- RRGB Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Red Robin Gourmet Burgers (RRGB) DEF 14ADefinitive proxy

Filed: 5 Apr 21, 4:07pm

Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| RED ROBIN GOURMET BURGERS, INC. | ||||

(Name of the Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

RED ROBIN GOURMET BURGERS, INC.

6312 South Fiddler's Green Circle, Suite 200N

Greenwood Village, CO 80111

(303) 846-6000

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 20, 2021

When: 8:00 a.m. MDT, on Thursday May 20, 2021

Where: Red Robin's Yummm U, located at 10000 East Geddes Avenue, Unit 500, Englewood, Colorado 80112 for the following purposes:

Items of Business:

We intend to hold our annual meeting in person again this year. As always, we encourage you to vote your shares prior to the annual meeting.

Record Date: Stockholders as of March 23, 2021 are entitled to vote

Annual Report: We filed with the U.S. Securities and Exchange Commission (the "SEC") an annual report on Form 10-K on March 3, 2021 for the fiscal year ended December 27, 2020. A copy of the annual report on Form 10-K has been made available concurrently with this proxy statement to all of our stockholders entitled to notice of and to vote at the annual meeting. In addition, you may obtain a copy of the annual report on Form 10-K, without charge, by writing to Red Robin Gourmet Burgers, Inc., Attn: Stockholder Services, 6312 South Fiddler's Green Circle, Suite 200N, Greenwood Village, Colorado 80111.

Who Can Attend: All stockholders as of the record date, or their duly appointed proxies, may attend the meeting

Date of Mailing: This Notice of Annual Meeting of Stockholders and related proxy materials are being distributed or made available to stockholders beginning on or about April 9, 2021

YOUR VOTE IS IMPORTANT

Whether or not you plan to attend, it is important that your shares be voted at the meeting. Please refer to your proxy card or Notice Regarding the Availability of Proxy Materials for more information

on how to vote your shares at the meeting and return your voting instructions as promptly as possible. Thank you for your continued support of Red Robin.

| By Order of the Board of Directors, | ||

| ||

Michael L. Kaplan Secretary |

Greenwood Village, Colorado

April 5, 2021

Neither the Securities and Exchange Commission nor any state securities regulatory agency has passed upon the adequacy or accuracy of the disclosure in this document. Any representation to the contrary is a criminal offense.

i

ii

| MEETING AGENDA, VOTING MATTERS, AND BOARD VOTING RECOMMENDATIONS |

| Proposal | Board's Voting Recommendation | Page Reference (for more detail) | ||||

|---|---|---|---|---|---|---|

| | | | | | | |

| 1 | Election of Directors | FOR All nominees | 10 | |||

2 | Advisory Vote to Approve Executive Compensation | FOR | 70 | |||

3 | Amendment to the Company's 2017 Performance Incentive Plan, as amended, to increase shares available for issuance | FOR | 71 | |||

4 | Ratification of Independent Auditor | FOR | 79 | |||

The following provides summary information about each director nominee. Our director nominees possess a range of diverse skills, backgrounds, experience, and viewpoints that we believe are integral to an effective board. Detailed information about each individual's qualifications, experience, skills, and expertise can be found starting on page 10.

| Director Nominee | Age | Director Since | Principal Occupation | Independent | Committee Assignments | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Anthony S. Ackil | | 46 | 2020 | Chief Executive Officer of Streetlight Ventures | ✓ | AC | |||||

Thomas G. Conforti | 62 | 2019 | Former Senior Advisor, Executive Vice President and Chief Financial Officer, Wyndham Worldwide | ✓ | *FC, AC | ||||||

Cambria W. Dunaway | | 58 | 2014 | Chief Marketing Officer, Duolingo | ✓ | *NGC, CC | |||||

G.J. Hart | 63 | 2019 | Chief Executive Officer, Torchy's Tacos | ✓ | CC, FC | ||||||

Kalen F. Holmes | | 54 | 2016 | Former Executive Vice President (Human Resources), Starbucks | ✓ | *CC, NGC | |||||

Glenn B. Kaufman | 53 | 2010 | Managing Member, D Cubed Group | ✓ | FC, NGC | ||||||

Steven K. Lumpkin | | 66 | 2016 | Consultant, Former Executive Vice President, Chief Financial Officer and director, Applebee's | ✓ | *AC, FC | |||||

Paul J.B. Murphy III | 66 | 2019 | President and Chief Executive Officer, Red Robin | ||||||||

David A. Pace | | 62 | 2019 | Co-Chief Executive Officer, Tastemaker | ✓ | (C), CC | |||||

Allison Page | 36 | 2020 | Co-Founder and President, SevenRooms | ✓ | FC, NGC | ||||||

Anddria Varnado | | 35 | 2021+ | GM and Head of the Consumer Business, | ✓ | + | |||||

| AC | Audit Committee | (C) | Denotes Chair of the Board | |||

| CC | Compensation Committee | * | Denotes Chair of the Committee | |||

| NGC | Nominating and Governance Committee | + | Denotes New Director, Committees TBD | |||

| FC | Finance Committee |

| 91% Independence | 36% Gender Diversity | 9% Racial/Ethnic Diversity | 50% Board committees | 54.6 years | 3.5 years |

2

| Experience / Skills | David A. Pace (Chairman) | Paul J.B. Murphy III (CEO) | Anthony S. Ackil | Thomas G. Conforti | Cambria W. Dunaway | G. J. Hart | Kalen F. Holmes | Glenn B. Kaufman | Steven K. Lumpkin | Allison Page | Anddria Varnado | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Public C-Suite Experience | ✓ | ✓ | ¨ | ✓ | ✓ | ✓ | ✓ | ¨ | ✓ | ¨ | ¨ | |||||||||||

Restaurant / Hospitality Executive Leadership | ✓ | ✓ | ✓ | ✓ | ¨ | ✓ | ✓ | ✓ | ✓ | ✓ | ¨ | |||||||||||

Accounting / Financial Expertise | ✓ | ✓ | ✓ | ✓ | ¨ | ✓ | ¨ | ✓ | ✓ | ✓ | ¨ | |||||||||||

Business Transformation | ✓ | ✓ | ¨ | ✓ | ¨ | ✓ | ✓ | ✓ | ¨ | ¨ | ✓ | |||||||||||

Technology Strategy | ✓ | ¨ | ✓ | ✓ | ¨ | ✓ | ¨ | ¨ | ✓ | ✓ | ¨ | |||||||||||

Marketing / Consumer Insights | ✓ | ✓ | ¨ | ✓ | ✓ | ✓ | ¨ | ✓ | ✓ | ✓ | ✓ | |||||||||||

M&A Experience | ✓ | ¨ | ¨ | ✓ | ¨ | ¨ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||

Gender / Ethnic Diversity | ¨ | ¨ | ¨ | ¨ | ✓ | ¨ | ✓ | ¨ | ¨ | ✓ | ✓ | |||||||||||

Governance | ✓ | ¨ | ¨ | ¨ | ✓ | ¨ | ✓ | ✓ | ¨ | ¨ | ¨ |

CORPORATE GOVERNANCE HIGHLIGHTS

3

STOCKHOLDER INTERESTS AND RIGHTS

We believe that strong corporate governance includes engagement with our stockholders and considering their views. In the last 12 months, we held meetings and discussions with stockholders representing more than 55% of our outstanding shares. We greatly value the feedback received from our stockholders. This engagement provides valuable insight that informs the work of both management and the board.

| RRGB Participants | | Types of Engagement | | Topics Covered | | |||||||

• Independent Directors, • Executive Management | • Stockholders (portfolio managers and corporate governance departments) • Investor conferences • Earnings conference calls • Proxy advisory firms • Prospective stockholders | • Key value drivers and competitive differentiators • Capital structure and capital allocation priorities • Key strategic initiatives and opportunities • Financial performance and goals • Board composition: qualifications, diversity, skills, and leadership structure • ESG risks and opportunities • Human capital management • Risk management • Executive compensation • COVID-19 response |

Engagement with our stockholders informed our actions in the topic areas covered above, particularly our changes to board composition, ESG strategy, human capital management disclosures, and executive compensation during 2020 and early 2021.

