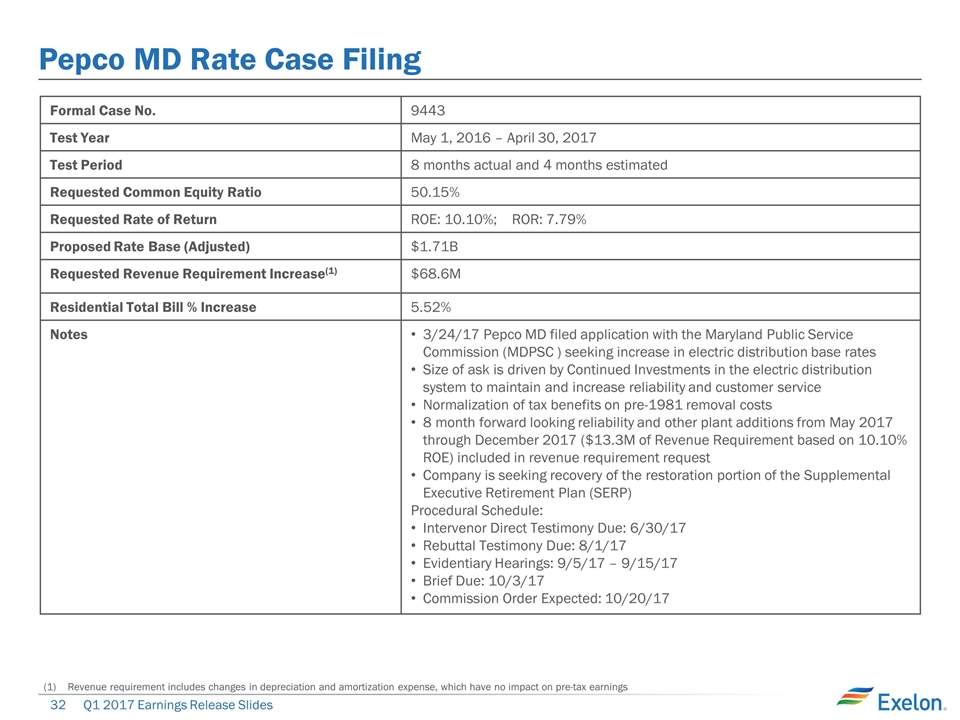

Pepco MD Rate Case Filing Formal Case No. 9443 Test Year May 1, 2016 – April 30, 2017 Test Period 8 months actual and 4 months estimated Requested Common Equity Ratio 50.15% Requested Rate of Return ROE: 10.10%; ROR: 7.79% Proposed Rate Base (Adjusted) $1.71B Requested Revenue Requirement Increase(1) $68.6M Residential Total Bill % Increase 5.52% Notes 3/24/17 Pepco MD filed application with the Maryland Public Service Commission (MDPSC ) seeking increase in electric distribution base rates Size of ask is driven by Continued Investments in the electric distribution system to maintain and increase reliability and customer service Normalization of tax benefits on pre-1981 removal costs 8 month forward looking reliability and other plant additions from May 2017 through December 2017 ($13.3M of Revenue Requirement based on 10.10% ROE) included in revenue requirement request Company is seeking recovery of the restoration portion of the Supplemental Executive Retirement Plan (SERP) Procedural Schedule: Intervenor Direct Testimony Due: 6/30/17 Rebuttal Testimony Due: 8/1/17 Evidentiary Hearings: 9/5/17 – 9/15/17 Brief Due: 10/3/17 Commission Order Expected: 10/20/17 Revenue requirement includes changes in depreciation and amortization expense, which have no impact on pre-tax earnings

