- CIT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Cit (CIT) 8-KRegulation FD Disclosure

Filed: 14 May 07, 12:00am

UBS Conference

New York

May 14, 2007

Exhibit 99.1

Notices

Forward Looking Statements

Certain statements made in these presentations that are not historical facts may constitute “forward-looking” statements under the Private

Securities Litigation Reform Act of 1995, including those that are signified by words such as “anticipate”, “believe”, “expect”, “estimate”, “target”,

and similar expressions. These forward-looking statements reflect the current views of CIT and its management and are subject to risks,

uncertainties, and changes in circumstances. CIT’s actual results or performance may differ materially from those expressed in, or implied by, such

forward-looking statements. Factors that could affect actual results and performance include, but are not limited to, potential changes in interest

rates, competitive factors and general economic conditions, changes in funding markets, industry cycles and trends, uncertainties associated with

risk management, risks associated with residual value of leased equipment, and other factors described in our Form 10-K for the year ended

December 31, 2006 and 10-Q for the quarter ended March 31, 2007. CIT does not undertake to update any forward-looking statements.

Non-GAAP Financial Measures

The data provided in these presentations have been modified from our previously reported periodic data, including, but not limited to, the exclusion

of certain noteworthy transactions and nonrecurring events, because management believes that the data presented herein better reflects core

operating results. As such, the data will vary from comparable data reported in CIT’s Forms 10-K & 10-Q. The data provided in these presentations

have not been examined by independent accountants and is not presented in accordance with generally accepted accounting principles (“GAAP”).

These presentations include certain non-GAAP financial measures, as defined in Regulation G promulgated by the Securities and Exchange

Commission. Any references to non-GAAP financial measures are intended to provide additional information and insight into CIT’s financial

condition and operating results. These measures are not in accordance with, or a substitute for, GAAP and may be different from or inconsistent

with non-GAAP financial measures used by other companies.

For a reconciliation of these non-GAAP measures to GAAP and a list of the transactions and events excluded from the data herein, please refer to

the appendix within this presentation or access the reconciliations through CIT's Investor Relations website at www.cit.com ..

This presentation is derived from CIT’s publicly available information and is to be used solely as part of CIT management’s continuing

investor communications program. This presentation has not been prepared in connection with, and should not be used in connection

with, any offering of securities by CIT. For the sale of any securities by CIT you are directed to rely only upon the offering document for

those particular securities.

Data as of or for the period ended March 31, 2007 unless otherwise noted.

2

Building on 99 Years of Success

$11 Billion Market Capitalization

Global Servicing Capabilities

Customized Financial Solutions

Strong Credit Culture

Managed Assets $80 Billion

Premium Brand

Diverse Portfolio

3

Solid Start to 2007

Increased 22%

$65,503

$79,712

Managed Assets

Increased 15%

$1.13

$1.30

EPS

Increased 60 basis points

14.2%

14.8%

ROE

Improved 140 basis points

45.7%

44.3%

Efficiency Ratio

Continued excellence

0.37%

0.39%

Net Charge-offs

Increased 14%

$707

$809

Revenue

Increased 24%

$8,716

$10,779

Volume

Comments

Q1 2006

Q1 2007

Metric

($ millions, except EPS)

4

2007 Initiatives

Leverage asset manager model

Proactively manage risk and capital

Drive operational excellence

Expand global footprint

5

Expanding the Asset Manager Model

Transportation Finance

Develop

aerospace

investment vehicle

Corporate Finance

Enter CLO market

and launch

Healthcare REIT

Consumer/SBL

Increase

originate-to-sell

activity

Release capital

Manage risk

Common Objectives

Provide ongoing capital source

Build non-spread revenue

Leverage platform

Maintain growth

6

Leveraging Originations

Balance Sheet

74%

Sold / Syndicated

26%

Investment Vehicles

2007 Initiatives

‘Hold’

‘Partner / Invest’

‘Distribute’

2006

Loan / Lease Volume

($41 billion)

Net Finance Income

Non-Spread Revenue

7

Balancing Revenue Growth

Revenue Composition

($ in Millions)