4

| COMPANY HIGHLIGHTS |

2020 began as a pivotal year of transformation for the Company and we entered the year with accelerating business momentum. Under a significantly refreshed board and a new CEO, Paul Murphy, the Company was making measurable progress on its turnaround plan. To that end, through the first eight weeks of fiscal 2020, the Company grew comparable restaurant revenue by 3.7%, driven in part by positive Guest count growth. Then, the COVID-19 crisis forced the Company to focus on adjusting to the impact of the pandemic.

With the onset of the pandemic in early 2020, the Company entered an unprecedented time for our business and industry. The pandemic brought forth complex challenges including severe limitations on dine-in capacity that materially reduced our traffic and sales and challenged our liquidity. In response, we reprioritized or suspended certain aspects of our strategic plan while accelerating others. With the health, safety, and well-being of Red Robin's Team Members, Guests, and communities as our top priority, we successfully shifted restaurants to an off-premise model and took action to preserve liquidity, enhance financial flexibility, and help mitigate the impact of COVID-19 on our business and to set ourselves up for the eventual recovery. Despite the challenges of the pandemic, we were able to significantly improve our operating and financial model. The material improvements we made to our business will enable us to resume our transformation in an even stronger position.

Through the pandemic, our CEO kept management focused on three priorities: (1) be a brand that survives the pandemic, (2) bring as many Team Members through the pandemic with the Company as possible, and (3) continue to make progress on the transformation strategy to position the Company well to thrive post-pandemic and beyond. These priorities also guided 2020 compensation actions, which included a temporary 20% reduction to executive officer and board member cash compensation and a shift to total shareholder return as the performance metric for our long-term incentive plan.

Despite the COVID-19 pandemic, we made significant progress on our transformation strategy during 2020 to solidify our financial longevity and develop a more robust business model, including the following accomplishments:

5

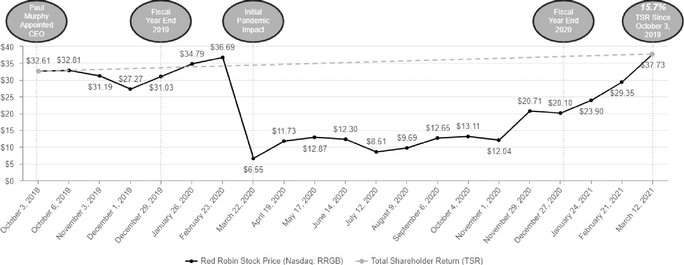

Under CEO Paul Murphy's leadership total shareholder return has increased by 15.7%. After growth in the first 8 weeks of 2020 as the Company implemented its turnaround plan, our share price decreased along with our peers during the pandemic. Our share price has shown significant improvement through the end of 2020 and early 2021 as the Company continued its transformation initiatives and positioned itself for strong recovery beyond the pandemic.

6

| SUSTAINABILITY |

Red Robin's strategy is closely tied to the communities in which it operates. Our ability to deliver long-term value for all of our stockholders is connected to the strength and long-term sustainability of each state and the overall economy and environment. This is why our board and management team are focused on collaborating with our communities to further a sustainable future.

Corporate Responsibility: Environmental, Social, and Governance (ESG)

We believe it is imperative that our ESG strategy is part of and aligned with our Company vision and overall strategy. With recent changes to our board and executive leadership teams and learnings from the ongoing pandemic, we are in the process of updating our long range strategic planning, including our ESG strategy. We have been engaging with our stakeholders to discuss the ESG topics most important to them. We are also evaluating meaningful metrics and targets for our ESG priority areas for this year and the future.

ESG is a board-level priority. The nominating and governance committee and the compensation committee oversee certain ESG related risks, but because ESG spans multiple committees, the full board retains overall ESG oversight responsibility. We believe full board oversight is important to ensure ESG is part of, and aligned with, our overall Company strategy.

Historically, our ESG practices have been focused on the following areas. See "Corporate Governance and Board Matters" for information related to our governance practices.

7

We recently launched an initiative with the assistance of a consultant to identify areas of opportunity and to support our focus and progress in creating an inclusive environment, including the development and execution of a comprehensive long-term diversity, equity, and inclusion strategy for Red Robin.

We highlight our activities in these areas in the "Sustainability" section of our corporate website at www.redrobin.com/pages/company/sustainability. We look forward to providing more information regarding our ESG strategy on our corporate website.

8

| EXECUTIVE COMPENSATION PRACTICES |

9

The Board of Directors ("board" or "board of directors") of Red Robin Gourmet Burgers, Inc. ("Red Robin" or the "Company") is providing this proxy statement to stockholders in connection with the solicitation of proxies on its behalf to be voted at the annual meeting of stockholders. The meeting will be held on Thursday, May 20, 2021, beginning at 8:00 a.m. MDT, at Red Robin's Yummm U, located at 10000 East Geddes Avenue, Unit 500, Englewood, Colorado 80112. The proxies may be voted at any time and date to which the annual meeting may be properly adjourned or postponed.

PROPOSAL 1:

ELECTION OF DIRECTORS

HOW OUR DIRECTORS ARE SELECTED, QUALIFIED, AND ELECTED

Our board of directors is highly engaged and committed to effective governance as reflected in the following actions:

Currently, 91% of our board is independent. Our board of directors consists of eleven directors, all of whom are independent except our CEO. Following the annual meeting, if all director nominees are elected, all of our directors will be independent, except our CEO. All of our directors are elected on an annual basis for a one-year term. One of our directors, Mr. Kaufman, will transition off the board effective as of December 31, 2021. He will continue on the board until year end in order to provide continuity given significant turnover on the board in the past two years. Following his departure, the board of directors intends to reduce its size to ten directors.

The directors elected at this annual meeting will serve in office until our 2022 annual meeting of stockholders or until their successors are duly elected and qualified, except for Mr. Kaufman, who will transition off the board effective as of December 31, 2021. Each of our nominees has consented to serve if elected and we expect each of them will be able to serve if elected. If any of our nominees should become unavailable to serve as a director, our board of directors can name a substitute nominee, and the persons named as proxies in the proxy card, or their nominees or substitutes, will vote your shares for such substitute nominee unless an instruction to the contrary is written on your proxy card.

The board recommends that you vote FOR all of the board's nominees to serve as directors of the Company.

10

Selecting Nominees for Director

Our board has delegated to the nominating and governance committee the responsibility for reviewing and recommending nominees for director. The board determines which candidates to nominate or appoint, as appropriate, after considering the recommendation of the committee.

In evaluating a director candidate, the nominating and governance committee considers the candidate's independence; character; corporate governance skills and abilities; business experience; industry specific experience; training and education; commitment to performing the duties of a director; and other skills, abilities, or attributes that fill specific needs of the board or its committees. Our board is committed to diversity and the nominating and governance committee considers diversity in business experience, professional expertise, gender, and ethnic background, along with various other factors when evaluating director nominees. The nominating and governance committee will use the same criteria in evaluating candidates suggested by stockholders.

The nominating and governance committee is authorized under its charter to retain, at our expense, outside search firms and any other professional advisors it deems appropriate to assist in identifying or evaluating potential nominees for director.

