Exhibit 99.1

Mitel –

Positioned for Profitable Growth

Financial Analyst Presentation

September 19th, 2013

Mitel –

Positioned for Profitable Growth

Steve Spooner

Chief Financial Officer

The Mitel Management Team

Presenters Panelists

Rich McBee Joe Vitalone

President and CEO EVP Americas

Steve Spooner Graham Bevington

Chief Financial Officer EVP International

Ron Wellard, EVP & GM Martyn Etherington

Communications Solutions EVP & Chief Marketing Officer

Jon Brinton, GM Jim Davies

Cloud and Network Solutions Chief Technology Officer

Attendees:

Mike McCarthy Amy MacLeod

Vice President, Investor Relations Director, Corporate Communications

4

Agenda

8:30–9:00 AM Breakfast

9:00–9:10 AM Welcome and Introductions

Steve Spooner, CFO

9:10–9:35 AM Mitel Overview and Strategy

Rich McBee, President and CEO

Mitel Unified Communications/IP Telephony

9:35–10:00 AM Mitel Contact Center

Ron Wellard, EVP and GM, Mitel Communications Solutions

10:00–10:30 AM Mitel Cloud

Jon Brinton, General Manager, Mitel Cloud and Network Solutions

10:30–10:45 AM Break

5

Agenda

Voice of the Customer Panel:

10:45–11:10 AM Moderator: Joe Vitalone, EVP Americas Almin Surani, CIO, Canadian Red Cross

Erin Ostler Director of Global Wholesale Kevin Portillo, IT Director, Kaplan

and Emerging Solutions, Sprint International Colleges

Mitel Go-to-Market Panel

10:45–11:10 AM Moderator: Steve Spooner, CFO Martyn Etherington, CMO

Graham Bevington, EVP International Joe Vitalone, EVP Americas

11:30–12:00 PM Financial Update

Steve Spooner, CFO

12:00–12:30 PM Executive Q&A

Mitel Management Team

12:30–1:00 PM Lunch

6

Safe Harbor Statement

Forward Looking Statements

Some of the statements in this presentation are forward-looking statements (or forward-looking information) within the meaning of applicable U.S. and Canadian securities laws. These include statements using the words target, outlook, may, will, should, could, estimate, continue, expect, intend, plan, predict, potential, project and anticipate, and similar statements which do not describe the present or provide information about the past. Actual results may differ materially from those presented in forward-looking statements. Material risks that could cause actual results to differ include: our ability to achieve or sustain profitability in the future; fluctuations in our quarterly and annual revenues and operating results; fluctuations in foreign exchange rates; current and ongoing global economic instability; intense competition; our reliance on channel partners for a significant component of our sales; our dependence upon a small number of outside contract manufacturers to manufacture our products; our ability to successfully integrate acquisitions; and, our ability to implement and achieve our business strategies successfully. Additional risks are described under the heading “Risk Factors” in Mitel’s Annual Report on Form 10-K. We have made assumptions regarding, among other things: no unforeseen changes occurring in the competitive landscape that would affect our industry generally or Mitel in particular; a stable or recovering economic environment; no significant event occurring outside the ordinary course of our business; and, stable foreign exchange and interest rates. Forward-looking information is intended to help you understand management’s current views of our future prospects, and it may not be appropriate for other purposes. Except as required by law, Mitel will not necessarily update forward-looking statements.

Non-GAAP Financial Measurements

This presentation includes references to non-GAAP financial measures including adjusted EBITDA, non-GAAP income and non-GAAP operating expenses. Non-GAAP financial measures do not have any standardized meaning and are therefore unlikely to be comparable to similar measures presented by other companies. We use these non-GAAP financial measures to assist management and investors in understanding our past financial performance and prospects for the future, including changes in our operating results, trends and marketplace performance, exclusive of unusual events or factors which do not directly affect what we consider to be our core operating performance. Non-GAAP measures are among the primary indicators management uses as a basis for our planning and forecasting of future periods. Investors are cautioned that non-GAAP financial measures should not be relied upon as a substitute for financial measures prepared in accordance with generally accepted accounting principles. Please see the reconciliation of non-GAAP financial measures to the most directly comparable U.S. GAAP measure included in this presentation and, if not contained in this presentation, contained in Mitel’s

Reports on Form 8-K which have been filed with the U.S. Securities and Exchange Commission on June 24, 2013 (fiscal 2013) and August 29, 2013 (Q1 of fiscal 2014).

7

Mitel –

Positioned for Profitable Growth

Rich McBee

President and CEO

A Celebration of Accomplishment

A History of Renewal

Adapting, changing and always innovating

9

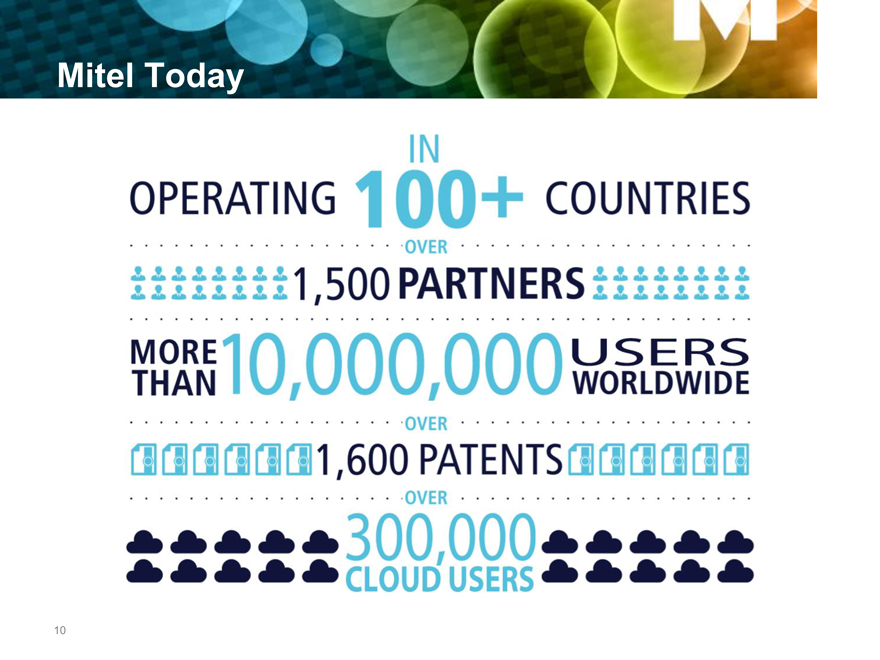

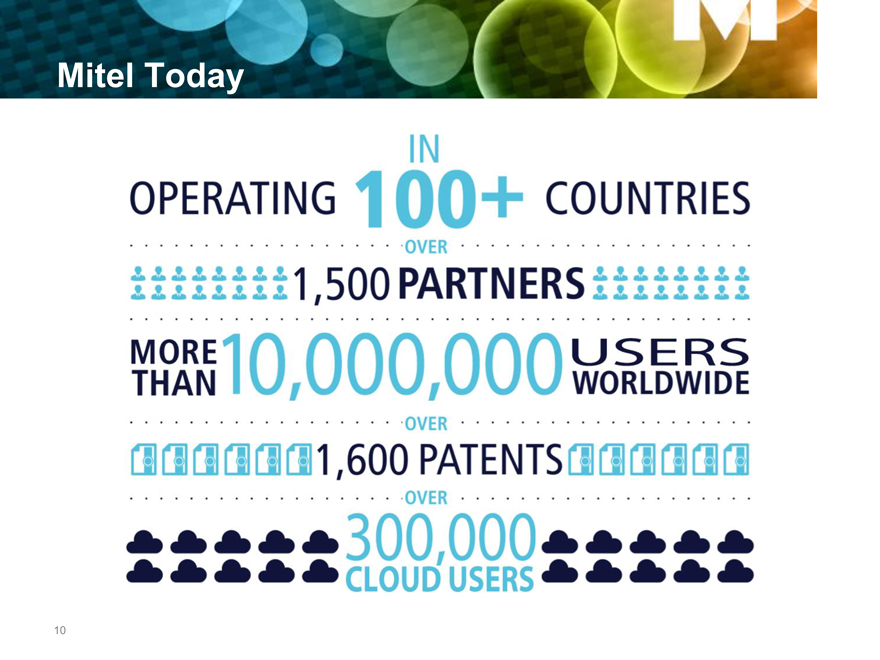

Mitel Today

OPERATING IN 100+ COUNTRIES OVER 1,500 PARTNERS

MORE THAN 10,000,000 USERS WORLDWIDE OVER

1,600 PATENTS OVER 300,000 CLOUD USERS

10

Mitel Today:

Customers Across All Market Segments

OT2012 Department of

Foreign Affairs Canada

11

Mitel Today:

Recognized for Innovation

12

Mitel Today:

Financial Performance

Significant revenues from our growth initiatives

Expanding operating margins

Four consecutive years of increasing profitability

Generating positive cash flow

Consistently paying down debt

13

Our Vision

To be the premier business communications and collaboration company in our industry

Not the Largest —Simply the Best

Delivering superior financial results

Loyal customers and partners

A place where people want to work

14

Our Mission

To deliver solutions that enable our customers to communicate and collaborate; anytime, anywhere, over any medium with the device of their choice.

15

We are Focused on Creating

Shareholder Value

Three things we hear from investors:

We evaluate our business progress and every strategic choice through these lenses

16

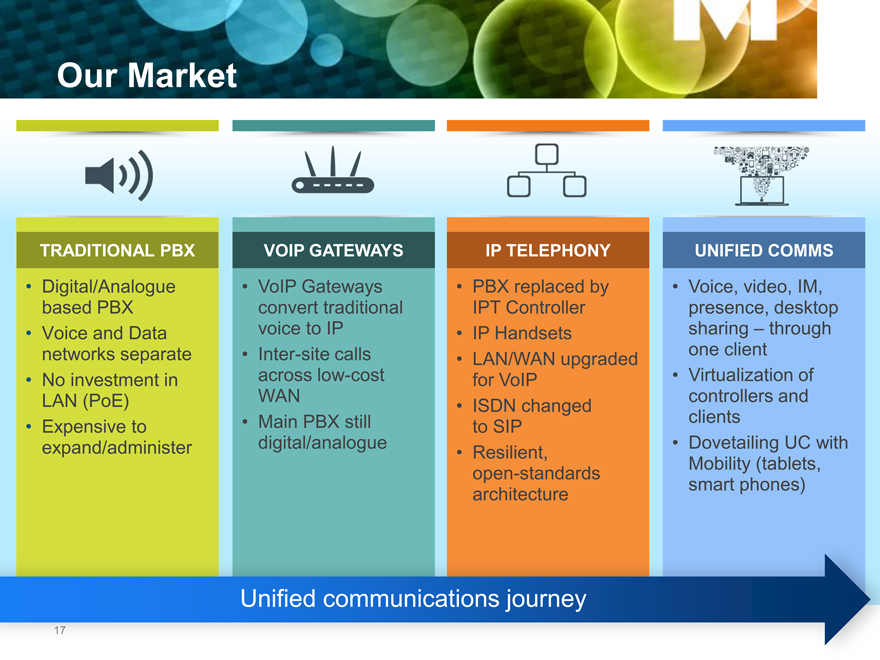

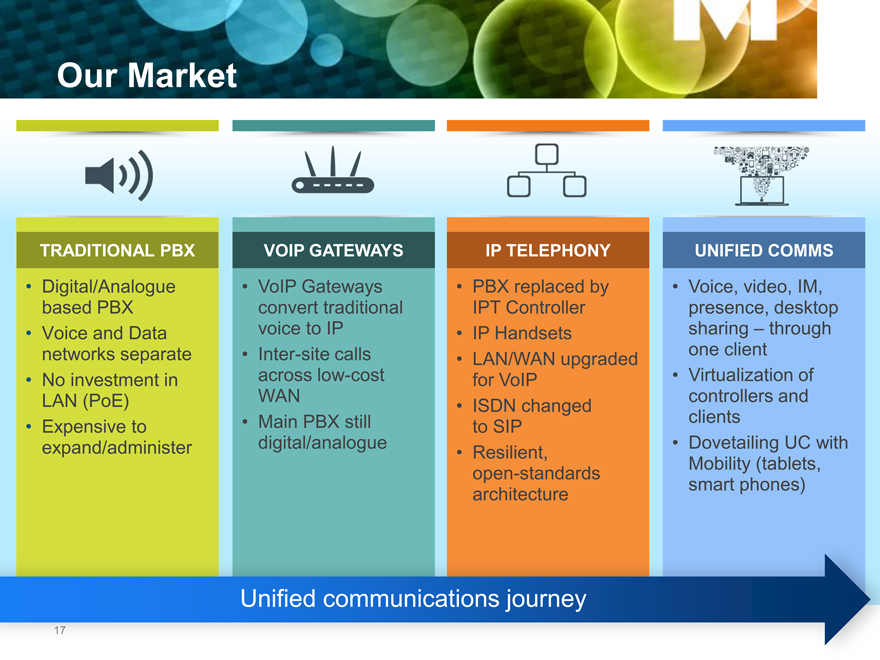

Our Market

TRADITIONAL PBX

Digital/Analogue based PBX

Voice and Data networks separate

No investment in

LAN (PoE)

Expensive to expand/administer

VOIP GATEWAYS

VoIP Gateways convert traditional voice to IP

Inter-site calls across low-cost

WAN

Main PBX still digital/analogue

IP TELEPHONY

PBX replaced by IPT Controller

IP Handsets

LAN/WAN upgraded for VoIP

ISDN changed to SIP

Resilient, open-standards architecture

UNIFIED COMMS

Voice, video, IM, presence, desktop sharing – through one client

Virtualization of controllers and clients

Dovetailing UC with Mobility (tablets, smart phones)

