1 Fourth Quarter 2012 Financial Results

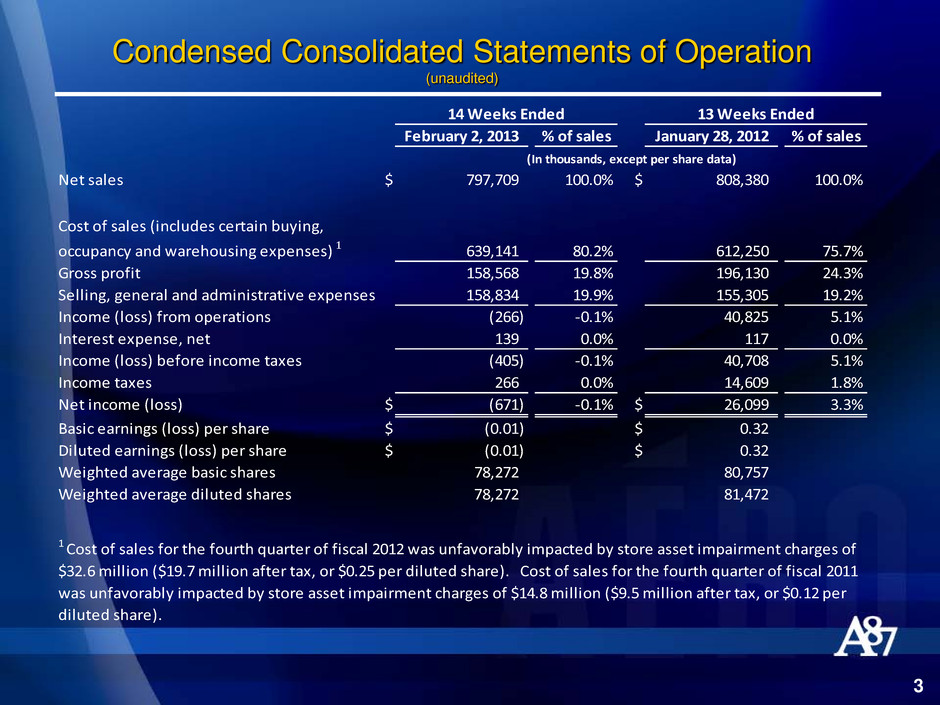

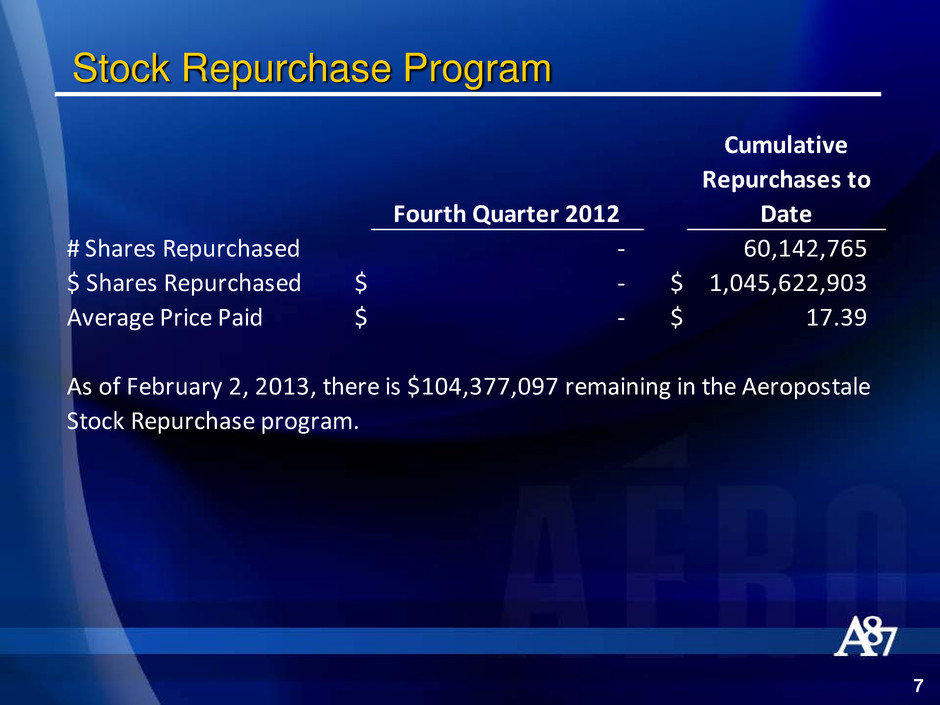

Condensed Consolidated Statements of Operation (unaudited) 3 February 2, 2013 % of sales January 28, 2012 % of sales Net sales $ 797,709 100.0% $ 808,380 100.0% Cost of sales (includes certain buying, occupancy and warehousing expenses) 1 639,141 80.2% 612,250 75.7% Gross profit 158,568 19.8% 196,130 24.3% Selling, general and administrative expenses 158,834 19.9% 155,305 19.2% Income (loss) from operations (266) -0.1% 40,825 5.1% Interest expense, net 139 0.0% 117 0.0% Income (loss) before income taxes (405) -0.1% 40,708 5.1% Income taxes 266 0.0% 14,609 1.8% Net income (loss) $ (671) -0.1% $ 26,099 3.3% Basic earnings (loss) per share $ (0.01) $ 0.32 Diluted earnings (loss) per share $ (0.01) $ 0.32 Weighted average basic shares 78,272 80,757 Weighted average diluted shares 78,272 81,472 (In thousands, except per share data) 1 Cost of sales for the fourth quarter of fiscal 2012 was unfavorably impacted by store asset impairment charges of $32.6 million ($19.7 million after tax, or $0.25 per diluted share). Cost of sales for the fourth quarter of fiscal 2011 was unfavorably impacted by store asset impairment charges of $14.8 million ($9.5 million after tax, or $0.12 per diluted share). 14 Weeks Ended 13 Weeks Ended

