Exhibit 99.1

Mitel Q1 2016 Earnings Call Presentation

May 5, 2016

Safe Harbor Statement

Forward Looking Statements

Some of the statements in this communication are forward-looking statements (or forward-looking information) within the meaning of applicable U.S. and Canadian securities laws. These include statements using the words believe, target, outlook, may, will, should, could, estimate, continue, expect, intend, plan, predict, potential, project and anticipate, and similar statements which do not describe the present or provide information about the past. There is no guarantee that the expected events or expected results will actually occur. Such statements reflect the current views of management of Mitel and are subject to a number of risks and uncertainties. These statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, operational and other factors. Any changes in these assumptions or other factors could cause actual results to differ materially from current expectations. All forward-looking statements attributable to Mitel or Polycom, or persons acting on either of their behalf, are expressly qualified in their entirety by the cautionary statements set forth in this paragraph. Undue reliance should not be placed on such statements. In addition, material risks that could cause actual results to differ from forward-looking statements include: the inherent uncertainty associated with financial or other projections; the integration of Mitel and Polycom and the ability to recognize the anticipated benefits from the combination of Mitel and Polycom; the ability to obtain required regulatory approvals for the transaction, the timing of obtaining such approvals and the risk that such approvals may result in the imposition of conditions that could adversely affect the expected benefits of the transaction; the risk that the conditions to the transaction are not satisfied on a timely basis or at all and the failure of the transaction to close for any other reason; risks relating to the value of the Mitel common shares to be issued in connection with the transaction; the anticipated size of the markets and continued demand for Mitel and Polycom products and services, the impact of competitive products and pricing and disruption to

Mitel’s and Polycom’s respective businesses that could result from the announcement of the transaction; access to available financing on a timely basis and on reasonable terms, including the refinancing of Mitel and Polycom debt to fund the cash portion of the consideration in connection with the transaction; the integration of Mavenir and the ability to recognize the anticipated benefits from the acquisition of Mavenir; Mitel’s ability to achieve or sustain profitability in the future; fluctuations in quarterly and annual revenues and operating results; fluctuations in foreign exchange rates; current and ongoing global economic instability, political unrest and related sanctions; intense competition; reliance on channel partners for a significant component of sales; dependence upon a small number of outside contract manufacturers to manufacture products; and, Mitel’s ability to successfully implement and achieve its business strategies, including its growth of the company through acquisitions and the integration of recently acquired businesses and realization of synergies, including the pending acquisition of Polycom. Additional risks are described under the heading “Risk Factors” in Mitel’s Annual Report on Form 10-K for the year ended December 31, 2015 and in Mitel’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2016 filed with the U.S. Securities and Exchange Commission (the “SEC”) and Canadian securities regulatory authorities on February 29, 2016 and May 5, 2016, respectively, and in Polycom’s Annual Report on Form 10-K for the year ended December 31, 2015 and in Polycom’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2016 filed with the SEC on February 29, 2016 and April 28, 2016, respectively. Forward-looking statements speak only as of the date they are made. Except as required by law, neither Mitel nor Polycom has any intention or obligation to update or to publicly announce the results of any revisions to any of the forward-looking statements to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward-looking statements.

2 | ©2015 Mitel. Proprietary and Confidential.

Non-GAAP Financial Measurements

In an effort to provide investors with additional information regarding the company’s results as determined by generally accepted accounting principles (GAAP), the company also discusses, in its earnings press release and earnings presentation materials, the following Non-GAAP information which management believes provides useful information to investors. Mitel provides a reconciliation between GAAP and non-GAAP financial information in our quarterly results announcements and in the supplemental slides used in conjunction with the company’s quarterly call. This information is available on our website at www.mitel.com under the “Investor Relations” section http://investor.mitel.com/events.cfm.

Non-GAAP Financial Measures

This presentation includes references to non-GAAP financial measures including Adjusted EBITDA, non-GAAP net income, non-GAAP operating expenses, non-GAAP Revenues and non-GAAP Gross Margin. Non-GAAP financial measures do not have any standardized meaning and are therefore unlikely to be comparable to similar measures presented by other companies. We use these non-GAAP financial measures to assist management and investors in understanding our past financial performance and prospects for the future, including changes in our operating results, trends and marketplace performance, exclusive of unusual events or factors which do not directly affect what we consider to be our core operating performance. Non-GAAP measures are among the primary indicators management uses as a basis for our planning and forecasting of future periods. Investors are cautioned that non-GAAP financial measures should not be relied upon as a substitute for financial measures prepared in accordance with generally accepted accounting principles. Please see the reconciliation of non-GAAP financial measures to the most directly comparable U.S. GAAP measure attached to our quarterly results announcement.

Mitel completed the acquisition of Mavenir Systems Inc. on April 29, 2015. “As reported” results in our quarterly results announcement and the attached tables refer to the U.S. GAAP results of Mitel, which include the results of Mavenir from the date of acquisition. Pro-forma results reflect the results of the company as if it had been fully combined with Mavenir Systems for the full presented period. Non-GAAP Revenues and non-GAAP Gross Margin have been adjusted to exclude the effect of purchase accounting. These adjustments have no impact on Mitel’s business or cash flows, but adversely affect the

Company`s reported revenues and gross margin in the period following an acquisition. For a reconciliation of Mitel’s as-reported results to the pro-forma results and non-GAAP results, please see the tables attached to our quarterly announcement as well as the Form 8-K presenting combined historical results of Mitel and Mavenir filed with the SEC on August 6, 2015.