Below, you can find the principal occupation and other information about each of our director nominees standing for election at the annual meeting. Information related to each of our director nominee's key attributes, experience, and skills, as well as their recent public company board service is included with each director's biographical information. Our board is comprised of a highly diverse array of leaders with relevant experience and leadership in each of the key areas of greatest importance to our financial and more general sustainability. These attributes are core to our ability to be nimble and take advantage of opportunities as they arise. In 2021, all eleven of our current directors are standing for re-election. One of our directors, Mr. Glenn B. Kaufman has indicated that he will transition off the board and conclude his service effective December 31, 2021. Following his departure, the board of directors intends to reduce its size to ten directors.

| | | | | | | |

| Anthony S. Ackil, 46 Director Since: March 2020 Current Committees: ■ Audit Other Board Service: B.GOOD (2004-present) Project Bread (2018-present) b.good Family Foundation (2014-present) | • Currently serves as CEO of Streetlight Ventures, a restaurant management platform that supports, manages, acquires, and invests in small to mid-sized restaurant brands, having founded the company in 2019. • From 2004 to 2018, served as CEO of B.GOOD, a healthy fast casual brand that grew to over 80 locations under his leadership. • Earlier in his career, he worked as a consultant for IBM, focusing on internet strategy and corporate structure, and as a consultant at PricewaterhouseCoopers. • Brings to the board of directors more than 15 years of executive experience in the restaurant industry, among other skills and qualifications. • Holds a B.A. in government from Harvard University. • Based on the foregoing, our board of directors has concluded Mr. Ackil should continue as a member of our board. | |||||

| | | | | | | |

11

| | | | | | | |

| Thomas G. Conforti, 62 Director Since: August 2019 Current Committees: ■ Finance (Chair) ■ Audit Other Board Service: Vista Life Innovations (2020-present) American School for the Deaf (2020-present) | • From 2017 to 2018, served as Senior Advisor to Wyndham Worldwide, where he advised on strategic transactions. • From 2009 to 2017, served as Executive Vice President and Chief Financial Officer for Wyndham Worldwide, during which time the company's TSR significantly outperformed the market and where Mr. Conforti had direct responsibility for finance, technology, real estate, and purchasing functions. • From 2002 to 2008, served as the Chief Financial Officer for IHOP/Dinequity. • Earlier in his career, he held leadership positions at PepsiCo, Inc., KB Home, and The Walt Disney Company, among others. • Currently serves as a Senior Fellow at Harvard's Advanced Leadership Initiative. • Brings to the board of directors more than 30 years of experience in financial, strategic, and operational roles across multiple industries, including restaurant, retail, consumer, and hospitality, among other skills and qualifications. • Based on the foregoing, our board of directors has concluded Mr. Conforti should continue as a member of our board. | |||||

| | | | | | | |

| Cambria W. Dunaway, 58 Director Since: June 2014 Current Committees: ■ Nominating and Governance (Chair) ■ Compensation Other Public Company Board Service: Planet Fitness Inc. (2017-present) Other Board Service: Go Health (2017-present) Recent Past Public Company Board Service: Nordstrom FSB (2014-2017) Marketo (2015-2016) Brunswick Corporation (2006-2014) | • Since 2018, has served as Chief Marketing Officer for Duolingo, a language education platform. • Since 2017, has served as a Director of Planet Fitness, during which time the company's TSR has significantly outperformed the market. • Previously was a private consultant supporting organizations with strategic initiatives to accelerate growth and innovation, and coached leaders on how to achieve maximum results, impact, and enjoyment. • From 2010 to 2014, served as the U.S. President and Global Chief Marketing Officer of KidZania, an international location-based entertainment concept focused on children's role-playing activities. • From 2007 to 2010, served as Executive Vice President for Nintendo, with oversight of all sales and marketing activities for the company in the United States, Canada, and Latin America. • From 2003 to 2007, was Chief Marketing Officer for Yahoo! • Previously at Frito-Lay for 13 years in various leadership roles in sales and marketing, including serving as the company's Chief Customer Officer and as Vice President of Kids and Teens Marketing. • Holds a B.S. in business administration from the University of Richmond and an M.B.A. from Harvard Business School. • Brings to the board of directors more than 20 years of experience as a senior marketing and general management executive, launching and growing consumer businesses in entertainment, media, consumer electronics, and packaged goods, including experience in marketing strategy, communications, data analytics, loyalty, digital transformation, and governance including service as the Nominating and Governance Chair at Planet Fitness, Inc., among other skills and qualifications. • Based on the foregoing, our board of directors has concluded Ms. Dunaway should continue as a member of our board. | |||||

| | | | | | | |

12

| | | | | | | |

| G.J. Hart, 63 Director Since: August 2019 Current Committees: ■ Compensation ■ Finance Other Board Service: Make A Wish Foundation (2012-present) Portillo's (2014-present) James Madison University of Business (2005-Present) The Hart School (2006-present) Recent Past Public Company Board Service: Texas Roadhouse (2004-2011) | • Since 2018, has served as Chief Executive Officer for Torchy's Tacos, a privately-held fast-casual restaurant concept. • From 2011 to 2018, served as Executive Chairman and Chief Executive Officer of California Pizza Kitchen. • From 2000 to 2011, served as President of Texas Roadhouse Holdings, LLC, and as Chief Executive Officer and member of the board from 2004 to 2011, during which time the company's TSR outperformed the market and the company increased revenues from $63 million to over $1 billion. • Earlier in his career, held leadership positions at TriFoods International, New Zealand Lamb Company, and Shenandoah Valley Poultry, among others. • Brings to the board of directors more than 35 years of experience in the food and beverage industry driving growth and innovation, among other skills and qualifications. • Based on the foregoing, our board of directors has concluded Mr. Hart should continue as a member of our board. | |||||

| | | | | | | |

| Kalen F. Holmes, 54 Director Since: August 2016 Current Committees: ■ Compensation (Chair) ■ Nominating and Governance Other Public Company Board Service: Zumiez Inc. (2014-present) 1Life Healthcare, Inc. (2017-present) Other Board Service: Pacific Northwest Ballet, Advisory Board (2019-present) | • Since 2017, has served as a Director of 1Life Healthcare, during which time the company has significantly grown its revenues, members, and launched its Initial Public Offering. • From 2009 until retirement in 2013, served as Executive Vice President of Partner Resources (Human Resources) at Starbucks Corporation. • From 2003 to 2009, held a variety of leadership roles with human resources responsibilities for Microsoft Corporation. • Previously held leadership roles in a variety of industries, including high-tech, energy, pharmaceuticals, and global consumer sales. • Holds a B.A. in Psychology from the University of Texas and a M.A. and Ph.D. in Industrial/Organization Psychology from the University of Houston. • Brings to the board of directors more than 20 years of experience as a senior human resources executive, experience with management of executive and compensation programs, and management across multiple industries including retail, technology, and consumer products, among other skills and qualifications. • Based on the foregoing, our board of directors has concluded Ms. Holmes should continue as a member of our board. | |||||

| | | | | | | |

| Glenn B. Kaufman, 53 Director Since: August 2010 Current Committees: ■ Finance ■ Nominating and Governance Other Board Service: KEH Holdings, LLC (2012-present) Trading Company Holdings LLC (2014-present) KPS Global LLC (2015-Present) | • Since 2011, has been a Managing Member of the D Cubed Group, a private-market investment firm. At D Cubed, in addition to leading the firm and its investment committee, chairs the boards of KEH Holdings, Trading Company Holdings, and KPS Global. • From 2009 to 2010, consulted for boards and senior executives of operating businesses and private investment firms. • Previously spent 11 years as a Managing Director at American Securities Capital Partners as a Managing Director; spearheaded the firm's investing in the restaurants, food service and franchising, and healthcare sectors. • Previously served as Chairman or a Director of Potbelly Sandwich Works, El Pollo Loco, Press Ganey Associates, Anthony International, and DRL Holdings (parent of multiple direct-to-consumer brands). • Spent four years as an attorney at Cravath, Swaine & Moore and worked in the small business consulting group of Pricewaterhouse. • Holds a B.S. in Economics from the Wharton School of Business of the University of Pennsylvania and a law degree from Harvard University. • Brings to the board of directors valuable strategic, finance, talent management, marketing, and executive leadership experience, as well as an extensive understanding of restaurant operations, analytical direct/omni-channel marketing, and franchising, among other skills and qualifications. • Has approximately 20 years of experience as an active, engaged, private market investor and extensive restaurant, food service, franchising, healthcare, and retail expertise, as well as legal and business consulting expertise. • Based on the foregoing, our board of directors has concluded Mr. Kaufman should continue as a member of our board. | |||||

