- CIT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Cit (CIT) 8-KCredit Suisse Financial Services Conference

Filed: 9 Feb 06, 12:00am

Credit Suisse Financial Services Conference

February 8, 2006

Exhibit 99.1

Notices

Forward Looking Statements

Certain statements made in this presentation that are not historical facts may constitute "forward-looking" statements under the Private

Securities Litigation Reform Act of 1995, including those that are signified by words such as "anticipate", "believe", "expect", "estimate",

“target”, and similar expressions. These forward-looking statements reflect the current views of CIT and its management and are

subject to risks, uncertainties, and changes in circumstances. CIT's actual results or performance may differ materially from those

expressed in, or implied by, such forward-looking statements. Factors that could affect actual results and performance include, but are

not limited to, potential changes in interest rates, competitive factors and general economic conditions, changes in funding markets,

industry cycles and trends, uncertainties associated with risk management, risks associated with residual value of leased equipment,

and other factors described in our Form 10-K for the year ended December 31, 2004 and our Form 10-Q for the quarter ended

September 30, 2005. CIT does not undertake to update any forward-looking statements.

Non-GAAP Financial Measures

The data provided in this presentation have been modified from our previously reported periodic data, including but not limited to,

exclusion of certain non-core transactions and non-recurring events, because management believes that the data presented herein

better reflects core operating results. As such, the data may vary from comparable data reported in CIT’s forms 10-K and 10-Q.

This presentation includes certain non-GAAP financial measures, as defined in Regulation G promulgated by the Securities and

Exchange Commission. Any references to non-GAAP financial measures are intended to provide additional information and insight into

CIT's financial condition and operating results. These measures are not in accordance with, or a substitute for, GAAP and may be

different from or inconsistent with non-GAAP financial measures used by other companies.

For a reconciliation of these non-GAAP measures to GAAP and a list of the transactions and events excluded from the data herein,

please refer to the appendix within this presentation or access the reconciliations through CIT's Investor Relations website at

investor.relations@cit.com.

Data as of or for the period ended December 31, 2005 unless otherwise noted.

