As filed with the Securities and Exchange Commission on January 7, 2008

Registration No. 333-_________

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________

Form SB-2

Registration Statement Under The Securities Act of 1933

BANCROFT URANIUM INC

(Name of small business issuer in its charter)

| Nevada | | 1000 | | 94-3409449 |

(State or other jurisdiction of incorporation or organization) | | (Primary standard industrial classification code number) | | (IRS Employer Identification Number) |

8655 East Via De Ventura, Suite G200

Scottsdale, AZ, 85258, (480) 346-1460

(Address and telephone number of principal executive offices)

8655 East Via De Ventura, Suite G200

Scottsdale, AZ, 85258

(Address of principal place of business or intended principal place of business)

P. Leslie Hammond

8655 East Via De Ventura, Suite G200

Scottsdale, AZ, 85258,

(480) 346-1460

((480) 346-1461

(Name, address and telephone number of agent for service)

Copies to:

Jonathan Dariyanani, Esq.

Zoma Law Group, LLC

4720 Center Blvd, Suite 317

New York, New York 11109

(415) 699-7121

(415) 358-5548 Facsimile

Approximate Date of Proposed Sale to the Public: As soon as practicable after this Registration Statement becomes effective.

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering o.

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering o.

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering o.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box:x.

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box o.

CALCULATION OF REGISTRATION FEE

| | | | | | | | | | | | | |

Title of Each Class of Securities to be Registered (1) | | Amount to be Registered(1) | | | Proposed Maximum Offering Price Per Security(2) | | | Proposed Maximum Aggregate Offering Price (2) | | | Amount of Registration Fee | |

| | | | | | | | | | | | | |

| Common Stock, $0.001 par value, issuable upon conversion of Convertible Debt (3) | | | 7,242,180 | | | $ | 2.00 | | | $ | 14,484,360 | | | $ | 569.24 | |

| Total | | | 7,242,180 | | | $ | 2.00 | | | $ | 14,484,360 | | | $ | 569.24 | |

| (1) | Relates to the resale of these shares of common stock by the selling security holders. |

| (2) | Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended (the “Securities Act”). Pursuant to Rule 457(c) under the Securities Act, the proposed maximum offering price of each share of the Registrant’s common stock is estimated to be the average of the high and low sales price of a share as of a date five business days before the filing of this registration statement. Accordingly, the Registrant has used $2.00 as such price per share, which is the price reported by the OTC Bulletin Board on January 3, 2007. |

| (3) | The actual number of shares of common stock offered in this prospectus, and included in the registration statement of which this prospectus is a part, includes such additional number of shares of common stock as may be issued or issuable upon conversion of convertible notes and exercise of the warrants by reason of any stock split, stock dividend or similar transaction involving the common stock, in accordance with Rule 416 under the Securities Act of 1933. However, the selling stockholders that participated in the financing have contractually agreed to restrict their ability to convert their convertible notes or exercise their warrants and receive shares of our common stock such that the number of shares of common stock held by them in the aggregate and their affiliates after such conversion or exercise does not exceed 4.99% of the then issued and outstanding shares of common stock as determined in accordance with Section 13(d) of the Exchange Act. Accordingly, the number of shares of common stock set forth in the table for the selling stockholders exceeds the number of shares of common stock that the selling stockholders could own beneficially at any given time through their ownership of the secured convertible notes and the warrants. In that regard, the beneficial ownership of the common stock by the selling stockholder set forth in the table is not determined in accordance with Rule 13d-3 under the Securities Exchange Act of 1934, as amended. |

Until (insert date), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers' obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

We hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until we have filed a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell or a solicitation of an offer to buy these securities in any state where the offer is not permitted.

SUBJECT TO COMPLETION, DATED January 7, 2008

Preliminary Prospectus

7,242,180 Shares

BANCROFT URANIUM INC.

Common Stock

This prospectus relates to the sale of shares of common stock of Bancroft Uranium Inc., a Nevada corporation (“Bancroft”) by Pierce Diversified Strategy Master Fund, Enable Opportunity Partners, L.P. and Enable Growth Partners L.P., referred to collectively as the selling security holders throughout this document. The selling security holders are offering to sell up to 7,242,180 shares of our common stock. We will not receive any proceeds from the resale of shares of common stock by the selling security holders, which includes up to 7,242,180 shares issuable upon the conversion of 8% Original Issue Discount Secured Convertible Debentures.

All of the shares of common stock being offered by this prospectus are being offered by the selling security holders named in this prospectus. This offering is not being underwritten. We will not receive any of the proceeds from the sale of the shares of our common stock in this offering. The selling security holders identified in this prospectus, or its pledgees, donees, transferees or other successors-in-interest, may offer the common stock or interests therein from time to time through public or private transactions at prevailing market prices, at prices related to prevailing market prices, or at privately negotiated prices. We will pay all expenses of registering this offering of shares of common stock which we estimate at $40,000.

The common stock is traded in the over-the-counter market and prices are quoted on the over-the-counter Bulletin Board under the symbol “BCFT.” On January 3, 2008 the price per share of our common stock was $2.00.

INVESTING IN OUR COMMON STOCK INVOLVES RISK. SEE “RISK FACTORS” BEGINNING ON PAGE 2.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY OTHER REGULATORY BODY HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY OF THE PROSPECTUS. ANY REPRESENTATIONS MADE TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this Prospectus is ___________, 2008.

Table of Contents

| SUMMARY | 1 |

| Overview | 1 |

| The Offering | 2 |

| RISK FACTORS | 2 |

| Risks Related to Our Business | 2 |

| Risks Related to Our Securities | 5 |

| SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS | 7 |

| USE OF PROCEEDS | 7 |

| DILUTION | 7 |

| SELLING SECURITY HOLDERS | 7 |

| Debt Financing | 7 |

| PLAN OF DISTRIBUTION | 9 |

| LEGAL PROCEEDINGS | 10 |

| DIRECTORS AND EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS | 10 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 11 |

| DESCRIPTION OF SECURITIES | 11 |

| General | 11 |

| Common Stock | 11 |

| DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES | 11 |

| DESCRIPTION OF BUSINESS | 12 |

| Overview | 12 |

| History and Background | 12 |

| Our Current Business | 12 |

| Marketing and Distribution | 16 |

| Manufacturing | 17 |

| Competition | 17 |

| Principal Suppliers | 17 |

| Major Customers | 17 |

| Intellectual Property | 17 |

| Mineral Exploration Rights | 17 |

| Government approval and regulation of our principal products or services | 18 |

| Costs and effects of compliance with environmental laws | 18 |

| Employees | 19 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION | 19 |

| Overview | 19 |

| Recent Developments | 20 |

| Critical accounting policies and estimates | 21 |

| Recent Accounting Pronouncements | 21 |

| Results of Operations | 22 |

| Going Concern, Liquidity and Capital Resources | 23 |

| Off-balance sheet arrangements | 24 |

| Inflation | 24 |

| DESCRIPTION OF PROPERTY | 24 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 24 |

| Transactions of Bancroft Subsequent to Acquisition of Ontario Limited | 24 |

| MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS | 25 |

| EXECUTIVE COMPENSATION | 26 |

| EXPERTS | 27 |

| LEGAL MATTERS | 27 |

| WHERE YOU CAN FIND MORE INFORMATION | 27 |

| FINANCIAL STATEMENTS | 28 |

| PART II - INFORMATION NOT REQUIRED IN THE PROSPECTUS | II-1 |

| EXHIBIT INDEX | II-6 |

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus.

