QuickLinks -- Click here to rapidly navigate through this documentAs filed with the Securities and Exchange Commission on November 19, 2004

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PANAMSAT CORPORATION

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of

incorporation or organization) | | 4899

(Primary Standard Industrial

Classification Code Number) | | 95-4607698

(I.R.S. Employer Identification No.) |

(see following pages for additional registrants) |

|

20 Westport Road

Wilton, Connecticut 06897

(203) 210-8000

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices) |

|

James W. Cuminale, Esq.

Executive Vice President—Corporate Development,

General Counsel and Secretary

PanAmSat Corporation

20 Westport Road

Wilton, Connecticut 06897

(203) 210-8000

(Name, address, including zip code, and telephone number, including area code, of agent for service) |

| Copies of all communications, including communications sent to agent for service, should be sent to: |

Joseph H. Kaufman, Esq.

Simpson Thacher & Bartlett LLP

425 Lexington Avenue

New York, New York 10017

(212) 455-2000 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the Registration Statement becomes effective.

If the only securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

| | Amount to be

Registered

| | Proposed Maximum

Offering Price Per

Unit

| | Proposed Maximum

Aggregate Offering

Price(1)

| | Amount of

Registration Fee

|

|---|

|

| 9% Senior Exchange Notes due 2014 | | $1,010,000,000 | | 100% | | $1,010,000,000 | | $127,967 |

|

| Guarantees of 9% Senior Exchange Notes due 2014(2) | | N/A(3) | | (3) | | (3) | | (3) |

|

- (1)

- Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(f) under the Securities Act of 1933, as amended (the "Securities Act").

- (2)

- See inside facing page for additional registrant guarantors.

- (3)

- Pursuant to Rule 457(n) under the Securities Act, no separate filing fee is required for the guarantees.

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the SEC, acting pursuant to said Section 8(a), may determine.

TABLE OF ADDITIONAL REGISTRANT GUARANTORS

Exact Name of Registrant as Specified in its Charter

| | State or Other Jurisdiction of

Incorporation or Organization

| | I.R.S Employer

Identification

Number

| | Industrial

Classification

Code Number

|

|---|

| PanAmSat Communications Carrier Services, Inc. | | California | | 95-3684190 | | 4899 |

PanAmSat Communications Japan, Inc. |

|

California |

|

95-3976181 |

|

4899 |

PanAmSat Communications Services, Inc. |

|

California |

|

95-3270893 |

|

4899 |

Southern Satellite Corp. |

|

Connecticut |

|

06-1396534 |

|

4899 |

AccessPas, Inc. |

|

Delaware |

|

06-1586835 |

|

4899 |

PanAmSat International Holdings, LLC |

|

Delaware |

|

95-4130814 |

|

4899 |

G2 Satellite Solutions Corporation |

|

Delaware |

|

01-0667473 |

|

4899 |

Service and Equipment Corporation |

|

Delaware |

|

06-1614545 |

|

4899 |

Southern Satellite Licensee Corporation |

|

Delaware |

|

06-1532182 |

|

4899 |

PanAmSat India Marketing, L.L.C. |

|

Delaware |

|

None |

|

4899 |

PanAmSat Asia Carrier Services, Inc. |

|

Delaware |

|

06-1532021 |

|

4899 |

PanAmSat Capital Corporation |

|

Delaware |

|

06-1371155 |

|

4899 |

PanAmSat Carrier Services, Inc. |

|

Delaware |

|

06-1377869 |

|

4899 |

PanAmSat India, Inc. |

|

Delaware |

|

06-1532023 |

|

4899 |

PAS International Employment, Inc. |

|

Delaware |

|

06-1475361 |

|

4899 |

PanAmSat International Sales, Inc. |

|

Delaware |

|

06-1532018 |

|

4899 |

PAS International, LLC |

|

Delaware |

|

None |

|

4899 |

PanAmSat Licensee Corp. |

|

Delaware |

|

06-1369810 |

|

4899 |

USHI, LLC |

|

Delaware |

|

95-4130816 |

|

4899 |

PanAmSat International Systems, LLC |

|

Delaware |

|

06-1407851 |

|

4899 |

PanAmSat International Systems Marketing, L.L.C. |

|

Delaware |

|

None |

|

4899 |

PanAmSat Satellite PAS 1R, Inc. |

|

Delaware |

|

20-1472039 |

|

4899 |

PanAmSat Satellite PAS 6B, Inc. |

|

Delaware |

|

55-0878680 |

|

4899 |

PanAmSat Satellite PAS 7, Inc. |

|

Delaware |

|

20-1472426 |

|

4899 |

PanAmSat Satellite PAS 8, Inc. |

|

Delaware |

|

20-1472451 |

|

4899 |

PanAmSat Satellite PAS 9, Inc. |

|

Delaware |

|

20-1472476 |

|

4899 |

PanAmSat Satellite PAS 10, Inc. |

|

Delaware |

|

20-1472491 |

|

4899 |

PanAmSat Satellite Galaxy 3C, Inc. |

|

Delaware |

|

20-1471588 |

|

4899 |

PanAmSat Satellite Galaxy 4R, Inc. |

|

Delaware |

|

20-1471713 |

|

4899 |

PanAmSat Satellite Galaxy 10R, Inc. |

|

Delaware |

|

20-1471804 |

|

4899 |

PanAmSat Satellite Galaxy 11, Inc. |

|

Delaware |

|

20-1471834 |

|

4899 |

PanAmSat Satellite Galaxy 12, Inc. |

|

Delaware |

|

20-1471854 |

|

4899 |

| | | | | | | |

1

PanAmSat Satellite Galaxy 13, Inc. |

|

Delaware |

|

20-1471917 |

|

4899 |

PanAmSat Satellite HGS 3, Inc. |

|

Delaware |

|

20-1471366 |

|

4899 |

PanAmSat Satellite HGS 5, Inc. |

|

Delaware |

|

20-1471468 |

|

4899 |

PanAmSat Satellite Galaxy 1R, Inc. |

|

Delaware |

|

20-1471522 |

|

4899 |

PanAmSat Satellite Galaxy 3R, Inc. |

|

Delaware |

|

20-1471588 |

|

4899 |

PanAmSat Satellite Galaxy 5, Inc. |

|

Delaware |

|

20-1471747 |

|

4899 |

PanAmSat Satellite Galaxy 9, Inc. |

|

Delaware |

|

20-1471773 |

|

4899 |

PanAmSat Satellite Galaxy 14, Inc. |

|

Delaware |

|

20-1471944 |

|

4899 |

PanAmSat Satellite Leasat F5, Inc. |

|

Delaware |

|

20-1472011 |

|

4899 |

PanAmSat Satellite PAS 2, Inc. |

|

Delaware |

|

20-1472059 |

|

4899 |

PanAmSat Satellite PAS 3, Inc. |

|

Delaware |

|

20-1472087 |

|

4899 |

PanAmSat Satellite PAS 4, Inc. |

|

Delaware |

|

20-1472113 |

|

4899 |

PanAmSat Satellite PAS 5, Inc. |

|

Delaware |

|

20-1472383 |

|

4899 |

PanAmSat Satellite SBS 6, Inc. |

|

Delaware |

|

20-1472512 |

|

4899 |

2

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated November 19, 2004

Filed Pursuant to Rule 424(b)(3)

Registration Nos. 333-117081 to 333-117081-27

$1,010,000,000

PANAMSAT CORPORATION

Offer to Exchange all outstanding 9% Senior Notes due 2014 for an equal amount of 9% Senior Exchange Notes due 2014, which have been registered under the Securities Act of 1933.

The Exchange Offer

- •

- We will exchange all outstanding notes that are validly tendered and not validly withdrawn for an equal principal amount of exchange notes that are freely tradeable.

- •

- You may withdraw tenders of outstanding notes at any time prior to the expiration of the exchange offer.

