NEW YORK Mitel Networks Analyst Day 2017 March 7, 2017 Exhibit 99.1

Agenda Welcome & Introductions – Mike McCarthy/VP-Investor Relations Strategic Overview – Rich McBee/CEO Enterprise Solutions – Bob Agnes/EVP Cloud Services – Jon Brinton/EVP Demo Preview – Mass Notification – Jim Davies/VP – Advanced Applications BREAK Customer Use Cases – A Mitel Demo Experience – Azekka Room Financial Review – Steve Spooner/CFO Q&A – Mitel Senior Executive Team with Steve Spooner/CFO to moderate

Safe Harbor Statement Forward Looking Statements Some of the statements in this communication are forward-looking statements (or forward-looking information) within the meaning of applicable U.S. and Canadian securities laws. These include statements using the words believe, target, outlook, may, will, should, could, estimate, continue, expect, intend, plan, predict, potential, project and anticipate, and similar statements which do not describe the present or provide information about the past. There is no guarantee that the expected events or expected results will actually occur. Such statements reflect the current views of management of Mitel and are subject to a number of risks and uncertainties. These statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, operational and other factors. Any changes in these assumptions or other factors could cause actual results to differ materially from current expectations. All forward-looking statements attributable to Mitel, or persons acting on its behalf, are expressly qualified in their entirety by the cautionary statements set forth in this paragraph. Undue reliance should not be placed on such statements. In addition, material risks that could cause actual results to differ from forward-looking statements include: the inherent uncertainty associated with financial or other projections; the ability to recognize the anticipated benefits from the divestment of Mitel’s mobile division; risks associated with the non-cash consideration received by Mitel in connection with the divestment of the Mobile division; the impact to Mitel’s business that could result from the announcement of the divestment of the Mobile division; the anticipated size of the markets and continued demand for Mitel products and services; access to available financing on a timely basis and on reasonable terms; Mitel’s ability to achieve or sustain profitability in the future; fluctuations in quarterly and annual revenues and operating results; fluctuations in foreign exchange rates; current and ongoing global economic instability, political unrest and related sanctions; intense competition; reliance on channel partners for a significant component of sales; dependence upon a small number of outside contract manufacturers to manufacture products; and, Mitel’s ability to successfully implement and achieve its business strategies, including its growth of the company through acquisitions and the integration of recently acquired businesses and realization of synergies. Additional risks are described under the heading “Risk Factors” in Mitel’s Annual Report on Form 10-K for the year ended December 31, 2016 filed with the U.S. Securities and Exchange Commission (the “SEC”) and Canadian securities regulatory authorities on March 1, 2017. Forward-looking statements speak only as of the date they are made. Except as required by law, Mitel has no intention or obligation to update or to publicly announce the results of any revisions to any of the forward-looking statements to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward-looking statements.

Non-GAAP Financial Measurements In an effort to provide additional and useful information regarding the company’s financial results and other financial information as determined by generally accepted accounting principles (GAAP), the company also discusses, in its earnings press release, earnings presentation materials and in this presentation, certain non-GAAP information. Mitel provides a reconciliation between GAAP and non-GAAP financial information in our quarterly results announcements and in the supplemental slides used in conjunction with the company’s quarterly call. This information is available on our website at www.mitel.com under the “Investor Relations” section http://investor.mitel.com/events.cfm. In addition, see the reconciliations located in the tables at the end of this presentation Non-GAAP measures for future periods would not include, when applicable, share-based compensation expense, amortization of acquisition-related intangible assets, impact to revenue and cost of sales from purchase accounting adjustments, acquisition-related/divestiture costs, significant asset impairments and restructurings, significant litigation settlements, the income tax effects of the foregoing, significant tax matters, and other items that Mitel may exclude from time to time in the future, such as significant gains or losses from contingencies. Non-GAAP Financial Measures This presentation includes references to non-GAAP financial measures including Adjusted EBITDA, non-GAAP net income, Non-GAAP revenues, Non-GAAP gross margin, non-GAAP operating expenses and free cash flow potential. Non-GAAP financial measures do not have any standardized meaning and are therefore unlikely to be comparable to similar measures presented by other companies. We use these non-GAAP financial measures to assist management and investors in understanding our past financial performance and prospects for the future, including changes in our operating results, trends and marketplace performance, exclusive of unusual events or factors which do not directly affect what we consider to be our core operating performance. Non-GAAP measures are among the primary indicators management uses as a basis for our planning and forecasting of future periods. Investors are cautioned that non-GAAP financial measures should not be relied upon as a substitute for financial measures prepared in accordance with generally accepted accounting principles. Please see the reconciliation of non-GAAP financial measures to the most directly comparable U.S. GAAP measure attached to our quarterly results announcement and in the tables at the end of this presentation. Mitel completed the acquisition of Mavenir Systems on April 29, 2015. “As reported” results in this release and the attached tables refer to the U.S. GAAP results of Mitel, which include the results of Mavenir from the date of acquisition, April 29, 2015. Pro-forma results reflect the results of the company as if it had been fully combined with Mavenir Systems for the full presented period. For a reconciliation of Mitel’s as-reported results to the pro-forma results and non-GAAP results, please see the tables attached to our quarterly results announcement as well as the Form 8-K presenting combined historical results of Mitel and Mavenir filed with the SEC on August 6, 2015. See “Constant Currency Estimates” below, which are non-GAAP measures. Constant Currency Management refers to growth rates at constant currency or adjusting for currency so that certain financial results can be viewed without the impact of fluctuations in foreign currency exchange rates, thereby facilitating period-to-period comparisons of the company's business performance. Financial results adjusted for currency are calculated by translating prior period activity in local currency using the current period currency conversion rate. This approach is used for countries where the functional currency is the local currency. Generally, when the US dollar either strengthens or weakens against other currencies, the growth at constant currency rates or adjusting for currency will be higher or lower than growth reported at actual exchange rates.

RICH MCBEE, CEO Mitel Overview March 7, 2017

“Change is the only constant.”

2016 – A Year of Change for Mitel Announced intent to acquire Polycom Took share in core markets Focused on growing recurring revenue Shifted internal investment to applications Refocused on UCC and sold Mobile Division Strongest financial position since going public

2016 – A Year of Change for Our Market Cloud adoption accelerated Call control commoditizing Pricing pressure increased Currency headwinds continued Competitive displacement materialized Market consolidation intensified Digital transformation becoming real

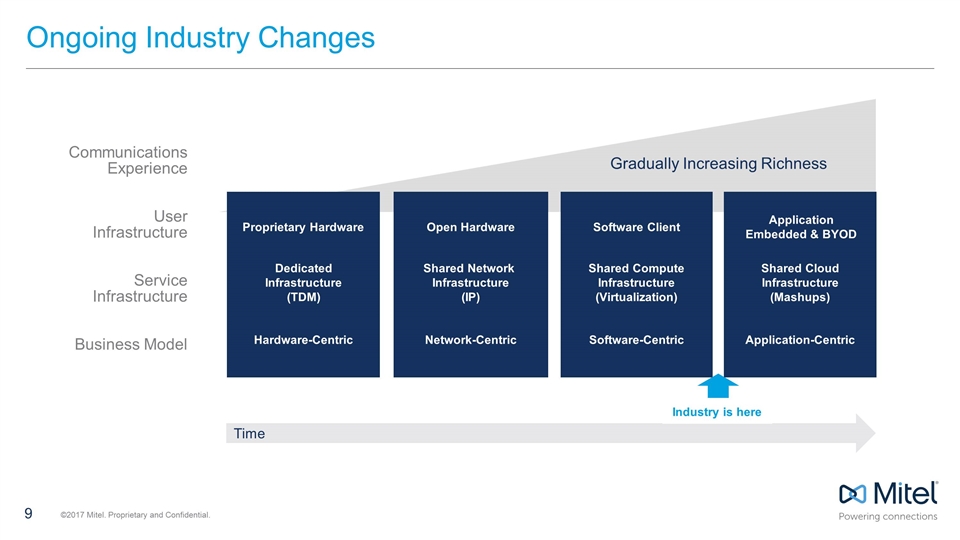

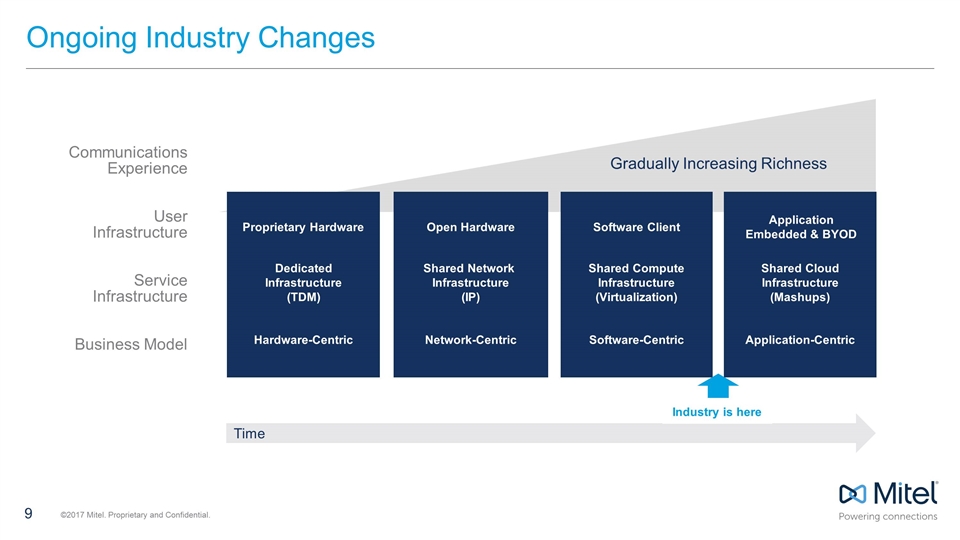

Ongoing Industry Changes Communications Experience User Infrastructure Service Infrastructure Business Model Hardware-Centric Network-Centric Software-Centric Application-Centric Proprietary Hardware Open Hardware Software Client Application Embedded & BYOD Time Industry is here Dedicated Infrastructure (TDM) Shared Network Infrastructure (IP) Shared Compute Infrastructure (Virtualization) Shared Cloud Infrastructure (Mashups) Gradually Increasing Richness

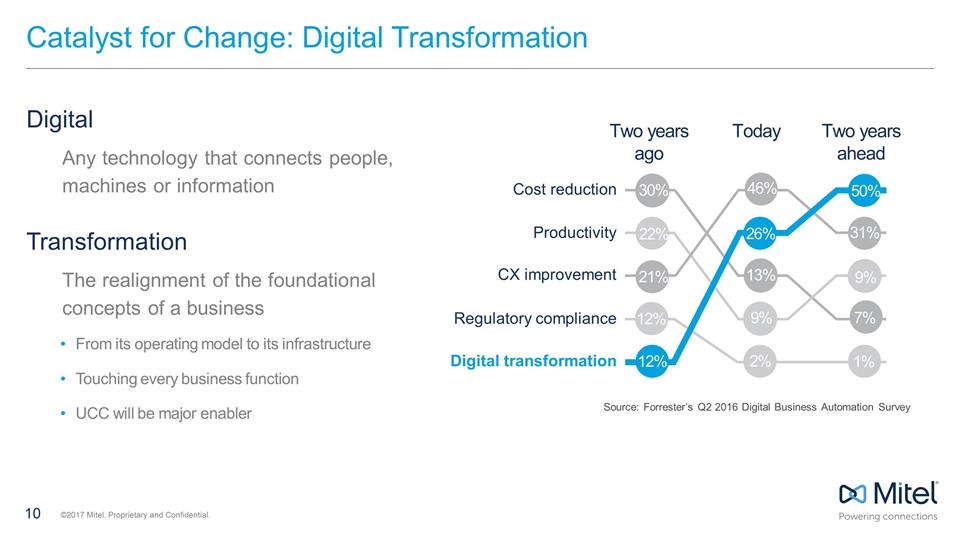

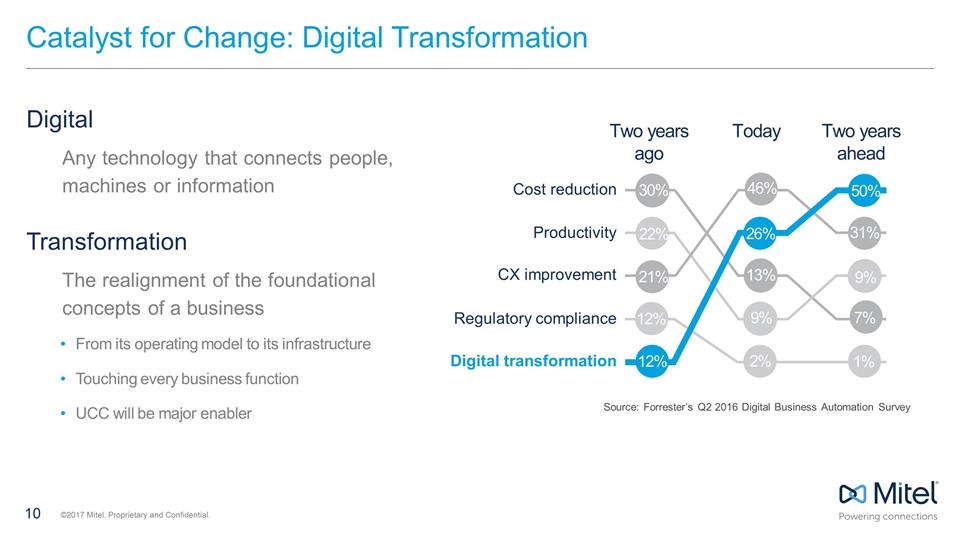

Catalyst for Change: Digital Transformation Digital Any technology that connects people, machines or information Transformation The realignment of the foundational concepts of a business From its operating model to its infrastructure Touching every business function UCC will be major enabler 30% 22% 21% 12% 12% 46% 26% 13% 9% 2% 50% 31% 9% 7% 1% Two years ago Today Two years ahead Cost reduction Productivity CX improvement Regulatory compliance Digital transformation Source: Forrester’s Q2 2016 Digital Business Automation Survey

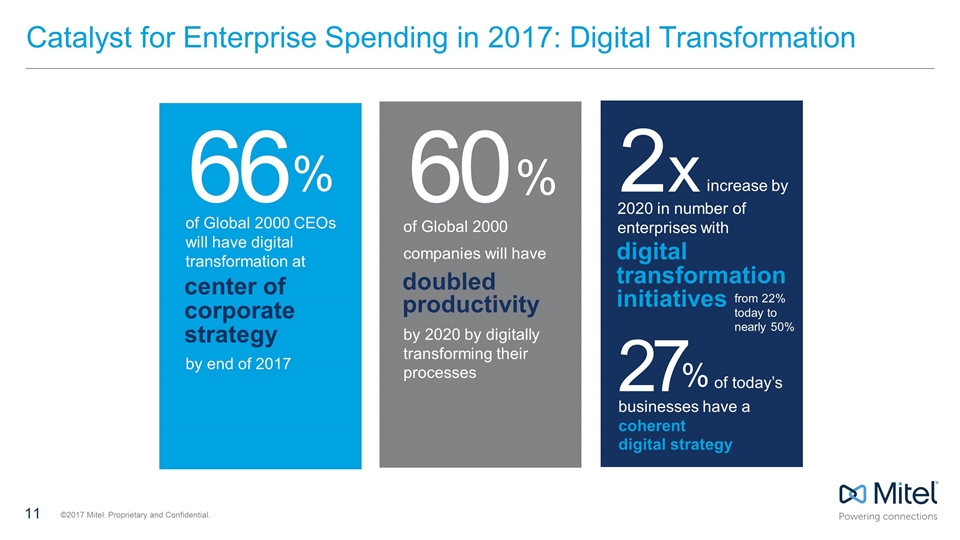

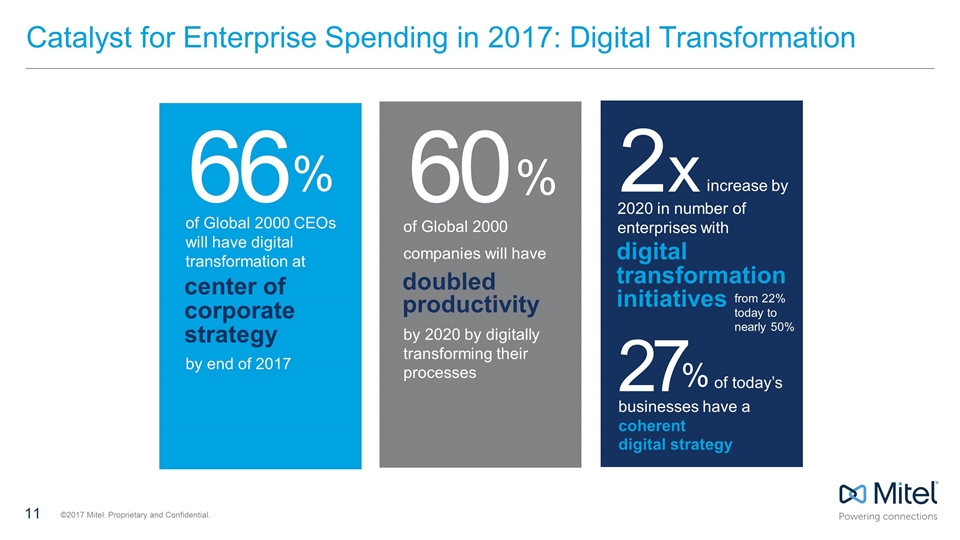

Catalyst for Enterprise Spending in 2017: Digital Transformation of Global 2000 CEOs will have digital transformation at by end of 2017 % 66 center of corporate strategy of Global 2000 companies will have by 2020 by digitally transforming their processes % 60 % businesses have a coherent digital strategy from 22% today to nearly 50% 2020 in number of enterprises with increase by of today’s 2x 27 doubled productivity digital transformation initiatives

2017 – Mitel Well Positioned in Rapidly Changing Landscape Focused on UCC as core market of opportunity Broad geographic diversity Broad product offering Solutions for all segments Differentiated for vertical application Large installed enterprise base Growing installed cloud base Growing and diversified channel Strong financial foundation

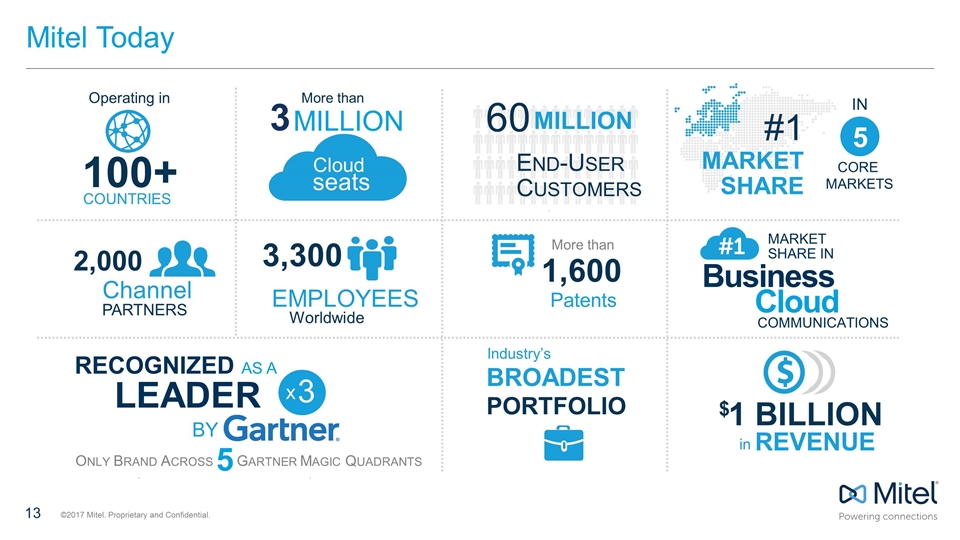

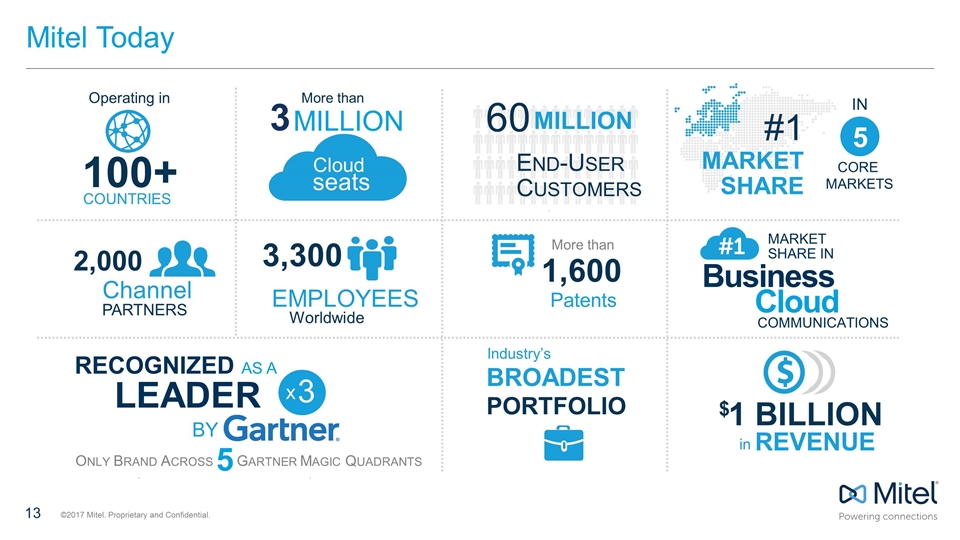

Mitel Today 60 MILLION End-User Customers Operating in 100+ COUNTRIES More than 1,600 Patents 2,000 Channel PARTNERS 3,300 EMPLOYEES Worldwide MARKETS #1 MARKET SHARE IN 5 CORE $ 1 BILLION in REVENUE BROADEST PORTFOLIO Industry’s 3 Cloud seats MILLION More than RECOGNIZED AS A LEADER BY 3 x Only Brand Across Gartner Magic Quadrants 5 MARKET SHARE IN Business Cloud COMMUNICATIONS

mission To deliver solutions that enable our customers to securely communicate and collaborate – anywhere, over any medium with the devices and applications of choice vision To make communication and collaboration seamless

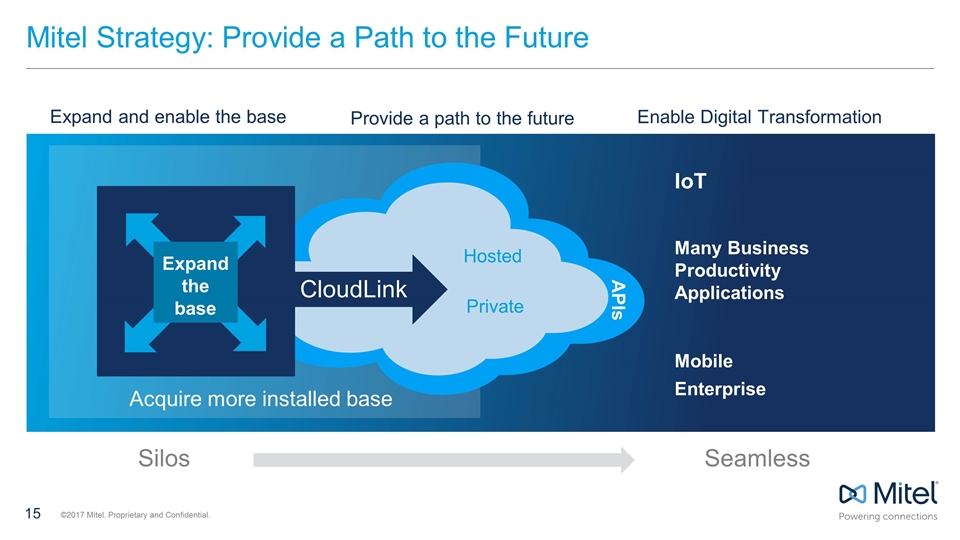

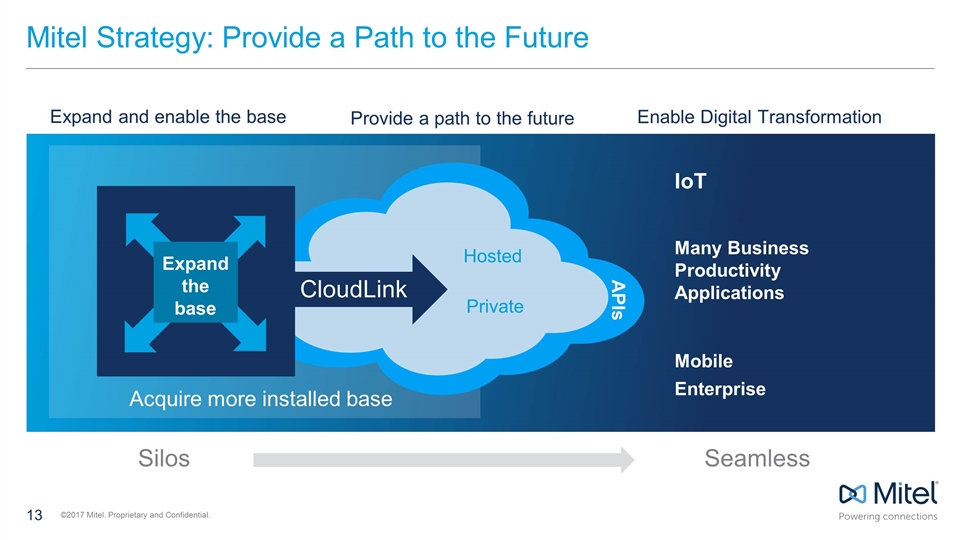

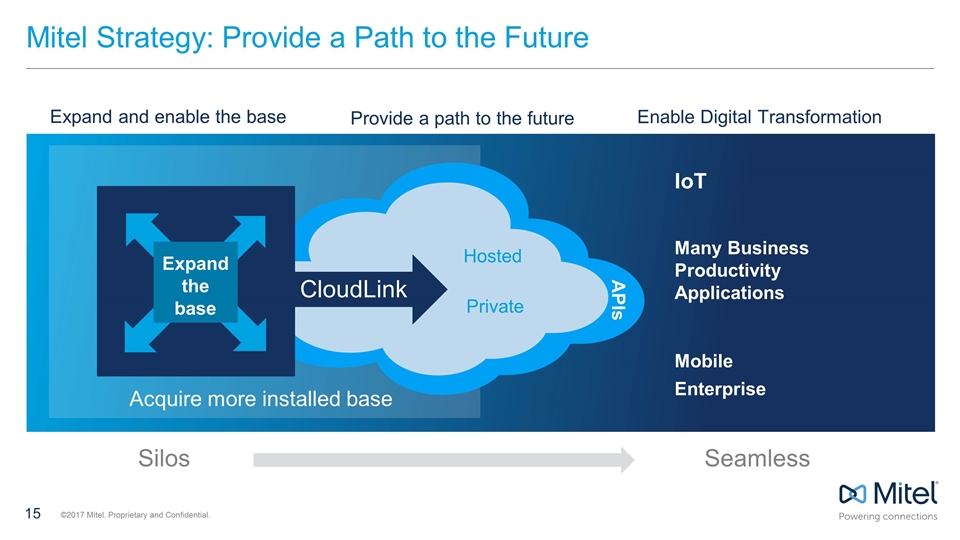

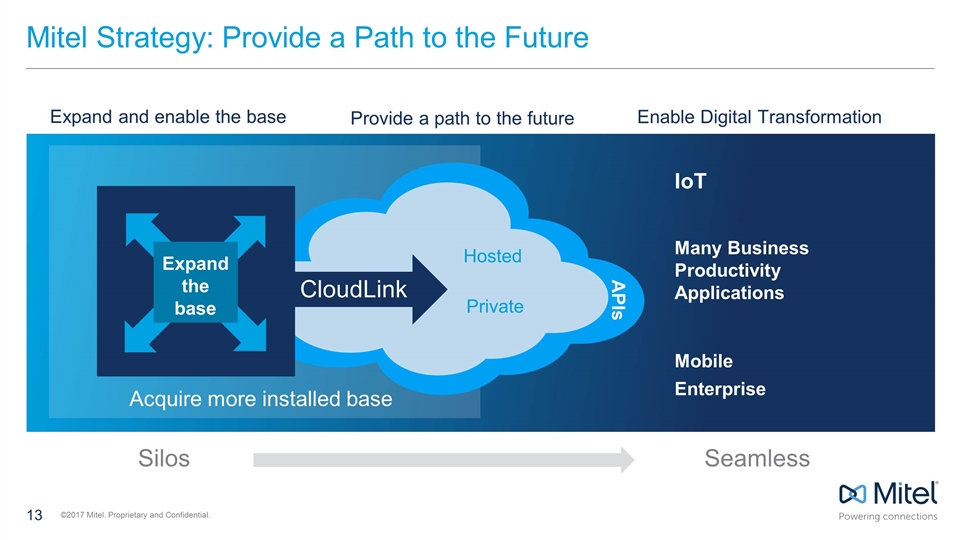

Mitel Strategy: Provide a Path to the Future Hosted IoT Mobile Enterprise APIs Private Many Business Productivity Applications Acquire more installed base Seamless Silos Provide a path to the future Expand and enable the base Enable Digital Transformation Expand the base CloudLink