Unified communications journey

17

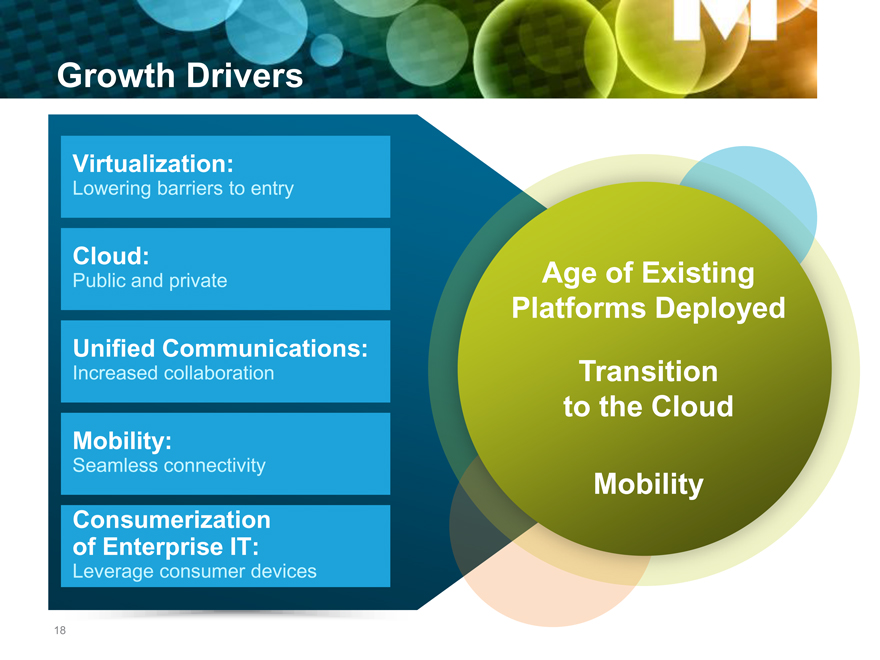

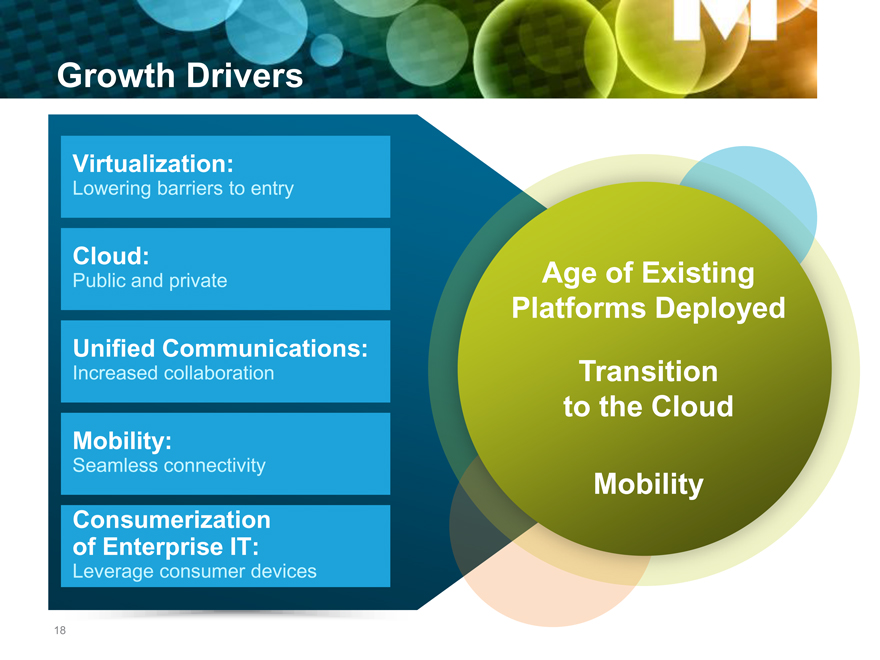

Growth Drivers

Virtualization:

Lowering barriers to entry

Cloud:

Public and private

Unified Communications:

Increased collaboration

Mobility:

Seamless connectivity

Consumerization of Enterprise IT:

Leverage consumer devices

Age of Existing Platforms Deployed

Transition to the Cloud

Mobility

18

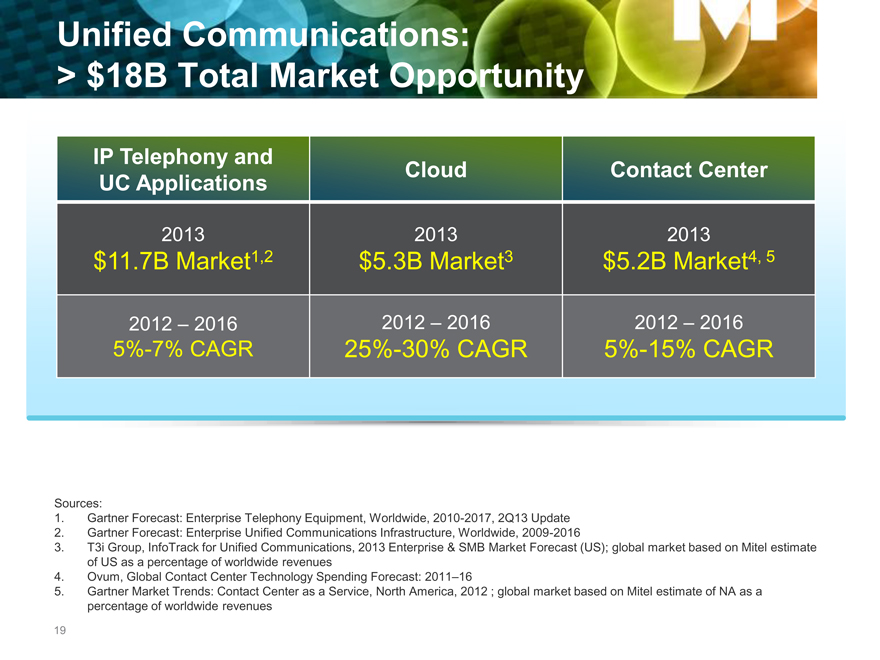

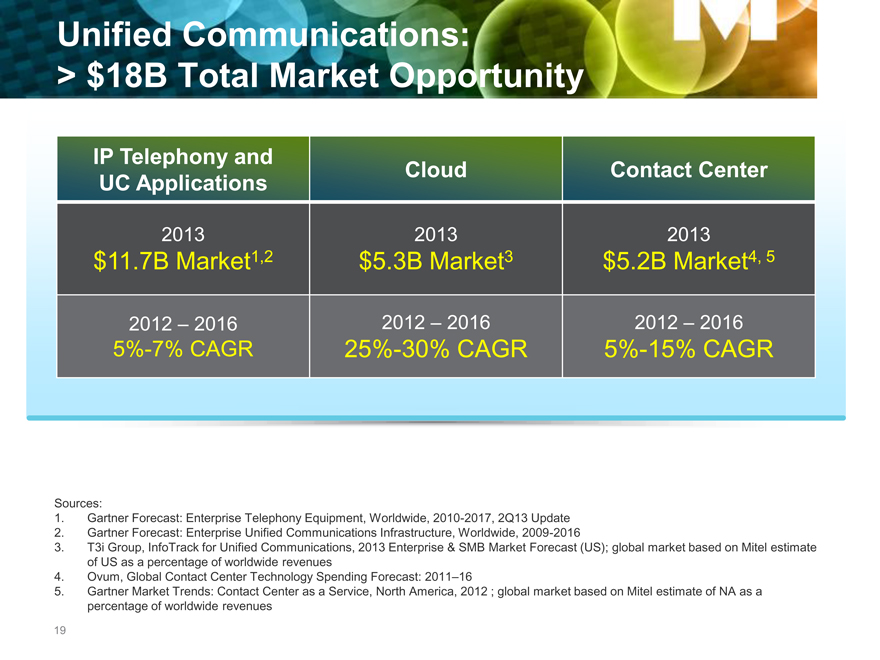

Unified Communications:

$18B Total Market Opportunity

IP Telephony and Cloud Contact Center

UC Applications

2013 2013 2013

$11.7B Market1,2 $5.3B Market3 $5.2B Market4, 5

2012 – 2016 2012 – 2016 2012 – 2016

5%-7% CAGR 25%-30% CAGR 5%-15% CAGR

Sources:

1. Gartner Forecast: Enterprise Telephony Equipment, Worldwide, 2010-2017, 2Q13 Update

2. Gartner Forecast: Enterprise Unified Communications Infrastructure, Worldwide, 2009-2016

3. T3i Group, InfoTrack for Unified Communications, 2013 Enterprise & SMB Market Forecast (US); global market based on Mitel estimate of US as a percentage of worldwide revenues

4. Ovum, Global Contact Center Technology Spending Forecast: 2011–16

5. Gartner Market Trends: Contact Center as a Service, North America, 2012 ; global market based on Mitel estimate of NA as a percentage of worldwide revenues

19

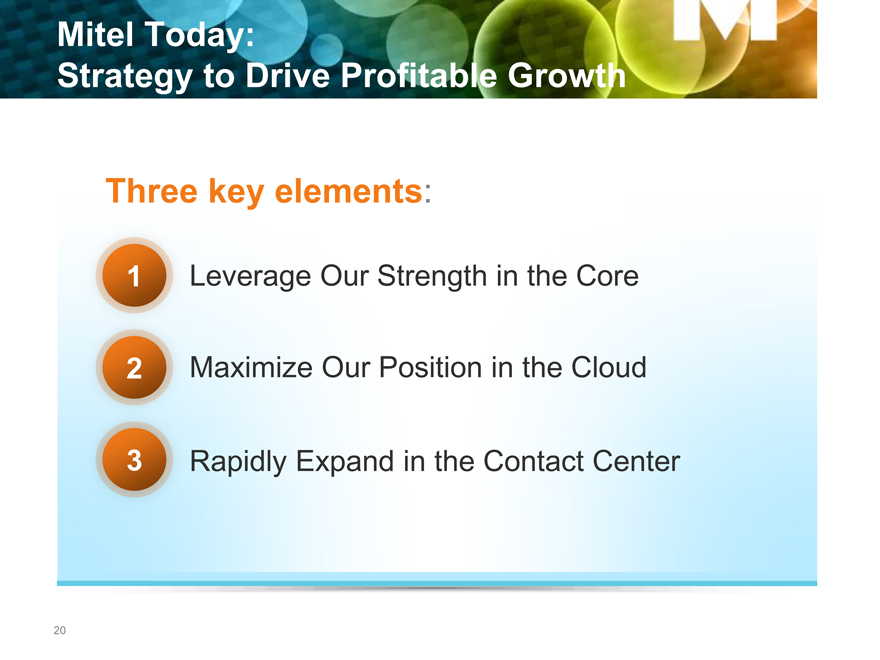

Mitel Today:

Strategy to Drive Profitable Growth

Three key elements:

1 | | Leverage Our Strength in the Core |

2 | | Maximize Our Position in the Cloud |

3 | | Rapidly Expand in the Contact Center |

20

Our Strategy for Profitable Growth

Mivoice

On Premise

Mi Contact Center

MiCloud

MiCollab

A single software stream to evolve with customer needs

21

Mitel Today:

Positioned for Profitable Growth

1Focused on large and growing markets

2 | | Differentiated solutions that meet the future needs of customers |

3 | | Created a solid financial foundation from which to grow |

4 | | Well positioned for growth with all initiatives beating market growth rates |

5Experienced and capable team

22

Mitel Core: Positioned for Profitable Growth

Ron Wellard, EVP & General Manager

Mitel Communications Solutions

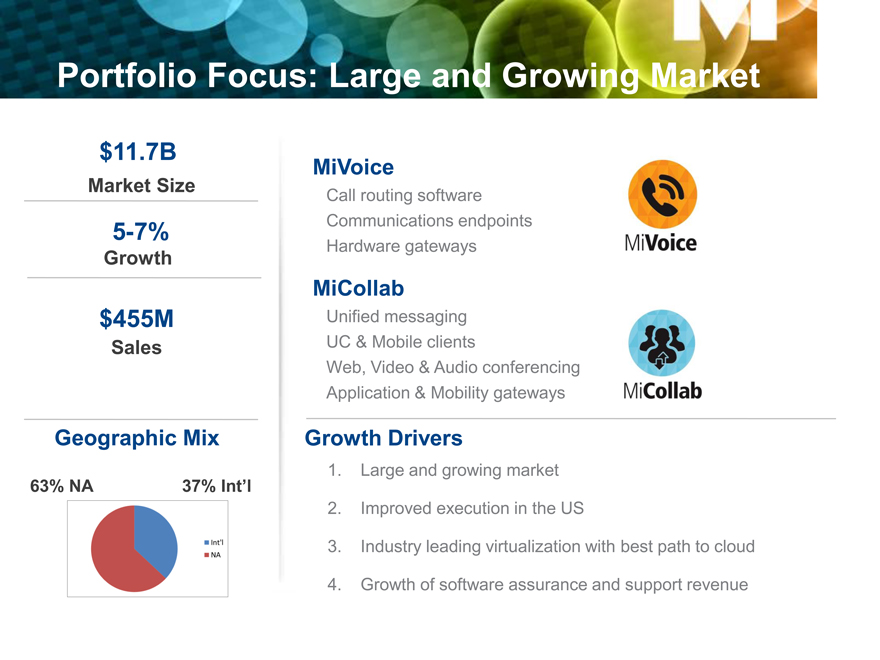

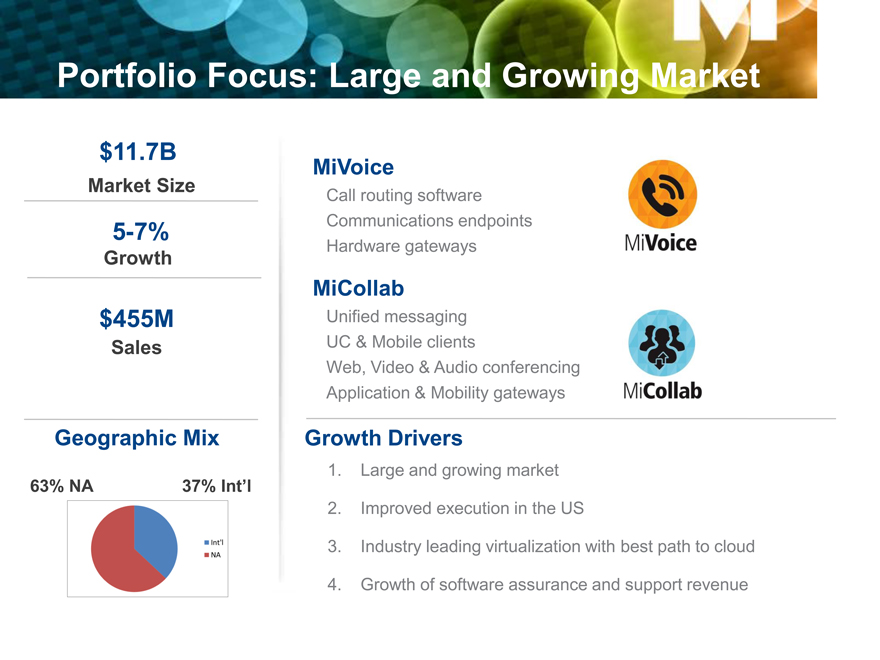

Portfolio Focus: Large and Growing Market

$11.7B

Market Size

5-7%

Growth

$455M

Sales

MiVoice

Call routing software Communications endpoints Hardware gateways

MiCollab

Unified messaging UC & Mobile clients

Web, Video & Audio conferencing Application & Mobility gateways

Geographic Mix

63% NA 37% Int’l

Growth Drivers

1. Large and growing market

2. Improved execution in the US

3. Industry leading virtualization with best path to cloud

4. Growth of software assurance and support revenue

Mitel Today:

Established IP Market Share in Key Markets

Q2 2013

COUNTRY MARKET

RANK SHARE

US 3 11%

Canada 2 23%

UK 4 16%

Netherlands 1 31%

25 Source: MZA PBX/IP PBX Market—World Quarterly Edition, IP Extension Shipments, Q2 2013

Mitel Core: Balancing Growth

Opportunities Challenges

Market share gains

Improved execution

Gains from weaker competitors

Move to Monthly Recurring Revenue

Cloud MRR substituting for Capex

Pull through from Contact Center

IPT & UC product

Software Assurance & Support Advanced Services

Commoditization of IM

Offset by growth in mobility

Greater deal sizes

Increased traction in US in ME / LE ARPU expansion w/ increased UC attach

Decline of hardware maintenance

Coupled to decline in TDM

26

Mitel Core: Why We Will Grow

Growth of Market

60% of customer wins net new to Mitel

Tremendous installed base opportunity for upgrades and Software Assurance

Improved execution in the US

New Sales leadership, processes and systems in large US market

Improved geographic coverage and revenue contribution from growth partners

Additional distribution partners

Best Path to Cloud

Industry leading virtualization

Move of Mitel base to enterprise cloud at the customers pace

Growth in recurring revenues

Software Assurance and Support, 35% revenue CAGR

27

Mitel Core: Recent Growth Highlights

Growth of Software Assurance and Support, 40%+ over last 2 years MiCollab virtualized deployments, ~60%, revenue up 15% YoY