$2,218

$2,661

$2,452

$3,057

22%

NSR

Growth

$707

$809

26%

NSR

Growth

8

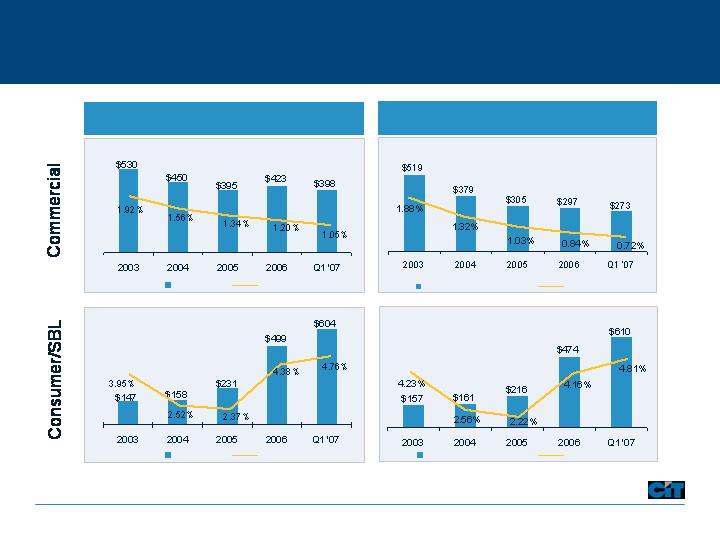

Non-Performing Assets

Monitoring Credit Quality

Delinquency 60+ Days

Owned portfolio statistics; Consumer/SBL excludes Student Loan Xpress

% of FR

Non-Accrual

Delinquent

% of FR

% of FR

Non-Accrual

Delinquent

% of FR

9

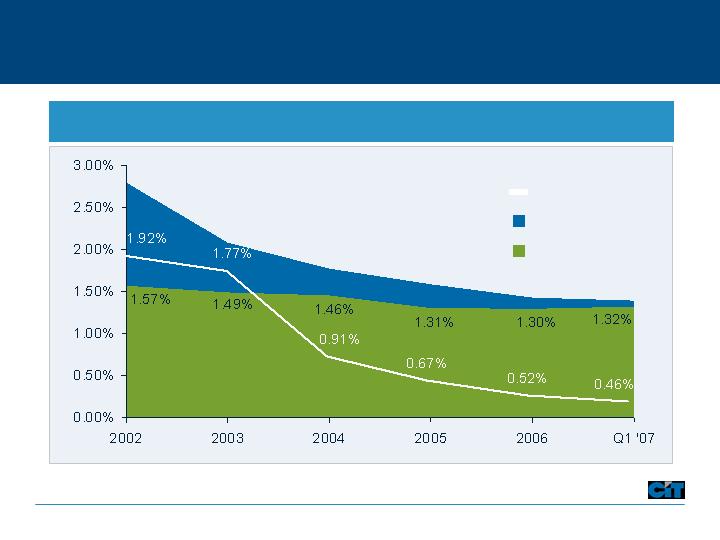

Charge-Offs

Specific

General

Maintaining Adequate Reserves

Loan Loss Reserves vs. Charge-Offs*

(% Finance Receivables)

* Excludes Student Loan Xpress finance receivables.

10

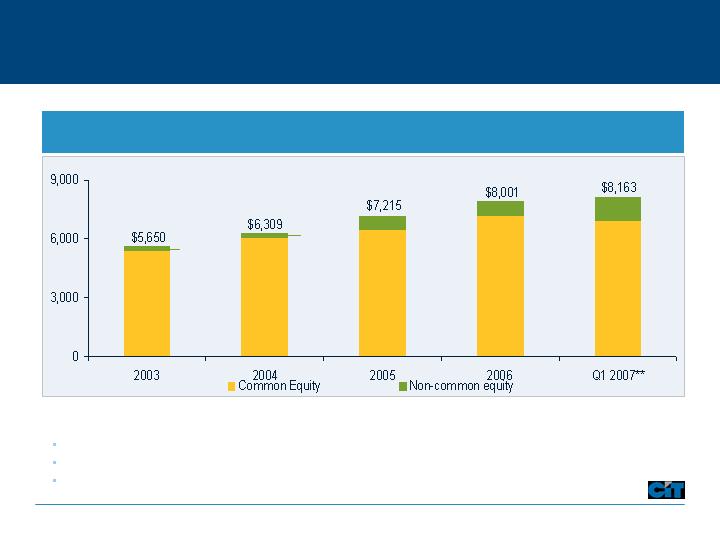

Optimizing the Capital Structure

Total Capital*

($ in Millions)

