SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

Dated May 24, 2006

Commission File Number: 0-31376

MILLEA HOLDINGS, INC.

(Translation of Registrant’s name into English)

Tokyo Kaijo Nichido Building Shinkan,

2-1, Marunouchi 1-chome,

Chiyoda-ku, Tokyo 100-0005, Japan

(Address of principal executive offices)

Indicate by check mark whether the Registrant files or will file

annual reports under cover of Form 20-F or Form 40-F:

Form 20-F [X] Form 40-F [ ]

Indicate by check mark whether the Registrant by furnishing

the information contained in this form is also thereby furnishing

the information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes [ ] No [X]

Table of Documents Submitted

| | | | |

| | | The information contained herein includes certain forward-looking statements that are based on our current plans, targets, expectations, assumptions, estimates and projections about our businesses and operations. These forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and actual results may materially differ from those contained in the forward-looking statements as a result of various factors. For a discussion of the factors which may have a material impact upon our financial condition, results of operation and liquidity, see our annual report on Form 20-F for the fiscal year ended March 31, 2005. | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | |

| | KABUSHIKI KAISHA MILLEA HOLDINGS |

| | (Millea Holdings, Inc.) |

| | |

| May 24, 2006 | | By: | | /s/ TAKASHI ITO |

| | | | General Manager, |

| | | | Corporate Legal Department |

Item 1

(English translation)

May 24, 2006

Millea Holdings, Inc.

FY2006 Business Plan of the Millea Group

Millea Holdings, Inc. (“Millea Holdings”, President and Director: Kunio Ishihara), has announced its business plan for the fiscal year ending March 31, 2007 (“FY2006”).

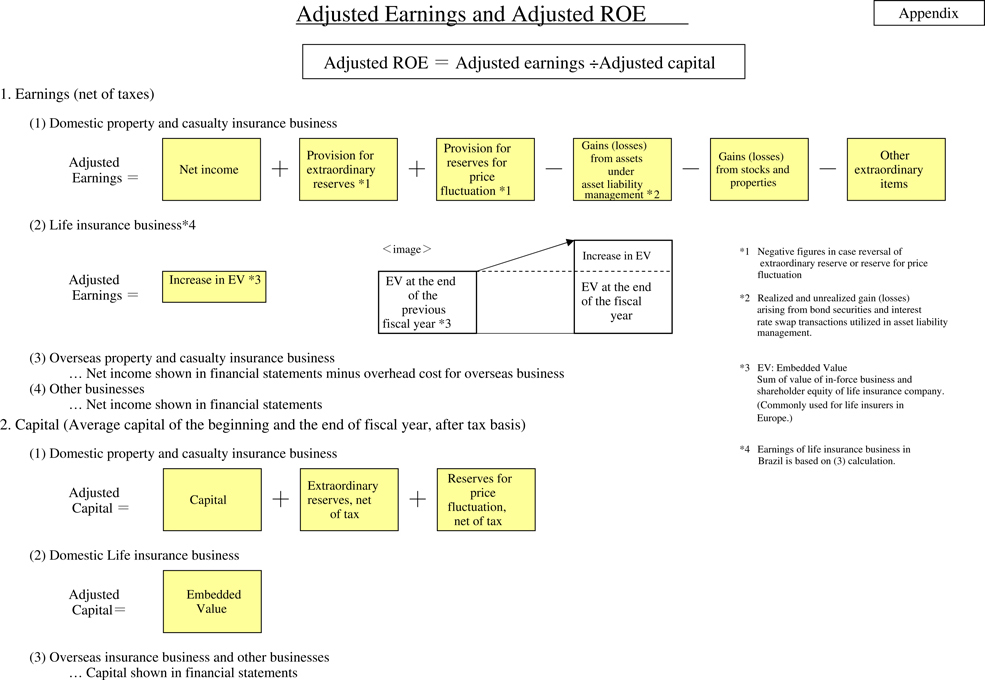

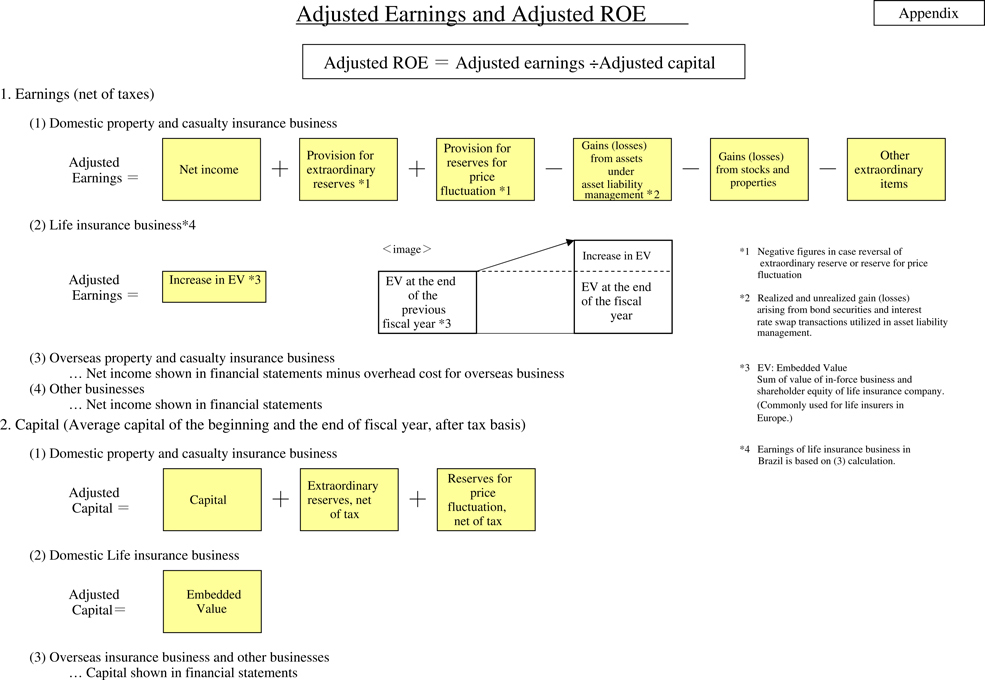

In the fiscal year ended March 31, 2006 (“FY2005”), the Millea Group actively promoted a profit increase in its domestic insurance business and the expansion of its business domain in the overseas insurance business as well as the financial business and other peripheral businesses. The Millea Group achieved 177.0 billion yen in adjusted earnings and 4.7% adjusted ROE for FY2005. The increase in adjusted earnings is attributable primarily to an increase in sales of variable benefit pension insurance and changes in the assumptions used in life insurance EV profit calculation. Excluding the impact of changes in the assumptions used in life insurance EV profit calculation, the Millea Group acheived 138.7 billion yen in adjusted earnings and 3.7% adjusted ROE.

