- CIT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Cit (CIT) 8-KRegulation FD Disclosure

Filed: 8 Feb 06, 12:00am

Investor Meetings: Europe

February 8-10, 2006

Exhibit 99.1

Notices

Forward Looking Statements

Certain statements made in this presentation that are not historical facts may constitute "forward-looking" statements under the Private

Securities Litigation Reform Act of 1995, including those that are signified by words such as "anticipate", "believe", "expect", "estimate", “target”,

and similar expressions. These forward-looking statements reflect the current views of CIT and its management and are subject to risks,

uncertainties, and changes in circumstances. CIT's actual results or performance may differ materially from those expressed in, or implied by,

such forward-looking statements. Factors that could affect actual results and performance include, but are not limited to, potential changes in

interest rates, competitive factors and general economic conditions, changes in funding markets, industry cycles and trends, uncertainties

associated with risk management, risks associated with residual value of leased equipment, and other factors described in our Form 10-K for

the year ended December 31, 2004 and our Form 10-Q for the quarter ended September 30, 2005. CIT does not undertake to update any

forward-looking statements.

Non-GAAP Financial Measures

The data provided in this presentation have been modified from our previously reported periodic data, including but not limited to, exclusion of

certain non-core transactions and non-recurring events, because management believes that the data presented herein better reflects core

operating results. As such, the data may vary from comparable data reported in CIT’s forms 10-K and 10-Q.

This presentation includes certain non-GAAP financial measures, as defined in Regulation G promulgated by the Securities and Exchange

Commission. Any references to non-GAAP financial measures are intended to provide additional information and insight into CIT's financial

condition and operating results. These measures are not in accordance with, or a substitute for, GAAP and may be different from or

inconsistent with non-GAAP financial measures used by other companies.

For a reconciliation of these non-GAAP measures to GAAP and a list of the transactions and events excluded from the data herein, please refer

to the appendix within this presentation or access the reconciliations through CIT's Investor Relations website at investor.relations@cit.com.

Data as of or for the period ended December 31, 2005 unless otherwise noted.

2

Overview

Specialty Finance

($29 billion)

Vendor Finance

Consumer / Small Business Lending

Commercial Finance

($34 billion)

Trade Finance

Corporate Finance

Transportation Finance

Equipment Finance

Client Focus

Life Cycle Financing

Disciplined Underwriting

Seasoned Leadership

Long standing customer relationships

Full product and service offering

Cash flow and collateral expertise

Broad and deep management team

Leading global finance company

with $63 billion of managed assets

3

International Operations

$13.2 (21% of CIT)

$1.4

$0.6

$1.8

$4.7

$4.7

Managed Assets (billions)

