- CIT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Cit (CIT) 8-KRegulation FD Disclosure

Filed: 8 Nov 05, 12:00am

Exhibit 99.1

Forward-Looking Statements

Certain statements made in these presentations that are not historical facts may constitute “forward-looking” statements

under the Private Securities Litigation Reform Act of 1995, including those that are signified by words such as “anticipate”,

“believe”, “expect”, “estimate”, “target”, and similar expressions. These forward-looking statements reflect the current views

of CIT and its management and are subject to risks, uncertainties, and changes in circumstances. CIT’s actual results or

performance may differ materially from those expressed in, or implied by, such forward-looking statements. Factors that

could affect actual results and performance include, but are not limited to, potential changes in interest rates, competitive

factors and general economic conditions, changes in funding markets, industry cycles and trends, uncertainties associated

with risk management, risks associated with residual value of leased equipment, and other factors described in our Form

10-K for the year ended December 31, 2004 and our Form 10-Q for the quarter ended September 30, 2005. CIT does not

undertake to update any forward-looking statements.

Non-GAAP Financial Measures

The data provided in these presentations have been modified from our previously reported periodic data, including, but

not limited to, the exclusion of certain non-core transactions and nonrecurring events, because management believes

that the data presented herein better reflects core operating results. As such, the data will vary from comparable data

reported in CIT’s Forms 10-K and 10-Q. The data provided in these presentations have not been examined by

independent accountants and is not presented in accordance with generally accepted accounting principles (“GAAP”).

These presentations include certain non-GAAP financial measures, as defined in Regulation G promulgated by the

Securities and Exchange Commission. Any references to non-GAAP financial measures are intended to provide

additional information and insight into CIT’s financial condition and operating results. These measures are not in

accordance with, or a substitute for, GAAP and may be different from or inconsistent with non-GAAP financial measures

used by other companies.

For a reconciliation of these non-GAAP financial measures and a list of the transactions and events excluded from the

data herein, please refer to the tables on the following page.

Please refer to the Company’s SEC filings on Forms 10-K and 10-Q for consolidated financial results prepared in

accordance with GAAP.

Data as of or for the period ended September 30, 2005 unless otherwise noted.

$ 5,195.6

$ 5,731.0

$ 5,787.0

Total Tangible stockholders' equity

255.5

253.8

252.5

Preferred capital securities

-

-

500.0

Preferred Stock

4,940.1

5,477.2

5,034.5

Tangible common stockholders' equity

(487.7)

(596.5)

(1,003.8)

Goodwill and intangible assets

(7.7)

(8.5)

(20.5)

Unrealized (gain) loss on securitization investments

41.3

27.1

(15.5)

Other comprehensive loss relating to derivative financial instruments

$ 5,394.2

$ 6,055.1

$ 6,074.3

Total common stockholders' equity

Total Tangible stockholders' equity:

$ 36,189.3

$ 41,313.6

$ 49,483.4

Earning assets

(3,894.6)

(3,847.3)

(4,267.1)

Credit balances of factoring clients

$ 40,083.9

$ 45,160.9

$ 53,750.5

Total financing and leasing portfolio assets

Earning assets:

$ 49,735.6

$ 53,470.6

$ 61,289.9

Managed assets

9,651.7

8,309.7

7,539.4

Securitized assets

40,083.9

45,160.9

53,750.5

Total financing and leasing portfolio assets

249.9

181.0

31.1

Equity and venture capital investments (included in other assets)

918.3

1,640.8

1,848.4

Finance receivables held for sale

7,615.5

8,290.9

9,184.4

Operating lease equipment, net

$ 31,300.2

$ 35,048.2

$ 42,686.6

Finance receivables

Managed assets:

12/31/2003

12/31/2004

9/30/2005

Non-GAAP financial measures disclosed by management are meant to provide additional information and insight relative to trends in the business to investors and, in certain cases, to

present financial information as measured by rating agencies and other users of financial information. These measures are not in accordance with, or a subsitute for, GAAP and may

be different from, or inconsistent with, non-GAAP financial measures used by other companies.

Non-GAAP Reconciliation

Non-Core Items

0.08

17.6

0.0

Commercial Finance

Provision for income taxes

Release of international tax reserves

Q3

2005

(0.06)

(11.9)

(20.0)

Specialty Finance

Other revenue

(Loss) on sale of manufactured housing

Q3

2005

(0.25)

(52.9)

(86.6)

Commercial Finance

Other revenue

(Loss) on sale of commercial and business aircraft

Q3

2005

0.34

69.7

115.0

Corporate

Other revenue

Gain on sale of real estate investment

Q3

2005

(0.02)

(4.4)

(6.8)

Corporate

Other revenue

Retained interest impairment from hurricanes Katrina and Rita

Q3

2005

(0.11)

(23.3)

(35.9)

Corporate

Provision for credit losses

Reserves for hurricanes Katrina and Rita

Q3

2005

(0.08)

(16.5)

(25.2)

Corporate

Provision for restructuring

Provision for restructuring

Q2

2005

0.07

14.4

22.0

Commercial Finance

Other revenue

Gain on sale of business aircraft

Q2

2005

(0.04)

(9.3)

(15.7)

Specialty Finance

Other revenue

(Loss) on sale of manufactured housing

Q4

2004

(0.04)

(8.7)

(14.0)

Corporate

Other revenue

(Loss) on venture capital investments

Q4

2004

0.12

26.8

43.3

Corporate

Provision for credit losses

Release of telecom reserves

Q4

2004

0.12

25.9

41.8

Corporate

Gain on redemption of debt

Gain on call of PINEs debt

Q1

2004

(0.17)

(37.5)

(60.5)

Corporate

Other revenue

Loss on venture capital investments

Q4

2003

0.15

31.2

50.4

Corporate

Gain on redemption of debt

Gain on call of PINEs debt

Q4

2003

EPS Impact

After-Tax

Pre-Tax

Group

P&L Line Item

Item Description

Impact on Income

EXECUTIVE OVERVIEW

Jeffrey M. Peek

Chairman and Chief Executive Officer

Today’s Agenda

Executive Overview

Sales & Marketing

Specialty Finance

Commercial Finance

Credit

Finance

2006 Outlook

Jeff Peek

Walter Owens

Tom Hallman

Rick Wolfert

Larry Marsiello

Joe Leone

Jeff Peek

2

Vision

Relationship-driven

Uniquely positioned in middle market

Unparalleled experience and expertise

The leading global finance company

for the middle market

3

Taking Action Quickly

Align organizational energies

Recruit new talent to complement existing team

Implement risk-based capital allocation

Focus on strategy

4

A Differentiated Corporate Strategy

Focus on most attractive opportunities in commercial

middle market in U.S. and globally

Active portfolio management – enter, grow, fix

Industry specialized customer teams with necessary

expertise and relationship focus

Broad product offering to deepen customer relationship

Reinvest in sales and IT

Leverage scale across businesses to contain costs

Maintain historic discipline (no compromise for growth)