In FY2006, the Millea Group aims to grow its domestic property and casualty insurance business, which is the key business in terms of earnings, its domestic life insurance business, which is the driving force of growth, and its overseas insurance business and other peripheral businesses. The Millea Group targets 165.5 billion yen in adjusted earnings and 3.9% adjusted ROE in FY2006.

1

(Yen in billions)

| | | | | | | | | |

Adjusted earnings by business segment | | Business Plan for FY2005 | | | Actual results FY2005 | | | Business Plan for FY2006 | |

Domestic property and casualty insurance business | | 95.5 | | | 91.5 | | | 104.0 | |

Domestic life insurance business | | 22.0 | | | 72.9 | | | 39.8 | |

Tokio Marine & Nichido Life | | 23.0 | | | 57.5 | | | 26.8 | |

Tokio Marine & Nichido Financial Life | | -0.8 | | | 15.4 | | | 13.0 | |

Overseas insurance business | | 5.5 | | | 7.7 | | | 19.0 | |

Asia | | 0.5 | | | 1.3 | | | 1.3 | |

North America | | 5.0 | | | 5.1 | | | 5.2 | |

Europe & Middle east | | 1.0 | | | 2.7 | | | 1.5 | |

South America | | 2.0 | | | 3.3 | | | 4.2 | |

Others | | 0.5 | | | 1.2 | | | 1.4 | |

Reinsurance | | -3.0 | | | -5.2 | | | 6.3 | |

Financial and other businesses | | 3.5 | | | 4.9 | | | 2.8 | |

| | | | | | | | | |

Group Total | | 126.5 | | | 177.0 | | | 165.5 | |

| | | | | | | | | |

Adjusted ROE | | 3.7 | % | | 4.7 | % | | 3.9 | % |

|

Excluding the impact of changes of assumptions used in life insurance EV profit calculation | |

Domestic life insurance business | | | | | 34.6 | | | | |

Tokio Marine & Nichido Life | | | | | 29.4 | | | | |

Tokio Marine & Nichido Financial Life | | | | | 5.2 | | | | |

| | | | | | | | | |

Group Total | | | | | 138.7 | | | | |

| | | | | | | | | |

Adjusted ROE | | | | | 3.7 | % | | | |

|

Details of the above impact of changes in the assumption used in life insurance EV profit calculation are as follows: | |

Tokio Marine & Nichido Life | | | | | | | | | |

Changes in the assumptions used in life insurance EV (note 1) | | | | | 28.7 | | | | |

Changes in interest rates | | | | | -0.6 | | | | |

Tokio Marine & Nichido Financial Life | | | | | | | | | |

Changes in the assumptions used in life insurance EV (note 2) | | | | | 0.8 | | | | |

Changes in interest rates, stock price and exchange rate | | | | | 6.8 | | | | |

Changes in reduction of capital cost due to subordinated loan | | | | | 2.7 | | | | |

(note 1) Changes in the frequency of death occurrence, rate of surrender and assumption of expense

(note 2) Change in the rate of surrender

| * | In order to capture the corporate value of the Millea Group and to aim for the enhancement thereof, the management uses “adjusted earnings” to determine adjusted income and adjusted ROE (see Appendix for details). |

| * | See next page for business performance indices for each major business segment. |

2

Business performance indices for major business segments

1.Domestic property and casualty business

Indices for Tokio Marine & Nichido Fire Insurance Co., Ltd. are as follows:

(Yen in billions)

| | | | | | |

| | | FY2005 (plan) | | FY2005 (actual) | | FY2006 (plan) |

Net premiums written | | 1,903.0 <1,756.7> | | 1,892.7 <1,746.1> | | 1,920.0 |

Expense ratio (%) | | 30.3 < 32.9> | | 30.2 < 32.8> | | 30.6 |

Adjusted earnings | | 95.0 | | 91.2 | | 102.3 |

| * | Figures in < > exclude the impact of revisions to the Compulsory Automobile Liability Insurance regulations. |

2.Domestic life insurance business

Indices for Tokio Marine & Nichido Life Insurance Co., Ltd. and Tokio Marine & Nichido Financial Life Insurance Co., Ltd. are as follows:

(Yen in billions)

| | | | | | |

| | | FY2005 (plan) | | FY2005 (actual) | | FY2006 (plan) |

Annualized premiums for new policies | | 85.5 | | 88.4 | | 115.6 |

Tokio Marine & Nichido Life | | 57.3 | | 45.6 | | 55.6 |

Tokio Marine & Nichido Financial Life | | 28.2 | | 42.8 | | 60.0 |

| * | Annualized premiums for new policies are derived by dividing the aggregate amount of premiums by the duration of insurance policies to show the amount of premiums per year. |

3

3.Overseas insurance business

We continue to position Asia as a main market in the overseas insurance business with high growth and profitability potential. We also intend to expand insurance operations in the Brazil, Russia, India and China group of countries, or BRICs, where the economy and the insurance market are expected to grow significantly. The indices for the overseas insurance business are as follows:

(Yen in billions)

| | | | | | |

| | | FY2005 (plan) | | FY2005 (actual) | | FY2006 (plan) |

Net premiums written | | 229.3 | | 240.2 | | 284.5 |

Asia | | 43.7 | | 47.1 | | 70.2 |

North America | | 51.2 | | 52.3 | | 56.7 |

Europe, Middle east | | 13.5 | | 13.5 | | 17.1 |

South America | | 86.2 | | 87.3 | | 96.3 |

Others | | 6.0 | | 6.9 | | 8.8 |

Reinsurance | | 28.7 | | 32.9 | | 35.4 |

| * | Net premiums written are calculated taking into account the ratio of respective equity interest of Millea Holdings in each local subsidiary. |

For further information, please contact:

Kazuyuki Nakano

Corporate Communications and Investor Relations Group

Corporate Planning Dept.