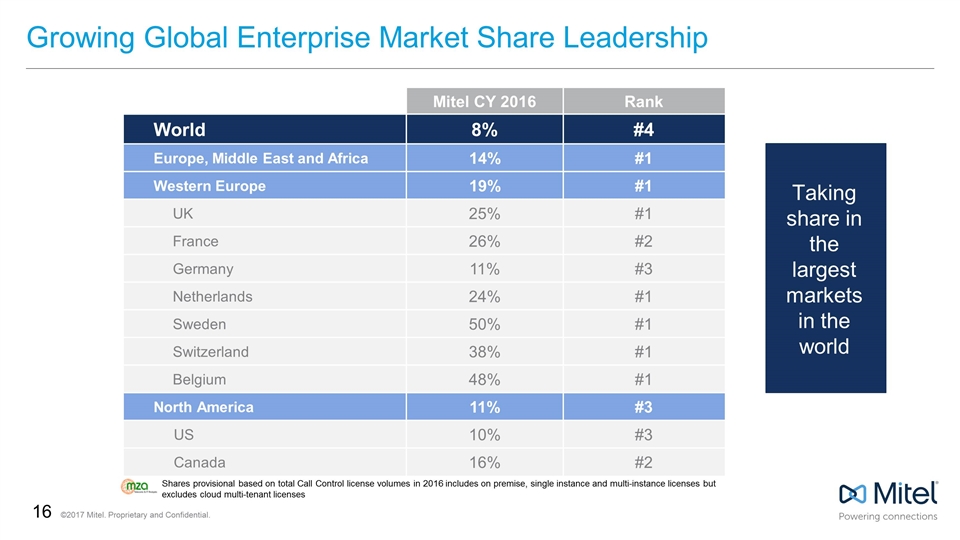

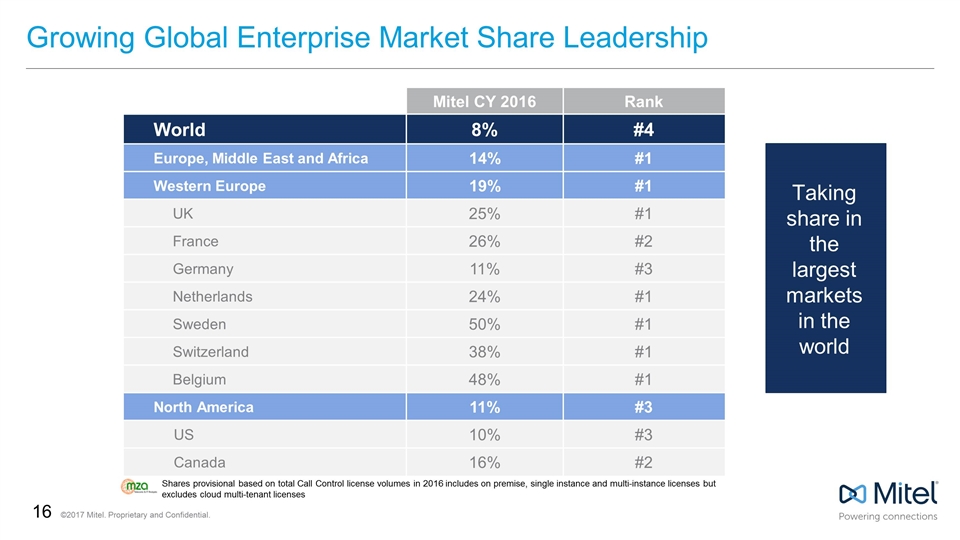

Growing Global Enterprise Market Share Leadership Mitel CY 2016 Rank World 8% #4 Europe, Middle East and Africa 14% #1 Western Europe 19% #1 UK 25% #1 France 26% #2 Germany 11% #3 Netherlands 24% #1 Sweden 50% #1 Switzerland 38% #1 Belgium 48% #1 North America 11% #3 US 10% #3 Canada 16% #2 Taking share in the largest markets in the world Shares provisional based on total Call Control license volumes in 2016 includes on premise, single instance and multi-instance licenses but excludes cloud multi-tenant licenses

Recognized Technology Leadership Only company in 5 Gartner Magic Quadrants for Business Communications Magic Quadrant for Corporate Telephony Magic Quadrant for Unified Communications Magic Quadrant for UC for Midsize Enterprises Magic Quadrant for Unified Communications as a Service Magic Quadrant for Contact Center Infrastructure Leader Leader Leader Visionary Challenger

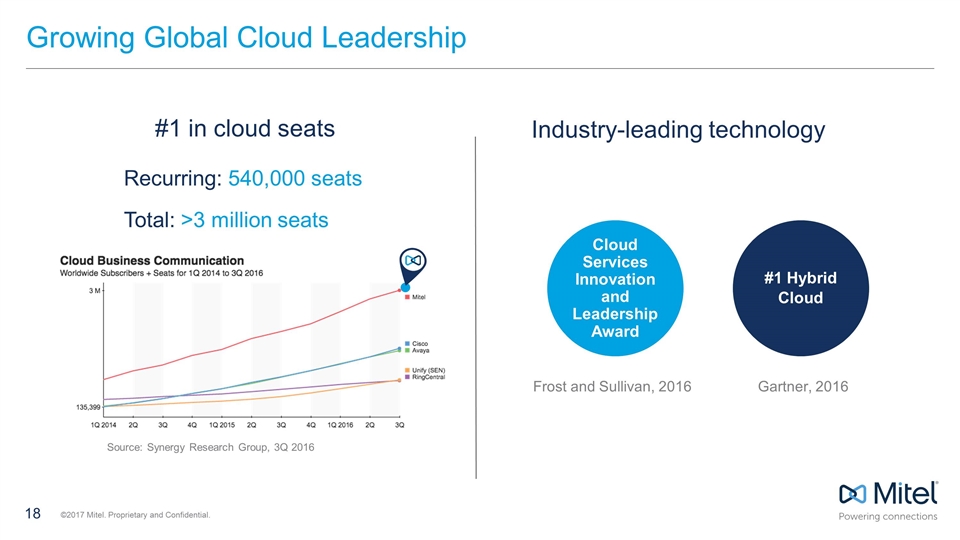

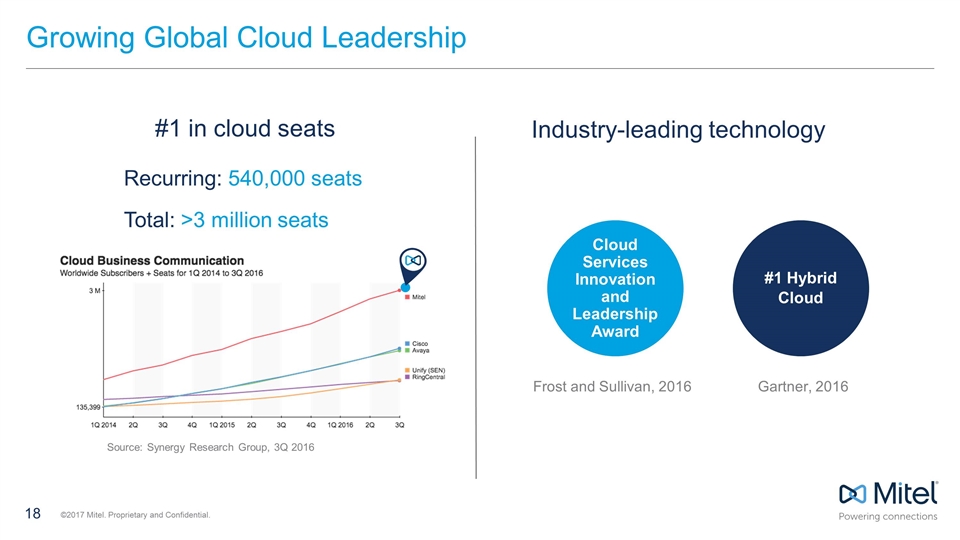

Growing Global Cloud Leadership Recurring: 540,000 seats Total: >3 million seats Source: Synergy Research Group, 3Q 2016 Gartner, 2016 #1 in cloud seats Industry-leading technology Cloud Services Innovation and Leadership Award #1 Hybrid Cloud Frost and Sullivan, 2016

Every customer will move to some kind of cloud

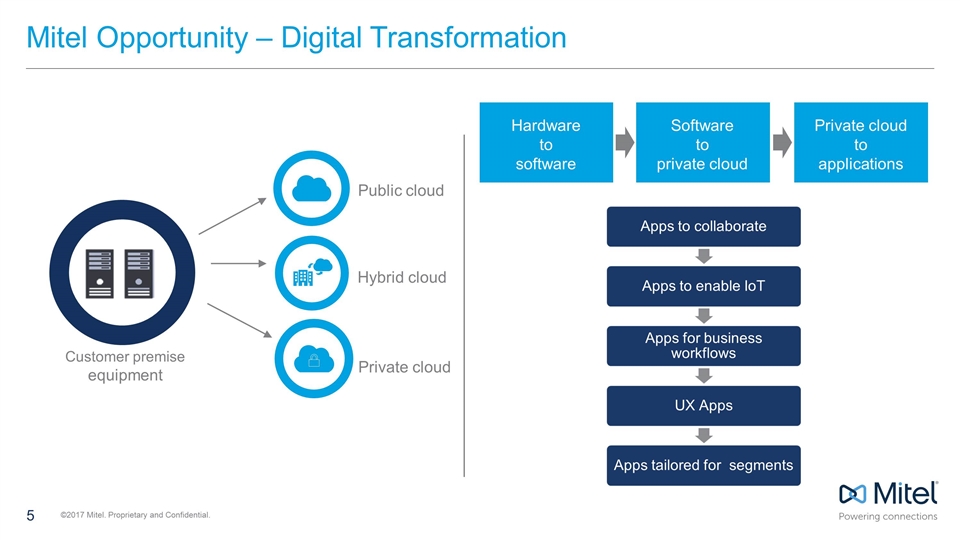

Mitel is Making Everything Cloud-Capable Customer premise equipment Public cloud Hybrid cloud Private cloud

Not all customers are the same

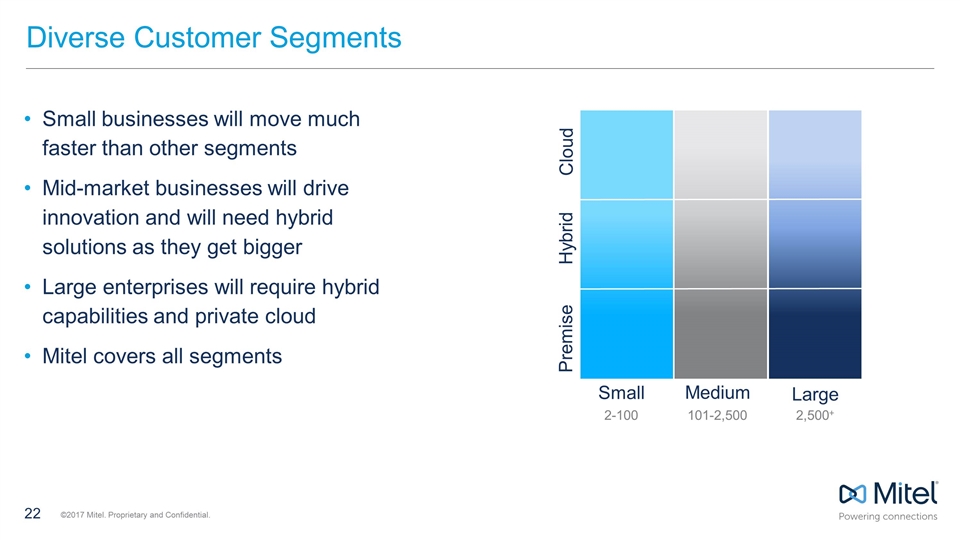

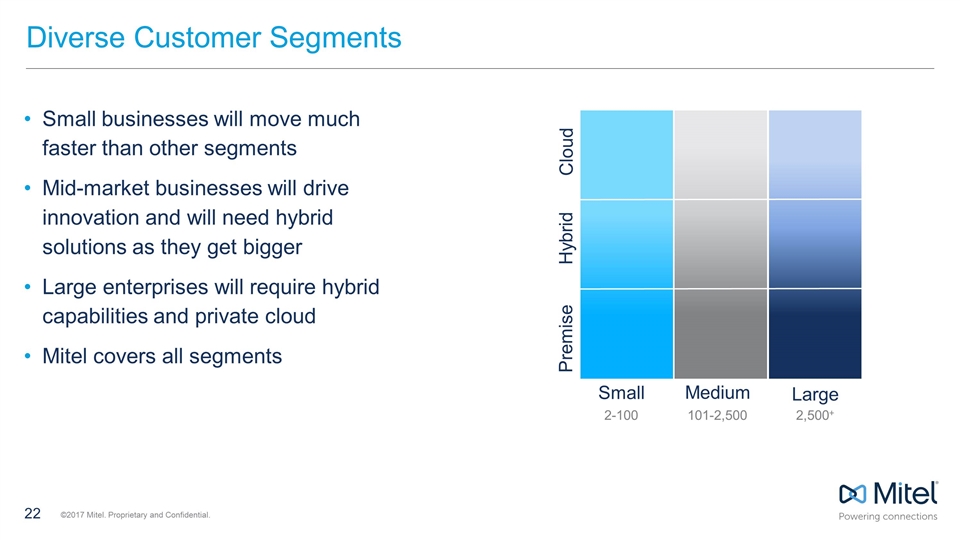

Diverse Customer Segments Cloud Hybrid Premise Small Medium Large 2-100 101-2,500 2,500+ Small businesses will move much faster than other segments Mid-market businesses will drive innovation and will need hybrid solutions as they get bigger Large enterprises will require hybrid capabilities and private cloud Mitel covers all segments

Our target markets are large and attractive

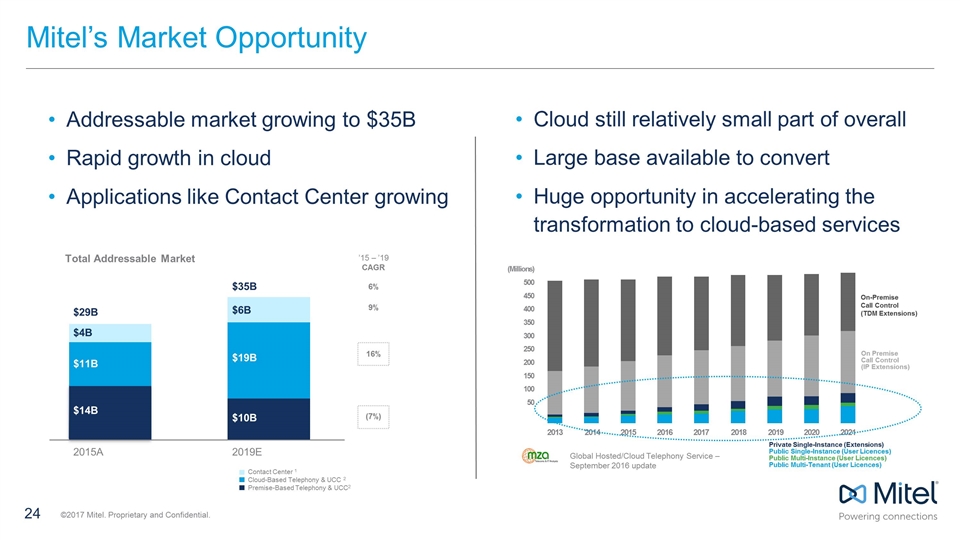

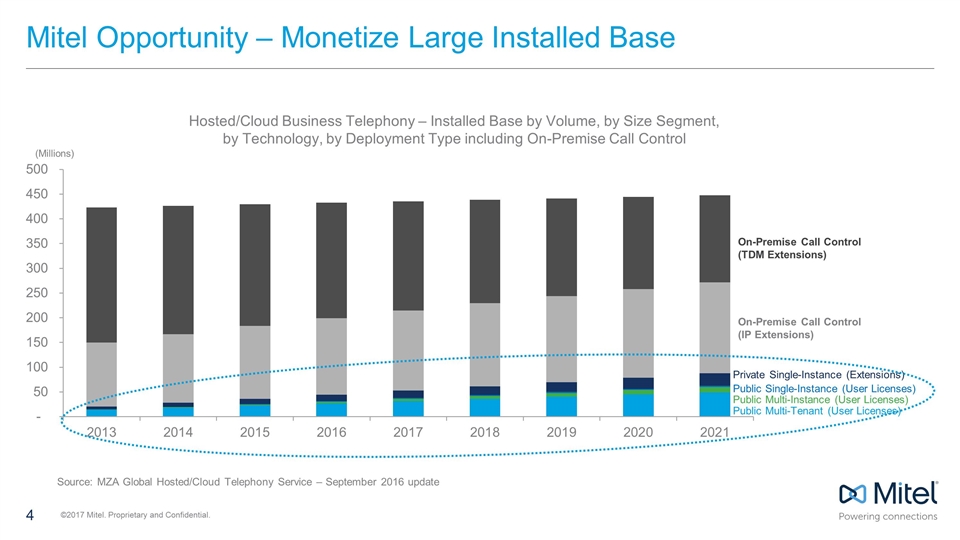

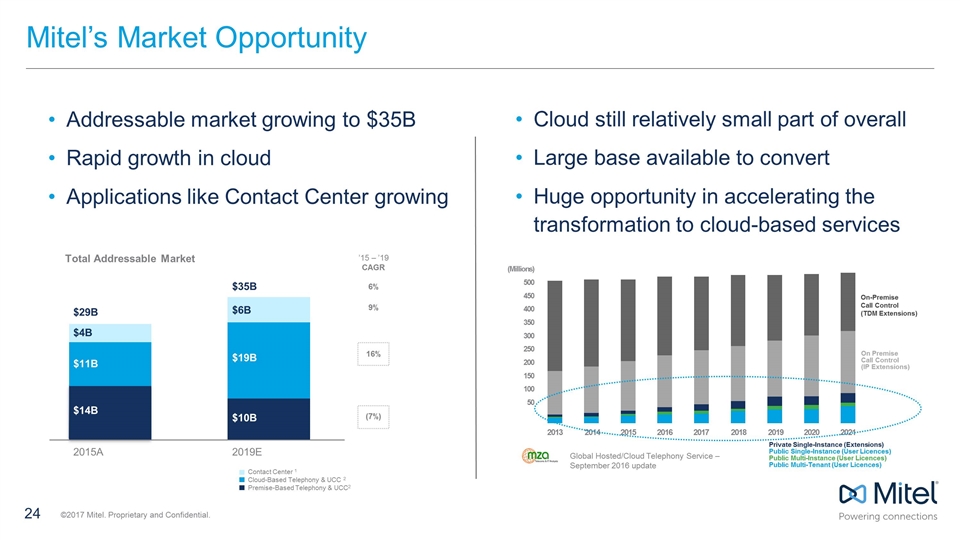

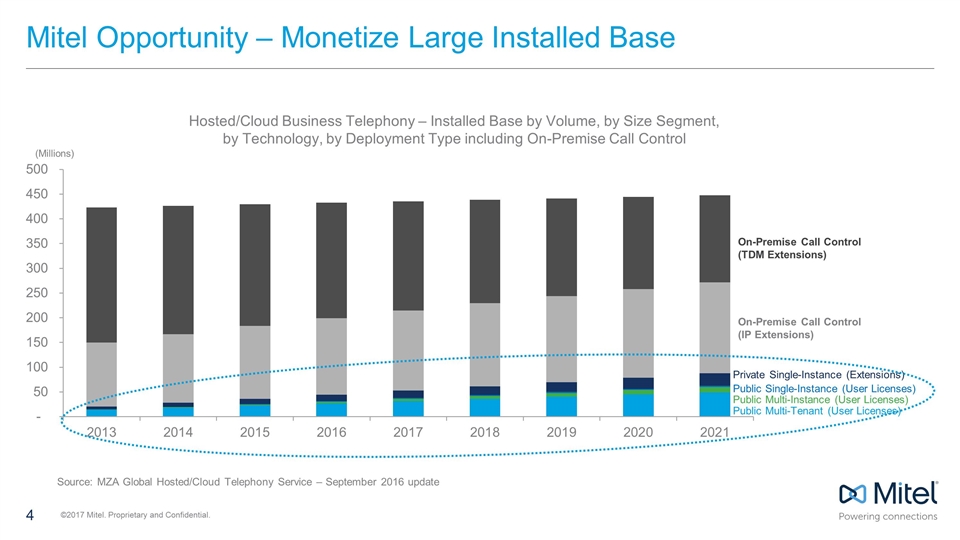

Mitel’s Market Opportunity Addressable market growing to $35B Rapid growth in cloud Applications like Contact Center growing Cloud still relatively small part of overall Large base available to convert Huge opportunity in accelerating the transformation to cloud-based services Total Addressable Market $29B $4B $11B $14B 2015A $35B $6B $19B $10B 2019E Contact Center 1 Cloud-Based Telephony & UCC 2 Premise-Based Telephony & UCC2 ’15 – ’19 CAGR 6% 9% 16% (7%) 2013 2014 2015 2016 2017 2018 2019 2020 2021 (Millions) 500 450 400 350 300 250 200 150 100 50 Private Single-Instance (Extensions) Public Single-Instance (User Licences) Public Multi-Instance (User Licences) Public Multi-Tenant (User Licences) On Premise Call Control (IP Extensions) On-Premise Call Control (TDM Extensions) Global Hosted/Cloud Telephony Service – September 2016 update

Summary Everything is moving toward the cloud: hosted or private Mitel is well positioned for this move Vertical applications will be the differentiator Mitel has demonstrated the ability to add applications quickly We are taking share where the major cloud transformations are occurring Americas, EMEA and Asia We are financially in the strongest position ever Cash generation, deleveraged balance sheet, recurring revenue We are well positioned to lead digital transformation of UCC Today we show you what digital transformation looks like

BOB AGNES, EVP Enterprise Solutions Leading the Digital Transformation March 7, 2017

Guiding Principles Put Customers First Taking a customer-centric view forward Investment Protection Mobile First Best Path To The Cloud “Open” Means “Open”

Customer First Leaves No One Stranded Best Path Forward Customers can move at their pace – Premise, Hybrid, Cloud, TDM, IP We are an enabler of customer success via an open path to the future Integration into the customer environment i.e., Connected Guests, Mass Notification, Contact Center, APIs…

Mitel Opportunity – Monetize Large Installed Base Hosted/Cloud Business Telephony – Installed Base by Volume, by Size Segment, by Technology, by Deployment Type including On-Premise Call Control Cloud (Millions) On-Premise Call Control (TDM Extensions) On-Premise Call Control (IP Extensions) Private Single-Instance (Extensions) Public Single-Instance (User Licenses) Public Multi-Instance (User Licenses) Public Multi-Tenant (User Licenses) On-Premise Call Control (TDM Extensions) Source: MZA Global Hosted/Cloud Telephony Service – September 2016 update

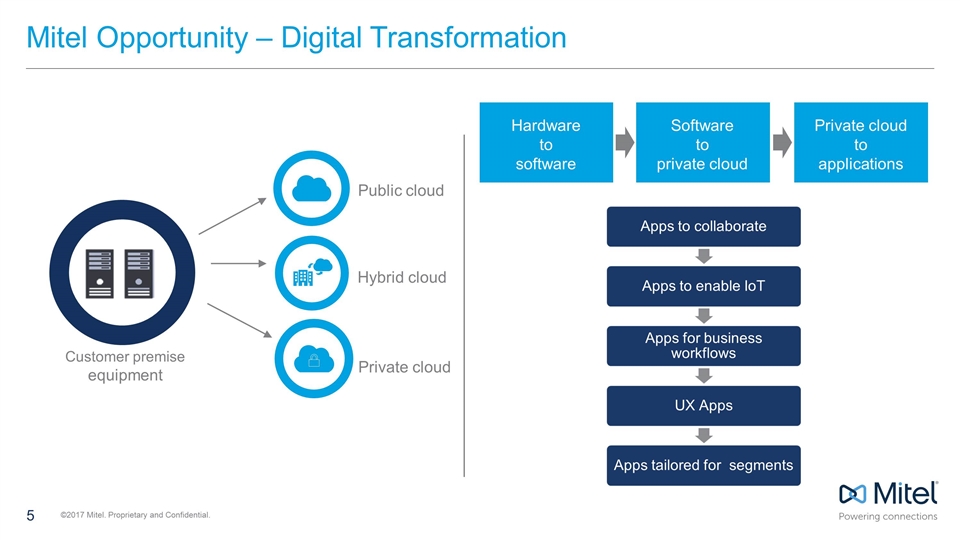

Mitel Opportunity – Digital Transformation Customer premise equipment Public cloud Hybrid cloud Private cloud Hardware to software Software to private cloud Private cloud to applications Apps to collaborate Apps to enable IoT Apps for business workflows UX Apps Apps tailored for segments

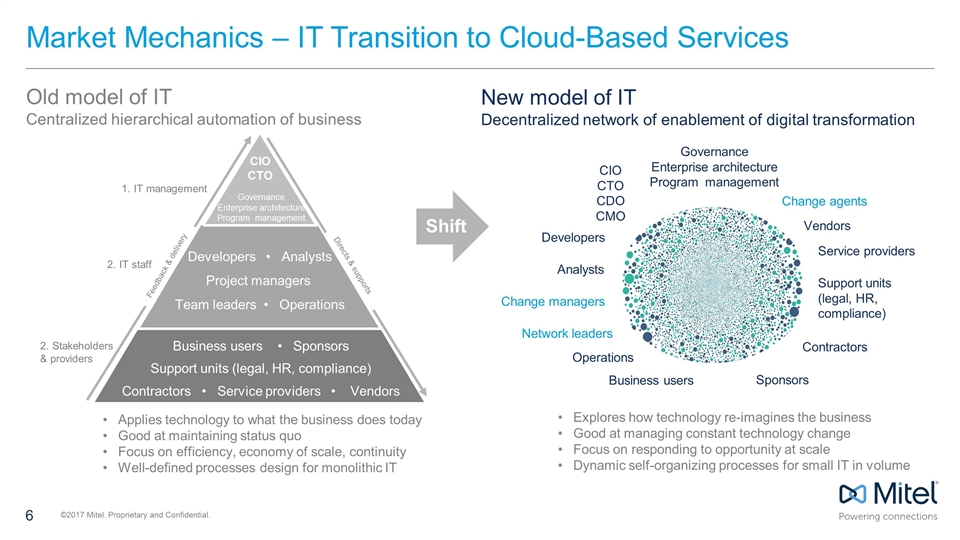

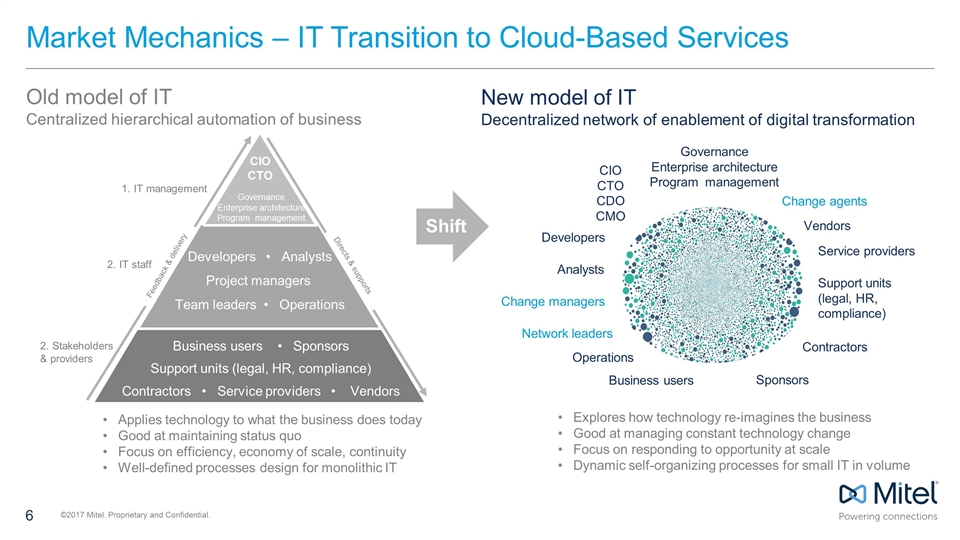

Market Mechanics – IT Transition to Cloud-Based Services Old model of IT Centralized hierarchical automation of business New model of IT Decentralized network of enablement of digital transformation Applies technology to what the business does today Good at maintaining status quo Focus on efficiency, economy of scale, continuity Well-defined processes design for monolithic IT 1. IT management 2. IT staff CIO CTO Governance Enterprise architecture Program management 2. Stakeholders & providers Feedback & delivery Directs & supports Developers • Analysts Project managers Team leaders • Operations Business users • Sponsors Support units (legal, HR, compliance) Contractors • Service providers • Vendors Shift Explores how technology re-imagines the business Good at managing constant technology change Focus on responding to opportunity at scale Dynamic self-organizing processes for small IT in volume CIO CTO CDO CMO Governance Enterprise architecture Program management Developers Analysts Change managers Network leaders Operations Business users Sponsors Contractors Support units (legal, HR, compliance) Vendors Change agents Service providers