Active management of portfolio exposures

Risk-based capital allocation

Diversification of funding sources including deposits

Sector

Alignment

Client

Focus

Productivity

Management

Credit and Risk

Management

Capital

Discipline

Build to script

5

Organizing Around our Customers

Provides factoring

and other trade

products to

companies in retail

supply chain, with

increasing

international focus

Trade

Finance

Provides longer-

term, large ticket

equipment, leases

and other secured

financing to

companies in rail

and aerospace

industries

Transportation

Finance

Provides

lending, leasing

and other

investment

banking

services to

middle market

companies, with

a focus on

specific

industries

Corporate

Finance

Provides financing

to manufacturers

and distributors

around the globe

Vendor

Finance

Provides

asset backed and

government

secured loans to

consumers and

small businesses,

leveraging broker

and intermediary

relationships

Consumer/

SBL

build to

script

6

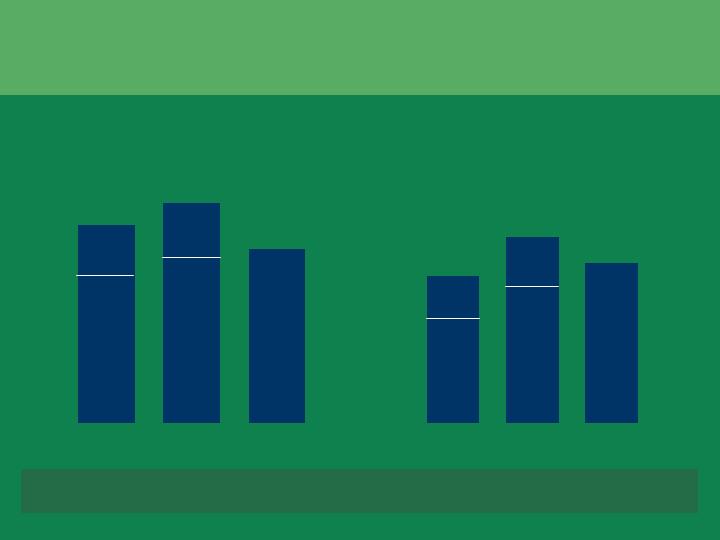

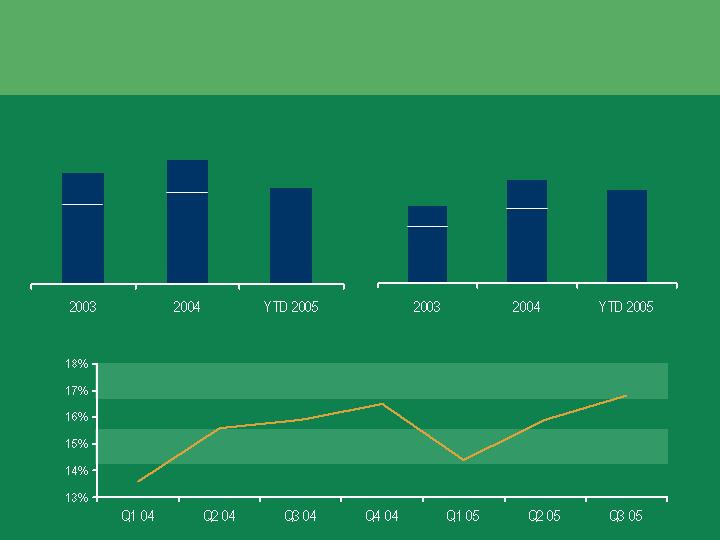

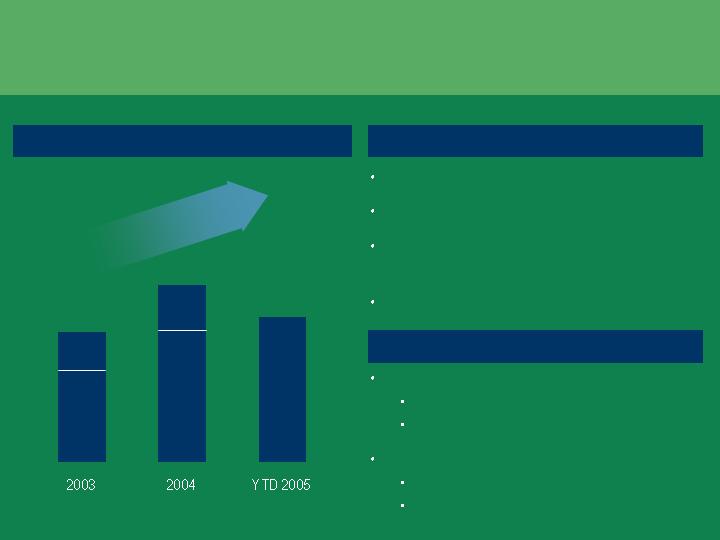

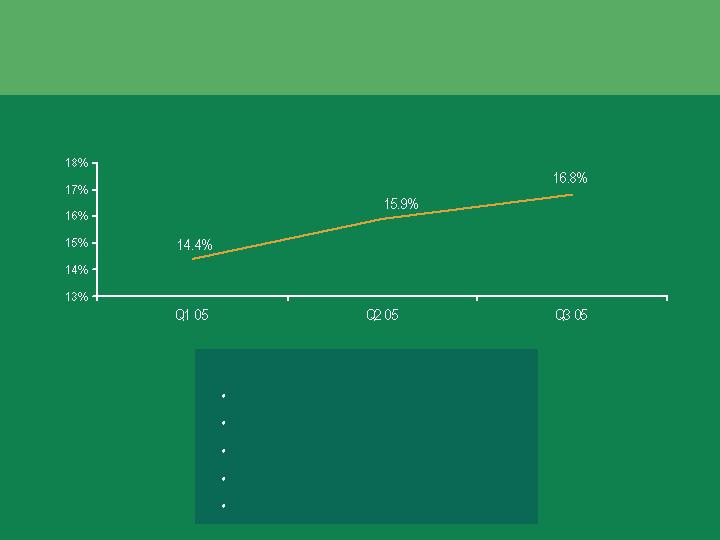

Deliver Strong Financial Results While

Investing in Growth

Return on Tangible Equity

Revenue ($ millions)

Net Income ($ millions)

9 months

9 months

9 months

9 months

2,215

2,452

573

720

1,965

658

7

13%

14%

15%

16%

17%

18%

Q1 04

Q2 04

Q3 04

Q4 04

Q1 05

Q2 05

Q3 05

SALES & MARKETING

Executive Vice President, Chief Sales & Marketing Officer

Walter J. Owens

Articulate growth opportunity

Assess current capabilities

Provide roadmap for growth and 2005 progress

Lay out 2006 sales execution plan

Key Takeaways

2

Huge Opportunity to Grow: Execution is Key

Well Positioned to Grow

Small share of huge

fragmented markets

Strong customer value

propositions

Best-in-class risk capabilities

2%

10%

2000-2004

2008

Increasing

Organic Growth

Rate

* Excludes Venture Capital gains

Revenue Growth*

3

Focusing on Revenue Growth

Available Drivers

Size / Share of addressable market

Channel penetration

Share of wallet

Deals seen

Conversion efficiency

Assimilation effectiveness

Selling face time

Market

Share

Sales Force

Size

Sales

Productivity

Growth

Number of new hires

Turnover optimization

Compensation alignment

Talent strength

4

Well Positioned with Ample Room for

Growth

Note: All figures above are based on 2004 data except railcar share position which is from 2005 figures

#3 position in

aerospace with

2% global

market share

#3 lessor of rail

cars in US with

9% share

Emerging player

in corporate

finance, with

2% share

Top three

independent

equipment lessor

worldwide, 3%

share of global

market

#1 in SBA

lending, with 6%

market share

Top ten originator

of consolidation

loans, but

1% share in

FFELP

Top 20 player in

home lending with

1% market

share

#1 player in US

market, but only

4% of

worldwide

market

Trade

Finance

Transportation

Finance

Corporate

Finance

Vendor

Finance

Consumer/

SBL

5

Commercial Finance

Scaling our Competitive Strengths

Value Proposition

Strong risk structuring capabilities

allow CIT to stand behind our

customers in good and bad times

Specialty Finance

Value Proposition

Superior product and processing

skills delivered in a flexible and

customer focused business model

“CIT acts like a true partner and works

with me to service my customers”

“CIT has unique processing and back

office capabilities”

“GE is transactional, CIT invests in

building relationships”

“CIT has strong risk screening

capabilities”

Quote Source: CIT “Voice of the Customer” Survey

6

Sales Productivity Next Steps

Create and retain long-term profitable relationships

Drive penetration of key intermediaries

Develop a targeted direct calling capability

Lever strong customer relationships to sell “One CIT”

Sales Force Size / Quality

Complete a targeted sales build-out

Build a high performing sales culture

Focusing our Sales Efforts

7

Key Takeaways

Articulate growth opportunity

Assess current capabilities

Provide roadmap for growth and 2005 progress

Lay out 2006 sales execution plan

8

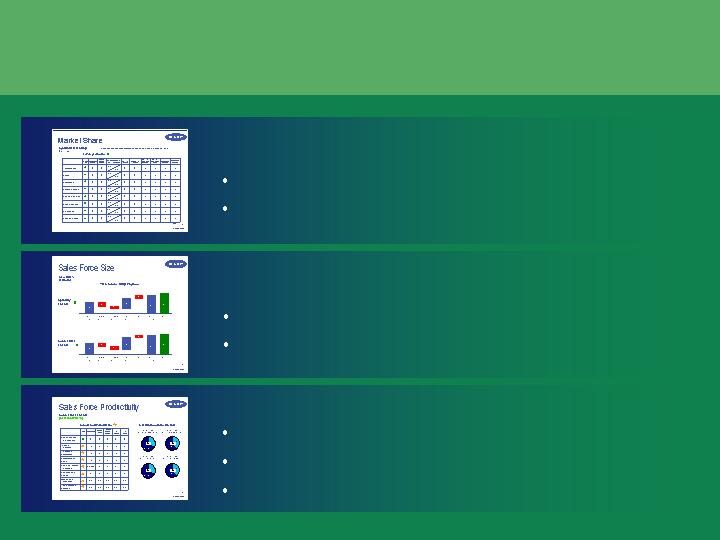

Recent History Tells a Slow Growth Story

Sales Force Headcount

Revenue

Salesperson Productivity

2002

2003

($ billions)

2004

996

2002

2003

2004

1,077

1,081

$2.4

2002

2003

2004

$2.0

$2.3

($ millions)

Flat growth in a very

competitive environment

Played defense coming out of

Tyco ownership

Lack of focus on sales

leadership and sales execution

Performance Drivers

$2.4

$2.2

$2.5

9

Evaluated the “Current” State of Sales

Voice of Sales Survey

800+ responses

Capability Assessment

100% completion rate

Sales Talent Assessment

90%+ sales coverage

10

Sales

Execution

Using lead

generation and

sales automation

tools to find new

customers

Sales

Leadership

Building and

developing sales

forces

Aligning growth

targets with

incentive

compensation

Focusing and

deploying sales force

by industry and

channels

Organization

Alignment

Targeting sales force

on specific market

segments where CIT

is most competitive

Strategic

Planning

And We Identified Key Capabilities to Build

11

Key Takeaways

Articulate growth opportunity

Assess current capabilities

Provide roadmap for growth and 2005 progress

Lay out 2006 sales execution plan

12

Phased Approach to Growth

2005

Phase I

Build Strong

Foundation

Create sales

organization

Energize sales

force

Focus front ends

Implement sales

automation

2006

Phase II

Drive Core Competitive

Advantages

Execute sales

plans

Build out

sales force

Drive productivity

Sell “One CIT”

Expand Core to

Accelerate Growth

2007-2008

Phase III

Drive

customer loyalty

Expand the core

New geographies

New markets

New products

13

13

Energized Sales Team

Communicated

Message

Touched 80% of

sales through 7

global and

regional sales

summits

Aligned CIT to Grow

Risk

Operations

Improved

Alignment

Listened

to Sales

Gained

buy-in and

developed

bottoms up

priorities

14

14

Organized Sales For Growth

Created team

of 8 senior

sales

professionals

Designated

senior sales

leader in all

business units

Implemented

councils to speed

decision making and

prioritization

Sales Councils

Corporate Sales

Chief Sales

Officer

Growth Culture

15

Refocused and Redeployed our Sales Forces

Organized to sell how

customers want

to buy

Controls full range of

products and services

Different coverage

models required for

middle versus

large market

Relationship selling is

incremental

Borrower

size

5

500

Borrower credit quality

Sub-D

AAA

Relationship Accounts

Historical CIT Sweet Spot

Example: Commercial Finance Verticals

($ millions)