Millea Holdings, Inc.

Phone: 03-5223-3213

4

Item 2

(English translation)

May 24, 2006

Millea Holdings, Inc.

2-1 Marunouchi 1-chome, Chiyoda-ku, Tokyo

TSE code number: 8766

Announcement regarding distribution of profits to shareholders

Millea Holdings, Inc. has been stepping up efforts to make distributions of profits to shareholders by paying cash dividends and repurchasing its own shares. On May 24, 2006, the Board of Directors adopted the following resolutions regarding the payment of interim cash dividends for the fiscal year ending March 31, 2007 and the share repurchases with an annual ceiling.

1. Payments of interim cash dividends

Even though the Company has had a system in place to pay interim cash dividends to shareholders registered as of September 30 each year, it has never paid such dividends in the past. On May 24, 2006, the Company resolved to pay interim cash dividends starting with the fiscal year ending March 31, 2007 in line with its efforts to make distributions of profits to its shareholders when possible.

In late November 2006, the Board of Directors will approve the payment and the amount of interim cash dividends.

(Reference) Expected cash dividends

| | | | | | | | | |

| | | Interim cash dividends per share | | | Cash dividends per share at year-end | | | Annual cash dividends per share | |

Forecast for the fiscal year ending March 31, 2007 | | 15.00 | yen | | 15.00 | yen | | 30.00 | yen |

At the meeting of the Board of Directors held on May 19, 2006, the Company resolved a split of its shares of common stock (one share into 500 shares). The per share cash dividends shown above reflect the stock split. At the same meeting, the Company also resolved to introduce a unit share system. The number of shares per one unit of shares will be 100 shares on and after October 2, 2006.

2. Share repurchases with an annual ceiling

The Company announced that, on May 24, 2006, its board of directors approved repurchases of its own shares with an annual ceiling on share repurchases at 150 billion yen during the period between June 29, 2006 and the Company’s 5th Ordinary General Meeting of Shareholders scheduled for June 2007. A part of Company’s shares repurchased under this plan will be used for a stock-for-stock exchange announced on May 19, 2006 by the Company to make The Nisshin Fire & Marine Insurance Co., Ltd. its wholly-owned subsidiary.

Based on this plan of share repurchases with an annual ceiling, the Board of Directors will set the maximum aggregate purchase price and its maximum aggregate number of shares to be repurchased for each period in which repurchases may be made, pursuant to Article 165, paragraph 2 of the Corporation Law. The Company may modify this plan of share repurchases, depending upon fluctuations in share prices of the Company and changes in expected future environment surrounding the Company.

For further information, please contact:

Kazuyuki Nakano

Corporate Communications and Investor Relations Group

Corporate Planning Dept.

Millea Holdings, Inc.

Phone: 03-5223-3213

| | |

| | Item 3 |

| (English translation) | | |

| | May 24, 2006 |

| Millea Holdings, Inc. | | |

| 2-1 Marunouchi 1-chome, Chiyoda-ku, Tokyo | | |

| TSE code number: 8766 | | |

Proposed amendments to the Articles of Incorporation

Millea Holdings, Inc. (the “Company”) announced that, at the meeting of the Board of Directors held on May 24, 2006, it resolved to propose for approval at the 4th Ordinary General Meeting of Shareholders to be held on June 28, 2006 amendments to the Articles of Incorporation as set forth below.

The Company intends to propose that certain amendments be made to the Articles of Incorporation as of June 28, 2006, September 30, 2006 and October 2, 2006, respectively.

Proposals for amendments as of June 28, 2006

1. Reasons for the amendments

| (1) | In accordance with the enforcement of the Corporation Law (Law No. 86, 2005), Law for Maintenance, etc. of Relevant Laws relating to the Enforcement of the Corporation Law (Law No. 87, 2005, hereinafter referred to as the “Maintenance Law”), Enforcement Regulations of the Corporation Law (Ministry of Justice Ordinance No. 12, 2006) and Regulations for Financial Statements of Corporations (Ministry of Justice Ordinance No. 13, 2006) on May 1, 2006, the Company intends to amend the Articles as follows. |

| | (i) | Certain Articles are inserted or amended to reflect the changes which are deemed to have been made at the time of enforcement of the Corporation Law. (Article 4, Article 8 and Article 10, paragraph 1.) |

| | (ii) | As the restriction regarding the venue of general meetings of shareholders was abolished, an Article is amended so that general meetings of shareholders may be convened within any of the wards of the Metropolis of Tokyo. (Article 14, paragraph 2.) |

| | (iii) | In order to diversify the means to provide information to shareholders, a new Article is inserted to the effect that the Company may be deemed to have provided shareholders with necessary information required to be described or presented in reference materials for general meetings of shareholders, business reports and non-consolidated and consolidated financial statements, if it is disclosed via the Internet. (Article 16.) |

| | (iv) | An Article is amended to stipulate the number of proxy through whom a shareholder may exercise his/her voting rights. (Article 18.) |

| | (v) | In order to make timely decisions at the Board of Directors of the Company, a new paragraph is inserted so that if and when all of the Directors express their approval in writing or by electronic means with respect to any matter to be resolved by the Board of Directors, and when none of the corporate auditors raises an objection thereto, it shall be deemed as a valid resolution of the Board of Directors to approve such matter. (Article 25, paragraph 2.) |

1

| | (vi) | In order to facilitate the appointment of suitable persons as outside directors and outside corporate auditors and their fulfillment of their roles, new Articles are inserted so that the Company may enter into an agreement with outside directors and outside corporate auditors to limit their liability in accordance with the provisions of Article 427, paragraph 1 of the Corporation Law. (Article 27 and Article 36.) |

Each of the corporate auditors has given consent to the insertion of Article 27.

| | (vii) | Since the powers of the Board of Directors and those of corporate auditors are evident by Article 362, paragraph 2 and Article 390, paragraph 2 of the Corporation Law, current Articles 20 and 29 of the Articles of Incorporation are deleted entirely. |

| | (viii) | Other necessary amendments are made, such as changes in terminology and quotations in accordance with the Corporation Law, changes in words and phrases and renumbering of Articles. |

| (2) | In order to enhance accessibility and efficiency of the Company’s public notices, an Article is amended so that the Company’s public notices shall be given by electronic means, except in the event that electronic public notices cannot be provided due to an accident or other unavoidable circumstances, in which case other means of public notices will be utilized. |

| (3) | An Article is amended to reflect a decrease in the number of shares authorized to be issued, due to the cancellation of 40,000 shares of the Company’s common stock on March 28, 2006. (Article 6.) |

2. Details of the amendments

The details of the amendments are as shown in appendix 1.