SUMMARY

This summary highlights information contained elsewhere in the prospectus. You should read the entire prospectus carefully, especially the risks of investing in the securities discussed under “Risk Factors” and the financial statements and related notes included elsewhere in this prospectus before deciding to invest in our common stock.

Overview

The Company was originally incorporated on October 12, 2001 as Conscious Intention, Inc. The Company’s original purpose was developing internet based software products for the executive coaching market. The Company was never successful in completing a product or attracting customers and abandoned this business in early 2005. In November of 2005, Mr. Andrew Hamilton replaced CEO Sylva Leduc and began to implement a plan to have the Company function in the area of management consulting. The Company intended to provide management consulting services to corporations through the efforts of Mr. Hamilton and other consultants he intended to hire through recruiting or acquisition. In June, 2007, the Company abandoned his efforts to provide management consulting services and the Company began to seek a business combination. On September, 14, 2007, the Company entered into an agreement to acquire a private Canadian corporation which had mining leases for the purposes of engaging in the mineral exploration business. In September, 2007, the Company changed its name to Bancroft Uranium Inc. to reflect its new business purpose. On October 3, 2007, the Company completed its acquisition of the Canadian corporation and began its mineral exploration efforts. The sole business of the company is mineral exploration. The Company’s current business consists of mineral rights leases which it owns on three properties in Canada. The Company intends to develop these properties so that uranium can be extracted from the properties.

The Offering

The selling security holders may offer and sell up to 7,242,180 shares of our common stock, which is approximately 33% of our currently outstanding common stock held by non-affiliated shareholders. See “Selling security holders.”

The offering is made by the selling security holders for their benefit. We will not receive any of the proceeds from its sale of common stock.

RISK FACTORS

You should carefully consider the factors described below and other information contained in this prospectus. If any of the following risks actually occurs, our business, financial condition or results of operations could be materially and adversely affected. In such case, the trading price of our common stock could decline, and you may lose all or part of your investment. This prospectus also contains forward-looking statements that involve risks and uncertainties. Please refer to “Special Note Regarding Forward-Looking Statements” included elsewhere in this prospectus.

Risks Related to Our Business

All of Our Assets Are Pledged to the Selling Shareholders. Failure to Repay the Selling Shareholders Will Result in the Loss of All of Our Assets

All of our mineral assets, which constitute all of the non-cash assets of the Company and our entire business, are pledged to the selling security holders under agreements which require repayment of $3,750,000 in principal plus interest plus additional fees, penalties, costs and expenses. If we fail to abide by the agreements with our selling shareholders, the selling shareholders can take possession of our assets, leaving us with no assets and no business. We do not presently have the cash or cash flow to repay the selling shareholders their principal and interest without obtaining additional financing.. There can be no assurance of our ability to obtain such financing. You are therefore taking a risk that we will default on our obligations to the selling shareholders, leaving the Company with no assets and no value.

We Have No Operating History. Accordingly, You Have No Basis Upon Which To Evaluate Our Ability To Achieve Our Business Objectives.

We are a development stage company and have never had revenue from operations. As a company without an operating history and limited property interests or related assets, it is difficult for potential investors to evaluate our business. Our proposed operations are therefore subject to all of the risks inherent in the establishment of a new business enterprise and must be considered in light of the expenses, difficulties, complications and delays frequently encountered in connection with the formation of any new business, as well as those risks that are specific to the uranium mining industry. Investors should evaluate us in light of the delays, expenses, problems and uncertainties frequently encountered by companies developing markets for new products, services and technologies. We may never overcome these obstacles.

We Have Not Yet Established Any Reserves And There Is No Assurance That We Ever Will.

There are numerous uncertainties inherent in estimating quantities of uranium resources, including many factors beyond our control, and no assurance can be given that the recovery of uranium will be realized. In general, estimates of recoverable uranium resources are based upon a number of factors and assumptions made as of the date on which the resource estimates were determined, such as geological and engineering estimates which have inherent uncertainties and the assumed effects of regulation by governmental agencies and estimates of future commodity prices and operating costs, all of which may vary considerably from actual results. All such estimates are, to some degree, uncertain and classifications of resources are only attempts to define the degree of uncertainty involved. For these reasons, estimates of the recoverable uranium, the classification of such resources based on risk of recovery, prepared by different engineers or by the same engineers at different times, may vary substantially.

Our Lack Of Diversification Will Increase The Risk Of An Investment In Us, As Our Financial Condition And Results Of Operations May Deteriorate If We Fail To Diversify.

Only our Monmouth property is in an active state of exploration. Efforts at Elliot Lake and Longlac have not progressed beyond initial prospecting and surveying. The majority of our efforts and spending are on the Monmouth property. Larger companies have the ability to manage their risks over many properties. However, we will lack diversification, in terms of both the nature and geographic scope of our business. As a result, we will likely be impacted more acutely by factors affecting our industry or the regions in which we operate than we would if our business were more diversified, enhancing our risk profile. If we cannot diversify our operations, our financial condition and results of operations could deteriorate.

Relationships Upon Which We May Rely Are Subject To Change, Which May Diminish Our Ability To Conduct Our Operations.

To develop our business, it will be necessary for us to establish business relationships which may take the form of joint ventures with private parties and contractual arrangements with other companies, including those that supply equipment and other resources that we expect to use in our business. We may not be able to establish these strategic relationships, or if established, we may not be able to maintain them. In addition, the dynamics of our relationships may require us to incur expenses or undertake activities we would not otherwise be inclined to in order to fulfill our obligations to these partners or maintain our relationships. If these relationships are not established or maintained, our business prospects may be limited, which could diminish our ability to conduct our operations.

We May Not Be Able To Effectively Establish Operations Or Manage Our Growth, Which May Harm Our Profitability.

Our strategy envisions establishing and expanding our business. If we are successful at establishing operations at Monmouth and elsewhere, we may be unable to manage our growth. Growth may place a strain on our management systems and resources. We must continue to refine and expand our business development capabilities, our systems and processes and our access to financing sources. As we grow, we must continue to hire, train, supervise and manage new personnel. We cannot assure you that we will be able to:

§ meet our capital needs;

§ expand our systems effectively or efficiently or in a timely manner;

§ allocate our human resources optimally;

§ identify and hire qualified employees or retain valued employees; or

§ incorporate effectively the components of any business that we may acquire in our effort to achieve growth.

If we are unable to manage our growth, our operations and our financial results could be adversely affected by inefficiency, which could diminish our profitability.

