®

CIT Restructuring Plan

Management Presentation

October 2009

Exhibit 99.1

Important Notices

This presentation contains forward-looking statements within the meaning of applicable federal securities laws that are based upon

our current expectations and assumptions concerning future events, which are subject to a number of risks and uncertainties that

could cause actual results to differ materially from those anticipated. The words “expect,” “anticipate,” “estimate,” “forecast,”

“initiative,” “objective,” “plan,” “goal,” “project,” “outlook,” “priorities,” “target,” “intend,” “evaluate,” “pursue,” “commence,” “seek,”

“may,” “would,” “could,” “should,” “believe,” “potential,” “continue,” or the negative of any of those words or similar expressions is

intended to identify forward-looking statements. All statements contained in this presentation, other than statements of historical fact,

including without limitation, statements about our plans, strategies, prospects and expectations regarding future events and our

financial performance, are forward-looking statements that involve certain risks and uncertainties. While these statements represent

our current judgment on what the future may hold, and we believe these judgments are reasonable, these statements are not

guarantees of any events or financial results, and our actual results may differ materially. Important factors that could cause our

actual results to be materially different from our expectations include, among others, the risk that if the exchange offers are not

consummated, the Company may need to seek protection under the US Bankruptcy Code. Even if the exchange offers are

consummated, the risk that the Company’s liquidity is not adequate due to material negative changes to the Company’s liquidity from

draw down of loans by customers, the risk that the Company is unsuccessful in its efforts to effectuate a comprehensive restructuring

of its liabilities, in which case the Company may be forced to seek bankruptcy relief. Accordingly, you should not place undue

reliance on the forward-looking statements contained in this presentation. These forward-looking statements speak only as of the

date on which the statements were made. CIT undertakes no obligation to update publicly or otherwise revise any forward-looking

statements, except where expressly required by law.

This presentation is derived from CIT’s publicly available information and is to be used solely as part of CIT management’s

continuing investor communications program. This presentation shall not constitute an offer or solicitation in connection

with any securities.

Please refer to the amended offering memorandum, disclosure statement and solicitation of acceptances of a prepackaged

plan of reorganization filed on Form 8-K on October 19, 2009 for full and complete disclosures.

Overview & Key Considerations

Restructuring Strategy Overview

Amendments and Revised Terms

Summary of the Offering

Value of CIT Franchise / Business Post Restructuring

Benefits of the Restructuring Plan

Restructuring Strategy

CIT’s commercial franchises provide financing, leasing and advisory services to small and mid-market businesses, a

critical and underserved part of the US economy

The Company continues to develop and execute its business restructuring strategy with the following objectives:

Create Financial Strength

Target capital ratios well in excess of regulatory standards

Enhance liquidity profile

Position the Company for return to profitability and investment grade ratings

Restructure Business Model

Optimize portfolio of businesses

Seek regulatory approval to transfer operating platforms into CIT Bank

Diversify funding model centered on CIT Bank

Multi phased approach to business restructuring strategy

Phase 1: (Complete) Address Immediate Liquidity Challenges – $3B Senior Credit Facility

Phase 2: Enhance Liquidity and Capital - Restructuring Plan (Exchange or Prepackaged Plan)

Phase 3: Optimize Business Model – identify core businesses and align the funding model

In absence of bank-centric model, orderly liquidation will likely be pursued.

Enhance Liquidity and Capital: Phase 2

Plan contains an exchange offer and a solicitation of acceptances of a prepackaged plan of reorganization

Supported by management, the board, the Company’s advisors and the Steering Committee of bondholders

Designed to provide certainty of terms and speed of execution to ensure CIT remains a “going concern” :

Protects against the loss of significant value in a free-fall bankruptcy filing

Preserves the possibility of a successful out-of-court solution

Regardless of path, CIT has designed an approach that can reposition the Company for future success:

Minimizes business and customer disruption during the restructuring

Creates an extended liquidity runway with a strong capital base

Continues to protect the safety and soundness of CIT Bank

Positions the Company for a sustainable, profitable, business model

Risks of An Unsuccessful Exchange or Plan of Reorganization

Without an approved restructuring plan, the Company will likely file for bankruptcy without the benefit of a plan of

reorganization and stakeholders will lose significant value.

