The following table summarizes our contractual obligations at December 31, 2006 and the effect that those obligations are expected to have on our liquidity and cash flows in future periods (in thousands):

We have no other material long-term contractual obligations.

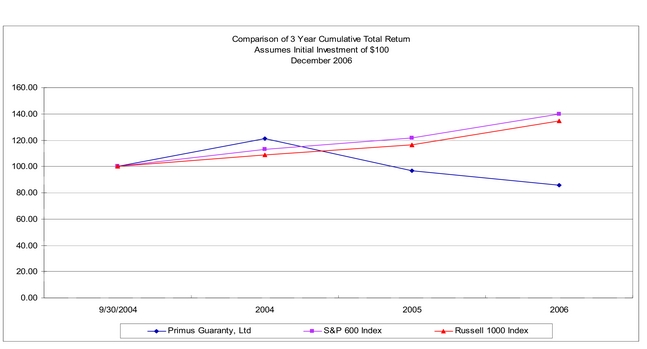

Our consolidated cash, cash equivalents and securities were $803.9 million and $629.5 million as of December 31, 2006 and 2005, respectively. Since its inception, Primus Guaranty has raised both debt and equity capital and has contributed capital to its operating subsidiaries. Primus Guaranty is a holding company with no direct operations of its own, and as such, it is largely dependent upon the ability of its operating subsidiaries to generate cash to service its debt obligations and working capital needs. Primus Guaranty completed its initial public offering on October 5, 2004 and issued 9,143,493 common shares at a price of $13.50, resulting in net proceeds of $110.7 million.

Primus Guaranty concurrently contributed $60.0 million of the initial public offering proceeds to Primus Financial, an operating subsidiary, to support the growth of its credit swap business. Primus Guaranty invested the remaining net proceeds from the initial public offering in short-term money market instruments, pending full deployment in our businesses. In January 2006, Primus Guaranty contributed $50.0 million to PRS Trading Strategies, a subsidiary company established to trade credit swaps and other trading instruments.

On December 27, 2006, Primus Guaranty completed an offering of $125 million of 7% senior notes, which mature in December 2036. The senior notes are senior unsecured obligations and rank equally with all of our other unsecured and unsubordinated indebtedness. The senior notes are also structurally subordinated to all liabilities of Primus Guaranty’s subsidiaries. The senior notes are redeemable at the option of Primus Guaranty, in whole or in part, at any time on or after December 27, 2011, at redemption price equal to 100% of the principal amount to be redeemed, plus any accrued and unpaid interest thereon to the redemption date. Interest on the senior notes is payable quarterly, beginning on March 27, 2007. The seni or notes are rated BBB+/Baa1 by S&P and Moody’s, respectively.

Table of ContentsPrimus Financial, in order to support its AAA/Aaa ratings, is required to maintain capital in an amount determined by the capital models it has agreed upon with S&P and Moody’s. The capital required is primarily a function of Primus Financial’s credit swap portfolio characteristics, operating expenses and tax position. Retained cash flow and proceeds from financings are utilized to increase our capital resources to support our credit swap business. At December 31, 2006, Primus Financial had cash, cash equivalents and investments of $624.5 million, which management believes is sufficient to operate its credit swap business.

Primus Financial receives cash from the receipt of credit swap premiums, realized gains from the early termination of credit swaps, interest income earned on our investment portfolio and capital raising activities. Cash is used to pay operating and administrative expenses, premiums on credit swaps purchased, realized losses from the early termination of credit swaps, interest on debt and preferred share distributions.

In addition to the portion of the initial public offering proceeds contributed to Primus Financial as discussed above, Primus Financial has issued preferred shares and incurred indebtedness in order to increase its capital resources and grow its credit swap business. The following is a detailed discussion of Primus Financial’s financing transactions.

Primus Financial issued $110.0 million of Primus Financial Cumulative Preferred Shares on December 19, 2002 in two series, Series I and Series II, to a trust, or the Trust. In conjunction with the receipt of the securities, the Trust issued $100.0 million of Money Market Preferred Securities Custodial Receipts, or MMP Receipts, in two series, Series A and Series B, to various institutional investors in a private placement. The Trust also issued $10.0 million of Variable Inverse Preferred Securities Custodial Receipts that were retained by Primus Financial. One series of MMP Receipts pays distributions every 28 days based on an auction rate set on the prior business day and the other series makes payments quarterly, based on a n auction rate, which was currently set annually until January 2007, but has now reverted to a 28 day rate-setting. After December 19, 2012, Primus Financial may redeem the securities, in whole or in part, on any distribution date at the face amount plus accumulated and unpaid dividends. However, Primus Financial is not required to redeem the securities, nor is it required to establish a sinking fund. For the years ended December 31, 2006, 2005 and 2004, Primus Financial made net distributions to holders of the Trust’s MMP Receipts in an amount equal to $5.7 million, $3.9 million and $2.1 million, respectively.

Primus Financial issued $75.0 million of subordinated deferrable interest notes on July 23, 2004. The notes are subordinated in right of payment to all existing and future senior indebtedness of Primus Financial, including counterparty claims. The notes are redeemable at the option of Primus Financial, in whole or in part, on any auction date, at redemption price equal to 100% of the principal amount of the notes to be redeemed, plus any accrued and unpaid interest thereon to the redemption date. The interest rate is set every 28 days through a monthly auction process. The notes mature in July 2034.

On December 19, 2005, Primus Financial issued in aggregate $125.0 million of subordinated deferrable interest notes, consisting of $75.0 million of Series A and $50.0 million of Series B notes, which mature in June 2021. The notes are subordinated in right of payment to all existing and future senior indebtedness of Primus Financial, including counterparty claims, and to the subordinated deferrable interest notes issued in July 2004. The notes are redeemable at the option of Primus Financial, in whole or in part, on any auction date, at redemption price equal to 100% of the principal amount of the notes to be redeemed, plus any accrued and unpaid interest thereon to the redemption date. The interest rate on the Series A not es and the Series B notes is set every 28 days through a monthly auction process.

Effective on March 23, 2006, with the consent of S&P and Moody’s, we terminated the $37.5 million liquidity facility that we previously maintained under our operating guidelines as an additional source of liquidity. Since inception, there were no credit events or any borrowings under such facility.

PRS Trading Strategies commenced operations in January 2006 with $50.0 million of capital contributed by Primus Guaranty from the proceeds of our initial public offering. The capital

49

Table of Contentscontribution will allow PRS Trading Strategies to trade in a broad range of fixed income products, including credit default swaps, leveraged loans and investment grade and speculative grade securities, among others. Unlike Primus Financial, PRS Trading Strategies has no counterparty ratings from rating agencies and, accordingly, may post collateral with its counterparties to support its contractual obligations.

Cash Flows

Cash flows from operating activities – Net cash provided by operating activities were $42.2 million and $36.3 million for the years ended December 31, 2006 and 2005, respectively. This increase is primarily attributable to higher premium income on a larger credit swap portfolio during 2006 compared with 2005, as a result of the continued growth of our credit swap portfolio.

Net cash provided by operating activities was $36.3 million and $33.1 million for the years ended December 31, 2005 and 2004, respectively. This increase is primarily attributable to higher premium income on swaps sold during 2005 compared to 2004, as a result of the continued growth of our credit swap portfolio.

Cash flows from investing activities – Net cash used in investing activities were $21.9 million and $404.3 million for the years ended December 31, 2006 and 2005, respectively. The decrease was primarily due to reduced purchases of available-for-sale-investments in 2006 compared with 2005.

Net cash used in investing activities was $404.3 million and $158.1 million for the years ended December 31, 2005 and 2004, respectively. The increase was primarily due to higher purchases of available-for-sale investments during 2005 compared with the 2004, as a result of the proceeds from the issuance of deferrable notes and our initial public offering.

Cash flows from financing activities – Net cash provided by financing activities were $114.6 million and $116.4 million for the years ended December 31, 2006 and 2005, respectively. This decrease is primarily due to an increase in preferred distributions of our subsidiary and higher debt issuance costs during 2006 compared with 2005, partly offset by lower repurchase and retirement of our common shares.

