Exhibit 99.2

UNITED STATES DISTRICT COURT

WESTERN DISTRICT OF PENNSYLVANIA

| | | | |

| | | X | | |

| Eric King, on behalf of himself and all others | | : | | |

| similarly situated, | | : | | CIVIL ACTION |

| | | : | | NO. |

Plaintiff, | | : | | |

vs. | | : | | CLASS ACTION |

| | | : | | COMPLAINT |

| | | : | | FOR VIOLATIONS OF |

| | | : | | FEDERAL SECURITIES |

| World Health Alternatives, Inc., Daszkal Bolton | | : | | LAWS |

| LLP, Richard E. McDonald, Mark D. Roup, and | | : | | |

| John C. Sercu. | | : | | |

Defendants. | | : | | |

| | | : | | |

| | | X | | |

PLAINTIFF’S CLASS ACTION COMPLAINT

Plaintiff makes the following allegations upon information and belief, except as to allegations specifically pertaining to Plaintiff and his counsel, based on the facts alleged below, which are predicated upon the investigation undertaken by Plaintiff’s counsel, which investigation included analysis of publicly-available news articles and reports, public filings, press releases and/or other matters of public record.

NATURE OF THE ACTION

1. This is a class action on behalf of all purchasers of the common stock of World Health Alternatives, Inc. (“WHAI” or the “Company”) between June 26,

2003 and August 18, 2005, inclusive, (the “Class Period”), seeking to pursue remedies under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 (the “Exchange Act”). According to WHAI’s Class Period press releases, WHAI is a premier medical staffing company that provides medical, professional, and administrative staffing services to the healthcare industry.

2. On August 16, 2005, the Company announced that its then Chief Executive Officer, Richard E. McDonald (“McDonald”) had resigned, allegedly for family and health reasons. Three days later, on August 19, 2005, the Company announced that it expected to restate its prior financial statements, that an independent investigation had been commenced, and that it had terminated its engagement with Daszkal Bolton LLP, its outside auditors. The Company also revealed that, among other things, it had made irregular reports to its lenders, resulting in excess funding which may have resulted in breaches of its financing agreements, had underpaid certain tax liabilities, and had not properly reported and/or accounted for all of its outstanding shares. In response to this news, the Company’s stock lost over 85% of its value in a three day period, wiping out millions of dollars of market capitalization.

3. As now revealed, at least in part, Defendants issued false and misleading financial statements at all times during the Class Period and misrepresented the true results of its operations.

- 2 -

JURISDICTION AND VENUE

4. This Court has jurisdiction over the subject matter of this action pursuant to 28 U.S.C. §§ 1331, 1337 and 1367 and Section 27 of the Exchange Act (15 U.S.C. § 78aa).

5. This action arises under Sections 10(b) and 20(a) of the Exchange Act (15 U.S.C. § § 78j(b) and 78t(a)) and Rule 10b-5 promulgated thereunder (17 C.F.R. §240.10b-5).

6. Venue is proper in this District pursuant to Section 27 of the Exchange Act (15 U.S.C. § 78aa) and 28 U.S.C. § 1391(b) and (c). Substantial acts in furtherance of the alleged fraud and/or its effects have occurred within this District and WHAI maintains its principal executive offices in this District.

7. In connection with the acts and omissions alleged in this complaint, Defendants, directly or indirectly, used the means and instrumentalities of interstate commerce, including, but not limited to, the mail, interstate telephone communications, and the facilities of the national securities markets.

PARTIES

8. Plaintiff Eric King purchased WHAI common stock during the Class Period, as set forth in the accompanying certification that is incorporated herein by reference, and was damaged thereby. Plaintiff King resides in Carmel, Indiana.

9. Defendant WHAI is a Florida corporation that maintains its principal

- 3 -

executive offices in this District at 777 Penn Center Blvd., Suite 111, Pittsburgh, PA 15235.

10. The Individual Defendants, at times relevant to this action, served in the various capacities listed below and received substantial compensation therefor:

| | |

Name

| | Position

|

Richard E. McDonald | | Chairman, Chief Executive Officer, President, Principle Financial Officer, Principle Accounting Officer. |

| |

Marc D. Roup | | Chief Executive Officer, Director. |

| |

John C. Serzu | | (Since 8/16/05) Acting President and Interim Chief Executive Officer, (prior) Chief Operating Officer. |

11. Daszkal Bolton LLP (“Daszkal Bolton”) is a limited liability partnership based in Florida, with offices in Boca Raton and West Palm Beach. Its website is http://www.daszkalbolton.com. Daszkal Bolton served as WHAI’s auditor at all relevant times.

12. Each of the Defendants is liable as a participant in a fraudulent scheme and course of business that operated as a fraud or deceit on purchasers of WHAI common stock, by disseminating materially false and misleading statements and/or concealing material adverse facts. The scheme: (i) deceived the investing public regarding WHAI’s business, its finances and the intrinsic value of WHAI common stock; and (ii) caused Plaintiff and other members of the Class to purchase WHAI

- 4 -

common stock at artificially inflated prices.

PLAINTIFF’S CLASS ACTION ALLEGATIONS

13. Plaintiff brings this action as a class action pursuant to Federal Rule of Civil Procedure 23(a) and (b)(3) on behalf of a Class, consisting of all persons who purchased or otherwise acquired WHAI common stock during the Class Period (June 26, 2003 through August 18, 2005), and who were damaged thereby. Excluded from the Class are Defendants, members of the immediate family of each of the Individual Defendants, any subsidiary or affiliate of WHAI and the directors, officers and employees of WHAI or its subsidiaries or affiliates, or any entity in which any excluded person has a controlling interest, and the legal representatives, heirs, successors and assigns of any excluded person.

14. The members of the Class are so numerous that joinder of all members is impracticable. While the exact number of Class members is unknown to Plaintiff at this time and can only be ascertained through appropriate discovery, Plaintiff believes that there are thousands of members of the Class situated throughout the United States. According to Yahoo Finance, there are over 40,000,000 shares of WHAI common stock outstanding. Throughout the Class Period, WHAI common stock was actively traded on the Over-The-Counter-Bulletin-Board (“OTCBB”). Record owners and other members of the Class may be identified from records maintained by WHAI and/or its transfer agents and may be notified of the pendency

- 5 -

of this action by mail, using a form of notice similar to that customarily used in securities class actions.

15. Plaintiff’s claims are typical of the claims of the other members of the Class as all members of the Class were similarly affected by Defendants’ wrongful conduct in violation of federal law that is complained of herein.

16. Plaintiff will fairly and adequately protect the interests of the members of the Class and have retained counsel competent and experienced in class and securities litigation.

17. Common questions of law and fact exist as to all members of the Class and predominate over any questions solely affecting individual members of the Class. Among the questions of law and fact common to the Class are:

(a) whether the federal securities laws were violated by Defendants’ acts and omissions as alleged herein;

(b) whether Defendants participated in and pursued the common course of conduct complained of herein;

(c) whether documents, press releases, and other statements disseminated to the investing public and the Company’s shareholders during the Class Period misrepresented material facts about the business, finances, financial condition and prospects of WHAI;

(d) whether statements made by Defendants to the investing public

- 6 -

during the Class Period misrepresented and/or omitted to disclose material facts about the business, finances, value, performance and prospects of WHAI;

(e) whether the market price of WHAI common stock during the Class Period was artificially inflated due to the material misrepresentations and failures to correct the material misrepresentations complained of herein; and

(f) to what extent the members of the Class have sustained damages and the proper measure of damages.

18. A class action is superior to all other available methods for the fair and efficient adjudication of this controversy since joinder of all members is impracticable. Furthermore, as the damages suffered by individual Class members may be relatively small, the expense and burden of individual litigation make it impossible for members of the Class to individually redress the wrongs done to them. There will be no difficulty in the management of this suit as a class action.