MiVoice port shipments up 16% YoY, revenue up 9% YoY

28

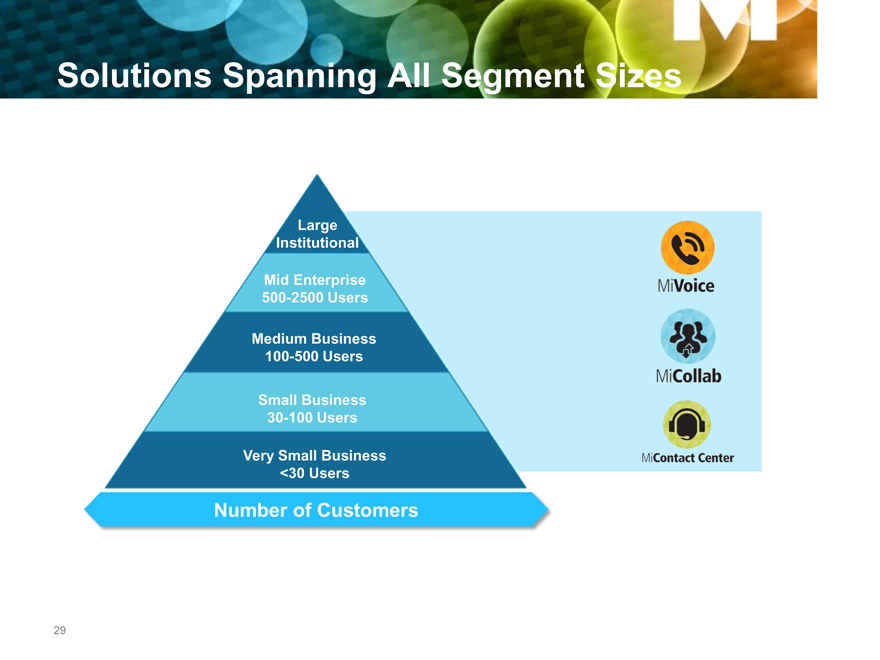

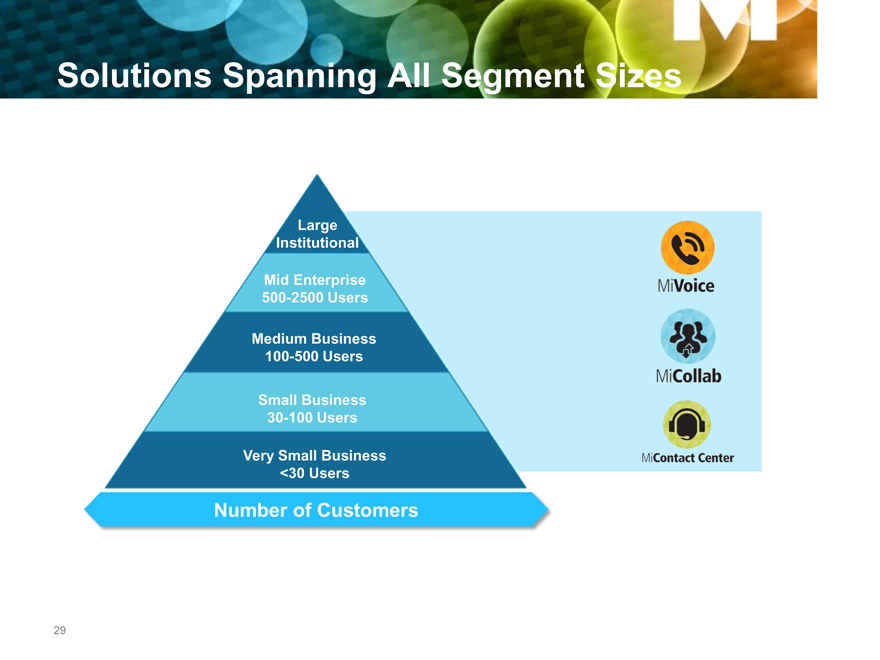

Solutions Spanning All Segment Sizes

Large Institutional

Mid Enterprise 500-2500 Users

Medium Business 100-500 Users

Small Business 30-100 Users

Very Small Business <30 Users

Number of Customers

29

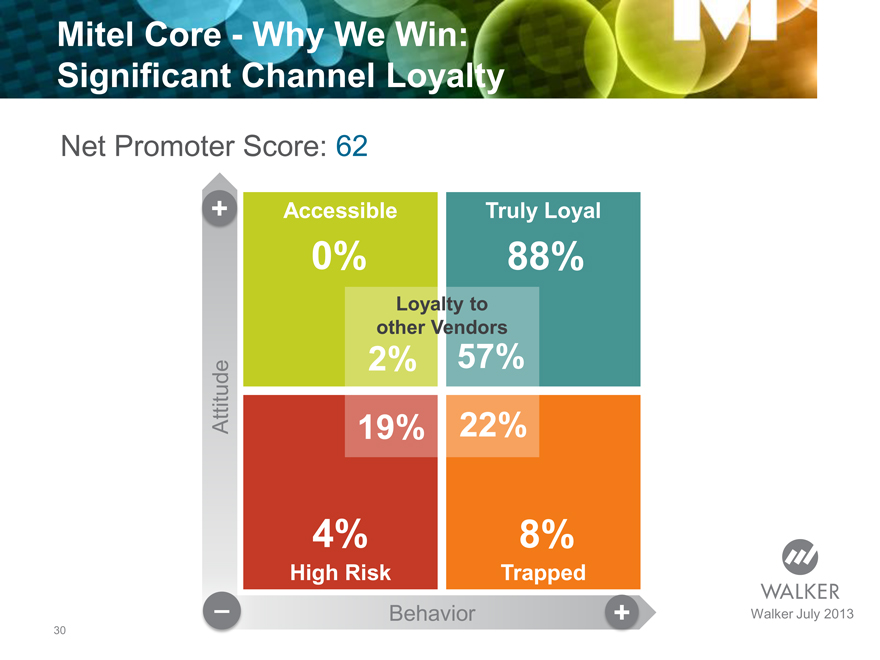

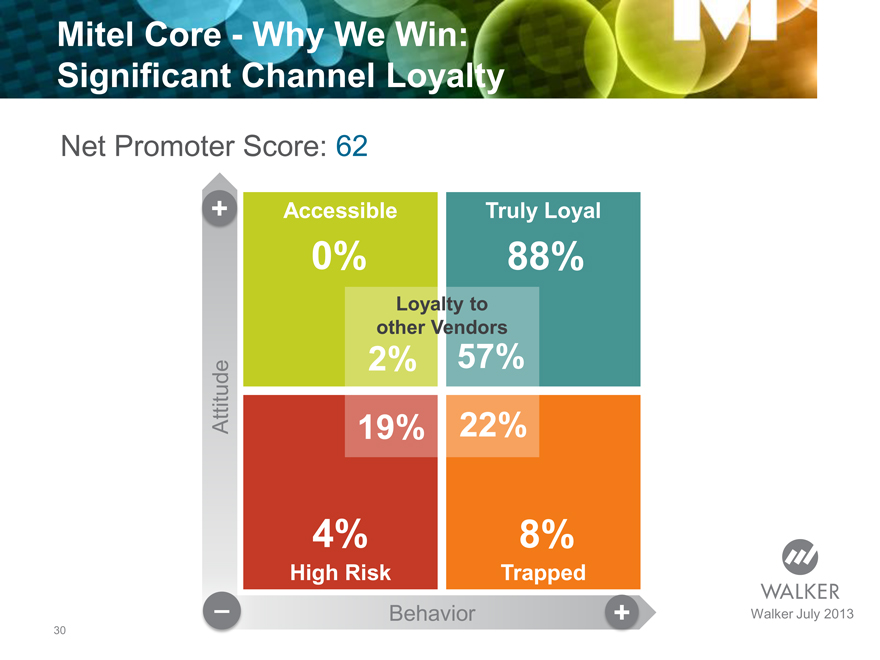

Mitel Core—Why We Win:

Significant Channel Loyalty

Net Promoter Score: 62

Attitude

Accessible Truly Loyal

0% 88%

Loyalty to other Vendors

2%

57%

19% 22%

4% 8%

High Risk Trapped

Behavior

Walker July 2013

30

Mitel Core – Why We Win:

Single Stream Software

Value for End Users

Fit to IT Strategy, Flexible Pace of Migration

Common User and Operational Experience

Value for Channel Partners

One time sales training, one time technical certification, one supply chain

Premise / Cloud flexibility, “Evergreen” value proposition

Value for Mitel’s Operating Model

Profit-driving economies of scale: product development, go-to-market / channel, supply chain

“The breadth and depth of its virtual UC solutions, which leverage a common software stream … stand out.” ? Robert Arnold, Frost & Sullivan

31

Mitel Core: Why We will Continue to Win

R&D Investments Aligned to Market Demand

Continue to lead Enhance UCC

in virtualization mobility and

and cloud multimedia

solutions integration

Drive channel Extend business

value and reduce applications

customer TCO integration

32

Summary

Mitel is well positioned for

growth & to take share in the

large IP Telephony and UCC

market Mitel is winning new

customers with a

differentiated offer

Growing highly profitable Mitel is migrating massive

recurring revenue stream installed base with single

from Software Assurance stream software

and Support

33

Mitel Contact Center: Positioned for Profitable Growth

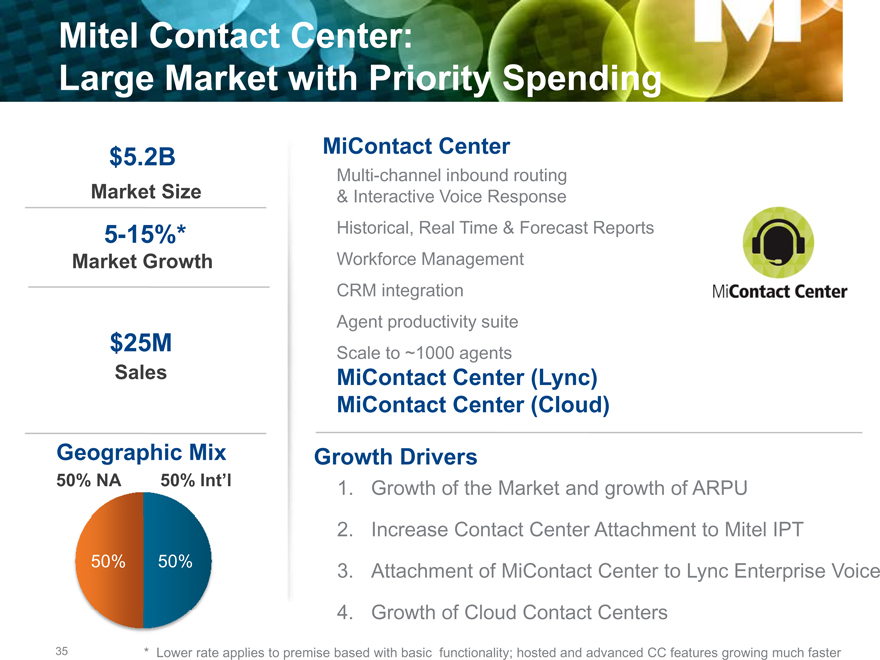

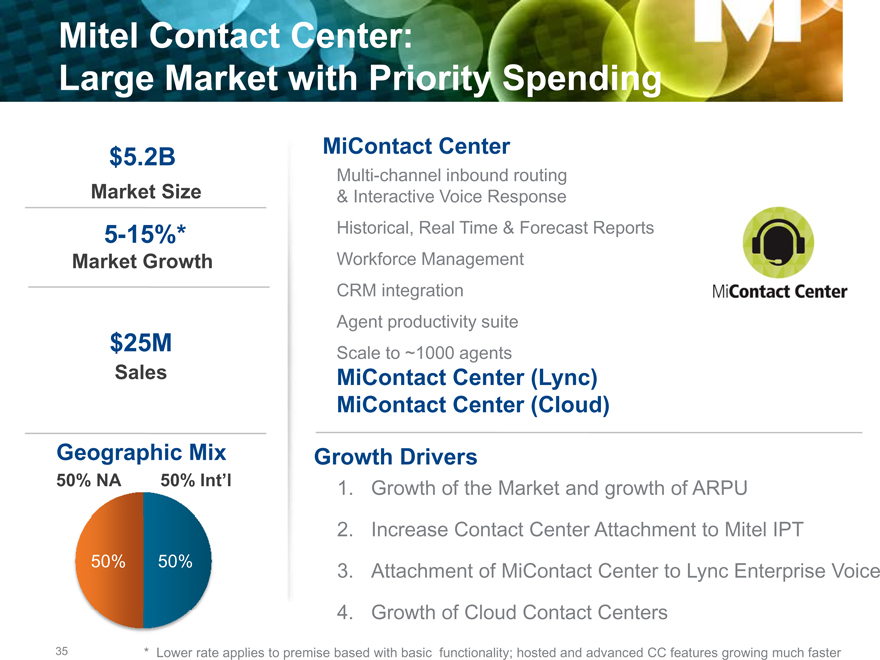

Mitel Contact Center:

Large Market with Priority Spending

$5.2B

Market Size

5-15%*

Market Growth

$25M

Sales

Geographic Mix

50% NA 50% Int’l

MiContact Center

Multi-channel inbound routing

& Interactive Voice Response

Historical, Real Time & Forecast Reports

Workforce Management

CRM integration

Agent productivity suite

Scale to ~1000 agents

MiContact Center (Lync)

MiContact Center (Cloud)

Growth Drivers

1. Growth of the Market and growth of ARPU

2. Increase Contact Center Attachment to Mitel IPT

3. Attachment of MiContact Center to Lync Enterprise Voice

4. Growth of Cloud Contact Centers

* | | Lower rate applies to premise based with basic functionality; hosted and advanced CC features growing much faster |

35

Mitel Contact Center:

External Growth Drivers

Cloud Delivery:

“Over the Top” to 3rd party PBX

Growth in Advanced

Capabilities:

Workforce Optimization, etc.

