- CIT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Cit (CIT) 8-KRegulation FD Disclosure

Filed: 7 Nov 06, 12:00am

Forward Looking Statement

Certain statements made in these presentations that are not historical facts may constitute “forward-looking” statements

under the Private Securities Litigation Reform Act of 1995, including those that are signified by words such as “anticipate”,

“believe”, “expect”, “estimate”, “target”, and similar expressions. These forward-looking statements reflect the current

views of CIT and its management and are subject to risks, uncertainties, and changes in circumstances. CIT’s actual

results or performance may differ materially from those expressed in, or implied by, such forward-looking statements.

Factors that could affect actual results and performance include, but are not limited to, potential changes in interest rates,

competitive factors and general economic conditions, changes in funding markets, industry cycles and trends,

uncertainties associated with risk management, risks associated with residual value of leased equipment, and other

factors described in our Form 10-K for the year ended December 31, 2005 and our Form 10-Q for the quarter ended

September 30, 2006. CIT does not undertake to update any forward-looking statements.

The data provided in these presentations have been modified from our previously reported periodic data, including, but not

limited to, the exclusion of certain non-core transactions and nonrecurring events, because management believes that the

data presented herein better reflects core operating results. As such, the data will vary from comparable data reported in

CIT’s Forms 10-K & 10-Q. The data provided in these presentations have not been examined by independent accountants

and is not presented in accordance with generally accepted accounting principles (“GAAP”).

These presentations include certain non-GAAP financial measures, as defined in Regulation G promulgated by the

Securities and Exchange Commission. Any references to non-GAAP financial measures are intended to provide additional

information and insight into CIT’s financial condition and operating results. These measures are not in accordance with, or

a substitute for, GAAP and may be different from or inconsistent with non-GAAP financial measures used by other

companies.

For a reconciliation of these non-GAAP measures to GAAP and a list of the transactions and events excluded from the

data herein, please refer to the tables on the following page.

Please refer to the Company’s SEC filings on Forms 10-K and 10-Q for consolidated financial results prepared in

accordance with GAAP.

Data as of or for the period ended September 30, 2006 unless otherwise noted.

Noteworthy Items

(0.03)

(5.5)

(8.5)

Corporate

Provision for restructuring

Provision for restructuring

Q3

2006

(0.04)

(9.2)

(15.0)

Transportation Finance

Other revenue

(Loss) on sale of non-strategic assets

Q3

2006

(0.02)

(3.6)

(5.8)

Transportation Finance

Interest expense

(Loss) on debt termination

Q3

2006

0.28

55.6

0.0

Transportation Finance

Provision for income taxes

Release of deferred tax liabilities

Q3

2006

0.03

6.5

0.0

Corporate

Provision for income taxes

Tax adjustment on planned NOL utilization

Q1

2006

(0.04)

(7.4)

(11.1)

Corporate

Provision for restructuring

Provision for restructuring

Q1

2006

0.08

17.0

0.0

Commercial

Provision for income taxes

Reversal of deferred tax liability

Q4

2005

(0.06)

(12.9)

(22.7)

Corporate

Other revenue

Loss on select derivative transactions

Q4

2005

(0.03)

(6.7)

(11.0)

Corporate

Operating expenses

Early termination fee on NYC lease / Legal Settlement

Q4

2005

0.13

26.8

44.3

Vendor Finance

Other revenue

Gain on sale of micro-ticket leasing point of sale unit

Q4

2005

(0.04)

(8.1)

(14.3)

Corporate

Other revenue

Loss on Restatement of select derivative transactions

Q3

2005

0.08

17.6

0.0

Transportation Finance

Provision for income taxes

Release of international tax reserves

Q3

2005

(0.06)

(11.9)

(20.0)

Vendor Finance

Other revenue

(Loss) on sale of manufactured housing

Q3

2005

(0.25)

(52.9)

(86.6)

Transportation Finance

Other revenue

(Loss) on sale of commercial and business aircraft

Q3

2005

0.34

69.7

115.0

Corporate

Other revenue

Gain on sale of real estate investment

Q3

2005

(0.02)

(4.4)

(6.8)

Corporate

Other revenue

Retained interest impairment from hurricanes Katrina and Rita

Q3

2005

(0.11)

(23.3)

(35.9)

Corporate

Provision for credit losses

Reserves for hurricanes Katrina and Rita

Q3

2005

(0.01)

(2.5)

(4.2)

Corporate

Operating margin

Other minor restatements (timing difference)

Q2

2005

0.14

30.9

52.4

Corporate

Other revenue

Gain on Restatement of select derivative transactions

Q2

2005

(0.08)

(16.5)

(25.2)

Corporate

Provision for restructuring

Provision for restructuring

Q2

2005

0.07

14.4

22.0

Transportation Finance

Other revenue

Gain on sale of business aircraft

Q2

2005

0.01

2.5

4.2

Corporate

Operating margin

Other minor restatements (timing difference)

Q1

2005

0.07

14.7

27.7

Corporate

Other revenue

Gain on restatement of select derivative transactions

Q1

2005

(0.04)

(9.3)

(15.7)

Vendor Finance

Other revenue

(Loss) on sale of manufactured housing

Q4

2004

(0.04)

(8.7)

(14.0)

Corporate

Other revenue

(Loss) on venture capital investments

Q4

2004

0.12

26.8

43.3

Corporate

Provision for credit losses

Release of telecom reserves

Q4

2004

0.12

25.9

41.8

Corporate

Gain on redemption of debt

Gain on call of PINEs debt

Q1

2004

(0.17)

(37.5)

(60.5)

Corporate

Other revenue

Loss on venture capital investments

Q4

2003

0.15

31.2

50.4

Corporate

Gain on redemption of debt

Gain on call of PINEs debt

Q4

2003

EPS

Impact

After-Tax

Pre-Tax

Segment

P&L Line Item

Item Description

Impact on Income

Non-GAAP Reconciliation

Non-GAAP financial measures disclosed by management are meant to provide additional information and insight relative to trends in the business to investors and, in certain cases, to

present financial information as measured by rating agencies and other users of financial information. These measures are not in accordance with, or a substitute for, GAAP and may

be different from, or inconsistent with, non-GAAP financial measures used

by other companies.

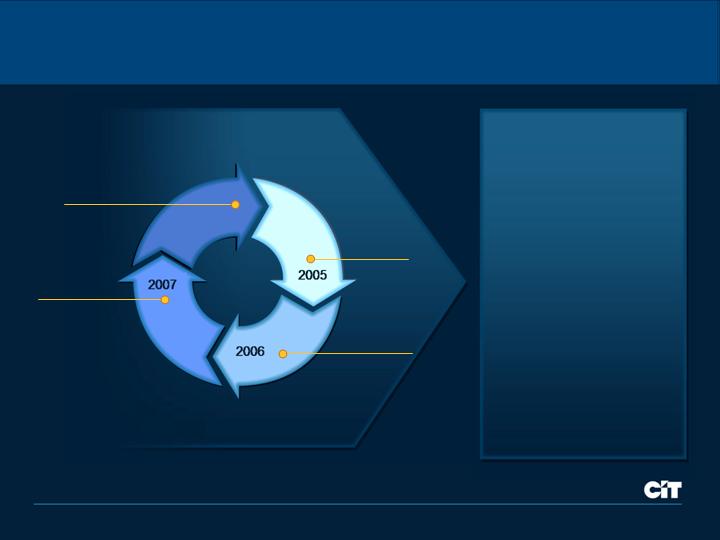

Overview

Jeffrey M. Peek

Chairman & Chief Executive Officer

Transforming Vision into Reality

Vision

The leading global finance company in the middle market

2004

Introduced

Operating

Principles

ROE

One CIT

RPM

2005

Set

Strategic

Framework

Productivity

Management

Credit and

Risk

Management

Capital

Discipline

Client

Focus

Sector

Alignment

Reorganized for Growth

Entered new markets and

expanded our offerings

Aligned around customer needs

Developed industry focused

teams

Established sales culture

Focused on back-office

efficiencies

Furthered credit and capital

disciplines

Trade

Finance

Transportation

Finance

Corporate

Finance

Vendor

Finance

Consumer /

SBL

Factoring and other trade products to

companies in retail supply chain, with

increasing international focus

Longer-term, large ticket equipment

leases and other secured financing to

companies in rail, aerospace and

defense industries

Lending, leasing and other services to

middle market companies, with a

focus on specific industries

Financing solutions to manufacturers

and distributors around the globe

Loans to consumers and small

businesses, leveraging broker and

intermediary relationships

Expanded Origination

Platforms

Broadened Product and

Service Offerings

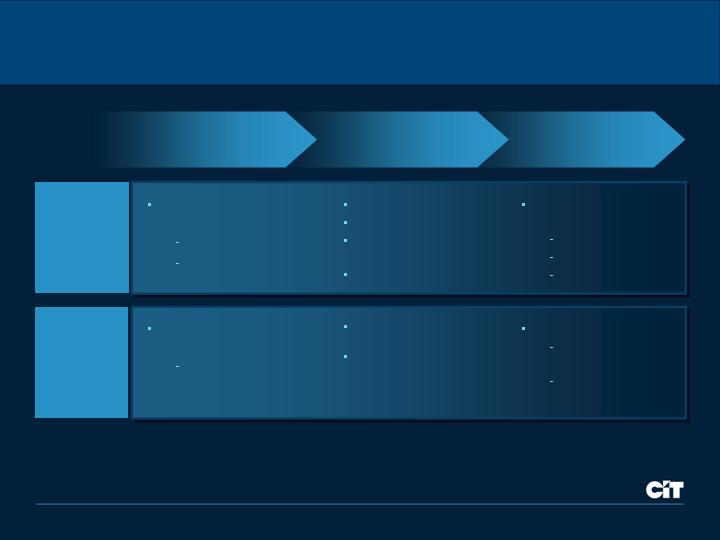

Transforming Vision into Reality

Vision

The leading global finance company in the middle market

2004

Introduced

Operating

Principles

ROE

One CIT

RPM

2005

Set

Strategic

Framework

2006

Built Growth

Engine

Productivity

Management

Credit and

Risk

Management

Capital

Discipline

Client

Focus

Sector

Alignment

2006 Building the Growth Engine

Expanded Asset Origination Capabilities

Enhanced market coverage through sales

force build-out — substantially complete

Developed strategic relationships to leverage

third party origination platforms

Developed Platform for Growth

Expanded into 21st century growth sectors

Increased products and services offerings

Grew capital markets distribution capabilities

Continued growth outside of North America

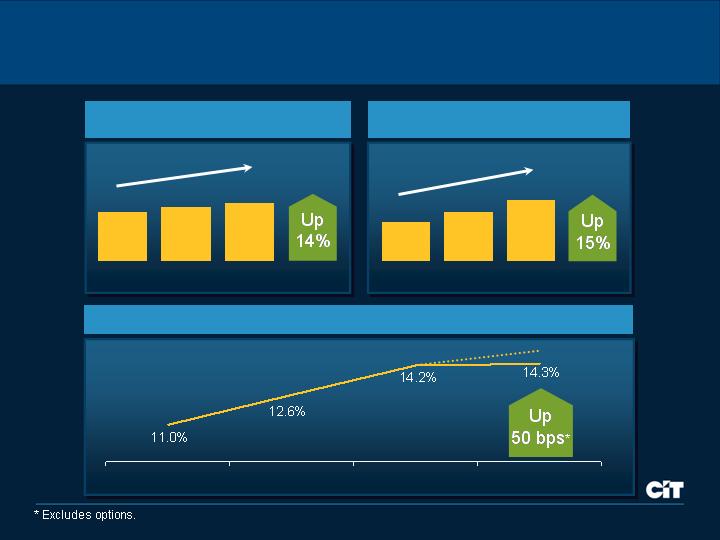

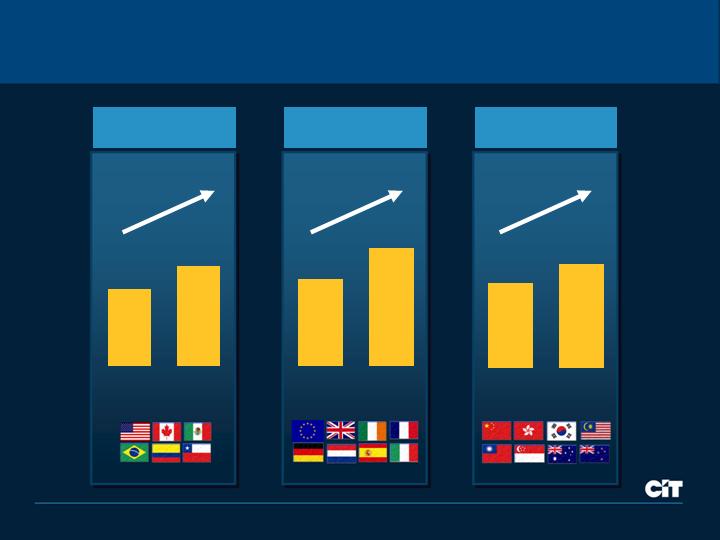

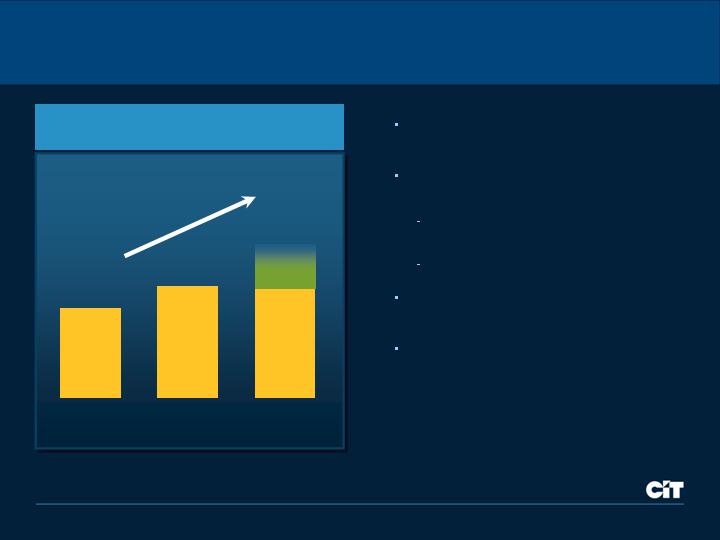

Volume

($ Billions)

38%

2005

9 mos.