Competition In Obtaining Rights To Acquire And Develop Uranium Reserves And To Market Our Production May Impair Our Business.

The uranium industry is highly competitive. Other companies may seek to acquire property leases and other properties and services we will need to operate our business in the areas in which we expect to operate. This competition has become increasingly intense as the price of uranium on the commodities markets has risen sharply in recent years.

Additionally, other companies engaged in our line of business may compete with us from time to time in obtaining capital from investors. Competitors include larger companies, which, in particular, may have access to greater resources, may be more successful in the recruitment and retention of qualified employees and may conduct their own refining capacity which may give them a competitive advantage. If we are unable to compete effectively or adequately respond to competitive pressures, this inability may materially adversely affect our business.

The uranium industry competes with other industries in supplying energy, fuel, and related products to consumers. If another industry were to be able to produce fuel and electricity more cheaply than the uranium alternative, fewer nuclear power plants may be built restricting the growth in demand for our product. Development of new projects or expansion of existing operations could materially increase the supply of recoverable uranium. Depending upon the levels of future demand, increased supplies could negatively impact the prices obtained for uranium.

Our Business May Suffer If We Do Not Attract And Retain Talented Personnel.

Our success will depend in large measure on the abilities, expertise, judgment, discretion integrity and good faith of our management and other personnel in conducting our intended business. We presently have a small management team which we intend to expand in conjunction with our planned operations and growth. The loss of a key individual or our inability to attract suitably qualified staff could materially adversely impact our business. We do not have written agreements in place with any employees, but we anticipate having such agreements in place soon. There can be no assurance that such agreements will be adequate to retain our employees.

Our success depends on the ability of our management to interpret market and geological data correctly and to interpret and respond to economic, market and other conditions in order to locate and adopt appropriate investment opportunities, monitor such investments, and ultimately, if required, to successfully divest such investments. Our future success also depends on our ability to identify, attract, hire, train, retain and motivate other highly skilled technical, managerial, and marketing personnel. Competition for such personnel is intense, and there can be no assurance that we will be able to successfully attract, integrate or retain sufficiently qualified personnel.

Our Management Team Does Not Have Extensive Experience In Public Company Matters, Which Could Impair Our Ability To Comply With Legal And Regulatory Requirements.

Our management team has had limited U.S. public company management experience or responsibilities, which could impair our ability to comply with legal and regulatory requirements such as the Sarbanes-Oxley Act of 2002 and applicable federal securities laws, including filing required reports and other information required on a timely basis. There can be no assurance that our management will be able to implement and affect programs and policies in an effective and timely manner that adequately respond to increased legal, regulatory compliance and reporting requirements imposed by such laws and regulations. Our failure to comply with such laws and regulations could lead to the imposition of fines and penalties and result in the deterioration of our business.

Losses And Liabilities Arising From Uninsured Or Under-Insured Hazards Could Have A Material Adverse Effect On Our Business.

Our proposed unconventional uranium operations will be subject to the customary hazards of recovering, transporting and processing hydrocarbons, such as fires, explosions, gaseous leaks, and migration of harmful substances. A casualty occurrence might result in the loss of equipment or life, as well as injury, property damage or other liability. We have not made a determination as to the amount and type of insurance that we will carry. It cannot be assured that our insurance will be sufficient to cover any such casualty occurrences or disruptions. Our operations could be interrupted by natural disasters or other events beyond our control. Losses and liabilities arising from uninsured or under-insured events could have a material adverse effect on our business, financial condition and results of operations.

Because Our Officers Have Other Business Interests, They May Not Be Able To Devote A Sufficient Amount Of Time To Our Business Operation, Causing Our Business To Fail.

Our officers and directors presently possess adequate time to attend to our interests. In the future, our management will use their best efforts to devote sufficient time to the management of our business and affairs and, provided additional staff may be retained on acceptable terms, to engage additional officers and other staff should additional personnel be required. However, it is possible that our demands on management's time could increase to such an extent that they come to exceed their available time, or that additional qualified personnel cannot be located and retained on commercially reasonable terms. This could negatively impact our business development.

Our Business Is Dependent on Our Mineral Lease Agreements. If We Violate the Agreements or They Are Otherwise Unenforceable, We Will Have No Assets and No Business

All of our rights to explore and develop our properties come from agreements we have in place regarding those properties. Any deficiency in those agreements or failure of ours to abide by those agreements or any defect in the claims or rights to those agreements, could prevent us from exploiting the properties. We are highly dependent on these agreements for our business success. Without them, we will have no ability to extract uranium and no ability to conduct our business.

Risks Related to Our Securities

The application of the "penny stock" rules could adversely affect the market price of our common stock and increase your transaction costs to sell those shares.

As long as the trading price of our common shares is below $5 per share, the open-market trading of our common shares will be subject to the "penny stock" rules. The "penny stock" rules impose additional sales practice requirements on broker-dealers who sell securities to persons other than established customers and accredited investors (generally those with assets in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 together with their spouse). For transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchase of securities and have received the purchaser's written consent to the transaction before the purchase. Additionally, for any transaction involving a penny stock, unless exempt, the broker-dealer must deliver, before the transaction, a disclosure schedule prescribed by the Securities and Exchange Commission relating to the penny stock market. The broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, monthly statements must be sent disclosing recent price information on the limited market in penny stocks. These additional burdens imposed on broker-dealers may restrict the ability or decrease the willingness of broker-dealers to sell our common shares, and may result in decreased liquidity for our common shares and increased transaction costs for sales and purchases of our common shares as compared to other securities.

Our common shares are thinly traded and you may be unable to sell at or near ask prices or at all if you need to sell your shares to raise money or otherwise desire to liquidate your shares.

We cannot predict the extent to which an active public market for our common stock will develop or be sustained.

Our common shares will likely be sporadically or "thinly-traded" on the “Over-the-Counter Bulletin Board”, meaning that the number of persons interested in purchasing our common shares at or near bid prices at any given time may be relatively small or non-existent. This situation is attributable to a number of factors, including the fact that we are a small company which is relatively unknown to stock analysts, stock brokers, institutional investors and others in the investment community that generate or influence sales volume, and that even if we came to the attention of such persons, they tend to be risk-averse and would be reluctant to follow an unproven company such as ours or purchase or recommend the purchase of our shares until such time as we became more seasoned and viable. As a consequence, there may be periods of several days or more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share price.

The market price for our common stock is particularly volatile given our status as a relatively small company with a small and thinly traded “float” and lack of current revenues that could lead to wide fluctuations in our share price. The price at which you purchase our common stock may not be indicative of the price that will prevail in the trading market. You may be unable to sell your common stock at or above your purchase price if at all, which may result in substantial losses to you.

Shareholders should be aware that, according to SEC Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include (1) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (2) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (3) boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (4) excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and (5) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses. We are aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities. The occurrence of these patterns or practices could increase the volatility of our share price.

Our corporate actions are substantially controlled by our principal shareholders and affiliated entities.