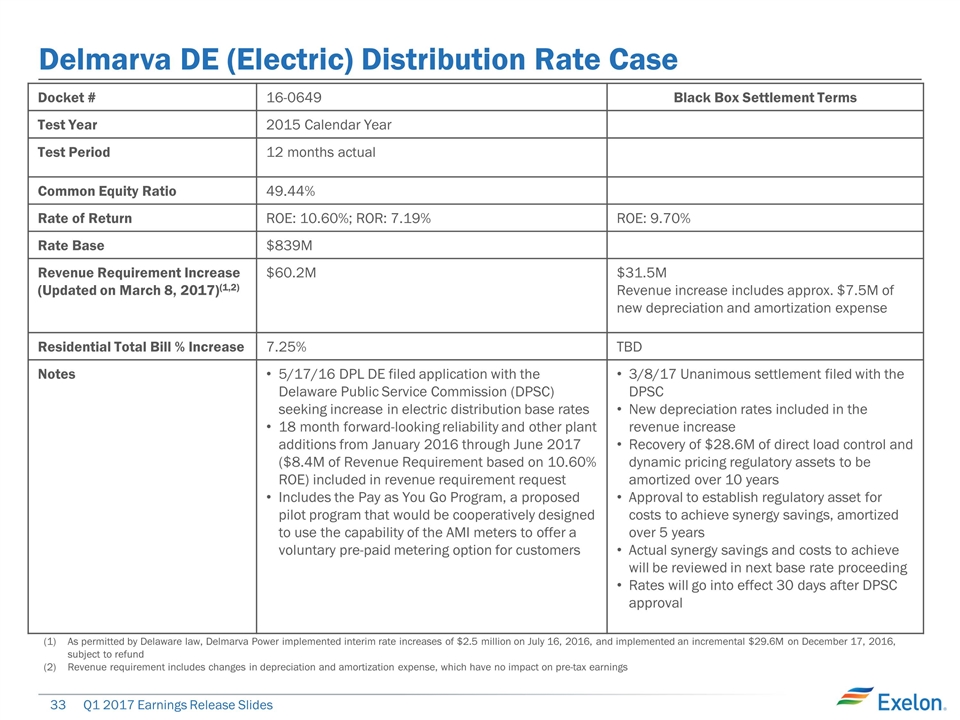

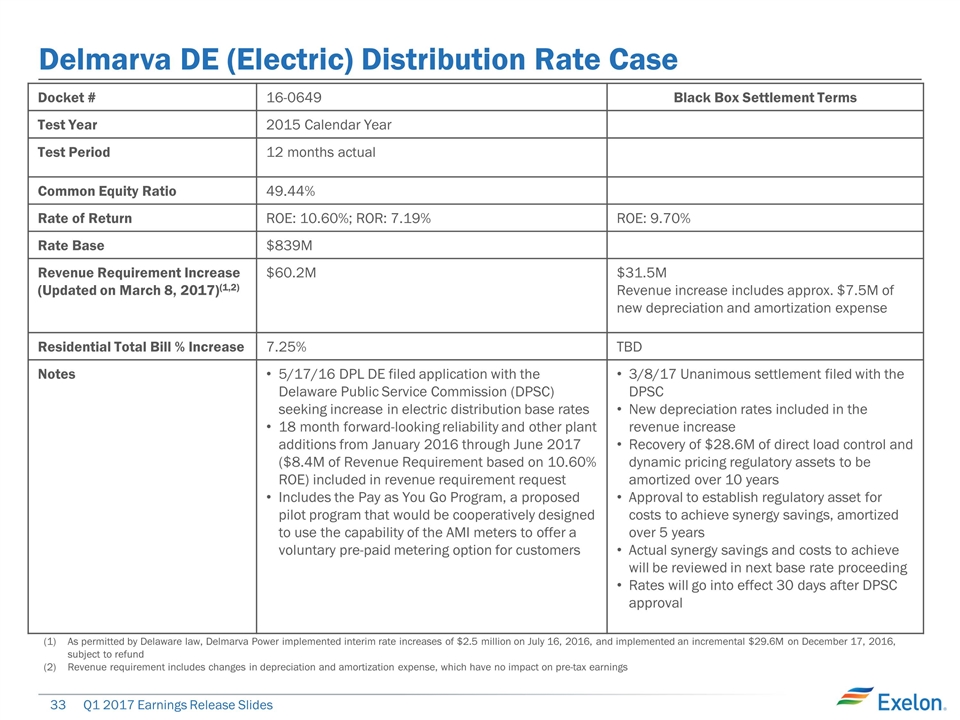

Delmarva DE (Electric) Distribution Rate Case As permitted by Delaware law, Delmarva Power implemented interim rate increases of $2.5 million on July 16, 2016, and implemented an incremental $29.6M on December 17, 2016, subject to refund Revenue requirement includes changes in depreciation and amortization expense, which have no impact on pre-tax earnings Docket # 16-0649 Black Box Settlement Terms Test Year 2015 Calendar Year Test Period 12 months actual Common Equity Ratio 49.44% Rate of Return ROE: 10.60%; ROR: 7.19% ROE: 9.70% Rate Base $839M Revenue Requirement Increase (Updated on March 8, 2017)(1,2) $60.2M $31.5M Revenue increase includes approx. $7.5M of new depreciation and amortization expense Residential Total Bill % Increase 7.25% TBD Notes 5/17/16 DPL DE filed application with the Delaware Public Service Commission (DPSC) seeking increase in electric distribution base rates 18 month forward-looking reliability and other plant additions from January 2016 through June 2017 ($8.4M of Revenue Requirement based on 10.60% ROE) included in revenue requirement request Includes the Pay as You Go Program, a proposed pilot program that would be cooperatively designed to use the capability of the AMI meters to offer a voluntary pre-paid metering option for customers 3/8/17 Unanimous settlement filed with the DPSC New depreciation rates included in the revenue increase Recovery of $28.6M of direct load control and dynamic pricing regulatory assets to be amortized over 10 years Approval to establish regulatory asset for costs to achieve synergy savings, amortized over 5 years Actual synergy savings and costs to achieve will be reviewed in next base rate proceeding Rates will go into effect 30 days after DPSC approval

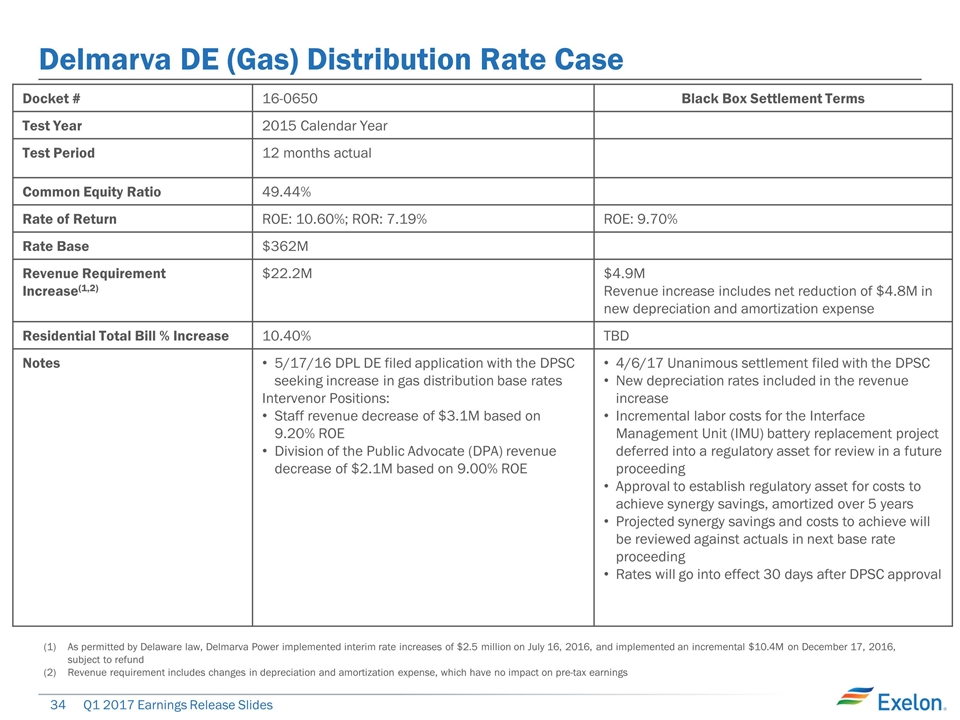

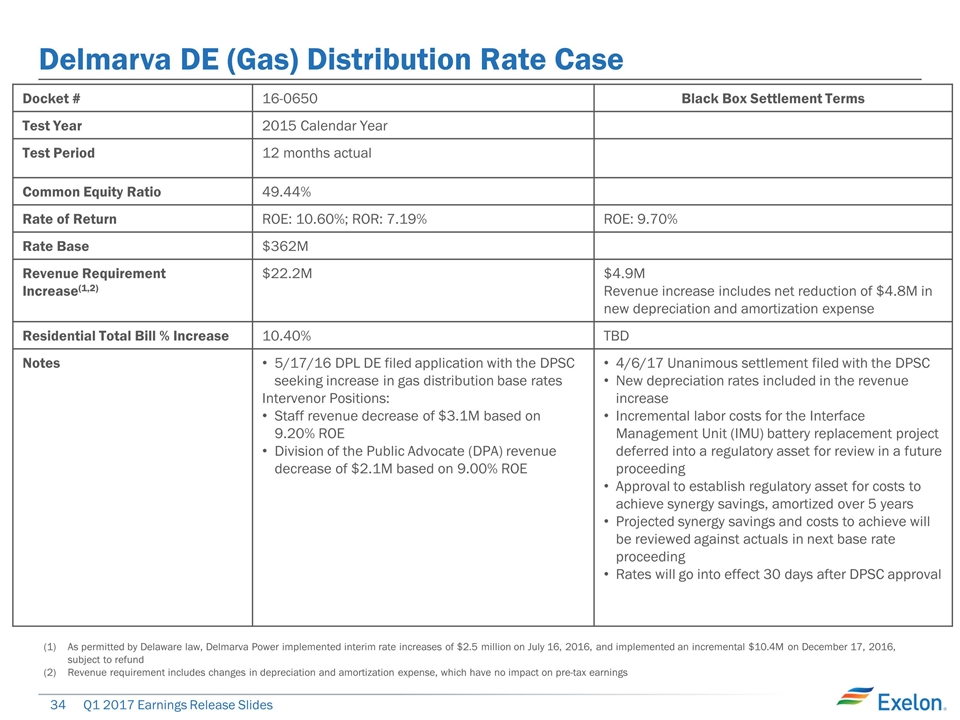

Delmarva DE (Gas) Distribution Rate Case As permitted by Delaware law, Delmarva Power implemented interim rate increases of $2.5 million on July 16, 2016, and implemented an incremental $10.4M on December 17, 2016, subject to refund Revenue requirement includes changes in depreciation and amortization expense, which have no impact on pre-tax earnings Docket # 16-0650 Black Box Settlement Terms Test Year 2015 Calendar Year Test Period 12 months actual Common Equity Ratio 49.44% Rate of Return ROE: 10.60%; ROR: 7.19% ROE: 9.70% Rate Base $362M Revenue Requirement Increase(1,2) $22.2M $4.9M Revenue increase includes net reduction of $4.8M in new depreciation and amortization expense Residential Total Bill % Increase 10.40% TBD Notes 5/17/16 DPL DE filed application with the DPSC seeking increase in gas distribution base rates Intervenor Positions: Staff revenue decrease of $3.1M based on 9.20% ROE Division of the Public Advocate (DPA) revenue decrease of $2.1M based on 9.00% ROE 4/6/17 Unanimous settlement filed with the DPSC New depreciation rates included in the revenue increase Incremental labor costs for the Interface Management Unit (IMU) battery replacement project deferred into a regulatory asset for review in a future proceeding Approval to establish regulatory asset for costs to achieve synergy savings, amortized over 5 years Projected synergy savings and costs to achieve will be reviewed against actuals in next base rate proceeding Rates will go into effect 30 days after DPSC approval

