- CIT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Cit (CIT) 8-KOther Events

Filed: 18 Dec 09, 12:00am

®

CIT Update

December 2009

Exhibit 99.1

Important Notices

This presentation contains forward-looking statements within the meaning of applicable federal securities laws that are

based upon our current expectations and assumptions concerning future events, which are subject to a number of risks

and uncertainties that could cause actual results to differ materially from those anticipated. The words “expect,”

“anticipate,” “estimate,” “forecast,” “initiative,” “objective,” “plan,” “goal,” “project,” “outlook,” “priorities,” “target,” “intend,”

“evaluate,” “pursue,” “commence,” “seek,” “may,” “would,” “could,” “should,” “believe,” “potential,” “continue,” or the

negative of any of those words or similar expressions is intended to identify forward-looking statements. All statements

contained in this presentation, other than statements of historical fact, including without limitation, statements about our

plans, strategies, prospects and expectations regarding future events and our financial performance, are forward-looking

statements that involve certain risks and uncertainties. While these statements represent our current judgment on what

the future may hold, and we believe these judgments are reasonable, these statements are not guarantees of any

events or financial results, and our actual results may differ materially. Important factors that could cause our actual

results to be materially different from our expectations include, among others, the risk that CIT is unsuccessful in its

efforts to complete the remaining stages of its business restructuring, the risk that CIT is delayed in completing its

management changes, the risk that CIT is delayed in completing its transition to a bank-centric business model, and the

risk that CIT continues to be subject to liquidity constraints and higher funding costs. Further, there is a risk that the

valuations resulting from our fresh start accounting analysis, which are inherently uncertain and still subject to

change, will differ significantly from our expectations, due to the complexity of the valuation process, the degree of

judgment required, and the amount of work still remaining. Accordingly, you should not place undue reliance on the

forward-looking statements contained in this presentation. These forward-looking statements speak only as of the date

on which the statements were made. CIT undertakes no obligation to update publicly or otherwise revise any forward-

looking statements, except where expressly required by law.

This presentation is derived from CIT's publicly available information and is to be used solely as part of CIT

management's continuing investor communications program. This presentation shall not constitute an offer or

solicitation in connection with any securities.

Restructuring Overview /

Update

Restructuring Update

CIT emerged from bankruptcy on December 10, 2009, less than 6 weeks after filing

Court-supervised process allowed the Company to achieve several important objectives:

Substantial debt reduction

Improved capital levels

Significant liquidity runway

Franchise value preserved during expedited process

Progress on corporate governance initiatives

Business optimization strategy under development

Restructuring Objectives on Track

Target capital structure with significantly

less leverage

Establish capital ratios in excess of

regulatory standards and more in-line with

financially sound peers

Defer liquidity demands through debt

restructuring

Reduce reliance on capital markets

Position Company for return to profitability

and investment grade ratings

Optimize portfolio of businesses

Move eligible businesses into CIT Bank*

Transition to a bank-centric funding

model*

Maintain and build key client relationships

in core franchises

Align expense base with smaller scale

Business Model

Financial Strength

= Achieved

* Subject to regulatory approval

Phased Approach to Restructuring

Recapitalization Allows for Measured Approach to Phase III

Implement governance and

leadership changes

Transition to smaller company

focused on small- and mid- sized

businesses

Transition to a bank-centric

business model*

Optimize value of non-bank eligible

businesses

Align expense base with smaller

scale

Launched dual path restructuring

plan Oct 1st

Overwhelming support for

prepackaged plan of reorganization

Voluntary prepackaged bankruptcy

filed Nov 1st

Plan of reorganization confirmed

Dec 8th

Emerged Dec 10th with significantly

improved liquidity and capital profile

Liquidity stress peaked after

government support was not

received in July 2009

Obtained $3B senior secured credit

facility from certain large

bondholders in July 2009

Completed successful tender offer

for $1B of debt maturities in August

2009

Completed $4.5B expansion to

senior secured credit facility in

October 2009

Phase III (In Process)

Optimize Business Model

Phase II (Complete)

Recapitalize Balance Sheet

Phase I (Complete)