Constant Currency Estimates

Management refers to growth rates at constant currency or adjusting for currency so that certain financial results can be viewed without the impact of fluctuations in foreign currency exchange rates, thereby facilitating period-to-period comparisons of the company’s business performance. Financial results adjusted for currency are calculated by translating prior period activity in local currency using the current period currency conversion rate. This approach is used for countries where the functional currency is the local currency. Generally, when the US dollar either strengthens or weakens against other currencies, the growth at constant currency rates or adjusting for currency will be higher or lower than growth reported at actual exchange rates.

Annualized Exit Monthly Cloud Recurring Revenue

Annualized Exit Monthly Cloud Recurring Revenue is a leading indicator of our anticipated cloud recurring revenues. We believe that trends in revenue are important to understanding the overall health of our cloud business. Our Annualized Exit Monthly Cloud Recurring Revenue equals our Monthly Cloud Recurring Revenue multiplied by 12. Our Monthly Cloud Recurring Revenue equals the monthly value of all customer subscriptions in effect at the end of a given month. For example, our Monthly Recurring Subscriptions at March 31, 2016 were $10.07 million. As such, our Annualized Exit Monthly Cloud Recurring Revenues at March 31, 2016 were $120.9 million.

3 | ©2015 Mitel. Proprietary and Confidential.

Additional Disclosures

No Offer or Solicitation

This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

Important Information For investors

In connection with the proposed transaction between Mitel and Polycom, Mitel will file with the SEC a registration statement on Form S-4 that is expected to include a Proxy Statement of Polycom that also constitutes a Prospectus of Mitel (the “Proxy Statement/Prospectus”). Mitel will also prepare a proxy circular in accordance with applicable Canadian securities and corporate law (the “Proxy Circular”). Polycom plans to mail to its shareholders the definitive Proxy Statement/Prospectus in connection with the transaction. INVESTORS AND SECURITY HOLDERS OF POLYCOM ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY WHEN IT BECOMES AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION ABOUT MITEL, POLYCOM, THE TRANSACTION AND RELATED MATTERS. Investors and security holders will be able to obtain free copies of the Proxy Statement/Prospectus and the Proxy Circular (when available) and other documents filed with the SEC by Mitel and Polycom through the website maintained by the SEC at www.sec.gov. Investors will also be able to obtain free copies of the Proxy Statement/Prospectus and the Proxy Circular (when available) and other documents filed with Canadian securities regulatory authorities by Mitel, through the website maintained by the Canadian Securities Administrators at www.sedar.com. In addition, investors and security holders will be able to obtain free copies of the documents filed with the SEC and Canadian securities regulatory authorities on Mitel’s website at investor.Mitel.com or by contacting Mitel’s Investor Relations Department at 469-574-8134. Copies of the documents filed with the SEC by Polycom will be available free of charge on Polycom’s website at http://investor.polycom.com/company/investor-relations/default.aspx or by contacting Polycom’s Investor Relations Department at 408-586-4271.

Participants in the Merger Solicitation

Mitel, Polycom and certain of their respective directors, executive officers and employees may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of the shareholders of Polycom in connection with the transaction, including a description of their respective direct or indirect interests, by security holdings or otherwise, will be included in the Proxy Statement/Prospectus described above when it is filed with the SEC and Canadian securities regulatory authorities. Additional information regarding Mitel’s directors and executive officers is also included in Mitel’s Annual Report on Form 10-K/A, which was filed with the SEC and Canadian securities regulatory authorities on April 27, 2016, and information regarding Polycom’s directors and executive officers is also included in Polycom’s Annual Report on Form 10-K/A, which was filed with the SEC on April 28, 2016. These documents are available free of charge as described above.

4 | ©2015 Mitel. Proprietary and Confidential.

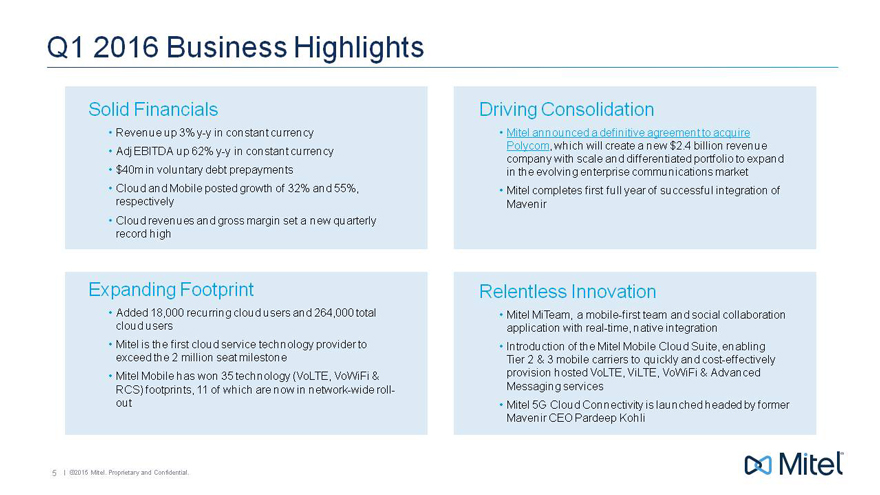

Q1 2016 Business Highlights

Solid Financials

Revenue up 3% y-y in constant currency

Adj EBITDA up 62% y-y in constant currency

$40m in voluntary debt prepayments

Cloud and Mobile posted growth of 32% and 55%, respectively

Cloud revenues and gross margin set a new quarterly record high

Driving Consolidation

Mitel announced a definitive agreement to acquire Polycom, which will create a new $2.4 billion revenue company with scale and differentiated portfolio to expand in the evolving enterprise communications market

