UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

ý ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2008

¨ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to _______.

Commission file number: 000-49725

Constitution Mining Corp.

(Exact name of registrant as specified in its charter)

| Nevada | | 88-0455809 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| Manuela Sáenz 323, Suite 706, Buenos Aires, Argentina C1107BPA |

| (Address of principal executive offices) (Zip Code) |

Registrant’s telephone, including area code: +54-11-5236-9978 |

Securities registered under Section 12(b) of the Exchange Act: None.

Securities registered under Section 12(g) of the Exchange Act:

| Common Stock, $0.001 par value | Not Applicable |

| (Title of class) | (Name of each exchange on which registered) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (229.405 of this chapter) is not contained herein, and will be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨

Non-accelerated filer ¨ (Do not check if a smaller reporting company) Smaller reporting company ý

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

As of June 30, 2008, the aggregate market value of the Company’s common equity held by non-affiliates computed by reference to the closing price ($1.09) was: $59,516,132

The number of shares of our common stock outstanding as of February 28, 2009 was: 58,469,456

Documents Incorporated by Reference: Parts of our definitive proxy statement to be prepared and filed with the Securities and Exchange Commission not later than 120 days after December 31, 2008 are incorporated by reference into Part III of this Form 10-K.

FORM 10-K

CONSTITUTION MINING CORP.

DECEMBER 31, 2008

PART I | Page |

| 4 |

| 17 |

| 25 |

| 25 |

| 41 |

| 41 |

PART II | |

| 42 |

| 43 |

| 44 |

| 49 |

| 49 |

| 49 |

| 50 |

| 51 |

PART II |

| 51 |

| 51 |

| 51 |

| 51 |

| 51 |

PART IV | | |

| 52 |

| | | |

| | |

| | |

Note Regarding Forward Looking Statements

This annual report contains forward-looking statements as that term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In some cases, you can identify forward-looking statements by terminology such as "may," "should," "expects," "plans," "anticipates," "believes," "estimates," "predicts," "potential," "continue," "intends," and other variations of these words or comparable words. In addition, any statements that refer to expectations, projections or other characterizations of events, circumstances or trends and that do not relate to historical matters are forward-looking statements. These forward-looking statements are based largely on our expectations or forecasts of future events, can be affected by inaccurate assumptions, and are subject to various business risks and known and unknown uncertainties, a number of which are beyond our control. Therefore, actual results could differ materially from the forward-looking statements contained in this document, and readers are cautioned not to place undue reliance on such forward-looking statements. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this report. Except as required by law, we do not undertake to update or revise any of the forward-looking statements to conform these statements to actual results, whether as a result of new information, future events or otherwise.

As used in this annual report, “Constitution Mining,” the “Company,” “we,” “us,” or “our” refer to Constitution Mining Corp., unless otherwise indicated.

PART I

Corporate History

We were incorporated in the state of Nevada under the name Crafty Admiral Enterprises, Ltd. on March 6, 2000. Our original business plan was to sell classic auto parts to classic auto owners all over the world through an Internet site/online store; however, we were unsuccessful in implementing the online store and were unable to afford the cost of purchasing, warehousing and shipping the initial inventory required to get the business started. As a result, we ceased operations in approximately July 2002.

During our fiscal year ended December 31, 2006, we reorganized our operations to pursue the exploration, development, acquisition and operation of oil and gas properties. On June 27, 2006, we acquired a leasehold interest in a mineral, oil and gas property located in St. Francis County, Arkansas for a cash payment of $642,006, pursuant to an oil and gas agreement we entered into on April 29, 2006 (the “Tombaugh Lease”). Shortly after acquiring the Tombaugh Lease, we suspended our exploration efforts on the property covered by the Tombaugh Lease in order to pursue business opportunities developing nickel deposits in Finland, Norway and Western Russia. On January 18, 2008, we assigned all of our right, title and interest in and to the Tombaugh Lease to Fayetteville Oil and Gas, Inc., which agreed to assume all of our outstanding payment obligations on the Tombaugh Lease as consideration for the assignment. On March 9, 2007, we changed our name to better reflect our business to “Nordic Nickel Ltd.” pursuant to a parent/subsidiary merger with our wholly-owned non-operating subsidiary, Nordic Nickel Ltd., which was established for the purpose of giving effect to this name change. We were not successful pursuing business opportunities developing nickel deposits in Finland, Norway and Western Russia and again sought to reorganize our operations in November 2007.

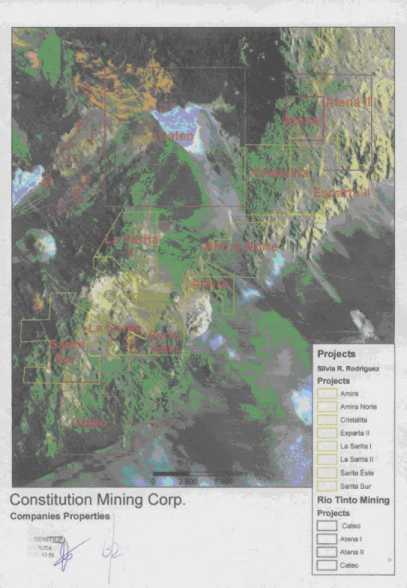

In November 2007, we reorganized our operations and changed our name to “Constitution Mining Corp.” to better reflect our current focus which is the acquisition, exploration, and potential development of mining properties. Since November 2007, we entered into agreements to secure options to acquire the mineral and mining rights underlying properties located in the Salta and Mendoza provinces of Argentina and in Peru.

Our common stock is quoted on the OTC Bulletin Board under the symbol “CMIN.” We conduct our business from Manuela Sáenz 323, Suite 706, (C1107BPA) Buenos Aires, Argentina. Our telephone number is +54-11-5236-9978.

Exploration Stage Company

We are considered an exploration or exploratory stage company because we are involved in the examination and investigation of land that we believe may contain valuable minerals, for the purpose of discovering the presence of ore, if any, and its extent. There is no assurance that a commercially viable mineral deposit exists on the properties underlying our mineral property interests, and a great deal of further exploration will be required before a final evaluation as to the economic and legal feasibility for our future exploration is determined. We have no known reserves of any type of mineral. To date, we have not discovered an economically viable mineral deposit on the property underlying our mineral property interests, and there is no assurance that we will discover one. If we cannot acquire or locate mineral deposits, or if it is not economical to recover any mineral deposits that we do find, our business and operations will be materially and adversely affected.

Surplus Strategy

Our current business plan calls for investing any surplus operating capital resulting from retained earnings into bullion accounts and does not include holding retained earnings, if any, in cash or cash equivalents. In the event that commercially exploitable reserves of minerals exist on any of our property interests and we are able to make a profit, our business plan is to sell enough mineral reserves to satisfy all of our expenses and invest all retained mineral reserves in bullion accounts established in Zurich, Switzerland. The price of precious and base metals such as gold and silver has fluctuated widely in recent years, and is affected by numerous factors beyond our control,

including international, economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates, global or regional consumptive patterns, speculative activities and increased production due to new extraction developments and improved extraction and production methods. The effect of these factors on the price of base and precious metals, and, therefore, the change in the value of our retained earnings, if any, held in bullion accounts cannot accurately be predicted and is subject to significant fluctuation. There can be no assurance that the value of any bullion accounts established by us in the future to hold retained mineral reserves, if any, will not be adversely impacted by fluctuations in the price of base and precious metals resulting in significant losses.