3. Schedule for the amendments

The date of the General Meeting of Shareholders: June 28, 2006.

Effective date of the amendments: June 28, 2006.

2

Proposals for amendments as of September 30, 2006 and October 2, 2006

1. Reasons for the amendments

In order to broaden investor base through lowering the unit price of the shares and to facilitate investment activities, the Company resolved as follows at the meeting of its Board of Directors held on May 19, 2006.

| (1) | A one to five hundred stock split shall be made for its shares of common stock as of September 30, 2006 and the Articles of Incorporation of the Company shall be amended to the effect that the total number of shares authorized to be issued by the Company shall be 3,300,000,000 shares as of the same date. |

| (2) | Simultaneously with the above stock split, a unit share system shall be introduced. One unit of shares of the Company shall consist of 500 shares, and a new Article shall be inserted in its Articles of Incorporation to that effect. |

| (3) | An Article shall be amended to the effect that the number of shares constituting one unit of shares shall be 100 shares as of October 2, 2006. |

The changes described in (1), (2) and (3) above can be effected by the resolutions of the Board of Directors pursuant to Article 183, Article 184, paragraph 2, Article 191 and Article 195, paragraph 1 of the Corporation Law. In addition to these changes, other amendments to the Articles of Incorporation shall be made in order to reflect the changes which are deemed to have been made in accordance with Article 86, paragraph 2 of the Maintenance Law, and to accomodate the introduction of the unit share system.

2. Details of the amendments

The details of the amendments are as shown in appendix 2.

3. Schedule for the amendments

The date of the General Meeting of Shareholders: June 28, 2006.

Effective date of the amendments: September 30, 2006 and October 2, 2006.

For further information, please contact:

Kazuyuki Nakano

Corporate Communications and Investor Relations Group

Corporate Planning Dept.

Millea Holdings, Inc.

Phone: 03-5223-3213

3

Appendix 1

Amendments as of June 28, 2006

Proposed amendments are set forth below:

Insertion of the new Article 4.

Proposed amendment:

(Organs)

Article 4.

The Company shall have the following organs:

1. Board of Directors;

2. Corporate Auditors;

3. Board of Corporate Auditors; and

4. Accounting Auditors

Article 4.

Current article:

(Method of giving public notices)

Article 4.

The Company’s public notices shall appear in the newspaperThe Nihon Keizai Shimbun, which is published in the Metropolis of Tokyo.

Proposed amendment:

(Method of giving public notices)

Article 5.

The Company’s public noticesshall be given by electronic means. However, in the event that electronic public notices cannot be provided due to an accident or other unavoidable circumstances, public notices shall appear in the newspaperThe Nihon Keizai Shimbun, which is published in the Metropolis of Tokyo.

Article 5.

Current article:

(Total number of shares to be issued)

Article 5.

The total number of the shares authorized to be issued by the Company shall be 6,870,000. However, in the case of any redemption of shares, the total number of shares authorized to be issued shall be decreased by a number of shares equal to the number being redeemed.

Proposed amendment:

(Total number of shares to be issued)

Article 6.

The total number of the shares authorized to be issued by the Company shall be6,830,000.

4

Article 6.

Current article:

(Acquisition by the Company of its own shares)

Article 6.

The Company may, by resolution of the Board of Directors, repurchase its own shares pursuant to Article 211-3, paragraph 1, item 2 of the Commercial Code.

Proposed amendment:

(Acquisition by the Company of its own shares)

Article 7.

The Company may, by resolution of the Board of Directors,acquire its own shares pursuant toArticle 165, paragraph 2 of the Corporation Law.

Insertion of the new Article 8.

Proposed amendment:

(Issuance of share certificates)

Article 8.

The Company shall issue share certificates representing its issued shares.

Article 7.

Current article:

Article 7. [Omitted]

Proposed amendment:

Article 9. [Not amended except for the article number]

Article 8.

Current article:

(Transfer agent)

Article 8.

The Company shall have a transfer agent with respect to its shares and fractional shares.

2. The transfer agent and its business office shall be selected by resolution of the Board of Directors, and public notice shall be given thereof.

3. The register of shareholders (which term, when used throughout these Articles of Incorporation, shall include the register of beneficial shareholders), the register of holders of fractional shares and the register of lost share certificates of the Company shall be kept at the transfer agent’s business office. Registration of transfers of shares, entries, including entries by electronic means, in the register of fractional shares and the register of lost share certificates, purchases and additional purchases of fractional shares and any other business relating to the Company’s shares and fractional shares shall be handled by the transfer agent and not by the Company.

5

Proposed amendment:

(Share registrar)

Article 10.

The Company shall have ashare registrar.

2. Theshare registrar and its business office shall beappointed by resolution of the Board of Directors, and public notice shall be given thereof.

3.The preparation and keeping of the register of shareholders (which term, when used throughout these Articles of Incorporation, shall include the register of beneficial shareholders),the register of stock acquisition rights and the register of lost share certificates of the Company, and other businesses relating to the register of shareholders, the register of stock acquisition rights and the register of lost share certificates, shall be delegated to the share registrar and shall not be handled by the Company.

Insertion of the new Article 11.

Proposed amendment:

(Transfer agent of the register of fractional shares)

Article 11.

The Company shall have a transfer agent with respect to its fractional shares.

2. The transfer agent and its business office shall be appointed by resolution of the Board of Directors, and public notice shall be given thereof.

3. The register of fractional shares of the Company shall be kept at the transfer agent’s business office. The making of entries, including entries by electronic means, in the register of fractional shares, purchases and additional purchases of fractional shares and any other business relating to the Company’s fractional shares shall be delegated to the share registrar and shall not be handled by the Company.