BACKGROUND AND SUBSTANTIVE ALLEGATIONS

19. On February 20, 2003, WHAI announced that it had acquired Better Solutions, Inc. (“BSI”). In connection with the acquisition of BSI, WHAI issued 33,000,000 shares, or approximately 82% of its newly issued WHAI common stock, to BSI’s two owners, McDonald and Roup.

20. On May 16, 2003, WHAI filed a Form 10QSB with the Securities and Exchange Commission (the “SEC”). In the Form 10QSB, WHAI reported that as of

- 7 -

March 31, 2003, WHAI had assets of $245,727 and sales for the three months ended March 31, 2003 of $942,887. Net loss was reported as $395,016 or $.01 per share.

21. Defendants reported on the sufficiency of WHAI’s internal controls in this filing as well, stating:

| ITEM 3. | CONTROLS AND PROCEDURES |

As of March 31, 2003, an evaluation was performed under the supervision and with the participation of the our management, including our Chief Executive Officer, of the effectiveness of the design and operation of our disclosure controls and procedures. Based on that evaluation, our management, including our Chief Executive Officer, concluded that our disclosure controls and procedures were effective as of March 31, 2003. There have been no significant changes in our internal controls or in other factors that could significantly affect internal controls subsequent to March 31, 2003.

22. The Form 10QSB was signed by Defendants Roup and McDonald.

23. The representations set forth in Paragraphs 20-21 were materially false and misleading because, as now known, WHAI lacked internal controls and its financial statements were materially incorrect and are expected to be restated.

24. WHAI stock began trading on the OTC Bulletin Board on June 26, 2003, the beginning of the Class Period.

25. Following a series of private placements to raise capital and various acquisitions of private entities, Defendants began touting the historical performance and expected earnings of WHAI to increase the price of WHAI’s common stock so that they could benefit therefrom. Indeed, as discussed further herein, Defendant

- 8 -

Roup sold over $2 million worth of stock at artificially inflated prices during the Class Period.

26. On August 13, 2003, Defendants filed or caused to be filed the Form 10Q for the period ending June 30, 2003. Defendants Roup and McDonald signed and filed Sarbanes-Oxley certifications in connection with this Form 10Q. Defendants represented that the Form 10Q accurately and fairly presented WHAI’s financial statements and results of operation for the periods represented therein and that WHAI’s internal controls were sufficient. The form of the Sarbanes-Oxley certification is set out in more detail in connection with the discussion of WHAI’s Form 10K for fiscal year 2004, filed April 14, 2005. Sarbanes-Oxley certifications were filed with the Company’s Forms 10Q and 10K throughout the Class Period, each representating that WHAI’s controls were adequate and that the financial statements which they accompanied were accurate and complete and fairly reflected WHAI’s results of operation.

27. As now revealed, WHAI’s previously issued financial statements are expected to be restated, demonstrating that they were and were known to be materially incorrect when issued. Defendants’ representations in said financial statements and in the Sarbanes-Oxley certifications attesting to the financial statements’ accuracy and the adequacy of WHAI’s internal controls were thus false and misleading when made.

- 9 -

28. On March 25, 2004, Defendants issued a Press Release announcing WHAI’s financial results for the fourth quarter and year ended December 31, 2003. The Press Release, filed that day with the SEC pursuant to Form 8-K, touted: “Gross Profits Up 49% for Fourth Quarter and 58% for the Year”; and “Fourth Quarter Net Income Rises 138%.” Among other things, the Press Release provided:

The Company’s sales for the fourth quarter were $962,000, which was a 19% increase over the fourth quarter sales in 2002 of $809,000. The increase was due primarily to revenue generated by new offices that the Company opened in Cleveland, Ohio and Boca Raton, Florida. The 2003 fourth quarter sales also included a 3.5% increase in revenues generated by the Company’s Pittsburgh, Pennsylvania office as compared to that office’s revenues in the fourth quarter of 2002.

Gross profits for the fourth quarter of 2003 rose to $490,000, an increase of 49% over the fourth quarter of 2002. As a percentage of sales, gross profit for the fourth quarter reached 50.9%, which was 10.2% higher than the 40.7% realized in the fourth quarter of 2002. The increase primarily resulted from significant increases in contract placements of staffing personnel, more favorable margins on those placements, and a rise in permanent placement fees during the fourth quarter.

Operating income more than doubled to $296,000 in the fourth quarter of 2003, up from $113,000 in the fourth quarter of 2002. This 162% increase is attributable to a combination of increased revenues and margins and a decrease of 11% in selling, marketing and administrative expenses in the fourth quarter that resulted from cost containment measures.

29. On April 20, 2004, Defendants filed with the SEC WHAI’s Annual Report on Form 10-KSB for the year ended December 31, 2003. Among other things, WHAI’s Form 10-KSB stated that:

- 10 -

Sales. Sales for the year ended December 31, 2003 increased 32% to $3,693,337 versus $2,796,911 in sales for the same period in 2002. The increase was due primarily to the Company’s growth, including revenue generated by the new offices in Cleveland, Ohio and Boca Raton, Florida, and 3.8% growth in revenues attributable to the Pittsburgh, Pennsylvania office.

Gross Profit. Gross profit for the year ended December 31, 2003 increased 57.6% to $1,599,794 versus $1,015,046 for the same period in 2002. The increase in gross profit is due to the increase in temporary placements, improved pricing for consultants and additional permanent placement fees received in the current year. Gross profit as a percentage of revenue increased to 43.3% in 2003 from 36.3% in 2002. The 7.0% increase in gross margin percentage from 2002 to 2003 is attributable to additional permanent placement fees received and to improved pricing for consultants’ services.

....

Income (Loss) Before Income Taxes. Income (loss) before income taxes decreased $111,195, from $78,101 in 2002 to $(33,094) in 2003 due to the aforementioned reasons.

Provision for Income Taxes. Our provision (benefit) for income taxes was $0 in 2002 and $(1,516) in 2003. The 2003 benefit includes a $27,000 federal benefit from the reversal of income taxes provided in 2001 and $25,484 of federal and state income tax expense relating to the current year. The current year provision is required as the consolidated entity had earnings for the ten and one-half month period in 2003 subsequent to the acquisition of Better Solutions. Better Solutions (the S Corporation) has a loss for the one and one-half month period prior to its acquisition by us. The shareholders of Better Solutions will receive the benefit of that loss when they file their income tax returns for 2003.

On January 1, 2002, Better Solutions, with the consent of its shareholders, made the election under the Internal Revenue Code to be an S Corporation. In lieu of corporation income taxes, the stockholders of an S Corporation are taxed on their proportionate share of the

- 11 -

Company’s taxable income. WHAI had no operations or earnings in 2002, therefore, no income tax provision was necessary. Consequently, no provision for income taxes was made for 2002.

Net Income (Loss). Net income decreased $109,679 from net income of $78,101 in 2002 to a net loss of $31,578 in 2003.

30. Defendants repeated each of these statements when they filed WHAI’s amended Form 10-KSB with the SEC on April 29, 2004.

31. On May 17, 2004, Defendants issued a Press Release announcing WHAI’s financial results for the first quarter ended March 31, 2004. The Press Release, filed that day with the SEC pursuant to Form 8-K, touted: “Sales and Gross Profits Soar As Operating Loss Narrows.” Among other things, the Press Release provided:

Sales for the quarter ended March 31, 2004 reached $1.68 million, up 78% from $943,000 for the same period in 2003. Management credits the increase to the sales made by Superior Staffing Solutions, Inc., which World Health acquired in December 2003.

Gross profit for the quarter ended March 31, 2004 more than doubled to $665,000, compared to $317,000 for the same quarter in 2003. The increase in gross profits resulted from additional permanent placement fees received in the first quarter of this year as well as from additional fees attributable to the Superior Staffing acquisition.

The Company reported an operating loss of $175,000 for the three months ended March 31, 2004, an improvement on the $362,000 operating loss for the same period in 2003.