Summary of our Mineral Property Interests

A description of each of our options to acquire the mineral and mining rights underlying properties located in Argentina and Peru and the conditions that we must meet to exercise these options is set forth in Item 2 of this annual report.

Effect of Governmental Regulation on Our Business

We will be required to comply with all regulations, rules and directives of governmental authorities and agencies applicable to the exploration of minerals in Argentina and Peru. The discussion that follows is a summary of the most significant government regulations which we anticipate will impact our operations.

Argentina

Argentina is the second largest country in South America, over 2.7 million square kilometres in area. In 1983, Argentina returned to a multi-party democracy, which brought an end to nearly a half century of military intervention and political instability. The country then began to stabilize; however, it was not until 1989, with the election of the government under President Carlos Menem, that Argentina's economy began to improve. President Menem initiated economic reforms that included the privatization of many state companies and the implementation of the Convertibility Plan, which fixed the Argentine peso to the U.S. dollar at par. Results of the reforms were positive; Argentina's gross domestic product grew at up to 8% per annum in the early 1990s and inflation dropped to between 1% and 3% per annum. However, following a recession in 1999 and 2000, a severe political and economic crisis occurred in late 2001. In early 2002, the government chose to devalue the peso, before allowing the peso to float in February 2002. During the period 2003-2008, Argentina has had one of its most important economic growth cycles with average annual growth rate of around 8%. However, during the last quarter of 2008, the economic growth in Argentina decreased due to the world-wide financial crisis and the reduction in commodity prices.

In 1993, the Mining Investments Act (the “Act”) instituted a new system for mining investment to encourage mineral exploration and foreign investment in Argentina. Key incentives provided by the Act include guaranteed tax stability for a 30-year period, 100% income tax deductions on exploration costs in addition to the deduction as expenses or investment that may correspond according to applicable income tax laws, accelerated amortization of investments in infrastructure, machinery and equipment, exemption from tax on minimum presumed income, and the exemption from import duties on capital goods, equipment and raw materials used in mining and exploration. Repatriation of capital or transfer of profits is unrestricted. Argentina's mineral resources, administered by its 23 provinces or the Argentinean Federal Government, depending where they are located, are subject to a provincial royalty capped at 3% of the “mouth of mine” value of production, although provinces may opt to waive or reduce this royalty.

Under Decree. No. 753/2004 (“Decree”), mining companies that obtain the stability rights afforded by the Act are excluded from the application of certain exchange control regulations currently in force. If fact, under this Decree, mining companies that obtain such stability rights:

| · | are exempted from the obligation of bringing into Argentina and trading on the Foreign Exchange Market (“FEM”) the proceeds from exports of products extracted from the project. This exemption also allows the collection of certain tax returns for the exportation of products without the need to fulfill the referred obligation (other exporters cannot collect the export tax returns before evidencing the fulfillment of said obligation); and |

| · | are exempted from restrictions on the free availability (meaning the obligation of bringing into Argentina and trading on the FEM) of foreign borrowings for the development of productive mining ventures in Argentina intended for export (provided that, in principle, such borrowings must be cancelled with export proceeds). |

Property and Title in Argentina

The laws, procedures and terminology regarding mineral title in Argentina differ considerably from those in the United States. According to Argentine Political State Organisation, the mines (and their mineral thereof) belong to the Provinces on where they are located, which grant the exploration permits and mine concessions to the applicants.

However, the Argentinean Federal Government is entitled to enact the National Mining Code (the “Mining Code”), which is applicable to the whole country, while the Provinces have the power to regulate the procedure aspects of the Mining Code through each Provincial Mining Procedure Code and to organize the concession and enforcement authorities.

In general, a similar concept applies to the environmental aspects related to mining activities. Although the Mining Code includes a chapter that regulates the main aspects of environmental regulations, Provinces are the enforcement authorities. Furthermore, in application of Section 121 and Section 41 of the Argentine Constitution, many provinces have also enacted additional environmental laws, which directly or indirectly are applicable to mining activities.

The following summarizes the material aspects of Argentinean mining law.

Mining Code

The rights, obligations, and procedures for the acquisition, exploration, exploitation, and use of mineral substances in Argentina are regulated by the Mining Code. The Mining Code establishes three classes of minerals, two of which are: (i) the main metalliferous substances such as gold, silver, copper, and lead whose ownership is vested in the provincial government, which in turn grants exploitation concessions to private companies; and (ii) the other metalliferous substances, which include earthy minerals and industrial minerals that belong to the land owner. Except for minerals contained in this last category, mineral rights in Argentina are separate rights from surface ownership rights. Creek bed and placer deposits, as well as abandoned tailings and mine waste rock deposits, are included in the latter mineral class.

Cateo

A cateo is an exploration concession which does not permit mining but gives the owner a preferential right to a mining concession for exploitation of minerals discovered in the same area. Cateos are measured in 500 ha unit areas. A cateo cannot exceed 20 units (10,000 ha). No person may hold more than 20 permits or 400 units in a single province. The term of a cateo is based on its area: 150 days for the first unit (500 ha) and an additional 50 days for each unit thereafter. After a period of 300 days, 50% of the area over four units (2,000 ha) must be relinquished. At 700 days, 50% of the area remaining must be relinquished. Extensions may be granted to allow for bad weather, difficult access, or similar issues. Cateos are identified by a file number or dossier number.

Cateos are awarded by the following process:

| (i) | an application is made in respect of a designated area, describing a minimum work program and an estimation of the investment to be made and a schedule for exploration; |

| (ii) | approval is granted by the province and a formal placement on the official map or graphic register is made provided the requested area is not superseded by a previous mining right; |

| (iii) | publication of the claim is made in the provincial official bulletin so as to notify third parties of the claim, and; |

| (iv) | upon expiry of a period following publication in the official bulletin, the cateo is awarded. |

The length of this process varies depending on the province, and often takes up to two years. Applications are processed on a first-come, first-serve, basis. During the application period, the first applicant has rights to any mineral discoveries made by third parties in the area of the cateo without its prior consent.

Until August 1995, a “canon fee”, or tax, of AR$400 per unit was payable upon the awarding of a cateo. A recent amendment to this law requires that a canon fee be paid upon application for the cateo. The canon fee for the cateo is paid once for the whole duration of the exploration permit.

Although the previous granting of a cateo is not a pre-condition for the granting of a exploitation right, the most common way to acquire a mina would be by discovering a mine as a consequence of an exploration process under the permit of a cateo. To convert an exploration concession to a mining concession, some or all of the area of a cateo must be converted to a “mina”. Minas are mining concessions which permit mining on a commercial basis. The area of a mina is measured in “pertenencias”. Each mina may consist of one or more pertenencias. “Common pertenencias” are 6 ha and “disseminated pertenencias” are 100 ha (relating to disseminated deposits of metals rather than discrete veins). The mining authority may determine the number of pertenencias required to cover the geologic extent of the mineral deposit in question. Once granted, minas have an indefinite term assuming the requirements of law and exploration development or mining is in progress.