Impacts include:

Substantial damage to the franchise

Inability to insulate valuable operating businesses from the proceedings

Increased risk of seizure of CIT Bank

Uncertainty and constraints with respect to liquidity

Significant bankruptcy related expenses

Lengthy process in court

Estimated recovery value for general unsecured claims in a accelerated liquidation is between 6 - 37 cents per

$1.00

Claim

Low

High

Low

High

General Unsecured Claims:

Canadian Senior Unsecured Note Guarantee

2,188

$

128

$

815

$

5.9%

37.2%

Long-Dated Senior Unsecured Note Claims

1,189

70

443

5.9%

37.2%

Senior Unsecured Note Claims

25,869

1,518

9,634

5.9%

37.2%

Senior Unsecured Term Loan Claims

321

19

119

5.9%

37.2%

Senior Unsecured Credit Agreement Claims

3,101

182

1,155

5.9%

37.2%

Deficiency Payments on Make Whole

250

15

93

5.9%

37.2%

Other Unsecured Liabilities

954

56

355

5.9%

37.2%

Accrued Liabilities & Accounts Payable

1,052

62

392

5.9%

37.2%

Total

34,924

$

2,050

$

13,006

$

5.9%

37.2%

-

$

-

$

Recovery

Percentage Recovery

Proceeds Available for Distribution to

Subordinated Unsecured Claims

Summary of Offering:

Amendments to Exchange Offer and Plan of Reorganization

Item

Amendment

Senior Notes due beyond 2018

Commenced offer to exchange and solicitation of acceptances

Shortened Maturities

Shortened maturity by 6 months (from November to May) for new

Series A and B Notes

Cash Sweep

Implemented a cash sweep mechanism to assure prompt repayment

of debt with excess cash

Delaware Funding Notes (Series B)

Increased coupon on $2.2bn of Series B Notes offered to Delaware

Funding Notes from 7% to 9%

Subordinated Notes

Increased consideration from 4% to 7.5% equity stake

Preferred Stocks (Series A, B, C)

Receive contingent value rights under plan of reorganization

Preferred Stock (Series D –TARP)

Receive contingent value rights under plan of reorganization and

greater equity consideration in the recapitalization post-exchange

Governance

Provisions regarding Board of Directors

Governance Changes

The Board of Directors will change in several ways as the Company restructures:

A search for new Directors is currently underway to increase the size of the Board from 10 to 13

Upon consummation of the Exchange Offers or Plan of Reorganization, the Board of Directors will include 5

Directors that were recommended by the Steering Committee

At the 2010 Annual Meeting, the slate of directors to be nominated will not include more than 5 of the currently

serving directors

Other governance matters agreed to in the Plan of Reorganization:

No implementation of a stockholders’ rights plan* during the Chapter 11 proceedings;

No staggered or classified board during the Chapter 11 proceedings; and

Provisions regarding special meetings of shareholders to vote for the election of directors

* Except for plans intended to preserve the tax benefits of net operating losses

Cash Sweep Mechanism

Significantly enhances repayment of debt with excess cash

Monthly deposit of available cash collections, net of operating and overhead expenses and secured debt service, from

business proceeds in:

Transportation Finance;

Consumer Finance (Student Loans);

Corporate Finance (exc. Small Business Lending); and

If platforms are transferred to CIT Bank, assets remaining outside the bank for Trade Finance, U.S. Vendor

Finance and Small Business Lending.

