UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-21061

Aetos Capital Multi-Strategy Arbitrage Fund, LLC

(Exact name of registrant as specified in charter)

c/o Aetos Capital, LLC

875 Third Avenue

New York, NY 10022

(Address of principal executive offices) (Zip code)

Harold Schaaff

Aetos Capital, LLC

New York, NY 10022

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-212-201-2500

Date of fiscal year end: January 31

Date of reporting period: January 31, 2018

Item 1. Reports to Stockholders.

AETOS CAPITAL MULTI-STRATEGY ARBITRAGE FUND, LLC

AETOS CAPITAL DISTRESSED INVESTMENT STRATEGIES FUND, LLC

AETOS CAPITAL LONG/SHORT STRATEGIES FUND, LLC

(Delaware Limited Liability Companies)

Financial Statements

January 31, 2018

Table of Contents

The Funds file their complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q within sixty days after the end of each period. The Funds’ Forms N-Q are available on the Commission's web site at http://www.sec.gov, and may be reviewed and copied at the Commission's Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Funds use to determine how to vote proxies relating to portfolio securities, as well as information relating to how the Funds voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-212-201-2500; and (ii) on the Commission's website at http://www.sec.gov

Aetos Capital Multi-Strategy Arbitrage Fund, LLC

Fund Commentary

For the year ended January 31, 2018

(Unaudited)

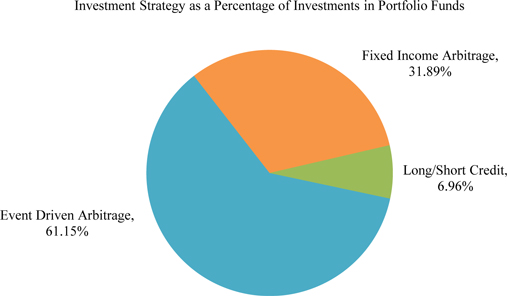

The Aetos Capital Multi-Strategy Arbitrage Fund, LLC (the “Fund”) allocates its assets among a select group of portfolio managers that utilize a variety of arbitrage strategies while seeking to produce an attractive absolute return on invested capital, largely independent of the various benchmarks associated with traditional asset classes.

The Fund includes allocations to event arbitrage, fixed income arbitrage and long/short credit. Event arbitrage managers seek to identify mispricings in securities that will be resolved through an anticipated event, which can include mergers, acquisitions, spinoffs, recapitalizations and bankruptcies (either entering into or emerging from them). Fixed income arbitrage managers seek to identify discrepancies in the prices of securities that are very closely related and arbitrage that discrepancy. Long/short credit managers seek to identify mispricings in securities based on fundamental security selection.

For the year ended January 31, 2018, the Fund had a total return of +7.35%.1 For the period from commencement of investment activities on September 1, 2002 through January 31, 2018, the Fund had an annualized return of +4.36%.

Merger arbitrage was a solid contributor within the Fund. The most notable winners were cross-border transactions in the healthcare and technology sectors, including Johnson & Johnson’s acquisition of Actelion (completed in June) and Qualcomm’s outstanding bid for NXP; however, some portfolios suffered losses in November as the US Department of Justice sued to block a merger in the media/telecom space. Our outlook for the strategy remains constructive as Mergers and Acquisitions ended 2017 on a strong note. Moreover, recent changes to the US tax code could incentivize companies to repatriate their foreign cash holdings, creating a tailwind for domestic M&A (and creating new opportunities in merger arbitrage).

Other event-driven strategies also contributed gains, particularly event-driven equities, with the Fund’s Europe-focused manager generating gains from financials and Spanish restructurings. Event-distressed and long/short credit strategies also delivered strong performance, with gains in liquidations and a variety of restructurings (including those of a Japanese electronics company and an American gaming & entertainment company).

Fixed income arbitrage was another source of profits. Both of the Fund’s managers earned profits in every month of the reporting period, highlighting the steady nature of their returns. Structured products, including RMBS and student loan securitizations, were the largest contributors to strategy performance. Additional gains came from hedged positions across sovereign yield curves and G7 swap spreads. Fixed income arbitrage strategies remain attractive, and could benefit from a global shift in monetary policies.

| 1 | Returns are net of expenses and fees incurred at the Fund level and do not reflect investment management fees paid outside of the Fund. |

| 1 |

Aetos Capital Distressed Investment Strategies Fund, LLC

Fund Commentary

For the year ended January 31, 2018

(Unaudited)

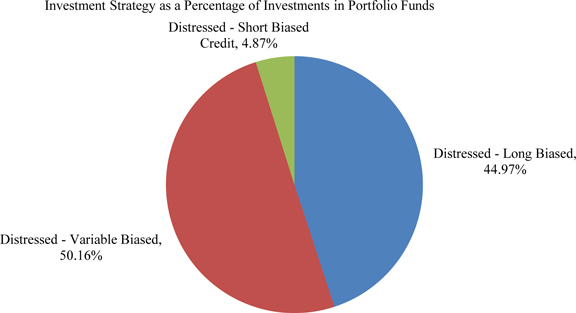

The Aetos Capital Distressed Investment Strategies Fund, LLC (the “Fund”) allocates its assets among a select group of portfolio managers across a variety of credit and distressed investment strategies while seeking to produce an attractive absolute return on invested capital, largely independent of the various benchmarks associated with traditional asset classes.

The Fund allocates to investment managers that buy the securities (generally bonds and bank loans) of companies that are in bankruptcy or in danger of bankruptcy, as well as other assets, such as structured products (including RMBS and CMBS) and post-reorganization equities. Managers seek to identify situations where they can buy these securities at a discount to their eventual value because traditional fixed income managers may not want to or be able to own them once they have been downgraded or are in default. The sellers may also not have the expertise and patience to go through a restructuring process. This kind of investing involves credit analysis, legal expertise and (often) negotiating ability, as the manager must determine the value of the underlying securities, the likely timing and resolution of a restructuring/refinancing process and also may need to negotiate with other creditors. Additionally, certain managers express their company-specific and market views through shorting, often with credit default swaps.

For the year ended January 31, 2018, the Fund had a total return of +3.66%.1 For the period from commencement of investment activities on September 1, 2002 through January 31, 2018, the Fund had an annualized return of +7.59%.

During the reporting period, our managers generated returns from investments in corporate restructurings as companies either completed exits from bankruptcy or progressed meaningfully toward negotiated resolutions. Liquidations, restructured equities, and structured credit were also contributors. In liquidations, notable positions included investments in the Lehman Brothers complex, Icelandic financials, and a European airline company. In restructured equities, managers realized gains on investments in the media, telecom, and energy sectors. In structured credit, one of the Fund’s managers earned profits in crisis-era CDOs, while others added value in MBS and monoline insurance. There were, however, some notable detractors. In the summer, one of our managers wrote off its position in the junior debt of a Spanish bank that was forced into insolvency and sold to a competitor. Other detractors included short positions in performing credit and positions in the debt of a restructuring municipality.

We were encouraged by the Fund’s performance during the reporting period and are optimistic about new opportunities. While it is true that tight credit spreads and late-cycle conditions are less conducive to traditional distressed investing, our managers have demonstrated their ability to succeed in this environment. We also remain confident in our short-biased credit manager who provides a degree of market protection and has demonstrated its ability to generate alpha on the short side through fundamental security selection.

| 1 | Returns are net of expenses and fees incurred at the Fund level and do not reflect investment management fees paid outside of the Fund. |

| 2 |

Aetos Capital Long/Short Strategies Fund, LLC

Fund Commentary

For the year ended January 31, 2018

(Unaudited)

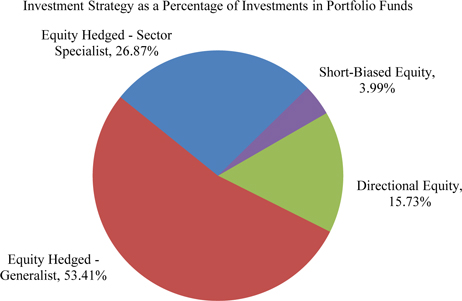

The Aetos Capital Long/Short Strategies Fund, LLC (the “Fund”) allocates its assets among a select group of portfolio managers across a variety of long/short strategies while seeking to produce an attractive absolute return on invested capital, largely independent of the various benchmarks associated with traditional asset classes. The Fund comprises managers of primarily stock portfolios that are constructed on a bottom-up, fundamental basis.

For the year ended January 31, 2018, the Fund had a total return of +9.17%.1 For the period from commencement of investment activities on September 1, 2002 through January 31, 2018, the Fund had an annualized return of +5.15%, delivering more than half the performance on an annualized basis of both the S&P 500 (+9.80%) and MSCI ACWI (+8.84%) and outperforming both on a beta-adjusted basis (0.23 to both indices since inception).

Our managers generated profits in a wide range of companies and industries and, in particular, benefited from the sharp rebound in growth equities, which had underperformed during the prior reporting period. The majority of gains came from the long sides of portfolios, which is typically the case in upward-trending markets. While managers were able to generate alpha in a number of short positions, the overall shorting environment was challenging. Net exposures for the Fund increased modestly as a result, but remained within normal ranges.

