Exhibit 99.2

FIRST QUARTER | 2014 SUPPLEMENTAL REPORTING PACKAGE

Table of Contents

| | | | |

Quarterly Highlights | | | 2 | |

Consolidated Statements of Operations | | | 3 | |

Consolidated Balance Sheets | | | 4 | |

Funds from Operations | | | 5 | |

Selected Financial Data | | | 6 | |

Property Overview | | | 7-8 | |

Consolidated Leasing Summary | | | 9 | |

Acquisition and Disposition Summary | | | 10 | |

Development Overview | | | 11 | |

Indebtedness | | | 12 | |

Capitalization and Fixed Charge Coverage | | | 13 | |

Investment in Unconsolidated Ventures Summary | | | 14 | |

Definitions | | | 15-17 | |

Forward Looking Statement

We make statements in this report that are considered “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, which are usually identified by the use of words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “seeks,” “should,” “will,” and variations of such words or similar expressions and includes statements regarding our anticipated yields. We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and are including this statement for purposes of complying with those safe harbor provisions. These forward-looking statements reflect our current views about our plans, intentions, expectations, strategies and prospects, which are based on the information currently available to us and on assumptions we have made. Although we believe that our plans, intentions, expectations, strategies and prospects as reflected in or suggested by those forward-looking statements are reasonable, we can give no assurance that the plans, intentions, expectations or strategies will be attained or achieved. Furthermore, actual results may differ materially from those described in the forward-looking statements and will be affected by a variety of risks and factors that are beyond our control including, without limitation:

| | • | | national, international, regional and local economic conditions, including, in particular, the strength of the United States economic recovery and global economic recovery; |

| | • | | the general level of interest rates and the availability of capital; |

| | • | | the competitive environment in which we operate; |

| | • | | real estate risks, including fluctuations in real estate values and the general economic climate in local markets and competition for tenants in such markets; |

| | • | | decreased rental rates or increasing vacancy rates; |

| | • | | defaults on or non-renewal of leases by tenants; |

| | • | | acquisition and development risks, including failure of such acquisitions and development projects to perform in accordance with projections; |

| | • | | the timing of acquisitions, dispositions and development; |

| | • | | natural disasters such as fires, floods, tornadoes, hurricanes and earthquakes; |

| | • | | the terms of governmental regulations that affect us and interpretations of those regulations, including the cost of compliance with those regulations, changes in real estate and zoning laws and increases in real property tax rates; |

| | • | | financing risks, including the risk that our cash flows from operations may be insufficient to meet required payments of principal, interest and other commitments; |

| | • | | lack of or insufficient amounts of insurance; |

| | • | | litigation, including costs associated with prosecuting or defending claims and any adverse outcomes; |

| | • | | the consequences of future terrorist attacks or civil unrest; |

| | • | | environmental liabilities, including costs, fines or penalties that may be incurred due to necessary remediation of contamination of properties presently owned or previously owned by us; and |

| | • | | other risks and uncertainties detailed from time to time in our filings with the Securities and Exchange Commission. |

In addition, our current and continuing qualification as a real estate investment trust, or REIT, involves the application of highly technical and complex provisions of the Internal Revenue Code of 1986, or the Code, and depends on our ability to meet the various requirements imposed by the Code through actual operating results, distribution levels and diversity of stock ownership.

| | | | |

| First Quarter 2014 | |  | | Page 1 |

| Supplemental Reporting Package | | | |

Quarterly Highlights

| | |

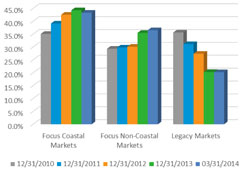

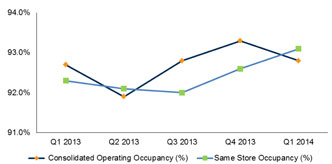

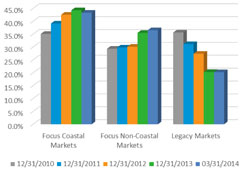

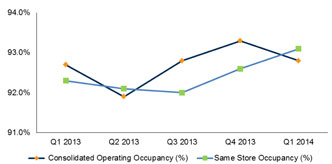

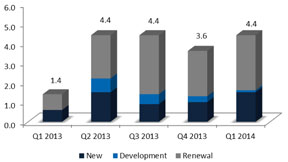

Portfolio Repositioning (1) | | Portfolio Occupancy (%)(2) |

| |  |

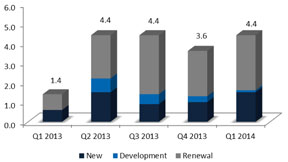

Total Leasing Volume (square feet, in millions) | | Acquisitions and Dispositions(3) ($ in millions) |

| |  |

Top 10 Markets(4)

Consolidated Operating

| | | | | | | | | | | | | | | | |

| | | ABR | | | Occupancy | | | Occupancy(2) | | | | |

Market | | (thousands) | | | Q1 2014 | | | Q1 2013 | | | Change | |

Southern California | | $ | 28,768 | | | | 93.6 | % | | | 98.3 | % | | | -4.7 | % |

Chicago | | | 25,111 | | | | 92.6 | % | | | 96.7 | % | | | -4.1 | % |

Houston | | | 18,805 | | | | 95.6 | % | | | 94.9 | % | | | 0.7 | % |

Atlanta | | | 18,562 | | | | 88.9 | % | | | 86.3 | % | | | 2.6 | % |

Dallas | | | 17,196 | | | | 98.2 | % | | | 94.6 | % | | | 3.6 | % |

Northern California | | | 16,043 | | | | 87.9 | % | | | 97.7 | % | | | -9.8 | % |

Cincinnati | | | 12,158 | | | | 93.9 | % | | | 91.6 | % | | | 2.3 | % |

Pennsylvania | | | 11,285 | | | | 92.1 | % | | | 92.0 | % | | | 0.1 | % |

Baltimore/Washington | | | 10,814 | | | | 88.9 | % | | | 92.0 | % | | | -3.1 | % |

Miami | | | 10,040 | | | | 99.2 | % | | | 97.6 | % | | | 1.6 | % |

| | | | | | | | | | | | | | | | |

Total/Weighted Average | | $ | 168,782 | | | | 92.8 | % | | | 93.7 | % | | | -0.9 | % |

| | | | | | | | | | | | | | | | |

| (1) | Percentages are based on annualized base rent as previously reported. |

| (2) | Prior period amounts are as previously reported. |

| (3) | Includes consolidated property acquisitions or dispositions. |

| (4) | Based on annualized base rent as of March 31, 2014. Occupancy is as of period end. |

| | | | |

| First Quarter 2014 | |  | | Page 2 |

| Supplemental Reporting Package | | | |

Consolidated Statements of Operations

(unaudited, amounts in thousands, except per share data)

| | | | | | | | |

| | | Three Months Ended

March 31, | |

| | | 2014 | | | 2013 | |

REVENUES: | | | | | | | | |

Rental revenues | | $ | 82,619 | | | $ | 67,309 | |

Institutional capital management and other fees | | | 764 | | | | 812 | |

| | | | | | | | |

Total revenues | | | 83,383 | | | | 68,121 | |

| | | | | | | | |

OPERATING EXPENSES: | | | | | | | | |

Rental expenses | | | 12,402 | | | | 8,349 | |

Real estate taxes | | | 13,197 | | | | 10,579 | |

Real estate related depreciation and amortization | | | 36,433 | | | | 30,196 | |

General and administrative | | | 6,834 | | | | 6,339 | |

Impairment losses | | | 4,359 | | | | — | |

Casualty and involuntary conversion gain | | | — | | | | (59 | ) |

| | | | | | | | |

Total operating expenses | | | 73,225 | | | | 55,404 | |

| | | | | | | | |

Operating income | | | 10,158 | | | | 12,717 | |

OTHER INCOME (EXPENSE): | | | | | | | | |

Development profit, net of taxes | | | 728 | | | | 268 | |

Equity in earnings of unconsolidated joint ventures, net | | | 3,613 | | | | 391 | |

Gain on acquisitions and dispositions of real estate interests | | | 2,045 | | | | — | |