Our principal shareholders and their affiliated or related persons presently own approximately 51.9% on a non-fully diluted basis of our outstanding common shares, representing approximately 52% of our voting power. These shareholders, acting individually or as a group, could exert substantial influence over matters such as electing directors and approving mergers or other business combination transactions. In addition, because of the percentage of ownership and voting concentration in these principal shareholders and their affiliated entities, elections of our board of directors will generally be within the control of these shareholders and their affiliated entities. While all of our shareholders are entitled to vote on matters submitted to our shareholders for approval, the concentration of shares and voting control presently lies with these principal shareholders and their affiliated entities. As such, it would be difficult for shareholders to propose and have approved proposals not supported by management.

The limitation of monetary liability against our directors, officers and employees under our articles of incorporation and the existence of indemnification rights to our directors, officers and employees may result in substantial expenditures by our company and may discourage lawsuits against our directors, officers and employees.

Our articles of incorporation limit the liability of our directors for monetary damages for breach of fiduciary duties to the maximum extent permitted by Nevada law. We will also be giving indemnification to our directors and officers to the maximum extent provided by Nevada law. We may also have contractual indemnification obligations under future agreements with our officers. The foregoing indemnification obligations could result in our company incurring substantial expenditures to cover the cost of settlement or damage awards against directors and officers, which we may be unable to recoup. These provisions and resultant costs may also discourage our company from bringing a lawsuit against directors and officers for breaches of their fiduciary duties, and may similarly discourage the filing of derivative litigation by our shareholders against our directors and officers even though such actions, if successful, might otherwise benefit our company and shareholders.

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

All statements other than statements of historical fact included in this prospectus including, without limitation, statements under, “Management’s Discussion and Analysis or Plan of Operation” regarding our financial position, business and the plans and objectives of management for future operations, are forward-looking statements. When used in this prospectus, words such as “anticipate,” “believe,” “estimate,” “expect,” “intend” and similar expressions, as such words or expressions relate to us or we, identify forward-looking statements. Such forward - looking statements are based on the beliefs of management, as well as assumptions made by, and information currently available to us. Actual results could differ materially from those contemplated by the forward-looking statements as a result of certain factors including but not limited to, the failure to obtain sufficient additional capital, fluctuations in projected operating results, market acceptance, technological changes or difficulties, management of future growth, dependence on proprietary technology, competitive factors, the ability to recruit and retain personnel, the dependence on key personnel and such other factors as described in our reports filed from time to time with the SEC. Such statements reflect our current views with respect to future events and are subject to these and other risks, uncertainties and assumptions relating to the operations, results of operations, growth strategy and liquidity. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this paragraph.

USE OF PROCEEDS

This prospectus relates to shares of our common stock that may be offered and sold from time to time by the selling security holders. We will not receive any of the proceeds from the sale of shares of common stock in this offering.

DILUTION

The company is not selling any of the shares of common stock in this offering. All the shares sold in this offering will be sold by the selling security holders at the time of the sale, so that no dilution will result from the sale of its shares.

SELLING SECURITY HOLDERS

Debt Financing

On December 5, 2007, we sold 8% Original Issue Discount Secured Convertible Debentures (“Convertible Debt”) under the terms of Securities Purchase Agreements and related documents (the “Financing Agreements”) in the principal amount of $3,750,000 million to Pierce Diversified Strategy Master Fund, Enable Opportunity Partners, L.P. and Enable Growth Partners L.P (referred to herein as the “Investor” or “selling share holders”) in exchange for $3.0 million in cash. The proceeds from the Convertible Debt were used for working capital mandatory debt repayment, and general corporate purposes. Contemporaneously, we entered into a Registration Rights Agreement with the Investor. This Registration Statement is filed to satisfy certain of our obligations under the Registration Rights Agreement as to the registration of shares of common stock issuable upon conversion of the Convertible Debt.

The Convertible Debt accrues interest at an annual rate of 8%. Interest payments are due monthly and can be made in cash or, under certain terms and conditions that we may or may not be able to meet, can be made in payment of our common stock. The Convertible Debt may be converted into our common shares at any time at the option of the holders. From December 1, 2008 onward we must begin to repay the full principal amount of the debt then outstanding in 12 equal monthly installments, in addition to the monthly payments of outstanding interest. These principal payments may also be made in stock provided that we can meet the various terms and conditions necessary to exercise this right. We do have the option to prepay the Convertible Debt prior to the Maturity Date with a penalty. Upon prepayment, we must redeem 100% of the Convertible Debt including interest, unless earlier converted, for an amount equal to 125% of the outstanding principal plus accrued interest and other charges or a greater amount determined by an adjustment to the conversion price as specified in the Financing Agreements.

The Convertible Debt is convertible into 15,000,000 shares of our common stock. The conversion price of the debt is subject to full anti-dilution protection on all subsequent financings by us. The Investor has the right at any time and from time to time prior to the Maturity Date, to convert, in whole or in part, outstanding Convertible Debt and any accrued interest into our common stock at the Investor’s discretion.

The Investor also received warrants aggregating 100% of the shares issuable on conversion to purchase 15,000,000 shares of common stock at an exercise price of $0.30 per share. The warrants have a five (5) year term expiring on December 5, 2012. The warrants are exercisable for our common stock at any time prior to expiration and permit cashless exercise.

We signed a Registration Rights Agreement with the Investor on December 5, 2007 whereby we are obligated to register the resale of its shares of common stock issuable upon conversion of the Convertible Debt and upon the exercise of the warrants and have the registration statement declared effective by the Securities and Exchange Commission. If the registration statement is not filed by January 7, 2008 or declared effective by August 1, 2008, or if the registration is suspended, we will be obligated to pay liquidated damages to the investor equal to 2% of the purchase price of any such shares per month or partial month of such non-registration. On December 5, 2007, certain of our shareholders entered into Lock-Up agreements with the Company as a condition of the Financing Agreements. These lock up agreements provide for a 12 month restriction on sales by the shareholders of our securities and apply to 38,316,220 of our common shares.

The following table sets forth the name of the selling security holders, the number of shares of common stock beneficially owned by such persons, the number of shares of common stock that may be sold in this offering and the number of shares of common stock such persons will own after the offering, assuming the sale of all of the shares being offered. Unless otherwise indicated, the following persons have sole voting and investment power with respect to the shares of common stock set forth opposite their name. We will not receive any proceeds from the resale of the common stock by the selling security holders.

