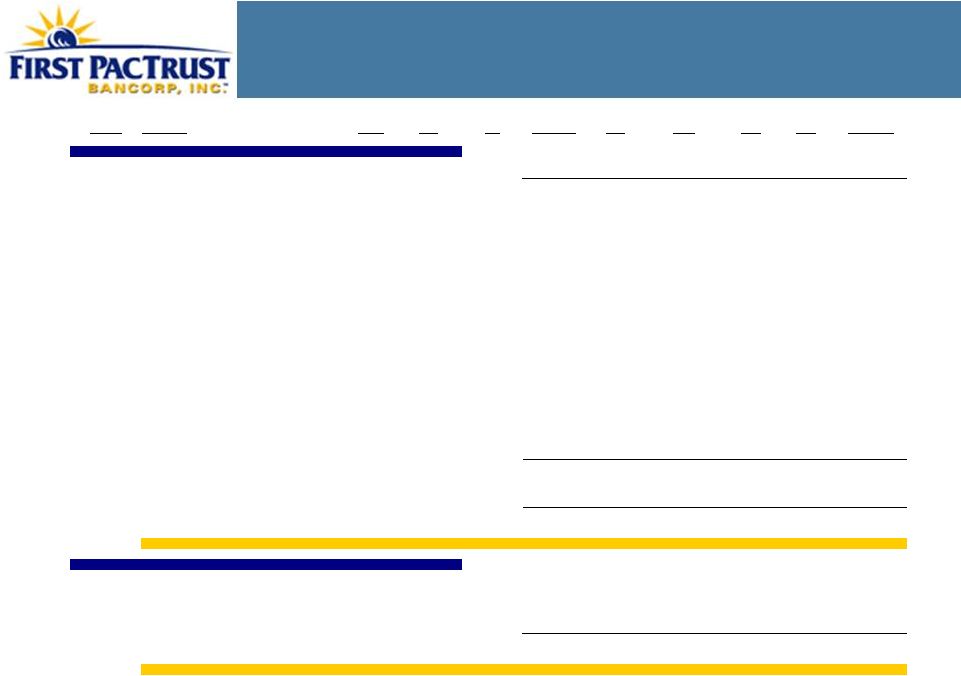

20 Securities Overview Investment Portfolio @ 09/30/2010 Lowest Maturity Est. Avg Original Coupon Par/Principal Purchase Book Current CUSIP # Investment Rating Date Life Face Value Rate Value Price Yield Book Value Pacific Trust Bank Security Portfolio (Bank) Government/Agency Securities: 3128X7MN1 FHLMC Note AAA 05/05/2011 0.6 Years 5,000,000 3.500% 5,000,000 104.2180 1.372% 5,062,747 Total Government/Agency Notes 5,000,000 3.500% 5,000,000 1.372% 5,062,747 Mortgage-Backed Securities: 22944BDK1 CSMC 2007-5 7A2 BBB 10/25/2024 3.5 Years 2,300,000 5.000% 1,223,668 97.0000 5.943% 1,186,958 02640CAE5 AGFMT 2009-1 A5 AA 09/25/2048 2.8 Years 5,000,000 5.750% 5,000,000 102.0000 5.001% 5,094,478 76110HTX7 RALI 2004-QS7 A3 AAA 05/25/2034 2.7 Years 2,000,000 5.500% 1,152,685 100.6250 5.208% 1,159,322 05948KCR8 BOAA 2003-5 2A1 A 07/25/2018 3.0 Years 3,800,000 5.000% 1,027,453 100.6250 4.730% 1,033,491 12667FU45 CWALT 2005-J1 4A1 B+ 08/25/2017 2.2 Years 20,000,000 6.000% 2,364,034 100.9063 5.474% 2,384,827 74958EAA4 RFMSI 2006-S12 1A1 B+ 12/25/2021 2.8 Years 5,160,000 5.500% 1,483,021 102.1563 4.093% 1,514,337 12643CCA7 CSMC 2010-1R 17A1 AAA 06/27/2036 0.7 Years 3,758,000 4.750% 2,749,287 101.2500 1.928% 2,767,931 2254W0PE9 CSFB 2005-11 8A1 B 12/25/2035 1.4 Years 3,000,000 5.250% 1,463,863 97.5000 6.322% 1,432,647 12643CGA3 CSMC 2010-1R 49A1 AAA 07/27/2036 1.2 Years 2,559,000 4.750% 2,118,160 101.3750 2.508% 2,136,766 46633PAJ1 JPMRR 2009-7 5A1 AAA 02/27/2037 2.0 Years 3,335,000 6.000% 2,652,886 98.1406 6.547% 2,607,553 74928QAT3 RBSSP 2009-9 8A4 AAA 10/26/2037 2.7 Years 1,296,444 6.000% 1,115,909 95.1875 7.812% 1,066,740 12642JCG0 CSMC 2009-11R 3A1 AAA 10/26/2037 2.6 Years 4,990,000 6.500% 3,962,975 96.9375 7.778% 3,848,657 92922F4A3 WAMU 2005-AR14 1A1 BB- 12/25/2035 0.7 Years 4,050,000 4.771% 977,351 81.5000 13.401% 853,451 07384YMB9 BSABS 2003-AC5 A2 AAA 10/25/2033 4.8 Years 11,460,000 5.000% 2,522,618 83.2500 8.382% 2,114,770 05955EAK9 BAFC 2009-R4A 2A4 AAA 07/26/2035 1.4 Years 2,910,438 5.250% 1,342,058 87.5000 9.757% 1,214,191 74928FAD2 RBSSP 2009-3 1A4 AAA 11/26/2035 1.2 Years 3,000,000 5.500% 