Multi-channel Interaction:

Web, Social, Customer Self-Service

Unified Communications:

Microsoft Lync

Virtualization:

Compute and Desktop

Public Private

36

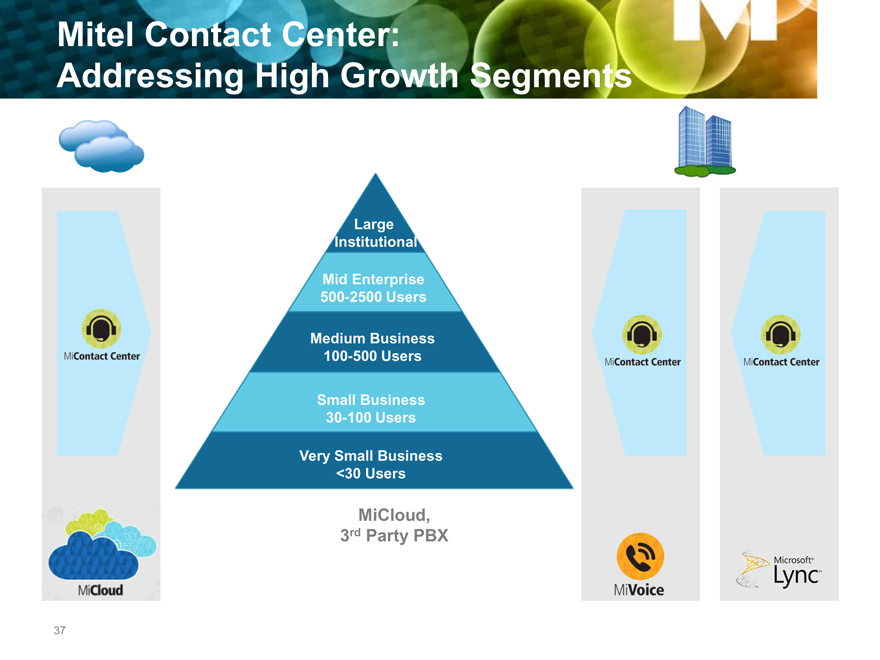

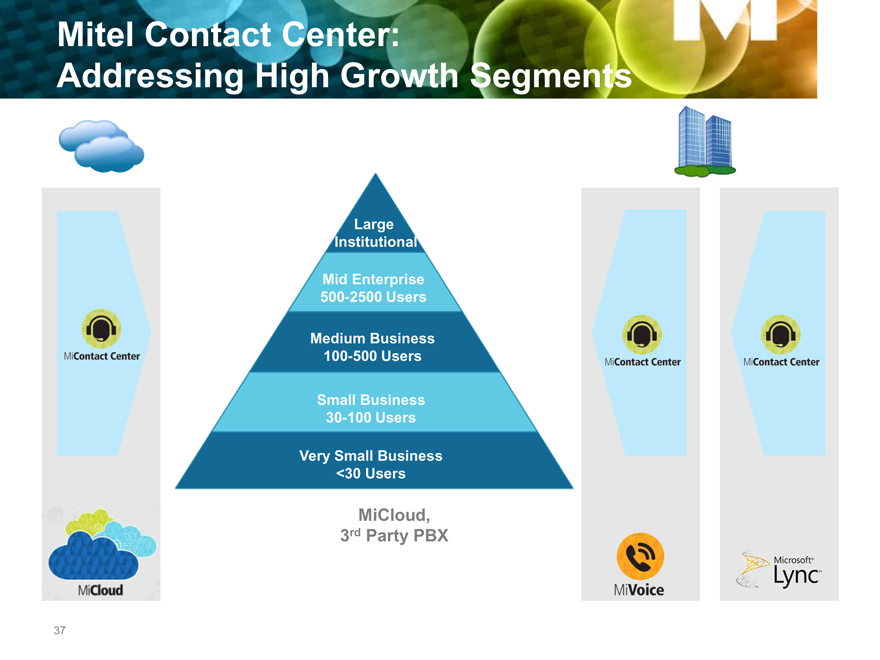

Mitel Contact Center:

Addressing High Growth Segments

Large

Institutional

Mid Enterprise

500-2500 Users

Medium Business

100-500 Users

Small Business

30-100 Users

Very Small Business

<30 Users

MiCloud,

3rd Party PBX

37

Mitel Contact Center:

History of Profitable Growth

Revenue growth, 3 Year track record of >20% growth

Average Contact Center size up 23%

Average revenue per seat up 17%

38

Mitel Contact Center ? Why We Win:

Simplicity and Value

Best technical integration to MiVoice

prairieFyre acquisition very well received by Mitel channel partners and customers

Superior value for the money relative to the competition

Flexible range of high value offerings to meet Small Business to Enterprise needs

Best technical integration to Microsoft Lync

Superior scalability, reliability and business analytics relative to the competition, Differentiated functionality

Single Software Stream across MiVoice, Lync and MiCloud

39

Why We Will Continue to Win:

R&D Investments Aligned to Market Demand

Deliver next Enhance unified

generation multi- suite including

channel and social outbound and

media integration workforce

optimization

Lead in cloud Extend contact

contact center center UC

and desktop integration

virtualization

40

Summary

MiContact Center 3 year track record of revenue growth Substantial investment increase in

(>20% CAGR) Contact Centers …

Research and Development Service Sales and Marketing

Mitel is well positioned to grow Contact Center share with a single stream software approach addressing MiVoice, Lync and Cloud integrations

41

Mitel Cloud: Positioned for Profitable Growth

Jon Brinton, General Manager

Cloud and Mitel Network Solutions

Mitel Network Solutions:

Exploiting New Revenue Opportunity

~$5.3B Business

Mitel cloud and network business

Market Size – $84M revenue

Cloud communications and related services for businesses

25-30% • Over $100M in contracted but unbilled revenue

Market Growth • 74% recurring revenue

Brand

~300K MiCloud Retail

Installed Seats Business Cloud Branded and Billed by Mitel

MiCloud: Powered by Mitel

Business+Enterprise Cloud—Branded & Billed by Service Provider

71% MiCloud Enterprise

YoY Cloud Growth Multi Channel Delivery

Geographic Mix Growth Drivers

1. Rapid Market Growth

63% NA 37% Int’l

2. Increased Sales and Marketing Investments

3. Powered by Mitel Service Provider & Channel Programs

4. Industry Leading Virtualization and Best Path to Cloud

43

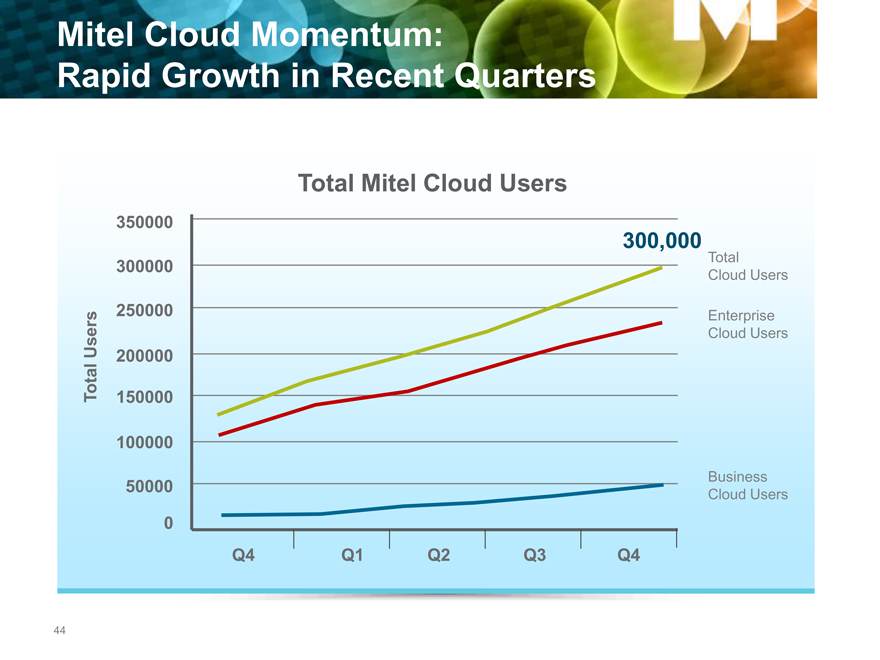

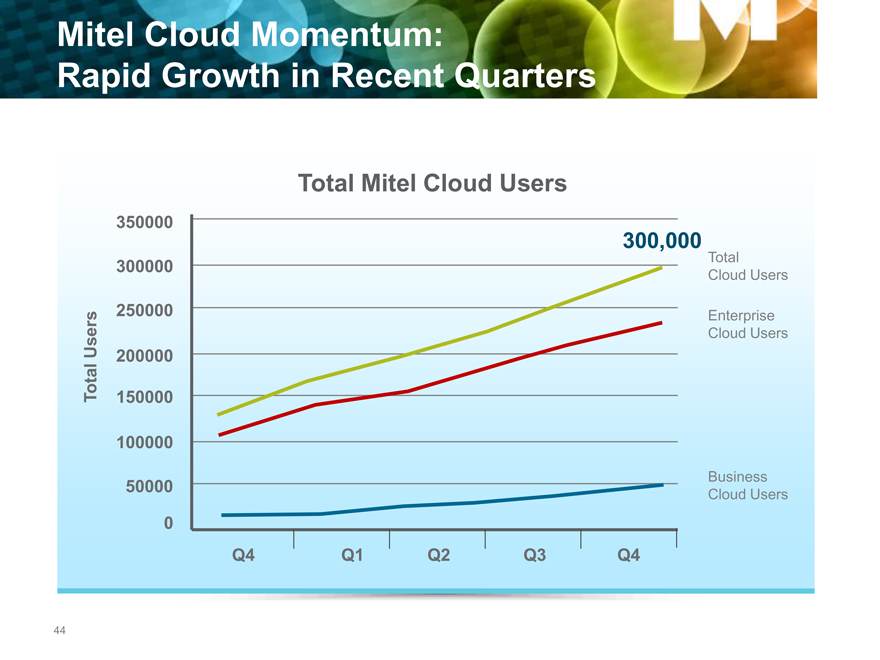

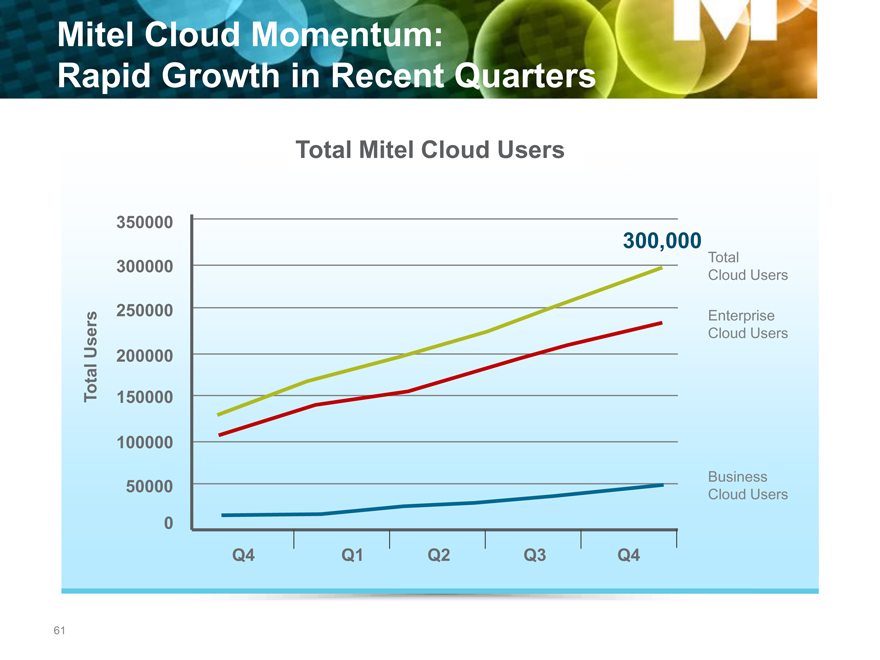

Mitel Cloud Momentum:

Rapid Growth in Recent Quarters

Total Mitel Cloud Users

350000

300,000

Total

300000 Cloud Users

250000 Enterprise

Users Cloud Users

200000

Total 150000

100000

Business

50000 Cloud Users

0

Q4 Q1 Q2 Q3 Q4

44

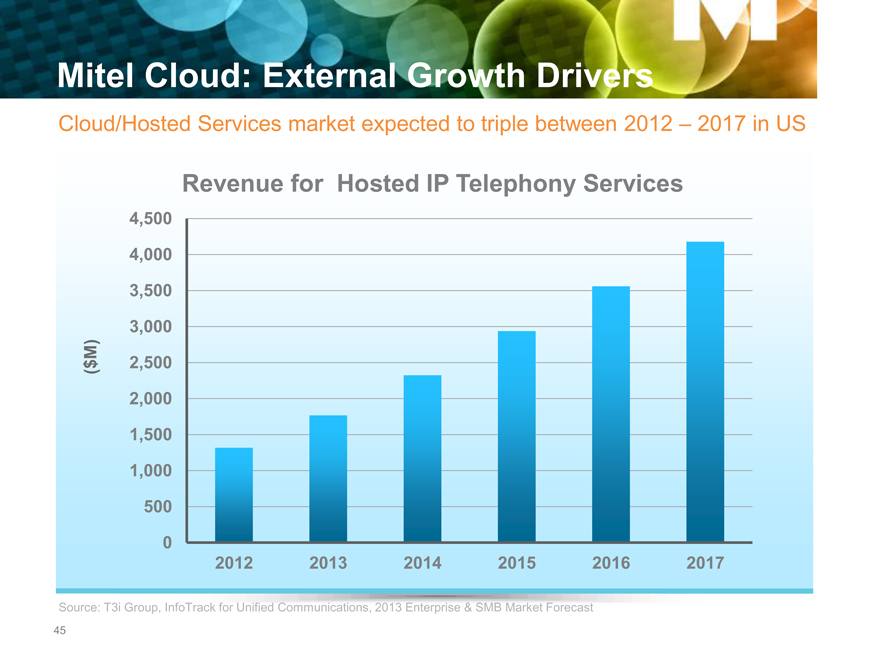

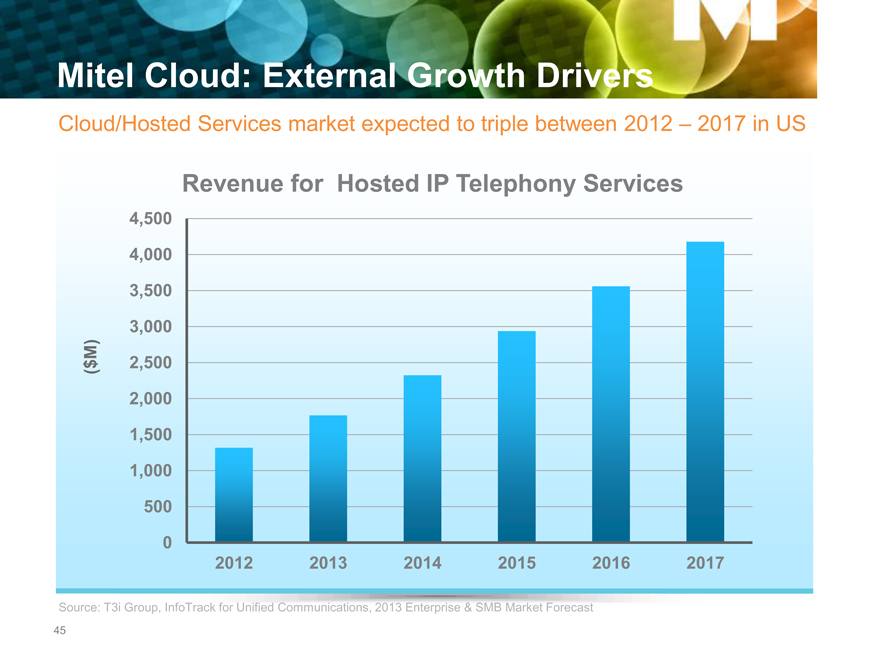

Mitel Cloud: External Growth Drivers

Cloud/Hosted Services market expected to triple between 2012 – 2017 in US

Revenue for Hosted IP Telephony Services

4,500

4,000

3,500

3,000

(M)

$ 2,500

2,000

1,500

1,000

500

0

2012 2013 2014 2015 2016 2017

Source: T3i Group, InfoTrack for Unified Communications, 2013 Enterprise & SMB Market Forecast