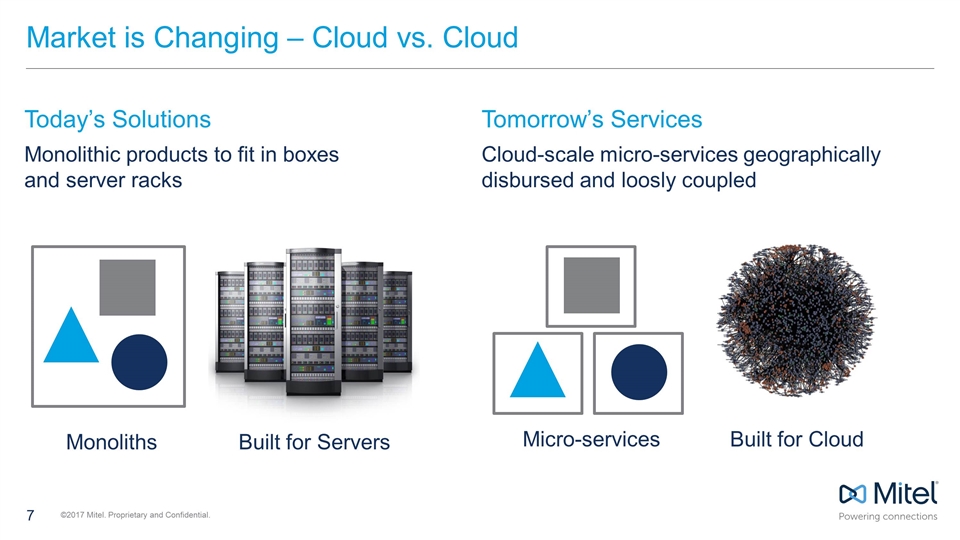

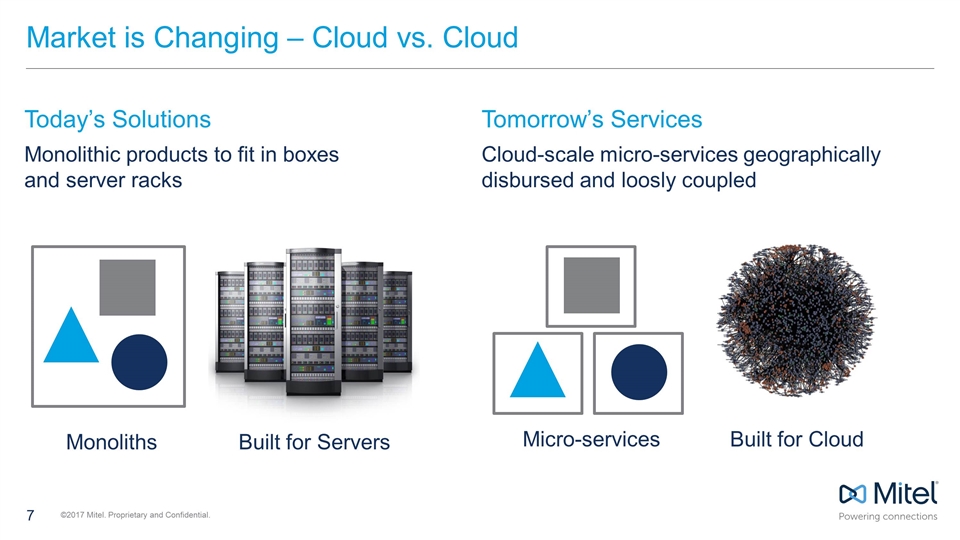

Market is Changing – Cloud vs. Cloud Today’s Solutions Monolithic products to fit in boxes and server racks Tomorrow’s Services Cloud-scale micro-services geographically disbursed and loosly coupled Monoliths Micro-services Built for Servers Built for Cloud

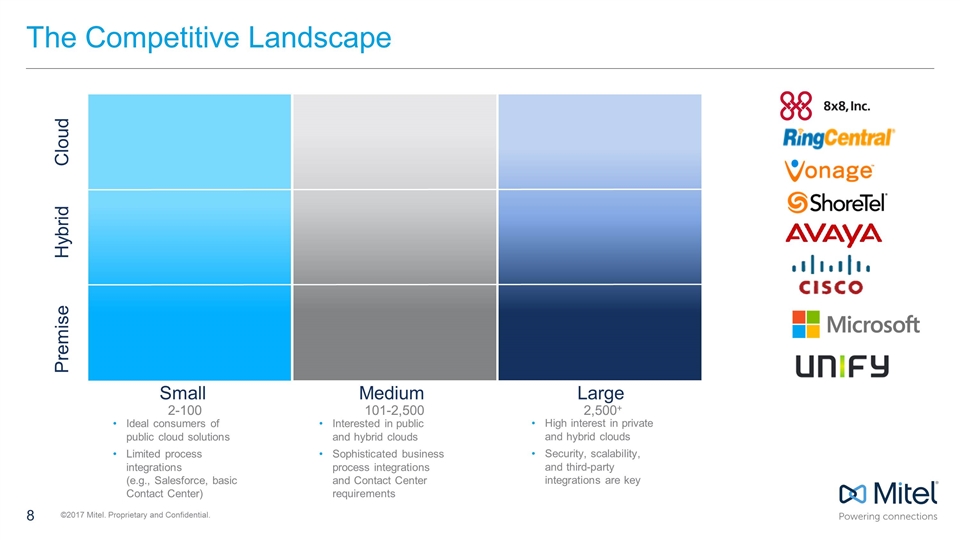

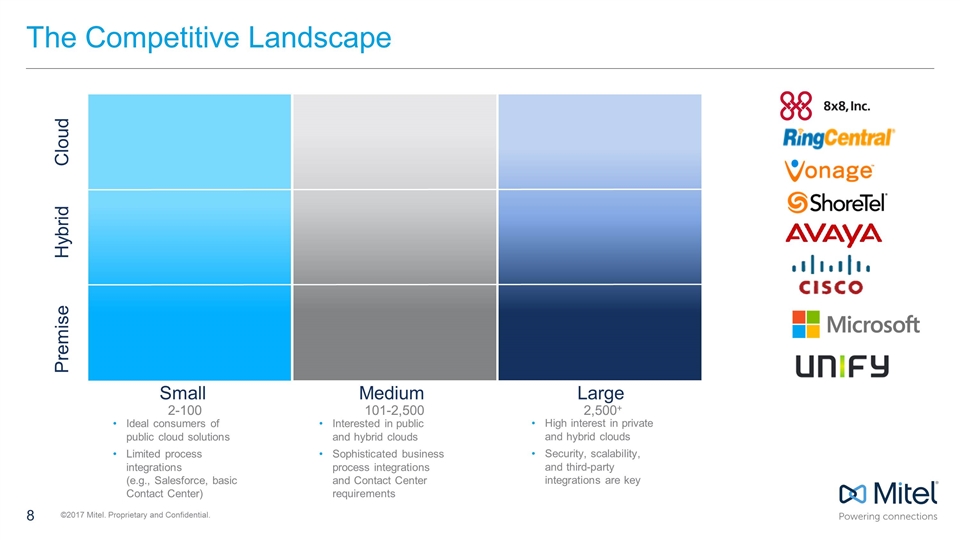

Cloud Hybrid Premise Small Medium Large 2-100 101-2,500 2,500+ Ideal consumers of public cloud solutions Limited process integrations (e.g., Salesforce, basic Contact Center) Interested in public and hybrid clouds Sophisticated business process integrations and Contact Center requirements High interest in private and hybrid clouds Security, scalability, and third-party integrations are key The Competitive Landscape

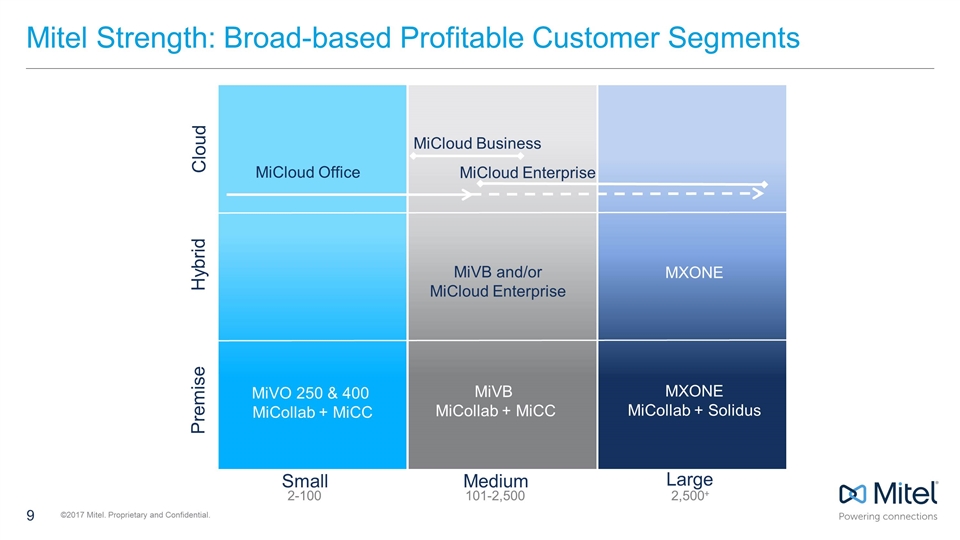

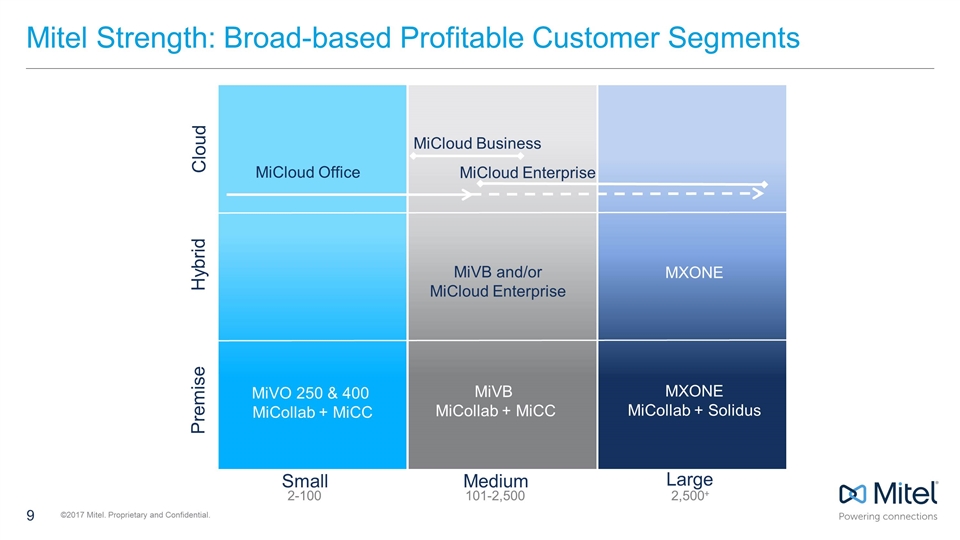

Cloud Hybrid Premises Cloud Hybrid Premise Small Medium Large 2-100 101-2,500 2,500+ MiCloud Office MiCloud Business MiCloud Enterprise MiVB and/or MiCloud Enterprise MXONE MiVO 250 & 400 MiCollab + MiCC MXONE MiCollab + Solidus MiVB MiCollab + MiCC Mitel Strength: Broad-based Profitable Customer Segments

Strategic Priorities – Differentiate Based on Choice Leverage installed base Give customers a choice Capitalize on deteriorating competitive landscape Share gains in core markets Leverage public cloud technology advancement to create seamless collaboration workflows tailored to industries, customers and geographies

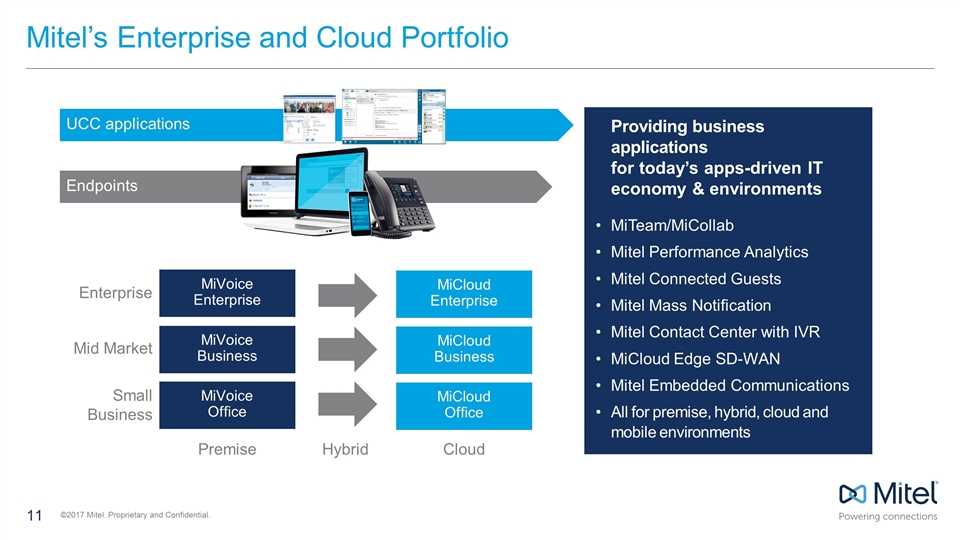

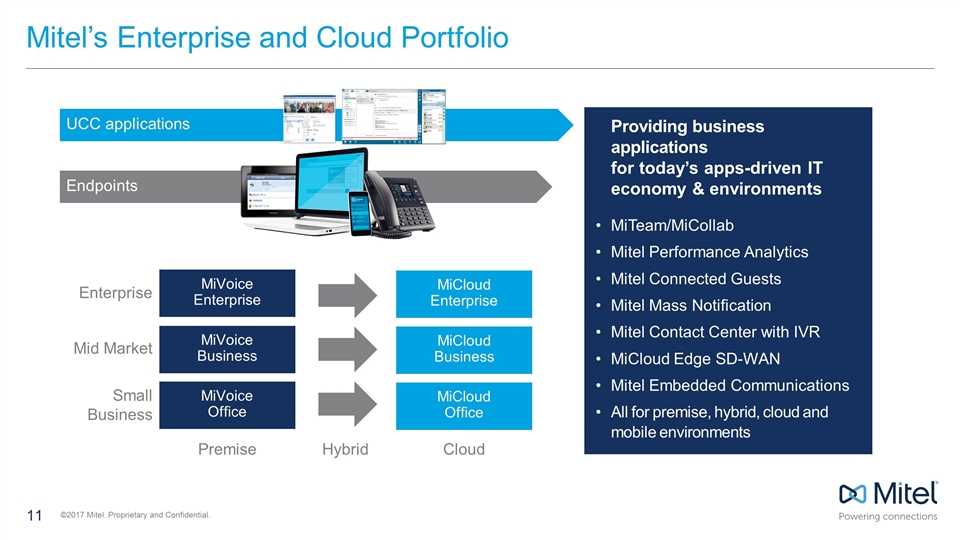

Mitel’s Enterprise and Cloud Portfolio Enterprise Mid Market Small Business MiVoice Enterprise MiVoice Business MiVoice Office UCC applications Endpoints MiCloud Enterprise MiCloud Business MiCloud Office Premise Cloud Hybrid Providing business applications for today’s apps-driven IT economy & environments MiTeam/MiCollab Mitel Performance Analytics Mitel Connected Guests Mitel Mass Notification Mitel Contact Center with IVR MiCloud Edge SD-WAN Mitel Embedded Communications All for premise, hybrid, cloud and mobile environments

A Few Market Maxims Call Control is becoming a commodity with little differentiation between competitors Call control provides access to our 60 million customers UC is table stakes The value to customers in the future is workflow applications Applications pull platform decisions Interoperability is the differentiator Applications are increasingly consumed in a recurring revenue model

Mitel Strategy: Provide a Path to the Future Hosted IoT Mobile Enterprise APIs Private Many Business Productivity Applications Acquire more installed base Seamless Silos Provide a path to the future Expand and enable the base Enable Digital Transformation Expand the base CloudLink

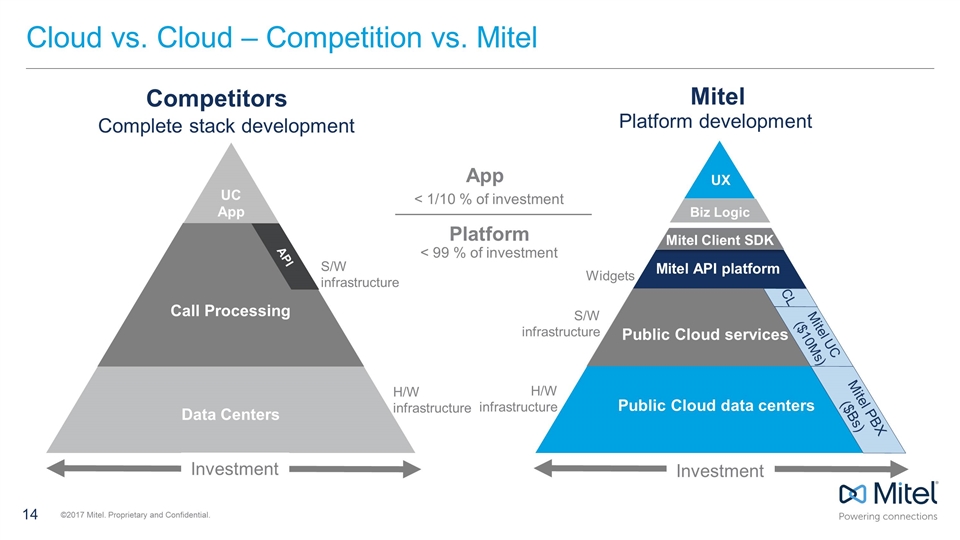

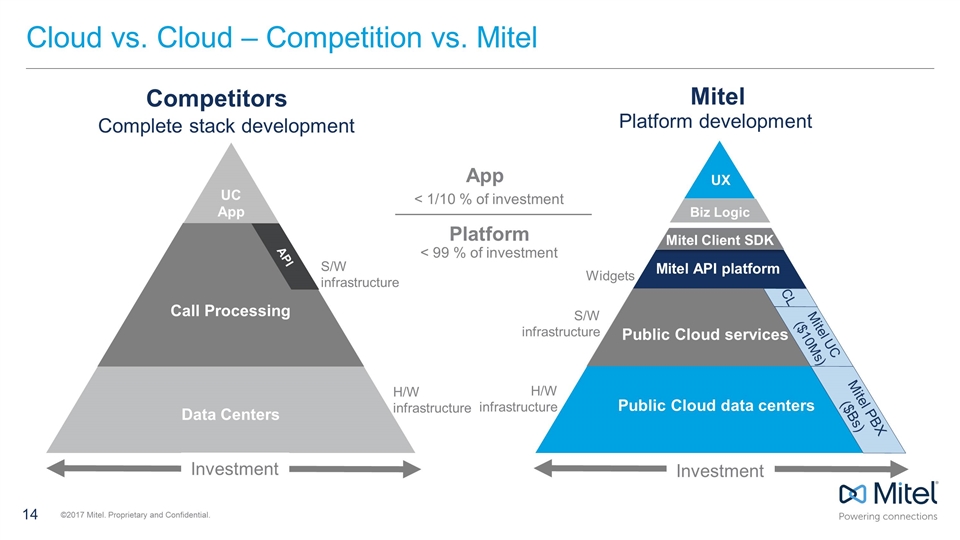

Cloud vs. Cloud – Competition vs. Mitel Platform App < 1/10 % of investment < 99 % of investment S/W infrastructure H/W infrastructure Biz Logic Widgets Investment Platform development Mitel Call Processing Data Centers S/W infrastructure H/W infrastructure UC App API Investment Complete stack development Competitors UX Mitel Client SDK Mitel API platform Public Cloud services Public Cloud data centers Mitel PBX ($Bs) Mitel UC ($10Ms) CL

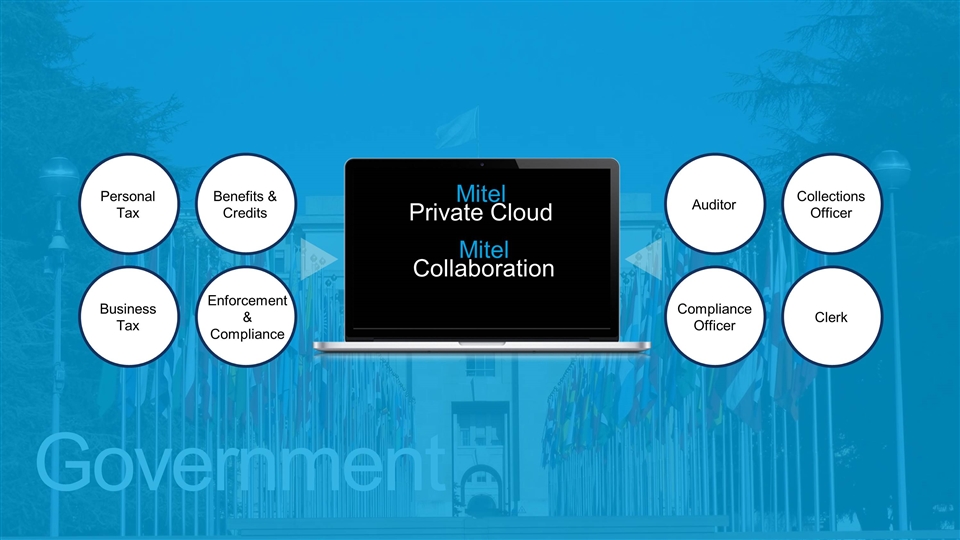

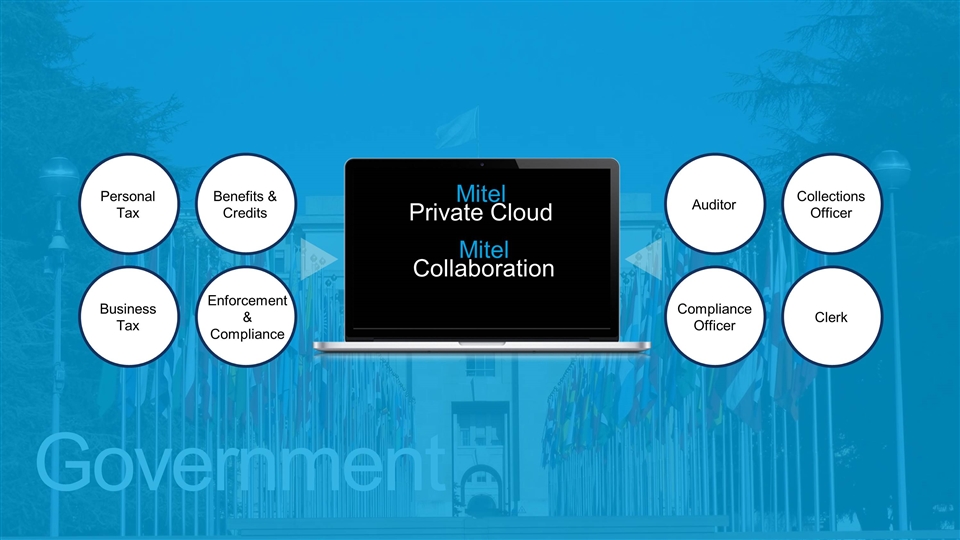

Government

Government Mitel Private Cloud Personal Tax Business Tax Benefits & Credits Enforcement & Compliance Auditor Compliance Officer Collections Officer Clerk Mitel Collaboration

Hospitality

Hospitality

Deliver Financial Fundamentals While Transforming the Business 21 Provide customers a path to future Link Premise and Cloud Private Cloud, Hybrid or Hosted Solutions Enable Applications – cloud – embedded – vertically focused Lead customers through their own digital transformation Expand the base – through competitive displacement and consolidation acquisitions Relentless focus on financial efficiency Manage through the industry change to build an applications-focused business Margin expansion Cost reduction

JON BRINTON, EVP Cloud Services March 7, 2017

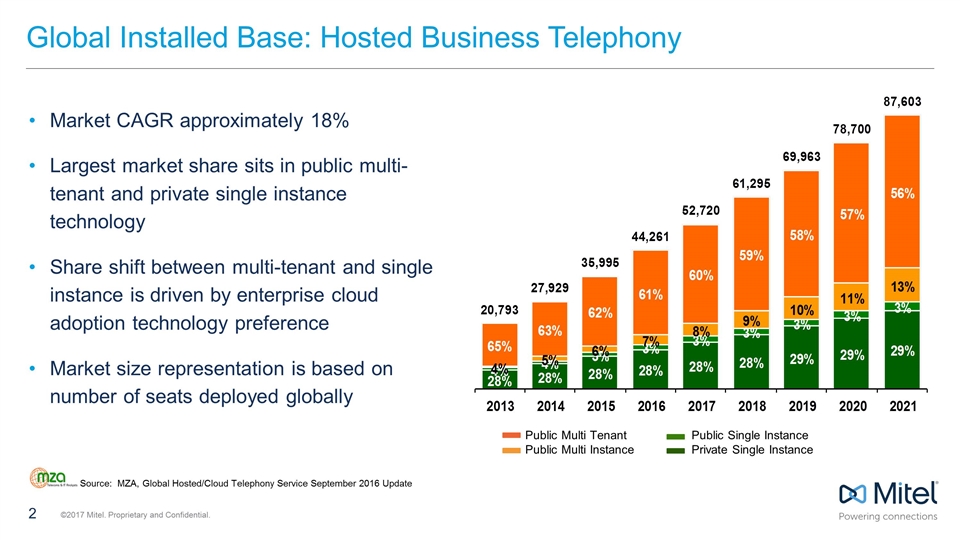

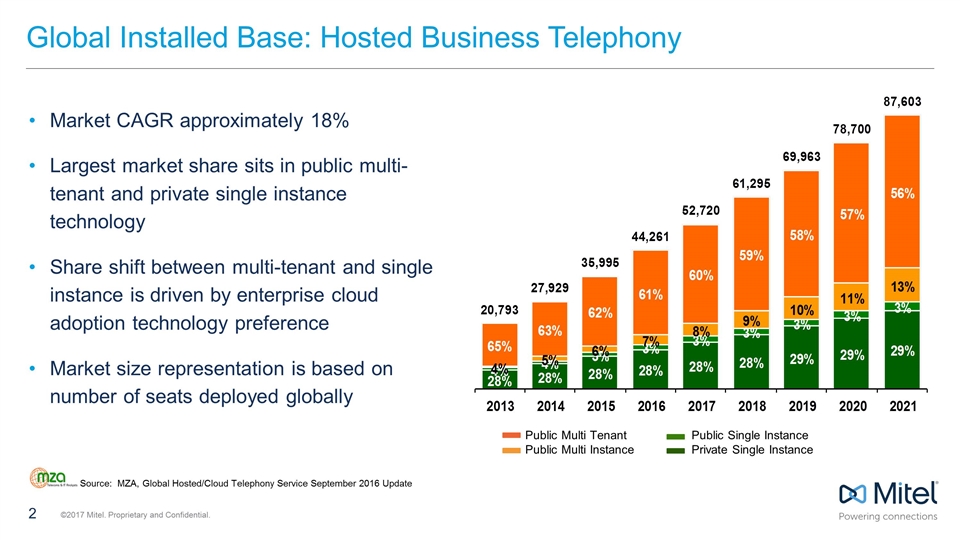

Global Installed Base: Hosted Business Telephony Market CAGR approximately 18% Largest market share sits in public multi-tenant and private single instance technology Share shift between multi-tenant and single instance is driven by enterprise cloud adoption technology preference Market size representation is based on number of seats deployed globally Public Multi Tenant Public Multi Instance Public Single Instance Private Single Instance Source: MZA, Global Hosted/Cloud Telephony Service September 2016 Update

