- CIT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Cit (CIT) 8-KFinancial statements and exhibits

Filed: 9 Jun 04, 12:00am

Opening Remarks

Albert R. Gamper, Jr.

Chairman and Chief Executive Officer

Exhibit 99.1

1

1

Solid Management Team

Seven Key Take Aways

Diversification

Slice of North American Economy

Outstanding Corporate Governance

Commitment to Financial Strength

Enduring Business Model

Achievable Earnings and ROE Targets

2

2

2

2

2

Credit Overview

Lawrence A. Marsiello

Vice Chairman and Chief Credit Officer

3

3

Balance of Financial and Collateral Analysis

4

4

Customized Risk Management Processes by Asset Class

Flow Businesses

Highly Credit Intensive

Automated Processes with Rapid Response

Behavioral Science Applications

Transaction Businesses

Traditional Cash-Flow Analysis

Collateral/Equipment Expertise

Relationship Based Lending

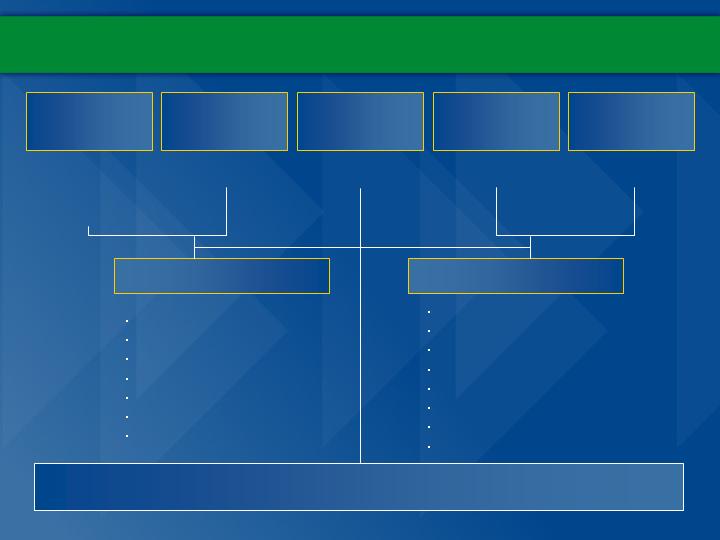

Credit Risk Management Organization

Corporate Credit Risk Management

Lawrence A. Marsiello

Vice Chairman

Chief Credit Officer

31 Years Experience

Anthony

Lombardi

Commercial

Services Clients

34 Years Experience

David

Bram

Commercial

Services Customers

36 Years Experience

John

O’Kane

Business

Credit

26 Years Experience

Bruce

Ells

Capital

Finance

18 Years Experience

Bill

Schumm

Specialty

Finance Consumer

29 Years Experience

Bill

Stoddard

Equipment

Finance

35 Years Experience

Thomas

Abbate

Administration &

Credit Audit

34 Years Experience

Timothy

Bennett

Capital & Commercial

Finance

23 Years Experience

Kenneth

Brown

Equipment &

Specialty Finance

23 Years Experience

Operating Group – Risk Management

Ken

Wendler

Specialty

Finance Commercial

16 Years Experience

Credit quality is a core competency woven into CIT’s heritage and culture

5

5

Collaborative effort between corporate and operating group credit teams

Credit Risk Management

Establish credit authorities by business

and industry

Align risk limits with risk-return tolerances

across various asset classes

Monitor CIT-wide industry, geographic,

collateral and single obligor concentrations

Assess the credit quality of targeted

acquisitions

Ensure adherence to credit risk management

policies, practices and processes

Corporate Functions

Operating Group Functions

Underwrite quality transactions within

established policies and procedures

Manage portfolio returns via risk-based

pricing strategies

Conduct routine monitoring and maintenance

of the portfolios

Maintain a high quality collection effort and

collateral monitoring program

Engage in problem loan workouts - Formulate

exit strategies and recommend reserves

6

6

Credit Risk Management Framework

Pre-approved underwriting criteria frame credit risk tolerances

Target Market Definitions (TMD) – Delineate markets and industries in

which an operating company is permitted to do business

Risk Acceptance Criteria (RAC) – Details acceptable transaction

structures, credit profiles and required returns by industry and product

RAC and TMD are approved by the Executive Credit Committee

and are updated annually

80% of transactions submitted for credit approval should conform

to pre-defined TMD and RAC

Operating Group compliance to standards is monitored by

the Corporate Credit Audit unit

7

7

Credit Risk Management Systems

Credit Scoring Systems

Automated commercial and proprietary

models rating a prospective client’s credit

worthiness

Typically used in flow businesses

with individual obligor exposures of

< $350K

Frequently updated to reflect shifts

in performance based on empirical

data

Risk Grading Systems

Numeric rating systems assessing the

probability of default and potential loss

based on:

Obligor risk

Facility risk

Global Exposure System

Centralized customer identification repository linking exposures across multiple business lines

Robust data supports real-time pricing and credit decisions

8

8

Continuous Portfolio Monitoring

Quarterly Asset Quality Review

Rigorous review of portfolio by Credit Risk

Management, Controllers and Operating

Groups

Discuss trends in predictive credit metrics

such as delinquencies and non-performers

Analyze and track default rates and review

loss projections

Monthly Surveillance Meetings

Report problem loans and review risk grades

Review collateral coverage and repayment

ability to estimate potential loss

Enhance predictability with respect to risk-return characteristics

Ad Hoc Portfolio Meetings

Driven by AQR findings or market

developments

Focus on select asset classes and obligor

groups

9

9

Finance Receivables vs Operating Leases

Cease accruing rent at 90 days

past due or sooner

Asset write-down through

depreciation (reduction in lease

margin)

Lost rental income for lease term

(reduction in lease margin)

Depreciate asset irrespective of

payment status

Rental payment

Operating Leases

Collateral realization (to the

extent the credit fails)

Equipment/Collateral

Exposure

Receivable balance net of

collateral value (charge-off)

Maximum

Credit Exposure

Amortize loan balance upon

receipt of payment

Asset Balance

Cease accruing interest at 90

days delinquent or sooner

Revenue Recognition

Full receivable balance

Delinquency

Finance Receivables

10

10

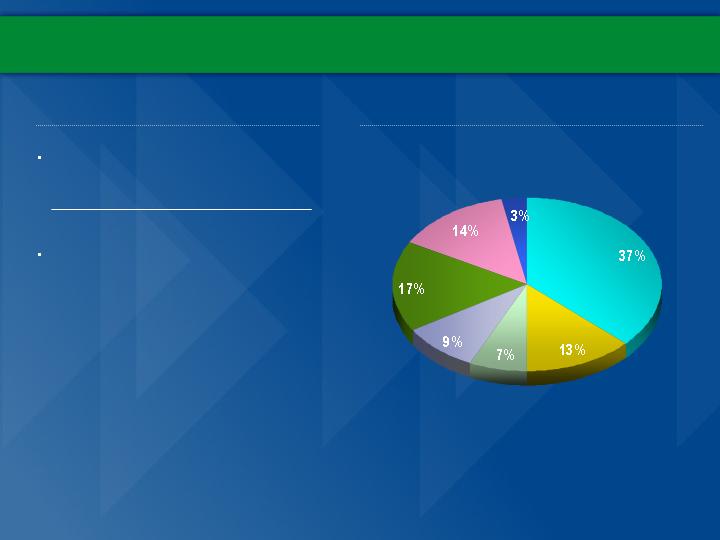

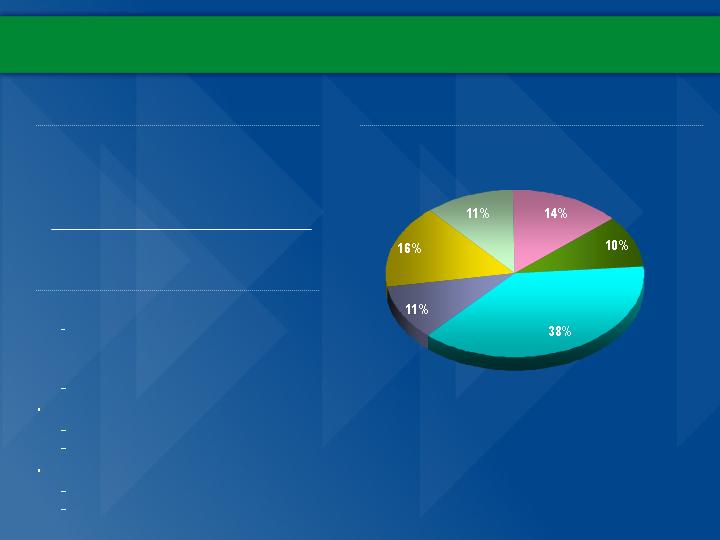

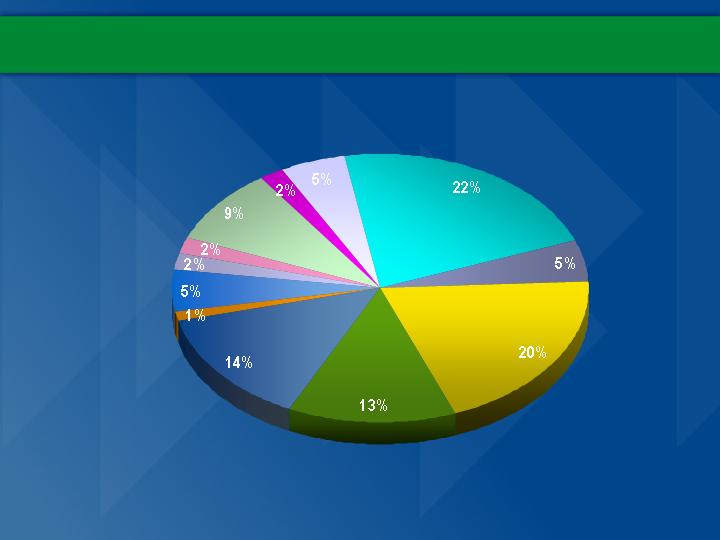

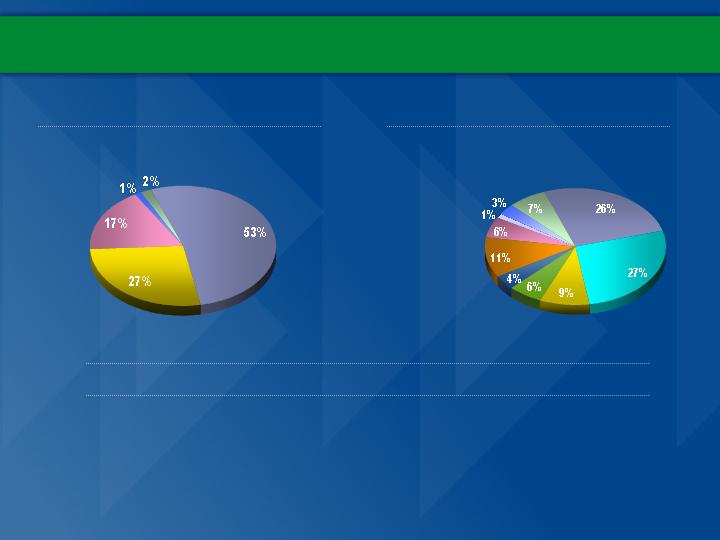

Portfolio Diversification

Geography

Asset / Collateral Type

Industries Served

Northeast

International

Canada

Southwest

Southeast

Midwest

West

A/R and

Inventory

Revolvers

Technology

Manufacturing

Construction

Transportation

- Land

Other*

Real Estate-Res

Manufacturing

Commercial Air

Consumer

Mortgage

Transportation

Services

Consumer Other

Construction

Wholesale

Communication

Auto

Other*

Retail

Transportation

- ComAir

Transporation

-CorpAir

Real Estate-Ind

*no collateral/industry greater than 3%

11

11

Top 10 Single Obligor Exposures

12

12

Total balance of $2.3 billion or 5.5% of finance and leasing assets at 3/31/04

Customer Industry

Amount (millions)