2006

9 mos.

22

30

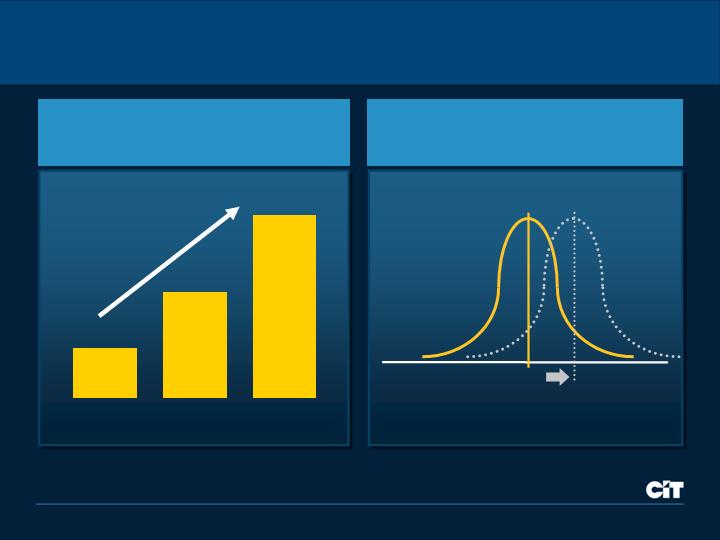

Delivering Results

Revenue

($ millions)

$2,218

$2,452

$2,661

10% CAGR

2003

2004

2005

2006

9 mos.

EPS

$2.69

$3.35

$4.18

25% CAGR

2003

2004

2005

2006

9 mos.

14.7%*

Return on Equity

2003

2004

2005

2006

9 mos.

Executing for Performance

Expanded Origination

Platforms

Broadened Product and

Service Offerings

Transforming Vision into Reality

Vision

The leading global finance company in the middle market

2004

Introduced

Operating

Principles

ROE

One CIT

RPM

2005

Set

Strategic

Framework

2006

Built Growth

Engine

Productivity

Management

Credit and

Risk

Management

Capital

Discipline

Client

Focus

Sector

Alignment

2007 Executing for Performance

Leverage revenue generation platforms

Increase the velocity of assets

Maintain positive operating leverage

Continue international expansion

Further risk management expertise

Strengthen performance-driven culture

Agenda

Sales & Marketing

Walter Owens

Commercial Finance

Frederick Wolfert

Specialty Finance

Thomas Hallman

Credit & Risk Management

Lawrence Marsiello

Finance

Joseph Leone

Outlook

Jeffrey Peek

Financial Capital

+ Intellectual Capital

+ Relationship Capital

= infinite possibilities

Sales & Marketing

Walter Owens

Executive Vice President

Chief Sales & Marketing Officer

We Are Building a Sustainable Growth Engine for CIT...

Build Strong

Foundation

Invest and Drive

Execution

Accelerate

Productive Growth

Deliver Sustainable

Long-Term Growth

Organic

Growth

14%

2000-2005

2006

9 mos.

3%

Revenue Growth

We Are Building a Sustainable Growth Engine for CIT...

Build Strong

Foundation

Invest and Drive

Execution

Accelerate

Productive Growth

Deliver Sustainable

Long-Term Growth

Organic

Growth

Financial Capital

+ Intellectual Capital

+ Relationship Capital

= infinite possibilities

To

Commoditized,

transaction-based capital

…with a Clear Value Proposition

From

+

‘Beyond Capital’

The net potential

of a business

The net worth

of a business

“I like to do business with people I can trust to get the right

advice. CIT takes a solutions approach to my needs rather

than going for the quick sale.”

“At the end of the day, CIT delivered a relationship

and not just a transaction.”

Guy Sansone

CEO, St Vincent’s Medical Centers

Why Our Customers Do Business with Us

Developed tactical sales plans

Implemented operating framework

Built-out sales force

Deployed sales force

Delivered selling tools

Invest and

Drive Execution

Where We Are Today

Created sales organization

Introduced SALE framework

Developed performance management system

Implemented sales automation

Developed market intelligence

Build Strong

Foundation

=

Delivering Strong Momentum in Top Line Growth

* Excludes Trade Finance, joint ventures and portfolio purchases.

+

Sales Force Size*

972

1,241

Sep

2005

28%

Sales Productivity

15.2

18.9

($ Millions)

24%

14.8

Volume*

23.4

($ Billions)

58%

Sep

2006

2005

9 mos.

2006

9 mos.

2005

9 mos.

2006

9 mos.

Developed In-Depth Growth Plans for Each Business…

Addressable

market share

Channel penetration

Share of wallet

Deployment strategy

Market

Coverage

Number of new hires

Turnover optimization

Leadership capabilities

Talent strength

Compensation

alignment

Sales Force

Size

Conversion efficiency

Penetration

effectiveness

Assimilation

effectiveness

Customer retention

strategies

Sales

Productivity

Revenue Growth

Spread

Non-Spread

…and a Robust Operating Process to Ensure Accountability

Sales playbooks in 32 businesses

Development and execution

owned by Chief Sales Officers

Rigorous monthly reviews using

dashboards

Identify areas of focus by

Sales SWAT teams

Leverage best practices

Operating Rhythm

Dashboards

Focused on Finding, Hiring and Assimilating Talent

Market intelligence

Sales competencies

Hiring screens

Interview guides

Finding and Hiring

the Right People

Buddy system

Deal strike zones

Technology support

Product knowledge

Assimilating to

Accelerate Productivity

Compensation alignment

Sales training

Leader development

Reward and recognition

Developing and Retaining

to Sustain Growth

1,241

972

Sep 2006

Sep 2005

Total Front-Line Sales Talent

28%

Deployed Sales Forces to Maximize Opportunity

Example: Communications, Media & Entertainment

New Business Volume

$0.7 Billion

$1.5 Billion

2006

9 mos.

Organized by

sub-industry vertical

Acquired talent with

deep industry expertise

Focused on

key relationships

Provided solutions

not products

Success Drivers

2005

9 mos.

Rolled Out Robust Toolkit to Make Selling Easier

Gets You Started

Makes You More Effective

Product Guide

Assimilation Guide

Salesforce.com

Visibility

Flexibility

Intelligence

Where We Are Heading

Retain and develop maturing sales force

Invest in strategic marketing

Deepen relationships with customers

Drive ‘One CIT’ cross-selling

Accelerate

Productive Growth

Slowing Build-Out in 2007 and Focusing on Productivity

2007 Agenda

Slow hiring pace

Increase productivity over 20%

Raise the sales performance bar

Targeted training and development

Percentage Increase in

Sales Force Size*

1,360

1,241

2007 (E)

2006

9 mos.

10%

28%

Headcount

* Excludes acquisitions.

Benefiting from a Maturing and Higher Quality Sales Force

400% increase

1

Leading

4

Rarely

Demonstrated

Current

Future

2.2

Average Monthly Volume

per Originator by Tenure

(Example: Student Loan Xpress)

Focus on Talent Development

to Lift Average Performance

<6 Months

6-12 Months

>12 Months

Increasing Market Coverage to See and Close More Deals

Market

Opportunities

Leads

Proposals

Commitments

Closed Deals

See More

#1

Touch More

#2

Close More

#3

Establishing Deeper Relationships Through Account Planning

Developed plans for top 100

opportunities for 2007 across

Specialty Finance businesses…

Resources from across CIT leveraged to

‘open doors’, create solutions, win deals

Improved visibility into customer potential

Stronger, more profitable client relationships

Key Outcomes

Identification of top accounts through

several measures … not just exposure

Representatives for top accounts will be

specially trained in planning and selling

skills

Key Activities

Solution sell

Combined teams

Team awards

c it pay

Deal referrals

All employees

eligible

Driving ‘One CIT’ to Gain Customer Share-of-Wallet

Share Leads

Deal Collaboration

‘One CIT’ Volume

($ Millions)

2005

9 mos.

‘One CIT’ Fees

($ Millions)

2005

9 mos.

Specialist sales force

Advisory fees:

Insurance

M&A

Real Estate

Advisory Services

2006

9 mos.

56

981

2006

9 mos.

Advisory

Fees

Cap

Markets

40

132

Delivering Sustainable Long-Term Growth

Accelerating Revenue

Growth

Larger and Better

Sales Force

+

=

Productivity Focus

Build Strong

Foundation

Invest and Drive

Execution

Accelerate

Productive Growth

Deliver Sustainable

Long-Term Growth

Organic

Growth

Commercial Finance

Rick Wolfert

Vice Chairman, Commercial Finance

A Recognized Leader in Commercial Finance

Managed Assets: $39 Billion

Large and loyal customer base

Over 57,000

2,450 employees

Large direct sales force: ~400

Preeminent brand

98 years of middle market lending

experience

Superior risk underwriting experience

and skill

Global scope

Operating in over 30 countries

Data as of September 30, 2006.

Broad Portfolio of Scaled Businesses in Attractive Markets

Commercial Finance Group

Commercial Services

Business Capital

Comm, Media & Entertainment

Commercial Real Estate

Construction

Equipment Finance

Energy

Healthcare

Mergers and Acquisitions

Sponsor Finance

Aerospace

Rail

Commercial Aircraft

Business Aircraft

Aerospace and Defense Finance

Commercial Credit

Commercial Services Int’l

Commercial Services Asia

Commercial Services Europe

Trade Finance

Transportation Finance

Corporate Finance

Net Revenue: $331 Million

Net Income: $129 Million

ROE: 26%

Net Revenue: $266 Million

Net Income: $182 Million

ROE: 17%

Net Revenue: $603 Million

Net Income: $240 Million

ROE: 16%

Net Revenue: $1.2 Billion

Net Income: $551Million

ROE: 17.9%

Syndicated Loan Group

Data as of or for the nine months ended September 30, 2006.

Clear Traction in Executing the New Strategy

33%

Efficiency Ratio

$12.5 Billion

Volume

$1.2 Billion

Net Revenue

17.9%

ROE

0.16%

Net Charge-offs

3.23%

Net Margin

$39 Billion

Managed Assets

$551 Million

Net Income

vs. 2005

2006

9 bps

Challenges

Aggressive market pricing

Liberal credit structures

Accomplishments

Successfully launched customer-centric,

market-focused growth strategy

Attracted over 150 top commercial

finance professionals

Enhanced state-of-the-art

risk management system

Executed well on new growth initiatives

Data as of or for the nine months ended September 30.

