SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 6-K/A

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

Dated December 2, 2005

Commission File Number: 0-31376

MILLEA HOLDINGS, INC.

(Translation of Registrant’s name into English)

Tokyo Kaijo Nichido Building Shinkan,

2-1, Marunouchi 1-chome,

Chiyoda-ku, Tokyo 100-0005, Japan

(Address of principal executive offices)

Indicate by check mark whether the Registrant files or will file

annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form 40-F ¨

Indicate by check mark whether the Registrant by furnishing

the information contained in this form is also thereby furnishing

the information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ¨ No x

Table of Documents Submitted

The information contained herein includes certain forward-looking statements that are based on our current plans, targets, expectations, assumptions, estimates and projections about our businesses and operations. These forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and actual results may materially differ from those contained in the forward-looking statements as a result of various factors. For a discussion of the factors which may have a material impact upon our financial condition, results of operation and liquidity, see our annual report on Form 20-F for the fiscal year ended March 31, 2005.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | |

| | | KABUSHIKI KAISHA MILLEA HOLDINGS |

| | | (Millea Holdings, Inc.) |

| | |

December 2, 2005 | | By: | | /S/ TAKASHI ITO

|

| | | | | Takashi Ito |

| | | | | General Manager, |

| | | | | Corporate Legal Department |

Item 1

December 2, 2005

Amendment of Information in “Long-Term and Medium-Term

Corporate Strategy of Millea Group”

On November 30, 2005, Millea Holdings, Inc. (“Millea Holdings”) submitted a Report of Foreign Private Issuer on Form 6-K with the Securities and Exchange Commission regarding the Long-Term and Medium-Term Corporate Strategy of Millea Group (the “previous submission”). Millea Holdings hereby amends certain parts the submission as indicated below. These amendments are intended to revise only the English translation of the original Japanese-language document. These are not intended to revise, update, amend or restate any other part of the previous information or reflect any events that have occurred after the Form 6-K was submitted on November 30, 2005.

The fourth paragraph under “4. Overseas Insurance Business” on page 9 of the previous submission read as follows:

In the European-American developed market, the Group will boldly expand its local insurance business primarily in the field of commercial casualty insurance by making a combined use of regional-oriented internal growth strategy and capital market-oriented growth strategies like M&A, equity participations and business alliances.

We hereby amend the paragraph to read as follows:

In the European-American developed market, the Group will boldly expand its local insurance business primarily in the field of commercialproperty and casualty insurance by making a combined use of regional-oriented internal growth strategy and capital market-oriented growth strategies like M&A, equity participations and business alliances.

The first column corresponding to Fiscal 2002—December in Reference 1 on page 12 of the previous submission read as follows:

Establishment of “Millea Asia Private Limited”

We hereby amend the column to read as follows:

Establishment of “Millea AsiaPte. Ltd.”

The second column corresponding to Fiscal 2002—December in Reference 1 on page 12 of the previous submission read as follows:

30% equity participation in Taiwanese casualty insurance company called “Newa Insurance Co., Ltd.” through Millea Asia Private Limited

i

We hereby amend the column to read as follows:

30% equity participation in Taiwaneseproperty and casualty insurance company called “Newa Insurance Co., Ltd.” through Millea AsiaPte. Ltd.

The column corresponding to Fiscal 2004—September in Reference 1 on page 12 of the previous submission read as follows:

Acquisition of 99.81% of the outstanding shares of Taiwanese casualty insurance company “Allianz President General Insurance Co., Ltd.” through Millea Asia Private Limited

We hereby amend the column to read as follows:

Acquisition of 99.81% of the outstanding shares of Taiwaneseproperty and casualty insurance company “Allianz President General Insurance Co., Ltd.” through Millea AsiaPte. Ltd.

The column corresponding to Fiscal 2005—April in Reference 1 on page 12 of the previous submission read as follows:

Incorporation of “Tokio Marine Newa Insurance Co., Ltd.” as a result of corporate merger between two Taiwanese subsidiaries of Millea Asia Private Ltd. engaged in property and casualty insurance business

We hereby amend the column to read as follows:

Incorporation of “Tokio Marine Newa Insurance Co., Ltd.” as a result of corporate merger between two Taiwanese subsidiaries of Millea AsiaPte. Ltd. engaged in property and casualty insurance business

* * * * *

The full revised document reflecting the above changes is set forth below.

ii

| | |

| | | Item 1 |

(English translation) | | |

| | | November 30, 2005 |

| |

| | | Millea Holdings, Inc. |

Long-Term and Medium-Term Corporate Strategy of Millea Group

Millea Holdings Inc. (President: Kunio Ishihara) was incorporated in April 2002 as the first holding company of a comprehensive insurance group in Japan. Since then, the Millea Group (hereinafter referred to as “the Group”) has actively promoted the development of a network of its domestic property and casualty and life insurance affiliates as well as those of its other businesses through a steady growth of existing businesses, combined with successive corporate mergers and acquisitions. Consequently, in order to further the Group’s strengths and functionalities, it is launching its long-term corporate strategy and a new medium-term corporate strategy called “Stage Expansion 2008”.