Net cash provided by financing activities was $116.4 million and $188.0 million for the years ended December 31, 2005 and 2004, respectively. The decrease was primarily due to our initial public offering in October 2004, from which proceeds of $110.7 million, net of expenses, were received, as well as the issuance of our $75.0 million of subordinated deferrable interest notes in July 2004. This decrease was partially offset by the issuance of our $125.0 million of subordinated deferrable interest notes in December 2005.

With our current capital resources and anticipated future credit swap premium receipts and interest income, we believe we have sufficient liquidity to pay our operating and financing expenses (including preferred distributions) over at least the next twelve months.

Recent Accounting Pronouncements

In December 2004, the Financial Accounting Standards Board (‘‘FASB’’) issued SFAS No. 123 (R), Share-Based Payment. SFAS No. 123 (R) is a revision of SFAS No. 123 and supersedes Accounting Principles Board (‘‘APB’’) Opinion No. 25, Accounting for Shares Issued to Employees, and amends SFAS No. 95, Statement of Cash Flows. SFAS No. 123 (R) eliminates the ability to account for share-based compensation transactions using APB Opinion No. 25 and requires all share-based payments to employees, including gran ts of employee options, to be recognized in the financial statements using a fair value-based method. In April 2005, the Securities and Exchange Commission (‘‘SEC’’) amended the effective date of SFAS No. 123 (R) until the first fiscal year beginning after June 15, 2005 to provide additional time for companies to comply with the reporting requirements. Effective January 1, 2006, the Company adopted SFAS No. 123 (R). See note 18 of notes to consolidated financial statements for further detail.

In March 2005, the SEC staff issued Staff Accounting Bulletin No. 107 (‘‘SAB No. 107’’) to provide supplemental implementation guidance on SFAS No. 123 (R). The Company applied the relevant provisions of SAB No. 107 in its adoption of SFAS No. 123 (R).

50

Table of ContentsIn May 2005, the FASB issued SFAS 154, Accounting Changes and Error Corrections – a replacement of APB Opinion No. 20 and FASB Statement No. 3. This statement requires retrospective application to prior periods’ financial statements of changes in accounting principle. SFAS 154 is effective for accounting changes and corrections of errors made in fiscal years beginning after December 15, 2005. The Company will apply SFAS 154 in future periods, if applicable.

In November 2005, the FASB issued FASB Staff Position FSP 115-1, The Meaning of Other-Than Temporary Impairment and Its Application to Certain Investments (FSP 115-1), which addresses the determination as to when an investment is considered impaired, whether that impairment is other-than-temporary, and the measurement of an impairment loss. FSP 115-1 also includes accounting considerations subsequent to the recognition of an other-than-temporary impairment and requires certain disclosures about unrealized losses that have not been recognized as other-than-temporary impairments. The guidance in FSP 115-1 is required to be applied to reporting periods beginning after Dece mber 15, 2005. The adoption did not have any effect on the consolidated financial statements.

In April 2006, the FASB issued FASB Staff Position FIN 46(R)-6, Determining the Variability to Be Considered in Applying FASB Interpretation No. 46(R) (‘‘FSP FIN 46(R)-6’’). FSP FIN 46(R)-6 addresses how variability should be considered when applying FIN 46(R). Variability affects the determination of whether an entity is a variable interest entity (VIE), which interests are variable interests, and which party, if any, is the primary beneficiary of the VIE required to consolidate. FSP FIN 46(R)-6 clarifies that the design of the entity also should be considered when identifying which interests are variable interests. The Company adopted FSP FIN 4 6(R)-6 during the third quarter of 2006 and applied it prospectively to all entities in which the Company first became involved with. The adoption of FSP FIN 46(R)-6 did not have a material effect on the Company’s consolidated financial statements.

In June 2006, the FASB issued Interpretation No. 48, Accounting for Uncertainty in Income Taxes-an interpretation of FASB Statement No. 109 (FIN 48). FIN 48 prescribes a recognition threshold and measurement attributes for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. FIN 48 also provides guidance on derecognition, classification, interest and penalties, accounting in interim periods, disclosure and transition. FIN 48 is effective for fiscal years beginning after December 15, 2006. The Company is currently evaluating the impact that adoption of FIN 48 will have on its consolidated financial stateme nts.

In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements (SFAS No. 157). SFAS 157 defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles (GAAP), and expands disclosures about fair value measurements. SFAS No. 157 is effective for fiscal years beginning after November 15, 2007. The Company is currently evaluating the impact that adoption of SFAS No. 157 will have on its consolidated financial statements.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk

Market risk represents the potential for gains or losses that may result from changes in the value of a financial instrument as a consequence of changes in market conditions. Our primary market risk is changes in market credit swap premium levels, which increase or decrease the fair value of our credit swap portfolio. Market credit swap premium levels change as a result of specific events or news related to a Reference Entity, such as a change in a credit rating by any of the rating agencies. Additionally, market credit swap premium levels can vary as a result of changes in market sentiment. As a general matter, given our strategy of holding credit swaps sold until maturity, we do not seek to manage our overall exposure to market credit swap premium levels, and we expect fluctuations in the fair value of our credit swap portfolio as a result of these changes. As of December 31, 2006, each one basis point increase or decrease in market credit swap premiums would decrease or increase the fair value of our credit swap portfolio by approximately $5.6 million. We face other market risks, which are likely to have a lesser impact upon our net income than those associated with market credit swap premium level risk. These other risks include interest rate risk associated with market interest rate movements. These movements may affect the value of our credit swap portfolio as our pricing model includes an interest rate component, which is used to discount future expected cash flows. Interest rate

51

Table of Contentsmovements may also affect the carrying value of and yield on our investments. The Primus Financial Cumulative Preferred Shares pays distributions that are based upon the auction rate preferred market. A difference between the rates we pay in the auction rate preferred market and the interest rates we receive on our investments may result in an additional cost to our company. Assuming that auction results with respect to the Primus Financial Cumulative Preferred Shares reflect prevailing short-term interest rates, each 25 basis point increase or decrease in the level of those rates would increase or decrease Primus Financial’s annual distribution cost by approximately $125,000 for each of the Series A and Series B MMP Receipts, but would not affect distributions on the Series B MMP Receipts as the interest and auction rate for such MMP Receipts were set for a one year period on January 20, 2006. In addition, interest rate movements may increase or decrease the interest expense we incur on our $200 mi llion of subordinated deferrable interest notes. A 25 basis point increase in the level of those rates would increase Primus Financial’s interest expense by $500,000 annually.

Counterparty risk represents the potential for loss should one or more of our counterparties be unable to meet its obligations due to bankruptcy or a similar event, which could adversely affect our results of operations. Our counterparties generally have investment grade credit ratings. At December 31, 2006, the notional and fair value amount of credit swaps outstanding with respect to one non-rated counterparty were $5.0 million and $25 thousand, respectively. The premiums on these transactions were fully prepaid by the counterparty, and as such, they have been categorized as AAA/Aaa rating in our credit swap portfolio.

52

Item 8. Financial Statements and Supplementary Data

Primus Guaranty, Ltd.

Index to Consolidated Financial Statements

All Financial Statement Schedules are omitted because they are not applicable or the required information is shown in the Consolidated Financial Statements or the Notes thereto.

53

Table of ContentsReport of Independent Registered Public Accounting Firm

To the Board of Directors and Shareholders’ of Primus Guaranty, Ltd.

We have audited the accompanying consolidated statements of financial condition of Primus Guaranty, Ltd. (the ‘‘Company’’) as of December 31, 2006 and 2005, and the related consolidated statements of operations, shareholders’ equity, and cash flows for each of the three years in the period ended December 31, 2006. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the consolidated financial position of Primus Guaranty, Ltd. at December 31, 2006 and 2005, and the consolidated results of its operations and its cash flows for each of the three years in the period ended December 31, 2006, in conformity with U.S. generally accepted accounting principles.

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the effectiveness of Primus Guaranty, Ltd’s internal control over financial reporting as of December 31, 2006, based on criteria established in Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission and our report dated March 8, 2007 expressed an unqualified opinion thereon.

/s/ Ernst & Young LLP

New York, New York

March 8, 2007

54

Table of ContentsReport of Independent Registered Public Accounting Firm

To the Board of Directors and Shareholders’ of Primus Guaranty, Ltd.

