SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

Dated July 7, 2006

Commission File Number: 0-31376

MILLEA HOLDINGS, INC.

(Translation of Registrant’s name into English)

Tokyo Kaijo Nichido Building Shinkan,

2-1, Marunouchi 1-chome,

Chiyoda-ku, Tokyo 100-0005, Japan

(Address of principal executive offices)

Indicate by check mark whether the Registrant files or will file

annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form 40-F ¨

Indicate by check mark whether the Registrant by furnishing

the information contained in this form is also thereby furnishing

the information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ¨ No x

Table of Documents Submitted

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | |

| | KABUSHIKI KAISHA MILLEA HOLDINGS (Millea Holdings, Inc.) |

| | |

July 7, 2006 | | By: | | /s/ TAKASHI ITO |

| | | | Takashi Ito General Manager, Corporate Legal Department |

Item 1

(English translation)

June 28, 2006

Millea Holdings, Inc.

2-1 Marunouchi 1-chome, Chiyoda-ku, Tokyo

TSE code number: 8766

Allotment of stock acquisition rights pursuant to a stock option compensation plan

The Board of Directors of Millea Holdings, Inc. (the “Company”) resolved today the details of offering for stock acquisition rights and to make such offering for stock acquisition rights to be issued to the Company’s directors and corporate auditors, to the directors (including non-members of the board) and corporate auditors of its wholly-owned subsidiary, Tokio Marine & Nichido Fire Insurance Co., Ltd. and to the directors and corporate auditors of its wholly-owned subsidiary, Tokio Marine & Nichido Life Insurance Co., Ltd. (collectively referred to as the “Directors and Corporate Auditors”), in accordance with Article 238, paragraphs 1 and 2 and Article 240 of the Corporation Law.

1. Name of the Stock Acquisition Rights

July 2006 Millea Holdings Stock Acquisition Rights (stock option scheme under a stock-linked compensation plan) (the “Stock Acquisition Rights”)

2. Total number of the Stock Acquisition Rights

194 stock acquisition rights.

The above number is the expected number of allotment. If the total number of the Stock Acquisition Rights is less than expected, such as in the case where no application was made, allotted total number of the Stock Acquisition Rights shall be deemed as the total number of the Stock Acquisition Rights.

3. Class and number of shares to be issued upon exercise of the Stock Acquisition Rights

Class of shares to be issued upon exercise of the Stock Acquisition Rights shall be the common stock of the Company. The number of shares to be issued upon exercise of each Stock Acquisition Right shall be one (1).

Regardless of the above, if the Company conducts a stock split (including an allotment of the Company’s common stock without receipt of monetary consideration) or a stock consolidation, the Company shall adjust the number of shares to be issued upon exercise of each Stock Acquisition Right in accordance with the following equation. Fractional number less than one share after the adjustment shall be truncated.

1

Number of shares after the adjustment = Number of shares before the adjustment x stock split or stock consolidation ratio

Other than the above, if an inevitable need arises after the date of allotment, the Company shall adjust the number of shares to be issued upon exercise of each Stock Acquisition Right as appropriate and to the extent reasonable.

4. Amount to be paid upon exercise of the Stock Acquisition Rights

The amount payable to the Company upon exercise of the Stock Acquisition Rights shall be determined by multiplying one (1) yen, the per-share exercise price, by the number of common shares to be issued upon exercise of such Stock Acquisition Rights.

5. Exercise period of the Stock Acquisition Rights

The exercise period of the Stock Acquisition Rights shall be from July 19, 2006 through July 18, 2036.

6. Matters concerning the amount of capital and additional paid-in capital increased by the issuance of the shares upon exercise of the Stock Acquisition Rights

(i) The amount of capital increased by the issuance of shares upon exercise of the Stock Acquisition Rights shall be the amount obtained by multiplying the maximum limit of capital increase, as calculated in accordance with the provisions of Article 40, paragraph 1 of the Company Accounting Regulation, by 0.5, and any fraction of less than one (1) yen arising as a result of such calculation shall be rounded up to the nearest one (1) yen.

(ii) The amount of additional paid-in capital increased by the issuance of shares upon exercise of the Stock Acquisition Rights shall be the amount obtained by deducting the capital to be increased, as provided in (i) above, from the maximum limit of capital increase, as also provided in (i) above.

