Jefferies 2016 Technology Conference - Miami Mitel: A Global Communications and Collaboration Leader Across Enterprise, Cloud, and Mobile Steve Spooner, CFO May 12, 2016 Exhibit 99.1

Safe Harbor Statement Forward Looking Statements Some of the statements in this communication are forward-looking statements (or forward-looking information) within the meaning of applicable U.S. and Canadian securities laws. These include statements using the words believe, target, outlook, may, will, should, could, estimate, continue, expect, intend, plan, predict, potential, project and anticipate, and similar statements which do not describe the present or provide information about the past. There is no guarantee that the expected events or expected results will actually occur. Such statements reflect the current views of management of Mitel and are subject to a number of risks and uncertainties. These statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, operational and other factors. Any changes in these assumptions or other factors could cause actual results to differ materially from current expectations. All forward-looking statements attributable to Mitel or Polycom, or persons acting on either of their behalf, are expressly qualified in their entirety by the cautionary statements set forth in this paragraph. Undue reliance should not be placed on such statements. In addition, material risks that could cause actual results to differ from forward-looking statements include: the inherent uncertainty associated with financial or other projections; the integration of Mitel and Polycom and the ability to recognize the anticipated benefits from the combination of Mitel and Polycom; the ability to obtain required regulatory approvals for the transaction, the timing of obtaining such approvals and the risk that such approvals may result in the imposition of conditions that could adversely affect the expected benefits of the transaction; the risk that the conditions to the transaction are not satisfied on a timely basis or at all and the failure of the transaction to close for any other reason; risks relating to the value of the Mitel common shares to be issued in connection with the transaction; the anticipated size of the markets and continued demand for Mitel and Polycom products and services, the impact of competitive products and pricing and disruption to Mitel’s and Polycom’s respective businesses that could result from the announcement of the transaction; access to available financing on a timely basis and on reasonable terms, including the refinancing of Mitel and Polycom debt to fund the cash portion of the consideration in connection with the transaction; the integration of Mavenir and the ability to recognize the anticipated benefits from the acquisition of Mavenir; Mitel’s ability to achieve or sustain profitability in the future; fluctuations in quarterly and annual revenues and operating results; fluctuations in foreign exchange rates; current and ongoing global economic instability, political unrest and related sanctions; intense competition; reliance on channel partners for a significant component of sales; dependence upon a small number of outside contract manufacturers to manufacture products; and, Mitel’s ability to successfully implement and achieve its business strategies, including its growth of the company through acquisitions and the integration of recently acquired businesses and realization of synergies, including the pending acquisition of Polycom. Additional risks are described under the heading “Risk Factors” in Mitel’s Annual Report on Form 10-K for the year ended December 31, 2015 and in Mitel’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2016 filed with the U.S. Securities and Exchange Commission (the “SEC”) and Canadian securities regulatory authorities on February 29, 2016 and May 5, 2016, respectively, and in Polycom’s Annual Report on Form 10-K for the year ended December 31, 2015 and in Polycom’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2016 filed with the SEC on February 29, 2016 and April 28, 2016, respectively. Forward-looking statements speak only as of the date they are made. Except as required by law, neither Mitel nor Polycom has any intention or obligation to update or to publicly announce the results of any revisions to any of the forward-looking statements to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward-looking statements.

In an effort to provide investors with additional information regarding the company's results as determined by generally accepted accounting principles (GAAP), the company also discusses, in its earnings press release and earnings presentation materials, the following Non-GAAP information which management believes provides useful information to investors. Mitel provides a reconciliation between GAAP and non-GAAP financial information in our quarterly results announcements and in the supplemental slides used in conjunction with the company’s quarterly call. This information is available on our website at www.mitel.com under the “Investor Relations” section http://investor.mitel.com/events.cfm. Non-GAAP Financial Measures This presentation includes references to non-GAAP financial measures including Adjusted EBITDA, non-GAAP net income, non-GAAP operating expenses, non-GAAP Revenues and non-GAAP Gross Margin. Non-GAAP financial measures do not have any standardized meaning and are therefore unlikely to be comparable to similar measures presented by other companies. We use these non-GAAP financial measures to assist management and investors in understanding our past financial performance and prospects for the future, including changes in our operating results, trends and marketplace performance, exclusive of unusual events or factors which do not directly affect what we consider to be our core operating performance. Non-GAAP measures are among the primary indicators management uses as a basis for our planning and forecasting of future periods. Investors are cautioned that non-GAAP financial measures should not be relied upon as a substitute for financial measures prepared in accordance with generally accepted accounting principles. Please see the reconciliation of non-GAAP financial measures to the most directly comparable U.S. GAAP measure attached to our quarterly results announcement. Mitel completed the acquisition of Mavenir Systems Inc. on April 29, 2015. “As reported” results in our quarterly results announcement and the attached tables refer to the U.S. GAAP results of Mitel, which include the results of Mavenir from the date of acquisition. Pro-forma results reflect the results of the company as if it had been fully combined with Mavenir Systems for the full presented period. Non-GAAP Revenues and non-GAAP Gross Margin have been adjusted to exclude the effect of purchase accounting. These adjustments have no impact on Mitel’s business or cash flows, but adversely affect the Company`s reported revenues and gross margin in the period following an acquisition. For a reconciliation of Mitel’s as-reported results to the pro-forma results and non-GAAP results, please see the tables attached to our quarterly announcement as well as the Form 8-K presenting combined historical results of Mitel and Mavenir filed with the SEC on August 6, 2015. Constant Currency Estimates Management refers to growth rates at constant currency or adjusting for currency so that certain financial results can be viewed without the impact of fluctuations in foreign currency exchange rates, thereby facilitating period-to-period comparisons of the company's business performance. Financial results adjusted for currency are calculated by translating prior period activity in local currency using the current period currency conversion rate. This approach is used for countries where the functional currency is the local currency. Generally, when the US dollar either strengthens or weakens against other currencies, the growth at constant currency rates or adjusting for currency will be higher or lower than growth reported at actual exchange rates. Annualized Exit Monthly Cloud Recurring Revenue Annualized Exit Monthly Cloud Recurring Revenue is a leading indicator of our anticipated cloud recurring revenues. We believe that trends in revenue are important to understanding the overall health of our cloud business. Our Annualized Exit Monthly Cloud Recurring Revenue equals our Monthly Cloud Recurring Revenue multiplied by 12. Our Monthly Cloud Recurring Revenue equals the monthly value of all customer subscriptions in effect at the end of a given month. For example, our Monthly Recurring Subscriptions at March 31, 2016 were $10.07 million. As such, our Annualized Exit Monthly Cloud Recurring Revenues at March 31, 2016 were $120.9 million. Non-GAAP Financial Measurements

Additional Disclosures No Offer or Solicitation This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. Important Information For investors In connection with the proposed transaction between Mitel and Polycom, Mitel will file with the SEC a registration statement on Form S-4 that is expected to include a Proxy Statement of Polycom that also constitutes a Prospectus of Mitel (the “Proxy Statement/Prospectus”). Mitel will also prepare a proxy circular in accordance with applicable Canadian securities and corporate law (the “Proxy Circular”). Polycom plans to mail to its shareholders the definitive Proxy Statement/Prospectus in connection with the transaction. INVESTORS AND SECURITY HOLDERS OF POLYCOM ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY WHEN IT BECOMES AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION ABOUT MITEL, POLYCOM, THE TRANSACTION AND RELATED MATTERS. Investors and security holders will be able to obtain free copies of the Proxy Statement/Prospectus and the Proxy Circular (when available) and other documents filed with the SEC by Mitel and Polycom through the website maintained by the SEC at www.sec.gov. Investors will also be able to obtain free copies of the Proxy Statement/Prospectus and the Proxy Circular (when available) and other documents filed with Canadian securities regulatory authorities by Mitel, through the website maintained by the Canadian Securities Administrators at www.sedar.com. In addition, investors and security holders will be able to obtain free copies of the documents filed with the SEC and Canadian securities regulatory authorities on Mitel’s website at investor.Mitel.com or by contacting Mitel’s Investor Relations Department at 469-574-8134. Copies of the documents filed with the SEC by Polycom will be available free of charge on Polycom’s website at http://investor.polycom.com/company/investor-relations/default.aspx or by contacting Polycom’s Investor Relations Department at 408-586-4271. Participants in the Merger Solicitation Mitel, Polycom and certain of their respective directors, executive officers and employees may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of the shareholders of Polycom in connection with the transaction, including a description of their respective direct or indirect interests, by security holdings or otherwise, will be included in the Proxy Statement/Prospectus described above when it is filed with the SEC and Canadian securities regulatory authorities. Additional information regarding Mitel’s directors and executive officers is also included in Mitel’s Annual Report on Form 10-K/A, which was filed with the SEC and Canadian securities regulatory authorities on April 27, 2016, and information regarding Polycom’s directors and executive officers is also included in Polycom’s Annual Report on Form 10-K/A, which was filed with the SEC on April 28, 2016. These documents are available free of charge as described above.

