Table of Contents

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

Dated November 22, 2006

Commission File Number: 0-31376

MILLEA HOLDINGS, INC.

(Translation of Registrant’s name into English)

Tokyo Kaijo Nichido Building Shinkan, 2-1, Marunouchi 1-chome, Chiyoda-ku,

Tokyo 100-0005, Japan

(Address of principal executive offices)

Indicate by check mark whether the Registrant files or will file

annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form 40-F ¨

Indicate by check mark whether the Registrant by furnishing

the information contained in this form is also thereby furnishing

the information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ¨ No x

Table of Contents

| Item | ||

| 1. | Revised forecasts of business results under Japanese GAAP for the fiscal year ending March 31, 2007 | |

| 2. | Revision of FY2006 Business Plan of Millea Holdings, Inc. | |

The information contained herein includes certain forward-looking statements that are based on our current plans, targets, expectations, assumptions, estimates and projections about our businesses and operations. These forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and actual results may materially differ from those contained in the forward-looking statements as a result of various factors. For a discussion of the factors which may have a material impact upon our financial condition, results of operation and liquidity, see our annual report on Form 20-F for the fiscal year ended March 31, 2006.

|

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| KABUSHIKI KAISHA MILLEA HOLDINGS | ||||

| (Millea Holdings, Inc.) | ||||

| November 22, 2006 | By: | /S/ TAKASHI ITO | ||

| Takashi Ito | ||||

| General Manager, | ||||

| Corporate Legal Department | ||||

Table of Contents

(English translation)

| November 22, 2006 |

| Millea Holdings, Inc. |

| President: Kunio Ishihara |

| TSE code number: 8766 |

Revised forecasts of business results under Japanese GAAP for the fiscal year ending March 31, 2007

Millea Holdings, Inc. (the “Company”) announced today that it has revised the original forecasts of business results of the Company and its consolidated subsidiary, Nisshin Fire & Marine Insurance Co., Ltd. (“Nisshin Fire”), for the fiscal year ending March 31, 2007 (from April 1, 2006 to March 31, 2007) as detailed below.

| 1. | Revised forecast of consolidated business results of the Company for the fiscal year ending March 31, 2007 |

(Unit: Million yen, %)

| Ordinary income | Ordinary profit | Net income | |||||||

Original forecast (A) (*1) | 3,694,000 | 156,000 | 83,000 | ||||||

Revised forecast (B) | 4,293,000 | 169,000 | 90,000 | ||||||

Difference (B)-(A) | 599,000 | 13,000 | 7,000 | ||||||

Rate of increase/decrease | 16.2 | % | 8.3 | % | 8.4 | % | |||

(Reference) Actual results for the fiscal year ended March 31, 2006 | 3,399,984 | 136,563 | 89,960 |

| (*1) | Announced on May 24, 2006. |

| 2. | Revised forecast of non-consolidated business results of Nisshin Fire for the fiscal year ending March 31, 2007 |

(Unit: Million yen, %)

| Net premiums written | Ordinary profit | Net income | ||||||

Original forecast (A) (*1) | 147,000 | 4,800 | 2,500 | |||||

Revised forecast (B) | 147,000 | 1,500 | 800 | |||||

Difference (B)-(A) | — | -3,300 | -1,700 | |||||

Rate of increase/decrease | — | -68.8 | % | -68.0 | % | |||

(Reference) Actual results for the fiscal year ended March 31, 2006 | 144,620 | 5,359 | 2,943 |

| (*1) | Announced on May 24, 2006. |

Table of Contents

| 3. | Reasons for the revisions |

| (a) | Reason for the revision of consolidated business results of the Company for the fiscal year ending March 31, 2007 |

The upward revision of forecasted ordinary income is primarily due to a significant increase projected in the amount of life insurance premium. The increase is a result of strong sales of individual annuity insurance of Tokio Marine & Nichido Financial Life Insurance Co., Ltd., a consolidated subsidiary of the Company.

| (b) | Reason for the revision of non-consolidated business results of Nisshin Fire for the fiscal year ending March 31, 2007 |

The principal reason for the revision is a decrease in the amount of forecasted ordinary profit and forecasted net income of Nisshin Fire, which is primarily due to an increase in the amount of claims incurred in connection with natural disasters such as Typhoon No. 13 which occurred in September 2006.

For further information, please contact:

Kazuyuki Nakano

Manager

Corporate Communications and Investor Relations Group

Corporate Planning Dept.

Phone: 03-5223-3213

Noriaki Tashimo

Group Leader

Corporate Accounting Dept.

Phone: 03-6212-3344

Table of Contents

(English translation)

| November 22, 2006 |

| Millea Holdings, Inc. |

| President: Kunio Ishihara |

| TSE code number: 8766 |

Revision of FY2006 Business Plan of Millea Holdings, Inc.

Millea Holdings, Inc. (“Millea Holdings”, President and director: Kunio Ishihara) announced today a revision to its business plan, originally announced on May 24, 2006, for the fiscal year ending March 31, 2007 (“FY2006”) to target 167.9 billion yen in total adjusted earnings.

In the domestic property and casualty insurance business, Millea Group is experiencing a steady growth in the amount of net premiums written. However, it made a downward revision of its target for adjusted earnings to 92.3 billion yen primarily due to an increase in the amount of claims and loss reserves incurred in connection with natural disasters.

Boosted by strong sales of variable annuity insurance, Millea Group revised its target for adjusted earnings in the domestic life insurance business to target 51.6 billion yen.

Millea Group aims to earn 21 billion yen in adjusted earnings in the overseas insurance business, in light of a favorable business result in the reinsurance business.