To convert an exploration concession to a mining concession a declaration of manifestation of discovery wherein a point within a cateo must be nominated as a discovery point. The manifestation of discovery is used as a basis for location of the pertenencias. Manifestations of discovery do not have a definite area until pertenencias are proposed. Within a period following designation of a manifestation of discovery, the claimant may do further exploration, if necessary, to determine the size and shape of the ore body.

Following a publication and opposition period and approval by the province, a formal survey of the pertenencias, together forming the mina, is completed. A surveyed mina provides the highest degree of mineral rights in Argentina.

The application to the mining authority must include official cartographic coordinates of the mine location and of the reconnaissance area, and a sample of the mineral discovered. The reconnaissance area, which may be as much as twice the surface area projection of the mine, is intended to allow for the geological extent of the ore body and for site layout and development. Excess area is released once the survey plans are approved by the mining authority.

Once the application for a mine has been submitted, the holder of the mining concession may commence the mining operation. Any person opposed to the mine operation, whether a holder of an overlapping cateo, a land owner disputing the existence of the ore deposit or the class of the economic mineral, or a partner in the discovery who claims to have been neglected, must register his opposition to the operation with the mining authority.

New mining concessions may also be awarded for mines that were abandoned or for which their original mining concessions were declared to have expired. In such cases, the first person claiming an interest in the property will have priority. A new mining concession will be awarded for the mine in the condition left by the previous holder.

The titleholder of a mine must fulfill three conditions as part of its mining concession in order to maintain its title to the mining concession in good standing: (i) payment of mining canons; (ii) provision of minimum investment; and (iii) continuous mining activity (if the mine is shut down for more than four years, the mining authority may demand the mine to be reactivated and a new investment plan be submitted).

Mining canons are paid to the state (national or provincial) under which the mining concession is registered, and are paid in equal instalments twice yearly. The canon is set by national law according to the category of the mine. In general, the canon due per year is AR$80 per 6 ha pertenencia for common ore bodies held by the mining concession, or AR$800 per 100 ha pertenencia for disseminated ore bodies. Failure to comply with this obligation for fourteen months results in the cancellation of the mining right. However, the titleholder can recover the mining right during 45 days after being notified by the Mining Authority, by paying the due canon plus 20% charge as a fine. The discoverer of the mine is exempt from paying canons for three years from the date on which formal title was awarded to the mine.

The holder of the mining concession must also commit to investing in the fixed assets of the property to a minimum of at least 500 times the value of the annual mining canon, over a period of five years. In the first two years, 20% of the total required investment must be made in each year. For the final three years, the remaining 60% of the total required investment may be distributed in any other manner to the discretion of the concessionaire. The mining concession expires if the minimum required investment schedule is not met. If the exploration or exploitation works at the mine are suspended for more than four years in a row, the mining authority can require the holder of the concession to prepare and undertake a plan to activate or reactivate work. Failure to file such reactivation plan within six months results in the cancellation of the mining right. Such work must be completed on the property within a maximum period of five years.

A new mining operation and the mineral products arisen therefrom are entitled to national, provincial, and municipal tax exemptions for five years (the obligation to pay mining canons is excluded from this exemption). The exemptions commence with the awarding of formal title to the mine. As discussed above, the Mining Investment Act has established a 30-year guarantee of fiscal stability for new mining projects and/or extension of existing projects which applies retroactively, once approved, to the date of presentation of the feasibility study for the project. The law allows for accelerated depreciation of capital goods, deductions in exploration costs, and access to machinery and equipment at international prices.

The major taxes that affect the mining sector are National Income Tax (35%), Gross Revenue Tax (1% of revenue, depending on the province), Mining Royalties paid to the provinces where the mining project is located (up to a maximum cap of 3% of the “mouth of mine” value of production, depending on the province), and export duties on mining products as set forth by Resolution 11/2002 (5% and 10%, depending on the mineral product).

Environmental Regulation

The Environmental Protection Section of the Mining Code of Argentina, enacted in 1995, requires that each Provincial government monitor and enforce the laws pertaining to subscribed development and protection of the environment.

Provinces are allowed to withdraw areas from the normal cateo/mina process. These lands may be held directly by the province or assigned to provincial companies for study or exploration and development.

A party wishing to commence or modify any mining-related activity as defined by the Mining Code, including prospecting, exploration, exploitation, development, preparation, extraction, and storage of mineral substances, as well as property abandonment or mine closure activity, must prepare and submit to the Provincial Environmental Management Unit (“PEMU”) an Informe de Impacto Ambiental or Environmental Impact Assessment (“EIA”) prior to commencing the work. Each EIA must describe the nature of the proposed work, its potential risk to the environment, and the measures that will be taken to mitigate that risk. The PEMU has a 60-day period to review and either approve or reject the EIA. However, the EIA is not considered to be automatically approved if the PEMU has not responded within that period. If the PEMU deems that the EIA does not have sufficient content or scope, the party submitting the EIA is granted a 30-day period in which to resubmit the document.

If accepted by the PEMU, the EIA is used as the basis to create a Declaración de Impacto Ambiental or Declaration of Environmental Impact (“DEI”) to which the party must swear to uphold during the mining-related activity in question. The DEI must be updated every two years, with a report on the results of the protection measures taken. If protection measures are deemed inadequate, additional environmental protection may be required. Mine operators are liable for environmental damage. Sanctions and penalties for non-compliance to the DEI are outlined in the Environmental Protection Section of the Mining Code, and may include warnings, fines, suspension of environmental Quality Certification, restoration of the environment, temporary or permanent closure of activities, and removal of authorization to conduct mining-related activities.

Further to the provisions of the Mining Code on Environmental Protection, mining activities are also subject to other environmental regulations issued at national and provincial level (from the province in where such activities are carried out).

All mineral rights described above are considered forms of proprietary rights and can be sold, leased or assigned to third parties on a commercial basis. As described before, cateos and minas can be forfeited if minimum work and investments requirements are not performed or if annual payments are not made. Generally, notice and an opportunity to cure defaults is provided to the owner of such rights.

Peru

Peru is located on the western coast of South America and has a population of approximately 28 million. It covers a geographic area of approximately 1.3 million square kilometres and is bordered by Bolivia, Brazil, Chile, Colombia and Ecuador. Lima is Peru's capital and principal city and has a population of approximately 7 million.

Peru has become a leading country for mining activities. No special taxes or registration requirements are imposed on foreign-owned companies and foreign investment is treated as equal to domestic capital. Peruvian law allows for full repatriation of capital and profits and the country’s mining legislation provides access to mining concessions under an efficient registration system.

Peruvian Mining Law

Under Peru’s Uniform Text of Mining Law (“UTM”), the right to explore for and exploit minerals is granted by the government by way of concessions. A Peruvian mining concession is a property right, independent from the ownership of surface land on which it is located. There are no restrictions or special requirements applicable to foreign companies or individuals regarding the holding of mining concessions in Peru unless the concessions are within 50 kilometres of Peru's borders. The rights granted by a mining concession can be transferred, or sold and, in general, may be the subject of any transaction or contract. Mining concessions may be privately owned and no state participation is required.