2

A Compelling Investment Opportunity

Differentiated strategy focused on global middle-market opportunities

Well positioned to grow in a fragmented market place

Reinvigorated sales and marketing platform focused on high quality

revenue growth

World class credit and risk management capabilities

Strong business momentum heading into 2006

3

3

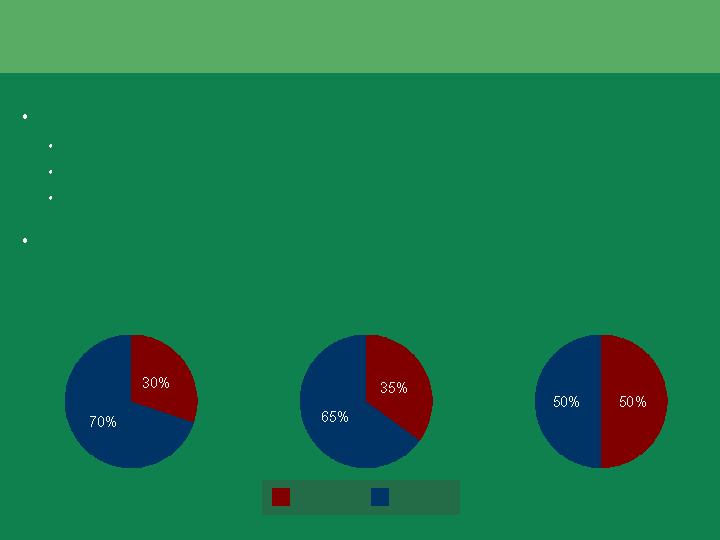

2005 – A Record Year

Very strong credit performance

0.60%

0.91%

Net Charge-offs

Increased 160 basis points

14.2%

12.6%

ROE

Exceeded 16% target

16.5%

13.9%

ROTE

Record earnings, up 23%

$882 M

$720 M

Net Income

Record asset levels

$63 B

$53 B

Managed Assets

Record new business originations

$32 B

$24 B

Volume

Comment

2005

2004

Metric

4

2005 – A Strategic Year

Performed rigorous strategic assessment of our business

Realigned portfolios around market sectors

Invested in high return / high growth opportunities

Acquired three businesses

Ordered 39 aircraft valued at $2.8 billion

Created Strategic Advisory Services group to accelerate fee income growth

Divested $1.7 billion of low return / low growth businesses

Reinvigorated sales culture

Enhanced shareholder value

Completed $500 million share repurchase program

Increased quarterly dividend by 25%

5

2005 – A Year of Improving Returns

Improving

Reflects student lending

Exceeds hurdle

Improving

Improving

Exceeds hurdle

Exceeds hurdle

Comment

14.2%

12.6%

Overall CIT ROE

9.4%

14.9%

Specialty Finance – Consumer

23.8%

21.8%

Specialty Finance – Commercial

10.5%

8.0%

Equipment Finance

11.3%

10.5%

Transportation Finance

19.3%

22.2%

Corporate Finance

27.1%

25.7%

Trade Finance

2005

2004

Segment

6

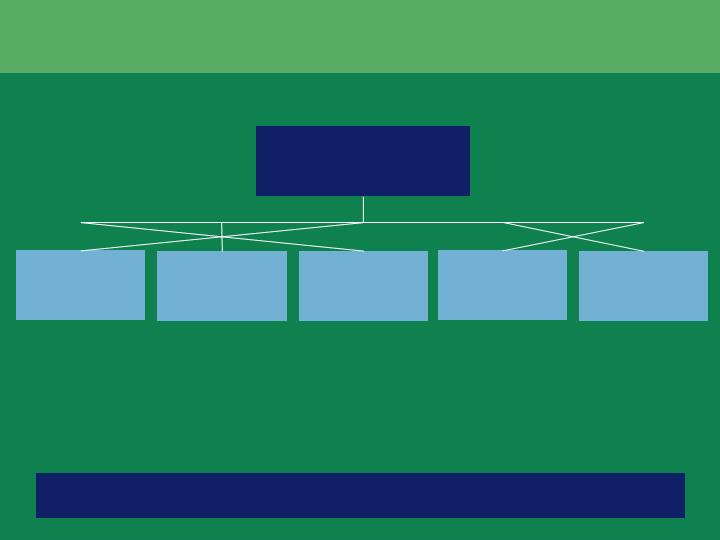

New Alignment Better Serves Customers

Provides factoring

and other trade

products to

companies in

retail supply

chain, with

increasing

international focus

Trade

Finance

Provides longer-

term, large ticket

equipment, leases

and

other secured

financing to

companies in rail

and aerospace

industries

Transportation

Finance

Provides

lending, leasing

and other

services to

middle-market

companies, with

a focus on

specific

industries

Corporate

Finance

Provides financing

solutions to

manufacturers

and distributors

around the globe

Vendor

Finance

Provides

secured loans to

consumers and

small businesses,

leveraging broker

and intermediary

relationships

Consumer/

SBL

Specialty Finance

($29 billion)

Commercial Finance

($34 Billion)

7

Specialty Finance

Tom Hallman

Home

Lending

Healthcare

Industrial

Equipment

Office

Products

Technology

Student

Loan

Xpress

Small

Business

Lending

Specialty Finance Overview

Vendor Finance

($13 billion / 30+ countries)

Consumer / Small Business

($16 billion / 50 U.S. states)

Global Insurance Services

CIT Bank

9

Intermediary relationship management

Technology / credit scoring

Servicing expertise

Attractive returns

Counter-cyclical with commercial businesses

Liquid assets

Scalable

Fragmented

Government guaranteed

Consumer and Small Business Characteristics

Match Our Core Competencies

Markets

Capabilities

Value to CIT

10

We deliver value-added lending solutions to mortgage brokers

via a national network of sales offices providing a

comprehensive set of competitive products through

superior customer facing technology and servicing capabilities

Home Lending: At-a-Glance

$6.9 B volume

236 sales

professionals

Over 4,600 relationships

$9.2 B managed assets

11

Home Lending Portfolio Strategy

Broker

Originations

Sell non-target demographics

Secondary Market

Sales

Acquire portfolios opportunistically

Disciplined Risk

Management

Secondary Market

Purchases

Hold target demographics in portfolio

12

Average FICO: 633

89% owner-occupied

100% appraisal review

92% of loans are first liens

No negative amortization loans

Disciplined lending standards define

a sustainable target market

Source: SMR

2004 Sub-prime Broker Originations

Focused Target Market

CIT Target

Market

($80 B)