45

Mitel Cloud: Why We Win

Smartphone-like experience with ease of 1 deployment, support and mass customization Consistent in-office experience on 2 any device at any location at any time Ability to deliver UC across geographic 3 locations without onsite hardware Existing customers adoption of Cloud delivery 4 models for other business applications Flexible commercial models

5 – Pay as you grow model

– Total cost of use versus total cost of ownership

46

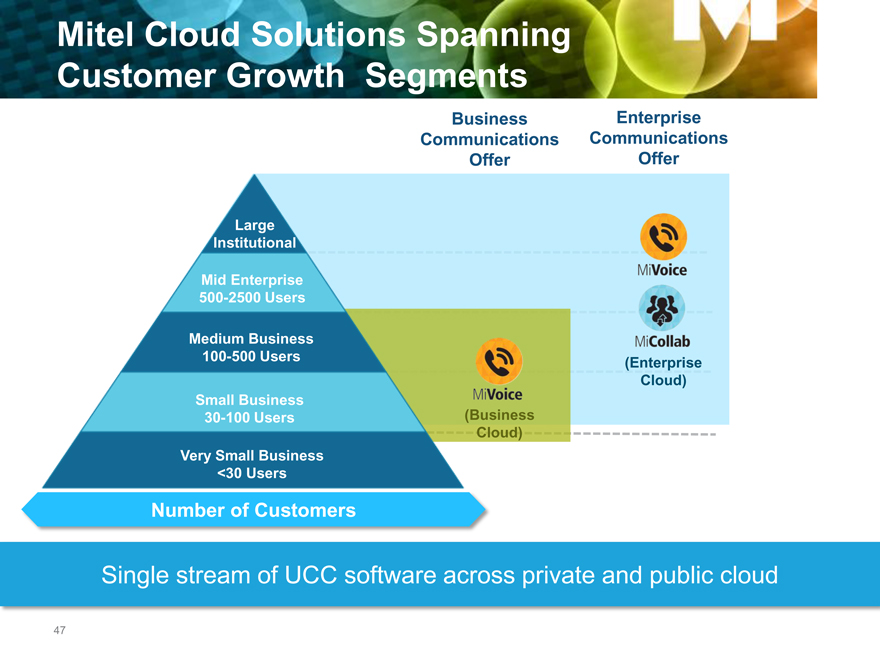

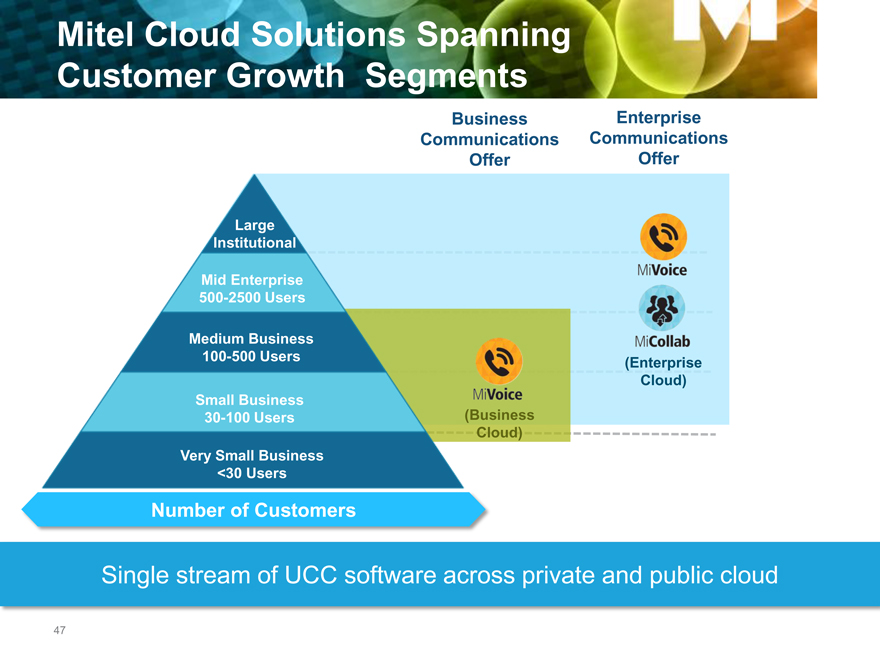

Mitel Cloud Solutions Spanning

Customer Growth Segments

Business Enterprise Communications Communications Offer Offer

Large Institutional

Mid Enterprise 500-2500 Users

Medium Business

100-500 Users (Enterprise Cloud) Small Business 30-100 Users (Business Cloud) Very Small Business <30 Users

Number of Customers

Single stream of UCC software across private and public cloud

47

Mitel Cloud ? Why We Will Grow:

Two Paths to Revenue and Share Expansion

1. MiCloud Retail

Customer managed and billed by Mitel

Sold through channel, web and direct sales

Maximum revenue per seat and margin

Target is large U.S. market

2. Powered by Mitel (ingredient brand)

Customer managed and billed by Partner

Leverages partners scale and footprint

Integrates with partner processes and systems

Target is rapidly growing global market

48

Mitel Cloud – Business:

Growing Market Presence

Purpose built all in one solution for pay as you grow demand

Targeted up to 500+

Mitel Cloud – Business Channel Representative Customers

49

Mitel Cloud – Enterprise:

Rapidly Growing Global Installed Based

Leveraging Mitel Virtual Applications portfolio

for global Enterprise demand

Targeted up to 50,000+

Mitel Cloud – Enterprise Channel Representative Customers

Department of

Foreign Affairs Canada

50

MiCloud Business: Metrics, Momentum and

Investment Driving Growth

MRR

? ARPU of $48 – up 15%

? Average Revenue Per Customer—$1,400 per – up 8%

Average of 29 Seats per installed customer Largest customer approximately 1,000 seats 196% YoY installed seat growth Over 75% of customers are new logos to Mitel

Ability to layer in contact center, rich video, collaboration Investing in:

Increased Cloud marketing driving web generated sales Ramping traditional and new channels as Agents of MiCloud Direct sales in target geographies and verticals

51

Powered by Mitel: Metrics, Momentum and

Investment Driving Growth

40 Powered By Mitel Service Providers live or in process of deployment 10 countries with Powered by Mitel Partners Over 100% YoY seat growth Implementation in process with 25,000 plus users for a single customer Investing in:

Global cloud sales and partner support Service Provider channel development

New on-boarding, operations and support resources Enhanced service provider tools and programs Consolidated and centralized global cloud strategy

52

Why We Will Grow:

Ramp Up of Global Powered by Mitel Partners

53

Summary

Mitel is poised to migrate installed base customers to the Cloud with single software stream

Mitel is winning new cloud customers

Mitel is accelerating growth with investment in sales and go-to-market initiatives

Mitel is an ideal ingredient brand for service providers and partners looking to introduce cloud services

Mitel is growing a significant recurring revenue stream

54

Mitel Voice of the Customer Panel

Almin Surani

Erin Ostler

Kevin Portillo

CIO, Canadian

Director of Global Wholesale

IT Director, Kaplan

Red Cross

and Emerging Solutions, Sprint

International Colleges

55

Mitel Go-To-Market Panel

Graham Bevington

Martyn Etherington

Joe Vitalone

EVP International

EVP and Chief Marketing Officer

EVP Americas

56

Mitel Financials:

Positioned for

Profitable Growth

Steve Spooner, Chief Financial Officer

Fiscal Year 2013 Results

$M FY13

Revenue $576.9

YoY Growth -5.7%

Margin 55.6% Record margins

Non-GAAP OPEX ($) $250.2 /43.4% Prudent management/

strategic investment

Non-GAAP NI ($) $45.6 / 7.9%

Solid profitability!

Adjusted EBITDA ($) $85.0 / 14.7%

58

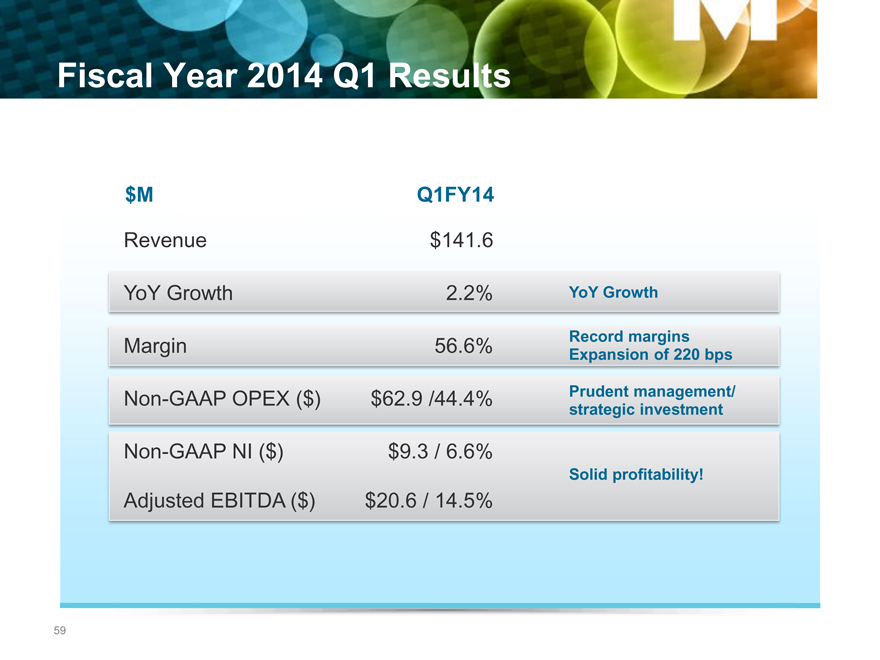

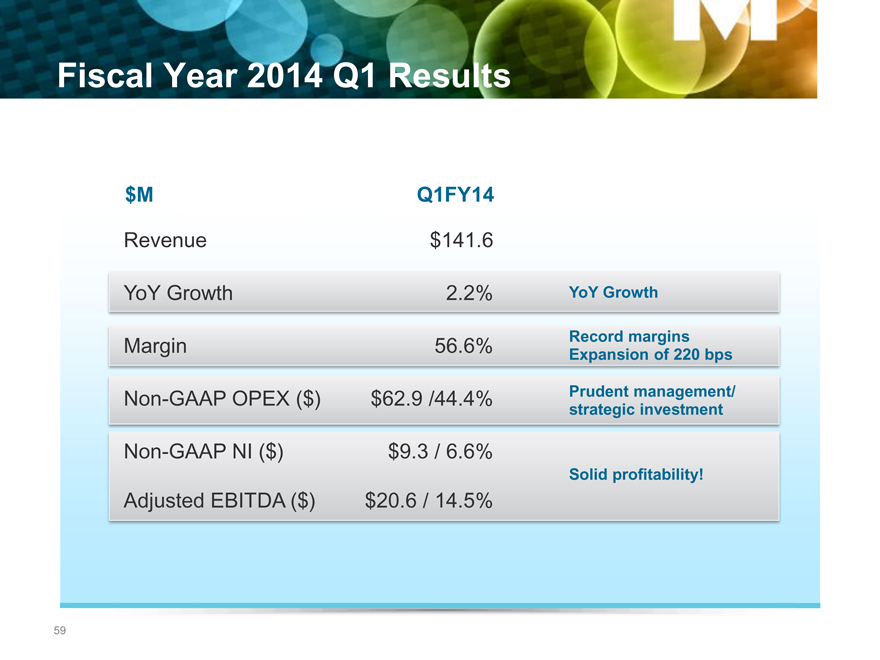

Fiscal Year 2014 Q1 Results

$M Q1FY14

Revenue $141.6

YoY Growth 2.2% YoY Growth

Margin 56.6% Record margins

Expansion of 220 bps

Non-GAAP OPEX ($) $62.9 /44.4% Prudent management/

strategic investment

Non-GAAP NI ($) $9.3 / 6.6%

Solid profitability!

Adjusted EBITDA ($) $20.6 / 14.5%

59

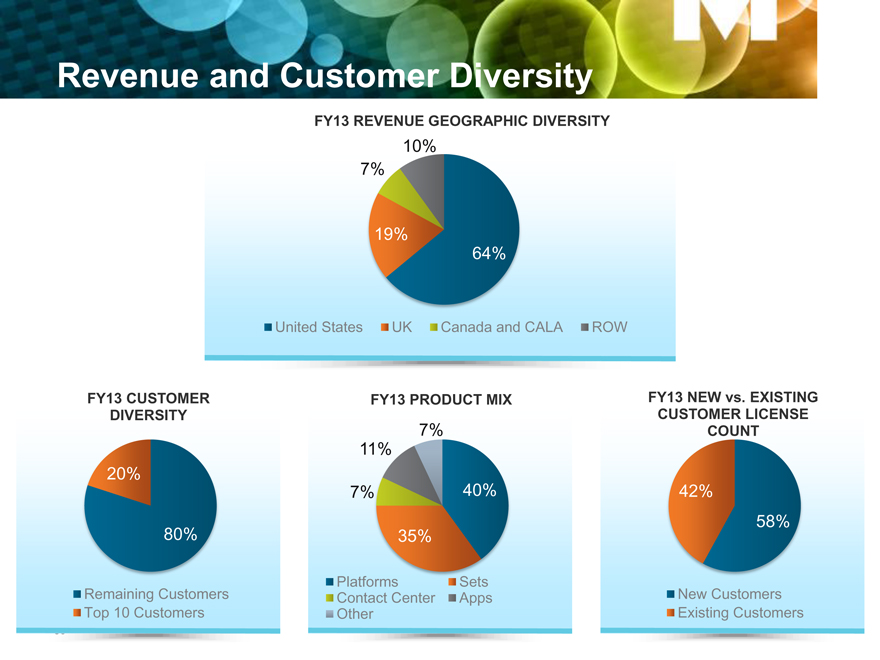

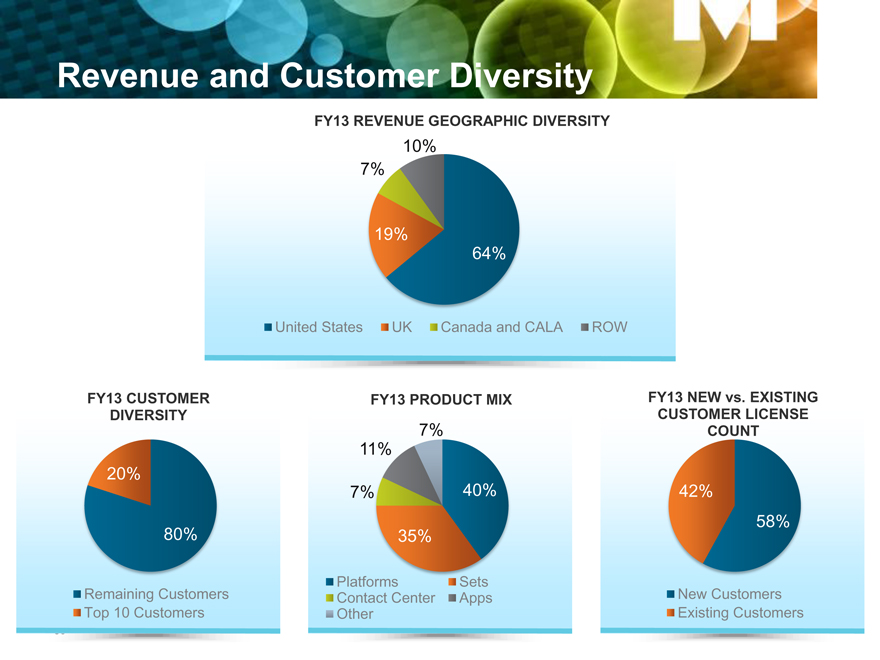

Revenue and Customer Diversity

FY13 REVENUE GEOGRAPHIC DIVERSITY

10% 7%

19%

64%

United States UK Canada and CALA ROW

FY13 CUSTOMER FY13 PRODUCT MIX FY13 NEW vs. EXISTING DIVERSITY CUSTOMER LICENSE

7% COUNT

11% 20%

7% 40% 42%

58% 80% 35%

Remaining Customers Platforms Sets New Customers Contact Center Apps Top 10 Customers Other Existing Customers