1995-2006: A Dramatically Changed Competitive Landscape

Banks consolidating

and moving up-market

Disrupted client

relationships

Shifting middle market

and industry strategies

Banking

Commercial Finance

1995-2006: A Dramatically Changed Competitive Landscape

Banks consolidating

and moving up-market

Disrupted client

relationships

Shifting middle market

and industry strategies

Banking

Commercial Finance

Revenue

Where We Compete

Junk

B-

$10M

$50M

$1B

$100B+

B+

BB-

BBB

AAA

Credit Rating

Middle Market

~$1.8 Trillion

Finance Companies

Local Banks

Large Banks

Investment Banks

Hedge Funds

Finance Companies

Regional Banks

Hedge Funds

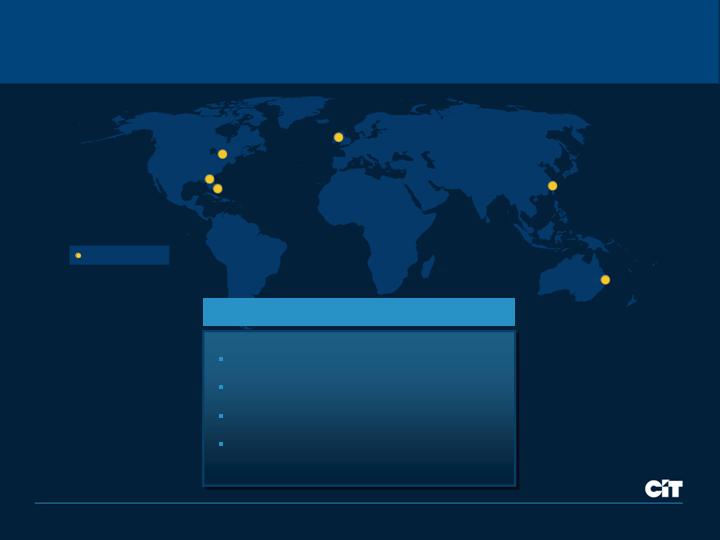

Positioned for Global Growth

Aerospace global headquarters opened in Dublin, 2005

Expanding European factoring platform – German Factoring acquisition Q2 2006

Fortifying Asian expansion – New Singapore Aerospace office Q4 2006

Atlanta

Boston

Charlotte

Chicago

Dallas

North America

Shanghai

Singapore

Hong Kong

$930 Billion

London

Dublin

Frankfurt

Europe

$330 Billion

$420 Billion

Asia-Pacific

$147 Billion

Houston

Los Angeles

New York

Tempe

Toronto

$410 Billion

Loans

Equipment

Finance

$750 Billion

$1.34 Trillion

Market

$330 Billion

$183 Billion

Market-Focused Model Driving Organic Growth

Relationship Managers

Industry thought leaders

Consultative approach

Develop / manage CIT relationship

Coordinate execution

Equipment Finance

& Leasing

Factoring

Asset Based Lending

Corporate Finance

Structured / Project Finance

M&A Advisory

Commercial Real Estate

Advisory & Finance

Products and Services

Target Industries

Communications,

Media & Entertainment

Construction

Retail

Healthcare

Energy

Aerospace

Rail

Private Equity

Sponsors

Intermediaries

Financial

Institutions

Channel Partners

Hedge

Funds

Syndicated

Loan Group

Sponsor

Finance

Capital Markets

Healthcare

Energy

Europe

Sales

Equipment

Finance

Commercial

Real Estate

M&A

Advisory

Commercial

Services

Canada

Risk

Communications,

Media & Entertainment

Business

Capital

Construction

Aerospace

Rail

Performance Driven by Strong Talent

New Strategy is Driving Strong Originations Growth

CAGR: ~40%

CAGR: 6%

Q4

9 months

New Business Volume

($ Billions)

8.1

9.1

8.2

11.4

12.5

7.8

Cross-Selling Strategy is Working

Tremendous growth in referral

activity in 2006

Incentive compensation

drives behaviors

Lowest cost origination lever

2005

2006

9 mos.

$228

$967

22

72

Transactions

Cross-Sell Volume

($ Millions)

YTD

324%

An Originations Powerhouse

$12.5 Billion Booked YTD

Investment

Vehicles

$9.3 Billion

2007 Initiative

$3.2 Billion

Capital

Markets

Syndications

Balance Sheet

$61 Billion Proposed YTD

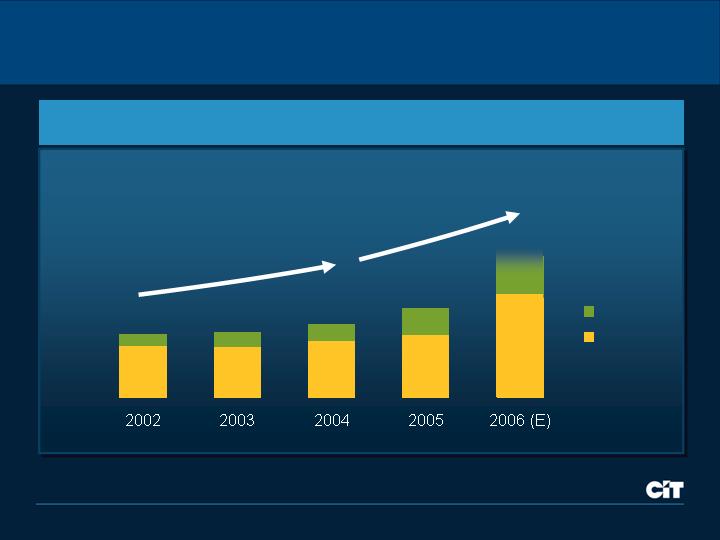

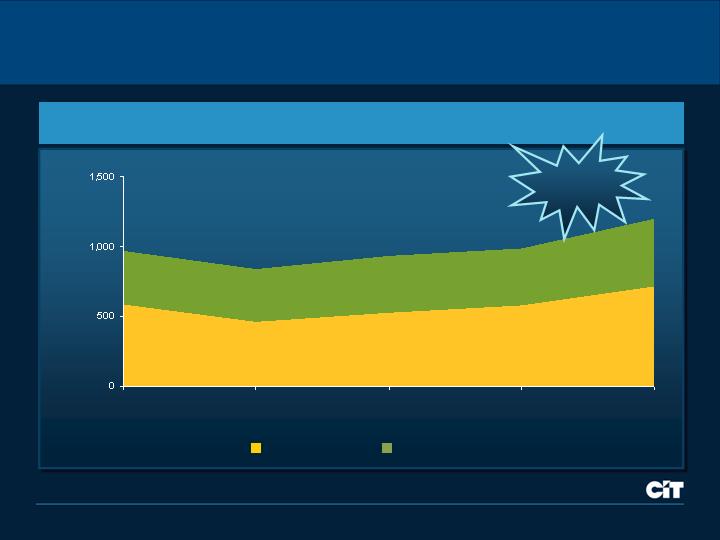

Driving Non-Spread Revenue and Improving Earnings Mix

Revenue Composition

($ in Millions)

2002

9 mos.

2003

9 mos.

2004

9 mos.

2005

9 mos.

2006

9 mos.

Spread

Non-Spread (NSR)

NSR Growth

22%

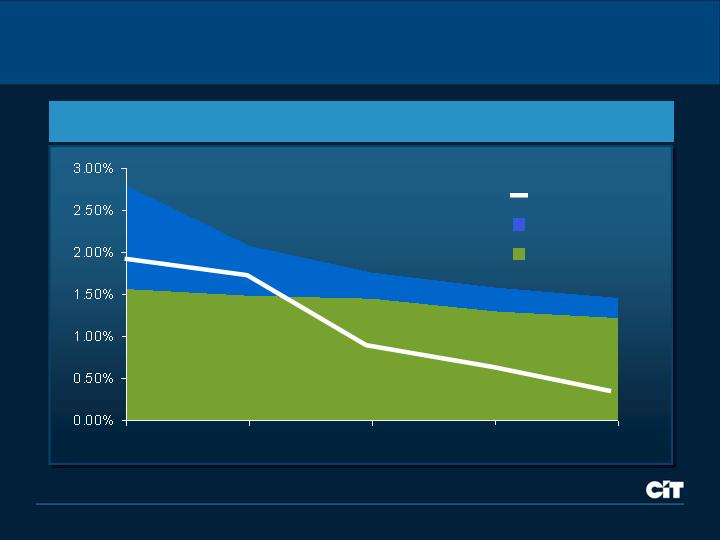

Owned Credit Losses

(% of Average Finance Receivables)

Best-in-Class Risk Management

660 person risk team lead by

seasoned veterans

Sophisticated systems provide

‘early warning detection’

State-of-the-art risk-adjusted

pricing discipline

Risk philosophy driven by

diversification and supported

by strong collateral positions

Risk Management Expertise

0.25%

0.16%

Risk-Adjusted Margin

(% of Average Earning Assets)

2006

9 mos.

2005

9 mos.

2.75%

3.11%

2006

9 mos.

2005

9 mos.

Model Designed to Deliver Earnings Through All Cycles

Strong Economy

Acquisition Finance

Growth Capital

Mergers and Acquisitions

Real Estate

Construction

Competitors enter,

margins decline

Down Cycle

Factoring

Restructuring

DIP Financing

Distressed Debt

Advisory Services

Competitors exit,

margins improve

What do Middle Market Customers Really Want?

Understand their business

Stand with them through cycles

Deliver solutions for complex financing needs

Respond quickly and always deliver on commitments

Limited

How We Win in the Middle Market

Relationship

Orientation

Structuring

Expertise

Middle Market

Advisory Capabilities

Agility

Direct Access to

Decision Makers

Broad Product

Offering

Long-Term Commitment

to Middle Market

Deep & Dedicated Industry

Focus / Expertise

Banks

Finance

Companies

Hedge

Funds

Limited

Limited

Limited

Limited

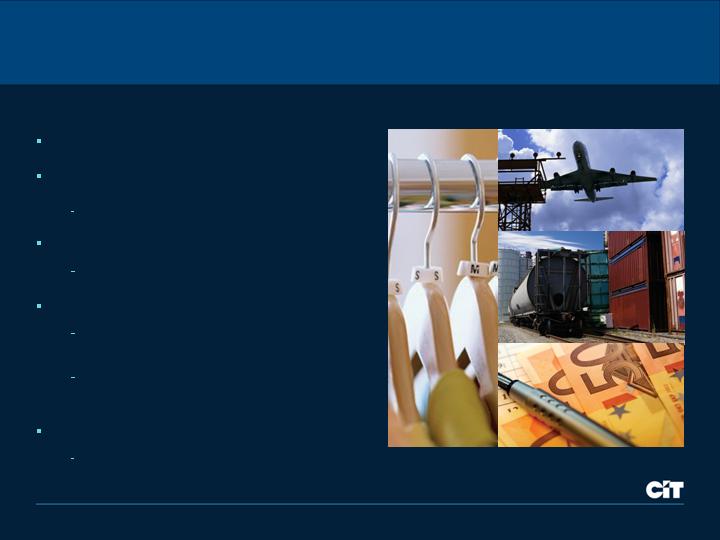

Business Overview

Trade Finance

Corporate Finance

Transportation Finance

Trade Finance: Commercial Services

#1 factoring position in the U.S.

~$45 Billion volume

Average client relationship

Over 10 years

Actively cross-selling insurance,

commercial credit and M&A

International expansion

Following our clients to Europe

and Asia

Factoring Volume

($ Billions)

9 mos.

CAGR: 12%

Transportation Finance: Rail

Youngest major fleet in the industry

Average age of 10 years versus

industry average of 19 years

#3 franchise position with over

100,000 car fleet

Over 99% utilization rate

Smart bolt-on acquisitions

Attractive pricing on renewals

Favorable railcar delivery positions

with manufacturers in 2007 / 2008

Managed Assets

($ Billions)

9 mos.

CAGR: 22%

Transportation Finance: Aerospace

#3 franchise position

40 years of industry experience

Over 120 customers

International platform: over 80%

of aircraft are outside North America

Modern, fuel efficient fleet

Commercial Aircraft: Over $2 trillion

requirement for aircraft financing in

the next 20 years

Business Aircraft: $156 billion of

aircraft deliveries in the next 10 years

Aerospace and Defense Finance:

Supply chain finance

Managed Assets

($ Billions)

9 mos.

CAGR: ~15%

Corporate Finance

9 mos.

Leveraging industry expertise,

specialty lending acumen, balance

sheet and capital market capabilities

Focused ‘One CIT’ approach

to channel partners

Collaborative deal teams driving

organic growth

Advisory services enhance

capabilities and fee revenue

Expanding lead generation through

Piper Jaffray alliance

New Business Volume

($ Billions)

Sponsor-Backed Transactions

CAGR: ~30%

2005

2006 9 mos.