Mitel completes first full year of successful integration of Mavenir

Expanding Footprint

Added 18,000 recurring cloud users and 264,000 total cloud users

Mitel is the first cloud service technology provider to exceed the 2 million seat milestone

Mitel Mobile has won 35 technology (VoLTE, VoWiFi & RCS) footprints, 11 of which are now in network-wide roll-out

Relentless Innovation

Mitel MiTeam, a mobile-first team and social collaboration application with real-time, native integration

Introduction of the Mitel Mobile Cloud Suite, enabling Tier 2 & 3 mobile carriers to quickly and cost-effectively provision hosted VoLTE, ViLTE, VoWiFi & Advanced Messaging services

Mitel 5G Cloud Connectivity is launched headed by former Mavenir CEO Pardeep Kohli

5 | ©2015 Mitel. Proprietary and Confidential.

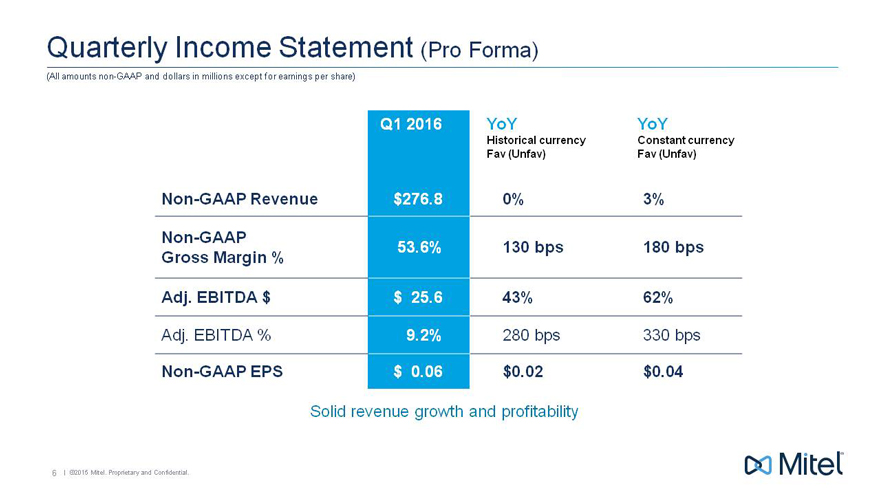

Quarterly Income Statement (Pro Forma)

(All amounts non-GAAP and dollars in millions except for earnings per share)

Q1 2016 YoY YoY

Historical currency Constant currency

Fav (Unfav) Fav (Unfav)

Non-GAAP Revenue $276.8 0% 3%

Non-GAAP 53.6% 130 bps 180 bps

Gross Margin %

Adj. EBITDA $ $ 25.6 43% 62%

Adj. EBITDA % 9.2% 280 bps 330 bps

Non-GAAP EPS $ 0.06 $0.02 $0.04

Solid revenue growth and profitability

6 | ©2015 Mitel. Proprietary and Confidential.

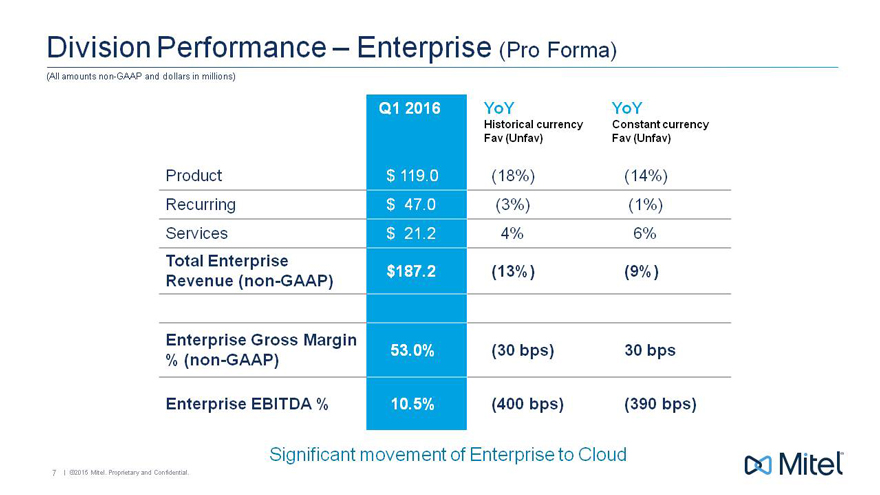

Division Performance – Enterprise (Pro Forma)

(All amounts non-GAAP and dollars in millions)

Q1 2016 YoY YoY

Historical currency Constant currency

Fav (Unfav) Fav (Unfav)

Product $ 119.0(18%)(14%)

Recurring $ 47.0(3%)(1%)

Services $ 21.2 4% 6%

Total Enterprise $ 187.2(13%)(9%)

Revenue (non-GAAP)

Enterprise Gross Margin 53.0%(30 bps) 30 bps

% (non-GAAP)

Enterprise EBITDA % 10.5%(400 bps)(390 bps)

Significant movement of Enterprise to Cloud

7 | ©2015 Mitel. Proprietary and Confidential.