| Selling Security Holders (1)(2) | | Number of shares beneficially Owned before the offering | | % | | Number of Shares Being Offered | | Number of shares beneficially owned after the offering | | % |

| Pierce Diversified Strategy Master Fund, LLC ena | | 720,000 | | >1% | | 173,812 | | 546,188 | | >1% |

| Enable Opportunity Partners, L.P. | | 2,928,000 | | 3.84% | | 706,837 | | 2,221,163 | | 2.9% |

| Enable Growth Partners, L.P. | | 26,352,000 | | 34.59% | | 6,361,531 | | 19,990,469 | | 26.2% |

| (1) | Includes full conversion of the 15,000,000 shares issuable upon conversion of the Convertible Debt and exercise of the warrants to purchase 15,000,000 common shares. The address of each selling shareholder is One Ferry Building, Suite 255, San Francisco, CA 94111. |

| (2) | The actual number of shares of common stock offered in this prospectus, and included in the registration statement of which this prospectus is a part, includes such additional number of shares of common stock as may be issued or issuable upon conversion of convertible debt and exercise of the warrants by reason of any stock split, stock dividend or similar transaction involving the common stock, in accordance with Rule 416 under the Securities Act of 1933. However, the selling stockholders that participated in the financing have contractually agreed to restrict their ability to convert their convertible debt or exercise their warrants and receive shares of our common stock such that the number of shares of common stock held by them in the aggregate and their affiliates after such conversion or exercise does not exceed 4.99% of the then issued and outstanding shares of common stock as determined in accordance with Section 13(d) of the Exchange Act. Accordingly, the number of shares of common stock set forth in the table for the selling stockholders exceeds the number of shares of common stock that the selling stockholders could own beneficially at any given time through their ownership of the secured convertible debentures and the warrants. In that regard, the beneficial ownership of the common stock by the selling stockholder set forth in the table is not determined in accordance with Rule 13d-3 under the Securities Exchange Act of 1934, as amended. |

PLAN OF DISTRIBUTION

Each Selling Stockholder (the “Selling Stockholders”) of the common stock and any of their pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their shares of common stock on the OTC Bulletin Board or any other stock exchange, market or trading facility on which the shares are traded or in private transactions. These sales may be at fixed or negotiated prices. A Selling Stockholder may use any one or more of the following methods when selling shares:

| • | ordinary brokerage transactions and transactions in which the broker dealer solicits purchasers; |

| • | block trades in which the broker dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| • | purchases by a broker dealer as principal and resale by the broker dealer for its account; |

| • | an exchange distribution in accordance with the rules of the applicable exchange; |

| • | privately negotiated transactions; |

| • | settlement of short sales entered into after the effective date of the registration statement of which this prospectus is a part; |

| • | broker dealers may agree with the Selling Stockholders to sell a specified number of such shares at a stipulated price per share; |

| • | through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| • | a combination of any such methods of sale; or |

| • | any other method permitted pursuant to applicable law. |

The Selling Stockholders may also sell shares under Rule 144 under the Securities Act of 1933, as amended (the “Securities Act”), if available, rather than under this prospectus.

Broker dealers engaged by the Selling Stockholders may arrange for other brokers dealers to participate in sales. Broker dealers may receive commissions or discounts from the Selling Stockholders (or, if any broker dealer acts as agent for the purchaser of shares, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this Prospectus, in the case of an agency transaction not in excess of a customary brokerage commission in compliance with FINRA NASD Rule 2440; and in the case of a principal transaction a markup or markdown in compliance with NASD IM-2440.

In connection with the sale of the common stock or interests therein, the Selling Stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the common stock in the course of hedging the positions they assume. The Selling Stockholders may also sell shares of the common stock short and deliver these securities to close out their short positions, or loan or pledge the common stock to broker-dealers that in turn may sell these securities. The Selling Stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The Selling Stockholders and any broker-dealers or agents that are involved in selling the shares may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. Each Selling Stockholder has informed the Company that it does not have any written or oral agreement or understanding, directly or indirectly, with any person to distribute the Common Stock. In no event shall any broker-dealer receive fees, commissions and markups which, in the aggregate, would exceed eight percent (8%).

The Company is required to pay certain fees and expenses incurred by the Company incident to the registration of the shares. The Company has agreed to indemnify the Selling Stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

Because Selling Stockholders may be deemed to be “underwriters” within the meaning of the Securities Act, they will be subject to the prospectus delivery requirements of the Securities Act including Rule 172 thereunder. In addition, any securities covered by this prospectus which qualify for sale pursuant to Rule 144 under the Securities Act may be sold under Rule 144 rather than under this prospectus. There is no underwriter or coordinating broker acting in connection with the proposed sale of the resale shares by the Selling Stockholders.

We agreed to keep this prospectus effective until the earlier of (i) the date on which the shares may be resold by the Selling Stockholders without registration and without regard to any volume limitations by reason of Rule 144(k) under the Securities Act or any other rule of similar effect or (ii) all of the shares have been sold pursuant to this prospectus or Rule 144 under the Securities Act or any other rule of similar effect. The resale shares will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain states, the resale shares may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with. Under applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale shares may not simultaneously engage in market making activities with respect to the common stock for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution. In addition, the Selling Stockholders will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of shares of the common stock by the Selling Stockholders or any other person. We will make copies of this prospectus available to the Selling Stockholders and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule 172 under the Securities Act).

LEGAL PROCEEDINGS

We are not currently involved in any legal or regulatory proceeding or arbitration, the outcome of which is expected to have a material adverse effect on our business.

DIRECTORS AND EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS

The following table summarizes our current executive officers and directors:

| Name | | Age | | Position |

| P. Leslie Hammond | | 61 | | President, Chief Executive Officer, Principal Financial and Accounting Officer, Director |

P. Leslie Hammond, President, Chief Executive Officer, Principal Financial and Accounting Officer, Director

P. Leslie Hammond is a chartered accountant who has been employed since 1985 as the President of Hammond Management Corporation based in Victoria, British Columbia. At Hammond Management Corporation, Mr. Hammond provides private and public companies with a wide variety of management and advisory services. Mr. Hammond has a bachelor of arts from Simon Fraser University in Economics and Commerce and has been a chartered accountant since 1974.

Directors are appointed to their position to serve until the next annual meeting of shareholders.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the beneficial ownership of shares of our voting stock, as of December 31, 2007 of (i) each person known by us to beneficially own 5% or more of the shares of outstanding common stock, based solely on filings with the Securities and Exchange Commission, (ii) each of our executive officers and directors and (iii) all of our executive officers and directors as a group. Except as otherwise indicated, all shares are beneficially owned, and the persons named as owners hold investment and voting power.

| Name of Beneficial Owner (1) | | Common Stock Beneficially Owned | | Rights to Acquire Beneficial Ownership Through Exercise of Warrants Within 60 Days | | Total Beneficially Owned as % of Outstanding Shares (2) |

| | | | | | |

| P. Leslie Hammond | | 23,972,000 | | 0 | | 51.9% |

(2) The number of outstanding shares of common stock is based upon 46,178,000 shares issued and outstanding on a non-fully diluted basis. The number of outstanding shares as calculated for each beneficial owner includes any shares that are potentially issuable to that owner under the terms of convertible debt and warrants as noted.

(3) Mr. Hammond is presently President, Chief Executive Officer, Principal Financial and Accounting Officer and Sole Director of the Company.

DESCRIPTION OF SECURITIES

General

Our Company’s Articles of Incorporation provides for authority to issue 500,000,000 shares of common stock, par value $.0001 per share, and no shares of preferred stock. As of December 31, 2007, there were outstanding 46,1780,000 shares of our common stock.