Total Market = $286 B

13

Strong Portfolio Demographics

81%

80%

77%

Loan to Value

Loan characteristics:

Borrower characteristics:

72%

Updated Loan

to Value at 7/31/05

43%

72%

86%

% Fixed

$118K

$87K

$61K

Loan size

9

9

11

Length of residence

9

9

10

Length of employment

40%

38%

37%

Debt to income

633

625

624

FICO

12/31/99

12/31/03

12/31/05

14

14

Low Delinquency vs. Competitors

Source: Loan Performance Service

60+ Delinquency Comparison by Geography

CIT

Sub-prime industry

15

Well-Positioned Against Market Risks

Increased delinquency

and defaults

Primary impact on higher

value areas and coastal

regions

Decrease in

Housing Values

Increase in

Unemployment

Rise in Interest

Rates

Defaults due to increasing

payments (for floating loans)

Disciplined ARM underwriting

No option ARM or negative

amortization products

Average loan size = $118K

CLTV = 72%*

Geographic diversification

Low participation in resort markets

Impact

CIT Position

*Updated loan to value at 7/31/05

Average customer

9 years in residence

9 years in current job

16

We deliver a broad range of student lending products and

services with distinctive borrower benefits to educational

institutions through a network of dedicated relationship

managers supported by an efficient centralized processing

and servicing capability

Student Loan Xpress: At-a-Glance

$2.7 B volume*

45 sales

professionals

881 partner schools;

direct channels

$5.3 B managed assets

*Reflects full year 2005

17

Drive growth in school channel

Enhance web leadership

Broaden direct-to-consumer

product offering

Build best-in-class servicing

capabilities

Capitalize on cross-sell

opportunities

Student Loan Xpress Strategy

18

18

Strong Growth

Direct Channel

Volume

$1.7 B

$2.7B

School Channel

$1.0 B

$0.5 B

$1.1 B

$1.6 B

19

19

Regulatory Update

Key 2006 student loan reauthorization provisions

Negative

Reduces lender insurance by 1 percentage point

Positive/Negative

Eliminates School as Lender rule

Neutral

Maintains current fixed rate structure

Positive

Extends PLUS loans to graduate and professional students

Positive

Increases loan limits

Open legislative items

Positive

Fair Credit Reporting Act

Very Positive

Elimination of Single Lender rule

20

2006 Expectations

Reach 1000+ partner schools

Increase school channel volume by 50%

Complete servicing transfer

Continued improvement in returns

Double school channel assets

21

Specialty Finance: Strategic Summary

Vendor

Finance

Consumer/

Small Business

Lending

Broaden vendor base

Penetrate and expand existing relationships globally

Scale global servicing platforms

Expand vendor business in China by leveraging our

market-leading expertise

Increase organic originations in Home Lending

Continue expansion of Student Loan Xpress’