Address Liquidity Challenge

* Subject to regulatory approval

Highly Successful Plan of Reorganization

Overwhelming Creditor Support

Participation by approximately $28B or 83% of debt holders solicited

Over 92% of principal amount voted was in favor of Plan of Reorganization

Broad support from both Institutional and Retail holders

Minimal Business Disruption

Only two non-operating legal entities filed; operating entities unaffected and have significant

liquidity to support clients

40-day court process

Significantly Improved Liquidity and Capital Profile

Reduced aggregate debt balances by approximately $10.5B

Limited debt maturities until 2012

Cancelled all pre-existing preferred and common stock

Issued new common stock (listed on NYSE) to bondholders

Bolstered capital position

Capital Structure Impact from Restructuring

(1) 10Q table updated to reflect known restructuring outcomes including the collateralization of select international BU debt

(2) Does not include the $4.5B expansion facility completed in October 2009

(3) Remaining senior unsecured notes principally include long-dated retail notes, international BU debt and FAS 133 MTM offsets

Total Debt

New Series B Notes

New Series A Notes

Subordinated notes and equity units

Senior unsecured notes

Unsecured bank credit facilities

Secured credit facility (2)

Secured borrowings

44,315

(10,430)

54,745

2,149

2,149

-

21,036

21,036

-

-

(2,099)

2,099

1,121

(28,967)

30,088

-

(3,100)

3,100

2,862

-

2,862

$17,147

550

$16,597

Pro-forma

9/30 B/S

Restructuring

Impact

Reported

9/30 B/S

Pro-forma September 30, 2009 Debt Balances(1)

Pro-forma debt amounts above are post restructuring, pre-fresh start accounting estimates and

are subject to change

All pre-existing common and preferred obligations eliminated

Significant capital generated through debt extinguishment

200 million new common shares issued to debt holders

(3)

Enhanced Liquidity Profile

Extended debt maturity profile

Strong cash position upon emergence

Able to reinvest all Trade, Vendor and SBL portfolio cash flows into the businesses prior to platform

transfers into CIT Bank*

No limitation on ability to fund existing commitments

* Subject to regulatory approval

** 2012 maturities include $4.5 billion expansion senior credit facility issued Oct 2009 and extendible to 2013

***Unsecured maturities exclude deposits, and FAS 133 mark-to-market and discount

Pro-forma Debt Maturity Profile at 9/30/09

Pre

Post

Q4-09

2010

2011

2012**

Restructuring

Pre

Post

Restructuring

Pre

Post

Restructuring

Pre

Post

Restructuring

Unsecured Debt***

Secured Debt

($in Billions)

$3.3

$1.9

$12.2

$4.4

$8.2

$1.9

$12.4

$8.6

Key Terms of New Debt Securities

Senior Secured

Second Lien

Notes

Senior Secured

Second Lien

Notes

Senior Secured

First Lien

Term Loan

Senior Secured

First Lien

Term Loan

Type

103.5 call premium

for year 1

102 call premium

for year 2

Cash sweep

provision

103.5 call

premium for

year 1

102 call

premium for

year 2

Cash sweep

provision

102 call premium

for year 1

2.5x fair value

collateral coverage

Cash sweep

provision

2% exit fee

2.5x fair value

collateral coverage

Cash sweep

provision

Other Terms

10.25%

(fixed)

7.0%

(fixed)

LIBOR + 7.5%

(2% LIBOR floor)

LIBOR + 10%

(3% LIBOR floor)

Rate

2013 - $0.2B

2014 - $0.3B

2015 - $0.3B

2016 - $0.5B

2017 - $0.8B

2013 - $2.1B

2014 - $3.2B

2015 - $3.2B

2016 - $5.3B

2017 - $7.4B

2012

(1-year extension option)

2012

Maturity

$2.1B

$21B

$4.5B

$3B

Principal Outstanding(1)

Series B Notes

Series A Notes

Sr. Credit Facility

Tranche 2

Sr. Credit Facility

Tranche 1

(1) Senior Credit Facility Tranche 1 issued July 2009 and Tranche 2 issued October 2009; outstandings of Series A and B Notes at emergence.