- •

- The exchange offer expires at 5:00 p.m., New York City time, on , 2004, unless extended. We do not currently intend to extend the expiration date.

- •

- The exchange of outstanding notes for exchange in the exchange offer will not be a taxable event for U.S. federal income tax purposes.

- •

- We will not receive any proceeds from the exchange offer.

The Exchange Notes

- •

- The exchange notes are being offered in order to satisfy certain of our obligations under the exchange and registration rights agreement entered into in connection with the placement of the outstanding notes.

- •

- The terms of the exchange notes to be issued in the exchange offer are substantially identical to the outstanding notes, except that the exchange notes will be freely tradeable.

Results of Exchange Notes

- •

- The exchange notes may be sold in the over-the-counter market, in negotiated transactions or through a combination of such methods. We do not plan to list the exchange notes on a national market.

If you are a broker-dealer and you receive exchange notes for your own account, you must acknowledge that you will deliver a prospectus in connection with any resale of such exchange notes. By making such acknowledgment, you will not be deemed to admit that you are an "underwriter" under the Securities Act of 1933. Broker-dealers may use this prospectus in connection with any resale of exchange notes received in exchange for outstanding notes where such outstanding notes were acquired by the broker-dealer as a result of market-making activities or trading activities. We have agreed that, for a period of 180 days after the consummation of the exchange offer or until any broker-dealer has sold all registered notes held by it, we will make this prospectus available to such broker-dealer for use in connection with any such resale. A broker-dealer may not participate in the exchange offer with respect to outstanding notes acquired other than as a result of market-making activities or trading activities. See "Plan of Distribution."

If you are an affiliate of PanAmSat Corporation or are engaged in, or intend to engage in, or have an agreement or understanding to participate in, a distribution of the exchange notes, you cannot rely on the applicable interpretations of the Securities and Exchange Commission and you must comply with the registration requirements of the Securities Act of 1933 in connection with any resale transaction.

You should consider carefully the risk factors beginning on page 20 of this prospectus before participating in the exchange offer.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2004

TABLE OF CONTENTS

| | Page

|

|---|

| Special Note Regarding Forward-Looking Statements | | ii |

| Industry and Market Data | | iii |

| Available Information | | iii |

| Summary | | 1 |

| Risk Factors | | 20 |

| Use of Proceeds | | 34 |

| Capitalization | | 35 |

| Unaudited Pro Forma Condensed Consolidated Financial Information | | 36 |

| Selected Historical Consolidated Financial, Operating and Other Data | | 41 |

| Management's Discussion and Analysis of Financial Condition and Results of Operations | | 44 |

| Business | | 101 |

| Management | | 122 |

| Principal Stockholders | | 131 |

| The Transactions | | 133 |

| Certain Relationships and Related Party Transactions | | 135 |

| Description of Certain Indebtedness | | 138 |

| The Exchange Offer | | 141 |

| Description of The Notes | | 151 |

| United States Federal Income Tax Consequences of the Exchange Offer | | 210 |

| Plan of Distribution | | 211 |

| Legal Matters | | 212 |

| Experts | | 212 |

| Index to Consolidated Financial Statements | | F-1 |

This prospectus does not constitute an offer to sell, or a solicitation of an offer to buy, any exchange notes offered hereby in any jurisdiction where, or to any person to whom, it is unlawful to make such offer or solicitation. The information contained in this prospectus speaks only as of the date of this prospectus unless the information specifically indicates that another date applies. No dealer, salesperson or other person has been authorized to give any information or to make any representations other than those contained in this prospectus in connection with the offer contained herein and, if given or made, such information or representations must not be relied upon as having been authorized by PanAmSat Corporation. Neither the delivery of this prospectus nor any sales made hereunder shall under any circumstances create an implication that there has been no change in our affairs or that of our subsidiaries since the date hereof.

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains certain forward-looking statements, including, without limitation, statements concerning the conditions in our industry, our operations, our economic performance and financial condition, including, in particular, statements relating to our business and growth strategy and service development efforts. The words "may", "might", "will", "should", "estimate", "project", "plan", "anticipate", "expect", "intend", "outlook", "believe" and other similar expressions are intended to identify forward-looking statements and information. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates. These forward-looking statements are based on estimates and assumptions by our management that, although we believe to be reasonable, are inherently uncertain and subject to a number of risks and uncertainties. These risks and uncertainties include, without limitation, those identified under "Risk Factors" and elsewhere in this prospectus.

The following list represents some, but not necessarily all, of the factors that could cause actual results to differ from historical results or those anticipated or predicted by these forward-looking statements:

- •

- risks associated with operating our in-orbit satellites;

- •

- satellite launch failures, satellite launch and construction delays and in-orbit failures or reduced performance;

- •

- our ability to obtain new or renewal satellite insurance policies on commercially reasonable terms or at all;

- •

- possible future losses on satellites that are not adequately covered by insurance;

- •

- domestic and international government regulation;

- •

- changes in our contracted backlog or expected contracted backlog for future services;

- •

- pricing pressure and overcapacity in the markets in which we compete;

- •

- inadequate access to capital markets;

- •

- competition;

- •

- customer defaults on their obligations owed to us;

- •

- our international operations and other uncertainties associated with doing business internationally;

- •

- our high level of indebtedness;

- •

- control by our controlling stockholders; and

- •

- litigation.

We caution you that the foregoing list of important factors is not exclusive. In addition, in light of these risks and uncertainties, the matters referred to in the forward-looking statements contained in this prospectus may not in fact occur. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

ii

INDUSTRY AND MARKET DATA

We obtained the industry, market and competitive position data used throughout this prospectus from our own internal estimates and research as well as from industry and general publications and research, surveys and studies conducted by third parties.

AVAILABLE INFORMATION

PanAmSat Corporation and the guarantors have filed with the SEC a registration statement on Form S-4 under the Securities Act with respect to the exchange notes being offered hereby. This prospectus, which forms a part of the registration statement, does not contain all of the information set forth in the registration statement. For further information with respect to us and the exchange notes, reference is made to the registration statement. Statements contained in this prospectus as to the contents of any contract or other document are not necessarily complete, and, where such contract or other document is an exhibit to the registration statement, each such statement is qualified by the provisions in such exhibit, to which reference is hereby made.

Following the offering of the exchange notes, PanAmSat Corporation and the guarantors will be subject to the informational requirements of the Exchange Act, and, in accordance therewith, will file reports and other information with the SEC. We file annual, quarterly and current reports, and other information with the SEC. You may read and copy any document we file at the SEC's public reference rooms in Washington, D.C., New York, New York and Chicago, Illinois. Please call the SEC at 1-888-SEC-0330 for further information on the public reference rooms. Our SEC filings are also available to the public from the SEC's website at www.sec.gov or from our website at www.panamsat.com. However, neither the information we file with the SEC nor the information on PanAmSat Corporation's website constitutes a part of this prospectus.

iii

SUMMARY

This summary highlights information appearing elsewhere in this prospectus. This summary does not contain all of the information that you should consider before tendering outstanding notes in the exchange offer. You should read the entire prospectus carefully. This prospectus contains forward-looking statements, which involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including those set forth in "Risk Factors" and elsewhere in this prospectus. Unless otherwise indicated, financial information identified in this prospectus as pro forma gives effect to the consummation of the Transactions in the manner described under "Unaudited Pro Forma Condensed Consolidated Financial Information" In this prospectus, all references to (1) "PanAmSat", "the Company" "we", "us" and "our" refer to PanAmSat Corporation and its subsidiaries, unless the context otherwise requires or it is otherwise indicated, (2) "The DIRECTV Group" refer to The DIRECTV Group, Inc., a company formerly known as Hughes Electronics Corporation, and (3) "News Corporation" refer to The News Corporation Limited.

