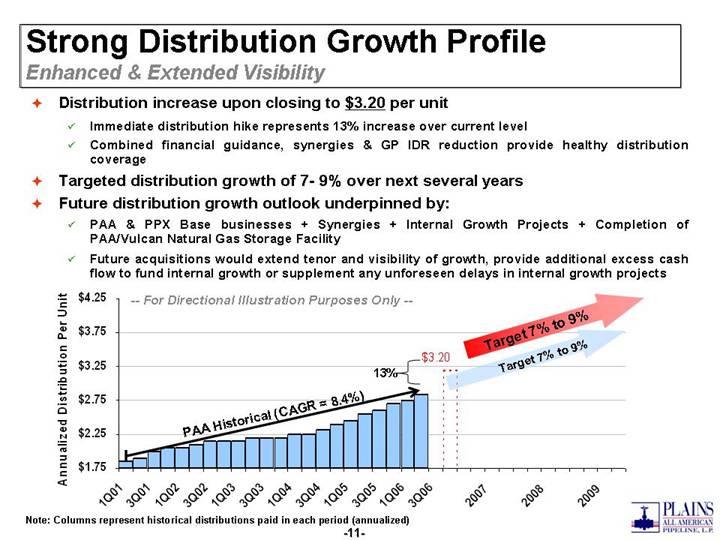

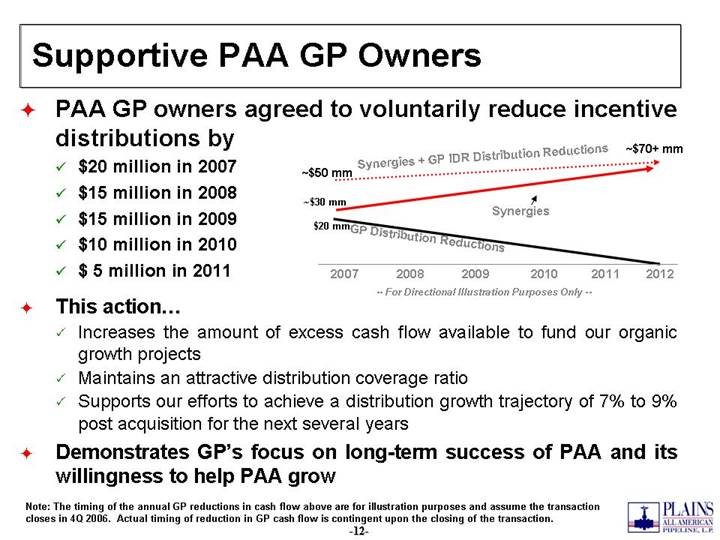

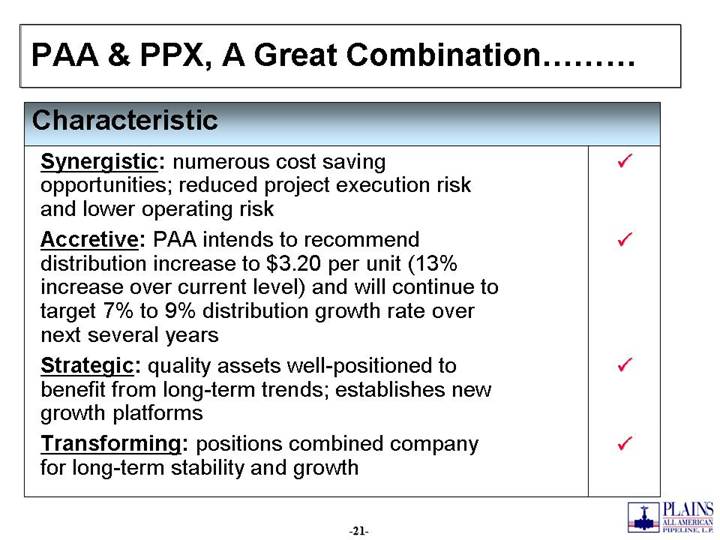

Forward-Looking Statements Certain statements made herein are forward-looking statements under the Private Securities Litigation Reform Act of 1995. The forward looking comments include statements regarding the timing and expected benefits of the business combination involving Plains and Pacific, including expected commercial and operational synergies over time and related additional anticipated cash flows, long-term stability and growth, expected acquisition multiple over time, future distribution increases and growth, anticipated integration timing, cost reductions, incremental margins, internal growth projects and platforms, anticipated growth capital expenditures, anticipated cost of capital benefits, expected long - term supply and demand trends, increased tariff and fee-based activities, pro forma capitalization and targeted credit profile, future issuances of debt and equity securities, and other objectives, expectations and intentions and other statements that are not historical facts. These statements are based on the current expectations and estimates of the management of Plains and Pacific and their general partners; actual results may differ materially due to certain risks and uncertainties. Although Plains, Pacific and their general partners believe that such expectations reflected in such forward-looking statements are reasonable, they cannot give assurances that such expectations will prove to be correct. For instance, although Plains and Pacific have signed a merger agreement, there is no assurance that they will complete the proposed merger. The merger agreement will terminate if Plains and Pacific do not receive the necessary approval of their unitholders, and also may be terminated if the parties fail to satisfy conditions to closing. Other risks and uncertainties that may affect actual results include Plains’ failure to successfully integrate the respective business operations upon completion of the merger or its failure to successfully integrate any future acquisitions; the failure to realize the anticipated cost savings, synergies and other benefits of the proposed merger; refinery downtime; unusual weather patterns; continued creditworthiness of, and performance by, counterparties; the effects of competition; the success of risk management activities; commodity price fluctuations; reductions in the production of, or demand for, crude oil that we purchase, gather or transport; releases of crude oil into the environment; fluctuations in the capital markets; regulatory changes; and other factors and uncertainties discussed in Plains’ and Pacific’s filings with the Securities and Exchange Commission, including their Annual Reports on Form 10-K and Form 10-K/A for the year ended December 31, 2005 and the Registration Statement on Form S-4 (No. 333-135712). |