1. Medium-to-Long-Term Corporate Vision and the Medium-Term Corporate Strategy called “Stage Expansion 2008”

(1) Medium-to-Long-Term Corporate Vision

The Group continues to emphasize its corporate social responsibilities (hereinafter referred to as “CSR”) as the base of Group management and will seek to continuously improve the Group’s corporate value by enhancing the value delivered to its various stakeholders, including its customers, through its global CSR activities while achieving mutual sustainable growth together with society as a whole.

By making utmost use of the management flexibility achieved by the holding company structure, including entry into general businesses, the Group will actively respond to the new risks and customer needs in the 21st century, building on the Group’s collective strengths in its business domain of global safety and security.

The Group advocates the following medium-to-long-term corporate vision that shall be realized by “revolutionarily changing the traditional notion of insurance” and “creating innovative products and services that will supersede the conventional insurance products”.

The Millea Group aims to become one of the world’s top-tier insurance groups by expanding its insurance business stages.

(2) New Medium-Term Corporate Strategy called “Stage Expansion 2008”

The Group has established a new corporate strategy of expanding its insurance business stages called “Stage Expansion 2008” for the period from fiscal 2006 to fiscal 2008 as a milestone for implementation of its long-term corporate strategy.

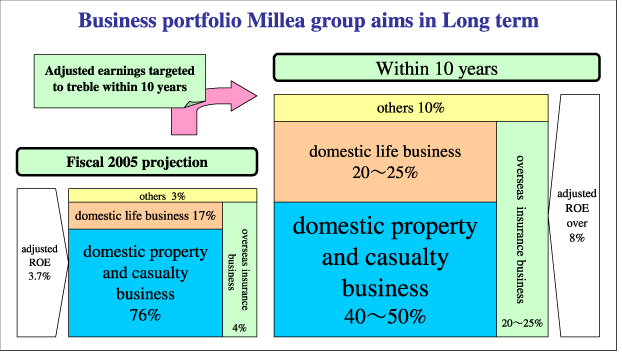

2. Targets of Long and Medium-Term Corporate Strategy

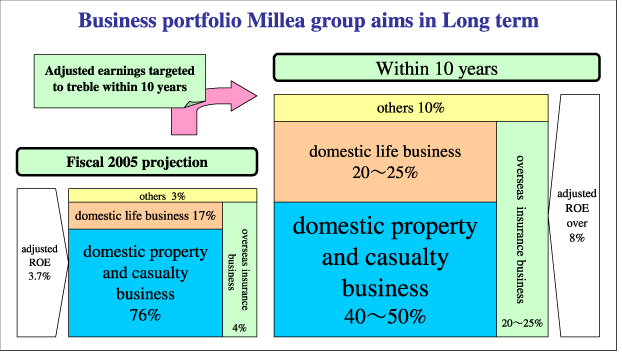

In its new medium-term corporate strategy, the Group aims to generate 190 billion yen in adjusted earnings for fiscal 2008 (a 50% increase when compared to fiscal 2005) and to achieve an adjusted Return on Equity (“ROE”) ratio of approximately 5%, with a goal, within the next 10 years, to increase adjusted earnings three fold from fiscal 2005 base and to improve adjusted ROE to an excess of 8%.