32. On May 17, 2004, Defendants filed with the SEC their Quarterly Report on Form 10-QSB for the quarter ended March 31, 2004. Defendants’ Form

- 12 -

10-QSB repeated the same financial information and made similar disclosures as made in the May 17, 2004, Press Release.

33. In addition, WHAI’s Form 10-QSB disclosed that WHAI had taxes payable in the amount of $13,484, a loss before income taxes in the amount of $244,203, and an accrued income tax benefit of $12,000. With respect to the company’s income taxes, the Form 10-QSB disclosed that:

No federal or state income tax has been provided for the three months ended March 31, 2004 and 2003 due to the losses. The income generated by Better Solutions in 2003 prior to our acquisition on February 20, 2003 was distributed to the shareholders of Better Solutions in proportion to their ownership. On January 1, 2002, Better Solutions, with the consent of its shareholders, elected to be an S Corporation under the Internal Revenue Code. In lieu of corporation income taxes, the stockholders are taxed on their proportionate share of a company’s taxable income.

34. Defendants’ March 25, April 20, April 29 and May 17, 2004, public statements and SEC filings were materially false and misleading because, as now revealed, WHAI did not account properly for its shares outstanding, lacked internal controls, underpaid its tax liability, and has to restate its previously issued financial statements.

35. On July 15, 2004 Defendant Roup sold 275,000 shares of his WHAI common stock for proceeds of approximately $902,000.

36. On August 16, 2004, Defendants issued a Press Release announcing WHAI’s financial results for the second quarter ended June 30, 2004. The Press

- 13 -

Release, filed that day with the SEC pursuant to Form 8-K, touted: “All Business Entities Produce Over $10 Million In Second Quarter Revenues”; “Actual Sales Up 560% Over Second Quarter of 2003”; “Gross Profit Remains High With Integration of New Businesses”; “Third Quarter Guidance is $13 Million—$17 Million in Revenue, EPS 6—8 Cents Per Share.” Among other things, the Press Release provided:

Actual sales for the Company for the quarter ended June 30, 2004, reached approximately $5.6 million, up 560% from $842,000 for the same period in 2003. The increase was primarily due to the three acquisitions, which were Pulse Healthcare Staffing, Inc. in May 2004, Care For Them, Inc. in May 2004 and Curley and Associates, LLC in June 2004. The Company was able to achieve this increase in sales even though the treatment under GAAP of the effective date for each acquisition meant the Company could not incorporate the acquisitions’ revenues until after the second quarter was partially completed.

Gross profit for the quarter ended June 30, 2004, hit approximately $1.75 million, which was an increase of 427% when compared to $332,000 for the same quarter in 2003. The Company attributes this growth to the acquisitions as well as strong margins produced by the core business.

. . . .

The Company estimates that its earnings before deductions for interest, depreciation, amortization and taxes for the three months ended June 30, 2004, was $438,897, or $0.02 per share, which is a $430,180 increase over the same period in 2003.

37. Defendant McDonald stated in the August 16 Press release:

Our top-line growth has been substantial and our margins have remained strong. This is mainly attributable to the Company’s success at executing its strategic business plans, which included raising capital and acquiring three medical staffing companies located in

- 14 -

Massachusetts, California and Florida. Following Generally Accepted Accounting Principles (“GAAP”), the Company was able to incorporate and benefit from the acquisitions’ revenues for only a fraction of the second quarter. More importantly, however, each acquisition is now operating within the World Health family and performed as anticipated under our guidance, showing strong organic growth of approximately 16% versus their second quarter of 2003 on an aggregate pro forma basis. The strategic nature of these acquisitions has enabled us to cross-sell services, which results in a higher utilization of existing resources and more favorable margins. Overall, the revenue generated by those units suggests that our business model and methods are working.

. . . .

We had immediate increases in the Company’s gross profit partly because the acquisitions allowed us to capitalize on economies of scale and gave us additional resources, thereby enabling us to more effectively and efficiently source people throughout the United States. Our travel costs per placement have decreased over 6% and our ability to offer a selection of high quality medical professionals to our clients has lead to increased pricing and more stable contracts. We have also realized an increase in the market for our services over the past two months.

. . . .

Because of the accounting rules governing the way we incorporate the financial results of the acquisitions into our own, the Company can only show a partial picture in its financial reporting for the second quarter of 2004. World Health is on track to exceed the goals of its business plan and we will continue integrating our recent acquisitions and searching for new ones. At the same time, we intend to continue to raise the margin levels of our acquisitions to the strong levels of our core operation.

. . . .

If we assume, on a pro forma basis, that the three business acquisitions in the second quarter of 2004 had been consummated on January 1, 2004, the Company estimates it would have realized sales of $23.8 million in the first half of 2004 versus $18.6 million in the first half of 2003. We also estimate that we would have realized pro forma income of $275,461 for the first half of 2004 versus a loss of $2,610,375 for the first half of 2003, and pro forma earnings before deductions for

- 15 -

interest, depreciation, amortization and taxes for the six months ended June 30, 2004 of $2,021,492, or $0.07 per share.

. . . .

Based on the progress World Health has made in integrating its acquisitions and in growing its business organically, I am comfortable projecting third quarter 2004 revenue of $13 million to $17 million and earnings of 6 to 8 cents per fully diluted share.

38. On August 23, 2004, Defendants filed with the SEC their Quarterly Report on Form 10-QSB for the quarter ended June 30, 2004. Defendants’ Form 10-QSB repeated the same financial information and made similar disclosures as made in the August 16, 2004, Press Release.

39. In addition, WHAI’s June 30, 2004 Form 10-QSB disclosed that, for the second quarter ending June 30, WHAI had taxes payable in the amount of $13,868, a loss before income taxes in the amount of $219,949, and an accrued income tax benefit of $12,000. WHAI also disclosed that, for the 6 months ending June 30, WHAI had a loss before income taxes in the amount of $464,152 and accrued income taxes in the amount of $11,616. With respect to the company’s income taxes for both the quarter and six months ending June 30, the Form 10-QSB disclosed that:

No federal or state income tax has been provided for the three months ended June 30, 2004 and 2003 due to the loss. The income generated by Better Solutions, Inc in 2003 prior to our acquisition on February 20, 2003 was distributed to the shareholders of Better Solutions in proportion to their ownership. On January 1, 2002, Better Solutions, with the consent of its shareholders, elected under the Internal Revenue Code to be an S Corporation. In lieu of corporation income taxes, the

- 16 -

stockholders are taxed on their proportionate share of a company’s taxable income.

40. Defendants’ August 16, 2004 public statements and August 23 SEC filing were materially false and misleading because, as now revealed, WHAI did not account properly for its shares outstanding, lacked internal controls, underpaid its tax liability, and has to restate its previously issued financial statements.

41. On October 4, 2004 Defendant Roup sold 57,800 shares of his WHAI common stock for proceeds of approximately $596,000.

42. On November 22, 2004, Defendants filed WHAI’s for 10-Q with the SEC which repeated the materially false and misleading financial results for 9 months ending September 30, 2004.

43. On January 5, 2005 Defendant Roup sold 142,000 shares of his WHAI common stock for proceeds of approximately $532,000.

44. On February 14, 2005, Defendants filed a Form 8-K with the SEC advising that WHAI had entered into a revolving credit, term loan and security agreement with Capital Source Finance, LLC in order to “refinance outstanding indebtedness and provide additional liquidity.” Among other things, the Form 8-K disclosed that each of the Company’s subsidiaries was a co-borrower under the agreement, that the agreement included a term loan in the amount of $7,500,000 and a revolving credit facility with a maximum loan amount of $35,000,000, and that

- 17 -

“all of the assets of the Company and its subsidiaries” secured these obligations.