16

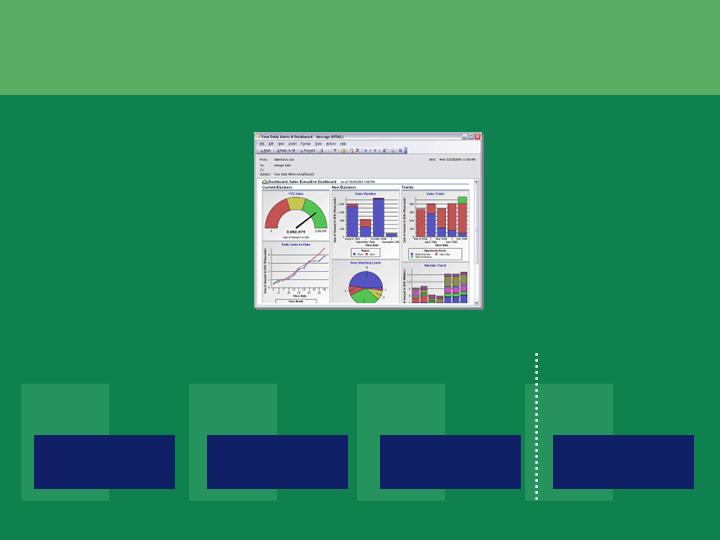

Automated the Front End

Automate / simplify tasks

Increase face time with

customers

Get to the right prospect at

the right time

Market coverage

view

Drivers of wins and

losses

Measure sales force

performance

Benefits for

Salespeople

Benefits for

Sales Managers

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

2005

Vendor

Evaluation

System Design

System

Implementation

Ongoing Use

We are here

17

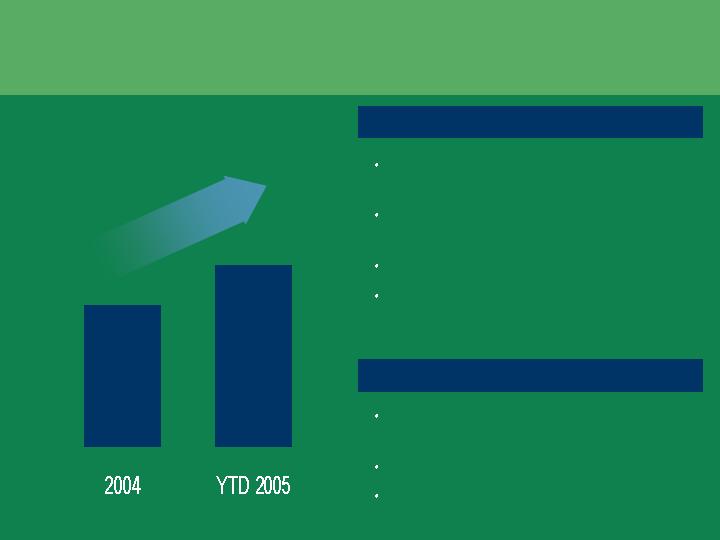

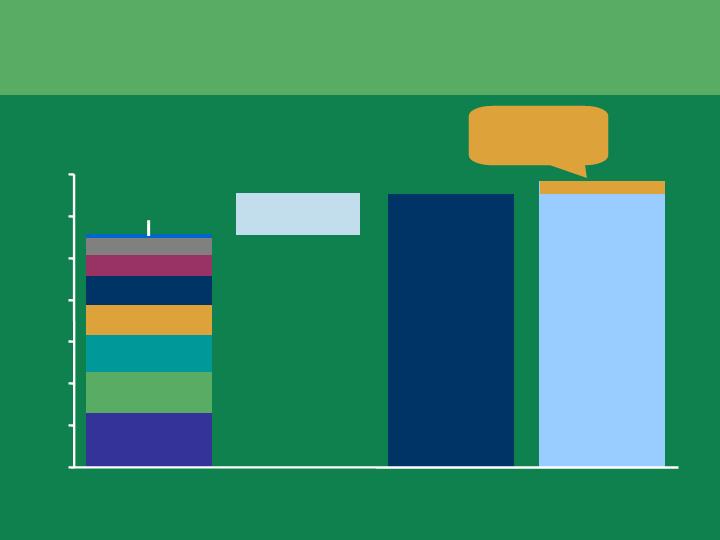

Results Starting to Pay Dividends

Sales Force Headcount

Revenue ($ billions)

Sales Person Productivity ($ millions)

Revenues flat in tough pricing

environment

Fees offset softness in volumes

Top graded and turned over 300

sales heads

Hired 500 new sales professionals

Increased industry focus and higher

account penetration offset by new hire

productivity

Performance Drivers

$1.8

9 months

2004

YTD 2005

$2.0

1,077

1,276

$1.7

$1.6

Sep-04

Sep-05

9 months

2004

YTD 2005

18

Key Takeaways

Articulate growth opportunity

Assess current capabilities

Provide roadmap for growth and 2005 progress

Lay out 2006 sales execution plan

19

2006 Priorities Focus on Driving Execution

Execution

Drive

rigorous

execution

Leadership

Leaders own

growth agenda

Align to accelerate

growth

Alignment

Find more

opportunities

Strategy

SALE

20

Sales Execution Linked to Strategy

Strategy

New disciplined approach to

sales planning

Key initiatives prioritized and

resourced

Sales leaders own execution

with compensation tied to

performance

Metrics monitor progress

21

Enhancing the Hiring Process

Total Front-Line Sales Talent

1,575

1,275

Finding the Right

People

Hiring Them Quickly

and Efficiently

Assimilating to

Accelerate

Productivity

Competencies

In-house recruiter(s)

Screening process

Interview process

Approval process

On-boarding process

Deal strike zones

Technology support

Sales support

Net Increase

300 People

Alignment

22

Objective

Shorten cycle time for

1st closed deal by 50%

Key Areas of Focus

Business information

Systems and tools training

Deal process

Contact lists

Risk parameters

And Accelerating Productivity

Leadership

23

23

Enhancing Customer Targeting

White space analysis

Market segmentation

Monthly dashboards

Identifying Opportunities

Tools identify high-priority

prospects

Company analyses to

support calling

Targeting Customers

Execution

24

Pilot Project Driving “One CIT”

Industry verticals

Strategic

accounts

High

Low

Complexity

Equity

Sponsors

M&A Group

Cross-BU

programs

Target

marketing

c it pay

BU referral

programs

Multiple Approaches to Driving Share of Wallet

Share Leads

Share

Customer

Databases

Combine

Sales Force

Enterprise

Sell

Alignment

25

Driving Progress with Better Visibility

Are we Seeing the Market?

Deals seen

Deals closed

Is our Sales Force Growing?

Sales force size

Time to first deal

Are we More Productive?

Profit per salesperson

Conversion rates

Penetration rates

26

Growing in 2006 and Beyond

Growing

Market Share

Completing

Sales Force

Build-out

Focusing on

Sales

Execution

+

=

Drive Core

Competitive

Advantages

Expand Core to

Accelerate Growth

2005

Phase I

Build Strong

Foundation

2006

Phase II

2007-2008

Phase III

27

SPECIALTY FINANCE

Thomas B. Hallman

Vice Chairman, Specialty Finance

Key Takeaways

Distinctive value proposition

Efficient operating model

Strong and consistent growth across business groups

Large and growing commercial and consumer customer base

Strategic imperatives to accelerate organic growth

2

Specialty Finance: At-a-Glance

$14 B volume year-to-date

700 sales

professionals

We deliver quantifiable value to vendor and consumer

markets through our core strengths in relationship

management, risk and behavior scoring capabilities and

global servicing reach

29 countries

$27 B managed assets

3,000+ relationships

1.4 M commercial customers

3.6 M consumers

3

Home

Lending

Technology

Construction

Healthcare

Industrial

Student

Lending

Small

Business

Lending

Two Major Business Groups

Consumer / Small Business

(United States)

Vendor Finance

(Global)

Global Insurance Services

CIT Bank (US)

4

Global Capability Supported by Efficient

Shared Services Model

Europe

Dublin, Ireland

Asia Pacific

Hong Kong

South Pacific

Sydney, Australia

Canada

Burlington, ON

United States

Jacksonville, FL

Vendor Finance

Austin, TX

Dell Financial Svcs.

Libertyville, IL

Snap-On Credit

Livingston, NJ

Small Business

Oklahoma City, OK

Consumer Lending

Cleveland, OH

Student Lending

Latin America

Miami Lakes, FL

5

5

Financial Highlights

Revenue ($ billions)

Net Income ($ millions)

Return on Equity

9 months

9 months

9 months

9 months

1.0

1.1

0.9

261

324

290

6

Vendor Finance: At-a-Glance

CIT Vendor Finance through its market leading leasing and

lending product capability, relationship structuring skills, global

presence, scalable shared services platforms and best-in-class

sales teams provides vendors and intermediaries with financial

solutions to maximize customer sales

$7.2 B volume year-to-date

375 sales

professionals

29 countries

$13.4 B managed assets

7

Strong and Profitable Growth

2003

2004

YTD 2005

Net Income ($ millions)

Volume ($ billions)

2003

2004

YTD 2005

7.2

8.2

9.1

199

251

216

9 months

9 months

9 months

9 months

Vendor Finance ROE: 24% year-to-date

8

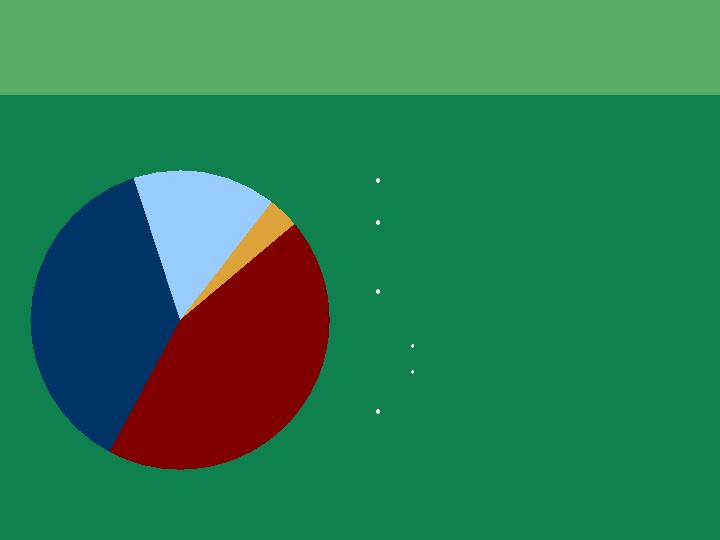

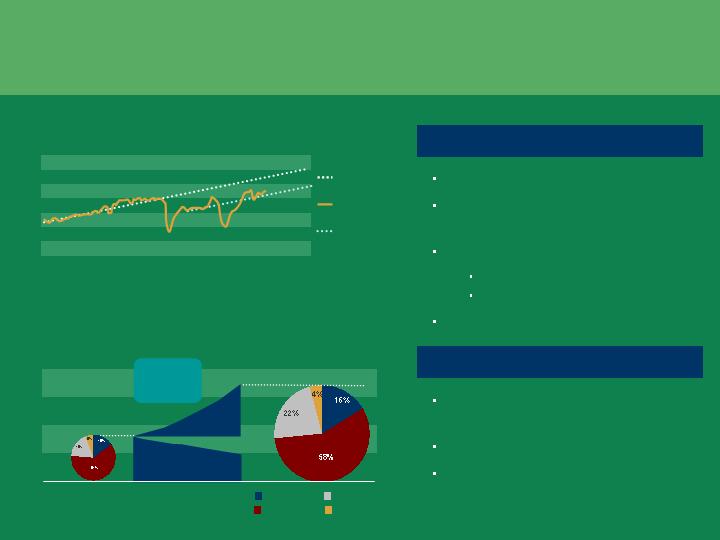

Large and Growing Global Market

Other

3%

Asia

16%

North

America

44%

Europe

37%

Total Vendor Leasing Volume = $318 B

Large and fragmented market

Subsectors with significant annual

growth

International markets growing

faster than U.S.

