Our Board of Directors has a Nominating Committee which consists of three directors. Messrs. Dally, Dobbins, and Welch are the current members of this committee. The Nominating Committee identifies individuals to become board members and selects, or recommends for the board’s selection, director nominees to be presented for shareholder approval at the annual meeting of shareholders or to fill any vacancies. During the fiscal year ended December 31, 2005, the Nominating Committee held one meeting.

The Nominating Committee’s policy is to consider director candidates recommended by shareholders. Such recommendations must be made pursuant to timely notice in writing to

Andrew J. Van Doren, Secretary

Monarch Community Bancorp

375 North Willowbrook Road

Coldwater, MI 49036

The Nominating Committee has established certain qualifications in order to be eligible for service on the Board:

Historically, the Nominating Committee used a subjective process for identifying and evaluating nominees for director, based on the information available to, and the subjective judgments of, the members of the Nominating Committee and our then current needs; and nominees have been existing directors or business associates of our directors or officers. In 2005, objective standards for evaluating director nominees were adopted, as follows:

A. Nominees for Directors of the Company shall possess such qualifications as the Company’s Bylaws may require.

B. Nominees shall own, directly or indirectly, at least 1,000 shares of common stock of the Company. Shares owned jointly with other persons shall be counted toward such minimum.

C. Nominees shall be at least 30 years of age as of the date of election to the Board.

D. Nominees shall be citizens of the United States of America.

E. Nominees shall possess a Bachelor’s Degree from an accredited college or university, or shall possess employment experience judged by the Committee to be the equivalent of such a degree.

F. Nominees shall possess a minimum of 10 years experience in a least one of the following:

| Ø | Management position(s) with a for-profit or non-profit entity; |

| Ø | Ownership of a business; or |

| Ø | Employment in a learned profession such as accounting or law. |

G. Nominees shall exhibit a basic understanding of financial statements and the banking industry.

H. Nominees shall not be or have been under any type of disciplinary order, sanction, or penalty from a national or state banking, securities, or licensed profession regulatory body.

I. Nominees shall not have been convicted of a crime, other than non-substance abuse related traffic offenses.

J. Nominees shall certify in writing that he or she possess the above qualifications.

K. Nominees shall furnish such references as the Committee may request.

L. Nominees shall answer such questions and attend such interviews as the Committee shall request.

Nominees recommended by a shareholder also will be evaluated in accordance with the above standards. The complete Nominating Committee Polices and Procedures is available on our website,www.monarchcb.com.

Nominations of persons for election to the Board of Directors may be made only by or at the direction of the Board of Directors or by any shareholder entitled to vote for the election of directors who complies with the notice procedures set forth in Monarch Community Bancorp’s bylaws. Pursuant to our bylaws, nominations by shareholders must be delivered in writing to the Secretary of Monarch Community Bancorp at least 90 days but no more than 120 days prior to the first anniversary of the preceding year’s annual meeting; provided, however, that in the event that the date of the annual meeting is advanced by more than 30 days or delayed by more than 60 days from such anniversary date, notice by the shareholder must be delivered not earlier than the 120th day prior to such annual meeting and not later than the close of business on the later of the 90th day prior to such annual meeting or the tenth day following the day on which notice of the date of annual meeting was mailed or public announcement of the date of such meeting is first made.

The Compensation Committee

The Compensation Committee is responsible for establishing annual and long-term performance goals for the Chief Executive Officer (Mr. Denney) and senior management. This Committee also approves the senior officers’ compensation and other incentive compensation programs. The Committee’s functions include:

| | |

| • | awarding shares or options under the Company’s stock option plan; and |

| | |

| • | publishing an annual Executive Compensation Committee Report for the shareholders. |

9

Code of Ethics

The Company has adopted a Code of Ethics that applies to all of our employees, officers and directors, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. Our Code of Ethics contains written standards that we believe are reasonably designed to deter wrongdoing and to promote:

| | |

| • | Honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

|

| • | Full, fair, accurate, timely, and understandable disclosure in reports and documents that we file with, or submit to, the Securities and Exchange Commissions and in other public communications we make; |

|

| • | Compliance with applicable governmental laws, rules and regulations; |

|

| • | The prompt internal reporting of violations of the code to an appropriate person or persons named in the code; and |

|

| • | Accountability for adherence to the code. |

This Code of Ethics is attached to our Annual Report on Form 10-K for the fiscal year ended December 31, 2005 as Exhibit 14. We have also posted it on our Web site athttp://www.monarchcb.com. We will provide to any person without charge, upon request, a copy of our Code of Ethics. Requests for a copy of our Code of Ethics should be made to our Secretary at 375 North Willowbrook Road, Coldwater, Michigan 49036. We intend to satisfy the disclosure requirement under Item 10 of Form 8-K regarding an amendment to, or a waiver from, a provision of our Code of Ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions and that relates to any element of the code definition enumerated in Securities and Exchange Commission, Regulation S-K, Item 406(b) by posting such information on our Web site athttp://www.monarchcb.com within five business days following the date of the amendment or waiver.

Shareholder Communications with the Board

Our Board of Directors has a process for shareholders to send communications to the Board of Directors, its Nominating Committee or its Audit Committee, including complaints regarding accounting, internal accounting controls, or auditing matters. Communications can be sent to the Board of Directors; its Nominating Committee or its Audit Committee or specific directors either by regular mail to the attention of the Board of Directors, its Nominating Committee, its Audit Committee or specific directors, at our principal executive offices at 375 North Willowbrook Road, Coldwater, Michigan 49036. All of these communications will be reviewed by our Secretary (1) to filter out communications that our Secretary deems are not appropriate for our directors, such as spam and communications offering to buy or sell products or services, and (2) to sort and relay the remainder to the appropriate directors. We encourage all of our directors to attend the annual meeting of shareholders, if possible.All of our then-current directors attended the 2005 annual meeting of shareholders.

10

Directors’ Compensation

The members of the Boards of Directors of Monarch Community Bancorp and Monarch Community Bank are identical. Except for Mr. Denney, during 2005, each director of the Bank received an annual retainer fee of $10,000 for his service on the Board of Directors. In addition, each director received $300 for each Bank regular and special board meeting attended, and a fee not to exceed $300 for each committee meeting attended. Effective January 1, 2006, the annual retainer fee is $12,000. The Chairman of the Board receives an additional $9,000 per year. No fees are paid for attending the Company’s board meetings or committee meetings if these meetings are held in conjunction with meetings of the Bank’s Board of Directors.