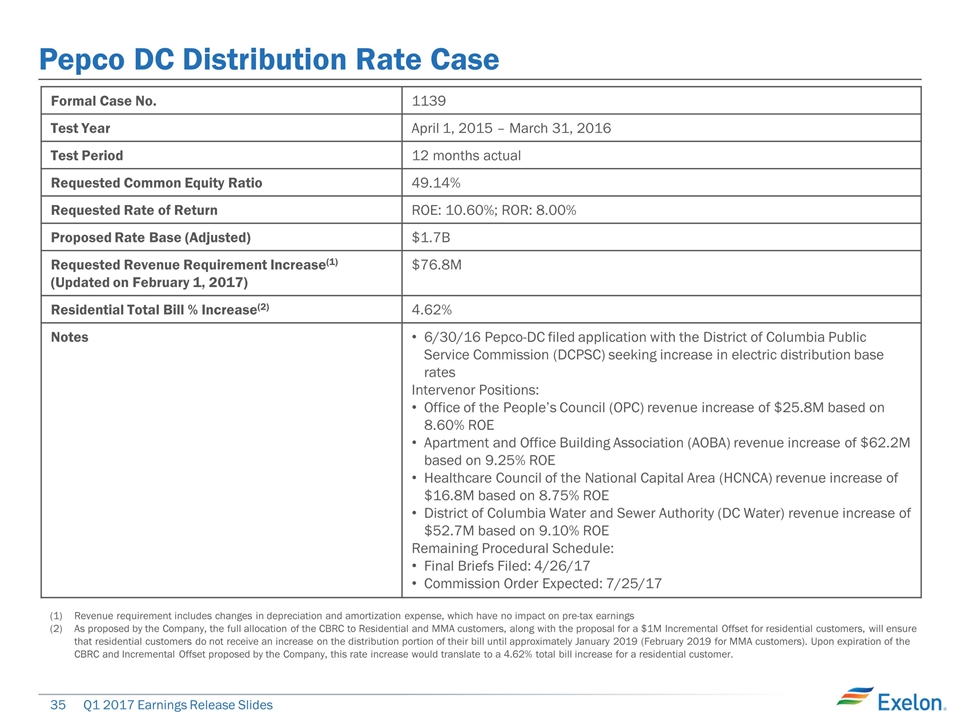

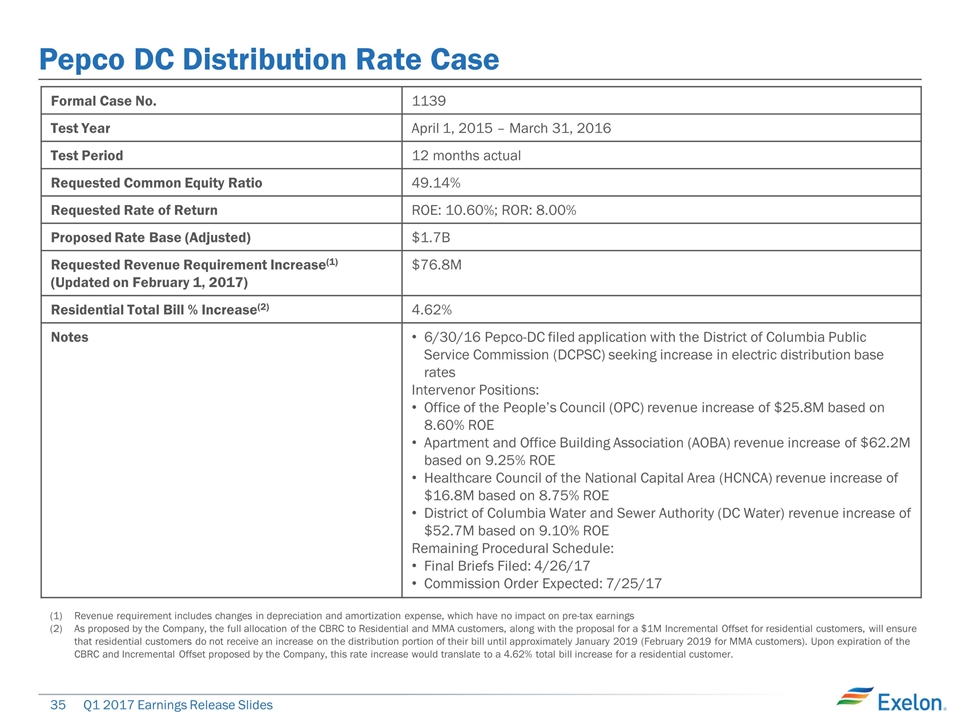

Pepco DC Distribution Rate Case Revenue requirement includes changes in depreciation and amortization expense, which have no impact on pre-tax earnings As proposed by the Company, the full allocation of the CBRC to Residential and MMA customers, along with the proposal for a $1M Incremental Offset for residential customers, will ensure that residential customers do not receive an increase on the distribution portion of their bill until approximately January 2019 (February 2019 for MMA customers). Upon expiration of the CBRC and Incremental Offset proposed by the Company, this rate increase would translate to a 4.62% total bill increase for a residential customer. Formal Case No. 1139 Test Year April 1, 2015 – March 31, 2016 Test Period 12 months actual Requested Common Equity Ratio 49.14% Requested Rate of Return ROE: 10.60%; ROR: 8.00% Proposed Rate Base (Adjusted) $1.7B Requested Revenue Requirement Increase(1) (Updated on February 1, 2017) $76.8M Residential Total Bill % Increase(2) 4.62% Notes 6/30/16 Pepco-DC filed application with the District of Columbia Public Service Commission (DCPSC) seeking increase in electric distribution base rates Intervenor Positions: Office of the People’s Council (OPC) revenue increase of $25.8M based on 8.60% ROE Apartment and Office Building Association (AOBA) revenue increase of $62.2M based on 9.25% ROE Healthcare Council of the National Capital Area (HCNCA) revenue increase of $16.8M based on 8.75% ROE District of Columbia Water and Sewer Authority (DC Water) revenue increase of $52.7M based on 9.10% ROE Remaining Procedural Schedule: Final Briefs Filed: 4/26/17 Commission Order Expected: 7/25/17