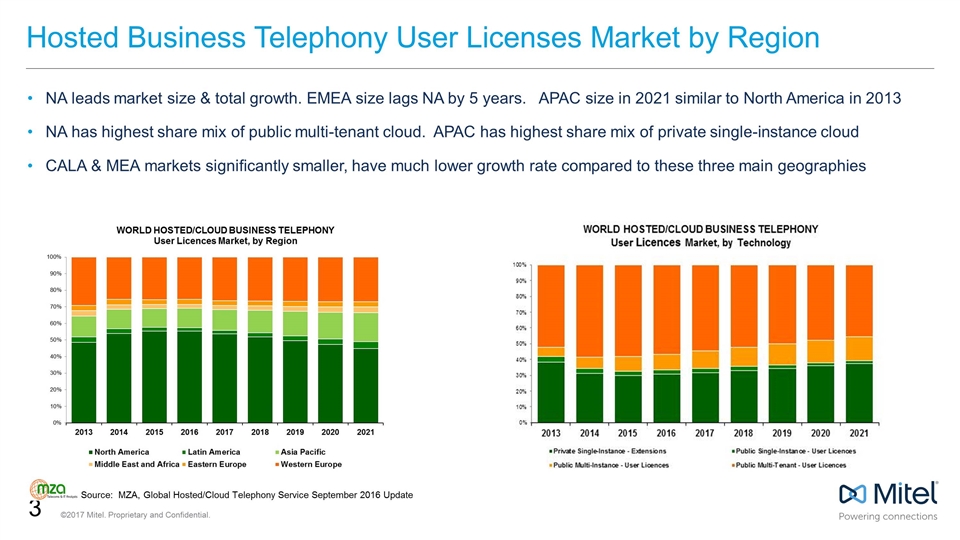

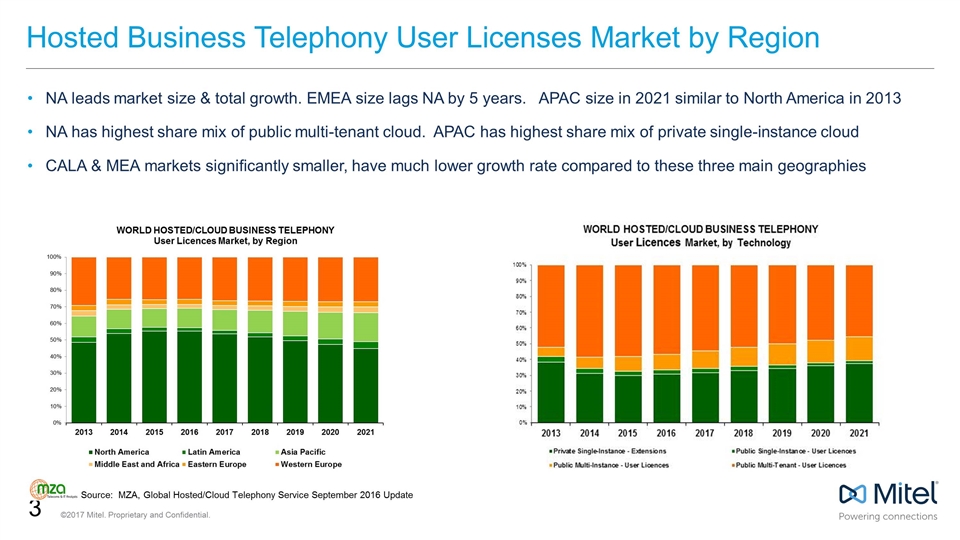

Hosted Business Telephony User Licenses Market by Region NA leads market size & total growth. EMEA size lags NA by 5 years. APAC size in 2021 similar to North America in 2013 NA has highest share mix of public multi-tenant cloud. APAC has highest share mix of private single-instance cloud CALA & MEA markets significantly smaller, have much lower growth rate compared to these three main geographies Source: MZA, Global Hosted/Cloud Telephony Service September 2016 Update

Cloud Communications Key Market Drivers Predictable operating expense profile Integration into larger IT framework Ease of administration & management Distributed workforce-teams Increased productivity

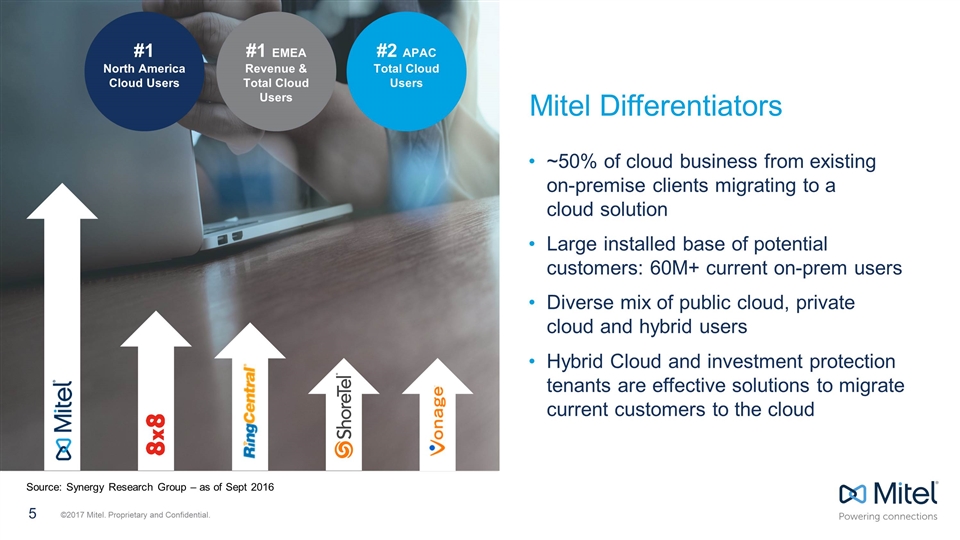

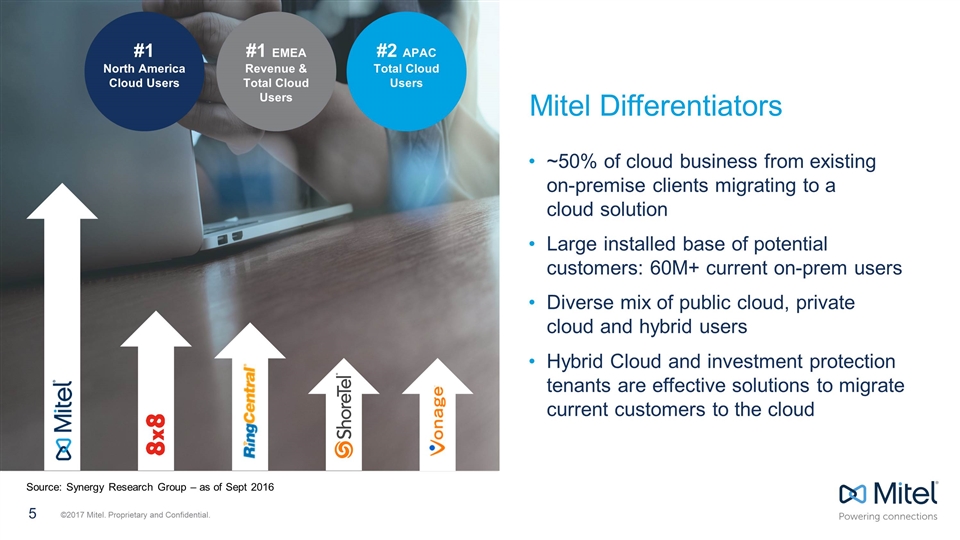

Mitel Differentiators ~50% of cloud business from existing on-premise clients migrating to a cloud solution Large installed base of potential customers: 60M+ current on-prem users Diverse mix of public cloud, private cloud and hybrid users Hybrid Cloud and investment protection tenants are effective solutions to migrate current customers to the cloud Source: Synergy Research Group – as of Sept 2016 #2 APAC Total Cloud Users #1 EMEA Revenue & Total Cloud Users #1 North America Cloud Users

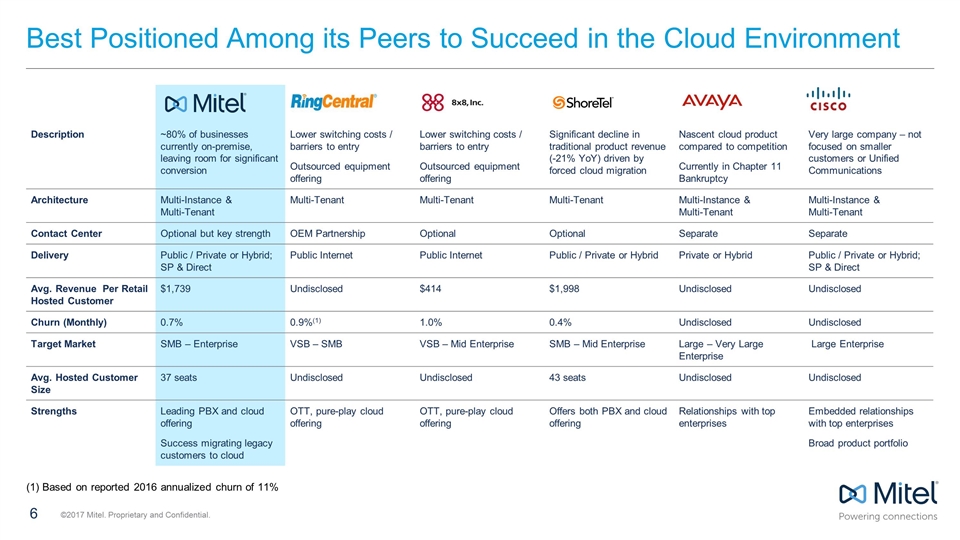

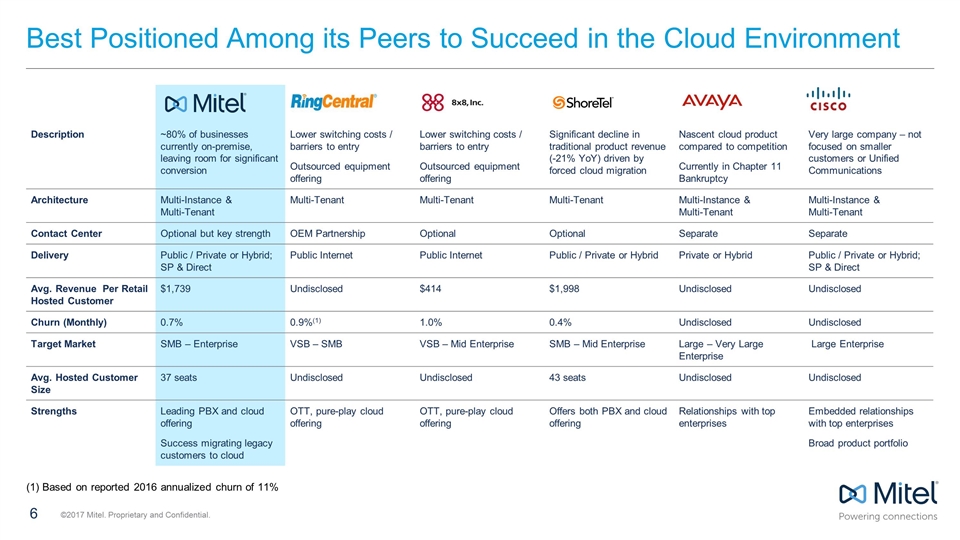

Description ~80% of businesses currently on-premise, leaving room for significant conversion Lower switching costs / barriers to entry Outsourced equipment offering Lower switching costs / barriers to entry Outsourced equipment offering Significant decline in traditional product revenue (-21% YoY) driven by forced cloud migration Nascent cloud product compared to competition Currently in Chapter 11 Bankruptcy Very large company – not focused on smaller customers or Unified Communications Architecture Multi-Instance & Multi-Tenant Multi-Tenant Multi-Tenant Multi-Tenant Multi-Instance & Multi-Tenant Multi-Instance & Multi-Tenant Contact Center Optional but key strength OEM Partnership Optional Optional Separate Separate Delivery Public / Private or Hybrid; SP & Direct Public Internet Public Internet Public / Private or Hybrid Private or Hybrid Public / Private or Hybrid; SP & Direct Avg. Revenue Per Retail Hosted Customer $1,739 Undisclosed $414 $1,998 Undisclosed Undisclosed Churn (Monthly) 0.7% 0.9%(1) 1.0% 0.4% Undisclosed Undisclosed Target Market SMB – Enterprise VSB – SMB VSB – Mid Enterprise SMB – Mid Enterprise Large – Very Large Enterprise Large Enterprise Avg. Hosted Customer Size 37 seats Undisclosed Undisclosed 43 seats Undisclosed Undisclosed Strengths Leading PBX and cloud offering Success migrating legacy customers to cloud OTT, pure-play cloud offering OTT, pure-play cloud offering Offers both PBX and cloud offering Relationships with top enterprises Embedded relationships with top enterprises Broad product portfolio Best Positioned Among its Peers to Succeed in the Cloud Environment (1) Based on reported 2016 annualized churn of 11%

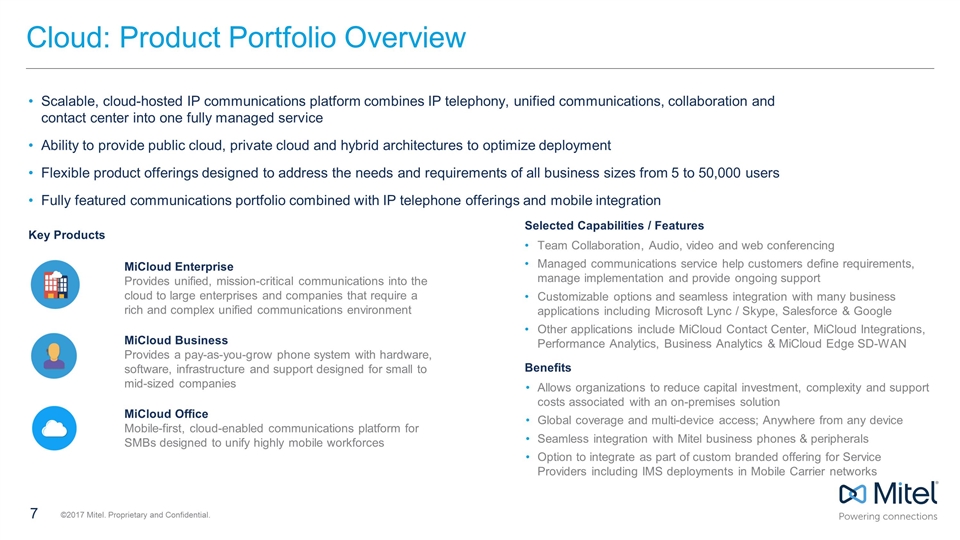

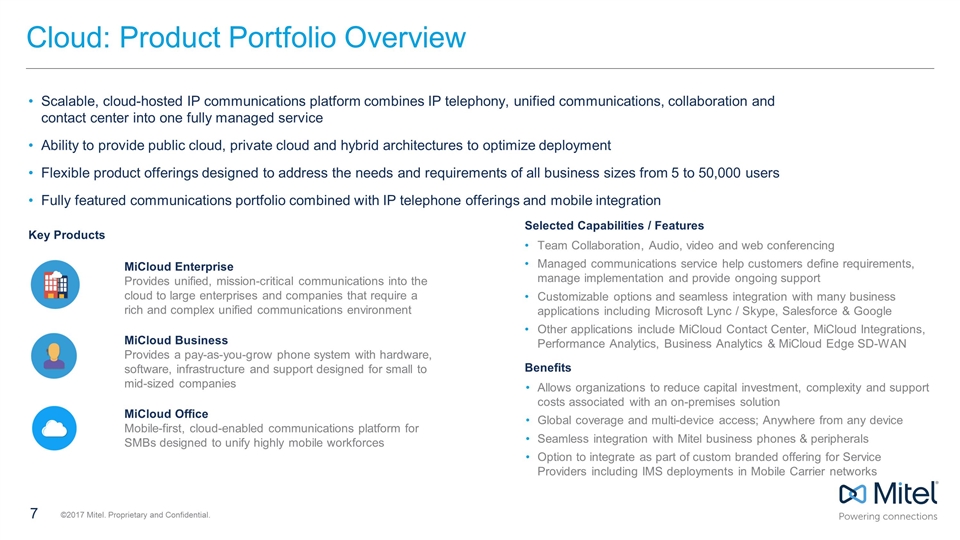

Cloud: Product Portfolio Overview Scalable, cloud-hosted IP communications platform combines IP telephony, unified communications, collaboration and contact center into one fully managed service Ability to provide public cloud, private cloud and hybrid architectures to optimize deployment Flexible product offerings designed to address the needs and requirements of all business sizes from 5 to 50,000 users Fully featured communications portfolio combined with IP telephone offerings and mobile integration Key Products MiCloud Enterprise Provides unified, mission-critical communications into the cloud to large enterprises and companies that require a rich and complex unified communications environment MiCloud Business Provides a pay-as-you-grow phone system with hardware, software, infrastructure and support designed for small to mid-sized companies MiCloud Office Mobile-first, cloud-enabled communications platform for SMBs designed to unify highly mobile workforces Selected Capabilities / Features Team Collaboration, Audio, video and web conferencing Managed communications service help customers define requirements, manage implementation and provide ongoing support Customizable options and seamless integration with many business applications including Microsoft Lync / Skype, Salesforce & Google Other applications include MiCloud Contact Center, MiCloud Integrations, Performance Analytics, Business Analytics & MiCloud Edge SD-WAN Benefits Allows organizations to reduce capital investment, complexity and support costs associated with an on-premises solution Global coverage and multi-device access; Anywhere from any device Seamless integration with Mitel business phones & peripherals Option to integrate as part of custom branded offering for Service Providers including IMS deployments in Mobile Carrier networks

We know the way Recurring Cloud Solutions SP-Built Cloud Solutions

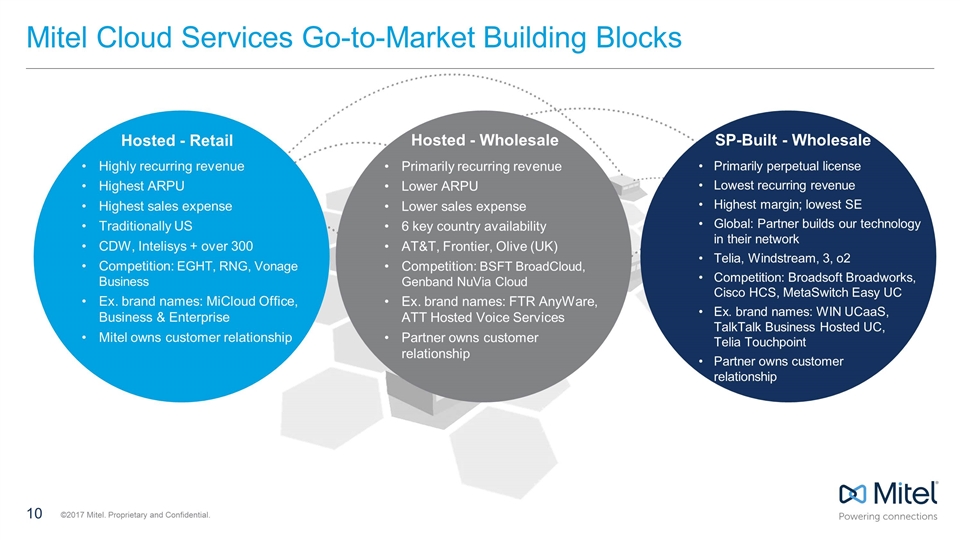

Mitel Cloud Services Driving Growth through Mitel’s Cloud GTM Building Blocks Hosted-Retail Hosted-Wholesale SP-Built Wholesale

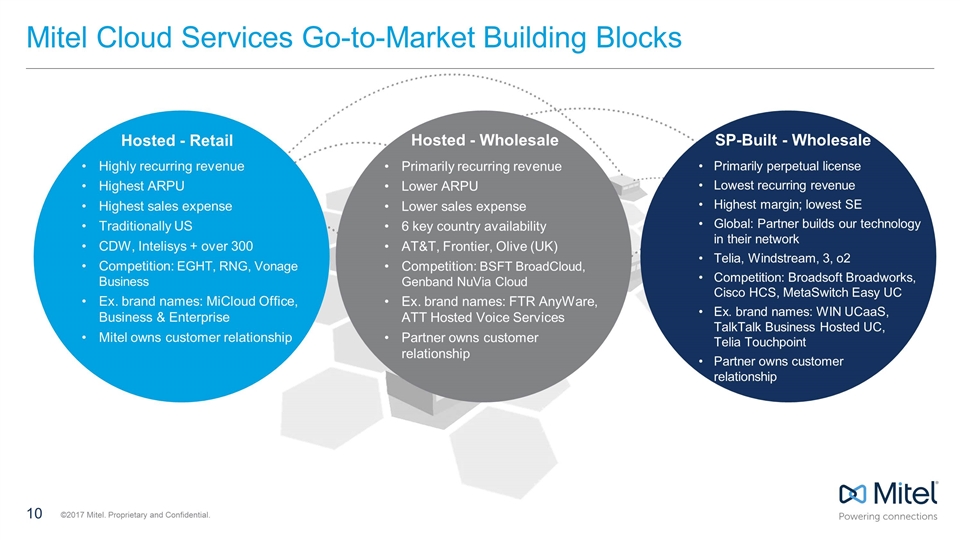

Mitel Cloud Services Go-to-Market Building Blocks Highly recurring revenue Highest ARPU Highest sales expense Traditionally US CDW, Intelisys + over 300 Competition: EGHT, RNG, Vonage Business Ex. brand names: MiCloud Office, Business & Enterprise Mitel owns customer relationship Hosted - Retail Primarily recurring revenue Lower ARPU Lower sales expense 6 key country availability AT&T, Frontier, Olive (UK) Competition: BSFT BroadCloud, Genband NuVia Cloud Ex. brand names: FTR AnyWare, ATT Hosted Voice Services Partner owns customer relationship Hosted - Wholesale Primarily perpetual license Lowest recurring revenue Highest margin; lowest SE Global: Partner builds our technology in their network Telia, Windstream, 3, o2 Competition: Broadsoft Broadworks, Cisco HCS, MetaSwitch Easy UC Ex. brand names: WIN UCaaS, TalkTalk Business Hosted UC, Telia Touchpoint Partner owns customer relationship SP-Built - Wholesale

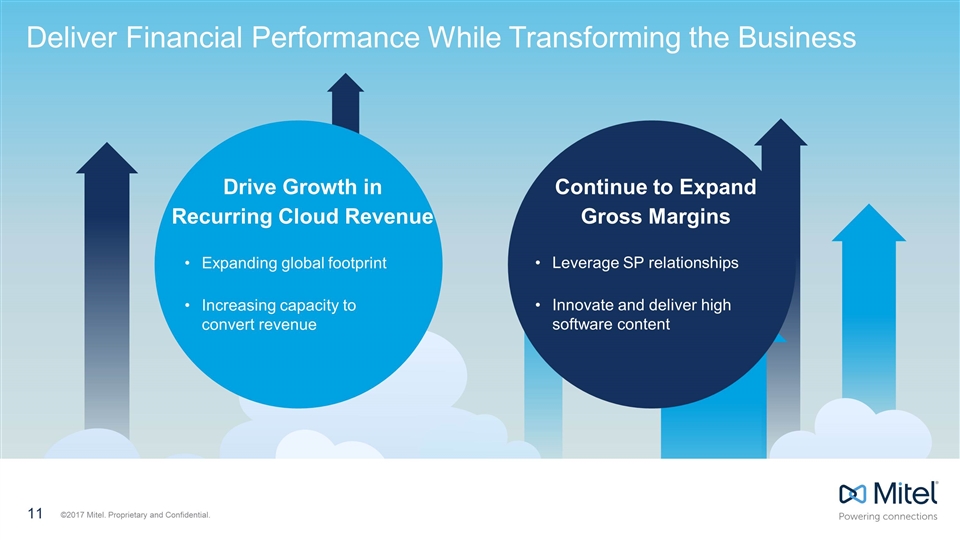

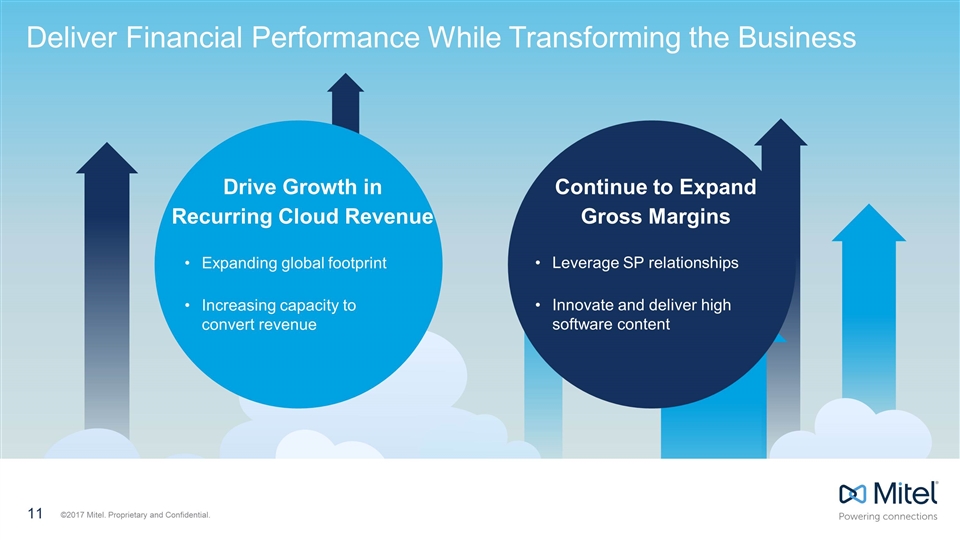

Deliver Financial Performance While Transforming the Business Drive Growth in Recurring Cloud Revenue Continue to Expand Gross Margins Expanding global footprint Increasing capacity to convert revenue Leverage SP relationships Innovate and deliver high software content

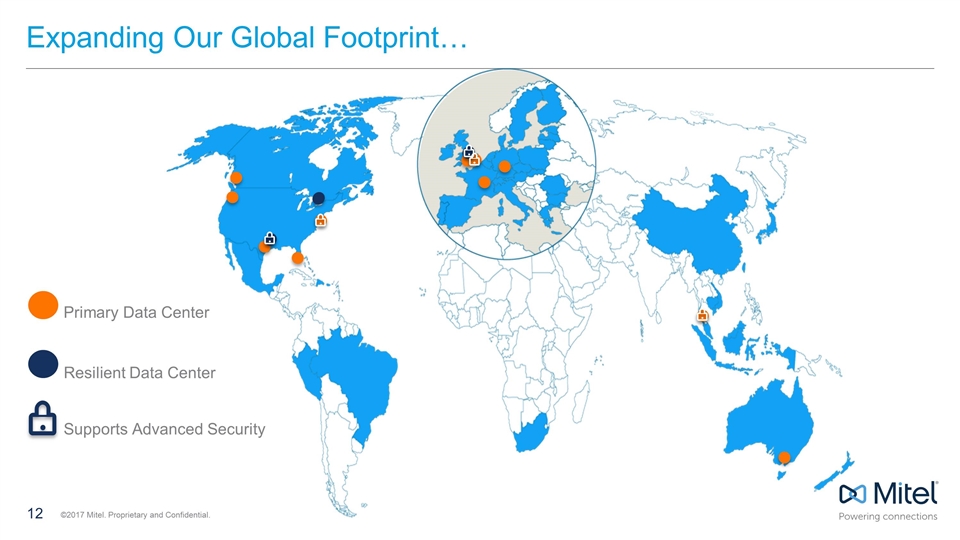

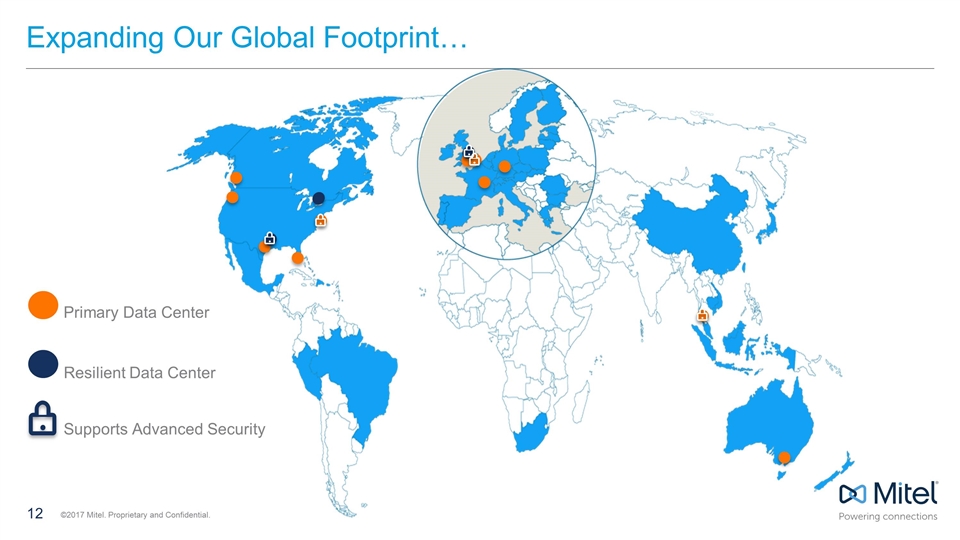

Expanding Our Global Footprint… Primary Data Center Resilient Data Center Supports Advanced Security

Mitel World Cloud …to Enable Worldwide Business Collaboration

Global Team Collaboration

Mitel Team Collaboration Athlete PT/ Orthopedic Personal Trainer Physician Nutritionist Sports Agent/ Representative League Officials/ Governing Body Coach Global Team Collaboration

“Knowing that they have a consistent platform that they can depend on and is going to work for them has been fantastic.” Michael Johnson