| | | | | | | |

13

| | | | | | | |

| Steven K. Lumpkin, 66 Director Since: August 2016 Current Committees: ■ Audit (Chair) ■ Finance Other Board Service: Hodgdon Powder Company (2015-present) Trading Company Holdings, LLC (2015-present) Fiorella Jack's Stack Restaurant Group (2009-present) Recent Past Public Company Board Service: Applebee's International, Inc. (2004-2007) | • Currently serves as Principal of Rolling Hills Capital Partners, a consulting firm. • From 1995 until retirement in 2007, served in various executive positions at Applebee's International, Inc., including as Chief Financial Officer and Treasurer from 2002 to 2007, during which time the company's TSR outperformed the market, and Director from 2004 to 2007. • Previously served as Executive Vice President and Director at Kimberly Quality Care, Inc. • Holds a B.S. in Accounting from the University of Missouri-Columbia and is a CPA. • Brings to the board of directors more than 30 years of experience in the management consulting, health care, and restaurant industries, among other skills and qualifications. • Has extensive M&A and management experience for franchise operations and an accounting and finance background. • Based on the foregoing, our board of directors has concluded Mr. Lumpkin should continue as a member of our board. | |||||

| | | | | | | |

| | Paul J.B. Murphy III, 66 Director Since: October 2019 Recent Past Public Company Board Service: Noodles & Company (2017-2019) Del Taco Restaurants, Inc. (2014-2017) | • Since October 2019, has served as our President, Chief Executive Officer, and Director. • From 2017 to 2019, served as Executive Chairman of Noodles & Company where he was responsible for 459 restaurants across 29 states and led a business turnaround that delivered 4 consecutive quarters of positive comparable restaurant sales growth on revenues of $457 million. • From 2009 to 2017, served as CEO and a member of the board of directors of Del Taco Restaurants, Inc., where he was responsible for 543 company-operated and franchised restaurants with revenues of $470 million and led a successful brand repositioning that resulted in 17 consecutive quarters of company-operated comparable restaurant sales growth and 11 consecutive quarters of system-wide comparable restaurant sales growth. • From 1996 to 2008, held various roles with Einstein Noah Restaurant Group, Inc.; joined as Senior Vice President, Operations and was promoted to Executive Vice President, Operations in 1998, and to Chief Operating Officer in 2002. In 2003, he was appointed President and CEO and a member of the board of directors. • Has significant experience in both operational and executive leadership in the restaurant industry, including leading companies through successful business transformations. • Brings to the board of directors over 20 years of experience in operational and executive leadership in the restaurant industry, including proven business transformation experience, among other skills and qualifications. • Based on the foregoing, our board of directors has concluded Mr. Murphy should continue as a member of our board. | ||||

| | | | | | | |

| | David A. Pace, 62 Director Since: August 2019 (Board Chair since November 2019) Current Committee: ■ Compensation Other Public Company Board Service: Tastemaker Acquisition Corporation (2020-present) Other Board Service: Dallas Stars Ownership Advisory Board (2017-present) Recent Past Public Company Board Service: Jamba Juice (2012-2018) | • Since October 2020, has served as Co-Chief Executive Officer of Tastemaker Acquisition Corporation, a special purpose acquisition company focusing on the restaurant, hospitality, and related technology and service sectors. • From 2012 to 2018, served as Director of Jamba Juice and as CEO from 2016 to 2018, during which the company delivered 8 consecutive quarters of comparable store sales growth that exceeded the industry benchmark, exited non-core and underperforming business units, and successfully merged with Focus Brands. • From 2014 to 2016, served as President of Carrabba's Italian Grill, and as Executive Vice President and Chief Resource Officer of Bloomin' Brands from 2010 to 2014. • Previously held executive positions with Starbucks Coffee Company, PepsiCo, Inc., and Yum! Brands, Inc. • Brings to the board of directors more than 30 years of leadership and turnaround experience in a range of industries including food and beverage retail, consumer products, entertainment, and ecommerce, among other skills and qualifications. • Based on the foregoing, our board of directors has concluded Mr. Pace should continue as a member of our board. | ||||

| | | | | | | |

14

| | | | | | | |

| Allison Page, 36 Director Since: February 2020 Current Committee: ■ Nominating and Governance ■ Finance Other Board Service: SevenRooms, Inc. (2011-present) Pillsbury Institute for Hospitality Entrepreneurship at Cornell University (2018-present) | • Co-Founder and President of SevenRooms, a data-driven operations, marketing, and guest engagement platform that empowers hospitality operators to maximize revenue, build brand loyalty, and enable personalized experiences across the guest journey. • Since SevenRooms' founding in 2011, has been responsible for driving product innovation; defining the company's product roadmap, vision, and strategic positioning; growing the company to over 150 employees across 4 global offices; and scaling the platform to over 250 cities worldwide. • From 2009 to 2011, served as an Associate at Hodes Weill & Associates, and was a founding member of the independent real estate and advisory business. • Began career in investment banking at Credit Suisse. • Holds a B.S. in Finance and Real Estate from The Wharton School, University of Pennsylvania. • Brings to the board of directors more than 10 years of leadership experience as an entrepreneur in the hospitality industry and in launching, building, and commercializing high-growth technology platforms at scale across global restaurant, hotel, and entertainment brands, among other skills and qualifications. • Brings extensive knowledge in the areas of technology, guest experience, guest engagement, CRM, marketing, loyalty, data analytics, and consumer trends; was named one of Hospitality Technology's 2019 "Top Women in Restaurant Technology." • Based on the foregoing, our board of directors has concluded Ms. Page should continue as a member of our board. | |||||

| | | | | | | |

| | Anddria Varnado, 35 Director Since: March 2021 Committee Service to be determined Other Public Company Board Service: Umpqua Holdings Corporation (2018-present) | • Since December 2020, has served as GM and Head of the Consumer Business at Kohler Company, a global leader in home products, hospitality destinations, and systems where she is responsible for consumer channels and ecommerce sales. • From 2019 to 2020, served as Vice President and Head of Strategy and Business Development at Macy's where she was responsible for the strategic evaluation of the future of the store and consumer. • From 2016 to 2019, served as Vice President and Head of Strategy and Business Development at Williams-Sonoma. • Prior roles include Management Consultant at ZS Associates and leadership roles at New York Life Insurance Company. • Began career as a corporate banking analyst at Citigroup. • Holds a B.A. in Business Administration from Clark Atlanta University and an M.B.A. from Harvard Business School. • Brings to the board of directors deep expertise in the areas of consumer insights and innovation, consumer engagement, and strategic planning and development, among other skills and qualifications. • Based on the foregoing, our board of directors has concluded Ms. Varnado should continue as a member of our board. | ||||

| | | | | | | |

Proposal No. 1 requires the approval of a majority of the votes cast for each director. Abstentions and broker non-votes are not considered votes cast and therefore will have no effect on the outcome of the vote.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE "FOR" ALL OF THE DIRECTOR NOMINEES.

15

CORPORATE GOVERNANCE AND BOARD MATTERS

The board of directors has created and oversees corporate governance guidelines which can be viewed on the Corporate Governance section of our website at www.redrobin.com/pages/company/investors.

Executive Development and Management Succession

Under the Company's corporate governance guidelines, the board maintains a policy and plan for the development and succession of the CEO and senior management that includes:

The nominating and governance committee:

Mr. Murphy regularly meets with the full board on his performance, and the CEO's annual performance evaluation is conducted under the oversight of the compensation committee. Our CEO conducts annual and interim performance and development evaluations of the other senior executives and reviews these evaluations with the compensation committee or full board.

Stockholder Communication with our Board

The board and management believe the Company's relationships with our stockholders and other stakeholders are an important part of our corporate governance responsibility and recognize the value of continuing communications. In the last 12 months, we held meetings and discussions with stockholders representing more than 55% of our outstanding shares.