The most successful themes for the year included: Internet franchises with dominant footprints in the social media, online retail, and search verticals; software developers providing differentiated solutions for design, engineering, gaming, security, and enterprise use; semiconductor applications for computing (memory, storage, and processing), automobiles, and communications; aviation businesses including low-cost and regional airlines, equipment manufacturers, and maintenance providers; biopharma and healthcare services business, especially in the mid-cap space; cyclical emerging market companies in the industrial, material, and financial sectors; and established brands in the cable and hospitality industries that are succeeding amid evolving competitive landscapes.

Notable detractors were limited. For longs, detractors included a printing technology company that disclosed accounting issues and reported poor earnings, and a pharmaceuticals company that saw its outlook deteriorate amid tougher competition in generic drugs. In both cases, managers continue to hold these stocks and have opportunistically added on weakness. For shorts, positions in an electric vehicle manufacturer and in a Chinese real estate firm incurred losses for several managers. While the former position remains in portfolios, the latter has mostly been covered.

We were pleased with the Fund’s performance, especially given our managers’ relatively low beta exposures. With inter-stock correlations falling to their lowest levels since 2000 and sector dispersion on the rise, we believe a rich opportunity set will persist over the coming quarters.

| 1 | Returns are net of expenses and fees incurred at the Fund level and do not reflect investment management fees paid outside of the Fund. |

| 3 |

Report of Independent Registered Public Accounting Firm

To the Board of Managers and Members of

Aetos Capital Multi-Strategy Arbitrage Fund, LLC

Aetos Capital Distressed Investment Strategies Fund, LLC

Aetos Capital Long/Short Strategies Fund, LLC

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities, including the schedules of investments, of Aetos Capital Multi-Strategy Arbitrage Fund, LLC, Aetos Capital Distressed Investment Strategies Fund, LLC, and Aetos Capital Long/Short Strategies Fund, LLC (hereafter collectively referred to as the "Funds") as of January 31, 2018, the related statements of operations and cash flows for the year ended January 31, 2018, the statements of changes in members' capital for each of the two years in the period ended January 31, 2018, including the related notes, and the financial highlights for each of the five years in the period ended January 31, 2018 (collectively referred to as the "financial statements"). In our opinion, the financial statements present fairly, in all material respects, the financial position of each of the Funds as of January 31, 2018, the results of each of their operations and each of their cash flows for the year then ended, the changes in each of their members' capital for each of the two years in the period ended January 31, 2018 and each of the financial highlights for each of the five years in the period ended January 31, 2018 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Funds' management. Our responsibility is to express an opinion on the Funds' financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of January 31, 2018 by correspondence with the portfolio funds, custodian and transfer agent. We believe that our audits provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

March 29, 2018

We have served as the auditor of one or more investment companies in the Aetos Capital Funds since 2002.

PricewaterhouseCoopers LLP, PricewaterhouseCoopers Center, 300 Madison Avenue, New York, NY 10017 T: (646) 471 3000, F: (813) 286 6000, www.pwc.com/us

| 4 |

Aetos Capital Multi-Strategy Arbitrage Fund, LLC

Schedule of Investments

January 31, 2018

| Investments | Date(s) of Acquisition | Cost | Fair Value | Percentage of Members' Capital (1) | Liquidity | |||||||||||

| Investments in Portfolio Funds** | ||||||||||||||||

| Event Driven Arbitrage (3) | ||||||||||||||||

| Davidson Kempner Partners | 01/01/06 - 07/01/12 | $ | 55,852,249 | $ | 91,409,313 | 17.87 | % | Semi-Annual | ||||||||

| Farallon Capital Offshore Investors, Inc. | 02/01/07 - 04/01/12 | 55,034,071 | 88,183,265 | 17.24 | Semi-Annual* | |||||||||||

| Governors Lane Onshore Fund LP | 08/01/15 - 08/01/16 | 35,000,000 | 38,975,597 | 7.62 | Quarterly* | |||||||||||

| Luxor Capital Partners Liquidating SPV, LLC | 05/01/16 - 07/01/16 | 1,526,331 | 1,873,045 | 0.37 | Liquidating | |||||||||||

| Oceanwood Opportunities Fund L.P. | 02/01/12 - 07/01/16 | 50,729,279 | 70,095,675 | 13.71 | Quarterly | |||||||||||

| Total Event Driven Arbitrage | 198,141,930 | 290,536,895 | 56.81 | |||||||||||||

The accompanying notes are an integral part of the financial statements

| 5 |

Aetos Capital Multi-Strategy Arbitrage Fund, LLC

Schedule of Investments

January 31, 2018

| Investments | Date(s) of Acquisition | Cost | Fair Value | Percentage of Members' Capital (1) | Liquidity | |||||||||||

| Fixed Income Arbitrage (4) | ||||||||||||||||

| FFIP, L.P. | 01/01/07 - 04/01/12 | 45,626,936 | 95,868,242 | 18.74 | Annual* | |||||||||||

| Parsec Onshore Partners, L.P. | 12/01/05 - 04/01/12 | 39,431,773 | 55,659,537 | 10.88 | Monthly | |||||||||||

| Total Fixed Income Arbitrage | 85,058,709 | 151,527,779 | 29.62 | |||||||||||||

| Long/Short Credit (5) | ||||||||||||||||

| Sound Point Credit Opportunities Fund, L.P. | 01/01/17 | 30,000,000 | 33,081,224 | 6.47 | Quarterly | |||||||||||

| Total Long/Short Credit | 30,000,000 | 33,081,224 | 6.47 | |||||||||||||

| Total investments in Portfolio Funds | 313,200,639 | 475,145,898 | 92.90 | |||||||||||||

| Money Market Investment | ||||||||||||||||

| JPMorgan U.S. Government Money Market Fund, Agency Shares, 0.01%(2) (Shares 42,269,544) | 42,269,544 | 42,269,544 | 8.27 | |||||||||||||

| Total investments | $ | 355,470,183 | $ | 517,415,442 | 101.17 | % | ||||||||||

* The liquidity of the Portfolio Funds may be further restricted due to withdrawal limitations.

** Non-income producing investments.

| (1) | Percentages are based on Members’ Capital of $511,438,811. |

| (2) | Rate disclosed is the 7-day effective yield as of 01/31/18. |

| (3) | A Portfolio Fund in this strategy invests in securities of companies involved in certain special situations, including mergers, acquisitions, asset sales, spin-offs, balance sheet restructuring, bankruptcy and other situations. These special situations constitute an “event” which the Portfolio Manager believes will trigger a change in the price of securities relative to their current price or close the gap between securities that are being arbitraged. |

| (4) | A Portfolio Fund in this strategy looks to exploit mispricings between related fixed income instruments, including sovereign debt, corporate debt and derivative instruments such as futures, options and swaps. Exploitable opportunities may be found in closely related securities trading at different prices, in the value between fixed income instruments and related derivative instruments, in the shape of yield curves and in credit spreads. These strategies typically require leverage in order to exploit relatively small mispricings. |

The accompanying notes are an integral part of the financial statements

| 6 |

Aetos Capital Multi-Strategy Arbitrage Fund, LLC

Schedule of Investments

January 31, 2018

| (5) | A Portfolio Fund in this strategy invests in long and short positions in various types of credit instruments such as senior and junior securities of the same corporate issuer, securities of equivalent credit quality from different corporate issuers and different tranches in the complex capital structure of mortgage-backed securities or collateralized loan obligations. The Portfolio Fund will tend to run its investment portfolio with a variable net exposure. |

The aggregate cost of investments for tax purposes was $502,773,432. Net unrealized appreciation on investments for tax purposes was $14,642,010 consisting of $34,311,178 of gross unrealized appreciation and $19,669,168 of gross unrealized depreciation.

The investments in Portfolio Funds shown above, representing 92.90% of Members’ Capital, have been fair valued using NAV as a practical expedient.