Cash Sweep Mechanism

Accelerate repayment of first and second lien debt with excess cash while preserving operational flexibility

Excess cash includes collections from owned assets in Student Lending, Corporate Finance (ex. SBL)

and Transportation, net of debt service, operating expenses, servicing costs and payments on certain

operating leases

Collections in Trade Finance, Vendor Finance – U.S. and Small Business Lending (“SBL”) are

available to fund the businesses and not included in sweep until the platforms are transferred into CIT

Bank

Also excludes cash collections in Vendor Finance – International, regulated entities (incl. CIT Bank),

certain other subsidiaries, restricted accounts, and cash held by or for third parties

Allows for normal course business activity at the Bank Holding Company including:

Maintain up to $500 MM of unrestricted and available cash at all times

Reinvestments into Corporate Finance (excluding SBL) and Transportation of up to $500 MM in any

12 month period

Discretionary CIT Bank investments of up to $400 MM per 12 month period

Debt service obligations, including recourse debt obligations at subsidiaries

Funding of existing contractual commitments in Corporate Finance and Transportation (e.g. railcar &

aircraft deliveries)

Required CIT Bank investments

Reasonable efforts to use cash balances > $1.5B to prepay debt after covering liquidity needs for the

upcoming quarter

Fresh Start Accounting Overview

Financial statements will be impacted significantly by Fresh Start Accounting (FSA)

FSA will be adopted in the fourth quarter of 2009 and will be finalized with the filing of the 2009 10-K

Assets and liabilities will be marked to “estimated fair value”

Receivable valuations to incorporate existing loan loss reserve

Lower near-term charge-offs due to netting of existing loan loss reserve in fresh start value

Yield adjustments accreted into interest income over asset life

Debt adjustments amortized / accreted into interest expense over debt life

Equity value will be determined as part of the FSA process

Offering Memorandum included $5 - $11B valuation range based on 3rd party analysis

FSA requires entire enterprise to be marked initially to estimated fair value; FAS 157 Fair Value

Footnote only values financial assets and liabilities (excludes operating leases)

Fresh Start Accounting Valuations per Offering Memorandum

Original Plan of Reorganization Assumptions

Asset carrying value assumed to be reduced by

$12.5B (~20%)

Allowance for credit losses reversed as loans

marked to fair value

Debt carrying value reduced by $6.5B based on

assumed initial trading values of:

100 cents for new first lien debt

80 cents for new second lien debt

87 cents for other secured borrowing

Pre-existing common stock and preferred interests

cancelled

Shareholders’ equity valuation range of $5-$11B

Valuation Trends Since Original Plan

Initial new common equity trading value within

valuation range

Also will use market value comparables (e.g.

price/book, discounted cash flow, etc.)

Income Statement

Receivable markdown (other than specific credit reserves) to be accreted over life of assets, creating non-cash interest income

Operating lease equipment markdown reduces depreciation expense over the remaining life of the asset

Original issue discount (OID) created due to mark-down of debt to be amortized over life of debt, creating non-cash interest

expense

Tax NOL carry forwards will be reduced by cancellation of indebtedness income; remaining NOL balance expected for future