Europe leasing growth 13%

Asia leasing growth 17%

Focused on growth in rapidly

growing sectors and geographies

Source: 2005 World Leasing Yearbook; 2005 Monitor 100

9

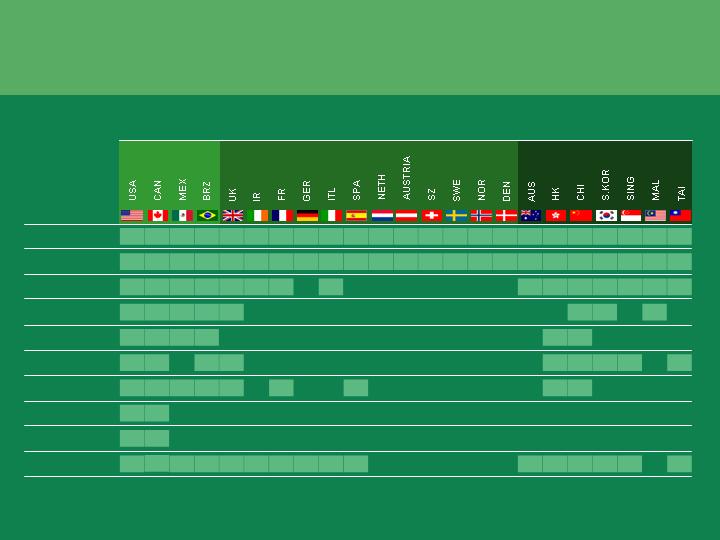

Broad Global Reach

IT

Telecom

Office Equipment

Printing

Construction

Test Equipment

Medical

Tools

Software

Other

Americas

Europe

Asia Pacific

10

New Vendor Relationships

11

11

Vendor Finance: Strategic Imperatives

Expand sales force

Increase penetration of

current relationships

Enter strategic geographies

Upgrade customer facing

technologies

Broaden product offering

12

12

Intermediary relationship management

Technology / credit scoring

Servicing expertise

Liquid

Attractive returns

Countercyclical with commercial

Consumer Dell, Honda etc.

Small Business Snap-on, Avaya etc.

Large / scalable

Fragmented

Government guaranteed

Consumer and Small Business Characteristics

Match our Core Strengths

Markets

Capabilities

Value to CIT

Vendor Enablers

13

Strong Consumer and Small Business Trends

2003

2004

YTD 2005

6.7

4.2

5.7

2003

2004

YTD 2005

74

62

73

Net Income ($ millions)

Volume ($ billions)

9 months

9 months

9 months

9 months

Consumer / Small Business ROE: 12% year-to-date (17% excluding SLX)

14

We deliver value-added lending solutions to mortgage brokers

through a national network of sales offices providing a

comprehensive set of competitive products through

superior customer facing technology and servicing capabilities

Home Lending: At-a-Glance

$4.4 B volume year-to-date

200 sales

professionals

Over 2,000 relationships

$7.8 B managed assets

15

Average FICO 630

90% owner-occupied

100% appraisal review

92% of loans are first liens

No negative amortization loans

Disciplined lending standards define

a sustainable target market

Source: SMR

2004 Sub-prime Broker Originations

Focused Target Market

CIT Target

Market

(~$80 B)

Total Market = $286 B

16

16

Strong Portfolio Demographics

81%

80%

77%

Loan to Value

Loan characteristics:

Borrower characteristics:

72%

Reevaluated Loan

to Value at 7/31/05

46%

72%

86%

% Fixed

$112K

$87K

$61K

Loan size

9

9

11

Length of residence

9

9

10

Length of employment

39%

38%

37%

Debt to income

631

625

624

FICO

12/31/99

12/31/03

9/30/05

17

17

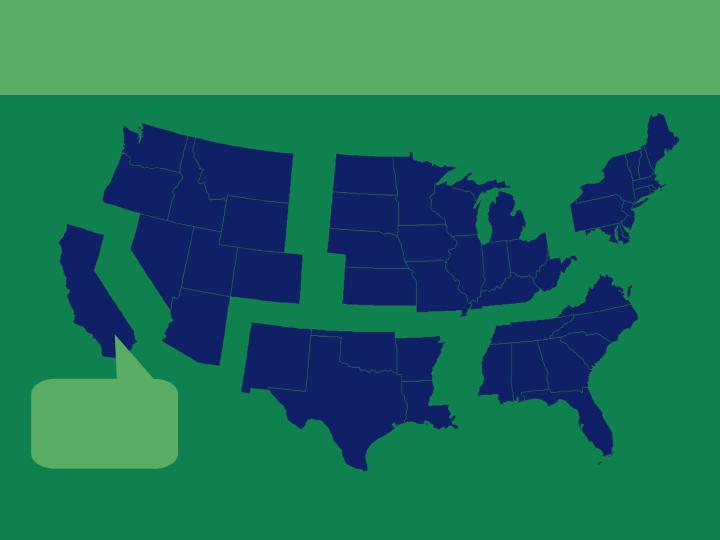

Geographic Diversification

16%

20%

11%

21%

14%

18%

Versus 39%

share of national

sub-prime

volume

Percent of total managed portfolio

18

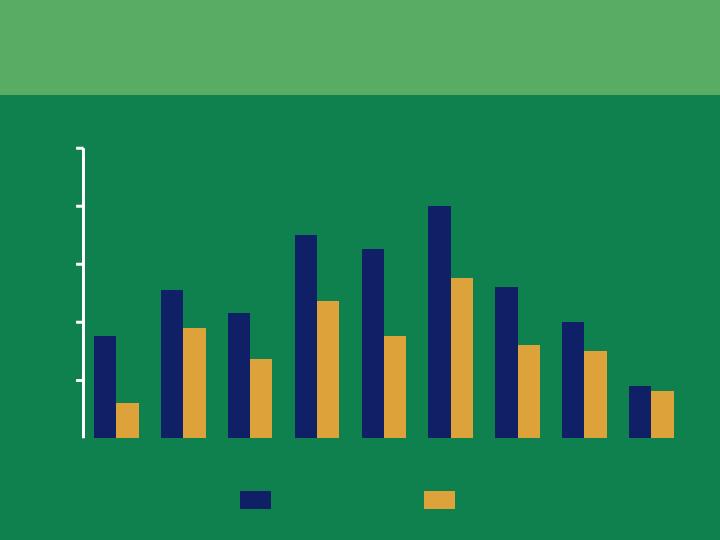

Low Delinquency vs. Competitors

Source: Loan Performance Service

90+ Delinquency Comparison by Geography

N.E.

Central

New

England

Mid

Atlantic

South

Atlantic

S.E.

Central

S.W.

Central

N.W.

Central

0.0

2.0

4.0

6.0

8.0

10.0%

Mountain

Pacific

CIT

Sub-prime industry

19

Home Lending: Financial Performance

YTD 2005

Volume

Managed assets

Efficiency ratio

Charge-offs

ROE

$4.4 B

$7.8 B

37.8%

0.78%

Mid-teens

20

Well Positioned Against Market Risks

Increased delinquency

and defaults

Primary impact on higher

value areas and coastal

regions

Decrease in

Housing Values

Increase in

Unemployment

Rise in Interest

Rates

Defaults due to increasing

payments (for floating

loans)

46% of portfolio fixed rate

No option ARM or negative

amortization

Average customer

9 years in residence

9 years in current job

Average loan size = $112K

CLTV = 72%

Geographic diversification

Low participation in resort / condo

markets

Impact

CIT Position

21

Expand sales force

Enhance front-end technology

Increase scale

Maintain risk and

target market discipline

Focus on broker channel growth

Home Lending: Strategic Imperatives

22

22

We deliver a broad range of student lending products and

services with distinctive borrower benefits to educational

institutions through a network of dedicated relationship

managers supported through an efficient centralized

processing and servicing capability

Student Lending: At-a-Glance

$1.8 B volume year-to-date

45 sales

professionals

820 partner schools;

direct channels

$4.6 B managed assets

23

Large and Growing Market

Major Trends

Strong and consistent growth in lending market

Educational costs outpacing inflation

Exponential growth in on-line education

Excluding Sallie Mae, competitors have a small share of market

Total Stafford and PLUS Volume ($ billion)

Source: U.S. Department of Education

24

Rapidly Expanding Partnerships

Partner Schools

Sep-05

2006

820

1000+

551

2004

25

25

Strong Growth

Direct Channel

Volume ($ millions)

26

1,209

9 months 2005

1,761

School Channel

552

359

826

9 months 2004

1,185

26

Leading Web Presence

485,000 registered users

Reaches 4.3% of the market

Top 25 ranked website

Over 350,000 unique visitors

per month

27

Expand school channel

sales force

Enhance web leadership

Broaden product offering

Build best-in-class

servicing capability

Capitalize on cross-sell

opportunities

Student Loan Xpress: Strategic Imperatives

28

28

We leverage our position as market leader in SBA loans

and our experienced sales force to deliver competitively

priced products and value-added advice to small business

entrepreneurs

Small Business Lending: At-a-Glance

$640 M volume year-to-date

80 sales

professionals

500+ relationships

$1.3 B managed assets

29

#1 Player in Growing Market

Major Trends

Strong growth rate – CAGR >10%

Market still relatively fragmented – top 25 have <50% share

SBA’s role changing resulting in greater barriers to entry for new and under-scaled competitors

Local banks not experts in SBA loans – emerging correspondent model

0

5

10

15

$20

2000

2001

2002

2003

2004

2005

Market Volume ($ billions)