PanAmSat Corporation

Overview

Through our owned and operated fleet of 24 satellites, we are a leading global provider of video, broadcasting and network distribution and delivery services. We lease transponder capacity on our satellites for the distribution and delivery of entertainment and information to cable television systems, television broadcast affiliates, direct-to-home, or DTH, television services, Internet service providers, or ISPs, telecommunications companies, governments and other corporations. Our customers include some of the world's leading media and communications companies, such as Time Warner, Inc. (which includes Home Box Office, Turner Broadcasting System and CNN), the BBC, News Corporation (which includes the Fox family of channels and The DIRECTV Group), Sony, Viacom (which includes MTV and Nickelodeon), China Central Television, Comcast and The Walt Disney Company (which includes ABC and ESPN). Through our satellite-based video distribution business, we believe we distribute more television channels over our network than any other company in the world.

We operate in the fixed satellite services, or FSS, segment, the most mature segment of the satellite communications business, historically characterized by steady and predictable revenue streams, strong cash flows from operations and substantial contracted backlog. In 2003, the FSS industry generated revenues of approximately $6.6 billion according to Euroconsult. As of September 30, 2004, we had approximately $5.13 billion in contracted backlog.

Our in-orbit fleet, which includes four in-orbit backups, is one of the world's largest commercial geostationary earth orbit, or GEO, satellite networks, capable of reaching over 98% of the world's population. We are one of only a few companies worldwide capable of servicing a global footprint through a fleet of owned satellites. We have one of the most sophisticated ground infrastructure networks available to support the needs of our customers. We have seven technical facilities in the United States, which provide transmission, monitoring and control services for operating our fleet and transmission and other services for our customers. We lease such services outside of the United States to support the remainder of our worldwide satellite fleet. For the period from 2000 to 2003, our customer circuit reliability was 99.999994%.

On August 20, 2004, affiliates of Kohlberg Kravis Roberts & Co. L.P., or KKR, The Carlyle Group, or Carlyle, and Providence Equity Partners, Inc., or Providence, completed a series of transactions resulting in an entity affiliated with KKR owning approximately 44% of our outstanding common stock and entities affiliated with Carlyle and Providence each owning approximately 27% of our common stock, with the remainder held by certain members of management. We collectively refer to KKR, Carlyle and Providence as the "Sponsors" in this prospectus.

1

On October 8, 2004, all of our outstanding common stock held by our then existing stockholders was contributed to PanAmSat Holding Corporation, or "Holdco", in exchange for an equal number of shares of Holdco common stock. In addition, options and other equity rights for our common stock were converted to similar rights for Holdco common stock. As a result of and immediately following that contribution, our then existing stockholders owned Holdco in equal proportion to their prior ownership interest in us, and we became a wholly-owned subsidiary of Holdco.

Our Services

Our operations are comprised of two segments, FSS and government services. We refer to our government services segment as "G2" in this prospectus.

Fixed Satellite Services segment

Our FSS segment is comprised of the following:

Video services. We provide satellite transponder capacity and other satellite and terrestrial services for the transmission of entertainment, news, sports and educational programming for over 300 content providers worldwide. Our video services are comprised of four categories:

- •

- Video distribution services—full-time transmission of television programming to cable systems, network affiliates and other redistribution systems;

- •

- DTH television services—full-time transmission of multiple television channels for household reception;

- •

- Full-time contribution services—transmission of news, sports and entertainment segments to cable and broadcast centers around the world; and

- •

- Occasional use services—short-term satellite services that we provide to broadcasters when they need on-the-scene coverage of sporting events and breaking news.

Network services. We provide satellite transponder capacity and other satellite and terrestrial network services to telecommunications carriers, multinational corporations and network service providers for relaying voice, video and data communications globally. Our network services are comprised of three categories:

- •

- Private business network services—satellite capacity that we provide for secure, high speed corporate data networks used in a variety of business functions;

- •

- Internet services—satellite capacity that we provide to ISPs for high data rate Internet connections and point-to-multipoint content distribution; and

- •

- Carrier services—satellite capacity that we provide to telecommunications carriers for voice, video or data communications networks for businesses and other users.

TT&C and other services. In addition to the telemetry, tracking and control, or TT&C, services we perform for many of our satellites, we also provide TT&C services for satellites owned by other satellite operators. TT&C services include monitoring and maintaining the proper orbital location and orientation of a satellite, monitoring on-board systems, adjusting transponder levels and remotely bringing backup systems on-line in the event of a subsystem failure. Our other services include in-orbit backup service, which is backup transponder capacity that we make available to certain customers. Our FSS segment also provides our G2 segment with certain of its satellite capacity requirements.

2

Government Services segment

Our G2 segment provides global satellite and related telecommunications services to the U.S. government, international government entities and their contractors. Through our G2 segment we provide a "one-stop shopping" resource for government customers to obtain satellite bandwidth, ground terminals and related services, either as stand-alone components or as a complete, end-to-end service offering. We offer transponder capacity on our satellites as well as other mobile and fixed satellite systems. In addition, through our G2 segment, we provide expertise on landing rights, terminal licensing and international installation, operation and support that can affect the operation of satellite-based communications networks.

We currently serve more than 100 military and government agencies and contractors worldwide, directly or as a sub-contractor, including the Army Corps of Engineers, The Boeing Company, the Federal Aviation Administration, the Federal Bureau of Investigation, NASA, the Government of Australia, Raytheon Company, the Transportation Security Administration and the U.S. Air Force, Army, Navy and Marine Corps.

Our Strengths

Our business is characterized by the following key strengths:

Substantial contracted backlog resulting from long-term contracts

Contracts for our video distribution services are typically long-term and may extend to the end of life of the satellite or beyond to a replacement satellite. These contracts are generally non-cancelable and early termination or cancellation by the customer of these long-term contracts will result in a significant cash obligation payable to us. As of September 30, 2004, we had contracted backlog for future services of approximately $5.13 billion, of which approximately $193 million was contracted for receipt in the remaining three months of 2004. Contracted backlog represents the actual dollar amount (without discounting for present value) of the expected future cash payments to be received from customers under all long-term contractual agreements, including operating leases, sales-type leases and related service agreements. Our contracted backlog as of September 30, 2004 included approximately $1.3 billion relating to future services on satellites we expect to launch.

Premier customer base and long-standing relationships

Through our commitment to superior customer service and our global reach, we have built a premier customer base for our video and network services. Some of the customers with whom we have long-standing relationships include Time Warner Inc., Viacom, News Corporation, The Walt Disney Company and Hughes Network Systems, Inc., or HNS.

Leading North American video franchise

We have established ourselves over time as a leading transmission platform to distribute video programming to cable systems in North America. Through a combination of our long-standing relationships with customers, key North American orbital slots, leading "anchor tenant" cable channels and 11,000 qualified cable head-ends, we have been successful in creating "cable neighborhoods". These cable neighborhoods are a powerful tool in attracting and retaining customers and create high barriers to entry for competitors because ground infrastructures are specifically designed to receive information from our satellites, making switching costs significant.

3

Market leading global network infrastructure

With 24 owned and operated satellites in orbit as of September 30, 2004 and approximately 97736 MHz equivalent transponders, we have one of the world's largest commercial GEO satellite networks, capable of reaching over 98% of the world's population. Our global reach and our ability to offer bundled services allow us to provide integrated worldwide distribution and delivery services, reducing our customers' risk of data loss or service interruptions. To complement our satellites, we have one of the most sophisticated ground infrastructure networks available to support our customers. Our ground infrastructure includes a technically advanced customer service center, teleports, a satellite operations control center and a fiber based terrestrial network.

Diversified revenues and contracted backlog by satellite

Our revenue base is diversified by satellite, which reduces our dependence on any one satellite. In 2003, no single satellite accounted for more than 11% of our total revenues and as of September 30, 2004, no single satellite accounted for more than 15% of contracted backlog.