Total

Aerospace

Vendor Finance

Other

Aerospace

Vendor Finance

Australia

Aerospace

Trade Finance

Vendor Finance

Asia

Aerospace

Corporate Finance

Vendor Finance

Europe

Aerospace

Corporate Finance

Equipment Finance

Trade Finance

Vendor Finance

Canada

Primary Businesses

Country

1,500 employees servicing international operations

4

2005 – A Strategic Year

Performed rigorous strategic assessment of our business

Realigned portfolios around market sectors

Invested in high return / high growth opportunities

Acquired three businesses

Ordered 39 aircraft valued at $2.8 billion

Created Strategic Advisory Services group to accelerate fee income growth

Divested $1.7 billion of low return / low growth businesses

Reinvigorated sales culture

Enhanced shareholder value

Completed $500 million share repurchase program

Increased quarterly dividend by 25%

5

2005 – A Record Year

Very strong credit performance

0.60%

0.91%

Net Charge-offs

Increased 160 basis points

14.2%

12.6%

ROE

Exceeded 16% target

16.5%

13.9%

ROTE

Record earnings, up 23%

$882 M

$720 M

Net Income

Record asset levels

$63 B

$53 B

Managed Assets

Record new business originations

$32 B

$24 B

Volume

Comment

2005

2004

Metric

6

2005 – A Year of Improving Returns

Improving

Reflects student lending

Exceeds hurdle

Improving

Improving

Exceeds hurdle

Exceeds hurdle

Comment

14.2%

12.6%

Overall CIT ROE

9.4%

14.9%

Specialty Finance – Consumer

23.8%

21.8%

Specialty Finance – Commercial

10.5%

8.0%

Equipment Finance

11.3%

10.5%

Transportation Finance

19.3%

22.2%

Corporate Finance

27.1%

25.7%

Trade Finance

2005

2004

Segment

7

2006 Priorities

Execute upon our growth strategies

Focus on productivity through technology

Maintain traditional disciplines

8

2006 Growth Drivers

Healthcare

Asset

Generation

Strategic Advisory Services

Fee

Generation

Syndications

Communications, Media &

Entertainment

Global Sponsor Finance

Aerospace

Student Loan Xpress

International

Global Insurance

Restructuring

9

Sales Force Execution is Key to Growth

Established a

corporate sales

office providing

direction and

oversight

Designated

Chief Sales

Officers in

all business

units

Implemented a

company wide

customer

management

system,

Salesforce.com

Aligned our sales

incentive plans

with growth

strategies

10

International Growth Agenda

Continue to build upon aerospace platform

Scale pan-European vendor operations

Expand Trade Finance (factoring) in Asia

Leverage recently acquired UK banking license

Build upon our leading equipment leasing position in China

11

Supporting Our Growth

Investing in technology to maximize the customer relationship

Salesforce.com (customer relationship database)

Credit adjudication and risk analysis software

Web-based applications

Re-directing investment from back-end to front-end

Front-end

Back-end

2004

2005

Longer Term

12

Furthering Commitment to Traditional Disciplines

Credit

Maintain prudent reserve position

Expand syndication and portfolio management activities to manage excess risk

Expect 2006 credit losses to be less than 80 basis points

Funding

Continue to match fund the portfolio

Increase funding from international capital markets

Leverage CIT Bank’s deposit-taking capability

Capital

Drive portfolio optimization

Explore further capital structure efficiencies

Continue to return capital to shareholders

13

2006 – The Year of Execution

Clearly defined our strategic

imperatives by business

Augmented leadership

Re-aligned around the customer

Rounded out our products and service

offerings

Energized the sales force

Organic volume benefits from the hiring

of sales professionals

Non-spread income reflects addition of

Strategic Advisory Services

Efficiency improves as revenue growth

accelerates

Funding diversity enhanced by deposit

base growth

Portfolio initiatives result from capital

discipline

2005 Actions

2006 Drivers

14

2006 Earnings Guidance

Target**

15%

$4.65 - $4.75

ROE

EPS*

*Includes estimated stock options expense of $0.08-$0.10 per share

**Guidance as provided on January 18, 2006. Reproduction of this slide should not be construed as an affirmation or update of that guidance.