We have audited management’s assessment, included in the accompanying Management’s Assessment of Internal Control over Financial Reporting, that Primus Guaranty, Ltd. (the ‘‘Company’’) maintained effective internal control over financial reporting as of December 31, 2006, based on criteria established in Internal Control – Integrated Framework, issued by the Committee of Sponsoring Organizations of the Treadway Commission (the COSO criteria). Primus Guaranty, Ltd.’s management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control o ver financial reporting. Our responsibility is to express an opinion on management’s assessment and an opinion on the effectiveness of the Company’s internal control over financial reporting based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit included obtaining an understanding of internal control over financial reporting, evaluating management’s assessment, testing and evaluating the design and operating effectiveness of internal control, and performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.

A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting p rinciples, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

In our opinion, management’s assessment that Primus Guaranty, Ltd. maintained effective internal control over financial reporting as of December 31, 2006, is fairly stated, in all material respects, based on the COSO criteria. Also, in our opinion, Primus Guaranty, Ltd. maintained, in all material respects, effective internal control over financial reporting as of December 31, 2006, based on the COSO criteria.

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated statement of financial condition of Primus Guaranty, Ltd. as of December 31, 2006 and 2005 and the related consolidated statements of income, changes in stockholders’ equity and cash flows for each of the three years in the period ended December 31, 2006 and our report dated March 8, 2007 expressed an unqualified opinion thereon.

/s/ Ernst & Young LLP

New York, New York

March 8, 2007

55

Table of ContentsManagement’s Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting for the Company. Internal control over financial reporting is defined in Rule 13a-15(f) or 15d-15(f) under the Securities Exchange Act of 1934 as a process designed by, or under the supervision of, our principal executive and principal financial officers and effected by our board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Management assessed the effectiveness of the Company’s internal control over financial reporting as of December 31, 2006. In making this assessment, it used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) Internal Control-Integrated Framework. Based on our assessment, we believe that as of December 31, 2006, the Company’s internal control over financial reporting is effective based on that criteria.

Ernst & Young LLP, an independent registered public accounting firm has issued a report on our assessment of the Company’s internal control over financial reporting. This report appears on page 55.

|  |  |  |

| /s/ Thomas W. Jasper |  |  | /s/ Richard Claiden |

| Thomas W. Jasper |  |  | Richard Claiden |

| Chief Executive Officer |  |  | Chief Financial Officer |

|

56

Table of ContentsPrimus Guaranty, Ltd.

Consolidated Statements of Financial Condition

(dollars in 000s except per share amounts)

|  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | December 31,

2006 |  |  | December 31,

2005 |

| Assets |  |  |  |  | | |  |  |  |  | | |

| Cash and cash equivalents |  |  |  | $ | 204,428 | |  |  |  | $ | 69,355 | |

| Available-for-sale investments |  |  |  |  | 584,911 | |  |  |  |  | 560,147 | |

| Trading account assets |  |  |  |  | 14,537 | |  |  |  |  | — | |

| Accrued interest receivable |  |  |  |  | 6,374 | |  |  |  |  | 5,127 | |

| Accrued premiums and receivables on credit and other swaps |  |  |  |  | 4,022 | |  |  |  |  | 3,461 | |

| Premiums receivable on financial guarantees |  |  |  |  | — | |  |  |  |  | 300 | |

| Unrealized gain on credit and other swaps, at fair value |  |  |  |  | 73,330 | |  |  |  |  | 25,342 | |

| Fixed assets and software costs, net |  |  |  |  | 5,510 | |  |  |  |  | 4,993 | |

| Debt issuance costs, net |  |  |  |  | 7,399 | |  |  |  |  | 3,147 | |

| Other assets |  |  |  |  | 1,957 | |  |  |  |  | 1,210 | |

| Total assets |  |  |  | $ | 902,468 | |  |  |  | $ | 673,082 | |

| Liabilities and shareholders’ equity |  |  |  |  | | |  |  |  |  | | |

| Accounts payable and accrued expenses |  |  |  | $ | 2,854 | |  |  |  | $ | 3,035 | |

| Accrued compensation |  |  |  |  | 8,800 | |  |  |  |  | 4,833 | |

| Interest payable |  |  |  |  | 625 | |  |  |  |  | 404 | |

| Accrued premiums on credit and other swaps |  |  |  |  | 44 | |  |  |  |  | — | |

| Taxes payable |  |  |  |  | 7 | |  |  |  |  | 54 | |

| Unrealized loss on credit and other swaps, at fair value |  |  |  |  | 2,931 | |  |  |  |  | 3,521 | |

| Trading account liabilities |  |  |  |  | 1,002 | |  |  |  |  | — | |

| Deferred credit swap premiums |  |  |  |  | 23 | |  |  |  |  | 46 | |

| Deferred financial guarantee premiums |  |  |  |  | — | |  |  |  |  | 401 | |

| Deferred rent payable |  |  |  |  | 570 | |  |  |  |  | 416 | |

| Long-term debt |  |  |  |  | 325,000 | |  |  |  |  | 200,000 | |

| Total liabilities |  |  |  |  | 341,856 | |  |  |  |  | 212,710 | |

| Preferred securities of subsidiary |  |  |  |  | 98,521 | |  |  |  |  | 98,521 | |

| Commitments and contingencies |  |  |  |  | | |  |  |  |  | | |

| Shareholders’ equity |  |  |  |  | | |  |  |  |  | | |

Common shares, $0.08 par value, 62,500,000 shares authorized, 43,380,893 and 43,176,511 shares issued and outstanding at

December 31, 2006 and 2005 |  |  |  |  | 3,470 | |  |  |  |  | 3,454 | |

| Additional paid-in-capital |  |  |  |  | 269,420 | |  |  |  |  | 265,966 | |

| Warrants |  |  |  |  | 612 | |  |  |  |  | 612 | |

| Accumulated other comprehensive loss |  |  |  |  | (2,375 | |  |  |  |  | (4,254 | |

| Retained earnings |  |  |  |  | 190,964 | |  |  |  |  | 96,073 | |

| Total shareholders’ equity |  |  |  |  | 462,091 | |  |  |  |  | 361,851 | |

| Total liabilities, preferred securities of subsidiary and shareholders’ equity |  |  |  | $ | 902,468 | |  |  |  | $ | 673,082 | |

|

See accompanying notes.

57

Table of ContentsPrimus Guaranty, Ltd.

Consolidated Statements of Operations

(dollars in 000s except per share amounts)

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Year Ended December 31, |

| |  |  | 2006 |  |  | 2005 |  |  | 2004 |

| Revenues |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| Net credit swap revenue |  |  |  | $ | 116,083 | |  |  |  | $ | 23,106 | |  |  |  | $ | 47,729 | |

| Premiums earned on financial guarantees |  |  |  |  | 400 | |  |  |  |  | 405 | |  |  |  |  | 395 | |

| Asset management and advisory fees |  |  |  |  | 1,263 | |  |  |  |  | 190 | |  |  |  |  | 15 | |

| Interest income |  |  |  |  | 28,374 | |  |  |  |  | 16,047 | |  |  |  |  | 4,850 | |

| Other trading revenue |  |  |  |  | 1,770 | |  |  |  |  | — | |  |  |  |  | — | |

| Rental income |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 40 | |

| Foreign currency revaluation income (loss) |  |  |  |  | (26 | |  |  |  |  | (1,546 | |  |  |  |  | 726 | |

| Total net revenues |  |  |  |  | 147,864 | |  |  |  |  | 38,202 | |  |  |  |  | 53,755 | |

| Expenses |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| Compensation and employee benefits |  |  |  |  | 21,512 | |  |  |  |  | 15,935 | |  |  |  |  | 17,801 | |

| Professional and legal fees |  |  |  |  | 5,147 | |  |  |  |  | 4,534 | |  |  |  |  | 2,414 | |

| Depreciation and amortization |  |  |  |  | 2,517 | |  |  |  |  | 2,123 | |  |  |  |  | 1,951 | |

| Technology and data feeds |  |  |  |  | 2,427 | |  |  |  |  | 1,630 | |  |  |  |  | 1,363 | |

| Interest expense |  |  |  |  | 10,849 | |  |  |  |  | 2,660 | |  |  |  |  | 881 | |