The accompanying notes are an integral part of the financial statements

| 7 |

Aetos Capital Distressed Investment Strategies Fund, LLC

Schedule of Investments

January 31, 2018

| Investments | Date(s) of Acquisition | Cost | Fair Value | Percentage of Members' Capital (1) | Liquidity | |||||||||

| Investments in Portfolio Funds*** | ||||||||||||||

| Distressed - Long Biased (3) | ||||||||||||||

| AG Mortgage Value Partners, L.P. | 03/01/12 - 05/01/13 | $ | 4,312,873 | $ | 6,000,706 | 1.86 | % | Side Pockets Only | ||||||

| Centerbridge Credit Partners, L.P. | 06/01/10 - 05/01/16 | 30,511,868 | 42,029,843 | 13.06 | Bi-Annual** | |||||||||

| Davidson Kempner Distressed Opportunities Fund LP | 11/01/09 - 05/01/13 | 31,491,740 | 58,125,819 | 18.06 | Annual | |||||||||

| Marble Ridge LP | 12/01/16 - 02/01/17 | 25,000,000 | 27,738,091 | 8.62 | Quarterly* | |||||||||

| Silver Point Capital Fund, L.P. | 07/01/08 | 390,994 | 931,984 | 0.29 | Side Pockets Only | |||||||||

| Total Distressed - Long Biased | 91,707,475 | 134,826,443 | 41.89 | |||||||||||

The accompanying notes are an integral part of the financial statements

| 8 |

Aetos Capital Distressed Investment Strategies Fund, LLC

Schedule of Investments

January 31, 2018

| Investments | Date(s) of Acquisition | Cost | Fair Value | Percentage of Members' Capital (1) | Liquidity | |||||||||||

| Distressed - Variable Biased (4) | ||||||||||||||||

| Anchorage Capital Partners, L.P. | 09/01/08 - 07/01/16 | 32,213,735 | 59,220,915 | 18.40 | Annual* | |||||||||||

| Aurelius Capital Partners, LP | 07/01/08 - 01/01/13 | 27,192,411 | 44,603,989 | 13.85 | Semi-Annual* | |||||||||||

| King Street Capital, L.P. | 08/01/07 - 07/01/08 | 26,065,850 | 46,581,198 | 14.47 | Quarterly* | |||||||||||

| Total Distressed - Variable Biased | 85,471,996 | 150,406,102 | 46.72 | |||||||||||||

| Distressed - Short Biased Credit (5) | ||||||||||||||||

| Anchorage Short Credit Fund, L.P. | 11/01/16 - 01/01/18 | 17,500,000 | 14,591,944 | 4.53 | Monthly | |||||||||||

| Total Distressed - Short Biased Credit | 17,500,000 | 14,591,944 | 4.53 | |||||||||||||

| Total investments in Portfolio Funds | 194,679,471 | 299,824,489 | 93.14 | |||||||||||||

| Money Market Investment | ||||||||||||||||

| JPMorgan U.S. Government Money Market Fund, Agency Shares, 0.01%(2) (Shares 28,998,926) | 28,998,926 | 28,998,926 | 9.01 | |||||||||||||

| Total investments | $ | 223,678,397 | $ | 328,823,415 | 102.15 | % | ||||||||||

* The liquidity of the Portfolio Funds may be further restricted due to withdrawal limitations.

** All or a portion of the investment is subject to lock-up provision.

*** Non-income producing investments.

| (1) | Percentages are based on Members’ Capital of $321,894,933. |

| (2) | Rate disclosed is the 7-day effective yield as of 01/31/18. |

| (3) | A Portfolio Fund in this strategy invests in securities of companies in various levels of financial distress, including bankruptcy, exchange offers, workouts, financial reorganizations and other credit-related situations. Corporate bankruptcy or distress often causes a company’s securities to trade at a discounted value. The Portfolio Fund will tend to run its investment portfolio with a long bias net exposure. |

The accompanying notes are an integral part of the financial statements

| 9 |

Aetos Capital Distressed Investment Strategies Fund, LLC

Schedule of Investments

January 31, 2018

| (4) | A Portfolio Fund in this strategy invests in securities of companies in various levels of financial distress, including bankruptcy, exchange offers, workouts, financial reorganizations and other credit-related situations. Corporate bankruptcy or distress often causes a company’s securities to trade at a discounted value. The Portfolio Fund will tend to run its investment portfolio with a variable net exposure. |

| (5) | A Portfolio Fund in this strategy invests in securities of companies in various levels of financial distress, including bankruptcy, exchange offers, workouts, financial reorganizations and other credit-related situations. Corporate bankruptcy or distress often causes a company’s securities to trade at a discounted value. The Portfolio Fund will tend to run its investment portfolio with a short bias net exposure. |

The aggregate cost of investments for tax purposes was $298,562,171. Net unrealized appreciation on investments for tax purposes was $30,261,244 consisting of $33,886,057 of gross unrealized appreciation and $3,624,813 of gross unrealized depreciation.

The investments in Portfolio Funds shown above, representing 93.14% of Members’ Capital, have been fair valued using NAV as a practical expedient.

The accompanying notes are an integral part of the financial statements

| 10 |

Aetos Capital Long/Short Strategies Fund, LLC

Schedule of Investments

January 31, 2018

| Investments | Date(s) of Acquisition | Cost | Fair Value | Percentage of Members' Capital (1) | Liquidity | |||||||||||

| Investments in Portfolio Funds*** | ||||||||||||||||

| Directional Equity (3) | ||||||||||||||||

| Egerton Capital Partners, L.P. | 05/01/11 - 05/01/15 | $ | 50,152,454 | $ | 91,574,327 | 9.45 | % | Monthly | ||||||||

| Sachem Head LP | 05/01/15 - 09/01/17 | 50,000,000 | 56,785,564 | 5.86 | Quarterly* | |||||||||||

| Spindrift Partners, L.P. | 01/01/11 - 01/01/17 | 79,613 | 109,588 | 0.01 | Side Pockets Only | |||||||||||

| Total Directional Equity | 100,232,067 | 148,469,479 | 15.32 | |||||||||||||

The accompanying notes are an integral part of the financial statements

| 11 |

Aetos Capital Long/Short Strategies Fund, LLC

Schedule of Investments

January 31, 2018

| Investments | Date(s) of Acquisition | Cost | Fair Value | Percentage of Members' Capital (1) | Liquidity | |||||||||||

| Equity Hedged - Generalist (4) | ||||||||||||||||

| Eminence Partners, L.P. | 01/01/14 - 01/01/17 | 61,000,000 | 77,061,626 | 7.95 | Quarterly | |||||||||||

| Eton Park Fund, L.P. | 05/01/15 | 3,082,488 | 2,872,044 | 0.30 | Liquidating | |||||||||||

| Highfields Capital II LP | 07/01/13 - 07/01/15 | 45,000,000 | 55,115,100 | 5.69 | Semi Annual* | |||||||||||

| Lakewood Capital Partners, LP | 05/01/17 - 09/01/17 | 65,000,000 | 68,365,258 | 7.05 | Quarterly** | |||||||||||

| MW TOPS Fund | 05/01/10 - 09/01/17 | 69,991,385 | 92,915,166 | 9.59 | Monthly | |||||||||||

| Nitorum Fund, L.P. | 12/01/17 | 35,000,000 | 35,615,164 | 3.67 | Annual** | |||||||||||

| Turiya Fund LP | 03/01/12 - 05/01/14 | 55,275,000 | 87,404,363 | 9.02 | Quarterly* | |||||||||||

| Viking Global Equities LP | 11/01/05 - 03/01/11 | 24,795,574 | 84,890,138 | 8.76 | Annual | |||||||||||

| Total Equity Hedged - Generalist | 359,144,447 | 504,238,859 | 52.03 | |||||||||||||

| Equity Hedged - Sector Specialist (5) | ||||||||||||||||

| Cadian Fund LP | 07/01/08 - 11/01/13 | 27,371,158 | 46,959,167 | 4.85 | Quarterly* | |||||||||||

| Crescent Park Partners, L.P. | 10/01/14 - 02/01/15 | 29,229,199 | 35,679,780 | 3.68 | Semi-Annual* | |||||||||||

| Encompass Capital Fund L.P. | 06/01/15 - 07/01/16 | 35,000,000 | 44,667,032 | 4.61 | Quarterly* | |||||||||||

| Long Pond Capital QP Fund, LP | 01/01/14 - 02/01/14 | 42,217,853 | 61,204,774 | 6.32 | Quarterly* | |||||||||||

| North River Partners, L.P. | 06/01/13 - 11/01/13 | 39,432,203 | 65,167,230 | 6.72 | Quarterly | |||||||||||

| Total Equity Hedged - Sector Specialist | 173,250,413 | 253,677,983 | 26.18 | |||||||||||||

| Short-Biased Equity (6) | ||||||||||||||||

| Kriticos International Limited | 01/01/12 - 12/01/17 | 64,007,196 | 37,705,385 | 3.89 | Quarterly** | |||||||||||

| Total Short-Biased Equity | 64,007,196 | 37,705,385 | 3.89 | |||||||||||||

| Total investments in Portfolio Funds | 696,634,123 | 944,091,706 | 97.42 | |||||||||||||

| Money Market Investment | ||||||||||||||||

| JPMorgan U.S. Government Money Market Fund, Agency Shares, 0.01%(2) (Shares 28,864,089) | 28,864,089 | 28,864,089 | 2.98 | |||||||||||||

| Total investments | $ | 725,498,212 | $ | 972,955,795 | 100.40 | % | ||||||||||

The accompanying notes are an integral part of the financial statements

| 12 |

Aetos Capital Long/Short Strategies Fund, LLC

Schedule of Investments

January 31, 2018

* The liquidity of the Portfolio Funds may be further restricted due to withdrawal limitations.