15

Capital and Liquidity Management

Commitment to Strong Debt Ratings

Corporate Ratings

Stable

A

R-1 Low

DBRS

Outlook

Long Term

Short Term

Fitch

S&P

Moody’s

Stable

A

F1

Stable

A

A-1

Stable

A2

P-1

17

Cash and Equivalents

Commitment to Strong Balance Sheet

Cash balance is ample

Maintain a minimum balance of $500 million

0.8

2.0

2.0

2.2

3.7

Loan Loss Reserve to Net Charge-offs

1.2

0.9

1.4

2.3

2.5

Reserves reflect risk

Strong coverage ratios

Capital supports asset base

9.5% Tangible Capital to Managed

Assets verses 9.0% requirement

Tangible Capital Base

18

Dec-01

Dec-02

Dec-03

Dec-04

Dec-05

Organic

Asset Growth

Opportunistic

Acquisitions

More Than

Supports

Strong Tangible Capital Generation

ROTE

17%+

Dividends

15% to 20%

Capital Generation

>13%+

less

equals

19

Building Funding Flexibility

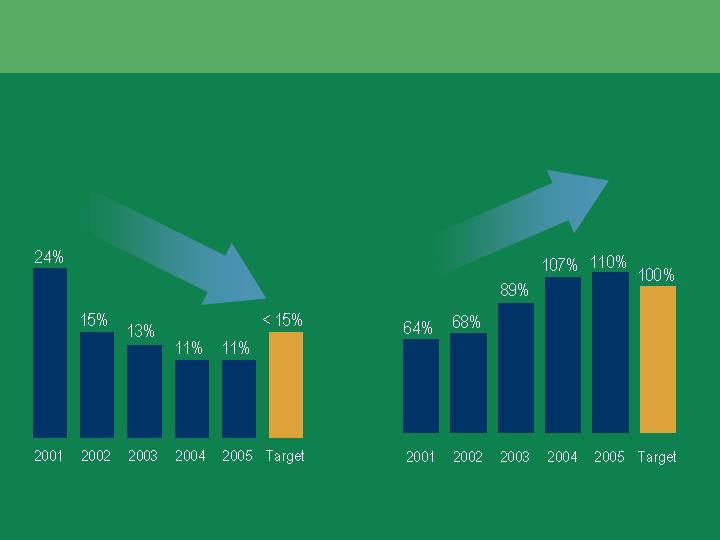

Commercial Paper / Total Debt

Alternate Liquidity* / Short Term Debt

*Alternate Liquidity includes available bank facilities, asset backed conduit facilities and cash

20

Unsecured Facilities

Committed Liquidity Facilities

Renewed Q1 2005

All term facilities with 3 years or longer to

expiration

No Mac Clause

1 Financial Covenant: Net worth >$4.0B

Well Over 100% CP Coverage

Apr 2009

$ 2.1B

Facility Expiration

Total

$ 6.5B

Mar 2006

A$ 0.2B

Oct 2008

2.1B

Apr 2010

2.1B

$9.3 billion of committed asset-backed facilities

Facilities cover a variety of asset classes (Equipment Finance, Vendor Finance,

Trade Receivables, Home Equity, Student Loans)

$4.8 billion of available capacity provides supplemental liquidity

Ability to structure facilities in other asset classes (Asset Based Loans, SBA

Loans, Rail)