Quarterly prepayment of outstanding first and second lien bank debt and notes, by priority, with swept and other free

cash subject to:

12 months of Time-to-Fund (TTF) Requirements, including payments in respect of debt obligations, contractual

commitments (e.g., railcar and aircraft deliveries), and up to 50% of obligations under committed and undrawn lines

in respect of transactions in which CIT is a lead agent

Required CIT Bank investments and additional investments in CIT Bank no greater than $400mm annually

Select reinvestments in Corporate Finance and Transportation Finance no greater than $500mm annually

Up to $500 million of other cash

In addition, reasonable efforts will be made to apply additional swept cash in excess of $2 billion towards further

prepayments

Comparison of Terms

The Company is proposing to lenders of debt not included above an out-of-court restructuring on economically equivalent

terms with the New Notes. Other debt includes:

Bank Credit Lines $3.1B

Other Private Debt $1.2B

Security

The Offers

Treatment Under

The Plan of Reorganization

Senior Debt Maturing 2009

90 cents of New Notes, plus New Preferred Stock

70 cents of New Notes, plus New Common Interests

Senior Debt Maturing 2010 (1)

Senior Debt Maturing 2011 - 2012

Senior Debt Maturing 2013 or Later

Structurally Senior Debt (2)

Subordinated Debt

Junior Subordinated Debt

Preferred Stock, Series A, B, C and D

Common Stock

85 cents of New Notes, plus New Preferred Stock

80 cents of New Notes, plus New Preferred Stock

70 cents of New Notes, plus New Preferred Stock

100 cents of New Notes

New Preferred Stock

New Preferred Stock

Not Solicited

Not Solicited

70 cents of New Notes, plus New Common Interests

70 cents of New Notes, plus New Common Interests

70 cents of New Notes, plus New Common Interests

100 cents of New Notes

New Common Interests plus, Contingent Value Rights

New Common Interests plus, Contingent Value Rights

Contingent Value Rights

No Recovery

(1) Includes 5.38% Notes due June 15, 2017, which notes have a put right on June 15, 2010

(2) Includes Delaware Funding notes and does not include certain other structurally senior debt such as CIT Group (Australia) Limited notes

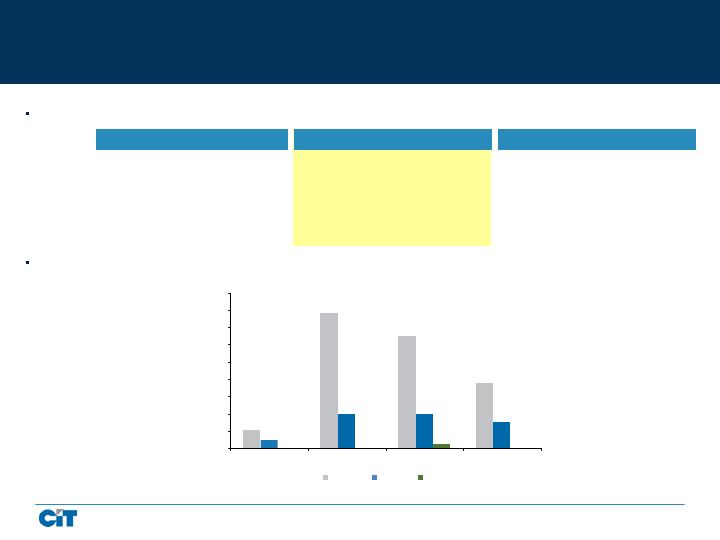

Liquidity Impact

A condition for consummating the offers is that remaining unsecured debt maturities can be no greater than:

Significant reduction in near term maturities

If Restructuring Plan is consummated, projected unrestricted cash at BHC does not drop below $1 billion