** All or a portion of the investment is subject to lock-up provision.

*** Non-income producing investments.

| (1) | Percentages are based on Members’ Capital of $969,108,487. |

| (2) | Rate disclosed is the 7-day effective yield as of 01/31/18. |

| (3) | A Portfolio Fund in this strategy makes investments that combine long positions in undervalued common stocks or corporate bonds and short positions in overvalued common stocks or corporate bonds in order to focus on generating positive returns through the Portfolio Manager’s ability to select securities through fundamental analysis, while hedging out some portion of market risk. The Portfolio Fund will tend to run its investment portfolio with a relatively high or variable net exposure. |

| (4) | A Portfolio Fund in this strategy makes investments that combine long positions in undervalued common stocks or corporate bonds and short positions in overvalued common stocks or corporate bonds in order to focus on generating positive returns through the Portfolio Manager’s ability to select securities through fundamental analysis, while hedging out some portion of market risk. The Portfolio Fund will tend to run its investment portfolio with a relatively low net exposure and will invest broadly across all market sectors. |

| (5) | A Portfolio Fund in this strategy makes investments that combine long positions in undervalued common stocks or corporate bonds and short positions in overvalued common stocks or corporate bonds in order to focus on generating positive returns through the Portfolio Manager’s ability to select securities through fundamental analysis, while hedging out some portion of market risk. The Portfolio Fund will tend to run its investment portfolio with a relatively low net exposure and will focus on investing in specific market sectors. |

| (6) | A Portfolio Fund in this strategy makes investments in short positions in overvalued common stocks or corporate bonds in order to focus on generating positive returns through the Portfolio Manager’s ability to select securities through fundamental analysis, while hedging out some portion of market risk. The Portfolio Fund will tend to run its investment portfolio with a permanent net short or short-only exposure. |

The aggregate cost of investments for tax purposes was $855,076,005. Net unrealized appreciation on investments for tax purposes was $117,879,790 consisting of $151,398,882 of gross unrealized appreciation and $33,519,092 of gross unrealized depreciation.

The investments in Portfolio Funds shown above, representing 97.42% of Members’ Capital, have been fair valued using NAV as a practical expedient.

The accompanying notes are an integral part of the financial statements

| 13 |

Statements of Assets and Liabilities

January 31, 2018

| Aetos Capital | ||||||||||||

| Aetos Capital | Distressed | Aetos Capital | ||||||||||

| Multi-Strategy | Investment | Long/Short | ||||||||||

| Arbitrage | Strategies | Strategies | ||||||||||

| Fund, LLC | Fund, LLC | Fund, LLC | ||||||||||

| Assets | ||||||||||||

| Investments in Portfolio Funds and Money Market Investment, at cost | $ | 355,470,183 | $ | 223,678,397 | $ | 725,498,212 | ||||||

| Investments in Portfolio Funds and Money Market Investment, at value | $ | 517,415,442 | $ | 328,823,415 | $ | 972,955,795 | ||||||

| Receivable for sale of investments | 2,107,412 | 4,457,291 | 2,214,118 | |||||||||

| Accrued income | 38,697 | 17,568 | 22,945 | |||||||||

| Total assets | 519,561,551 | 333,298,274 | 975,192,858 | |||||||||

| Liabilities | ||||||||||||

| Redemptions of Interests payable | 7,493,386 | 10,878,343 | 5,330,863 | |||||||||

| Investment management fees payable | 234,517 | 147,603 | 444,379 | |||||||||

| Professional fees payable | 359,460 | 346,770 | 263,310 | |||||||||

| Board of Managers’ fees payable | 19,083 | 19,083 | 19,083 | |||||||||

| Other accrued expenses | 16,294 | 11,542 | 26,736 | |||||||||

| Total liabilities | 8,122,740 | 11,403,341 | 6,084,371 | |||||||||

| Net Members’ Capital | $ | 511,438,811 | $ | 321,894,933 | $ | 969,108,487 | ||||||

| Members’ Capital | ||||||||||||

| Net capital | $ | 349,493,552 | $ | 216,749,915 | $ | 721,650,904 | ||||||

| Net unrealized appreciation on investment in Portfolio Funds | 161,945,259 | 105,145,018 | 247,457,583 | |||||||||

| Members’ Capital | $ | 511,438,811 | $ | 321,894,933 | $ | 969,108,487 | ||||||

The accompanying notes are an integral part of the financial statements

| 14 |

For the year ended January 31, 2018

| Aetos Capital | ||||||||||||

| Aetos Capital | Distressed | Aetos Capital | ||||||||||

| Multi-Strategy | Investment | Long/Short | ||||||||||

| Arbitrage | Strategies | Strategies | ||||||||||

| Fund, LLC | Fund, LLC | Fund, LLC | ||||||||||

| Investment income: | ||||||||||||

| Dividends from money market funds | $ | 181,745 | $ | 163,504 | $ | 296,892 | ||||||

| Total investment income | 181,745 | 163,504 | 296,892 | |||||||||

| Expenses: | ||||||||||||

| Investment management fees | 3,825,738 | 2,587,349 | 6,937,469 | |||||||||

| Administration fees | 373,224 | 253,945 | 673,600 | |||||||||

| Board of Managers’ fees | 76,333 | 76,333 | 76,333 | |||||||||

| Professional fees | 498,542 | 458,982 | 372,542 | |||||||||

| Custodian fees | 69,431 | 54,019 | 110,983 | |||||||||

| Registration fees | 17,439 | 21,903 | 15,207 | |||||||||

| Printing fees | 15,205 | 15,205 | 15,205 | |||||||||

| Other expenses | 19,990 | 19,150 | 21,710 | |||||||||

| Total expenses | 4,895,902 | 3,486,886 | 8,223,049 | |||||||||

| Net investment loss | (4,714,157 | ) | (3,323,382 | ) | (7,926,157 | ) | ||||||

| Net realized gain on Portfolio Funds sold | 33,717,876 | 43,612,369 | 43,953,627 | |||||||||

| Net change in unrealized appreciation on investments in Portfolio Funds | 7,901,434 | (27,952,473 | ) | 46,501,531 | ||||||||

| Net increase in Members’ Capital derived from investment activities | $ | 36,905,153 | $ | 12,336,514 | $ | 82,529,001 | ||||||

The accompanying notes are an integral part of the financial statements

| 15 |

Statements of Changes in Members’ Capital

For the year ended January 31, 2018 and January 31, 2017

| Aetos Capital Multi-Strategy Arbitrage Fund, LLC | Aetos Capital Distressed Investment Strategies Fund, LLC | |||||||||||||||

| 2/1/17– | 2/1/16– | 2/1/17– | 2/1/16– | |||||||||||||

| 1/31/18 | 1/31/17 | 1/31/18 | 1/31/17 | |||||||||||||

| From investment activities: | ||||||||||||||||

| Net investment loss | $ | (4,714,157 | ) | $ | (5,344,279 | ) | $ | (3,323,382 | ) | $ | (1,539,876 | ) | ||||

| Net realized gain on Portfolio Funds sold | 33,717,876 | 65,266,390 | 43,612,369 | 48,346,614 | ||||||||||||

| Net change in unrealized appreciation on investments in Portfolio Funds | 7,901,434 | (22,217,681 | ) | (27,952,473 | ) | (5,001,506 | ) | |||||||||

| Net increase in Members’ Capital derived from investment activities | 36,905,153 | 37,704,430 | 12,336,514 | 41,805,232 | ||||||||||||

| Distributions: | ||||||||||||||||

| Tax withholding on behalf of foreign investors | (338,129 | ) | (341,406 | ) | (893,332 | ) | (335,340 | ) | ||||||||

| Refund of tax withholding on behalf of foreign investors | 112,246 | — | 184,834 | 94,172 | ||||||||||||

| Total distributions | (225,883 | ) | (341,406 | ) | (708,498 | ) | (241,168 | ) | ||||||||

| Members’ Capital transactions: | ||||||||||||||||

| Proceeds from sales of Interests (1) | 18,996,084 | 43,167,445 | 11,979,051 | 31,497,540 | ||||||||||||

| Repurchase of Interests (2) | (78,449,693 | ) | (187,043,504 | ) | (111,038,081 | ) | (100,909,714 | ) | ||||||||

| Net decrease in Members’ Capital derived from capital transactions | (59,453,609 | ) | (143,876,059 | ) | (99,059,030 | ) | (69,412,174 | ) | ||||||||

| Net decrease in Members’ Capital | (22,774,339 | ) | (106,513,035 | ) | (87,431,014 | ) | (27,848,110 | ) | ||||||||

| Members’ Capital at beginning of year | 534,213,150 | 640,726,185 | 409,325,947 | 437,174,057 | ||||||||||||

| Members’ Capital at end of year | $ | 511,438,811 | $ | 534,213,150 | $ | 321,894,933 | $ | 409,325,947 | ||||||||

(1) Proceeds from sales of Interests during the year 2/1/16 – 1/31/17 include transfers amongst the Funds.

(2) Repurchases of Interests during the year 2/1/16 - 1/31/17 include transfers amongst the Funds.