Secured Facilities

21

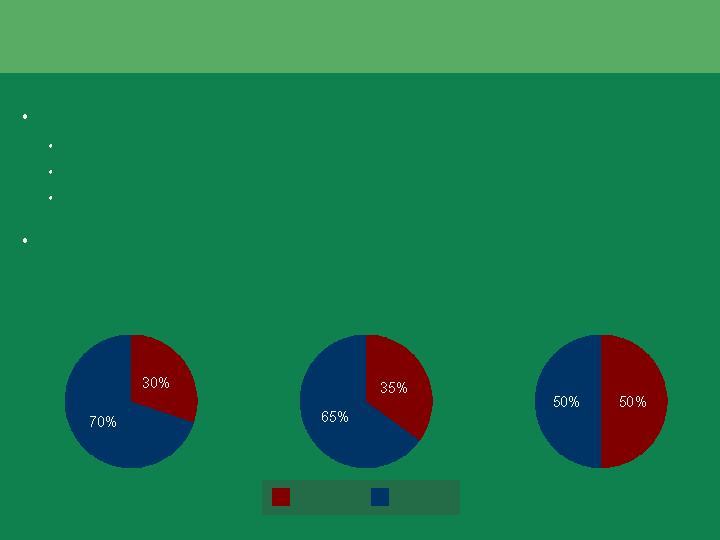

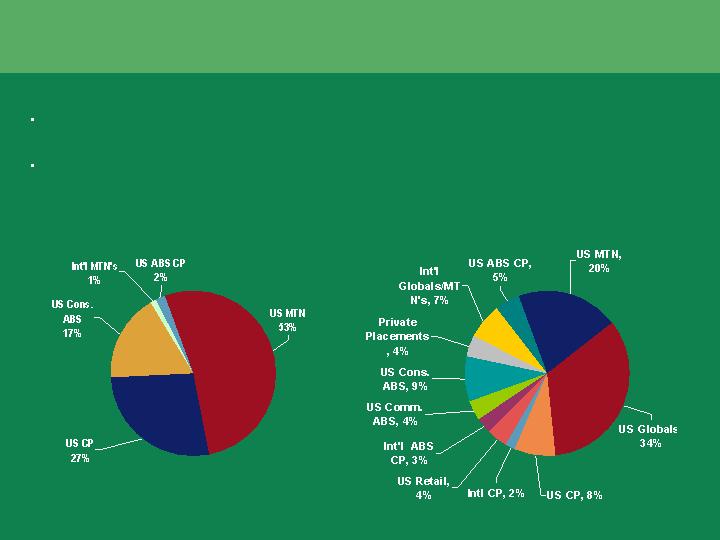

Funding Diversity

December 31, 1998

December 31, 2005

CIT takes great care in ensuring depth and diversity of its funding sources

We have dramatically expanded and diversified our funding composition

22

Effective Matched Funding

3.4 years

44%

$20B Debt

2.8 years

49%

$26B

Fixed

$26B Debt

Amount

Funding (after swaps)

56%

Portfolio

Term

Term

Portfolio

Amount

4.3 years

3.2 years

51%

$26B

Floating

Assets

$6B Equity

Margin at Risk

Value at Risk

After-tax impact of $15 million (liability sensitive)

After-tax impact of $51 million (asset sensitive)

Risk Metrics*

*Sensitivity to immediate 100 basis point rate increase

23

Stable Margin In All Rate Environments

3 month LIBOR

Risk Adjusted Margin

24

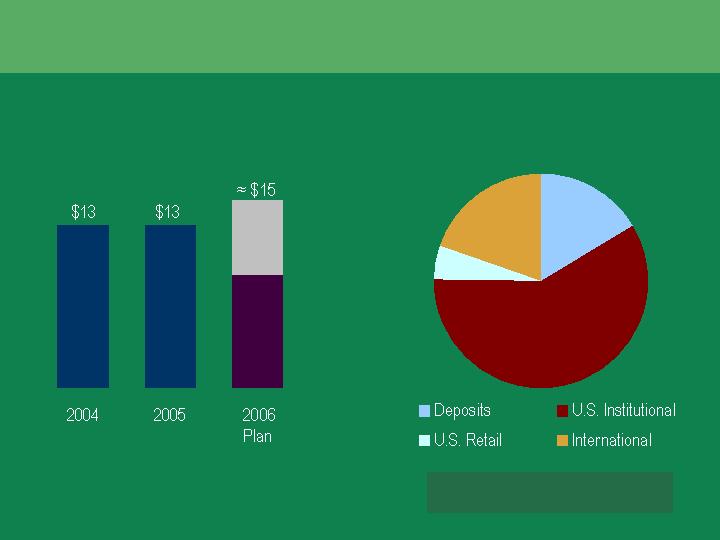

2006 Funding Plan

$2

$8-10

$3

$1

Unsecured Term Issuance

($ billions)

Growth

Maturities

$6

$9

2006 Sources

($ billions)

No significant change in planned commercial

paper issuance

Secured Issuance: $ 4-6 billion

25

A Compelling Investment Opportunity

Differentiated strategy focused on global middle-market opportunities

Well positioned to grow in a fragmented market place

Reinvigorated sales and marketing platform focused on high quality

revenue growth

World class credit and risk management capabilities

Strong business momentum heading into 2006

26

26