Article 9.

Current article:

(Share Handling Regulations)

Article 9.

The denominations of share certificates to be issued by the Company, the registration of transfers of shares, the making of entries, including entries by electronic means, in the register of fractional shares and the register of lost share certificates, purchases and sales of fractional shares and any other proceedings concerning the Company’s shares and fractional shares, including the fees therefor, shall be governed by the Share Handling Regulations adopted by the Board of Directors from time to time.

Proposed amendment:

(Share Handling Regulations)

Article 12.

The denominations of share certificates to be issued by the Company, the making of entries, including entries by electronic means, inthe register of shareholders, the register of fractional shares and the register of lost share certificates, purchases and additional purchases of fractional shares and any other proceedings concerning the Company’s shares, including the fees therefor, shall be governed by the Share Handling Regulations adopted by the Board of Directors from time to time.

6

Article 10.

Current article:

(Record date)

Article 10.

Shareholders having voting rights who appear in the register of shareholders, including those recorded by electronic means, as of the close of business on March 31 in each year shall be treated by the Company as the shareholders entitled to exercise rights at the ordinary general meeting of shareholders relating to the business year ending on that March 31.

2. In addition to the preceding paragraph, the Company may, by giving prior public notice in accordance with a resolution of the Board of Directors, treat the shareholders or the registered pledgees appearing in the register of shareholders, including those recorded by electronic means, and/or the holders of fractional shares appearing in the register of fractional shares, including those recorded by electronic means, as of the close of business on a specified date as the shareholders or the registered pledgees and/or the holders of fractional shares entitled to exercise rights in respect of specified matters.

Proposed amendment:

(Record date)

Article 13.

Shareholders having voting rights who appear in the register of shareholders, including those recorded by electronic means, as of the close of business on March 31 in each year shall be treated by the Company as the shareholders entitled to exercise rights at the ordinary general meeting of shareholders relating to the business year ending on that March 31. [Amendment to the Japanese text only]

2. In addition to the preceding paragraph, the Company may, by giving prior public notice in accordance with a resolution of the Board of Directors, treat the shareholders or the registered pledgeeson shares appearing in the register of shareholders, including those recorded by electronic means, and/or the holders of fractional shares appearing in the register of fractional shares, including those recorded by electronic means, as of the close of business on a specified date as the shareholders or the registered pledgeeson shares and/or the holders of fractional shares entitled to exercise rights in respect of specified matters.

Article 11.

Current article:

(Convocation)

Article 11.

[Omitted]

2. [Insert new paragraph]

7

Proposed amendment:

(Convocation)

Article 14.

[Not amended]

2. General meetings of shareholdes shall be convened within any of the wards of the Metropolis of Tokyo.

Article 12.

Current article:

Proposed amendment:

Article 15. [Not amended except for the article number]

Insertion of the new Article 16.

Proposed amendment:

(Disclosure of reference materials for general meetings of shareholders, etc. via the Internet and deemed provision thereof)

Article 16.

When convening a general meeting of shareholders, the Company may be deemed to have provided shareholders with necessary information that is required to be described or presented in reference materials for the general meeting of shareholders, business reports, non-consolidated and consolidated financial statements, if it is disclosed via the Internet in accordance with the Ministry of Justice Ordinance.

Article 13.

Current article:

(Resolutions)

Article 13.

Unless otherwise provided in laws or ordinances or in these Articles of Incorporation, resolutions of a general meeting of shareholders shall be adopted by the holders of a majority of the shares having voting rights present at the meeting.

2. Resolutions to be adopted pursuant to Article 343 of the Commercial Code shall be adopted by not less than two-thirds of the voting rights held by shareholders present at the meeting who represent not less than one-third of the voting rights of all shareholders.

Proposed amendment:

(Resolutions)

Article 17.

Unless otherwise provided in laws or ordinances or in these Articles of Incorporation, resolutions of a general meeting of shareholders shall be adopted by a majority of voting rights of the shareholders present at the meetingwho are entitled to vote.

2. Resolutions to be adopted pursuant toArticle 309, paragraph 2 of the Corporation Law shall be adopted by not less than two-thirds of the voting rights held by shareholders present at the meeting who represent not less than one-third of the voting rights of theshareholders who are entitled to vote.

8

Article 14.

Current article:

(Exercise of voting rights by proxy)

Article 14.

A shareholder or his/her legal representative may exercise his/her voting rights by proxy, who shall be another shareholder of the Company entitled to vote.

Proposed amendment:

(Exercise of voting rights by proxy)

Article 18.

A shareholder or his/her legal representative may exercise his/her voting rightsthrough one proxy who shall be another shareholder of the Company entitled to vote.

Article 15.

Current article:

Proposed amendment:

Article 19. [Not amended except for the article number]

Article 16.

Current article:

(Election)

Article 16.

[Omitted]

2. Resolutions for the election of Directors shall be adopted by a majority of the voting rights held by shareholders present at the meeting who represent not less than one-third of the voting rights of all shareholders.

9

Proposed amendment:

(Election)

Article 20.

[Not amended]

2. Resolutions for the election of Directors shall be adopted by a majority of the voting rights held by shareholders present at the meeting who represent not less than one-third of the voting rights of theshareholders who are entitled to vote.

Article 17.

Current article:

(Term of office)

Article 17.

The term of office of Directors shall expire at the close of the ordinary general meeting of shareholders held in respect of the first business year to end after their assumption of office.

Proposed amendment:

(Term of office)

Article 21.

The term of office of Directors shall expire at the close of the ordinary general meeting of shareholders held in respect of thelast business year that ends within one (1) year from their appointment.

Article 18.

Current article:

(Remuneration)

Article 18.

Remuneration for the Directors shall be determined at a general meeting of shareholders.

Proposed amendment:

(Remuneration, etc.)

Article 22.

Remuneration, bonuses and any other financial interest provided to a Director by the Company as consideration for his/her performance of duties (hereinafter referred to as “remuneration, etc.”) shall be determined at a general meeting of shareholders.

Article 19.

Current article:

(Representative Directors and Directors with specific titles)

Article 19.

One or more Representative Directors shall be appointed by resolution of the Board of Directors.