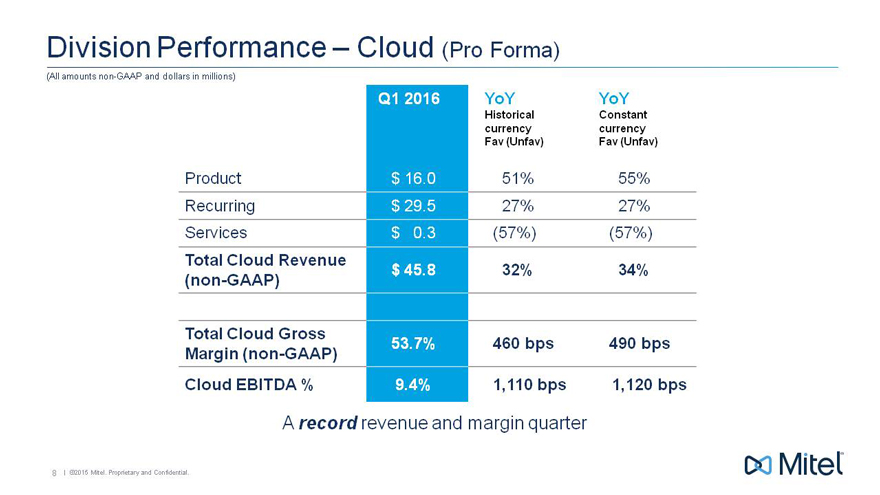

Division Performance – Cloud (Pro Forma)

(All amounts non-GAAP and dollars in millions)

Q1 2016 YoY YoY

Historical Constant

currency currency

Fav (Unfav) Fav (Unfav)

Product $ 16.0 51% 55%

Recurring $ 29.5 27% 27%

Services $ 0.3(57%)(57%)

Total Cloud Revenue $ 45.8 32% 34%

(non-GAAP)

Total Cloud Gross 53.7% 460 bps 490 bps

Margin (non-GAAP)

Cloud EBITDA % 9.4% 1,110 bps 1,120 bps

A record revenue and margin quarter

8 | ©2015 Mitel. Proprietary and Confidential.

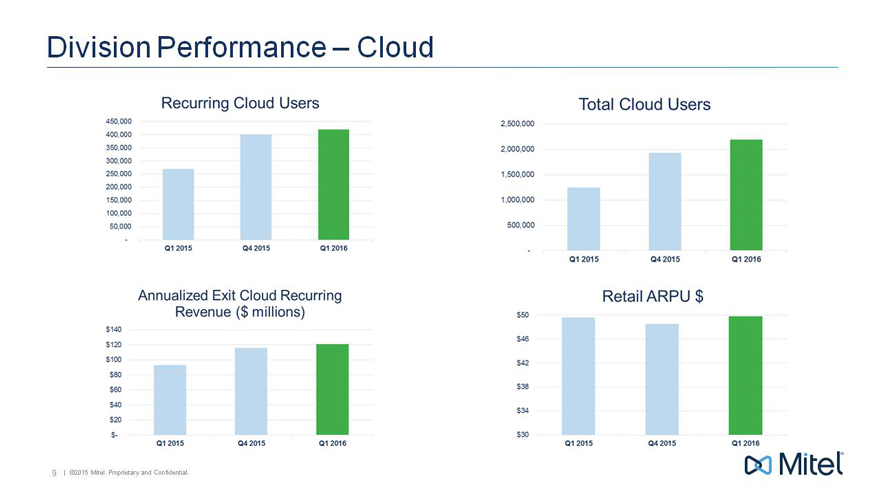

Division Performance – Cloud

450,000 400,000 350,000 250,000 200,000 150,000 100,000 50,000

Q1 2015 Q4 2015 Q1 2016

Total Cloud Users

2,500,000 2,000,000 1,500,000 1,000,000 500,000

Q1 2015 Q4 2015 Q1 2016

Annualized Exit Cloud Recurring Revenue ($ millions)

$140 $120 $100 $80 $60 $40 $20 $-

Q1 2015 Q4 2015 Q1 2016

Retail ARPU $

$60 $46 $42 $36 $34 $30

Q1 2015 Q4 2015 Q1 2016

9 | ©2015 Mitel. Proprietary and Confidential.

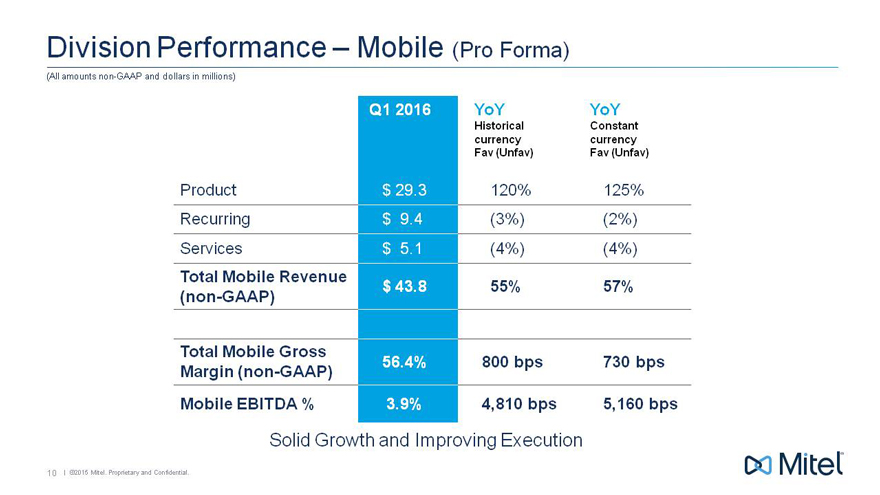

Division Performance – Mobile (Pro Forma)

(All amounts non-GAAP and dollars in millions)

Q1 2016 YoY YoY

Historical Constant

currency currency

Fav (Unfav) Fav (Unfav)

Product $ 29.3 120% 125%

Recurring $ 9.4(3%)(2%)

Services $ 5.1(4%)(4%)

Total Mobile Revenue $ 43.8 55% 57%

(non-GAAP)

Total Mobile Gross 56.4% 800 bps 730 bps

Margin (non-GAAP)

Mobile EBITDA % 3.9% 4,810 bps 5,160 bps

Solid Growth and Improving Execution

10 | ©2015 Mitel. Proprietary and Confidential.