use

Asset values improving

Credit trends continue to weigh on values

Initial actual secured debt trading values are higher

than assumed

Business Update

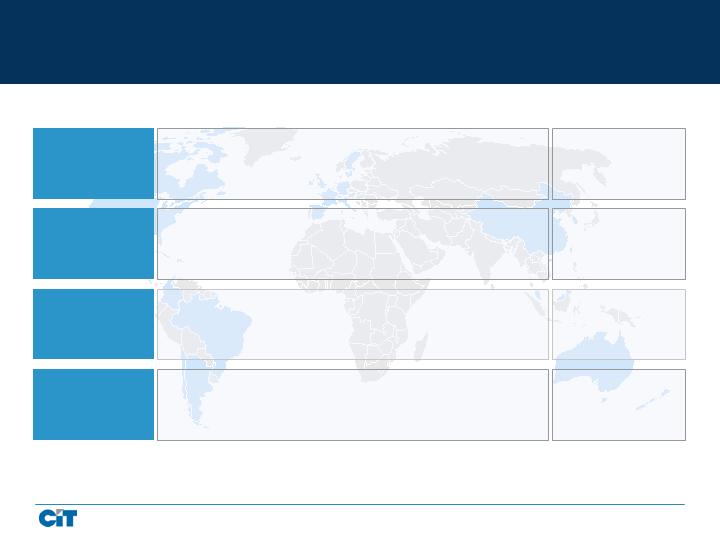

Market Leader in Small Business and Middle-Market Financing

Trade

Finance

Factoring, lending, receivables management and trade finance to

companies in retail supply chain

Vendor

Finance

Financing and leasing solutions to manufacturers and distributors

around the globe. Operations in Americas, Europe, Asia and South

Pacific

Mgd. Assets: $4B

Market Rank: #1

Mgd. Assets: $12B

Market Rank: Top 3*

Managed Assets data as of 9/30/2009

Market ranks as of 2008

* Represents ranking for US Office Products/Tech market; exact global ranking data unavailable

Corporate

Finance

Lending, leasing and other financial and advisory services to middle

market companies (including SBA business), with focus on specific

industries (e.g., Healthcare, Communications, Media, Entertainment,

Energy, Retail)

Mgd. Assets: $18B

Market Rank: N/A

Transportation

Finance

Lending, leasing and advisory services to transportation industry,

principally aerospace and rail

Mgd. Assets: $15B

Market Rank: #3

Trade Finance – Overview and Strategy Update

Traditional factoring volumes down due to soft macro-economic conditions and

concerns over CIT bankruptcy

Product migration away from traditional factoring toward deferred purchase

and credit guaranty contracts to mitigate perceived CIT risk

Dedicated $1B liquidity to business

Core business

Increase factoring market share

Transition platform to CIT Bank (regulatory approval required)

Use more efficient funding from CIT Bank

Continue focus on serving U.S. market

Efficient platform that can be scaled

Strategy

Update

Overview

Largest factoring company in the United States

$42B in factored volume in 2008, representing ~50% of the U.S. market

Vital link in retail supply chain providing credit protection, accounts receivable

management and asset-based lending to manufacturers and importers

Considered “best in class” in terms of credit management, new business

generation, operations, and technology

Vendor Finance – Overview and Strategy Update

Core business

Transfer US Vendor Platform to CIT Bank (regulatory approval required)

Focus on core industry segments and select vendor partners

Discontinue customer relationships with marginal profitability

Rationalize geographies while maintaining strategic global presence

Prioritizing liquidity to key vendor relationships

Increasing pricing to reflect risk and market trends

Aggressively managing credit and lease residuals

Dedicated $1B liquidity to business

Partner with original equipment manufacturers and dealers, distributors and

resellers to provide financing solutions to customers.

Lease office equipment, computers, technology, and other products to middle-

market end-users

Primary industry segments: Information Technology, Telecommunications and

Office Products

Strategy

Update

Overview

Corporate Finance – Overview and Strategy Update

Provide financing to small and middle-market companies in the U.S., Canada

and Europe

Organized by industry vertical: e.g. Healthcare, Commercial & Industrial, Energy

and CM&E (Communications, Media and Entertainment)

Includes Small Business Lending, which provides credit to small businesses in

conjunction with Small Business Administration sponsored programs

Originate middle market loans at CIT Bank

Transfer SBL platform to CIT Bank (requires regulatory approval)

Restructure business to increase direct calling, enhance credit focus and

reduce expenses

Prioritize volume for SBA business and products/industries that are

traditional strengths including asset-based lending, Healthcare, and Retail

Volume proactively constrained to preserve liquidity

Hardest hit by economic downturn; economic conditions, market illiquidity and

portfolio deterioration impacting credit performance and syndication activities

Commercial Real Estate, Media and Energy portfolios under greatest stress

Dedicated $500 MM liquidity to SBA business

Strategy

Update

Overview

Transportation Finance – Overview and Strategy Update

Full utilization in aerospace book; rail utilization under pressure

Portfolio credit performance strong

Funding currently limited to contractual commitments (e.g., deliveries for aircraft and

railcars)

Operating lease businesses unlikely to be transferred to CIT Bank

Strong order book and young fleet facilitates preservation of franchise value

Provides commercial leasing, private aircraft leasing and financing solutions to operators

and suppliers in global aviation and North American rail car industries

Aerospace portfolio of approximately 325 aircraft, operated by 109 customers in 55

countries

Rail fleet of over 100,000 railcars and 1,000 locomotives, serving ~500 customers