2007 Update:

Issued $750 million of junior capital with high equity credit

Repurchased $500 million common stock thru accelerated stock repurchase

Called $250 million of trust preferred securities

*Capital = common stock + preferred stock + preferred capital securities + junior capital

**Excludes preferred capital which was called April 2007.

15%

10%

10%

4%

5%

11

Gaining Global Traction

Europe

Acquired factoring platform in Germany

Expanding global relationship with Microsoft

Acquired vendor business in U.K. and Germany

Canada

Full suite of commercial products and services

Expanding middle-market corporate finance team

Asia Pacific

Largest foreign owned leasing company in China

Centralizing vendor servicing in Shanghai

Servicing aerospace region through Singapore

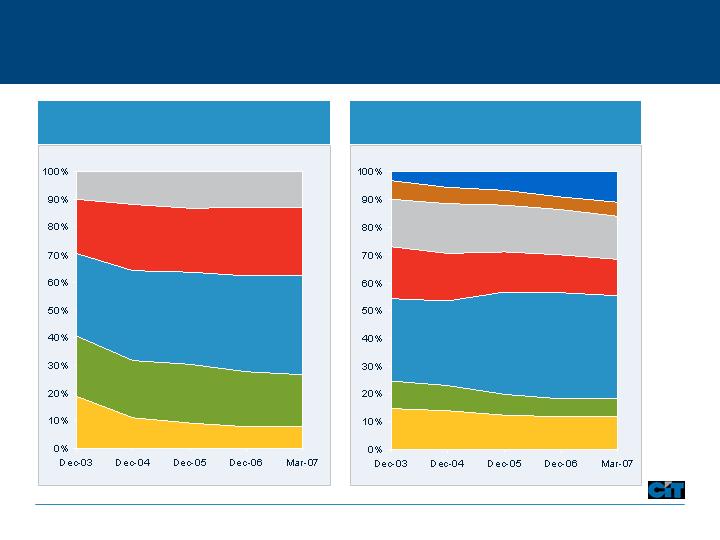

International Portfolio Assets

Canada

Europe

South Pacific

Asia Pacific

Latin America

Other

Recent Initiatives

Approx. $17 billion

24%

45%

8%

5%

10%

8%

12

Driving Operational Excellence

*Guidance as presented on November 7, 2006. This should not be construed as an affirmation or update of that guidance.

* Excludes acquisitions.