1

| | | | | | | | | | | | | | | | | |

(unit: 100 million yen) |

| | | Fiscal 2005 (Estimate)

| | | Fiscal 2008 (Target)

| | Within 10 years Period (Target)

|

| | | Profit

| | Percentage of Total Profit

| | | Profit

| | Percentage of Total Profit

| | | Profit Growth Ratio

| | Percentage of

Total Profit

| | | Profit Growth Ratio

|

Domestic Property and Casualty Insurance Business | | approx. 955 | | approx. 76 | % | | approx. 1,200 | | approx. 63 | % | | approx. 1.3

times | | 40~50 | % | | approx. 3

times

when

compared to

fiscal 2005 |

Domestic Life Insurance Business | | approx. 220 | | approx. 17 | % | | approx. 400 | | approx. 21 | % | | approx. 1.8

times | | 20~25 | % | |

Overseas Insurance Business | | approx. 55 | | approx. 4 | % | | approx. 250 | | approx. 13 | % | | approx. 4.5

times | | 20~25 | % | |

Financial & General Business | | approx. 35 | | approx. 3 | % | | approx. 50 | | approx. 3 | % | | approx. 1.4

times | | approx. 10 | % | |

Total | | approx. 1,265 | | 100 | % | | approx. 1,900 | | 100 | % | | approx. 1.5

times | | 100 | % | |

Adjusted ROE | | approx. 3.7% | | | approx. 5% | | in excess of 8% |

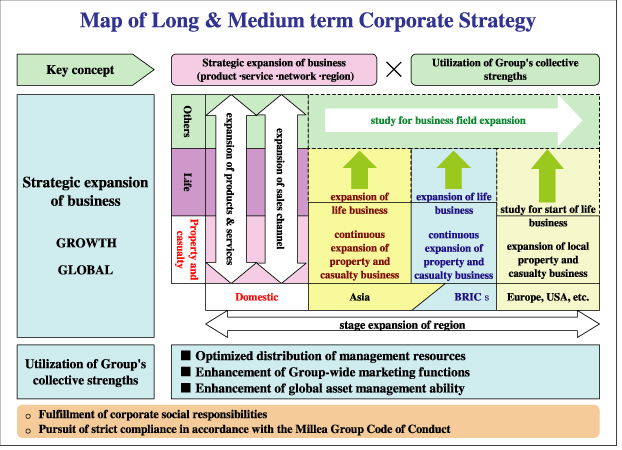

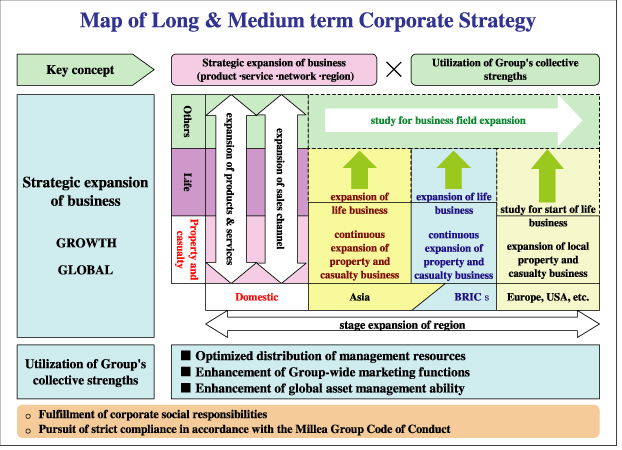

3. Outline of the Medium-to-Long-Term Corporate Strategy

The Group intends to increase its corporate value by “Strategic Expansion of Business Stages” through the Group’s collective strengths based on the fulfillment of its corporate social responsibilities and pursuit of strict compliance.

(1) Strategic expansion of the Group’s business stages from the viewpoints of “Products & Services”, “Sales Channels” and “Global Business Span”

The “Strategic Expansion of Business Stages” comprises expansion of the following three business stages:

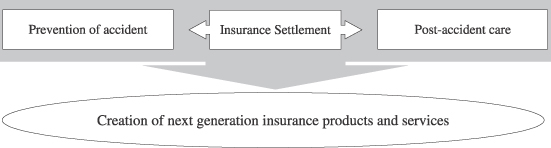

Strategic business expansion of the products and services

By making utmost use of its advantageous holding company structure, the Group aims to provide products and services that correspond to the rapidly diversifying customer needs through the development of innovative products, comprehensive product design with a combination of multiple products and services, enhancement of pre-accident prevention and post-accident care services and strengthening of peripheral services.

Strategic business expansion of the sales channel

In view of the anticipated changes in the financial services market that include the full liberalization of over-the-counter sales of insurance products at banks, the Group aims to establish sales channels that correspond to today’s customer needs based on precise market analysis and well-founded judgment.

Strategic business expansion of the region (global business strategy)

With the combined use of regional internal growth through a careful product design and marketing strategy and strategic options like M&A, equity participations and business alliances, the Group aims to boldly expand its local insurance business on a global scale.

More active penetration into the world’s biggest European and American markets is currently under consideration, following the Group’s entry into Asian and BRICs markets.