The application for a mining concession involves the filing of documents before the mining administrative authority. The mining concession boundaries are specified in the application documents, with no requirement to mark the concession boundaries in the field since the boundaries are fixed by UTM coordinates. In order to conduct exploration or mining activities, the holder of a mining concession must purchase the surface land required for the project or reach agreement with the owner for its temporary use. If any of this is not possible, a legal easement may be requested from the mining authorities, although these easements have been rarely granted.

Mining concessions are irrevocable as long as their holders pay an annual fee of US $3 per hectare and reach minimum production levels within the terms set forth by law or otherwise pay penalties, as applicable. Non-compliance with any of these mining obligations for two consecutive years will result in the cancellation of the mining concession.

Pursuant to the original legal framework, in force since 1992, holders of mining concessions are obliged to achieve a minimum production of US $100 per hectare per year within six years following the year in which the respective mining concession title is granted. If this minimum production is not reached, as of the first six months of the seventh year, the holder of the concession shall pay a US $6 penalty per hectare per year until such production is reached and penalties increase to US $20 in the 12th year. Likewise, it is possible to avoid payment of the penalty if evidence is submitted to the mining authorities that an amount 10 times the applicable penalty or more had been invested.

However, this regime has been recently and partially amended providing for, among other matters, increased minimum production levels, new terms for obtaining such minimum production, increased penalties in case such minimum production is not reached, and even the cancellation of mining concessions if minimum production is not reached within certain terms. Pursuant to this new regime, the holder of the mining concession should achieve a minimum production of at least one tax unit (S/. 3,500, approximately US $1,100) per hectare per year, within a ten-year term following the year in which the mining concession title is granted. If such minimum production is not reached within the referred term, the holder of the concession shall pay penalties equivalent to 10% of the tax unit.

If the minimum production is not reached within a fifteen-year term following the granting of the concession title, the mining concession shall be cancelled by the mining authority, unless (i) a qualified force majeure event is evidenced to and approved by the mining authority, or (ii) by paying the applicable penalties and concurrently evidencing minimum investments of at least ten times the amount of the applicable penalties; in which cases the concession may not be cancelled up to a maximum term of five additional years. If minimum production is not reached within a twenty-year term following the granting of the concession title, the concession shall inevitably be cancelled.

This amended regime is currently applicable to all new mining concessions granted since October 11, 2008. Regarding those mining concessions existing prior to such date, the new term for obtaining the increased minimum production level or otherwise pay the increased penalties pursuant to the amended regime shall be counted as from the first business day of 2009. Nevertheless, until such new term for obtaining the increased minimum production level does not expire, the minimum production level, the term for obtaining such minimum production, the amount of the penalties and the causes for cancellation of the mining concessions shall continue to be those provided in the original legal framework existing since 1992.

The amended regime shall not be applicable to (i) those concessions handed by the Peruvian State through private investment promotion procedures, which shall maintain the production and investment obligations contained in their respective agreements, and/or (ii) to titleholders of concessions with mining stability agreements in force.

Environmental Laws

The Peruvian Ministry of Energy and Mines ("MEM") regulates environmental affairs in the mining sector, including establishing an environmental protection regulations; while the Organism for Supervising Investment in Energy and Mining verifies environmental compliance and imposes administrative sanctions, although it is likely that in the near future this functions be assumed by the recently created Ministry of Environment.

Each stage of exploration or mining requires some type of authorization or permit, beginning with an application for an environmental permit for initial exploration and continuing with an Environmental Impact Assessment ("EIA") for mining, which includes public hearings.

For permitting purposes, exploration activities in Peru are classified in two categories:

| · | Category I projects: Mining exploration activities that comprise any of the following: (i) a maximum of 20 drilling platforms; (ii) a disturbed area of less than 10 hectares considering drilling platforms, trenches, auxiliary facilities and access means; and, (iii) the construction of tunnels with a total maximum length of 50 meters. Holders of these projects must submit an Environmental Impact Statement (“EIS”) before the MEM, which in principle, is subject to automatic approval upon its filing, and subject to subsequent (ex post) review by the latter. Nevertheless, in any of the following cases, the project shall not be subject to automatic approval and shall necessarily obtain an express prior approval by MEM, which should be granted, in principle, within a term of two months since filing the EIS: (i) the project is located in a protected natural area or its buffer zone; (ii) the project is oriented to determining the existence of radioactive minerals; (iii) the platforms, drill holes, trenches, tunnels or other components would be located within certain specially environmental sensitive areas specified in the applicable regulations (e.g., glaciers, springs, water wells, groundwater wells, protection lands, primary woods, etc.); (iv) the project covers areas where mining environmental contingencies or non-environmental rehabilitated previous mining works, already exist |

| · | Category II projects: Mining exploration activities that comprise any of the following: (i) more than 20 drilling platforms; (ii) a disturbed area of more than 10 hectares considering drilling plants, trenches, auxiliary facilities and access means; and, (iii) the construction of tunnels over a total length of 50 meters. These projects require an authorization that should be granted once the semi-detailed Environmental Impact Assessment (EIA) is approved by the MEM. Such authorization should, in principle, take approximately four months. |

Before initiating construction or exploitation activities and to the expansion of existing operations, an EIA should be approved. This process of authorization involves public hearings in the place where the project is located and, in principle, should conclude within a term of 120 calendar days, although in practice it might take between eight months and one year.

Holders of mining activities performing mining exploration shall conduct remediation works of disturbed areas, as part of the progressive closure of the project. Likewise, they shall undertake those final closure and post closure actions in the terms and conditions set forth in the approved environmental instrument.

If said holders shall carry out mining exploration activities involving the removal of more than 10,000 tonnes of material, or more than 1,000 tonnes of material with a potential neutralization (PN) over potential acidity (“PA”) relation lower than 3 (PN/PA<3), then they shall be required to file a Mine Closure Plan (“MCP”) along with the corresponding environmental instrument, as well as to establish a financial guarantee to secure compliance therewith.

Holders of mining exploitation activities must file a MCP before the MEM, within one year of the approval of their EIA. The MCP must be implemented as from the beginning of the mining operation. Semi-annual reports must be filed evidencing compliance with the MCP. An environmental guarantee covering the MCP’s estimated costs should be granted.

Mining Royalties

Peruvian law requires that concession holders pay a mining royalty as consideration for the extraction of mineral resources. The mining royalty is payable monthly on a variable cumulative rate of 1% to 3% of the value of the ore concentrate or equivalent, calculated in accordance with price quotations in international markets, subject to certain deductions such as indirect taxes, insurance, freight and other specified expenses. The mining royalty

payable is determined based on the following schedule: (i) under US $60 million of annual sales of concentrates: 1% royalty; (ii) in excess of US $60 million and up to US $120 million of annual sales: 2% royalty; and (iii) in excess of US $120 million of annual sales: 3% royalty.

Competition

We are an exploration stage mineral resource exploration company that competes with other mineral resource exploration companies for financing and for the acquisition of new mineral properties. Many of the mineral resource exploration companies with whom we compete have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford more geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration and development. This competition could adversely impact on our ability to achieve the financing necessary for us to conduct further exploration of our mineral properties. We will also compete with other mineral exploration companies for financing from a limited number of investors that are prepared to make investments in mineral exploration companies. The presence of competing mineral exploration companies may impact on our ability to raise additional capital in order to fund our exploration programs if investors are of the view that investments in competitors are more attractive based on the merit of the mineral properties under investigation and the price of the investment offered to investors. We will also be compete with other mineral companies for available resources, including, but not limited to, professional geologists, camp staff, mineral exploration supplies and drill rigs.