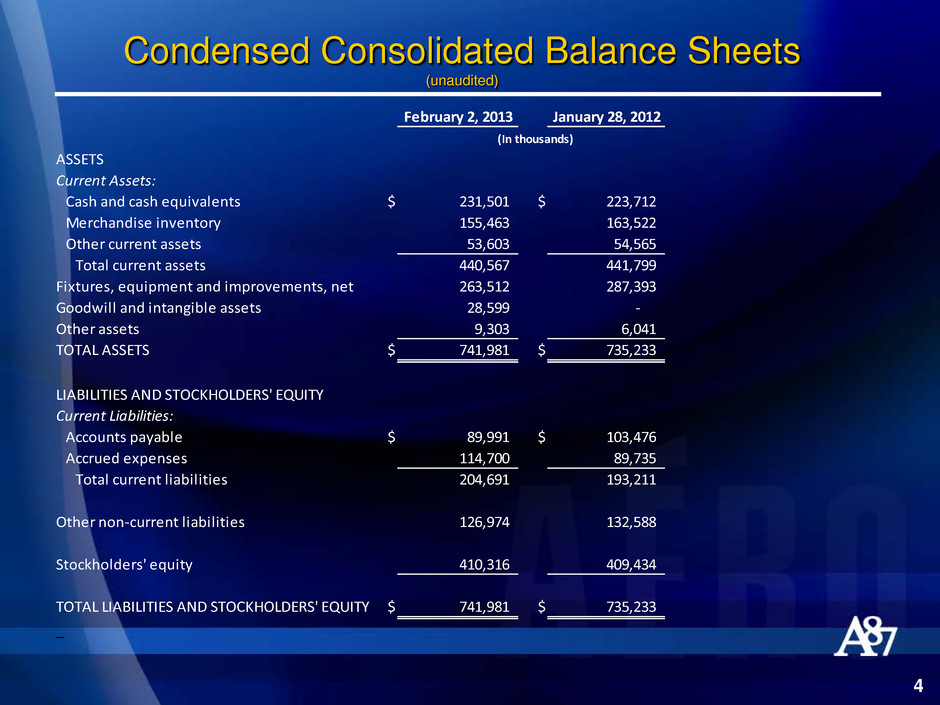

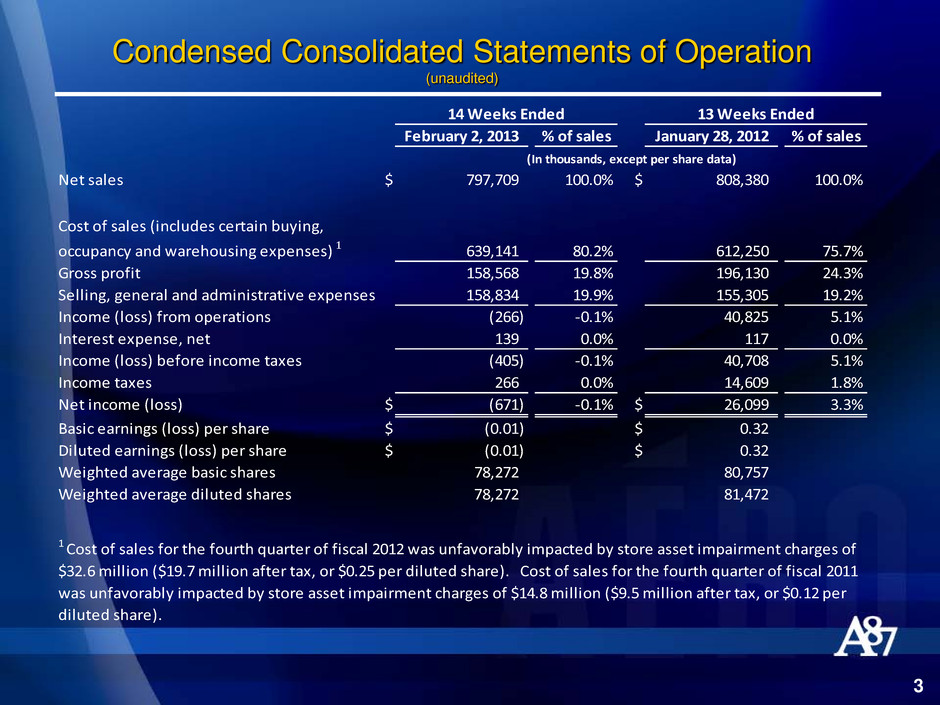

Condensed Consolidated Balance Sheets (unaudited) 4 February 2, 2013 January 28, 2012 ASSETS Current Assets: Cash and cash equivalents $ 231,501 $ 223,712 Merchandise inventory 155,463 163,522 Other current assets 53,603 54,565 Total current assets 440,567 441,799 Fixtures, equipment and improvements, net 263,512 287,393 Goodwill and intangible assets 28,599 - Other assets 9,303 6,041 TOTAL ASSETS $ 741,981 $ 735,233 LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities: Accounts payable $ 89,991 $ 103,476 Accrued expenses 114,700 89,735 Total current liabilities 204,691 193,211 Other non-current liabilities 126,974 132,588 Stockholders' equity 410,316 409,434 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $ 741,981 $ 735,233 _ (In thousands)