Loan/Lease

CIT Division

Retail

$359

Loan

Commercial Services

Aerospace

$267

Lease

Capital Finance

Rail

$240

Lease

Capital Finance

Aerospace

$238

Lease

Capital Finance

Power

$204

Loan

Structured Finance

Aerospace

$197

Lease

Capital Finance

Aerospace

$191

Lease

Capital Finance

Retail

$186

Loan

Commercial Services

Retail

$185

Loan

Commercial Services

Construction

$185

Loan

Equipment Finance

Top 10 Non-Accruals

13

13

Total balance $147 million or 0.4% of finance and leasing assets at 3/31/04

Customer Industry

Amount (millions)

CIT Division

Manufacturing

$23.8

Structured Finance

Telecom

$17.9

Structured Finance

Construction

$17.7

Equipment Finance

Construction

$15.0

Business Credit

Telecom

$13.6

Structured Finance

Manufacturing

$13.4

Business Credit

Telecom

$13.3

Structured Finance/Business Credit

Telecom

$13.0

Structured Finance

Telecom

$ 9.8

Structured Finance

Construction

$ 9.7

Equipment Finance

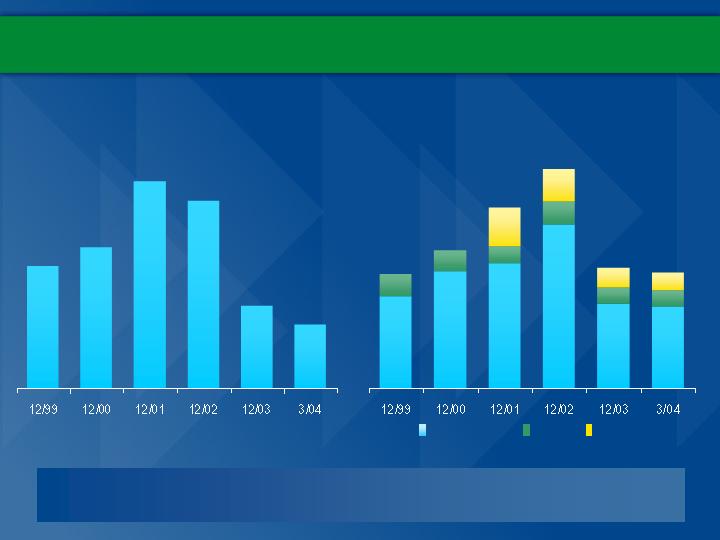

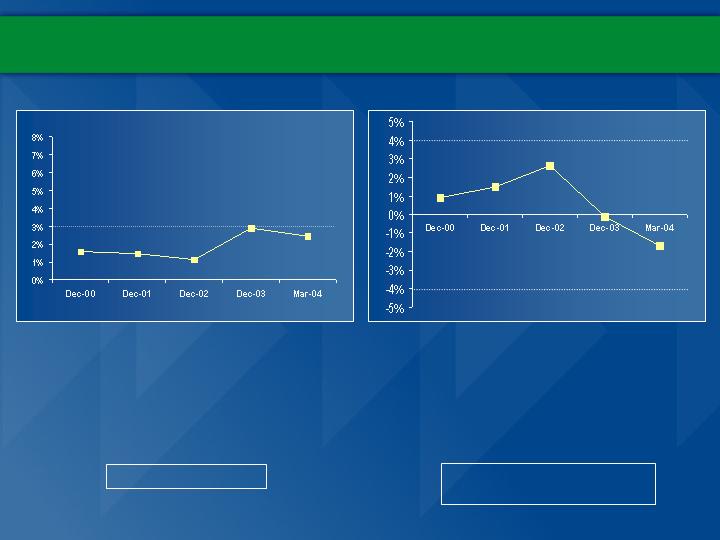

Historic Credit Losses

14

Credit Losses by Segment*

Structured Finance

Commercial Finance

Specialty Finance

Equipment Finance

*Excludes Telecom, Liquidating, Argentine and other non-recurring losses.

15

Equipment Finance – A Case Study

Allocated additional resources

to impacted portfolios

Office closures

Tightened underwriting standards

Lowered LTVs

Created a specialized work-out

group to address problem loans

Deflation in equipment values

Exited challenged markets

Economic slow down

Action Taken

Situation

16

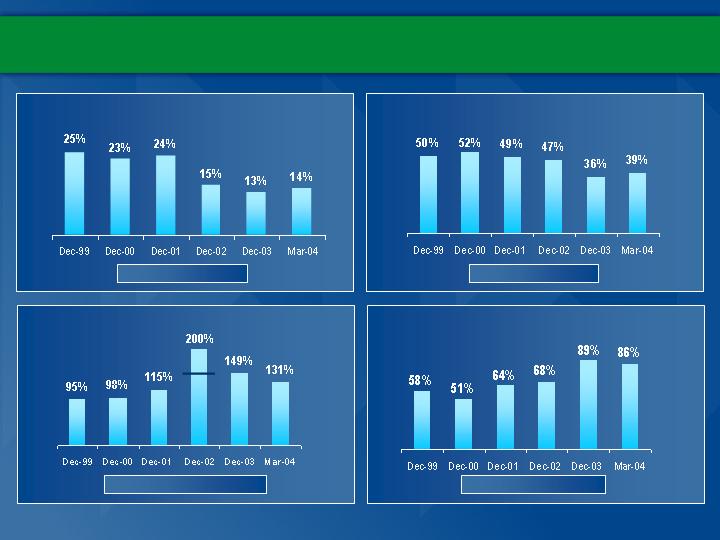

Credit Metrics

Owned Delinquency 60+ days

Liquidating

Repo

Non-Accrual

3.24%

2.47%

2.05%

3.93%

2.16%

Non-Performing Assets

2.07%

Sharp improvement in forward markers

2.71%

2.98%

3.90%

3.63%

2.16%

1.89%

17

Reserves

General Reserves to Finance Receivables

Telecom

General

Argentine

18

Topical Areas

Liquidating Portfolios

Aerospace

Argentina

Telecommunications

Currency issue; not credit

Sold remainder Q2-2004 at slight gain

Ongoing claim against Argentine Government

$874 million Down from $2.0 billion March 2001

2/3rds Manufactured Housing

1/3rd RV, Marine, Franchise, Trucking

$519 million total exposure to sector

$191 million with CLECs

$93 million remaining reserve 1.4 times NPAs

19

$4.7 billion portfolio

Receiving management focus

Asset management business

(collateral vs credit)

New fundings limited to order book

Risk Management: A Dynamic Disciplined Process

Upgrade risk taking skills

Drive risk-based pricing

Thin portfolio concentrations

Enhance systems and processes

Improve predictability of credit performance

The “C” in CIT still stands for Credit

20

Specialty Finance

Thomas B. Hallman

Vice Chairman

21

Market Focus

Flow Business

Consumer Finance

Government Guaranteed/Small

Business Lending

International

Major Vendor

Small & Mid-Ticket Leasing

Overview

Leadership Team

Tom Hallman, Vice Chairman

30 years experience

Senior Leadership Team (8 members)

Average experience: 22 years

Key Profitability Drivers

Operating efficiency through scale

Use of differentiated technology

Residual gains through end-of-lease management

Predictable credit results

22

Key Statistics

Headquarters:

Livingston, NJ

Employees:

3,000 in 23 countries

Market Presence:

Market leader in

chosen franchises

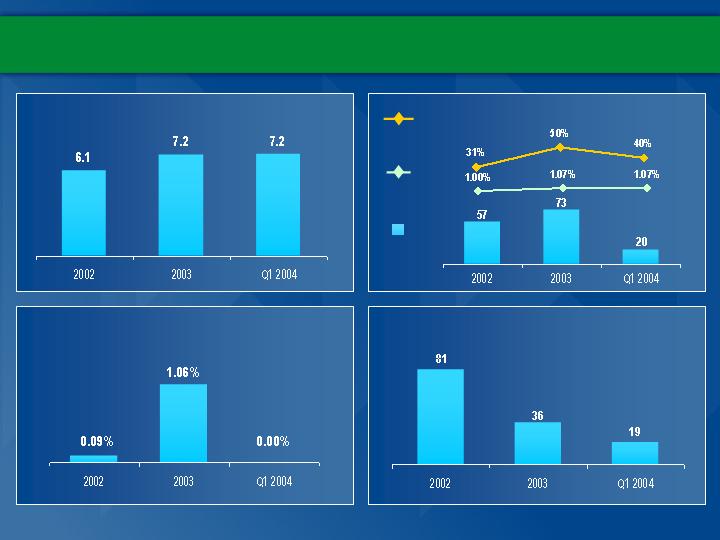

Specialty Finance: Financial Summary

Note: 2002 data excludes impact of SBL/TRS portfolios transferred to Specialty in 2003.