The accompanying notes are an integral part of the financial statements

| 16 |

Statements of Changes in Members’ Capital (Concluded)

For the year ended January 31, 2018 and January 31, 2017

| Aetos Capital Long/Short Strategies Fund, LLC | ||||||||

| 2/1/17– | 2/1/16– | |||||||

| 1/31/18 | 1/31/17 | |||||||

| From investment activities: | ||||||||

| Net investment loss | $ | (7,926,157 | ) | $ | (8,358,128 | ) | ||

| Net realized gain on Portfolio Funds sold | 43,953,627 | 101,246,279 | ||||||

| Net change in unrealized appreciation on investments in Portfolio Funds | 46,501,531 | (60,603,567 | ) | |||||

| Net increase in Members’ Capital derived from investment activities | 82,529,001 | 32,284,584 | ||||||

| Distributions: | ||||||||

| Tax withholding on behalf of foreign investors | (1,225,452 | ) | (961,813 | ) | ||||

| Refund of tax withholding on behalf of foreign investors | 31,055 | 8 | ||||||

| Total distributions | (1,194,397 | ) | (961,805 | ) | ||||

| Members’ Capital transactions: | ||||||||

| Proceeds from sales of Interests (1) | 29,122,586 | 46,288,729 | ||||||

| Repurchase of Interests (2) | (58,516,006 | ) | (212,453,500 | ) | ||||

| Net decrease in Members’ Capital derived from capital transactions | (29,393,420 | ) | (166,164,771 | ) | ||||

| Net increase/ (decrease) in Members’ Capital | 51,941,184 | (134,841,992 | ) | |||||

| Members’ Capital at beginning of year | 917,167,303 | 1,052,009,295 | ||||||

| Members’ Capital at end of year | $ | 969,108,487 | $ | 917,167,303 | ||||

(1) Proceeds from sales of Interests during the year 2/1/16 – 1/31/17 include transfers amongst the Funds.

(2) Repurchases of Interests during the year 2/1/16 - 1/31/17 include transfers amongst the Funds.

The accompanying notes are an integral part of the financial statements

| 17 |

For the year ended January 31, 2018

| Aetos Capital Multi-Strategy Arbitrage Fund, LLC | Aetos Capital Distressed Investment Strategies Fund, LLC | Aetos Capital Long/Short Strategies Fund, LLC | ||||||||||

| Cash flows from operating activities | ||||||||||||

| Net increase in Members’ Capital derived from investment activities | $ | 36,905,153 | $ | 12,336,514 | $ | 82,529,001 | ||||||

| Adjustments to reconcile net increase in Members’ Capital derived from investment activities to net cash provided by operating activities | ||||||||||||

| Purchases of Portfolio Funds | — | (4,000,000 | ) | (127,520,197 | ) | |||||||

| Net Purchases of Money Market Investments | (23,140,512 | ) | (15,238,458 | ) | (7,126,901 | ) | ||||||

| Sales of Portfolio Funds | 92,437,498 | 116,653,779 | 181,490,516 | |||||||||

| Net realized gain on Portfolio Funds sold | (33,717,876 | ) | (43,612,369 | ) | (43,953,627 | ) | ||||||

| Net change in unrealized appreciation on Investments in Portfolio Funds | (7,901,434 | ) | 27,952,473 | (46,501,531 | ) | |||||||

| Decrease in receivable for income distribution from Portfolio Fund | — | 1,143,739 | — | |||||||||

| Increase in accrued income | (30,221 | ) | (12,314 | ) | (13,301 | ) | ||||||

| Decrease in investment management fees payable | (99,575 | ) | (108,386 | ) | (129,209 | ) | ||||||

| Decrease in professional fees and other accrued expenses | (3,574 | ) | (24,654 | ) | (31,548 | ) | ||||||

| Increase in Board of Managers’ fees payable | 508 | 508 | 508 | |||||||||

| Net cash provided by operating activities | 64,449,967 | 95,090,832 | 38,743,711 | |||||||||

| Cash flows from financing activities | ||||||||||||

| Tax withholding on behalf of foreign investors | (338,129 | ) | (893,332 | ) | (1,225,452 | ) | ||||||

| Refund of tax withholding on behalf of foreign investors | 112,246 | 184,834 | 31,055 | |||||||||

| Proceeds from sales of Interests | 18,996,084 | 11,979,051 | 29,122,586 | |||||||||

| Repurchases of Interests | (83,230,832 | ) | (106,367,083 | ) | (66,683,379 | ) | ||||||

| Net cash used in financing activities | (64,460,631 | ) | (95,096,530 | ) | (38,755,190 | ) | ||||||

| Net decrease in cash | (10,664 | ) | (5,698 | ) | (11,479 | ) | ||||||

| Cash, beginning of year | 10,664 | 5,698 | 11,479 | |||||||||

| Cash, end of year | — | — | — | |||||||||

The accompanying notes are an integral part of the financial statements

| 18 |

Aetos Capital Multi-Strategy Arbitrage Fund, LLC

| 2/1/17 - 1/31/18 | 2/1/16 - 1/31/17 | 2/1/15 - 1/31/16 | 2/1/14 - 1/31/15 | 2/1/13 - 1/31/14 | ||||||||||||||||

| Total return(1) | 7.35 | % | 7.08 | % | (3.21 | %) | 1.16 | % | 7.30 | % | ||||||||||

| Net assets, end of period (000's) | $ | 511,439 | $ | 534,213 | $ | 640,726 | $ | 733,314 | $ | 752,547 | ||||||||||

| Ratios to average net assets: | ||||||||||||||||||||

| Expenses(2)(3) | 0.94 | % | 0.95 | % | 0.89 | % | 0.89 | % | 0.88 | % | ||||||||||

| Net investment loss | (0.90 | %) | (0.94 | %) | (0.89 | %) | (0.89 | %) | (0.88 | %) | ||||||||||

| Portfolio turnover rate | 0.00 | % | 14.96 | % | 2.85 | % | 0.00 | % | 0.00 | % | ||||||||||

Aetos Capital Distressed Investment Strategies Fund, LLC

| 2/1/17 - 1/31/18 | 2/1/16 - 1/31/17 | 2/1/15 - 1/31/16 | 2/1/14 - 1/31/15 | 2/1/13 - 1/31/14 | ||||||||||||||||

| Total return(1) | 3.66 | % | 10.98 | % | (4.30 | %) | 3.06 | % | 11.66 | % | ||||||||||

| Net assets, end of period (000's) | $ | 321,895 | $ | 409,326 | $ | 437,174 | $ | 501,507 | $ | 510,864 | ||||||||||

| Ratios to average net assets: | ||||||||||||||||||||

| Expenses(2)(3) | 0.98 | % | 0.97 | % | 0.94 | % | 0.95 | % | 0.94 | % | ||||||||||

| Net investment income/(loss) | (0.93 | %) | (0.37 | %) | (0.28 | %) | (0.40 | %) | 0.19 | % | ||||||||||

| Portfolio turnover rate | 5.88 | % | 7.30 | % | 0.37 | % | 0.00 | % | 2.46 | % | ||||||||||

Aetos Capital Long/Short Strategies Fund, LLC

| 2/1/17 - 1/31/18 | 2/1/16 - 1/31/17 | 2/1/15 - 1/31/16 | 2/1/14 – 1/31/15 | 2/1/13 - 1/31/14 | ||||||||||||||||

| Total return(1) | 9.17 | % | 3.77 | % | 0.90 | % | 9.18 | % | 10.86 | % | ||||||||||

| Net assets, end of period (000's) | $ | 969,108 | $ | 917,167 | $ | 1,052,009 | $ | 1,152,928 | $ | 1,096,591 | ||||||||||

| Ratios to average net assets: | ||||||||||||||||||||

| Expenses(2)(3) | 0.87 | % | 0.88 | % | 0.87 | % | 0.87 | % | 0.89 | % | ||||||||||

| Net investment loss | (0.84 | %) | (0.87 | %) | (0.87 | %) | (0.87 | %) | (0.89 | %) | ||||||||||

| Portfolio turnover rate | 14.10 | % | 4.83 | % | 13.87 | % | 14.44 | % | 17.93 | % | ||||||||||

| (1) | Tax withholding on behalf of certain investors is treated as a reinvested distribution. |

| (2) | Expense ratios do not reflect the Fund’s proportionate share of expenses of the Portfolio Funds. |

| (3) | The expense ratios do not include the Program Fees charged separately to investors as described in Note 3 in the Notes to Financial Statements. |

The accompanying notes are an integral part of the financial statements

| 19 |

January 31, 2018

1. Organization

The Aetos Capital Multi-Strategy Arbitrage Fund, LLC, the Aetos Capital Distressed Investment Strategies Fund, LLC, and the Aetos Capital Long/Short Strategies Fund, LLC (collectively the “Funds” and individually a “Fund”) were formed in the state of Delaware as limited liability companies. The Funds are registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as closed-end, non-diversified, management investment companies. The Funds are investment companies and, accordingly, follow the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946 - Investment Companies, which is part of U.S. generally accepted accounting principles (“GAAP”). Each Fund is a fund-of-funds. The Funds seek capital appreciation by allocating their assets among a select group of private investment funds (commonly known as hedge funds) (“Portfolio Funds”) that utilize a variety of alternative investment strategies that seek to produce an attractive absolute return on invested capital, largely independent of the various benchmarks associated with traditional asset classes. Aetos Alternatives Management, LLC serves as the Investment Manager to the Funds.