| Other |  |  |  |  | 4,796 | |  |  |  |  | 3,326 | |  |  |  |  | 3,476 | |

| Total expenses |  |  |  |  | 47,248 | |  |  |  |  | 30,208 | |  |  |  |  | 27,886 | |

| Distributions on preferred securities of subsidiary |  |  |  |  | (5,683 | |  |  |  |  | (3,865 | |  |  |  |  | (2,138 | |

| Income before provision for income taxes |  |  |  |  | 94,933 | |  |  |  |  | 4,129 | |  |  |  |  | 23,731 | |

| Provision for income taxes |  |  |  |  | 42 | |  |  |  |  | 46 | |  |  |  |  | 46 | |

| Net income available to common shares |  |  |  | $ | 94,891 | |  |  |  | $ | 4,083 | |  |  |  | $ | 23,685 | |

| Earnings per common share: |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| Basic |  |  |  | $ | 2.19 | |  |  |  | $ | 0.09 | |  |  |  | $ | 1.44 | |

| Diluted |  |  |  | $ | 2.13 | |  |  |  | $ | 0.09 | |  |  |  | $ | 0.59 | |

| Average common shares outstanding: |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| Basic |  |  |  |  | 43,306 | |  |  |  |  | 43,150 | |  |  |  |  | 16,486 | |

| Diluted |  |  |  |  | 44,472 | |  |  |  |  | 44,645 | |  |  |  |  | 40,256 | |

|

See accompanying notes.

58

Table of ContentsPrimus Guaranty, Ltd.

Consolidated Statements of Shareholders’ Equity

(dollars in 000s)

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Year Ended December 31, |

| |  |  | 2006 |  |  | 2005 |  |  | 2004 |

| Common shares |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| Balance at beginning of year |  |  |  | $ | 3,454 | |  |  |  | $ | 3,422 | |  |  |  | $ | 208 | |

| Conversion of warrants to common shares |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 85 | |

| Shares repurchased and retired |  |  |  |  | — | |  |  |  |  | (15 | |  |  |  |  | — | |

| Shares vested under employee compensation plans |  |  |  |  | 12 | |  |  |  |  | 42 | |  |  |  |  | — | |

| Issuance of common shares from exercise of options |  |  |  |  | 4 | |  |  |  |  | 5 | |  |  |  |  | | |

| Shares issued in Initial Public Offering |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 731 | |

| Conversion of Series A preferred shares |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 2,398 | |

| Balance at end of year |  |  |  |  | 3,470 | |  |  |  |  | 3,454 | |  |  |  |  | 3,422 | |

| Additional paid-in-capital |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| Balance at beginning of year |  |  |  |  | 265,966 | |  |  |  |  | 264,973 | |  |  |  |  | 1,325 | |

| Conversion of warrants to common shares |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 5,875 | |

| Shares repurchased and retired |  |  |  |  | (793 | |  |  |  |  | (3,139 | |  |  |  |  | — | |

| Shares vested under employee compensation plans |  |  |  |  | 3,642 | |  |  |  |  | 3,644 | |  |  |  |  | 6,253 | |

| Issuance of common shares from exercise of options |  |  |  |  | 605 | |  |  |  |  | 488 | |  |  |  |  | — | |

| Shares issued in Initial Public Offering |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 110,010 | |

| Conversion of Series A preferred shares |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 141,510 | |

| Balance at end of year |  |  |  |  | 269,420 | |  |  |  |  | 265,966 | |  |  |  |  | 264,973 | |

| Convertible preferred shares |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| Balance at beginning of year |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 143,908 | |

| Conversion of Series A to common shares |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | (143,908 | |

| Balance at end of year |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |

| Warrants |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| Balance at beginning of year |  |  |  |  | 612 | |  |  |  |  | 612 | |  |  |  |  | 1,070 | |

| Conversion of warrants to common shares |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | (458 | |

| Balance at end of year |  |  |  |  | 612 | |  |  |  |  | 612 | |  |  |  |  | 612 | |

| Accumulated other comprehensive loss |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| Balance at beginning of year |  |  |  |  | (4,254 | |  |  |  |  | — | |  |  |  |  | — | |

| Foreign currency translation adjustments |  |  |  |  | 203 | |  |  |  |  | — | |  |  |  |  | — | |

| Change in unrealized holding gains (losses) on available-for-sale securities |  |  |  |  | 1,676 | |  |  |  |  | (4,254 | |  |  |  |  | — | |

| Balance at end of year |  |  |  |  | (2,375 | |  |  |  |  | (4,254 | |  |  |  |  | — | |

| Retained earnings |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| Balance at beginning of year |  |  |  |  | 96,073 | |  |  |  |  | 91,990 | |  |  |  |  | 68,305 | |

| Net income |  |  |  |  | 94,891 | |  |  |  |  | 4,083 | |  |  |  |  | 23,685 | |

| Balance at end of year |  |  |  |  | 190,964 | |  |  |  |  | 96,073 | |  |  |  |  | 91,990 | |

| Total shareholders’ equity at end of year |  |  |  | $ | 462,091 | |  |  |  | $ | 361,851 | |  |  |  | $ | 360,997 | |

| Comprehensive income (loss) |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| Net income |  |  |  | $ | 94,891 | |  |  |  | $ | 4,083 | |  |  |  | $ | 23,685 | |

| Foreign currency translation adjustments |  |  |  |  | 203 | |  |  |  |  | — | |  |  |  |  | — | |

| Change in unrealized gains (losses) on available-for-sale investments |  |  |  |  | 1,676 | |  |  |  |  | (4,254 | |  |  |  |  | — | |

| Comprehensive income (loss) |  |  |  | $ | 96,770 | |  |  |  | $ | (171 | |  |  |  | $ | 23,685 | |

|

See accompanying notes.

59

Table of ContentsPrimus Guaranty, Ltd.

Consolidated Statements of Cash Flows

(dollars in 000s)

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Year Ended December 31, |

| |  |  | 2006 |  |  | 2005 |  |  | 2004 |

| Cash flows from operating activities |  |  | |  |  | |  |  | |

| Net income |  |  |  | $ | 94,891 | |  |  |  | $ | 4,083 | |  |  |  | $ | 23,685 | |

| Adjustments to reconcile net income to net cash provided by operating activities: |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| Non-cash items included in net income: |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| Depreciation and amortization |  |  |  |  | 2,517 | |  |  |  |  | 2,123 | |  |  |  |  | 1,951 | |

| Share compensation |  |  |  |  | 3,654 | |  |  |  |  | 3,686 | |  |  |  |  | 6,230 | |

| Net unrealized (gain) loss on credit swap portfolio |  |  |  |  | (48,578 | |  |  |  |  | 24,437 | |  |  |  |  | 268 | |

| Net amortization of premium and discount on securities. |  |  |  |  | (4,243 | |  |  |  |  | — | |  |  |  |  | — | |

| Unrealized gain on sublease |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | (39 | |

| Deferred rent |  |  |  |  | 154 | |  |  |  |  | (39 | |  |  |  |  | (18 | |

| Loss on disposal of assets |  |  |  |  | 25 | |  |  |  |  | — | |  |  |  |  | — | |

| Amortization of debt issuance costs |  |  |  |  | 166 | |  |  |  |  | 64 | |  |  |  |  | 14 | |

| Distributions on preferred securities of subsidiary |  |  |  |  | 5,683 | |  |  |  |  | 3,865 | |  |  |  |  | 2,138 | |

| Increase (decrease) in cash resulting from changes in: |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| Accrued interest receivable |  |  |  |  | (1,247 | |  |  |  |  | (3,746 | |  |  |  |  | (1,252 | |

| Accrued premiums and interest receivable on credit and other swaps |  |  |  |  | (561 | |  |  |  |  | 85 | |  |  |  |  | 236 | |

| Premiums receivable on financial guarantees |  |  |  |  | 300 | |  |  |  |  | 500 | |  |  |  |  | 401 | |

| Other assets |  |  |  |  | (747 | |  |  |  |  | (48 | |  |  |  |  | (498 | |

| Trading account assets |  |  |  |  | (14,537 | |  |  |  |  | — | |  |  |  |  | — | |

| Accounts payable and accrued expenses |  |  |  |  | (81 | |  |  |  |  | 2,117 | |  |  |  |  | 215 | |

