Exhibit 99.2

Proprietary and confidential. For internal use only. © 2009 Così, Inc. All rights reserved. * Fiscal 2014 Investor Teleconference Supplemental Information March 26, 2015

Proprietary and confidential. For internal use only. © 2009 Così, Inc. All rights reserved. * Safe Harbor Concerning Forward Looking Statements Proprietary and confidential. For internal use only. © 2009 Così, Inc. All rights reserved. SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995. Matters discussed in this presentation that relate to events or developments which are expected to occur in the future, including any discussion, expressed or implied, of anticipated growth, new store openings, operating results or earnings, constitute forward-looking statements under the federal securities laws and not statements of historical fact. The words "believe," "may," "will," "should," "anticipate," "estimate," "expect," "intend," "objective," "seek," "plan," "strive," or similar words, or negatives of these words, identify forward- looking statements. We qualify any forward-looking statements entirely by these cautionary factors. Forward-looking statements are based on management's beliefs, assumptions and expectations of our future economic performance, taking into account the information currently available to management. Forward-looking statements involve risks and uncertainties that may cause our actual results, performance or financial condition to differ materially from the expectations of future results, performance or financial condition we express or imply in any forward-looking statements. Factors that could contribute to these differences include, but are not limited to: the cost of our principal food products and supply and delivery shortages and interruptions; labor shortages or increased labor costs; changes in demographic trends and consumer tastes and preferences, including changes resulting from concerns over nutritional or safety aspects of beef, poultry, produce, or other foods or the effects of food-borne illnesses, such as E. coli, “mad cow disease” and avian influenza or “bird flu”; competition in our markets, both in our business and in locating suitable restaurant sites; our operation and execution in new and existing markets; expansion into new markets, including foreign markets; our ability to attract and retain qualified franchisees and our franchisees’ ability to open restaurants on a timely basis; our ability to locate suitable restaurant sites in new and existing markets and negotiate acceptable lease terms; the rate of our internal growth and our ability to generate increased revenue from our existing restaurants; our ability to generate positive cash flow from existing and new restaurants; fluctuations in our quarterly results due to seasonality; increased government regulation and our ability to secure required government approvals and permits; our ability to create customer awareness of our restaurants in new markets; the reliability of our customer and market studies; cost effective and timely planning, design and build out of restaurants; our ability to recruit, train and retain qualified corporate and restaurant personnel and management; market saturation due to new restaurant openings; inadequate protection of our intellectual property; our ability to obtain additional capital and financing; adverse weather conditions which impact customer traffic at our restaurants; and adverse economic conditions. Further information regarding factors that could affect our results and the statements made herein are included in our filings with the Securities and Exchange Commission. Additional information is available on the Cosi, Inc. website at www.getcosi.com.

Proprietary and confidential. For internal use only. © 2009 Così, Inc. All rights reserved. * Fiscal 2014 Teleconference Agenda Introductory Comments Financial Results Slide 4 – Restaurant Margin Performance Q4 Slide 5 – Reconciliation of Non-GAAP Measures To Net Income Q4 Slide 6 – Restaurant Margin Performance YTD Slide 7 – Reconciliation of Non-GAAP Measures To Net Income YTD CEO Comments