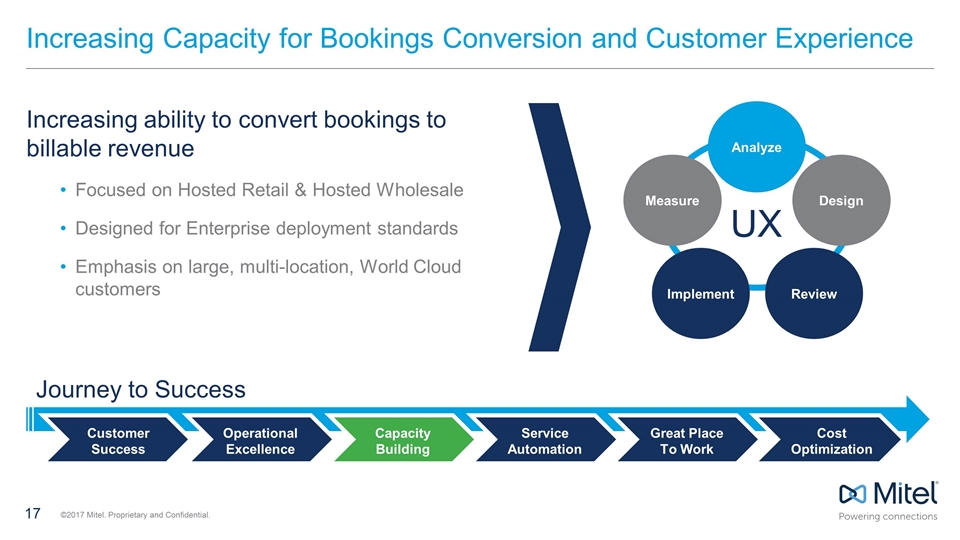

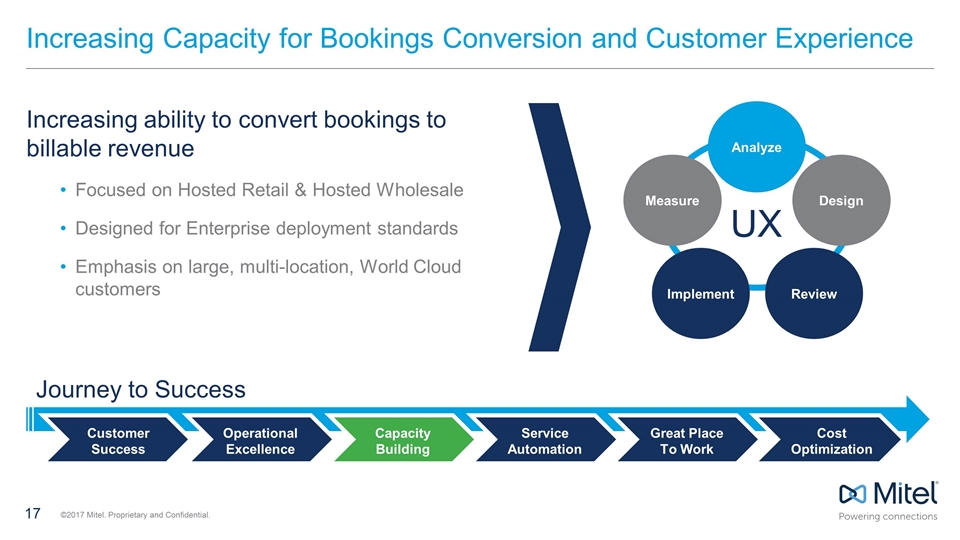

Increasing Capacity for Bookings Conversion and Customer Experience Increasing ability to convert bookings to billable revenue Focused on Hosted Retail & Hosted Wholesale Designed for Enterprise deployment standards Emphasis on large, multi-location, World Cloud customers Analyze Analyze Design Implement Measure Review UX Customer Success Operational Excellence Capacity Building Service Automation Great Place To Work Cost Optimization Journey to Success

Leveraging Service Provider-built offers reaching 30 countries

Major Nordic Capital City

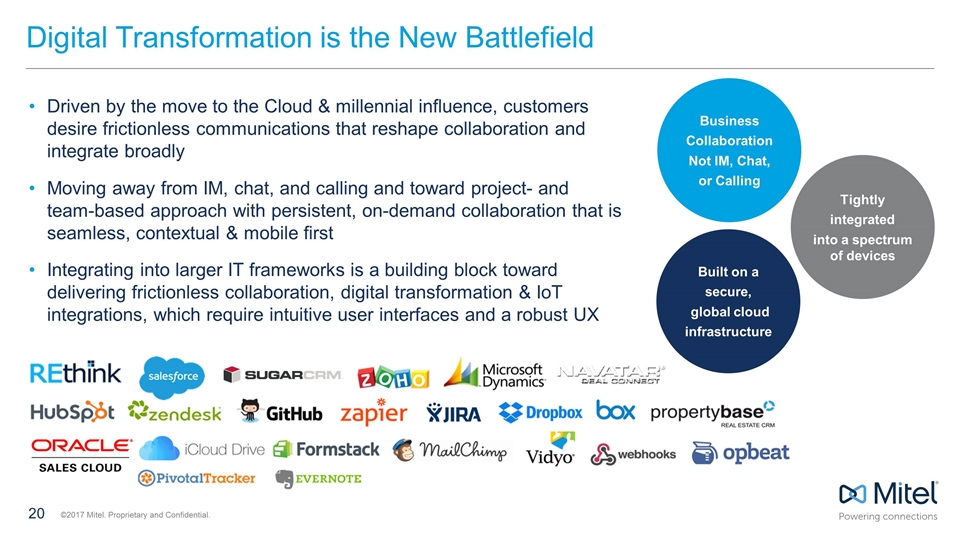

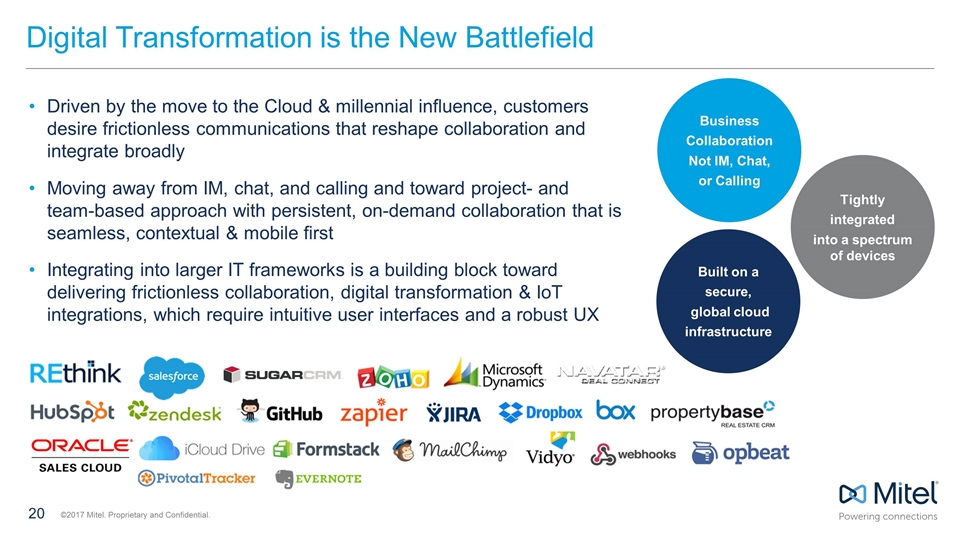

Digital Transformation is the New Battlefield Driven by the move to the Cloud & millennial influence, customers desire frictionless communications that reshape collaboration and integrate broadly Moving away from IM, chat, and calling and toward project- and team-based approach with persistent, on-demand collaboration that is seamless, contextual & mobile first Integrating into larger IT frameworks is a building block toward delivering frictionless collaboration, digital transformation & IoT integrations, which require intuitive user interfaces and a robust UX Business Collaboration Not IM, Chat, or Calling Tightly integrated into a spectrum of devices Built on a secure, global cloud infrastructure

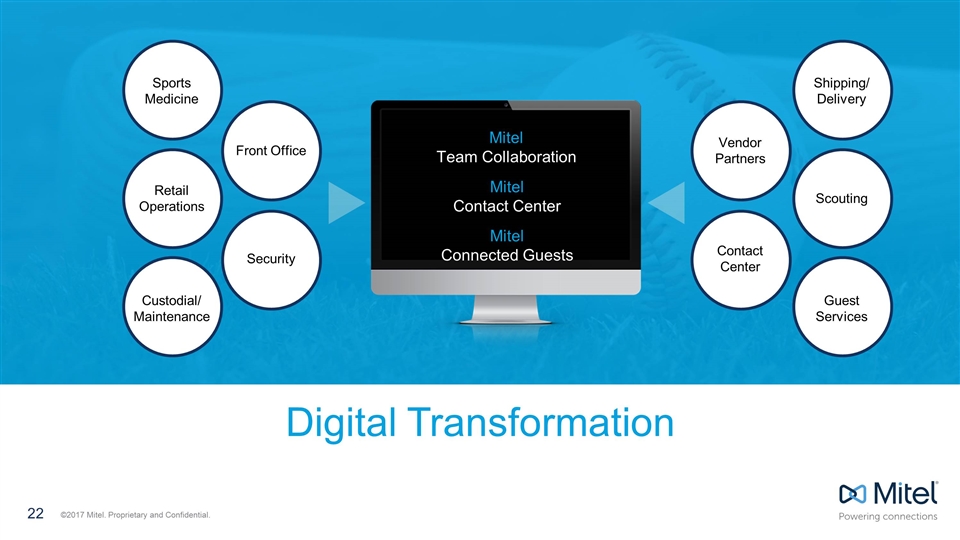

Digital Transformation

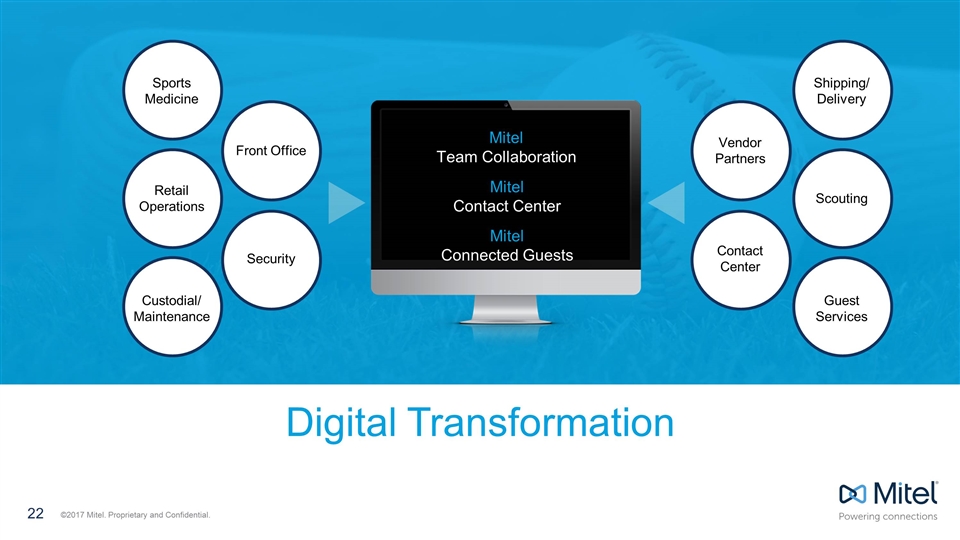

Digital Transformation Sports Medicine Shipping/ Delivery Vendor Partners Front Office Contact Center Security Retail Operations Scouting Custodial/ Maintenance Guest Services Mitel Team Collaboration Mitel Connected Guests Mitel Contact Center

Secure Collaboration

Secure Collaboration Mitel Secure Collaboration Mitel Mass Notification CIA Sheriff’s Office Local Police FBI Fire Department ATF Counter- Terrorism State Police NSA EMT

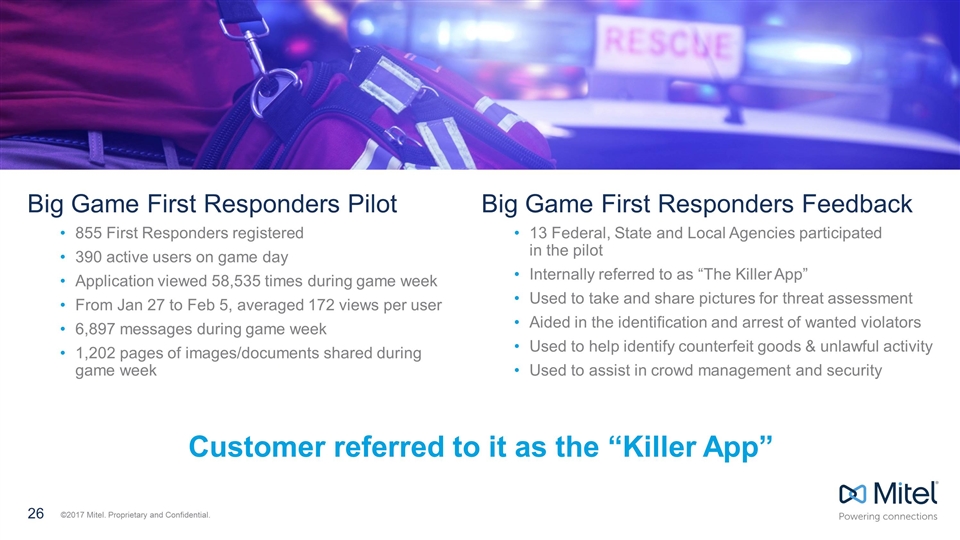

Big Game First Responders Pilot 855 First Responders registered 390 active users on game day Application viewed 58,535 times during game week From Jan 27 to Feb 5, averaged 172 views per user 6,897 messages during game week 1,202 pages of images/documents shared during game week Big Game First Responders Feedback 13 Federal, State and Local Agencies participated in the pilot Internally referred to as “The Killer App” Used to take and share pictures for threat assessment Aided in the identification and arrest of wanted violators Used to help identify counterfeit goods & unlawful activity Used to assist in crowd management and security Customer referred to it as the “Killer App”

Mitel Will Win in the Cloud Transition By expanding our footprint By growing our capacity to deliver & support By leveraging our service provider relationships By extending our capabilities through innovation

JIM DAVIES, VP – ADVANCED APPLICATIONS Mass Notification Preview March 7, 2017

STEVE SPOONER, CFO Analyst Day March 7, 2017

Outline CY16 in review Target model review & update New segmentation Financing update EBITDA/FCF conversion and cash-on-cash returns Share buyback plans Q&A

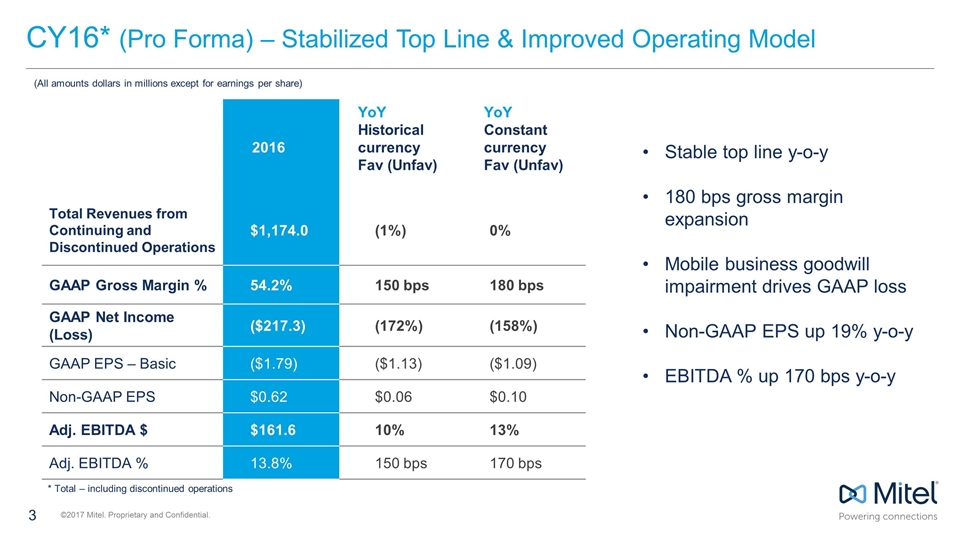

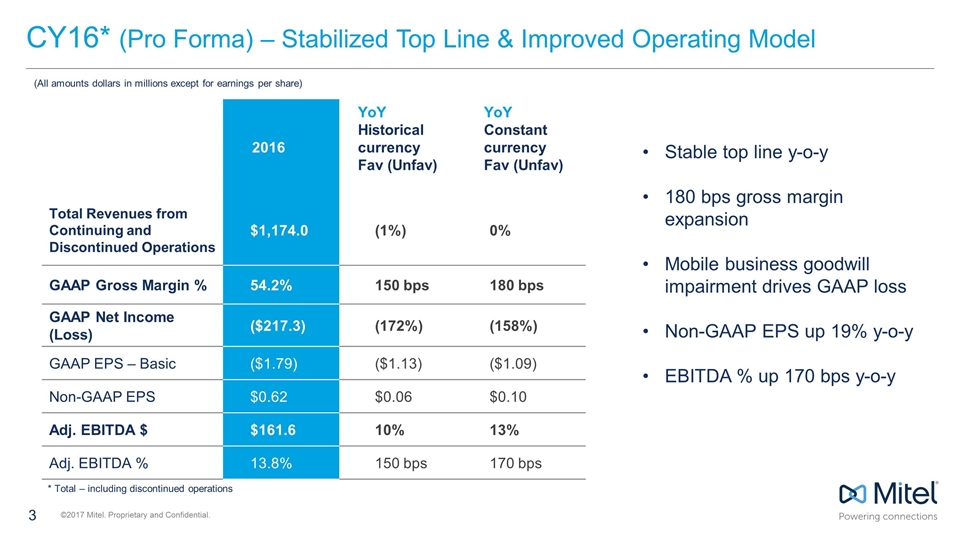

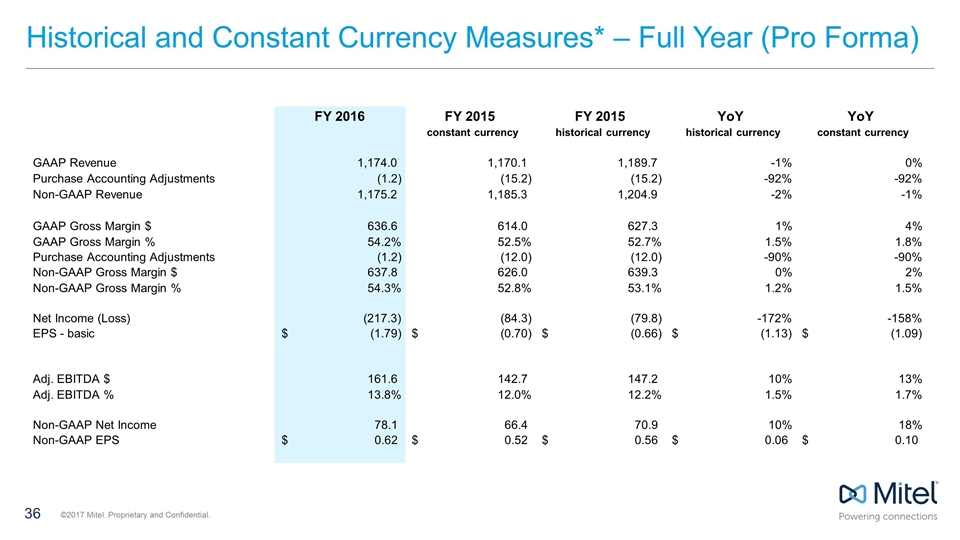

CY16* (Pro Forma) – Stabilized Top Line & Improved Operating Model 2016 YoY Historical currency Fav (Unfav) YoY Constant currency Fav (Unfav) Total Revenues from Continuing and Discontinued Operations $1,174.0 (1%) 0% GAAP Gross Margin % 54.2% 150 bps 180 bps GAAP Net Income (Loss) ($217.3) (172%) (158%) GAAP EPS – Basic ($1.79) ($1.13) ($1.09) Non-GAAP EPS $0.62 $0.06 $0.10 Adj. EBITDA $ $161.6 10% 13% Adj. EBITDA % 13.8% 150 bps 170 bps (All amounts dollars in millions except for earnings per share) * Total – including discontinued operations Stable top line y-o-y 180 bps gross margin expansion Mobile business goodwill impairment drives GAAP loss Non-GAAP EPS up 19% y-o-y EBITDA % up 170 bps y-o-y

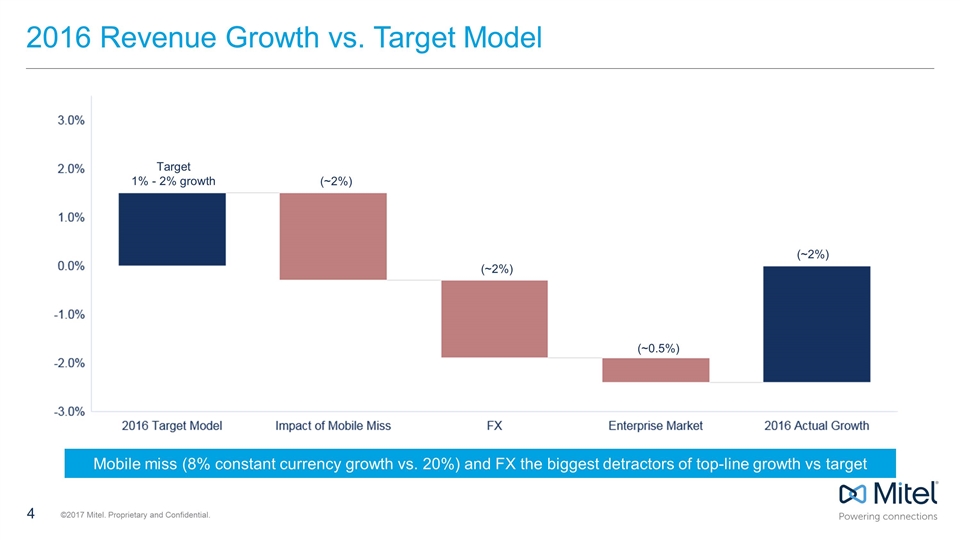

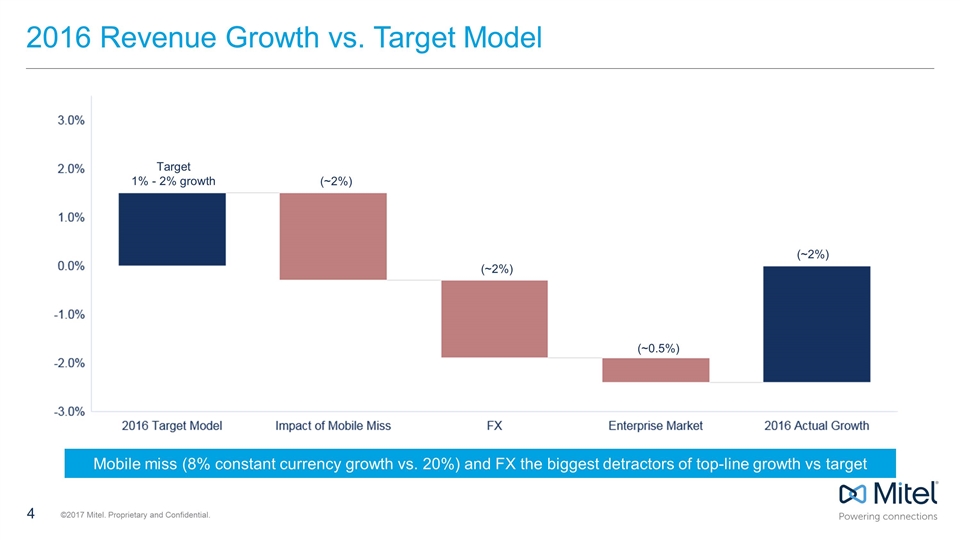

2016 Revenue Growth vs. Target Model Mobile miss (8% constant currency growth vs. 20%) and FX the biggest detractors of top-line growth vs target Target 1% - 2% growth (~2%) (~2%) (~0.5%) (~2%)

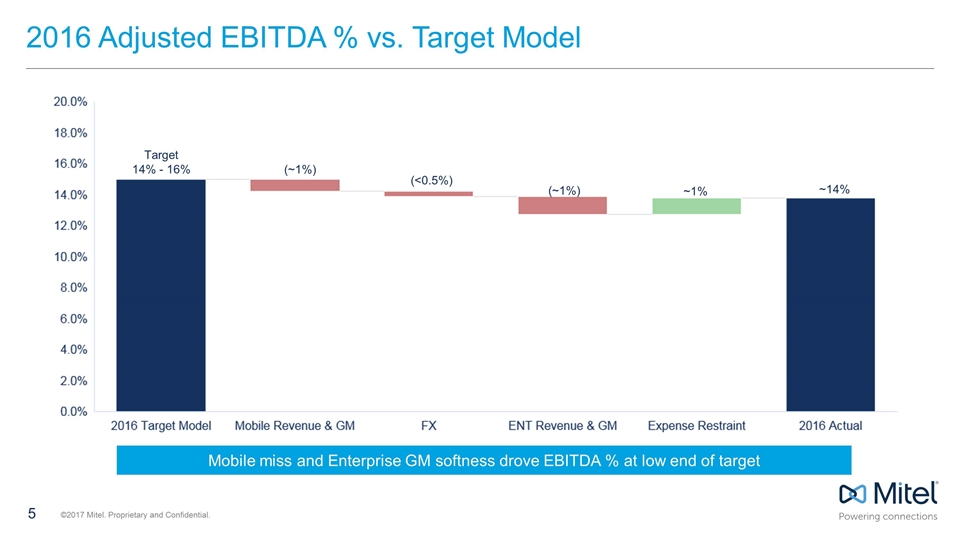

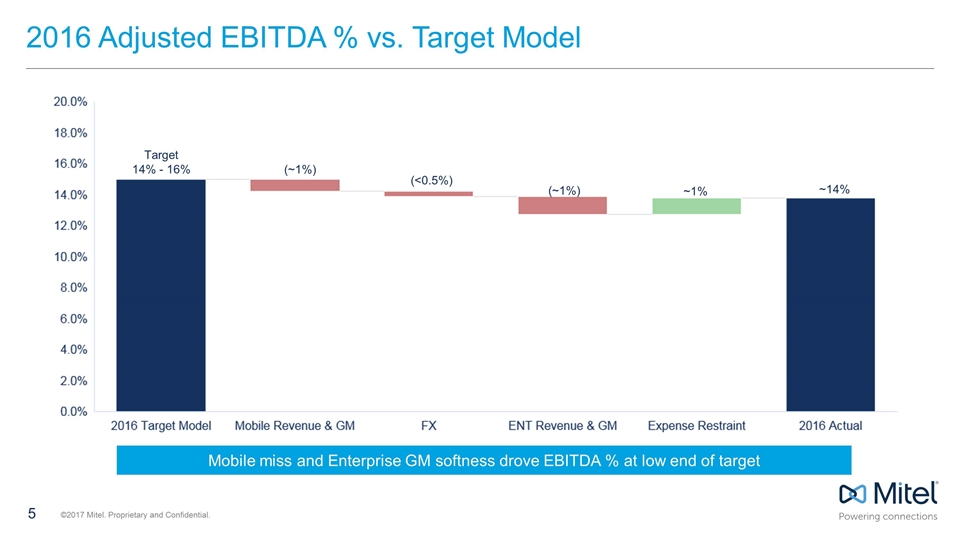

2016 Adjusted EBITDA % vs. Target Model Target 14% - 16% (~1%) (<0.5%) ~1% (~1%) ~14% Mobile miss and Enterprise GM softness drove EBITDA % at low end of target

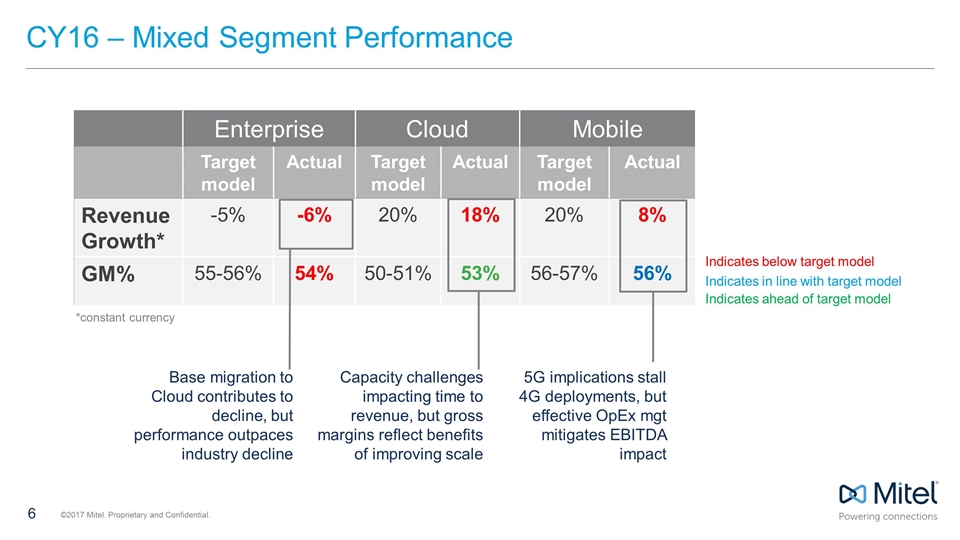

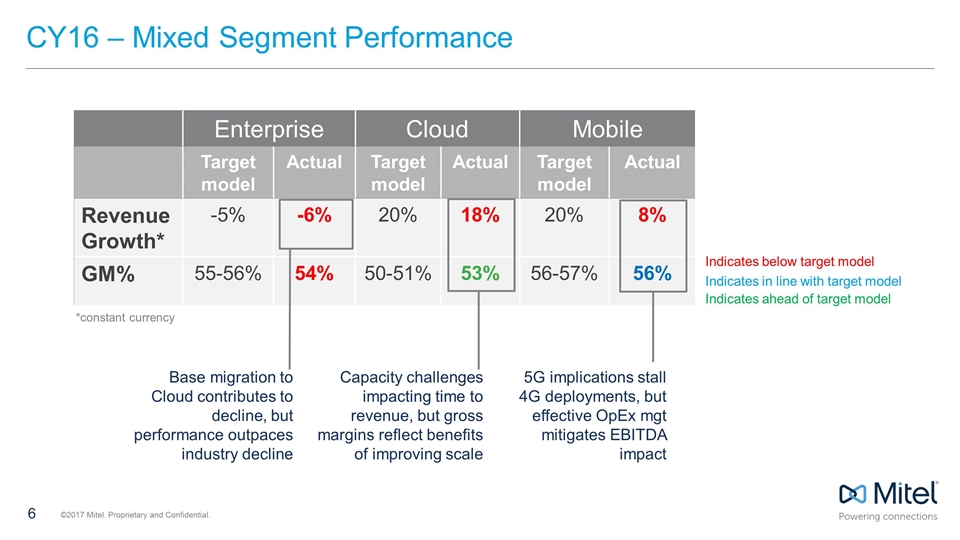

CY16 – Mixed Segment Performance Enterprise Cloud Mobile Target model Actual Target model Actual Target model Actual Revenue Growth* -5% -6% 20% 18% 20% 8% GM% 55-56% 54% 50-51% 53% 56-57% 56% *constant currency Indicates below target model Indicates in line with target model Indicates ahead of target model 5G implications stall 4G deployments, but effective OpEx mgt mitigates EBITDA impact Capacity challenges impacting time to revenue, but gross margins reflect benefits of improving scale Base migration to Cloud contributes to decline, but performance outpaces industry decline