school channel

Accelerate growth in Small Business Lending

Leverage CIT Bank deposit-taking capability

Broad-based build out of global sales capabilities

22

Continuing The Momentum

Jeff Peek

2006 Priorities

Execute upon our growth strategies

Focus on productivity through technology

Maintain traditional disciplines

24

Sales Force Execution is Key to Growth

Established a

corporate sales

office providing

direction and

oversight

Designated

Chief Sales

Officers in

all business

units

Implemented a

company wide

customer

management

system,

Salesforce.com

Aligned our sales

incentive plans

with growth

strategies

25

2006 Growth Drivers

Healthcare

Asset

Generation

Strategic Advisory Services

Fee

Generation

Syndications

Communications, Media &

Entertainment

Global Sponsor Finance

Aerospace

Student Loan Xpress

International

Global Insurance

Restructuring

26

International Growth Agenda

Continue to build upon aerospace platform

Scale pan-European vendor operations

Expand Trade Finance (factoring) in Asia

Leverage recently acquired UK banking license

Build upon our leading equipment leasing position in China

27

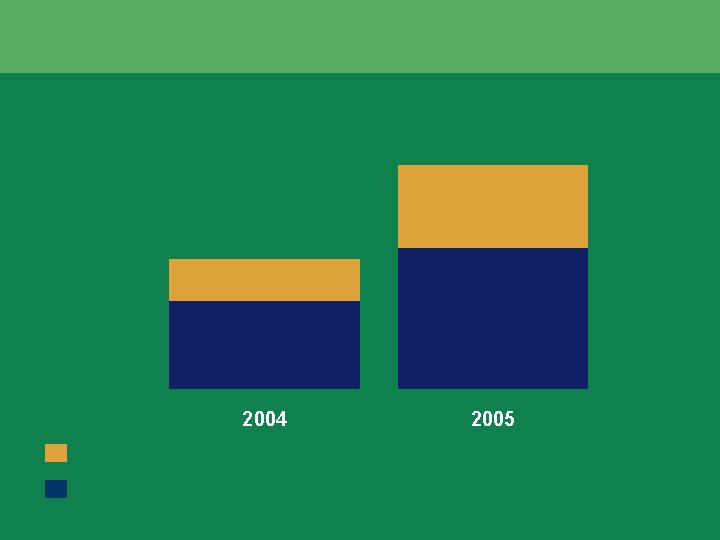

Supporting Our Growth

Investing in technology to maximize the customer relationship

Salesforce.com (customer relationship database)

Credit adjudication and risk analysis software

Web-based applications

Re-directing investment from back-end to front-end

Front-end

Back-end

2004

2005

Longer Term

28

Furthering Commitment to Traditional Disciplines

Credit

Maintain prudent reserve position

Expand syndication and portfolio management activities to manage excess risk

Expect 2006 credit losses to be less than 80 basis points

Funding

Continue to match fund the portfolio

Increase funding from international capital markets

Leverage CIT Bank’s deposit-taking capability

Capital

Drive portfolio optimization

Explore further capital structure efficiencies

Continue to return capital to shareholders

29

2006 – The Year of Execution

Clearly defined our strategic

imperatives by business

Augmented leadership

Re-aligned around the customer

Rounded out our products and service

offerings

Energized the sales force

Organic volume benefits from the hiring

of sales professionals

Non-spread income reflects addition of

Strategic Advisory Services

Efficiency improves as revenue growth

accelerates

Funding diversity enhanced by deposit

base growth

Portfolio initiatives result from capital

discipline

2005 Actions

2006 Drivers

30

2006 Earnings Guidance

Target**

15%

$4.65 - $4.75

ROE

EPS*

*Includes estimated stock options expense of $0.08-$0.10 per share

**Guidance as provided on January 18, 2006. Reproduction of this slide should not be construed as an affirmation or update of that guidance.

31

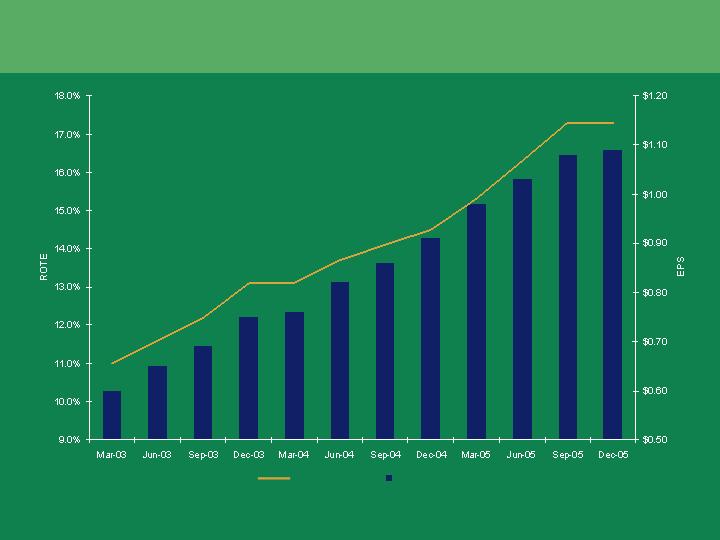

Continuing The Trend

ROTE

Earnings Per Share

32

Appendix

33

Corporate History

Dai-Ichi Kangyo

Bank acquired 60%

of CIT from

Manufacturers

Hanover

CIT Financial

Corporation,

company’s

industrial

financing entity,

was incorporated

CIT founded as

Commercial Credit

and Investment

Company by Henry

Ittleson in St. Louis

CIT launched a 20% IPO to

acquire from DKB its option

to purchase the 20%

interest owned by Chase

Manhattan. CIT again listed

on the NYSE (“CIT”)

Albert R. Gamper, Jr.,

named Chairman and

CEO of CIT.