This approach has resulted in our receiving important input and perspectives that have informed our decision making and resulted in action including the addition of new independent directors and enhanced human capital management and ESG disclosures. Throughout the year, we proactively engage with our stockholders directly, through individual meetings, attendance at investor conferences, issuance of press releases, and quarterly conference calls, as well as other stockholder communications. We discuss topics of importance to both our Company and stockholders, including value creation, strategy and

16

performance, board refreshment and leadership changes, capital structure and allocation, and governance matters.

The board values stockholder communication and provides many means for it to occur, including attending the annual meeting, voting, engaging, and writing, by sending a letter to the chair, the board of directors, or a committee addressed to: Board of Directors, 6312 South Fiddler's Green Circle, Suite 200N, Greenwood Village, CO 80111, or by sending an e-mail to the board's dedicated email address: Board@redrobin.com. Our finance committee and full board is involved in overseeing stockholder engagement.

With respect to issues arising under the Company's Code of Ethics, you may also communicate directly with the chair of the audit committee, director of internal audit, or the compliance officer in the manner provided in the Code of Ethics and the Company's Problem Resolution and Whistleblower Policy and Reporting Procedures. Both the Code of Ethics and the Problem Resolution and Whistleblower Policy and Reporting Procedures may be found on the Corporate Governance section of our website at: www.redrobin.com/pages/company/investors.

Red Robin follows the Investor Stewardship Group's (ISG)

Corporate Governance Framework for U.S. Listed Companies

| ISG Principle | Red Robin Practice | |||||||

| | | | | | | | | |

| Principle 1: Boards are accountable to stockholders | • Declassified board structure with all directors standing for election annually • Majority voting in uncontested director elections, plurality voting in contested elections, and directors not receiving majority support must tender their resignation for consideration by the board | |||||||

| | | | | | | | | |

| Principle 2: Stockholders should be entitled to voting rights in proportion to their economic interest | • No dual class structure; each stockholder gets one vote per share | |||||||

| | | | | | | | | |

| Principle 3: Boards should be responsive to stockholders and be proactive in order to understand their perspectives | • Management and board members engaged directly with investors owning more than 55% of shares outstanding in the last 12 months • Engagement topics included value creation, Company strategy and performance, board refreshment and leadership changes, capital structure and allocation, executive compensation, ESG, and governance | |||||||

| | | | | | | | | |

| Principle 4: Boards should have a strong, independent leadership structure | • Strong independent board chair • Board considers appropriateness of its leadership structure at least annually • Strong independent committee chairs • Proxy discloses why board believes current leadership structure is appropriate | |||||||

| | | | | | | | | |

17

| ISG Principle | Red Robin Practice | |||||||

| | | | | | | | | |

| Principle 5: Boards should adopt structures and practices that enhance their effectiveness | • Board members have diverse backgrounds, expertise, and skills • Currently, 91% of board members are independent • Robust board annual evaluation process and regular board education instead of arbitrary age or term limits • Active board refreshment plan; six new independent board members through refreshment in 2019-2021 • Directors attended over 88% of combined total board and applicable committee meetings in 2020 • Limits on outside board service for board members • Independent directors meet regularly in board and committee executive session without members of management present • Annual review of succession plan and talent development plan • Formal policy prohibiting hedging and pledging of Company securities by executive officers and directors | |||||||

| | | | | | | | | |

| Principle 6: Boards should develop management incentive structures that are aligned with the long-term strategy of the company | • Executive compensation program received approximately 96.9% stockholder support in 2020 • Compensation committee annually reviews and approves incentive program design, goals, and objectives for alignment with compensation and business strategies • Annual and long-term incentive programs are designed to reward financial and operational performance that furthers short- and long-term strategic objectives | |||||||

| | | | | | | | | |

The board recognizes one of its key responsibilities is to evaluate and determine the optimal leadership structure to provide independent oversight of management. At this time, we believe it is appropriate for our board to maintain the separation of the roles of board chair and chief executive officer. David Pace currently serves as chair of the board because of his significant leadership experience, especially in the food and beverage retail industry.

The separation of the roles of board chair and chief executive officer allows our chief executive officer to focus on managing the Company's business and operations, and allows Mr. Pace to focus on board matters, which we believe is especially important in light of the high level of regulation and scrutiny of public company boards. Further, we believe the separation of these roles ensures the independence of the board in its oversight role of evaluating and assessing the chief executive officer and management generally.

Our executive officers have the primary responsibility for enterprise risk management within our Company. Our board actively oversees the Company's risk management and regularly engages in discussions of the most significant risks the Company faces and how these risks are being managed.

The full board receives regular reports on enterprise risk areas from senior officers of the Company, including regarding COVID-19 related risks, human capital management, food safety, and cyber security.

The board delegates certain risk oversight functions to the audit committee. Under its charter, the audit committee is responsible for oversight of the enterprise risk assessment and management process and ensures the board or a designated committee is monitoring the identification, assessment, and

18

mitigation of all significant enterprise risks. Robust discussion of enterprise risk management (ERM) is held at the full board level. The audit committee oversees policies and guidelines that govern the process by which major financial and accounting risk assessment and management may be undertaken by the Company. The audit committee also oversees our corporate compliance programs and the internal audit function.

In addition, the other board committees receive reports and evaluate risks related to their areas of focus. The finance committee actively oversees the company's risks related to liquidity and access to capital. The nominating and governance committee and the compensation committee oversee certain ESG related risks, but because ESG spans multiple committees, the full board retains overall ESG oversight authority. The committees regularly report to the full board on the assessment and management of risks that fall under their purview.

The board believes the work undertaken by its committees, the full board, and the senior officers of the Company, enables the board to effectively oversee the Company's risk management.

Selection of Nominees for the Board

A key role of the board is to ensure that it has the skills, expertise, and attributes needed in light of the Company's strategy, challenges, and opportunities. The board believes that there are skill sets, qualities, and attributes that should be represented on the board as a whole but do not necessarily need to be possessed by each director. The nominating and governance committee thus considers the qualifications and attributes of incumbent directors and director candidates both individually and in the aggregate in light of the current and future needs of the Company. The nominating and governance committee assists the board in identifying and evaluating persons for nomination or renomination for board service or to fill a vacancy on the board. The nominating and governance committee's evaluation process does not vary based on whether a candidate is recommended by a stockholder, a board member, a member of management, or self-nomination. Once a person is identified as a potential director candidate, the committee may review publicly available information to assess whether the candidate should be further considered. If so, a nominating and governance committee member or designated representative for the nominating and governance committee will contact the person. If the person is willing to be considered for nomination, the person is asked to provide additional information regarding his or her background; his or her specific skills, experience, and qualifications for board service; and any direct or indirect relationships with the Company. In addition, one or more interviews may be conducted with nominating and governance committee and board members and nominating and governance committee members may contact one or more references provided by the candidate or others who would have first-hand knowledge of the candidate's qualifications and attributes.

19

with environmental and social issues and stakeholder concerns, and other factors that the committee considers appropriate in the context of the needs of the board;

The board considers the recommendations of the nominating and governance committee and then makes the final decision whether to renominate incumbent directors and whether to approve and extend an invitation to a candidate to join the board upon appointment or election, subject to any approvals required by law, rule or regulation.

The Board's Role in Management Succession Planning

The board, led by its nominating and governance committee, is actively engaged in succession planning and talent development, with a focus on the CEO and senior management of the Company. The board and the nominating and governance committee consider talent development programs and succession candidates through the lens of Company strategy and anticipated future opportunities and challenges. At its meetings throughout the year, the board and nominating and governance committee review progress of talent development and succession programs and discuss internal and external succession candidates, including their capabilities, accomplishments, goals, and development plans. The full board also reviews and discusses talent strategy and evaluations of potential succession candidates. In addition, potential leaders are given exposure to the board, which enables the board to select successors for the senior executive positions when appropriate.

Board Membership and Director Independence

Our board of directors has determined that each of our directors, except our CEO, Mr. Murphy, qualifies as an independent director under the rules promulgated by the SEC and The Nasdaq Stock Market® ("Nasdaq") listing standards. Therefore, 91% of our current directors are independent. Following the annual meeting, if all directors are elected, all of our continuing directors will be independent, except our CEO. Pursuant to SEC and Nasdaq rules and standards, only independent directors may serve on the board's audit committee, compensation committee, and nominating and governance committee. All members of all board committees are independent in accordance with SEC rules and Nasdaq listing standards. There are no family relationships among any of our executive officers, directors, or nominees for directors.