High barriers to entry

There are a number of regulatory, economic and other barriers to entry in our industry that help to preserve our position as one of the leading satellite service providers. One of the most significant barriers to entry is the need to obtain operating rights to an orbital slot, a costly and time-consuming process. Most of the commercially useful GEO slots are either currently in use or already subject to filings for use. Once the use of particular frequencies at an orbital slot has been licensed and coordinated, it is protected against interference from other operations at the same or adjacent slots. Even with access to orbital slots, significant time and expense is necessary to build, launch and insure satellites. We have invested approximately $4.0 billion in our existing satellite fleet and ground infrastructure through September 30, 2004. As of December 31, 2003, our satellite fleet, which we have recently upgraded, had an average estimated remaining useful life of approximately nine years, excluding satellites we classified as being in secondary operating service.

Experienced senior management team

Our senior management team has operated together successfully since 2001. Our senior management team, which is currently comprised of six individuals and has a combined 70 years of industry experience, is led by Joseph R. Wright who has been our President and Chief Executive Officer since August 2001 and a member of our Board of Directors since 1997.

Our Business Strategy

Our goal is to be the world's leading provider of video, broadcasting and network distribution and delivery services through customer-driven, integrated, state-of-the-art satellite and terrestrial networks. To achieve our goal, we plan to increase the use of our existing satellite fleet, improve connectivity to our terrestrial network and continue to provide a 24/7 customer support organization that is capable of serving distributors of video entertainment, operators of business networks, government agencies and other customers around the world. Our strategy includes the following initiatives:

Continuing to increase the value of our U.S. and international video services

Continue to capitalize on our cable neighborhoods. Because of our ability to create cable neighborhoods with channels such as the HBO family of channels, the Fox family of channels, TBS, The Disney Channel, ESPN, MTV and Nickelodeon, we have been able to attract additional

4

programmers to these satellites. These cable neighborhoods have been sustainable over multiple generations of satellites, and we plan to continue to develop and expand our cable neighborhoods in the United States, South America and the Asia-Pacific region. As cable operators build out their plant capacity, we have the opportunity to benefit as more channels, services and other data require satellite distribution to cable head-ends. As the number of channels grows, so do the number of video distribution opportunities for us by creating greater demand for our premium cable neighborhood satellites.

Become a leader in HDTV distribution. We believe demand for high-definition television, or HDTV, will experience significant growth in the coming years, which will result in the need for more satellite bandwidth. According to a 2004 report by the Yankee Group, the number of U.S. households viewing HDTV is forecasted to increase from 8.3 million in 2004 to 57.5 million by year-end 2008. To take advantage of this opportunity, we have implemented a marketing program to make our newest satellite, Galaxy 13/Horizons 1, an HDTV neighborhood and attract the newest and fastest growing cable television segment. We believe that we carry more HDTV channels than any of our competitors in the FSS segment. As part of our normal capital replacement program, we have taken the opportunity to build two additional, more powerful, "HD-ready" satellites that we expect will be deployed before the end of 2005.

Expand DTH services. We believe that greater demand for satellite capacity will be required from U.S. DTH providers as a result of increased HDTV demand and increased local and ethnic programming. We believe these services will consume bandwidth beyond what is currently available to DTH operators and will cause them to rely more heavily on FSS services.

Increasing sales to the U.S. government

According to the United States General Accounting Office, the U.S. government is the single largest user of commercial satellite bandwidth in the world. Through our G2 segment, we offer a range of satellite and value-added services to support the requirements of the U.S. government. G2's strategy is to sell its services to the government and assist in the migration of government satellite usage onto PanAmSat capacity. We intend to leverage the skills acquired by G2 across our video and data networking customers, which we believe will further distinguish us from our competition.

Increasing VSAT sales

We believe we are a leading provider of satellite capacity for VSAT applications. These proprietary network services allow our customers and their end users to connect many remote business sites to a large central antenna by satellite for one-way or two-way communications. This is particularly valuable in developing regions where terrestrial alternatives are not available. We expect growth in the use of VSATs to continue as more businesses realize the benefits of communicating via a VSAT network. We believe that our strong knowledge of VSAT platforms, coupled with the availability of our international satellite capacity, position us as the preferred provider of VSAT services.

Selectively pursuing complementary acquisitions

Over the last several years, the FSS industry has been reshaped as a result of consolidation, deregulation, privatization and, more recently, through increased private equity ownership of satellite operators. We believe that these trends may present opportunities to selectively pursue complementary acquisitions and joint ventures, which would allow us to expand our scope and scale to meet the needs of our customers.

5

The Transactions

On August 20, 2004, the Sponsors and certain members of management recapitalized the Company through a series of transactions that we collectively refer to as the "Recapitalization". The aggregate transaction value of the Recapitalization, including the assumption of indebtedness, premiums and fees and expenses, was approximately $4.4 billion, including approximately $547.6 million of cash contributed as equity by the Sponsors and certain members of management.

In connection with the Recapitalization, we:

- •

- entered into senior secured credit facilities, consisting of a $800.0 million Term Loan A Facility (of which $674.3 million is currently outstanding), a $1,660.0 million Term Loan B Facility (of which $1,647.5 million is currently outstanding) and a $250.0 million revolving credit facility, of which $42.6 million was drawn at the closing of the Transactions and repaid in September 2004;

- •

- issued $1,010.0 million aggregate principal amount of the outstanding notes;

- •

- repaid approximately $1,079.1 million of our indebtedness (including accrued interest), including pursuant to tender offers for our $800.0 million 81/2% Senior Notes due 2012 and our $275.0 million 61/8% Senior Notes due 2005;

- •

- paid approximately $307.1 million of transaction fees and expenses, including tender premiums;

- •

- issued new shares and options to purchase shares of common stock to certain members of management; and

- •

- entered into new contractual arrangements with affiliates of The DIRECTV Group as described under "Management's Discussion and Analysis of Financial Conditions and Results of Operations—Transaction Contracts".

The Recapitalization and related financing transactions, together with our new contractual arrangements, are referred to collectively in this prospectus as the "Transactions". For a more detailed description of the Transactions, see "The Transactions".

Through November 19, 2004, we received $69 million in insurance proceeds for our claim on Galaxy 10R, which was filed as the result of the failure of its secondary XIPS on August 3, 2004. On November 19, 2004, those proceeds, along with cash on hand, were utilized to make a voluntary prepayment of approximately $137 million under our senior secured credit facilities. Approximately $124.5 million of this prepayment was applied to the Term Loan A Facility while the remaining $12.5 million was applied to the Term Loan B Facility.

6

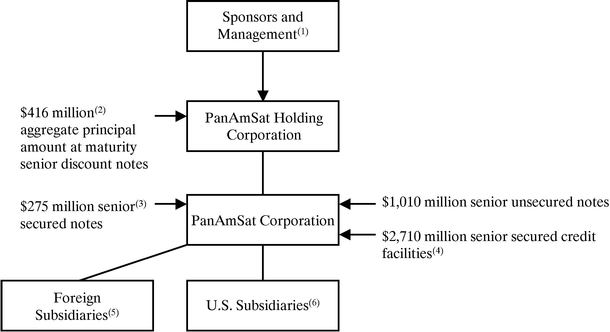

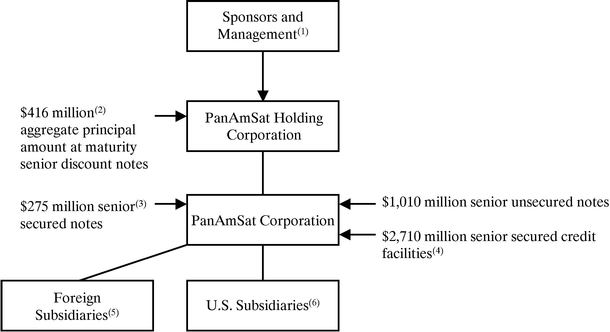

Ownership and Corporate Structure

On October 8, 2004, the owners of PanAmSat Corporation contributed their capital stock to Holdco, a newly-formed Delaware corporation, thereby creating our parent corporation. The chart below illustrates our current ownership and corporate structure.