45. In connection with the transaction, WHAI disclosed in the February 14, 2005, Form 8-K among other things that:

The Agreement includes the following covenants as measured at the end of each month for the average of the three most recent calendar months: (a) the Company must maintain EBITDA (earnings before interest, taxes, depreciation and amortization) of not less than $3.5 million as of February 28, 2005 and increasing on a monthly basis to not less than $7.6 million as of December 31, 2005 and thereafter; (b) the Company’s senior leverage ratio (total senior debt to EBITDA) cannot exceed 1.8 to 1.0 as of February 28, 2005 and decreasing on a monthly basis to 1.0 to 1.0 as of September 30, 2005 and thereafter; and (c) the Company’s fixed charge coverage ratio (EBITDA divided by the sum of debt service, capital expenditures, income taxes and dividends) must be not less than 1.5 to 1.0 as of February 28, 2005 and increasing on a monthly basis to 2.0 to 1.0 as of August 31, 2005 and thereafter. In addition, the Company’s collections of accounts receivable may not be less than $11.5 million for each calendar month through April 30, 2005, and increasing thereafter on a quarterly basis to monthly collections of not less than $15 million for October 2005 and thereafter. The Company is also required to maintain available cash, including amounts available for borrowing under the Revolving Facility, of not less than $1.5 million. Additional covenants governing permitted indebtedness, liens, payments of dividends and protection of collateral are included in the Agreement.

46. Defendants’ February 14, 2005 public statements were materially false and misleading because, as later revealed, Defendants had made irregular reports to WHAI’s lenders, causing the lenders to provide excess fundings and, likely, breaches of WHAI’s financing agreements.

47. On April 14, 2005, WHAI filed its fiscal year 2004 annual report on

- 18 -

Form 10-K/A for the year ended December 31, 2004 (“the 2004 Form 10-K/A). The 2004 Form 10-K/A included Daszkal Bolton’s unqualified audit report dated April 14, 2005, which falsely represented that Daszkal Bolton had conducted its audit for WHAI’s year-end 2004 financial statements in accordance with Generally Accepted Accounting Standards (“GAAS”), and that WHAI’s financial statements conformed with GAAP.

48. Daszkal Bolton’s audit letter opinion stated:

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Stockholders

World Health Alternatives, Inc.

We have audited the accompanying consolidated balance sheets of World Health Alternatives, Inc. as of December 31, 2004 and 2003, and the related consolidated statements of operations, changes in shareholders’ equity (deficit) and cash flows for the years then ended. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

Except as discussed in the following paragraph, we conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

- 19 -

The Company is currently in consultation with members of the Office of the Chief Accountant of the Securities and Exchange Commission (SEC) regarding the application of Emerging Issues Task Force 00-19,Accounting for Derivative Financial Instruments Indexed to, and Potentially Settled in, a Company’s Own Stock,and Financial Accounting Standards Board Statement No. 133Accounting for Derivative Instruments and Hedging Activitiesto the redemption and conversion features of the preferred stock issued in December 2004. The financial statements for the fiscal year ended December 31, 2004 (“2004 financial statements”) reflect the classification of these features of the preferred stock as embedded derivatives as more fully discussed in Note 2. Resolution of the accounting treatment discussion between the Company and the SEC may result in a restatement of the 2004 financial statements.

In our opinion, except for the effects on the 2004 financial statements of such adjustments, if any, as might be determined to be necessary depending on the resolution of the accounting treatment discussed in the preceding paragraph, the financial statements referred to in the first paragraph above present fairly, in all material respects, the financial position of World Health Alternatives, Inc. at December 2004 and 2003, and the results of its operations and its cash flows for the years then ended in conformity with accounting principles generally accepted in the United States of America.

/s/ DASZKAL BOLTON LLP

Boca Raton, Florida

April 14, 2005

49. Contrary to the statements in its audit report, Daszkal Bolton did not perform its fiscal 2003 or 2004 audit in accordance with GAAS, and the financial statements were not in conformity with GAAP, as alleged herein. As now revealed, WHAI did not account properly for its shares outstanding, lacked internal controls, underpaid its tax liability, and has to restate its previously issued financial

- 20 -

statements.

50. Daszkal Bolton represented in unqualified audit opinions in connection with the filing of WHAI’s 10-K’s that its audits for the fiscal years ended 2003 and 2004 were performed in a manner consistent with GAAS. Such representations were materially false, misleading and without reasonable basis.

51. WHAI filed its Form 10Q for the period ending March 31, 2005 on May 16, 2005. In Item 3, Defendants again misrepresented the sufficiency of their internal controls, stating:

| ITEM 3. | CONTROLS AND PROCEDURES |

Under the supervision and with the participation of our management, including our Chief Executive Officer and Principal Financial Officer, we conducted an evaluation of the effectiveness of our disclosure controls and procedures, as defined in Rules 13a-15(e) and 15d-15(e) of the Securities Exchange Act of 1934 as of the end of the period covered by this Report. Based on that evaluation, our Chief Executive Officer and Principal Financial Officer have concluded that our disclosure controls and procedures as of March 31, 2005 were effective to ensure that information required to be disclosed by us in reports that we file or submit under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms.

There have been no material changes in our internal controls over financial reporting or in other factors that could materially affect, or are reasonably likely to affect, our internal controls over financial reporting during the quarter ended March 31, 2005.

52. Defendant McDonald also signed and filed with this Form 10Q several Sarbanes-Oxley Certifications, as follows:

- 21 -

CERTIFICATION OF CEO PURSUANT TO SECTION 302 OF THE

SARBANES-OXLEY ACT

CERTIFICATIONS

I, Richard E. McDonald, certify that:

| 1. | I have reviewed this quarterly report on Form 10-QSB of World Health Alternatives, Inc.; |

| 2. | Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

| 3. | Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; |

| 4. | The registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) for the registrant and have: |

| a) | Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

| b) | Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our |

- 22 -

| | conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| c) | Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and |

| 5. | The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of registrant’s board of directors (or persons performing the equivalent functions): |

| a) | All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and |

| b) | Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting. |

| | |

| |

| By | | /s/ Richard E. McDonald |

| | | Richard E. McDonald |

| | | President, Chief Executive Officer |

Date: May 16, 2005

- 23 -

Exhibit 32.1

CERTIFICATIONS PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

(18 U.S.C. SECTION 1350)

In connection with the Quarterly Report of World Health Alternatives, Inc. (the “Company”) on Form 10-QSB for the period ending March 31, 2005 as filed with the Securities and Exchange Commission on the date hereof (the “Report”), I, Richard E. McDonald, President and Chief Executive Officer of the Company, certify, pursuant to 18 U.S.C. § 1350, as adopted pursuant to § 906 of the Sarbanes-Oxley Act of 2002, that:

(1) The Report fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended; and

(2) The information contained in the Report fairly presents, in all material respects, the financial condition and result of operations of the Company.

| | |

| |

| By | | /s/ Richard E. McDonald |

| | | Richard E. McDonald |

| | | President, Chief Executive Officer |

| | | |

Date: May 16, 2005

53. The representations in paragraphs 51-52 were false because WHAI’s internal controls were inadequate and because WHAI’s financial statements did not accurately and fairly present WHAI’s financial condition and results of operation.

THE TRUTH BEGINS TO BE REVEALED

54. On August 16, 2005, before the market opened, the Company

- 24 -

announced that its Chief Executive Officer, Richard E. McDonald, had resigned. Mr. McDonald, the press release stated, had “indicated that he was resigning for health and family reasons.”

55. In the same release, the Company announced that it would be filing with the Securities and Exchange Commission (the “SEC”) a Form 12b-25, notifying the SEC that the Company’s quarterly report on Form 10-QSB for the period ending June 30, 2005, which was due to be filed on August 15, 2005, could not be filed within the prescribed time period. The Company further explained in the release that the date on which the Company will release its second quarter financial results and host the associated conference call and webcast would be announced at a future date.