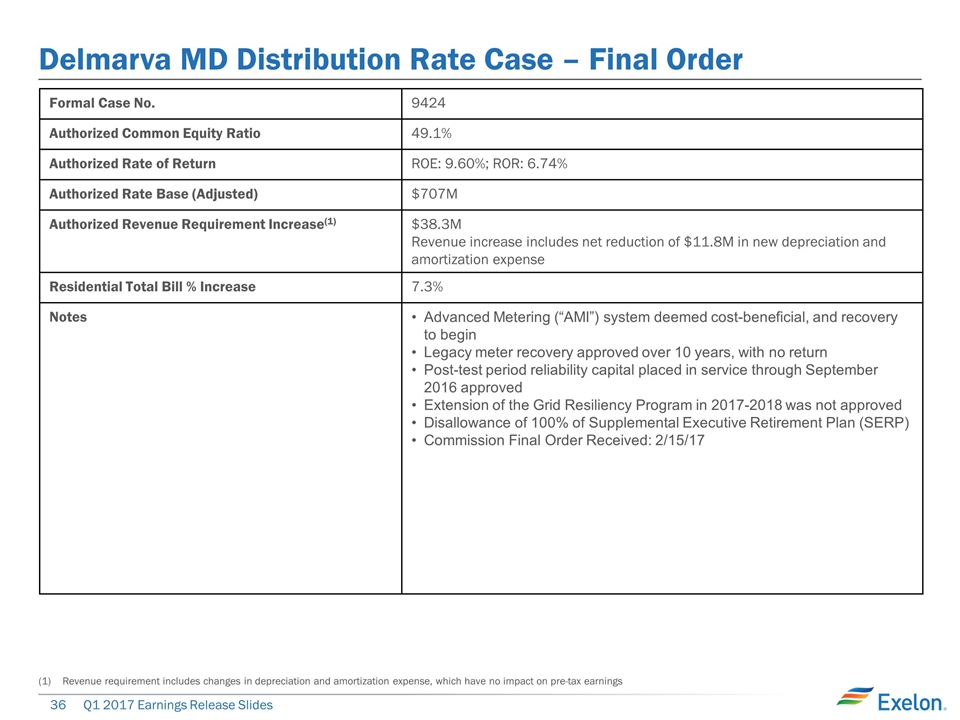

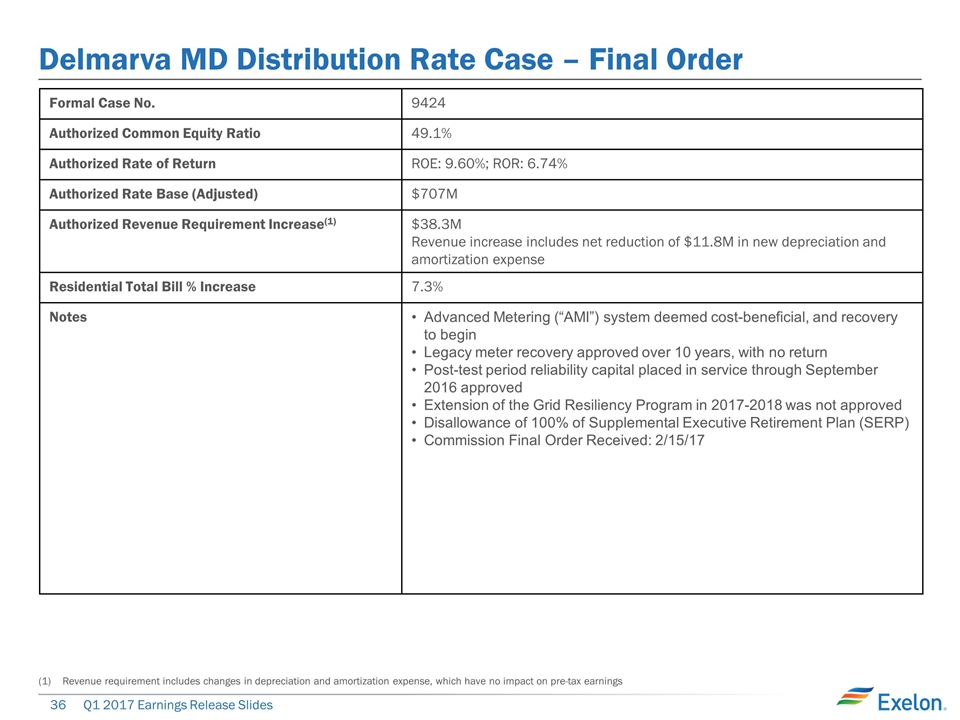

Delmarva MD Distribution Rate Case – Final Order Formal Case No. 9424 Authorized Common Equity Ratio 49.1% Authorized Rate of Return ROE: 9.60%; ROR: 6.74% Authorized Rate Base (Adjusted) $707M Authorized Revenue Requirement Increase(1) $38.3M Revenue increase includes net reduction of $11.8M in new depreciation and amortization expense Residential Total Bill % Increase 7.3% Notes Advanced Metering (“AMI”) system deemed cost-beneficial, and recovery to begin Legacy meter recovery approved over 10 years, with no return Post-test period reliability capital placed in service through September 2016 approved Extension of the Grid Resiliency Program in 2017-2018 was not approved Disallowance of 100% of Supplemental Executive Retirement Plan (SERP) Commission Final Order Received: 2/15/17 Revenue requirement includes changes in depreciation and amortization expense, which have no impact on pre-tax earnings

Appendix Reconciliation of Non-GAAP Measures

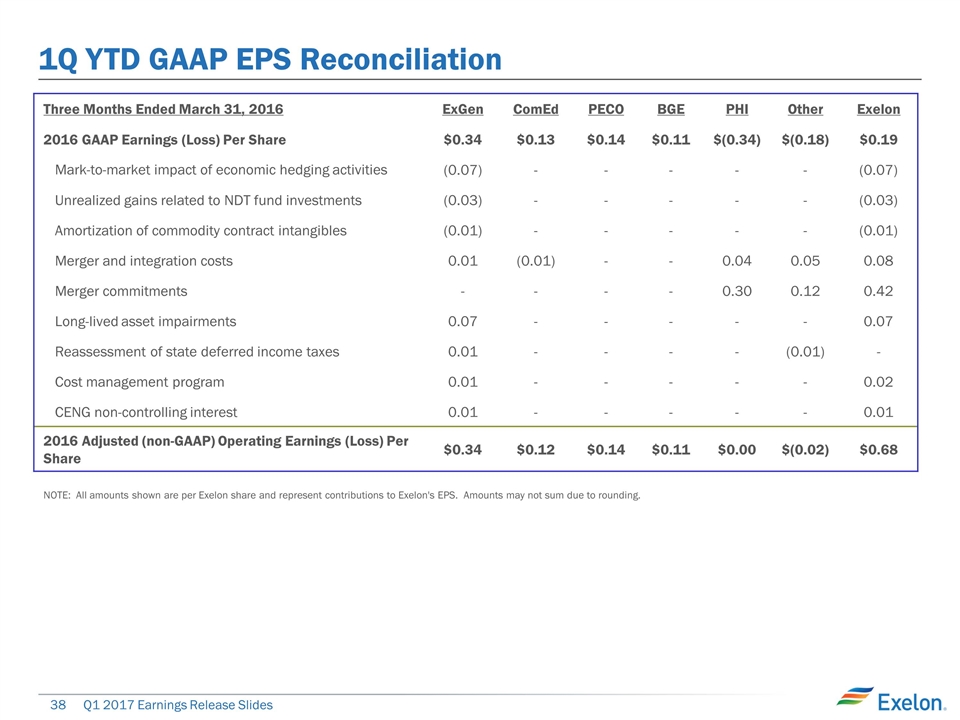

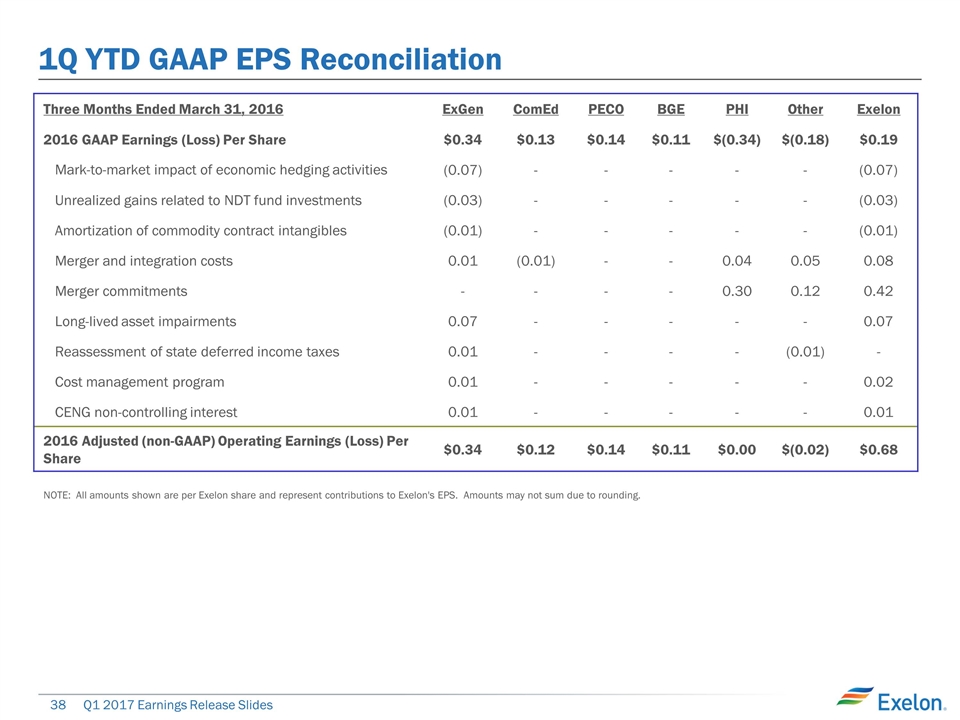

1Q YTD GAAP EPS Reconciliation Three Months Ended March 31, 2016 ExGen ComEd PECO BGE PHI Other Exelon 2016 GAAP Earnings (Loss) Per Share $0.34 $0.13 $0.14 $0.11 $(0.34) $(0.18) $0.19 Mark-to-market impact of economic hedging activities (0.07) - - - - - (0.07) Unrealized gains related to NDT fund investments (0.03) - - - - - (0.03) Amortization of commodity contract intangibles (0.01) - - - - - (0.01) Merger and integration costs 0.01 (0.01) - - 0.04 0.05 0.08 Merger commitments - - - - 0.30 0.12 0.42 Long-lived asset impairments 0.07 - - - - - 0.07 Reassessment of state deferred income taxes 0.01 - - - - (0.01) - Cost management program 0.01 - - - - - 0.02 CENG non-controlling interest 0.01 - - - - - 0.01 2016 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share $0.34 $0.12 $0.14 $0.11 $0.00 $(0.02) $0.68 NOTE: All amounts shown are per Exelon share and represent contributions to Exelon's EPS. Amounts may not sum due to rounding.