- (1)

- An entity affiliated with KKR owns approximately 44% of Holdco's outstanding common stock and entities affiliated with Carlyle and Providence each own approximately 27% of Holdco's outstanding common stock, with the remainder of Holdco's common stock held by certain members of management and of our Board of Directors.

- (2)

- These 103/8 Senior Discount Notes were issued by Holdco on October 20, 2004. We are not an obligor under or a guarantor of these notes and they are structurally junior in right of payment to all of our existing and future indebtedness.

- (3)

- Consists of $150.0 million aggregate principal amount of 63/8% Senior Notes due 2008 and $125.0 million aggregate principal amount of 67/8% Senior Debentures due 2028 both secured equally and ratably with the senior secured credit facilities. In addition, we have approximately $1.2 million aggregate principal amount of unsecured 81/2% Senior Notes due 2012 outstanding. We redeemed the entire outstanding principal amount of our 61/8% Senior Notes due 2005 on October 22, 2004 with cash on hand and cash from operations.

- (4)

- Consists of a five-year $800.0 million Term Loan A Facility ($674.3 million of which is currently outstanding), a seven-year $1,660.0 million Term Loan B Facility ($1,647.5 million is currently outstanding), and a $250.0 million five-year revolving credit facility. Our senior secured credit facilities are secured by a perfected lien on and a pledge of all the capital stock and intercompany notes of each of our existing and future direct and indirect subsidiaries, except that with respect to foreign subsidiaries such lien and pledge is limited to 65% of the capital stock of "first-tier" foreign subsidiaries, and substantially all of our and our existing and future domestic subsidiaries' tangible and intangible assets. As noted in footnote (2) above, our 63/8% Senior Notes due 2008 and 67/8% Senior Debentures due 2028 are secured equally and ratably with our senior secured credit facilities.

- (5)

- As noted in footnote (3) above, we have granted a security interest to the lenders under our senior secured credit facilities and to the holders of our $150.0 million aggregate principal amount of 63/8% Senior Notes due 2008 and $125.0 million aggregate principal amount of 67/8% Senior Debentures due 2028, in 65% of the capital stock of our "first-tier" foreign subsidiaries.

- (6)

- In connection with the Transactions, we transferred our satellites to newly-formed domestic subsidiaries. All of these entities guarantee all amounts outstanding under our senior secured credit facilities and our existing senior secured notes on a senior secured basis and the notes on a senior unsecured basis.

7

Our Sponsors

Kohlberg Kravis Roberts & Co. L.P.

KKR is one of the world's oldest and most experienced private equity firms specializing in management buyouts. KKR's investment approach is focused on acquiring attractive business franchises and working closely with management over the long-term to design and implement value creating strategies. Over the past 28 years, KKR has raised approximately $25.0 billion in private equity funds and invested over $19.0 billion of equity in more than 115 transactions.

The Carlyle Group

Carlyle is a global private equity firm with more than $18.4 billion under management. Carlyle invests in buyouts, venture, real estate, leveraged finance, and turnarounds in North America, Europe, and Asia, focusing on aerospace & defense, automotive & transportation, consumer, energy & power, healthcare, industrial, technology & business services and telecommunications & media. Since 1987, the firm has invested more than $11.0 billion of equity in over 330 transactions.

Providence Equity Partners, Inc.

Providence is one of the world's leading private investment firms specializing in equity investments in media and communications companies. The principals of Providence manage funds with over $5.0 billion in equity commitments, including Providence Equity Partners IV, a $2.8 billion private equity fund, and have invested in more than 70 companies operating in over 20 countries since the firm's inception in 1991. Current and previous areas of investment include cable television content and distribution, wireless and wireline telephony, publishing, radio and television broadcasting and other media and communications sectors.

8

Summary of Terms of the Exchange Offer

On August 20, 2004, PanAmSat Corporation completed the private offering of the outstanding notes. References to the "notes" in this prospectus are references to both the outstanding notes and the exchange notes. This prospectus is part of a registration statement covering the exchange of the outstanding notes for the exchange notes.

We and the guarantors entered into a registration rights agreement with the initial purchasers in the private offering in which we and the guarantors agreed to deliver to you this prospectus as part of the exchange offer and we agreed to use all commercially reasonable efforts to complete the exchange offer within 30 business days after the effective date of the registration statement covering the exchange. You are entitled to exchange in the exchange offer your outstanding notes for exchange notes which are identical in all material respects to the outstanding notes except:

- •

- the exchange notes have been registered under the Securities Act;

- •

- the exchange notes are not entitled to certain registration rights which are applicable to the outstanding notes under the registration rights agreement; and

- •

- certain special interest rate provisions are no longer applicable.

The Exchange Offer |

|

We are offering to exchange up to $1,010,000,000 aggregate principal amount of our 9% Senior Exchange Notes due 2014, which we refer to in this prospectus as the exchange notes, for up to $1,010,000,000 million aggregate principal amount of our 9% Senior Notes due 2014, which we refer to in this prospectus as the outstanding notes. Outstanding notes may be exchanged only in integral multiples of $1,000. |

Resale |

|

Based on an interpretation by the staff of the SEC set forth in no-action letters issued to third parties, we believe that the exchange notes issued pursuant to the exchange offer in exchange for outstanding notes may be offered for resale, resold and otherwise transferred by you (unless you are an "affiliate" of the Company, within the meaning of Rule 405 under the Securities Act) without compliance with the registration and prospectus delivery provisions of the Securities Act, provided that you are acquiring the exchange notes in the ordinary course of your business and that you are not engaged in, do not intend to engage in, and have no arrangement or understanding with any person to participate in, a distribution of the exchange notes. |

|

|

Each participating broker-dealer that receives exchange notes for its own account pursuant to the exchange offer in exchange for outstanding notes that were acquired as a result of market-making or other trading activity must acknowledge that it will deliver a prospectus in connection with any resale of the exchange notes. See "Plan of Distribution." |

|

|

Any holder of outstanding notes who: |

|

|

• |

|

is an affiliate of the Company; |

|

|

•

|

|

does not acquire exchange notes in the ordinary course of business; or |

| | | | | |

9

|

|

•

|

|

tenders in the exchange offer with the intention to participate, or for the purpose of participating, in a distribution of exchange notes; |

|

|

cannot rely on the position of the staff of the SEC enunciated in Exxon Capital Holdings Corporation, Morgan Stanley & Co. Incorporated or similar no-action letters and, in the absence of an exemption therefrom, must comply with the registration and prospectus delivery requirement of the Securities Act in connection with the resale of the exchange notes. |

Expiration Date; Withdrawal of Tender |

|

The exchange offer will expire at 5:00 p.m., New York City time, on , 2004, or such later date and time to which we extend it (the "expiration date"). We do not currently intend to extend the expiration date. A tender of outstanding notes pursuant to the exchange offer may be withdrawn at any time prior to the expiration date. Any outstanding notes not accepted for exchange for any reason will be returned without expense to the tendering holder promptly after the expiration or termination of the exchange offer. |

Certain Conditions to the Exchange Offer |

|

The exchange offer is subject to customary conditions, which we may waive. Please read the section captioned "The Exchange Offer—Certain Conditions to the Exchange Offer" of this prospectus for more information regarding the conditions to the exchange offer. |