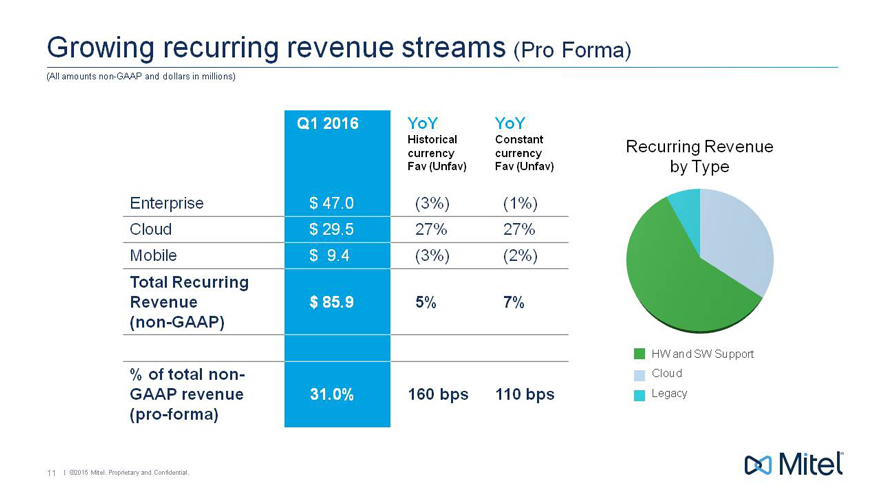

Growing recurring revenue streams (Pro Forma)

(All amounts non-GAAP and dollars in millions)

Q1 2016 YoY YoY

Historical Constant

currency currency

Fav (Unfav) Fav (Unfav)

Enterprise $ 47.0(3%)(1%)

Cloud $ 29.5 27% 27%

Mobile $ 9.4(3%)(2%)

Total Recurring

Revenue $ 85.9 5% 7%

(non-GAAP)

% of total non-

GAAP revenue 31.0% 160 bps 110 bps

(pro-forma)

Recurring Revenue by Type

HW and SW Support Cloud Legacy

11 | ©2015 Mitel. Proprietary and Confidential.

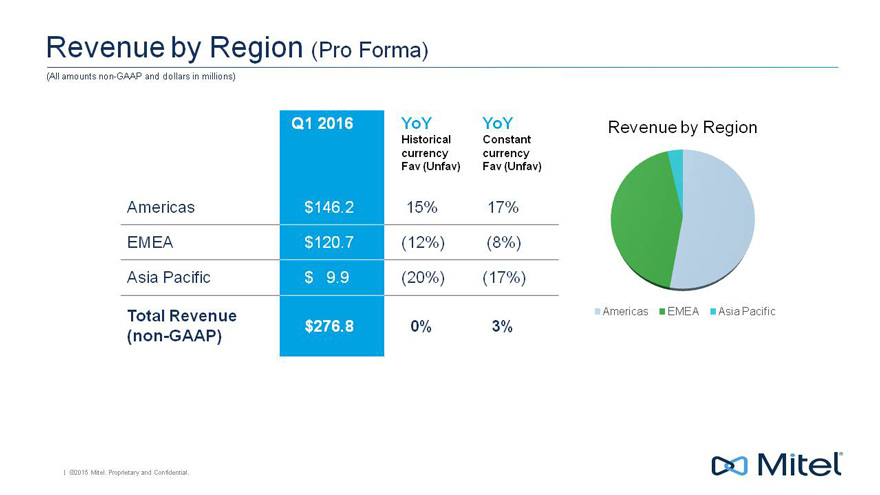

Revenue by Region (Pro Forma)

(All amounts non-GAAP and dollars in millions)

Q1 2016 YoY YoY

Historical Constant

currency currency

Fav (Unfav) Fav (Unf

Americas $146.2 15% 17%

EMEA $120.7(12%)(8%)

Asia Pacific $ 9.9(20%)(17%)

Total Revenue

(non-GAAP) $276.8 0% 3%

Revenue by Region

Americas EMEA Asia Pacific

| ©2015 Mitel. Proprietary and Confidential.