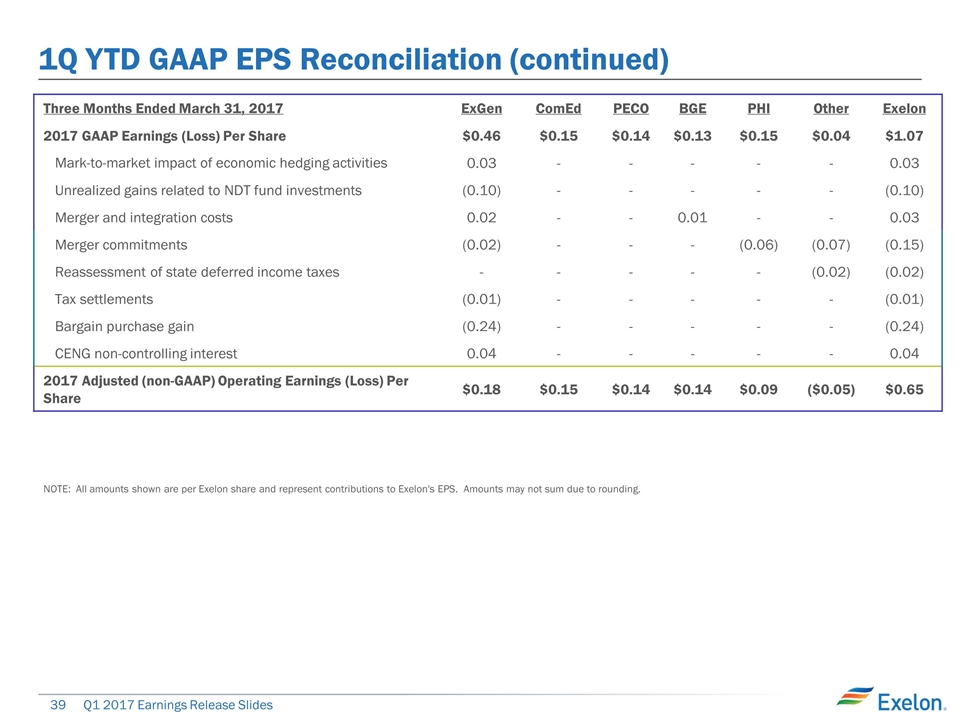

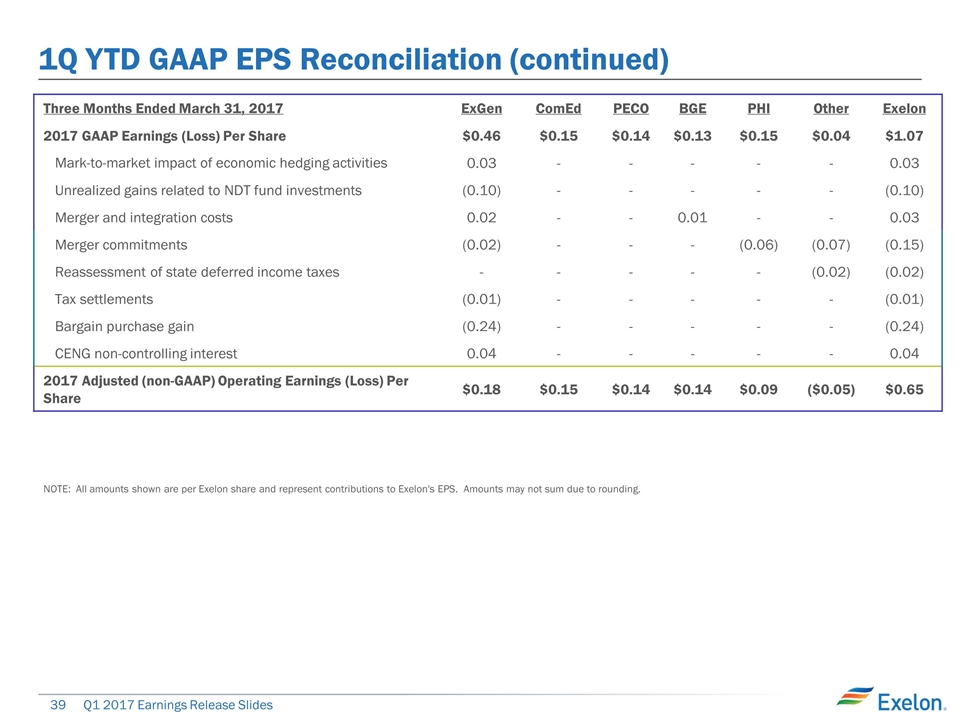

1Q YTD GAAP EPS Reconciliation (continued) Three Months Ended March 31, 2017 ExGen ComEd PECO BGE PHI Other Exelon 2017 GAAP Earnings (Loss) Per Share $0.46 $0.15 $0.14 $0.13 $0.15 $0.04 $1.07 Mark-to-market impact of economic hedging activities 0.03 - - - - - 0.03 Unrealized gains related to NDT fund investments (0.10) - - - - - (0.10) Merger and integration costs 0.02 - - 0.01 - - 0.03 Merger commitments (0.02) - - - (0.06) (0.07) (0.15) Reassessment of state deferred income taxes - - - - - (0.02) (0.02) Tax settlements (0.01) - - - - - (0.01) Bargain purchase gain (0.24) - - - - - (0.24) CENG non-controlling interest 0.04 - - - - - 0.04 2017 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share $0.18 $0.15 $0.14 $0.14 $0.09 ($0.05) $0.65 NOTE: All amounts shown are per Exelon share and represent contributions to Exelon's EPS. Amounts may not sum due to rounding.

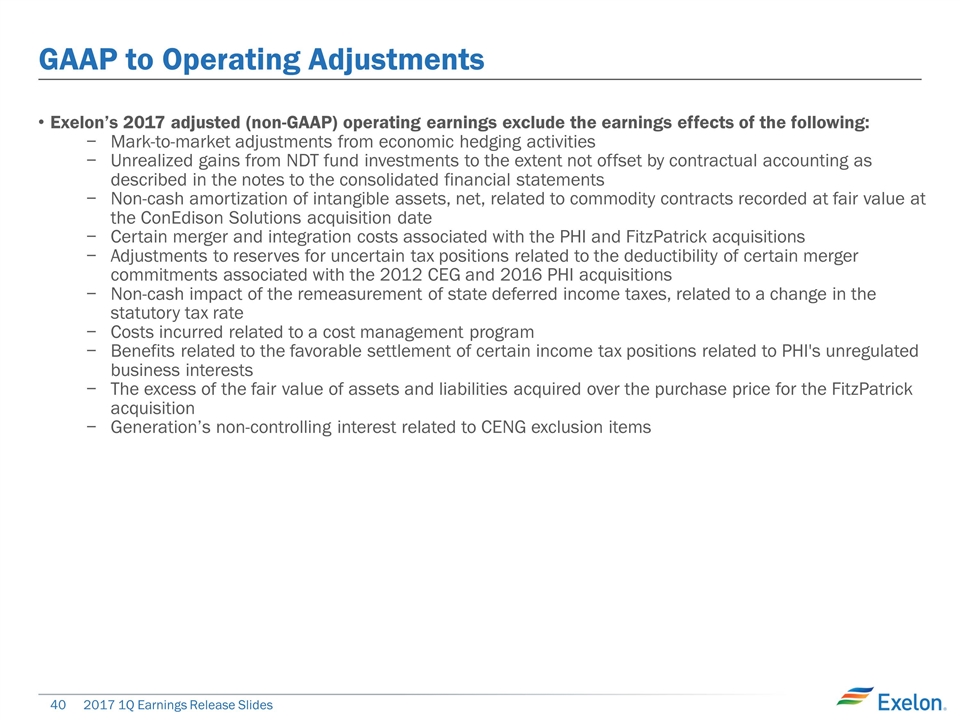

GAAP to Operating Adjustments Exelon’s 2017 adjusted (non-GAAP) operating earnings exclude the earnings effects of the following: Mark-to-market adjustments from economic hedging activities Unrealized gains from NDT fund investments to the extent not offset by contractual accounting as described in the notes to the consolidated financial statements Non-cash amortization of intangible assets, net, related to commodity contracts recorded at fair value at the ConEdison Solutions acquisition date Certain merger and integration costs associated with the PHI and FitzPatrick acquisitions Adjustments to reserves for uncertain tax positions related to the deductibility of certain merger commitments associated with the 2012 CEG and 2016 PHI acquisitions Non-cash impact of the remeasurement of state deferred income taxes, related to a change in the statutory tax rate Costs incurred related to a cost management program Benefits related to the favorable settlement of certain income tax positions related to PHI's unregulated business interests The excess of the fair value of assets and liabilities acquired over the purchase price for the FitzPatrick acquisition Generation’s non-controlling interest related to CENG exclusion items