2004 Competitor Originations ($ millions)

0

200

400

600

800

$1,000

CIT

Wells

Wachovia

US BanCorp

Source: U.S. Small Business Administration; CIT Estimates

30

Major Alliances and Intermediaries

31

31

Expand leadership position

in SBA lending

Maintain leading position in

current segments

Enter adjacent small

business markets

Broaden product offering

Capitalize on cross-sell

opportunities

Small Business Lending: Strategic Imperatives

32

32

Specialty Finance: Strategic Summary

Leading global player

Vendor

Finance

Consumer/

Small Business

Lending

Home Lending

Major share player in target markets

Sales force

New relationships

Increased penetration

Geographic expansion

Student Loan Xpress

Major share player in school channel

Small Business Lending

#1 SBA player with leading position

in target SB markets

Sales force

Increased penetration

Technology leadership

Sales force

New partnerships

Consolidated in-house

servicing

Sales force

Product expansion

New industry segments

33

COMMERCIAL FINANCE

Vice Chairman, Commercial Finance

Frederick E. Wolfert

Creating a new model for the 21st Century

Focused on large and attractive markets

Enabling growth while maintaining risk discipline

Positioned to deliver strong results through all cycles

Key Takeaways

2

Commercial Finance: At-A-Glance

Profile

Strong middle market focus

Global reach – 60 countries

29 offices – U.S., Canada,

Europe and China

2,250 employees

57,000 client relationships

Financial Highlights

$34 billion in managed assets

$8 billion in YTD loan and lease

originations

$31 billion in YTD factoring

volume

A Recognized Leader in Commercial Finance

3

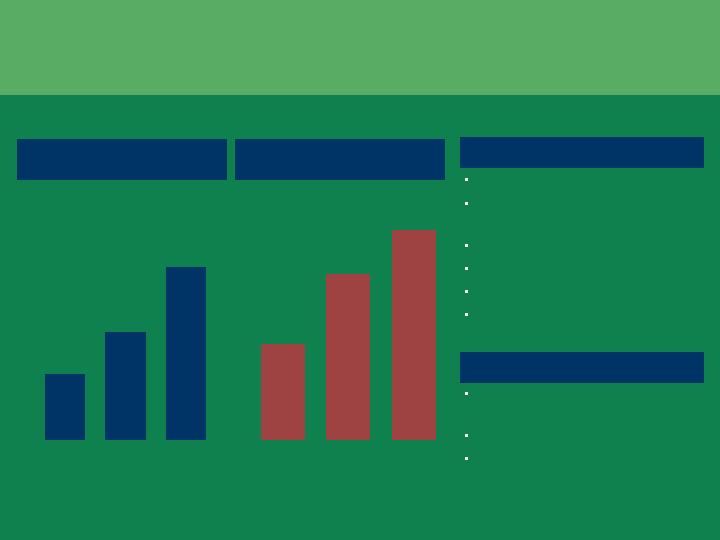

Financial Highlights

Revenue ($ billions)

Net Income ($ millions)

9 months

9 months

9 months

9 months

Return on Equity

1.1

1.3

1.0

356

472

430

4

Aerospace

Commercial Services

Businesses

Trade Finance

Transportation

Finance

Corporate

Finance

54,000 client relationships

340 sales professionals

900 client relationships

70 sales professionals

2,150 client

relationships

40 sales professionals

Profile

$486 M revenue

$195 M net income

15% ROE

$188 M revenue

$107 M net income

11% ROE

$311 M revenue

$128 M net income

26% ROE

Financial Highlights

(YTD 2005)

Business Groups

Rail Resources

5

Energy & Infrastructure

Healthcare

Business Capital

Global Sponsor

Finance

Construction

Diversified Industries

Communications,

Media & Entertainment

5

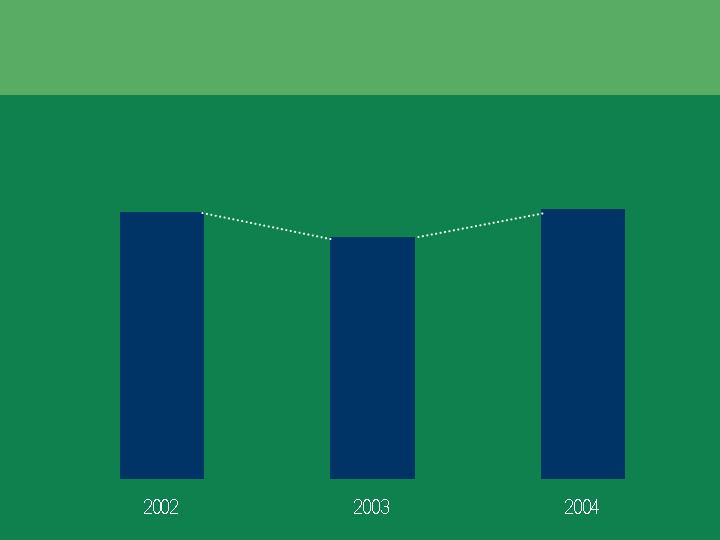

The Growth Challenge

Loan and Lease Volume ($ billions)

8.6

7.8

8.7

6

Observations

Unclear growth strategy

Uncoordinated market coverage

Limited advisory services

Built-in silos – difficult to work together

Focus on ROA vs. Risk Adjusted ROE

Initial Business Assessment

Fortress balance sheet

Experienced management team

Broad industry – specific knowledge

Product and risk structuring acumen

Relationship orientation – delivers on

commitments

Loyal customer base

Strong brand

Scale and global reach

Strengths

7

The Business Model

Do we have the right

model and the right

talent to execute the

strategy?

Key Question: How To Drive Growth?

The Market

What is the size of

the opportunity?

How will we

compete?

The Customer

How do we

differentiate our

offering in the market

and provide

customers the value

they demand?

8

Banking

Dramatic Change in Competitive Landscape

Commercial Finance & Leasing

Banks consolidating and moving up-market

Disrupted client relationships

Shifting strategies

1995-2005

9

Huge Opportunity For Growth

Small shares in large fragmented markets

< 2% U.S. Market share

Market

Opportunity

Source: Bain & Company

10

Aerospace

$328 B

Business Capital

$203 B

Healthcare

$159 B

Construction

$104 B

Global Sponsor Finance

$94 B

Energy

$62 B

Media, Communications & Entertainment

$34 B

Customer Requirements

Staying Power through all Cycles

Financial Strength and Capacity

Deliver on Commitments

Access to Decision Makers

Broad Product Offering

Specific Industry Expertise

Experience in Middle Market Lending

11

11

Blueprint for the Future:

“Client-Centric, Market-Focused Model”

Relationship Managers

Industry “Thought Leaders”

Consultative approach

Develop/manage CIT relationship

Coordinate execution

12

Equipment Finance

& Leasing

Factoring

Asset Based Lending

Corporate Finance

Structured / Project Finance

Advisory Services

Commercial Real Estate

Finance

Products and Services

Target Industries

Direct Coverage

Communications, Media &

Entertainment

Construction

Retail

Healthcare

Energy

& Infrastructure

Aerospace

Diversified Industries

Rail Resources

Private Equity

Sponsors

Intermediaries

and Hedge Funds

Equipment

Manufacturers and

Distributors

Financial

Institutions

Channel Partners

12

Focused on Growth and Productivity

Specific Design

Drives efficiency – leverages technology

and platforms for growth + productivity

Delivers the full value of CIT to customers

– integrates company offerings

Assigns our best sales resources to the right

customers + maximizes effectiveness

Leverages deep product and

industry knowledge across units

Promotes better transparency and

performance management

Provides “One CIT” face to the customer

Expected Benefits

13

“CIT Strike Zone”

Junk

B-

$10M

$50M

$1B

$100B+

B+

BB-

BBB

AAA

Credit rating

Revenue

CIT Target Market

Commercial

Finance

Companies

Regional Banks

Hedge Funds

Finance Companies

Local Banks

Large Banks

Investment Banks

14

Hedge Funds

14

Bulge Bracket

Investment Banks

M&A Advisory

Merchant Banking

Capital Markets

Fairness Opinions

Commercial Real Estate Services

High Yield Underwriting

Equity Underwriting

Investment Banking Services Strategy:

“Bringing Wall Street to Main Street”

CIT Investment

Banking Services

Boutique

Investment Banks

Driving increased fee revenue and incremental loan volume

15

Attracting Top Talent

Significant investment in people to support our growth strategy

Recruited 60 new senior executives – averaging 15+ years experience

New leadership complements existing CIT veterans

16

Completing

Transformation

Moved Aerospace

International to

Ireland

Announced

$2.2 billion Airbus

order

Acquired HBCC and

PLM rail cars

Announced

Canadian

restructuring

Announced

disposition of out of

production aircraft

Launched

Commercial Real

Estate Advisory

Completed Strategic

Planning process

Sold $900 million

corporate aircraft

portfolio

Restructured

Equipment Finance

and Business Credit

Launched Strategic

Planning process

Announced

Commercial Finance

reorganization

Acquired RCM

(SunTrust factoring)

Established Shared

Services

Q4

2005

Q3

2005

Q2

2005

Q1

2005

Major Actions

2006 +

Execute

17

17

Select Business Updates

Trade

Finance

Aerospace

Healthcare

Rail

Resources

Equipment

Finance

18

#1 Market position

Expanded international platform

Deep industry expertise in retail and

consumer goods

Experienced sales and marketing team

$4 billion per month in factoring volume

Trade Finance

Highlights

Growth Agenda

Expanding in adjacent sectors

Textiles, home furnishings and furniture

Housewares, electronics and hardware

Focusing on international expansion

U.S. – Asia and Europe – Asia trade flows

Pursuing major global alliances

28

38

31

Factoring volume ($ billions)

9 months

9 months

19

Aerospace

World Air Travel Now Above 2000 Levels

26

0

240

220

200

180

160

140

120

100

1998

1999

2000

2001

2002

2003

2004

2005

Long-term

trend

Actual

trend

Future

trend

Source: Boeing

The World Fleet Will More Than Double

Regional

Twin Aisle

Single Aisle

747 and larger

2004

2024

40,000

30,000

20,000

10,000

7,200

Replacements

2024

35,300 airplanes

2004

16,800

airplanes

25,700

New Aircraft

Deliveries

# 3 market position

Investing in commercial fleet to meet

increased customer demand

Transferred international to Dublin

Moved closer to customers

Optimized tax structure

Repositioned corporate aircraft business

Highlights

Growth Agenda

Launch Corporate Finance strategy

targeting aerospace and defense sector

Opportunistic “spot market” purchases

Expand international corporate aircraft

20

Investing in technology to deliver best-in-

class service and improved efficiency

Expand direct sales force

Drive sales productivity

Equipment Finance

Highlights

Installed new leadership team with deep

industry expertise

Refocused on core industries –

Construction and Diversified Industries

Increased focus on ROE

Improving cost structure and operating

efficiencies

ROE

8.0%

10.2%

Growth Agenda

21

Organized for success

Hospitals

Long-Term

Care

Outpatient

Managed

Care

Healthcare

Highlights

Launched healthcare

vertical

Hired top industry talent

Grew FTE’s from 20

to 140

Accelerated build-out via

HBCC acquisition

$1 billion in asset growth

>15% of U.S. GDP and growing

Estimated 2004 Industry Financings: $159 billion

Growth Agenda

Leverage 2005

investments and execute

Cross-sell HBCC

customer base

$49

Hospitals

$25

Long-Term Care

$7

Outpatient

$10

Vendor

$8

Physician / Dental Practice

$20

Life Sciences

$15

Managed Care

$25

Specialty Pharma / Medtech

22

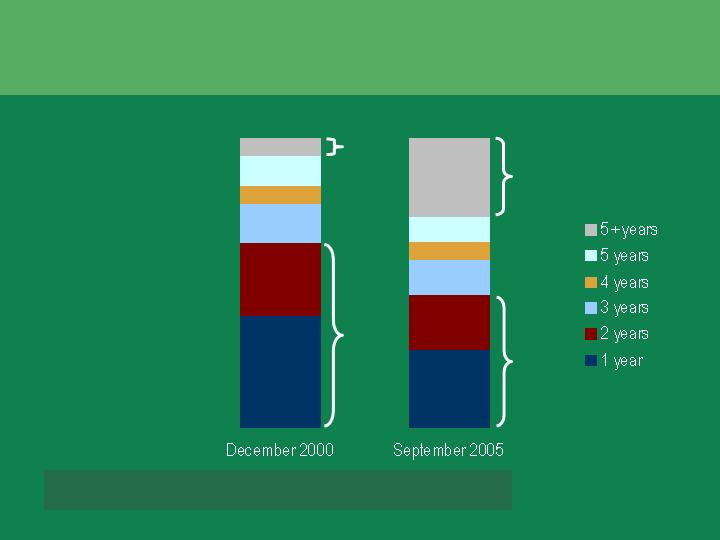

Growing the fleet…

…And lengthening terms to lock in

growth and profits

Highlights

#3 market position

Youngest fleet in industry,

80% of fleet < 9 years

Diversified mix of car types

Excellent service reputation

Full economic utilization: 99%

Strong ROEs, with positive trends

* Owned or serviced

Rail Resources

Rail cars under lease*

(thousands)