Our board is committed to diversity and as such includes directors with gender and ethnic diversity and a diverse set of backgrounds, experience, and skills, including:

✓ Executive leadership ✓ Business transformation ✓ Technology strategy ✓ Marketing and consumer insights ✓ Governance ✓ Accounting | ✓ Talent, human capital, and organizational development ✓ Finance, investor relations, strategic transactions, and M&A ✓ Restaurant executive leadership ✓ Value creation |

20

The board of directors held 14 meetings in 2020, including 1 in-person meeting in early 2020. Our board and committees met more frequently and primarily over video conference during 2020 due to the COVID-19 pandemic. Each of our current directors who served in 2020 attended at least 88% of the aggregate total of meetings of the board of directors and committees during their period of service in 2020. The non-management directors of the Company meet at least quarterly throughout the year and as necessary or appropriate in executive sessions at which members of management are not present.

The board of directors strongly encourages each of the directors to attend the annual meeting of stockholders. Nine of our ten directors serving at the time attended our 2020 annual meeting. One director was unable to attend due to technical difficulties joining via teleconference.

Our board of directors currently has four standing committees: an audit committee, a compensation committee, a finance committee, and a nominating and governance committee. The board added a finance committee in 2019 to provide guidance on long-range planning, budget and capital allocation, and extraordinary stockholder engagement, among other matters. Each standing committee generally meets at least once each quarter. In addition, other regular and special meetings are scheduled as necessary and appropriate depending on the responsibilities of the particular committee. Each committee regularly meets in executive session without management present. Each board committee operates pursuant to a written charter. The charter for each committee is available on the Corporate Governance section of our website at www.redrobin.com/pages/company/investors. Committee charters are reviewed at least annually by the respective committee to revise and update its duties and responsibilities as necessary.

| | | | | | | | | |

| Name of Committee and Principal Functions | | Current Members and Number of Meetings in 2020 | | |||||

| | | | | | | | | |

| Audit Committee | Committee Members: | |||||||

• Oversees our financial reporting activities, including our annual report and the accounting standards and principles followed • Reviews earnings releases and annual and quarterly reports, including use of any non-GAAP disclosures • Oversees the disclosure process, including understanding and monitoring of the Company's disclosure committee • Selects and retains the independent auditor • Participates in the process to rotate and select the lead audit partner at least every five years • Reviews scope and results of audit to be conducted by the independent auditor • Evaluates performance and monitors independence, commitment to objectivity, and skepticism of selected independent auditor • Approves the budget for fees to be paid to the independent auditor for audit services and non-audit services; evaluates fees for reasonableness and fairness based on benchmarking • Oversees the Company's internal audit function, scope and plan, and the Company's disclosure and internal controls • Oversees the Company's ethical and regulatory compliance • Provides oversight of the Company's enterprise risk management • Regularly meets with independent auditor in executive session • Participates in the evaluation of independent auditor and lead audit partner | Steven K. Lumpkin Thomas G. Conforti Anthony A. Ackil

Number of Meetings in 2020: The audit committee held eight meetings in 2020, all of which were held via videoconference. | |||||||

| | | | | | | | | |

21

| | | | | | | | | |

| Name of Committee and Principal Functions | | Current Members and Number of Meetings in 2020 | | |||||

| | | | | | | | | |

| Compensation Committee | Committee Members: | |||||||

• Develops and performs an annual performance evaluation of our CEO • Approves salary, short-term, and long-term incentive compensation programs for the CEO and all executive officers • Reviews and adopts employee benefit plans • Oversees compensation and benefits related ESG areas • Reviews and approves compensation for directors • May engage its own compensation consulting firms or other professional advisors to assist in discharging its responsibilities, as necessary | Kalen F. Holmes Cambria W. Dunaway G.J. Hart David A. Pace

Number of Meetings in 2020: The compensation committee held nine meetings in 2020, all of which were held via videoconference. | |||||||

| | | | | | | | | |

| Nominating and Governance Committee | Committee Members: | |||||||

• Identifies, evaluates, and recommends to the board of directors, candidates for appointment or election to the board and their independence • Determines whether to recommend to the board to include the nomination of incumbent directors in the proxy statement • Considers candidates to fill any vacancies that may occur • At least once a year, considers whether the number of directors and skill sets is appropriate for the Company's needs and recommends to the board any changes in the composition of the board • Evaluates and recommends to the board committee structure and membership • Develops and oversees the Company's corporate governance policies • Oversees governance related ESG areas • Oversees the Company's litigation and insurance coverage • Oversees the process to assess the performance of the board and its committees | Cambria W. Dunaway Kalen F. Holmes Glenn B. Kaufman Allison Page

Number of Meetings in 2020: The nominating and governance committee held six meetings in 2020, all of which were held via videoconference. | |||||||

| | | | | | | | | |

22

| | | | | | | | | |

| Name of Committee and Principal Functions | | Current Members and Number of Meetings in 2020 | | |||||

| | | | | | | | | |

| Finance Committee | Committee Members: | |||||||

• Participates in and provides guidance to the board of directors and management on: o material acquisitions and dispositions o long range planning o annual budget o capital allocation (including share repurchase programs and 10b5-1 plan) o adjustments to capital structure o extraordinary stockholder engagement | Thomas G. Conforti G.J. Hart Glenn B. Kaufman Steven K. Lumpkin Allison Page

Number of Meetings in 2020: The finance committee held twelve meetings in 2020, all of which were held via videoconference. | |||||||

| | | | | | | | | |

The board recognizes that a robust and constructive board evaluation process is essential to its effectiveness. As such, the board and each committee conduct annual evaluations to determine whether it and its committees are functioning effectively. As part of the evaluation process, each director also evaluates his or her own performance and periodically completes peer evaluations of the other directors, designed to assess individual director performance. The evaluation process is overseen by the nominating and governance committee, in consultation with the board chair. Outcomes of the evaluation process have been used to inform board succession planning, committee memberships, chair service, and enhancements to board effectiveness.

| | | | | | | |

| Review of Evaluation Process & Assessment Guides | Assessment Guides & Evaluation Forms | One-on-One Discussions | Evaluation Results | |||

• Nominating and Governance Committee reviews process and assessment guide forms | • Drive robust discussion and valuable feedback • Focus on efficiency and effectiveness, board and committee composition, quality of board discussions, quality of materials and information provided, and board culture | • One-on-one discussions between each member of the board and either the nominating and governance committee chair, board chair, or both, regarding evaluation results | • Final evaluation results discussed with each committee and the full board in executive session | |||

| | | | | | | |

23

The Company has entered into agreements to indemnify its directors, executive officers, and certain other key employees. Under these agreements, the Company is obligated to indemnify its directors and officers to the fullest extent permitted under the Delaware General Corporation Law for expenses, including attorneys' fees, judgments, fines, and settlement amounts incurred by them in any action or proceeding arising out of their services as a director or officer. The Company believes these agreements are necessary in attracting and retaining qualified directors and officers.

Limits on Outside Board Service

As provided in our corporate governance guidelines, without specific approval from our board, no director of the Company may serve on more than four public company boards (including the Company's board) and no member of the audit committee may serve on more than three public company audit committees (including the Company's audit committee). Any audit committee member's service on more than three public company audit committees will be subject to the board's determination that the member is able to effectively serve on the Company's audit committee.

Stockholder Submission of Director Nominees

A stockholder may submit the name of a director candidate for consideration by the nominating and governance committee by writing to: Nominating and Governance Committee of the Board of Directors, Red Robin Gourmet Burgers, Inc., 6312 South Fiddler's Green Circle, Suite 200N, Greenwood Village, CO 80111.