10

Proposed amendment:

(Representative Directors and Directors with specific titles)

Article 23.

One or more Representative Directors shall be appointed by resolution of the Board of Directors. [Amendment to the Japanese text only]

Article 20.

Current article:

(Powers of the Board of Directors)

Article 20.

The Board of Directors shall make decisions on the execution of business of the Company and supervise the performance by the Directors of their duties.

Proposed amendment:

[To be deleted entirely]

Article 21.

Current article:

Article 21. [Omitted]

Proposed amendment:

Article 24. [Not amended except for the article number]

Article 22.

Current article:

(Resolutions)

Article 22.

[Omitted]

Proposed amendment:

(Resolutions)

Article 25.

[Not amended]

2. Notwithstanding the provision of the preceding paragraph, with respect to matters to be resolved by the Board of Directors, if and when all of the Directors express their approval of a certain matter in writing or by electronic means, it shall be deemed as a valid resolution of the Board of Directors to approve such a matter. Provided, however, that this provision shall not apply when any Corporate Auditor raises an objection thereto.

11

Article 23.

Current article:

Article 23. [Omitted]

Proposed amendment:

Article 26. [Not amended except for the article number]

Insertion of the new Article 27.

Proposed amendment:

(Agreement with outside Directors to limit liability)

Article 27.

In accordance with the provisions of Article 427, paragraph 1 of the Corporation Law, the Company may enter into an agreement with outside Directors to limit their liability provided for in Article 423, paragraph 1 of the Corporation Law. Provided, however, that the limitation of liability under such agreement shall be the higher of either the amount previously determined, which shall not be less than 10 million yen or the amount provided by laws and ordinances.

Article 24.

Current article:

Article 24. [Omitted]

Proposed amendment:

Article 28. [Not amended except for the article number]

Article 25.

Current article:

(Election)

Article 25.

[Omitted]

2. Resolutions for the election of Corporate Auditors shall be adopted by a majority of the voting rights held by shareholders present at the meeting who represent not less than one-third of the voting rights of all shareholders.

Proposed amendment:

(Election)

Article 29.

[Not amended]

2. Resolutions for the election of Corporate Auditors shall be adopted by a majority of the voting rights held by shareholders present at the meeting who represent not less than one-third of the voting rights ofthe shareholders who are entitled to vote.

12

Article 26.

Current article:

(Term of office)

Article 26.

The term of office of Corporate Auditors shall expire at the close of the ordinary general meeting of shareholders held in respect of the fourth business year to end after their assumption of office.

Proposed amendment:

(Term of office)

Article 30.

The term of office of Corporate Auditors shall expire at the close of the ordinary general meeting of shareholders held in respect of thelast business year that ends within four (4) years from their appointment.

Article 27.

Current article:

(Remuneration)

Article 27.

Remuneration for the Corporate Auditors shall be determined at a general meeting of shareholders.

Proposed amendment:

(Remuneration, etc.)

Article 31.

Remuneration, etc. for the Corporate Auditors shall be determined at a general meeting of shareholders.

Article 28.

Current article:

(Standing Corporate Auditors)

Article 28.

One or more Standing Corporate Auditors shall be elected by the Corporate Auditors from among their number.

Proposed amendment:

(Standing Corporate Auditors)

Article 32.

One or more Standing Corporate Auditors shall beappointed by resolution of the Boardof Corporate Auditors.

13

Article 29.

Current article:

(Powers of the Board of Corporate Auditors)

Article 29.

The Board of Corporate Auditors shall have such powers as specifically provided for in laws or ordinances, as well as make decisions with respect to matters relating to the performance by the Corporate Auditors of their duties. However, the foregoing provision shall not prevent the exercise by the Corporate Auditors of their authority.

Proposed amendment:

[To be deleted entirely]

Article 30 to Article 32.

Current articles:

Articles 30 to 32. [Omitted]

Proposed amendment:

Articles 33 to 35. [Not amended except for the article numbers]

Insertion of the new Article 36.

(Agreement with outside Corporate Auditors to limit liability)

Article 36.

In accordance with the provisions of Article 427, paragraph 1 of the Corporation Law, the Company may enter into an agreement with outside Corporate Auditors to limit their liability provided for in Article 423, paragraph 1 of the Corporation Law. Provided, however, that the limitation of liability under such agreement shall be the higher of either the amount previously determined, which shall not be less than 10 million yen or the amount provided by laws and ordinances.

Article 33.

Current article:

Article 33. [Omitted]

Proposed amendment:

Articles 37. [Not amended except for the article number]

14

Article 34.

Current article:

(Dividends)

Article 34.

Dividends to shareholders shall be paid to the shareholders (or the registered pledgees) appearing in the register of shareholders, including those recorded by electronic means, and to the holders of fractional shares appearing in the register of fractional shares, including those recorded by electronic means, as of the close of business on March 31 of each year.

Proposed amendment:

(Distribution of surplus)

Article 38.

Distribution of surplus shall be made to the shareholders or the registered pledgeeson shares appearing in the register of shareholders, including those recorded by electronic means, and to the holders of fractional shares appearing in the register of fractional shares, including those recorded by electronic means, as of the close of business on March 31 of each year.

Article 35.

Current article:

(Interim dividends)

Article 35.

The Company may, by resolution of the Board of Directors, distribute dividends as provided for in Article 293-5 of the Commercial Code of Japan (hereinafter referred to as “interim dividends”) to shareholders (or registered pledgees) appearing in the register of shareholders, including those recorded by electronic means, and to holders of fractional shares appearing in the register of fractional shares, including those recorded by electronic means, as of the close of business on September 30 of each year.

Proposed amendment:

(Interimdistribution of surplus)

Article 39.

The Company may, by resolution of the Board of Directors, distributesurplus as provided for inArticle 454, paragraph 5 of the Corporation Law to the shareholders or the registered pledgeeson shares appearing in the register of shareholders, including those recorded by electronic means, and to the holders of fractional shares appearing in the register of fractional shares, including those recorded by electronic means, as of the close of business on September 30 of each year.

15

Article 36.

Current article:

(Period of limitations on dividends)

Article 36.