Procedures for Tendering Outstanding Notes |

|

If you wish to accept the exchange offer, you must complete, sign and date the accompanying letter of transmittal, or a facsimile of the letter of transmittal, according to the instructions contained in this prospectus and the letter of transmittal. You must also mail or otherwise deliver the letter of transmittal, or a facsimile of the letter of transmittal, together with the outstanding notes and any other required documents, to the exchange agent at the address set forth on the cover page of the letter of transmittal. If you hold outstanding notes through The Depository Trust Company, or DTC, and wish to participate in the exchange offer, you must comply with the Automated Tender Offer Program procedures by DTC, by which you will agree to be bound by the letter of transmittal. By signing, or agreeing to be bound by the letter of transmittal, you will represent to us that, among other things: |

|

|

•

|

|

any exchange notes that you receive will be acquired in the ordinary course of business; |

|

|

•

|

|

you have no arrangement or understanding with any person or entity to participate in a distribution of the exchange notes; |

|

|

•

|

|

if you are a broker-dealer that will receive exchange notes for your own account in exchange for outstanding notes that were acquired as a result of market-making activities or other trading activity, that you will deliver a prospectus, as required by law, in connection with any resale of such exchange notes; and |

| | | | | |

10

|

|

•

|

|

you are not an "affiliate," as defined in Rule 405 of the Securities Act, of the Company or, if you are an affiliate, you will comply with any applicable registration and prospectus delivery requirements of the Securities Act. |

Special Procedures for Beneficial Owners |

|

If you are a beneficial owner of outstanding notes which are registered in the name of a broker, dealer, commercial bank, trust company or other nominee, and you wish to tender such outstanding notes in the exchange offer, you should contact such registered holder promptly and instruct such registered holder to tender on your behalf. If you wish to tender on your own behalf, you must, prior to completing and executing the letter of transmittal and delivering your outstanding notes, either make appropriate arrangements to register ownership of the outstanding notes in your name or obtain a properly completed bond power from the registered holder. The transfer of registered ownership may take considerable time and may not be able to be completed prior to the expiration date. |

Guaranteed Delivery Procedures |

|

If you wish to tender your outstanding notes and your outstanding notes are not immediately available or you cannot deliver your outstanding notes, the letter of transmittal or any other documents required by the letter of transmittal or comply with the applicable procedures under DTC's Automated Tender Offer Program prior to the expiration date, you must tender your outstanding notes according to the guaranteed delivery procedures set forth in this prospectus under "The Exchange Offer—Guaranteed Delivery Procedures." |

Effect on Holders of Outstanding Notes |

|

As a result of the making of, and upon acceptance for exchange of all validly tendered outstanding notes pursuant to the terms of the exchange offer, we will have fulfilled a covenant contained in the registration rights agreement and, accordingly, there will be no increase in the interest rate on the outstanding notes under the circumstances described in the registration rights agreement. If you are a holder of outstanding notes and you do not tender your outstanding notes in the exchange offer, you will continue to hold such outstanding notes and you will be entitled to all the rights and limitations applicable to the outstanding notes in the indenture, except for any rights under the registration rights agreement that by their terms terminate upon the consummation of the exchange offer. To the extent that outstanding notes are tendered and accepted in the exchange offer, the trading market for outstanding notes could be adversely affected. |

Consequences of Failure to Exchange |

|

All untendered outstanding notes will continue to be subject to the restrictions on transfer provided for in the outstanding notes and in the indenture. In general, the outstanding notes may not be offered or sold, unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Other than in connection with the exchange offer, we do not currently anticipate that we will register the outstanding notes under the Securities Act. |

| | | | | |

11

Certain Income Tax Considerations |

|

The exchange of outstanding notes for exchange notes in the exchange offer will not be a taxable event for the United States federal income tax purposes. See "United States Federal Income Tax Consequences of the Exchange Offer." |

Use of Proceeds |

|

We will not receive any cash proceeds from the issuance of exchange notes pursuant to the exchange offer. |

Exchange Agent |

|

The Bank of New York is the exchange agent for the exchange offer. The address and telephone number of the exchange agent are set forth in the section caption "The Exchange Offer—Exchange Agent" of this prospectus. |

12

Summary of Terms of the Exchange Notes

| Issuer | | PanAmSat Corporation. |

Notes Offered |

|

$1,010,000,000 aggregate principal amount of 9% Senior Exchange Notes Due 2014. |

Maturity Date |

|

August 15, 2014. |

Interest Payment Dates |

|

February 15 and August 15 of each year, beginning February 15, 2005. |

Guarantees |

|

The exchange notes will be guaranteed, jointly and severally, on a senior unsecured basis, by all of our existing and certain of our future domestic subsidiaries. |

Ranking |

|

The exchange notes and the guarantees will be our and the applicable guarantor's senior unsecured obligations and will rank: |

|

|

• |

|

senior in right of payment to any of our and such guarantor's existing and future subordinated indebtedness; |

|

|

• |

|

equal in right of payment with any of our and such guarantor's existing and future senior unsecured indebtedness; |

|

|

• |

|

effectively junior in right of payment to any of our and such guarantor's existing and future secured indebtedness (to the extent of the value of the security for that indebtedness); and |

|

|

• |

|

effectively junior in right of payment to the existing and future liabilities of our non-guarantor subsidiaries. |

|

|

As of September 30, 2004, the aggregate amount of our outstanding senior debt was approximately $3,769.2 million, $2,758.0 million of which was secured. As of September 30, 2004, our foreign subsidiaries had approximately $1.7 million of liabilities and 0.4% of our total assets. None of our foreign subsidiaries will guarantee the exchange notes. |

Optional Redemption |

|

Prior to August 15, 2009, we may redeem the notes, in whole or in part, at a price equal to 100% of the principal amount thereof plus the make-whole premium described under "Description of the Notes—Optional Redemption". |

|

|

We may redeem some or all of the notes at any time and from time to time on or after August 15, 2009, in whole or in part, in cash at the redemption prices described under "Description of the Notes—Optional Redemption", plus accrued and unpaid interest to the date of redemption. |

|

|

In addition, prior to August 15, 2007, we may redeem up to 35% of the aggregate principal amount of the notes with the proceeds of certain equity offerings. |

| | | | | |

13

Change of Control |

|

If a change of control occurs, each holder of the notes may require us to repurchase all or a portion of such holder's notes at a price equal to 101% of their principal amount, plus accrued and unpaid interest, if any, to the date of repurchase. |

Restrictive Covenants |

|

The terms of the notes place certain limitations on our ability and the ability of our restricted subsidiaries to, among other things, |

|

|

• |

|

incur or guarantee additional indebtedness or issue disqualified or preferred stock; |

|

|

• |

|

create liens; |

|

|

• |

|

enter into sale and lease-back transactions; |

|

|

• |

|

pay dividends or make other equity distributions; |

|

|

• |

|

repurchase or redeem capital stock; |

|

|

• |

|

make investments; |

|

|

• |

|

sell assets or consolidate or merge with or into other companies; |

|

|

• |

|

create limitations on the ability of our restricted subsidiaries to make dividends or distributions to us; and |

|

|

• |

|

engage in transactions with affiliates. |

|

|

These covenants are subject to important exceptions and qualifications, which are described under "Description of the Notes—Certain Covenants". |

No Prior Market; PORTAL Market Listing |

|

The exchange notes will be new securities for which there is no market. Although the initial purchasers in the private offering of the outstanding notes have informed us that they intend to make a market in the outstanding notes and, if issued, the exchange notes, they are not obligated to do so and may discontinue market-making at any time without notice. Accordingly, we cannot assure you that a liquid market for the outstanding notes or exchange notes will develop or be maintained. The notes have been made eligible for trading on the Private Offerings, Resale and Trading through Automatic Linkages, or PORTALSM, market. |

Use of Proceeds |

|

There will be no cash proceeds to us from the exchange offer. |

14

Risk Factors

Investing in the notes involves substantial risks. You should consider carefully all of the information set forth in this prospectus and, in particular, should evaluate the specific factors set forth under "Risk Factors" in deciding whether to invest in the notes.