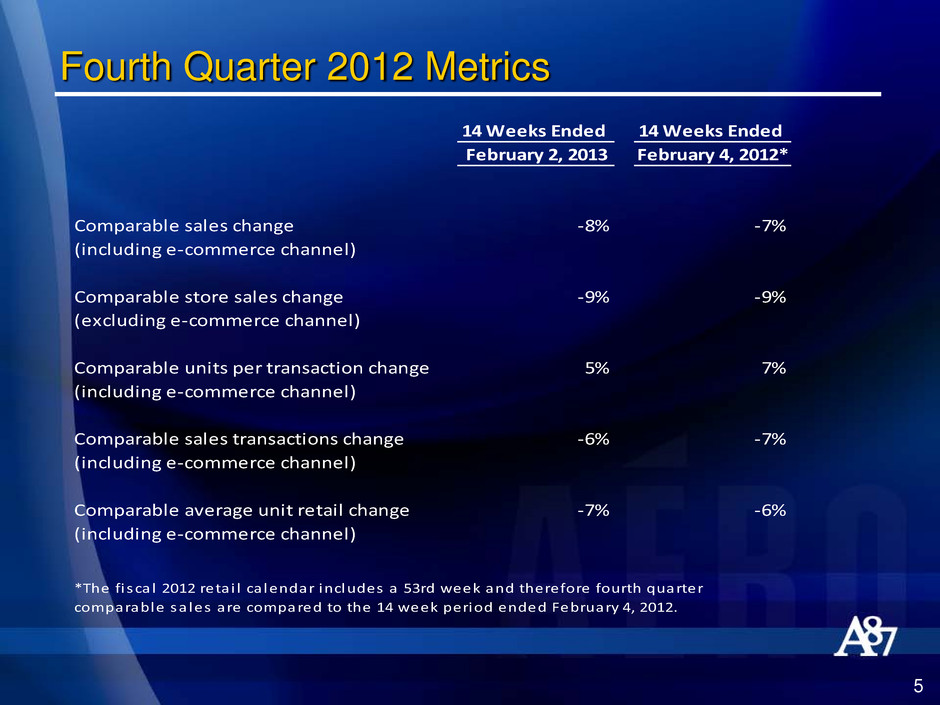

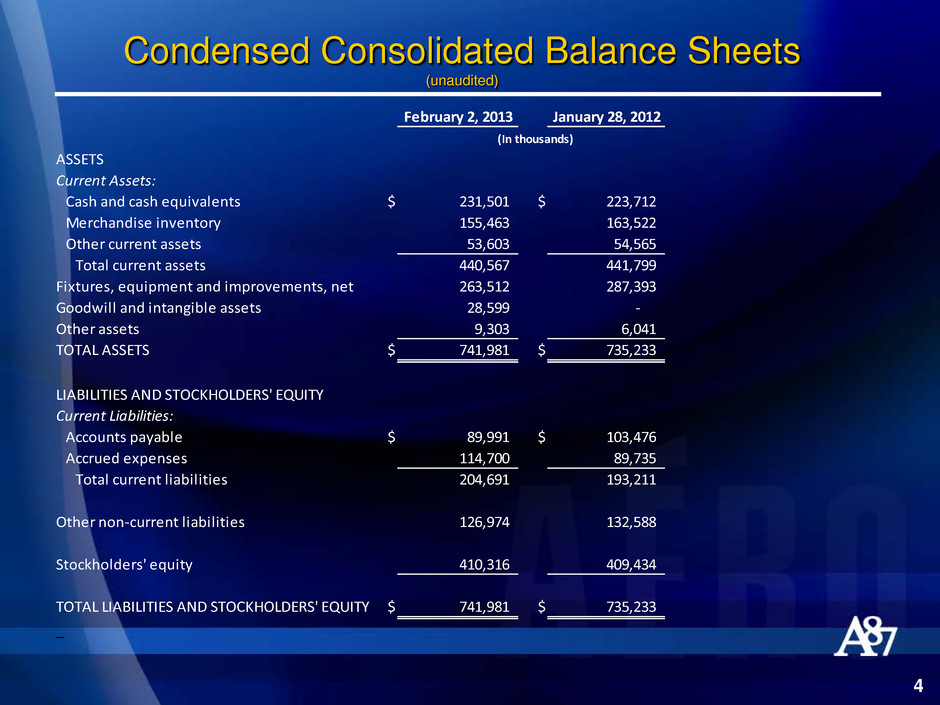

5 Fourth Quarter 2012 Metrics 14 Weeks Ended 14 Weeks Ended February 2, 2013 February 4, 2012* Comparable sales change -8% -7% (including e-commerce channel) Comparable store sales change -9% -9% (excluding e-commerce channel) Comparable units per transaction change 5% 7% (including e-commerce channel) Comparable sales transactions change -6% -7% (including e-commerce channel) Comparable average unit retail change -7% -6% (including e-commerce channel) *The fi sca l 2012 reta i l ca lendar includes a 53rd week and therefore fourth quarter comparable sa les are compared to the 14 week period ended February 4, 2012.