2009

2009 - 2010

2009 - 2011

2009 - 2012

Current Cumulative Maturities

$ 1,415 Million

$ 9,698 Million

$16,321 Million

$20,146 Million

Maximum Cumulative Maturities

$ 500 Million

$2,500 Million

$4,500 Million

$6,000 Million

Reduction Required

65%

74%

72%

70%

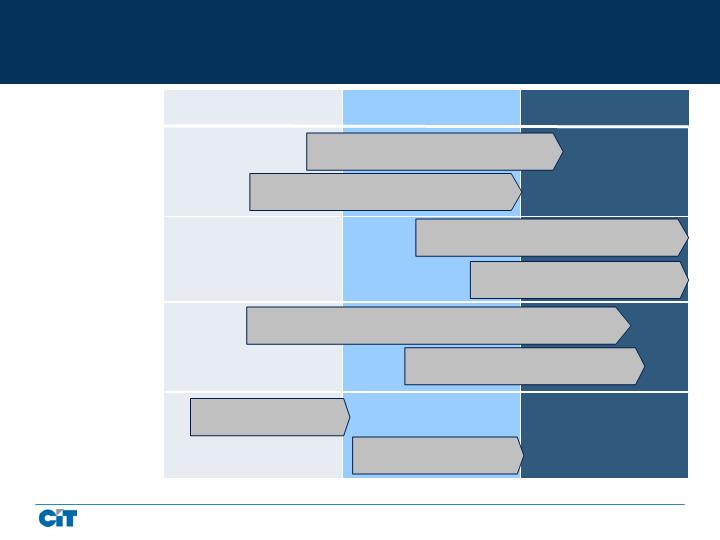

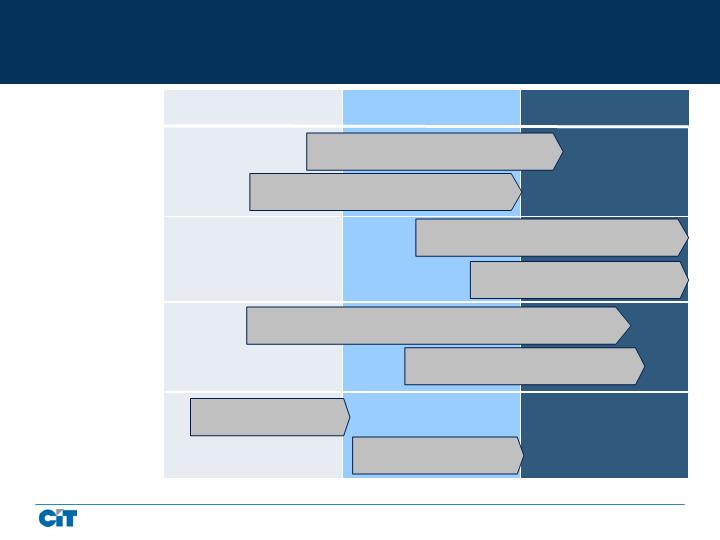

Maturity Comparison (Excluding First Lien)

$1,046

$7,831

$6,514

$3,751

$500

$2,000

$2,000

$1,500

$0

$0

$242

$0

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

$9,000

2009 (Nov-Dec)

2010

2011

2012

Status Quo

Exch Offer

Pre-Pack

Capital Structure Comparison

1.

Does not include the addition of the $3 billion Senior Credit Facility or other post 6/30/09 debt related transactions

2.

Assumes full participation. Does not include impact of TDR accounting or subsequent recapitalization

3.

Assumes ‘Fresh Start Reporting’

Actual

As Adjusted for

As Adjusted for

Exchange

(1)(2)

Pre-pack Plan

(1)(3)

Bank credit facilities

$3,100.0

$-

$-

Secured borrowings

17,635.3

17,635.3

15,601.3

Senior unsecured notes-variable

7,451.7

1,159.0

1,159.0

Senior unsecured notes-fixed

23,801.7

1,511.3

1,511.3

Junior subordinated notes and convertible equity units

2,098.9

199.9

-

Series A Notes offered in the Offers

-

-

16,017.1

14,947.3

Series B Notes offered in the Offers

-

-

1,908.5

1,946.9

Junior Credit Facilities

-

-

2,281.4

1,916.4

Total Debt

54,087.6

40,712.5

37,082.2

Preferred Stock - Series A thru D

3,146.7

3,146.7

-

Preferred Stock - Series F (liquidation preference of $1,400/ share)

-

-

4,828.0

-

Total Common Stockholders' Equity

2,932.2

11,479.3

8,000.0

Total Stockholders' Equity

6,078.9

19,454.0

8,000.0

Total Capitalization

65,545.2

65,545.2

50,460.9

Common Shares Outstanding

392

392

400

Book Value per Common Share

$7.48

$29.28

$20.00

(in millions, except per share amounts)

As of June 30, 2009

Recapitalization Analysis

If we consummate the offers, we intend to effectuate a recapitalization as soon as practicable