The stockholder must submit the following information in support of the candidate: (a) all information relating to such person as would be required to be disclosed in solicitations of proxies for the election of such nominees as directors pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and such person's written consent to serve as a director if elected; and (b) as to the stockholder giving the notice and the beneficial owner, if any, on whose behalf the nomination or proposal is made (i) the name and address of such stockholder, as they appear on the Company's books, and of such beneficial owner, (ii) the class and number of shares of the Company that are owned beneficially and of record by such stockholder and such beneficial owner, (iii) a description of any agreement, arrangement, or understanding (including any derivative or short positions, profit interests, options, warrants, convertible securities, stock appreciation or similar rights, hedging transactions, and borrowed or loaned shares) that has been entered into as of the date of such stockholder's notice by, or on behalf of, such stockholder and such beneficial owner, whether or not such instrument or right shall be subject to settlement in underlying shares of capital stock of the Company, the effect or intent of which is to mitigate loss to, manage risk of share price changes for, or increase or decrease the voting power of, such stockholder or such beneficial owner, with respect to shares of stock of the Company, and (iv) whether either such stockholder or beneficial owner intends to deliver a proxy statement and form of proxy to holders of, in the case of a proposal, at least the percentage of the Company's voting shares required under applicable law to carry the proposal or, in the case of a nomination or nominations, a sufficient number of holders of the Company's voting shares to elect such nominee or nominees.

Certain Relationships and Related Transactions

For 2020, we had no material related party transactions which were required to be disclosed in accordance with SEC regulations.

The board of directors recognizes transactions between the Company and certain related persons present a heightened risk of conflicts of interest. To ensure the Company acts in the best interest of our

24

stockholders, the board has delegated the review and approval of related party transactions to the audit committee. Pursuant to our Code of Ethics and the audit committee charter, any related party transaction required to be disclosed in accordance with applicable SEC regulations must be reviewed and approved by the audit committee. In reviewing a proposed transaction, the audit committee must:

After its review, the audit committee will only approve or ratify transactions that are fair to the Company and not inconsistent with the best interests of the Company and our stockholders.

Compensation Committee Interlocks and Insider Participation

During the last completed fiscal year, Cambria W. Dunaway, G.J. Hart, Kalen F. Holmes, and David A. Pace each served as members of the Company's compensation committee for all or a portion of such period. None of the members of the compensation committee is, or at any time has been, an officer or employee of the Company. None of our current executive officers serves as a director of another entity that has an executive officer who serves on our board.

25

The compensation program for our directors is set forth in the table below. The director compensation program is evaluated annually by the compensation committee's independent consultant to assess the program's alignment with the market. As a result of the analysis, the committee chair fee for the nominating and governance committee was updated in the fourth quarter of 2020 to maintain market median levels. In light of the impact of COVID-19 on the global business environment and on the Company's stock price, the compensation committee temporarily reduced non-employee director cash compensation in order to reduce costs. In March 2020, the Company temporarily reduced the annual cash retainer and committee chair fees by 20%. These fees were not reinstated until Q4 2020. Directors did not receive repayment for the lost wages when payment was restored.

| | | | | | | | | | | | | | |

| Annual Retainer | | Each non-employee director of the Company receives an annual cash retainer of $70,000, payable in substantially equal quarterly installments. In addition, the chair of the board and each board committee chair receive annual retainers in substantially equal quarterly installments: | |||||||||||

| | Chair of the board | $ | 85,000 | |||||||||

| | | | Chair of audit committee | $ | 15,000 | ||||||||

| | | | Chair of compensation committee | $ | 12,500 | ||||||||

| | | | Chair of nominating and governance committee | $ | 10,000 | * | |||||||

| | | | Chair of finance committee | $ | 10,000 | ||||||||

| * Chair fee increased from $7,500 to $10,000 beginning in Q4 2020 based on review of market data to align with the market median. | ||||||||||||

| | | | | | | | | | | | | | |

| Equity Awards | | Each non-employee director receives an annual grant of restricted stock units with a grant date value of approximately $110,000 and a vesting term of one year or the date of the next annual meeting of stockholders, whichever is earlier. The vesting term is consistent with the Company's declassification of its board of directors with annual elections for one-year terms (until the next annual meeting) in accordance with governance best practices. | |||||||||||

| | | | | | | | | | | | | | |

The following table sets forth a summary of the compensation earned by our non-employee directors in fiscal 2020.

| Name | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2) | All Other Compensation ($)(3) | Total ($) | ||||

|---|---|---|---|---|---|---|---|---|

Current Directors* | ||||||||

Anthony S. Ackil(4) | 67,603 | 128,332 | - | 195,935 | ||||

Thomas G. Conforti | 72,000 | 109,995 | - | 181,995 | ||||

Cambria W. Dunaway | 71,000 | 109,995 | - | 180,995 | ||||

G.J. Hart | 63,000 | 109,995 | - | 172,995 | ||||

Kalen F. Holmes | 74,250 | 109,995 | - | 184,245 | ||||

Glenn B. Kaufman | 63,000 | 109,995 | - | 172,995 | ||||

Steven K. Lumpkin | 76,500 | 109,995 | - | 186,495 | ||||

David A. Pace | 139,500 | 109,995 | - | 249,495 | ||||

Allison Page(5) | 77,192 | 146,655 | - | 223,847 | ||||

Former Directors |

| |||||||

Stuart I. Oran(6) | 8,093 | - | - | 8,093 |

26

As of the end of the fiscal year 2020, the aggregate number of options and restricted stock units outstanding for each non-employee director is set forth below. Options are considered outstanding until exercised and restricted stock units are considered outstanding until vested and paid.

| Director | Options | Restricted Stock Units | ||

|---|---|---|---|---|

Anthony S. Ackil | - | 9,063 | ||

Thomas G. Conforti | - | 7,768 | ||

Cambria W. Dunaway | 5,000 | 7,768 | ||

G.J. Hart | - | 7,768 | ||

Kalen F. Holmes | 5,000 | 7,768 | ||

Glenn B. Kaufman | - | 7,768 | ||

Steven K. Lumpkin | 5,000 | 7,768 | ||

David A. Pace | - | 7,768 | ||

Allison Page | - | 10,357 | ||

Former Directors | ||||

Stuart I. Oran | - | - |

Director Stock Ownership Guidelines

The compensation committee has stock ownership guidelines in place for non-employee directors which require non-employee directors to own Company securities with a cumulative cost basis of at least five times the director's annual retainer. Based on the current annual retainer for non-employee directors, that dollar amount is $350,000. The value of each director's holdings is based on the cumulative cost basis of securities held, which is calculated using the price of the Company's common stock at the date of acquisition. All forms of equity owned of record or beneficially, including vested in-the-money options, are credited toward the guidelines. New non-employee directors have five years from the time the director joins the board to reach the minimum ownership threshold. Non-employee directors may not sell, transfer, or otherwise dispose of common stock that would decrease such director's cumulative cost basis below the ownership guideline amount. All of our directors are currently in compliance or on track to be in compliance with the guidelines at this time. In addition, a majority of directors have not sold any of their awarded shares.

27

COMPENSATION DISCUSSION AND ANALYSIS

In this Compensation Discussion and Analysis, we provide an analysis and explanation of our executive compensation program and the compensation derived from this program by our executive officers, including our "named executive officers." For 2020, our named executive officers were:

Former officer included as a Named Executive Officer for 2020 as required by SEC rules:

Red Robin is committed to building long-term stockholder value. Our executive compensation program is designed to pay for performance and link incentives to current and long-term sustained achievement of Company strategic and financial goals. This executive summary provides an overview of our fiscal 2020 performance, compensation actions, and compensation outcomes based on pay for performance alignment. References to "2020" herein are to the Company's fiscal year ended December 27, 2020.

2020 COMPANY OPERATIONAL AND PERFORMANCE HIGHLIGHTS

2020 began as a pivotal year of transformation for the Company and we entered the year with accelerating business momentum. Under a significantly refreshed board and a new CEO, Paul Murphy, the Company was making measurable progress on its turnaround plan. To that end, through the first eight weeks of 2020, the Company grew comparable restaurant revenue by 3.7%, driven in part by positive Guest count growth. Then, the COVID-19 crisis forced the Company to adjust and respond to the impact of the pandemic.