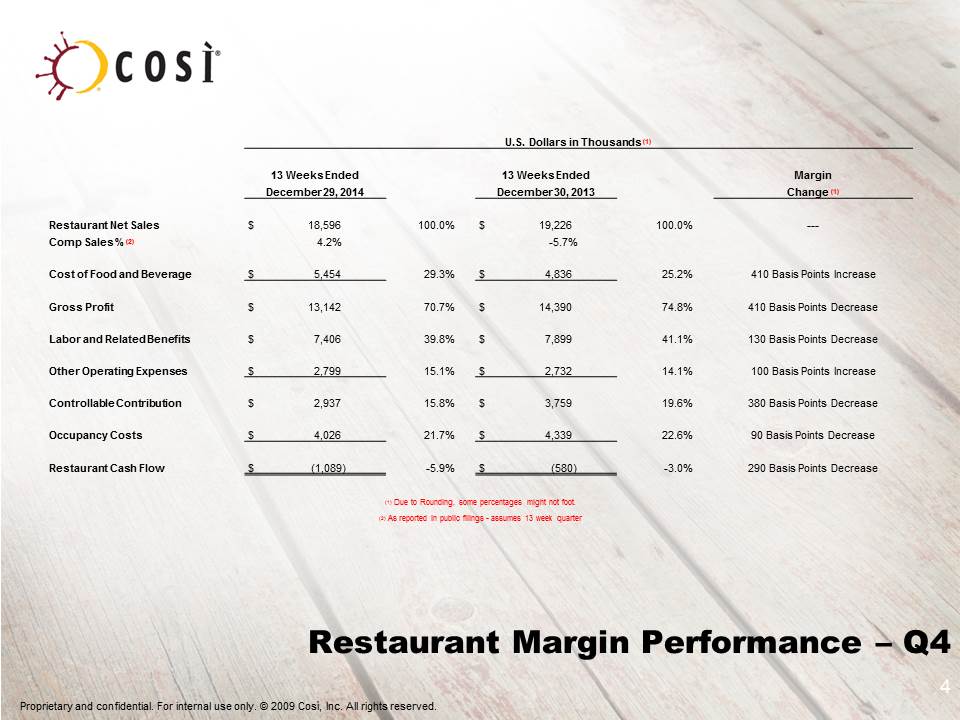

Proprietary and confidential. For internal use only. © 2009 Così, Inc. All rights reserved. * Restaurant Margin Performance – Q4 U.S. Dollars in Thousands (1) U.S. Dollars in Thousands (1) U.S. Dollars in Thousands (1) U.S. Dollars in Thousands (1) U.S. Dollars in Thousands (1) U.S. Dollars in Thousands (1) U.S. Dollars in Thousands (1) 13 Weeks Ended 13 Weeks Ended Margin December 29, 2014 December 30, 2013 Change (1) Restaurant Net Sales $ 18,596 100.0% $ 19,226 100.0% --- Comp Sales % (2) 4.2% -5.7% Cost of Food and Beverage $ 5,454 29.3% $ 4,836 25.2% 410 Basis Points Increase Gross Profit $ 13,142 70.7% $ 14,390 74.8% 410 Basis Points Decrease Labor and Related Benefits $ 7,406 39.8% $ 7,899 41.1% 130 Basis Points Decrease Other Operating Expenses $ 2,799 15.1% $ 2,732 14.1% 100 Basis Points Increase Controllable Contribution $ 2,937 15.8% $ 3,759 19.6% 380 Basis Points Decrease Occupancy Costs $ 4,026 21.7% $ 4,339 22.6% 90 Basis Points Decrease Restaurant Cash Flow $ (1,089) -5.9% $ (580) -3.0% 290 Basis Points Decrease (1) Due to Rounding, some percentages might not foot. (1) Due to Rounding, some percentages might not foot. (1) Due to Rounding, some percentages might not foot. (1) Due to Rounding, some percentages might not foot. (1) Due to Rounding, some percentages might not foot. (1) Due to Rounding, some percentages might not foot. (1) Due to Rounding, some percentages might not foot. (1) Due to Rounding, some percentages might not foot. (2) As reported in public filings - assumes 13 week quarter (2) As reported in public filings - assumes 13 week quarter (2) As reported in public filings - assumes 13 week quarter (2) As reported in public filings - assumes 13 week quarter (2) As reported in public filings - assumes 13 week quarter (2) As reported in public filings - assumes 13 week quarter (2) As reported in public filings - assumes 13 week quarter (2) As reported in public filings - assumes 13 week quarter