There are currently an aggregate of 30,000,000 potentially issuable shares under the terms of the Convertible Debt and outstanding warrants.

Common Stock

The holders of our common stock are entitled to receive dividends when and as declared by the Board of Directors, out of funds legally available therefore. We have not paid cash dividends in the past and do not expect to pay any within the foreseeable future since any earnings are expected to be reinvested in our business. In the event of liquidation, dissolution or winding up of the Company, either voluntarily or involuntarily, each outstanding share of our common stock is entitled to share equally in our assets. Each outstanding share of our common stock is entitled to equal voting rights, consisting of one vote per share.

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

Our Articles of Incorporation and By-Laws provide our directors with protection for breaches of their fiduciary duties to us and our security holders. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers or persons controlling us, we have been advised that it is the SEC’s opinion that such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

DESCRIPTION OF BUSINESS

Overview

Bancroft Uranium is engaged in the mineral exploration business. The Company has rights to exploit and extract minerals from three properties in Ontario, Canada. These properties are potential sources of uranium ore. The Company is currently engaged in the development of these properties in order to identify and exploit uranium deposits thereon. There are currently no marketing, distribution, sales or other activities of the Company outside of the exploration of its mining properties.

History and Background

We were incorporated in the State of Nevada on October 12, 2001 as Conscious Intention, Inc. From inception through September 30, 2005, the Company was engaged in the business of developing executive coaching support materials to be sold on line. We intended to seek financing to implement this plan and to acquire certain software being developed by our then chief executive officer. As financing was not forthcoming, in June, 2005, our former CEO sold the software business to John Wiley and Sons, Inc., financial publishers. On November 10, 2005, Ms. Leduc sold the substantial portion of her interest in the Company to Mr. Andrew Hamilton, appointed him as Sole Officer and Director of the Company and resigned from all of her positions and offices at the Company. Mr. Hamilton attempted to conduct a management consulting business in the Company, but was not successful in attracting financing or customers. In June, 2007, Mr. Hamilton abandoned his efforts to secure financing for the Company and began looking for a new direction. In August, 2007, shareholders of the Company voted to amend the articles of incorporation to give the board of directors authority to change the corporation’s name and to increase the authorized shares to 500,000,000.

On September 14, 2007, the Company entered into the a Share Purchase Agreement (“Agreement) with 2146281 Ontario Limited, a private Canadian corporation with interests in three mineral properties in Ontario, Canada. The Agreement provided that the Company would acquire 100% of the issued and outstanding shares of Ontario Limited, including thereby ownership of the mineral interests, for payment of a 7% net mineral royalty and 1,250,000 shares of the Company’s common stock, after the forward split described below. The mineral rights interests also require additional cash payments which the Company will have to make.

To indicate our new business focus and in anticipation of the Closing of the Agreement, we filed an amendment to our Articles of Incorporation with the Nevada Secretary of State on September 21, 2007 which changed our name to “Bancroft Uranium Inc” and increased our authorized capital stock from 10,000,000 shares of common stock, par value $0.001, to 500,000,000 shares of common stock, par value $0.001.

On October 1, 2007 we effected a 52 for 1 forward stock split. The forward stock split was effective immediately prior to the opening of business on October 1, 2007. Subsequent to the stock split, we issued 1,250,000 shares of our common stock to the former holders of our mineral claims as partial payment for those claims.

On October 3, 2007, the Company completed its acquisition of the Canadian corporation and began its mineral exploration efforts. The sole business of the company is mineral exploration. The Company’s current business consists of mineral rights leases which it owns on three properties in Canada. The Company intends to develop these properties so that uranium can be extracted from the properties.

We maintain our principal offices at 8655 East Via De Ventura, Suite G200, Scottsdale, AZ, 85258. Our telephone number at that address is (480) 346-1460 and our internet address is www.Bancrofturanium.com.

Our Current Business

We are a natural resource exploration company engaged in the exploration of properties that may contain uranium minerals in Southern Ontario, Canada. Our strategy is to complete exploration of a parcel in Monmouth township (“Monmouth”), continue initial exploration of properties near Longlac (“Longlac”) and Elliot Lake (“Elliot Lake”), respectively, and to acquire properties that are thought to be prospective for uranium exploration. Monmouth has been the subject of historical exploration by another mining company the results of which, we believe, are promising. We are focusing our own exploration efforts on the Monmouth property. Neither Longlac nor the Elliot Lake properties have been the subject of historical exploration, but we believe that their location near other uranium producing land merits our initial exploration efforts.

Our properties do not have any established reserves. We plan to conduct exploration programs on these properties with the objective of ascertaining whether any of them contain commercially viable deposits of uranium. As such, we are considered an exploration or exploratory stage company. There is no assurance that a commercially viable mineral deposit exists on any of our properties, and further exploration will be required before a final evaluation as to the economic and legal feasibility for our future exploration is determined. The Longlac and Elliot Lake properties will require a great deal more exploration work than at Monmouth. We have no known reserves of uranium or any other type of mineral. Since inception, we have not established any proven or probable reserves on our mineral property interests.

The Uranium Industry

Uranium (U3O8) is one of the more common elements in the Earth's crust—about 40 times more common than silver and 500 times more common than gold. It occurs in concentrated deposits called skarns which intrude into the existing rock formations, such as limestone. When it is separated from the surrounding rock, by gravity separation, in situ methods, or otherwise, it can be refined or converted into a more concentrated form known as yellowcake. Yellowcake can be processed to make fuel rods which are used by nuclear power plants to make electricity.

Demand for Uranium Generally

Demand for uranium in the United States, Canada, and Western Europe has increased steadily over the past 35 years, from 18,000,000 pounds per year in 1970, to 160,000,000 pounds in 2005 (figures are approximate). These numbers are before considering nuclear reactors in the former Soviet bloc, South America or Asia. The world is experiencing another wave of new nuclear plants being built: Finland and France are each building one; China alone has ordered four additional plants from Westinghouse and expressed interest in two plants of European design; and further construction is planned in Russia, India, and other nations of Asia.

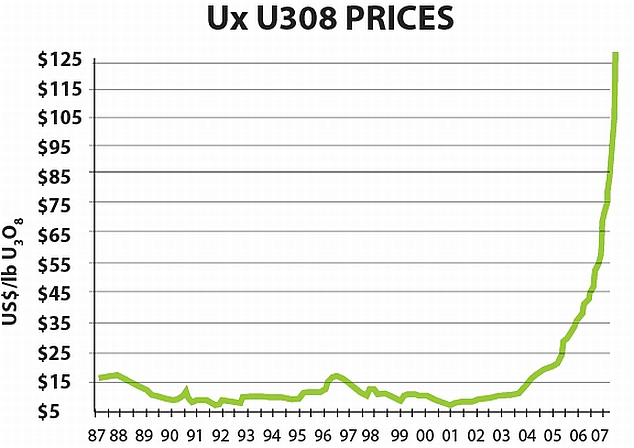

Source: The Ux Consulting Company, LLC

This increased demand has affected uranium’s price on the world market. Between 1987 and 2004, spot prices fluctuated between approximately $6-$16 per pound of U3O8. Prices during 2004-2006 increased from approximately $15-$35 per pound. During 2006-2007, prices climbed as high as $136 at June 25, 2007.