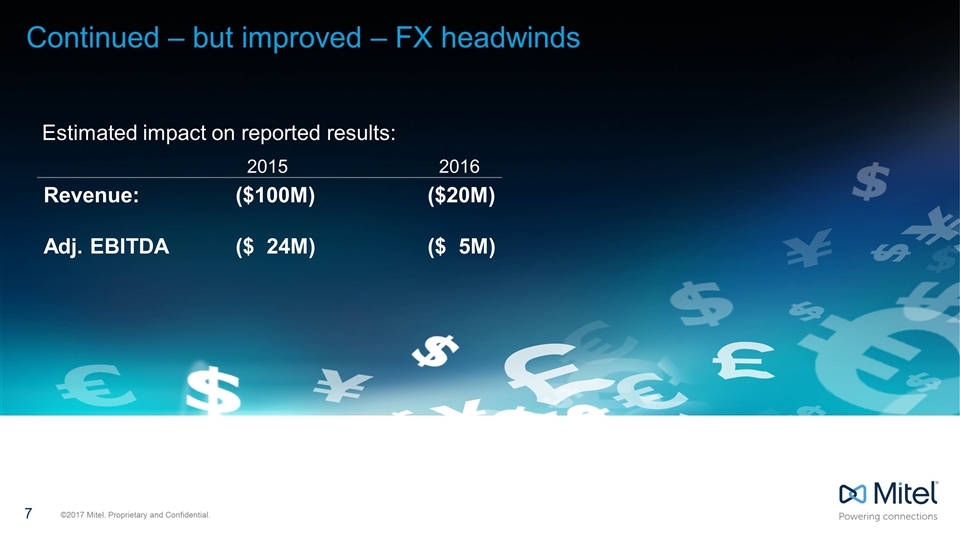

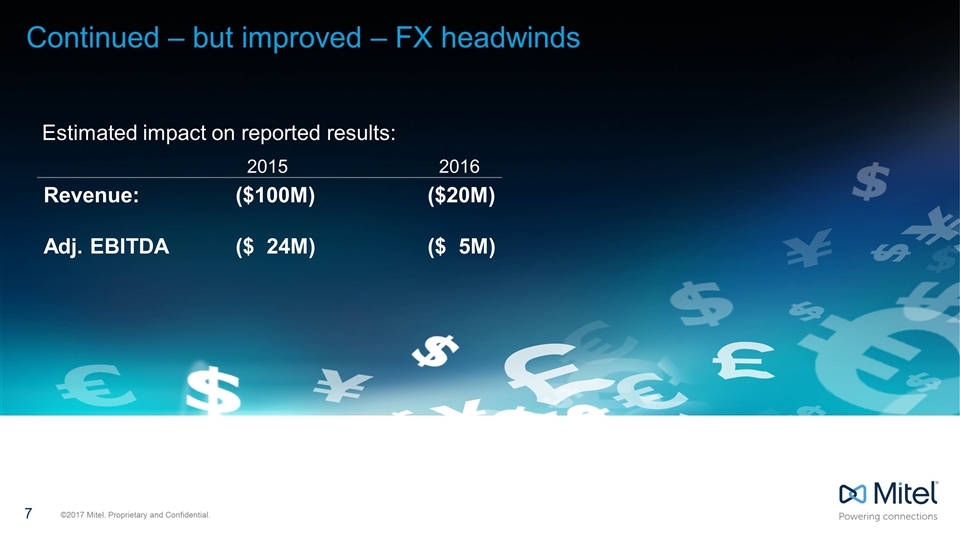

Continued – but improved – FX headwinds Estimated impact on reported results: Revenue:($100M)($20M) Adj. EBITDA($ 24M)($ 5M) 20152016

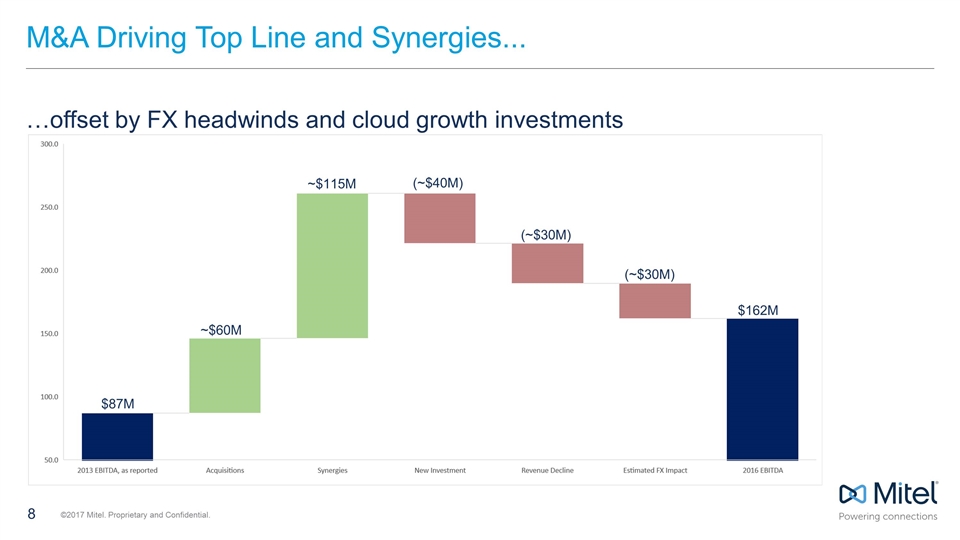

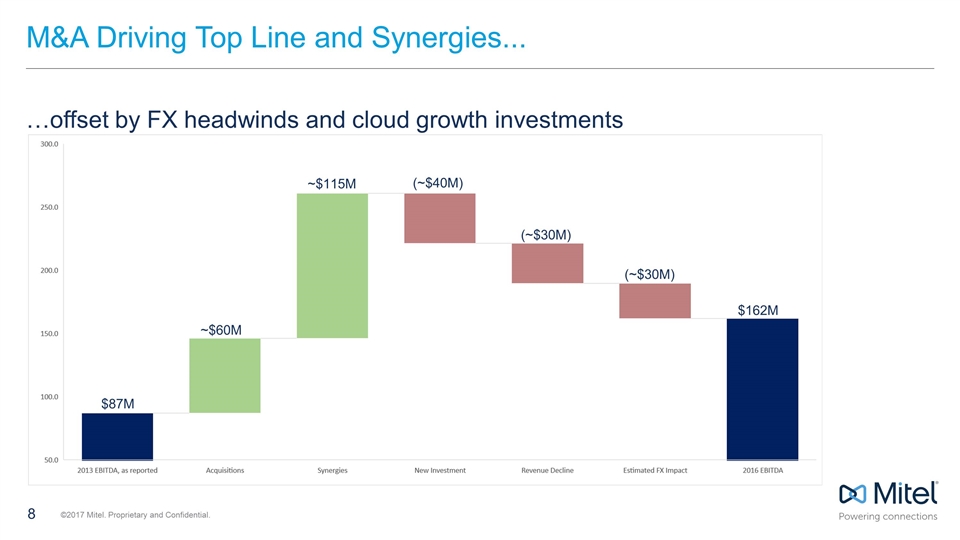

M&A Driving Top Line and Synergies... …offset by FX headwinds and cloud growth investments $87M ~$60M ~$115M (~$40M) (~$30M) (~$30M) $162M

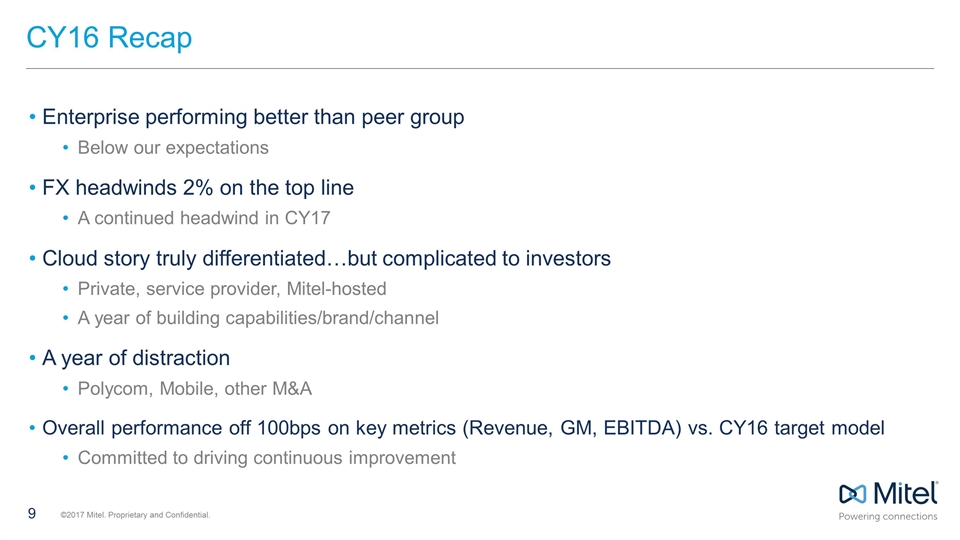

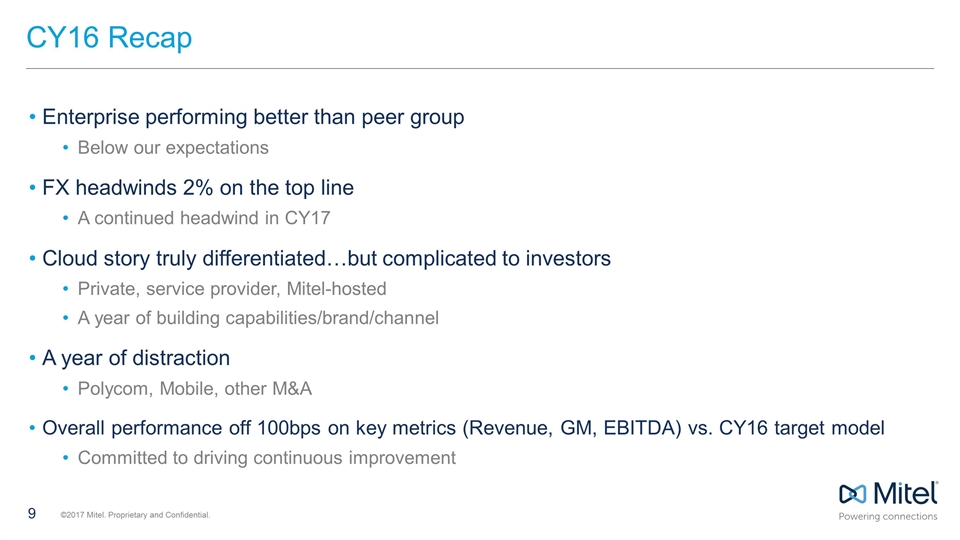

CY16 Recap Enterprise performing better than peer group Below our expectations FX headwinds 2% on the top line A continued headwind in CY17 Cloud story truly differentiated…but complicated to investors Private, service provider, Mitel-hosted A year of building capabilities/brand/channel A year of distraction Polycom, Mobile, other M&A Overall performance off 100bps on key metrics (Revenue, GM, EBITDA) vs. CY16 target model Committed to driving continuous improvement

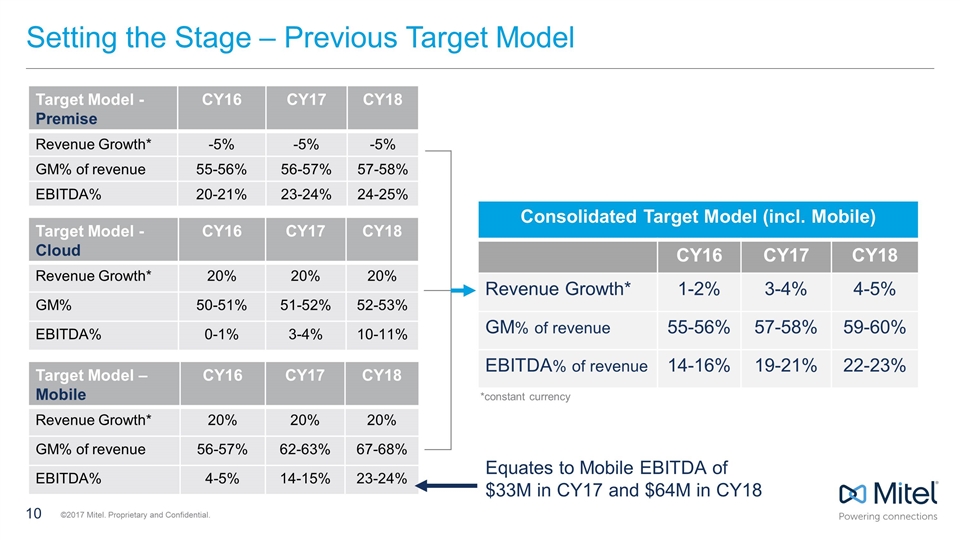

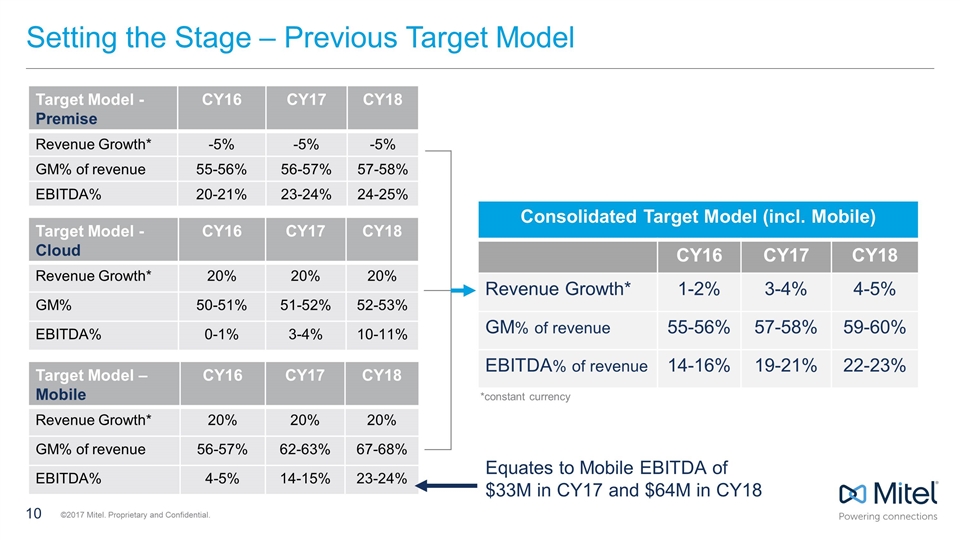

Setting the Stage – Previous Target Model Target Model - Premise CY16 CY17 CY18 Revenue Growth* -5% -5% -5% GM% of revenue 55-56% 56-57% 57-58% EBITDA% 20-21% 23-24% 24-25% Consolidated Target Model (incl. Mobile) CY16 CY17 CY18 Revenue Growth* 1-2% 3-4% 4-5% GM% of revenue 55-56% 57-58% 59-60% EBITDA% of revenue 14-16% 19-21% 22-23% Target Model - Cloud CY16 CY17 CY18 Revenue Growth* 20% 20% 20% GM% 50-51% 51-52% 52-53% EBITDA% 0-1% 3-4% 10-11% Target Model – Mobile CY16 CY17 CY18 Revenue Growth* 20% 20% 20% GM% of revenue 56-57% 62-63% 67-68% EBITDA% 4-5% 14-15% 23-24% *constant currency Equates to Mobile EBITDA of $33M in CY17 and $64M in CY18

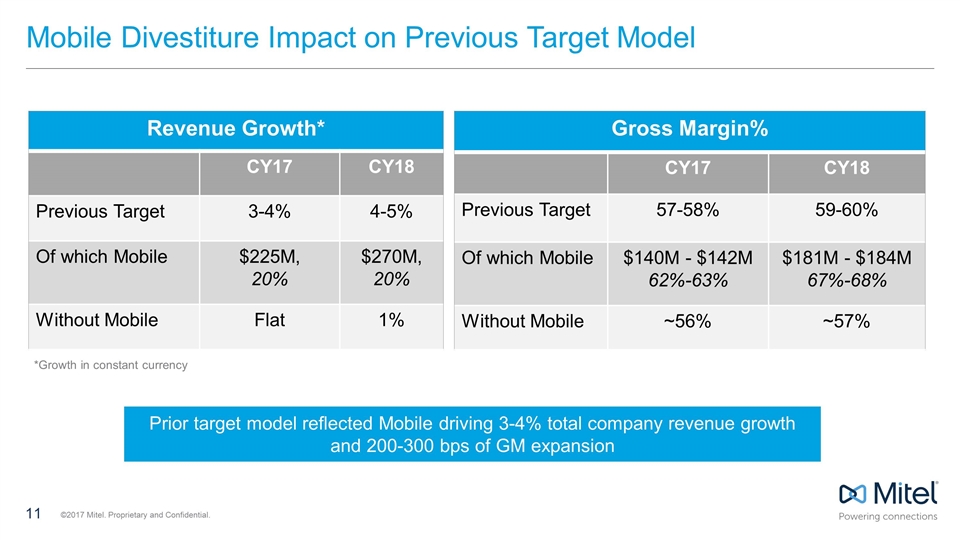

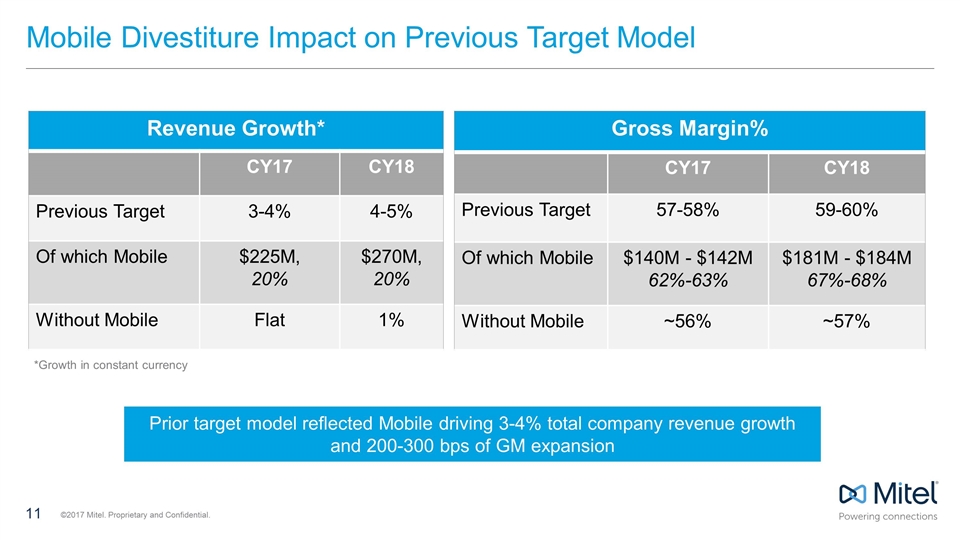

Mobile Divestiture Impact on Previous Target Model Revenue Growth* CY17 CY18 Previous Target 3-4% 4-5% Of which Mobile $225M, 20% $270M, 20% Without Mobile Flat 1% Gross Margin% CY17 CY18 Previous Target 57-58% 59-60% Of which Mobile $140M - $142M 62%-63% $181M - $184M 67%-68% Without Mobile ~56% ~57% Prior target model reflected Mobile driving 3-4% total company revenue growth and 200-300 bps of GM expansion *Growth in constant currency

We listened

We listened… Historical presentation of our Cloud segment highlighted Mitel’s differentiated cloud story Hosted cloud (Mitel as service provider) Wholesale cloud (Mitel as ingredient brand to channel/service provider-branded cloud services) Private cloud (customers adopting Mitel Cloud hybrid/cloud solutions in private network deployment) Broader metric set than most competitors (often leading to confusion given our varied offerings and go to market, impacting our metrics vs. comps) A technology view (move to cloud), not a commercial-terms view (i.e., recurring vs CapEx) Identified a distinct cloud segment…unlike most competitors, who do not

Positioning Relative to Competition We are not 8x8 or RingCentral Our offerings are broader We enable service providers to build and deliver cloud services based on Mitel technology We target a larger customer, with multi-year contracts Our customers often prefer private network vs. public internet (which lowers our cloud margins) We can offer premise, hybrid or cloud…not just hosted cloud, AND the ability to migrate between each We can leverage a 60M user installed base to avoid spending 60% of revenue on sales/marketing

Positioning Relative to Competition We are not 8x8 or RingCentral We own our own hosted cloud customers AND we equip service providers to offer cloud services We are not BroadSoft

Positioning Relative to Competition We are not 8x8 or RingCentral We are an industry leader, international, with scale and highly profitable We are not BroadSoft We are not ShoreTel

Positioning Relative to Competition We are not 8x8 or RingCentral Industry leader in Enterprise communications, with a suite of differentiated premise, hybrid & cloud offerings We are not BroadSoft We are not ShoreTel We are Mitel

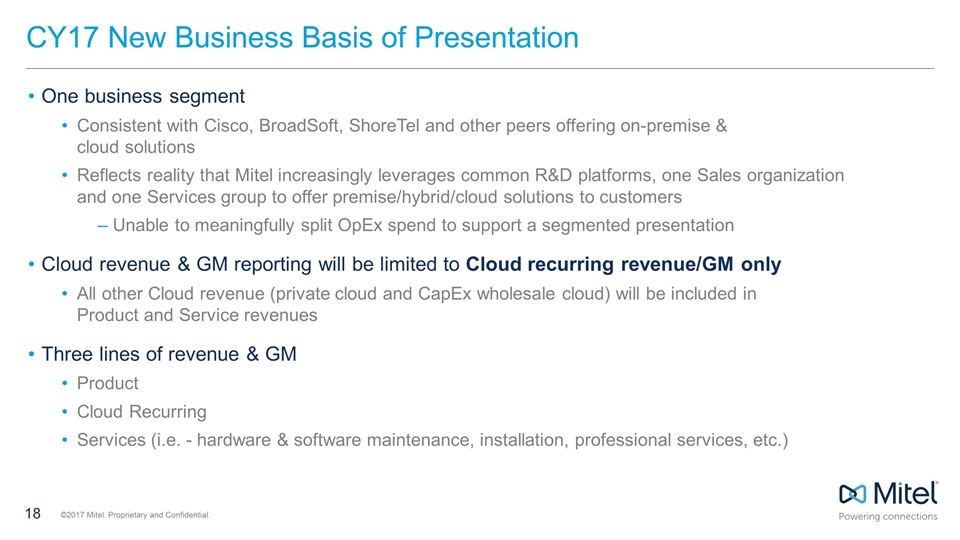

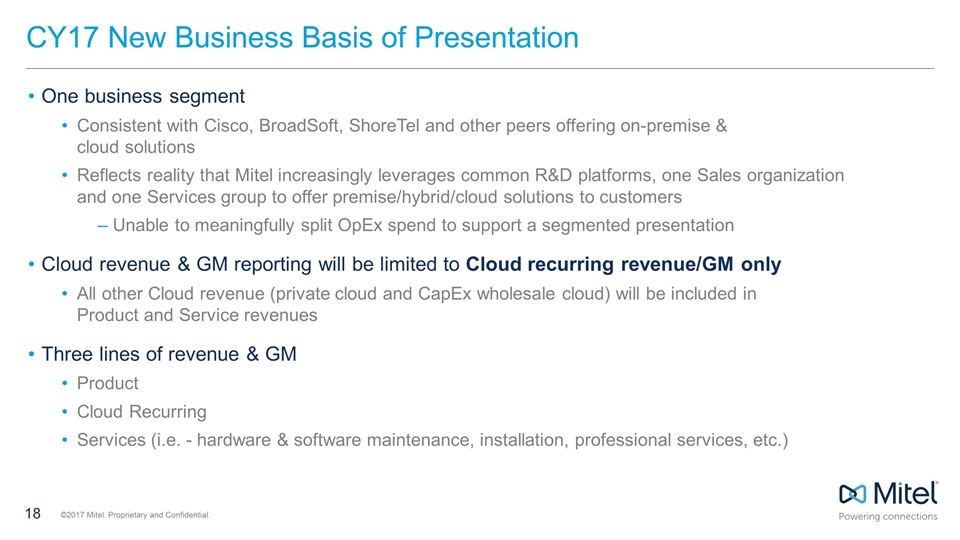

CY17 New Business Basis of Presentation One business segment Consistent with Cisco, BroadSoft, ShoreTel and other peers offering on-premise & cloud solutions Reflects reality that Mitel increasingly leverages common R&D platforms, one Sales organization and one Services group to offer premise/hybrid/cloud solutions to customers Unable to meaningfully split OpEx spend to support a segmented presentation Cloud revenue & GM reporting will be limited to Cloud recurring revenue/GM only All other Cloud revenue (private cloud and CapEx wholesale cloud) will be included in Product and Service revenues Three lines of revenue & GM Product Cloud Recurring Services (i.e. - hardware & software maintenance, installation, professional services, etc.)