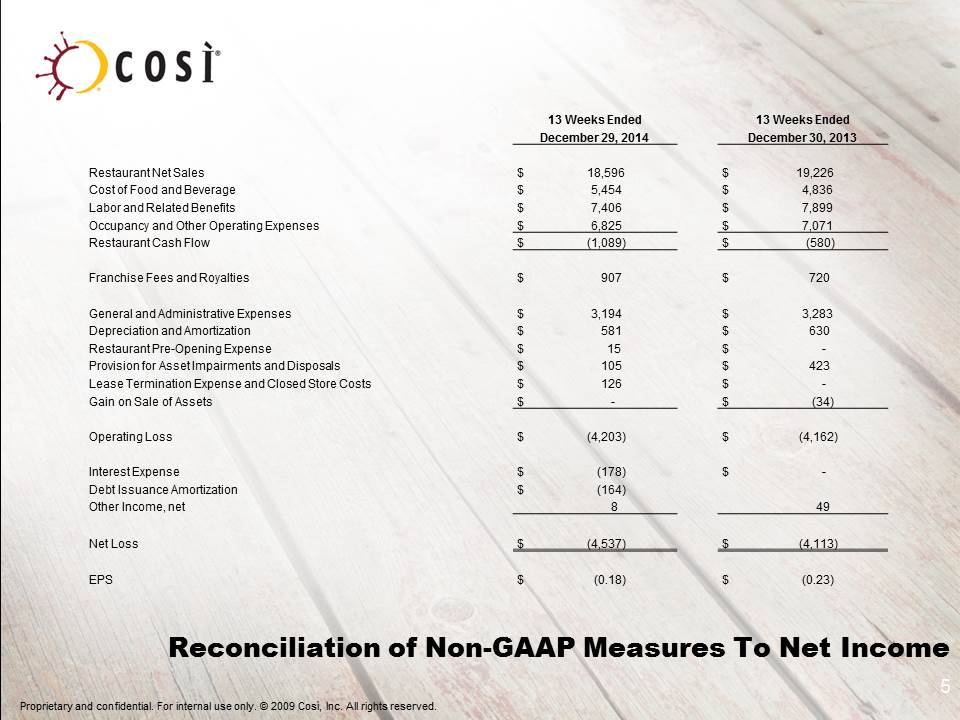

Proprietary and confidential. For internal use only. © 2009 Così, Inc. All rights reserved. * Reconciliation of Non-GAAP Measures To Net Income 13 Weeks Ended 13 Weeks Ended December 29, 2014 December 30, 2013 Restaurant Net Sales $ 18,596 $ 19,226 Cost of Food and Beverage $ 5,454 $ 4,836 Labor and Related Benefits $ 7,406 $ 7,899 Occupancy and Other Operating Expenses $ 6,825 $ 7,071 Restaurant Cash Flow $ (1,089) $ (580) Franchise Fees and Royalties $ 907 $ 720 General and Administrative Expenses $ 3,194 $ 3,283 Depreciation and Amortization $ 581 $ 630 Restaurant Pre-Opening Expense $ 15 $ - Provision for Asset Impairments and Disposals $ 105 $ 423 Lease Termination Expense and Closed Store Costs $ 126 $ - Gain on Sale of Assets $ - $ (34) Operating Loss $ (4,203) $ (4,162) Interest Expense $ (178) $ - Debt Issuance Amortization $ (164) Other Income, net 8 49 Net Loss $ (4,537) $ (4,113) EPS $ (0.18) $ (0.23)

Proprietary and confidential. For internal use only. © 2009 Così, Inc. All rights reserved. * U.S. Dollars in Thousands (1) U.S. Dollars in Thousands (1) U.S. Dollars in Thousands (1) U.S. Dollars in Thousands (1) U.S. Dollars in Thousands (1) U.S. Dollars in Thousands (1) U.S. Dollars in Thousands (1) 52 Weeks Ended 52 Weeks Ended Margin December 29, 2014 December 30, 2013 Change (1) Restaurant Net Sales $ 74,905 100.0% $ 83,338 100.0% --- Comp Sales % (2) -4.7% -5.1% Cost of Food and Beverage 20,078 26.8% 20,736 24.9% 190 Basis Points Increase Gross Profit 54,827 73.2% 62,602 75.1% 190 Basis Points Decrease Labor and Related Benefits 29,046 38.8% 32,379 38.9% 10 Basis Points Decrease Other Operating Expenses 10,859 14.5% 11,357 13.7% 80 Basis Points Increase Controllable Contribution 14,922 19.9% 18,866 22.6% 260 Basis Points Decrease Occupancy Costs 16,861 22.5% 17,614 21.1% 140 Basis Points Increase Restaurant Cash Flow $ (1,939) -2.6% $ 1,252 1.5% 400 Basis Points Decrease (1) Due to Rounding, some percentages might not foot. (1) Due to Rounding, some percentages might not foot. (1) Due to Rounding, some percentages might not foot. (1) Due to Rounding, some percentages might not foot. (1) Due to Rounding, some percentages might not foot. (1) Due to Rounding, some percentages might not foot. (1) Due to Rounding, some percentages might not foot. (1) Due to Rounding, some percentages might not foot. (2) As reported in public filings - assumes 52 week year. (2) As reported in public filings - assumes 52 week year. (2) As reported in public filings - assumes 52 week year. (2) As reported in public filings - assumes 52 week year. (2) As reported in public filings - assumes 52 week year. (2) As reported in public filings - assumes 52 week year. (2) As reported in public filings - assumes 52 week year. (2) As reported in public filings - assumes 52 week year. Restaurant Margin Performance - YTD