Operating Efficiency ($ millions)

Managed Assets ($ billions)

Net Income ($ millions)

Charge-offs (% AFR)

% of

AMA

Operating

Expenses

Efficiency

Ratio

370

415

23

ROE Trend

Q1 and Q2 2002 results include $2.1

billion in Home Equity securitizations

Q1 and Q2 2002 exclude $135 million

reserves related to Argentina de-

dollarization

Cost of Funds fully allocated to

Business Units starting Q1 2003

Returns strong and improving

Volume and assets growing

Relationship base expanding

Factors Impacting Performance

Current Environment

Return on Equity

24

Systems - PC/Servers/Printers

$235-245 billion in PC spending expected in 2004

PC shipments up 16% year-over-year to 41.2

million units

Strong growth expected to continue

Networking Equipment

$52.1 billion market

Networking growth up 5.4% year-over-year

A leader in providing financing to the US direct and

reseller markets

Strong growth expected to continue

Storage

$24.4 billion market

Storage growth 1.6% year-over-year

Increased market penetration by CIT expected

Targeted Technology Markets

Sources: IDC, InfoTech and CIT

PBX/IP-PBX/Key Systems

$20-30 billion market

Telephony growth flat at 2.3% but IP-PBX growth

forecasted at 34%

Avaya #1 or #2 in Worldwide Enterprise and IP

Telephony, Applications and Services

After declines since 1999, increased

capital spending is driving growth 2004+

25

Specialty Finance Overview

Global provider of lending and leasing solutions to consumers and

commercial customers of manufacturers, distributors, dealers and

brokers

Diverse customer base

Broad product offering

Differentiated technology

Diverse equipment classes

Customer behavior-based models

Global reach

26

Extensive market knowledge

Thousands of relationships with

manufacturers, distributors, brokers

and dealers

BrokerEdge PLUS CIT DigitalEdge

Robust e-Commerce platforms

State-of-the-art call center systems

Comprehensive risk management

systems and analytics

Conducts business in 23 countries

Over 3 million customers worldwide

Over $19 billion in managed assets

Specialty Finance – Core Strengths

27

27

Specialty Finance – Business Segments

Consumer/

Home Equity

Small

Business

Lending

International

Major Vendor

Small &

Mid-Ticket

Leasing

Large,

National

Home Equity

Lender

CIT Bank

#1 SBA

Lender in US

Leader in

Technology

Leasing

#1 in Point-of-

Sale Equipment

Leasing

Agilent

Avaya

Dell

Snap-On

Spanning 23

Countries

$5.1B in

Managed Assets

$1.6B in Serviced

Assets (Sales

Financing)

$1.1B in

Managed Assets

$1.5B in

Serviced Assets

$1.8B in

Managed Assets

$7.4B in

Managed Assets

$2.2B in

Managed Assets

28

Specialty Finance – Financial Target

Exceeds

Exceeds

Small & Mid-Ticket Leasing

Exceeds

Exceeds

Specialty Finance

Exceeds

Exceeds

Major Vendor

Below

Exceeds

International

Exceeds

Exceeds

Small Business Lending

Below

Exceeds

Consumer

Return on

Equity of 15%

Managed Asset

Growth of 8-10%

Corporate Target

29

Market Strategies / Growth Opportunities

Grow assets 10% or more year-over-year

Supplement organic growth with ‘Bolt-on’ acquisitions, such as GTS

Expand relationship base through targeted business

development efforts

Exploit international growth opportunities, particularly in Europe

Leverage consumer capability to support vendors with

consumer/commercial financing requirements

Increase utilization of CIT Bank as a strategic resource

Target high growth areas in key industries such as Technology

30

Consumer Finance

National home equity and consumer finance lender

$3.4 billion in 2003 originations

31 home equity area offices in major markets of US

4000+ mortgage brokers driving originations

CIT Bank originates consumer loans and lines of credit for consumers of

manufacturers and distributors

Virtually all originations are web-based through BrokerEdge.com for

home equity loans

31

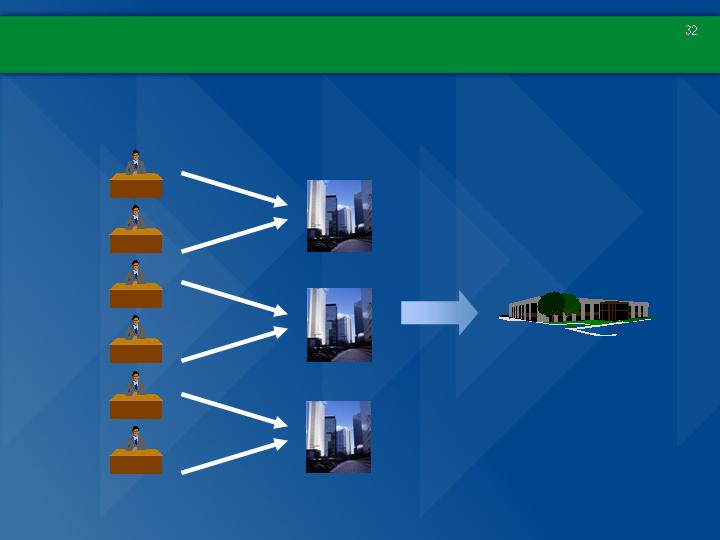

Mortgage Brokers

CIT Market Presence

CIT Servicing

Brokers originate loan

applications/packages

Application through closing via the

internet

Low cost servicing provider

31 CIT locations in major markets

National servicing center in Oklahoma City

4,000+ Brokers

Home Equity – How It Works

32

Home Equity – Competitive Differentiators

31 Office national platform located in major MSA’s enables CIT to

provide “best-in-class” levels of customer service

CIT’s “BrokerEdge” web-based technology provides mortgage brokers

access to CIT products, pricing and programs in real-time to more

effectively manage response times to their borrowers

Broad product set offers our clients multiple financial solutions

Credit expertise and servicing capabilities drive favorable industry

comparisons

These differentiators have proven to be effective throughout

various interest rate cycles and market conditions

33

Home Equity – Portfolio Demographics

34

34

Average Amount Financed

$94,500

FICO

630

Debt Ratio

38%

First Liens

91%

Annual Income

$86,074

Length of Employment

9 Years

Length of Residence

8 Years

LTV

74%

Small Business Lending

The nation's #1 SBA lender for the last four years

$812 million in annual originations

Floating rate loans to small/medium businesses for equipment,

real estate, acquisitions and working capital

Designated a “preferred lender” by the SBA

Differentiators

National origination capability

Scale and efficiency

On-line technology – originations / processing

SBL’s website and online SBA loan application are

located at www.smallbizlending.com

Focused on targeted segments

SBA Lending – Market Position*

*Compiled by Coleman Publishing from Data Provided by the SBA

CIT’s market share has increased 50% since 2000

36

2003 SBA 7(a)

Rank

Competition

Guaranteed Loans

Market Share

1

CIT

$ 753

million

6.7%

2

Wells Fargo

476

4.2

3

Business Loan Express

434

3.8

4

US Bancorp

432

3.8

5

Comerica Bank

370

3.2

6

Others

$8,835

78.3

TOTAL

$11,300

million

100.0%

International

Global presence

$1.2 billion in 2003 originations

Leasing and lending capabilities span 23 countries

Vendor relationships around the world

Target new global and regional vendors

Partner with vendors in wide range of industries

Customize partnerships based on local market requirements

Differentiators

Intellectual capital

Online originations technology

Servicing capabilities

Credit scoring and risk management systems and analytics

Risk-based pricing

Geographical presence

37

($ in millions)

79 Employees

$294 Assets

$201 Volume

142 Employees

$329 Assets

$175 Volume

377 Employees

$859 Assets

$621 Volume

82 Employees

$282 Assets

$252 Volume

100 Employees

$312 Assets

$144 Volume

Singapore

Malaysia

China

Hong Kong

Korea

Taiwan

Australia

New Zealand

Mexico

Colombia

Brazil

Chile

Canada

Scandinavia

UK

Ireland

Benelux

France

Spain

Italy

Germany

Switzerland

International Presence

38

38

39

39

President, Major Vendor Finance

Jeffrey D. Simon

Major Vendor

40

F

F

i

i

n

n

a

a

n

n

c

c

i

i

a

a

l

l

S

S

e

e

r

r

v

v

i

i

c

c

e

e

s

s

Providing a compelling alternative to traditional 3rd

party vendor finance programs or wholly owned

captives

$5.8 billion in 2003 originations

Customized partnerships with vendors

characterized by common interests

Sales

Earnings

Customer control

Channel management

Integration with front end sales, order

management and fulfillment processes and

systems

Centralized global service delivery network

provides

Local originations and credit decisions

Centralized shared services

Efficient processes and systems

“Cutting edge” information technology systems

Major Vendor – Agilent Financial Services

41

Type of Agreement:

Highly structured vendor program

Name of Entity:

Agilent Financial Services

Purpose of Entity:

Provide leases/loans to Agilent customers worldwide

Ownership:

100% CIT

Inception:

2000

Maturity:

2005

Last Extension:

n/a

Governance:

1) Equal representation on Advisory Board

2) CIT manages all day-to-day activity

Markets:

Electronics, Semiconductor and Telecommunication Industries

Growth Opportunity:

Grow with Agilent, increase penetration of current

business and grow as Agilent’s markets recover from

recent downturn

Major Vendor – Avaya Financial Services

42

Type of Agreement:

Virtual Joint Venture

Name of Entity:

Avaya Financial Services

Purpose of Entity:

Provide financial services to Avaya customers

Ownership:

100% CIT

Inception:

1984

Maturity:

2006

Last Extension:

2003

Governance:

1) Equal representation on “Board of Directors”

2) CIT manages all day-to-day activities

3) Serviced through CIT Communications Finance

Markets:

Small Business through Fortune 100

Growth Opportunity:

Increase penetration and grow as telecommunications

market recovers

Major Vendor – Dell Financial Services

43

Type of Agreement:

True joint venture

Name of Entity:

Dell Financial Services (DFS)

Purpose of Entity:

Provide financial services (other than

credit cards) to Dell customers in the US

Ownership:

70% / 30% - Dell/CIT

Inception:

April 1997

Maturity:

2005

Last Extension:

2000

Governance:

Equal representation by Dell and CIT plus one

independent third party

Markets:

Consumers through Fortune 500

Growth Opportunity:

Continue to grow with Dell and increase penetration

Major Vendor – Snap-On Credit

44

Type of Agreement:

True joint venture

Name of Entity:

Snap-On Credit, LLC

Purpose of Entity:

Provide financial services to Snap-On Tools customers

Ownership:

50% Snap-On Tools / 50% CIT

Inception:

1999

Maturity:

2006

Last Extension:

2000

Governance:

1) Equal representation on Board of Directors

2) Snap-On Credit manages all day-to-day activities

3) Services through Snap-On Credit

Markets:

Automotive technical professionals

Growth Opportunity:

Continue to penetrate US market and expand geographically

Major Vendor – Growth Strategies

Increase penetration within current vendor relationships

Expand product and markets within current relationships

Identify and sign-up new partners

Utilize international capability as a catalyst for new, large domestic

business relationships

45

46

46

President, Small & Mid-Ticket Leasing

Ron G. Arrington

Small & Mid-Ticket Leasing

Market Leader in Leasing point-of-sale (POS),

office products, IT and telecom equipment in the

US and Canada

$1.2 billion in annual originations

Originating business through thousands of sales

persons of Independent Sales Organizations

(ISOs), manufacturers and dealers

Customers include Fortune 1000 and

middle-market businesses

Differentiators

Superior online service delivery

Customer behavioral databases

Scale

Small & Mid-Ticket Leasing – Market Approach

Indirect Market

Value added financing solutions to

customers of

Manufacturers

Distributors

Resellers

Leverage clients’ sales infrastructure

Direct Market

Provide financing to Fortune 1000

and middle market customers

Work closely with business partners

Manufacturers

Integrators/Outsourcing

Distributors

48

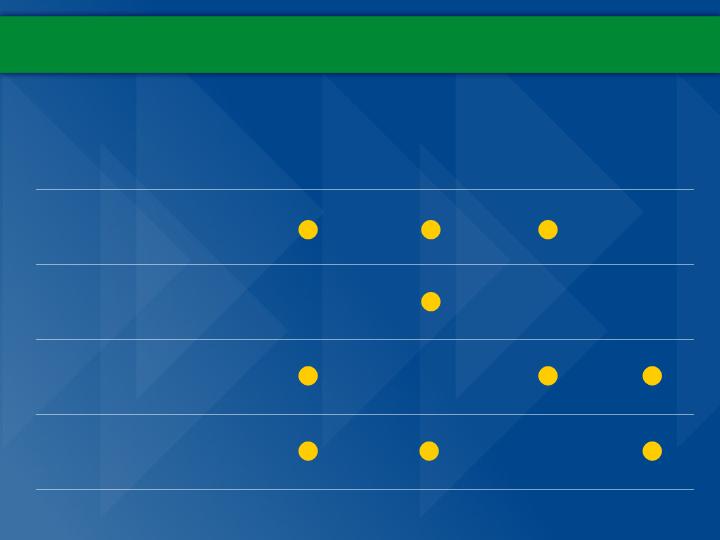

Small & Mid-Ticket Leasing: Markets

Office and Technology – Provides value added financing and services to

manufacturers, distributors and resellers for the sale of office and technology

equipment in the US and Canada. Equipment types include copiers, PC’s, printers,

servers and other technology equipment

Point-of-Sale – Equipment leasing operation for point-of-sale equipment to small and

mid-size retail merchants throughout the US and Canada

Mid-Ticket Technology – Technology equipment leasing provided directly to Fortune

1000 and middle market customers utilizing relationships with manufacturers, resellers

and distributors. Equipment types include servers, network equipment and mid-range

systems

Telecommunications – Leases telecom equipment to Fortune 1000 and middle

market companies working directly with end users

49

Small & Mid-Ticket Leasing – Distribution Channels

Telecommunications

Mid-Ticket Technology

Point-of-Sale

Office and Technology

Direct

Brokers

ISO / Dealers

Manufacturers

50

Small & Mid-Ticket Leasing – Growth Strategies

Indirect Market

Expand vendor relationship base

Increase penetration with existing

vendors

Continue to enhance our origination

and servicing technology

Identify portfolio acquisition targets

Direct Market

Expand sales force

Increase manufacturer and integrator

relationships

Capitalize on synergies within the

small and mid-ticket businesses

Identify portfolio acquisition targets

(e.g. GTS)

51

52

52

Vice Chairman

Thomas B. Hallman

Achieve 10%+ Owned Asset Growth in 2004

Establish new relationships

Expand into new markets

Add new products and geographies within current customer case

Increase penetration within current customer base

Specialty Finance – Business Growth

53

53

Commercial Finance

John F. Daly

President, Commercial Services

Victor D. Russo

President, Business Credit

54

Key Statistics

Headquarters: New York, NY

Employees: 1120

Market Presence:

Leading provider of asset-based, cash flow

and retail financing to middle market

companies

Largest US factoring company

Market Focus

Business Credit

Asset-based and cash flow lending

Acquisition, recapitalizations, restructuring and DIP financing

Commercial Services

Factoring, credit protection and working capital

Serves retail and consumer product industry

Overview

Leadership Team

John F. Daly, President, CIT Commercial Services

31 years experience

Victor D. Russo, President, CIT Business Credit

21 years experience

Senior Leadership Team (14 members)

Average experience: 27 years

Key Profitability Drivers

Business Credit

Disciplined underwriting and portfolio management

Fee generation opportunities

Customized client service

Commercial Services

Factored volume

Advance rates

Risk-based pricing

Operating efficiency

55

Financial Summary

Operating Efficiency ($ millions)

Managed Assets ($ billions)

Charge-offs (% AFR)

Net Income ($ millions)

% of

AMA

Operating

Expenses

Efficiency

Ratio

56

ROE Trend

Competitive landscape

Credit cycle

Risk premiums extremely high in late 2002

through mid 2003

Strong operating leverage

Improving credit quality

Refinancings and acquisitions

Restructurings

Non-traditional competitors are entering market

Risk premium pricing not as readily available

Credit losses near historical lows

Continued strong operating expense leverage

Factors Impacting Performance

Current Environment

Return on Equity

57

2004 Performance Expectations

Exceeds

Below

Commercial Finance

Exceeds

Meets

Business Credit

Exceeds

Below

Commercial Services

Return on Equity

of 15%

Managed Asset

Growth of 8-10%

58

59

59

John F. Daly

President, CIT Commercial Services

Commercial Services

Market Focus

Accounts Receivable Protection

Credit insurance companies

ACI

AIG

Coface

Hedge funds

Amrock

Fortress

Fifth Avenue Fund

Credit Information Services

D & B

Bookkeeping &

Collection Services

Bookkeeping firms

Collection agencies

D & B

Creditek

Asset-Based Financing

Money center banks

Regional banks

Finance companies

60

60

Competitive Advantages

Core competencies of credit, administration and collections

Technological advantages

Comprehensive on-line system enables clients to view detailed credit and

collection account information in real-time

Most credit decisions are systems-generated resulting in approved

orders within seconds

Clients can customize reports on-line

Streamlined internal processes result in quick credit decisions and

efficient collections

Why do business with CIT?

One-stop solution for factoring and borrowing needs

Broad range of services, competitively priced

61

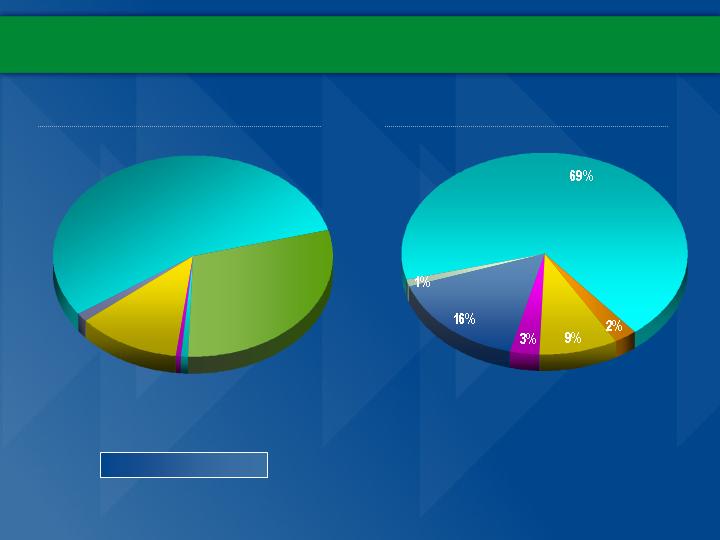

Portfolio Composition

Products/Services Offered

Industries Served

Women's &

Children's

Apparel

Men's Apparel

Footwear

Textiles

Furniture &

Home

Furnishings

Consumer

Goods

Other

Data as of December 31, 2003

62

Financial Products:

(millions)

Trade Receivables

$5,037

ABL / Overadvances

1,413

Total Managed Assets

$6,450

Financial Services:

(millions)

Factored Volume

$9,137

Distribution/Marketing Channels

Business

Development

Sales Force

Industry

Professionals

Cross-sell from

Other CIT

Units

63

Client Demographics

2,100 clients

Many clients have been with CIT for over 25 years, some dating back to the 1930’s

Clients range in size from $2 million in annual sales to Fortune 500 companies

Primarily in apparel, textiles, footwear, furniture, home furnishings, housewares,

consumer electronics and other consumer goods industries

Sell into retail channels of distribution

Factoring volume

Ranges from $2 million to $500 million per year

85% of clients factor $25 million or less with CIT

Asset-based loans

Agent and underwrite loans up to $100 million

Typical hold position is $30 million

64

GE & HSBC Acquisitions

Successful Integrations

Acquired GE factoring portfolio September 2003

Acquired HSBC factoring portfolio December 2003

Fully integrated both purchases within 60 days of closing

Additional staffing complete

Post conversion – all systems are operating satisfactorily

First quarter ’04 revenue exceeded plan

Challenges

Client retention

Maintaining service levels

Opportunities

Sell additional CIT services to acquired clients

65

Market Strategies / Growth Opportunities

Demand for factoring and credit protection services remain high as companies seek to

reduce customer credit exposures

Continued demand for asset-based lending services as borrowers are confronted with

contraction in the banking industry

Benefit from trend in outsourcing non-strategic functions to reduce costs in credit,

accounts receivable bookkeeping and collections

Leverage presence in Shanghai and Hong Kong with Asian manufacturers looking for

credit protection on US sales

Expand beyond core industries with new products offerings such as Concentration Risk

Management and E-TAD

66

Business Initiatives

Concentration Risk Management

A solution for companies with high customer concentrations

Credit line approvals and customer guarantees

Reduces potential for bad-debt losses

“E-TAD” - Electronic Trade Acceptance Draft

Electronic payment obligations from a buyer to a supplier payable

on a future date, just like a check

Fee-based service for CIT’s credit protection service and ability

to advance payment to the seller

Value-added solutions for companies seeking

credit protection and payment expertise

67

68

68

Victor D. Russo

President, Business Credit

Business Credit

Asset-Based Lenders

Congress Financial

Foothill

PNC Business Credit

LaSalle Business Credit

Cash Flow Lenders

Antares

Madison Capital

Dymas Financial

Merrill Lynch Capital

Lenders providing both asset-based and cash flow solutions

CIT, GE Capital, Bank of America

Regional banks

Money center banks: JP Morgan, Citibank, Goldman Sachs, Deutsche Bank

Hedge Funds

Business Development Companies

Market and Competitive Analysis

69

69

Business Overview

Asset-Based

Lending

Retail

Media and

Communications

Corporate

Finance

Secured by accounts receivable, inventory, fixed assets and intangibles

Tranche B loans as part of senior financing facilities

Cash-flow based senior debt financing

Target market: Equity sponsor groups

Specialized group targeting public and private retailers nationwide

Specialized group providing senior debt and advisory services

Target market: Equity sponsor groups, end users in telecommunications,

TV, radio, etc.