Intellectual Property

We do not own, either legally or beneficially, any patent or trademark.

Employees

We have no full-time employees at the present time. Our executive officers do not devote their services full time to our operations.

We also engage contractors from time to time to consult with us on specific corporate affairs or to perform specific tasks in connection with our exploration programs. On October 15, 2008, we entered into a services contract with Logistica y Servicios Aluviales San Lorenzo SAC ("San Lorenzo"), a Peruvian Service company, to supply us with mining services on a contract basis for the purpose of developing our interests in mining properties located in the area referred to as the Gold Sands district of northeastern Peru.

Research and Development Expenditures

We have not incurred any research or development expenditures since our incorporation.

Subsidiaries

We have one subsidiary, Constitution Mining SA, which was registered with the General Inspection of Corporations in Argentina on March 4, 2008 and formed for the purpose of acquiring and exploring natural resource properties in Argentina.

Glossary of Certain Mining Terms

| Alluvial - | Material deposited by the action of running water. |

| Alternation - | Any physical or chemical change in a rock or mineral subsequent to its formation. Milder and more localized than metamorphism. |

| Andesite - | A volcanic rock of intermediate composition. |

| Anomaly - | Any departure from the norm which may indicate the presence of mineralization in the underlying bedrock. |

| Anticline - | An arch or fold in layers of rock shaped like the crest of a wave. |

| Aplite - | A fine-grained, light coloured intrusive rock of granitic composition. |

| Arsenic-sulfides - | Sulphide minerals rich in arsenic such as arsenopyrite and arsenopolybasite. |

| Banded - | Iron formation - A bedded deposit of iron minerals. |

| Basalt - | An excursive volcanic rock composed primarily of plagioclase, pyroxene and some olivine. |

| Base Camp - | Centre of operations from which exploration activity is conducted. |

| Base Metal - | Any non-precious metal (e.g., copper, lead, zinc, nickel, etc.). |

| Bedding - | The arrangement of sedimentary rocks in layers. |

| Biotite - | A platy magnesium-iron mica, common in igneous rocks. |

| Breccia - | A rock in which angular fragments are surrounded by a mass of fine-grained minerals. |

| Bulk Sample - | A large sample of mineralized rock, frequently hundreds of tonnes, selected in such a manner as to be representative of the potential orebody being sampled. Used to determine metallurgical characteristics. |

| Bullion - | Metal formed into bars or ingots. |

| Carbonate - | A sediment formed by the organic or inorganic precipitation from aqueous solution of carbonates of calcium, magnesium, or iron; e.g., limestone and dolomite. |

| Chalcopyrite - | A sulphide mineral of copper and iron; the most important ore mineral of copper. |

| Chlorite - | Fe (iron) and Mg (magnesium) rich mineral that is commonly an alteration product of mafic mineral |

| Clay - | A fine-grained material composed of hydrous aluminum silicates. |

| Collar - | The term applied to the timbering or concrete around the mouth of a shaft; also used to describe the top of a mill hole. |

| Concentrate - | A fine, powdery product of the milling process containing a high percentage of valuable metal. |

| Concentrator - | A milling plant that produces a concentrate of the valuable minerals or metals. Further treatment is required to recover the pure metal. |

| Contact - | A geological term used to describe the line or plane along which two different rock formations meet. |

| Core - | The long cylindrical piece of rock, about an inch in diameter, brought to surface by diamond drilling. |

| Crystalline - | Pertaining to, or having the nature of, a crystal. |

| Development - | Underground work carried out for the purpose of opening up a mineral deposit. Includes shaft sinking, crosscutting, drifting and raising. |

| Diamond - | The hardest known mineral, composed of pure carbon; low-quality diamonds are used to make bits for diamond drilling in rock. |

| Diamond drill - | A rotary type of rock drill that cuts a core of rock that is recovered in long cylindrical sections, two cm or more in diameter. |

| Diamond drilling - | A type of rotary drilling in which diamond bits are used as the rock-cutting tool to produce a recoverable drill core sample of rock for observation and analysis. |

| Diorite - | An intrusive igneous rock composed chiefly of sodic plagioclase, hornblende, biotite or pyroxene. |

| Dip - | The angle at which a vein, structure or rock bed is inclined from the horizontal as measured at right angles to the strike. |

| Disseminated - | Where minerals occur as scattered particles in the rock. |

| Disseminated ore - | Ore carrying small partides of valuable minerals spread more or less uniformly through the host rock. |

| Dyke - | A long and relatively thin body of igneous rock that, while in the molten state, intruded a fissure in older rocks. |

| Epithermal - | Low temperature hydrothermal process or product. |

| Erosion - | The breaking down and subsequent removal of either rock or surface material by wind, rain, wave action, freezing and thawing and other processes. |

| Exploration - | Prospecting, sampling, mapping, diamond drilling and other work involved in searching for ore. |

| Fault - | A break in the Earth’s crust caused by tectonic forces which have moved the rock on one side with respect to the other. |

| Feldspar - | A group of common rock-forming minerals that includes microcline, orthoclase, plagioclase and others. |

| Fine gold - | Fineness is the proportion of pure gold or silver in jewelry or bullion expressed in parts per thousand. Thus, 925 fine gold indicates 925 parts out of 1,000, or 92.5% is pure gold. |

| Fold - | Any bending or wrinkling of rock strata. |

| Fracture - | A break in the rock, the opening of which allows mineral-bearing solutions to enter. A “cross-fracture” is a minor break extending at more-or-less right angles to the direction of the principal fractures. |

| Galena - | Lead sulphide, the most common ore mineral of lead. |

| Geochemistry - | The study of the chemical properties of rocks, soil or silt. |

| Geology - | The science concerned with the study of the rocks which compose the Earth. |

| Geophysical Survey - | A scientific method of prospecting that measures the physical properties of rock formations. Common properties investigated include magnetism, specific gravity, electrical conductivity and radioactivity. |

| Geophysics - | The study of the physical properties of rocks and minerals. |

| Grab Sample - | A sample from a rock outcrop that is assayed to determine if valuable elements are contained in the rock. A grab sample is not intended to be representative of the deposit, and usually the best-looking material is selected. |

| Granite - | A coarse-grained intrusive igneous rock consisting of quartz, feldspar and mica. |

| Granodiorties - | A coarse-grained intrusive rock of intermediate composition. |

| Hematite - | An oxide of iron, and one of that metal’s most common ore minerals. High grade - Rich ore. As a verb, it refers to selective mining of the best ore in a deposit. |

| Host Rock - | The rock surrounding an ore deposit. |

| Hydrothermal - | Relating to hot fluids circulating in the earth’s crust. |

| Induced polarization (IP) - | A method of ground geophysical surveying employing an electrical current to determine indications of mineralization. |

| Industrial Minerals - | Non-metallic, non-fuel minerals used in the chemical and manufacturing industries. Examples are asbestos, gypsum, salt, graphite, mica, gravel, building stone and talc. |