The Funds operate under a master fund/feeder fund structure. Feeder Funds invest substantially all of their investable assets in the Funds. As of January 31, 2018 the Feeder Funds’ beneficial ownership of their corresponding Master Funds’ members’ capital are 84%, 86%, 91%, 2%, 2% and 1%, for the Aetos Capital Multi-Strategy Arbitrage Cayman Fund, Aetos Capital Distressed Investment Strategies Cayman Fund, Aetos Capital Long/Short Strategies Cayman Fund, Aetos Capital Multi-Strategy Arbitrage Cayman Fund II, Aetos Capital Distressed Investment Strategies Cayman Fund II and Aetos Capital Long/Short Strategies Cayman Fund II respectively. The Investment Manager may receive an additional management fee and/or an incentive fee at the feeder fund level.

The principal investment objective of each Fund is as follows:

Aetos Capital Multi-Strategy Arbitrage Fund, LLC seeks to produce an attractive absolute return on invested capital, largely independent of the various benchmarks associated with traditional asset classes, by allocating its assets among a select group of portfolio managers that utilize a variety of arbitrage strategies.

Aetos Capital Distressed Investment Strategies Fund, LLC seeks to produce an attractive absolute return on invested capital, largely independent of the various benchmarks associated with traditional asset classes, by allocating its assets among a select group of portfolio managers across a variety of distressed investment strategies.

Aetos Capital Long/Short Strategies Fund, LLC seeks to produce an attractive absolute return on invested capital, largely independent of the various benchmarks associated with traditional asset classes, by allocating its assets among a select group of portfolio managers across a variety of long/short strategies.

| 20 |

Notes to Financial Statements (continued)

1. Organization (continued)

The Funds may offer, from time to time, to repurchase outstanding members’ interests (“Interests”) pursuant to written tenders by members. The Funds may offer to repurchase Interests four times each year, as of the last business day of March, June, September and December. However, repurchase offers will only be made at such times and on such terms as may be determined by the Funds’ Board of Managers (the “Board”) in its sole discretion.

Interests may be purchased on the first business day of each calendar month or at such other times as may be determined by the Board.

2. Significant Accounting Policies

The Funds’ financial statements are prepared in conformity with accounting principles generally accepted in the United States of America. The following is a summary of the significant accounting policies followed by the Funds:

A. Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires the Investment Manager to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from these estimates, and such differences could be material.

B. Portfolio Valuation and Security Transactions

The net asset values of the Funds are determined as of the close of business at the end of each month in accordance with the valuation principles set forth below or as may be determined from time to time pursuant to policies established by the Board.

The Investment Manager has established a Valuation Committee that has oversight responsibility for the valuation of each of the Funds’ investments in Portfolio Funds. Members of the Valuation Committee include key members of the Investment Manager’s Senior Management, Compliance, Due Diligence and Risk Management teams.

Investments in Portfolio Funds are presented in the accompanying financial statements at fair value, as determined by the Funds’ Investment Manager under the general supervision of the Board. Such fair value generally represents a Fund’s pro-rata interest in the net assets of a Portfolio Fund as provided by the Portfolio Funds. As a general matter, the fair value of the Funds’ interests in Portfolio Funds will represent the amount that the Funds could reasonably expect to receive from the Portfolio Funds if the Funds’ interests were redeemed at the time of the valuation, based on information reasonably available at the time the valuation is determined and that the Funds believe to be reliable.

| 21 |

Notes to Financial Statements (continued)

2. Significant Accounting Policies (continued)

B. Portfolio Valuation and Security Transactions (continued)

The Investment Manager considers information provided by the Portfolio Funds regarding the methods they use to value underlying investments in the Portfolio Funds and any restrictions on or illiquidity of the interests in the Portfolio Funds, in determining fair value.

Considerable judgment is required to interpret the factors used to develop estimates of fair value. Accordingly, the estimates may not be indicative of the amounts a Fund could realize in a current market exchange and the differences could be material to the financial statements. The use of different factors or estimation methodologies could have a significant effect on the estimated fair value.

Investments in open-end registered investment companies are valued at net asset value (“NAV”).

The FASB issued ASC Topic 820, Fair Value Measurements and Disclosures which establishes a fair value hierarchy and specifies that a valuation technique used to measure fair value shall maximize the use of observable inputs and minimize the use of unobservable inputs. The objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). Accordingly the fair value hierarchy gives the highest priority to valuations based upon unadjusted quoted prices in active markets for identical assets or liabilities and the lowest priority to valuations based upon unobservable inputs that are significant to the valuation. The levels of the fair value hierarchy under FASB ASC Topic 820-10-35-39 to 55 are as follows:

| · | Level 1 – Inputs that reflect unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Funds have the ability to access at the measurement date; |

| · | Level 2 – Inputs other than quoted prices that are observable for the asset or liability either directly or indirectly, including inputs in markets that are not considered to be active. |

| · | Level 3 – Inputs that are unobservable. |

Inputs broadly refer to assumptions that market participants use to make valuation decisions, including assumptions about risk. ASC Topic 820-10-35-59 permits the Investment Manager to estimate the fair value of the investments in the Portfolio Funds at the net asset value reported by the Portfolio Funds if the net asset value is calculated in a manner consistent with the measurement principles of ASC Topic 946, Financial Services – Investment Companies. The Investment Manager evaluates each Portfolio Fund individually to determine that its net asset value is calculated in a manner consistent with ASC 946.

| 22 |

Notes to Financial Statements (continued)

2. Significant Accounting Policies (continued)

B. Portfolio Valuation and Security Transactions (continued)

The Investment Manager also considers whether an adjustment to the net asset value reported by the Portfolio Fund is necessary based upon various factors, including, but not limited to, the attributes of the interest in the Portfolio Fund held, including the rights and obligations, and any restrictions on or illiquidity of such interests, and the fair value of such Portfolio Fund’s investment portfolio or other assets and liabilities. The net asset value reported by the Portfolio Funds may be based upon unobservable inputs and a significant change in those unobservable inputs could result in a significantly lower or higher reported net asset value reported for such Portfolio Funds.

Valuations reflected in this report are as of the report date. As a result, changes in the valuation due to market events and/or issuer related events after the report date and prior to the issuance of the report are not reflected herein.

The following table presents information about the level within the fair value hierarchy at which the Funds’ investments are measured as of January 31, 2018:

| Aetos Capital Multi-Strategy Arbitrage Fund, LLC | ||||||||||||||||

| Strategy | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Investments in Portfolio Funds (1) | $ | — | $ | — | $ | — | $ | 475,145,898 | ||||||||

| Money Market Investment | 42,269,544 | — | — | 42,269,544 | ||||||||||||

| Total Investments | $ | 42,269,544 | $ | — | $ | — | $ | 517,415,442 | ||||||||

| Aetos Capital Distressed Investment Strategies Fund, LLC | ||||||||||||||||

| Strategy | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Investments in Portfolio Funds (1) | $ | — | $ | — | $ | — | $ | 299,824,489 | ||||||||

| Money Market Investment | 28,998,926 | — | — | 28,998,926 | ||||||||||||

| Total Investments | $ | 28,998,926 | $ | — | $ | — | $ | 328,823,415 | ||||||||

| Aetos Capital Long/Short Strategies Fund, LLC | ||||||||||||||||

| Strategy | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Investments in Portfolio Funds (1) | $ | — | $ | — | $ | — | $ | 944,091,706 | ||||||||

| Money Market Investment | 28,864,089 | — | — | 28,864,089 | ||||||||||||

| Total Investments | $ | 28,864,089 | $ | — | $ | — | $ | 972,955,795 | ||||||||

(1) In accordance with ASU 2015-07 investments in Portfolio Funds that are measured at fair value using the net asset value per share (or its equivalent) practical expedient have not been classified in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the amounts presented in the Statements of Assets and Liabilities.

Realized gains and losses from Portfolio Fund transactions are calculated on the identified cost basis. Investments are recorded on the effective date of the subscription in the Portfolio Fund.

| 23 |

Notes to Financial Statements (continued)

2. Significant Accounting Policies (continued)

C. Fund Income and Expenses

Expenses are recorded on an accrual basis. Each Fund bears its own expenses including, but not limited to, any taxes and investment-related expenses incurred by the Funds (e.g., fees and expenses charged by the Portfolio Managers and Portfolio Funds, professional fees, custody and administrative fees). Most expenses of the Funds can be directly attributed to a particular Fund. Expenses which cannot be directly attributed are apportioned among the Funds based upon relative net assets or on another reasonable basis.

Dividend income is recorded on the ex-dividend date.