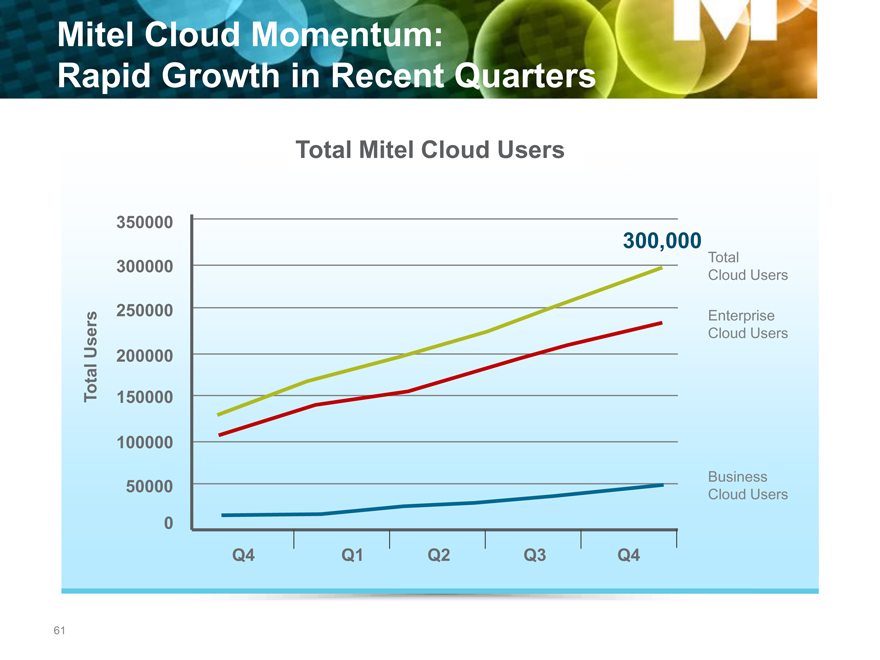

Mitel Cloud Momentum:

Rapid Growth in Recent Quarters

Total Mitel Cloud Users

350000

300,000

Total

300000 Cloud Users

250000 Enterprise

Users Cloud Users

200000

Total 150000

100000

Business

50000 Cloud Users

0

Q4 Q1 Q2 Q3 Q4

61

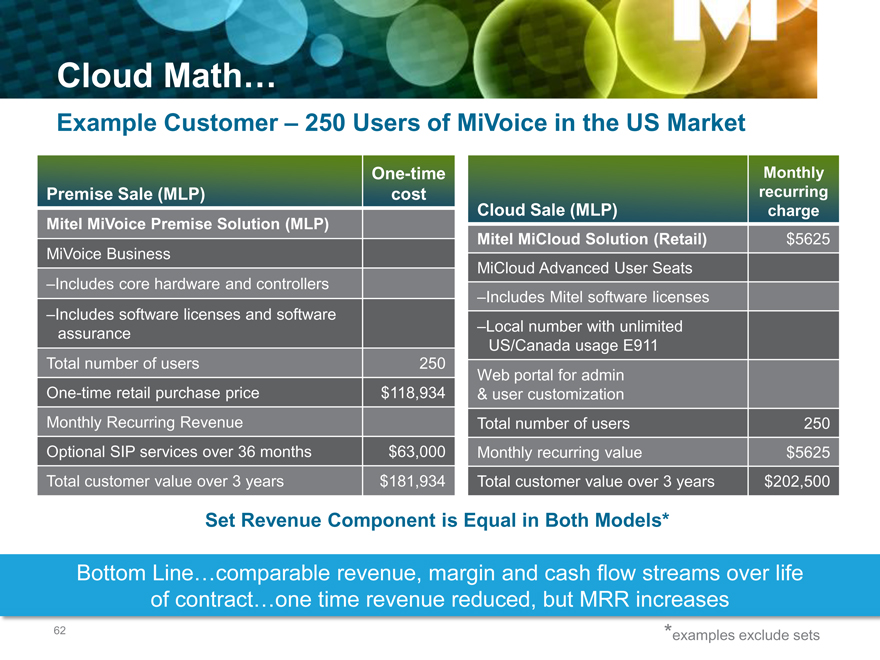

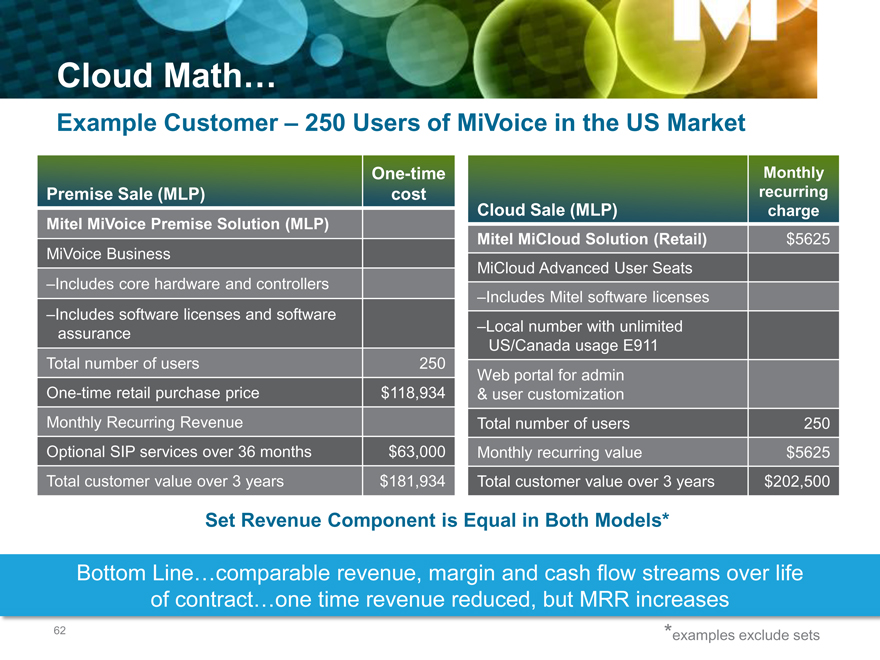

Cloud Math…

Example Customer – 250 Users of MiVoice in the US Market

One-time Monthly

Premise Sale (MLP) cost recurring

Cloud Sale (MLP) charge

Mitel MiVoice Premise Solution (MLP)

Mitel MiCloud Solution (Retail) $5625

MiVoice Business

MiCloud Advanced User Seats

–Includes core hardware and controllers

–Includes Mitel software licenses

–Includes software licenses and software

assurance –Local number with unlimited

US/Canada usage E911

Total number of users 250

Web portal for admin

One-time retail purchase price $118,934 & user customization

Monthly Recurring Revenue Total number of users 250

Optional SIP services over 36 months $63,000 Monthly recurring value $5625

Total customer value over 3 years $181,934 Total customer value over 3 years $202,500

Set Revenue Component is Equal in Both Models*

Bottom Line…comparable revenue, margin and cash flow streams over life of contract…one time revenue reduced, but MRR increases

examples exclude sets

62

Recurring Revenue Growth

Driven by Software Assurance and Cloud

Decrease in Legacy MRR offset by growth in Software Assurance Cloud growth to drive additional MRR

FY11 Revenue FY13 Revenue Target Revenue

26% 26% 35%

74% 65% 74%

Capital Sale Capital Sale Capital Sale

Recurring Revenue Recurring Revenue Recurring Revenue

63

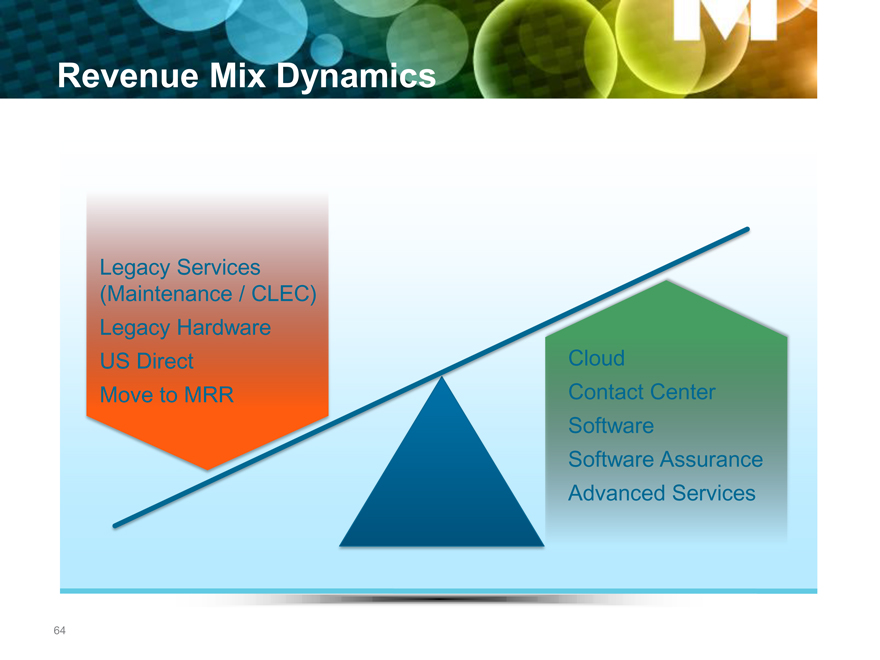

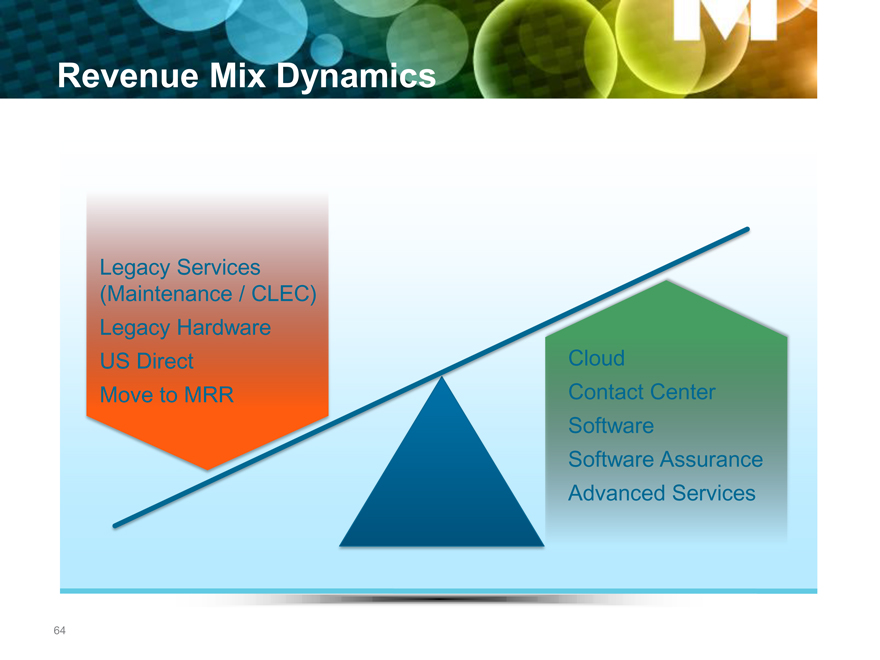

Revenue Mix Dynamics

64

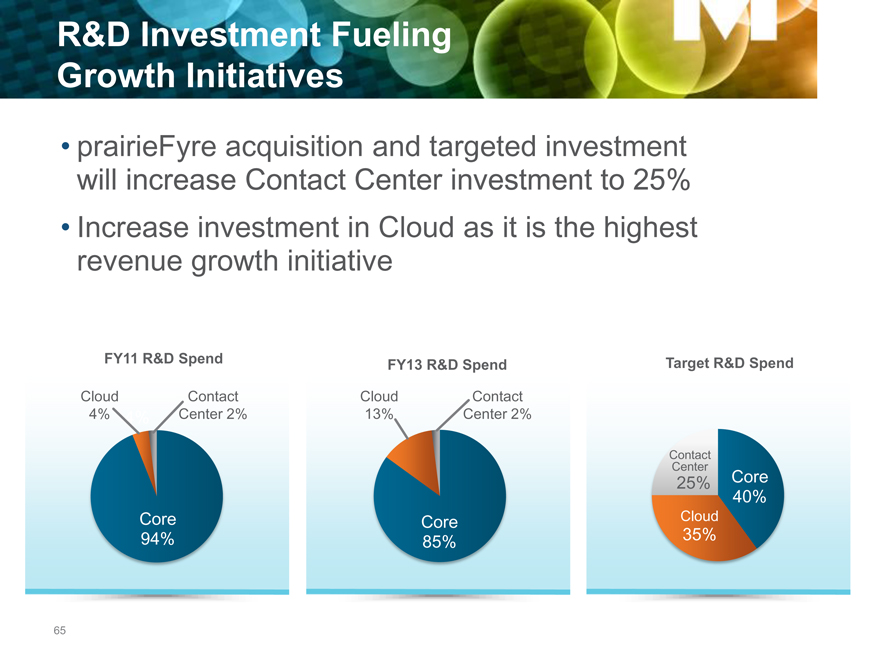

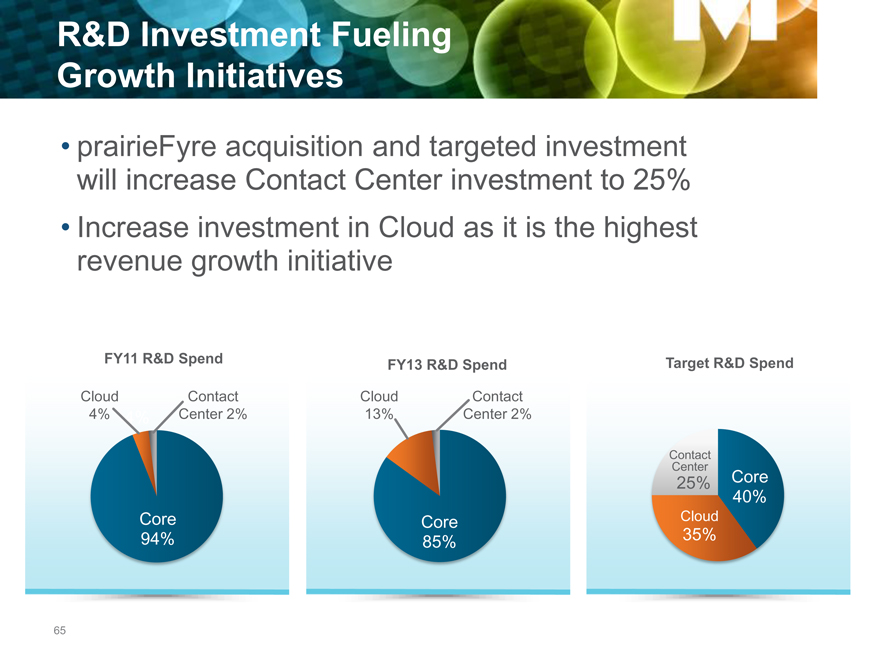

R&D Investment Fueling

Growth Initiatives

prairieFyre acquisition and targeted investment will increase Contact Center investment to 25% Increase investment in Cloud as it is the highest revenue growth initiative