CIT completed 100%

initial public offering

(NYSE: CIT)

Tyco International

acquired CIT

CIT acquired

Newcourt Credit

Successful CIT secondary stock

offering reduced DKB’s stake to

approximately 44%, with balance

of shares held publicly

1997

Chemical Bank merged with

Chase Manhattan. CIT

ownership was 80% by DKB

and 20% by Chase

Manhattan

Dai-Ichi Kangyo Bank

acquired an additional

20% of CIT from

Chemical Bank

Manufacturers

Hanover

purchased CIT

from RCA

CIT went public and

was listed on NYSE.

The company had 600

employees and assets

of $44.7 MM

July

2002

June

2001

July

2000

CIT was added

to the S&P 500

Index

1999

1998

1996

1995

1989

1987

1984

1980

RCA acquired

CIT

1942

1924

1908

July

2004

Jeff Peek named

President & CEO

CIT was added

to the S&P 500

Index

October

2004

January

2005

Jeff Peek named

Chairman & CEO

34

Board of Directors

2005

Seymour Sternberg

2005

Timothy M. Ring

2004

Gary Butler

2003

Lois M. Van Deusen

Chair

2003

John R. Ryan

2003

Marianne Miller Parrs

2003

William M. Freeman

Chair

Lead

2002

Peter J. Tobin

Chair

2002

Thomas H. Kean

2003

Jeffery M. Peek

Nominating &

Governance

Compensation

Audit

Board Member

Board Committees

Independent

Directors

Member

Since

35

Executive Leadership

Lawrence A. Marsiello

Vice Chairman

Chief Credit Officer

Joined CIT in 1974

Corporate Credit

Risk Management

Joseph M. Leone

Vice Chairman

Chief Financial Officer

Joined CIT in 1983

Treasury

Accounting

Tax

Investor Relations

M&A

Information Technology

Thomas B. Hallman

Vice Chairman

Specialty Finance

Joined CIT in 1995

Vendor Finance

Consumer/Small

Business Lending

Frederick E. Wolfert

Vice Chairman

Commercial Finance

Joined CIT September 2004

Trade Finance

Corporate Finance

Transportation Finance

Walter J. Owens

EVP & Chief Sales and

Marketing Officer

Joined CIT March 2005

Sales

Marketing

Seasoned, balanced management team

Jeffrey M. Peek

Chairman & CEO

Joined CIT September 2003

36

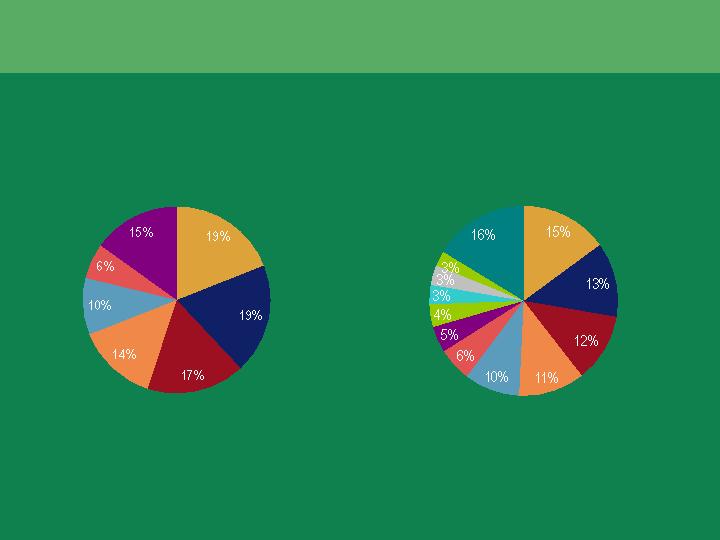

Broad and Diverse Portfolio

Geography

Northeast

Europe and Asia

Canada

Southwest

Southeast

Midwest

West

*No other collateral type or industry served greater than 3%

Manufacturing

Commercial Air

Home Lending

Transportation

Services

Consumer Other