Increase sales force productivity

Scale international operations

Consolidate leasing platforms

Expand shared services model

Offshore select functions

Control headcount

Efficiency Ratio

~ 42%

Target

13

Recognizing the Benefit of Diversity

Trade

Finance

Transportation

Finance

Corporate

Finance

Vendor

Finance

Consumer /

SBL

Factoring and other trade products to companies in

retail supply chain, with increasing international focus

Longer-term, large ticket equipment leases and other

secured financing to companies in rail, aerospace

and defense industries

Lending, leasing and other services to middle market

companies, with a focus on specific industries

Financing solutions to manufacturers and distributors

around the globe

Loans to consumers and small businesses,

leveraging intermediary relationships

6%

$23 B

20%

$15 B

13%

$22 B

19%

$12 B

17%

$7 B

ROE

Managed Assets

14

Keys to Enhancing Long-term Profitability

Leverage originations platform

Drive capital allocation and efficiency

Further credit and cost disciplines

Balance revenue streams

15

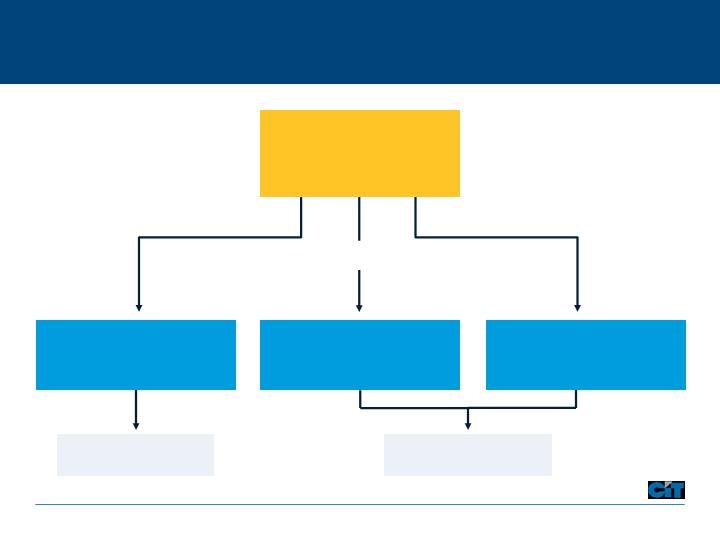

Specialty Finance

Thomas B. Hallman

Specialty Finance At-a-Glance

CIT-Wide

CIT Bank

U.S. Focus

Consumer /

Small Business Lending

Home Lending

Student Loan Xpress

Small Business Lending

Specialty Finance Group

Global Focus

Vendor Finance

Industrial

Healthcare

Technology / Office Products

Insurance Services

17

Assets: $38 Billion

$6.8 Billion in new business volume

Employees: ~3,900

Global sales force: ~1,000

Large and diversified partner base: Over 5,000

4.3 million consumer and 500,000+ commercial

customers

Global reach: 34 countries

Efficient and scalable platforms serving

customers on 5 continents

Best–in-class risk and collateral

management capabilities

Specialty Finance: Leaders in Relationship Financing

18

12.8%

ROE

47.8%

Efficiency Ratio

$7 Billion

Volume

$381 Million

Revenue

0.72%

Net Charge-offs

$38 Billion

Managed Assets

$94 Million

Net Income

vs. 1Q 2006

1Q 2007

Strong Performance

Challenges

Home Lending returns below expectation

due to US real estate market impact

Accomplishments

Expanded sales force globally and

increased productivity

Executed acquisition strategy to

complement organic growth

Won several global marquee

relationships including Microsoft

Strong Student Loan Xpress performance

Continued strong credit and residual

management performance

200 bps

130 bps

Record growth in Small Business Lending

Vendor finance relationship diversification

ahead of plan

19

Home Lending Overview

20

Consistent Demographics

Business Overview

Broker-driven origination network

Conservative product set

Primarily 1st liens and owner occupied

No negative amortization loans

Limited interest only exposure

No Option ARMs

Centralized servicing

100% appraisal review

Disciplined lending standards define a

sustainable target market

93%

83%

81%

Owner occupied

82%*

80%

77%

LTV at origination

6

9

11

Length of residence

8

9

10

Length of employment

41%

38%

37%

Debt to income

636

625

624

FICO

3/31/07

12/31/03

12/31/99

*LTV (portfolio) estimate based on recent appraisals: 70%

20

FICO

LTV

Uniform Underwriting Standards

700 & Up

650 - 699

600 - 649

550 - 599

Less than 550

Less than or equal to 70%

70.01% - 75%

90.01% - 95%

75.01% - 80%

80.01% - 85%

85.01% - 90%

95.01% - 100%

21

Attractive Product Distribution

Lien Position

First

89%

Second

11%

Term

15 Year 5%

30 Year

69%

40 Year

12%

I/O 11%

Rate

Fixed

42%

Variable

58%

Vintage

Pre-2004

11%

2004 8%

2005

28%

2006

36%

2007

17%

HELOC 4%

22

Low Delinquency vs. Industry

As of December 2006

Data source LoanPerformance

60+ Delinquency Comparison by Geography

CIT

Sub-prime industry

Geographic Diversification

17%

12%

9%

20%

22%

21%

23

Prudent Response to Challenging Market

Softening housing market

Reduced prepayment speeds

Tighter secondary market pricing

Industry consolidation

Market Trends

Initiatives

Tightened underwriting criteria

Added loss mitigation resources

Closed offices

Targeted collection efforts

Raised pricing

Increased reserves

Rising delinquencies

24

Business Highlights

Government guaranteed FFELP collateral

Ninth largest FFELP consolidation loan

originator

Sixteenth largest FFELP Stafford/PLUS loan

originator

Record first quarter originations

Returns doubled from last year

Relationships at more than 1,300 schools

Servicing nearly 2/3 of loans in-house

Performing ahead of expectations

Q1 2007 Update

Student Lending

Portfolio ($ billions)