If any dividend or interim dividend remains unclaimed after the expiration of five full years from the date of its becoming due and payable, the Company shall be relieved of the obligation to pay such dividend or interim dividend.

2. Dividends and interim dividends shall bear no interest.

Proposed amendment:

(Period of limitations on dividends)

Article 40.

In the event that distributed property is cash, if such property remains unclaimed after the expiration of five full years from the date it became due and payable, the Company shall be relieved of the obligation to pay suchproperty.

2.The cash set forth in the preceding paragraph shall bear no interest.

16

Appendix 2

Amendments as of September 30, 2006

Proposed amendments are set forth below:

Article 6.

Article as of June 28:

(Total number of shares to be issued)

Article 6.

The total number of the shares authorized to be issued by the Company shall be 6,830,000.

Proposed amendment:

(Total number of shares to be issued)

Article 6.

The total number of the shares authorized to be issued by the Company shall be 3,300,000,000.

Insertion of the new Article 8.

Proposed amendment:

(Number of shares to constitute one unit)

Article 8.

The number of shares to constitute one unit of shares of the Company shall be 500 shares.

Article 8.

Article as of June 28:

(Issuance of share certificates)

Article 8.

[Omitted]

Proposed amendment:

(Issuance of share certificates)

Article 9.

[Not amended]

2. Notwithstanding the provision of the preceding paragraph, the Company shall not issue share certificates representing less-than-one-unit shares. Provided, however, that this provision shall not apply to cases otherwise provided in the Share Handling Regulations.

17

Insertion of the new Article 10.

Proposed amendment:

(Rights concerning less-than-one-unit shares)

Article 10.

A shareholder of the Company (shareholder shall include a beneficial shareholder; same hereafter) cannot exercise any rights other than the rights set forth below concerning less-than-one-unit shares held by the said shareholder:

| | (i) | The rights stipulated in Article 189, paragraph 2 of the Corporation Law; |

| | (ii) | The right to make requests in accordance with the provisions of Article 166, paragraph 1 of the Corporation Law; |

| | (iii) | The right to receive allocations of shares and stock acquisition rights offered to a shareholder in proportion to the number of shares held by the said shareholder; and |

| | (iv) | The right to request for additional purchase of less-than-one-unit shares as provided in the following Article. |

Article 9.

Article as of June 28:

(Additional purchase of fractional shares by holders of fractional shares)

Article 9.

A holder of fractional shares may request the Company to sell to such holder such amount of fractional shares which will, when added together with the fractional shares held by the holder, constitute one share of stock.

2. The Company may refuse a request made pursuant to the foregoing paragraph 1, if the Company does not hold any shares available for such sale.

Proposed amendment:

(Additional purchase ofless-than-one-unit shares by holders thereof)

Article 11.

A shareholder of the Company may request the Company to sell to such shareholdersuch number of less-than-one-unit shares which will, when added together with theless-than-one-unit shares held by the shareholder, constitute oneunit of shares.

2. The Company may refuse a request made pursuant to the foregoing paragraph 1, if the Company does not holdthe number of shares available for such sale.

Article 10.

Article as of June 28:

Proposed amendment:

Article 12. [Not amended except for the article number]

18

Article 11.

Article as of June 28:

(Transfer agent of the register of fractional shares)

Article 11.

The Company shall have a transfer agent with respect to its fractional shares.

2. The transfer agent and its business office shall be appointed by resolution of the Board of Directors, and public notice shall be given thereof.

3. The register of fractional shares of the Company shall be kept at the transfer agent’s business office. The making of entries, including entries by electronic means, in the register of fractional shares, purchases and additional purchases of fractional shares and any other business relating to the Company’s fractional shares shall be delegated to the share registrar and shall not be handled by the Company.

Proposed amendment:

[To be deleted entirely]

Article 12.

Article as of June 28:

(Share Handling Regulations)

Article 12.

The denominations of share certificates to be issued by the Company, the making of entries, including entries by electronic means, in the register of shareholders, the register of fractional shares and the register of lost share certificates, purchases and additional purchases of fractional shares and any other proceedings concerning the Company’s shares, including the fees therefor, shall be governed by the Share Handling Regulations adopted by the Board of Directors from time to time.

Proposed amendment:

(Share Handling Regulations)

Article 13.

The denominations of share certificates to be issued by the Company, the making of entries, including entries by electronic means, in the register of shareholders and the register of lost share certificates, purchases and additional purchases ofless-than-one-unit shares and any other proceedings concerning the Company’s shares, including the fees therefor, shall be governed by the Share Handling Regulations adopted by the Board of Directors from time to time.

Article 13.

Article as of June 28:

(Record date)

Article 13.

[Omitted]

2. In addition to the preceding paragraph, the Company may, by giving prior public notice in accordance with a resolution of the Board of Directors, treat the shareholders or the registered pledgees on shares appearing in the register of shareholders, including those recorded by electronic means, and/or the holders of fractional shares appearing in the register of fractional shares, including those recorded by electronic means, as of the close of business on a specified date as the shareholders or the registered pledgees on shares and/or the holders of fractional shares entitled to exercise rights in respect of specified matters.

19

Proposed amendment:

(Record date)

Article 14.

[Not amended except for the article number]

2. In addition to the preceding paragraph, the Company may, by giving prior public notice in accordance with a resolution of the Board of Directors, treat the shareholders or the registered pledgees on shares appearing in the register of shareholders, including those recorded by electronic means, as of the close of business on a specified date as the shareholders or the registered pledgees on shares entitled to exercise rights in respect of specified matters.

Article 14 to Article 37.

Article as of June 28:

| Articles | 14 to 37. [Omitted] |

Proposed amendment:

Articles 15 to 38. [Not amended except for the article numbers]

Article 38.

Article as of June 28:

(Distribution of surplus)

Article 38.

Distribution of surplus shall be made to the shareholders or the registered pledgees on shares appearing in the register of shareholders, including those recorded by electronic means, and to the holders of fractional shares appearing in the register of fractional shares, including those recorded by electronic means, as of the close of business on March 31 of each year.

Proposed amendment:

(Distribution of surplus)

Article 39.

Distribution of surplus shall be made to the shareholders or the registered pledgees on shares appearing in the register of shareholders, including those recorded by electronic means, as of the close of business on March 31 of each year.