Average renewal term

(months)

Dec-00

32

Dec-04

52

Sep-05

83

22

38

48

Dec-00

Dec-04

Sep-05

Growth Agenda

Maximize rental rates as existing

leases renew

Seek opportunistic bulk purchases

Launch Corporate Finance

strategies

23

A Diverse Portfolio of Growth Businesses

15%+

10-15%

Aerospace

Business Capital

Communications, Media &

Entertainment

Diversified Industries

Energy & Infrastructure

Global Sponsor

Healthcare

Construction

Rail Resources

Trade Finance

Projected earnings growth rate

24

Delivering on Commitments while

Transforming the Business

Return on Equity

Strong momentum going into 2006

New business volume up 30% YTD

Strong pipeline

Earnings up 23% YTD

Credit quality considerably improved

Increasing rate environment favorable

25

New Model for the 21st Century

Improved go-to-market synergies

Sharper focus on growth opportunities

Increased fee income – Investment Banking

Enhanced risk management – domain expertise

Improved transaction execution

Scale and productivity gains

Benefits to CIT

Market focused

Customer centric

End-to-end solutions

Relationship driven

Leverages CIT’s strengths

The Right Model at the

Right Time

Industry expertise valued

Capital expenditures increasing

Large and growing financing needs

Fragmented financing market

Global scope

Focus on Large and

Attractive Markets

26

26

CREDIT OVERVIEW

Lawrence A. Marsiello

Vice Chairman & Chief Lending Officer

Disciplined underwriting practices

Diverse portfolio with broad spread of risk

Strong credit metrics

Supporting growth initiatives

Preparing for the next credit downturn

Key Takeaways

2

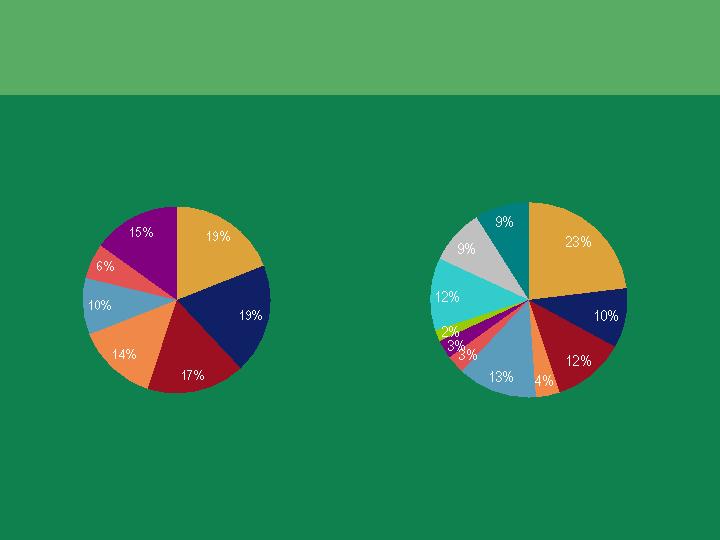

Broad and Diverse Portfolio

Northeast

Geography

Europe and Asia

Canada

Southwest

Southeast

Midwest

West

* No other collateral type greater than 3%

Asset / Collateral Type

A/R and

Inventory

Revolvers

Technology

Manufacturing

Construction

Transportation

Land

Other*

RE- Residential

Transportation

Air

RE-Industrial

Government

Subsidized

Healthcare

3

Wide Array of Industries

* No other industry served greater than 3%

Manufacturing

Commercial Air

Home Lending

Transportation

Services

Consumer Other

Construction

Wholesale

Communication

Healthcare

Other*

Retail

Education Lending

4

Client Ratings Reflect Middle Market Focus

1-10 internal risk grading system

Focus on transactions just below

investment grade

Good portion of high quality assets

Little change in our client risk profile

Consistent market focus

Continuously refine underwriting criteria

A-AAA

BBB

BB

B

Below B

Risk grading based on credit quality of obligor and transactional details

(collateral coverage, tenor, etc.)

15%

13%

40%

28%

4%

5

Minimal Concentration Risk

Data based on individual transaction sizes

6

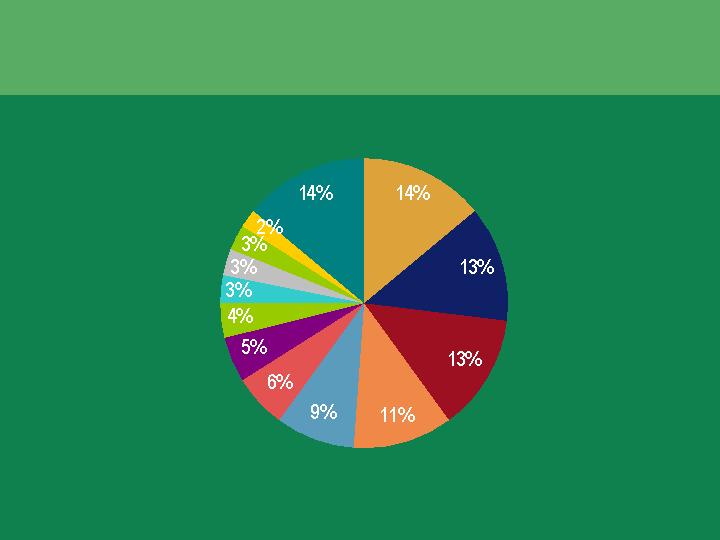

Mix Shift Toward Small Ticket Businesses

Sep-95

Sep-05

$17B

$61B

Composition of Managed Assets

7

Rank Industry Amount ($ millions) Business Facility Grade

Top 10 Exposures: Less than 5% of

Portfolio Assets

Data based on aggregate client exposures

8

1.

Retail

360

Trade Finance

AA

2.

Retail

302

Trade Finance

BBB

3.

Technology

288

Vendor Finance

A

4.

Retail

230

Trade Finance

BB+

5.

Energy

223

Corporate Finance

CCC

6.

Retail

192

Trade Finance

A

7.

Retail

153

Trade Finance

A+

8.

Retail

144

Trade Finance

A-

9.

Retail

139

Trade Finance

BB

10.

Construction

130

Equipment Finance

BB

Top 10 Non-Accruals: Represents 0.3% of

Finance Receivables

Data based on aggregate client exposures

9

Rank

Industry

Amount ($ millions)

Business

1.

Aerospace

50

Transportation Finance

2.

Aerospace

33

Transportation Finance

3.

Telecom

15

Corporate Finance

4.

Telecom

12

Corporate Finance

5.

Construction

12

Equipment Finance

6.

Manufacturing

11

Corporate Finance

7.

Telecom

9

Equipment Finance

8.

Healthcare

8

Corporate Finance

9.

Energy

7

Corporate Finance

10.