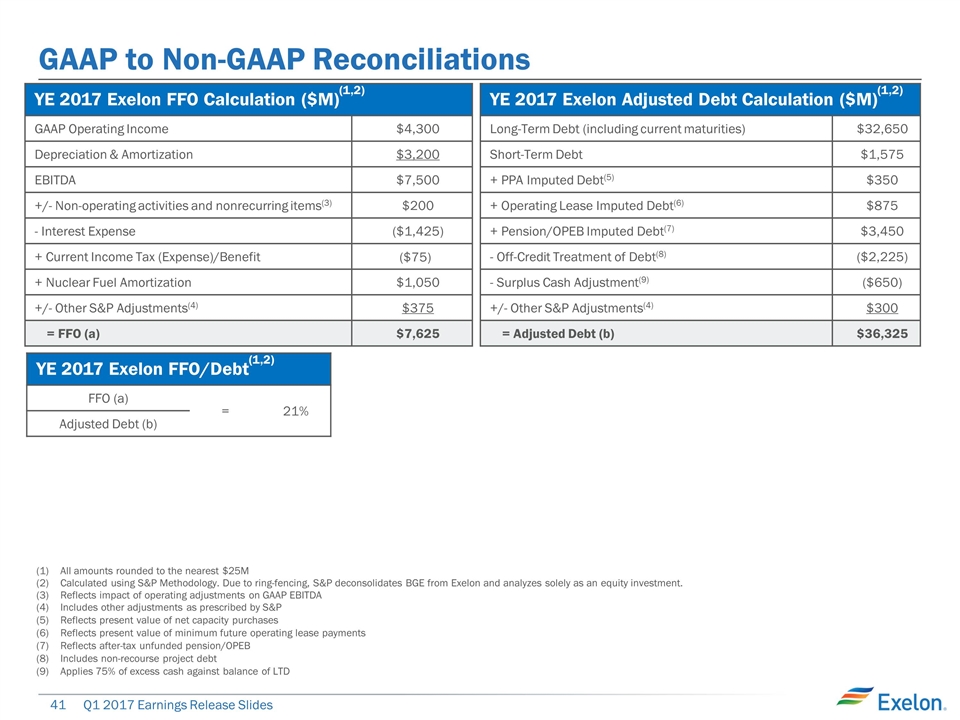

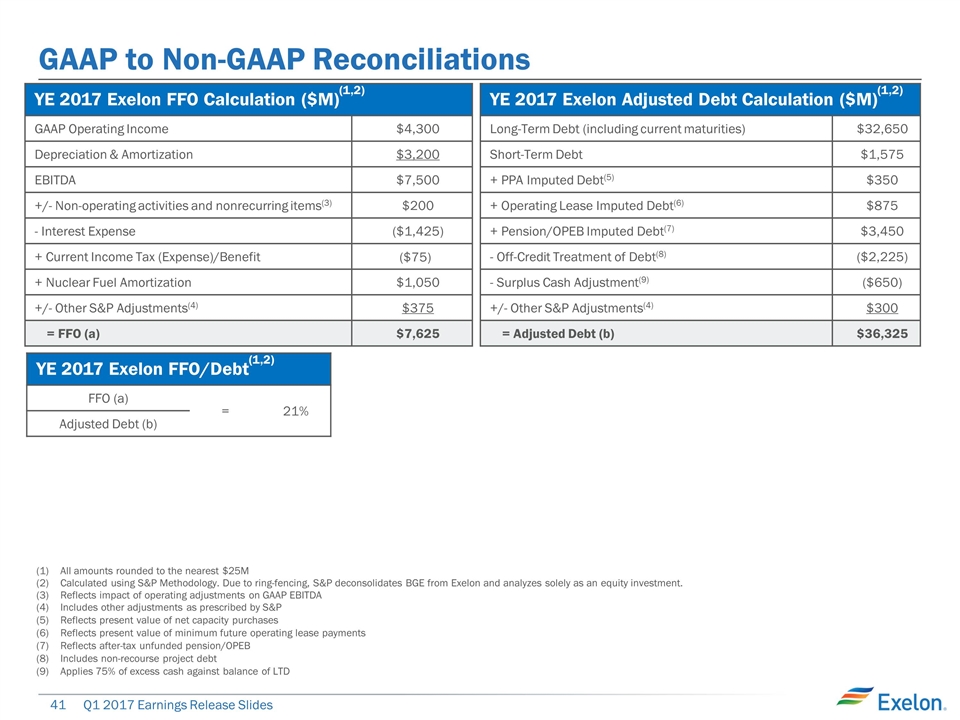

All amounts rounded to the nearest $25M Calculated using S&P Methodology. Due to ring-fencing, S&P deconsolidates BGE from Exelon and analyzes solely as an equity investment. Reflects impact of operating adjustments on GAAP EBITDA Includes other adjustments as prescribed by S&P Reflects present value of net capacity purchases Reflects present value of minimum future operating lease payments Reflects after-tax unfunded pension/OPEB Includes non-recourse project debt Applies 75% of excess cash against balance of LTD YE 2017 Exelon FFO Calculation ($M)(1,2) GAAP Operating Income $4,300 Depreciation & Amortization $3,200 EBITDA $7,500 +/- Non-operating activities and nonrecurring items(3) $200 - Interest Expense ($1,425) + Current Income Tax (Expense)/Benefit ($75) + Nuclear Fuel Amortization $1,050 +/- Other S&P Adjustments(4) $375 = FFO (a) $7,625 YE 2017 Exelon Adjusted Debt Calculation ($M)(1,2) Long-Term Debt (including current maturities) $32,650 Short-Term Debt $1,575 + PPA Imputed Debt(5) $350 + Operating Lease Imputed Debt(6) $875 + Pension/OPEB Imputed Debt(7) $3,450 - Off-Credit Treatment of Debt(8) ($2,225) - Surplus Cash Adjustment(9) ($650) +/- Other S&P Adjustments(4) $300 = Adjusted Debt (b) $36,325 YE 2017 Exelon FFO/Debt(1,2) FFO (a) = 21% Adjusted Debt (b) GAAP to Non-GAAP Reconciliations