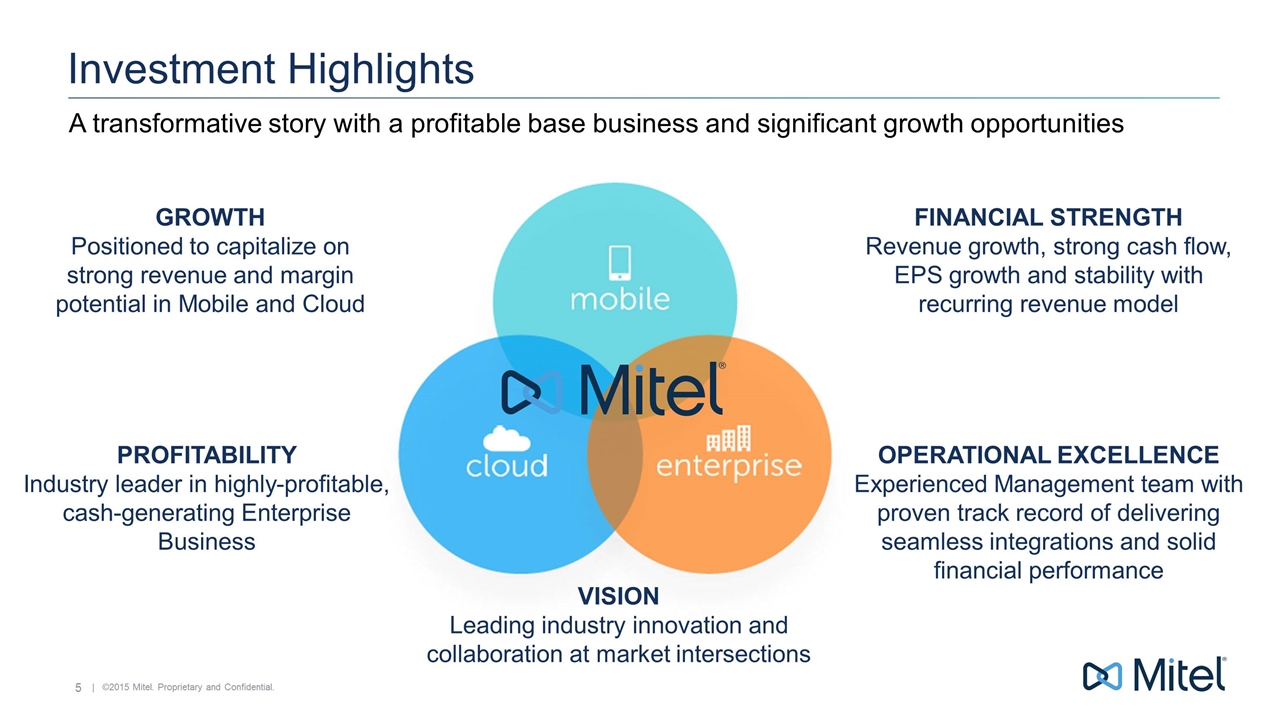

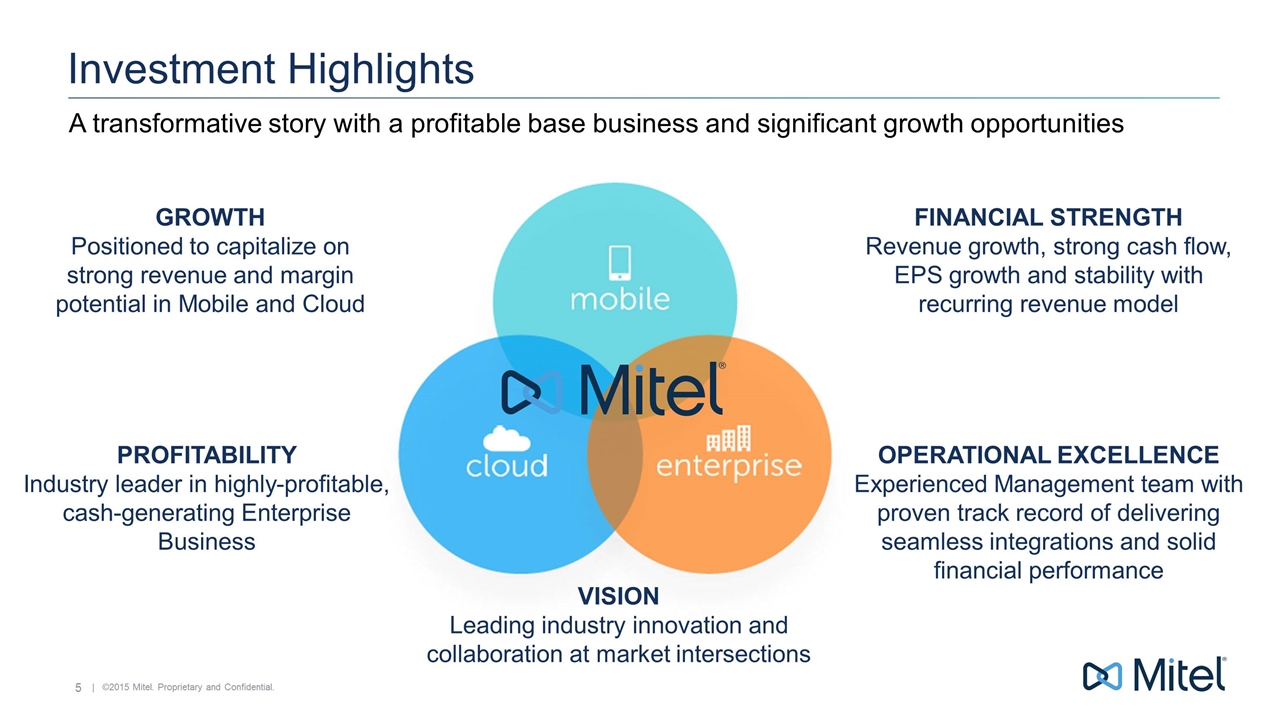

Investment Highlights PROFITABILITY Industry leader in highly-profitable, cash-generating Enterprise Business VISION Leading industry innovation and collaboration at market intersections OPERATIONAL EXCELLENCE Experienced Management team with proven track record of delivering seamless integrations and solid financial performance A transformative story with a profitable base business and significant growth opportunities GROWTH Positioned to capitalize on strong revenue and margin potential in Mobile and Cloud FINANCIAL STRENGTH Revenue growth, strong cash flow, EPS growth and stability with recurring revenue model

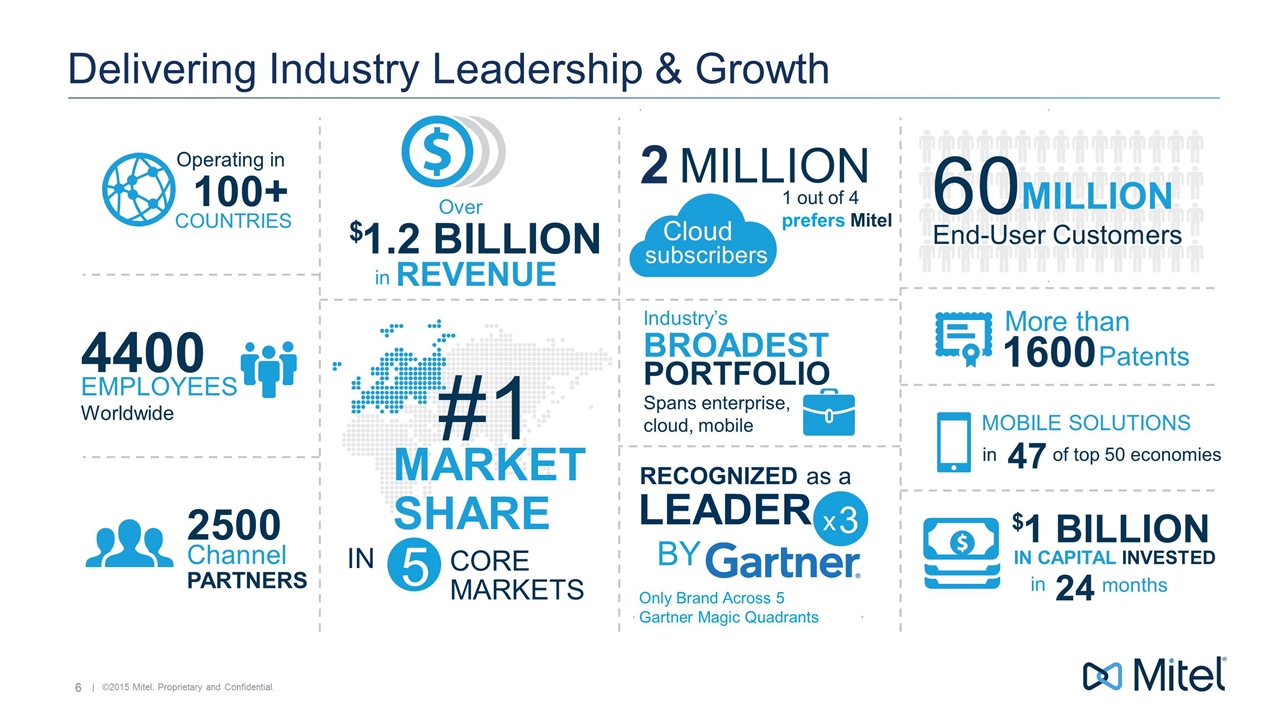

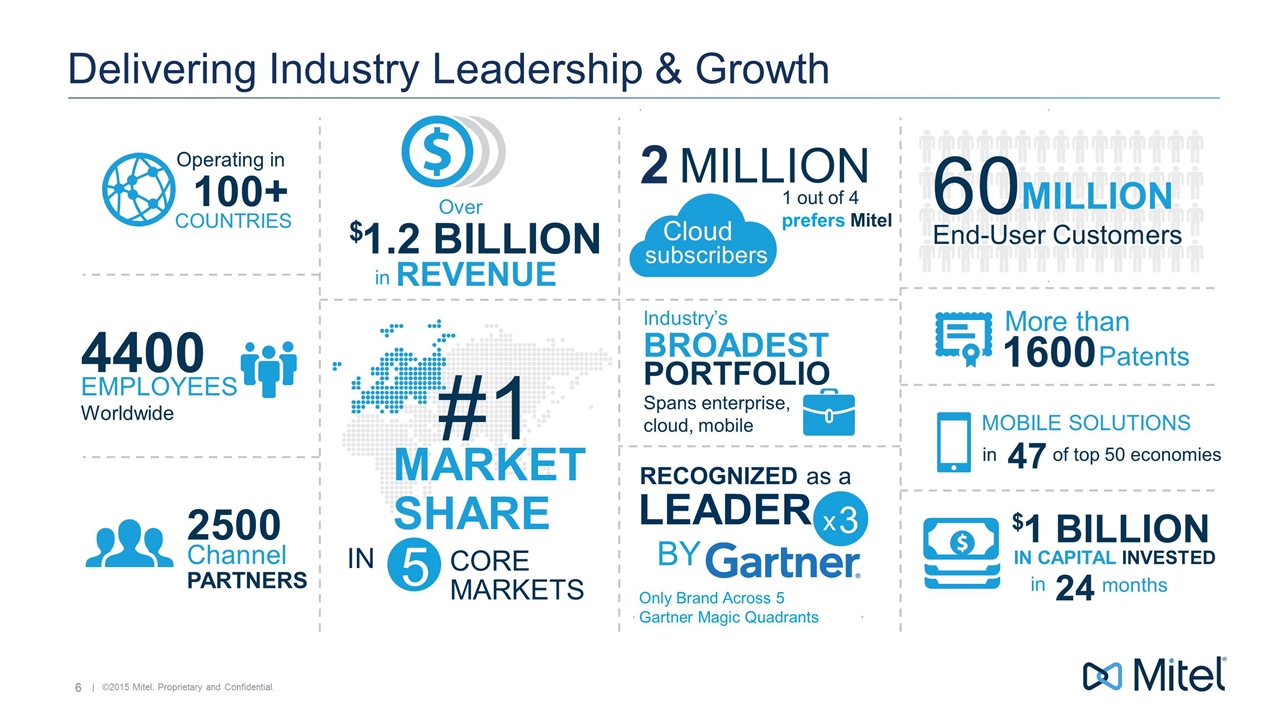

60 MILLION End-User Customers Operating in 100+ COUNTRIES 4400 EMPLOYEES Worldwide More than 1600 Patents MOBILE SOLUTIONS in 2500 Channel PARTNERS IN CAPITAL INVESTED $ 1 BILLION in 24 months 2 Cloud subscribers MILLION Over $ 1.2 BILLION in REVENUE #1 MARKET SHARE 1 out of 4 prefers Mitel MARKETS IN 5 CORE RECOGNIZED as a LEADER BY 3 x Only Brand Across 5 Gartner Magic Quadrants BROADEST PORTFOLIO Industry’s Spans enterprise, cloud, mobile 47 of top 50 economies Delivering Industry Leadership & Growth

2011 2016 to Meet Customers’ Needs Transforming Mobile, Cloud, Enterprise solutions #1 in global business cloud communications Mobile solutions in 47 of top 50 economies #1 Europe #3 North America #4 globally #1.2 billion revenue Premises solutions No cloud business No mobile business Europe: strong position in two countries Top 10 globally $600 million revenue