Deferred Compensation Plan

Through December 2004, we maintained a deferred compensation plan for the benefit of our directors. Under the plan each director may make an annual election to defer receipt of all or a portion of his monthly director fees into a non-qualified deferred program to supplement his retirement. The deferred amounts are allocated to a deferral account and credited with interest at the rate equal to the greater of 5% or Monarch Community Bank’s return on average equity for the previous fiscal year. On December 16, 2004, the plan was terminated effective December 31, 2004.

|

|

|

ITEM 1. ELECTION OF DIRECTORS |

|

|

Currently, the Board of Directors has nine members divided into three classes of three directors per class. Each class of directors has three-year terms. One class of directors is up for election each year. This results in a staggered Board which ensures continuity from year to year.

Three directors will be elected at the Annual Meeting to serve for three-year terms expiring at our Annual Meeting in the year 2009.

The persons named in the enclosed proxy card intend to vote the proxy for the election of each of the three nominees unless you indicate on the proxy card that your vote should be withheld from any or all of such nominees. Each nominee elected as director will continue in office until his or her successor has been elected, or until his death, resignation or retirement.

The Board of Directors has proposed the following nominees for election as Directors with terms expiring in 2009 at the Annual Meeting: Martin L. Mitchell, Stephen M. Ross and Gordon L. Welch.

The Board of Directors recommends a vote FOR the election of these nominees as Directors.

We expect each nominee to be able to serve if elected. If any nominee is not able to serve, proxies will be voted in favor of the remainder of those nominated and may be voted for substitute nominees. The principal occupation and certain other information about the nominees and other directors whose terms of office continue after the Annual Meeting is set forth below. Such terms may include years of services for the Bank prior to the formation of the Company.

11

|

|

|

NOMINEES WHOSE TERMS WILL EXPIRE IN 2009 |

|

|

| | | |

Name and Age as of

the Annual Meeting | | | Position, Principal Occupation,

Business Experience and Directorship |

| | |

|

| | | |

Martin L. Mitchell | 55 | | Director since April 2004. Previously served as Director of MSB Financial, Inc. and Marshall Saving Bank, F.S.B. from 1987 to 2004. In 2004, Dr. Mitchell became President and Chief Executive Officer of Starr Commonwealth, a non-profit organization serving youth and their families with campuses in Albion, Battle Creek and Detroit, Michigan and Columbus and Van Wert, Ohio. Previously he was Executive Vice President and Chief Operations Officer 2002-2004, Vice President and COO 1999-2002, and Vice President of Program from 1981-1999. Dr. Mitchell has served on the Board of Directors of Olivet College, Olivet Michigan since 1995. |

| | | |

Stephen M. Ross | 62 | | Director since 1994. Appointed Chairman in 2004. From 1980 until August, 2003, Mr. Ross was Senior Vice President for logistics and purchasing for the Hillsdale division of Eagle-Picher, Inc., an automotive supplier. Mr. Ross currently is Vice President of Sales and Marketing for Southern Michigan Tool, an automotive parts supplier in Hillsdale, Michigan. |

| | | |

Gordon L. Welch | 59 | | Director since 1986. Principal Account Executive, Aquila Corporation, a publicly traded gas and electric utility headquartered in Kansas City, Missouri. Previously, Mr. Welch was Economic Development Director for Utilicorp United, now known as Aquila Corporation. Prior to obtaining that position in February 2001, Mr. Welch was a sales representative for Utilicorp United. |

|

|

|

CONTINUING DIRECTORS WITH TERMS EXPIRING 2007 |

|

|

| | | |

Name and Age as of

the Annual Meeting | | | Position, Principal Occupation,

Business Experience and Directorship |

| | |

|

| | | |

Craig W. Dally | 59 | | Director since 1992. Vice President, Treasurer and General Manager of Dally Tire Co., a retail and commercial tire reseller with over $1 million in sales located in Coldwater, Michigan. Mr. Dally has served in this capacity for over 20 years. |

| | | |

Donald L. Denney | 55 | | Director since September, 2004. President and Chief Executive Officer |

12

| | | |

| | | of Monarch Community Bancorp, Inc. and Monarch Community Bank since September, 2004. From April 2004 to September 2004, Vice President, Monarch Community Bank. From 1996-2004, Mr. Denney was President and Chief Lending Officer, Farmers Citizens Bank, Bucyrus, Ohio. Previously, he served as Community President for Bank One in Michigan from 1988-1996. Mr. Denney has 35 years experience in banking. |

| | | |

Richard L. Dobbins | 61 | | Director since April, 2004. Previously served as a Director of MSB Financial, Inc. and Marshall Savings Bank, F.S.B. from 1974 to 2004. Mr. Dobbins is an attorney in private practice since 1973, and is President of North Concord Farms, Inc., North Parma Farms, Inc., and Dobbins Farms, Inc. From 1990 to 2002, he was a director of Caster Concepts, Inc., a manufacturer of industrial wheels and casters in Albion, Michigan. |

|

|

|

CONTINUING DIRECTORS WITH TERMS EXPIRING 2008 |

|

|

| | | |

Name and Age as of

the Annual Meeting | | | Position, Principal Occupation,

Business Experience and Directorship |

| | |

|

| | | |

Harold A. Adamson | 65 | | Director since 1988. Former Chief Executive Officer of Plastic Technology Center, a non-profit organization located in Angola, Indiana from 1995 through 2001. During 2002 and until June 2003, Mr. Adamson was the Assistant Director of Kellogg Community College’s Grahl Center. Mr. Adamson currently is the Chair of the School of Business, Miller College, Battle Creek, Michigan. |

| | | |

Lauren L. Bracy | 71 | | Director since 1991. President and Chief Executive Officer of Bracy & Jahr, Inc., a masonry and building contractor firm located in Quincy, Michigan, and has served in that capacity for over 30 years. |

| | | |

James R. Vozar | 70 | | Director since 1987. Owner of the James R. Vozar Insurance Agency, located in Quincy Michigan, since 1967. |

| | | |

|

|

|

ITEM 2. RATIFICATION OF AUDITORS |

|

|

The Audit Committee of the Board of Directors has appointed Plante & Moran, PLLC to serve as our independent auditors for 2006 and is seeking the ratification of the appointment of Plante & Moran, PLLC by our shareholders.

13

In the event our shareholders fail to ratify the selection of Plante & Moran, PLLC, the Audit Committee will consider it as a direction to select other auditors for the subsequent year. Representatives of Plante & Moran, PLLC will be present at the Annual Meeting to answer questions. They will also have the opportunity to make a statement if they desire to do so.