$9.9

Portfolio

0.4

Private Loans

1.3

Other Guaranteed Loans

$8.2

Consolidation Loans

3/31/07

2005

2.7

2004

1.5

Volume ($ billions)

2006

6.3

Direct Channel

School Channel

Whole Loan

25

Small Business Lending

Growing high return business

Enhance market coverage through expanded

504 and conventional loans

Execute intermediary strategy

(franchise and hospitality)

Add more flow relationships (e.g., with banks)

Continue to aggressively cross-sell with other

businesses at CIT

Volume

($ Billions)

Business Highlights

#1 SBA 7(a) lender to small businesses

– seven consecutive years

Leading lender to women, veterans and minorities

Market leader in medical, dental and

day care segments

Record first quarter performance

26

Insurance Services and CIT Bank

CIT Bank

Insurance Services

Utah Industrial bank – regulated by FDIC

Facilitates asset originations

Vendor finance

Student loans

Mortgages

Target: 10% of CIT funding

Deposits ($ billions)

Centralized expertise

Solid product set

Consumer based programs

Commercial insurance capabilities

to small business & middle-market

companies

Accelerating global roll-out

Strong non-spread revenue source

Revenue ($ millions)

27

Vendor Finance Vision

Global market leadership

Premier sales organization

Marquee customer relationships

Market innovator

The ‘standard’ for operating efficiencies

The Global Leader in Vendor Finance

Technology, Office Products, Healthcare and Diversified

Industries

28

Vendor Finance: At-a-Glance

Business Highlights

Leading Global Vendor Finance Company

Presence approaching 40 countries

Efficient Servicing: 6 strategic locations

serving 5 continents

Sophisticated customer facing and servicing

technology capability

Customer-centric business model

~600 sales representatives

Behavioral-based leasing model

Hundreds of relationships

Sophisticated end of lease expertise

*2006 volume

Managed

Assets

$15 B

Annual

Volume

$8 B*

ROE

20%

29

Rapidly Expanding the Franchise

New marquee relationships

Microsoft

AGFA

Leverage sales organization (~600

professionals) to drive global volume objectives

Increase market penetration in technology,

healthcare and industrial sectors

Enter new segments in Canada, Europe, Latin

America and South Pacific

Build-out Asian operating platform in Shanghai

Expand to new geographies

Barclays

Increased European presence

Expanded sales force (U.K. and Germany)

Primarily industrial and technology leasing

Integration on schedule

CitiCapital

Strategically important US acquisition

Adds valuable vendor relationships

Leverages centralized operating platform

Strong Organic Growth

Recent Strategic Acquisitions

Global leader in Vendor Finance

Manitowoc

Rohde & Schwarz

30

Vendor Finance Competitive Positioning is Very Strong

Captives

Banks

Independents

Organization alignment

to support vendors

Residual management

Global reach

Specialized products and

structures

Balance sheet /

syndication capabilities

Key Attributes

Risk management expertise

Limited

Limited

Limited

Limited

Limited

Limited

Limited

Limited

31

Efficient / Scalable Global Platforms

Jacksonville (U.S.)

Miami (Latin America)

Dublin (Europe)

Shanghai (Asia)

Sydney (South Pacific)

Regional servicing hubs

In-country sales and credit

Scalable systems and processes

34 countries and growing

Operations / Technology

Burlington (Canada)

Servicing Centers

Mexico City

Future Servicing Center

32

Marquee Vendor Relationships

33

Growth Agenda

Increase Relationship

Penetration

Add New

Relationships

Increase End-to-End

Productivity

Pursue Bolt-

on

Acquisitions

Scale Global

Operations

Expand Market

Coverage

34

Appendix

Board of Directors

President & CEO

Martha Stewart Living

Chairman & CEO New York Life

Insurance Co.