Only Company in for Business Communications Gartner MQs 5 Magic Quadrant for Corporate Telephony A Leader A Leader A Leader A Visionary A Challenger Magic Quadrant for Unified Communications Magic Quadrant for UC for Midsize Enterprises Magic Quadrant for Unified Communications as a Service Magic Quadrant for Contact Center Infrastructure

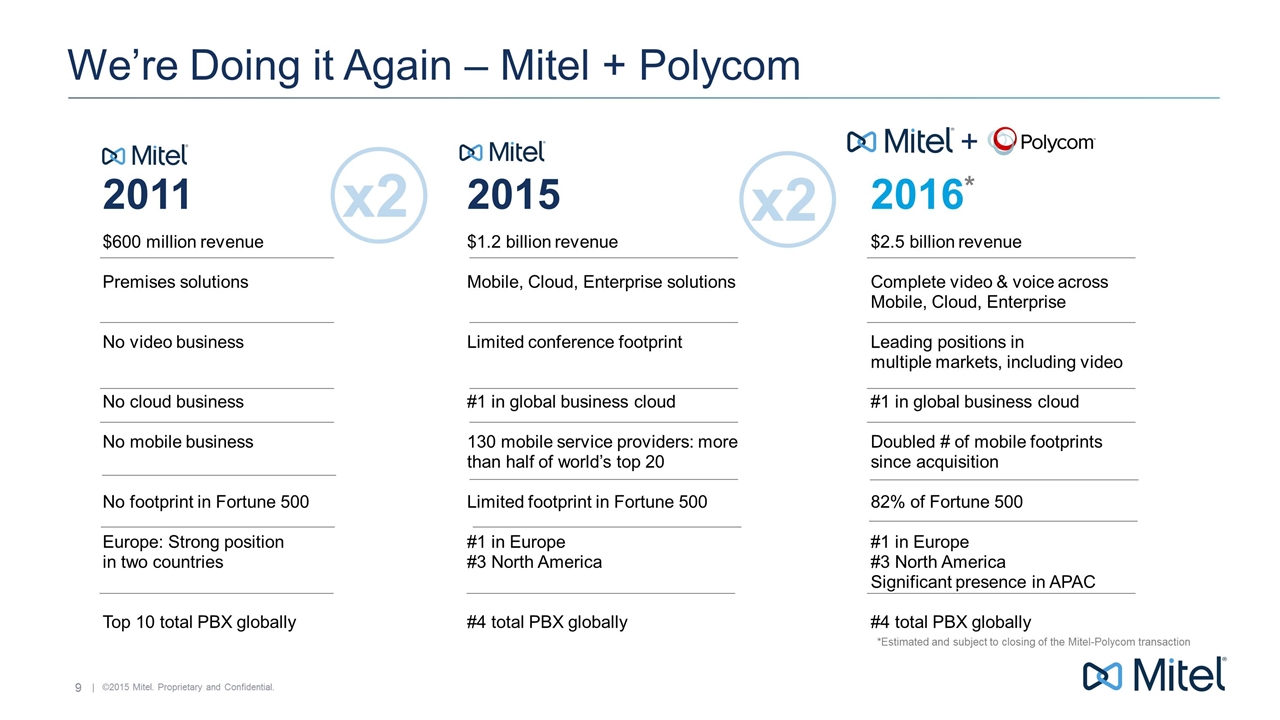

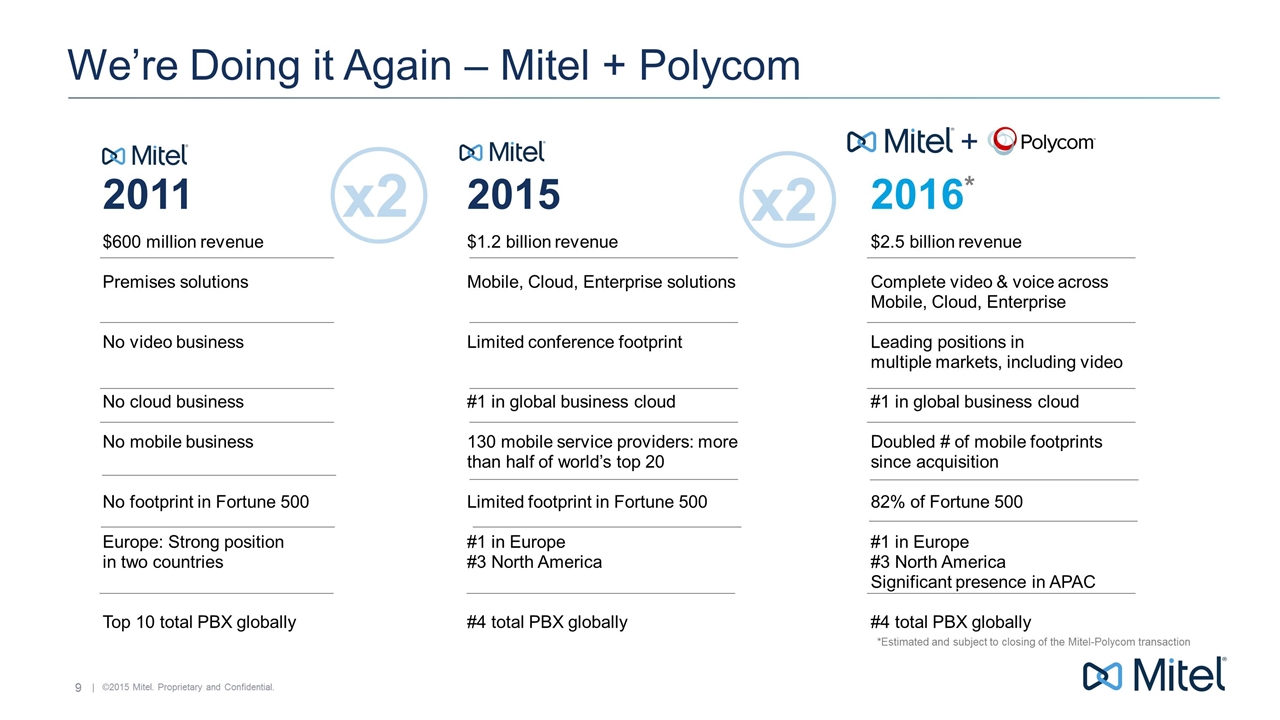

We’re Doing it Again �� Mitel + Polycom 2015 $1.2 billion revenue Mobile, Cloud, Enterprise solutions Limited conference footprint #1 in global business cloud 130 mobile service providers: more than half of world’s top 20 Limited footprint in Fortune 500 #1 in Europe #3 North America #4 total PBX globally 2016* $2.5 billion revenue Complete video & voice across Mobile, Cloud, Enterprise Leading positions in multiple markets, including video #1 in global business cloud Doubled # of mobile footprints since acquisition 82% of Fortune 500 #1 in Europe #3 North America Significant presence in APAC #4 total PBX globally 2011 $600 million revenue Premises solutions No video business No cloud business No mobile business No footprint in Fortune 500 Europe: Strong position in two countries Top 10 total PBX globally *Estimated and subject to closing of the Mitel-Polycom transaction x2 x2 +

Creates $2.4B global collaboration leader across Enterprise, Cloud & Mobile Achieves Immediate Operational and Financial Scale and Improved Capital Structure Creates the ONLY company across Enterprise, Cloud & Mobile with all the technology pieces to deliver seamless collaboration and communication Expands market leadership with addition of the #2 video brand in the world Delivers attractive installed customer base with 82% of Fortune 500 companies and attractive potential revenue synergies Enhanced EMEA presence Delivers 2x revenue expansion to $2.4B $160M targeted cost synergies by 2018 Combined pro forma EBITDA of more than $500M after synergies* Immediately de-leverages net debt ratio from 3.9x to 2.1x Expected to be accretive in calendar year 2017 *Assumes $160M of synergies by 2018 Creating a Highly Competitive Company with global scale and strong capital structure

Building a Competitive Powerhouse with Leading Market Share #1 #1 #1 #1 #2 #2 Conference phones Next-generation SIP sets Business cloud communications IP/PBX extensions in Europe Videoconferencing Installed audio Strong presence 100+ countries, expand in APAC In more than 82% of Fortune 500 companies Nearly 9,000 channel partners Deep product integration with Microsoft solutions RCS, VoWiFi, VoLTE in more than half of top 20 mobile operators More than 2,100 patents; 500 patents pending