Providing total financing solutions to middle market companies

70

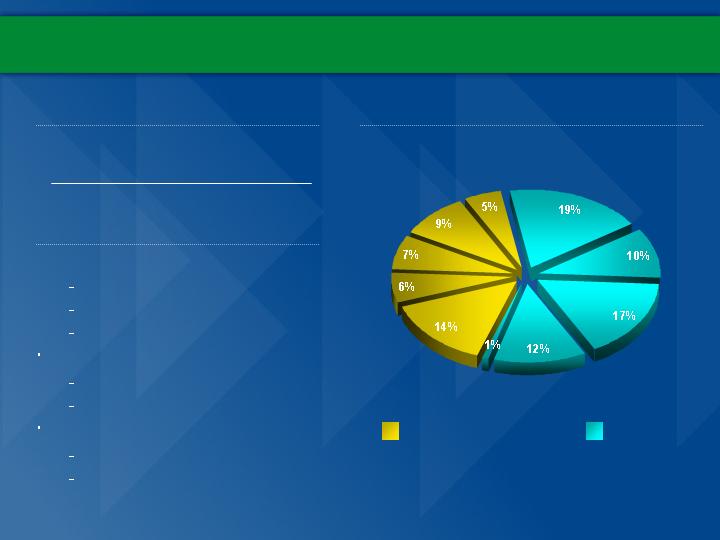

Portfolio Composition

Portfolio Breakdown (millions)

Industries Served

Other

Wholesale

Retail

Media

Manufacturing

Communications

71

Asset-Based Lending

$

3,554

Cash Flow Lending

552

Media

749

Communications

543

Total Managed Assets

$

5,398

Products Offered

Asset-Based Lending

Used for acquisitions, growth, refinancing,

leveraged buyouts, turnaround financing,

DIP and exit financing

Tranche B Loans

Corporate Finance (Cash Flow)

Acquisition financing

Recapitalizations

Specialty Groups

Retail Finance Group

Media and Communications

Core Competencies

Disciplined credit process with experienced credit managers

Strong origination, credit and portfolio management skills

Known and respected by borrowers, referral sources and

other lenders

Industry specializations in retail, media and communications

Dedicated origination, underwriting and portfolio staff

Industry focus supports in-depth knowledge of customers,

valuations, industry trends and important intermediaries

Long-term franchise with expertise in managing through

industry cycles

72

Borrower Demographics

Asset-Based Lending Borrowers

550 public and private companies with annual sales of $30 million+

Senior revolving and term debt secured by accounts receivable, inventory and fixed

assets

Hold positions generally up to $50 million

Agents and underwrites positions up to $600 million

Cash Flow Lending Borrowers

75 portfolio companies largely owned by private equity sponsor groups

Senior debt based on a multiple of EBITDA and enterprise valuations

Hold positions is generally up to $15 million

Media and Communications Borrowers

125 companies with typical deal sizes ranging from $10-$100 million

Hold positions generally up to $25 million

Senior debt based on multiple of EBITDA and/or asset valuations

73

Distribution/Marketing Channels

Investment Banks

Cross-sell from other

CIT units

Direct Prospect

Calling

Attorneys

Accountants

Turnaround

Consultants

Equity Sponsors

Other Lenders

74

74

2004 Business Combination

Media and Communications transferred to Business Credit

in April 2004

Synergies

Both target middle market companies

Similar origination channels

Similar credit culture, underwriting, portfolio skills and process

Overlapping financing solutions (combination of asset-based

and cash flow)

Benefits

Leverage capital markets network to syndicate loans

Draw upon expertise and experience in turnaround situations

and DIP financing

75

Media and Communications – Portfolio

Media 58%

Communications 42%

Portfolio Breakdown (millions)

Industries Served

Media-Other

CLEC

LEC-ILEC/RLEC

Tower

Wireless

Publishing

Cable

Television

Radio

Comm-Other

76

Media

$

749

Communications

543

Total Managed Assets

$

1,292

Products Offered

Senior debt

Acquisition, growth financing

Term loans, revolving lines of credit

Bridge financing

Mezzanine debt

Subordinated debt

Convertible instruments

Investment banking services

Capital formation

Balance sheet restructuring

Business Credit Growth Opportunities

Leverage origination expertise to win more deals

Arrange total financing by bringing in junior lenders to provide second

tier financing

Exploit increased liquidity in mezzanine lending market created by hedge

funds and other new entrants

Leverage syndication capabilities to work with other lenders

Continue to build upon middle market platform

Addition of media and communications broadens reach into middle market companies

Asset-based, corporate finance, media and communication and retail are all

sourced via a common referral base

Build platform for additional specializations to leverage calling efforts,

syndications, systems and operations

Expand lending capabilities outside of United States

Build upon media and communication’s UK presence by offering asset-based

lending and corporate finance in the United Kingdom

77

Equipment Finance

Roy W. Keller, Jr.

President

78

Key Statistics

Headquarters: Tempe, AZ

Employees: 770

Market Presence:

Industry leader in dealer/manufacturer

programs in the U.S.

Leader in both transportation and

direct healthcare markets in Canada

Market Focus

Flow Business

Secured equipment lender in construction, industrial,

healthcare, business aircraft, sports/gaming

Dealers, manufacturers and end-users

Overview

Leadership Team

Roy W. Keller, Jr., President

31 years experience

Senior Leadership Team (13 members)

Average experience: 25 years

Key Profitability Drivers

Asset Growth

Credit Costs

Operating Efficiency

79

Operating Efficiency ($ millions)

Managed Assets ($ billions)

Charge-offs (% AFR)

Net Income ($ millions)

Financial Summary

% of

AMA

Operating

Expenses

Efficiency

Ratio

80

ROE Trend

Low levels of capital spending

Glut of equipment pressuring collateral

values

Aggressive pricing by captives to

stimulate manufacturing parent

Tighter underwriting criteria negatively

impacted volumes

Positive results from annual construction

industry survey

Initial signs of pick-up in business

investment and capital spending

Reduced repossessed inventory levels

within portfolio

Increased liquidity among clients

Return on Equity

Factors Impacting Performance

Current Environment

81

2004 Performance Outlook

Below

Below

Equipment Finance

Meets

Meets

Canada

Below

Exceeds

Specialized

Below

Below

C & I

Return on

Equity of 15%

Managed Asset

Growth of 8-10%

82

Business Overview

Premium brand name

Industry leader in key markets:

Construction equipment

Manufacturing

Corporate aircraft

Wide range of product offerings including

direct financing programs with equipment

manufacturers and dealers

Collateral and equipment management

expertise

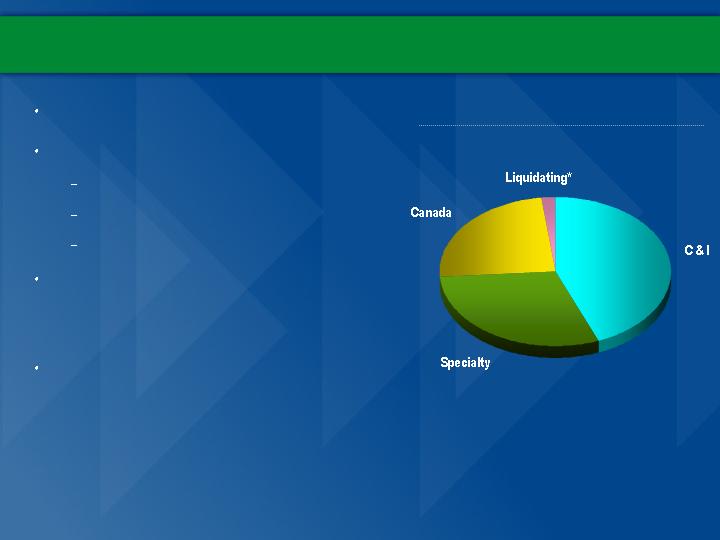

Assets by Operating Division

* Liquidating Portfolios include Franchise

Finance & Owner Operated Trucking

44%

30%

24%

2%

83

Construction & Industrial Profile

National Account

Division

East Region

Southwest

Region

West Region

8 DSMs

Serves vendors

& manufacturers

nationwide

17 DSMs

18 DSMs

17 DSMs

16 DSMs

Construction Equipment

Industrial Equipment

Printing

Imaging

Extruding

Packaging

Machine tools

Plastic injection molding

Fitness

Other light equipment

Great Lakes

Region

Centralized credit, funding, collections and portfolio management (Tempe, AZ)

84

Lifting

Ground engagement

Hauling

Vocation transport

Material handling

Crushing

Paving

Growth Strategies – C & I

Construction

Leveraging existing customer relationships

Improving quality of field force

Expanding dealer/manufacturer relationships through shared customer marketing

Placing stronger emphasis on tele-sales to follow on small balance customers

Industrial

Increasing direct call activity in printing and machine tool markets

Expanding manufacturer vendor relationships in printing and machine tool

industries

Establishing strategic alliances in the other industrial markets

Using ‘One CIT’ to expand industrial business segment

85

Centralized credit, funding, collections and portfolio management (Tempe, AZ)

Specialized Industry Profile

8 DSMs

7 DSMs

10 DSMs

14 DSMs

6 DSMs

Profile

Finances turbine

powered aircraft

Floating rate loans

Fixed rate capital

leases

Operating leases

Business

Aircraft

Sports/

Gaming

Healthcare

IMME

Syndications

Profile

Profile

Profile

Profile

Finances sports

teams & casinos

Floating rate loans

Fixed rate loans

Finances

healthcare

equipment with an

emphasis on

diagnostic

equipment

Customers:

hospitals,

outpatient centers,

physician practices

Floating and Fixed

rate loans

Finances inland

marine operators,

mining companies

and some energy

Sells loans and

leases to manage

risk exposure levels

Buys loans and

leases that fit with

equipment financing

units

86

Growth Strategies – Specialized Industry

Aircraft

Expanding helicopter financing

Tightening relationships with manufacturers

Healthcare

Adding manufacturer relationships

Increasing sales coverage

Sports / Gaming

Taking lead positions in Sports Franchise and Casino Financings

Inland Marine, Mining, Energy and Real Estate

Expanding into auxiliary power in the energy industry by hiring a specialist

Leveraging “One CIT” working with Business Credit and other CIT units

Syndications

Purchasing “plug-in” portfolios

Strategically purchasing or participating in syndicated transactions

87

Centralized credit, funding, collections and portfolio management (Burlington, Ontario)