7. Restriction on the transfer of Stock Acquisition Rights

Any transfer of the Stock Acquisition Rights requires the approval of the Board of Directors of the Company.

8. Conditions regarding the acquisition of the Stock Acquisition Rights

The Company shall be able to acquire stock acquisition rights without any consideration on the day which shall be determined by the Board of Directors, if any of the following items (i), (ii), (iii), (iv) or (v) is approved by shareholders in a general meeting of shareholders, or where a shareholder approval in a general meeting of shareholders is not necessary, when approved by the Board of Directors or a representative director.

2

(i) Approval of a merger contract pursuant to which the Company shall be a dissolving company;

(ii) Approval of an agreement or a plan for corporate split pursuant to which the Company shall be a split company;

(iii) Approval of a share exchange agreement or a share transfer plan where the Company shall become a wholly-owned subsidiary of another company;

(iv) Approval of an amendment of the Company’s Articles of Incorporation so that any acquisition by transfer of shares issued by the Company shall require approval of the Company; or

(v) Approval of an amendment of the Company’s Articles of Incorporation that would require an approval of the Company for an acquisition by transfer of shares issued upon exercise of stock acquisition rights, or that would allow the Company to acquire all such shares with the approval by shareholders in a general meeting of shareholders.

9. Policy regarding cancellation of Stock Acquisition Rights in the event of reorganization and issuance of stock acquisition rights of a subject company of reorganization

If the Company conducts a merger (but only when the Company is the dissolving company), company split, share exchange or share transfer (hereinafter collectively the “corporate reorganization”), the Company shall grant the persons holding stock acquisition rights existing immediately before the effectiveness of the corporate reorganization (hereinafter the “existing stock acquisition rights”) stock acquisition rights of the joint stock company as stipulated in Article 236, paragraph 1, subparagraph 8, items (a) to (e) (hereinafter the “subject company”) in accordance with the following conditions. In such event, the existing stock acquisition rights shall be cancelled and the stock acquisition rights of the subject company shall be newly issued. This only applies in cases where such grant of stock acquisition rights is stipulated in the applicable merger contract, statutory consolidation contract, company split contract, share exchange contract or share transfer plan.

(i) The number of the stock acquisition rights of the subject company to be granted

The number of the stock acquisition rights of the subject company to be granted shall be the same as the number of existing stock acquisition rights.

(ii) The class of shares of the subject company to be issued upon exercise of the stock acquisition rights

Common stock of the subject company.

(iii) The number of shares of the subject company to be issued upon exercise of the stock acquisition rights

It shall be determined following Item 3 above, considering the terms and conditions of the company reorganization.

3

(iv) Amount to be paid upon exercise of stock acquisition rights

The amount payable to the Company upon exercise of stock acquisition rights shall be determined by multiplying one (1) yen, the per-share exercise price of the subject company, by the number of shares of the subject company to be issued upon exercise of such stock acquisition rights as determined in accordance with (iii) above.

(v) Exercise period of the stock acquisition rights

The exercise period of the stock acquisition rights shall begin on the date of commencement of the exercise period stipulated in Item 5 above or the effective date of the corporate reorganization, whichever is later, and end on the closing date of the exercise period stipulated in Item 5 above.

(vi) Matters concerning the amount of capital and additional paid-in capital increased by the issuance of the shares upon exercise of stock acquisition rights

Shall be determined in accordance with Item 6 above.

(vii) Restriction on the transfer of stock acquisition rights

Any transfer of stock acquisition rights requires the approval of the Board of Directors of the subject company.

(viii) Conditions regarding the acquisition of Stock Acquisition Rights

Shall be determined in accordance with Item 8 above.

(ix) Additional conditions for the exercise of the stock acquisition rights

Shall be determined in accordance with Item 11 below.

10. Treatment of fractional shares upon exercise of Stock Acquisition Rights

If fractional portion of shares were to be allotted upon exercise of stock acquisition rights, they shall be disregarded.

11. Additional conditions for the exercise of the stock acquisition rights

A Director or Corporate Auditor may exercise his/her stock acquisition rights that he/she holds only after he/she has retired from any position that he/she holds as a director or corporate auditor in the Company, Tokio Marine & Nichido or Tokio Marine & Nichido Life, respectively.