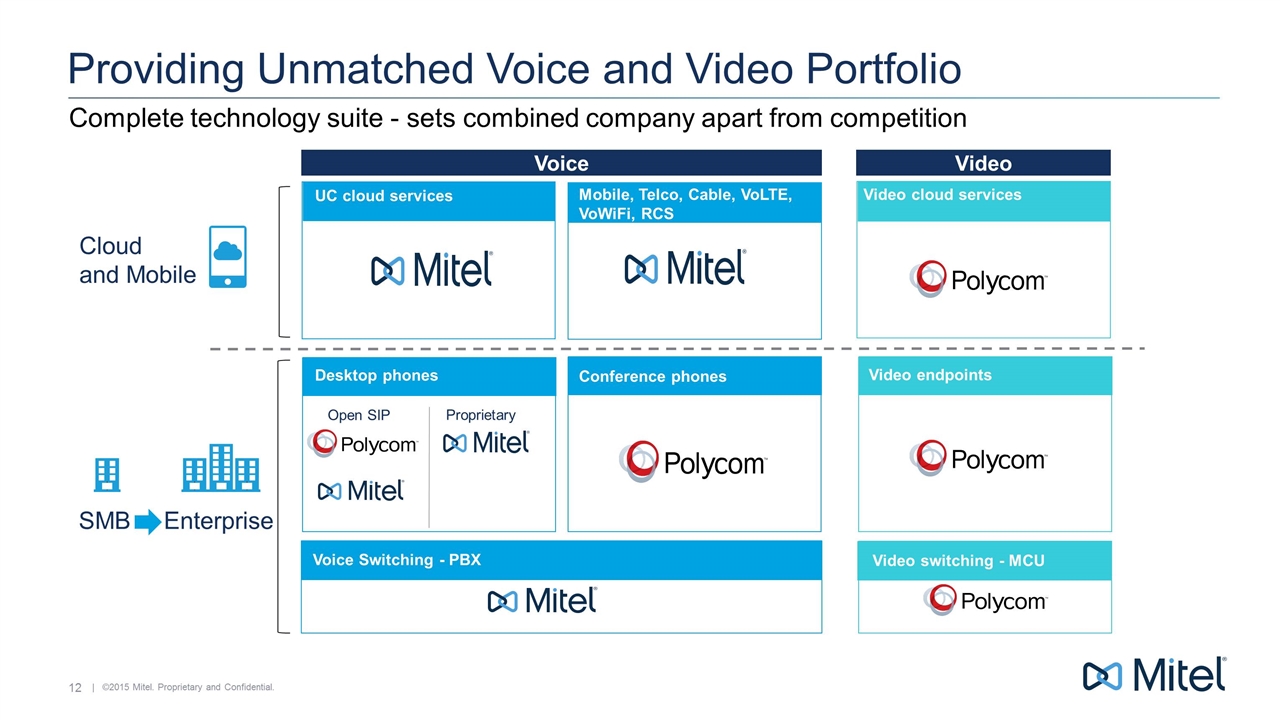

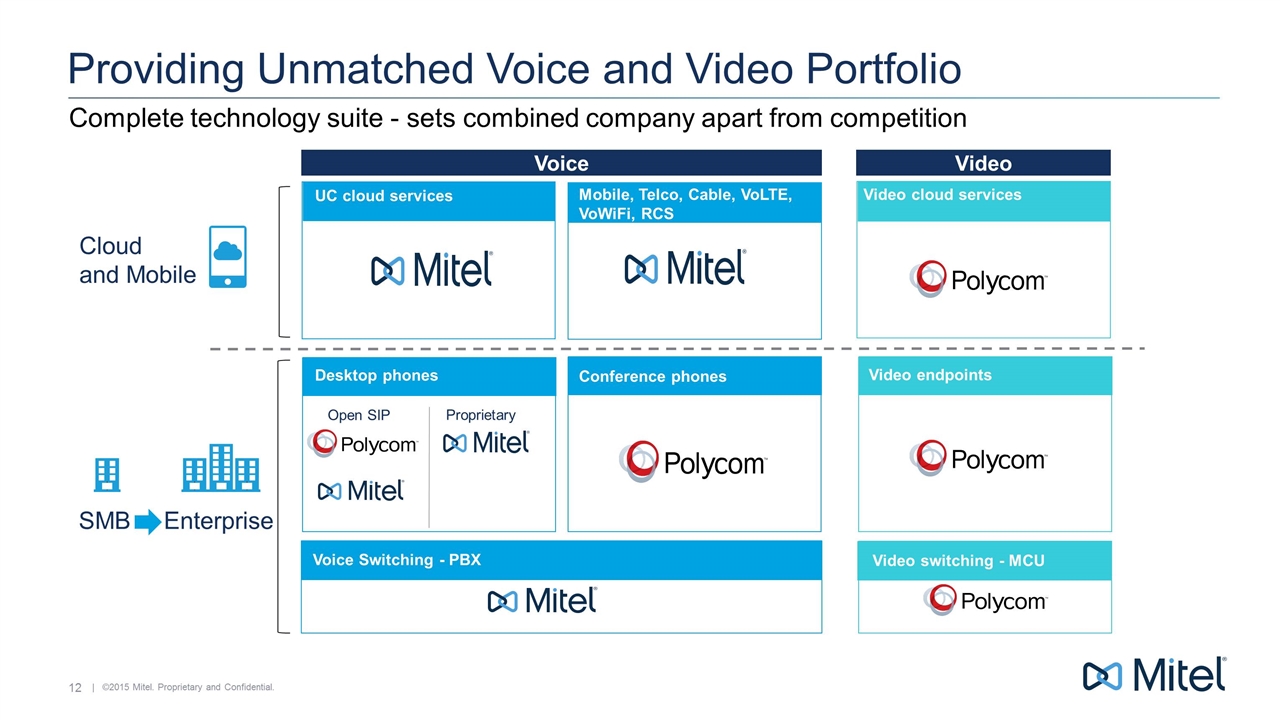

Providing Unmatched Voice and Video Portfolio Complete technology suite - sets combined company apart from competition Voice Open SIP Proprietary Cloud and Mobile Video UC cloud services Mobile, Telco, Cable, VoLTE, VoWiFi, RCS Video cloud services SMB Enterprise Desktop phones Conference phones Voice Switching - PBX Video endpoints Video switching - MCU

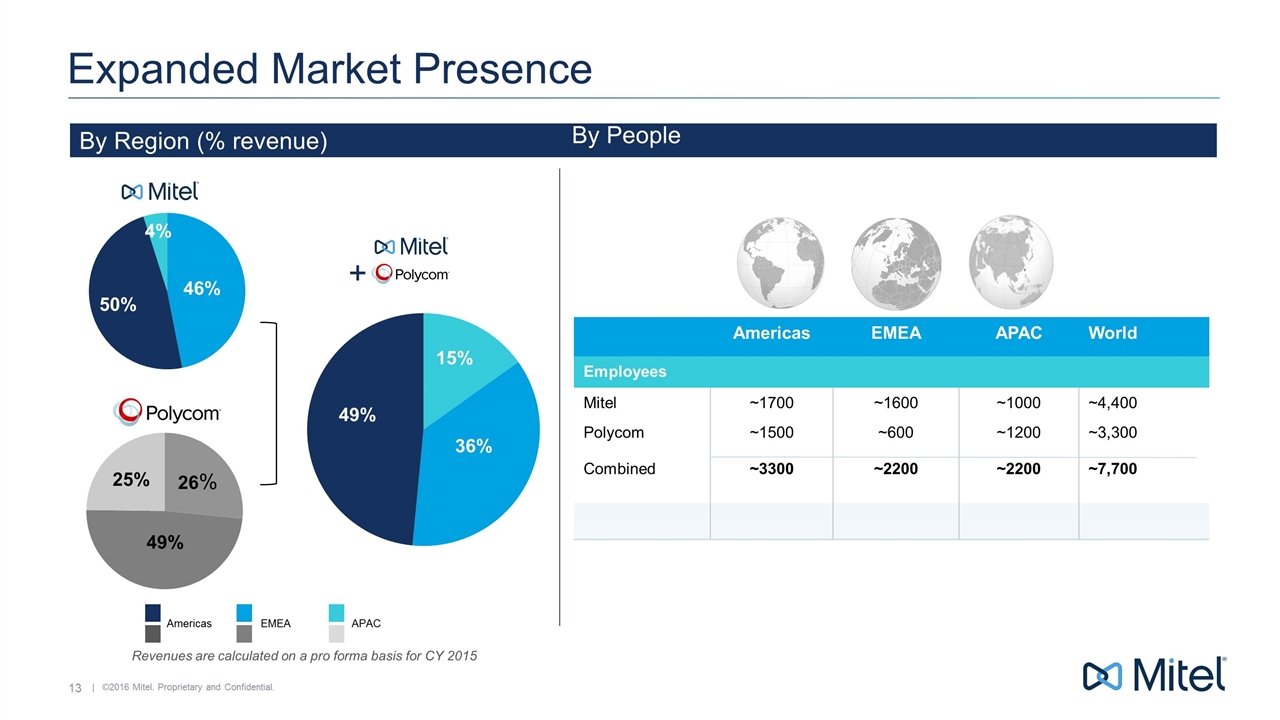

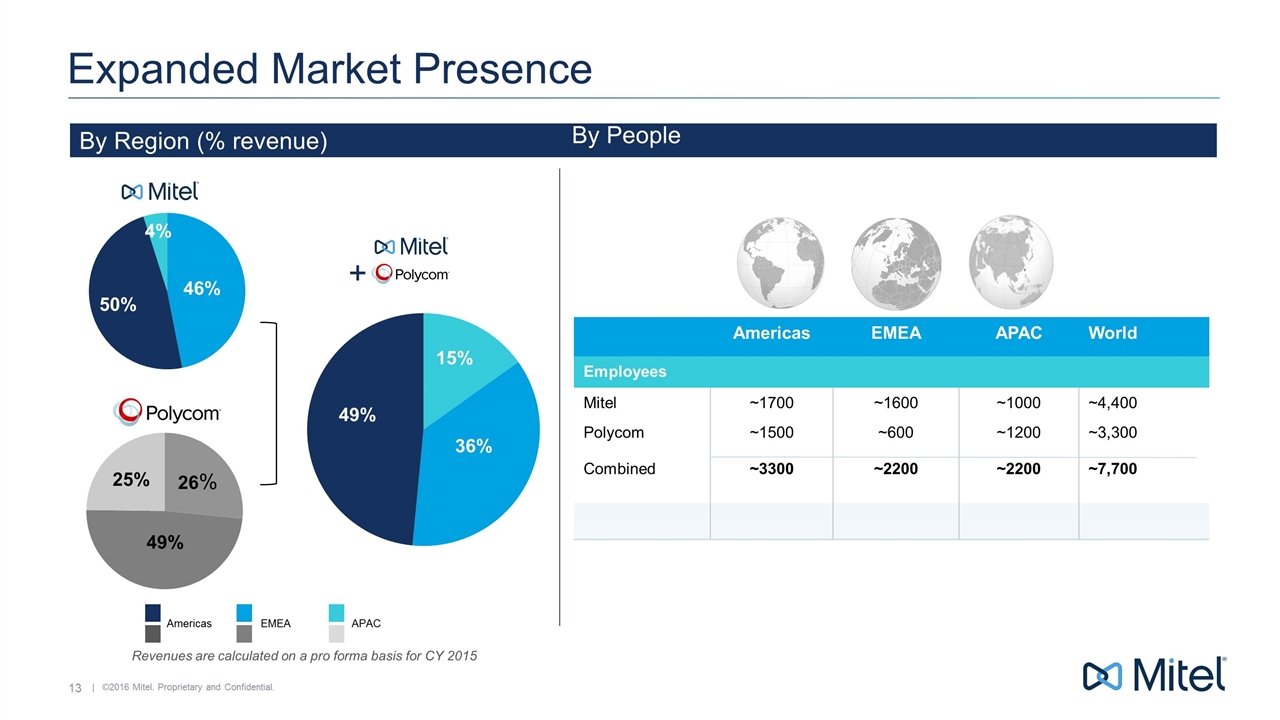

Expanded Market Presence 49% 49% 50% 4% + By Region (% revenue) By People Americas EMEA APAC World Employees Mitel ~1700 ~1600 ~1000 ~4,400 Polycom ~1500 ~600 ~1200 ~3,300 Combined ~3300 ~2200 ~2200 ~7,700 46% 49% 25% 15% 36% Americas EMEA APAC Revenues are calculated on a pro forma basis for CY 2015