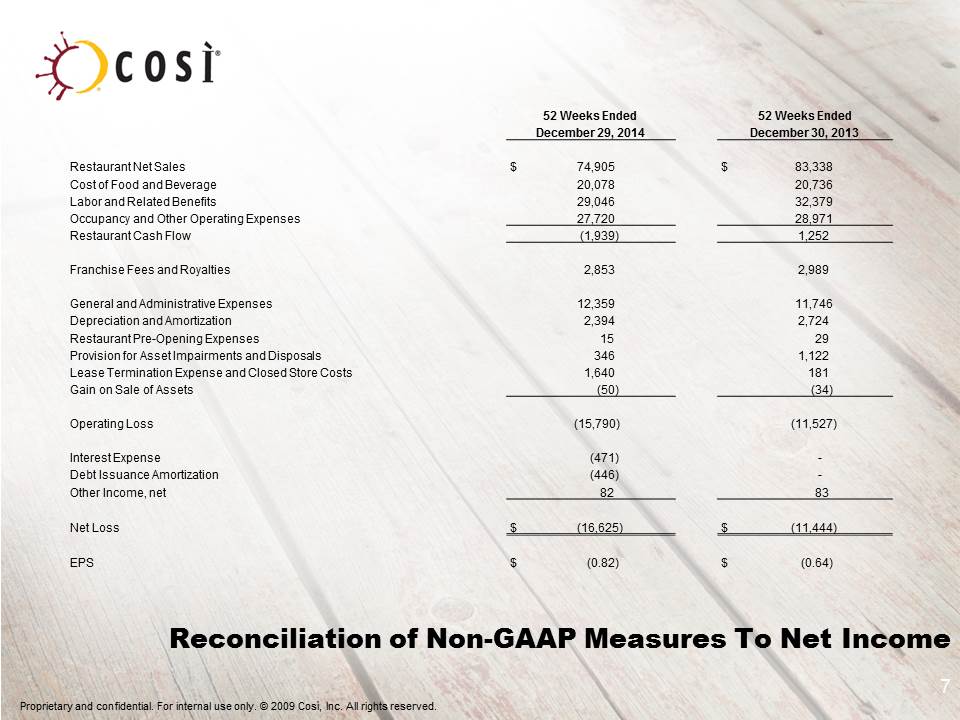

Proprietary and confidential. For internal use only. © 2009 Così, Inc. All rights reserved. * Reconciliation of Non-GAAP Measures To Net Income 52 Weeks Ended 52 Weeks Ended December 29, 2014 December 30, 2013 Restaurant Net Sales $ 74,905 $ 83,338 Cost of Food and Beverage 20,078 20,736 Labor and Related Benefits 29,046 32,379 Occupancy and Other Operating Expenses 27,720 28,971 Restaurant Cash Flow (1,939) 1,252 Franchise Fees and Royalties 2,853 2,989 General and Administrative Expenses 12,359 11,746 Depreciation and Amortization 2,394 2,724 Restaurant Pre-Opening Expenses 15 29 Provision for Asset Impairments and Disposals 346 1,122 Lease Termination Expense and Closed Store Costs 1,640 181 Gain on Sale of Assets (50) (34) Operating Loss (15,790) (11,527) Interest Expense (471) - Debt Issuance Amortization (446) - Other Income, net 82 83 Net Loss $ (16,625) $ (11,444) EPS $ (0.82) $ (0.64)