| Intrusive - | A body of igneous rock formed by the consolidation of magma intruded into other rocks, in contrast to lavas, which are extruded upon the surface. |

| Jig - | A piece of milling equipment used to concentrate ore on a screen submerged in water, either by the reciprocating motion of the screen or by the pulsation of water through it. |

| Lamprophyre - | An igneous rock, composed of dark minerals, that occurs in dykes; sometimes contains diamonds. |

| Lens - | Generally used to describe a body of ore that is thick in the middle and tapers towards the ends. |

| Level - | The horizontal openings on a working horizon in a mine; it is customary to work mines from a shaft, establishing levels at regular intervals, generally about 50 meters or more apart. |

| Limonite - | A brown, hydrous iron oxide. |

| Lode - | A mineral deposit in solid rock. |

| Mafic - | Igneous rocks composed mostly of dark, iron- and magnesium-rich minerals. |

| Magma - | The molten material deep in the Earth from which rocks are formed. |

| Magnetite - | Black, magnetic iron ore, an iron oxide. |

| Metallurgical coal - | Coal used to make steel. |

| Microcrystalline - | A crystalline texture visible only under a microscope. |

| Mineral - | A naturally occurring homogeneous substance having definite physical properties and chemical composition and, if formed under favorable conditions, a definite crystal form. |

| Mineralization - | Occurrences of minerals, which may have an economic value. |

| Mineralization - | A natural concentration in rocks or soil of one or more metalliferous minerals. |

| Monzogranite - | A coarse-grained, quartz-poor intrusive rock of granitic. |

| Net smelter return - | A share of the net revenues generated from the sale of metal produced by a mine. |

| Oligocene - | An epoch of the lower Tertiary period of the Cenozoic era considered to have covered the span of time between 38 and 25 million years ago. |

Ordovician age - | The second earliest period of the Palaeozoic era considered to have covered the span of time between 500 and 440 million years ago. |

| Ore - | A mixture of ore minerals and gangue from which at least one of the metals can be extracted at a profit. |

| Orebody - | A natural concentration of valuable material that can be extracted and sold at a profit. |

| Outcrop - | An exposure of rock or mineral deposit that can be seen on surface, that is, not covered by soil or water. |

| Pegmatite - | A coarse-grained, igneous rock, generally coarse, but irregular in texture, and similar to a granite in composition; usually occurs in dykes or veins and sometimes contains valuable minerals. |

| Permian - | The last period of the Palaeozoic era considered to have covered the span of time between 290 and 250 million years ago. |

| Placer - | A deposit of sand and gravel containing valuable metals such as gold, tin or diamonds. |

| Plant - | A building or group of buildings in which a process or function is carried out; at a mine site it will include warehouses, hoisting equipment, compressors, maintenance shops, offices and the mill or concentrator. |

| Plug - | A common name for a small offshoot from a large body of molten rock. |

| Porphyry - | Any igneous rock in which relatively large crystals , called phenocrysts, are set in a fine-grained groundmass. |

| Prospect - | A mining property, the value of which has not been determined by exploration. |

| Pyrite - | A yellow iron sulphide mineral, normally of little value. It is sometimes referred to as “fool’s gold” |

| Pyrite - | An iron sulphide mineral (FeS2), the most common naturally occurring sulphide mineral. |

| Quartenary - | The last period of time considered to have covered the span of time between 0 and 2 million years ago. |

| Quartz - | Common rock-forming mineral consisting of silicon and oxygen. |

| Reclamation - | The restoration of a site after mining or exploration activity is completed. |

| Reconnaissance - | A preliminary survey of ground. |

| Resource - | The calculated amount of material in a mineral deposit, based on limited drill information. |

| Reverse Circulation Drilling (RC) - | A drilling method used in geological appraisals whereby the drilling fluid passes inside the drill stem to a down-the-hole percussion bit and returns to the surface outside the drill stem carrying the drill chip samples. |

| Rhyolite - | A fine-grained, extrusive igneous rock which has the same chemical composition as granite. |

| Rock - | Any natural combination of minerals; part of the earth’s crust. |

| Sample - | A small portion of soil, silt, rock or a mineral deposit taken so that the metal content can be determined by assaying. |

| Sampling - | Selecting a fractional but representative part of a mineral deposit for analysis. |

| Scorodite - | A pale leek-green iron and arsenic rich mineral. |

| Sedimentray - | Formed by the deposition of sediment or pertaining to the process of sedimentation. |

| Sediments - | Solid fragmental material that originates from weathering of rocks and is transported or deposited by air, water, or ice, or that accumulates by other natural agents, such as chemical precipitation from solution or secretion by organisms, and that forms in layers on the Earth's surface at ordinary temperatures in a loose, unconsolidated form; e.g., sand, gravel, silt, mud, alluvium. |

| Seismic prospecting - | A geophysical method of prospecting, utilizing knowledge of the speed of reflected sound waves in rock. |

| Shear or Shearing - | The deformation of rocks by lateral movement along innumerable parallel planes, generally resulting from pressure and producing such metamorphic structures as cleavage and schistosity. |

| Shear zone - | A zone in which shearing has occurred on a large scale. |

| Shoot - | A concentration of mineral values; that part of a vein or zone carrying values of ore grade. |

| Showing - | Surface occurrence of mineral. |

| Siderite - | Iron carbonate, which when pure, contains 48.2% iron; must be roasted to drive off carbon dioxide before it can be used in a blast furnace. Roasted product is called sinter. |

| Silica - | Silicon dioxide. Quartz is a common example. |

| Siliceous - | A rock containing an abundance of quartz. |

| Sill - | An intrusive sheet of igneous rock of roughly uniform thickness that has been forced between the bedding planes of existing rock. |

| Skam - | Name for the metamorphic rocks surrounding an igneous intrusive where it comes in contact with a limestone formation. |

| Sphalerite - | A zinc sulphide mineral; the most common ore mineral of zinc. |

| Stratigraphy - | Strictly, the description of bedded rock sequences; used loosely, the i" sequence of bedded rocks in a particular area. |

| Strike - | The direction, or bearing from true north, of a vein or rock formation measure on a horizontal surface. |

| Strike-slip - | The component of movement or slip that is parallel to the strike of a body or plane. |

| Stripping ratio - | The ratio of waste relative to ore removed from a surface mine. Usually expressed as tonne:tonne (t:t). |

| Subvolcanic - | A volcanic rock formed not far from the surface. |

| Sulphide - | A compound of sulphur and some other element. |

| Tailings - | Material rejected from a mill after most of the recoverable valuable minerals have been extracted. |

| Tertiary - | The first period of the Cenozoic era considered to have covered the span of time between 2 and 65 million years ago. |

| Trench - | A long, narrow excavation dug through overburden, or blasted out of rock, to expose a vein or ore structure. |

| Trenching - | The process of exploration by which material is removed from a trench cut from the earth's surface. |

| Trend - | The direction, in the horizontal plane, of a linear geological feature, such as an ore zone, measured from true north. |

| Tuff - | Rock composed of fine volcanic ash. |

| Tunnel - | A horizontal underground opening, open to the atmosphere at both ends. |

| Vein - | A fissure, fault or crack in a rock filled by minerals that have travelled upwards from some deep source. |

| Volcaniclastics - | Fragmental volcanic rocks. |

| Waste - | Un-mineralized, or sometimes mineralized, rock that is not minable at a profit. |

| Zone - | An area of distinct mineralization. |

You should carefully consider the following risk factors in evaluating our business and us. The factors listed below represent certain important factors that we believe could cause our business results to differ. These factors are not intended to represent a complete list of the general or specific risks that may affect us. It should be recognized that other risks may be significant, presently or in the future, and the risks set forth below may affect us to a greater extent than indicated. If any of the following risks occur, our business, financial condition or results of operations could be materially and adversely affected. You should also consider the other information included in this Annual Report and subsequent quarterly reports filed with the SEC.