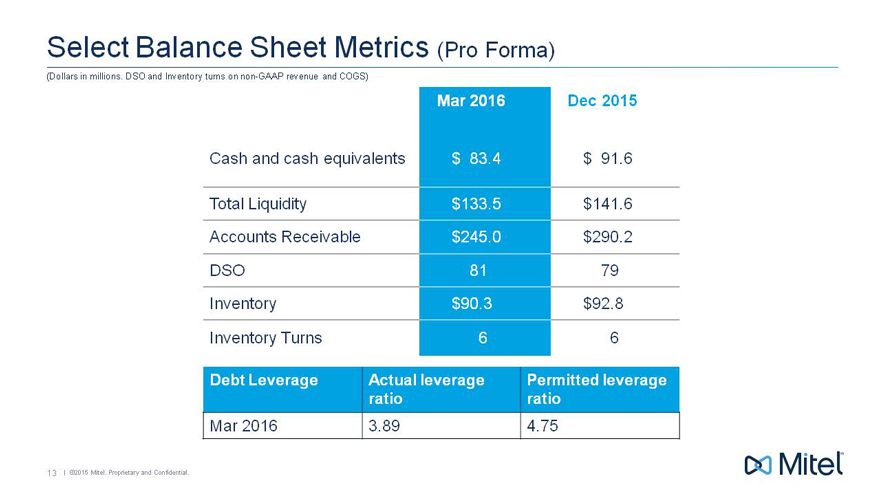

Select Balance Sheet Metrics (Pro Forma)

(Dollars in millions. DSO and Inventory turns on non-GAAP revenue and COGS)

Mar 2016 Dec 2015

Cash and cash equivalents $ 83.4 $ 91.6

Total Liquidity $ 133.5 $ 141.6

Accounts Receivable $ 245.0 $ 290.2

DSO 81 79

Inventory $ 90.3 $ 92.8

Inventory Turns 6 6

Debt Leverage Actual leverage Permitted leverage

ratio ratio

Mar 2016 3.89 4.75

13 | ©2015 Mitel. Proprietary and Confidential.

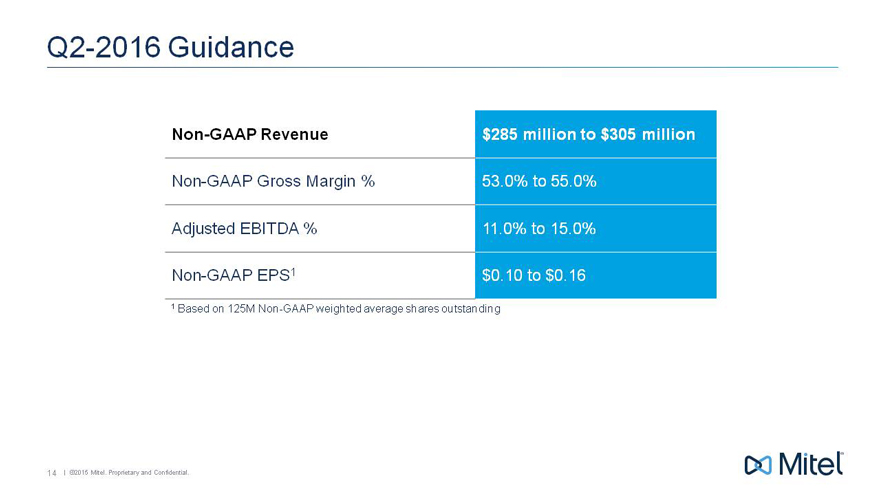

Q2-2016 Guidance

Non-GAAP Revenue $285 million to $305 million

Non-GAAP Gross Margin % 53.0% to 55.0%

Adjusted EBITDA % 11.0% to 15.0%

Non-GAAP EPS1 $0.10 to $0.16

1 Based on 125M Non-GAAP weighted average shares outstanding

14 | ©2015 Mitel. Proprietary and Confidential.

Recent Events

15 | ©2015 Mitel. Proprietary and Confidential.

Mitel + Polycom: A Compelling Strategic Acquisition

Significantly strengthens Mitel’s competitive and financial position

Creates $2.4B global collaboration leader across Enterprise, Cloud & Mobile

Achieves Immediate Operational and Financial Scale and Improved Capital Structure

Creates the ONLY company across Enterprise, Cloud & Mobile with all the technology pieces to deliver seamless collaboration and communication

Expands market leadership with addition of the #2 video brand in the world

Delivers attractive installed customer base with 82% of Fortune 500 companies and attractive potential revenue synergies

Enhanced EMEA presence

Delivers 2x revenue expansion to $2.4B

$160M targeted cost synergies by 2018

Combined pro forma EBITDA of more than $500M after synergies*

Immediately de-leverages net debt ratio from 3.9x to 2.1x

Expected to be accretive in calendar year 2017

*Assumes $160M of synergies by 2018

16 | ©2015 Mitel. Proprietary and Confidential.

Transaction Highlights

Transaction Summary

Mitel to acquire Polycom in a $1.96 billion transaction

Polycom shareholders will receive $3.12 per share in cash and 1.31 Mitel common shares for each share they hold

Represents 22% premium to Polycom’s “unaffected” share price on April 5, 2016

Transaction Structure

Combined company to be owned 40% by current Mitel shareholders and 60% by current Polycom shareholders

Polycom brand to be retained

Rich McBee to become CEO; Steve Spooner to become CFO

Combined company to be headquartered in Ottawa, Canada

2 Polycom directors to join Mitel board

Approvals and Timing

Unanimously approved by the Boards of Directors of both companies

Polycom and Mitel shareholder and regulatory approvals required

Expected to close in Q3 2016

17 | ©2015 Mitel. Proprietary and Confidential.