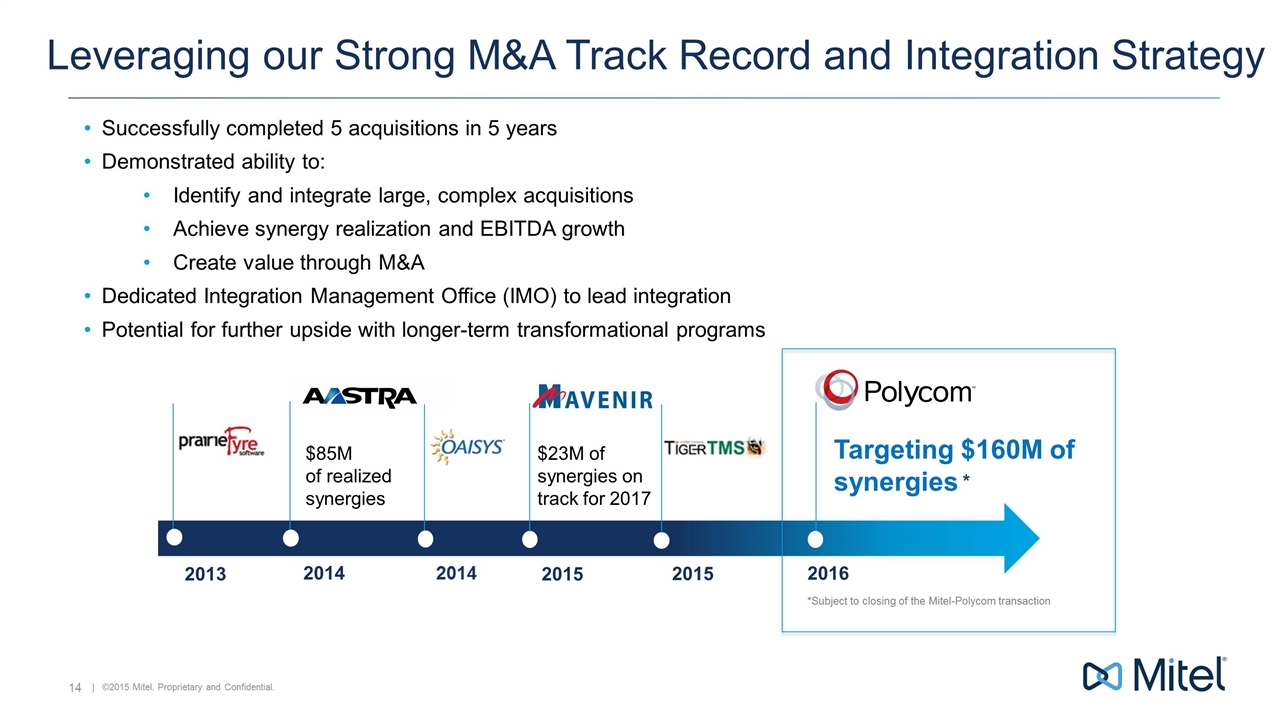

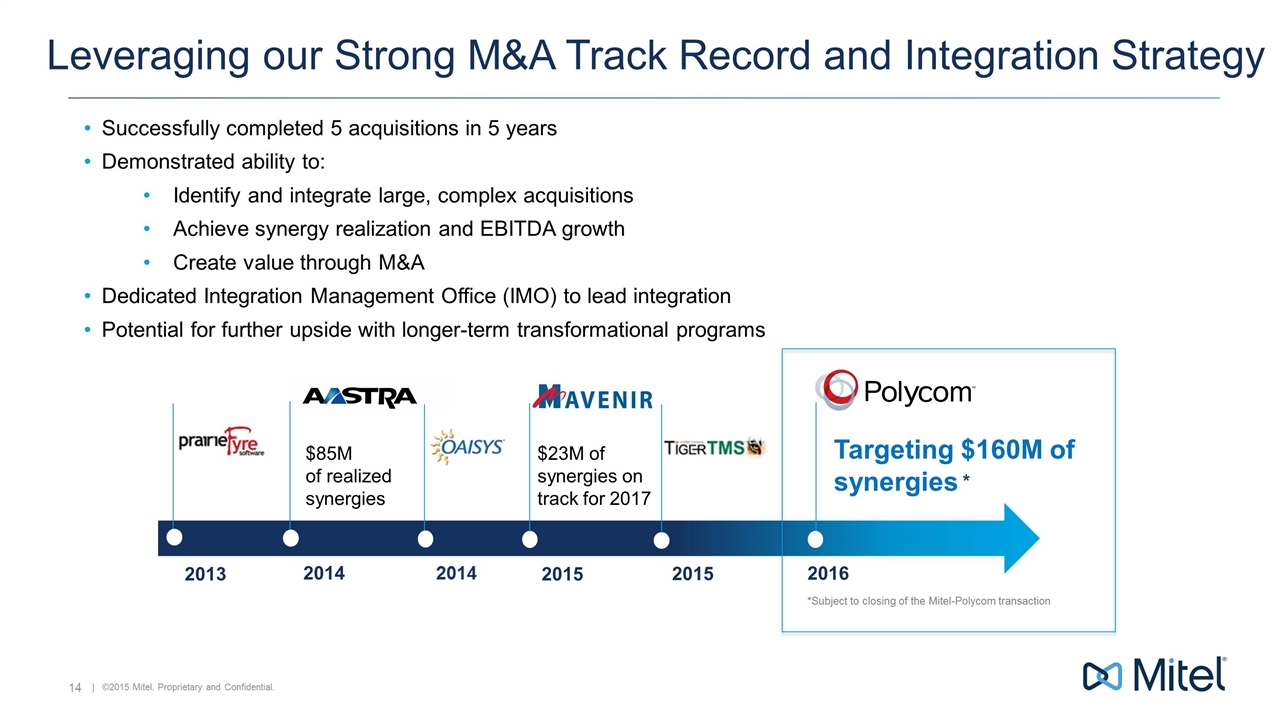

Leveraging our Strong M&A Track Record and Integration Strategy Successfully completed 5 acquisitions in 5 years Demonstrated ability to: Identify and integrate large, complex acquisitions Achieve synergy realization and EBITDA growth Create value through M&A Dedicated Integration Management Office (IMO) to lead integration Potential for further upside with longer-term transformational programs Targeting $160M of synergies $85M of realized synergies 2014 $23M of synergies on track for 2017 2015 2016 * *Subject to closing of the Mitel-Polycom transaction 2013 2015

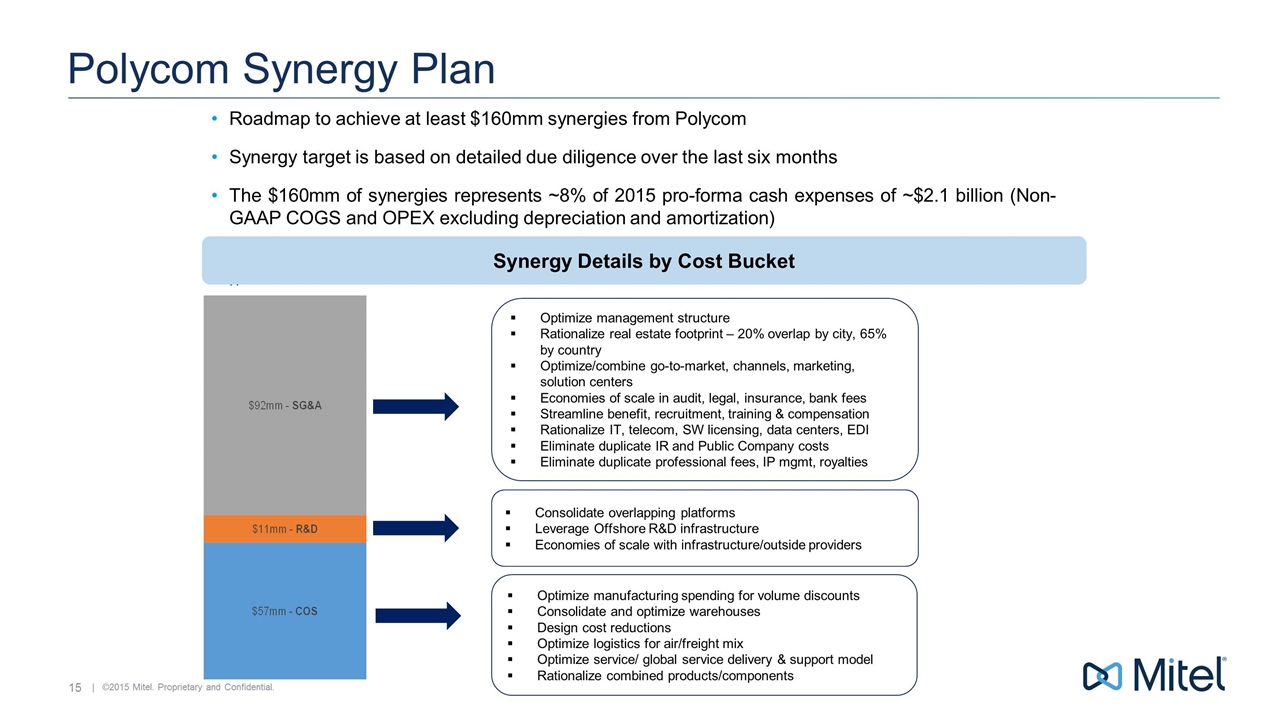

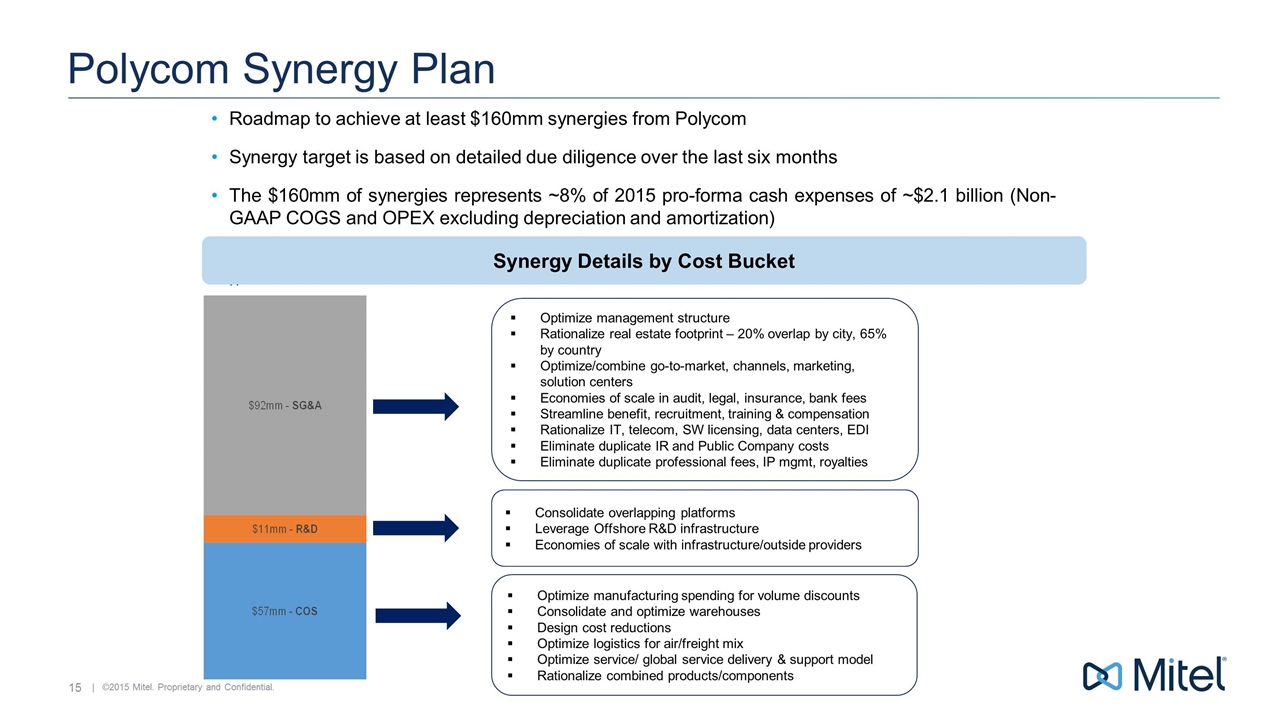

Roadmap to achieve at least $160mm synergies from Polycom Synergy target is based on detailed due diligence over the last six months The $160mm of synergies represents ~8% of 2015 pro-forma cash expenses of ~$2.1 billion (Non-GAAP COGS and OPEX excluding depreciation and amortization) )) Polycom Synergy Plan Synergy Details by Cost Bucket Optimize management structure Rationalize real estate footprint – 20% overlap by city, 65% by country Optimize/combine go-to-market, channels, marketing, solution centers Economies of scale in audit, legal, insurance, bank fees Streamline benefit, recruitment, training & compensation Rationalize IT, telecom, SW licensing, data centers, EDI Eliminate duplicate IR and Public Company costs Eliminate duplicate professional fees, IP mgmt, royalties Optimize manufacturing spending for volume discounts Consolidate and optimize warehouses Design cost reductions Optimize logistics for air/freight mix Optimize service/ global service delivery & support model Rationalize combined products/components Consolidate overlapping platforms Leverage Offshore R&D infrastructure Economies of scale with infrastructure/outside providers