| Accrued compensation |  |  |  |  | 3,967 | |  |  |  |  | (484 | |  |  |  |  | (157 | |

| Trading account liabilities |  |  |  |  | 1,002 | |  |  |  |  | — | |  |  |  |  | — | |

| Interest payable |  |  |  |  | 221 | |  |  |  |  | 40 | |  |  |  |  | 364 | |

| Accrued premiums payable on credit swaps |  |  |  |  | 44 | |  |  |  |  | — | |  |  |  |  | — | |

| Taxes payable |  |  |  |  | (47 | |  |  |  |  | 42 | |  |  |  |  | 12 | |

| Deferred credit swap premiums |  |  |  |  | (23 | |  |  |  |  | (23 | |  |  |  |  | (43 | |

| Deferred financial guarantee premiums |  |  |  |  | (401 | |  |  |  |  | (405 | |  |  |  |  | (395 | |

| Net cash provided by operating activities |  |  |  |  | 42,159 | |  |  |  |  | 36,297 | |  |  |  |  | 33,112 | |

| Cash flows from investing activities |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| Fixed asset purchases and capitalized software costs |  |  |  |  | (3,059 | |  |  |  |  | (1,019 | |  |  |  |  | (924 | |

| Purchases of available-for-sale and other investments |  |  |  |  | (261,045 | |  |  |  |  | (755,659 | |  |  |  |  | (157,133 | |

| Maturities and sales of available-for-sale investments |  |  |  |  | 242,200 | |  |  |  |  | 352,359 | |  |  |  |  | — | |

| Net cash used in investing activities |  |  |  |  | (21,904 | |  |  |  |  | (404,319 | |  |  |  |  | (158,057 | |

| Cash flows from financing activities |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| Proceeds from issuance of common shares |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 110,744 | |

| Repurchase and retirement of common shares |  |  |  |  | (793 | |  |  |  |  | (3,154 | |  |  |  |  | — | |

| Proceeds from employee exercise of options and issuance of common shares |  |  |  |  | 609 | |  |  |  |  | 493 | |  |  |  |  | — | |

| Proceeds from exercise of warrants |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 5,500 | |

| Proceeds from issuance of debt |  |  |  |  | 125,000 | |  |  |  |  | 125,000 | |  |  |  |  | 75,000 | |

| Debt issuance costs |  |  |  |  | (4,518 | |  |  |  |  | (2,086 | |  |  |  |  | (1,139 | |

| Net preferred distributions of subsidiary |  |  |  |  | (5,683 | |  |  |  |  | (3,865 | |  |  |  |  | (2,138 | |

| Net cash provided by financing activities |  |  |  |  | 114,615 | |  |  |  |  | 116,388 | |  |  |  |  | 187,967 | |

| Net effect of exchange rate changes on cash |  |  |  |  | 203 | |  |  |  |  | — | |  |  |  |  | — | |

| Net increase (decrease) in cash |  |  |  |  | 135,073 | |  |  |  |  | (251,634 | |  |  |  |  | 63,022 | |

| Cash and cash equivalents at beginning of year |  |  |  |  | 69,355 | |  |  |  |  | 320,989 | |  |  |  |  | 257,967 | |

| Cash and cash equivalents at end of year |  |  |  | $ | 204,428 | |  |  |  | $ | 69,355 | |  |  |  | $ | 320,989 | |

| Supplemental disclosures |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| Cash paid for interest |  |  |  | $ | 10,461 | |  |  |  | $ | 2,572 | |  |  |  | $ | 503 | |

| Cash paid for taxes |  |  |  |  | 90 | |  |  |  |  | 4 | |  |  |  |  | 44 | |

|

See accompanying notes.

60

Table of ContentsPrimus Guaranty, Ltd.

Notes to Consolidated Financial Statements

1. Organization and Business

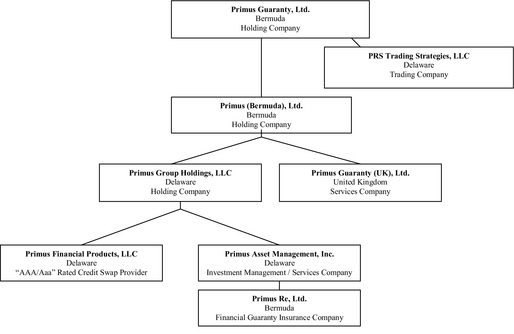

Primus Guaranty, Ltd., together with its consolidated subsidiaries (‘‘Primus Guaranty’’ or ‘‘the Company’’), is a Bermuda holding company that conducts business through several operating subsidiaries, including Primus Financial Products, LLC (‘‘Primus Financial’’), and Primus Asset Management, Inc. (‘‘Primus Asset Management’’).

Primus Financial is a Delaware financial products limited liability company that maintains a long-term counterparty credit rating of AAA from Standard & Poor’s (‘‘S&P’’) and Aaa from Moody’s Investors Service, Inc. (‘‘Moody’s’’ and, together with S&P, the ‘‘Rating Agencies’’). Primus Financial is primarily a seller of credit swaps against investment grade credit obligations of corporate and sovereign reference entities. Primus Financial also sells credit swaps referencing portfolios containing obligations of multiple reference entities.

Primus Asset Management, a Delaware services company, acts as an investment manager to affiliated companies and third party entities. It currently manages the investment portfolios of its affiliates Primus Financial and PRS Trading Strategies, LLC (‘‘PRS Trading Strategies’’). In addition, Primus Asset Management manages three investment grade synthetic collateralized debt obligations, or synthetic CDO’s, on behalf of third parties. The synthetic CDO’s issue securities backed by one or more credit swaps sold against unaffiliated clients’ debt obligations. Primus Asset Management has commenced acting as asset manager with respect to collateralized loan obligation, or CLO, transactions. Prim us Asset Management receives fees for its investment management services. Primus Asset Management’s business plan includes the expansion of its assets under management and coverage of additional financial products and asset classes including, among others, mortgage-backed and other asset-backed securities and speculative grade investments.

Primus Re, Ltd. (‘‘Primus Re’’), is a Bermuda company that operates as a financial guaranty insurance company and is licensed as a Class 3 Insurer under the Bermuda Insurance Act of 1978. Primus Re’s business is to act as a conduit, or transformer, between parties interested in buying or selling protection in insurance form and other parties interested in assuming the opposite risk position in the form of credit swaps.

In July 2005, PRS Trading Strategies, a Delaware limited liability company, was formed. PRS Trading Strategies commenced operations in January 2006 with $50 million of capital contributed by Primus Guaranty from the proceeds of our initial public offering. PRS Trading Strategies trades in a broad range of fixed income products, including credit default swaps, leveraged loans and investment grade and speculative grade securities, among others. Unlike Primus Financial, PRS Trading Strategies has no counterparty ratings from rating agencies and, accordingly, may post collateral with its counterparties to support its contractual obligations. PRS Trading Strategies does not engage in trading activity with Primus Financial.

In November 2005, Primus Guaranty (UK), Ltd. (‘‘PGUK’’) was incorporated in England to expand the Company’s presence and further develop its business and relationships across Europe.

2. Summary of Significant Accounting Policies

Basis of Presentation

The consolidated financial statements include the accounts of Primus Guaranty and its subsidiaries and are presented in accordance with U.S. generally accepted accounting principles (‘‘GAAP’’). Significant intercompany transactions have been eliminated in consolidation.

The consolidated financial statements represent a single reportable segment, as defined in Statement of Financial Accounting Standards (‘‘SFAS’’) No. 131, Disclosures about Segments of an Enterprise and Related Information.

61

Table of ContentsPrimus Guaranty, Ltd.

Notes to Consolidated Financial Statements

The consolidated financial statements are presented in U.S. dollar equivalents. At December 31, 2006 and 2005, Primus Financial’s credit swap activities were conducted in U.S. dollars and euros.

Certain prior year amounts have been reclassified to conform to current year presentation.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from those estimates. Management’s estimates and assumptions are used mainly in estimating the fair value of credit swaps and the deferred tax asset valuation.

Cash and Cash Equivalents

Primus Guaranty defines cash equivalents as short term, highly liquid securities and interest earning deposits with original maturities or maturities at time of purchase of 90 days or less.