Construction

Wholesale

Healthcare

Other*

Retail

Education Lending

Industry

37

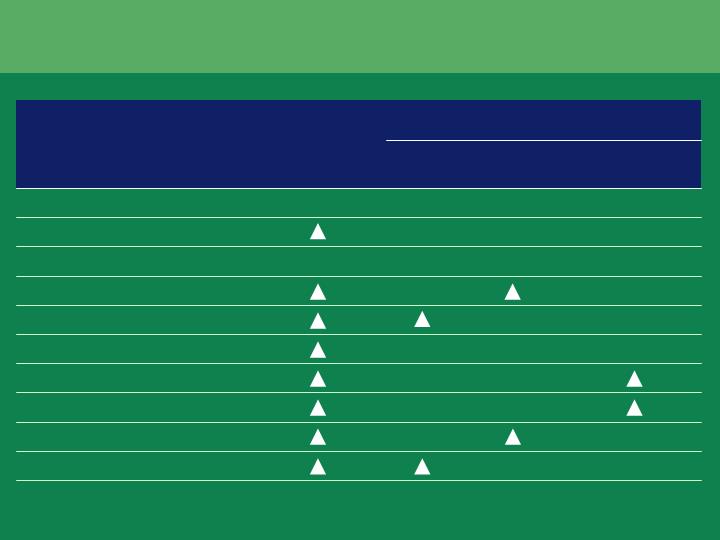

Growth Indicators

Industrial Production

Car Loadings

Oil Prices

Capacity Utilization

Capital Spending

C & I Loan Growth

Bankruptcy Filings

Consumer Confidence

Government Sponsorship

7(a) Funding Levels Switch

Home Prices

Mortgage Applications

PC Sales

IP – Telephony Sales

C & I Loan Growth

Construction Spending

Equipment Finance

Consumer Confidence

Small Business Lending

Cost of Education

Student Loan Xpress

Restructuring Activity

LBO Activity

Asset Based Lending

Coal Production

Grain Yield

Rail

Revenue Passenger Miles

Global Economic Growth

Air

Retail Sales

Consumer Credit Growth

Factoring

Interest Rates

Consumer Confidence

Home Lending

Capital Spending

GDP

Vendor Finance

Key Data Points

38

Portfolio Composition

Commercial Aerospace

Aircraft

Net Investment

100.0%

215

100.0%

5,951.9

1.4%

3

1.1%

67.7

Capital Leases

3.3%

7

2.3%

135.2

Tax-Op. Leveraged Leases

6.0%

13

3.2%

189.8

Loans

4.7%

10

3.9%

232.1

Leveraged Leases

84.6%

182

89.5%

5,327.1

Operating Leases

%

Number

%

$ millions

157

Millions

Top US exposure

277

Millions

Top exposure

Planes

Years

Europe

Asia Pacific

North America

Latin America

Africa / Middle East

Boeing

Airbus

Other

Narrow

Intermediate

Wide

Other

Grouping

44.5%

54.9%

0.6%

Manufacturer

10

Aircraft on the ground

6

Weighted average age

39.4%

26.4%

20.9%

9.0%

4.3%

Geographic diversity

72.8%

22.6%

4.0%

0.6%

Body type

%

Category

0

5

0.6

2009+

14

66

3.3

Total $

0

19

0.8

2008

0

23

1.0

2007

14

19

0.9

2006

Placed

Number

Amt ($B)

Year

Portfolio Statistics

Remaining Order Book

39

International Operations

$13.2 (21% of CIT)

$1.4

$0.6

$1.8

$4.7

$4.7

Managed Assets (billions)

Total

Aerospace

Vendor Finance

Other

Aerospace

Vendor Finance

Australia

Aerospace

Trade Finance

Vendor Finance

Asia

Aerospace

Corporate Finance

Vendor Finance

Europe

Aerospace

Corporate Finance

Equipment Finance

Trade Finance

Vendor Finance

Canada

Primary Businesses

Country

1,500 employees servicing international operations

40

Effective Matched Funding

3.4 years

44%

$20B Debt

2.8 years

49%

$26B

Fixed

$26B Debt

Amount

Funding (after swaps)

