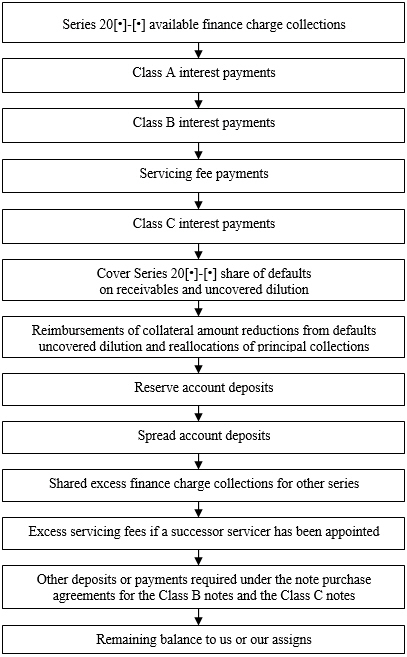

(8) an amount equal to the sum of (a) any additional unpaid amounts due and owing under the fee letter, the series indenture supplement or the Class A note purchase agreement and (b) any amounts due and owing to the Class B noteholders under the series indenture supplement or the Class B note purchase, for distribution, first, to the funding agent for distribution in accordance with the fee letter, the series indenture supplement or the Class A note purchase agreement, as applicable, and second, to the Class B noteholder; and

(9) the remaining available finance charge collections, if any, are allocated, as follows:

first, as excess finance charge collections, on a pro rata basis, to other series of notes to fund finance charge shortfalls;

second, to pay any unpaid excess servicing fees due and owing to any successor servicer;

third, to the series funding account to the extent of any funding account deficiency; and

fourth, the remaining amount, if any, is distributed to the holder of the Transferor Interest.

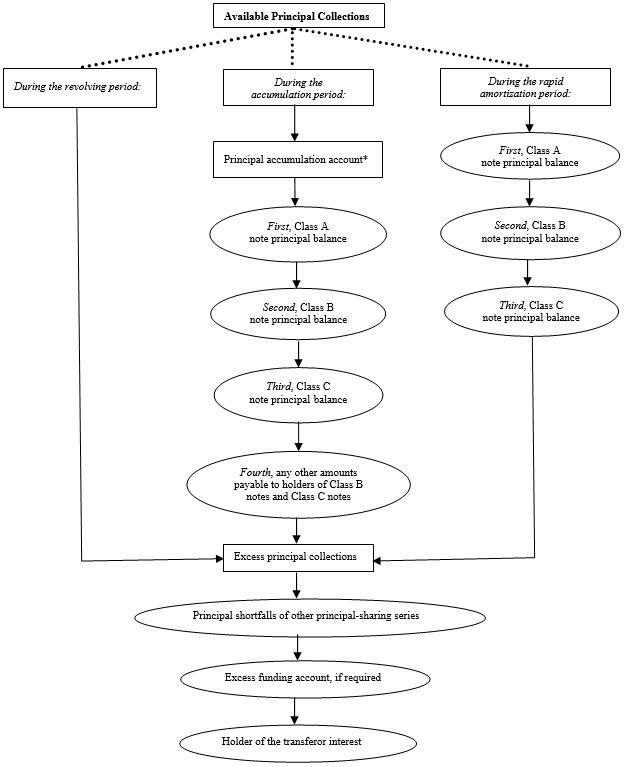

Under the series indenture supplement for each existing series of variable funding notes and on each transfer date, the indenture trustee allocates the available principal collections as follows:

(1) During the revolving period, (a) an amount equal to any funding amount deficiency is deposited to the series funding account and (b) any remaining available principal collections are first, allocated as excess principal collections, on a pro rata basis, to other series of notes in order to fund principal shortfalls and, second, the remaining amount, if any, is distributed to the holder of the Transferor Interest.

(2) During the controlled amortization period, (a) an amount equal to the Class A controlled amortization principal payment for such distribution date is deposited to the distribution account for distribution to the Class��A noteholders, (b) an amount equal to the Class B controlled amortization principal payment for such distribution date is deposited to the distribution account for distribution to the Class B noteholders, (c) any amounts due and owing under the series indenture supplement or the note purchase agreements to the Class A noteholders and the Class B noteholders is distributed, first, to the Class A noteholders and second, to the Class B noteholders, (d) any remaining available principal collections are, first, allocated as excess principal collections, on a pro rata basis, to other series of notes in order to fund principal shortfalls and second, the remaining amount, if any, is distributed to the holder of the Transferor Interest.

(3) During the rapid amortization period, (a) an amount equal to the outstanding principal balance of the Class A notes is deposited to the distribution account for distribution to the Class A noteholders until the Class A notes are paid in full, (b) an amount equal to the outstanding principal balance of the Class B notes is deposited to the distribution account for distribution to the Class B noteholders until the Class B notes are paid in full, (c) any amounts due and owing under the series indenture supplement or the note purchase agreements to the Class A noteholders and the Class B noteholders is distributed, first, to the Class A noteholders and second, to the Class B noteholders and (d) the remaining available principal collections, if any, are first, allocated as excess principal collections, on a pro rata basis, to other series of notes to fund principal shortfalls and second, the remaining amount, if any, is distributed to the holder of the Transferor Interest.

The issuance of a new series of variable funding notes by the issuing entity is subject to the terms and conditions described in “Description of the Notes—New Issuances of Notes” in this prospectus.

A-II-3