Number of Deals

196

262

Lead Deals

15

40

Commitments

$4.0 B

$7.3 B

Fundings

$2.2 B

$4.0 B

Advancing Lead Arranger Status

Q3 2005

314,500,000

National City Corporation

25

325,000,000

Zions First National Bank

24

345,000,000

CIT Group

23

352,000,000

KeyBank

22

360,000,000

Deutsche Bank

21

387,000,000

RBC Capital Markets

20

407,300,000

Antares Capital Corporation

19

510,000,000

PNC Bank

18

Volume

($)

Company

Rank

530,000,000

Bear Stearns Companies

17

602,500,000

CIBC World Markets

16

638,241,305

ABN AMRO Bank N.V.

15

702,500,000

Lehman Brothers

14

734,000,000

Royal Bank of Scotland Plc

13

750,000,000

SunTrust Bank

12

792,500,000

Merrill Lynch & Company

11

819,000,000

Bank of New York Company

10

962,000,000

BNP Paribas

9

1,178,750,000

General Electric Capital Corporation

8

1,205,000,000

Citigroup

7

1,221,674,000

Wachovia Securities

6

1,602,300,000

Credit Suisse First Boston

4

1,487,500,000

Wells Fargo & Company

5

2,067,250,000

UBS AG

3

4,113,300,000

Bank of America

2

5,212,900,000

JP Morgan

1

Source: Reuters Loan Pricing Corporation / DealScan.

Q3 2006

212,500,000

U.S. Bancorp

25

215,000,000

KeyBank

24

227,500,000

National City Corporation

23

237,500,000

TD Securities

22

250,000,000

Regions Bank

21

275,000,000

ABN AMRO Bank N.V.

20

295,000,000

Merrill Lynch & Company

19

315,000,000

BMO Capital Markets

18

Volume

($)

Company

Rank

329,500,000

Bank of New York Company

17

378,500,000

CIBC World Markets

16

557,500,000

Bear Stearns Companies

15

558,797,950

General Electric Capital Corporation

14

650,000,000

SunTrust Bank

13

727,500,000

Wells Fargo & Company

12

799,000,000

Lehman Brothers

11

841,200,000

CIT Group

10

882,500,000

UBS AG

9

937,297,950

BNP Paribas

8

1,000,000,000

Goldman Sachs & Company

7

1,061,100,000

PNC Bank

6

1,809,750,000

Wachovia Securities

4

1,473,500,000

Credit Suisse

5

1,852,500,000

Citigroup

3

4,204,800,000

JP Morgan

2

4,382,850,000

Bank of America

1

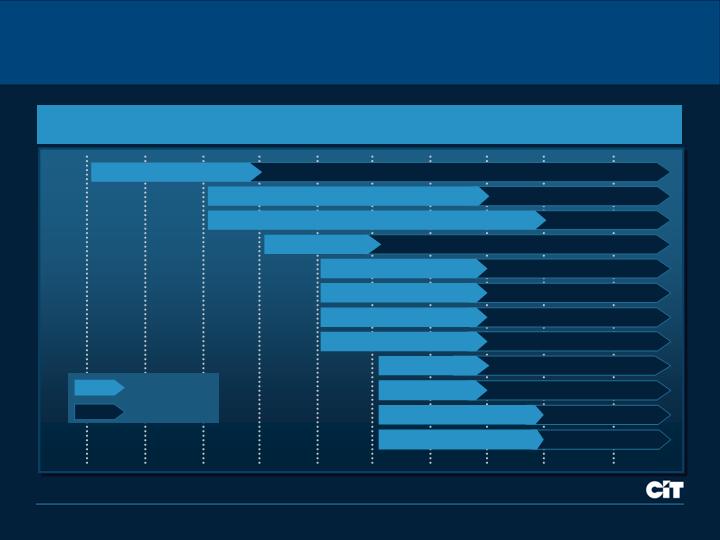

New Strategic Initiatives are Growth Engines for the Future

Q1 2005

Q2 2005

Q3 2005

Q4 2005

Q1 2006

Q2 2006

Q3 2006

Q4 2006

2007

Overall Investment vs. Return

($ Millions)

Investment phase

Revenue positive

Healthcare

Mergers & Acquisition

Commercial Real Estate

Capital Markets

Global Sponsor

Syndicated Loan

Energy

Aerospace & Defense Finance

International Trade Finance

Commercial Credit

Business Capital Restructuring

Structured

Equipment Finance

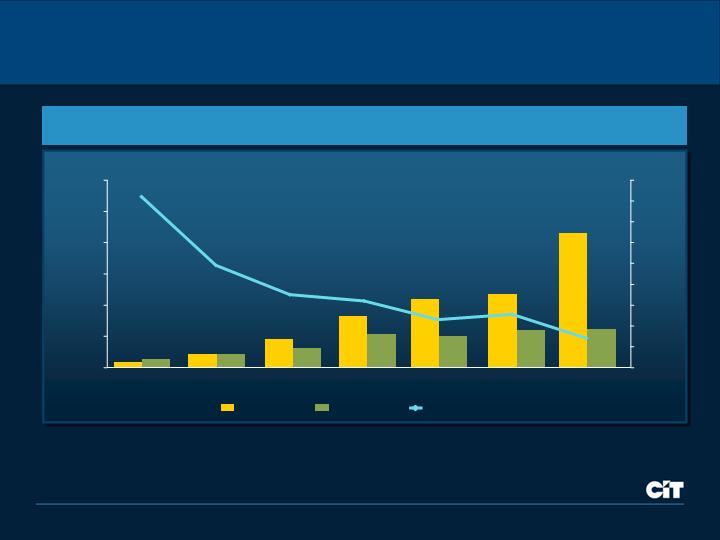

New Strategic Initiatives are Growth Engines for the Future

Overall Investment vs. Return

($ Millions)

Q1 2005

Q2 2005

Q3 2005

Q4 2005

Q1 2006

Q2 2006

Q3 2006

Q4 2006

2007

-50

-30

-10

10

30

50

70

90

110

130

150

Q1 2005

Q2 2005

Q3 2005

Q4 2005

Q1 2006

Q2 2006

Q3 2006

Expense

Revenue

Net Revenue

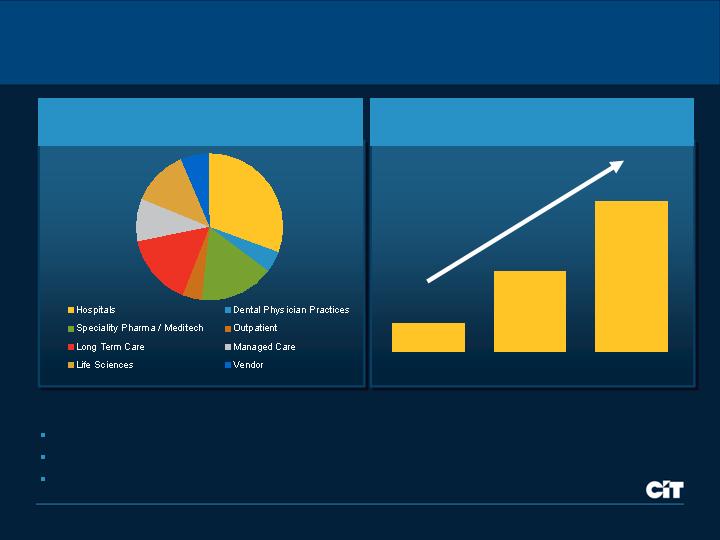

Healthcare Vertical Driving Growth

Healthcare as a growth engine

Launched industry vertical in 2005

Hired best-in-class team

Organized sales force around large healthcare sub-segments

2005 Healthcare Financings:

~ $170 Billion

Managed Assets

($ Billions)

Dec 2004

Dec 2005

Sep 2006

0.5

1.5

2.5

31%

5%

16%

5%

16%

9%

12%

6%

CAGR: 144%

Healthcare - Rapid Payback on Investment

0

10

20

30

40

50

60

Q1 2005

Q2 2005

Q3 2005

Q4 2005

Q1 2006

Q2 2006

Q3 2006

0

20

40

60

80

100

120

140

160

180

Revenues

Expenses

Efficiency Ratio

Accelerating Productivity

($ Millions)

Efficiency Ratio (%)

Building Scale Through Bolt-On Acquisitions

Trade Finance

Transportation Finance

Rail Fleet

(Railcars)

German Factoring 166

SunTrust 864

Factoring Assets

($ Millions)

Corporate Finance

Healthcare Finance Assets

($ Millions)

HBCC 515

PLM 5,845

DJ Joseph 2,100

Bombardier 15,000

Acquisitions are a core competency

Accretive from inception

All are tracking at or above plan

Construction: Transformation Success Story

Refocused on core strategy

Restructured the business

$11 million cost take-out

106 headcount reduction

Re-deployed sales force

Effective use of capital markets

distribution capabilities

The result:

Improved front-end and

operational efficiency

Sales productivity more

than doubled

Achieving ROE hurdle rate

$28 M

Non-Spread Revenue

$1.2 B

Volume

15.1%

ROE

27.2%

Efficiency Ratio

$32 M

Net Income

2006

9 mos.

2005

9 mos.

VS.

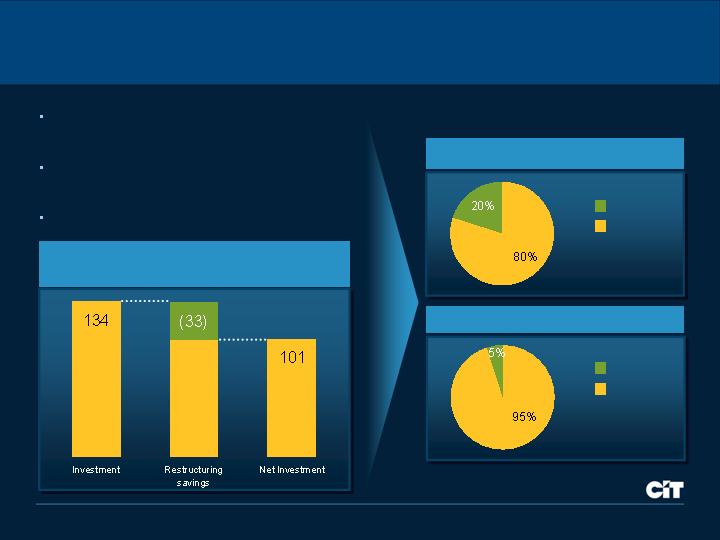

Investment Phase in Growth Initiatives is Nearly Complete

Funded 25% by exiting slow-growth /

low-return businesses

Rigorous focus on productivity and

expense management

Platforms built without incurring goodwill

Back-end

Front-end

Majority of investment has been…

Focused on the Front-End

Cost and Revenue Correlated

Fixed

Variable

Investment for Growth

($ Millions)

Balancing Size of Sales Force with Productivity

275

Sep

2005

20%

=

+

28

32%

37

59%

12.1

7.6

Sales Force Size*

Sales Productivity

($ Millions)

Volume*

($ Billions)

Sep

2006

2005

9 mos.

2006

9 mos.

2005

9 mos.

2006

9 mos.

330

* Excludes Trade Finance volume and headcount.