Audit Fees

Audit fees and expenses billed to the Company by Plante & Moran, PLLC for the audit of the Company’s financial statements for the fiscal years ended December 31, 2005 and December 31, 2004, and for review of the Company’s financial statements included in the Company’s quarterly reports on Form 10-Q, are as follows:

| | |

2005 | | 2004 |

| |

|

$83,500 | | $127,500 |

Audit Related Fees

Audit related fees and expenses billed to the Company by Plante & Moran, PLLC for fiscal years 2005 and 2004 for services related to the performance of the audit or review of the Company’s financial statements that were not included under the heading “Audit Fees”, are as follows:

Tax Fees

Tax fees and expenses billed to the Company for fiscal years 2005 and 2004 for services related to tax compliance, tax advice and tax planning, consisting primarily of preparing the Company’s federal and state income tax returns for the previous fiscal periods and inclusive of expenses are as follows:

All Other Fees

Fees and expenses billed to the Company by Plante & Moran, PLLC for all other services provided during fiscal years 2005 and 2004 are as follows:

In accordance with Section 10A(i) of the Exchange Act, before Plante & Moran, PLLC is engaged by us to render audit or non-audit services, the engagement is approved by our Audit Committee. None of the audit-related, tax and other services described in the table above were approved by the Audit Committee pursuant to Rule 2-01(c)(7)(i)(C) of Regulation S-X. None of the time devoted by Plante & Moran, PLLC on its engagement to audit the Company’s financial statements for the year ended December 31, 2005 is attributable to work performed by persons other than Plante & Moran, PLLC employees.

14

The affirmative vote of a majority of votes cast on this proposal, without regard to abstentions or broker “non votes,” is required for the ratification of the appointment of Plante & Moran, PLLC.

The Board of Directors recommends a vote FOR the ratification of the appointment of Plante & Moran, PLLC as our independent auditors for the year 2006.

|

|

SECURITY OWNERSHIP OF DIRECTORS, NOMINEES FOR DIRECTORS

MOST HIGHLY COMPENSATED EXECUTIVE OFFICERS AND

ALL DIRECTORS AND EXECUTIVE OFFICERS AS A GROUP

|

|

| | | | | | | |

Name | | Amount and

Nature of Beneficial

Ownership (1) | | Ownership

As a Percent of Class | |

| |

| |

| |

Harold A. Adamson, Director | | | | 9,935 | (2) | | | | * | | |

Lauren L. Bracy, Director | | | | 32,885 | (3) | | | | 1.2 | | |

Craig W. Dally, Director | | | | 7,835 | (4) | | | | * | | |

Donald L. Denney, President, CEO & Director | | | | 25,896 | (5) | | | | * | | |

Richard L. Dobbins, Director | | | | 17,097 | (6) | | | | * | | |

William C. Kurtz, Executive Officer | | | | 22,949 | (7) | | | | * | | |

Martin L. Mitchell, Director | | | | 12,556 | (6) | | | | * | | |

Stephen M. Ross, Chairman | | | | 20,465 | (2) | | | | * | | |

James R. Vozar, Director | | | | 19,935 | (2) | | | | * | | |

Gordon L. Welch, Director | | | | 9,935 | (2) | | | | * | | |

| | | | | | | | | | | |

All directors and executive officers as a group(13 persons)(8) | | | | 213,164 | (9) | | | | 7.9 | | |

| |

|

(1) | Except as otherwise noted in these footnotes, the nature of beneficial ownership for shares reported in this table is sole voting and investment power, however, includes shares in the 2003 Recognition and Retention Plan that have not yet vested. |

| |

(2) | Includes 3,968 shares issuable upon the exercise of options exercisable within 60 days. |

| |

(3) | Includes 12,500 shares owned by Bracy & Jahr, Inc. where Mr. Bracy is President and Chief Executive Officer and 3,968 shares issuable upon the exercise of options exercisable within 60 days. |

| |

(4) | Includes 100 shares owned by Dally Tire Company where Mr. Dally is Vice President, Treasurer and General Manager, and 3,968 shares issuable upon the exercise of options exercisable within 60 days. |

| |

(5) | Includes shares held in 401(k) Plan and Employee Stock Ownership Plan that have not yet vested, and 5,000 shares issuable upon the exercise of options exercisable within 60 day. |

| |

(6) | Includes 1,984 shares issuable upon the exercise of options exercisable within 60 days. |

| |

(7) | Includes 4,628 shares issuable upon the exercise of options exercisable within 60 days. |

| |

(8) | Includes shares held directly, as well as shares held jointly with family members, shares held in retirement accounts, held in a fiduciary capacity, held by certain of the group members’ families, or held by trusts of which the group member is a trustee or substantial beneficiary, with respect to which shares the group member may be deemed to have sole or shared voting and/or investment powers. |

| |

(9) | Includes a total of 41,104 shares issuable upon the exercise of options exercisable within 60 days. |

| |

* | Less than 1% ownership as a percent of class. |

15

|

|

SECURITY OWNERSHIP OF SHAREHOLDER

|

HOLDING 5% OR MORE

|

|

| | | | | | | |

NAME AND ADDRESS OF

BENEFICIAL OWNER | | NUMBER

OF SHARES | | PERCENT

OF CLASS | |

|

Jeffrey L. Gendell

55 Railroad Avenue, 3rd Floor

Greenwich, CT 06830 | | | | 215,520 | (1) | | | | 8.1 | % | |

|

Monarch Community Bancorp, Inc. Employee Stock Ownership Plan (“ESOP”)

375 North Willowbrook Road

Coldwater, Michigan 49036 | | | | 173,866 | (2) | | | | 6.5 | % | |

| |

(1) | Based upon information disclosed in Schedule 13D filed with the SEC on June 10, 2004. |

| |

(2) | Shares of Common Stock were acquired by the ESOP in the Bank’s conversion from mutual to stock form (the “Conversion”). The ESOP Committee administers the ESOP. First Bankers Trust Company has been appointed as the corporate trustee for the ESOP (“ESOP Trustee”). The ESOP Trustee, subject to its fiduciary duty, must vote all allocated shares held in the ESOP in accordance with the instructions of the participants. As of February 13, 2006, 62,776 shares have been allocated to ESOP participants’ accounts. |

The following table shows, for the years ended December 31, 2005, 2004 and 2003, the cash compensation paid by the Company, as well as certain other compensation paid or accrued for those years, to the Chief Executive Officer and other executive officers (“Named Executive Officers”) who accrued salary and bonus in excess of $100,000 in fiscal year 2005.