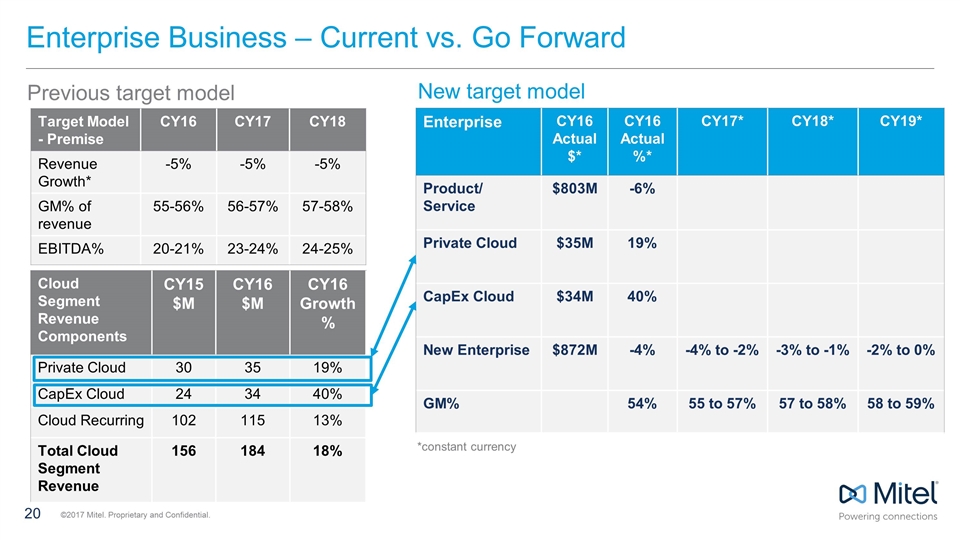

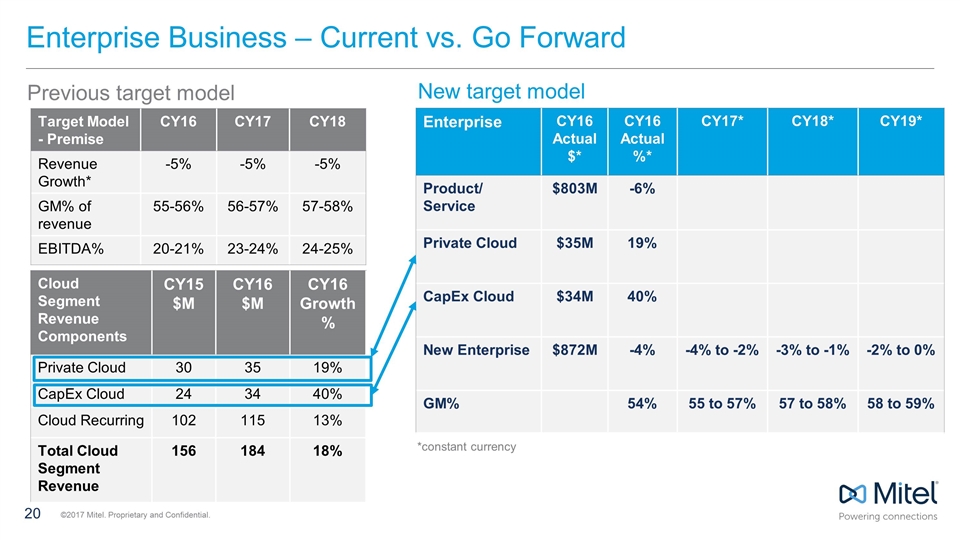

Cloud Business – Current vs. Go Forward Cloud CY16 CY17 CY18 Revenue Growth* 20% 20% 20% GM% 50-51% 51-52% 52-53% Cloud Segment Components CY15 $M CY16 $M CY16 Growth % Private Cloud 30 35 19% CapEx Cloud 24 34 40% Cloud Recurring 102 115 13% Total Cloud Segment 156 184 18% Previous target model Cloud Recurring CY16 Actual CY17 CY18 CY19 Revenue Growth* 13% 16-18% 18-20% 19-21% GM% 50% 51-53% 53-55% 55-57% New target model *constant currency *constant currency

Enterprise Business – Current vs. Go Forward *constant currency Cloud Segment Revenue Components CY15 $M CY16 $M CY16 Growth % Private Cloud 30 35 19% CapEx Cloud 24 34 40% Cloud Recurring 102 115 13% Total Cloud Segment Revenue 156 184 18% Enterprise CY16 Actual $* CY16 Actual %* CY17* CY18* CY19* Product/ Service $803M -6% Private Cloud $35M 19% CapEx Cloud $34M 40% New Enterprise $872M -4% -4% to -2% -3% to -1% -2% to 0% GM% 54% 55 to 57% 57 to 58% 58 to 59% *constant currency Target Model - Premise CY16 CY17 CY18 Revenue Growth* -5% -5% -5% GM% of revenue 55-56% 56-57% 57-58% EBITDA% 20-21% 23-24% 24-25% Previous target model New target model

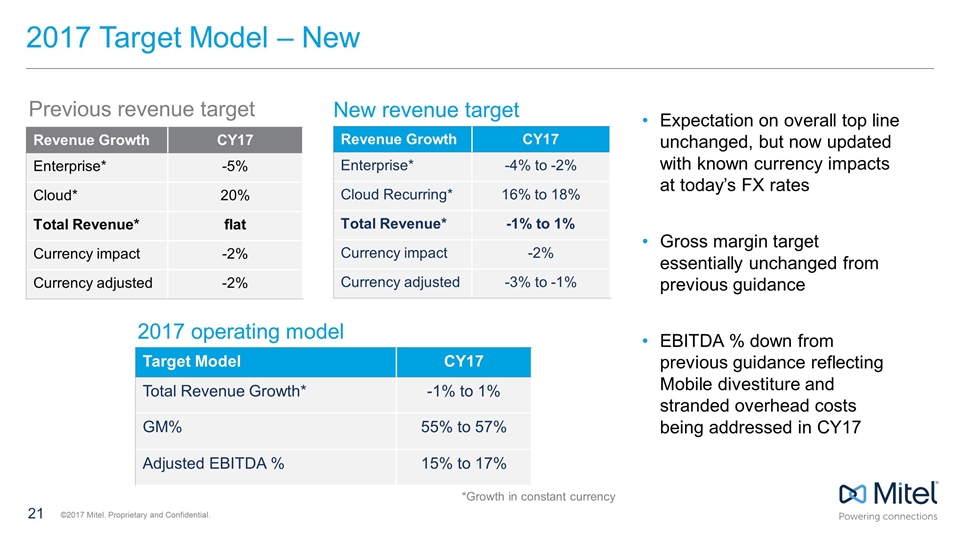

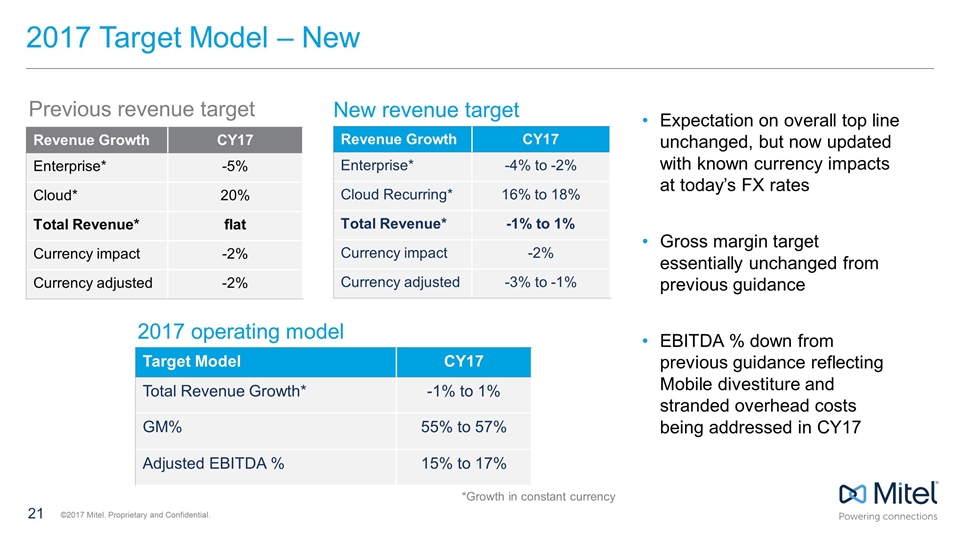

2017 Target Model – New Revenue Growth CY17 Enterprise* -5% Cloud* 20% Total Revenue* flat Currency impact -2% Currency adjusted -2% Revenue Growth CY17 Enterprise* -4% to -2% Cloud Recurring* 16% to 18% Total Revenue* -1% to 1% Currency impact -2% Currency adjusted -3% to -1% Target Model CY17 Total Revenue Growth* -1% to 1% GM% 55% to 57% Adjusted EBITDA % 15% to 17% Expectation on overall top line unchanged, but now updated with known currency impacts at today’s FX rates Gross margin target essentially unchanged from previous guidance EBITDA % down from previous guidance reflecting Mobile divestiture and stranded overhead costs being addressed in CY17 Previous revenue target New revenue target 2017 operating model *Growth in constant currency

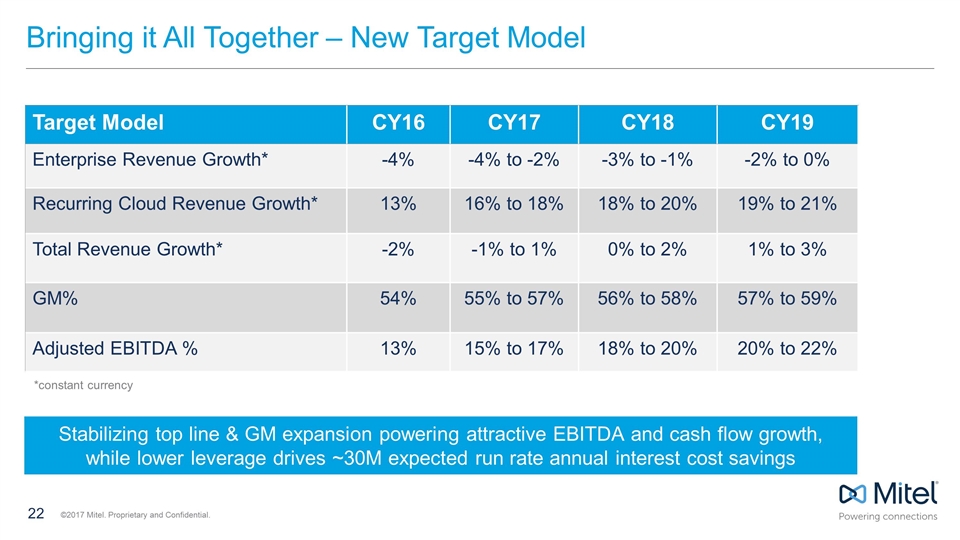

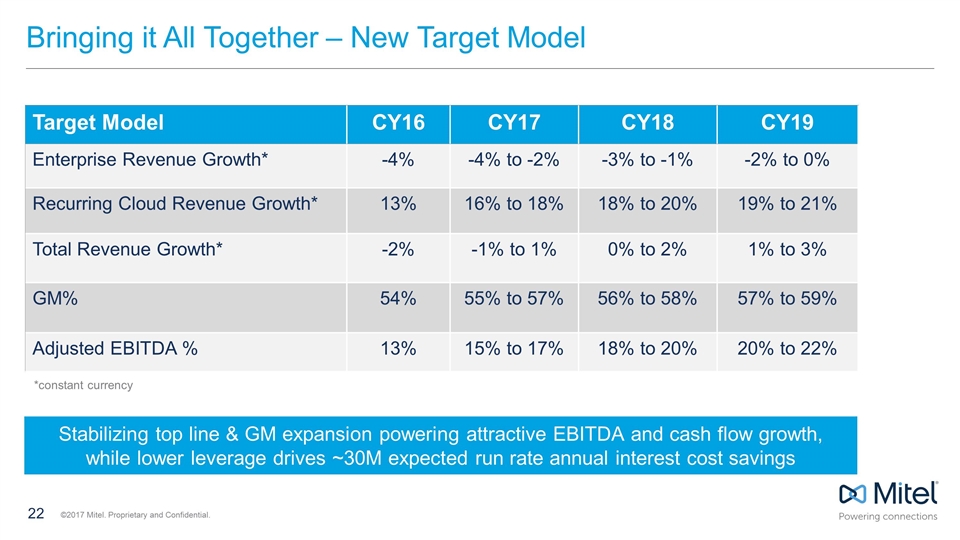

Bringing it All Together – New Target Model Target Model CY16 CY17 CY18 CY19 Enterprise Revenue Growth* -4% -4% to -2% -3% to -1% -2% to 0% Recurring Cloud Revenue Growth* 13% 16% to 18% 18% to 20% 19% to 21% Total Revenue Growth* -2% -1% to 1% 0% to 2% 1% to 3% GM% 54% 55% to 57% 56% to 58% 57% to 59% Adjusted EBITDA % 13% 15% to 17% 18% to 20% 20% to 22% *constant currency Stabilizing top line & GM expansion powering attractive EBITDA and cash flow growth, while lower leverage drives ~30M expected run rate annual interest cost savings

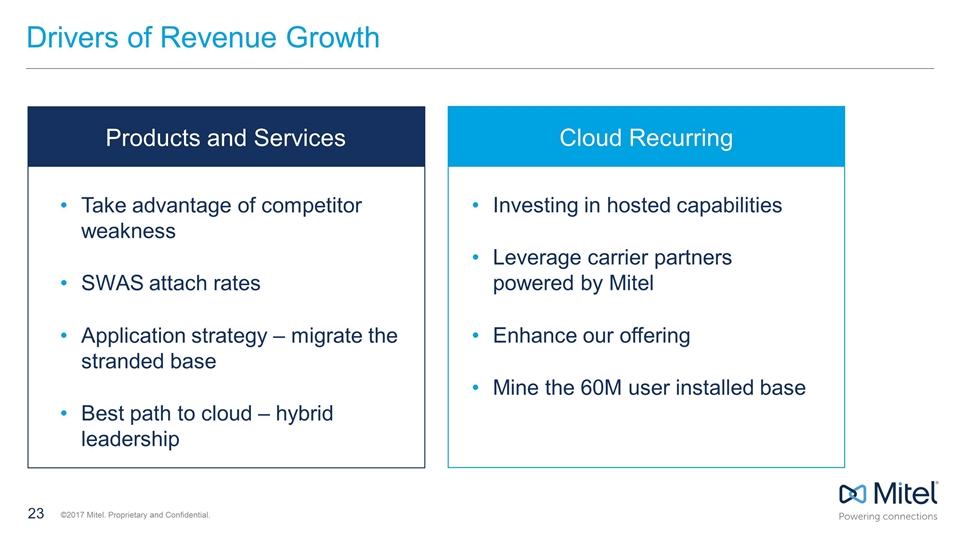

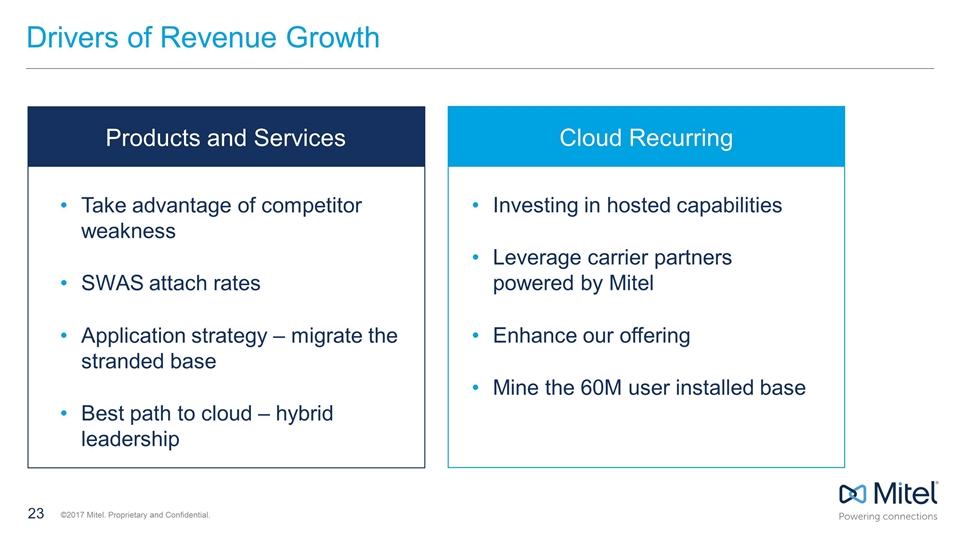

Drivers of Revenue Growth Take advantage of competitor weakness SWAS attach rates Application strategy – migrate the stranded base Best path to cloud – hybrid leadership Investing in hosted capabilities Leverage carrier partners powered by Mitel Enhance our offering Mine the 60M user installed base Products and Services Cloud Recurring

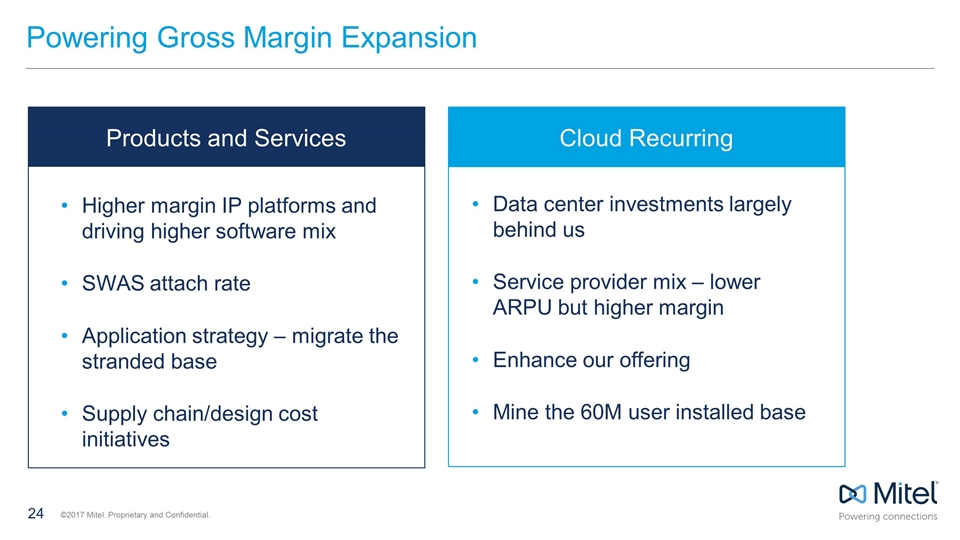

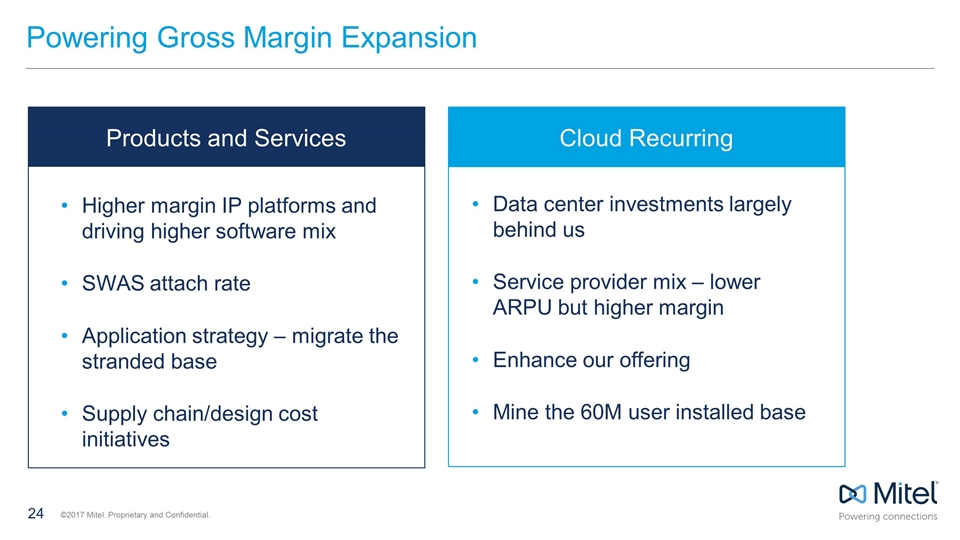

Powering Gross Margin Expansion Higher margin IP platforms and driving higher software mix SWAS attach rate Application strategy – migrate the stranded base Supply chain/design cost initiatives Data center investments largely behind us Service provider mix – lower ARPU but higher margin Enhance our offering Mine the 60M user installed base Products and Services Cloud Recurring

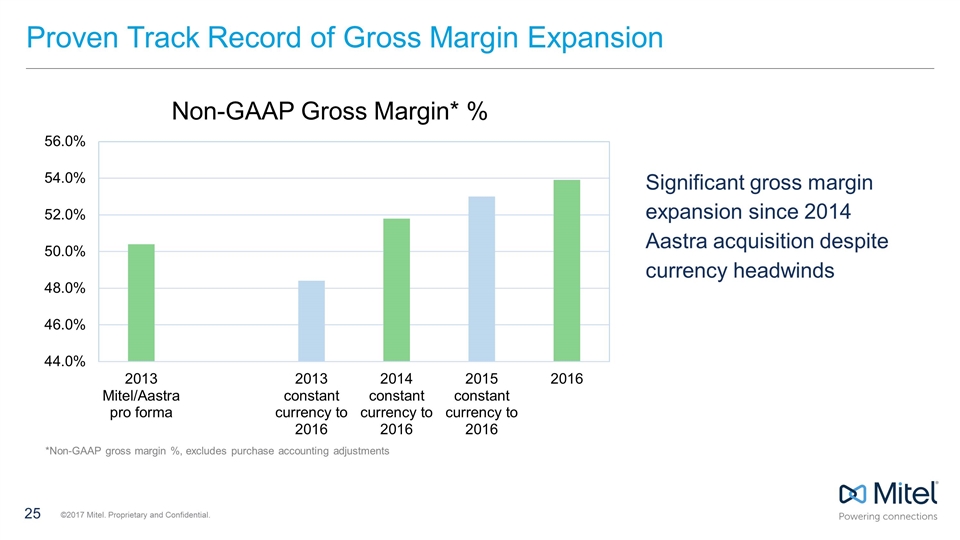

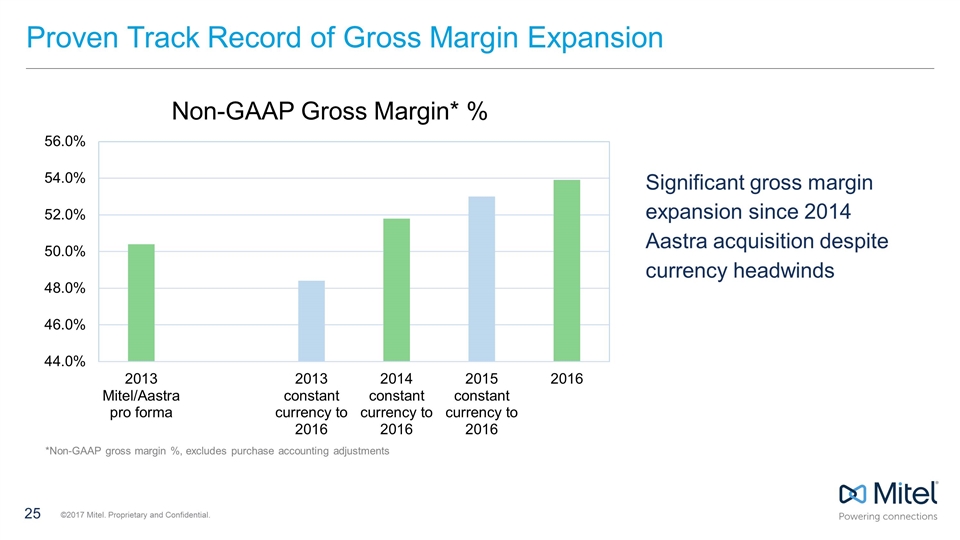

Proven Track Record of Gross Margin Expansion Significant gross margin expansion since 2014 Aastra acquisition despite currency headwinds *Non-GAAP gross margin %, excludes purchase accounting adjustments

OpEx Initiatives Complete enterprise lab consolidation High cost to low cost offshore 14 ERPs to 1 by end of CY17, now enables: Integrated service organizations Complete distribution consolidation Complete sales/go-to-market consolidation Facilities rationalization Actions to address Mobile stranded overhead costs ~$12M Target elimination exiting 2017 Ongoing program to balance OpEx with top-line trajectory

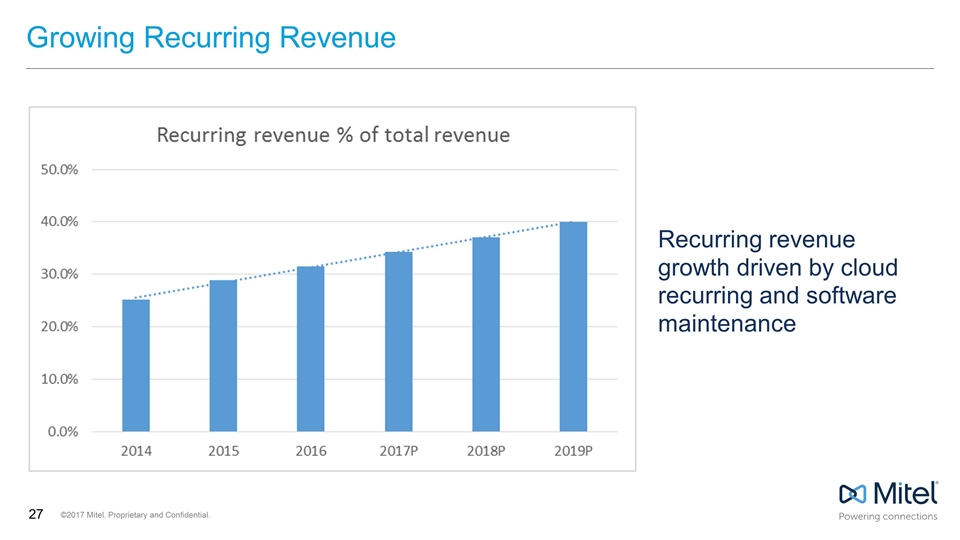

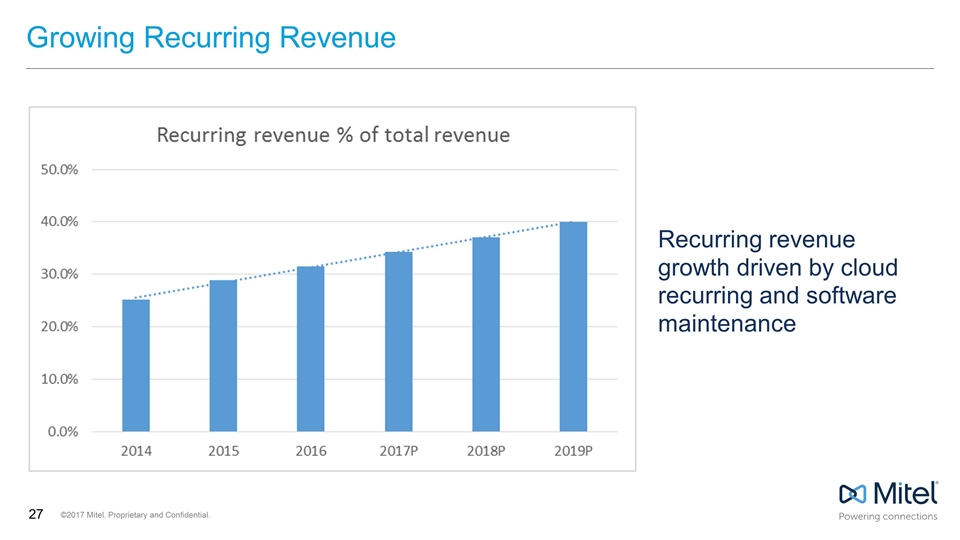

Growing Recurring Revenue Recurring revenue growth driven by cloud recurring and software maintenance

Financing Update Substantially de-leveraged balance sheet Debt markets open for business Optimistic re: securing a new debt facility* Improved flexibility Better rate structure M&A-friendly Shareholder buyback-friendly Expect a substantial cash interest expense reduction given reduced debt and favorable market conditions *expected to close March 2017

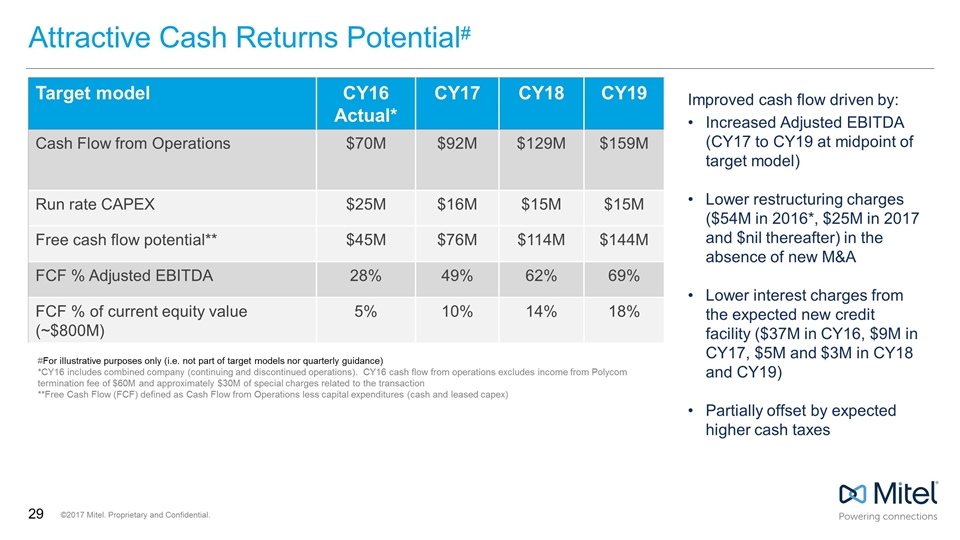

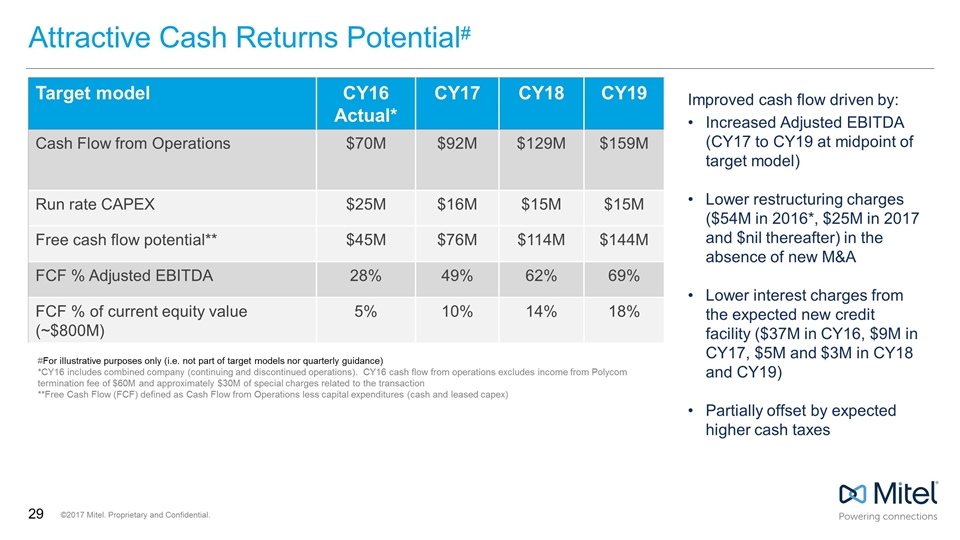

Attractive Cash Returns Potential# Target model CY16 Actual* CY17 CY18 CY19 Cash Flow from Operations $70M $92M $129M $159M Run rate CAPEX $25M $16M $15M $15M Free cash flow potential** $45M $76M $114M $144M FCF % Adjusted EBITDA 28% 49% 62% 69% FCF % of current equity value (~$800M) 5% 10% 14% 18% #For illustrative purposes only (i.e. not part of target models nor quarterly guidance) *CY16 includes combined company (continuing and discontinued operations). CY16 cash flow from operations excludes income from Polycom termination fee of $60M and approximately $30M of special charges related to the transaction **Free Cash Flow (FCF) defined as Cash Flow from Operations less capital expenditures (cash and leased capex) Improved cash flow driven by: Increased Adjusted EBITDA (CY17 to CY19 at midpoint of target model) Lower restructuring charges ($54M in 2016*, $25M in 2017 and $nil thereafter) in the absence of new M&A Lower interest charges from the expected new credit facility ($37M in CY16, $9M in CY17, $5M and $3M in CY18 and CY19) Partially offset by expected higher cash taxes