Delivering Strong Growth and Returns

Profitability

Drivers

Volume ($ Millions)

ROE

Record new business volumes

Stable risk-adjusted margins

Increasing levels of fee income

Strong credit quality

Focus for 2007: Accelerating Growth and Productivity

Harvest investment in new

initiatives

Focus on fee income growth

Build asset management

complement

Build on our

growth momentum

Operational

excellence

driving productivity

Accelerate sales productivity

Optimize back-office

platforms

Efficiencies driven

through IT enhancements

Revenue

Expense

Commercial Finance Panel

Gregg Smith

M&A

Jim Hudak

Communications, Media & Entertainment

Flint Besecker

Healthcare

Healthcare Team Leads with Trusted Advisor Approach

Top 5 healthcare leaders have over 100 years of industry experience

Applies intellectual capital to drive value for clients

Healthcare is huge market representing 16% of GDP

Added 289 new relationships in past 12 months

Sole Lead Arranger

$55,000,000

Senior Secured Credit Facility

Supporting the Acquisition of Tarrant

Dialysis Centers by US Renal

$47,100,000

Senior Secured Credit Facilities

Acquisition Finance

Relationship Case Study

Widely respected middle market private

equity firm with long standing healthcare

investment track record

4 Closed lead mandate financings in 2006

3 Pending commitments due to fund

2 Buy-side advisory engagements

CIT Healthcare is preferred source for

private equity firm’s activities

Sole Lead Arranger

M&A Advisory Team Executes Mandates Across CIT’s Platform

Over 90 opportunities have been reviewed:

have acquired

September 2006

and

Sanus Holdings, LLC

®

®

The undersigned initiated the transaction and acted as exclusive

financial advisor to Arcapita Inc. and Sanus Holdings, LLC

Common Characteristics

A leading distributor

of women’s apparel

®

®

Exclusive sell-side advisor

PROJECT

YELLOW JACKET

In Process

Aerospace & Defense (1)

Communication, Media & Entertainment (14)

Consumer Products (5)

Diversified Industrials (20)

Energy (5)

Healthcare (30)

Rail (1)

Retail & Apparel (15)

Long-term relationships

Leverage CIT’s balance sheet

Deep industry expertise

CIT initiated

Case Studies

Communications, Media & Entertainment

Validation of Industry Vertical Strategy

Strategic Group with Great Growth

and New Potential

Industry experts with long term

relationships in each sub-vertical

Deliver multiple products for a total

financing solution

Expanded into contiguous areas -

Sports and Entertainment

Repositioned team for stronger

underwritings and lead positions

27 co-lead or sole lead arranger

transactions to date in 2006

Proof of Concept

Sole Arranger,

Administrative Agent

and Acquisition Advisor

First Lien Revolving Line of

Credit, First Lien Term Loan B

and Second Lien Term Loan

used for acquisition

Casino and hotel operator

$222,000,000

Sole Arranger,

Administrative Agent

and Acquisition Advisor

First Lien Revolving Line of

Credit, First Lien Term Loan B

and Second Lien Term Loan

used for acquisition

First Lien Revolving Line of

Credit, First Lien Term Loan B

and Second Lien Term Loan

used for acquisition

Casino and hotel operator

$222,000,000

Administrative Agent

(Senior)

Documentation Agent

(Mezzanine)

Revolving line of credit and

mezzanine facility for the purpose

of film production

Successful genre film label

$212,500,000

Administrative Agent

(Senior)

Documentation Agent

(Mezzanine)

Revolving line of credit and

mezzanine facility for the purpose

of film production

Successful genre film label

$212,500,000

Syndication Volume

($ Millions)

250%

Fee Income

($ Millions)

140%

Volume

($ Billions)

114%

Commercial Finance

Improved go-to-market synergies

Focus on major growth opportunities

Greatly enhanced fee income generation

Enhanced risk management – domain expertise

Scalable model

Deliver consistently through all cycles

Benefits

Market and industry focused

Customer-centric

End-to-end solutions

Relationship driven

Enables cross-selling

Originate and distribute model

The Right Model

at the Right Time

Industry expertise valued

Capital expenditures increasing

Complex and growing financing needs

Fragmented competitive landscape

Global scope

Focus on Large and

Attractive Markets

Specialty Finance

Tom Hallman

Vice Chairman, Specialty Finance

Specialty Finance: Leaders in Relationship Financing

Assets: $33 Billion

$17.6 Billion in new business volume

ROE: 19.5%

Employees: ~3,800

Large experienced sales force: ~900

Large and diversified partner base: Over 5,000

4.3 million consumer and over 500,000

commercial customers

Global reach: 34 countries

Efficient and scalable platforms serving

customers in 5 continents

Best–in-class risk and collateral

management capabilities

Data as of the nine months ended September 30, 2006.

Specialty Finance At-a-Glance

Global Focus

Vendor Finance

U.S. Focus

Consumer /

Small Business Lending

CIT-Wide

Insurance Services

Industrial

Healthcare

Home Lending

Student Loan Xpress

Small Business Lending

Specialty Finance Group

Technology / Office Products

CIT Bank

Strong Performance

19.5%

ROE

$537 Million

Pre-Tax

39.9%

Efficiency Ratio

$17.6 Billion

Volume

$1.1 Billion

Revenue

0.64%

Net Charge-offs

3.14%

Net Margin

$33 Billion

Managed Assets

$332 Million

Net Income

vs. 2005

2006

Challenges

Lower year-over-year volume from

largest vendor relationships

Pressure in the housing market

Accomplishments

Expanded sales force globally and

increased productivity

Realigned vendor organization to

better serve customers

Won several global marquee

relationships including Microsoft

Student Loan Xpress performance

significantly ahead of plan

Continued strong credit and residual

management performance

15 bps

10 bps

60 bps

Data as of or for the nine months ended September 30.

Significant Market Opportunities

Global Vendor

Financing

Home

Lending*

Student

Lending

Small Business

Lending**

Markets are large,

growing and

fragmented

Scalable platforms

in all segments

Relationship

expansion drives

growth

Market Trends

($ Billions)

Market

Growth

* Non-prime market data based on YTD market trend.

**SBA lending only. Based on SBA 2006 fiscal year.

~340

~700

~70

~20

2006 Estimated Market Size

Distinctive Value Proposition

Over 5,000 strong

relationships

Over 900 sales

representatives in 34

countries

Differentiated

relationship

management tools

Customer-centric

business model

Proven talent with

extensive industry

experience

International expertise

Capability to structure

sophisticated

partnerships

Risk-scoring expertise

Collateral

management skills

Relationship Capital

Intellectual Capital

Sustainable

Competitive

Advantage

=

+

Capturing More of the Market

Software financing

Managed services

Conventional small

business products

Private education loans

People

Products

Places

Over 30% increase

in sales forces

35% Vendor

26% Consumer / SBL

Increase sales presence

in U.K. and Germany

Over 60 sales

executives

Industrial leasing

products

Technology leasing

solutions

Expanded to 34

countries including

Portugal

Czech Republic

Puerto Rico (U.S.)

Increased presence in

U.K. technology

finance

German dealer /

reseller finance

Organic

Barclays

Vendor

Finance

Acquisition

Sales Build-Out Across the Globe

Europe

117

160

37%

Asia / Pacific

68

84

24%

667

512

Sep

2005

Sep

2006

30%

Americas

Sep

2005

Sep

2006

Sep

2005

Sep

2006

* Excludes joint ventures and portfolio purchases.

Productive Sales Growth in 2006

697

911

31%

=

+

10.2

21%

12.4

59%

11.3

7.1

Sales Force Size

Sales Productivity

($ Millions)

Volume*

($ Billions)

2005

9 mos.

2006

9 mos.

2005

9 mos.

2006

9 mos.

Sep.

2005

Sep.

2006

End-to-End Efficiency Enhancements to Fund Future Growth

Maturing sales force

Enhanced lead-generation and

prospecting tools

Broader product set

New global markets

Sales Drivers

Efficiency Ratio

(%)

Scaling of operation

Best-practice sharing across platforms

LEAN processes to reduce ‘waste’

Improved technologies

Operations Drivers

2005

9 mos.

2006

9 mos.

2004

9 mos.

45

40

35

Strong Focus on Driving Non-Spread Revenue

Expanded sales force generating new

relationships and incremental volume

Increase in syndication and

secondary market gains

Secondary market activity for

Consumer / SBL

Syndication in Vendor Finance

Robust growth in Insurance cross-sell

across all businesses

Increase in fees due to expanded

customer base and greater volume

generation

2006

9 mos.

350

434

Non-Spread Revenue

($ Millions)

2005

2004

CAGR: ~30%

420

New And Expanded Relationships

New And Expanded Relationships

New And Expanded Relationships

Efficient / Scalable Global Platforms: Vendor Example

Jacksonville (U.S.)

Miami (Latin America)

Dublin (Europe)

Shanghai (Asia)

Sydney (South Pacific)

Regional servicing hubs

In-country sales and credit

Scalable systems and processes

34 countries and growing

Operations / Technology

Burlington (Canada)

Servicing Centers

Owned Credit Losses

(% of Finance Receivables)

Best-in-Class Risk Management

Underwriting capabilities

Tenured senior risk management team

Tailored risk systems across all

business units

Predictive scoring

Proprietary behavioral scoring models

for consumer and commercial credits

In-house management science

expertise

Collateral management

Deep expertise in each collateral

category

Efficient end-of-lease processes create

low inventory levels and positive

residual experience

Risk Management Expertise

0.79%

0.64%

Residual Realization

153%

150%

2006

9 mos.

2005

9 mos.

2006

9 mos.

2005

9 mos.

100%

Growth Agenda

Increase Relationship

Penetration

Add New

Relationships

Increase End-to-End

Productivity

Pursue Bolt-on

Acquisitions

Scale Global

Operations

Expand Market

Coverage

Specialty Finance Group

Global Focus

Vendor Finance

Vendor Finance Overview

Vendor Finance

Industrial

Healthcare

Technology / Office Products

Global Focus

Specialty Finance Group

CIT-Wide

Insurance Services

Home Lending

Student Loan Xpress

Small Business Lending

CIT Bank

U.S. Focus

Consumer /

Small Business Lending

Vendor Finance: At-a-Glance

2006 Business Highlights

Leading Global Vendor Finance Company

Extensive Geographic Coverage

Over 500 sales representatives in 34 countries

6 Service Centers in 4 continents

Doubled market presence in Europe

New marquee relationships: Microsoft, AGFA,

Manitowoc

2007 Growth Initiatives

Leverage new organization to drive volume for

global and strategic accounts

Increase market penetration in technology,

healthcare and industrial sectors

Enter new segments in Canada, Europe, Latin

America and South Pacific

Integrate and grow Barclays Vendor Business

Build-out Asian operating platform in Shanghai

Volume

($ Billions)

Vendor Finance Performance

662

Managed Assets

$13 B

ROE

25.8%

838

Revenue

($ Millions)

Net Income

($ Millions)

222

249

278

2004

2005

2006

9 mos.

2004

2005

2006

9 mos.

810

6.1

9.1

9.8

2005

2006

9 mos.

2004

Data as of or for the nine months ended September 30, 2006.

Growth Beyond Dell U.S. Joint Venture

New Business Volume Growth*

Accelerating growth rates across

all geographies

35% increase in Vendor Finance

sales force

Sales force focused on building

new relationships and greater

penetration with existing partners

Record new vendor signings

Strong pipeline and funnel

Robust growth in new vendor

programs

New programs in Europe

growing at over 100% annually

11%

18%

2005

9 mos.

2006

9 mos.

* Excludes Dell U.S. joint venture.

Technology

Telco

Software

OP / Printing

Healthcare

Industrial

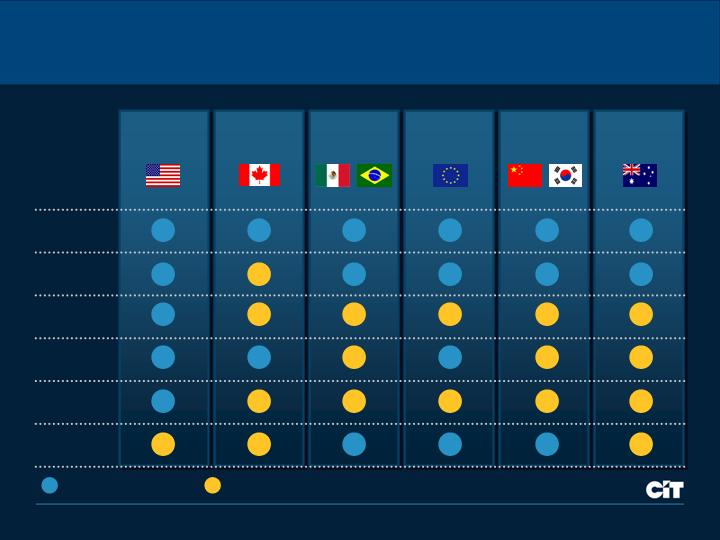

Growth Across Industry Segments and Geographies

U.S.

Canada

Latin

America

Asia

South

Pacific

Europe

Significant Presence

Significant Opportunity

Vendor Finance Competitive Positioning is Very Strong

Captives

Banks

Independents

Organization alignment

to support vendors

Residual management

Global reach

Specialized products and

structures

Balance sheet /

syndication capabilities

Key Attributes

Risk management expertise

Limited

Limited

Limited

Limited

Limited

Limited

Limited

Limited

Organizational Alignment is a Key Differentiator

Customer Centric Model

Global Accounts

Global Vendors with

centralized decision making

Strategic Accounts

Global Vendors with

decentralized (geographic)

decision making

Local Accounts

Single geography

Managed by Global Major

Relationships team

Coordinated by Global Major

Relationships team

Managed locally

Managed locally

Enhanced focus on Global and Strategic Accounts will

enable over 30% * annual volume growth

Over 30

Relationships

Over 60

Relationships

Over 1,000

Relationships

* Excluding Dell U.S. joint venture.