Compensation Table

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Annual Compensation | | Long-Term Compensation | | | | |

| | | | |

| |

| | | | |

| | | | | | | | | | | | | | Awards | | Payouts | | | | |

| | | | | | | | | | | | | |

| |

| | | | |

Name and Principal

Positions | | Year | | Salary

($) | | Bonus

($) | | Other

Annual

Compen-

sation(10)

($) | | Restricted

Stock Awards

($) | | Securities

Underlying

Options/

SARs

(#) | | LTIP

Payouts

($) | | All Other

Compen-

sation

($) | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Donald L. Denney, | | 2005 | | | 180,000 | | | 11,423 | | | | — | | 23,000 | (1) | | — | | | | — | | 23,771 | (2) | |

President and Chief Executive | | 2004 | | | 103,269 | | | — | | | | — | | 256,680 | (3) | | 25,000 | | | | — | | 935 | (4) | |

Officer | | 2003 | (5) | | — | | | — | | | | — | | — | | | — | | | | — | | — | | |

16

| | | | | | | | | | | | | | | | | | | | | | | | | |

William C. Kurtz, | | 2005 | | | 102,743 | | | 5,808 | | | | — | | — | | | — | | | | — | | 12,092 | (6) | |

Senior Vice President, | | 2004 | | | 102,081 | | | 1,500 | | | | — | | — | | | — | | | | — | | 12,782 | (7) | |

and Chief Operating Officer | | 2003 | | | 97,389 | | | 7,000 | | | | — | | 120,900 | (8) | | 11,570 | | | | — | | 25,254 | (9) | |

| |

|

1) | Represents 2,000 shares which have a market value of $22,600 at December 31, 2005. |

| |

2) | Represents contributions made to Monarch Community Bancorp’s 401(k) plan and employee stock ownership plan on behalf of Mr. Denney. |

| |

3) | Represents 18,000 shares which have a market value of $203,400 at December 31, 2005. |

| |

4) | Represents contributions made to Monarch Community Bancorp’s 401(k) plan on behalf of Mr. Denney. |

| |

5) | Mr. Denney was not employed by the Company prior to 2004. |

| |

6) | Represents contributions made to Monarch Community Bancorp’s 401(k) plan and employee stock ownership plan on behalf of Mr. Kurtz as follows: $2,168 and $9,924. |

| |

7) | Represents payment of accrued leave time and contributions made to Monarch Community Bancorp’s 401(k) plan and employee stock ownership plan on behalf of Mr. Kurtz as follows: $343, $2,168 and $10,271. |

| |

8) | Represents 9,300 shares which have a market value of $105,090 at December 31, 2005. |

| |

9) | Represents payment of accrued leave time and payment for attendance at Board of Directors’ meetings and contributions made to Monarch Community Bank’s 401(k) plan and employee stock ownership plan on behalf of Mr. Kurtz as follows: $4,615, $4,500, $637, and $15,502. |

| |

10) | The annual amount of perquisites and other personal benefits did not exceed the lesser of $50,000 or 10% of the total annual salary and bonus of Mr. Denney or Mr. Kurtz and has been omitted as permitted by rules of the SEC. |

Backgrounds of our Executive Officers

In addition to the information about our President and Chief Executive Officer, Donald L. Denney, which is set forth on page 12, following is information about the Company’s other executive officers.

William C. Kurtz, Age 47, Senior Vice President and COO, formerly CFO. Mr. Kurtz has been employed by Monarch Community Bank since 1997. He has held the positions of Chief Financial Officer, Controller, Head of Consumer and Mortgage Lending, and Compliance Officer.

Andrew J. Van Doren, Age 57, Vice President, Secretary, and General Counsel for Monarch Community Bancorp, Inc. since the Company was formed in 2002. He has been employed by Monarch Community Bank since 2001 as Vice President, Secretary, General Counsel, and Chief compliance Officer. Prior to coming to the Bank, Mr. Van Doren was President of Biringer, Hutchinson, Van Doren, Lillis, and Bappert, P.C., a law firm in Coldwater, Michigan, which he joined in 1983. Mr. Van Doren holds a B.A. from Western Michigan University and aJuris Doctordegree from Northwestern University School of Law.

Eric C. Cook,Age 35, Vice President of the Company since April 15, 2004. Mr. Cook began his banking career 1992 with Marshall Savings Bank. He currently is employed by Monarch Community Bank as Vice President and Regional President in Marshall, with responsibility for the Bank’s northern operations. Mr. Cook holds a B.A. from Alma College, an M.B.A from Western Michigan University’s Haworth School of Business, and has completed the Graduate School of Banking at the University of Wisconsin. He serves on several Michigan Bankers Association committees.

Ralph A. Micalizzi, Jr.,Age 43, appointed Vice President, Chief Financial Officer, and Treasurer on February 16, 2006. He joined Monarch Community Bank as Internal Auditor in February 2005; became Bank Vice President and Chief Accountant in October, 2005; and Bank Chief Financial Officer and Treasurer on February 16, 2006. Previously, Mr. Micalizzi served as Chief Financial Officer of United Midwest Savings Bank, Columbus Ohio; Chief Financial Officer of First Central Bank, Lenoir

17

City, Tennessee, Vice President of Corporate Accounting Department for First American Corporation, Nashville, Tennessee; Vice President and Internal Auditor, Southeast Bancorp, Inc., Corbin Kentucky; and was employed for 10 years by public accounting firms. He holds a Bachelor of Accounting degree from Florida International University and has been a Certified Public Accountant since 1992.

Total Options Exercised in 2005 and Year End Values

| |

| This table gives information for options exercised by each of the named executive officers in 2005 and the value (stock price less exercise price) of the remaining options held by those officers at year-end price of the Common Stock. |

FISCAL YEAR-END OPTION/SAR VALUES

| | | | | | | | | | | | | | |

| | | Shares Acquired

On Exercise | | Value Realized

($) | | Number of Securities

Underlying Unexercised

Options/SARs at

Fiscal Year-End (#)(1)

Exercisable/Unexercisable | | Value of Unexercised

In-the-Money

Options/SARs at Fiscal

Year End ($)(2)

Exercisable/Unexercisable | |

| | |

| |

| |

| |

| |

| Donald L. Denney | | | 0 | | | 0 | | 5,000/20,000 | | | | 0/0 | |

| William C. Kurtz | | | 0 | | | 0 | | 4,628/6,842 | | | | 0/0 | |

| | |

| (1) | The options held by Mr. Kurtz in this table have an exercise price of $13.00 and became exercisable at an annual rate of 20% beginning April 24, 2004. 20,000 of the options held by Mr. Denney have an exercise price of $14.00 and become exercisable at an annual rate of 20% beginning September 16, 2005; 5,000 have an exercise price of $13.10 and become exercisable at an annual rate of 20% commencing December 16, 2005. The options expire 10 years from the date of grant. |

| | |

| (2) | Based on market value of the underlying stock at the fiscal year end of $11.30, minus the exercise price. The market price on February 24, 2006 was $12.65 per share. |