Relatively young fleets compared to competitors

Strategy

Update

Overview

Refinement of Business Model

– Streamline Business

Restructuring Focus Now on Phase III – Optimizing Business Model

Strengthen market-leading position as lender to small and middle-market

companies

Focus on businesses consistent with bank-centric model

– Pursue potential strategic options for non-core business lines

Shrink balance sheet

Maintain conservative volumes as transition to new model is completed

– Return to growth in core businesses as Company and economy recover

Seek regulatory approvals to transition Small Business Lending, Trade Finance and

US Vendor Finance platforms to CIT Bank

Capture commercial deposits from Corporate Finance and Trade Finance customers

Build commercial deposits and retail deposits through potential strategic transactions

Pursue debt ratings at CIT Bank to enhance access to capital markets

Actively manage direct expenses at business segment level

Decrease overhead

Pay down expensive debt

Bank-Centric Funding Model

– Attain Competitive Cost of Funds

Enhance Efficiency

– Reduce Expenses

Review strategic priorities

Maximize stakeholder value

Corporate Governance / Leadership

– Implement Changes

Progress on Corporate Governance

Board to consist of 13 directors

New CEO

7 bondholder-identified Directors

5 incumbent Directors

NYSE listing complete

Authorized 600 MM common shares and 100 MM preferred shares

Issued 200 MM new common shares to former debt holders

Incumbent Directors identified

Significant progress on identifying the 7 new directors recommended by bondholders

Current CEO Jeff Peek announced resignation

Board committee formed; search firm engaged

Candidate to be selected by new Board

CEO

Board of Directors

Board Transition

Update

Other Matters

Next Steps in Fulfilling Bank Strategy

Confirm new independent Board members

Select new CEO

Obtain regulatory approvals to transfer business platforms to CIT Bank

Phase 1 – Small Business Lending

Phase 2 – Trade Finance and US Vendor Finance

Work with FDIC to lift Cease and Desist order on CIT Bank

Attain debt ratings for CIT Bank

Implement diversified funding model

Short term - Use conduits and securitizations

Long term – Expand deposits (commercial & retail) and increase capital markets access

Enhance bank compliance and credit risk functions

Obtain approvals for platform transfers

Evolve bank funding model:

Retail and commercial deposits

Bank rating

Secured facilities and securitizations

2010 Strategic Priorities

Volume-based front-end reductions

Selective needs-based hiring

Back office downsizing

Employee retention

Client retention

Focus on core industry and collateral strengths

Pay-down high-cost credit facilities

Optimize value of non-bank eligible businesses

Transportation Finance

Certain international assets

Right-size Business Processes

Reinvigorate Franchise

Portfolio Optimization

Evaluate / Implement Bank Centric Model

Financial Roadmap and

Conclusions

2010 Financial Roadmap

New volume flat to down compared to 2009 depending on macroeconomic conditions and

progress with Bank-Centric model

New Business Volume

Assets decline due to conservative volume

Portfolio optimization strategies could further portfolio contraction

Asset Growth

Fresh Start Accounting (FSA) to result in significant NIM improvement

Operating NIM pressure thru 2010 due to high cost financing

Operating NIM to improve post 2010 with Platform transfers to CIT Bank*:

Excess cash used to pay down expensive secured (first lien) debt.

Expected improvement in operating lease margins as economic cycle turns

Net Interest Margin

Modest improvement in 2010 due to potential syndication of loans (as economy recovers)

Non-Spread Revenue

Improvement in 2010 as direct business expenses and corporate overhead are re-sized

Operating Expenses

Provisions decrease as credit metrics improve and FSA valuations consider expected loss

Credit Provisions

* Subject to regulatory approval

CIT Positioned for Value Creation

Court-supervised restructuring complete

Significantly improved liquidity and capital profile

Bank Holding Company is source of strength to CIT Bank

Franchise value preserved

Governance and leadership transition in process

Well-positioned to resume role as ‘lender of choice’ to small and mid-sized businesses

CIT Investor Relations - Key Contacts

Ken Brause

Executive Vice President

212-771-9650

ken.brause@cit.com

Steve Klimas

Senior Vice President

973-535-3769

steve.klimas@cit.com

Bhavin Shah

Vice President

973-597-2603

bhavin.shah@cit.com