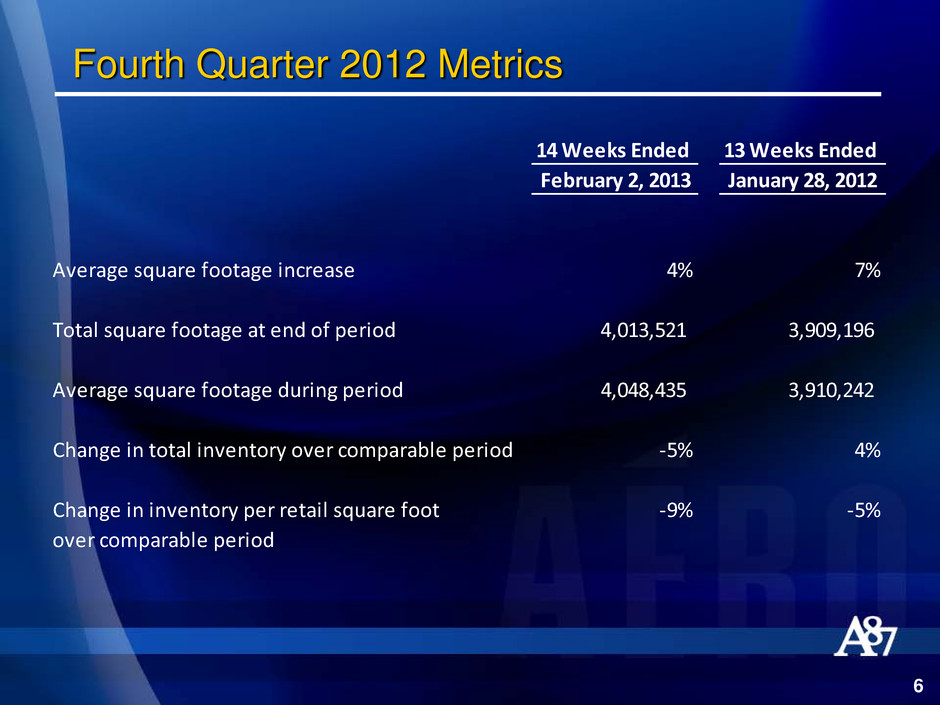

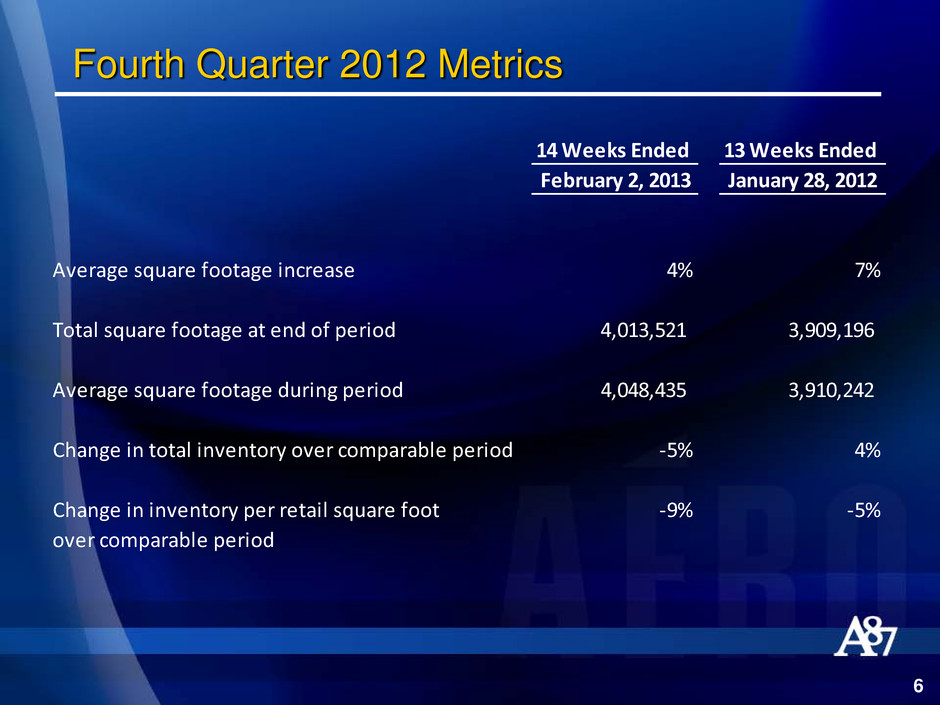

Fourth Quarter 2012 Metrics 6 14 Weeks Ended 13 Weeks Ended February 2, 2013 January 28, 2012 Average square footage increase 4% 7% Total square footage at end of period 4,013,521 3,909,196 Average square footage during period 4,048,435 3,910,242 Change in total inventory over comparable period -5% 4% Change in inventory per retail square foot -9% -5% over comparable period