2

(2) Bold but orderly promotion of M&A transactions

Building on the Group’s enhanced ability to collect information and to execute M&A transactions, the Group will promote bold but orderly M&A transactions in business sectors that include Overseas Insurance, Financial Services and General Businesses.

(3) Business Renovation Project of the domestic property and casualty insurance that constitutes a core business of the Group

The Group will implement a fundamental renovation of its business processes to improve customer satisfaction and to realize a high quality claim payment services.

The aim of this project is to renovate the business processes utilized both by our agents and the Group, and to implement the reconstruction of the supporting system infrastructure, to ensure proper management and sustainable growth of the Group’s domestic property and casualty insurance business and optimized allocation of management resources among the Group companies.

(4) Utilization of Group’s Collective Strengths

Optimized distribution of management resources

The Group will dynamically allocate its management resources through its “Group-wide Personnel Strategy”, “Group-wide IT strategy” and “Group-wide Capital Strategy”.

Enhancement of group-wide marketing functions

Through a group-wide enhancement of marketing functions, the Group aims to provide products and services that best correspond to customer needs through various sales channels, including channels that exploit the anticipated full liberalization of over-the-counter sales of insurance products at banks.

Enhancement of global asset management ability

The Group will exert its utmost effort to enhance the Group’s global asset management ability, operating on a global scale.

To achieve these strategic goals, the Group will continue to place the highest priority on the pursuit of strict compliance in all aspects of its business activities, in accordance with the Millea Group Code of Conduct.

For further information, please contact:

Shuji Asano

Manager

Corporate Communications and Investor Relations Group

Corporate Planning Dept.

Millea Holdings, Inc.

Phone: 03-5223-3212

3

Exhibit

Specific Measures to Accomplish the Business Goal in the Respective Fields of Business

(Medium-term Corporate Strategy)

1. Domestic Property and Casualty Business

(1) Business performance targets in the Medium-term Corporate Strategy

| | | | | | | | | |

| (unit: 100 million yen) | |

| | | |

| | | Fiscal 2005

(Expected business performance)

| | | Fiscal 2008

(Targeted business performance)

| | | Changes from

Fiscal 2005

| |

Net Premiums Written | | 19,030 | | | 20,500 | | | approx. 8 | % |

Expense ratio | | 30.3 | % | | 29.3 | % | | -1.0 | % |

Adjusted earnings | | 955 | | | 1,200 | | | approx. 25 | % |

(2) Strategic Expansion of Business Stages, Business Renovation Project

1) Strategic business expansion of the product and service stage

Under the Group Corporate Philosophy of “By providing customers with the highest quality of products and service, we will spread safety and security to all around us”, Tokio Marine & Nichido has developed innovative insurance products like “Cho Hoken (Super-Insurance)”, “Total Assist” and “Diabetes-dedicated Casualty Insurance” that have been well received by customers.

With the collective strengths of the Group, Tokio Marne & Nichido will continue to exert its best efforts to establish new business models to respond to customer needs (which goes beyond the traditional notion of insurance in creating innovative additional value relating to pre- and post-accident safety and security) by improving the quality of its products and services, developing revolutionarily innovative products, promoting comprehensive product design through a combination and packaging of its multiple products and services, enhancing its pre-accident prevention and post-accident care services and strengthening its peripheral services.

| | | | | | | | | | | | |

| | | Conventional type

of insurance | | Upgraded insurance coverage | | Risk-reducing service

packaging | | | | Name of existing

products and services | | Group companies in charge of services |

| Case 1 | | Automobile Insurance (Non-Fleet) | | Supplemental insurance coverage for indemnification of sundry expenses associated with personal accident liability Supplemental insurance coverage for attorney fees | | Road assistance service | | ð | | Total Assist | | Millea Mondial (from January 2006) |

| Case 2 | | Automobile Insurance (Non-Fleet) | | Supplemental insurance coverage for the cost of safety measures | | Camera-mounted driving recorder | | ð | | Fleet Accident Reduction Assistance | | Tokio Marine & Nichido Risk Consulting |

| Case 3 | | None | | Supplemental insurance coverage for designated physical disorders | | Lifestyle-improvement assistance service, etc. | | ð | | Diabetes-dedicated Casualty Insurance | | Tokio Marine & Nichido Medical Service |

4

2) Enhancement of distribution network (strategic business expansion of the sales channel stage)

Tokio Marine & Nichido will promote qualitative and quantitative expansion of the sales network of its agencies that have high professional expertise and pragmatic customer-oriented professional skills, by utilizing new channels including but not limited to over-the-counter sales at banks (See Section 3.(1) for more detail).

| | • | | Expansion of sales network |

Tokio Marine & Nichido aims to aggressively expand its sales network of excellent agencies (with a targeted annual increase of 1,200 agencies each year) and actively promote recruiting IPs (in-house trainees, with an annual recruiting target of 1,000 trainees each year.)

| | • | | Reform and collaborative expansion of the existing sales agency network |

Tokio Marine & Nichido will assist its excellent sales agencies that have grown in scale to further expand their sales power. At the same time, Tokio Marine & Nichido will actively promote business alliances between its agencies with an aim to improve their customer-care services and sales productivity.