Interest expense | | | (16,056 | ) | | | (16,860 | ) |

Interest and other income | | | 28 | | | | 162 | |

Income tax expense and other taxes | | | (57 | ) | | | (109 | ) |

| | | | | | | | |

Income (loss) from continuing operations | | | 459 | | | | (3,431 | ) |

Discontinued operations: | | | | | | | | |

Operating income and other expenses | | | 141 | | | | 2,190 | |

Gain (loss) on dispositions of real estate interests from discontinued operations | | | (132 | ) | | | 2,877 | |

| | | | | | | | |

Income from discontinued operations | | | 9 | | | | 5,067 | |

| | | | | | | | |

Consolidated net income of DCT Industrial Trust Inc. | | | 468 | | | | 1,636 | |

Net income attributable to noncontrolling interests | | | (151 | ) | | | (357 | ) |

| | | | | | | | |

Net income attributable to common stockholders | | | 317 | | | | 1,279 | |

| | | | | | | | |

Distributed and undistributed earnings allocated to participating securities | | | (166 | ) | | | (173 | ) |

| | | | | | | | |

Adjusted net income attributable to common stockholders | | $ | 151 | | | $ | 1,106 | |

| | | | | | | | |

EARNINGS PER COMMON SHARE – BASIC | | | | | | | | |

Income (loss) from continuing operations | | $ | 0.00 | | | $ | (0.01 | ) |

Income from discontinued operations | | | 0.00 | | | | 0.01 | |

| | | | | | | | |

Net income attributable to common stockholders | | $ | 0.00 | | | $ | 0.00 | |

| | | | | | | | |

EARNINGS PER COMMON SHARE – DILUTED | | | | | | | | |

Income (loss) from continuing operations | | $ | 0.00 | | | $ | (0.01 | ) |

Income from discontinued operations | | | 0.00 | | | | 0.01 | |

| | | | | | | | |

Net income attributable to common stockholders | | $ | 0.00 | | | $ | 0.00 | |

| | | | | | | | |

WEIGHTED AVERAGE COMMON SHARES OUTSTANDING: | | | | | | | | |

Basic | | | 323,942 | | | | 281,063 | |

Diluted | | | 324,994 | | | | 281,063 | |

| | | | |

| First Quarter 2014 | |  | | Page 3 |

| Supplemental Reporting Package | | | |

Consolidated Balance Sheets

(amounts in thousands)

| | | | | | | | |

| | | March 31, | | | December 31, | |

| | | 2014 | | | 2013 | |

| | | (unaudited) | | | | |

ASSETS: | | | | | | | | |

Operating properties | | $ | 3,544,095 | | | $ | 3,442,442 | |

Properties under development | | | 132,829 | | | | 142,903 | |

Properties under redevelopment | | | — | | | | 12,194 | |

Properties in pre-development including land held | | | 50,478 | | | | 73,512 | |

| | | | | | | | |

Total investment in properties | | | 3,727,402 | | | | 3,671,051 | |

Less accumulated depreciation and amortization | | | (680,140 | ) | | | (654,097 | ) |

| | | | | | | | |

Net investment in properties | | | 3,047,262 | | | | 3,016,954 | |

Investments in and advances to unconsolidated joint ventures | | | 101,198 | | | | 124,923 | |

| | | | | | | | |

Net investment in real estate | | | 3,148,460 | | | | 3,141,877 | |

Cash and cash equivalents | | | 17,025 | | | | 32,226 | |

Restricted cash | | | 2,489 | | | | 12,621 | |

Deferred loan costs, net | | | 9,704 | | | | 10,251 | |

Straight-line rent and other receivables, net | | | 50,596 | | | | 46,247 | |

Other assets, net | | | 15,860 | | | | 14,545 | |

Assets held for sale | | | 22,869 | | | | 8,196 | |

| | | | | | | | |

Total assets | | $ | 3,267,003 | | | $ | 3,265,963 | |

| | | | | | | | |

LIABILITIES AND EQUITY: | | | | | | | | |

Accounts payable and accrued expenses | | $ | 61,640 | | | $ | 63,281 | |

Distributions payable | | | 24,265 | | | | 23,792 | |

Tenant prepaids and security deposits | | | 24,632 | | | | 28,542 | |

Other liabilities | | | 6,257 | | | | 10,122 | |

Intangible lease liability, net | | | 19,868 | | | | 20,389 | |

Line of credit | | | 34,000 | | | | 39,000 | |

Senior unsecured notes | | | 1,122,459 | | | | 1,122,407 | |

Mortgage notes | | | 279,782 | | | | 290,960 | |

Liabilities related to assets held for sale | | | 5,961 | | | | 278 | |

| | | | | | | | |

Total liabilities | | | 1,578,864 | | | | 1,598,771 | |

| | | | | | | | |

Total stockholders’ equity | | | 1,568,695 | | | | 1,543,806 | |

Noncontrolling interests | | | 119,444 | | | | 123,386 | |

| | | | | | | | |

Total liabilities and equity | | $ | 3,267,003 | | | $ | 3,265,963 | |

| | | | | | | | |

| | | | |

| First Quarter 2014 | |  | | Page 4 |

| Supplemental Reporting Package | | | |

Funds from Operations

(unaudited, amounts in thousands, except per share and unit data)

| | | | | | | | |

| | | Three Months Ended

March 31, | |

| | | 2014 | | | 2013 | |

Reconciliation of net income attributable to common stockholders to FFO: | | | | | | | | |

Net income attributable to common stockholders | | $ | 317 | | | $ | 1,279 | |

Adjustments: | | | | | | | | |

Real estate related depreciation and amortization | | | 36,433 | | | | 32,690 | |

Equity in earnings of unconsolidated joint ventures, net | | | (3,613 | ) | | | (391 | ) |

Equity in FFO of unconsolidated joint ventures | | | 2,716 | | | | 2,353 | |

Impairment losses on depreciable real estate | | | 4,491 | | | | — | |

Gain on acquisitions and dispositions of real estate interests | | | (2,045 | ) | | | (2,877 | ) |

Gain on dispositions of non-depreciable real estate | | | 98 | | | | — | |

Noncontrolling interest in the above adjustments | | | (2,164 | ) | | | (2,323 | ) |

FFO attributable to unitholders | | | 1,994 | | | | 2,217 | |

| | | | | | | | |

FFO attributable to common stockholders and unitholders(1) | | | 38,227 | | | | 32,948 | |

| | | | | | | | |

Adjustments: | | | | | | | | |

Acquisition costs | | | 725 | | | | 377 | |

| | | | | | | | |

FFO, as adjusted, attributable to common stockholders and unitholders – basic and diluted | | $ | 38,952 | | | $ | 33,325 | |

| | | | | | | | |

FFO per common share and unit — basic and diluted | | $ | 0.11 | | | $ | 0.11 | |

| | | | | | | | |

FFO, as adjusted, per common share and unit — basic and diluted | | $ | 0.11 | | | $ | 0.11 | |

| | | | | | | | |

FFO weighted average common shares and units outstanding: | | | | | | | | |

Common shares for earnings per share—basic | | | 323,942 | | | | 281,063 | |

Participating securities | | | 2,228 | | | | 2,250 | |

Units | | | 17,828 | | | | 20,283 | |

| | | | | | | | |

FFO weighted average common shares, participating securities and units outstanding – basic | | | 343,998 | | | | 303,596 | |

Dilutive common stock equivalents | | | 1,052 | | | | 813 | |

| | | | | | | | |

FFO weighted average common shares, participating securities and units outstanding – diluted | | | 345,050 | | | | 304,409 | |

| | | | | | | | |

| (1) | Funds from operations, FFO, as defined by the National Association of Real Estate Investment Trusts (NAREIT). |

| | | | |

| First Quarter 2014 | |  | | Page 5 |

| Supplemental Reporting Package | | | |

Selected Financial Data

(unaudited, amounts in thousands)

| | | | | | | | |

| | | Three Months Ended

March 31, | |

| | | 2014 | | | 2013 | |

NET OPERATING INCOME:(1) | | | | | | | | |

Rental revenues | | $ | 82,619 | | | $ | 67,309 | |

Rental expenses and real estate taxes | | | (25,599 | ) | | | (18,928 | ) |

| | | | | | | | |

Net operating income(2) | | $ | 57,020 | | | $ | 48,381 | |

| | | | | | | | |

TOTAL CONSOLIDATED PROPERTIES:(3) | | | | | | | | |

Square feet as of period end | | | 64,496 | | | | 60,250 | |

Average occupancy | | | 91.6 | % | | | 90.8 | % |

Occupancy as of period end | | | 91.8 | % | | | 91.3 | % |

CONSOLIDATED OPERATING PROPERTIES:(3) | | | | | | | | |

Square feet as of period end | | | 63,809 | | | | 59,165 | |

Average occupancy | | | 92.2 | % | | | 92.5 | % |

Occupancy as of period end | | | 92.8 | % | | | 92.7 | % |

SAME STORE PROPERTIES:(4) | | | | | | | | |

Square feet as of period end | | | 53,375 | | | | 53,375 | |

Average occupancy | | | 92.7 | % | | | 92.3 | % |

Occupancy as of period end | | | 93.1 | % | | | 92.3 | % |

Rental revenues | | $ | 69,969 | | | $ | 66,853 | |

Rental expenses and real estate taxes | | | (21,506 | ) | | | (18,783 | ) |

| | | | | | | | |

Same store net operating income | | | 48,463 | | | | 48,070 | |

Less: revenue from lease terminations | | | (925 | ) | | | (115 | ) |

Add: early termination straight-line rent adjustment | | | 263 | | | | 19 | |

| | | | | | | | |

Net operating income (excluding revenue from lease terminations) | | | 47,801 | | | | 47,974 | |

| | | | | | | | |

Less: straight-line rents, net of related bad debt expense | | | (878 | ) | | | (1,271 | ) |