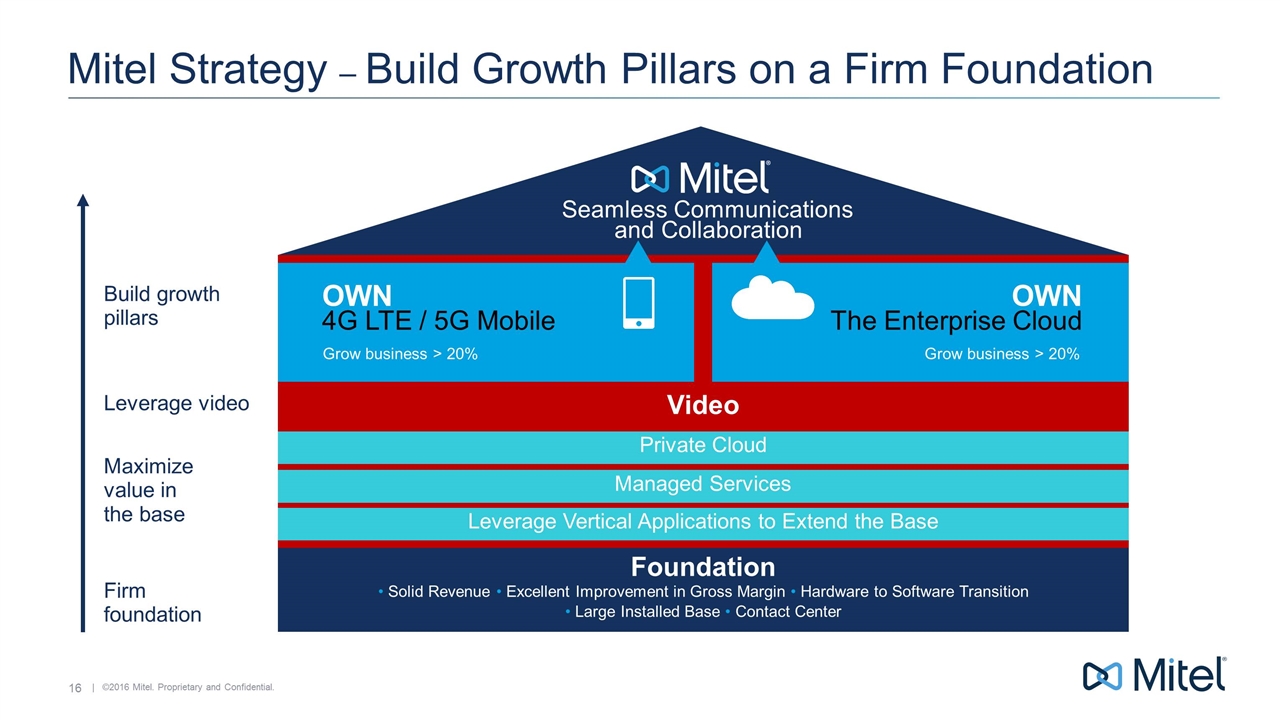

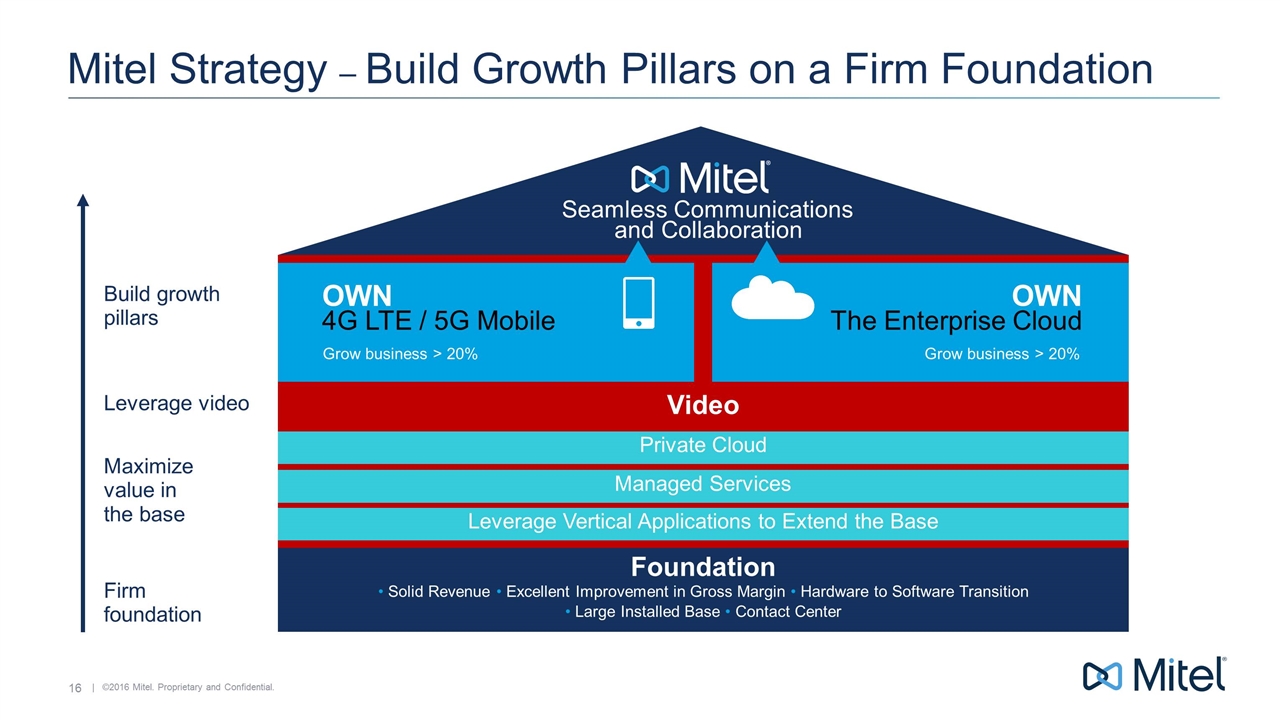

Mitel Strategy – Build Growth Pillars on a Firm Foundation OWN The Enterprise Cloud OWN 4G LTE / 5G Mobile Grow business > 20% Grow business > 20% Video Seamless Communications and Collaboration Private Cloud Managed Services Leverage Vertical Applications to Extend the Base Firm foundation Maximize value in the base Leverage video Build growth pillars Foundation • Solid Revenue • Excellent Improvement in Gross Margin • Hardware to Software Transition • Large Installed Base • Contact Center