Investments

The Company accounts for its investments classified as debt securities and fixed maturity securities in accordance with SFAS No. 115, Accounting for Certain Investments in Debt and Equity Securities (SFAS 115) and Emerging Issues Task Force (‘‘EITF’’) Issue No. 99-20, Recognition of Interest Income and Impairment on Purchased and Retained Beneficial Interests in Securitized Financial Assets (EITF 99-20). The Company’s management determines the appropriate classification of securities at the time of purchase and are recorded in the consolidated statements of financial condition on t he trade date. The Company has certain debt securities and fixed maturity securities that are classified as available-for-sale investments. Available-for-sale investments have original maturities or maturities at time of purchase greater than 90 days. Available-for-sale investments are carried at fair value with the unrealized gains or losses, net of tax, reported in accumulated other comprehensive loss as a separate component of shareholders’ equity. The Company does not have any investments classified as held-to-maturity.

Interest Income

The Company earns interest income on its cash and cash equivalents, including commercial paper and other securities, and on investments, which include the accretion of discount and amortization of the premium recorded upon the acquisition of such securities.

Credit Swaps

Credit swaps are over-the-counter (‘‘OTC’’) derivative financial instruments and are recorded at fair value in accordance with SFAS No. 133, Accounting for Derivative Instruments and Hedging Activities. Obtaining the fair value (as such term is defined in SFAS No. 133) for such instruments requires the use of management’s judgment. These instruments are valued using pricing models based on the net present value of expected future cash flows and observed prices for other OTC transactions bearing similar risk characteristics. The fair value of these instruments appears on the consolidated statement of financial condition as unrealized gains or losses on credit swaps. The Company does not believe that its credit swaps fall outside the scope of the guidance of SFAS No. 133 paragraph 10d, as amended by SFAS No. 149, Amendment of Statement 133 on Derivative Instruments and Hedging Activities, because there is no contractual requirement that the protection purchaser be exposed to the underlying risk.

Net credit swap revenue includes realized and unrealized gains and losses on credit swaps and net premiums earned. Premiums are taken into income as they are earned over the life of the transaction.

62

Table of ContentsPrimus Guaranty, Ltd.

Notes to Consolidated Financial Statements

Foreign Currency Translation

Assets and liabilities denominated in non-U.S. dollar currencies are translated into U.S. dollar equivalents at exchange rates prevailing on the date of the consolidated statements of financial condition. Revenues and expenses are translated at average exchange rates during the period. The gains or losses resulting from translating foreign currency financial statements into U.S. dollars, are included in accumulated other comprehensive loss, a component of shareholders’ equity. Gains and losses resulting from currency transactions to U.S. dollar equivalents are reflected in foreign currency revaluation income (loss) caption in the consolidated statements of operations.

Variable Interest Entities

In January 2003, the Financial Accounting Standards Board (‘‘FASB’’) issued FASB Interpretation 46, Consolidation of Variable Interest Entities, an Interpretation of ARB No. 51 (FIN46). In December 2003, the FASB issued a revision of FIN46 to address certain technical corrections and implementation issues (FIN46R). Under FIN46R, a variable interest entity or VIE is defined as an entity that: (1) has an insufficient amount of equity investment to carry out its principal activities without additional subordinated financial support; (2) has a group of equity owners that are unable to make significant decisions about its activities; or (3) has a group of equity owners that do not have the obligation to absorb losses or the right to receive returns generated by the entity.

In accordance with FIN46R, the Company is required to consolidate the variable interest entity if it is determined to be the primary beneficiary. The primary beneficiary of the VIE, is the party that absorbs a majority of the entity’s expected losses, receives a majority of the entity’s expected residual returns, or both. The Company may be involved with various entities in the normal course of business that may be deemed to be VIE’s and may hold interests therein, including debt securities and derivative instruments that may be considered variable interests. Transactions associated with these entities include structured financing arrangements, including collateralized loan obligations.

The Company determines whether it is the primary beneficiary of a VIE by performing a qualitative analysis of the VIE that includes a review of, among other factors, its capital structure, contractual terms, which interests create or absorb variability, related party relationships and the design of the VIE. When the primary beneficiary cannot be identified through a qualitative analysis, the Company performs a quantitative analysis, which computes and allocates expected losses or expected residual returns to variable interest holders. Under this method, the Company calculates its share of the VIE’s expected losses and expected residual returns using the specific cash flows that would be allocated to it, based on the contract ual arrangements and the Company’s position in the VIE’s capital structure, under various probability-weighted scenarios.

Financial Guarantee Insurance Contracts

The Company has undertaken a limited amount of financial guarantee business through its subsidiary Primus Re. Financial guarantees are insurance contracts that contingently require the guarantor to make payments to the guaranteed party. The Company designs its guarantee contracts to qualify as non-derivatives in accordance with the scope exception under paragraph 10d of SFAS 133 as amended by SFAS No. 149, Amendment of Statement 133 on Derivative Instruments and Hedging Activities. This scope exception provides that financial guarantee contracts are not subject to SFAS 133, if they meet certain specified criteria. Thus, the Company accounts for its financial guarant ee contracts in accordance with SFAS No. 60, Accounting and Reporting by Insurance Enterprises. This requires that premiums are deferred and recognized over the life of the contract and that losses are recorded in the period that they occur based on an estimate of the ultimate cost of losses incurred.

The Company does not actively offer financial guarantee insurance. Rather, it is an alternative the Company has available when a counterparty requests an insurance contract instead of a credit swap.

63

Table of ContentsPrimus Guaranty, Ltd.

Notes to Consolidated Financial Statements

Generally, a counterparty’s choice of a financial guarantee insurance contract versus a credit swap is determined by economic terms available in the marketplace as well as regulatory and accounting considerations. Also, the purchaser of an insurance contract cannot submit a claim for payment unless it has an insurable loss, whereas the purchaser of a credit swap need not have actual exposure to the underlying risk.

Insurance Premiums Earned and Receivable and Related Expenses

In exchange for providing financial guarantee protection to counterparties, Primus Re receives premiums over the life of the contract. The amount expected over the life of the policy is reflected in the consolidated statements of financial condition and will be reduced as payments are received quarterly in advance.

The accounts of Primus Re are not deemed to be separate accounts under Statement of Position (‘‘SOP’’) 03-01, Accounting & Reporting by Insurance Enterprises for Certain Nontraditional Long-Duration Contracts for Separate Accounts, since investment performance is not passed through to the contract holder.

Policy acquisition costs include only those expenses that relate primarily to, and vary with, premium production. Such costs generally include compensation of employees involved in underwriting and policy issuance functions, certain rating agency fees, state premium taxes and certain other underwriting expenses. As of December 31, 2006 and 2005, no costs have been deferred by the Company, as any such amounts have been immaterial.

Deferred Financial Guarantee Premiums

Unearned premiums related to the financial guarantee protection provided are used to establish the liability at inception. This liability is reflected in income on a straight-line basis over the period the risk protection is provided.

Unpaid Losses and Loss Expenses on Financial Guarantees

Liabilities for unpaid losses and loss expenses include the accumulation of individual case estimates for claims reported as well as estimates of incurred but not reported claims and estimates of loss settlement expenses on the obligations it has insured. Estimates will be based upon historical industry loss experience modified for current trends as well as prevailing economic, legal and social conditions. Any changes in estimates are reflected in operating results in the period in which the estimates changed. At December 31, 2006 and 2005, the Company had no loss reserves recorded.

Property, Plant and Equipment

Fixed assets are stated at cost less accumulated depreciation and amortization. Fixed assets include computers, office and telephone equipment and furniture and fixtures, which are depreciated using a straight-line method over the estimated useful lives of the assets. Leasehold improvements are amortized using the straight-line method over the shorter of the lease term or estimated useful life.

Internal Use Software Costs

In accordance with SOP 98-1, Accounting for the Costs of Computer Software Developed or Obtained for Internal Use (Statement 98-1), the Company capitalizes qualifying computer software costs. The Company amortizes capitalized internal use software costs using the straight-line method over the estimated useful lives of five years.

64

Table of ContentsPrimus Guaranty, Ltd.