New Preferred stock will convert to common shares aggregating approximately 91% of the Company’s common equity

and voting power

Recapitalization process includes:

Solicit majority approval from shareholders (current common and new preferred vote as one class)

Amend certificate of incorporation to increase authorized common stock

Reclassify preferred stock into approximately 15.3 billion shares of our common stock

Approve reverse split to reduce total shares outstanding

New Preferred Stock

Existing Preferred Stock

Common Stock (Book Value)

Total Equity

at 6/30

$-

3,147

2,932

$6,079

Proposed Offer

(Assumes 100%

Participation)

$4,828

3,147

11,479

$19,454

$-

-

19,454

$19,454

Following

Recapitalization

(Pre-Reverse Split)

392 million

$7.48

Share Count

BV / Share

392 million

$29.28

15.7 billion

$1.24

Refinement of Business Model

– Streamlined Business

Optimize Business Model: Phase 3

Strengthen market-leading position as lender to small and middle-market companies

Focus on businesses consistent with a bank-centric model – pursue potential strategic

options for non-core business lines

Shrink balance sheet to improve liquidity and capital profile

Maintain conservative volumes as transition to new model is completed – return to growth

in core businesses as Company and economy recovers

Obtain regulatory approvals to transition Small Business Lending, Trade Finance and

Vendor Finance platforms to CIT Bank

Capture commercial deposits from Corporate Finance and Trade Finance customers

Build commercial and retail deposits through potential strategic transactions

Pursue rating at CIT Bank to enhance access to Capital Markets

Actively manage direct expenses at business segments

Decrease corporate overhead

Bank-Centric Funding Model –

Competitive Cost of Funds

Efficiency Enhancements –

Lower Operating Expense

Market Leader in Small and Mid-Market Financing

Trade

Finance

Factoring, lending, receivables management and trade finance to

companies in retail supply chain

Transportation

Finance

Lending, leasing and advisory services to the transportation industry,

principally aerospace and rail

Vendor

Finance

Financing and leasing solutions to manufacturers and distributors

around the globe. Operations in Americas, Europe, Asia and South

Pacific

Mgd. Assets: $5B

Market Rank: #1

Mgd. Assets: $15B

Market Rank: #3

Mgd. Assets: $13B

Market Rank: Top 3*

Managed Assets data as of 6/30/2009

Market ranks as of 2008

* Represents ranking for US Office Products/Tech market; exact global ranking data unavailable

Corporate

Finance

Lending, leasing and other financial and advisory services to middle

market companies (including SBA business), with a focus on specific

industries (e.g., Healthcare, Communications, Media, Entertainment,

Energy, Retail)

Mgd. Assets: $19B

Market Rank: N/A

Serving a Wide Spectrum of Commercial Customers

Trade

Finance

Transportation

Finance

Vendor

Finance

End Users

Vendor Partners

Corporate

Finance

Retailers

Manufacturers & Importers

Air

(Commercial & Regional Airlines)

Rail

(Class 1, Regional, Short Rail Lines & Manufacturers)

Small Business

Mid Market

Large Enterprise

Small Business

Traditional Mid-Market

Trade Finance: Strategy Overview

Continued to fund customers in Trade Finance given the strength of this franchise and

commitment to customers

Experienced a decline in factoring volume due to managed reductions, a weak

economic environment, and CIT’s weakened credit ratings

Some non-borrowing customers (i.e., those who only rely on CIT for factoring

receivables only) have been less willing to stay

Some customers left but returned after realizing the servicing difference between

CIT and competitors

Dedicate a significant portion of CIT’s liquidity to Trade Finance – $1B announced in

July as dedicated funds for Trade Finance

Enter into modified (e.g., deferred purchase) agreements with non-borrowing

customers to mitigate their risk

Transition platform to CIT Bank to leverage improved funding costs and potentially

stronger credit ratings at the Bank (regulatory approval required)

Lever stronger funding and credit profile at CIT Bank to actively grow the business

Expand platform through organic growth as well as potential acquisitions

CIT has best-in-class platform which can be easily scaled

Some sub-scale players likely to exit market

Impact of Liquidity Crisis (2009)