Less: amortization of below market rents, net | | | (350 | ) | | | (399 | ) |

| | | | | | | | |

Cash net operating income (excluding revenue from lease terminations) | | $ | 46,573 | | | $ | 46,304 | |

| | | | | | | | |

Net operating income growth (excluding revenue from lease terminations) | | | -0.4 | % | | | | |

Cash net operating income growth (excluding revenue from lease terminations) | | | 0.6 | % | | | | |

SUPPLEMENTAL CONSOLIDATED CASH FLOW AND OTHER INFORMATION: | | | | | | | | |

Straight-line rents - increase to revenue, net of related bad debt expense(3) | | $ | 2,111 | | | $ | 1,537 | |

Straight-line rent receivable (balance sheet)(3) | | $ | 43,793 | | | $ | 40,418 | |

Net amortization of below market rents – increase to revenue(3) | | $ | 427 | | | $ | 399 | |

Capitalized interest | | $ | 1,948 | | | $ | 2,044 | |

Noncash interest expense(3) | | $ | 1,137 | | | $ | 1,046 | |

Stock-based compensation amortization | | $ | 1,304 | | | $ | 1,072 | |

Revenue from lease terminations(3) | | $ | 925 | | | $ | 115 | |

Bad debt expense, excluding bad debt expense related to straight-line rents(3) | | $ | 329 | | | $ | 171 | |

CONSOLIDATED CAPITAL EXPENDITURES:(3) | | | | | | | | |

Development | | $ | 26,252 | | | $ | 21,467 | |

Redevelopment | | | 363 | | | | 1,777 | |

Due diligence | | | 2,056 | | | | 614 | |

Casualty expenditures | | | 392 | | | | 2,119 | |

Building and land improvements | | | 1,542 | | | | 927 | |

Tenant improvements and leasing costs | | | 9,678 | | | | 6,043 | |

| | | | | | | | |

Total capital expenditures | | $ | 40,283 | | | $ | 32,947 | |

| | | | | | | | |

| (1) | Excludes discontinued operations. |

| (2) | See reconciliation of net operating income to income (loss) from continuing operations in Definitions. |

| (3) | Includes discontinued operations and assets held for sale. |

| (4) | See the Definitions for same store properties. |

| | | | |

| First Quarter 2014 | |  | | Page 6 |

| Supplemental Reporting Package | | | |

Property Overview

As of March 31, 2014

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Markets | | Number of

Buildings | | | Percent

Owned (1) | | | Square Feet | | | Percentage of

Total Square

Feet | | | Occupancy

Percentage(5) | | | Annualized

Base Rent(2) (6) | | | Percent of Total

Annualized Base

Rent | |

| | | | | | | | | (in thousands) | | | | | | | | | (in thousands) | | | | |

CONSOLIDATED OPERATING: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Atlanta | | | 41 | | | | 100.0 | % | | | 6,592 | | | | 10.2 | % | | | 88.9 | % | | $ | 18,562 | | | | 7.9 | % |

Baltimore/Washington D.C. | | | 19 | | | | 100.0 | % | | | 2,236 | | | | 3.5 | % | | | 88.9 | % | | | 10,814 | | | | 4.6 | % |

Charlotte | | | 1 | | | | 100.0 | % | | | 472 | | | | 0.7 | % | | | 100.0 | % | | | 1,604 | | | | 0.7 | % |

Chicago | | | 39 | | | | 100.0 | % | | | 8,291 | | | | 12.9 | % | | | 92.6 | % | | | 25,111 | | | | 10.6 | % |

Cincinnati | | | 31 | | | | 100.0 | % | | | 3,782 | | | | 5.9 | % | | | 93.9 | % | | | 12,158 | | | | 5.1 | % |

Columbus | | | 12 | | | | 100.0 | % | | | 3,480 | | | | 5.4 | % | | | 100.0 | % | | | 7,501 | | | | 3.2 | % |

Dallas | | | 35 | | | | 100.0 | % | | | 5,231 | | | | 8.1 | % | | | 98.2 | % | | | 17,196 | | | | 7.3 | % |

Denver | | | 2 | | | | 100.0 | % | | | 278 | | | | 0.4 | % | | | 96.5 | % | | | 1,230 | | | | 0.5 | % |

Houston | | | 43 | | | | 100.0 | % | | | 3,269 | | | | 5.1 | % | | | 95.6 | % | | | 18,805 | | | | 8.0 | % |

Indianapolis | | | 7 | | | | 100.0 | % | | | 2,299 | | | | 3.6 | % | | | 91.8 | % | | | 7,130 | | | | 3.0 | % |

Louisville | | | 3 | | | | 100.0 | % | | | 1,109 | | | | 1.7 | % | | | 91.0 | % | | | 3,357 | | | | 1.4 | % |

Memphis | | | 8 | | | | 100.0 | % | | | 3,712 | | | | 5.7 | % | | | 86.5 | % | | | 8,788 | | | | 3.7 | % |

Miami | | | 10 | | | | 100.0 | % | | | 1,362 | | | | 2.1 | % | | | 99.2 | % | | | 10,040 | | | | 4.3 | % |

Nashville | | | 4 | | | | 100.0 | % | | | 2,064 | | | | 3.2 | % | | | 96.5 | % | | | 5,918 | | | | 2.5 | % |

New Jersey | | | 15 | | | | 100.0 | % | | | 2,033 | | | | 3.1 | % | | | 90.6 | % | | | 9,766 | | | | 4.1 | % |

Northern California | | | 27 | | | | 100.0 | % | | | 3,171 | | | | 4.9 | % | | | 87.9 | % | | | 16,043 | | | | 6.8 | % |

Orlando | | | 20 | | | | 100.0 | % | | | 1,864 | | | | 2.9 | % | | | 86.8 | % | | | 6,449 | | | | 2.7 | % |

Pennsylvania | | | 14 | | | | 100.0 | % | | | 2,828 | | | | 4.4 | % | | | 92.1 | % | | | 11,285 | | | | 4.8 | % |

Phoenix | | | 18 | | | | 100.0 | % | | | 2,101 | | | | 3.3 | % | | | 91.8 | % | | | 7,504 | | | | 3.2 | % |

Seattle | | | 14 | | | | 100.0 | % | | | 1,696 | | | | 2.6 | % | | | 95.4 | % | | | 7,923 | | | | 3.4 | % |

Southern California | | | 42 | | | | 92.9 | % | | | 5,939 | | | | 9.2 | % | | | 93.6 | % | | | 28,768 | | | | 12.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total/weighted average – operating properties | | | 405 | | | | 99.3 | % | | | 63,809 | | | | 98.9 | % | | | 92.8 | % | | | 235,952 | | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

DEVELOPMENT PROPERTIES: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Houston | | | 2 | | | | 100.0 | % | | | 400 | | | | 0.6 | % | | | 0.0 | % | | | — | | | | 0.0 | % |

Seattle | | | 1 | | | | 100.0 | % | | | 188 | | | | 0.3 | % | | | 0.0 | % | | | — | | | | 0.0 | % |

Southern California | | | 1 | | | | 94.0 | % | | | 99 | | | | 0.2 | % | | | 0.0 | % | | | — | | | | 0.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total/weighted average – development properties | | | 4 | | | | 99.1 | % | | | 687 | | | | 1.1 | % | | | 0.0 | % | | | — | | | | 0.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total/weighted average – consolidated properties | | | 409 | | | | 99.3 | % | | | 64,496 | | | | 100.0 | % | | | 91.8 | % | | $ | 235,952 | (3) | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

See footnotes on next page.

| | | | |

| First Quarter 2014 | |  | | Page 7 |

| Supplemental Reporting Package | | | |

Property Overview

(continued)