Option Grants in 2005

The following table sets forth certain information concerning the number and value of stock options granted in the last fiscal year to the individuals named above in the summary compensation table:

| | | | | | | | | | | | | | |

| Name | | Options

Granted

(#) | | % of Total Options

Granted to

Employees in

Fiscal Year | | Exercise or Base

Price ($/Sh) | | Expiration

Date | |

|

| |

| |

| |

| |

| |

|

Donald L. Denney

| | | 0 | | | — | | | — | | | — | |

| | | | | | | | | | | | | | |

| William C. Kurtz | | | 0 | | | — | | | — | | | — | |

18

|

|

|

OTHER COMPENSATION ARRANGEMENTS |

|

|

Denney Employment Agreement

Donald L. Denney’s (“Executive”) employment agreement with the Company, dated September 16, 2004, provides that he will serve in the capacity of President and Chief Executive Officer of the Company. The term of the agreement is for two years beginning on September 6, 2004 and ending on September 5, 2006, unless terminated earlier in accordance with the agreement. During the term of the agreement, the Company will pay to Executive a base salary of $180,000 annually. The rate of Executive’s base salary beginning in 2006 will be reviewed by the Board of Directors, and Executive will be entitled to an increase in such amount as the Board may decide. Executive is also entitled to receive an annual discretionary bonus pursuant to the bonus program then in effect and is eligible for stock options, awards, and participation in the Company’s employee benefit and fringe benefit programs.

Upon any termination of Executive’s employment with the Company (other than a termination which occurs following a change in control), Executive has agreed not to compete with the Company for the longer of (i) the period that Executive continues to receive his base salary under the agreement, or (ii) one year following his date of termination. The agreement’s prohibition on competition prohibits Executive from working for or advising, consulting or otherwise serving or having a material financial interest in any entity whose business is similar to or which materially competes with the business activities of the Company within a 50 mile radius of Coldwater, Michigan. The prohibition on competition also prohibits Executive from offering employment to or employing on his own behalf or on behalf of another person or entity, any person who is employed by the Company within six months of Executive’s termination of employment.

If the Board terminates Executive’s employment without cause prior to the expiration of the term, Executive is entitled to his base salary and to continue to participate in the Company’s health care plan for the longer of (i) the remainder of the term of his agreement, or (ii) one year following the date of termination of employment. If Executive’s employment is terminated for cause, no continued payments or benefits are due under the agreement. “For cause” is defined as termination due to Executive’s personal dishonesty, incompetence, willful misconduct, breach of fiduciary duty involving personal profit, failure to perform stated duties or to follow one or more specific written directives of the Board, reasonable in nature and scope, willful violation of any law, rule or regulation (other than traffic violations or similar offenses) or final cease and desist order, or material breach of any provision of the agreement.

If, following a change in control, the agreement is terminated by the Company without cause or by Executive for good reason, Executive is entitled to his base salary and to continue to participate in the Company’s health care plan for a period of two years. “Good reason” generally includes: (A) if Executive would be required to move his personal residence or perform his principal executive functions more than 25 miles from the Company’s main office; (B) if, in the organizational structure of the Company, Executive would be required to report to a person or persons other than the Board; (C) if the Company should fail to maintain Executive’s base salary or fail to maintain employee benefit plans or arrangements generally comparable to those currently in place; (D) if Executive is assigned substantial duties and responsibilities other than those normally associated with his current position; or (E) if Executive is removed from or not re-nominated to serve on the Board.

19

A “change in control” is defined to include the following: (A) any third person becoming the beneficial owner of shares of the Company with respect to which 25% or more of the total number votes for the election of the Board may be cast; (B) a change in control of the Company’s subsidiary bank within the meaning of the Home Owners Loan Act of 1933; (C) as a result of or in connection with, any merger or other business combination, sale of assets or contested election, wherein the persons who are directors of the Company before such transaction or event ceased to constitute a majority of the Board of the Company or any successor to the Company; or (D) the Company transfers substantially all of its assets to another corporation or entity which is not an affiliate of the Company.

In the event of disputes under the agreement, the parties have agreed to binding arbitration in accordance with the rules of the American Arbitration Association and have waived their right to a trial by jury. The Company has also agreed to indemnify Executive to the fullest extent permitted under law and applicable regulation against all expenses and liabilities reasonably incurred by him in connection with or arising out of any action, suit or proceeding in which he may be involved by reason of his having been a director or officer of the Company.

Management Continuity Agreements

On December 16, 2004, the Company entered into management continuity agreements with two of its executive officers: William C. Kurtz, Senior Vice President and Chief Operating Officer and Andrew J. Van Doren, Vice President and General Counsel, and on February 21, 2005, with Ralph A. Micalizzi, Jr., Vice President, Treasurer, and Chief Financial Officer (each an “Executive”). The agreements are valid for a period of one year and will renew automatically for successive one-year periods, unless the Board of Directors of the Company indicates by resolution adopted at least three months prior to the end of the relevant one-year term that the agreements shall not be renewed.

Pursuant to the agreements if, during a change in control period, Executive is terminated other than for cause, death, disability or retirement, or if Executive terminates his employment for good reason, then the Executive is entitled to receive his annual base salary for a period of twelve months following the date of termination and ongoing health insurance coverage for Executive and his family under the Bank’s health care plan for a period of twelve months. If Executive’s employment is terminated by reason of death, disability or retirement during the change in control period, then the agreement terminates and the Company must pay Executive his annual base salary through the date of termination and any benefits that have accrued prior to that date. If Executive’s employment is terminated for cause, then the agreement terminates without any further obligations to Executive.

A “change in control” is defined to include the following: (A) any third person becoming the beneficial owner of shares of the Company with respect to which 25% or more of the total number votes for the election of the Board may be cast; (B) a change in control of the Company’s subsidiary bank within the meaning of the Home Owners Loan Act of 1933; (C) as a result of or in connection with, any merger or other business combination, sale of assets or contested election, wherein the persons who are directors of the Company before such transaction or event ceased to constitute a majority of the Board of the Company or any successor to the Company; or (D) the Company transfers substantially all of its assets to another corporation or entity which is not an affiliate of the Company. The “change in control period” is defined as the period commencing on the date of the change in control and ending twelve months later.

20

“Cause” is defined as termination due to Executive’s personal dishonesty, incompetence, willful misconduct, breach of fiduciary duty involving personal profit, failure to perform stated duties or to follow one or more specific written directives of the Board, reasonable in nature and scope, willful violation of any law, rule or regulation (other than traffic violations or similar offenses) or final cease and desist order, or material breach of any provision of the agreement. “Good reason” generally includes: (A) if Executive would be required to move his personal residence or perform his principal executive functions more than 25 miles from the Executive’s primary office; (B) if the Company should fail to maintain Executive’s base salary or fail to maintain employee benefit plans or arrangements generally comparable to those currently in place; or (C) if Executive is assigned substantial duties and responsibilities other than those normally associated with his current position.