Risk Factors

Risks Associated With Our Business

Our accountants have raised substantial doubt with respect to our ability to continue as a going concern.

As noted in our financial statements, we have incurred a net loss of $6,873,664 for the period from inception on March 6, 2000 to December 31, 2008 and have present no source of revenue. At December 31, 2008, we had a working capital deficiency of $162,440. As of December 31, 2008, we had cash and cash equivalents in the amount of US $66,580. We will have to raise additional funds to meet our currently budgeted operating requirements for the next twelve months.

The audit report of James Stafford, Inc., Chartered Accountants for the fiscal year ended December 31, 2008 and 2007 contained a paragraph that emphasizes the substantial doubt as to our continuance as a going concern. This is a significant risk that we may not be able to generate and/or raise enough resources to remain operational for an indefinite period of time.

We own the options to acquire the mining and mineral rights underlying certain properties and if we fail perform the obligations necessary to exercise these options we will lose our options and cease operations.

We hold options to acquire the mineral and mining rights underlying properties located the Salta and Mendoza provinces of Argentina and in Peru, and, if we fail to meet the requirements of the agreement under which we acquired such options , including any payments and/or any exploration obligations that we have regarding these properties, we may lose our right to exercise the options to acquire the mineral and mining rights underlying these properties. If we do not fulfill these conditions, then our ability to commence or continue operations could be materially limited. In addition, substantially all of our assets will be put into commercializing our rights to the areas covered by these option agreements. Accordingly, any adverse circumstances that affect the areas covered by these option agreements and our rights thereto would affect us and your entire investment in shares of our common stock. If any of these situations were to arise, we would need to consider alternatives, both in terms of our prospective operations and for the financing of our activities. Management cannot provide assurance that we will ultimately achieve profitable operations or become cash-flow positive, or raise additional debt and/or equity capital. If we are unable to raise additional capital in the near future, we will experience liquidity problems and management expects that we will need to curtail operations, liquidate assets, seek additional capital on less favorable terms and/or pursue other remedial measures.

We have a limited operating history and have incurred losses that we expect to continue into the future.

We have not yet located any mineral reserves and we have never had any revenues from our operations. In addition, we have a very limited operating history upon which an evaluation of our future success or failure can be made. We have only recently taken steps to implement our business plan to engage in the acquisition of mineral and mining rights to exploration and development properties in Argentina and Peru, and it is too early to determine whether such steps will prove successful. Our business plan is in its early stages and faces numerous regulatory, practical, legal and other obstacles. At this early stage of our operation, we also expect to face the risks, uncertainties, expenses and difficulties frequently encountered by companies at the start-up stage of their business development. We cannot be sure that we will be successful in addressing these risks and uncertainties, and our failure to do so could have a materially adverse effect on our financial condition.

No assurances can be given that we will be able to successfully complete the purchase of mineral and mining rights to any properties, including the ones for which we currently hold options. Our ability to achieve and maintain profitability and positive cash flow over time will be dependent upon, among other things, our ability to (i) identify and acquire properties or interests therein that ultimately have probable or proven mineral reserves, (ii) sell such mining properties or interests to strategic partners or third parties or commence the production of a mineral deposit, (iii) produce and sell minerals at profitable margins and (iv) raise the necessary capital to operate during this possible extended period of time. At this stage in our development, it cannot be predicted how much financing will be required to accomplish these objectives.

We have no known reserves and we may not find any mineral resources or, if we find mineral resources, the deposits may be uneconomic or production from those deposits may not be profitable.

Our due diligence activities have been limited, and to a great extent, have relied upon information provided to us by third parties. We have not established that any of the properties for which we hold options contain adequate amounts of gold or other mineral reserves to make mining any of the properties economically feasible to recover that gold or other mineral reserves, or to make a profit in doing so. If we do not, our business will fail. If we cannot find economic mineral resources or if it is not economic to recover the mineral resources, we will have to cease operations.

We may not have access to all of the supplies and materials we need to begin exploration that could cause us to delay or suspend operations.

Competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of supplies, such as explosives, and certain equipment, such as bulldozers and excavators, that we might need to conduct exploration. We have not attempted to locate or negotiate with any suppliers of products, equipment or materials. We will attempt to locate products, equipment and materials. If we cannot find the products and equipment we need, we will have to suspend our exploration plans until we do find the products and equipment we need.

We do not have enough money to complete our exploration and consequently may have to cease or suspend our operations unless we are able to raise additional financing.

We presently do not have sufficient capital to exercise our options to acquire the mineral and mining rights underlying property located in the Salta and Mendoza provinces of Argentina and in Peru. Although management believes that sources of financing are available to complete the acquisition of these property interests, no assurances can be given that these financing sources will ultimately be sufficient. Other forms of financing, if available, may be on terms that are unfavorable to our stockholders.

As we cannot assure a lender that we will be able to successfully explore and develop our mineral properties, we will probably find it difficult to raise debt financing from traditional lending sources. We have traditionally raised our operating capital from sales of equity and debt securities, but there can be no assurance that we will continue to be able to do so. If we cannot raise the money that we need to continue exploration of our mineral properties, we may be forced to delay, scale back, or eliminate our exploration activities. If any of these were to occur, there is a substantial risk that our business would fail.

Our success is dependent upon a limited number of people.

The ability to identify, negotiate and consummate transactions that will benefit us is dependent upon the efforts of our management team. The loss of the services of any member of management could have a material adverse effect on us.

Our business will be harmed if we are unable to manage growth.

Our business may experience periods of rapid growth that will place significant demands on our managerial, operational and financial resources. In order to manage this possible growth, we must continue to improve and expand our management, operational and financial systems and controls. We will need to expand, train and manage our employee base. We must carefully manage our mining exploration activities. No assurances can be given that we will be able to timely and effectively meet such demands.

We may not be able to attract and retain qualified personnel necessary for the implementation of our business strategy and mineral exploration programs.

Our future success depends largely upon the continued service of board members, executive officers and other key personnel. Our success also depends on our ability to continue to attract, retain and motivate qualified personnel, particularly employees, consultants and contractors for our operations in Argentina and Peru. Personnel represents a significant asset, and the competition for such personnel is intense in the mineral exploration industry. We may have particular difficulty attracting and retaining key personnel in the initial phases of our operations.

Our officers and directors may have conflicts of interest and do not devote full time to the our operations.

Our officers and directors may have conflicts of interest in that they are and may become affiliated with other mining companies. In addition, our officers do not devote full time to our operations. Until such time that we can afford executive compensation commensurate with that being paid in the marketplace, our officers will not devote their full time and attention to our operations. No assurances can be given as to when we will be financially able to engage our officers on a full-time basis.