As of March 31, 2014

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Markets | | Number of

Buildings | | | Percent

Owned (1) | | | Square Feet | | | Percentage of

Total Square

Feet | | | Occupancy

Percentage(5) | | | Annualized

Base Rent(2) | | | Percent of

Total

Annualized

Base Rent | |

| | | | | | | | | (in thousands) | | | | | | | | | (in thousands) | | | | |

UNCONSOLIDATED OPERATING PROPERTIES: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

IDI (Nashville and Savannah) | | | 2 | | | | 50.0 | % | | | 1,060 | | | | 12.4 | % | | | 84.3 | % | | $ | 969 | | | | 3.8 | % |

Southern California Logistics Airport(4) | | | 6 | | | | 50.0 | % | | | 2,160 | | | | 25.2 | % | | | 99.6 | % | | | 7,913 | | | | 30.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total/weighted average – unconsolidated operating properties | | | 8 | | | | 50.0 | % | | | 3,220 | | | | 37.6 | % | | | 94.6 | % | | | 8,882 | | | | 34.6 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

OPERATING PROPERTIES IN CO-INVESTMENT VENTURES: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Chicago | | | 2 | | | | 20.0 | % | | | 1,033 | | | | 12.1 | % | | | 100.0 | % | | | 3,238 | | | | 12.6 | % |

Cincinnati | | | 1 | | | | 20.0 | % | | | 543 | | | | 6.4 | % | | | 100.0 | % | | | 1,656 | | | | 6.4 | % |

Dallas | | | 1 | | | | 20.0 | % | | | 540 | | | | 6.3 | % | | | 100.0 | % | | | 1,390 | | | | 5.4 | % |

Denver | | | 5 | | | | 20.0 | % | | | 772 | | | | 9.0 | % | | | 97.4 | % | | | 3,121 | | | | 12.1 | % |

Louisville | | | 4 | | | | 10.0 | % | | | 736 | | | | 8.6 | % | | | 100.0 | % | | | 1,353 | | | | 5.2 | % |

Nashville | | | 2 | | | | 20.0 | % | | | 1,020 | | | | 11.9 | % | | | 100.0 | % | | | 2,768 | | | | 10.8 | % |

Orlando | | | 2 | | | | 20.0 | % | | | 696 | | | | 8.1 | % | | | 100.0 | % | | | 3,308 | | | | 12.9 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total/weighted average – co-investment operating properties | | | 17 | | | | 18.6 | % | | | 5,340 | | | | 62.4 | % | | | 99.6 | % | | | 16,834 | | | | 65.4 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total/weighted average – unconsolidated properties | | | 25 | | | | 30.4 | % | | | 8,560 | | | | 100.0 | % | | | 97.7 | % | | $ | 25,716 | | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

SUMMARY: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total/weighted average – operating properties | | | 430 | | | | 91.2 | % | | | 72,369 | | | | 99.1 | % | | | 93.4 | % | | $ | 261,668 | | | | 100.0 | % |

Total/weighted average – development properties | | | 4 | | | | 99.1 | % | | | 687 | | | | 0.9 | % | | | 0.0 | % | | | — | | | | 0.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total/weighted average – all properties | | | 434 | | | | 91.3 | % | | | 73,056 | | | | 100.0 | % | | | 92.5 | % | | $ | 261,668 | | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Percent owned is based on equity ownership weighted by square feet. |

| (2) | Annualized base rent is calculated as monthly contractual base rent (cash basis) per the terms of the lease, as of March 31, 2014, multiplied by 12. |

| (3) | Excludes total annualized base rent associated with tenants currently in free rent periods of $10.9 million based on the first month’s cash base rent. |

| (4) | Although we contributed 100% of the initial cash equity capital required by the venture, after return of certain preferential distributions on capital invested, profits and losses are generally split 50/50. |

| (5) | Based on leases commenced as of March 31, 2014. |

| (6) | Excludes total annualized base rent of $1.7 million from one non-industrial property acquired for future development. |

| | | | |

| First Quarter 2014 | |  | | Page 8 |

| Supplemental Reporting Package | | | |

Consolidated Leasing Summary

Leasing Statistics(1)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Number

of

Leases

Signed | | | Square Feet

Signed | | | Cash Basis

Rent

Growth | | | GAAP Basis

Rent

Growth | | | Weighted

Average

Lease

Term(2) | | | Turnover

Costs | | | Turnover

Costs Per

Square

Foot | |

| | | | | | (in thousands) | | | | | | | | | (in months) | | | (in thousands) | | | | |

FIRST QUARTER 2014 | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

New | | | 31 | | | | 1,445 | | | | 3.1 | % | | | 10.0 | % | | | 65 | | | $ | 5,086 | | | $ | 3.52 | |

Renewal | | | 35 | | | | 2,813 | | | | 7.0 | % | | | 17.7 | % | | | 68 | | | | 6,611 | | | | 2.35 | |

Development and redevelopment | | | 2 | | | | 93 | | | | N/A | | | | N/A | | | | 69 | | | | N/A | | | | N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total/Weighted Average | | | 68 | | | | 4,351 | | | | 5.7 | % | | | 15.1 | % | | | 67 | | | $ | 11,697 | | | $ | 2.75 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Weighted Average Retention | | | 80.8 | % | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

FOUR QUARTERS ROLLING | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

New | | | 126 | | | | 4,947 | | | | 1.8 | % | | | 11.0 | % | | | 57 | | | $ | 15,830 | | | $ | 3.20 | |

Renewal | | | 164 | | | | 10,213 | | | | 0.5 | % | | | 8.9 | % | | | 54 | | | | 13,992 | | | | 1.37 | |

Development and redevelopment | | | 10 | | | | 1,583 | | | | N/A | | | | N/A | | | | 79 | | | | N/A | | | | N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total/Weighted Average | | | 300 | | | | 16,743 | | | | 0.8 | % | | | 9.4 | % | | | 57 | | | $ | 29,822 | | | $ | 1.97 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Weighted Average Retention | | | 78.1 | % | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Lease Expirations for Consolidated Properties as of March 31, 2014(2)

| | | | | | | | | | | | |

Year | | Square Feet Related to

Expiring Leases | | | Annualized Base Rent of

Expiring Leases(3) | | | Percentage of Total

Annualized Base Rent | |

| | | (in thousands) | | | (in thousands) | | | | |

2014(4) | | | 5,953 | | | $ | 26,294 | | | | 9.8 | % |

2015 | | | 9,676 | | | | 39,259 | | | | 14.7 | % |

2016 | | | 9,904 | | | | 43,272 | | | | 16.1 | % |

2017 | | | 9,297 | | | | 37,352 | | | | 14.0 | % |

2018 | | | 6,661 | | | | 30,691 | | | | 11.5 | % |

Thereafter | | | 17,697 | | | | 90,659 | | | | 33.9 | % |

| | | | | | | | | | | | |

Total occupied | | | 59,188 | | | $ | 267,527 | | | | 100.0 | % |

| | | | | | | | | | | | |

Available or leased but not occupied | | | 5,308 | | | | | | | | | |

| | | | | | | | | | | | |

Total consolidated properties | | | 64,496 | | | | | | | | | |

| | | | | | | | | | | | |

| (1) | Excludes month-to-month leases. |

| (2) | Assumes no exercise of lease renewal options. |

| (3) | Includes contractual rent changes. |

| (4) | Includes month-to-month leases. |

| | | | |

| First Quarter 2014 | |  | | Page 9 |

| Supplemental Reporting Package | | | |

Acquisition and Disposition Summary

For the Three Months Ended March 31, 2014

| | | | | | | | | | | | | | | | |

| | | Property Name | | Market | | Size | | | Occupancy at

Acquisition/

Disposition | | | Occupancy at

March 31,

2014 | |

| | | | | | | (building in sq. ft) | | | | | | | |

BUILDING ACQUISITIONS: | | | | | | | | | | | | | | | | |

January | | 1501 Michael Drive | | Chicago | | | 174,000 | | | | 100.0 | % | | | 100.0 | % |

January | | 511 S Royal | | Dallas | | | 71,000 | | | | 100.0 | % | | | 100.0 | % |

February | | 8041 S 228th Street | | Seattle | | | 42,000 | | | | 66.6 | % | | | 66.6 | % |

March | | 3401 S Chicago Street | | Chicago | | | 184,000 | | | | 32.6 | % | | | 32.6 | % |

March | | Fife 45 | | Seattle | | | 56,000 | | | | 100.0 | % | | | 100.0 | % |

March | | Prairie Point West(1) | | Chicago | | | 363,000 | | | | 100.0 | % | | | 100.0 | % |

| | | | | | | | | | | | | | | | |

Total YTD Purchase Price - $40.7 million | | | | | | | 890,000 | | | | 84.5 | % | | | 84.5 | % |

| | | | | | | | | | | | | | | | |

LAND ACQUISITIONS: | | | | | | | | | | | | | | | | |

January | | Freeport North | | Dallas | | | 6.4 acres | | | | N/A | | | | N/A | |