In the event of disputes under the agreement, the parties have agreed to binding arbitration in accordance with the rules of the American Arbitration Association and have waived their right to a trial by jury.

401(k) Plan

The Bank has a 401(k) Plan in which substantially all employees may participate. The 401(k) Plan provides for matching contributions equal to 50% on the first 6% of the participant’s 401(k) deferrals for the year.

Employee Stock Ownership Plan and Trust

The Bank has established an ESOP for employees of the Bank. Full-time employees who have been credited with at least 1,000 hours of service during a 12-month period and who have attained age 21 are eligible to participate in our employee stock ownership plan.

The ESOP borrowed funds from the Company to purchase 185,150 shares of Common Stock in the Bank’s conversion from mutual to stock form. The loan to the ESOP will be repaid principally from the Bank’s contributions to the ESOP over a period of ten years, and the collateral for the loan is the Common Stock purchased by the ESOP. The ESOP is subject to the requirements of the Employee Retirement Income Security Act of 1974, and the regulations of the Internal Revenue Service and the Department of Labor thereunder.

2003 Recognition and Retention Plan

The Recognition Plan acquired 92,575 shares of Common Stock. At December 31, 2005, 60,502 shares had been granted to current directors and executive officers and 20,208 of such shares had vested. Under the Recognition Plan, shares are awarded as restricted stock which vests over a five-year period.

2003 Stock Option Plan

An aggregate of 231,438 shares of Common Stock were reserved under the 2003 Stock Option Plan. At December 31, 2005, 243,207 options to acquire shares of Common Stock had been granted. However, 56,300 options were granted to persons who are no longer employed; such options were forfeited by those persons—11,069 of such forfeited options were granted to others, and 45,931 are available for future grants.

21

Transactions with Certain Related Persons

We have followed a policy of granting consumer loans and loans secured by the borrower’s personal residence to our officers, directors and employees. Loans to all officers and directors up to $250,000 when aggregated with other loans to that officer or director must be reported to the Board of Directors. Loans exceeding $250,000 (when aggregated) must be approved by a majority of the disinterested directors. All loans to our employees, executive officers and directors were made in the ordinary course of business and on the same terms and conditions as those of comparable transactions prevailing at the time, in accordance with our underwriting guidelines, and do not involve more than the normal risk of collectibility or present other unfavorable features. All loans to directors and executive officers were performing in accordance with their terms at December 31, 2005.

Compensation Committee Interlocks and Insider Participation

The Compensation Committee of the Board of Directors is comprised of Lauren L. Bracy, James R. Vozar, and Gordon L. Welch, none of whom is or was formerly an officer of the Company. Neither Mr. Bracy, Mr. Vozar nor Mr. Welch had any relationship with the Company which would have required disclosure in this Proxy Statement under the caption “Transactions with Certain Related Persons.” No executive officer of the Company served as a director or on the compensation committee of any other entity in 2005.

22

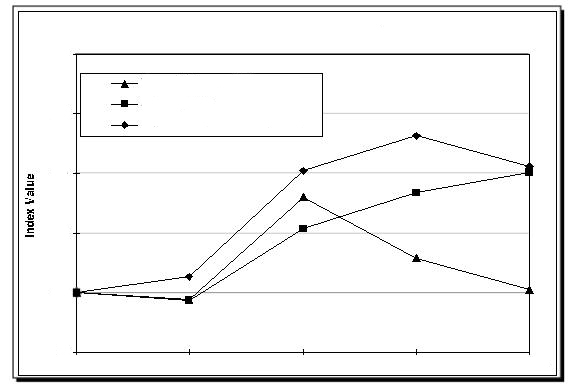

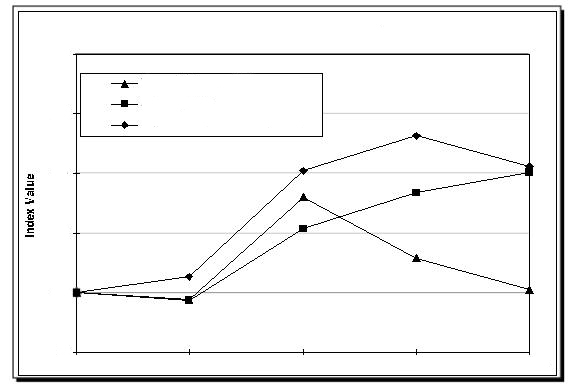

The following graph compares the cumulative total stockholder return on the Company’s common stock (“MCBF”), with cumulative return for the Russell 3000 Index and the SNL $250 - $500 Million Thrift Index over the same period, assuming the investment of $100 on August 30, 2002, and reinvestment of all dividends.

|

Monarch Community Bancorp |

|

Total Return Performance

Monarch Community Bancorp

Russell 3000

SNL $250M-$500M Thrift Index

200

175

150

125

100

75

08/30/02

12/31/02

12/31/03

12/31/04

12/31/05

| | | | | | | | | | | | | | | | |

| | Period Ending | |

| |

|

Index | | 08/30/02 | | 12/31/02 | | 12/31/03 | | 12/31/04 | | 12/31/05 | |

|

|

|

|

|

|

|

|

|

|

|

|

Monarch Community Bancorp | | 100.00 | | | 97.09 | | | 139.91 | | | 114.49 | | | 101.24 | | |

Russell 3000 | | 100.00 | | | 96.67 | | | 126.70 | | | 141.83 | | | 150.51 | | |

SNL $250M-$500M Thrift Index | | 100.00 | | | 106.64 | | | 150.95 | | | 165.80 | | | 152.89 | | |

|

Source: SNL Financial LC, Charlottesville, VA |

© 2006 |

|

23

EXECUTIVE COMPENSATION COMMITTEE REPORT

Under rules established by the Securities and Exchange Commission, the Company is required to provide certain information in regard to the compensation and benefits provided to Donald Denney, as President and Chief Executive Officer of the Company and the Bank, and the other three executive officers of the Company and the Bank. The disclosure requirements for these four individuals (the “executive officers”) include information set forth in various compensation tables contained in this Proxy Statement and a report explaining the rationale and manner regarding executive officer salaries, bonuses and contributions to the ESOP by the Board of Directors of the Company, with Mr. Denney abstaining from and voting on such matters. Decisions regarding the grant of awards to executive officers pursuant to the Incentive Stock Plan are made by the Compensation Committee of the Board of Directors. The Compensation Committee of the Board of Directors of the Company has prepared the following report.

