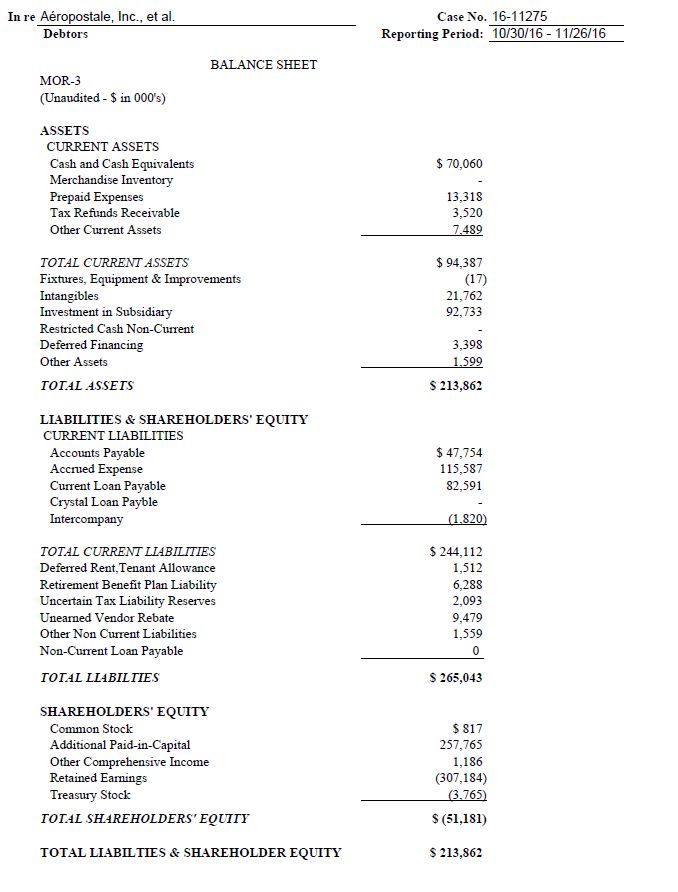

In re Aéropostale, Inc., et al. Case No. 16-11275 Debtors Reporting Period: 10/30/16 - 11/26/16 BALANCE SHEET MOR-3 (Unaudited - $ in 000's) Aéropostale Aero GC Aéropostale Aéropostale PS from Procurement Jimmy'Z Surf Aéropostale GoJane Aéropostale Elimination Consolidated Aéropostale, Inc. Management LLC West Puerto Rico Aéropostale Co. Co., LLC Licensing LLC Holdings Company (a) U.S. Companies 1 2 3 4 5 6 7 9 10 78 98 ASSETS CURRENT ASSETS Cash and Cash Equivalents $ 70,060 $ - $ - $ - $ - $ - $ - $ - $ 70,060 Merchandise Inventory 138,689 33,870 2,560 1,849 1,618 1 1,256 (179,843) $ - Prepaid Expenses 11,229 228 36 12 504 1,309 $ 13,318 Prepaid Taxes 3,401 119 $ 3,520 Other Current Assets 374 338 7,012 1,500 2,813 3,270 6,045 666 (14,529) $ 7,489 TOTAL CURRENT ASSETS $ 223,753 $ 566 $ 40,882 $ 4,215 $ 4,674 $ 5,392 $ 1 $ 7,354 $ 1,922 $ (194,372) $ 94,387 Fixtures, Equipment & Improvements (17) (2) 2 $ (17) Intangibles 21,762 $ 21,762 Investment in Subsidiary 153,447 23,145 32,575 92,733 (209,167) $ 92,733 Restricted Cash Non-Current $ - Deferred Financing 3,398 $ 3,398 Other Assets 1,300 25 37 12 225 $ 1,599 TOTAL ASSETS $ 381,881 $ 566 $ 64,050 $ 4,252 $ 37,261 $ 5,617 $ 1 $ 7,354 $ 23,686 $ 92,733 $ (403,539) $ 213,862 LIABILITIES & SHAREHOLDERS' EQUITY CURRENT LIABILITIES Accounts Payable 31,069 27 210,839 191 (194,372) $ 47,754 Accrued Expense 91,135 13,292 2,854 594 883 5,809 70 350 553 47 $ 115,587 Current Loan Payable 82,591 $ 82,591 Crystal Loan Payble $ - Intercompany 957,532 (45,507) (523,673) 2,566 222,346 (545,804) 59,127 (117,601) (10,807) 1 $ (1,820) TOTAL CURRENT LIABILITIES $ 1,162,327 $ (32,215) $ (520,819) $ 3,160 $ 223,256 $ (329,156) $ 59,197 $ (117,251) $ (10,063) $ 1 $ (194,325) $ 244,112 Deferred Rent,Tenant Allowance 1,259 (330) 2 581 $ 1,512 Retirement Benefit Plan Liabilities 6,288 $ 6,288 Uncertain Tax Liability Reserves 76 2,017 $ 2,093 Unearned Vendor Rebate 9,479 $ 9,479 Other Non Current Liabilities 61,011 (59,628) 176 $ 1,559 Non-Current Loan Payable 0 TOTAL LIABILTIES $ 1,230,961 $ (32,215) $ (578,760) $ 3,160 $ 223,258 $ (319,677) $ 59,197 $ (117,075) $ (9,482) $ 1 $ (194,325) $ 265,043 SHAREHOLDERS' EQUITY Common Stock 816 1 $ 817 Additional Paid-in-Capital 257,766 25,134 3,001 32,576 23,145 1 1 32,575 92,733 (209,167) $ 257,765 Other Comprehensive Income 1,186 $ 1,186 Retained Earnings (1,105,083) 32,781 617,675 (1,909) (218,573) 302,149 (59,197) 124,428 593 (1) (47) $ (307,184) Treasury Stock (3,765) $ (3,765) TOTAL SHAREHOLDERS' EQUITY $ (849,080) $ 32,781 $ 642,810 $ 1,092 $ (185,997) $ 325,294 $ (59,196) $ 124,429 $ 33,168 $ 92,732 $ (209,214) $ (51,181) TOTAL LIABILTIES & SHAREHLD EQUITY $ 381,881 $ 566 $ 64,050 $ 4,252 $ 37,261 $ 5,617 $ 1 $ 7,354 $ 23,686 $ 92,733 $ (403,539) $ 213,862 - - - - - - - - - - - - (a) Elimination Company is not a legal entity. It is included in the balance sheet to reflect entries to eliminate intercompany transactions to produce accurate consolidated financial statements.