March | | Fife North and Fife South | | Seattle | | | 8.6 acres | | | | N/A | | | | N/A | |

| | | | | | | | | | | | | | | | |

Total YTD Land Purchase Price - $2.9 million | | | | | | | 15.0 acres | | | | | | | | | |

| | | | | | | | | | | | | | | | |

BUILDING DISPOSITIONS: | | | | | | | | | | | | | | | | |

January | | 8th & Vineyard A(2) | | So. California | | | 130,000 | | | | N/A | | | | N/A | |

| | | | | | | | | | | | | | | | |

Total YTD Sales Price - $9.9 million | | | | | | | 130,000 | | | | | | | | | |

| | | | | | | | | | | | | | | | |

LAND DISPOSITIONS: | | | | | | | | | | | | | | | | |

March | | Boone Industrial Park | | Indianapolis | | | 28.4 acres | | | | N/A | | | | N/A | |

| | | | | | | | | | | | | | | | |

Total YTD Sales Price - $1.1 million | | | | | | | 28.4 acres | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| (1) | During March 2014, we purchased our partner’s 50.0% interest in one property from the IDI-DCT joint venture for $10.3 million. |

| (2) | During January 2014, we completed the build-to-suit and sold 8th & Vineyard A, a 130,000 square foot building located in the Inland Empire West submarket of Southern California. |

| | | | |

| First Quarter 2014 | |  | | Page 10 |

| Supplemental Reporting Package | | | |

Development Overview

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Costs Incurred | | | | | | | | | | |

Project | | Market | | Acres | | | Number

of

Buildings | | | Square Feet | | | Percent

Owned | | | Q1-2014 | | | Cumulative

Costs at

3/31/2014 | | | Projected

Investment | | | Completion

Date(3) | | | Percent

Leased | |

| | | | | | | | | | | (in thousands) | | | | | | (in thousands) | | | (in thousands) | | | (in thousands) | | | | | | | |

Consolidated Development Activities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Projects Under Development | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Development Projects in Lease Up | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

DCT Beltway Tanner Business Park | | Houston | | | 11 | | | | 1 | | | | 133 | | | | 100 | % | | | 425 | | | | 10,626 | | | | 15,424 | | | | Q1-2014 | | | | 79 | % |

DCT Airtex Industrial Center | | Houston | | | 13 | | | | 1 | | | | 267 | | | | 100 | % | | | 654 | | | | 12,815 | | | | 14,657 | | | | Q4-2013 | | | | 100 | % |

DCT Summer South Distribution Center | | Seattle | | | 9 | | | | 1 | | | | 188 | | | | 100 | % | | | 1,191 | | | | 10,385 | | | | 12,536 | | | | Q1-2014 | | | | 0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Total | | | 33 | | | | 3 | | | | 588 | | | | 100 | % | | $ | 2,270 | | | $ | 33,826 | | | $ | 42,617 | | | | | | | | 63 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Under Construction | | | | | | | | | | | | | | | | | | | �� | | | | | | | | | | | | | | | | | | | |

DCT Airtex Industrial Center II | | Houston | | | 7 | | | | 1 | | | | 125 | | | | 100 | % | | $ | 474 | | | $ | 1,929 | | | $ | 9,882 | | | | Q4-2014 | | | | 0 | % |

DCT White River Corporate Center Phase I | | Seattle | | | 30 | | | | 1 | | | | 649 | | | | 100 | % | | | 7,661 | | | | 30,712 | | | | 42,747 | | | | Q3-2014 | | | | 0 | % |

DCT Auburn 44 | | Seattle | | | 3 | | | | 1 | | | | 49 | | | | 100 | % | | | 1,383 | | | | 4,724 | | | | 4,724 | | | | Q2-2014 | | | | 100 | % |

Slover Logistics Center II | | So. California | | | 28 | | | | 1 | | | | 610 | | | | 100 | % | | | 8,572 | | | | 32,813 | | | | 37,121 | | | | Q2-2014 | | | | 100 | % |

DCT Rialto Logistics Center | | So. California | | | 42 | | | | 1 | | | | 928 | | | | 100 | % | | | 1,490 | | | | 22,970 | | | | 59,560 | | | | Q4-2014 | | | | 0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Total | | | 110 | | | | 5 | | | | 2,361 | | | | 100 | % | | $ | 19,580 | | | $ | 93,148 | | | $ | 154,034 | | | | | | | | 28 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Projects Under Development | | | | | 143 | | | | 8 | | | | 2,949 | | | | 100 | % | | $ | 21,850 | | | $ | 126,974 | | | $ | 196,651 | | | | | | | | 35 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Projected Stabilized Yield - Projects Under Development(1) | | | | | 7.3 | % | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Development Projects for Sale | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

8th & Vineyard A(6) | | So. California | | | 6 | | | | 1 | | | | 130 | | | | 91 | % | | $ | 392 | | | $ | 8,165 | | | $ | 8,165 | | | | Q1-2014 | | | | N/A | |

8th & Vineyard B | | So. California | | | 4 | | | | 1 | | | | 99 | | | | 91 | % | | | 612 | | | | 5,855 | | | | 6,117 | | | | Q1-2014 | | | | N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Total | | | 10 | | | | 2 | | | | 229 | | | | 91 | % | | $ | 1,004 | | | $ | 14,020 | | | $ | 14,282 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Development Projects Moved to Operating | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

DCT 55(5) | | Chicago | | | 33 | | | | 1 | | | | 604 | | | | 100 | % | | $ | 686 | | | $ | 26,904 | | | $ | 28,810 | | | | Q4-2012 | | | | 66 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Pre-Development(2) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

DCT River West | | Atlanta | | | 47 | | | | | | | | | | | | 100 | % | | $ | 192 | | | $ | 6,819 | | | | | | | | | | | | | |

DCT Freeport North | | Dallas | | | 6 | | | | | | | | | | | | 100 | % | | | 1,315 | | | | 1,315 | | | | | | | | | | | | | |

DCT Northwest Crossroads Phase I | | Houston | | | 21 | | | | | | | | | | | | 100 | % | | | 575 | | | | 4,114 | | | | | | | | | | | | | |

DCT Northwest Crossroads Phase II | | Houston | | | 18 | | | | | | | | | | | | 100 | % | | | 50 | | | | 2,957 | | | | | | | | | | | | | |

DCT White River Corporate Center Phase II North | | Seattle | | | 13 | | | | | | | | | | | | 100 | % | | | 270 | | | | 6,147 | | | | | | | | | | | | | |

DCT White River Corporate Center Phase II South | | Seattle | | | 4 | | | | | | | | | | | | 100 | % | | | 88 | | | | 1,313 | | | | | | | | | | | | | |

DCT Fife 45 North | | Seattle | | | 5 | | | | | | | | | | | | 100 | % | | | 1,175 | | | | 1,175 | | | | | | | | | | | | | |

DCT Fife 45 South | | Seattle | | | 4 | | | | | | | | | | | | 100 | % | | | 908 | | | | 908 | | | | | | | | | | | | | |

8th & Vineyard C | | So. California | | | 3 | | | | | | | | | | | | 91 | % | | | 139 | | | | 1,287 | | | | | | | | | | | | | |

8th & Vineyard D | | So. California | | | 4 | | | | | | | | | | | | 91 | % | | | 72 | | | | 1,543 | | | | | | | | | | | | | |

8th & Vineyard E | | So. California | | | 2 | | | | | | | | | | | | 91 | % | | | 103 | | | | 945 | | | | | | | | | | | | | |

DCT Jurupa Ranch(4) | | So. California | | | 39 | | | | | | | | | | | | 100 | % | | | 59 | | | | 26,428 | | | | | | | | | | | | | |

DCT Airport Distribution Center North Building C | | Orlando | | | 8 | | | | | | | | | | | | 100 | % | | | 229 | | | | 1,584 | | | | | | | | | | | | | |

Seneca Commerce Center Phase I | | Miami | | | 14 | | | | | | | | | | | | 90 | % | | | 379 | | | | 1,556 | | | | | | | | | | | | | |

Seneca Commerce Center Phase II | | Miami | | | 11 | | | | | | | | | | | | 90 | % | | | 103 | | | | 1,319 | | | | | | | | | | | | | |