Specialty Finance Group

Global Focus

Vendor Finance

Industrial

Healthcare

Technology / Office Products

CIT Bank

Global Focus

Vendor Finance

Industrial

Healthcare

Specialty Finance Group

Technology / Office Products

CIT Bank

Consumer / Small Business Lending Overview

U.S. Focus

Consumer /

Small Business Lending

Home Lending

Student Loan Xpress

Small Business Lending

Insurance Services

CIT-Wide

Consumer / Small Business Lending Performance

11.6

392

5.7

10.5

283

387

Volume

($ Billions)

Revenue

($ Millions)

Managed Assets

$20 B

ROE

13.4%

ROE

16.6%

(excludes SLX Goodwill)

2004

2005

2006

9 mos.

2004

2005

2006

9 mos.

Net Income

($ Millions)

110

75

100

2004

2005

2006

9 mos.

Data as of or for the nine months ended September 30, 2006.

Home Lending: At-a-Glance

2006 Business Highlights

Proven, disciplined originator

Over 250 sales representatives

Over 2,500 broker relationships

Strong portfolio management through

all cycles

2007 Strategy

Increase sales and operations productivity

Leverage originate and sell capability

Maintain competitive position

Continue risk and target market discipline

Enhance loan origination technology

Volume

($ Billions)

2004

2005

2006

9 mos.

5.8

4.6

6.9

Disciplined Portfolio Approach

Geographic Diversification

17%

12%

10%

20%

22%

19%

24% U.S.

non-prime market

Portfolio Demographics

2005

2006

2005

2006

Data as of September 30 (Current LTV as of June 30).

Borrower

Characteristics

FICO

631

636

Debt to Income

39%

40%

Length of employment

9

8

Length of residence

9

8

Loan

Characteristics

Loan Size

$112K

$120K

% Fixed

46%

44%

Loan to Value

81%

81%

at Origination

Current LTV

70%

69%

Student Loan Xpress: At-a-Glance

2006 Business Highlights

12th largest loan originator

~1,200 school channel partners

(doubled in 18 months)

State-of-the-art servicing facility

2007 Growth Initiatives

Continue investment in sales coverage

Increase school channel penetration

Increase productivity through scale and

systems enhancement

School Channel Partners

2004

2005

2006

9 mos.

Volume

($ Billions)

2004

2005

2006

9 mos.

4.7

1.6

2.7

1,198

601

876

Small Business Lending: At-a-Glance

2006 Business Highlights

#1 SBA 7(a) lender to small businesses

– seven consecutive years

Leading lender to women and minorities

Market leader in medical, dental and

day care segments

2007 Growth Initiatives

Increase sales and servicing productivity

Enhance market coverage through expanded 504

and conventional loans

Expand intermediary strategy

(franchise and hospitality)

Continue to focus on cross-sell opportunities

Volume

($ Billions)

2004

2005

2006

9 mos.

0.7

0.8

0.9

Global Insurance Cross-Sell Momentum

Core Business Model

Integrated cross-sell model

Distribution focus

Centralized expertise; ‘thin infrastructure’

Recurring non-spread revenues

High margins

2007 Growth Initiatives

Expand product set

Consumer based programs

Commercial insurance capabilities

to small business & middle market

companies

Accelerate rollout in Europe,

Canada and Australia

Revenue

($ Millions)

2006

9 mos.

21

26

2005

2004

CAGR: ~30%

28

Deposits

($ Billions)

CIT Bank: At-a-Glance

Origination Strategy

Funding Strategy

Unsecured consumer installment lending

through targeted intermediaries

Fee income generated through bank

affiliation programs

Focused on consumer, personal and

household markets

Leverage deposit market for lower

cost funding

Broker deposit market

Participation in deposit sweep

programs

0.3

2.2

Assets

($ Billions)

0.4

2.6

Sep.

2006

Sep.

2005

Sep.

2006

Sep.

2005

Well-Positioned for Continued Success

Specialty Finance Panel

Jeffrey Simon

Vendor Finance, Global Major Relationships

Michael Shaut

Student Loan Xpress, a CIT Company

Terry Kelleher

Vendor Finance, Europe, Asia and South Pacific

Randall Chesler

Consumer Finance, Home Lending

Christine Reilly

Small Business Lending

Dublin (Europe)

Shanghai (Asia)

Sydney (South Pacific)

Servicing Centers

International growth

Barclays vendor finance

acquisition

$2 Billion portfolio

$1 Billion volume

IT / Industrial leasing in U.K.,

Germany

Microsoft rollout in Europe

U.K.

Germany

France

Switzerland

Scalable platforms

Pan-European: Dublin

Pan-Asian: Shanghai

South Pacific: Sydney

Vendor Finance Europe, Asia, South Pacific

Vendor Finance, Global Major Relationships

Global Relationship Management

Coordination and Expansion

Latin

America

North

America

Europe

Asia/

South

Pacific

Global relationship management

Consistent execution

Cross-CIT coordination

Dell relationship

Growing internationally

Building new global

relationships, including

Microsoft

AGFA

Honeywell

Expanding relationships

to new geographies, including

Avaya

Heidelberg

Toshiba

Small Business Lending

Key Messages

#1 SBA 7(a) lender – seven consecutive years

Market coverage

Increased sales presence

Focus geographies

Flow partnerships

Growth segments

Hospitality

Franchise

Expanded product set

SBA 504 lending

Conventional small business product

(real estate)

Strategic marketing focus to improve lead

generation / targeting

Servicing excellence

Consumer Finance, Home Lending

Demographics

Consistent market player through cycles

Disciplined origination strategy

Strong partner relationships

Sales presence across U.S.

Local underwriting capabilities

Portfolio management expertise

Geographically diversified

Limited exposure to high-volatility

markets (e.g., coastal properties)

Proven / experience-based products

Technology investments

BrokerEdge enhancements

New loan origination system

Data as of December 31, 2003 and September 30, 2006.

2003

2006

FICO

625

636

Debt to Income

38%

40%

Length of employment

9

8

Loan Size

$87K

$120K

House price

$109K

$148K

LTV at origination

80%

81%

Successful CIT integration

Growth story

12th largest originator

Extensive industry expertise

Best-in-market sales force

1,200 school relationships

The CIT advantage

Balance sheet strength

Marketing and brand recognition

Sales culture

Investment in technology

Focus on school penetration

Top schools

Corporate relationships

Top 10 servicing facility: over $5 billion

in managed assets

Student Loan Xpress, a CIT Company

UT Austin

Texas A&M

Pepperdine

USC

Remington

Florida State

DeVry

Capella

Portland

State

Wisconsin

Widener

Temple

Columbia

Auburn

Univ. of

Arizona

Thomas

M. Cooley

Saint

Louis

Univ. of

Oklahoma

Inter American

Meharry

Wichita

State

Akron

Credit & Risk Management

Lawrence Marsiello

Vice Chairman and

Chief Lending Officer

2006 Progress and 2007 Expectations

Well-positioned to perform through the cycle

Robust and consistent credit grading methodology and process

Risk-based pricing and capital allocation

Active portfolio management approach

Creating more stable and predictable credit performance

Credit Execution Agenda

Key portfolio attributes

Diversification

Cross-business correlations

Counter-cyclicality

Credit management science

Delivering superior credit performance

Consistency

Lower volatility in credit metrics

Stable risk-adjusted returns

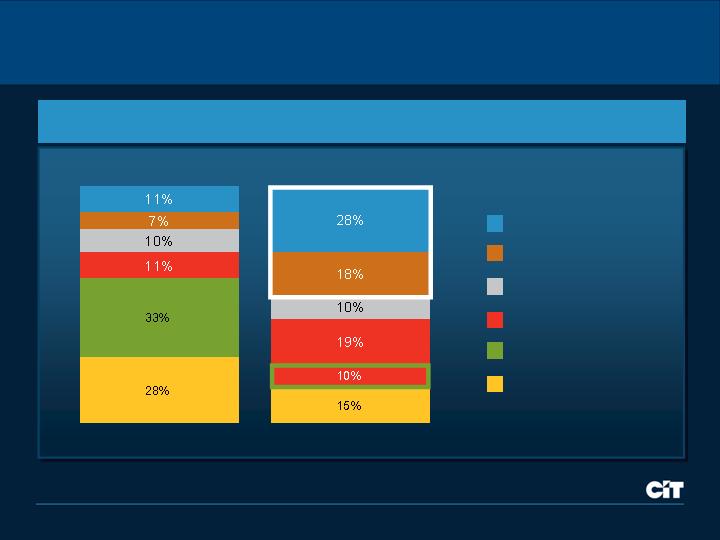

Balanced Portfolio

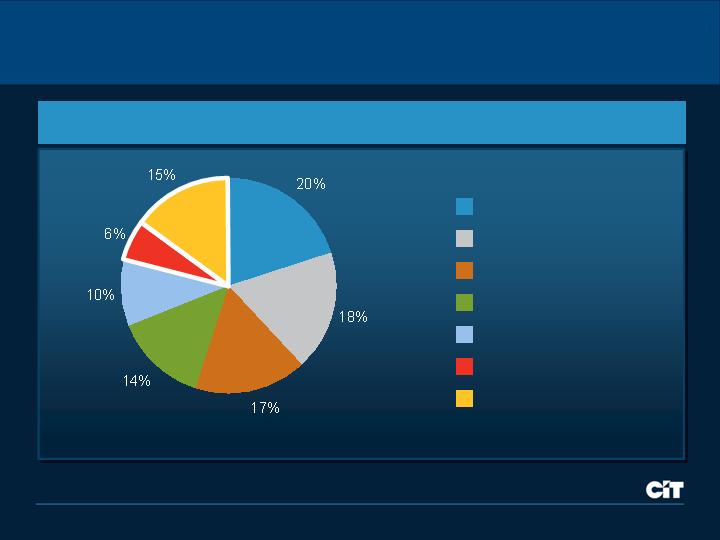

Consumer / SBL

Vendor Finance

Trade Finance

Corporate Finance

Equipment Finance*

Transportation Finance

1996

Sept 2006

$17 Billion

$72 Billon

Composition of Managed Assets

* Equipment Finance was combined with Corporate Finance in 2006.

Client Ratings Reflect Middle Market Focus

A-AAA

BBB

BB

B

Below B

6%

12%

39%

37%

6%

* Risk grading based on credit quality of obligor and probability of default.

Portfolio by Risk Grade*

Focus on transactions just below

investment grade

Minimal change in our client

risk profile

-

Consistent market focus

-

Continuously refine

underwriting criteria

Top 10 Exposures

High ratings for large hold positions = less portfolio value at risk

B

Transportation Finance

207

Aerospace

10

BB

Transportation Finance

219

Aerospace

9

BBB

Trade Finance

228

Retail

8

B

Transportation Finance

233

Aerospace

7

A

Trade Finance

235

Retail

6

BB

Transportation Finance

292

Aerospace

5

D

Corporate Finance

62

Energy

4b

B

Corporate Finance

231

Energy

4a

BBB

Trade Finance

309

Retail

3

AA

Trade Finance

379

Retail

2

BBB

Transportation Finance

395

Rail

1

Rank

Industry

Amount

Business

Facility Grade

($ millions)

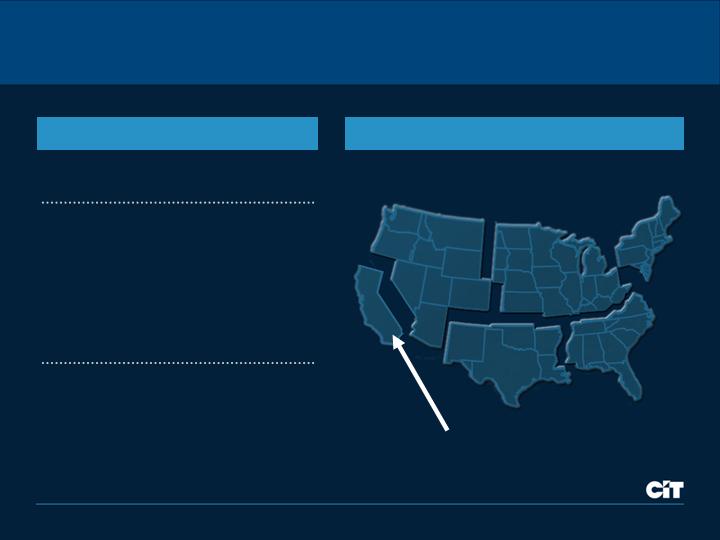

Broad Geographic Dispersion

Northeast

West

Midwest

Southeast

Southwest

Canada

Europe, Latin

America and Asia

Asset Diversification

(% Financing and Leasing Assets)

Data as of September 30, 2006.