FY11 R&D Spend FY13 R&D Spend Target R&D Spend

Cloud Contact Cloud Contact

4% 4% Center 2% 13% Center 2%

Contact

Center

25% Core

40%

Core Core Cloud

94% 85% 35%

65

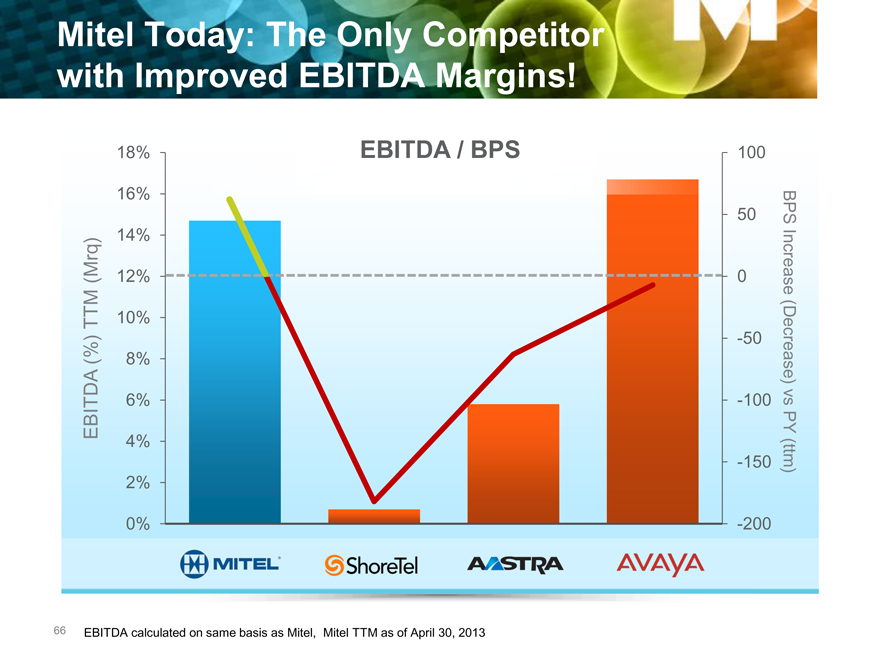

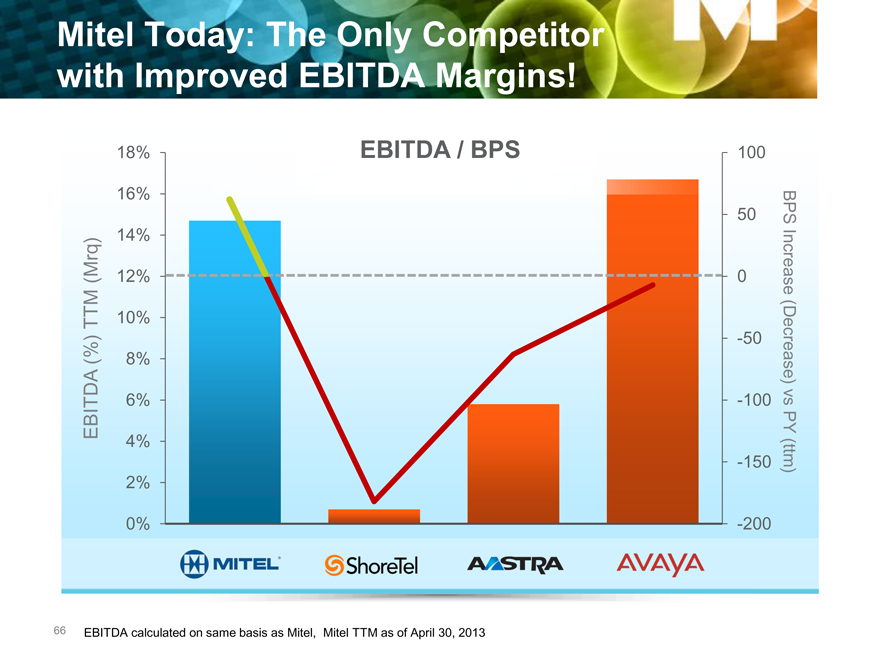

Mitel Today: The Only Competitor with Improved EBITDA Margins!

18% EBITDA / BPS 100

16%

50 BPS

14%

(Mrq) 12% 0 Increase

TTM 10%

-50

(%) 8% (Decrease)

6% -100 vs

EBITDA PY

4%

-150 (ttm)

2%

0% -200

EBITDA calculated on same basis as Mitel, Mitel TTM as of April 30, 2013

66

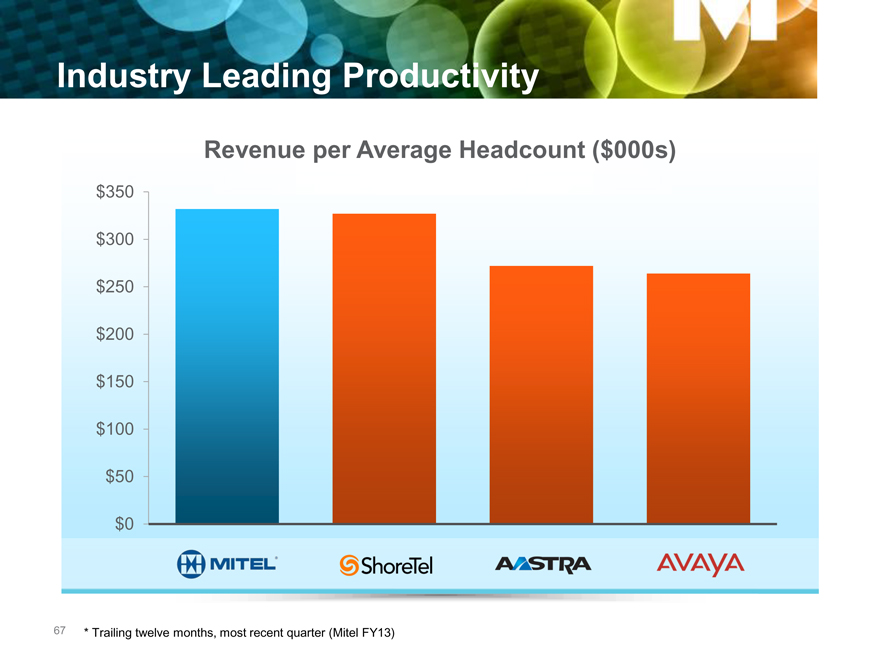

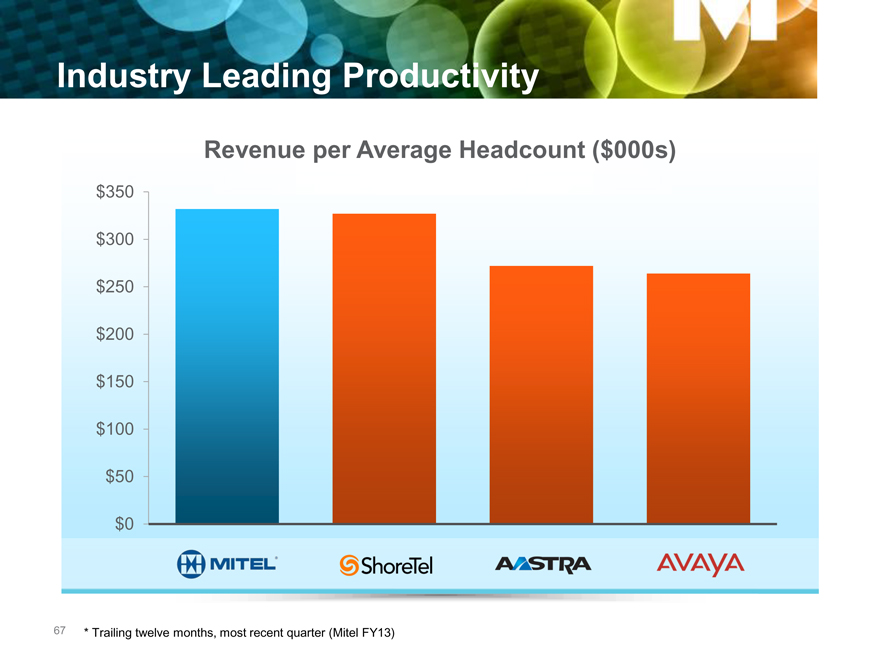

Industry Leading Productivity

Revenue per Average Headcount ($000s)

$350

$300

$250

$200

$150

$100

$50

$0

* | | Trailing twelve months, most recent quarter (Mitel FY13) |

67

Operating Margin Growth Plan

Gross Margin Expansion

prairieFyre acquisition

Software Assurance Contact Center mix Software mix Supply chain optimization

Revenue Leverage

Operating Margin Expansion

Cloud growth Contact Center growth Software Assurance growth Improved US execution

Leverage vs. “Fixed

Cost” structure

FY2016: 16%—19%

68

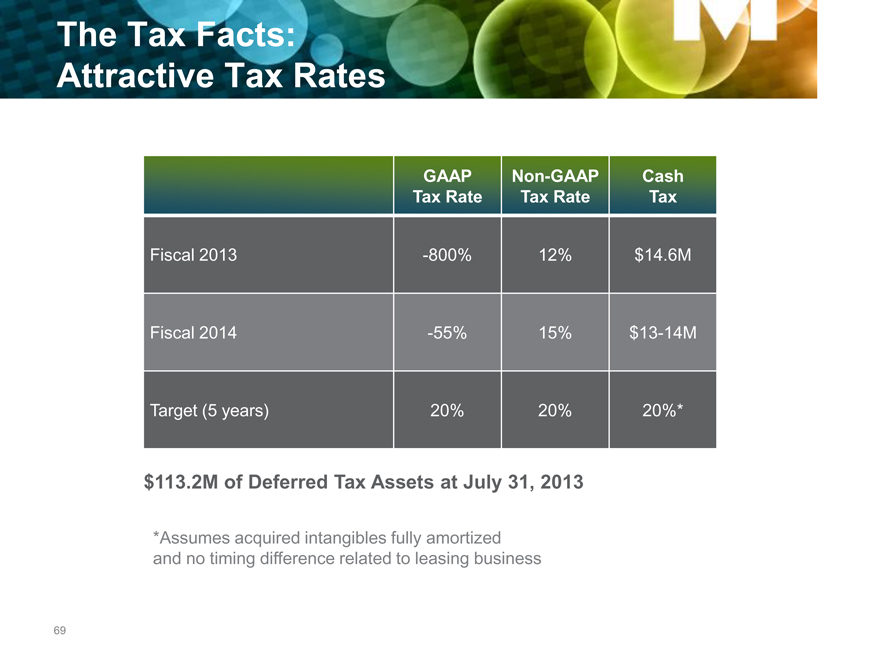

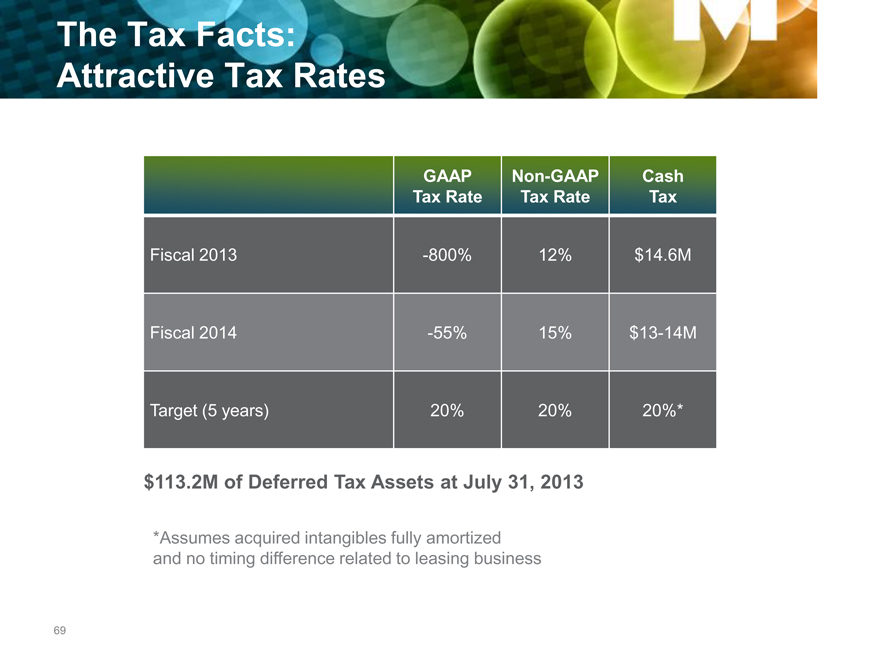

The Tax Facts:

Attractive Tax Rates

GAAP Non-GAAP Cash

Tax Rate Tax Rate Tax

Fiscal 2013 -800% 12% $14.6M

Fiscal 2014 -55% 15% $13-14M

Target (5 years) 20% 20% 20%*

$113.2M of Deferred Tax Assets at July 31, 2013

*Assumes acquired intangibles fully amortized and no timing difference related to leasing business