3) Business Renovation Project

Tokio Marine & Nichido aims to provide more satisfying, expanded products and services by implementing its business expansion strategy in the product and service stage, and to enhance the timely and optimal delivery of such products and services to customers through quantitatively and qualitatively enhanced sales channels by implementing its business expansion strategy in the sales channel stage. In order to achieve these goals, Tokio Marine & Nichido will introduce a fundamental renovation of its business processes and infrastructure (the total investment is expected to amount to 42 billion yen over the three-year period of the Medium-Term Corporate Strategy).

Through this Business Renovation Project, Tokio Marine & Nichido will reconstruct its sales network for its insurance products and services between agencies and Tokio Marine & Nichido in order to realize “Drastic Improvements in Operational Efficiency” and “Revolutionary Changes in Business Procedures with an Optimized Use of Information Technologies”. With the introduction of this Business Renovation, Tokio Marine & Nichido aims to concentrate its management resources on customer-relation matters and to acquire outstanding customer trust for its improved user-friendliness and high-quality claim payment services.

Adjustment, Integration and Simplification of Product Lineup

Tokio Marine & Nichido will make utmost efforts to provide user-friendly products with improved swiftness and accuracy of processing by means of a fully automated processing support system to be used in the calculation of insurance premiums and production of application forms.

Improved Efficiency in the Development of Insurance Products and Services

The aforementioned Business Renovation will enable Tokio Marine & Nichido to realize improved efficiency and flexibility in the development of its products and services.

Innovation of Operational Procedures with the Use of Highly Sophisticated Information Technologies

With the renovation of its agency network system and in-house communication infrastructure, Tokio Marine & Nichido will aim to realize improved group-wide informative communication and work-efficient and paperless management.

5

Standardization of Office Procedures and Improvement in Work Efficiency

With the renovation of its agency network system, Tokio Marine & Nichido will aim to reduce the clerical workload of its sales agencies through the promotion of their self-complete accounting method and cashless insurance premium receipt system so as to enable them to focus on their customers.

Renovation of Business Processes

With the renovation of its agency network system, Tokio Marine & Nichido will enhance the partnership between its employees and agents and improve the performance of its employees and agents.

4) Enhanced Asset Management Profit-Earning Capacity

Tokio Marine & Nichido will aim to enhance its profit-earning capacity in its asset management operations, which constitutes, together with its insurance underwriting business, a core profit source, through initiatives such as absolute return investment.

6

2. Domestic Life Insurance Business

(1) Business performance targets in the Medium-term Corporate Strategy

1) Tokio Marine & Nichido Life Insurance (hereinafter referred to as “TMN Life”)

<Business performance targets in the Medium-Term Corporate Strategy of TMN Life>

| | | | | | | |

| | | (unit: 100 million yen) | |

| | | Fiscal 2005

(Expected business performance)

| | Fiscal 2008

(Targeted business performance)

| | Changes from

Fiscal 2005

| |

ANP* | | 573 | | approx. 800 | | approx. 40 | % |

EV** increase | | 230 | | approx. 300 | | approx. 30 | % |

Insurance premium revenue | | 4,168 | | approx. 6,450 | | approx. 55 | % |

| * | ANP: Annualized premiums for new policies |

2) Tokio Marine & Nichido Financial Life Insurance (hereinafter referred to as “Financial Life”)

<Business performance targets in the Medium-Term Corporate Strategy of Financial Life>

| | | | | | | |

| | | (unit: 100 million yen) | |

| | | Fiscal 2005

(Expected business performance)

| | Fiscal 2008

(Targeted business performance)

| | Changes from

Fiscal 2005

| |

ANP | | 282 | | approx. 290 | | approx. 3 | % |

EV increase | | -8 | | approx. 90 | | — | |

Insurance premium revenue | | 2,939 | | approx. 2,960 | | approx. 1 | % |

(2) Strategic Expansion of Business Stages

1) Strategic business expansion in the product and service stage

TMN Life has introduced innovative products like “Nagawari” and “Mittsu-no-anshin”, and also provided products designed to meet specific customer needs, such as “Anshin Amulet”, a medical insurance product exclusively for women, and “Anshin Iryou Plus”, covering cancer, stroke and heart attack. TMN Life will continue to deliver innovative products that respond to customer needs. Financial Life will provide customers with highly competitive and profitable products and services in a responsive manner, aiming to be one of the top-tier players in the variable annuity market.