In financial and other businesses, Millea Group aims to earn 2.9 billion yen in adjusted earnings, almost unchanged from the amount announced in the initial business plan.

(Yen in billions except percentages)

Adjusted Earnings by Business Segment | FY2005 Actual Results | FY2006 Business Plan | FY2006 Revised Plan | ||||||

Domestic property & casualty insurance | 91.5 | 104.0 | 92.3 | ||||||

Tokio Marine & Nichido | 90.8 | 102.3 | 91.2 | ||||||

Nisshin Fire | 0.7 | 1.6 | 1.0 | ||||||

Domestic life insurance | 34.6 | 39.8 | 51.6 | ||||||

Tokio Marine & Nichido Life | 29.4 | 26.8 | 25.2 | ||||||

Tokio Marine & Nichido Financial Life | 5.2 | 13.0 | 26.3 | ||||||

Overseas insurance | 7.7 | 19.0 | 21.0 | ||||||

Asia | 1.3 | 1.3 | 1.5 | ||||||

North/Central America | 5.1 | 5.2 | 5.0 | ||||||

Europe, Africa, Middle East | 2.7 | 1.5 | 1.5 | ||||||

South America | 3.3 | 4.2 | 4.4 | ||||||

Others | 1.2 | 1.4 | 1.3 | ||||||

Reinsurance | -5.2 | 6.3 | 7.9 | ||||||

Financial/other businesses | 4.9 | 2.8 | 2.9 | ||||||

Group total | 138.7 | 165.5 | 167.9 | ||||||

Group total ROE | 3.7 | % | 3.9 | % | 4.0 | % |

- 1 -

Table of Contents

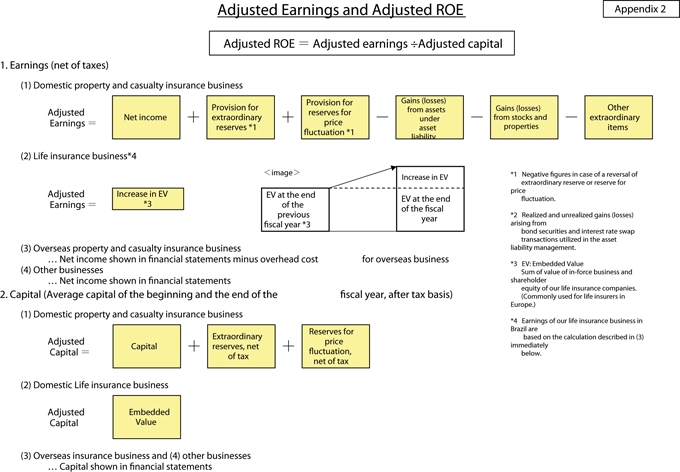

* In order to capture the corporate value of the Millea Group and to aim for the enhancement thereof, the management uses “adjusted earnings” to determine adjusted income and adjusted ROE (see Appendix 2 for details).

* The actual results of FY2005 in the domestic life insurance business exclude the effects of changes in key assumptions such as interest rate fluctuations and the frequency of claims.

* Overhead costs for overseas operations are charged to the overseas insurance business.

* See Appendix 1 for business performance indices for each major business segment.

- 2 -

Table of Contents

Appendix 1

Business performance indices for major business segments

1. Domestic property and casualty insurance business

Indices for Tokio Marine & Nichido and Nisshin Fire are as follows:

(Yen in billions except percentages)

| FY2005 Actual Results | FY2006 Business plan | FY2006 Revised Plan | |||||||

Net premium written | 2,037.3 | 2,067.0 | 2,069.0 | ||||||

Tokio Marine & Nichido | 1,892.7 | 1,920.0 | 1,922.0 | ||||||

Nisshin Fire | 144.6 | 147.0 | 147.0 | ||||||

Expense ratio | — | — | — | ||||||

Tokio Marine & Nichido | 30.2 | % | 30.6 | % | 30.9 | % | |||

Nisshin Fire | 36.5 | % | 36.2 | % | 36.4 | % |

2. Domestic life insurance business

Indices for Tokio Marine & Nichido Life and Tokio Marine & Nichido Financial Life are as follows:

(Yen in billions)

| FY2005 Actual Results | FY2006 Business Plan | FY2006 Revised Plan | ||||

Annualized premiums for new policies | 88.4 | 115.6 | 186.6 | |||

Tokio Marine & Nichido Life | 45.6 | 55.6 | 54.8 | |||

Tokio Marine & Nichido Financial Life | 42.8 | 60.0 | 131.7 |

| * | Annualized premiums for new policies are derived by dividing the aggregate amount of premiums (lump-sum premiums for single payment policies) by the duration of insurance policies to show the amount of premiums per year. |

3. Overseas insurance business

Indices for the overseas insurance business are as follows:

(Yen in billions)

FY2005 Actual Results | FY2006 Business Plan | FY2006 Revised Plan | ||||

Net premiums written | 240.2 | 284.5 | 307.6 | |||

Asia | 47.1 | 70.2 | 71.1 | |||

North/Central America | 52.3 | 56.7 | 55.4 | |||

Europe, Africa, Middle East | 13.5 | 17.1 | 17.5 | |||

South America | 87.3 | 96.3 | 101.3 | |||

Others | 6.9 | 8.8 | 8.6 | |||

Reinsurance | 32.9 | 35.4 | 53.4 |

| * | Net premiums written are calculated taking into account the ratio of respective equity interest of Millea Holdings in each local subsidiary. |

For further information, please contact:

Kazuyuki Nakano

Manager

Corporate Communications and Investor Relations Group

Corporate Planning Dept.

Phone: 03-5223-3213

- 3 -

Table of Contents