56%

Portfolio

Term

Term

Portfolio

Amount

4.3 years

3.2 years

51%

$26B

Floating

Assets

$6B Equity

Margin at Risk

Value at Risk

After-tax impact of $15 million (liability sensitive)

After-tax impact of $51 million (asset sensitive)

Risk Metrics*

*Sensitivity to immediate 100 basis point rate increase

41

Leasing Businesses

Utilization of Net Operating Loss

Dublin Aerospace Initiative

Improved International Vendor Profitability

Efficient Tax Management

$479

$483

Accounting Provision for Taxes

$100 (E)

$115

Cash Taxes Paid

</= 33%

35%

39%

Effective Tax Rate

2006 (E)

2005

2004

Income Taxes

Why it is decreasing

Why cash is lower

42

Non-Core Items

0.08

17.0

0.0

Commercial

Provision for income taxes

Reversal of deferred tax liability

Q4

2005

0.08

17.2

32.0

Corporate

Other Revenue

Gain on Restatement of select derivative transactions

Q1

2005

0.13

28.4

48.3

Corporate

Other Revenue

Gain on Restatement of select derivative transactions

Q2

2005

(0.04)

(5.7)

(14.3)

Corporate

Other Revenue

Loss on Restatement of select derivative transactions

Q3

2005

(0.06)

(12.9)

(22.7)

Corporate

Other Revenue

Loss on select derivative transactions

Q4

2005

(0.03)

(6.7)

(11.0)

Corporate

Operating Expenses

Early termination fee on NYC lease / Legal Settlement

Q4

2005

0.13

26.8

44.3

Specialty Finance

Other revenue

Gain on sale of micro-ticket leasing point of sale unit

Q4

2005

0.08

17.6

0.0

Commercial Finance

Provision for income taxes

Release of international tax reserves

Q3

2005

(0.06)

(11.9)

(20.0)

Specialty Finance

Other revenue

(Loss) on sale of manufactured housing

Q3

2005

(0.25)

(52.9)

(86.6)

Commercial Finance

Other revenue

(Loss) on sale of commercial and business aircraft

Q3

2005

0.34

69.7

115.0

Corporate

Other revenue

Gain on sale of real estate investment

Q3

2005

(0.02)

(4.4)

(6.8)

Corporate

Other revenue

Retained interest impairment from hurricanes Katrina and Rita

Q3

2005

(0.11)

(23.3)

(35.9)

Corporate

Provision for credit losses

Reserves for hurricanes Katrina and Rita

Q3

2005

(0.08)

(16.5)

(25.2)

Corporate

Provision for restructuring

Provision for restructuring

Q2

2005

0.07

14.4

22.0

Commercial Finance

Other revenue

Gain on sale of business aircraft

Q2

2005

(0.04)

(9.3)

(15.7)

Specialty Finance

Other revenue

(Loss) on sale of manufactured housing

Q4

2004

(0.04)

(8.7)

(14.0)

Corporate

Other revenue

(Loss) on venture capital investments

Q4

2004

0.12

26.8

43.3

Corporate

Provision for credit losses

Release of telecom reserves

Q4

2004

0.12

25.9

41.8

Corporate

Gain on redemption of debt

Gain on call of PINEs debt

Q1

2004

(0.17)

(37.5)

(60.5)

Corporate

Other revenue

Loss on venture capital investments

Q4

2003

0.15

31.2

50.4

Corporate

Gain on redemption of debt

Gain on call of PINEs debt

Q4

2003

EPS Impact

After-Tax

Pre-Tax

Group

P&L Line Item

Item Description

Impact on Income

43

Non-GAAP Reconciliation

$ 6,158.6

252.0

500.0

5,406.6

(1,011.5)

(17.0)

(27.6)

$ 6,462.7

$ 51,392.9

(4,187.8)

$ 55,580.7

$ 62,866.4

7,285.7

55,580.7

30.2

1,620.3

9,635.7

$ 44,294.5

12/31/2005

$ 5,731.0

Total Tangible stockholders' equity

253.8

Preferred capital securities

-

Preferred Stock

5,477.2

Tangible common stockholders' equity

(596.5)