69

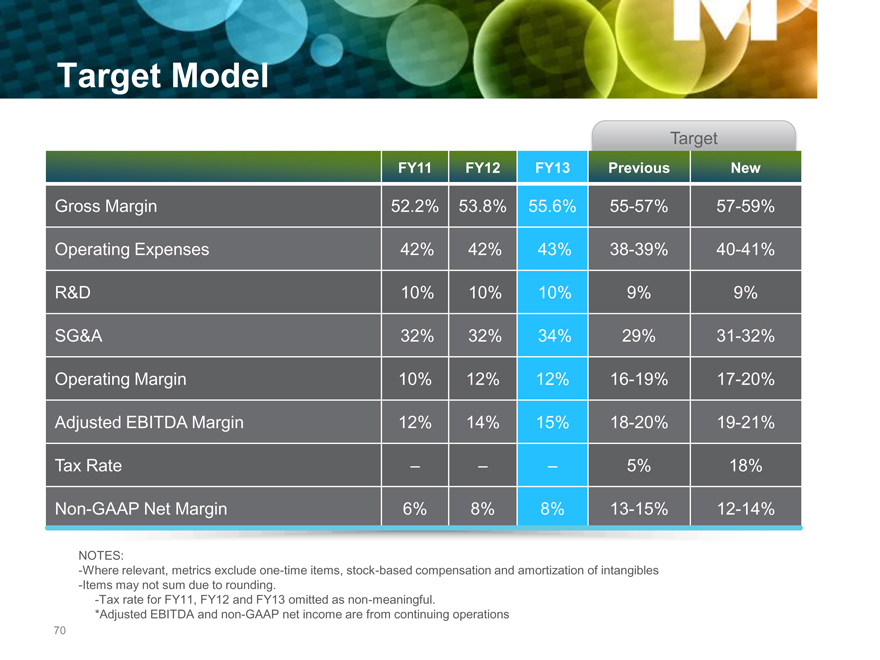

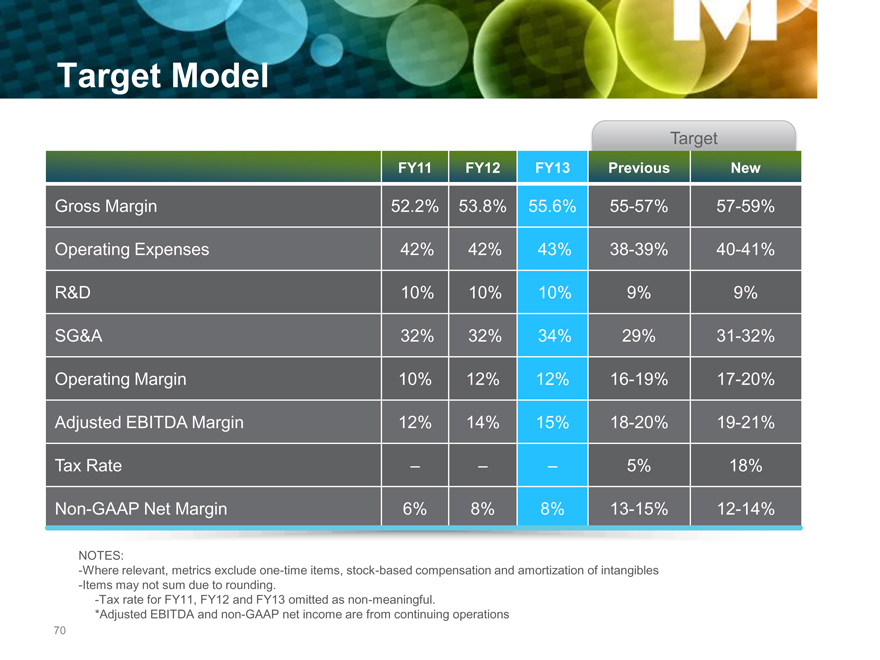

Target Model

Target

FY11 FY12 FY13 Previous New

Gross Margin 52.2% 53.8% 55.6% 55-57% 57-59%

Operating Expenses 42% 42% 43% 38-39% 40-41%

R&D 10% 10% 10% 9% 9%

SG&A 32% 32% 34% 29% 31-32%

Operating Margin 10% 12% 12% 16-19% 17-20%

Adjusted EBITDA Margin 12% 14% 15% 18-20% 19-21%

Tax Rate – – – 5% 18%

Non-GAAP Net Margin 6% 8% 8% 13-15% 12-14%

NOTES:

-Where relevant, metrics exclude one-time items, stock-based compensation and amortization of intangibles -Items may not sum due to rounding.

-Tax rate for FY11, FY12 and FY13 omitted as non-meaningful.

*Adjusted EBITDA and non-GAAP net income are from continuing operations

70

A Well Run Business

EBITDA Margin from Continuing Operations

16%

15%

14%

13% In the past 5 years

Mitel has

12% generated $412M

of EBITDA

11%

10%

FY09 FY10 FY11 FY12 FY13

71

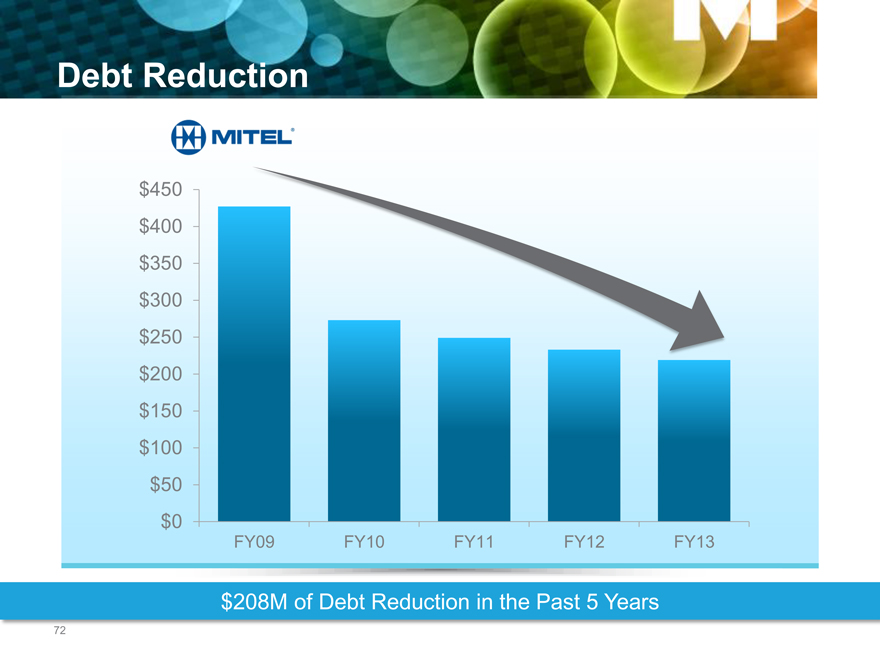

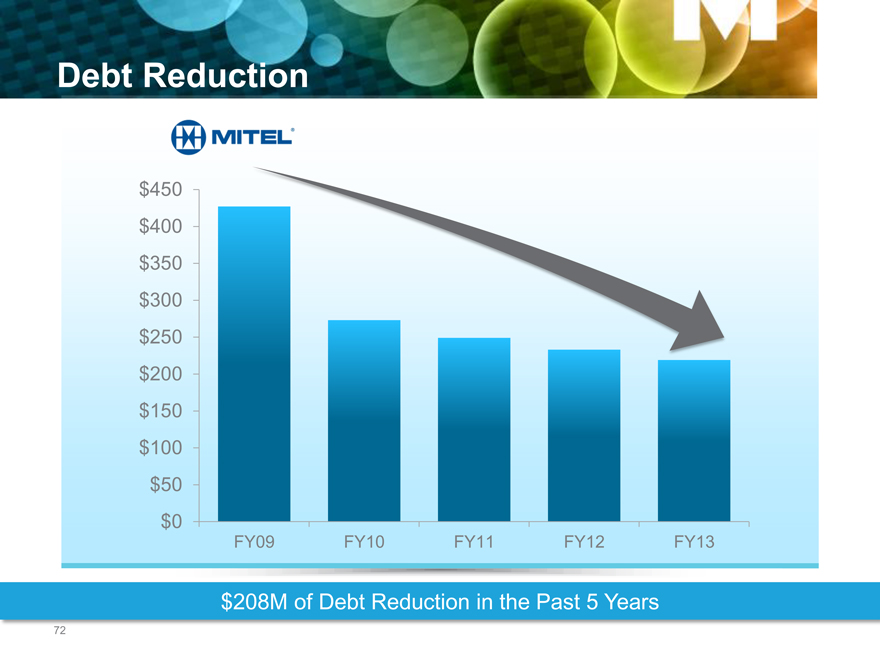

Debt Reduction

$450

$400

$350

$300

$250

$200

$150

$100

$50

$0

FY09 FY10 FY11 FY12 FY13

$208M of Debt Reduction in the Past 5 Years

72

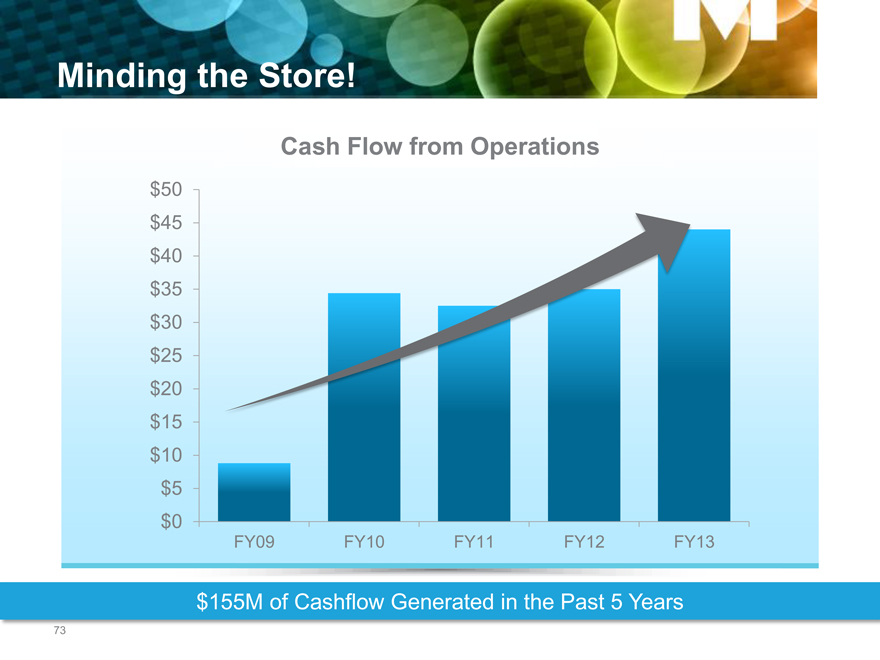

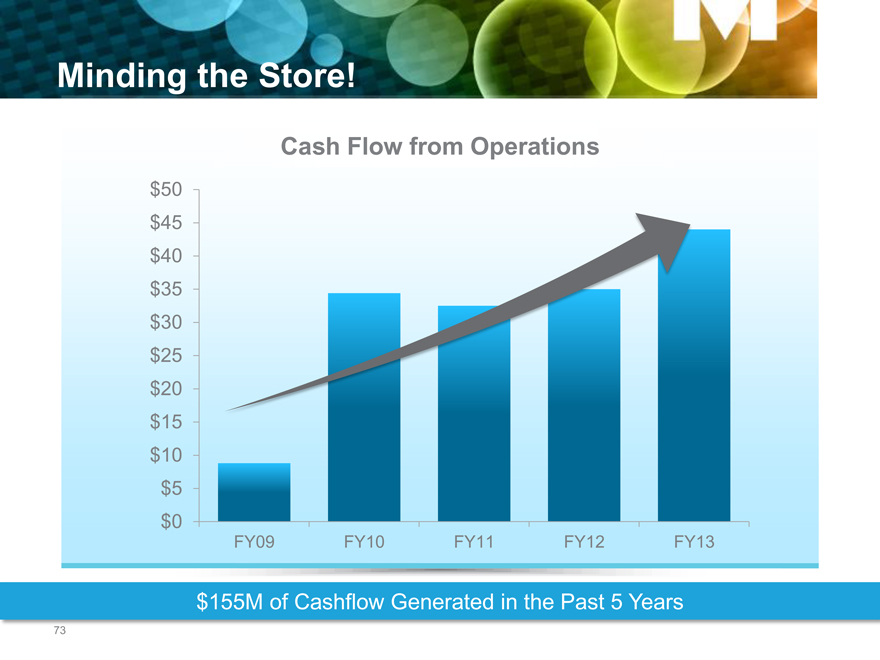

Minding the Store!

Cash Flow from Operations

$50 $45 $40 $35 $30 $25 $20 $15 $10 $5 $0

FY09 FY10 FY11 FY12 FY13

$155M of Cashflow Generated in the Past 5 Years

73

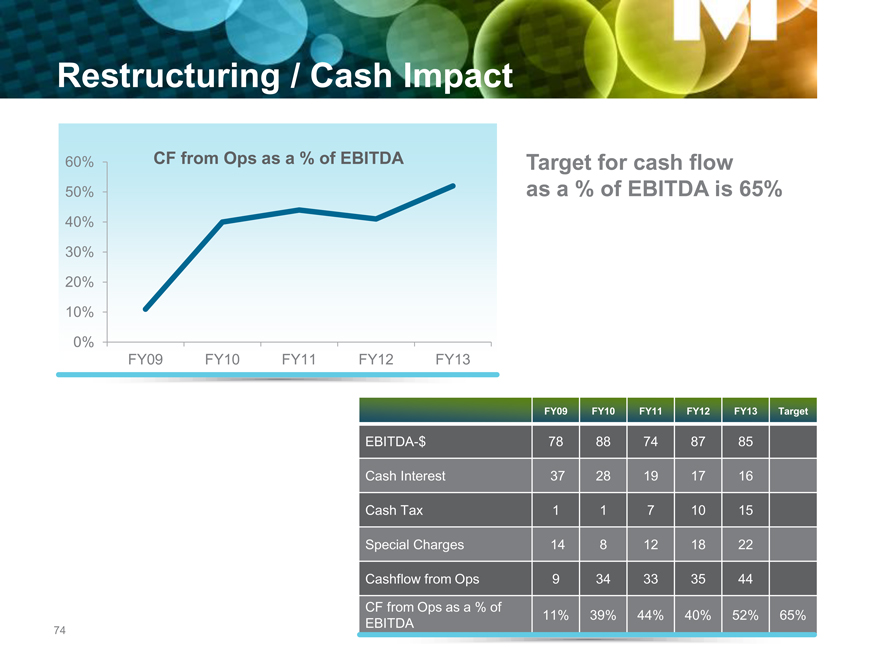

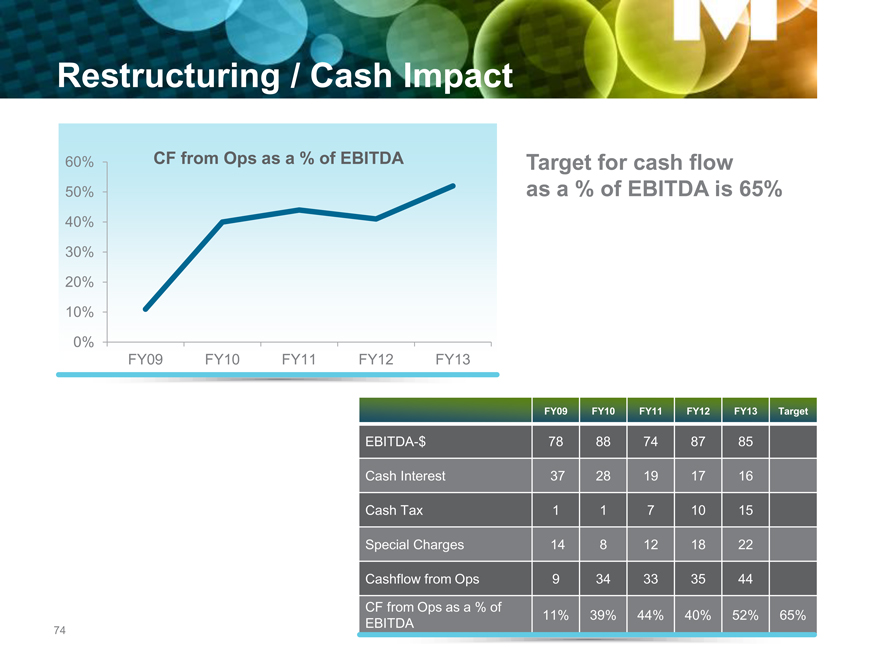

Restructuring / Cash Impact

60% CF from Ops as a % of EBITDA Target for cash flow

50% as a % of EBITDA is 65%

40%

30%

20%

10%

0%

FY09 FY10 FY11 FY12 FY13

FY09 FY10 FY11 FY12 FY13 Target

EBITDA-$ 78 88 74 87 85

Cash Interest 37 28 19 17 16

Cash Tax 1 1 7 10 15

Special Charges 14 8 12 18 22

Cashflow from Ops 9 34 33 35 44

CF from Ops as a % of

74 EBITDA 11% 39% 44% 40% 52% 65%

Why Invest in Mitel

A multi-billion dollar market opportunity

Technology leadership position

single software stream, virtualization, “Powered by Mitel”

Revenue growth in all investment initiatives

Profitable with demonstrated operating leverage

Generating cash/continued debt reduction

Experienced management team

Mitel is positioned for profitable growth

75

MITEL