D. Income Taxes

Each Fund intends to continue to be treated as a partnership for Federal income tax purposes. Each Member is responsible for the tax liability or benefit relating to the Member’s distributive share of taxable income or loss. Accordingly, no provision for Federal income taxes is reflected in the accompanying financial statements. The Funds withhold and pay taxes on foreign Members’ share of U.S. source income and U.S. effectively connected income, if any, allocated from Portfolio Funds to the extent such income is not exempted from withholding under the Internal Revenue Code and Regulations thereunder. The actual amount of such taxes is not known until all Form K-1s from Portfolio Funds are received, usually in the following tax year. Prior to the final determination, the amount of tax is estimated based on information available. The final tax could be different from the estimated tax and the difference could be significant. Such withholdings are recorded as distributions in the Statements of Changes in Members’ Capital, and are allocated to the individual Members’ Capital accounts to which they apply and are not an expense of the Funds.

The Investment Manager applies the authoritative guidance on accounting for and disclosure of uncertainty in tax positions, which requires the Investment Manager to determine whether a tax position of the Funds is more likely than not to be sustained upon examination, including resolution of any related appeals or litigation processes, based on the technical merits of the position. However, the Investment Manager's conclusions regarding Accounting for Uncertainty in Income Taxes may be subject to review and adjustment at a later date based on on-going analyses of tax laws, regulations and interpretations thereof and other factors. Each of the Fund's federal, state and local tax returns for all open tax years remains subject to examination by the Internal Revenue Service and local tax authorities.

E. Distribution Policy

The Funds have no present intention of making periodic distributions of their net investment income or capital gains, if any, to Members. The amount and frequency of distributions, if any, will be determined in the sole discretion of the Board.

| 24 |

Notes to Financial Statements (continued)

2. Significant Accounting Policies (continued)

F. Distributions from Portfolio Funds

Distributions from Portfolio Funds will be classified as investment income or realized gains in the Statements of Operations, or alternatively, as a decrease to the cost of the investments based on the U.S. income tax characteristics of the distribution if such information is available. In cases where the tax characteristics are not available, such distributions are generally classified as investment income.

G. Cash

Cash is defined as cash on deposit at financial institutions.

H. New Accounting Pronouncements

In November 2016 the FASB issued Accounting Standards Update (“ASU”) 2016-18, Restricted Cash. This update requires the Statements of Cash Flows to explain the change during the period in total cash, cash equivalents and amounts generally described as restricted cash. As a result, amounts generally described as restricted cash should be included with cash and cash equivalents when reconciling the beginning and ending total amounts shown on the Statements of Cash Flows. The update is effective for fiscal years beginning after December 15, 2018. Management does not expect the adoption of this guidance to have a material effect on the financial statements.

3. Investment Manager Fee, Related Party Transactions and Other

The Funds paid the Investment Manager a monthly management fee (the “Management Fee”) at the annual rate of 0.75% of the net asset value of each Fund as of the last day of the month (before any repurchases of Interests). As of January 1, 2018 this rate was amended to 0.55%. The Investment Manager is responsible for providing day-to-day investment management services to the Funds, and for providing various administrative services to the Funds.

The Investment Manager may also be paid a Program Fee outside of the Funds for services rendered to investors. The Program Fee is paid directly by the investors at an annual rate of up to 0.60% of an investor’s assets in the Funds, which was amended from 0.50% as of January 1, 2018. The Program Fee may also include an annual performance-based incentive fee outside of the Funds based on the return of an investor’s account with the Investment Manager.

| 25 |

Notes to Financial Statements (continued)

3. Investment Manager Fee, Related Party Transactions and Other (continued)

HedgeServ (Cayman) Ltd., a limited company incorporated in the Cayman Islands, (the “Administrator”) provides administration, accounting and investor services to the Funds. In consideration for such services, the Funds pay the Administrator a monthly fee based on their combined prior month-end net assets at an annual rate of 0.12% on the first $250 million of net assets, 0.10% on net assets between $250 million and $500 million, 0.07% on net assets between $500 million and $750 million and 0.06% on net assets over $750 million, and will reimburse the Administrator for certain out-of-pocket expenses. Each Fund is allocated its pro-rata share of the monthly fee based upon its prior month-end members capital adjusted for capital activity.

JPMorgan Chase Bank, N.A. acts as the custodian (the “Custodian”) for the Funds’ assets. In consideration for such services, each Fund pays the Custodian a monthly fee, based on month-end assets under management, at an annual rate of up to 0.01%. Each Fund also pays the Custodian an annual fee of $7,500 per Cayman Feeder Fund to act as qualified Custodian for each Cayman feeder fund.

Each Member of the Board who is not an “interested person” of the Funds as defined by the 1940 Act receives an annual retainer of $55,000 and regular quarterly meeting fees of $5,000 per meeting (additional meeting fees are $500 per meeting). The chairman of the audit committee receives an additional annual retainer of $4,000. Any Member of the Board of Managers who is an “interested person” does not receive any annual or other fee from the Funds. All Members of the Board of Managers are reimbursed by the Funds for reasonable out-of-pocket expenses.

Net profits or net losses of the Funds for each fiscal period are allocated among and credited to or debited against the capital accounts of Members as of the last day of each fiscal period in accordance with each Member’s respective investment percentage for each Fund. Net profits or net losses are measured as the net change in the value of the net assets of a Fund during a fiscal period, before giving effect to any repurchases of Interests in the Fund, and excluding the amount of any items to be allocated among the capital accounts of the Members of the Fund, other than in accordance with the Members’ respective investment percentages.

4. Financial Instruments with Off-Balance Sheet Risk

In the normal course of business, the Portfolio Funds in which the Funds invest trade various financial instruments and enter into various investment activities with off-balance sheet risk. These include, but are not limited to, short selling activities, writing option contracts, use of leverage and swap contracts. The Funds’ risk of loss in these Portfolio Funds is limited to the value of their investments in the Portfolio Funds.

| 26 |

Notes to Financial Statements (continued)

5. Risk Factors

Limitations on the Funds’ ability to withdraw their assets from Portfolio Funds may limit the Funds’ ability to repurchase their Interests. For example, many Portfolio Funds impose lock-up periods prior to allowing withdrawals, which can be two years or longer. After expiration of the lock-up period, withdrawals typically are permitted only on a limited basis, such as monthly, quarterly, semi-annually, annually or biannually. Many Portfolio Funds may also indefinitely suspend redemptions or establish restrictions on the ability to fully receive proceeds from redemptions through the application of a redemption restriction or “gate.” In instances where the primary source of funds to repurchase Interests will be withdrawals from Portfolio Funds, the application of these lock-ups and withdrawal limitations may significantly limit the Funds’ ability to repurchase their Interests.

The Funds invest primarily in Portfolio Funds that are not registered under the 1940 Act and invest in and actively trade securities and other financial instruments using different strategies and investment techniques that may involve significant risks. Such risks include those related to the volatility of the equity, credit, and currency markets, the use of leverage associated with certain fixed income strategies, derivative contracts and in connection with short positions, the potential illiquidity of certain instruments and counterparty and broker arrangements.

Some of the Portfolio Funds in which the Funds invest may invest all or a portion of their assets in securities which are illiquid or are subject to an anticipated event. These Portfolio Funds may create “side pockets” in which to hold these securities. Side pockets are series or classes of shares which are not redeemable by the investors but which are automatically redeemed or converted back into the Portfolio Fund’s regular series or classes of shares upon the realization of those securities or the happening of some other liquidity event with respect to those securities.

These “side pockets” can often be held for long periods before they are realized, and may therefore be much less liquid than the general liquidity offered on the Portfolio Fund’s regular series or classes of shares. Should the Funds seek to liquidate their investment in a Portfolio Fund that maintains investments in a side pocket arrangement or that holds a substantial portion of its assets in illiquid securities, the Funds might not be able to fully liquidate their investments without delay, which could be considerable. In such cases, during the period until the Funds are permitted to fully liquidate the investment in the Portfolio Fund, the value of the investment could fluctuate.

The Portfolio Funds may utilize leverage in pursuit of achieving a potentially greater investment return. The use of leverage exposes a Portfolio Fund to additional risk including (i) greater losses from investments than would otherwise have been the case had the Portfolio Fund not used leverage to make the investments; (ii) margin calls or interim margin requirements may force premature liquidations of investment positions; and (iii) losses on investments where the investment fails to earn a return that equals or exceeds the Portfolio Fund’s cost of leverage related to such investment. In the event of a sudden, precipitous drop in the value of a Portfolio Fund’s assets, the Portfolio Fund might not be able to liquidate assets quickly enough to repay its borrowings, further magnifying the losses incurred by the Portfolio Fund.

| 27 |

Notes to Financial Statements (continued)

5. Risk Factors (continued)

The Portfolio Funds may invest a higher percentage of their assets in specific sectors of the market in order to achieve a potentially greater investment return. As a result, the Portfolio Funds may be more susceptible to economic, political and regulatory developments in a particular sector of the market, positive or negative, and may experience increased volatility of the Portfolio Fund's net asset value.