With the onset of the pandemic in early 2020, the Company entered an unprecedented time for our Guests, Team Members, business, and industry. The pandemic brought forth complex challenges including severe limitations on dine-in capacity that materially reduced our traffic and sales and challenged our liquidity. With the health, safety, and well-being of Red Robin's Team Members, Guests, and communities as our top priority, we successfully shifted restaurants to an off-premise only model and took action to preserve liquidity, enhance financial flexibility, and help mitigate the impact of COVID-19 on our business and to set ourselves up for the eventual recovery. Despite the challenges of the pandemic, we were able to significantly improve our operating and financial model. The material improvements we made to our business will enable us to resume our transformation strategy in an even stronger position as we emerge from the pandemic.

28

Through the pandemic, our CEO kept management focused on three priorities: (1) be a brand that survives the pandemic, (2) bring as many Team Members through the pandemic with the Company as possible, and (3) continue to make progress on the transformation strategy to position the Company well to thrive post-pandemic and beyond. These priorities also guided 2020 compensation actions, which included a temporary 20% reduction to executive officer and board member cash compensation and a shift to total shareholder return as the performance metric for our long-term incentive plan.

Despite the COVID-19 pandemic, we made significant progress on our transformation strategy during 2020 to solidify our financial longevity and develop a more robust business model, including the following accomplishments.

29

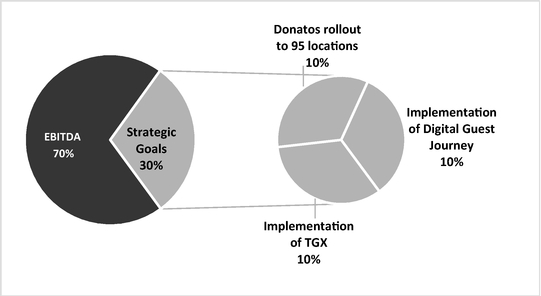

Our incentive programs demonstrate our commitment to a pay for performance compensation philosophy. The Company made multiple positive changes to its compensation program beginning in 2020 prior to the pandemic:

Prior to the pandemic, the compensation committee set 2020 compensation for our named executive officers as follows:

Annual Performance-Based Incentive

30

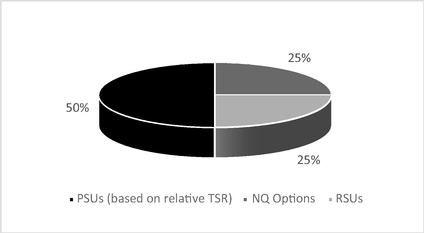

Long-Term Performance-Based Incentive

The Company's performance and its response to the COVID-19 pandemic impacted 2020 compensation actions. In light of the impact of COVID-19 on the global business environment and on the Company's stock price, the compensation committee took certain additional actions with respect to the 2020 compensation program in order to meaningfully reduce costs and set performance targets that were most appropriate given the uncertainty and challenges at that time:

31

The Company's challenged 2020 performance impacted our named executive officers' compensation outcomes, consistent with our commitment to a pay for performance compensation philosophy. Based on 2020 performance, the compensation committee:

See "Compensation Discussion and Analysis—Key Components of our Executive Compensation Program—Incentive-Based Compensation" for further information on the annual corporate incentive and long-term incentive program. See "Compensation Discussion and Analysis—2020 Executive Compensation—2020 Recognition Awards" for further information on the discretionary bonus paid for contributions in 2020.

32

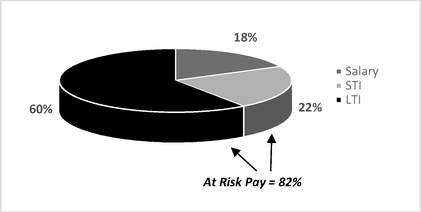

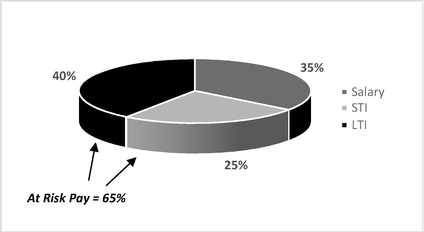

Our executive compensation program is designed to pay for performance and link incentives to current and long-term sustained achievement of Company strategic and financial goals. It encourages our executive officers to think and act like owners, because they are owners and as such are compensated in significant part based on the performance of the Company.

Our compensation objectives are designed to link incentives and rewards with current and long-term sustained achievement of these goals:

Our compensation program is designed to pay for performance and is comprised of performance-based short-term and long-term incentive awards. Such compensation varies in value and is at-risk of forfeiture or reduced payout if performance goals are not achieved or our stock price declines. Performance metrics used for the annual and long-term cash incentive grants are reviewed and approved by the compensation committee. Restricted stock units and stock options vest ratably over multiple years, the value of which is dependent, in whole or in part, on an increase in the Company's stock price.

COMPENSATION DECISION PROCESSES

The compensation committee approves target total direct compensation levels for named executive officers by establishing base salaries and setting annual and long-term incentive compensation targets. When appropriate, the committee also approves special awards and relatively modest perquisites. The Company makes pay decisions based on a variety of factors, including:

33

CONSIDERATION OF PRIOR SAY-ON-PAY VOTES

At our 2020 annual meeting of stockholders, 96.9% of votes were cast to approve the advisory "say on pay" vote on the 2019 compensation of our named executive officers. This is the third consecutive year of over 90% support for our "say on pay" proposal, with 90.7% of stockholders voting to approve our "say on pay" proposal in 2019 and 99.3% in 2018.

We believe the level of support we received from stockholders for the last three years was driven in part by our commitment to a pay for performance philosophy and our linking incentives to current and long-term sustained achievement of Company strategic goals. The compensation committee considered the results of the advisory vote when setting executive compensation for 2020 and will continue to do so in future executive compensation policies and decisions. We regularly engage with our stockholders and this engagement provides valuable insight that informs the work of both management and the board, including in the areas of executive compensation. In the last 12 months, we held meetings and discussions with stockholders representing more than 55% of our outstanding shares. See "Proxy Summary—Stockholder Engagement" for more discussion about our engagement with our stockholders, including Company participants and topics covered.

Restaurant peer group companies were selected and approved by the compensation committee upon the recommendation of management and the committee's independent compensation consultant and are based on their similarity to us with respect to several criteria, including revenue, size, business model, and scope. The peer group used for 2020 compensation benchmarking consists of the 18 restaurant companies identified in the chart below. No changes to the peer group were made in 2020 and therefore the same peer group is being used to set 2021 compensation.

| Peer Group | | |||

|---|---|---|---|---|

| Biglari Holdings, Inc. | Dine Brands Global, Inc. | |||

| BJ's Restaurants, Inc. | Domino's Pizza, Inc. | |||

| Brinker International, Inc. | Fiesta Restaurant Group, Inc. | |||

| Carrols Restaurant Group, Inc. | Jack in the Box, Inc. | |||

| The Cheesecake Factory, Inc. | Noodles & Company | |||

| Chuy's Holdings, Inc. | Papa John's International, Inc. | |||

| Cracker Barrel Old Country Store, Inc. | Ruth's Hospitality Group, Inc. | |||

| Dave & Buster's Entertainment, Inc. | Texas Roadhouse, Inc. | |||

| Denny's Corporation | The Wendy's Company | |||

34

2020 Compensation Setting. The compensation committee uses competitive compensation data from the annual total compensation study of peer and other restaurant companies and other relevant survey sources to inform its decisions about overall compensation opportunities and specific compensation elements. Additionally, the compensation committee uses multiple reference points when establishing targeted compensation levels. The committee applies judgment and discretion in establishing targeted pay levels, considering not only competitive market data, but also factors such as company, business unit, and individual performance, scope of responsibility, critical needs and skill sets, leadership potential, and succession planning.

INDEPENDENT COMPENSATION CONSULTANT