Aerospace

7

Transportation Finance

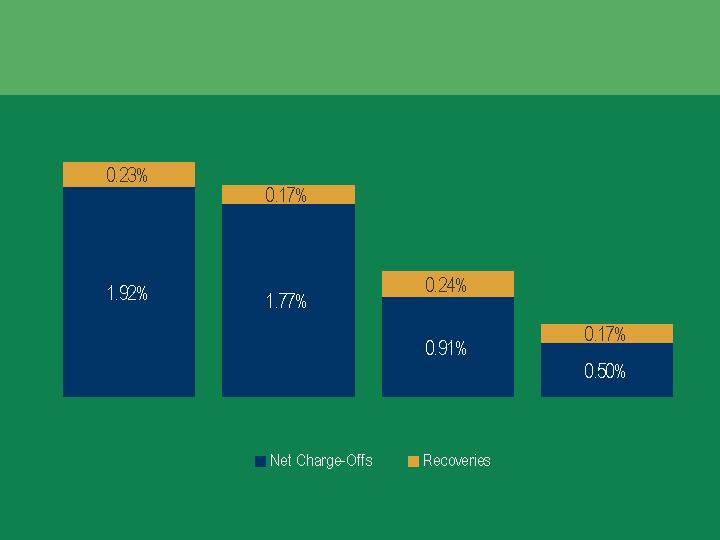

Charge-offs Are Below Historic Run-Rate

10

Charge-offs and Recoveries Strong

2002

2003

2004

YTD 2005

11

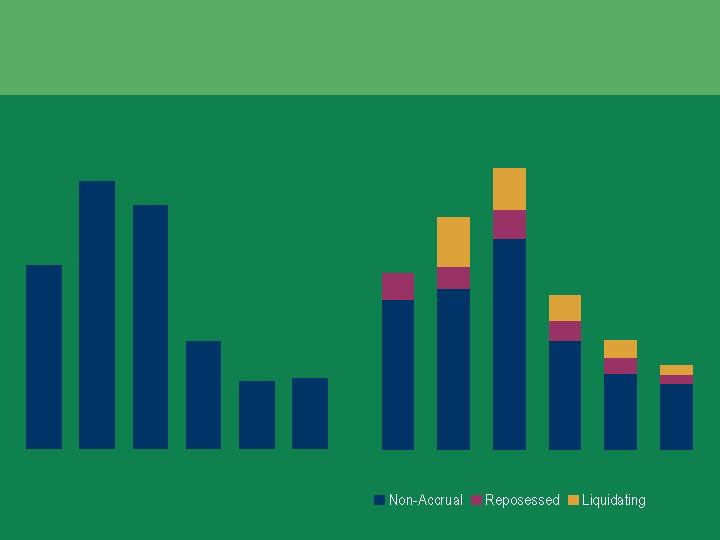

Forward Markers Remain Strong

3.24%

2.47%

3.93%

2.16%

1.54%

1.28%

Owned Delinquency 60+ days

Non-Performing Assets

Dec-00

Dec-01

Dec-02

Dec-03

Dec-04

Sep-05

Dec-00

Dec-01

Dec-02

Dec-03

Dec-04

Sep-05

1.76%

1.73%

2.16%

3.63%

3.90%

2.98%

12

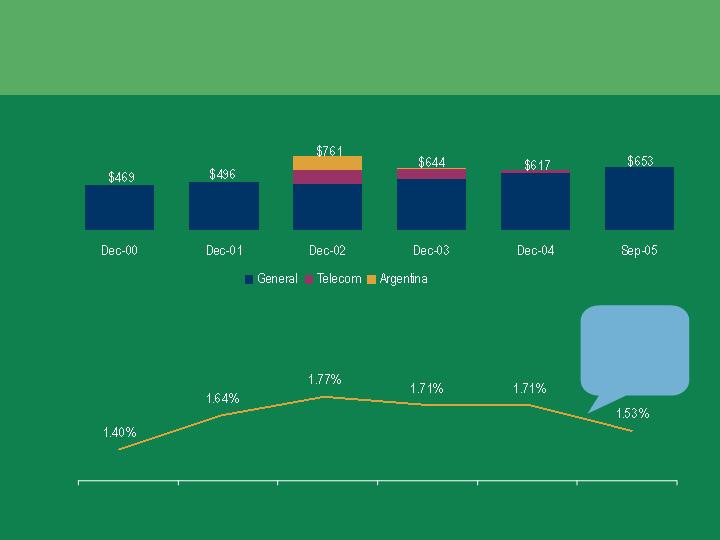

Solid Loan Loss Reserves

Decrease

reflects addition

of student

lending assets

Reserves ($ millions)

General Reserves as % of Finance Receivables

Dec-00

Dec-01

Dec-02

Dec-03

Dec-04

Sep-05

13

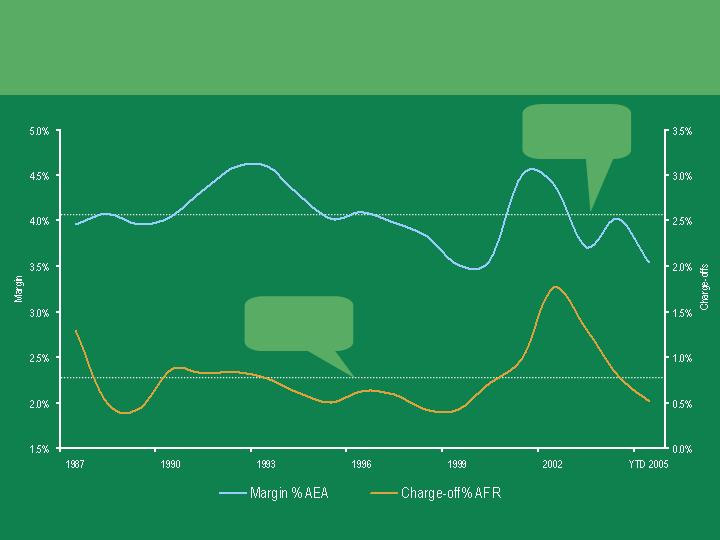

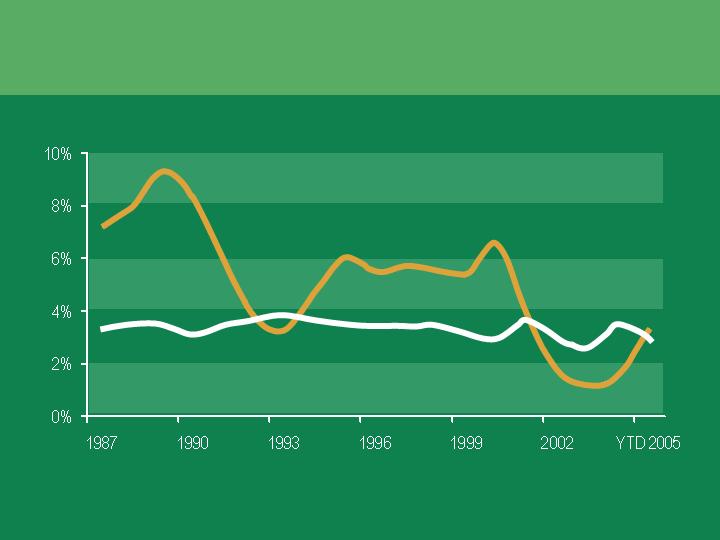

Margin and Charge-offs Are Correlated

18 Year

Avg = 0.79%

18 Year

Avg = 4.08%

14

Factors Influencing Pricing and Structure

Pricing

Influx of

New

Lenders

Robust

Market

Liquidity

Historically

Low Defaults

Rising

Interest

Rates

Rising

Energy

Prices

Structure

15

Forward View of Credit

Default rates start creeping up

Consolidated losses average 0.70% to

0.80% through the cycle

2006 losses below that range

16

Key Objectives Going Forward

Prepare for the next downturn

Support growth initiatives

Launching

new products

Entering

new industries

Expanding

internationally

17

Credit Risk Management Enhancements

New analytics

Installing a powerful Risk

Management System

Creating a two-tiered Risk

Grading System reflecting

probability of default and

loss given default

React quicker

Expanding syndication and

hedging activities to shed

excessive risk and gain

insight on market returns

Do what we do better

Developing common

definitions and methodologies

Linking credit grades to

default rates in pricing models

Driving capital allocation

down to the portfolio and

obligor level

18

Close Working Relationship Between

Credit and Sales

Standardize and streamline credit review process

Pre-approve underwriting criteria and credit risk tolerances

Enhance the knowledge base and skill sets of both credit and sales staff

Accelerate decisioning without cutting corners

19

Preparing for next

downturn

Supporting growth

initiatives

Summary

Key Attributes

Key Initiatives

Disciplined underwriting practices

Diverse portfolio with broad

spread of risks

Solid loan loss reserves

Proactive portfolio

risk management program

20

CFO PRESENTATION

Joseph M. Leone

Vice Chairman & Chief Financial Officer

Strong capital position and disciplined treasury management

Broad based and high quality revenue sources

Further opportunities to enhance productivity and funding

2006 funding and capital update

Key Takeaways

2

Organic

Asset Growth

Opportunistic

Acquisitions

More Than

Supports

Strong Capital Generation

ROTE

16%+

Dividends

15% to 20%

Capital Generation

>12%+

less

equals

3

Increased dividend 23% in Q1 2005

Repurchased shares to cover options

Freed $200 million in capital

Bought back $500 million common

stock – 15% cost

Accelerated Healthcare build-out

Acquired HBCC

Action-Oriented Capital Management

Strong internal capital generation

Reduced discontinued

portfolios $600 million

Issued $500 million of preferred

stock – 6% cost

Sold $900 million of

low-returning business aircraft

Improved ROTE to over 17%

4

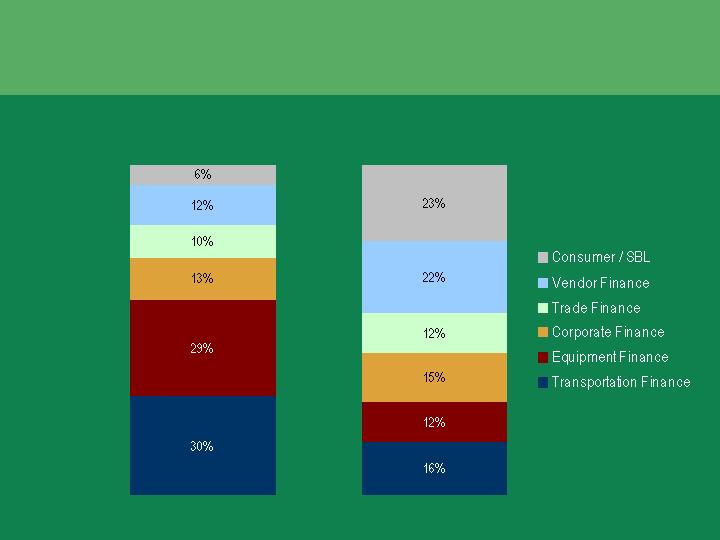

Disciplined Capital Allocation

$6.5

$6.8

($ billions)

$0.3 billion

excess capital

Rail

Corporate

Finance

Aerospace

Equipment

Finance

Trade

Finance

Vendor

Finance

Consumer

SLX

$1.0

Required

Actual

0

1

2

3

4

5

6

7

Business

Goodwill

Equity

Equity

5

Building Funding Flexibility

Commercial Paper / Total Debt

Alternate Liquidity* / Short Term Debt

*Alternate Liquidity includes available bank facilities, asset backed conduit facilities and cash

~

6

Extending Debt Maturities

28

35

1.9 years

3.5 years

Average Term

6%

64%

46%

27%

($ billions)

7

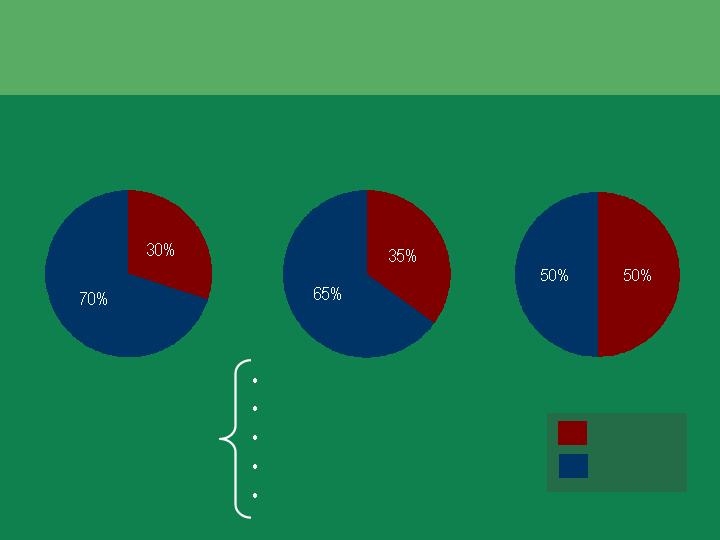

Next Funding Source: CIT Bank

Current

2006 and Beyond

Industrial Bank

Facilitates originations

Standard documentation

Used for Dell Financial

Services program

$400 million of vendor assets

Chartered in 2000

Broaden focus

A funding source

Target 10% of funding

Access Federal Home

Loan Bank

Student loans and mortgages

Timing: Early 2006

8

3.2 years

43%

2.4 years

48%

$24B

Fixed

$25B Debt

Amount

Funding (after swaps)