COMPENSATION POLICY

This report describes the current compensation policy as endorsed by the Company’s Board of Directors and the Compensation Committee, and the resulting actions taken in arriving at 2005 compensation as reported in the various compensation tables. The executive compensation program of the Bank has been designed to:

| | |

| 1. | Provide a pay-for-performance policy that differentiates compensation amounts based upon corporate and individual performance. |

| | |

| 2. | Provide compensation opportunities comparable to those offered by other Michigan-based financial institutions and Eastern US banks of similar asset size, thus allowing the Bank to compete for and retain talented executives who are essential to the long-term success of the Company and the Bank. |

| | |

| 3. | Align the interest of the executive officers with the long-term interest of the Company’s shareholders through the ownership of Company Common Stock. |

The executive compensation program is comprised of salary, opportunities for annual cash bonuses, participation in the ESOP, participation in the Incentive Stock Option Plan and participation in the Retention and Recognition Plan (RRP). An executive officer’s salary is based on a number of factors, including, (1) the Bank’s performance as compared to internally established goals for the most recently ended fiscal year and to the performance of other Michigan-based financial institutions, (2) the individual officer’s level of responsibility with the Bank and (3) comparisons to salaries paid to officers holding similar positions in other Michigan–based financial institutions. The award of an annual cash bonus is made in the discretion of the Board of Directors and is pursuant to a formal plan or formula. A bonus, if granted, is based on the individual performance of the executive officer and the achievement of financial performance goals of the Company, as established in the Company’s annual budget and business plan. The Bank, as plan sponsor of the ESOP, made an ESOP contribution which was allocated among all participating employees of the Bank, including the executive officers based on their annual salaries. The Compensation Committee uses the award of stock options and/or available (RRP) stock to officers to

24

align the officers’ interests with those of the shareholders; significant vesting periods are also used to retain employees. The amount of stock granted is determined by reviewing the practices of other financial institutions based on information provided by an outside reliable research consultants to the Board of Directors.

In 1993, Section 162 (m) of the Internal Revenue Code was amended to place limits on the deductibility of compensation in excess of $1 million paid to executive officers of publicly held companies. The Board of Directors of the Company does not believe, however, that the amendment has had or will have any impact on the compensation policies followed by the Board.

President/Chief Executive Officer’s Compensation

Mr. Denney’s base salary was $180,000 for 2005. The base salary reflected consideration of (i) an assessment of the Company’s performance during 2004 as compared to goals set in the Company’s annual budget and business plan for 2004, (ii) a comparison of the Company’s performance as compared to the performance of other Michigan-based financial institutions, and (iii) compensation data provided by comparative industry surveys. Each year, management of the Bank prepares, and the Board of Directors approves, an annual budget and business plan containing financial performance goals measured primarily in terms of earnings per share, asset quality, return on assets and return on stockholders’ equity. In setting Mr. Denney’s salary for 2005, the Board reviewed the goals established for 2004 and determined that such goals have been achieved by the Company. The Board also reviewed the Company’s performance as compared to the performance of other Michigan-based financial institutions of similar asset size. Compensation data for other Michigan-based financial institutions of similar asset size is also provided through surveys independently prepared by the Michigan Bankers Association. The survey reviewed by the Board in setting Mr. Denney’s 2005 salary contained information on salaries paid during 2004 to the chief executive officers of financial institutions in the same region and asset size of Michigan-based banks with deposits in excess of $250 million. The Board also reviewed the compensation data from Crowe Chizek and Company LLC by comparing the salaries of CEOs of Michigan banks with an asset size similar to the Bank. While the foregoing factors are not specifically weighted in the decision-making process, primary emphasis is placed on the Company’s performance during the previous year as compared to the internally-established goals. Review of comparable compensation data is used primarily as a check to ensure that the salary established is within the range of salaries paid to other chief executive officers of Michigan-based financial institutions. Although the Board reviewed a number of objective factors as described above in setting Mr. Denney’s salary for 2005 its final decision was based on a subjective determination.

Mr. Denney was awarded a 5 per cent bonus ($9,000) bonus for 2005 and received additional 2000 Shares of (RRP) Stock (5 years vesting period). He also was eligible for ESOP contribution. Mr. Denney’s contribution was $18,504 for the year 2005. The size of the contribution (as limited by the Internal Revenue Code) was determined as a function of Mr. Denney’s 2005 salary and the size of the contribution made by the Bank, as plan sponsor, to the ESOP for the benefit of all employees of the Bank eligible to participate in the ESOP Plan. For 2005, the ESOP Plan contribution made by the Bank amounted to 7.35 % of the aggregate salaries paid ($245,646) to all Bank employees eligible to participate in the plans. Mr. Denney was eligible for the 401K Plan with a Company match up to 3% maximum.

Compensation for Other Executive Officers

Effective January 31, 2005, the Board of Directors increased the base salaries of the 4 other executive officers, Mr. Kurtz (3.0 per cent increase), Mr. Cook (1.0 per cent increase) and Mr. Van Doren

25

(3.0 per cent increase) all increases of 2005 salary base. Bonus was awarded to all 4 executive officers of 5 per cent of annual salary for 2005 payable in 2006. All executive officers received additional compensation representing the contributions the Bank made to the ESOP Plan. The size of those ESOP contributions was determined in accordance with the same procedures as was used for all employees of the Bank the salaries were based on the same considerations as those used in making the compensation decisions concerning the President/Chief Executive Officer of the Bank and those considerations described under the Compensation Policy.

THE COMPENSATION COMMITTEE

| | |

Lauren L. Bracy | Gordon L. Welch | James R. Vozar |

AUDIT COMMITTEE REPORT

The Audit Committee is comprised of three directors (Messrs. Adamson, Dobbins, and Mitchell). Each of the directors is independent, under the definition contained in Rule 4200(a)(15) of the NASD’s listing standards. The Board of Directors has adopted a written charter for the Audit Committee, which was included as an Appendix to the Proxy Statement in connection with the 2005 Annual Meeting.

In connection with the audited financial statements contained in the Company’s 2005 Annual Report on Form 10-K for the fiscal year ended December 31, 2005, the Audit Committee reviewed and discussed the audited financial statements with management and Plante & Moran, PLLC. The Audit Committee discussed with Plante & Moran, PLLC the matters required to be discussed by SAS 61 (Codification of Statements on Auditing Standards, AU § 380). The Audit Committee has also received the written disclosures and the letter from Plante & Moran, PLLC required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and has discussed with them their independence.

Based on the review and discussions, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2005.