2) Strategic business expansion in the sales channel stage

While positioning the conventional cross-selling by insurance agents as its core sales channel, TMN Life will also actively promote a multi-channel sales strategy that incorporates the use of Life Partners* or Life Professionals** and the adoption of over-the-counter sales at banks and mail order sales. By employing such sales strategies, TMN Life will aim at expanding its insurance premium revenue by fiscal 2008 (a targeted 40% increase when compared to fiscal 2005 in terms of ANP) and improving its earning potential (a targeted 30% increase when compared to fiscal 2005 in terms of EV increase).

Life-insurance-dedicated sales agents with high professional skills rendering sales consultant services mainly with respect to first sector life insurance.

Independent sales agents, the majority of whose business is life insurance.

7

Financial Life aims to increase the number of banks distributing its products, while enhancing the support infrastructure, to play a leading role in the Group with respect to over-the-counter sales at banks.

3) Business Renovation Project

Like Tokio Marine & Nichido, TMN Life will also introduce a fundamental renovation in its business processes and infrastructure, and, from the viewpoint of improved user-friendliness for customers and agents, will promote the cashless insurance premium receipt system and a renovation of its agency network system.

4) Enhanced Asset Management Profit-Earning Capacity

TMN Life and Financial Life aim to continue to earn stable investment income by enhancing the capacity of their asset and liability management.

3. Common Trends in Property and Casualty and Life Insurance

(1) Strategy for liberalization of over-the-counter sales of insurance products at banks

The Group, through its group companies such as Tokio Marine & Nichido, TMN Life and Financial Life, has been providing a broad range of highly innovative products and services which meet various needs of customers, including but not limited to, management of defined contribution pension plans, variable annuity, investment trust, weather derivatives and risk consulting service. The Group’s products and services have been highly received by customers and by financial institutions that undertake consignment sales.

<Example>

Tokio Marine & Nichido developed a state of the art service, comprehensive plans, in defined contribution pension plans for corporate customers. The number of all the customers in defined contribution pension plans, including those not yet formally approved, exceeded 1,000 as of the end of August, 2005.

It is the strength of the Group to design packages that will best fit the individual needs of respective financial institutions, consisting of products and services utilizing the group companies’ specialty. The Group will continue to take advantage of the Group’s collective strength, keeping in mind the anticipated full liberalization of over-the-counter sales of insurance products at banks scheduled to take place in December 2007.

Specifically, the Group intends to (i) increase the number of banks distributing the Group’s insurance products by closely addressing the individual needs of respective banks, (ii) adopt product design and marketing strategies that enable the Group to respond effectively and expeditiously to the individual needs of respective banks and (iii) develop sales support strategies that will create considerable advantages in over-the-counter sales at banks by reinforcing front- and back-office human resources and functions.

(2) Third sector strategy

With its successful business experience of realizing stable and continuous sales performance through consulting sales, the Group will continue to provide highly competitive products and services that will best fit the needs and characteristics of respective sales channels by making utmost use of intrinsic features of life and non-life insurance products.

8

In preparation for the scheduled full liberalization of over-the-counter sales of insurance products at banks, the Group will strive to develop innovative insurance products both in life and non-life insurance so as to meet the product needs of respective banks.

Sales target

| | | | |

<Estimated sales in fiscal 2005> | | | | <Targeted sales in fiscal 2008> |

Number of insurance policies sold: | | | | |

260,000 policies | | ð | | 60% increase when compared to fiscal 2005 |

Insurance premium revenue: | | | | |

52 billion yen | | ð | | 70% increase when compared to fiscal 2005 |

4. Overseas Insurance Business

With the combined use of a regional-oriented internal growth strategy and capital-market-oriented growth strategies like M&A, equity participations and business alliances, the Group will boldly expand its business not only in the businesses of Japanese-origin but also in local markets.