Medium- to Long-Term Growth

Strategy

Near-Term Strategy to Preserve

Franchise

Impact of Liquidity Crisis (2009)

Medium- to Long-Term Growth

Strategy

Transportation Finance: Strategy Overview

Rail and Air markets have weakened due to macroeconomic conditions – Rail has

been impacted to a greater degree due to slow down in US economy

Leasing assets has become more challenging:

Impact on the air business has been limited

Lessees in Rail require a much higher level of ‘customer management’

Near-Term Strategy to Preserve

Franchise

Fund legal commitments of the business (e.g., deliveries for aircraft and railcars)

Strong order book and relatively young fleets allow CIT to pursue this course

through 2010 without weakening the franchise

Focus on credit and operations to ensure continued excellence

Businesses unlikely to be transferred to CIT Bank

Strong order book is essential to maintain a young fleet – a key differentiator

Vendor Finance: Strategy Overview

Continued to fund new volume to preserve vital franchise

Most large vendors have been supportive of CIT through the liquidity crisis and

monitor the situation closely

Microsoft and Snap-On terminated their vendor agreements with CIT due to loss of

investment grade ratings

Focus on core vendor partners

Rationalize geographies to eliminate marginally profitable countries that are not

critical for core partners – Decrease non-US volume

Transfer US Vendor platform to CIT Bank (regulatory approval required)

Utilize CIT Bank funding to actively grow US Vendor business – one of the best

operational platforms in the US

Capture market share from competitors who do not view this as a core business

Maintain a strategic global presence as key selling point. Focus on:

Large developed economies with significant sales for vendor partners

Strengthen platforms in select developing markets (e.g., China)

Impact of Liquidity Crisis (2009)

Medium- to Long-Term Growth

Strategy

Near-Term Strategy to Preserve

Franchise

Corporate Finance: Strategy Overview

Market for middle market leveraged financing has been extremely weak for several

quarters limiting potential new business

Volumes have been minimized to preserve liquidity:

Non-Bank volume has been eliminated (other than legal commitments)

CIT Bank volume has been minimal since July to preserve cash

Focus on retaining top talent through the downturn – sales and credit professionals

are key to franchise preservation

Resize front-end (sales force) given new market realities

Restructure business model to further strengthen credit culture, ensure alignment of

incentives across sales and credit, and reduce expenses

Complete transition to a primarily direct calling organization (vs. past practice of

originating majority of the volume through sponsors and intermediaries)

Prioritize volume for SBL business and industry sub-segments that have been

traditional strengths for CIT: Healthcare, Retail, Communications, Media,

Entertainment, Energy

Continue to develop fee-based advisory capabilities – which will become more

important as the origination effort shifts to direct calling

Impact of Liquidity Crisis (2009)

Medium- to Long-Term Growth

Strategy

Near-Term Strategy to Preserve

Franchise

Post-Restructuring Financial Trends

Volumes remain conservative in 2010 given macroeconomic conditions and bank transition

Measured growth in core businesses post-2010

New Business Volume

Assets will decline over the next few years due to conservative volume and streamlining of

business segments

Asset Growth

Continued pressure through 2010 due to high cost financing required during restructuring

process

NIM to improve post 2010:

Excess cash used to pay down most expensive secured (first lien) debt

Utilization rates improve in the Rail business

Net Interest Margin

Improvement in 2010 due to increase in factoring commissions and ability to syndicate loans

for gains (as economy recovers)

Non-Spread Revenue

Improvement in 2010 as direct business expenses and corporate overhead are re-sized to

align with smaller CIT

Operating Expenses

Provisions decrease as credit metrics improve

Credit Provisions

Benefits of Restructuring Plan

Recognizes value in commercial franchise – market-leading positions built over a century

Exchange Offers or Plan of Reorganization provides:

Speed and certainty to ensure CIT remains a “going concern”

Significant liquidity extension

Robust capital generation

Clear roadmap to profitability

Amended terms improve economics and governance

Restructuring strategy endorsed by bondholders and reviewed by regulators

Submit ballots to your nominees on or before October 29th