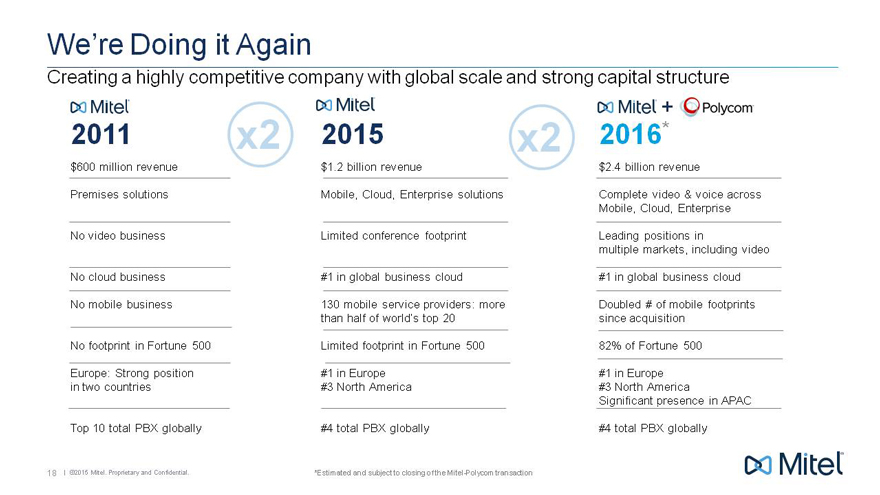

We’re Doing it Again

Creating a highly competitive company with global scale and strong capital structure

2011

$600 million revenue

Premises solutions

No video business

No cloud business

No mobile business

No footprint in Fortune 500

Europe: Strong position in two countries

Top 10 total PBX globally

x2

2015

$1.2 billion revenue

Mobile, Cloud, Enterprise solutions

Limited conference footprint

#1 in global business cloud

130 mobile service providers: more than half of world’s top 20

Limited footprint in Fortune 500

#1 in Europe

#3 North America #4 total PBX globally

2016*

$2.4 billion revenue

Complete video & voice across Mobile, Cloud, Enterprise

Leading positions in multiple markets, including video

#1 in global business cloud

Doubled # of mobile footprints since acquisition

82% of Fortune 500

#1 in Europe

#3 North America

Significant presence in APAC

#4 total PBX globally

x2

*Estimated and subject to closing of the Mitel-Polycom transaction

18 | ©2015 Mitel. Proprietary and Confidential.

Synergies Plan Update

Mitel/Polycom

May 2016

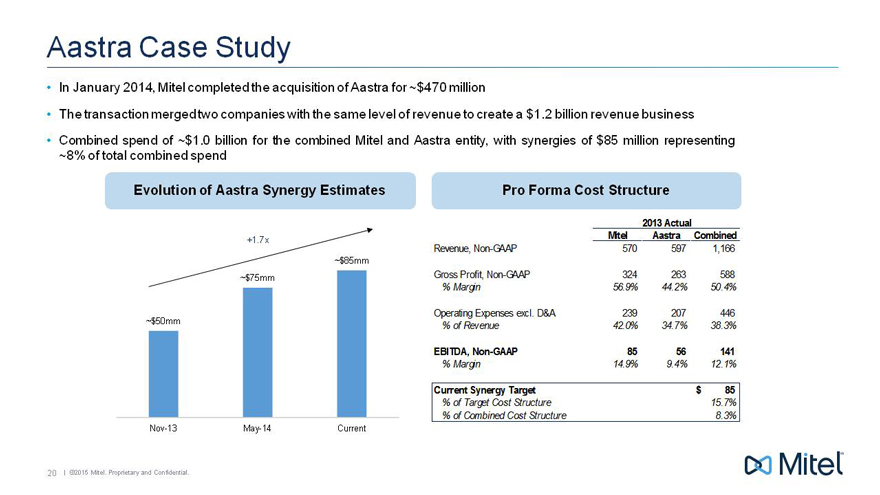

Aastra Case Study

In January 2014, Mitel completed the acquisition of Aastra for ~$470 million

The transaction merged two companies with the same level of revenue to create a $1.2 billion revenue business

Combined spend of ~$1.0 billion for the combined Mitel and Aastra entity, with synergies of $85 million representing ~8% of total combined spend

Evolution of Aastra Synergy Estimates

+1.7x

~$85mm

~$75mm

~$50mm

Nov-13 May-14 Current

Pro Forma Cost Structure

2013 Actual

Mitel Aastra Combined

Revenue, Non-GAAP 570 597 1,166

Gross Profit, Non-GAAP 324 263 588

% Margin 56.9% 44.2% 50.4%

Operating Expenses excl. D&A 239 207 446

% of Revenue 42.0% 34.7% 38.3%

EBITDA, Non-GAAP 85 56 141

% Margin 14.9% 9.4% 12.1%

Current Synergy Target $ 85

% of Target Cost Structure 15.7%

% of Combined Cost Structure 8.3%

20 | ©2015 Mitel. Proprietary and Confidential.

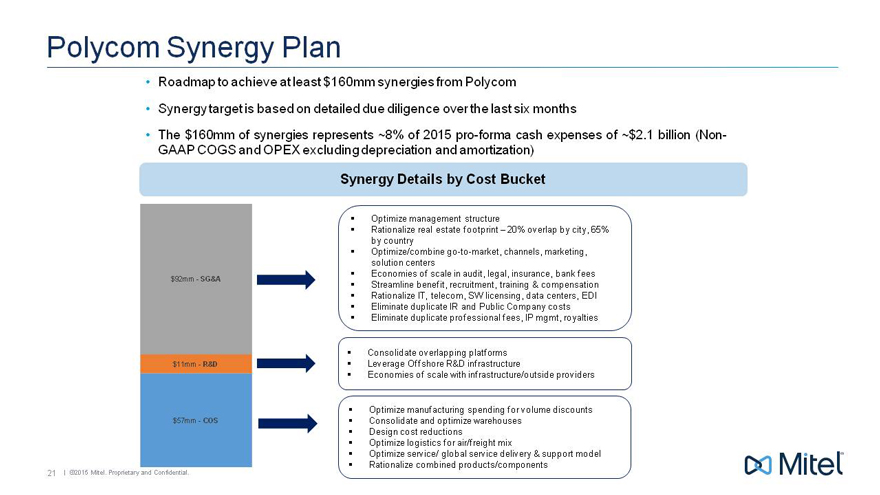

Polycom Synergy Plan

Roadmap to achieve at least $160mm synergies from Polycom

Synergy target is based on detailed due diligence over the last six months

The $160mm of synergies represents ~8% of 2015 pro-forma cash expenses of ~$2.1 billion (Non- GAAP COGS and OPEX excluding depreciation and amortization)