©UxC, The Ux Consulting Company, LLC

Generally speaking, uranium exploration activities include (i) prospecting, looking at the land’s surface structure and taking readings with a sciutollmeter, a device that detects the radioactive signature of uranium; (ii) geological mapping of surface rock outcroppings; (iii) surface trenching of outcroppings, removing the earth, brush, and trees from the underlying rock formations; (iv) sampling and assaying of underlying rock and performing geochemical analysis thereof; (v) line cutting comprised of cutting a grid through trees and brush; (vi) diamond drilling of exploratory vertical drill holes between 500-1,000 feet deep and analyzing the cores; and (vii) metallurgical analysis of small scale bulk sampling of prospective areas of the underlying rock.

Monmouth

Generally

In August, 2007, Ontario Limited purchased an option from Yvon Gagne, to acquire an undivided 100% interest in the mining rights associated with approximately 1,560 acres on Crown land. Monmouth consists of 39 units within six mining claims. Each unit covers approximately 40 acres.

The purchase price was (i) $20,000 that had been previously paid; (ii) 500,000 shares of common stock of Ontario Limited or its parent; and (iii) progress payments totaling $180,000 to be paid between May 14, 2008 and May 14, 2010. Upon complete payment of the purchase price, Ontario Limited will be deemed to have exercised the option.

The seller retained a 3% royalty after cost recovery on the sale of mineral ore from mining operations. Ontario Limited may reduce such royalty interest by half in exchange of a payment of $1.5 million.

Previous Exploration

In the 1960s, Northern Nuclear Mines Limited conducted an exploration program based on 44 diamond drill holes and one 10-ton bulk sample. It commissioned a noted uranium geoscientist of the day to compile an analysis of the exploration. He published a report in July 1968 (the “1968 Report”) in connection with the Monmouth claims, which is now in the public domain. We are in possession of the 1968 Report and all underlying data. In addition we are in possession of the metallurgical results conducted on the bulk sample by Lakefield Industries, now operated by SGS Laboratories.

The 1968 Report indicated that uranium mineralization is disseminated in a limestone skarn of a thickness between 15-60 feet. The skarn horizon has been mapped for a length of 6,000 feet, 1,500 of which has been explored with detailed geological mapping, trenching, sampling and scintillometer surveys. Drill core analysis of the skarn shows uranium values of between 1/10th pound to over six pounds per ton, averaging 0.9 pounds per ton.

The 1968 estimated that Monmouth contained at least 1,500,000 pounds of uranium, which, at today’s prices, would indicate a present value of $202.5 million.

Initial metallurgic tests underlying the 1968 Report indicate that greater than 80% of the uranium could be extracted from the surrounding rock by simple gravity separation comprised of crushing rock and removing the heavy uranium minerals by way of density separation. Our own metallurgical studies will determine the optimal recovery procedures.

We believe that the 1968 Report and the underlying field program are of a high quality, gathered accurate data and have well supported conclusions. However, new Canadian securities regulations prevent us from solely relying on the 1968 Report to quote historical reserves. Instead, to be compliant with the new regulations, we need to repeat the exploration efforts that underlay the 1968 Report. Until we comply with all applicable regulations, our Company must be considered an exploration state enterprise.

Current Exploration

As of the date of this report, we have paid independent contractors to dig 24 surface trenches by hand and have undertaken channel saw assaying of the trenches and are awaiting the results. We are also in the process of completing 180 kilometers of cut grid to facilitate the property-wide geological mapping and prospection. Approximately 50% of this grid is now complete. We expect these efforts will be completed by the end of January, 2008.

During January, 2008, we expect to begin a comprehensive diamond drilling program to confirm the conclusions of the 1968 Report and to test newly discovered uranium occurrences. By February, 2008, the Company plans to ship a number of bulk samples to Lakefield/SGS for metallurgical and recovery analysis. When all field results have been received and compiled, the Company will prepare a pre-feasibility study of the Monmouth Project, and if we believe it to be sufficiently promising, we will use it to seek additional capital to prepare a complete feasibility study. We will need to raise additional capital to prepare the feasibility study or conduct further mining activities.

Longlac and Elliot Lake

Longlac Generally

In August, 2007, Ontario Limited purchased a 100% undivided interest in eight mineral claims comprised of 128 units (approximately 5,120 acres) from 2060014 Ontario, Ltd. The purchase price was $15,149 paid at closing and 375,000 shares of common stock of Ontario Ltd. or its parent.

Elliot Lake Generally

In August, 2007, Ontario Limited purchased a 100% undivided interest in four mineral claims comprised of 30 units (approximately 1,200 acres) from 2060014 Ontario, Ltd. The purchase price was $3,550 paid at closing and 375,000 shares of common stock of Ontario Ltd. or its parent.

The Elliot Lake property is located approximately a ½ mile from the past producing Pronto mine, which, between 1955-1959, produced 2,100,000 tons averaging approximately 2.3 pounds of uranium per ton of ore.

Previous Exploration

The Longlac and Elliot Lake properties lie within high prospective areas of favorable rock for the discovery of uranium. The current projects are “grass roots” and have no history of recorded work. The programs to be conducted will be prospecting and limited mapping during the Fall of 2007.

Outlook

We are hopeful about these properties’ potential, but, in the near future, do not expect to engage in exploration beyond prospecting and surface geological mapping. Were these efforts to reveal suspected deposits of significance, we would increase our exploration activity which could require that we raise additional capital.

Marketing and Distribution

We expect that Cameco Corporation (“Cameco”) will be the sole customer of our end product, uranium ore. Cameco has uranium processing and refining facilities at Port Hope, Ontario, located approximately 1½ hours from Monmouth. Cameco has an additional facility at Blind River, Ontario, located less than one hour by road from Elliot Lake. The Cameco installations are facilities which refine uranium ore, our end product, into fuel rods used in the operation of nuclear power plants. Cameco also sells processed uranium worldwide.

Historically, Cameco’s facilities have unused capacity and purchase ore from all parties wishing to use its facilities. In the recent past, Cameco has reported increased production from the facilities we expect to use. There can be no assurance that Cameco will continue to have the refining capacity to purchase our ore. Additional refining plants are available to purchase our product, but at greater distance and with higher transport costs. We do not currently have any understandings with Cameco or any other purchaser of uranium ore.

Uranium is traded on world commodity markets. Historically, these markets are highly liquid and may be volatile. Spot purchase prices for uranium can be affected by a number of factors, all of which are beyond our control, including but not limited to:

· fluctuation in the supply of, demand;

· mining activities of others;

· interest rates;

· currency exchange rates;

· inflation or deflation;

· fluctuation in the value of the United States and Canadian dollars and other currencies; and

· political and economic conditions of major uranium or other mineral-producing countries.