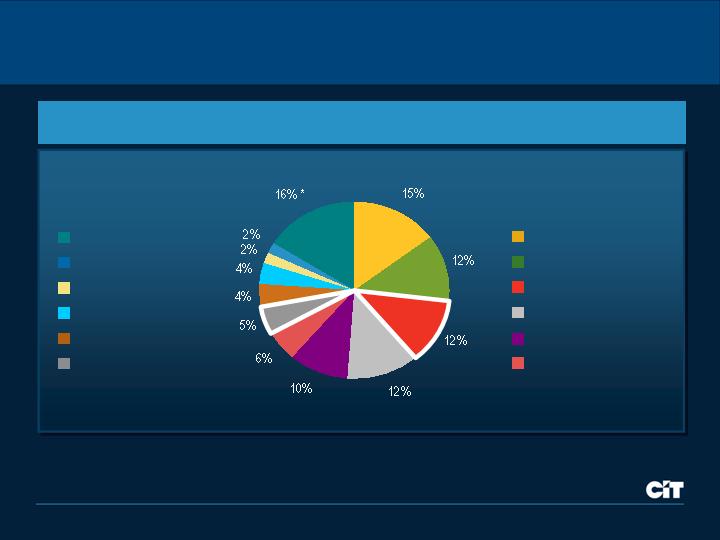

Diverse Industry Profile

Home Lending

Manufacturing

Educational Lending

Retail

Commercial Air

Services

*No other industry served greater than 2%.

Data as of September 30, 2006.

Other*

Communications

Consumer Other

Wholesale

Transportation

Healthcare

Asset Diversification

(% Financing and Leasing Assets)

Portfolio Correlation Analysis

Less credit loss

volatility than

monoline companies

Modeled business segments

to anticipate performance through credit cycles

Corporate

Finance

Transportation

Finance

Trade

Finance

Transportation

Finance

Vendor

Finance

Consumer

Finance

Credit Performance Linkage

(% of Average Finance Receivables)

Sample correlations:

STRONG

(38%)

MODERATE

(34%)

NEGATIVE / LOW

(28%)

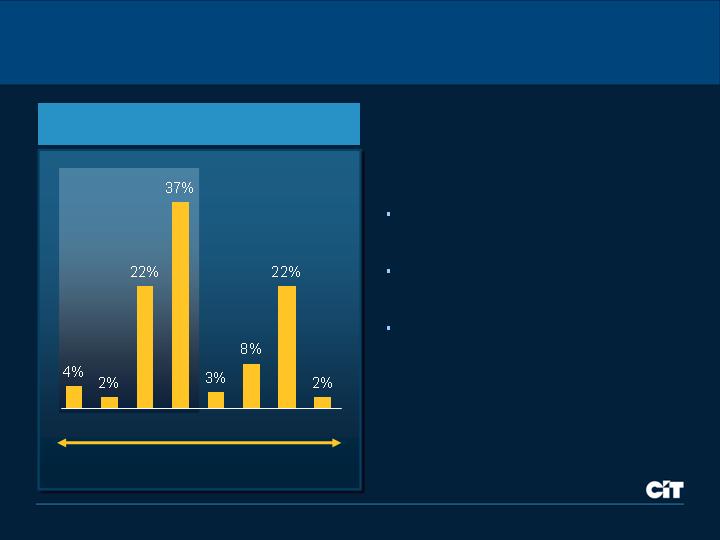

Limited Economic Sensitivity

Negative /

Low

Portfolio Correlation to U.S. Economy

(% of Financing and Leasing Assets)

65% portfolio minimally

correlated to US economy

Adjusting mix to non-cyclical

industries

Well-equipped to manage risk

in cyclical industries

Strong

More decisions made closer to the customer

Improving Risk Skill Set

Consistent views of portfolio volatility

Consistent skill sets

Consistent processes

Developing Intellectual Capital

Identifying gaps and making

investments across the business

Providing additional training to

existing teams

Adding new talent to the

organization in critical roles

Driving Empowerment

Using two-tier risk rating system

and standard processes

Larger decision authorities

pushed down into units

Aligned compensation to reward

growth, risk balance and margins

Active Credit

Portfolio

Management

Risk-adjusted ROE /

Economic profit

ROE

Income

Performance

Measure

Portfolio driven

Risk based

Traditional

Pricing

Credit portfolio manager

Originators / Credit

Originators

Ownership

Originate, portfolio

optimization, hedging

and redistribution

Mostly originate and hold, some

use of risk mitigation tools

Originate and hold

Investment

Philosophy

Transaction specific, with some

regard to overall portfolio

Transaction-by-transaction

Marginal impact relative

to existing portfolio

Transaction

Evaluation

Evolving Credit Portfolio Management

Aggregate Portfolio Management

Sophistication

Current State

Pre-2004

2004 - 2005

Enhanced Credit Portfolio Management

Transition matrix

Market data

Credit conversions

Loss-given defaults

Etc.

Modeling

Parameters

Simulation Setting Options

Confidence interval

MTM / book value

No. of simulations

Portfolio

Parameters

Correlations

Simulation Summaries

Loss Distribution

Sampling

Stress tests

Horizon

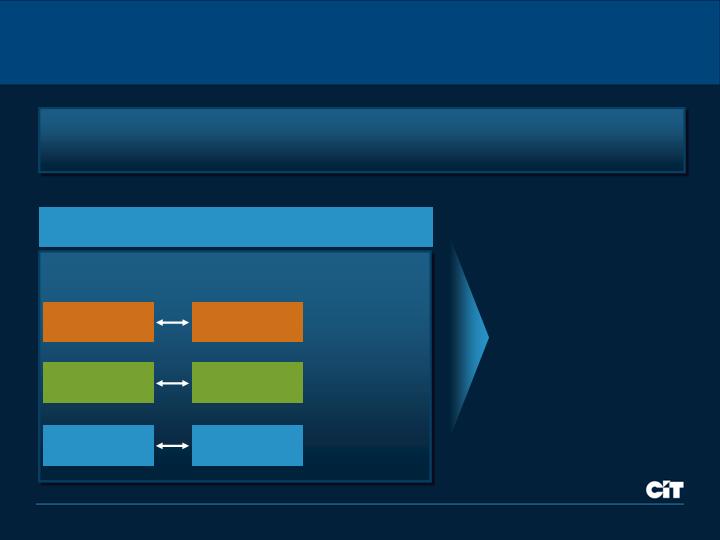

Greater Depth

of Model Inputs

Improved Ability to

Manage Risk

More Simulation

Options

+

=

Reporting

tables

Obligors,

transaction

data

Reference

data

(industry,

ratings,

etc.)

Data Inputs

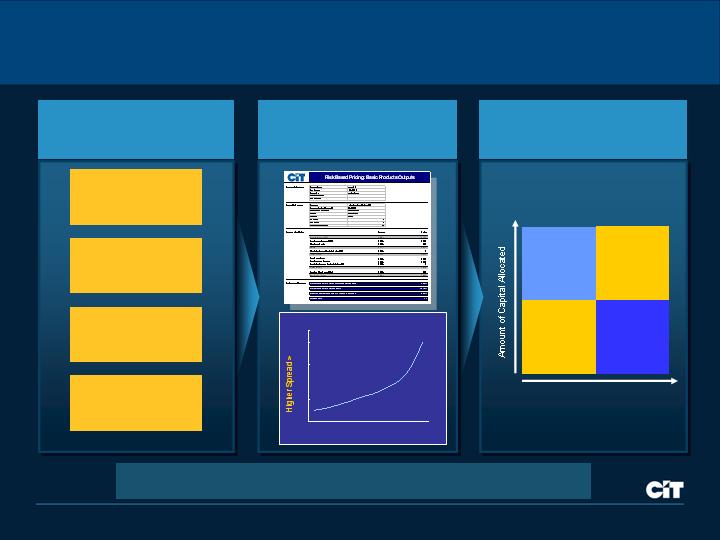

Transition to three common pricing models

Improved Risk Based Pricing

Probability of

Default

Cost of Funds

Operating

Expenses

Capital

Allocation

Standard RBP Modeling

Methodology

Risk-

Adjusted

Returns

Under-

performing

Asset Portfolio

Risk-

Adjusted

Returns

Missed

Opportunities

Asset Risk

High

High

Low

Consistent Outputs

Guide Credit,

Sales Organizations

Common Input

Parameters

Increasing Risk >

PRICING CURVE

Charge-Off History

(% Average Finance Receivables)

Historic Credit Losses

Expect 2007 to remain below full cycle credit losses

2003

2004

2005

2006

9 mos.

2007 (E)

Full Cycle

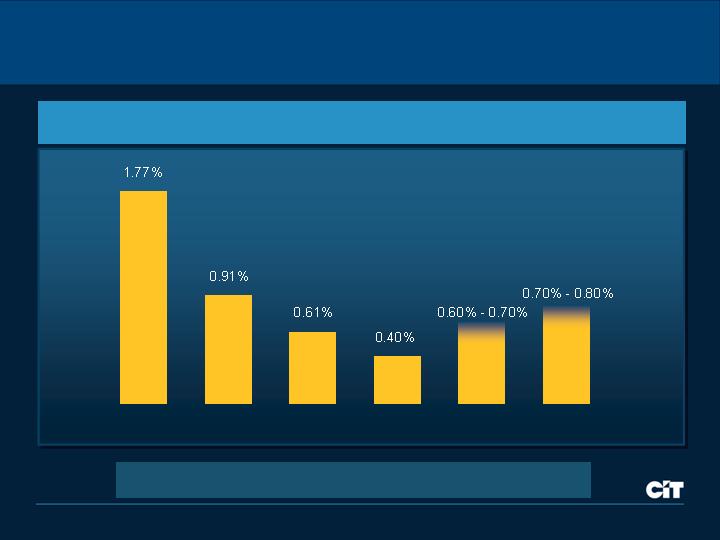

Consistent Reserve Coverage

Loan Loss Reserves vs. Charge-Offs*

(% Finance Receivables)

1.92%

1.77%

0.91%

0.61%

0.40%

1.57%

1.49%

1.46%

1.31%

1.22%

Charge-Offs

Specific

General

* Excludes Student Loan Xpress finance receivables.

2002

2003

2004

2005

2006

9 mos.

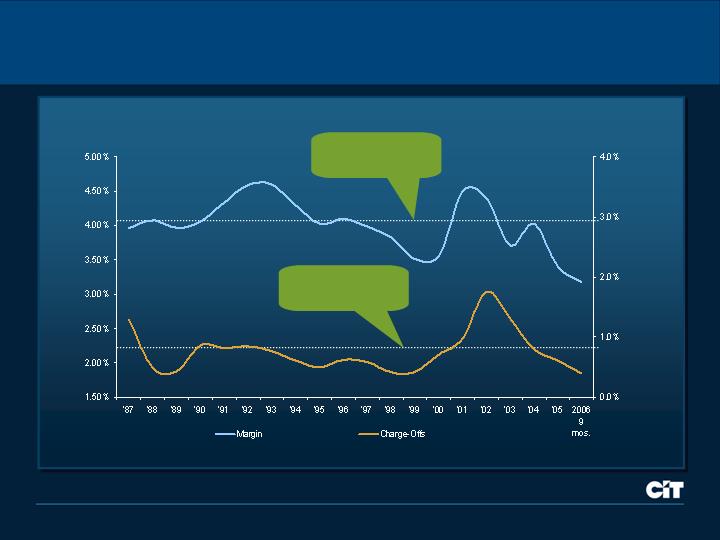

Stable Margin In All Environments

Margin

(% AEA*)

* Average Earning Assets

** Average Finance Receivables

Charge-Offs

(% AFR **)

20 Year

Average: 4.00%

20 Year

Average: 0.76%

2006 Progress and 2007 Expectations

Well-positioned to perform through the cycle

Robust and consistent credit grading methodology and process

Risk-based pricing and capital allocation

Active portfolio management approach

Continual investment in transactional level talent, skills and processes

Robust syndication capabilities for risk distribution and portfolio optimization

Creating more stable and predictable credit performance

Finance

Joseph M. Leone

Vice Chairman &

Chief Financial Officer

Financial Execution Agenda

Optimizing the balance sheet…

Robust liquidity

Resilient liability structure

Disciplined capital management

Strong capital generation

Strong credit ratings

…to drive financial performance

Leveraging originations

Managing net finance revenue

Improving productivity

Prudent tax planning

Robust Liquidity

* Includes available bank facilities, asset backed conduit facilities and cash.