<Business performance targets in the Medium-Term Corporate Strategy of overseas insurance >

| | | | |

| | | (unit: 100 million yen) |

| | | Business performance in fiscal 2005 (Estimate)

| | Targeted business performance in fiscal 2008

|

Asia | | 5 | | 30 |

Property and Casualty Insurance | | 20 | | 25 |

Life Insurance | | -15 | | 5 |

North and Central America | | 50 | | 40 |

Europe, Africa and Middle East | | 10 | | 20 |

South America | | 20 | | 40 |

Property and Casualty Insurance | | 15 | | 30 |

Life Insurance | | 5 | | 10 |

Other territories | | 5 | | 5 |

Total profit from original contracts | | 90 | | 135 |

Total cost of reinsurance | | -30 | | 115 |

| | |

| |

|

Total adjusted earnings | | 55 | | 250 |

| | |

| |

|

In India, one of the BRIC countries, the Group has already become a top-tier foreign-owned property and casualty insurance company, and in China, another BRIC country, it is steadily growing its life insurance business, in addition to its property and casualty business, through the establishment of 19 offices all over the country and active utilization of banks as its sales channel. Moreover, the Group will continue to expand its business both in the local life and non-life insurance businesses in Taiwan, Thailand and Malaysia. In 2005, the Group acquired a large local insurance group in Brazil and will promote sales of its personal life, pension and non-life insurance products, through local banks with about 1,500 branches in addition to its conventional sales channels.

The Group will also actively engage in the local development of Muslim-style insurance (Takaful) business in Islamic countries.

In the European-American developed market, the Group will boldly expand its local insurance business primarily in the field of commercial property and casualty insurance by making a combined use of regional-oriented internal growth strategy and capital market-oriented growth strategies like M&A, equity participations and business alliances.

9

5. Financial Business

The Company will aim at realizing approximately 3 billion yen in profits net of taxes in fiscal 2008 by mainly promoting the development of its asset management business, where high synergy effects generated from the combination of domestic and overseas insurance business experiences are expected most effectively.

Financial Business-related Companies in Millea Group (as of September 2005)

| | |

Tokio Marine Asset Management (Investment advisory business) | | It intends to increase its trust assets with an increased number of fiduciary contracts with public sector investors in its investment advisory business and expanded sales of investment trust products. |

Tokio Marine Capital (Private equity investment) | | It intends to carry out quality investments and promote the continuous setting-up of buyout funds and growth funds. |

Tokio Marine Financial Solutions (Financial derivatives business) | | Based on appropriate risk management system, it intends to expand and upgrade its financial products and services, including the fund-raising arrangement through Private Finance Initiative (PFI) scheme. |

Tokio Marine Investment Services (Private equity investment in Asia) | | It intends to set up and manage investment funds for unlisted stocks of Asian business enterprises. |

Millea Real Estate Risk Management (Real estate investment advisory business) | | It intends to acquire high quality properties and continuously set up attractive real estate funds. |

10

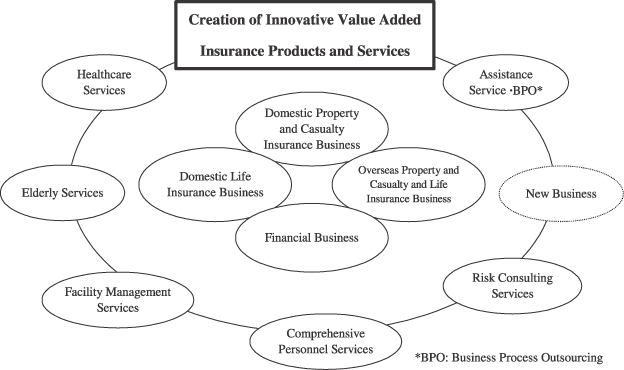

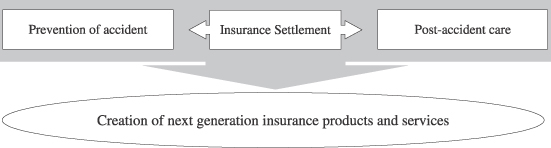

6. General Business

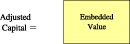

In order to respond to diversifying customer needs for innovative insurance products relating to pre- and post-accident safety and security, the Group will strive to create innovative additional value through active business development of next generation insurance which goes beyond the traditional notion of insurance.