Manufacturing

Other than the refining and sale of our mineral ore by purchasers of that ore, we do not engage in any manufacturing or any other activities outside of exploration of our mineral properties.

Competition

We compete with other exploration companies, many of which possess greater financial resources and technical abilities than we do. Our main areas of competition are acquiring exploration rights and engaging qualified personnel. The uranium exploration industry is highly fragmented, and we are a very small participant in this sector. Many of our competitors explore for a variety of minerals and control many different properties around the world. Almost all of them have been in business longer than we have and have probably established more strategic partnerships and relationships and have greater financial accessibility than we do.

There is significant competition for properties suitable for uranium exploration. As a result, we may be unable to continue to acquire interests in attractive properties on terms that we consider acceptable.

Principal Suppliers

There are a number of potential suppliers of drilling equipment and exploration services and we do not anticipate any dependence on any single supplier of exploration or drilling services to us.

Major Customers

We do not yet have any customers for any uranium ore found on our property. Cameco is the most likely purchaser of our ore and we have no arrangements or understandings with them of any kind. There are only a handful of uranium end-purchasers in the world and we are highly dependent on having our ore purchased by one of these producers.

Intellectual Property

We rely on a combination of trademark, copyright and trade secret protection laws in the United States and other jurisdictions, as well as confidentiality procedures and contractual provisions to protect our intellectual property and our brand. Because our business involves the straightforward mining and extraction of a commodity, intellectual property does not play a critical role in our business. We do not currently have in place any non-compete or confidentiality agreements with employees or consultants, though we anticipate doing so in the future.

Mineral Exploration Rights

All of our rights to explore and develop our properties come from agreements we have in place regarding those properties. Any deficiency in those agreements or failure of ours to abide by those agreements or any defect in the claims or rights to those agreements, could prevent us from exploiting the properties. We are highly dependent on these agreements for our business success.

Government approval and regulation of our principal products or services

The Canadian federal government requires that Ontario Limited spend approximately Cdn$500 per acre (or approximately Cdn$800,000 in the aggregate for Monmouth) in exploration and development to maintain its claim in good standing. Failure to maintain a claim in good standing results in forfeiture of the claim to the government. Our proposed business will be affected by numerous laws and regulations, including energy, conservation, tax and other laws and regulations relating to the industry. Any extraction operations will require permits or authorizations from federal, provincial or local agencies.

Costs and effects of compliance with environmental laws

Various levels of governmental controls and regulations address, among other things, the environmental impact of mineral exploration and mineral processing operations and establish requirements for decommissioning of mineral exploration properties after operations have ceased. With respect to the regulation of mineral exploration and processing, legislation and regulations establish performance standards, air and water quality emission standards and other design or operational requirements for various aspects of the operations, including health and safety standards. Legislation and regulations also establish requirements for decommissioning, reclamation and rehabilitation of mineral exploration properties following the cessation of operations and may require that some former mineral properties be managed for long periods of time after exploration activities have ceased.

Our exploration activities are subject to various levels of regulations relating to protection of the environment, including requirements for closure and reclamation of mineral exploration properties. As part of our planned feasibility study, we would secure all necessary permits for our exploration activities. Obtaining such permits usually requires the posting of bonds for subsequent remediation of trenching, drilling and bulk sampling. Delays in the granting of permits are not uncommon, and any delays in the granting of permits may adversely affect our exploration activities. Additionally, necessary permits may be denied, in which case we will be unable to pursue any exploration activities on our properties. It may be possible to appeal any denials of permits, but any such appeal will result in additional delays and expense.

We do not anticipate discharging water into active streams, creeks, rivers, lakes or any other bodies of water without an appropriate permit. We also do not anticipate disturbing any endangered species or archaeological sites or causing damage to our properties. Re-contouring and re-vegetation of disturbed surface areas will be completed pursuant to the applicable permits. The cost of remediation work varies according to the degree of physical disturbance. It is difficult to estimate the cost of compliance with environmental laws since the full nature and extent of our proposed activities cannot be determined at this time.

In late 2002 the Government of Canada ratified the Kyoto Protocol, an international agreement designed to manage greenhouse gas emissions which became effective on February 16, 2005. Other than as described in the 2005 Kyoto Plan, relatively few details regarding its implementation in Canada have been provided by the federal government. Numerous uncertainties regarding details of the Kyoto Protocol's implementation remain and there can be no assurance that future rules and regulations will not affect our ability to operate as planned. It may become necessary to develop and install certain equipment to mitigate adverse effects of rules and regulations on emission controls with a significant increase in capital or operating costs. If emissions cannot be physically controlled or mitigated to the satisfaction of new rules and regulations, tax or other fiscal means may be introduced to penalize us or otherwise increase our operating costs.

Changes in environmental regulation could have an adverse effect on us from the standpoint of product demand, product reformulation and quality, methods of production and distribution and costs, and financial results. For example, requirements for cleaner-burning fuels could cause additional costs to be incurred, which may or may not be recoverable in the marketplace. The complexity and breadth of these issues make it extremely difficult to predict their future impact on us. Management anticipates that the implementation of new and increasingly stringent environmental regulations will increase necessary capital expenditures and operating expenses from present estimates. Compliance with environmental regulation can require significant expenditures and failure to comply with environmental regulation will result in the imposition of fines and penalties, liability for clean up costs and damages and the loss of important permits.

Employees

Currently, we have 1 employee. In addition, we have 3 consultants utilized for administration, operations and technical consulting. Management believes that relations with its employee and consultants are good.

MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

The following discussion should be read in conjunction with the consolidated financial statements and the related notes in this registration statement.

Overview

Bancroft Uranium is engaged in the mineral exploration business. The Company has rights to exploit and extract minerals from three properties in Ontario Canada. These properties are potential sources of uranium ore. The Company is currently engaged in the development of these properties in order to identify and exploit uranium deposits thereon. There are currently no marketing, distribution, sales or other activities of the Company outside of the exploration of its mining properties.

We were incorporated in the State of Nevada on October 12, 2001 as Conscious Intention, Inc. From inception through September 30, 2005, the Company was engaged in the business of developing executive coaching support materials to be sold on line. We intended to seek financing to implement this plan and to acquire certain software being developed by our then chief executive officer. As financing was not forthcoming, in June, 2005, our former CEO sold the software business to John Wiley and Sons, Inc., financial publishers. On November 10, 2005, Ms. Leduc sold the substantial portion of her interest in the Company to Mr. Andrew Hamilton, appointed him as Sole Officer and Director of the Company and resigned from all of her positions and offices at the Company. Mr. Hamilton attempted to conduct a management consulting business in the Company, but was not successful in attracting financing or customers. In June, 2007, Mr. Hamilton abandoned his efforts to secure financing for the Company and began looking for a new direction. In August, 2007, shareholders of the Company voted to amend the articles of incorporation to give the board of directors authority to change the corporation’s name and to increase the authorized shares to 500,000,000.

On September 14, 2007, the Company entered into the Agreement with Ontario Limited, a private Canadian corporation with interests in three mineral properties in Ontario, Canada.