57%

Portfolio

Term

Term

Portfolio

Amount

4.1 years

2.6 years

52%

$26B

Floating

Assets

Effective Matched Funding

$19B Debt

$6B Equity

9

Measured Risk Analysis

Accounting measure

Short-term measurement

Earnings sensitivity = $14 million after-tax

Minimal rate sensitivity

Economic measure

Long-term measurement

Equity sensitivity = $111 million

Consistent risk taking

Margin at Risk*

Equity at Risk*

* Based on an immediate 100 basis point rate increase

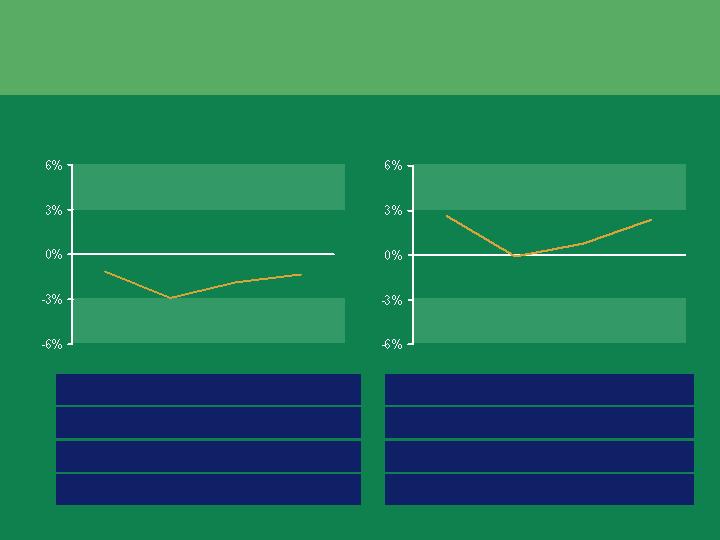

2002

2003

2004

Q3 05

2002

2003

2004

Q3 05

10

Stable Margin In All Rate Environments

3 month LIBOR

Risk Adjusted Margin

11

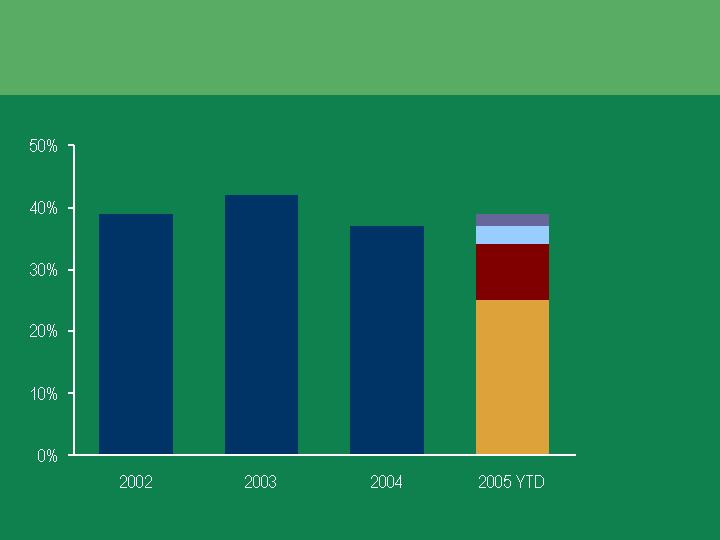

High Percentage of Non-Spread Revenue

Fees and other

Equipment gains

Factoring commissions

Securitization gains

12

2005

2004

Operating Group

38%

46%

43% ex. SLX

39%

45%

Efficiency Ratios (incl. corp. allocation)

3-Year Asset

CAGR

6%

Commercial Finance

15%

Specialty Finance

Growing Efficiently

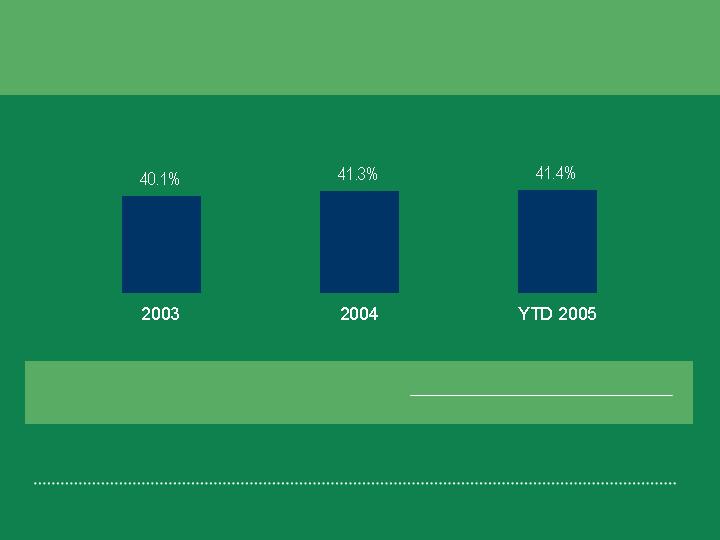

Consolidated Efficiency Ratio

40.2%

ex. SLX

13

In Process

Evaluating 20 processing platforms and systems

Leveraging shared services organizations

Examining offshore opportunities

Developing more automated credit adjudication

Remodeling the Back Office

Completed

Eliminated 17 transaction processing platforms

Consolidated 9 servicing centers

Reduced procurement spending

Servicing international aerospace in Dublin (tax savings)

14

Investing in Revenue Generation

2004

Longer Term

YTD 2005

Front-end

Back-end

Investing Back

Office Savings in

Sales Force

M&A and Real Estate Advisory

Sponsor Finance

Syndication

Insurance

Expense Composition

15

Minimal Impact From Expensing Stock Options

2 - 3%

2%

3%

Pro-Forma

Dilution

$3.09

$3.35

EPS

16

Leasing Businesses

Utilization of Net Operating Loss

Dublin Aerospace Initiative

Improved International Vendor Profitability

Efficient Tax Management

$329

$483

Accounting Provision for Taxes

$64

$115

Cash Taxes Paid

< 35%

35%

39%

Effective Tax Rate

2006 (E)

YTD 2005

2004

Income Taxes: Another Expense

Why it is decreasing

Why cash is lower

17

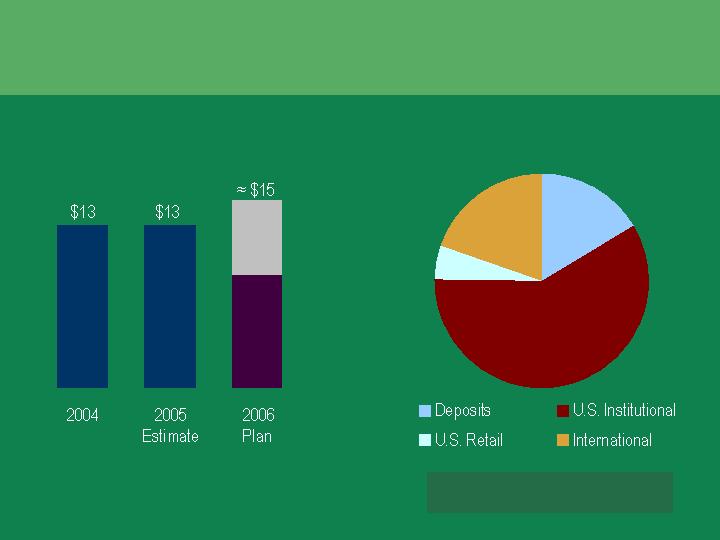

Our 2006 Funding Plan

$2

$8-10

$3

$1

Unsecured Term Issuance

($ billions)

Growth

Maturities

$6

$9

2006 Sources

($ billions)

No significant change in planned commercial

paper or securitization levels

18

Our Case for a Ratings Upgrade

Governance

Experienced management with strong ISS ratings

Profitability

Quality, stable earnings, high returns

Credit Quality

Strong culture, performance and reserves

Funding

Robust liquidity, diverse sources and experienced

Capital

Strong base with disciplined management

Premium name with leadership positions

Franchise

19

Support

Quality

Growth

Even Stronger Fundamentals

20

Broader Based Revenues

More Diverse Funding

Improving Productivity

Enhanced Capital Position

Long-

standing

Credit and

Control

Culture

20

2006 OUTLOOK

Jeffrey M. Peek

Chairman and Chief Executive Officer

What You Have Heard Today

Vision &

Strategy

Sales & Marketing

Business Execution

Risk Management & Capital Discipline

Trade

Finance

Transportation

Finance

Corporate

Finance

Vendor

Finance

Consumer /

SBL

2

Targets

16.4%

27%

YTD 2005

Updated

Initial

15%

Mid-teens

16%+

ROTE

20%+

EPS growth

Exceeding Our 2005 Targets

3

Execution of our Strategy Will

Drive 2006 Results

Trade Finance, Vendor Finance, Corporate Finance

initiatives critical to success

Invest in Energy, Advisory and Technology

Grow sales force from 1,275 to 1,575

Increase pipeline visibility through Salesforce.com

Leverage strategic account program

Pursue next round of expense opportunities, including

offshoring and further platform consolidation

Invest in technology

Expand analytics, syndication and hedging

Maintain historic discipline (no compromise for growth)

Further diversify funding including brokered deposits

through CIT Bank

Implement risk-based capital allocation at customer level

Sector

Alignment

Client

Focus

Productivity

Management

Credit and

Risk Management

Capital

Discipline

build to script

4

Looking Ahead

Trade

Finance

Maintain #1 position

in U.S. market

Leadership in

attractive non-

traditional segments

Build international

platform

The leading global finance company for the middle market

Transportation

Finance

Leadership position

(top 3 player)

The most modern

fleet

Participation in

emerging air markets

(Asia and India)

Increasing

penetration of non-

spread products

Corporate

Finance

Partner of choice for

middle market

companies

A leader in each

target customer-

focused market

Increasing

penetration of non-

spread revenue

Vendor

Finance

The #1 global provider

of vendor finance

Increasing penetration

of current partners

within and across

geographies

Scale global back-

office platforms

Consumer/

SBL

#1 provider of sub-

prime home lending

with targeted brokers

The #1 SBA lender in

U.S.

Leader in student

lending (top 5 player)

Continued provider of

growth and earnings

diversification

5