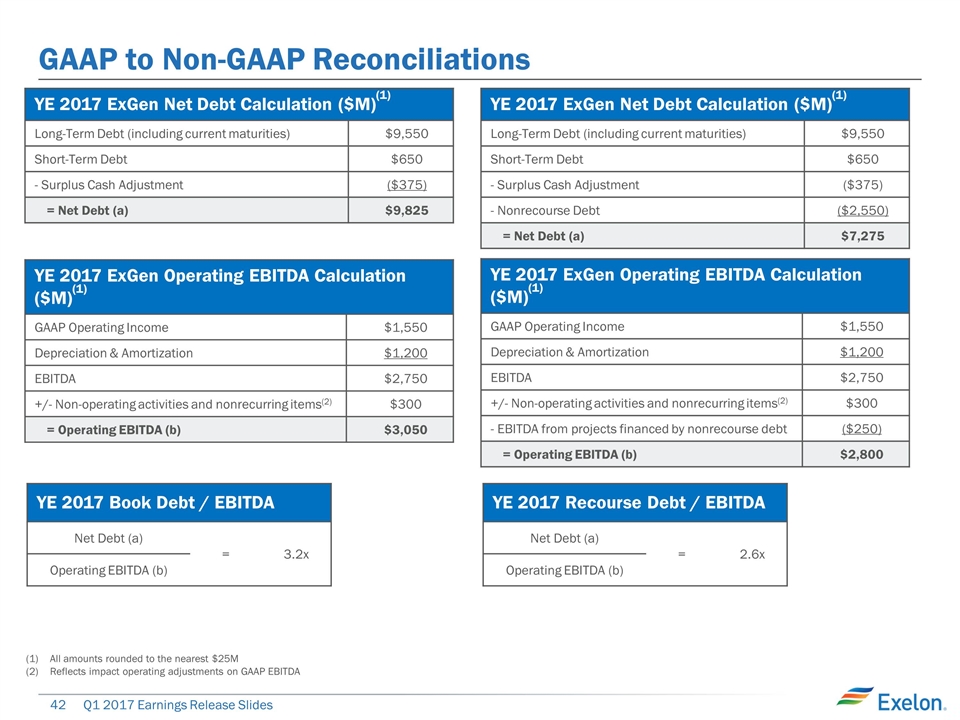

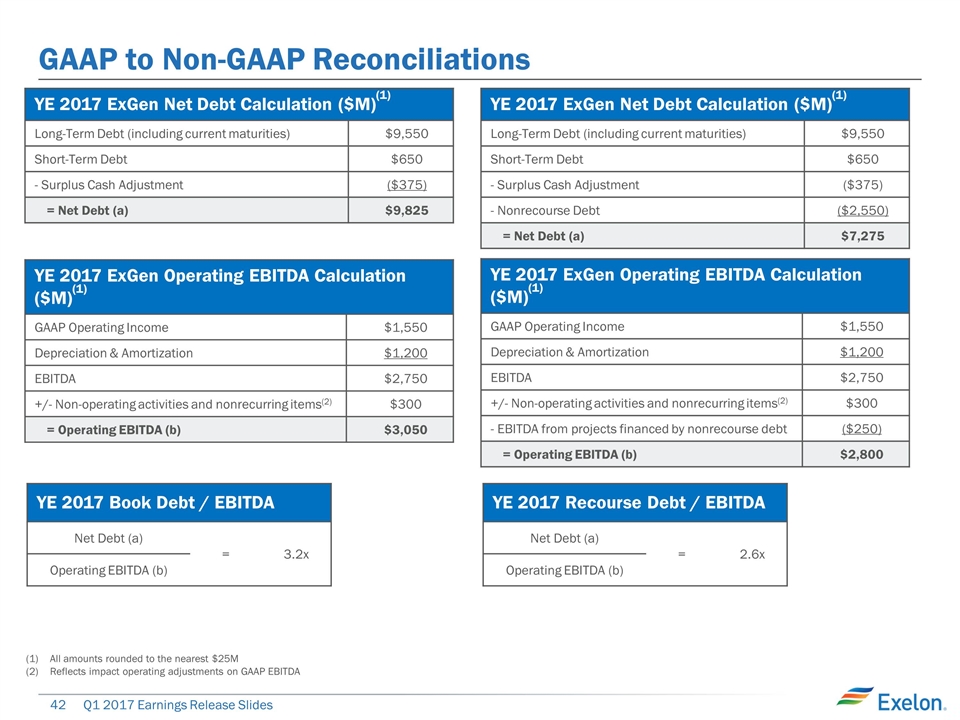

YE 2017 ExGen Net Debt Calculation ($M)(1) Long-Term Debt (including current maturities) $9,550 Short-Term Debt $650 - Surplus Cash Adjustment ($375) = Net Debt (a) $9,825 YE 2017 Book Debt / EBITDA Net Debt (a) = 3.2x Operating EBITDA (b) All amounts rounded to the nearest $25M Reflects impact operating adjustments on GAAP EBITDA YE 2017 ExGen Operating EBITDA Calculation ($M)(1) GAAP Operating Income $1,550 Depreciation & Amortization $1,200 EBITDA $2,750 +/- Non-operating activities and nonrecurring items(2) $300 = Operating EBITDA (b) $3,050 GAAP to Non-GAAP Reconciliations YE 2017 ExGen Net Debt Calculation ($M)(1) Long-Term Debt (including current maturities) $9,550 Short-Term Debt $650 - Surplus Cash Adjustment ($375) - Nonrecourse Debt ($2,550) = Net Debt (a) $7,275 YE 2017 Recourse Debt / EBITDA Net Debt (a) = 2.6x Operating EBITDA (b) YE 2017 ExGen Operating EBITDA Calculation ($M)(1) GAAP Operating Income $1,550 Depreciation & Amortization $1,200 EBITDA $2,750 +/- Non-operating activities and nonrecurring items(2) $300 - EBITDA from projects financed by nonrecourse debt ($250) = Operating EBITDA (b) $2,800