�� Our principal executive offices are located at 20 Westport Road, Wilton, Connecticut 06897 and our telephone number there is (203) 210-8000. We maintain a website at www.panamsat.com.Information contained on our website does not constitute a part of this prospectus and is not being incorporated by reference herein.

15

Summary Historical Consolidated Financial, Operating and Other Data

Set forth below is summary historical consolidated financial, operating and other data of PanAmSat at the dates and for the periods indicated.

Our summary historical consolidated statement of income data for the fiscal years ended December 31, 2001, 2002 and 2003 and the summary historical consolidated balance sheet data as of December 31, 2002 and 2003 were derived from our audited consolidated financial statements and related notes appearing elsewhere in this prospectus. Our summary historical consolidated statement of income data for the nine months ended September 30, 2003 and 2004 and the summary historical consolidated balance sheet data as of September 30, 2003 and 2004 were derived from our unaudited consolidated financial statements and related notes appearing elsewhere in this prospectus, which have been prepared on a basis consistent with our audited financial statements. In the opinion of management, the unaudited financial data reflect all adjustments, consisting only of normal and recurring adjustments, necessary for a fair presentation of the results for those periods. The results of operations for any interim period are not necessarily indicative of the results to be expected for the full year or any future period.

The summary historical consolidated financial, operating and other data should be read in conjunction with "Unaudited Pro Forma Condensed Consolidated Financial Information", "Selected Historical Consolidated Financial, Operating and Other Data", "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and related notes appearing elsewhere in this prospectus.

16

| | Year Ended December 31,

| | Nine Months Ended September 30,

| |

|---|

| | 2001

| | 2002

| | 2003

| | 2003

| | 2004

| |

|---|

| | (In thousands (other than contracted backlog and ratio of earnings to fixed charges))

| |

|---|

| Statement of Income Data: | | | | | | | | | | | | | | | | |

| Revenues: | | | | | | | | | | | | | | | | |

| Operating leases, satellite services and other | | $ | 802,194 | | $ | 792,691 | | $ | 814,006 | | $ | 600,853 | | $ | 607,165 | |

| Outright sales and sales-type leases(1) | | | 67,881 | | | 19,599 | | | 17,005 | | | 12,576 | | | 12,185 | |

| | |

| |

| |

| |

| |

| |

| Total revenues | | | 870,075 | | | 812,290 | | | 831,011 | | | 613,429 | | | 619,350 | |

| | |

| |

| |

| |

| |

| |

| Operating costs and expenses: | | | | | | | | | | | | | | | | |

| Cost of outright sales and sales-type leases | | | 12,766 | | | — | | | — | | | — | | | 2,224 | |

| Depreciation and amortization | | | 414,744 | | | 335,717 | | | 312,833 | | | 232,194 | | | 220,969 | |

| Direct operating costs (exclusive of depreciation and amortization) | | | 147,401 | | | 126,387 | | | 149,696 | | | 103,983 | | | 118,484 | |

| Selling, general and administrative expenses | | | 121,622 | | | 101,983 | | | 86,081 | | | 58,687 | | | 88,814 | |

| Facilities restructuring and severance costs | | | 8,223 | | | 13,708 | | | 4,227 | | | 1,390 | | | 4,508 | |

| Gain on insurance claims | | | — | | | (40,063 | ) | | — | | | — | | | — | |

| Satellite impairment loss | | | — | | | — | | | — | | | — | | | 99,946 | |

| Loss on termination of sales-type leases | | | — | | | 18,690 | | | — | | | — | | | — | |

| Transaction-related costs | | | — | | | — | | | — | | | — | | | 155,035 | |

| | |

| |

| |

| |

| |

| |

| Total operating cost and expenses | | | 704,756 | | | 556,422 | | | 552,837 | | | 396,254 | | | 689,980 | |

| | |

| |

| |

| |

| |

| |

| Income (loss) from operations | | | 165,319 | | | 255,868 | | | 278,174 | | | 217,175 | | | (70,630 | ) |

| Interest expense, net(2) | | | 111,153 | | | 142,470 | | | 143,632 | | | 106,311 | | | 122,503 | |

| | |

| |

| |

| |

| |

| |

| Income (loss) before income taxes | | | 54,166 | | | 113,398 | | | 134,542 | | | 110,864 | | | (193,133 | ) |

| Income tax expense (benefit) | | | 23,562 | | | 28,350 | | | 35,010 | | | 28,712 | | | (95,215 | ) |

| | |

| |

| |

| |

| |

| |

| Net income (loss) | | $ | 30,604 | | $ | 85,048 | | $ | 99,532 | | $ | 82,152 | | $ | (97,918 | ) |

| | |

| |

| |

| |

| |

| |

Balance Sheet Data (at end of period): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents | | $ | 443,266 | | $ | 783,998 | | $ | 511,248 | | $ | 496,768 | | $ | 48,204 | |

| Short-term investments | | | — | | | 99,785 | | | 38,936 | | | 55,394 | | | — | |

| Satellites and other property and equipment—Net | | | 3,152,082 | | | 2,865,279 | | | 2,306,705 | | | 2,621,288 | | | 2,036,651 | |

| Net investment in sales-type leases | | | 251,899 | | | 184,727 | | | 139,721 | | | 120,858 | | | 115,799 | |

| Total assets | | | 6,296,810 | | | 6,487,738 | | | 5,734,877 | | | 5,981,855 | | | 4,882,582 | |

| Total debt, including to affiliates(3) | | | 2,521,542 | | | 2,550,000 | | | 1,700,000 | | | 2,000,000 | | | 3,769,156 | |

| Total long-term liabilities | | | 3,134,897 | | | 3,063,003 | | | 2,400,273 | | | 2,672,642 | | | 3,984,153 | |

| Total stockholders' equity | | | 2,992,560 | | | 3,077,542 | | | 3,178,758 | | | 3,160,116 | | | 673,419 | |

| | Year Ended December 31,

| | Nine Months Ended September 30,

| |

|---|

| | 2001

| | 2002

| | 2003

| | 2003

| | 2004

| |

|---|

| | (In thousands (other than operating data and percentages))

| |

|---|

| Other Financial Data: | | | | | | | | | | | | | | | | |

| Net cash provided by operating activities | | $ | 507,904 | | $ | 519,247 | | $ | 473,381 | | $ | 327,745 | | $ | 167,051 | |

| Net cash provided by (used in) investing activities | | | (203,836 | ) | | (179,096 | ) | | 108,762 | | | (58,463 | ) | | 217,021 | |

| Net cash provided by (used in) financing activities | | | 9,853 | | | 1,420 | | | (855,267 | ) | | (556,874 | ) | | (847,444 | ) |

| Capital expenditures | | | 338,203 | | | 294,313 | | | 104,082 | | | (87,161 | ) | | (108,308 | ) |

| Contracted backlog (at end of period; in billions)(4) | | $ | 5.84 | | $ | 5.55 | | $ | 4.56 | | $ | 4.80 | | $ | 5.13 | |

| Ratio of earnings to fixed charges(5) | | | 1.43 | x | | 1.62 | x | | 1.86 | x | | 1.93 | x | | — | |

| | | | | | | | | | | | | | | | | |

17

Operating Data (at end of period): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Number of satellites in orbit | | | 21 | | | 21 | | | 25 | | | 25 | | | 24 | |

| Number of transponders(6): | | | | | | | | | | | | | | | | |

| | C-band | | | 413 | | | 413 | | | 491 | | | 491 | | | 491 | |

| | Ku-band | | | 457 | | | 500 | | | 522 | | | 522 | | | 486 | |

Capacity utilization: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | C-band | | | 75 | % | | 79 | % | | 78 | % | | 76 | % | | 83 | % |

| | Ku-band | | | 65 | % | | 65 | % | | 65 | % | | 70 | % | | 67 | % |

Selected Segment Data(7): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues: | | | | | | | | | | | | | | | | |