Notes to Consolidated Financial Statements

Deferred Debt Issuance Costs

The Company has incurred costs in connection with its debt issuances. These costs are capitalized as debt issuance costs in the consolidated statements of financial condition and are being amortized over the life of the related debt arrangement which ranges from fifteen to thirty years. Amortization of these debt issuance costs are included in interest expense in the consolidated statements of operations.

Income Taxes

Income tax expense is computed in accordance with the requirements of SFAS No. 109, Accounting for Income Taxes, which prescribes the asset and liability approach to accounting for income taxes. The asset and liability approach requires the recognition of deferred tax liabilities and assets for the expected future tax consequences of temporary differences between the carrying amounts and the tax bases of assets and liabilities. The Company establishes a valuation allowance against deferred tax assets when it is more likely than not that some portion or all of those deferred tax assets will not be realized.

Share-Based Compensation

Effective January 1, 2006, the Company adopted SFAS No. 123(R), Share-Based Payment, using the modified prospective transition method. SFAS No. 123(R) requires the measurement and recognition of compensation expense for all share-based payment awards made to employees and directors including employee options and other forms of equity compensation based on estimated fair values.

Prior to the adoption of SFAS No. 123(R), the Company used the fair value approach for recording share-based employee compensation in accordance with the fair value method prescribed by SFAS No. 123, Accounting for Share-based Compensation, as amended by SFAS No. 148, Accounting for Share Based Compensation – Transition and Disclosure. The approach to accounting for share-based payments in SFAS No. 123(R) is similar to the approach described in SFAS 123; therefore, there were no material changes made to our recognition method upon adoption of SFAS No. 123(R). Under the fair value method, share-based compe nsation expense had been recognized in our results of operations in prior periods.

Compensation expense is recognized based on the fair value of options, performance shares, restricted shares and restricted share units (‘‘RSU’’) as determined on the date of grant and is being expensed over the related vesting period. The fair value of the options granted is determined using the Black-Scholes option-pricing model. Upon the adoption of SFAS No. 123(R), the Company continues to apply the Black-Scholes option pricing model for determining the estimated fair value for share awards as it deems it to be the most appropriate model. The use of the Black-Scholes model requires certain estimates for values of variables used in the model. The fair value of each option grant is estimated on the date o f grant using the Black-Scholes option-pricing model. See note 18 for further discussion.

Recent Accounting Pronouncements

In December 2004, the FASB issued SFAS No. 123(R), Share-Based Payment. SFAS No. 123(R) is a revision of SFAS No. 123 and supersedes Accounting Principles Board (‘‘APB’’) Opinion No. 25, Accounting for Shares Issued to Employees, and amends SFAS No. 95, Statement of Cash Flows. SFAS No. 123(R) eliminates the ability to account for share-based compensation transactions using APB Opinion No. 25 and requires all share-based payments to employees, including grants of employee options, to be recognized in the financial statements using a fair value-based method. In April 2005, the Securities and Exchange Commission (‘‘SEC’’) amended the effective date of SFAS

65

Table of ContentsPrimus Guaranty, Ltd.

Notes to Consolidated Financial Statements

No. 123(R) until the first fiscal year beginning after June 15, 2005 to provide additional time for companies to comply with the reporting requirements. Effective January 1, 2006, the Company adopted SFAS No. 123(R). See note 18 for further detail.

In March 2005, the SEC staff issued Staff Accounting Bulletin No. 107 (‘‘SAB No. 107’’) to provide supplemental implementation guidance on SFAS No. 123(R). The Company applied the relevant provisions of SAB No. 107 in its adoption of SFAS No. 123(R).

In May 2005, the FASB issued SFAS 154, Accounting Changes and Error Corrections – a replacement of APB Opinion No. 20 and FASB Statement No. 3. This statement requires retrospective application to prior periods’ financial statements of changes in accounting principle. SFAS 154 is effective for accounting changes and corrections of errors made in fiscal years beginning after December 15, 2005. The Company will apply SFAS 154 in future periods, if applicable.

In November 2005, the FASB issued FASB Staff Position FSP 115-1, The Meaning of Other-Than Temporary Impairment and Its Application to Certain Investments (FSP 115-1), which addresses the determination as to when an investment is considered impaired, whether that impairment is other-than-temporary, and the measurement of an impairment loss. FSP 115-1 also includes accounting considerations subsequent to the recognition of an other-than-temporary impairment and requires certain disclosures about unrealized losses that have not been recognized as other-than-temporary impairments. The guidance in FSP 115-1 is required to be applied to reporting periods beginning after Dece mber 15, 2005. The adoption did not have any effect on the consolidated financial statements.

In April 2006, the FASB issued FASB Staff Position FIN 46(R)-6, Determining the Variability to Be Considered in Applying FASB Interpretation No. 46(R) (‘‘FSP FIN 46(R)-6’’). FSP FIN 46(R)-6 addresses how variability should be considered when applying FIN 46(R). Variability affects the determination of whether an entity is a variable interest entity (VIE), which interests are variable interests, and which party, if any, is the primary beneficiary of the VIE required to consolidate. FSP FIN 46(R)-6 clarifies that the design of the entity also should be considered when identifying which interests are variable interests. The Company adopted FSP FIN 4 6(R)-6 during the third quarter of 2006 and applied it prospectively to all entities in which the Company first became involved with. The adoption of FSP FIN 46(R)-6 did not have a material effect on the Company’s consolidated financial statements.

In June 2006, the FASB issued Interpretation No. 48, Accounting for Uncertainty in Income Taxes-an interpretation of FASB Statement No. 109 (FIN 48). FIN 48 prescribes a recognition threshold and measurement attributes for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. FIN 48 also provides guidance on derecognition, classification, interest and penalties, accounting in interim periods, disclosure and transition. FIN 48 is effective for fiscal years beginning after December 15, 2006. The Company is currently evaluating the impact that adoption of FIN 48 will have on its consolidated financial stateme nts.

In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements (SFAS No. 157). SFAS 157 defines fair value, establishes a framework for measuring fair value in GAAP, and expands disclosures about fair value measurements. SFAS No. 157 is effective for fiscal years beginning after November 15, 2007. The Company is currently evaluating the impact that adoption of SFAS No. 157 will have on its consolidated financial statements.

3. Cash and Cash Equivalents

As of December 31, 2006 and 2005, the Company’s cash and cash equivalents included U.S. government agency obligations (including government-sponsored enterprises) rated AAA and Aaa by the respective rating agencies, interest bearing bank deposits, commercial paper and money market funds. All outstanding obligations in this category mature within 90 days.

66

Table of ContentsPrimus Guaranty, Ltd.

Notes to Consolidated Financial Statements

4. Available-for-sale investments

Available-for-sale investments included U.S. government agency obligations (including government-sponsored enterprises) rated AAA and Aaa by the respective rating agencies, commercial paper rated A-1 and P-1 by the respective rating agencies and the Company’s equity investment in a CLO as discussed in more detail in note 9. Available-for-sale investments have original maturities or maturities at time of purchase greater than 90 days.

The following table summarizes the composition of the Company’s available-for-sale investments at December 31, 2006 and 2005 (in thousands):

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | December 31, 2006 |

| |  |  | Amortized

Cost |  |  | Unrealized

Gains |  |  | Unrealized

Losses |  |  | Estimated

Fair Value |

| U.S government agency obligations |  |  |  | $ | 554,691 | |  |  |  | $ | 89 | |  |  |  | $ | (2,551 | |  |  |  | $ | 552,229 | |

| Commercial paper |  |  |  |  | 26,275 | |  |  |  |  | 1 | |  |  |  |  | — | |  |  |  |  | 26,276 | |

| Collateralized loan obligation (CLO) |  |  |  |  | 6,536 | |  |  |  |  | — | |  |  |  |  | (130 | |  |  |  |  | 6,406 | |

| Total |  |  |  | $ | 587,502 | |  |  |  | $ | 90 | |  |  |  | $ | (2,681 | |  |  |  | $ | 584,911 | |

|

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | December 31, 2005 |

| |  |  | Amortized

Cost |  |  | Unrealized

Gains |  |  | Unrealized

Losses |  |  | Estimated

Fair Value |

| U.S government agency obligations |  |  |  | $ | 544,824 | |  |  |  | $ | — | |  |  |  | $ | (4,259 | |  |  |  | $ | 540,565 | |

| Commercial paper |  |  |  |  | 19,577 | |  |  |  |  | 5 | |  |  |  |  | — | |  |  |  |  | 19,582 | |

| Total |  |  |  | $ | 564,401 | |  |  |  | $ | 5 | |  |  |  | $ | (4,259 | |  |  |  | $ | 560,147 | |

|

The following table summarizes the fair value of investments that have been in a continuous unrealized loss position for less than 12 months and for 12 months or more at December 31, 2006 and 2005 (in thousands):