Canada Profile

25 DSMs

11 DSMs

11 DSMs

14 DSMs

Profile

Recognized market

leader in the

transportation

sector

Finances

construction

equipment

Transportation

& Construction

Commercial

& Industrial

Healthcare

CIBC

Profile

Profile

Profile

Specializes in

vendor programs

Finances printing,

food processing &

other industrial

equipment

Recognized

market leader in

direct dental and

pharmacy

financing

Dedicated DSMs

located in the

commercial bank

branches of the

Bank of Commerce

88

Growth Strategies - Canada

Transportation & Construction

New business opportunities from the 2010 Winter Olympics

Actively promoting “Wholesale” financing programs

Increasing non-transportation mix to the 35%-40% range

Healthcare

Maintaining leadership position in the direct dental and pharmacy markets

Taking advantage of the recent mortgage interest tax ruling

Remaining the lender of choice for two major pharmacy chains in Canada

CEFL (Canadian Imperial Bank of Commerce)

Re-alignment of sales staff in the branches

Partnering with the bank’s “Oil & Gas group”

Commercial & Industrial

Increasing sales coverage in the key markets of Toronto and Calgary

Expanding role in the printing & food processing industries

89

Portfolio Composition

Products/Services Offered

Industries Served

*No industry greater than 3%

Construction

Mining

Food

Transportation

Aircraft

Services

Other

Healthcare

Retail

Financial

Entertainment

Manufacturing*

Wholesale

90

Financial Products:

($ millions)

Owned

$6,872

Securitized

3,052

Total Managed Assets

$9,924

Financial Services:

Collateral/Cash Flow Loans

Leases

Revolving Lines of Credit

Sale and Leaseback Arrangements

Wholesale/Retail Financing for

Distributors/Manufacturers

Discounting Programs

Portfolio Acquisitions

Acquisition Financing

Debt Refinancing

Leveraged Leases/Loans

Equipment Diversification

Healthcare

Transportation

Other

Aircraft

Real Estate

Machine Tools

Construction

Furniture

Material Handling

Printing

Manufacturing

Technology

91

Distribution/Marketing Channels

Leads obtained through advertisement referrals, direct calls, direct mail

programs, trade shows, industry related events and repeat customers.

Products are distributed through manufacturers, dealers and sales force

Sales force is broken down into regions both the U.S. and Canada (123 U.S.

and 69 Canadian sales professionals)

Industry in several key markets

Canada: transportation and direct healthcare

U.S.: dealer and manufacturer programs

92

Canada

C & I

Specialized

EF – Sales Team Representation

93

93

Competition

Competitors

Manufacturer captives

Caterpillar Finance

Cessna Finance

Phillips Medical Capital

Siemens Financial Services

John Deere Credit

Independents

General Electric

Financial Federal

Banks

Wells Fargo

Citicapital

US Bancorp

Competitive Advantages

Key customer relationships

Expertise in evaluating and managing risk

Customer service focus

Leadership positions in primary markets

Long-term industry presence

Strong brand recognition in U.S.; growing

brand recognition in Canada

Diverse and customized financial products

and service offerings

Customers choose CIT because of our flexibility in creating custom financial

packages and our innovative, relationship driven approach

94

Capital Finance

Nikita Zdanow & David D. McKerroll

Co-Group Chief Executive Officers

95

Overview

Key Statistics

Headquarters: New York, NY

Employees: 200+

Market Presence:

Top player serving serving the Rail and

Aerospace industries for 30+ years

Recognized leader in structuring

complex finance transactions

Market Focus

Full service provider of financing and leasing

alternatives to:

Aerospace

Rail

Power, Energy and Infrastructure

Principal and/or advisory capabilities

Leadership Team

Nikita Zdanow

40+ years experience

David McKerroll

20+ years experience

Senior Leadership Team (10 members)

Average experience: 19 years

Key Profitability Drivers

Equipment utilization

Lease margins (rental rates)

Operating efficiency

Gains on equipment sales

Fee generation

96

Financial Summary (pre-combination)

Operating Efficiency ($ millions)

Managed Assets ($ billions)

Charge-offs (% AFR)

Net Income ($ millions)

% of

AMA

Operating

Expenses

Efficiency

Ratio

97

Capital Finance (pre-combination)

Return on Equity

Sluggish economy dampened rail

rental rates

Aerospace cyclical downturn

exacerbated by 9/11, SARS and the

Iraqi war

Near full utilization on rail and air

Rail rates continuing to firm

2004 air order book is fully placed

Aerospace rents starting to firm

Performance Factors

Current Environment

98

99

99

David D. McKerroll

Co-Group Chief Executive Officer

Capital Finance

Business Re-Alignment

Power, Energy

& Infrastructure, Regional

Air and SD&L

$1.8

Communication & Media

$1.3

1 Includes $0.3 billion of product with the rail industry

$ billions

100

Capital Finance

Air

$5.1

Rail

2.7

Power, Energy & Infrastructure

1.1

Structured Debt & Leasing

0.1

Other

0.1

New Capital Finance

$9.1

Business Credit

Business Credit - Old

$ 4.1

Communication & Media

1.3

New Business Credit

$ 5.4

Structured Finance

Communication & Media

$1.3

Power, Energy & Infrastructure

1.1

Air - Regional

0.3

Structured Debt & Leasing1

0.4

Total

$3.1

2004 Business Combination

Industry knowledge

Expertise in long-lived assets

Remarketing capability

Strong manufacturer and industry

relationships

Capital Finance

Asset Management Skills

Full Service

Provider of

Financing

Solutions

Competitive player in purchase of newly

manufactured equipment

Structuring expertise as principal or advisor

Syndication capabilities

Collateral expertise

Key Value Drivers

Structured Finance

Structuring Expertise

Distinguishes us from financial players

Aerospace

Other

Inter-

modal

Rail *

Total = $9.1B *

Aircraft

209 Commercial

119 Regional

50,000+ Railcars

500+ Locos

Asset Classes

* Excludes $0.4B / 8,000 railcars related to 9/01 Rail Sale Leaseback

Power,

Energy &

Infrastructure

Product Types

Structured

Debt &

Leasing

Portfolio Composition

Aero Tax

Optimized Lev

Lease

Single Investor

& Finance

Lease

Other

Loans

Other

Leveraged

Lease

Operating

Lease

$5.1

$1.1

$2.7

$0.1

$0.1

$0.1

102

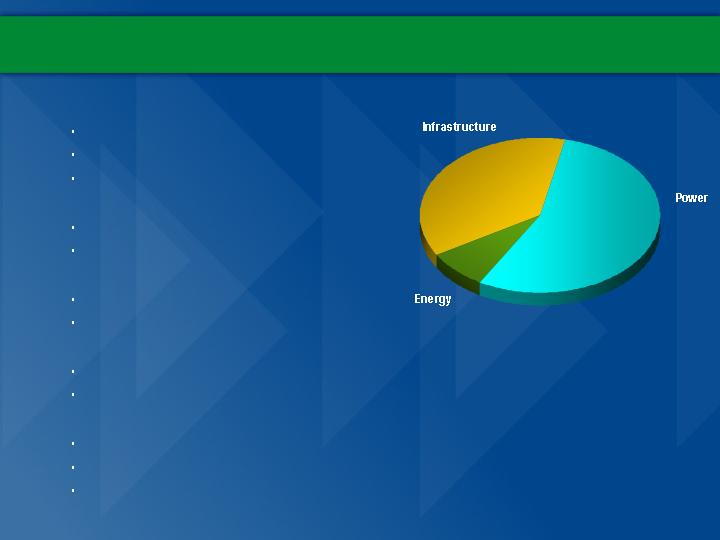

Power, Energy & Infrastructure

Primarily Senior Secured Investments

Investment grade projects

Middle market projects

Some mezzanine investments (high quality projects)

Balanced Revenue Profile

Net interest margin ~ 70% of net revenues

Non-spread income ~ 30% of net revenues

Steady Growth and Profitability

Double-digit earnings growth

Historic ROE above 15% threshold

Competitive Advantage

Professional staff experienced in lending through industry/business cycles

Proven track record of successfully managing large scale domestic and international projects

Growth Opportunities

Power – Sector recovery will provide refinancing opportunities in the under-banked middle market

Energy – Growing use of natural gas will increase investment in terminals, pipelines and storage

Infrastructure – Exploit expertise in working with Public Private Partnerships

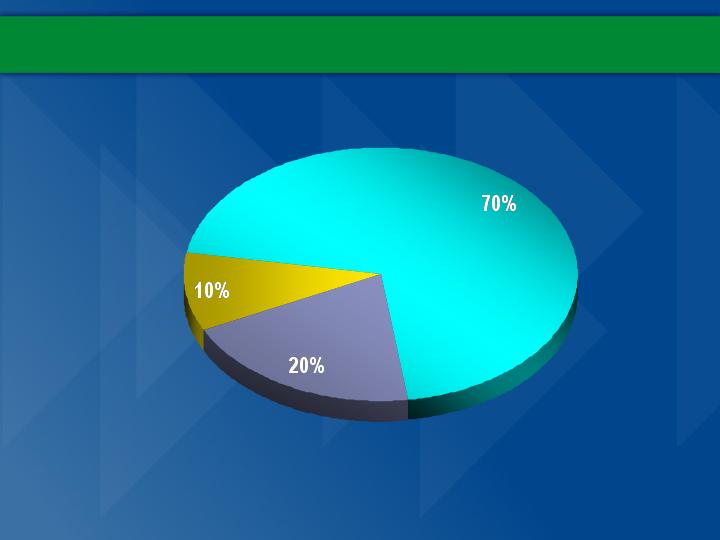

37%

55%

8%

103

Structured Debt & Leasing

Leasing companies

Hedge funds

Banks

Pension funds

Life insurance companies

Syndication network

Extensive knowledge of accounting, tax, finance and structural issues in multiple

jurisdictions and capital markets

Experience

Single investor leases

Leveraged leases

Cross-border/International leasing

Senior debt

Mezzanine debt

Credit tenant leases

Specialized product-oriented division

104

Benefits Structured brings to Capital Finance

Enhanced structuring and syndication capabilities

Increased originations

Ability to offer a broader range of financing products

Opportunity to participate in larger transactions through syndication

Ability to manage exposures

Increased returns

Advisory fees

Structuring fees

Syndication fees

105

106

106

C. Jeffrey Knittel

President, CIT Aerospace

Aerospace

$5.1B Portfolio

$4.8B Commercial

$0.3B Regional

Leading lessor of commercial aircraft

Leading advisor in regional aircraft

Broad distribution including most major foreign and domestic airlines

Expanding client base

Balanced commercial fleet mix

Over 72% narrow body aircraft

Over 84% aircraft built since 1990

CIT Aerospace – Attributes

107

107

Softer economic conditions

Industry Overview - What Happened?