Commercial Paper / Total Debt

Alternate Liquidity* / Short Term Debt

$6.3 Billion committed multi-year, unsecured credit facilities

$9.4 Billion committed asset backed commercial paper facilities

CIT Bank – deposits and Federal Home Loan Bank

Resilient Liability Structure

Average

Term:

1.9 yrs

4.6 yrs

1

2

3

4

5

5+

1

2

3

4

5

5+

2000

2006

2006 (9 mos.) Term Funding

Debt Maturity Distribution

Disciplined Capital Management

Barclays vendor finance

German factoring

RBS / Citizen’s portfolio

Immediately accretive

Short-term achievement of ROE hurdle

Bolt-on to existing platforms

Mergers &

Acquisitions

Expand syndication capabilities

Asset management complement

Generate optimal ROE

Asset-based capital allocation

Capital

Deployment

Programmatic share repurchase

$500 million ASR executed in 2005

Support compensation program

Opportunistic strategies

Share

Repurchase

Payout Ratio of 15% - 20%

Stable dividend within peer group

Capital retention to support growth

Dividends

Common and preferred / hybrid

15% available; 10% used

Efficient and flexible

Capital Structure

Target ~9.00%

Address portfolio risk

Capitalization

Philosophy

Actions

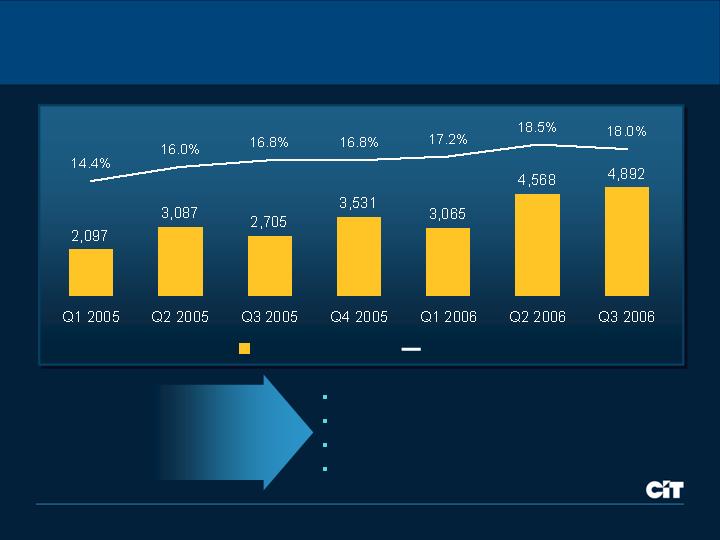

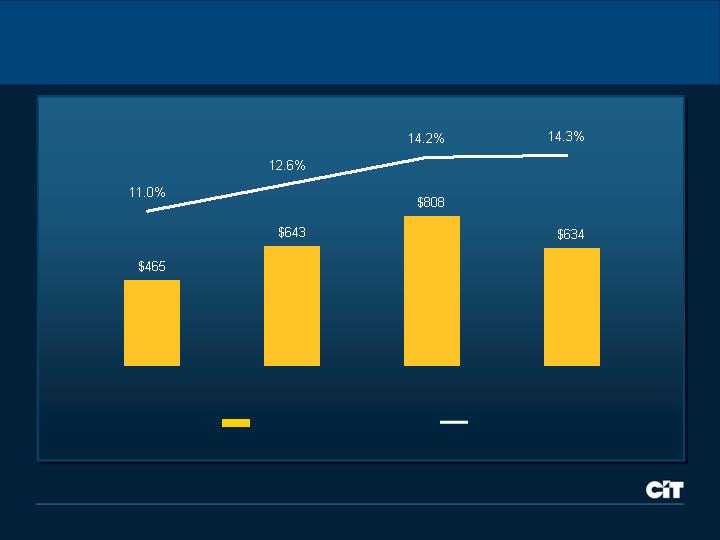

Strong Capital Generation

Net Capital Generation

($ Millions)

ROE

2003

2004

2005

2006

9 mos.

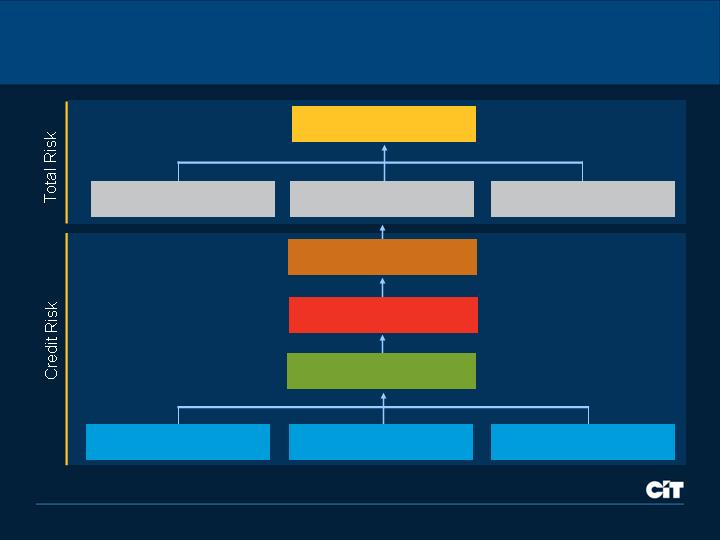

Rigorous Capital Allocation

Required Capital

Transactional Credit Risk

Portfolio Correlations

Transactional Data

Modeling Parameters

Simulation Settings

Market Risk

Goodwill

Operational Risk

Portfolio Credit Risk (VAR)

2007 Segment Capital Allocations

No. of Sub-

Segments

Capital

Range

5%

6%

11%

11%

12%

1% - 20%

2% - 15%

5% - 15%

5% - 20%

8% - 15%

5%

5

Consumer and SBL

9%

15

Vendor Finance

Specialty Finance

14%

4

Transportation Finance

10%

15

Corporate Finance

10%

4

Trade Finance

Commercial Finance

Segment Allocations

2006

2007 Refinements

Segment

Average

Leveraging Originations

Balance Sheet

76%

Sold / Syndicated

24%

Investment Vehicles

2007 Initiatives

‘Hold’

‘Partner / Invest’

‘Distribute’

Loan / Lease

Volume

Managing Net Finance Revenue Dynamics

(0.11%)

Funding Strategy

3.03%

Q3 2006

(0.08%)

Fees and Other

(0.10%)

Market Pricing

(0.10%)

Leverage

(0.17%)

Yield Curve

(0.35%)

Portfolio Mix

3.94%

2004

2007 Impact

Net Finance Margin

Efficiency ratio improvement expected

2007

Impact

Net

Revenue

($ Millions)

Operating

Expense

($ Millions)

Efficiency

Ratio

(%)

$3,175

---

---

---

$400

$300

$2,475

44%

1.3%

1.0%

(1.6%)

1.1%

2.4%

40%

---

$30

Options

---

$40

Other

$190

New businesses

$1,410

Q3 2006 (annualized)

---

($50)

Expense take-outs

$200

Business expansion

$1,000

Q3 2004 (annualized)

Targeting Productivity

Prudent Tax Planning

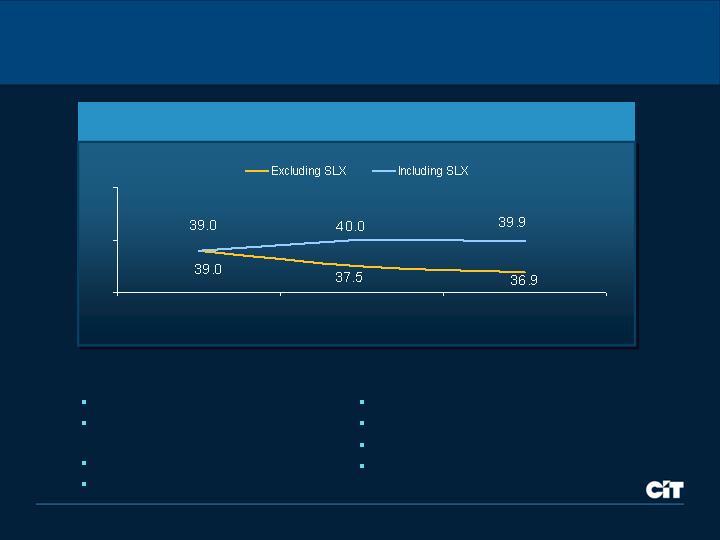

Effective Tax Rate

39.0%

34.8%

30.5%

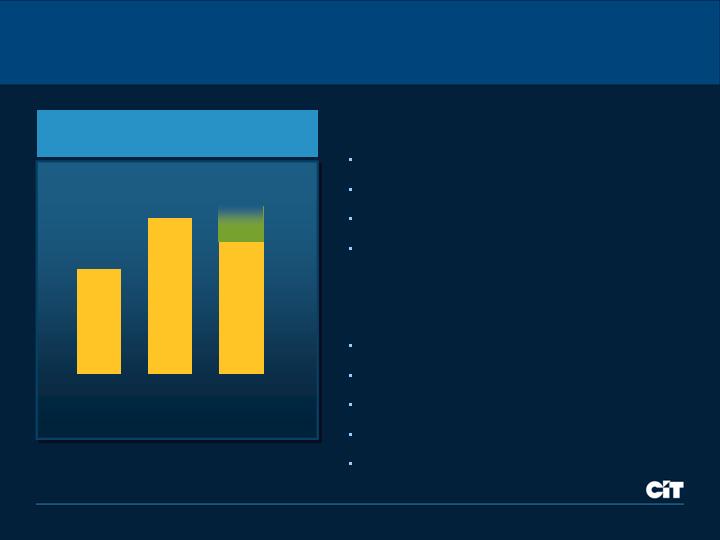

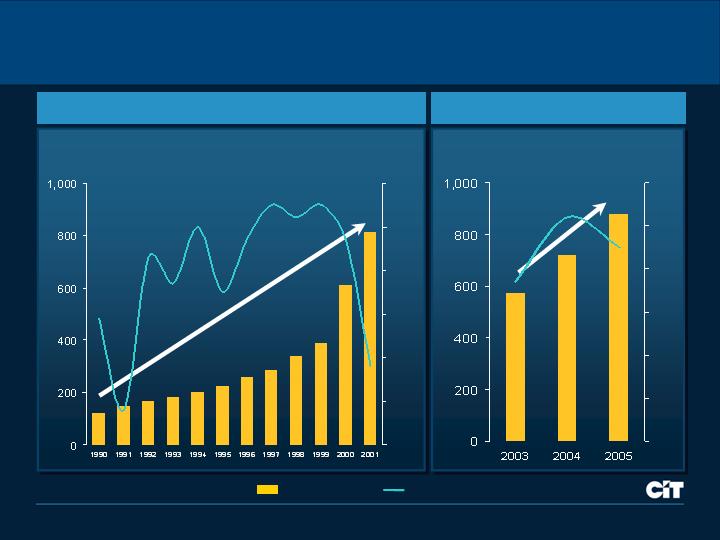

Sustainable Earnings

Net Income

($ in Millions)

Real GDP

(%)

CAGR: 19%

Net Income

($ in Millions)

Real GDP

(%)

Net Income

US GDP

CAGR: 24%

-1

0

1

2

3

4

5

-1

0

1

2

3

4

5

Pre-IPO

Post-IPO

2007 Focus

Efficiency

Allocate corporate expenses

Improve efficiency ratio by ≥2%

Tax rate ≤30%

Funding

$16 - $18 billion issuance

Over 20% issuance non-dollar

Grow deposits to $4.0 billion

Refinance $1.3 Billion

high-cost debt

Capital

Manage to optimal capitalization

Composition

Share repurchase

Target capital ratios

Rating Agencies

Two Agencies with positive

outlook

Aspire to high single A ratings

Outlook

Jeffrey M. Peek

Chairman & Chief Executive Officer

2007 Segment Performance Expectations

Corporate

Finance

Strong originations

Higher fees

Improved productivity

Trade

Finance

Modest growth

Expanding breadth

Stable credit

Transportation

Finance

Consistent expansion

Solid utilization

Efficient tax structure

Vendor

Finance

Strong global volume

Increased productivity

Stable credit

Consumer /

SBL

Focused growth

Strong fees

Seasoning portfolio

Key Take-Aways

Drive volume through sales force productivity

Consistent credit performance

Stable margins and increased tax efficiency

Strong business momentum and focused execution plans

2007 Earnings Guidance

Target

………………

DO NOT PRINT

GUIDANCE IN BOOKS

EPS

ROE

………………

CIT Investor Conference 2006

Executing for Performance