56. On August 16, 2005, the Company filed its Notification of Late Filing on Form 12b-25. In Part II of this SEC filing, the Company noted that:

(b) The subject annual report, semi-annual report, transition report on Form 10-K, 10-KSB, 20-F, 11-K or Form N-SAR, or portion thereof will be filed on or before the 15th calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q, 10-QSB, or portion thereof will be filed on or before the fifth calendar day following the prescribed due date; and

57. In Part III of this SEC filing, the Company explained the reasons for filing the Form 12b-25 and represented that:

- 25 -

Registrant has been unable to complete its Form 10-QSB for the quarter ended June 30, 2005, within the prescribed time because of delays in completing the preparation of its unaudited financial statements and its management discussion and analysis. Such delays are primarily due to Registrant’s change in management, which has delayed the review of the unaudited financial statements for the quarter ended June 30, 2005.

58. In Part IV of this SEC filing, for “Other Information”, the Company affirmed that the the delayed filing would contain significant changes in results of operations from the corresponding period for the last fiscal year, but explained that the changes were due to the Company’s growth in 2004 due to acquisitions.

59. John Sercu signed the Form 12b-25 in his capacity as Acting President and Chief Executive Officer.

60. On August 16, 2004, over 13,407,300 shares of WHAI stock were traded, according to Yahoo Finance. The price of WHAI stock closed at $2.34 per share, down $1.12 or 34.7% from the previous day’s close of $3.46 per share.

61. On August 19, 2005, at 10:22 a.m., the Company announced that it was suspending trading in its common stock due to issues it discovered following its former CEO’s departure and its commencement of an independent investigation. The press release stated in pertinent part:

World Health Alternatives, Inc. Suspends Trading

Friday August 19, 10:22 am ET

- 26 -

PITTSBURGH—(BUSINESS WIRE)—Aug. 19, 2005—World Health Alternatives, Inc. announced today that it was taking action to suspend trading as a result of certain issues that have come to light following the recent departure of its chief executive officer, Richard E. McDonald. The company is commencing an independent investigation and has hired independent counsel.

62. At the end of the business day on August 19, 2005, the Company issued a press release in which the Company disclosed that it had terminated its auditor, Daszkal Bolton LLP. Due to issues the Company said it discovered after its former CEO resigned, the Company explained further that it had commenced an internal investigation, which the Company expected would lead to the restatement of the Company’s previously issued financial statements. The Company also revealed that it had made “irregular reports” to the Company’s lenders which may constitute breaches of existing financing documents.

63. The press release provided in pertinent part:

WORLD HEALTH ALTERNATIVES, INC.

COMMENCES INVESTIGATION

Pittsburgh, PA, August 19, 2005 – World Health Alternatives, Inc. (OTC BB: WHAI.OB) announced today that, following the recent departure of former Chief Executive Officer, Richard E. McDonald, the Company is investigating issues that include, but may not be limited to, apparent discrepancies in the amount of the Company’s shares outstanding, financial statement recognition of a convertible debenture and warrant agreement associated with the Company’s preferred stock, the underpayment of certain tax liabilities in excess of $4 million, and irregular reports to the Company’s lenders that resulted in excess funding under the Company’s lending arrangements of approximately

- 27 -

$6.5 million, in addition to other issues which may constitute breaches of existing financing documents.

The Company has retained outside counsel, and the Board of Directors has retained special counsel to conduct an investigation into the discrepancies. The amounts at issue could change as the investigation continues. Since the Company’s stock is traded on the OTC Bulletin Board, the Company does not have the authority to suspend trading of its stock.

The Company has also terminated its engagement with Daszkal Bolton LLP, its outside auditing firm, and will begin a search for a new auditing firm.It is expected that the Company’s prior financial reports will be restated.The Company is actively working with its investment banking and funding sources to raise capital to meet its short-term cash obligations. John Sercu, the interim Chief Executive Officer of the Company, stated, “It is very unfortunate to have discovered that we have to deal with these issues, but management and the Board are working diligently to resolve them. The Company continues to make staffing placements of its medical and other professionals on a daily basis with its clients, and we look forward to continuing our business into the future.”

64. On August 19, 2005, 32,052,000 shares of WHAI stock were traded. The price of WHAI stock closed at $0.49 on August 19, 2005, down $2.97 or 85.8% from the price of WHAI stock just before the August 16, 2005 press release announcing the CEO’s resignation.

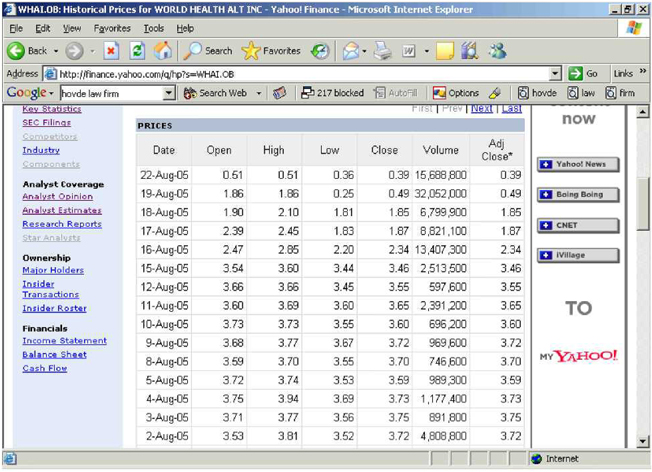

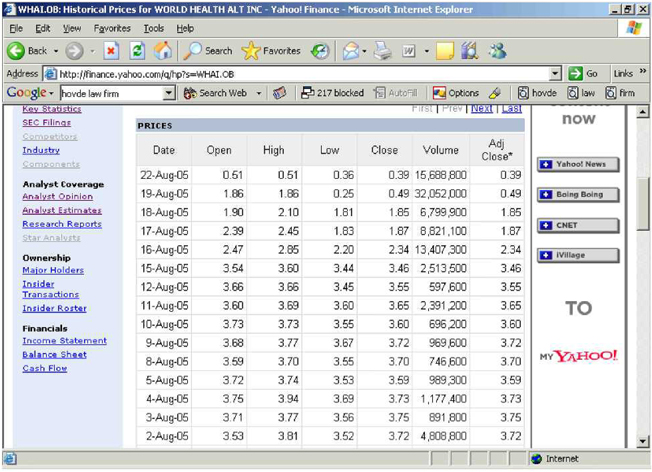

65. A chart of this historical prices for WHAI stock, as reported on Yahoo Finance, from August 2, 2005 through August 19, 2005 shows as follows:

- 28 -

66. The market for WHAI’s common stock was open, well-developed and efficient at all relevant times. As a result of these materially false and misleading statements and failures to disclose, WHAI common stock traded at artificially inflated prices during the Class Period. Plaintiff and other members of the Class purchased or otherwise acquired WHAI common stock relying upon the integrity of the market price of WHAI stock and market information relating to WHAI, and have been damaged thereby.

67. During the Class Period, Defendants materially misled the investing public, thereby inflating the price of WHAI stock, by publicly issuing false and

- 29 -

misleading statements and omitting to disclose material facts necessary to make Defendants’ statements, as set forth herein, not false and misleading. Said statements and omissions were materially false and misleading in that they failed to disclose material adverse information and misrepresented the truth about the Company, its business, finances and operations, including,interalia:

(1) that the Company’s financial statements were not prepared in accordance with GAAP and in accordance with the federal securities laws and SEC regulations concerning fair reporting;

(2) that the Company had violated GAAP policies through artificially inflating its operating results and, in particular, by misrepresenting the Company’s earnings per share, understating its tax liability and thus overstating its net income;

(3) that the Company’s internal controls were woefully lacking.

68. At all relevant times, the material misrepresentations and omissions particularized in this Complaint directly or proximately caused or were a substantial contributing cause of the damages sustained by Plaintiff and other members of the Class. As described herein, during the Class Period, Defendants made or caused to be made a series of materially false or misleading statements about WHAI’s business, business practices and operations. These material misstatements and

- 30 -

omissions had the cause and effect of creating in the market an unrealistically positive assessment of WHAI and its business, finances and operations, thus causing the Company’s common stock to be overvalued and artificially inflated at all relevant times. Defendants’ materially false and misleading statements during the Class Period resulted in Plaintiff and other members of the Class purchasing the Company’s common stock at an artificially inflated price, thus causing the damages complained of herein.