Seneca Commerce Center Phase III | | Miami | | | 11 | | | | | | | | | | | | 90 | % | | | 9 | | | | 1,228 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Total | | | 210 | | | | | | | | | | | | | | | $ | 5,666 | | | $ | 60,638 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Yield computed on a GAAP basis including rents on a straight-line basis. |

| (2) | Excludes land held totaling 119 acres with cumulative costs of approximately $16.3 million at March 31, 2014. |

| (3) | The completion date represents the date of building shell completion or estimated date of shell completion. |

| (4) | The property is currently leased through December 2014. |

| (5) | The property has been shell complete for more than 12 months and is classified as an operating property. |

| (6) | During January 2014, we completed the build-to-suit and sold 8th & Vineyard A. |

| | | | |

| First Quarter 2014 | |  | | Page 11 |

| Supplemental Reporting Package | | | |

Indebtedness

(dollar amounts in thousands)

As of March 31, 2014

| | | | | | | | | | | | | | |

Description | | Stated

Interest

Rate | | | Effective

Interest

Rate | | | Maturity Date | | Balance as of

March 31,

2014 | |

SENIOR UNSECURED NOTES: | | | | | | | | | | | | | | |

2015 Notes, fixed rate | | | 5.63 | % | | | 5.63 | % | | June 2015 | | | 40,000 | |

2016 Notes, fixed rate | | | 4.90 | % | | | 4.89 | % | | April & August 2016 | | | 99,000 | |

2017 Notes, fixed rate | | | 6.31 | % | | | 6.31 | % | | June 2017 | | | 51,000 | |

2018 Notes, fixed rate | | | 5.62 | % | | | 5.62 | % | | June & August 2018 | | | 81,500 | |

2018 Notes, variable rate(1) | | | 1.50 | % | | | 1.50 | % | | February 2018 | | | 225,000 | |

2019 Notes, fixed rate | | | 4.97 | % | | | 4.97 | % | | August 2019 | | | 46,000 | |

2020 Notes, fixed rate | | | 5.43 | % | | | 5.43 | % | | April 2020 | | | 50,000 | |

2021 Notes, fixed rate | | | 6.70 | % | | | 6.70 | % | | June & August 2021 | | | 92,500 | |

2022 Notes, fixed rate | | | 4.61 | % | | | 7.13 | % | | August & September 2022 | | | 130,000 | |

2023 Notes, fixed rate | | | 4.62 | % | | | 4.73 | % | | August & October 2023 | | | 310,000 | |

Premiums (discounts), net of amortization | | | | | | | | | | | | | (2,541 | ) |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | $ | 1,122,459 | |

| | | | | | | | | | | | | | |

MORTGAGE NOTES(4): | | | | | | | | | | | | | | |

Fixed rate secured debt | | | 5.81 | % | | | 5.21 | % | | January 2015 – Aug. 2025 | | | 280,440 | |

Premiums (discounts), net of amortization | | | | | | | | | | | | | 4,739 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | $ | 285,179 | |

| | | | | | | | | | | | | | |

UNSECURED CREDIT FACILITY: | | | | | | | | | | | | | | |

Senior unsecured revolving credit facility(2) | | | 1.33 | % | | | 1.33 | % | | February 2017 | | | 34,000 | |

| | | | | | | | | | | | | | |

Total carrying value of consolidated debt | | | | | | | | | | | | $ | 1,441,638 | |

| | | | | | | | | | | | | | |

Fixed rate debt | | | 5.31 | % | | | 5.47 | % | | | | | 82 | % |

Variable rate debt | | | 1.48 | % | | | 1.48 | % | | | | | 18 | % |

| | | | | | | | | | | | | | |

Weighted average interest rate | | | 4.62 | % | | | 4.76 | % | | | | | 100 | % |

| | | | | | | | | | | | | | |

DCT PROPORTIONATE SHARE OF UNCONSOLIDATED JOINT VENTURE DEBT(3) | | | | | | | | | | | | | | |

Institutional joint ventures | | | | | | | | | | | | | 826 | |

IDI | | | | | | | | | | | | | 11,110 | |

Stirling Capital Investments (SCLA) | | | | | | | | | | | | | 36,668 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | $ | 48,604 | |

| | | | | | | | | | | | | | |

Scheduled Principal Payments of Debt as of March 31, 2014 (excluding premiums and discounts)

| | | | | | | | | | | | | | | | |

Year | | Senior Unsecured Notes | | | Mortgage Notes(4) | | | Unsecured Credit Facility | | | Total | |

2014 | | $ | — | | | $ | 5,634 | | | $ | — | | | $ | 5,634 | |

2015 | | | 40,000 | | | | 49,981 | | | | — | | | | 89,981 | |

2016 | | | 99,000 | | | | 61,183 | | | | — | | | | 160,183 | |

2017 | | | 51,000 | | | | 11,768 | | | | 34,000 | | | | 96,768 | |

2018 | | | 306,500 | | | | 6,411 | | | | — | | | | 312,911 | |

2019 | | | 46,000 | | | | 51,018 | | | | — | | | | 97,018 | |

2020 | | | 50,000 | | | | 65,055 | | | | — | | | | 115,055 | |

2021 | | | 92,500 | | | | 18,475 | | | | — | | | | 110,975 | |

2022 | | | 130,000 | | | | 3,303 | | | | — | | | | 133,303 | |

2023 | | | 310,000 | | | | 6,363 | | | | — | | | | 316,363 | |

Thereafter | | | — | | | | 1,249 | | | | — | | | | 1,249 | |

| | | | | | | | | | | | | | | | |

Total | | $ | 1,125,000 | | | $ | 280,440 | | | $ | 34,000 | | | $ | 1,439,440 | |

| | | | | | | | | | | | | | | | |

| (1) | The $225.0 million term loan facility bears interest at a variable rate equal to LIBOR, plus a margin of between 1.10% to 2.05% per annum, or, at our election, an alternate base rate plus a margin of between 0.10% to 1.05% per annum, depending on our public debt credit rating. |

| (2) | The $300.0 million senior unsecured revolving credit facility matures in February 2017 and bears interest at a variable rate equal to LIBOR, plus a margin of between 1.00% to 1.75% per annum or, at our election, an alternate base rate plus a margin of between 0.00% to 0.75% per annum, depending on our public debt credit rating. There was $266.0 million available under the unsecured revolving credit facility as March 31, 2014. |

| (3) | Based on our ownership share as of March 31, 2014. |

| (4) | Mortgage notes includes approximately $5.1 million of principal debt and $0.3 million of debt premiums associated with properties held for sale as of March 31, 2014. |

| | | | |

| First Quarter 2014 | |  | | Page 12 |

| Supplemental Reporting Package | | | |

Capitalization and Fixed Charge Coverage

(unaudited, dollar amounts in thousands, except share price)

Capitalization at March 31, 2014

| | | | | | | | | | | | |

Description | | Shares or Units (1) | | | Share Price | | | Market Value | |

| | | (in thousands) | | | | | | | |

Common shares outstanding | | | 326,919 | | | $ | 7.88 | | | $ | 2,576,122 | |

Operating partnership units outstanding | | | 17,590 | | | $ | 7.88 | | | | 138,609 | |

| | | | | | | | | | | | |

Total equity market capitalization | | | | | | | | | | | 2,714,731 | |

| | | | | | | | | | | | |

Consolidated debt | | | | | | | | | | | 1,441,638 | |

Less: Noncontrolling interests’ share of consolidated debt(2) | | | | | | | | | | | (8,969 | ) |

Proportionate share of debt related to unconsolidated joint ventures | | | | | | | | | | | 48,604 | |

| | | | | | | | | | | | |

DCT share of total debt | | | | | | | | | | | 1,481,273 | |

| | | | | | | | | | | | |

Total market capitalization | | | | | | | | | | $ | 4,196,004 | |

| | | | | | | | | | | | |

DCT share of total debt to total market capitalization | | | | | | | | | | | 35.3 | % |

| | | | | | | | | | | | |

Fixed Charge Coverage

| | | | | | | | |

| | | Three Months Ended March 31, | |

| | | 2014 | | | 2013 | |

Net income attributable to common stockholders(3) | | $ | 317 | | | $ | 1,279 | |

Interest expense | | | 16,056 | | | | 16,860 | |

Proportionate share of interest expense from unconsolidated joint ventures | | | 317 | | | | 445 | |

Real estate related depreciation and amortization | | | 36,433 | | | | 32,690 | |

Proportionate share of real estate related depreciation and amortization from unconsolidated joint ventures | | | 1,466 | | | | 1,489 | |