| FSS | | $ | 867,097 | | $ | 806,272 | | $ | 775,009 | | $ | 581,946 | | $ | 570,154 | |

| G2 | | | 11,912 | | | 24,074 | | | 74,550 | | | 46,813 | | | 64,918 | |

| Eliminations | | | (8,934 | ) | | (18,056 | ) | | (18,548 | ) | | (15,330 | ) | | (15,722 | ) |

| | |

| |

| |

| |

| |

| |

| | Total revenues | | $ | 870,075 | | $ | 812,290 | | $ | 831,011 | | $ | 613,429 | | $ | 619,350 | |

| | |

| |

| |

| |

| |

| |

Income from operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FSS(8) | | $ | 162,341 | | $ | 249,850 | | $ | 269,573 | | $ | 209,728 | | $ | (78,640 | ) |

| G2 | | | 2,978 | | | 6,018 | | | 8,601 | | | 7,447 | | | 8,010 | |

| Eliminations | | | — | | | — | | | — | | | — | | | — | |

| | |

| |

| |

| |

| |

| |

| | Total income from operations | | $ | 165,319 | | $ | 255,868 | | $ | 278,174 | | $ | 217,175 | | $ | (70,630 | ) |

| | |

| |

| |

| |

| |

| |

- (1)

- Under an outright sales contract, we sell all rights and title to a transponder to a customer, which in turn pays us the full amount of the sale price in cash at the commencement of the contract. At that time, we recognize the sale amount as revenues and record the cost of the transponder to cost of outright sales. Under sales-type leases, we recognize as revenues at the inception of the lease the net present value of the future minimum lease payments, but we continue to receive cash payments from the lessee throughout the term of the lease. In addition, during the life of the lease, we recognize as revenues the portion of each periodic lease payment deemed to be attributable to interest income. The principal difference between a sales-type lease and an operating lease is when we recognize the revenues and related costs, but not when we receive the cash.

- (2)

- Net of capitalized interest of $23.3 million, $27.3 million, $13.9 million, $11.3 million and $4.3 million for the years ended December 31, 2001, 2002 and 2003 and the nine months ended September 30, 2003 and 2004, respectively, and net of interest income of $13.5 million, $15.2 million, $13.3 million, $11.4 million and $6.8 million for the years ended December 31, 2001, 2002 and 2003 and the nine months ended September 30, 2003 and 2004, respectively.

- (3)

- Includes debt of $796.5 million, $2.55 billion, $1.7 billion, $2.0 billion and $3.769 billion as of December 31, 2001, 2002 and 2003 and September 30, 2003 and 2004, respectively, and amounts due to affiliates of $1.7 billion as of December 31, 2001. There were no amounts due to affiliates as of December 31, 2002 and 2003 and September 30, 2003 and 2004. PanAmSat does not currently have any outstanding borrowings under the revolving credit facility.

- (4)

- Contracted backlog represents the actual dollar amount (without discounting for present value) of the expected future cash payments to be received from customers under all long-term contractual agreements, including operating leases, sales-type leases and related service agreements, which may extend to the end of the life of the satellite or beyond to a replacement satellite. Contracted backlog is attributable to both satellites currently in orbit and those planned for future launch.

- (5)

- For purposes of calculating the ratio of earnings to fixed charges, earnings are defined as income (loss) before extraordinary item, cumulative effect of accounting change and provision (benefit) for income taxes paid plus fixed charges. Fixed charges consist of interest expense on all indebtedness (including amortization of discount and financing costs) plus one-third of rent expense which management believes is representative of the interest

18

component of rent expense. For the nine months ended September 30, 2004, our earnings were insufficient to cover our fixed charges by approximately $178.5 million. The pro forma ratio of earnings to fixed charges for the year ended December 31, 2003 would have been 1.21x.

- (6)

- The number of transponders is in36 MHz equivalents.

- (7)

- We organized our business into two operating segments starting in the three months ended March 31, 2004. See "Management's Discussion and Analysis of Financial Condition and Results of Operations" for a further discussion of our segments.

- (8)

- Includes the $99.9 million PAS-6 impairment loss recorded during the three months ended March 31, 2004.

19

RISK FACTORS

You should carefully consider the following factors in addition to the other information set forth in this prospectus before you decide to tender outstanding notes in the exchange offer. The risks and uncertainties described below are not the only ones facing us. Additional risks and uncertainties not presently known to us or that we currently believe are immaterial may also adversely impact our business operations. If any of the following risks actually occur, our business, financial condition, results of operations and our ability to make payments on the notes would likely suffer and you may lose all or part of your investment in the notes.

Risks Related to the Exchange Offer

If you choose not to exchange your outstanding notes, the present transfer restrictions will remain in force and the market price of your outstanding notes could decline.

If you do not exchange your outstanding notes for exchange notes in the exchange offer, then you will continue to be subject to the transfer restrictions on the outstanding notes as set forth in the offering circular distributed in connection with the private offering of the outstanding notes. In general, the outstanding notes may not be offered or sold unless they are registered or exempt from registration under the Securities Act and applicable state securities laws. Except as required by the registration rights agreement, we do not intend to register resales of the outstanding notes under the Securities Act. You should refer to "Summary—Summary of Terms of the Exchange Offer" and "The Exchange Offer" for information about how to tender your outstanding notes.

The tender of outstanding notes under the exchange offer will reduce the principal amount of the outstanding notes outstanding, which may have an adverse effect upon, and increase the volatility of, the market price of the outstanding notes due to reduction in liquidity.

Risks Relating to Our Indebtedness and the Exchange Notes

We have a substantial amount of indebtedness, which may adversely affect our cash flow and our ability to operate our business, remain in compliance with debt covenants and make payments on our indebtedness, including the notes.

As of September 30, 2004 we had outstanding indebtedness of approximately $3,769.2 million, which represented approximately 85% of our total consolidated capitalization. As of September 30, 2004 we had availability of $213.9 million (net of standby letters of credit of approximately $36.1 million) under our new revolving credit facility.

Our substantial indebtedness could have important consequences to you. For example, it could:

- •

- make it more difficult for us to satisfy our obligations with respect to our indebtedness, including the notes, and any failure to comply with the obligations of any of our debt instruments, including financial and other restrictive covenants, could result in an event of default under the indenture governing the notes and the agreements governing such other indebtedness;

- •

- require us to dedicate a substantial portion of our cash flow to pay principal and interest on our debt, which will reduce the funds available for working capital, capital expenditures, acquisitions and other general corporate purposes;

- •

- limit our flexibility in planning for and reacting to changes in our business and in the industry in which we operate;

20

- •

- make us more vulnerable to adverse changes in general economic, industry and competitive conditions and adverse changes in government regulation;

- •

- limit our ability to borrow additional amounts for working capital, capital expenditures, acquisitions, debt service requirements, execution of our strategy, or other purposes; and

- •

- place us at a disadvantage compared to our competitors who have less debt.

Any of the above listed factors could materially and adversely affect our business and results of operations. Furthermore, our interest expense could increase if interest rates increase because the entire amount of our debt under our senior secured credit facilities is expected to bear interest at floating rates. See "Description of Certain Indebtedness—Senior Secured Credit Facilities". If we do not have sufficient earnings to service our debt, we may be required to refinance all or part of our existing debt, sell assets, borrow more money or sell securities, none of which we can guarantee we will be able to do.

We will be able to incur significant additional indebtedness in the future. Although the indenture governing the notes and the credit agreement governing our senior secured credit facilities contain restrictions on the incurrence of additional indebtedness, these restrictions are subject to a number of important qualifications and exceptions and the indebtedness incurred in compliance with these restrictions could be substantial. If new debt is added to our anticipated debt levels, the related risks that we now face, including those described above, could intensify.