THE COMPANY’S FINANCIAL STATEMENTS

AND RELATED REPRESENTATIONS

WERE MATERIALLY FALSE AND MISLEADING

69. All of the reported financial statements and the related discussions contained therein, which the Individual Defendants caused the Company to file and issue during the Class Period, and in public reports about and press releases issued by the Company, were false products of financial manipulations that deceived members of the investing public who purchased WHAI common stock based upon those representations.

70. During the Class Period, Defendants materially misled the investing public, thereby inflating the price of WHAI stock by publicly issuing false and misleading statements and by omitting to disclose material facts necessary to make defendants’ statements, as set forth herein, not false and misleading. Said statements and omissions were materially false and misleading in that they failed to

- 31 -

disclose material adverse information and misrepresented the truth about the Company, its financial performance, accounting, reporting and condition, including,interalia:

(1) During the Class Period, the Company’s financial results were materially overstated;

(2) The Company’s financial statements did not present, in all material respects, the Company’s true financial condition, and did not reflect all adjustments that were necessary for a fair statement of the interim and full year period presented;

(3) The Company’s internal controls were inadequate and, as a result, the Company improperly reported its earnings per share; and

(4) The Company’s financial statements were not presented in conformity with GAAP or principles of fair reporting.

71. Moreover:

(1) Defendants failed to disclose the existence of known trends, events or uncertainties that it reasonably expected would have a material unfavorable impact on net revenues or income or that were reasonably likely to result in the Company’s liquidity decreasing in a material way, in violation of Item 303 of Regulation S-K under the federal securities laws (17 C.F.R. 229.303),

- 32 -

and that failure to disclose rendered the statements that were made during the Class Period materially false and misleading; and

(2) By failing to file financial statements with the SEC that conformed to the requirements of GAAP, such financial statements were presumptively misleading and inaccurate pursuant to Regulation S-X, 17 CFR 210.4-01(a)(1).

72. As a result of its accounting improprieties, the Company’s reported financial results (and all Defendants) also violated at least the following provisions of GAAP for which each Defendant is responsible:

(1) The principle that financial reporting should provide information that is useful to present to potential investors and creditors and other users in making rational investment, credit and similar decisions was violated (FASB Statement of Concepts No. 1, ¶ 34);

(2) The principle that financial reporting should provide information about the economic resources of an enterprise, the claims to those resources, and the effects of transactions, events and circumstances that change resources and claims to those resources was violated (FASB Statement of Concepts No. 1, ¶ 40);

(3) The principle that financial reporting should provide

- 33 -

information about how management of an enterprise has discharged its stewardship responsibility to owners (stockholders) for the use of enterprise resources entrusted to it was violated. To the extent that management offers securities of the enterprise to the public, it voluntarily accepts wider responsibilities for accountability to prospective investors and to the public in general (FASB Statement of Concepts No. 1, ¶ 50);

(4) The principle that financial reporting should provide information about an enterprise’s financial performance during a period was violated. Investors and creditors often use information about the past to help in assessing the prospects of an enterprise. Thus, although investment and credit decisions reflect investors’ expectations about future enterprise performance, those expectations are commonly based at least partly on evaluations of past enterprise performance (FASB Statement of Concepts No. 1, ¶ 42);

(5) The principle that financial reporting should be reliable in that it represents what it purports to represent was violated. That information should be reliable as well as relevant to a notion that is central to accounting (FASB Statement of Concepts No. 2, ¶¶ 58-59);

(6) The principle of completeness, which means that nothing is left out of the information that may be necessary to ensure that it validly

- 34 -

represents underlying events and conditions, was violated (FASB Statement of Concepts No. 2, ¶ 79); and

(7) The principle that conservatism be used as a prudent reaction to uncertainty to try to ensure that uncertainties and risks inherent in business situations are adequately considered was violated. The best way to avoid injury to investors is to try to ensure that what is reported represents what it purports to represent (FASB Statement of Concepts No. 2, ¶¶ 95, 97).

73. Moreover, Daszkal Bolton violated GAAS by, among other things, failing to expand or otherwise properly conduct its audit to detect the understatement in the recognition of tax expenses and liabilities and overstatement of earnings.

74. GAAS, as approved and adopted by the American Institute of Certified Public Accountants (“AICPA”), defines the required conduct of auditors in performing and reporting on audit engagements. Statements on Audited Standards (“SAS”) are endorsed by the AICPA as the authoritative promulgation of GAAS.

75. Daszkal Bolton’s failure to qualify, modify or abstain from issuing its audit opinions, when it knew or recklessly turned a blind eye to WHAI’s accounting manipulations, caused Daszkal Bolton to violate the provisions of GAAS discussed in detail below.

- 35 -

76. According to AICPA, Codification of Statements on Auditing Standards (AU) § 150.02, GAAS’ first standard of field work requires that audit work be adequately planned. Particularly, GAAS provides that “in planning the audit, the auditor should consider, among other matters . . . conditions that may require extension or modification of audit tests, such as the risk of material error or fraud or the existence of related party transactions.” AU § 311.03.Seealso AU § 316A (“Consideration of Fraud in a Financial Statement Audit”). Contrary to this standard, Daszkal Bolton failed to adequately plan the fiscal 2003 and 2004 audits after learning of several facts over a short period of time that, either standing alone or in the context of the other facts learned during that period, constituted red flags that should have alerted it to the possibility that WHAI’s financial statements might be misstated due to fraud.

77. Audit Standard 316, paragraph 16 (“AU 316”) states that risk factors relating to misstatements arising from fraudulent financial reporting may be grouped into categories, including,inter alia:(a)Management’s characteristics and influence over the control environment. These pertain to management’s abilities, pressures, style, and attitude relating to internal control and the financial reporting process; and (c)Operating characteristics and financial stability.These pertain to the nature and complexity of the entity and its transactions, the entity’s financial condition, and its profitability.

- 36 -

78. Examples of risk factors relating to misstatements arising from fraudulent financial reporting are set forth in AU 316, paragraph 17:

(a) Risk factors relating to management’s characteristics and influence over the control environment. Examples include –

| | • | | A motivation for management to engage in fraudulent financial reporting. Specific indicators might include – |

| | • | | A significant portion of management’s compensation represented by bonuses, stock options or other incentives, the value of which is contingent upon the entity achieving unduly aggressive targets for operating results, financial position, or cash flow. |

| | • | | An excessive interest by management in maintaining or increasing the entity’s stock price or earnings trend through the use of unusually aggressive accounting practices. |

| | • | | A practice by management of committing to analysts, creditors, and other third parties to achieve what appear to be unduly aggressive or clearly unrealistic forecasts. |

| | • | | A failure by management to display and communicate an appropriate attitude regarding internal control and the financial reporting process. Specific indicators might include – |

. . . .

- 37 -

| | • | | Domination of management by a single person or small group without compensating controls such as effective oversight by the board of directors or audit committee. |

| | • | | Inadequate monitoring of significant controls. |

| | • | | Management failing to correct known reportable conditions on a timely basis. |

| | • | | Management setting unduly aggressive financial targets and expectations for operating personnel. |

. . . .