Goodwill and intangible assets

(8.5)

Unrealized (gain) loss on securitization investments

27.1

Other comprehensive loss relating to derivative financial instruments

$ 6,055.1

Total common stockholders' equity

Total Tangible stockholders' equity:

$ 41,313.6

Earning assets

(3,847.3)

Credit balances of factoring clients

$ 45,160.9

Total financing and leasing portfolio assets

Earning assets:

$ 53,470.6

Managed assets

8,309.7

Securitized assets

45,160.9

Total financing and leasing portfolio assets

181.0

Equity and venture capital investments (included in other assets)

1,640.8

Finance receivables held for sale

8,290.9

Operating lease equipment, net

$ 35,048.2

Finance receivables

Managed assets:

12/31/2004

Non-GAAP financial measures disclosed by management are meant to provide additional information and insight relative to trends in the business to investors and, in certain cases, to

present financial information as measured by rating agencies and other users of financial information. These measures are not in accordance with, or a subsitute for, GAAP and may

be different from, or inconsistent with, non-GAAP financial measures used by other companies.

44

Financial Statements

211,017

206,059

Number of shares - basic (thousands)

-

500.0

Preferred Stock

$ 51,111.3

$ 63,386.6

Total Liabilities and Stockholders' Equity

6,055.1

6,962.7

Total Stockholders' Equity

(63.8)

(596.1)

Less: Treasury stock, at cost

(58.4)

115.2

Accum. other comprehensive income (loss)

(4,499.1)

(3,691.4)

Accum. deficit

10,674.3

10,632.9

Paid-in capital

215,054

210,734

Number of shares - diluted (thousands)

2.1

2.1

Common stock

$ 3.50

$ 4.44

Diluted earnings per share

Stockholders' Equity:

$ 3.57

$ 4.54

Basic earnings per share

40.4

49.8

Minority interest

Earnings per share

45,015.8

56,374.1

Total Liabilities

3,443.7

4,321.8

Accrued liabilities and payables

753.6

$ 936.4

Net income

3,847.3

4,187.8

Credit balances of factoring clients

-

(12.7)

Preferred stock dividends

37,724.8

47,864.5

Total debt

$ 753.6

$ 949.1

Net income before preferred stock

253.8

252.0

Preferred capital securities

(1.1)

(3.3)

Minority interest, after tax

-

4,048.8

Non-recourse, secured borrowings

(483.2)

(464.2)

Provision for income taxes

21,715.1

22,853.6

Fixed-rate senior unsecured notes

1,237.9

1,416.6

Income before provision for income taxes

11,545.0

15,485.1

Variable-rate senior unsecured notes

41.8

-

Gain on redemption of debt

$ 4,210.9

$ 5,225.0

Commercial paper

-

25.2

Provision for restructuring

Debt:

1,012.1

1,113.8

Salaries and general operating expenses

LIABILITIES AND STOCKHOLDERS' EQUITY

2,208.2

2,555.6

Operating margin

$ 51,111.3

$ 63,386.6

Total Assets

2,713.7

2,647.8

Other assets

887.1

1,137.4

Other revenue

596.5

1,011.5

Goodwill and intangible assets, net

1,321.1

1,418.2

Net finance margin after provision

1,228.2

1,139.9

Retained interests

214.2

217.0

Provision for credit losses

2,210.2

3,658.6

Cash and cash equivalents

1,535.3

1,635.2

Net finance margin

1,640.8

1,620.3

Finance receivables held for sale

965.4

968.0

Depreciation on op. lease equipment

8,290.9

9,635.7

Operating lease equipment, net

2,500.7

2,603.2

Net finance income

34,431.0

43,672.8

Net finance receivables

1,260.1

1,912.0

Interest expense

(617.2)

(621.7)

Reserve for credit losses

$ 3,760.8

$ 4,515.2

Finance income

$ 35,048.2

$ 44,294.5

Finance receivables

Financing and leasing assets:

2004

2005

ASSETS

December 31,

December 31,

2004

2005

Year Ended

December 31,

December 31,

Balance Sheet

Income Statement

45