- CIT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Cit (CIT) 8-KRegulation FD Disclosure

Filed: 8 Nov 05, 12:00am

2006 OUTLOOK

Jeffrey M. Peek

Chairman and Chief Executive Officer

What You Have Heard Today

Vision &

Strategy

Sales & Marketing

Business Execution

Risk Management & Capital Discipline

Trade

Finance

Transportation

Finance

Corporate

Finance

Vendor

Finance

Consumer /

SBL

2

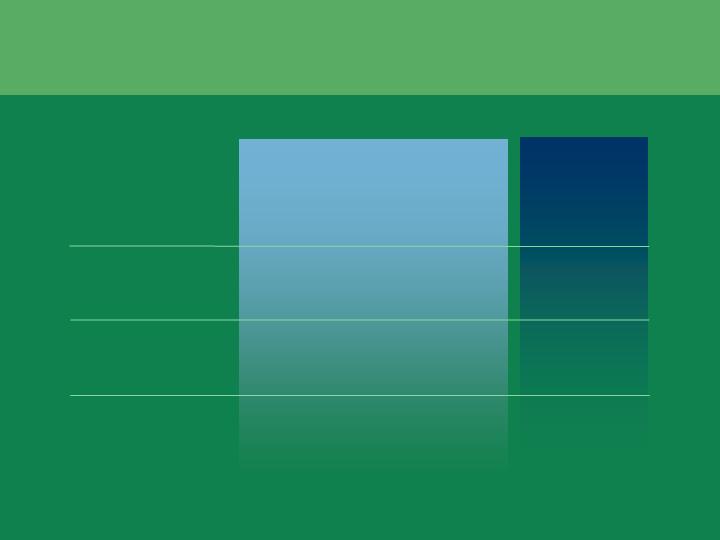

Targets

16.4%

27%

YTD 2005

Updated

Initial

15%

Mid-teens

16%+

ROTE

20%+

EPS growth

Exceeding Our 2005 Targets

3

*Assumes consistent treatment of option expense

2006 Earnings Guidance

Target

15%

Mid-teens

ROE

EPS Growth*

4

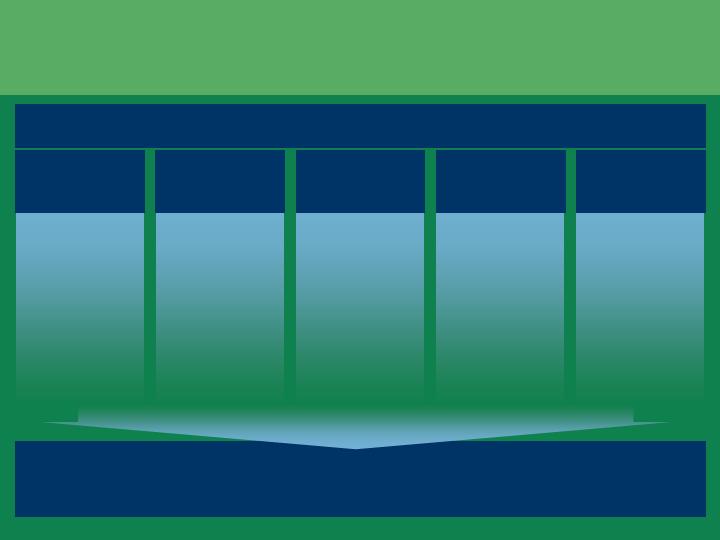

Execution of our Strategy Will

Drive 2006 Results

Trade Finance, Vendor Finance, Corporate Finance

initiatives critical to success

Invest in Energy, Advisory and Technology

Grow sales force from 1,275 to 1,575

Increase pipeline visibility through Salesforce.com

Leverage strategic account program

Pursue next round of expense opportunities, including

offshoring and further platform consolidation

Invest in technology

Expand analytics, syndication and hedging

Maintain historic discipline (no compromise for growth)

Further diversify funding including brokered deposits

through CIT Bank

Implement risk-based capital allocation at customer level

Sector

Alignment

Client

Focus

Productivity

Management

Credit and

Risk Management

Capital

Discipline

build to script

5

Looking Ahead

EPS Growth 15%+ / ROE 16-18%

The leading global finance company for the middle market

Trade

Finance

Maintain #1 position

in U.S. market

Leadership in

attractive non-

traditional segments

Build international

platform

Transportation

Finance

Leadership position

(top 3 player)

The most modern

fleet

Participation in

emerging air markets

(Asia and India)

Increasing

penetration of non-

spread products

Corporate

Finance

Partner of choice for

middle market

companies

A leader in each

target customer-

focused market

Increasing

penetration of non-

spread revenue

Vendor

Finance

The #1 global provider

of vendor finance

Increasing penetration

of current partners

within and across

geographies

Scale global back-

office platforms

Consumer/

SBL

#1 provider of sub-

prime home lending

with targeted brokers

The #1 SBA lender in

U.S.

Leader in student

lending (top 5 player)

Continued provider of

growth and earnings

diversification

build to

script

6