1,607,486 86.7500 9.482% 1,434,188 74928EAC7 RBSSP 2009-2 2A1 AAA 05/26/2036 1.4 Years 5,000,000 5.500% 3,133,116 89.2500 11.453% 2,822,240 12667GQS5 CWALT 2005-20CB 4A1 B- 07/25/2020 3.3 Years 12,000,000 5.250% 4,432,339 81.5000 12.044% 3,670,692 743873BK6 PFMLT 2005-2 1A1A BB- 10/25/2035 6.3 Years 9,000,000 2.820% 2,347,782 78.7500 10.142% 1,851,873 74928DAG0 RBSSP 2009-1 4A1 AAA 10/26/2035 1.1 Years 2,500,000 5.500% 1,218,327 90.5000 10.683% 1,135,481 12669D2Z0 CWHL 2003-HYB2 2A1 AAA 07/19/2033 2.0 Years 20,000,000 3.964% 1,664,899 81.0000 10.535% 1,350,411 05954XAJ1 BAFC 2008-R3 3A4 AAA 01/25/2037 2.1 Years 6,000,000 6.000% 4,309,242 87.8125 10.455% 3,864,017 32051GFV2 FHAMS 2005-FA1 2A1 B+ 02/25/2020 3.5 Years 22,376,000 5.000% 8,355,534 81.8750 11.212% 6,989,137 863576CE2 SASC 2005-6 4A1 B 05/25/2035 3.6 Years 6,595,000 5.000% 2,514,862 69.5000 13.633% 1,761,574 Total Non-Agency CMOs/REMICs 162,089,882 5.296% 60,739,555 8.262% 55,295,731 38374VQ77 GNR 2009-50 A AAA 08/20/2036 1.2 Years 9,950,000 5.500% 6,051,177 104.5625 2.400% 6,298,346 31358LV94 FNMA REMIC 1992-30 F AAA 03/25/2022 3.4 Years 2,000,000 0.781% 3,144 99.9688 0.786% 3,144 362095HK0 GNMA 62334 AAA 07/15/2013 0.8 Years 100,000 12.000% 379 100.0000 12.000% 379 Total Agency MBS/CMO/REMICs 12,050,000 5.498% 6,054,699 2.400% 6,301,869 Total Mortgage Backed Securities 5.314% 66,794,254 7.662% 61,597,600 Total Negotiable Securities 5.188% 71,794,254 7.185% 66,660,347 First Pactrust Bancorp Securities Portfolio (Holding Company) Re-REMIC Accural Tranches: 05955EAJ2 BAFC 2009-R4 2A3 NR 07/26/2035 3.0 Years 359,718 5.250% 390,812 0.5000 0.000% 0 74928FAC4 RBSSP 2009-3 1A3 NR 11/26/2035 3.3 Years 409,090 5.500% 444,187 0.5000 0.000% 0 74928EAD5 RBSSP 2009-2 2A2 NR 05/26/2036 3.7 Years 1,896,551 5.500% 2,077,977 0.5000 0.000% 0 74928DAH8 RBSSP 2009-1 4A2 NR 10/26/2035 2.7 Years 277,777 5.500% 305,768 0.5000 0.000% 0 05954XAN2 BFAC 2008-R3 3A3 NR 01/25/2037 10.4 Years 3,230,769 6.000% 3,605,405 0.5000 0.000% 0 Total Re-REMIC Z Tranches 6,173,905 5.750% 6,824,148 0.000% 0 Total Mortgage Backed Securities 5.750% 6,824,148 0.000% 0 Total Negotiable Securities 5.750% 6,824,148 0.000% 0 |