Financial Overview

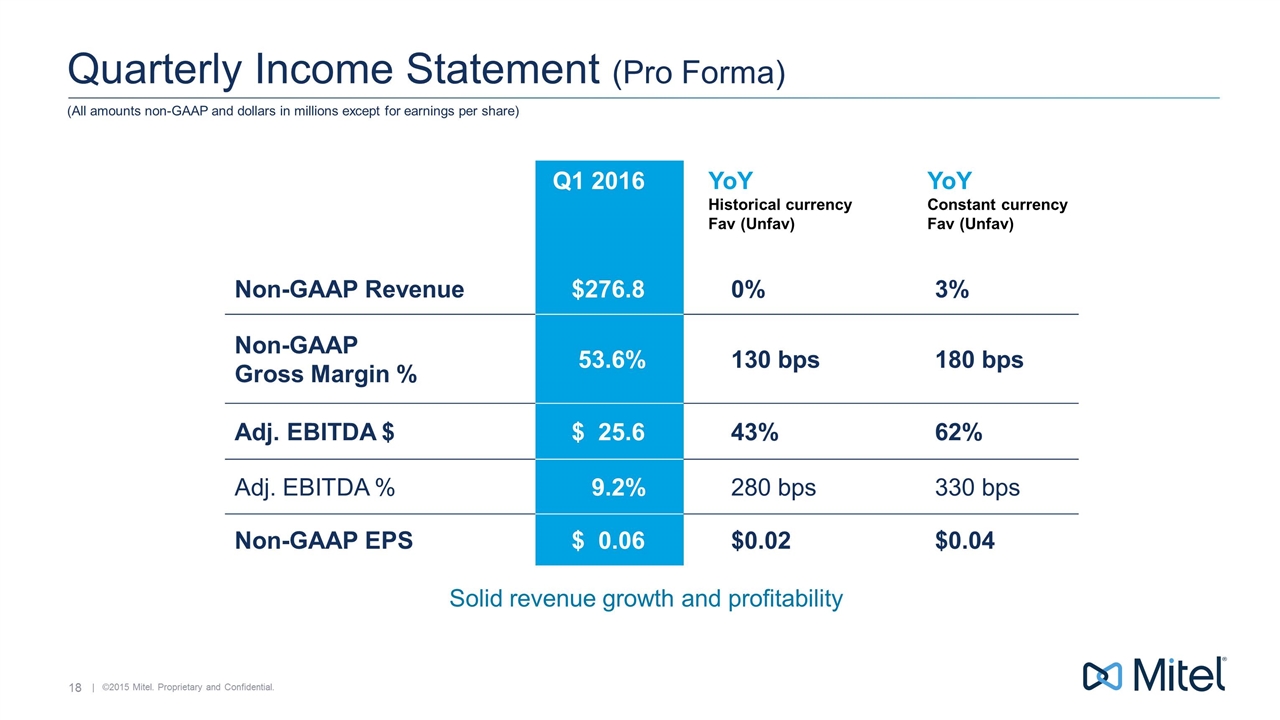

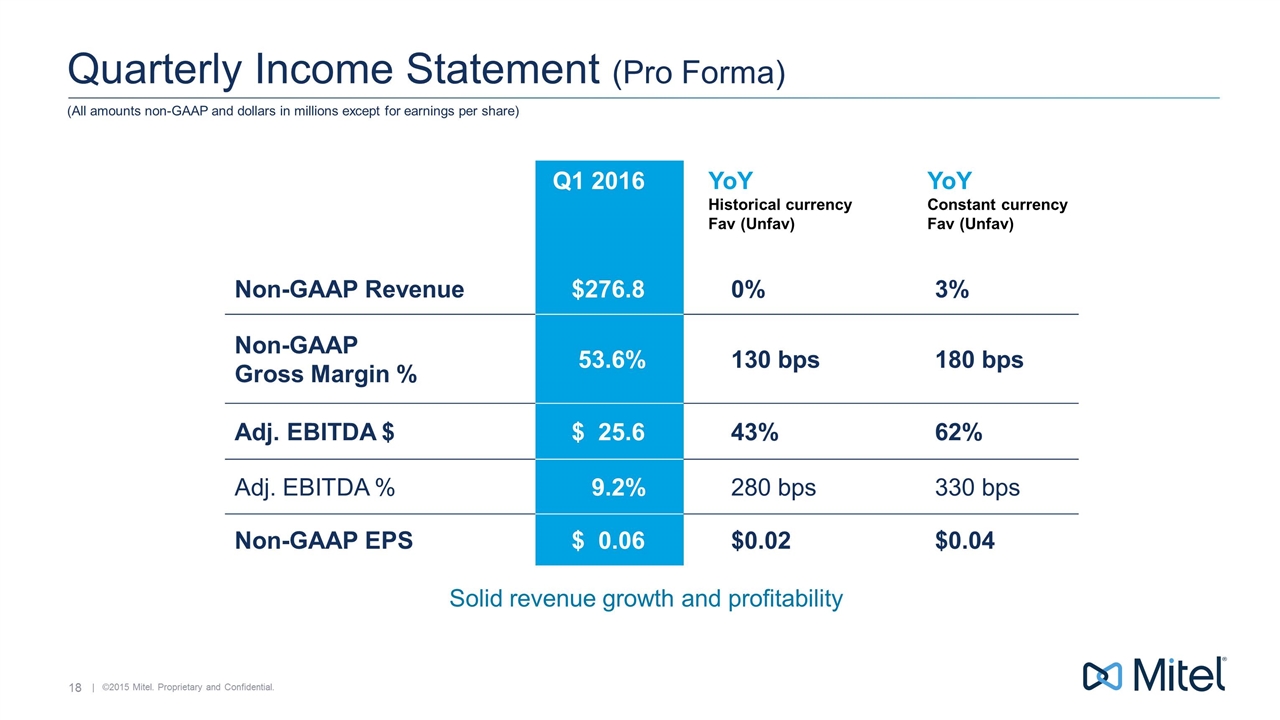

Quarterly Income Statement (Pro Forma) (All amounts non-GAAP and dollars in millions except for earnings per share) Q1 2016 YoY Historical currency Fav (Unfav) YoY Constant currency Fav (Unfav) Non-GAAP Revenue $276.8 0% 3% Non-GAAP Gross Margin % 53.6% 130 bps 180 bps Adj. EBITDA $ $ 25.6 43% 62% Adj. EBITDA % 9.2% 280 bps 330 bps Non-GAAP EPS $ 0.06 $0.02 $0.04 Solid revenue growth and profitability

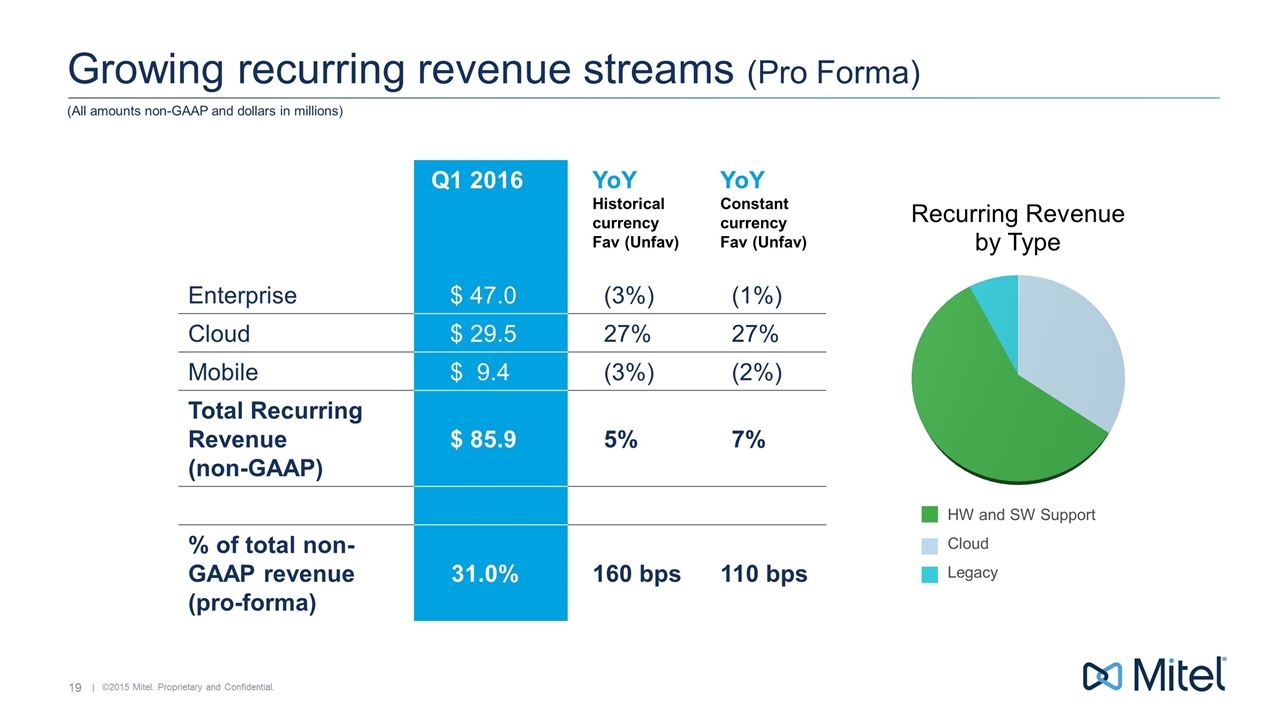

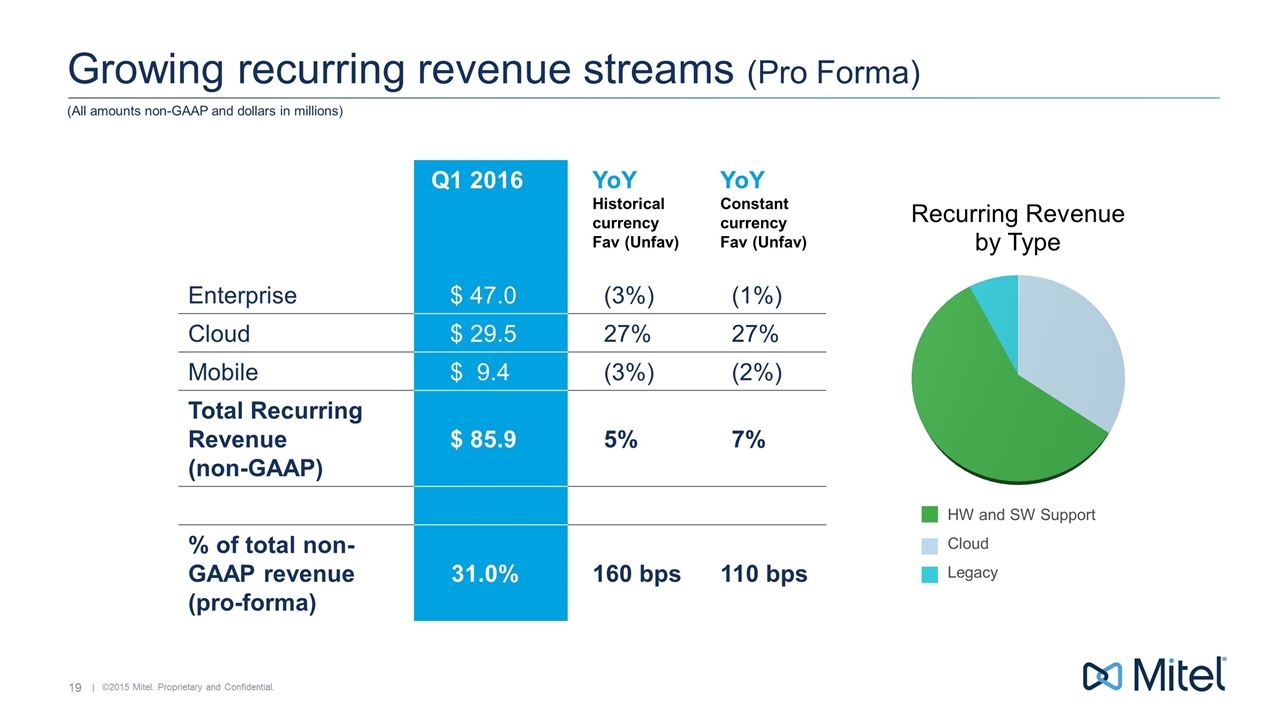

Growing recurring revenue streams (Pro Forma) Q1 2016 YoY Historical currency Fav (Unfav) YoY Constant currency Fav (Unfav) Enterprise $ 47.0 (3%) (1%) Cloud $ 29.5 27% 27% Mobile $ 9.4 (3%) (2%) Total Recurring Revenue (non-GAAP) $ 85.9 5% 7% % of total non-GAAP revenue (pro-forma) 31.0% 160 bps 110 bps HW and SW Support Cloud Legacy (All amounts non-GAAP and dollars in millions)