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | December 31, 2006

Securities with Unrealized Losses |

| |  |  | Less than 12 months |  |  | 12 months or more |  |  | Total |

| |  |  | Value

Fair |  |  | Gross

Unrealized

Losses |  |  | Fair

Value |  |  | Gross

Unrealized

Losses |  |  | Fair

Value |  |  | Gross

Unrealized

Losses |

| U.S. government agency obligations |  |  |  | $ | 19,978 | |  |  |  | $ | (90 | |  |  |  | $ | 331,709 | |  |  |  | $ | (2,461 | |  |  |  | $ | 351,687 | |  |  |  | $ | (2,551 | |

| Collateralized loan obligation CLO) |  |  |  |  | 6,406 | |  |  |  |  | (130 | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 6,406 | |  |  |  |  | (130 | |

| Total |  |  |  | $ | 26,384 | |  |  |  | $ | (220 | |  |  |  | $ | 331,709 | |  |  |  | $ | (2,461 | |  |  |  | $ | 358,093 | |  |  |  | $ | (2,681 | |

|

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | December 31, 2005

Securities with Unrealized Losses |

| |  |  | Less than 12 months |  |  | 12 months or more |  |  | Total |

| |  |  | Value

Fair |  |  | Gross

Unrealized

Losses |  |  | Fair

Value |  |  | Gross

Unrealized

Losses |  |  | Fair

Value |  |  | Gross

Unrealized

Losses |

| U.S. government agency obligations |  |  |  | $ | 544,824 | |  |  |  | $ | (4,259 | |  |  |  | $ | — | |  |  |  | $ | — | |  |  |  | $ | 544,824 | |  |  |  | $ | (4,259 | |

| Total |  |  |  | $ | 544,824 | |  |  |  | $ | (4,259 | |  |  |  | $ | — | |  |  |  | $ | — | |  |  |  | $ | 544,824 | |  |  |  | $ | (4,259 | |

|

The unrealized losses on the Company’s investments in U.S. government agency obligations were the result of an increase in interest rates during 2006 and 2005. Because the decline in market value is attributable to changes in interest rates and not credit quality, and the Company has the ability and intent to hold these investments until maturity, the Company does not consider these investments to

67

Table of ContentsPrimus Guaranty, Ltd.

Notes to Consolidated Financial Statements

be other-than-temporarily impaired at December 31, 2006 and 2005. The U.S. government agency obligations mature within two years and the CLO matures in 2019.

5. Trading account assets and liabilities

Trading account assets include debt securities held for trading purposes that the Company owns (long positions). Trading account liabilities include debt securities that the Company has sold to other parties but does not own (short positions). The Company is obligated to purchase securities at a future date to cover the short positions.

During 2006, PRS Trading Strategies purchased and sold corporate bonds for trading purposes. Trading positions are carried at fair value on the consolidated statements of financial condition, with unrealized gains or losses recorded in the consolidated statements of operations. At December 31, 2006, the fair value of these trading account assets and trading account liabilities was approximately $14.5 million and $1.0 million, respectively.

6. Primus Re Financial Guarantee Transactions

On December 31, 2006, the three-year financial guarantee insurance contracts written by Primus Re expired. The Company did not incur any credit losses on the contracts. On December 31, 2003, Primus Re wrote three-year financial guarantee insurance policies on three separate reference entities. Primus Re then transferred all of its risk to Primus Financial through back-to-back credit swaps referencing the same reference entities as the financial guarantee contracts and with the same maturities. These credit swaps and the related effects on results of operations were eliminated in consolidation. The aggregate notional amount of the credit swaps was $87.0 million at December 31, 2005.

7. Credit Swap Revenues and Portfolio

Overview

Net credit swap revenue as presented in the consolidated statements of operations comprises changes in the fair value of credit swaps, realized gains or losses on the termination of credit swaps and premium income or expense. The realized gains and losses on credit swaps represent realized gains and losses on the termination of credit swaps. The realization of gains or losses on credit swaps will generally result in a reduction in unrealized gains or losses and accrued premium at the point in time realization occurs.

Credit swaps are derivative transactions that obligate one party to the transaction (the ‘‘Seller’’) to pay an amount to the other party to the transaction (the ‘‘Buyer’’) should an unrelated third party or portfolio of third parties (the ‘‘Reference Entity’’) specified in the contract be subject to one of a specified group of events (‘‘Credit Events’’). The amount to be paid by the Seller will either be (a) the notional amount of the transaction, in exchange for which the Seller must be delivered a defined obligation of the Reference Entity (called physical settlement), or (b) the difference between the current market value of a define d obligation of the Reference Entity and the notional amount of the transaction (called cash settlement). In exchange for taking the risk of the contract, the Seller will receive a fixed premium for the term of the contract (or until the occurrence of a Credit Event). The fixed premium is generally paid quarterly in arrears over the term of the transaction. Premium income is recognized ratably over the life of the transaction as a component of net credit swap revenue. When the Company purchases credit swaps from its counterparties, the Company pays fixed premiums over the term of the contract. Premium expense is recognized ratably over the life of the transaction as a component of net credit swap revenue.

All credit swap transactions entered into between the Buyer and the Seller are, or will shortly be, subject to an International Swaps and Derivatives Association, Inc. Master Agreement or (‘‘ISDA

68

Table of ContentsPrimus Guaranty, Ltd.

Notes to Consolidated Financial Statements

Master Agreement’’) executed by both parties. The ISDA Master Agreement allows for the consolidation of the market exposures and termination of all transactions between the Buyer and Seller in the event a default (as defined by the ISDA Master Agreement) occurs in respect of either party.

The primary risks inherent in the Company’s activities are (a) where the Company is a Seller that Reference Entities specified in its credit swap transactions will experience Credit Events that will require the Company to make payments to the Buyers of the transactions. Credit Events may include any or all of the following: bankruptcy, failure to pay, repudiation or moratorium, and modified or original restructuring, (b) where the Company is a Buyer of a credit swap and a Credit Event occurs, the Seller fails to make payment to the Company, and (c) that Buyers of the transactions from the Company will default on their required premium payments. During the years ended December 31, 2006, 2005 and 2004, none of these events h ave occurred.

The Company terminates a credit swap in one of two ways. The Company may negotiate an agreed termination with the original counterparty (an unwind). The Company may negotiate an assignment and novation of its rights and obligations under the credit swap to a third party (an assignment). As an alternative to terminating a transaction, in order to reduce its exposure, the Company may enter into an equal and opposite transaction with a third party under which the Company purchases credit swaps on terms that match the terms of the original transaction (an offset). In this last case, both sides of the position may subsequently be unwound or assigned.

In the event of an unwind or assignment, the Company pays or receives a cash settlement negotiated with the counterparty or assignee, based on the fair value of the credit swap contract and the accrued premium on the swap contract at the time of negotiation. The amounts the Company pays or receives are recorded as a realization of fair value and as a realization of accrued premiums in the period in which the termination occurs.

In accordance with accounting principles generally accepted in the United States, the Company carries its credit swaps on its consolidated statements of financial condition at their fair value. Changes in the fair value of the Company’s credit swap portfolio are recorded as unrealized gains or losses as a component of net credit swap revenue in the Company’s consolidated statements of operations. If a credit swap has an increase or decline in fair value during a period, the increase will add to the Company’s net credit swap revenue and the decline will subtract from the Company’s net credit swap revenue for that period, respectively. Changes in the fair value of the Company’s credit swap portfolio are a function of the notional amount and composition of the portfolio and prevailing market credit swap premiums for comparable credit swaps. The Company generally holds the credit swaps it sells to maturity, at which point, assuming no credit event has occurred, the cumulative unrealized gains and losses on each credit swap would equal zero.