Chairman & CEO

C.R. Bard Inc.

President & CEO

ADP

Managing Partner McCarter &

English LLP

Chancellor SUNY

Maritime College

EVP& CFO International

Paper Company

Chairman

TerreStar Networks Inc

Retired

CEO & Chairman

CIT Group Inc.

Current

Position

2006

Susan Lyne

2005

Seymour Sternberg

2005

Timothy M. Ring

2004

Gary Butler

2003

Lois M. Van Deusen

Chair

2003

John R. Ryan

2003

Marianne Miller Parrs

Chair

2003

William M. Freeman

Chair

Lead

2002

Peter J. Tobin

2003

Jeffery M. Peek

Nominating &

Governance

Compensation

Audit

Board Member

Board Committees

Independent

Directors

Member

Since

36

Aircraft

Net Investment

100.0%

244

100.0%

7,318.3

0.8%

2

0.6%

40.5

Leveraged Leases

0.4%

1

0.6%

43.9

Tax-Op. Leveraged Leases

3.3%

8

2.9%

214.2

Capital Leases

14.3%

35

7.9%

580.6

Loans

81.1%

198

88.0%

6,439.1

Operating Leases

%

Number

%

$ millions

Portfolio Composition

Commercial Aerospace

286.0

Millions

Top exposure

Planes

Years

Europe

Asia Pacific

North America

Latin America

Africa / Middle East

Boeing

Airbus

Other

Narrow

Intermediate

Wide

Other

Grouping

43.2%

56.7%

0.1%

Manufacturer

0

Aircraft on the ground

6

Weighted average age

38.6%

24.0%

17.2%

13.5%

6.7%

Geographic diversity

73.7%

22.7%

3.6%

0.1%

Body type

%

Category

0

28

2.3

Thereafter

0

13

0.8

2009

39

86

5.6

Total $

18

24

1.4

2008

21

21

1.1

2007

Placed

Number

Amt ($B)

Year

Portfolio Statistics

Remaining Order Book

37

Proven Acquisition Strategy

Doubled assets

Q1

4,300

Education Loans

EDLG

Solid returns

Q1

860

Factoring

SunTrust

Accelerated build out

Q3

500

Healthcare

HBCC

Closed April 30

Q2

2,000

Vendor Finance (US)

Citigroup

Realized synergies

Q3

700

Vendor Finance

CitiCapital

Strong volume

Q2

520

Technology Leasing

GATX

Completed integration Q107

Q4

700

Diversified equipment

RBS/Citizens

Included serviced fleet

Q4

90

Rail

Bombardier

Established foothold

Hit the ground running

Comments

165

2,000

Assets ($mm)

Q2

Factoring (Germany)

Enterprise Finance

Q1

Vendor Finance (Europe)

Barclays

Closed

Asset Type

Seller

38

Effective Matched Funding

4.7 years

48%

$31 B Debt

2.6 years

53%

$37 B

Fixed

$32 B Debt

Amount

Funding

(after swaps)

52%

Portfolio

Term

Term

Portfolio

Amount

3.9 years

2.5 years

47%

$33 B

Floating

Assets

$7 B Tangible Equity

Margin at Risk

Value at Risk

After-tax impact of $17M (liability sensitive – reduces net income)

Pre-tax impact of $140M (asset sensitive – increases economic value)

Risk Metrics*

*Sensitivity to immediate100 basis point rate increase.