| | |

Business Fields

| | Principal Group Companies

|

| |

| Comprehensive Personnel Services | | Tokio Marine & Nichido Career Service |

| |

| Facility Management Services | | Tokio Marine & Nichido Facilities |

| |

| Risk Consulting Services | | Tokio Marine & Nichido Risk Consulting |

| |

| Healthcare Services | | Tokio Marine & Nichido Medical Service (International Assistance) |

| |

| Elderly Services | | Tokio Marine & Nichido Better Life Service Tokio Marine & Nichido Samuel (Starting from Feb. 2006) |

| |

| Assistance Service, BPO | | International Assistance, Millea Mondial (Starting from Jan. 2006) |

11

Reference 1

Corporate History of Millea Group

| | | | | | | | |

| | | | | Domestic Insurance Business | | Overseas Insurance Business | | Financial & General Business |

| Fiscal 2002 | | April | | Incorporation of Millea Holdings, Inc. |

| | December | | | | Establishment of “Millea Asia Pte. Ltd.” | | |

| | | | | 30% equity participation in Taiwanese property and casualty insurance company called “Newa Insurance Co., Ltd.” through Millea Asia Pte. Ltd. | | |

| Fiscal 2003 | | February | | | | | | Establishment of “Millea Real Estate Risk Management Co., Ltd.” |

| | July | | | | | | Incorporation of Tokio Marine & Nichido Career Service Co., Ltd. as a result of corporate merger among four personal service related companies |

| | October | | Incorporation of Tokio Marine & Nichido Life Insurance Co., Ltd. as a result of corporate merger between Tokio Marine Life and Nichido Life | | | | |

| | November | | | | Commencement of business in Shanghai of Sino Life Insurance Co., Ltd. with Millea Group’s 24.9% capital participation | | |

| Fiscal 2004 | | February | | Acquisition of all outstanding shares of Scandia Life Insurance Corp. through Tokio Marine & Fire Insurance Co., Ltd. (In April of 2004, the company name was changed to “Tokio Marine & Nichido Financial Life Insurance Co., Ltd.”) | | | | |

| | September | | | | Acquisition of 99.81% of the outstanding shares of Taiwanese property and casualty insurance company “Allianz President General Insurance Co., Ltd.” through Millea Asia Pte. Ltd. | | |

| | October | | Incorporation of “Tokio Marine & Nichido Fire Insurance Co., Ltd.” as a result of corporate merger between Tokio Marine & Fire Insurance Co., Ltd. and Nichido Fire & Marine Insurance Co., Ltd. | | | | |

| Fiscal 2005 | | April | | | | Incorporation of “Tokio Marine Newa Insurance Co., Ltd.” as a result of corporate merger between two Taiwanese subsidiaries of Millea Asia Pte. Ltd. engaged in property and casualty insurance business | | |

| | July | | | | Acquisition of Brazilian insurance subsidiary of Dutch major financial conglomerate ABN-AMRO | | |

| | October | | | | | | Making Tokan Corp. as direct subsidiary and changing its name to “Tokio Marine & Nichido Facilities Co., Ltd.” |

| | November | | | | | | Announcement of a scheduled 50% equity participation in an assistance service company called “AS 24 Co., Ltd.” in January 2006 and subsequent corporate name change to “Millea Mondial Co., Ltd.” |

| | | | | | | Announcement of a scheduled 49% equity participation in an institutional nursing care service company called “Samuel Corp.” in February 2006 and subsequent corporate name change to “Tokio Marine & Nichido Samuel Co., Ltd.” |

12

Reference 2

13

| | | | |

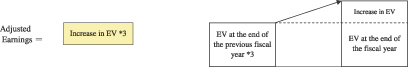

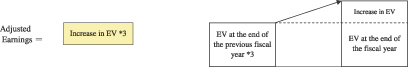

| | | Adjusted Earnings and Adjusted ROE | | Reference 3 |

Adjusted ROE = Adjusted earnings ÷Adjusted capital

1. Earnings (net of taxes)

(1) Property and casualty insurance business

(2) Domestic and overseas life insurance business *4

(3) Overseas property and casualty insurance and other businesses... Net income shown in financial statements

| *1 | Negative figures in case reversal of extraordinary reserve or reserve for price fluctuation. |

| *2 | Realized and unrealized gain(losses) arising from bond securities and interest rate swap transactions utilized in asset liability management. |

Sum of value of in-force business and shareholder equity of life insurance company.

(Commonly used for life insurers in Europe.)

| *4 | Net income as shown in (3) for life insurance business in Brazil. |

2. Capital (Average capital of the beginning and the end of fiscal year, net of taxes)

(1) Property and casualty insurance business

(2) Domestic Life insurance business

(3) Overseas property and casualty and life insurance and other businesses … Capital shown in financial statements

14