Increased passenger price sensitivity

Difficulty supporting high cost structures

9/11 + War in Iraq + SARS

Reduction in demand

Supply - Demand imbalance

Lower lease rates

108

Industry Outlook

Industry in transition where price is

the #1 driver

Low fare opportunities stimulating

passenger demand

Market share shifting from legacy to

low cost carriers

International demand growing

Where are we now?

Where are we going?

Long-term air travel expected to

grow 5% per annum

Passenger demand will result in a

doubling of the world fleet by 2025

Regional jets will represent a

growing proportion of the world fleet

Capital starved airlines will look to

leasing companies for aircraft

109

Activity since 9/11

Commercial Market

Took delivery of and placed in excess of 50 new aircraft

Effectively remarketed/renewed over 80 leases

Expanded our market base

Signed deals with 43 new customers

Placed aircraft in 16 new countries

Sold approximately 20 aircraft – All at values greater than book

Managed fleet through multiple airline bankruptcies

Enhanced relationship with Airbus and Boeing by developing over 20 new clients

Regional Market

As advisor, placed over 120 regional aircraft representing over $2 billion

of financings

110

Portfolio Composition

Aircraft

Net Investment

100.0%

328

100.0%

5,060

0.0%

---

1.3%

67

Other

2.1%

7

2.9%

149

Capital Leases

2.7%

9

4.3%

219

Tax-Optimized leveraged leases

29.6%

97

4.6%

235

Loans

6.7%

22

5.4%

272

Leveraged Leases

58.8%

193

81.4%

4,118

Operating Leases

%

Number

%

$ Millions

Risk Management Focus

Risk

Management

111

Equipment

Balanced

Credit

Operating leases

Loans

Leveraged leases

Capital leases

Residual reviews

Technical expertise

Proactive management

Business and financial

Performance monitoring

Quarterly credit review

Performance Objectives

Structuring / Syndication Skills

Increase Fee Income

Diverse Customer Base

Minimize Risk Concentrations

Operating Lease Capability

Capitalize on Industry Transition

Lease Term Management

Maximize Rental Income

Desirable Fleet

Maintain High Utilization

Success Driver

Objective

Focused on improving profitability

112

Commercial Aerospace – Utilization

Broad & diverse customer base

Strong remarketing team with technical expertise

Aircraft fleet with broad appeal (type, age)

Drivers of High Utilization

113

Commercial Aerospace – Portfolio Migration

Years

Years

Europe

Asia and Australia

North America

Latin America and Caribbean

Middle East and Africa

Boeing

Airbus

Other

Narrow

Intermediate

Wide

Other

Grouping

54.8%

44.8%

0.4%

86.0%

9.0%

5.0%

Manufacturer

6.8

9.2

Average Lease Term

7.1

9.8

Weighted Average Age

42.4%

22.1%

21.3%

12.9%

1.2%

38.6%

11.1%

37.5%

10.8%

2.0%

Geographic Diversity

72.7%

18.4%

8.5%

0.4%

71.0%

8.3%

16.2%

4.5%

Body Type

2004

1999

Category

Attractive fleet with broader distribution

114

Commercial Aerospace – Lease Rates

Impact varied by type and age of aircraft falling 10-60% from

pre-9/11 highs

Less impacted models - A320s, A330s, 737 NGs

More impacted models - 737 classics and 757s

Rates up across the board versus December 2003

Less impacted models are approaching pre-9/11 rates

More impacted models are still well below pre-9/11 rates

Lower lease rates today due in part to lower interest rates

Expect lease rates to continue to rise as supply-demand balance

improves

115

Commercial Aerospace – Lease Book*

176 Aircraft - $4.3 billion

Lease Expiration Schedule

Expirations planned to take

advantage of lease rate

improvement

Beginning process of gradually

lengthening lease terms

* Excludes finance leases and FSC leveraged leases

Proactive portfolio management will speed recovery

116

Commercial Aerospace – Deliveries

20

60

2.9

Total $

0

5

0.3

2007

0

20

1.0

2006

3

18

0.9

2005

17

17

0.7

2004

Poised

for

recovery

Placed

Number

Amt ($B)

Year

Remaining

order book

52

52

2.5

Total $

1

1

0.1

2004 (Q1)

22

22

0.9

2003

16

16

0.8

2002

9

9

0.5

2001

4

4

0.2

2000

Placed with

22 clients

in 16

countries

Placed

Number

Amt ($B)

Year

Deliveries

taken to

date

117

Regional Aerospace

Portfolio composition

$292 million net investment

119 planes

30 customers

Focused on providing customized financing solutions

Fee based business whose primary product is intellectual capital

Experienced in structuring, arranging and placing complex financings

Broad client base: manufacturers, export credit agencies, airlines

and investors

Strong client retention based on a strong history of success and value added

Arranged $2 billion in financing for SkyWest aircraft since 1995

118

Outlook

Manage through current down cycle while positioning for turn-around

and future profit growth

Global airlines will need capital to meet future passenger demand forecasts

Ideal condition for leasing opportunities

Improve profitability through cycles

Maintain high utilization

Better supply/demand characteristics should improve pricing power / lease rates

Continue to seek further efficiencies from a low cost infrastructure

Increase advisory/fee generation business

Return aerospace to its historical profitability

119

120

120

Stephen McClure

President, CIT Rail Resources

Rail Resources

$ 2.7 billion owned portfolio

$ 0.4 billion serviced portfolio

Diverse customer base

Clients include all US and Canadian class I railroads

Excellent growth rate

New and diversified railcar fleet

80% of leased portfolio < 8 years old

Broad based penetration of market

Rail Resources – Attributes

121

121

Rail - Industry Overview

Increased Utilization

& Mileage

More Demand for

New/High

Capacity Cars

Aging N.A.

Railcar Fleet

Higher Rental Rates

& Fleet Value

Increased Cost

for New Cars

Higher Steel

Prices

Greater Demand for

Existing Assets

Severe Component

Shortages

50% Rise in

Railcar Orders

(QTQ)

Strong Demand &

Higher Rental Rates

Increased Rail

Traffic

Improving

Economy

Impact on CIT

External Environment

Enhanced demand, increased rates and improved asset values

122

Performance Objectives

Growing the Business

Purchase approximately 4,000 new

railcars and 34 locomotives with a

value approaching $300mm in 2004

Actively review portfolios for sale in

the secondary market

Continue aggressive marketing to the

higher margin shipper business

Expand programs to monetize rail

assets of customer base

Increasing Profitability

Increase rental margins

Continue to aggressively push rental

rates while containing costs

Approximately 50% of our lease fleet

will re-price in 2004/2005, allowing us

to lock-in favorable future returns

Increase equipment gains

5-year residual realization 118%

Improving values Higher gains

Generate additional fee income by

offering structuring/advisory services to

customer base

123

Portfolio Demographics

Industries Served

Railcar Age

Class 1 RR

Shortline &

Regional RR

Manufacturing

Grain Products

Utilities

Leasing

Mining

Other

1999-2004

1994-1998

1989-1993

1984-1988

1979-1983

1978 and

older

124

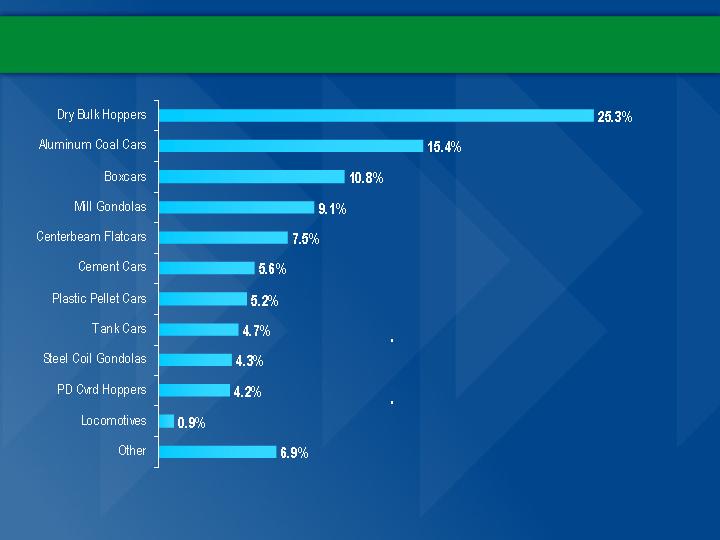

Well diversified fleet – compares

favorably to national railcar fleet

Fleet mix managed through asset

sales and purchases – excellent

history of gains

Railcar Types

125

Rail Resources – Utilization

Relationship/Service oriented

Superior financial structuring

Advanced fleet management

Youngest fleet among the majors

Primarily 286K capable fleet

Well diversified by category

Drivers of High Utilization

By Unit

126

Portfolio Management

Strategic Actions

Shortened lease terms during period of compressed rates (2000-2003)

Purchased assets at depressed equipment prices (Flex)

Lengthen lease terms in response to current market improvements

Plan Lease Expirations

Avoid concentrations

Minimize seasonality

Focus on high quality clients

Leads to higher renewal rates

Increases operating efficiency

Maintain Desirable Fleet

Proactively buy and sell equipment

Target average fleet age of 8-10 years

Focus on balanced car base with proven

track record

Ensure well-serviced and properly

maintained fleet

127

Opportunities and Initiatives

Continue to increase rental rates as the market further improves

Pull cars from lessees who are unable to absorb higher rates

Sell select assets to capitalize on value improvements and manage

fleet age dynamics

Continue system and process enhancement to insure scalability,

premium service and high efficiency

Seek strategic acquisitions to expand portfolio base and take

advantage of operating efficiencies

Superior industry and equipment knowledge distinguish us from the rest

128

2004 Performance Expectations

Below

Meets

Total Capital Finance

Exceeds

Meets

Structured Portfolios

Meets

Meets

Rail

Below

Meets

Aerospace

Return on Equity

of 15%

Managed Asset

Growth of 8-10%

Division

129

Finance Overview

Joe Leone

Vice Chairman and Chief Financial Officer

130

Agenda

Financial Scorecard

Technology

Risk Management

Liquidity

Interest Rate

Capital

Ratings Objective

131

Financial Scorecard

* Excludes $25.5MM after-tax gain on PINES debt call

8% - 10%

5% (owned 6%)

50.1

47.5

Managed Assets ($ billions)