39

2007 Segment Capital Allocations

13%

8% - 15%

4

Transportation Finance

8.5% - 9%

1% - 15%

40

Total

Segment

Average

Capital

Range

No. of Sub-

Segments

5%

8%

10%

11%

1% - 11%

7% - 11%

8% - 13%

8% - 12%

4

Consumer and SBL

15

Vendor Finance

15

Corporate Finance

2

Trade Finance

2007 Refinements

40

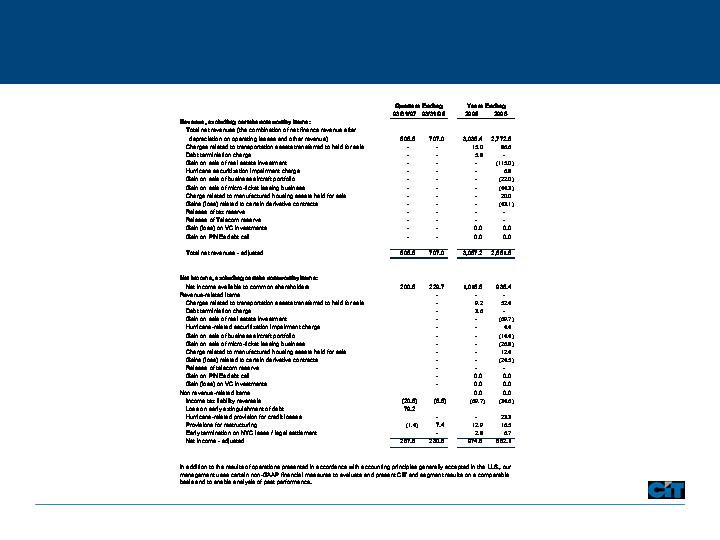

Noteworthy Items

41

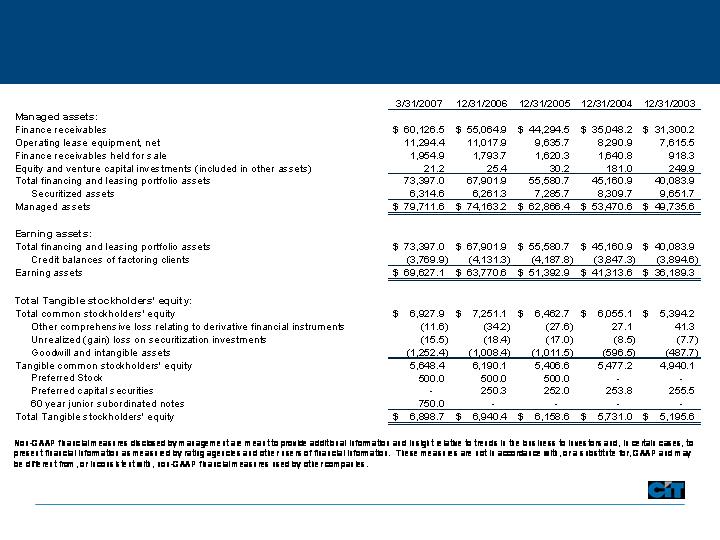

Non-GAAP Reconciliation

*The preferred capital securities were called on April 10, 2007. On March 16, 2007, $250 million of additional junior subordinated notes were issued in anticipation

of the preferred capital securities call. Accordingly only $500 million of the junior subordinated notes were included in our March 31, 2007 capitalization ratios.

*

42

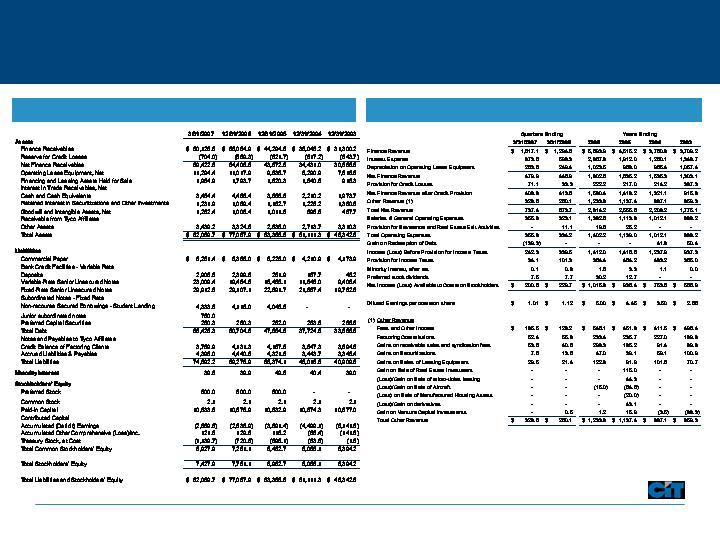

Financial Statements

Balance Sheet

Income Statement

43