Income tax expense and other taxes | | | 89 | | | | 109 | |

Stock-based compensation | | | 1,304 | | | | 1,072 | |

Noncontrolling interests | | | 151 | | | | 357 | |

Non-FFO gains on acquisitions and dispositions of real estate interests | | | (2,045 | ) | | | (2,877 | ) |

| | | | | | | | |

Adjusted EBITDA | | $ | 54,088 | | | $ | 51,424 | |

| | | | | | | | |

CALCULATION OF FIXED CHARGES | | | | | | | | |

Interest expense | | $ | 16,056 | | | $ | 16,860 | |

Capitalized interest | | | 1,948 | | | | 2,044 | |

Amortization of loan costs and debt premium/discount | | | (113 | ) | | | (46 | ) |

Other noncash interest expense | | | (1,024 | ) | | | (1,000 | ) |

Proportionate share of interest expense from unconsolidated joint ventures | | | 317 | | | | 445 | |

| | | | | | | | |

Total fixed charges | | $ | 17,184 | | | $ | 18,303 | |

| | | | | | | | |

Fixed charge coverage | | | 3.1 | | | | 2.8 | |

| | | | | | | | |

| (1) | Excludes 1.8 million unvested Long-Term Incentive Plan Units, 0.6 million shares of unvested Restricted Stock and 0.2 million Phantom Shares outstanding as of March 31, 2014. |

| (2) | Amount includes the portion of consolidated debt related to properties in which there are noncontrolling ownership interests. |

| (3) | Includes amounts related to discontinued operations, where applicable. |

| | | | |

| First Quarter 2014 | |  | | Page 13 |

| Supplemental Reporting Package | | | |

Investment in Unconsolidated Ventures Summary

(unaudited, dollar amounts in thousands)

Statements of Operations & Other Data

| | | | | | | | | | | | | | | | | | | | |

| | | For the three months ended March 31, 2014 | |

| | | TRT-

DCT JV III | | | JP Morgan | | | IDI/DCT | | | IDI/DCT

Buford | | | Stirling

Capital

Investments | |

Total rental revenues | | $ | 665 | | | $ | 5,475 | | | $ | 1,056 | | | $ | — | | | $ | 3,005 | |

Rental expenses and real estate taxes | | | 175 | | | | 1,570 | | | | 308 | | | | — | | | | 488 | |

| | | | | | | | | | | | | | | | | | | | |

Net operating income | | | 490 | | | | 3,905 | | | | 748 | | | | — | | | | 2,517 | |

Depreciation and amortization | | | 232 | | | | 2,456 | | | | 588 | | | | — | | | | 1,232 | |

General and administrative | | | 1 | | | | 184 | | | | 1 | | | | — | | | | 366 | |

| | | | | | | | | | | | | | | | | | | | |

Operating income | | | 257 | | | | 1,265 | | | | 159 | | | | — | | | | 919 | |

Interest expense | | | (160 | ) | | | — | | | | (221 | ) | | | — | | | | (851 | ) |

Interest and other expense | | | (4 | ) | | | (1 | ) | | | (4 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | 93 | | | $ | 1,264 | | | $ | (66 | ) | | $ | — | | | $ | 68 | |

| | | | | | | | | | | | | | | | | | | | |

Other Data: | | | | | | | | | | | | | | | | | | | | |

Number of buildings | | | 4 | | | | 13 | | | | 2 | | | | — | | | | 6 | |

Square feet (in thousands) | | | 735 | | | | 4,605 | | | | 1,060 | | | | — | | | | 2,160 | |

Occupancy | | | 100.0 | % | | | 99.6 | % | | | 84.3 | % | | | 0.0 | % | | | 99.6 | % |

DCT ownership | | | 10.0 | % | | | 20.0 | % | | | 50.0 | % | | | 75.0 | % | | | 50.0 | %(1) |

| |

Balance Sheets | | | |

| | | As of March 31, 2014 | |

| | | TRT-

DCT JV III | | | JP Morgan | | | IDI/DCT | | | IDI/DCT

Buford | | | Stirling

Capital

Investments | |

Total investment in properties | | $ | 25,983 | | | $ | 279,825 | | | $ | 40,099 | | | $ | 7,590 | | | $ | 111,535 | |

Accumulated depreciation and amortization | | | (6,226 | ) | | | (64,789 | ) | | | (4,522 | ) | | | — | | | | (18,245 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net investment in properties | | | 19,757 | | | | 215,036 | | | | 35,577 | | | | 7,590 | | | | 93,290 | |

Cash and cash equivalents | | | 228 | | | | 3,128 | | | | 262 | | | | 56 | | | | 534 | |

Other assets | | | 620 | | | | 5,749 | | | | 868 | | | | 4 | | | | 3,397 | |

| | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 20,605 | | | $ | 223,913 | | | $ | 36,707 | | | $ | 7,650 | | | $ | 97,221 | |

| | | | | | | | | | | | | | | | | | | | |

Other liabilities | | $ | 380 | | | $ | 5,401 | | | $ | 423 | | | $ | 9 | | | $ | 801 | |

Secure debt maturities – 2014 | | | — | | | | — | | | | — | | | | — | | | | — | |

Secure debt maturities – 2015 | | | — | | | | — | | | | 22,220 | (3) | | | — | | | | — | |

Secure debt maturities – 2016 | | | 8,265 | (2) | | | — | | | | — | | | | — | | | | — | |

Secure debt maturities – 2017 | | | — | | | | — | | | | — | | | | — | | | | 73,336 | (4) |

Secure debt maturities thereafter | | | — | | | | — | | | | — | | | | — | | | | 11,815 | (4) |

| | | | | | | | | | | | | | | | | | | | |

Total secured debt | | | 8,265 | | | | — | | | | 22,220 | | | | — | | | | 85,151 | |

| | | | | | | | | | | | | | | | | | | | |

Total liabilities | | | 8,645 | | | | 5,401 | | | | 22,643 | | | | 9 | | | | 85,952 | |

Partners or members’ capital | | | 11,960 | | | | 218,512 | | | | 14,064 | | | | 7,641 | | | | 11,269 | |

| | | | | | | | | | | | | | | | | | | | |

Total liabilities and partners or members’ capital | | $ | 20,605 | | | $ | 223,913 | | | $ | 36,707 | | | $ | 7,650 | | | $ | 97,221 | |

| | | | | | | | | | | | | | | | | | | | |

| (1) | Although we contributed 100% of the initial cash equity capital required by the venture, after return of certain preferential distributions on capital invested, profits and losses are generally split 50/50. |

| (2) | $8.3 million of debt requires principal and interest payments until 2016 and has a stated interest rate of 7.4%. |

| (3) | $22.2 million of debt requires interest only payments through October 2015 and has a weighted average variable interest rate of LIBOR plus 2.35%. |

| (4) | $73.4 million of debt requires interest only payments through October 2017 and has a variable interest rate of LIBOR plus 2.2%. $11.8 million of debt is payable to DCT and requires principal and interest payments through November 2021 and has a fixed rate of 8.5%. |

| | | | |

| First Quarter 2014 | |  | | Page 14 |

| Supplemental Reporting Package | | | |

Definitions

Adjusted EBITDA:

Adjusted EBITDA represents net loss attributable to common stockholders before interest, taxes, depreciation, amortization, stock-based compensation expense, impairment losses, loss on business combinations, noncontrolling interest, and proportionate share of interest, depreciation and amortization from unconsolidated joint ventures, and excludes non-FFO gains. We use Adjusted EBITDA to measure our operating performance and to provide investors relevant and useful information because it allows fixed income investors to view income from our operations on an unleveraged basis before the effects of non-cash items, such as depreciation and amortization.

Annualized Base Rent:

Annualized Base Rent is calculated as monthly contractual base rent (cash basis) per the terms of the lease, as of period end, multiplied by 12.

Capital Expenditures:

Capital expenditures include building and land improvements, development costs and acquisition capital, tenant improvement and leasing costs required to maintain current revenues and/or improve real estate assets.

Cash Basis Rent Growth:

Cash basis rent growth is the ratio of the change in base rent due in the first month after the lease commencement date compared to the base rent of the last month prior to the termination of the lease, excluding new leases where there were no prior comparable leases. Free rent periods are not considered.

Cash Net Operating Income:

We calculate Cash Net Operating Income as Net Operating Income (as defined below) excluding non-cash amounts recorded for straight-line rents including related bad debt expense and the amortization of above and below market rents. See definition of Net Operating Income for additional information. DCT Industrial considers Cash NOI to be an appropriate supplemental performance measure because Cash NOI reflects the operating performance of DCT Industrial’s properties and excludes certain non-cash items that are not considered to be controllable in connection with the management of the property such as accounting adjustments for straight-line rent and the amortization of above and below market rent. Additionally, DCT Industrial presents Cash NOI, excluding revenue from lease terminations, as such revenue is not considered indicative of recurring operating performance.