Synergy Details by Cost Bucket

$92mm—SG&A $11mm—R&D $57mm—COS

Optimize management structure

Rationalize real estate footprint – 20% overlap by city, 65% by country

Optimize/combine go-to-market, channels, marketing, solution centers

Economies of scale in audit, legal, insurance, bank fees

Streamline benefit, recruitment, training & compensation

Rationalize IT, telecom, SW licensing, data centers, EDI

Eliminate duplicate IR and Public Company costs

Eliminate duplicate professional fees, IP mgmt, royalties

Consolidate overlapping platforms

Leverage Offshore R&D infrastructure

Economies of scale with infrastructure/outside providers

Optimize manufacturing spending for volume discounts

Consolidate and optimize warehouses

Design cost reductions

Optimize logistics for air/freight mix

Optimize service/ global service delivery & support model

Rationalize combined products/components

21 | ©2015 Mitel. Proprietary and Confidential.

Appendix

22 | ©2015 Mitel. Proprietary and Confidential.

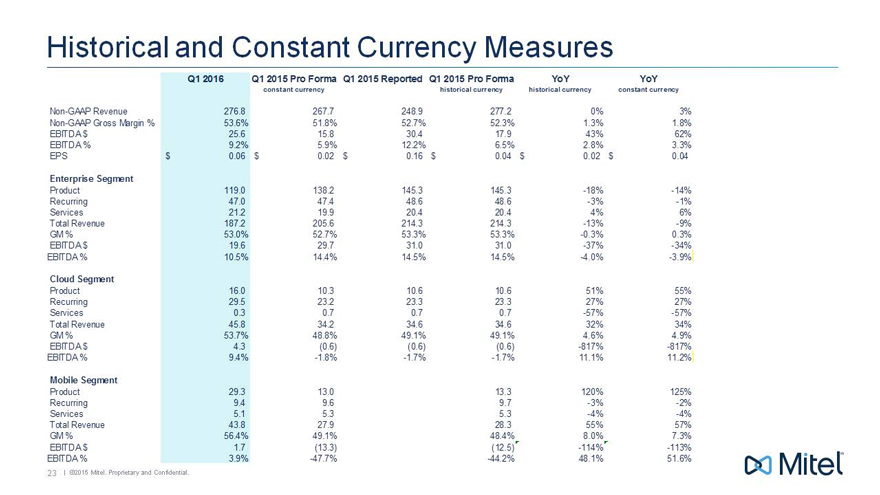

Historical and Constant Currency Measures

Q1 2016 Q1 2015 Pro Forma Q1 2015 Reported Q1 2015 Pro Forma YoY YoY

constant currency historical currency historical currency constant currency

Non-GAAP Revenue 276.8 267.7 248.9 277.2 0% 3%

Non-GAAP Gross Margin % 53.6% 51.8% 52.7% 52.3% 1.3% 1.8%

EBITDA $ 25.6 15.8 30.4 17.9 43% 62%

EBITDA % 9.2% 5.9% 12.2% 6.5% 2.8% 3.3%

EPS $ 0.06 $ 0.02 $ 0.16 $ 0.04 $ 0.02 $ 0.04

Enterprise Segment

Product 119.0 138.2 145.3 145.3 -18% -14%

Recurring 47.0 47.4 48.6 48.6 -3% -1%

Services 21.2 19.9 20.4 20.4 4% 6%

Total Revenue 187.2 205.6 214.3 214.3 -13% -9%

GM % 53.0% 52.7% 53.3% 53.3% -0.3% 0.3%

EBITDA $ 19.6 29.7 31.0 31.0 -37% -34%

EBITDA % 10.5% 14.4% 14.5% 14.5% -4.0% -3.9%

Cloud Segment

Product 16.0 10.3 10.6 10.6 51% 55%

Recurring 29.5 23.2 23.3 23.3 27% 27%

Services 0.3 0.7 0.7 0.7 -57% -57%

Total Revenue 45.8 34.2 34.6 34.6 32% 34%

GM % 53.7% 48.8% 49.1% 49.1% 4.6% 4.9%

EBITDA $ 4.3(0.6)(0.6)(0.6) -817% -817%

EBITDA % 9.4% -1.8% -1.7% -1.7% 11.1% 11.2%

Mobile Segment

Product 29.3 13.0 13.3 120% 125%

Recurring 9.4 9.6 9.7 -3% -2%

Services 5.1 5.3 5.3 -4% -4%

Total Revenue 43.8 27.9 28.3 55% 57%

GM % 56.4% 49.1% 48.4% 8.0% 7.3%

EBITDA $ 1.7(13.3)(12.5) -114% -113%

EBITDA % 3.9% -47.7% -44.2% 48.1% 51.6%

23 | ©2015 Mitel. Proprietary and Confidential.

#Mitel