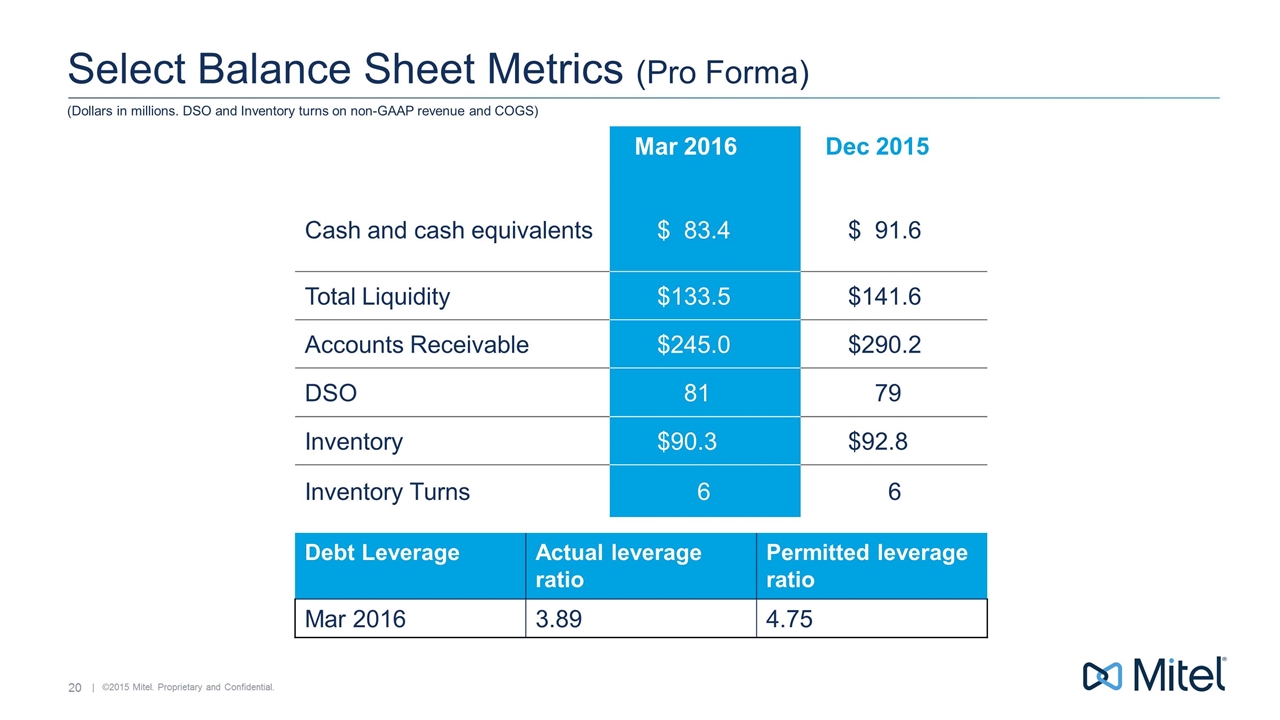

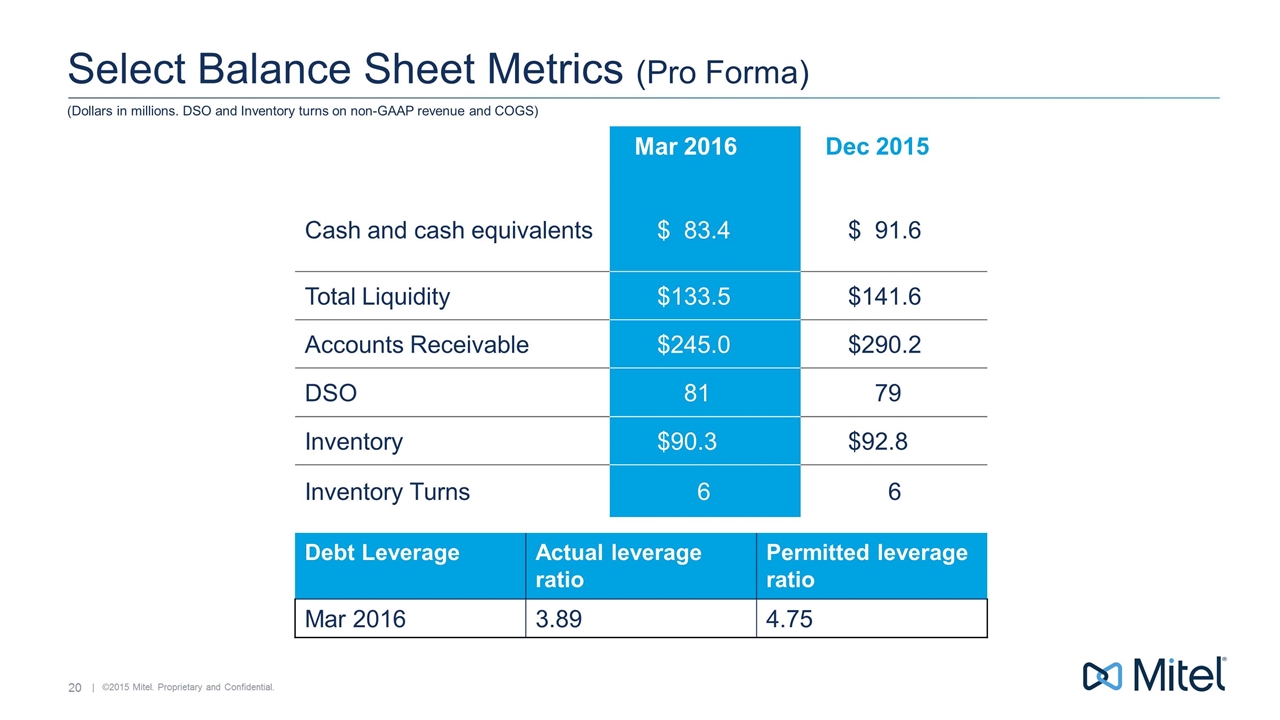

Select Balance Sheet Metrics (Pro Forma) Mar 2016 Dec 2015 Cash and cash equivalents $ 83.4 $ 91.6 Total Liquidity $133.5 $141.6 Accounts Receivable $245.0 $290.2 DSO 81 79 Inventory $90.3 $92.8 Inventory Turns 6 6 Debt Leverage Actual leverage ratio Permitted leverage ratio Mar 2016 3.89 4.75 (Dollars in millions. DSO and Inventory turns on non-GAAP revenue and COGS)

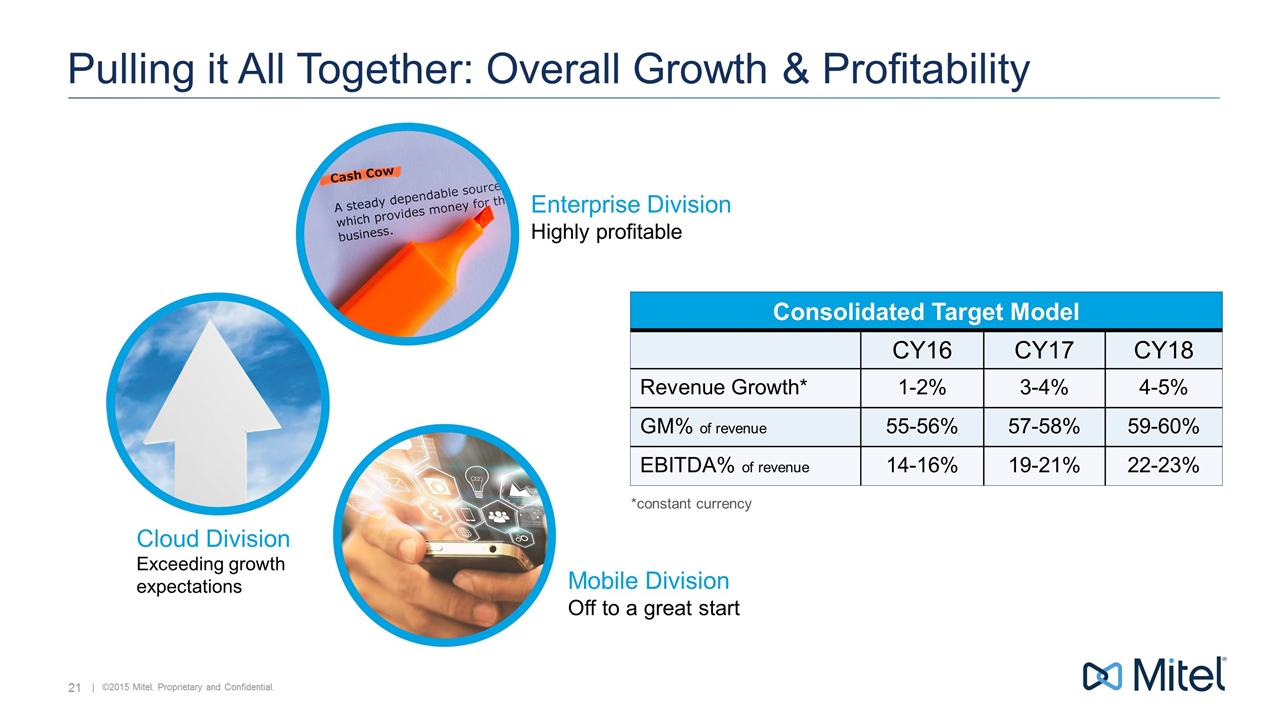

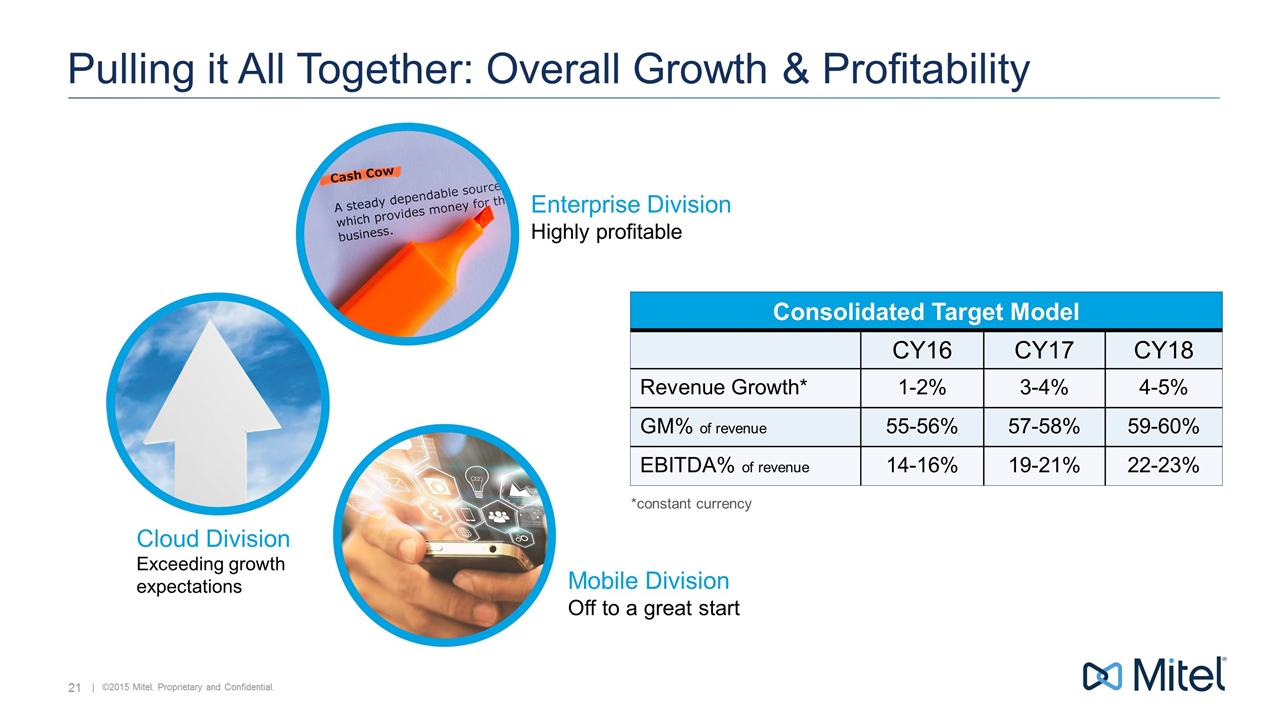

Pulling it All Together: Overall Growth & Profitability *constant currency Enterprise Division Highly profitable Cloud Division Exceeding growth expectations Mobile Division Off to a great start Consolidated Target Model CY16 CY17 CY18 Revenue Growth* 1-2% 3-4% 4-5% GM% of revenue 55-56% 57-58% 59-60% EBITDA% of revenue 14-16% 19-21% 22-23%

May 2016 Q&A