(c) Risk factors relating to operating characteristics and financial stability. Examples include —

. . . .

| | • | | Significant pressure to obtain additional capital necessary to stay competitive considering the financial position of the entity – including need for funds to finance major research and development or capital expenditures. |

| | • | | Assets, liabilities, revenues, or expenses based on significant estimates that involve unusually subjective judgments or uncertainties, or that are subject to potential significant change in the near term in a manner that may have a financially disruptive effect on the entity – such as ultimate collectibility of receivables, timing of revenue recognition, realizability of financial instruments based on the highly |

- 38 -

| | subjective valuation of collateral or difficult-to-assess repayment sources, or significant deferral of costs. |

79. Additionally, AU 316 paragraph 23 states that Section 319, entitled “Consideration of Internal Control in a Financial Statement Audit,” requires the auditor to obtain a sufficient understanding of the entity’s internal control over financial reporting to plan the audit. It also notes that such knowledge should be used to identify types of potential misstatements, consider factors that affect the risk of material misstatement and design substantive tests. The understanding will affect the auditor’s consideration of the significance of fraud risk factors. In addition, when considering the significance of fraud risk factors, the auditor may wish to assess whether there are specific controls that mitigate the risk or whether specific control deficiencies may exacerbate the risk.

80. Under AU 316 paragraph 27, judgments about the risk of material misstatement due to fraud may affect the audit in the following ways:

| | • | | Professional skepticism.Due professional care requires the auditor to exercise professional skepticism – that is, an attitude that includes a questioning mind and critical assessment of audit evidence. Some examples demonstrating the application of professional skepticism in response to the auditor’s assessment of the risk of material misstatement due to fraud include (a) increased sensitivity in the selection of the nature and extent of documentation to be examined in support of |

- 39 -

| | material transactions; and (b) increased recognition of the need to corroborate management explanations or representations concerning material matters – such as further analytical procedures, examination of documentation or discussion with others within or outside the entity. |

. . . .

| | • | | Accounting principles and policies.The auditor may decide to consider further management’s selection and application of significant accounting policies, particularly those related to revenue recognition, asset valuation, or capitalizing versus expensing. In this respect, the auditor may have a greater concern about whether the accounting principles selected and policies adopted are being applied in an inappropriate manner to create a material misstatement of the financial statements. |

81. Under AU § 150.02, GAAS’ first standard of reporting states that “[t]he report shall state whether the financial statements are presented in accordance with generally accepted accounting principles.” Contrary to this standard, Daszkal Bolton issued an unqualified audit report on WHAI’s fiscal 2003 and 2004 financial statements even though the financial statements did not conform to GAAP. Particularly, Daszkal Bolton knew, or shown have known, of the material deficiencies of WHAI’s financial statements as alleged in herein.

82. Daszkal Bolton also failed to exercise due professional care. GAAS’

- 40 -

third general standard provides that, “[d]ue professional care is to be exercised in the performance of the audit and the preparation of the report.” AU § 150. Among other things, due professional care requires an auditor to observe the fieldwork and reporting standards of GAAS. AU § 230.02. Additionally, due professional care requires an auditor to employ professional skepticism, which is “an attitude that includes a questioning mind and a critical assessment of audit evidence.” AU § 230.07. GAAS also provides that an auditor “neither assumes that management is dishonest nor assumes unquestioned honesty. In exercising professional skepticism, the auditor should not be satisfied with less than persuasive evidence because of a belief that management is honest.” AU § 230.09.

83. Daszkal Bolton failed to exercise due professional care in violation of this standard because it failed to: (1) adequately plan the audit; (2) obtain sufficient competent evidential matter; and (3) properly state whether the financial statements were presented in accordance with GAAP.

APPLICABILITY OF PRESUMPTION OF RELIANCE:

FRAUD-ON-THE-MARKET DOCTRINE

84. At all relevant times, the market for WHAI common stock was an efficient market for the following reasons, among others:

(1) WHAI common stock met the requirements for listing, and was listed and actively traded, on the OTCBB, a highly efficient market under the

- 41 -

symbol “WHAI”;

(2) As a regulated issuer, WHAI filed periodic public reports with the SEC and the NASD;

(3) WHAI stock was followed by Dutton Associates, an independent analyst, who wrote reports that were distributed to the sales force and certain customers of their respective brokerage firms. Each of these reports was publicly available and entered the public marketplace; and

(4) WHAI regularly issued press releases that were carried by national newswires. Each of these releases was publicly available and entered the public marketplace.

85. As a result, the market for WHAI securities promptly digested current information with respect to WHAI from all publicly-available sources and reflected such information in WHAI’s stock price. To be sure, following the adverse disclosures issued by WHAI on August 19, 2005, the market reacted swifly and precipitously, wiping out millions of dollars of market capitalization. Under these circumstances, all purchasers of WHAI common stock during the Class Period suffered similar injury through their purchase of stock at artificially inflated prices and a presumption of reliance applies.

- 42 -

LOSS CAUSATION/ECONOMIC LOSS

86. During the Class Period, as detailed herein, defendants engaged in a scheme to deceive the market and a course of conduct that artificially inflated Coke’s stock price and operated as a fraud or deceit on Class Period purchasers of Coke stock by misrepresenting the Company’s financial results, business success and future business prospects. Defendants achieved this facade of success, growth and strong future business prospects by issuing false financial statements that failed to accurately reflect the true results of operations.

87. Later, however, when defendants’ prior misrepresentations and fraudulent conduct were disclosed and became apparent to the market, WHAI stock fell precipitously as the prior artificial inflation came out of Coke’s stock price. As a result of their purchases of Coke stock during the Class Period, plaintiff and other members of the Class suffered economic loss,i.e.,damages under the federal securities laws.

88. By (a) failing to properly account for all of its shares outstanding, (b) concealing its lack of internal controls, (c) misrepresenting the true tax liabilities of the Company, (d) misrepresenting that it was in compliance with covenants with its lenders, and (e) misrepresenting the true results of its operations, the Defendants presented a misleading picture of WHAI’s business and prospects. Thus, instead of truthfully disclosing during the Class Period that WHAI’s business was not as

- 43 -

healthy as represented, Defendants caused WHAI to falsely report its financial results and results of operations.

89. These misrepresentations caused and maintained the artificial inflation in WHAI’s stock price throughout the Class Period and until the truth was revealed to the market. Defendants’ false and misleading statements had the intended effect and caused WHAI stock to trade at artificially inflated levels throughout the Class Period.

90. On August 16, 2005, Defendant McDonald abruptly resigned. Three days later, on August 19, 2005, Defendants were forced to publicly disclose that they expected to restate their prior financial statements, had to fire their independent auditor, had found irregularities and had made irregular reports to WHAI’s lenders, which may have resuled in breaches of WHAI’s financing agreements. On this news, WHAI’s stock declined from $3.46 prior to the news to $0.49 per share. Moreover, in the days following these announcements, the trading volume in WHAI’s stock was extremely high as noted in the chart from Yahoo Finance set forth in paragraph 65 above.

91. This volume was much higher than in months prior to this announcement when WHAI’s stock generally traded in the hundreds of thousands of shares per day.

- 44 -

92. As investors and the market became aware that WHAI’s prior statements and financial results had been false and that WHAI’s actual business results and prospects were, in fact, poor, the prior artificial inflation came out of WHAI’s stock price, damaging investors.

93. The 85% decline in WHAI’s stock price at the end of the Class Period was a direct result of the nature and extent of Defendants’ fraud being revealed to investors and the market. The timing and magnitude of WHAI’s stock price declines negate any inference that the loss suffered by Plaintiff and other Class members was caused by changed market conditions, macroeconomic or industry factors or Company-specific facts unrelated to the Defendants’ fraudulent conduct. The economic loss,i.e.,damages, suffered by plaintiff and other members of the Class was a direct result of Defendants’ fraudulent scheme to artificially inflate WHAI’s stock price and the subsequent significant decline in the value of WHAI’s stock when Defendants’ prior misrepresentations and other fraudulent conduct was revealed.