20

Article 39.

Article as of June 28:

(Interim distribution of surplus)

Article 39.

The Company may, by resolution of the Board of Directors, distribute surplus as provided for in Article 454, paragraph 5 of the Corporation Law to the shareholders or the registered pledgees on shares appearing in the register of shareholders, including those recorded by electronic means, and to the holders of fractional shares appearing in the register of fractional shares, including those recorded by electronic means, as of the close of business on September 30 of each year.

Proposed amendment:

(Interim distribution of surplus)

Article 40.

The Company may, by resolution of the Board of Directors, distribute surplus as provided for in Article 454, paragraph 5 of the Corporation Law to the shareholders or the registered pledgees on shares appearing in the register of shareholders, including those recorded by electronic means, as of the close of business on September 30 of each year.

Article 40.

Article as of June 28:

Article 40. [Omitted]

Proposed amendment:

Article 41. [Not amended except for the article number]

Amendment as of October 2, 2006

Proposed amendment is set forth below:

Article 8.

Article as of September 30:

(Number of shares to constitute one unit)

Article 8.

The number of shares to constitute one unit of shares of the Company shall be 500 shares.

Proposed amendment:

(Number of shares to constitute one unit)

Article 8.

The number of shares to constitute one unit of shares of the Company shall be100 shares.

21

| | |

| | Item 4 |

| |

(English translation) | | |

| |

| | May 24, 2006 |

| |

Millea Holdings, Inc. | | |

2-1 Marunouchi 1-chome, Chiyoda-ku, Tokyo | | |

TSE code number: 8766 | | |

Issuance of stock acquisition rights

The Board of Directors of Millea Holdings, Inc. (the “Company”) resolved today to make the following proposal at the 4th Ordinary General Meeting of Shareholders to be held on June 28, 2006. The proposal is to change the amount of compensation to the directors and the corporate auditors (collectively referred to as the “Directors and Corporate Auditors”) and the determination of compensation to Directors and Corporate Auditors.

The Company hereby announces that the proposal shall be on the agenda of the 4th Ordinary General Meeting of Shareholders as a precondition to the issuance of stock acquisition rights pursuant to a stock option scheme to the Directors and Corporate Auditors.

Specifics of the issuance and the allotments of stock acquisition rights will be determined by the Board of Directors of the Company to be held after the resolution of the 4th Ordinary General Meeting of Shareholders on June 28, 2006.

The Company introduced a stock option scheme last year to enhance motivation for the improvement of business results by strengthening the link between compensation of the Directors and Corporate Auditors and the Company’s share price and business results, and by aligning the Directors’ and Corporate Auditors’ exposure to the Company’s share price with those of its shareholders. Under the stock option scheme, the Company intends to issue stock acquisition rights to the Directors and Corporate Auditors at the exercise price of one (1) yen per share.

After the enforcement of the Corporation Law, the stock acquisition rights allotted to the Directors and Corporate Auditors as stock options became recognized as part of remunerations for the Directors and Corporate Auditors. In this connection, an approval on the “Change in the amount of compensation to directors and corporate auditors and determination of compensation to directors and corporate auditors” will be required at the 4th Ordinary General Meeting of Shareholders as a precondition to the Company’s allotments of the stock acquisition rights.

Particulars of stock acquisition rights

| (1) | Total number of stock acquisition rights / Class and number of shares to be issued upon exercise of stock acquisition rights |

The maximum number of stock acquisition rights to be allotted within 1 year after the ordinary general meeting of each fiscal year shall be 50 for the Directors and 20 for the Corporate Auditors;provided, however, if the number of shares to be issued upon exercise of each stock acquisition right shall become the number of shares constituting one unit share as described below, the maximum number of stock acquisition rights that may be allotted to Directors and Corporate Auditors shall be adjusted to the number equal to the maximum number of shares that may be issued upon exercise of stock acquisition rights, as provided below (or, if adjusted as described below, the maximum shares after such adjustment), divided by the number of shares constituting one unit (fractional share will be truncated).

The maximum number of shares that may be issued upon exercise of stock acquisition rights within 1 year after the ordinary general meeting of each fiscal year shall be 50 for the Directors and 20 for the Corporate Auditors.

The number of shares to be issued upon exercise of each stock acquisition right shall be one (1) share of the Company’s common stock. However, if any provision relating to the number of shares constituting one unit share is introduced or amended in the Articles of Incorporation of the Company, the number of shares to be issued upon exercise of each stock acquisition right shall be the number of shares constituting one unit.

If the Company conducts a stock split (including an allotment of the Company’s common stock without receipt of monetary consideration) or a stock consolidation, etc., the Company shall adjust the maximum number of shares that may be issued upon exercise of the stock acquisition rights, or the number of shares to be issued upon exercise of each stock acquisition right, as applicable and as appropriate.

| (2) | Amount to be paid upon exercise of stock acquisition rights |

The amount payable to the Company upon exercise of stock acquisition rights shall be determined by multiplying one (1) yen, the per-share exercise price, by the number of common shares to be issued upon exercise of such stock acquisition rights.

| (3) | Exercise period of stock acquisition rights |

The exercise period of stock acquisition rights shall be determined by the Board of Directors of the Company not later than 30 days from the day allotted.

| (4) | Restriction on the transfer of stock acquisition rights |

Any transfer of stock acquisition rights requires the approval of the Board of Directors of the Company.

| (5) | Additional conditions for the exercise of stock acquisition rights |

Any Director or Corporate Auditor may exercise his/her stock acquisition rights during the exercise period defined in (3) above that he/she holds only after such Director or Corporate Auditor has retired from any position that he/she holds as a Director or Corporate Auditor of the Company.

Other additional conditions for the exercise of stock acquisition rights shall be determined by the Board of Directors of the Company.

The Company also intends to issue stock acquisition rights as stock options to the directors and corporate auditors of its wholly-owned subsidiaries, Tokio Marine & Nichido Fire Insurance Co., Ltd. and Tokio Marine & Nichido Life Insurance Co., Ltd.

For further information, please contact:

Kazuyuki Nakano

Corporate Communications and Investor Relations Group

Corporate Planning Dept.

Millea Holdings, Inc.

Phone: 03-5223-3213