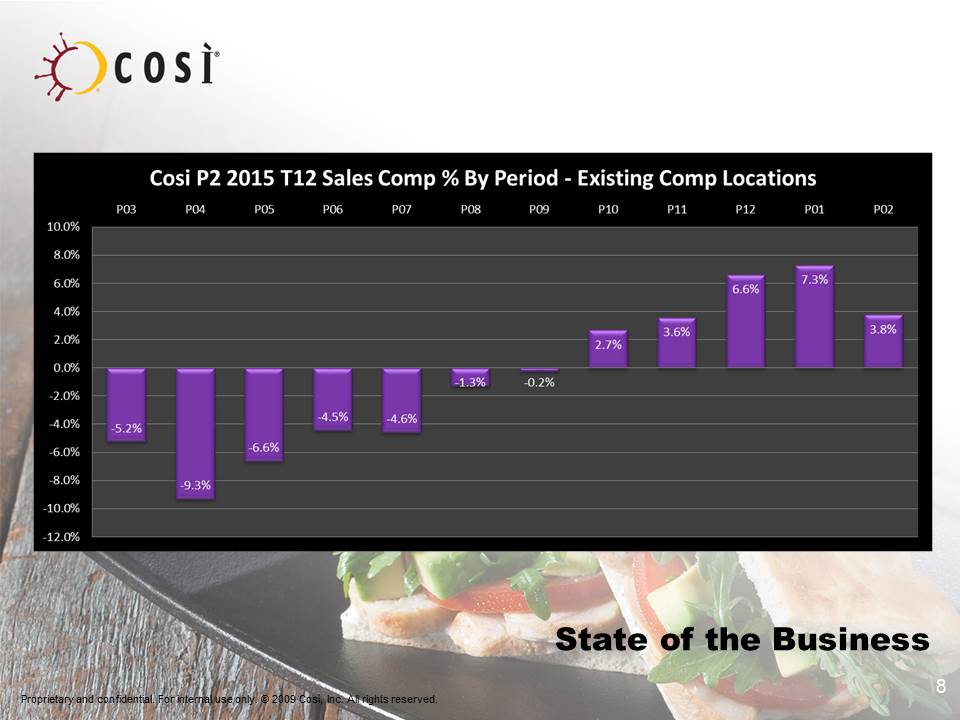

Proprietary and confidential. For internal use only. © 2009 Così, Inc. All rights reserved. * State of the Business Proprietary and confidential. For internal use only. © 2009 Così, Inc. All rights reserved. 8

Proprietary and confidential. For internal use only. © 2009 Così, Inc. All rights reserved. * 2014 Heavily Focused on Building the Foundation Be aggressive addressing key issues Leverage what works Build a strong corporate culture Absolute clarity as to our priorities We listened to our guest Test for tomorrow Be ready

Proprietary and confidential. For internal use only. © 2009 Così, Inc. All rights reserved. * Brand Clarity has been Established Focus Groups and Consumer intercepts Put into test what we took away We are happy with the results we are seeing

Proprietary and confidential. For internal use only. © 2009 Così, Inc. All rights reserved. * Menu Refresh are underway Foundation for technology Brand consistency Hearthstone component is leveraged Profit initiatives to help deliver our 2015 plan 2015 Moving Forward

Proprietary and confidential. For internal use only. © 2009 Così, Inc. All rights reserved. * Proprietary and confidential. For internal use only. © 2009 Così, Inc. All rights reserved. Merger is in process Franchisees 12

Proprietary and confidential. For internal use only. © 2009 Così, Inc. All rights reserved. * Proprietary and confidential. For internal use only. © 2009 Così, Inc. All rights reserved. Guidance We believe we are on course to go cash flow positive (excluding capital expenditures) by year end. Later this year we will start talking about our future. 13

Proprietary and confidential. For internal use only. © 2009 Così, Inc. All rights reserved. * Proprietary and confidential. For internal use only. © 2009 Così, Inc. All rights reserved. Board of Directors Leadership and Operations Team Investors Friends in the industry Support 14

Proprietary and confidential. For internal use only. © 2009 Così, Inc. All rights reserved. * Proprietary and confidential. For internal use only. © 2009 Così, Inc. All rights reserved. CFO Search is coming to a close 15

Proprietary and confidential. For internal use only. © 2009 Così, Inc. All rights reserved. * Proprietary and confidential. For internal use only. © 2009 Così, Inc. All rights reserved. Question & Answer 16