NO SAFE HARBOR

94. The statutory safe harbor provided for forward-looking statements under certain circumstances does not apply to any of the allegedly false statements pleaded in this complaint. The specific statements pleaded herein were not identified as “forward-looking statements” when made. Nor was it stated with

- 45 -

respect to any of the statements forming the basis of this complaint that actual results “could differ materially from those projected.” To the extent there were any forward-looking statements, there were no meaningful cautionary statements identifying important factors that could cause actual results to differ materially from those in the purportedly forward-looking statements. Alternatively, to the extent that the statutory safe harbor does apply to any forward-looking statements pleaded herein, defendants are liable for those false forward-looking statements because at the time each of those forward-looking statements were made the particular speaker knew that the particular forward-looking statement was false, and/or the forward-looking statement was authorized and/or approved by an executive officer of WHAI who knew that those statements were false when made.

SCIENTER ALLEGATIONS

95. As alleged herein, Defendants acted with scienter in that Defendants knew that the public documents and statements, issued or disseminated by or in the name of the Company were materially false and misleading; knew or recklessly disregarded that such statements or documents would be issued or disseminated to the investing public; and knowingly and substantially participated or acquiesced in the issuance or dissemination of such statements or documents as primary violators of the federal securities laws. As set forth elsewhere herein in detail, Defendants, by virtue of their receipt of information reflecting the true facts regarding WHAI and

- 46 -

its business practices, their control over and/or receipt of WHAI’s allegedly materially misleading misstatements and/or their associations with the Company that made them privy to confidential proprietary information concerning WHAI were active and culpable participants in the fraudulent scheme alleged herein. Defendants knew and/or recklessly disregarded the falsity and misleading nature of the information that they caused to be disseminated to the investing public. This case does not involve allegations of false forward-looking statements or projections but instead involves false statements concerning the Company’s business, finances and operations. The ongoing fraudulent scheme described in this Complaint could not have been perpetrated over a substantial period of time, as has occurred, without the knowledge and complicity of the personnel at the highest level of the Company, including the Individual Defendants.

96. The Individual Defendants engaged in such a scheme to inflate the price of WHAI common stock in order to: (i) protect and enhance their executive positions and the substantial compensation and prestige they obtained thereby; (ii) enhance the value of their personal holdings of WHAI common stock and/or options; and/or (iii) permit profitable insider sales by WHAI insiders.

FIRST CLAIM

(Violations Of Section 10(b) Of The Exchange Act

And Rule 10b-5 Promulgated Thereunder Against All Defendants)

- 47 -

97. Plaintiff repeats and realleges each and every allegation contained above.

98. Each of the Defendants: (a) knew or recklessly disregarded material adverse non-public information about WHAI’s financial results and then existing business conditions, which was not disclosed; and (b) participated in drafting, reviewing and/or approving the misleading statements, releases, reports and other public representations of and about WHAI.

99. During the Class Period, Defendants, with knowledge of or severely reckless disregard for the truth, disseminated or approved the false statements specified above, which were misleading in that they contained misrepresentations and failed to disclose material facts necessary in order to make the statements made, in light of the circumstances under which they were made, not misleading.

100. Defendants have violated § 10(b) of the Exchange Act and Rule 10b-5 promulgated thereunder in that they: (a) employed devices, schemes and artifices to defraud; (b) made untrue statements of material facts or omitted to state material facts necessary in order to make statements made, in light of the circumstances under which they were made, not misleading; or (c) engaged in acts, practices and a course of business that operated as a fraud or deceit upon the purchasers of WHAI stock during the Class Period.

101. Plaintiff and the Class have suffered damage in that, in reliance on the

- 48 -

integrity of the market, they paid artificially inflated prices for WHAI stock. Plaintiff and the Class would not have purchased WHAI stock at the prices they paid, or at all, if they had been aware that the market prices had been artificially and falsely inflated by Defendants’ false and misleading statements.

SECOND CLAIM

(Violation Of Section 20(a) Of The

Exchange Act Against Individuals Defendants)

102. Plaintiff repeats and realleges each and every allegation contained above.

103. The Individual Defendants acted as controlling persons of WHAI within the meaning of Section 20(a) of the Exchange Act. By reason of their senior executive and/or Board positions they had the power and authority to cause WHAI to engage in the wrongful conduct complained of herein.

104. By reason of such wrongful conduct, WHAI and the Individual Defendants are liable pursuant to §20(a) of the Exchange Act. As a direct and proximate result of these Defendants’ wrongful conduct, Plaintiff and the other members of the Class suffered damages in connection with their purchases of WHAI stock during the Class Period.

WHEREFORE,Plaintiff prays for relief and judgment, as follows:

A. Determining that this action is a proper class action and certifying

- 49 -

plaintiff as class representative under Rule 23 of the Federal Rules of Civil Procedure;

B. Awarding compensatory damages in favor of Plaintiff and the other Class members against all Defendants, jointly and severally, for all damages sustained as a result of Defendants’ wrongdoing, in an amount to be proven at trial, including interest thereon;

C. Awarding Plaintiff and the Class their reasonable costs and expenses incurred in this action, including counsel fees and expert fees; and

D. Such other and further relief as the Court may deem just and proper.

JURY TRIAL DEMANDED

Plaintiff hereby demands a trial by jury.

| | | | |

DATED: August 25, 2005. | | | | LAW OFFICE OF ALFRED G. YATES JR., PC |

| | |

| | | | | /s/ Gerald L. Rutledge |

| | | | | Alfred G. Yates Jr. (Pa. Id. no. 17419) Gerald L. Rutledge (Pa. Id. no. 62027) 429 Forbes Avenue Pittsburgh, PA 15219 Phone: (412) 391-5164 Fax: (412) 471-1033 e-mail: yateslaw@aol.com and |

- 50 -

| | | | |

| | | | | CHITWOOD HARLEY HARNES LLP Martin D. Chitwood Lauren S. Antonino 2300 Promenade II 1230 Peachtree Street, NE Atlanta, Georgia 30309 Tel: (404) 873-3900 Fax: (404) 876-4476 and |

| | |

| | | | | Frederick R. Hovde Robert Dassow Hovde, Dassow & Deets LLC One Meridican Plaza, Suite 205 10585 North Meridian Street Indianapolis, IN 46290 Tel: (317) 818-3100 Fax:(317) 818-3111 Counsel for Plaintiff |

- 51 -

CERTIFICATION OF NAMED PLAINTIFF

PURSUANT TO FEDERAL SECURITIES LAWS

I, ERIC KING (“Plaintiff”), being duly sworn, declares, as to his or her claims asserted under the federal securities laws against World Health Alternatives, Inc. (“WHAI”), et al, that:

1. Plaintiff has reviewed the complaint and authorized its filing.

2. Plaintiff did not purchase the security that is the subject of this action at the direction of Plaintiff’s counsel or in order to participate in this private action.

3. Plaintiff is willing to serve as a representative party on behalfof the class, including providing testimony at deposition and trial, if necessary.

4. Plaintiff’s transactions in the security that is the subject of this action during the Class Period are as follows:

| | | | | | | |

| Purchases: | | | | | | | |

| | | |

Security

| | Number of shares

| | Date

| | Price

|

WHAI | | 1,000 | | 9/13/04 | | $ | 3.00 |

| | | |

| Sales: | | | | | | | |

| | | |

Security

| | Number of shares

| | Date

| | Price

|

WHAI | | N/A | | | | | |

5. Plaintiff has sought to serve as a class representative in the following cases within the last 3 years:

6. Plaintiff will not accept any payment for serving as a representative party on behalf of the class beyond Plaintiff’s pro rata share of any recovery, except such reasonable costs and expenses (including lost wages) directly relating to the representation of the class as ordered or approved by the court.

I declare under penalty of perjury that the foregoing is true and correct. Executed this 25th day of August, 2005 in Carmel, Indiana.

Return form to:

Lauren S. Antonino, Esq.

Chitwood Harley Harnes LLP

1230 Peachtree Street, NE

Promenade II, Suite 2300

Atlanta, GA 30309

www.chitwoodlaw.com

1-888-873-3999 ext. 6888

404-607-6888 direct

404-876-4476 fax

- 2 -