THE AUDIT COMMITTEE

| | |

Harold A. Adamson | Richard L. Dobbins | Martin L. Mitchell |

26

COMPLIANCE WITH SECTION 16

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s executive officers and directors, and persons who own more than 10% of any registered class of the Company’s equity securities, to file reports of ownership and changes in ownership with the SEC. Executive officers, directors and greater than 10% shareholders are required by regulation to furnish the Company with copies of all Section 16(a) reports they file.

Based on its review of the copies of the reports it has received and written representations provided to the Company from the individuals required to file the reports, the Company believes that all Directors and Executives of the Company filed all reports required on a timely basis pursuant to Section 16 of the Securities Exchange Act of 1934, except as follows: The Form 4 for transactions of Donald L. Denney that occurred on September 30, 2005 and December 15, 2005 was not filed until January 18, 2006. One Form 4 reporting one transaction by Mr. Kurtz was filed 3 days late.

SHAREHOLDER PROPOSALS FOR THE YEAR 2007 PROXY STATEMENT

In order to be eligible for inclusion in next year’s proxy materials for the annual meeting of shareholders, any shareholder proposal to take action at such meeting must be received at our executive office located at 375 North Willowbrook Road, Coldwater, Michigan 49035, on or before November 24, 2006. Any shareholder proposals received after December 19, 2006, but on or before January 18, 2007, may be considered for presentation at next year’s annual meeting although not included in the proxy statement. In the event that the date of the annual meeting is advanced by more than 30 days or delayed by more than 60 days from April 18, 2007, the shareholder proposal must be delivered not earlier than the 120th day prior to the date of such annual meeting and not later than the close of business on the later of the 90th day prior to the date of such annual meeting or the tenth day following the day on which notice of the date of the annual meeting was mailed or public announcement of the date of such meeting is first made.

All shareholder proposals for inclusion in Monarch Community Bancorp’s proxy materials may be subject to the requirements of the proxy rules adopted under the Securities Exchange Act of 1934 and, as with any shareholder proposal, regardless of whether included in our proxy materials, Monarch Community Bancorp’s articles of incorporation and bylaws and Maryland law.

Whether or not you plan to attend the Meeting, please vote by marking, signing, dating and promptly returning the enclosed proxy in the enclosed envelope.

| | |

| By Order of the Board of Directors, |

| | |

| | Andrew J. Van Doren |

| | Corporate Secretary |

27

| | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | |

x | PLEASE MARK VOTES | | REVOCABLE PROXY | | | | | With-

hold | | For All

Except |

AS IN THIS EXAMPLE | | MONARCH COMMUNITY BANCORP, INC. | | | For | | |

| ANNUAL MEETING OF SHAREHOLDERS APRIL 18, 2006 | | I. | The election ofMartia L. Mitchell, Stephen M. Ross and Gordon L. Welchas directors of Monarch Community Bancorp, Inc. each for a term of three years. | | o | | o | | o |

The undersigned hereby appoints the members of the Board of Directors of Monarch Community Bancorp, Inc. and its survivor, with full power of substitution, and authorizes them to represent and vote, as designated below and in accordance with their judgment upon any other matters property presented at the annual meeting, all the shares of Monarch Community Bancorp, Inc. common stock held of record by the undersigned at the close of business on February 24, 2006, at the annual meeting of shareholders, to be held Thursday, April 18, 2006, and at any and all adjournments or postponements thereof. The Board of Directors recommends a vote “FOR” each of the listed proposals.

Should a director nominee be unable to serve as a director, an event the Monarch Community Bancorp, Inc. does not currently anticipate, the persons named in this proxy reserve the right, in their discretion to vote for a substitute nominee designated by the Board of Directors. | | | | | | | | | |

| | | | | | | | |

| |

INSTRUCTION: To vote for all the nominees mark the box “FOR” with an “X”. To withhold your vote for all the nominees mark the box “WITHHOLD” with an “X”. To withhold your vote for an Individual nominee mark the box “FOR All EXCEPT” and write the name of the nominee on the following line for whom you wish to withhold your vote.

|

| |

| |

| |

| |

| | |

| | |

| | | | For | | Against | | Abstain |

| II. | The ratification of appointment of Plante & Moran, PLLC as the Independent auditors for the Corporation for the fiscal year ending December 31, 2006. | | o | | o | | o |

| | | | | | | | |

| | | | | | | | | | |

| | | |

This proxy, when property executed, will be voted in the manner directed herein by the undersigned shareholder(s). If no direction is made, this proxy will be voted FOR each of the proposals set forth herein. If any other business is presented at such meeting, this proxy will be voted by those named in this proxy in their best judgement. At the present time, the Board of Directors knows of no other business to be presented at the meeting.

|

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | |

| | | | This proxy may be revoked at any time before it is voted on by delivering to the Secretary of Monarch Community Bancorp, Inc., on or before the taking of the vote at the annual meeting, a written notice of revocation bearing a later date than the proxy of a later dated proxy relating to the same shares of Monarch Community Bancorp, Inc. common stock, or by attending the annual meeting and voting in person. Attendance at the annual meeting will not in it self constitute the revocation of a proxy. If this proxy is properly revoked as described above, then the power of such attorneys and proxies shall be deemed terminated and of no further force and effect. |

| | | |

| | | |

Please be sure to sign and date this Proxy in the box below. | | Date | | |

| | | |

| | |

| | |

| Shareholder sign above | | Co-holder (if any) sign above | | | | |

| | | | | |

+ | | | | | | | | | | | | | | | + |

| | |

Ç | Detach above card, sign, date and mail in postage-paid envelope provided. | Ç |

| | |

| MONARCH COMMUNITY BANCORP, INC. | |

| | |

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS.

|

The abovesigned acknowledges receipt from Monarch Community Bancorp, Inc., prior to the execution of this Proxy, of Notice of Annual Meeting scheduled to held on April 18, 2006, a Proxy Statement dated on or about March 24, 2006 and Monarch Community Bancorp, Inc.’s Annual Report to Shareholders for the fiscal year ended December 31, 2005.

|

Please sign exactly as your name appears above on this card. When signing as attorney, executor, administrator, trustee or guardian, please give your full title as such. If shares are held jointly, each holder should sign.

|

PLEASE PROMPTLY COMPLETE, DATE, SIGN AND MAIL THIS PROXY IN THE ENCLOSED POSTAGE-PAID ENVELOPE |

| | |

IF YOUR ADDRESS HAS CHANGED, PLEASE CORRECT THE ADDRESS IN THE SPACE PROVIDED BELOW AND RETURN THIS PORTION WITH THE PROXY IN THE ENVELOPE PROVIDED. |