The Portfolio Funds may invest in securities of foreign companies that involve special risks and considerations not typically associated with investments in the United States of America, due to concentrated investments in a limited number of countries or regions, which may vary throughout the year depending on the Portfolio Fund. Such concentrations may subject the Portfolio Funds to additional risks resulting from political or economic conditions in such countries or regions and the possible imposition of adverse governmental laws or currency exchange restrictions could cause the securities and their markets to be less liquid and their prices to be more volatile than those of comparable U.S. securities.

The Funds invest in a limited number of Portfolio Funds and such concentrations may result in additional risk. Various risks are also associated with an investment in the Funds, including risks relating to the multi-manager structure of the Fund, risks relating to compensation arrangements and risks related to limited liquidity of the Interests.

The Funds and Portfolio Funds are also subject to the risk of losses arising in connection with cybersecurity incidents.

In the normal course of business, the Funds enter into contracts that contain a variety of representations which provide general indemnifications. Each Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against each Fund that have not yet occurred. However, based on experience, the Funds expect the risk of loss to be remote.

6. Investment Transactions

For the year ended January 31, 2018, purchases and sales of Portfolio Funds were as follows:

| Fund | Purchases | Sales | ||||||

| Aetos Capital Multi-Strategy Arbitrage Fund, LLC | $ | — | $ | 94,270,551 | ||||

| Aetos Capital Distressed Investment Strategies Fund, LLC | 20,000,000 | 112,053,623 | ||||||

| Aetos Capital Long/Short Strategies Fund, LLC | 127,520,197 | 182,317,156 | ||||||

7. Investments

As of January 31, 2018, collectively the Funds had investments in thirty-four Portfolio Funds, none of which were related parties. The agreements related to investments in Portfolio Funds provide for compensation to the general partners/managers in the form of management fees of 0.5% to 2.0% (per annum) of the net assets and incentive fees or allocations of 10% to 20% of net profits earned. The Portfolio Funds generally provide for periodic redemptions, with lock-up provisions ranging up to 3 years from initial investment.

| 28 |

Notes to Financial Statements (continued)

7. Investments (continued)

The liquidity provisions shown in the following tables apply after any applicable lock-up provisions. Further liquidity detail is also provided in the Schedule of Investments.

| Number of Portfolio Funds | % of Total Portfolio Funds | |||||

| Aetos Capital Multi-Strategy Arbitrage Fund, LLC | ||||||

| Funds allowing monthly withdrawals (notice period of 30 days) | 1 | 11.71 | % | |||

| Funds allowing quarterly withdrawals (notice periods ranging from 60 to 90 days) | 3 | 29.92 | % | |||

| Funds allowing semi-annual withdrawals (notice periods ranging from 60 to 65 days) | 2 | 37.80 | % | |||

| Funds allowing annual withdrawals (notice period of 60 days) | 1 | 20.18 | % | |||

| Funds in liquidation | 1 | 0.39 | % | |||

| Number of Portfolio Funds | % of Total Portfolio Funds | |||||

| Aetos Capital Distressed Investment Strategies Fund, LLC | ||||||

| Funds allowing monthly withdrawals (notice period of 45 days) | 1 | 4.87 | % | |||

| Funds allowing quarterly withdrawals (notice period of 65 days) | 2 | 24.79 | % | |||

| Funds allowing semi-annual withdrawals (notice period of 65 days) | 1 | 14.87 | % | |||

| Funds allowing annual withdrawals (notice periods ranging from 65 to 90 days) | 2 | 39.14 | % | |||

| Funds allowing bi-annual withdrawals (notice period of 90 days) | 1 | 14.02 | % | |||

| Funds fully comprised of side-pocket investments | 2 | 2.31 | % | |||

| Number of Portfolio Funds | % of Total Portfolio Funds | |||||

| Aetos Capital Long/Short Strategies Fund, LLC | ||||||

| Funds allowing monthly withdrawals (notice period of 30 days) | 2 | 19.54 | % | |||

| Funds allowing quarterly withdrawals (notice periods ranging from 30 to 65 days) | 9 | 57.76 | % | |||

| Funds allowing semi-annual withdrawals (notice period of 60 days) | 2 | 9.62 | % | |||

| Funds allowing annual withdrawals (notice periods ranging from 30 to 45 days) | 2 | 12.76 | % | |||

| Funds fully comprised of side-pocket investments | 1 | 0.01 | % | |||

| Funds in liquidation | 1 | 0.31 | % | |||

| 29 |

Notes to Financial Statements (continued)

8. Commitments

Through March 1, 2018, the Funds had made no commitments to purchase Portfolio Funds and made the following redemption request from Portfolio Funds, which is effective February 1, 2018:

| Fund | Redemptions | Amount | ||||

| Aetos Capital Multi-Strategy Arbitrage Fund, LLC | ||||||

| Luxor Capital Partners Liquidating SPV, LLC | $ | 1,463,109 | ||||

9. Subsequent Events

Through March 1, 2018, the Funds made no repurchases of Interests and received the following contributions:

| Fund | Amount | |||

| Aetos Capital Multi-Strategy Arbitrage Fund, LLC | $ | 3,094,450 | ||

| Aetos Capital Distressed Investment Strategies Fund, LLC | 1,705,950 | |||

| Aetos Capital Long/Short Strategies Fund, LLC | 3,810,350 | |||

The following table summarizes the repurchase requests received by the Funds subsequent to January 31, 2018, all of which are effective March 31, 2018:

| Fund | Number of Investors | Estimated Redemption Amount Subsequent to 01/31/18 | % of Members’ Capital | |||||||

| Aetos Capital Multi-Strategy Arbitrage Fund, LLC | 6 | $ | 5,895,877 | 1.15 | % | |||||

| Aetos Capital Distressed Investment Strategies Fund, LLC | 6 | $ | 3,026,658 | 0.94 | % | |||||

| Aetos Capital Long/Short Strategies Fund, LLC | 6 | $ | 6,681,289 | 0.69 | % | |||||

The Funds have evaluated the need for additional disclosures and/or adjustments resulting from subsequent events through the date the financial statements were issued. Based on this evaluation, no additional disclosures or adjustments were required to the financial statements as of January 31, 2018.

| 30 |

Managers and Officers of the Funds (unaudited)

| Name, Address(1), Age | Position(s) Held with Funds | Length of Time Served(2) | Principal Occupation(s) During the Past 5 Years/Other Directorships(3) Held by Board Member | Number of Funds in the Fund Complex Overseen by | ||||

| Independent Managers: | ||||||||

Ellen Harvey 63 | Manager | Since 2002 | Principal, Lindsey Criswell LLC, July 2008-Present; Managing Director, Miller Investment Management, September 2008-Present; Trustee of Cutwater Select Income Fund, March 2010-Present; Trustee of Managed Duration Investment Grade Municipal Fund, November 2016-Present | 3 | ||||

Pierre de Saint Phalle 69 | Manager | Since 2002 | Managing Director, Promontory Financial Group, May 2006-November 2016; Senior Consultant, Promontory Financial Group, December 2016-Present | 3 | ||||

Warren J. Olsen 61 | Manager | Since 2003 | Chairman and Chief Investment Officer, SCB Global Capital Management, July 2014-Present; Chairman and Chief Investment Officer, First Western Investment Management, September 2002-July 2014 | 3 | ||||

| Interested Managers: | ||||||||

Michael Klein(5) 59 |

Manager and President | Since 2003 | Co-President, Aetos Alternatives Management, LLC and Managing Director, Aetos Capital, LLC, March 2000-Present; Director/Trustee of certain funds in the Morgan Stanley Fund Complex, August 2006-Present | 3 | ||||

| Officers: | ||||||||

Anne Casscells 59 | Chief Investment Officer | Since 2002 | Co-President, Aetos Alternatives Management, LLC and Managing Director, Aetos Capital, LLC, October 2001- Present | N/A | ||||

Scott Sawyer 49 | Treasurer | Since 2004 | Director, Aetos Capital, LLC, August 2004- Present | N/A | ||||

Harold J. Schaaff 57 | Vice President and Secretary | Since 2001 | General Counsel and Managing Director, Aetos Capital, LLC, March 2001-Present | N/A |

| (1) | Each Manager can be contacted by writing to Aetos Capital, LLC 875 Third Avenue, New York, NY 10022. |

| (2) | Each Manager holds office until the next meeting of shareholders at which Managers are elected following his or her election or appointment and until his successor has been elected and qualified. |

| (3) | Directorships of companies required to report to the Securities and Exchange Commission under the Securities Exchange Act of 1934 (i.e., “public companies”) or other investment companies registered under the 1940 Act. |

| (4) | The “Fund Complex” consists of all registered investment companies for which Aetos Alternatives Management, LLC or any of its affiliates serves as investment adviser. |

| (5) | Mr. Klein is considered to be an “interested person” of the Fund as defined in the 1940 Act because he is a Co-President of Aetos Alternatives Management, LLC. |

| 31 |

Approval of Investment Advisory Agreements

January 31, 2018

(Unaudited)