Because our Chief Executive Officer, Willem Fuchter, is also the president and a director of Proyectos Mineros S.A., situations may arise that would present a conflict of interests, which may result in decisions disadvantageous to our shareholders.

Dr. Fuchter, our Chief Executive Officer, is also the president and a director of Proyectos Mineros S.A. (“PMSA”), the party from which we acquired our options to acquire the mining and mineral rights in Argentina. Although the terms of some of these agreements with PMSA were negotiated and agreed to prior to Dr. Fuchter’s appointment as Chief Executive Officer, future situations may develop where Dr. Fuchter’s interest as a director of PMSA conflicts with his fiduciary duties as an officer and director of our company. Although, we will attempt to minimize or eliminate Dr. Fuchter’s ability to influence any of our decisions affecting PMSA, including the recusal of Dr. Fuchter from certain decisions involving PMSA, should a conflict occur it is possible that any such conflict could be resolved in the interests of PMSA instead of our shareholders.

Because most of our officers and directors are located outside of the United States, you may have no effective recourse against our us or our management for misconduct and may not be able to enforce judgment and civil liabilities against our officers, directors, experts and agents.

Most of our directors and officers are nationals and/or residents of countries other than the United States, and all or a substantial portion of such persons’ assets are located outside the United States. As a result, it may be difficult for investors to enforce within the United States any judgments obtained against our officers or directors, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof.

Risks Associated With Mining

There is no assurance that we can establish the existence of any mineral resource on any of our property interests in commercially exploitable quantities. Until we can do so, we cannot earn any revenues from operations and if we do not do so we will lose all of the funds that we expend on exploration. If we do not discover any mineral resource in a commercially exploitable quantity, our business will fail.

We have not established that any of our properties contain any commercially exploitable mineral reserve, nor can there be any assurance that we will be able to do so. If we do not, our business will fail. A mineral reserve is defined by the Securities and Exchange Commission in its Industry Guide 7 (which can be viewed over the Internet at http://www.sec.gov/divisions/corpfin/forms/industry.htm#secguide7) as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. The probability of an individual prospect ever having a “reserve” that meets the requirements of the Securities and Exchange Commission’s Industry Guide 7 is extremely remote; in all probability our mineral resource property does not contain any ‘reserve’ and any funds that we spend on exploration will probably be lost.

Even if we do eventually discover a mineral reserve on one or more of our properties, there can be no assurance that we will be able to develop our properties into producing mines and extract those resources. Both mineral exploration and development involve a high degree of risk and few properties that are explored are ultimately developed into producing mines. If we do discover mineral resources in commercially exploitable quantities on any of our properties, we will be required to expend substantial sums of money to establish the extent of the resource, develop processes to extract it and develop extraction and processing facilities and infrastructure.

The commercial viability of an established mineral deposit will depend on a number of factors including, by way of example, the size, grade and other attributes of the mineral deposit, the proximity of the resource to infrastructure such as a smelter, roads and a point for shipping, government regulation and market prices. Most of these factors will be beyond our control, and any of them could increase costs and make extraction of any identified mineral resource unprofitable.

Mineral operations are subject to applicable law and government regulation. Even if we discover a mineral resource in a commercially exploitable quantity, these laws and regulations could restrict or prohibit the exploitation of that mineral resource. If we cannot exploit any mineral resource that we might discover on our properties, our business may fail.

Both mineral exploration and extraction require permits from various foreign, federal, state, provincial and local governmental authorities and are governed by laws and regulations, including those with respect to prospecting, mine development, mineral production, transport, export, taxation, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. There can be no assurance that we will be able to obtain or maintain any of the permits required for the continued exploration of our mineral properties or for the construction and operation of a mine on our properties at economically viable costs. If we cannot accomplish these objectives, our business could fail.

We believe that we are in compliance with all material laws and regulations that currently apply to our activities but there can be no assurance that we can continue to do so. Current laws and regulations could be amended and we might not be able to comply with them, as amended. Further, there can be no assurance that we will be able to obtain or maintain all permits necessary for our future operations, or that we will be able to obtain them on reasonable terms. To the extent such approvals are required and are not obtained, we may be delayed or prohibited from proceeding with planned exploration or development of our mineral properties.

Because our property interest and exploration activities in Argentina and Peru are subject to political, economic and other uncertainties, situations may arise that could have a significantly adverse material impact on us.

Our activities in Argentina and Peru are subject to political, economic and other uncertainties, including the risk of expropriation, nationalization, renegotiation or nullification of existing contracts, mining licenses and permits or other agreements, changes in laws or taxation policies, currency exchange restrictions, changing political conditions and international monetary fluctuations. Future government actions concerning the economy, taxation, or the operation and regulation of nationally important facilities such as mines could have a significant effect on our plans and on our ability to operate. No assurances can be given that our plans and operations will not be adversely affected by future developments in Argentina and Peru.

Because we presently do not carry title insurance and do not plan to secure any in the future, we are vulnerable to loss of title.

We do not maintain insurance against title on any of our properties. Title on mineral properties and mining rights involves certain inherent risks due to the difficulties of determining the validity of certain claims as well as the potential for problems arising from the frequently ambiguous conveyance history characteristic of many mining properties. Disputes over land ownership are common, especially in the context of resource developments. We cannot give any assurance that title to such properties will not be challenged or impugned and cannot be certain that we will have or acquire valid title to the mining and mineral rights on such properties. The possibility also exists that title to existing properties or future prospective properties may be lost due to an omission in the claim of title. As a result, any claims against us may result in liabilities we will not be able to afford, resulting in the failure of our business.

Because we are subject to various governmental regulations and environmental risks, we may incur substantial costs to remain in compliance.

Our activities in Argentina and Peru are subject to federal and local laws and regulations regarding environmental matters, the abstraction of water, and the discharge of mining wastes and materials. Any significant mining operations will have some environmental impact, including land and habitat impact, arising from the use of land for mining and related activities, and certain impact on water resources near the project sites, resulting from water use, rock disposal and drainage run-off. No assurances can be given that such environmental issues will not cause our operations in the future to fail.

The federal and/or local government in Argentina and Peru could require us to remedy any negative environmental impact. The costs of such remediation could cause us to fail. Future environmental laws and regulations could impose increased capital or operating costs on us and could restrict the development or operation of any mines.

We have, and will in the future, engage consultants to assist us with respect to our operations in Argentina and Peru. We are beginning to address the various regulatory and governmental agencies, and the rules and regulations of such agencies, in connection with the options for the properties in Argentina and Peru. No assurances can be given that we will be successful in our efforts. Further, in order for us to operate and grow our business in Argentina and Peru, we need to continually conform to the laws, rules and regulations of such country and local jurisdiction. It is possible that the legal and regulatory environment pertaining to the exploration and development of mining properties will change. Uncertainty and new regulations and rules could dramatically increase our cost of doing business, or prevent us from conducting its business; both situations could cause us to fail.

Mineral exploration and development is subject to extraordinary operating risks. We do not currently insure against these risks. In the event of a cave-in or similar occurrence, our liabilities may exceed our resources, which could cause our business to fail.