9% Plus

10.7%

10.4%

Tangible Equity/Managed Assets

Balance Sheet

1.26%

1.61%

Credit Losses - Total

Credit

35% Area

41.1%

41.7%

Efficiency Ratio

Expenses

Max. 15%

8%

14%

Securitization Gain (% PT Income)

3.40% - 3.60%

3.09%

2.34%

Risk Adjusted Margin

15%

13.1%

11.0%

ROTE

1.42%

1.13%

ROMA

27%

0.76

0.60

EPS ($)

29%

164

127

Net Income ($ millions)

Profitability

Long Term

Targets

Increase

2004

Q1*

2003

Q1

132

Risk Adjusted Margin

Need 40 bps improvement to meet target

Mix – Allocate capital to higher return businesses

Lower total credit losses – Move below 1.00%

Refinance higher cost debt - Improve margin 10 bps or more

133

Year-to-Date Issuance

Remaining 2004 Maturities

Amount

Spread

Term

Amount

Spread

Term

Fixed

$1.9B

100 bps

8.6 yrs

$1.2B

133 bps

5.0 yrs

Floating

3.8B

21 bps

2.9 yrs

2.1B

56 bps

1.2 yrs

Total

$5.7B

$3.3B

Efficiency Ratio

134

Efficiency Ratio (1Q04)

41%

Improve cost of funds

(1%)

Operating leverage

(1 - 2%)

Additional efficiencies

(1 - 2%)

Other

(1%)

Target Ratio (depending on mix)

35%

IT Standardization

135

Category

1999

Today

Infrastructure

Data Center

7

1

Mainframe Processors

3

1

Global Network

2

1

E-Commerce Gateway

5

1

Business Applications

General Ledgers

30

2

Credit Exposure

2

1

Leasing

Credit Origination

5

3

Lease Accounting

20

4

Customer Service/Collection

6

2

Web Front-end

5

1

Contact Center Technology

5

2

Document Management/Imaging

5

1

IT Investment Profile

Future investment emphasizes innovation…

Today’s investment includes…

136

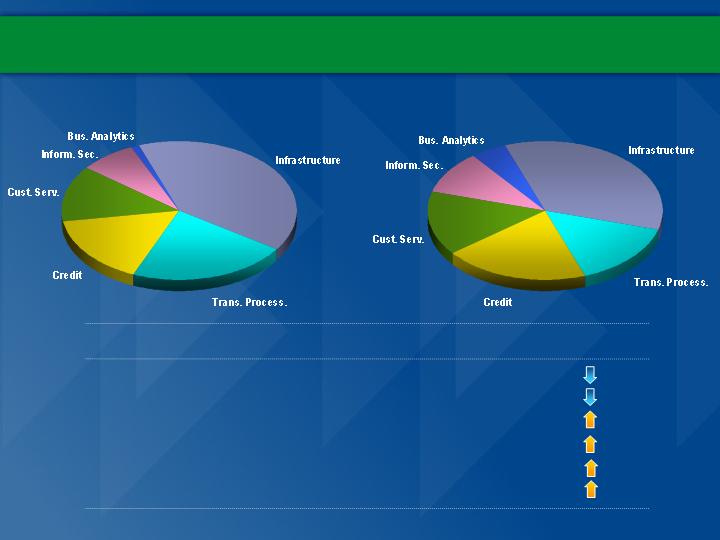

2004

Spending Category

Beyond

40%

Infrastructure

35%

22%

Customer Transaction Processing

15%

13%

Customer Service

15%

16%

Credit

20%

8%

Information Security

10%

1%

Business Analytics

5%

Enterprise – Wide Best Practices

eFinance It (full service front-end web customer service portal)

eBoss (credit origination for commercial loans and leases)

CIT Connect (collection workflow)

Asset Management (residual management)

Business Intelligence (performance scorecards and decision support)

Improved generation of credit scoring

High technology centers

137

Treasury Risk Management Framework

Interest Rate/

FX Risk

Definition

Strategy

Exposure to accounting or

economic loss due to changes

in interest rates or foreign

exchange rates

Match-funding practice

Hedging

Liquidity

Risk that funds needed to meet

potential cash outflows are not

available

Diverse funding sources

Committed back-up credit facilities

Securitization facilities

Contingency funding plan

Derivative

Risk

Risks associated with the use of

derivative instruments including

counterparty credit, liquidity,

legal and systemic risks

Counterparty selection based

on ratings

Monitoring of current and

potential exposure

Uniform documentation

Market Risk

138

Capital Committee

Charter

Define, monitor & direct management of market

risks arising from financing the business

Ensure uninterrupted funding access

Objectives

Review economic, interest rate and FX outlook

Monitor external factors impacting the company

Authorize Treasury financing plans and risk management policies

Formulate and monitor capital ratio and risk targets

139

139

Liquidity Risk Metrics

*Alternate Liquidity includes available bank facilities, asset backed conduit facilities and cash

Bank Line Coverage / Total Commercial Paper

Target minimum of 100%

Commercial Paper / Total Debt

Short Term Debt / Total Debt

Target cap of 15%

Target cap of 45%

Alternate Liquidity* / Short Term Debt

Target minimum of 75%

140

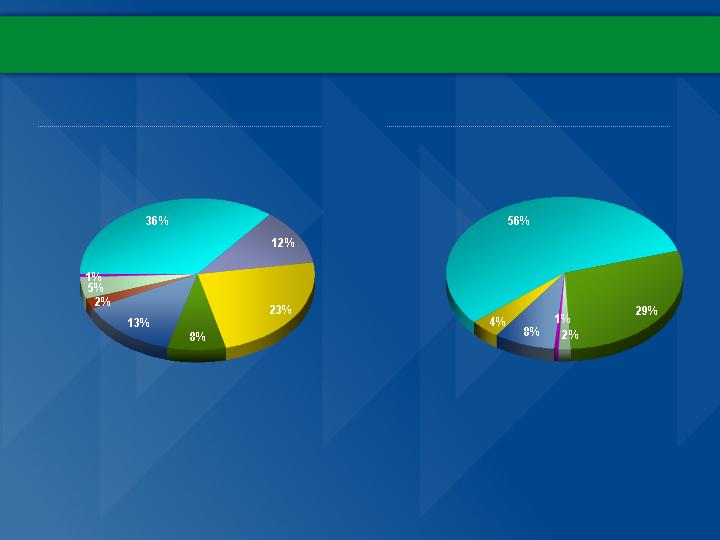

Diversified Liquidity Sources

US MTN

US CP

US Cons. ABS

Int'l MTN's

US ABS CP

US MTN

Globals

US CP

US Retail

Int'l ABS CP

US Comm. ABS

US Cons. ABS

Int'l MTN's

US ABS CP

Private

Placements

December 31, 1998

December 31, 2003

141

2004 Funding To Date

Long-Term

International CP

Globals

$1,250 Million

A$CP

A$ 285 Million

MTNs

$3,224 Million

Euro Note

€1,000 Million

ABS

$1,244 Million

Traits of a Rising Rate Environment

Cyclical lenders return

Capital available for new entrants

Pricing pressure increases

Competition

More liquidity for customers

Asset and collateral values appreciate

Lower losses and improved credit metrics

Credit

Higher asset growth drives more margin

Stronger deal flow leads to fee generation

Equipment gains higher

Revenue

Matched funding philosophy minimizes risk

Margin

Higher capital spending

Activity picks up and growth accelerates

Volume

142

Interest Rate Sensitivity - Portfolio Mix

$38B

$ 5B

$17B

$16B

$38B

—

$17B

$21B

Debt (after swaps)

Receivables

Total

—

—

Tangible Equity

52%

44%

Floating Rate

48%

56%

Fixed Rate

143

Interest Rate Risk Metrics

Target cap of 4%

Target cap of 3%

* 100 bps rate shock

Margin at Risk (MAR)*

Equity at Risk (VAR)*

Negligible impact on margin

Represents increased equity value

reflective of longer liability duration

144

Accounting Based

Short-term Horizon (12 Months)

Risk to Earnings

MAR = 2.45% [~ $15 million after-tax]

Economic Based

Long-term Horizon

Risk to the Value of Equity

VAR = -1.70% [+$83 million]

Capital Generation

Return on Equity

13%

Dividend Payout

17%

Capital

Generation

11%

Asset growth target 8-10%

Increased dividend 8%

Stock buyback program to support employee stock option program

Acquisitions that are accretive to earnings

Capital Allocation

Transitioning to risk-adjusted capital allocation methodology

Ensure capital is invested in businesses with superior returns

Identify level of required capital reflective of the following risks:

Credit

Operational

Market

Implementation

Process rolled out January 2004

Transition effective 2005

146

Below Target

11 - 13%

10%

Equipment Finance

Below Target

15 - 20%

10%

Capital Finance

Exceeds Target

6 -10%

10%

Specialty Finance

Exceeds Target

8 - 10%

10%

Commercial Finance

Risk-Adjusted

ROE

Risk-Adjusted

Target

Current

Risk-Adjusted Capital Impact

147

10.7%

86%

10.3%

43%

Tang Equity/MA

Alt. Liquidity/STD

Capitalization:

0.98%*

2.07%

0.42%

1.40%

Charge-offs

NPA’s

Asset Quality:

1.42%

13.1%

1.48%

14.0%

ROMA

ROTE

Profitability:

A2/A

Aa3/A

Rating

Q1-04

1998

Ratings Objective

Well-defined succession plan

Experienced management

Management

Transition

Expanded funding diversity

Reduced refinancing risk

Proven alternate liquidity

Wholesale

Funding Model

Improving economy

Diverse business franchises

Economic

Environment

Current Status

Issue

Comparative Analysis

Other Qualitative Factors

* Core Charge-offs

Focus on returning to high single A long-term debt rating

148

CIT Characteristics 2004 and Beyond

149

Fortress Balance Sheet

Well Capitalized

Prudent Reserves

Proven and Effective

Broad Access

Funding Model

Strong Liquidity

High Debt Ratings

Improving Profitability

Growth

Margins

Efficiency

ROE

Strategic Review

Jeffrey M. Peek

President and Chief Operating Officer

150

Diverse Business Mix

Powerful Brand

Clean, Efficient Operating Platform

Experienced and Highly Skilled Team

CIT Strengths

151

151

Key Financial Metrics

Asset Growth

Operating Efficiency

Return on Equity

152

Economic Environment Favors Growth

Expanding GDP

Moderate inflation

Consolidation of competitors

Middle market opportunity

153

Middle Market Opportunity

154

154

Classic

Organic

Achieving Asset Growth Target

155

155

Focus on

High-Growth

Areas

Classic

Organic

Achieving Asset Growth Target

156

156