Due Diligence Capital:

Capital improvements related to acquisitions generally incurred within 12 months of the acquisition date.

Effective Interest Rate:

Reflects the impact to interest rates of GAAP adjustments for discounts/premiums and hedging transactions. These rates do not reflect the impact of other interest expense items such as fees and the amortization of loan costs.

Fixed Charges:

Fixed charges include interest expense, interest capitalized, our proportionate share of our unconsolidated joint venture interest expense and adjustments for amortization of discounts, premiums, loan costs and other noncash interest expense.

Fixed Charge Coverage:

We calculate Fixed Charge Coverage as Adjusted EBITDA divided by total Fixed Charges.

Funds from Operations (“FFO”):

DCT Industrial believes that net income attributable to common stockholders, as defined by GAAP, is the most appropriate earnings measure. However, DCT Industrial considers funds from operations (“FFO”), as defined by the National Association of Real Estate Investment Trusts (“NAREIT”), to be a useful supplemental, non-GAAP measure of DCT Industrial’s operating performance. NAREIT developed FFO as a relative measure of performance of an equity REIT in order to recognize that the value of income-producing real estate historically has not depreciated on the basis determined under GAAP. FFO is generally defined as net income attributable to common stockholders, calculated in accordance with GAAP, plus real estate-related depreciation and amortization, less gains from dispositions of operating real estate held for investment purposes, plus impairment losses on depreciable real estate and impairments of in substance real estate investments in investees that are driven by measureable decreases in the fair value of the depreciable real estate held by the unconsolidated joint ventures and adjustments to derive DCT Industrial’s pro rata share of FFO of unconsolidated joint ventures. We exclude gains and losses on business combinations and include the gains or losses from dispositions of properties which were acquired or developed with the intention to sell or contribute to an investment fund in our definition of FFO. Although the NAREIT definition of FFO predates the guidance for accounting for gains and losses on business combinations, we believe that excluding such gains and losses is consistent with the key objective of FFO as a performance measure. We also present FFO excluding severance, acquisition costs, debt modification costs and impairment losses on properties which are not depreciable. We believe that FFO excluding severance, acquisition costs, debt modification costs and impairment losses on non-depreciable real estate is useful supplemental information regarding our operating performance as it provides a more meaningful and consistent comparison of our operating performance and allows investors to more easily compare our operating results. Readers should note that FFO captures neither the changes in the value of DCT Industrial’s properties that result from use or market conditions, nor the level of capital expenditures and leasing commissions necessary to maintain the operating performance of DCT Industrial’s properties, all of which have real economic effect and could materially impact DCT Industrial’s results from operations. NAREIT’s definition of FFO is subject to interpretation, and modifications to the NAREIT definition of FFO are common. Accordingly, DCT Industrial’s FFO may not be comparable to other REITs’ FFO and FFO should be considered only as a supplement to net income as a measure of DCT Industrial’s performance.

GAAP:

United States generally accepted accounting principles.

GAAP Basis Rent Growth:

GAAP basis rent growth is a ratio of the change in monthly Net Effective Rent (on a GAAP basis, including straight-line rent adjustments as required by GAAP) compared to the Net Effective Rent (on a GAAP basis) of the comparable lease. New leases where there were no prior comparable leases due to materially different lease structures are excluded.

Net Effective Rent:

Average base rental rate over the term of the lease, calculated in accordance with GAAP.

| | | | |

| First Quarter 2014 | |  | | Page 15 |

| Supplemental Reporting Package | | | |

Definitions

Net Operating Income (“NOI”):

NOI is defined as rental revenues, including expense reimbursements, less rental expenses and real estate taxes, and excludes institutional capital management fees, depreciation, amortization, casualty and involuntary conversion gain (loss), impairment, general and administrative expenses, equity in (earnings) loss of unconsolidated joint ventures, interest expense, interest and other income and income tax expense and other taxes. DCT Industrial considers NOI to be an appropriate supplemental performance measure because NOI reflects the operating performance of DCT Industrial’s properties and excludes certain items that are not considered to be controllable in connection with the management of the property such as amortization, depreciation, impairment, interest expense, interest income and general and administrative expenses. We also present NOI excluding lease termination revenue as it is not considered to be indicative of recurring operating performance. However, NOI should not be viewed as an alternative measure of DCT Industrial’s financial performance since it excludes expenses which could materially impact our results of operations. Further, DCT Industrial’s NOI may not be comparable to that of other real estate companies, as they may use different methodologies for calculating NOI. Therefore, DCT Industrial believes net income, as defined by GAAP, to be the most appropriate measure to evaluate DCT Industrial’s overall financial performance (in thousands).

| | | | | | | | |

| | | Three Months Ended March 31, | |

| | | 2014 | | | 2013 | |

Reconciliation of income (loss) from continuing operations to NOI: | | | | | | | | |

Income (loss) from continuing operations | | $ | 459 | | | $ | (3,431 | ) |

Income tax expense and other taxes | | | 57 | | | | 109 | |

Interest and other income | | | (28 | ) | | | (162 | ) |

Interest expense | | | 16,056 | | | | 16,860 | |

Equity in earnings of unconsolidated joint ventures, net | | | (3,613 | ) | | | (391 | ) |

General and administrative | | | 6,834 | | | | 6,339 | |

Real estate related depreciation and amortization | | | 36,433 | | | | 30,196 | |

Impairment losses | | | 4,359 | | | | — | |

Development profit, net of taxes | | | (728 | ) | | | (268 | ) |

Gain on acquisitions and dispositions of real estate interests | | | (2,045 | ) | | | — | |

Casualty and involuntary conversion gain | | | — | | | | (59 | ) |

Institutional capital management and other fees | | | (764 | ) | | | (812 | ) |

| | | | | | | | |

Total GAAP net operating income | | | 57,020 | | | | 48,381 | |

Less net operating income – non-same store properties | | | (8,557 | ) | | | (311 | ) |

| | | | | | | | |

Same store GAAP net operating income | | | 48,463 | | | | 48,070 | |

Less revenue from lease terminations | | | (925 | ) | | | (115 | ) |

Add early termination straight-line rent adjustment | | | 263 | | | | 19 | |

| | | | | | | | |

Same store GAAP net operating income, excluding revenue from lease terminations | | | 47,801 | | | | 47,974 | |

Less straight-line rents, net of related bad debt expense | | | (878 | ) | | | (1,271 | ) |

Less amortization of above/(below) market rents | | | (350 | ) | | | (399 | ) |

| | | | | | | | |

Same store cash net operating income, excluding revenue from lease terminations | | $ | 46,573 | | | $ | 46,304 | |

| | | | | | | | |

Projected Stabilized Yield – Projects Under Development:

Calculated as projected stabilized Net Operating Income divided by total projected investment.

Redevelopment:

Represents assets acquired with the intention to reposition or redevelop. May include buildings taken out of service for redevelopment where we generally expect to spend more than 20% of the building’s book value on capital improvements, if applicable.

Retention:

Calculated as (retained square feet + relocated square feet) / ((retained square feet + relocated square feet + expired square feet) - (square feet of vacancies anticipated at acquisition + month-to-month square feet + bankruptcy square feet + early terminations)).

Sales Price:

Contractual price of real estate sold before closing adjustments.

Same Store Population:

The same store population is determined independently for each period presented, quarter-to-date and year-to-date, by including all consolidated operating properties and properties Held for Sale that have been owned and stabilized for the entire current and prior periods presented.

Same Store Net Operating Income Growth:

The change in same store net operating income growth is calculated by dividing the change in NOI, year over year, by the preceding period NOI, based on a same store population for the quarter most recently presented.

| | | | |

| First Quarter 2014 | |  | | Page 16 |

| Supplemental Reporting Package | | | |

| | |

Definitions Square Feet: Represents square feet in building that are available for lease. Stabilized: Buildings are generally considered stabilized when 90% occupied. Stock-based Compensation Amortization Expense: Represents the non-cash amortization of the cost of employee services received in exchange for an award of an equity instrument based on the award’s fair value on the grant date and amortized over the vesting period. Total Project Investment: An estimate of total expected capital expenditures on development properties in accordance with GAAP. | | Turnover Costs: Turnover costs are comprised of the costs incurred or capitalized for improvements of vacant and renewal spaces, as well as the commissions paid and costs capitalized for leasing transactions. The amount indicated for leasing statistics represents the total turnover costs expected to be incurred on the leases signed during the period and does not reflect actual expenditures for the period. |

| | | | |

| First Quarter 2014 | |  | | Page 17 |

| Supplemental Reporting Package | | | |