12. Calculation of the amount to be paid for the Stock Acquisition Rights

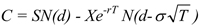

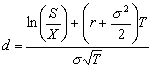

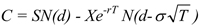

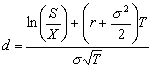

The amount to be paid for the Stock Acquisition Rights shall be the option price per share calculated based on the following formula, multiplied by the number of shares to be issued upon exercise of the Stock Acquisition Rights.

4

In this formula,

(i)C = option price per share

(ii)S = share price: the regular closing price of the Company’s common stock on the Tokyo Stock Exchange on July 11, 2006 (or the standard price on the following trading day if there is no closing price on that date)

(iii)X = exercise price: 1 yen

(iv)T = expected duration: 4 years

(v)s = volatility: computed based on the regular closing price on each trading day of the Company’s common stock for 4.25 years (from April 1, 2002 to July 11, 2006)

(vi)r = risk-free interest rate: the interest rate on Japanese government bonds for the remaining years corresponding to the expected duration

(vii)N (.) = cumulative distribution function of the standard normal distribution

13. Date of allotment of the Stock Acquisition Rights

Date of allotment of the Stock Acquisition Rights shall be July 18, 2006.

14. Date of payment of consideration in exchange of the Stock Acquisition Rights

Date of payment of consideration in exchange of the Stock Acquisition Rights shall be July 18, 2006.

15. Where to submit the application for the exercise of the Stock Acquisition Rights

The Personnel Planning Department of the Company.

16. The place of handling of payments upon exercise of the Stock Acquisition Rights

Head office of Mitsubishi UFJ Trust and Banking Corporation (or its successor bank or branch, as applicable).

5

17. Persons allotted with the Stock Acquisition Rights

Total of 56 persons, consisting of 7 directors and 2 corporate auditors of the Company, 12 directors, 2 corporate auditors and 27 directors (non-members of the board) of Tokio Marine & Nichido, the Company’s wholly-owned subsidiary, and 5 directors and 1 corporate auditor of Tokio Marine & Nichido Life, also the Company’s wholly-owned subsidiary.

For further information, please contact:

Kazuyuki Nakano

Corporate Communications and Investor Relations Group

Corporate Planning Dept.

Millea Holdings, Inc.

Phone: 03-5223-3213

6

Item 2

(English translation)

July 4, 2006

Millea Holdings, Inc.

President: Kunio Ishihara

2-1 Marunouchi 1-chome, Chiyoda-ku, Tokyo

TSE code number: 8766

Appointment of a temporary independent auditor

Millea Holdings, Inc. (the “Company”) announced that on July 4, 2006, pursuant to the provisions of Article 346, paragraphs 4 and 6 of the Corporation Law, the Board of Corporate Auditors has appointed PricewaterhouseCoopers Aarata as the Company’s temporary independent auditor under Japanese Law.

1. Reasons for the appointment

On May 10, 2006 the Company’s former independent auditor, ChuoAoyama PricewaterhouseCoopers, was ordered by the Financial Services Agency a two-month suspension of auditing services from July 1, 2006 to August 31, 2006. As a result, ChuoAoyama PricewaterhouseCoopers lost its capacity to serve as the Company’s independent auditor under Japanese Law as of July 1, 2006. Accordingly, the Board of Corporate Auditors appointed PricewaterhouseCoopers Aarata as a temporary independent auditor under Japanese Law at the meeting of the Board of Corporate Auditors held on July 4, 2006.

As for the appointment of an independent auditor, the Company intends to make a proposal at the ordinary general meeting of shareholders scheduled for June 2007.

2. Outgoing independent auditor

| | |

Name: | | ChuoAoyama PricewaterhouseCoopers |

Location: | | 2-5 Kasumigaseki 3-chome, Chiyoda-ku, Tokyo, Japan |

Date of retirement: | | July 1, 2006 |

|

3. Incoming temporary independent auditor |

| |

Name: | | PricewaterhouseCoopers Aarata |

Location: | | 8-3 Shinbashi 1-chome, Minato-ku, Tokyo, Japan |

Date of appointment: | | July 4, 2006 |

For further information, please contact:

Kazuyuki Nakano

Corporate Communications and Investor Relations Group

Corporate Planning Dept.

Millea Holdings, Inc.

Phone: 03-5223-3213