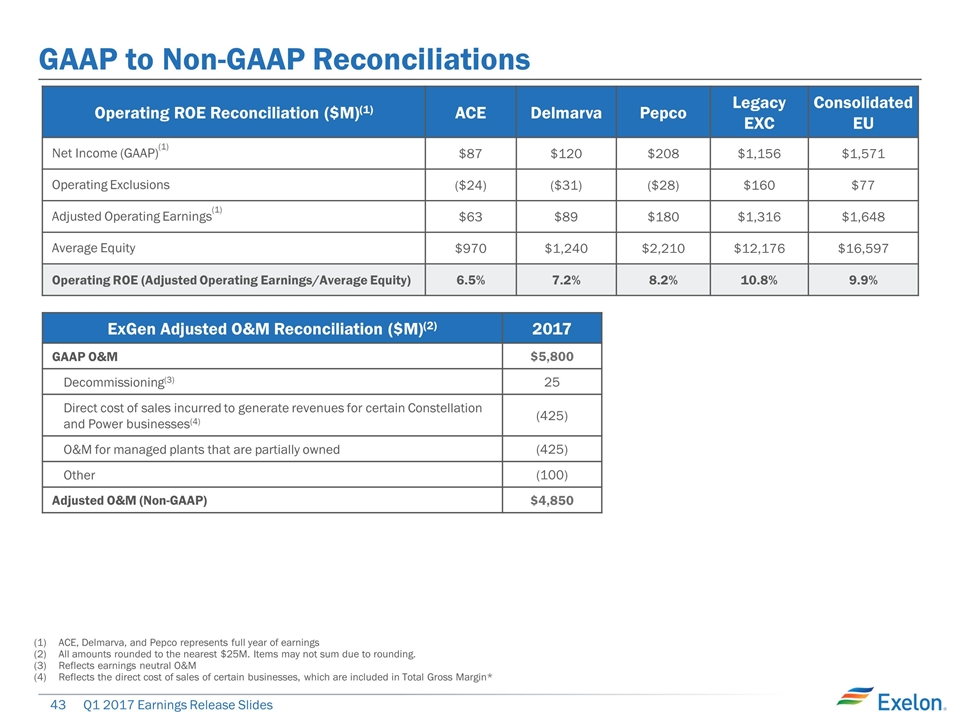

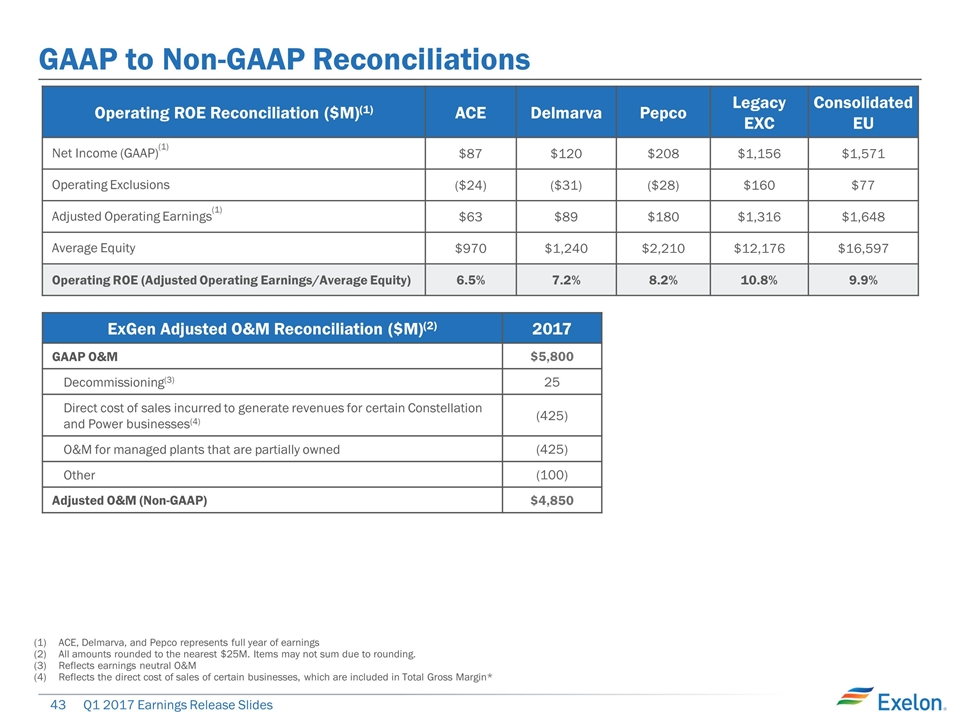

GAAP to Non-GAAP Reconciliations ACE, Delmarva, and Pepco represents full year of earnings All amounts rounded to the nearest $25M. Items may not sum due to rounding. Reflects earnings neutral O&M Reflects the direct cost of sales of certain businesses, which are included in Total Gross Margin* Operating ROE Reconciliation ($M)(1) ACE Delmarva Pepco Legacy EXC Consolidated EU Net Income (GAAP)(1) $87 $120 $208 $1,156 $1,571 Operating Exclusions ($24) ($31) ($28) $160 $77 Adjusted Operating Earnings(1) $63 $89 $180 $1,316 $1,648 Average Equity $970 $1,240 $2,210 $12,176 $16,597 Operating ROE (Adjusted Operating Earnings/Average Equity) 6.5% 7.2% 8.2% 10.8% 9.9% ExGen Adjusted O&M Reconciliation ($M)(2) 2017 GAAP O&M $5,800 Decommissioning(3) 25 Direct cost of sales incurred to generate revenues for certain Constellation and Power businesses(4) (425) O&M for managed plants that are partially owned (425) Other (100) Adjusted O&M (Non-GAAP) $4,850

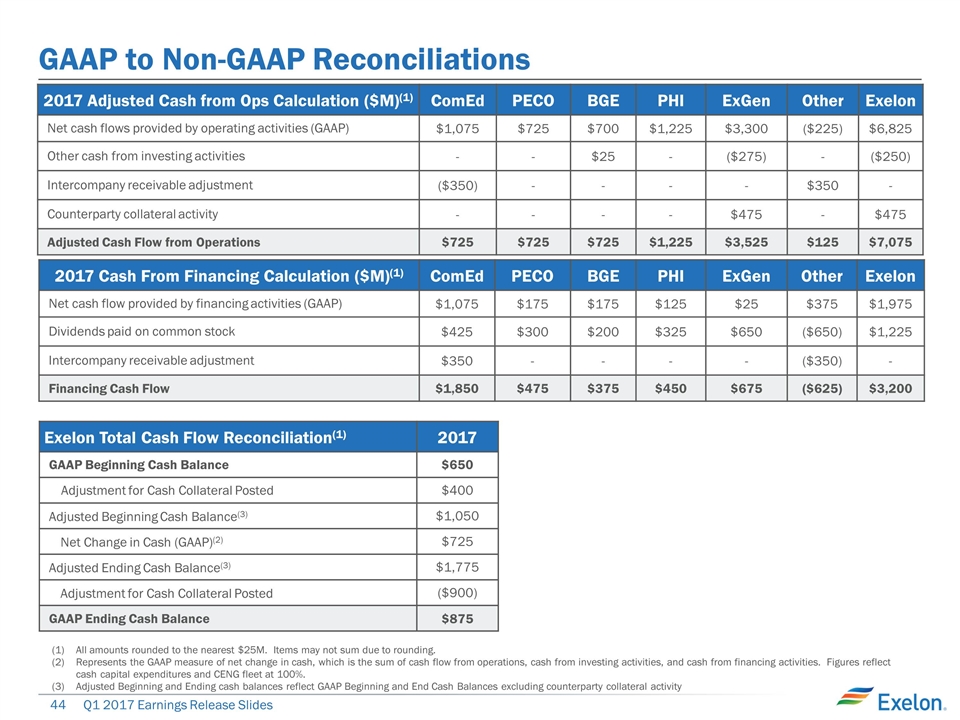

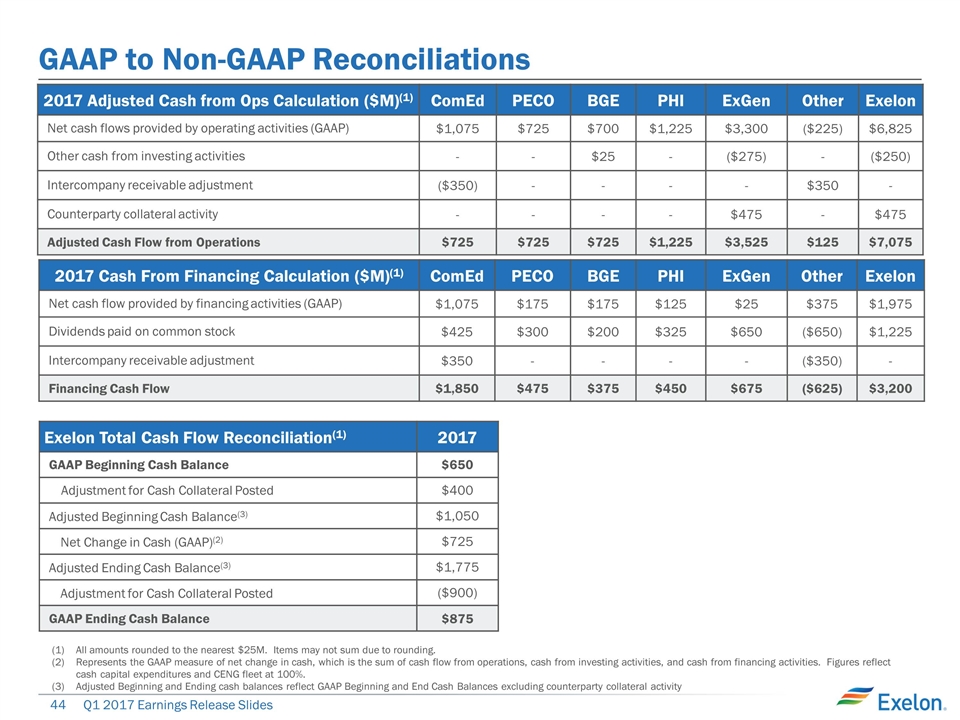

GAAP to Non-GAAP Reconciliations 2017 Adjusted Cash from Ops Calculation ($M)(1) ComEd PECO BGE PHI ExGen Other Exelon Net cash flows provided by operating activities (GAAP) $1,075 $725 $700 $1,225 $3,300 ($225) $6,825 Other cash from investing activities - - $25 - ($275) - ($250) Intercompany receivable adjustment ($350) - - - - $350 - Counterparty collateral activity - - - - $475 - $475 Adjusted Cash Flow from Operations $725 $725 $725 $1,225 $3,525 $125 $7,075 2017 Cash From Financing Calculation ($M)(1) ComEd PECO BGE PHI ExGen Other Exelon Net cash flow provided by financing activities (GAAP) $1,075 $175 $175 $125 $25 $375 $1,975 Dividends paid on common stock $425 $300 $200 $325 $650 ($650) $1,225 Intercompany receivable adjustment $350 - - - - ($350) - Financing Cash Flow $1,850 $475 $375 $450 $675 ($625) $3,200 Exelon Total Cash Flow Reconciliation(1) 2017 GAAP Beginning Cash Balance $650 Adjustment for Cash Collateral Posted $400 Adjusted Beginning Cash Balance(3) $1,050 Net Change in Cash (GAAP)(2) $725 Adjusted Ending Cash Balance(3) $1,775 Adjustment for Cash Collateral Posted ($900) GAAP Ending Cash Balance $875 All amounts rounded to the nearest $25M. Items may not sum due to rounding. Represents the GAAP measure of net change in cash, which is the sum of cash flow from operations, cash from investing activities, and cash from financing activities. Figures reflect cash capital expenditures and CENG fleet at 100%. Adjusted Beginning and Ending cash balances reflect GAAP Beginning and End Cash Balances excluding counterparty collateral activity