Share Buybacks We are well positioned to utilize shareholder buybacks to enhance shareholder returns Deleveraged balance sheet Strong operating cash flows Expect to put in place a new shareholder-friendly credit facility Believe current Mitel share price does not reflect value of the company Normal Course Issuer Bid (NCIB) approved by Board and launched Permits repurchase of a max of 7.8M shares in 12-month period Excess cash expected to be utilized to fund either/both repurchase of shares or attractive M&A

Strategic Takeaways Capitalize on 60M user install base to drive refresh to new premise/hybrid/cloud solutions Leverage market leadership/competitive weakness to stabilize Enterprise revenues and continue share gains Continued investment to fuel Cloud revenue growth Drive software/new higher margin services mix to expand margins Grow recurring revenues with increasing Cloud revenue mix Drive OpEx reductions with identified initiatives

What Does This Mean For Investors? Reset and simplified business model (that investors can easily understand) 2 core businesses: Stabilizing Enterprise business and fast-growing Recurring Cloud business Operational scale and margin/OpEx initiatives lead to 200bps+ annual Adjusted EBITDA margin expansion next 3 years Stable top line + Margin expansion => Growing bottom line Highly profitable business with improving FCF conversion rates Restructuring charges largely over for past M&A Expected interest cost savings of $30M (run rate over 2016) Double-digit FCF yield

What Does This Mean For Investors? Singular focus on enhancing shareholder value Deleveraged balance sheet Reduced interest costs Announced share buyback program Balance sheet capacity & strong FCF in the business Powerful tools to undertake: Accretive M&A Share repurchases

Q&A

Financial Appendix

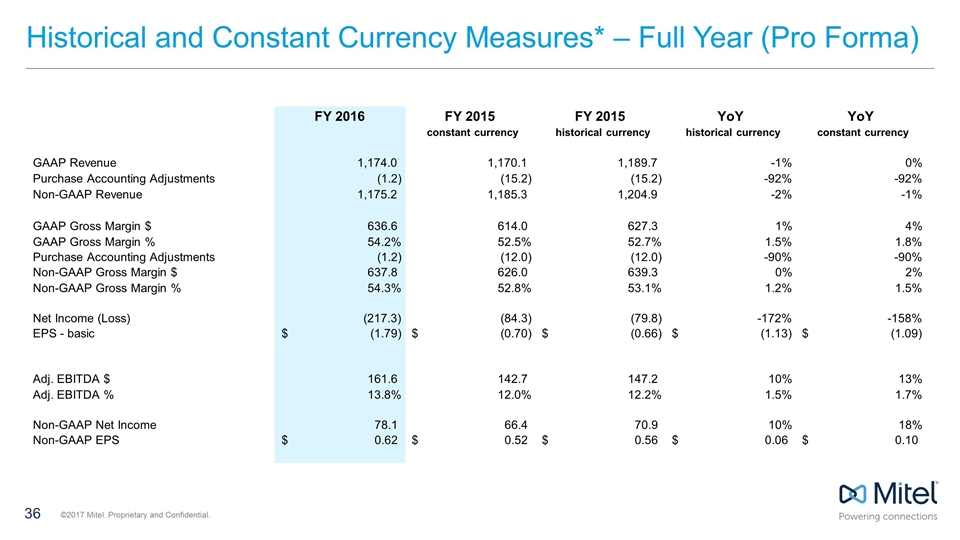

Historical and Constant Currency Measures* – Full Year (Pro Forma) FY 2016 FY 2015 FY 2015 YoY YoY constant currency historical currency historical currency constant currency GAAP Revenue 1,174.0 1,170.1 1,189.7 -1% 0% Purchase Accounting Adjustments (1.2) (15.2) (15.2) -92% -92% Non-GAAP Revenue 1,175.2 1,185.3 1,204.9 -2% -1% GAAP Gross Margin $ 636.6 614.0 627.3 1% 4% GAAP Gross Margin % 54.2% 52.5% 52.7% 1.5% 1.8% Purchase Accounting Adjustments (1.2) (12.0) (12.0) -90% -90% Non-GAAP Gross Margin $ 637.8 626.0 639.3 0% 2% Non-GAAP Gross Margin % 54.3% 52.8% 53.1% 1.2% 1.5% Net Income (Loss) (217.3) (84.3) (79.8) -172% -158% EPS - basic (1.79) $ (0.70) $ (0.66) $ (1.13) $ (1.09) $ Adj. EBITDA $ 161.6 142.7 147.2 10% 13% Adj. EBITDA % 13.8% 12.0% 12.2% 1.5% 1.7% Non-GAAP Net Income 78.1 66.4 70.9 10% 18% Non-GAAP EPS 0.62 $ 0.52 $ 0.56 $ 0.06 $ 0.10 $

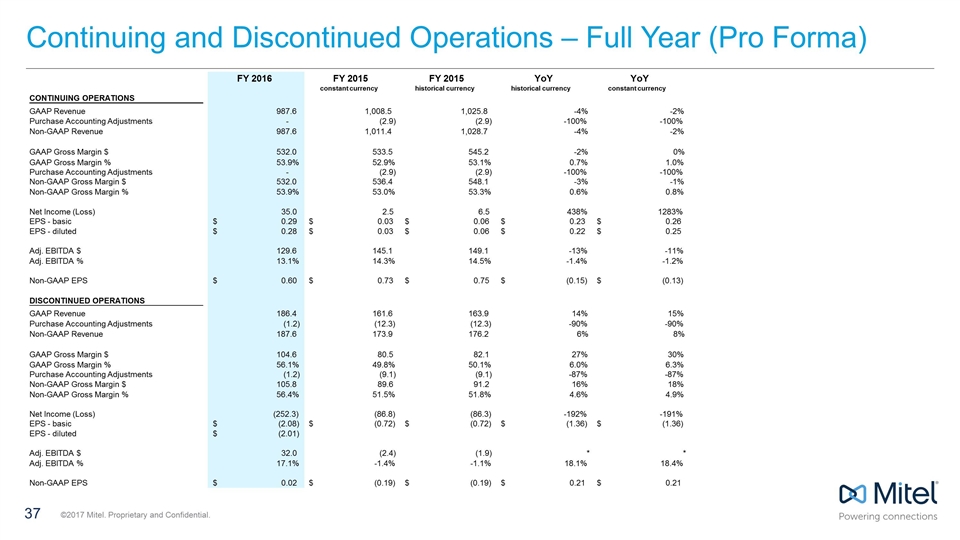

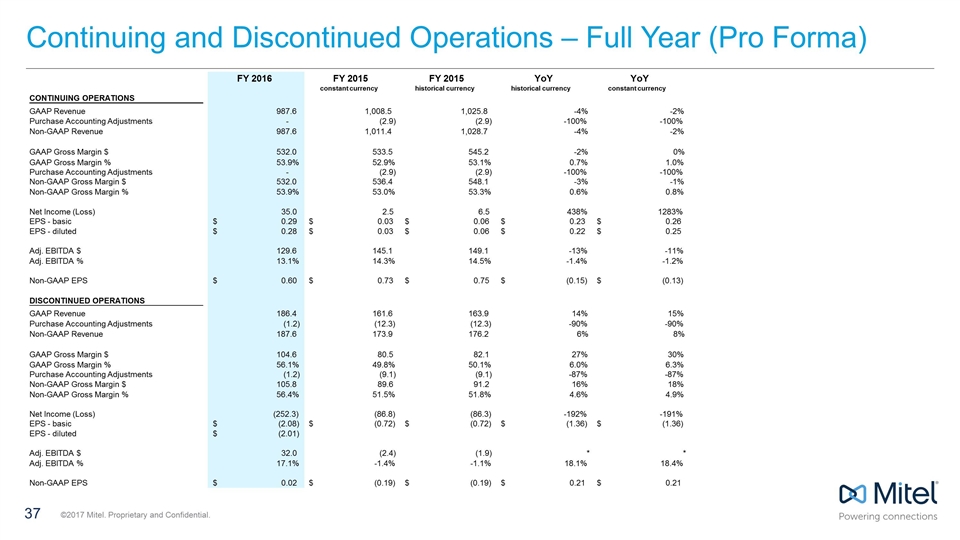

Continuing and Discontinued Operations – Full Year (Pro Forma) FY 2016 FY 2015 FY 2015 YoY YoY constant currency historical currency historical currency constant currency CONTINUING OPERATIONS GAAP Revenue 987.6 1,008.5 1,025.8 -4% -2% Purchase Accounting Adjustments - (2.9) (2.9) -100% -100% Non-GAAP Revenue 987.6 1,011.4 1,028.7 -4% -2% GAAP Gross Margin $ 532.0 533.5 545.2 -2% 0% GAAP Gross Margin % 53.9% 52.9% 53.1% 0.7% 1.0% Purchase Accounting Adjustments - (2.9) (2.9) -100% -100% Non-GAAP Gross Margin $ 532.0 536.4 548.1 -3% -1% Non-GAAP Gross Margin % 53.9% 53.0% 53.3% 0.6% 0.8% Net Income (Loss) 35.0 2.5 6.5 438% 1283% EPS - basic 0.29 $ 0.03 $ 0.06 $ 0.23 $ 0.26 $ EPS - diluted 0.28 $ 0.03 $ 0.06 $ 0.22 $ 0.25 $ Adj. EBITDA $ 129.6 145.1 149.1 -13% -11% Adj. EBITDA % 13.1% 14.3% 14.5% -1.4% -1.2% Non-GAAP EPS 0.60 $ 0.73 $ 0.75 $ (0.15) $ (0.13) $ DISCONTINUED OPERATIONS GAAP Revenue 186.4 161.6 163.9 14% 15% Purchase Accounting Adjustments (1.2) (12.3) (12.3) -90% -90% Non-GAAP Revenue 187.6 173.9 176.2 6% 8% GAAP Gross Margin $ 104.6 80.5 82.1 27% 30% GAAP Gross Margin % 56.1% 49.8% 50.1% 6.0% 6.3% Purchase Accounting Adjustments (1.2) (9.1) (9.1) -87% -87% Non-GAAP Gross Margin $ 105.8 89.6 91.2 16% 18% Non-GAAP Gross Margin % 56.4% 51.5% 51.8% 4.6% 4.9% Net Income (Loss) (252.3) (86.8) (86.3) -192% -191% EPS - basic (2.08) $ (0.72) $ (0.72) $ (1.36) $ (1.36) $ EPS - diluted (2.01) $ Adj. EBITDA $ 32.0 (2.4) (1.9) * * Adj. EBITDA % 17.1% -1.4% -1.1% 18.1% 18.4% Non-GAAP EPS 0.02 $ (0.19) $ (0.19) $ 0.21 $ 0.21 $

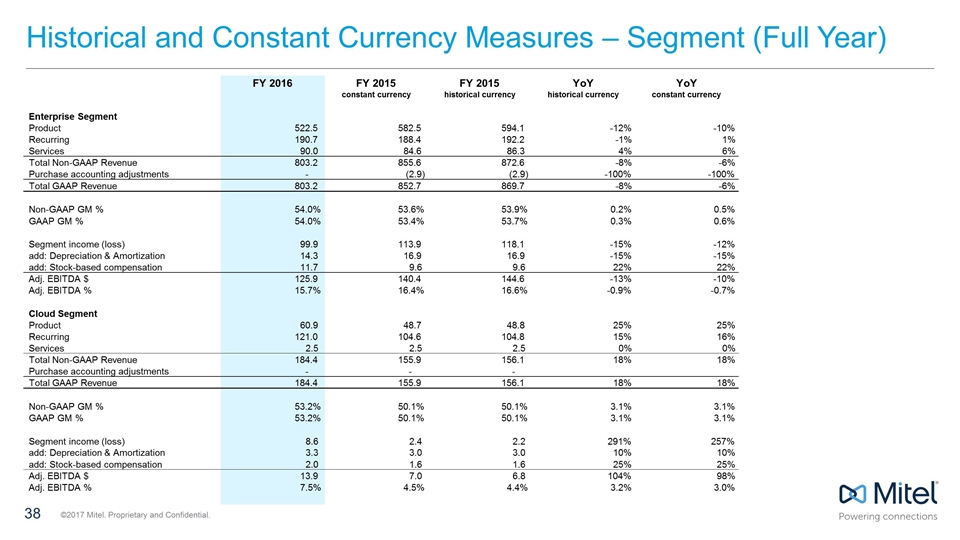

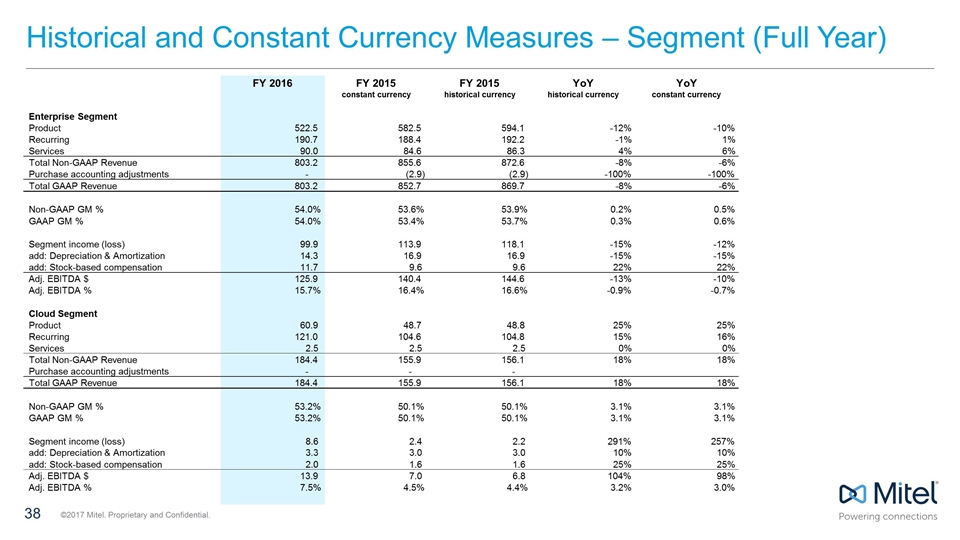

Historical and Constant Currency Measures – Segment (Full Year) FY 2016 FY 2015 FY 2015 YoY YoY constant currency historical currency historical currency constant currency Enterprise Segment Product 522.5 582.5 594.1 -12% -10% Recurring 190.7 188.4 192.2 -1% 1% Services 90.0 84.6 86.3 4% 6% Total Non-GAAP Revenue 803.2 855.6 872.6 -8% -6% Purchase accounting adjustments - (2.9) (2.9) -100% -100% Total GAAP Revenue 803.2 852.7 869.7 -8% -6% Non-GAAP GM % 54.0% 53.6% 53.9% 0.2% 0.5% GAAP GM % 54.0% 53.4% 53.7% 0.3% 0.6% Segment income (loss) 99.9 113.9 118.1 -15% -12% add: Depreciation & Amortization 14.3 16.9 16.9 -15% -15% add: Stock-based compensation 11.7 9.6 9.6 22% 22% Adj. EBITDA $ 125.9 140.4 144.6 -13% -10% Adj. EBITDA % 15.7% 16.4% 16.6% -0.9% -0.7% Cloud Segment Product 60.9 48.7 48.8 25% 25% Recurring 121.0 104.6 104.8 15% 16% Services 2.5 2.5 2.5 0% 0% Total Non-GAAP Revenue 184.4 155.9 156.1 18% 18% Purchase accounting adjustments - - - Total GAAP Revenue 184.4 155.9 156.1 18% 18% Non-GAAP GM % 53.2% 50.1% 50.1% 3.1% 3.1% GAAP GM % 53.2% 50.1% 50.1% 3.1% 3.1% Segment income (loss) 8.6 2.4 2.2 291% 257% add: Depreciation & Amortization 3.3 3.0 3.0 10% 10% add: Stock-based compensation 2.0 1.6 1.6 25% 25% Adj. EBITDA $ 13.9 7.0 6.8 104% 98% Adj. EBITDA % 7.5% 4.5% 4.4% 3.2% 3.0%

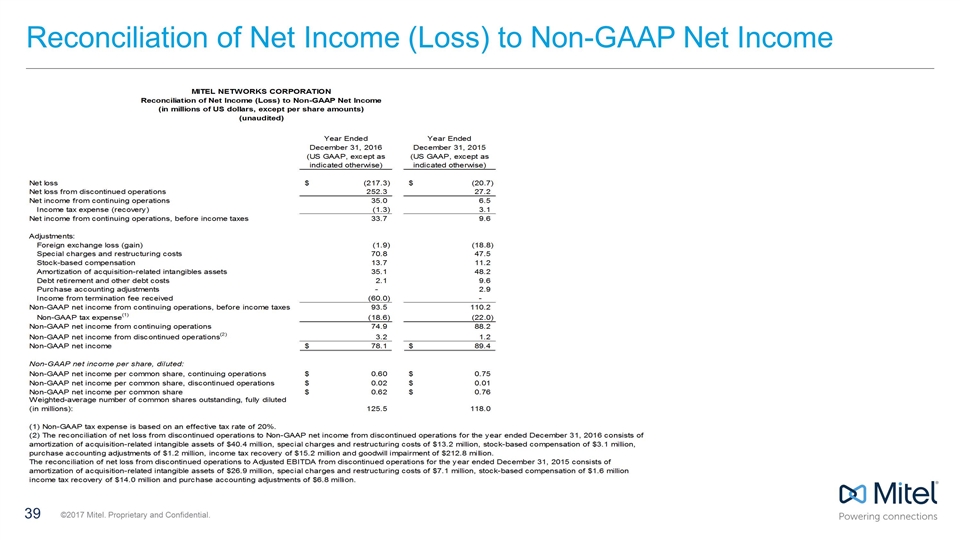

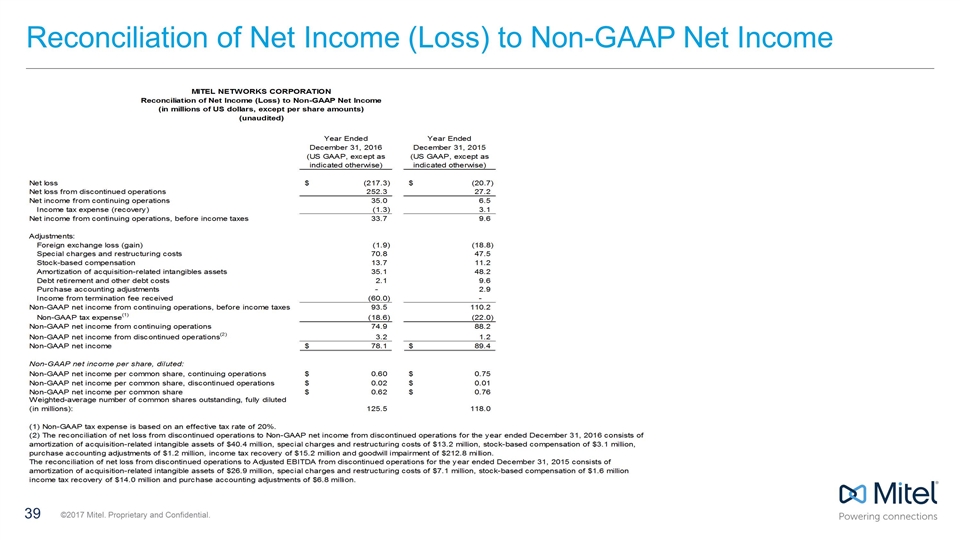

Reconciliation of Net Income (Loss) to Non-GAAP Net Income

Reconciliation of Net Income (Loss) to Adjusted EBITDA Net loss (217.3) $ (20.7) $ Net loss from discontinued operations 252.3 27.2 Net income from continuing operations 35.0 6.5 Adjustments: Interest expense 16.8 17.8 Income tax expense (recovery) (1.3) 3.1 Amortization and depreciation 54.4 69.3 Foreign exchange gain (1.9) (18.8) Special charges and restructuring costs 70.8 47.5 Stock-based compensation 13.7 11.2 Debt retirement and other debt costs 2.1 9.6 Purchase accounting adjustments - 2.9 Income from termination fee received (60.0) - Adjusted EBITDA from continuing operations 129.6 149.1 Adjusted EBITDA from discontinued operations (1) 32.0 19.0 Adjusted EBITDA 161.6 $ 168.1 $ (1) The reconciliation of net loss from discontinued operations to Adjusted EBITDA from discontinued operations for the year ended December 31, 2016 consists of interest expense of $22.0 million, income tax recovery of $14.3 million, amortization and depreciation of $46.3 million, special charges and restructuring costs of $13.2 million, stock-based compensation of $3.1 million, purchase accounting adjustments of $1.2 million and goodwill impairment of $212.8 million. The reconciliation of net loss from discontinued operations to Adjusted EBITDA from discontinued operations for the year ended December 31, 2015 consists of interest expense of $14.6 million, income tax recovery of $13.7 million, amortization and depreciation of $29.8 million, special charges and restructuring costs of $7.1 million, stock-based compensation of $1.6 million and purchase accounting adjustments of $6.8 million. Year Ended December 31, 2016 (US GAAP, except Adjusted EBITDA) Year Ended December 31, 2015 (US GAAP, except Adjusted EBITDA) MITEL NETWORKS CORPORATION Reconciliation of Net Income (Loss) to Adjusted EBITDA (in millions of US dollars) (unaudited)

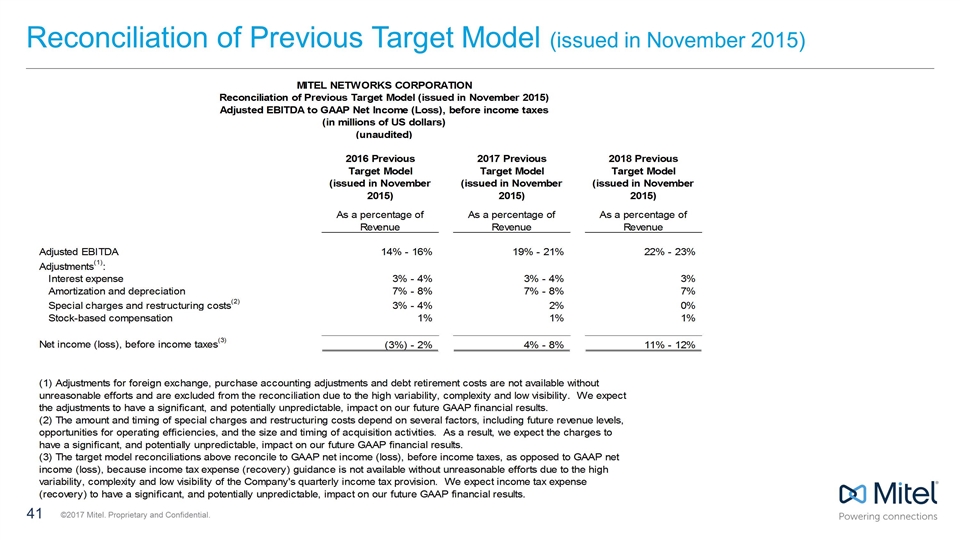

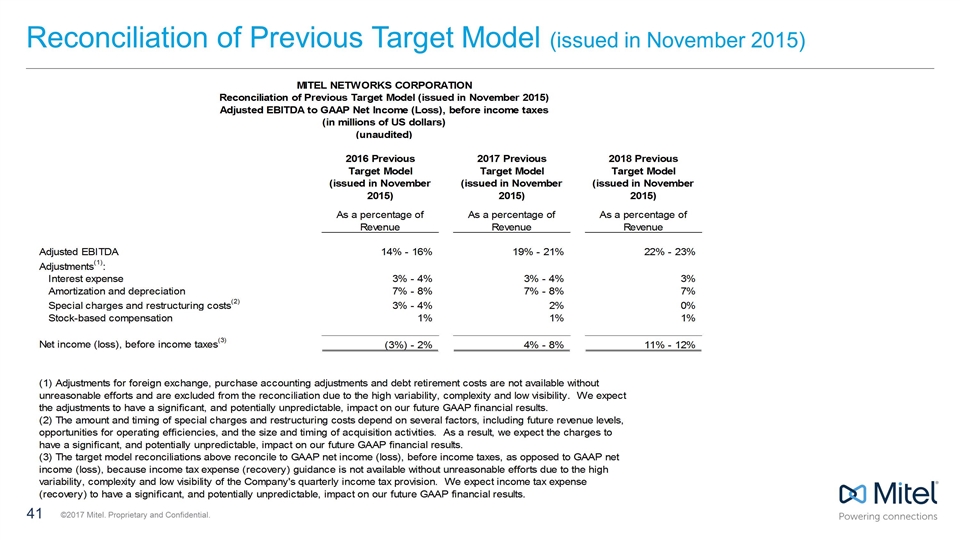

Reconciliation of Previous Target Model (issued in November 2015) 41

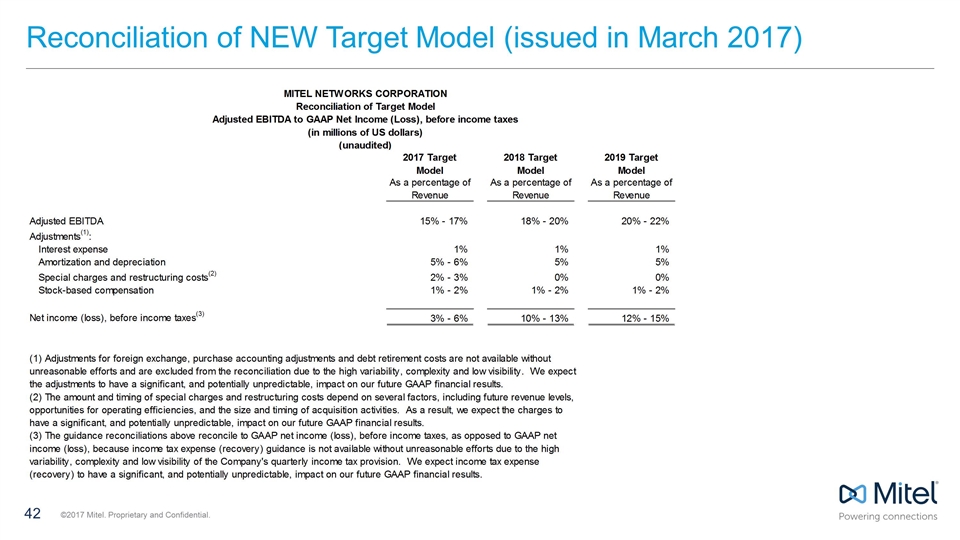

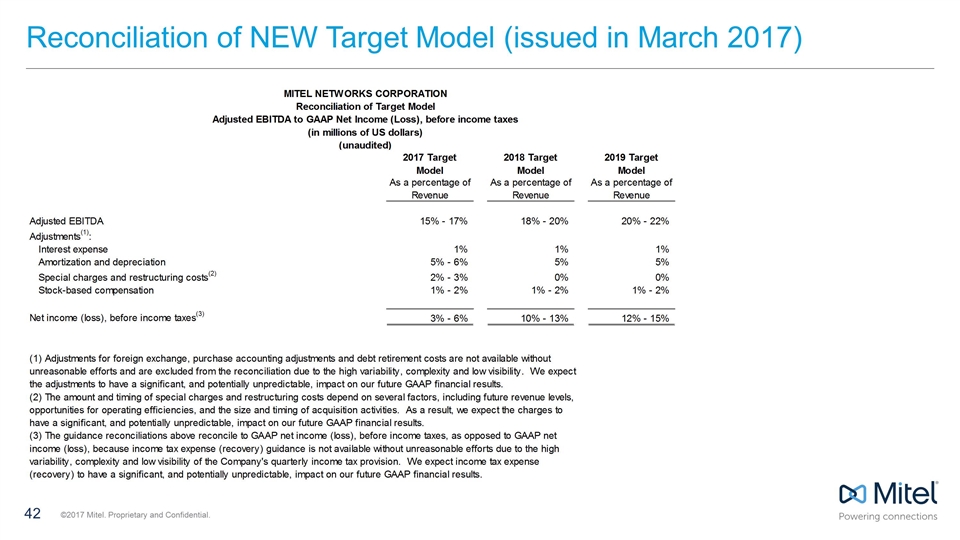

Reconciliation of NEW Target Model (issued in March 2017) 42

43 Thank You