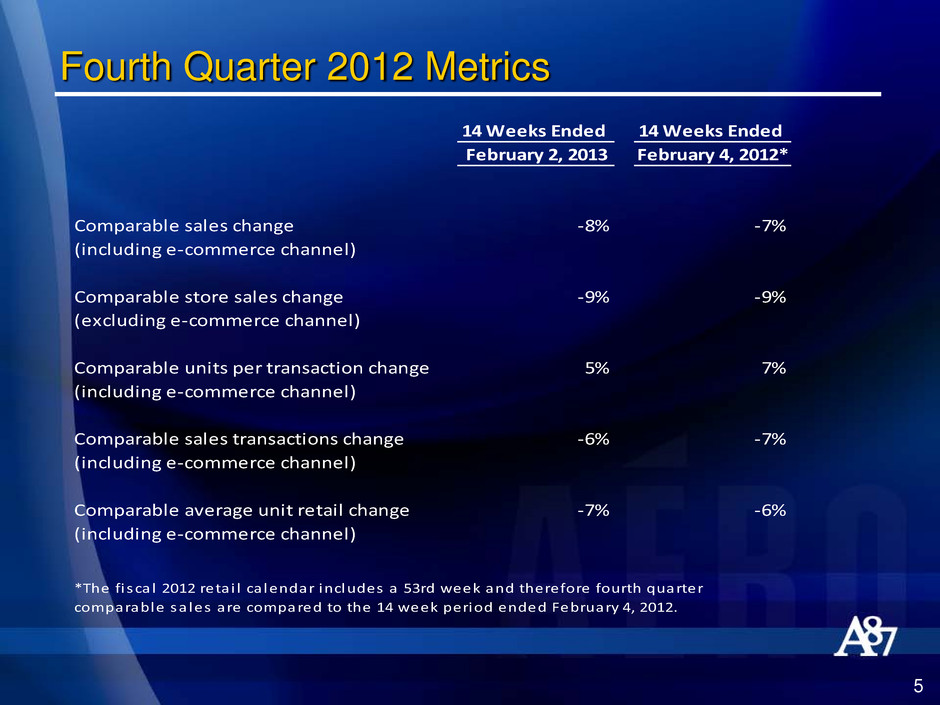

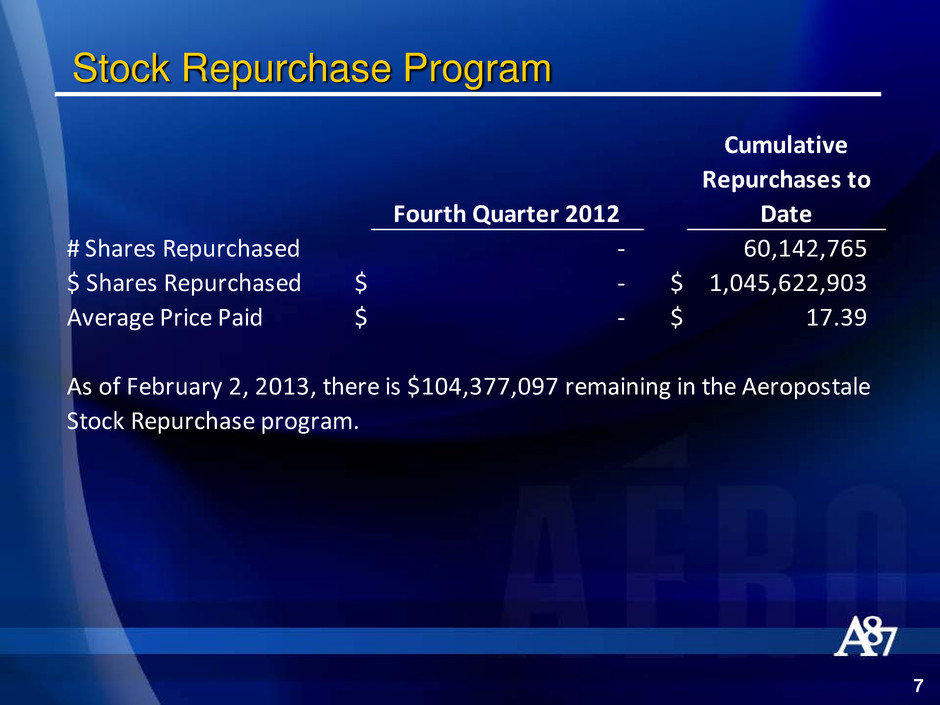

Stock Repurchase Program 7 Fourth Quarter 2012 Cumulative Repurchases to Date # Shares Repurchased - 60,142,765 $ Shares Repurchased $ - $ 1,045,622,903 Average Price Paid $ - $ 17.39 As of February 2, 2013, there is $104,377,097 remaining in the Aeropostale Stock Repurchase program.

8 Fourth Quarter 2012 Store Count Q3 Additions Closures Q4 Aéropostale U.S. 914 3 (11) 906 Aéropostale Canada 78 - - 78 Total Aéropostale 992 3 (11) 984 P.S. from Aéropostale 99 1 - 100 Total stores 1,091 4 (11) 1,084