Exhibit 99.2

®CITThird Quarter 2013 Financial ResultsOctober 22, 2013

Important NoticesThis presentation contains forward-looking statements within the meaning of applicable federal securities laws that are based upon our current expectations and assumptions concerning future events, which are subject to a number of risks and uncertainties that could cause actual results to differ materially from those anticipated. The words “expect,” “anticipate,” “estimate,” “forecast,” “initiative,” “objective,” “plan,” “goal,” “project,” “outlook,” “priorities,” “target,” “intend,” “evaluate,” “pursue,” “commence,” “seek,” “may,” “would,” “could,” “should,” “believe,” “potential,” “continue,” or the negative of any of those words or similar expressions is intended to identify forward-looking statements. All statements contained in this presentation, other than statements of historical fact, including without limitation, statements about our plans, strategies, prospects and expectations regarding future events and our financial performance, are forward-looking statements that involve certain risks and uncertainties. While these statements represent our current judgment on what the future may hold, and we believe these judgments are reasonable, these statements are not guarantees of any events or financial results, and our actual results may differ materially. Important factors that could cause our actual results to be materially different from our expectations include, among others, the risk that CIT is unsuccessful in implementing its strategy and business plan, the risk that CIT is unable to react to and address key business and regulatory issues, the risk that CIT is unable to achieve the projected revenue growth from its new business initiatives or the projected expense reductions from efficiency improvements, the risk that CIT is delayed in implementing its branch strategy, and the risk that CIT becomes subject to liquidity constraints and higher funding costs. Further, there is a risk that the valuations resulting from our fresh start accounting analysis, which are inherently uncertain, will differ significantly from the actual values realized, due to the complexity of the valuation process, the degree of judgment required, and changes in market conditions and economic environment. We describe these and other risks that could affect our results in Item 1A, “Risk Factors,” of our latest Annual Report on Form 10-K for the year ended December 31, 2012, which was filed with the Securities and Exchange Commission. Accordingly, you should not place undue reliance on the forward-looking statements contained in this presentation. These forward-looking statements speak only as of the date on which the statements were made. CIT undertakes no obligation to update publicly or otherwise revise any forward-looking statements, except where expressly required by law.This presentation is to be used solely as part of CIT management's continuing investor communicationsprogram. This presentation shall not constitute an offer or solicitation in connection with any securities.1

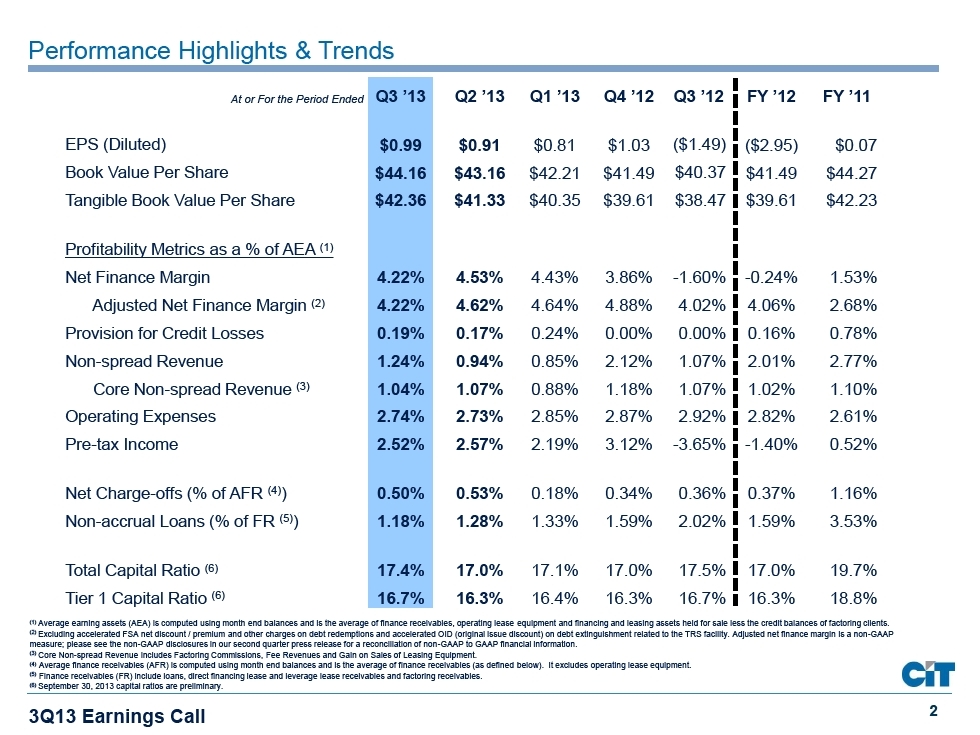

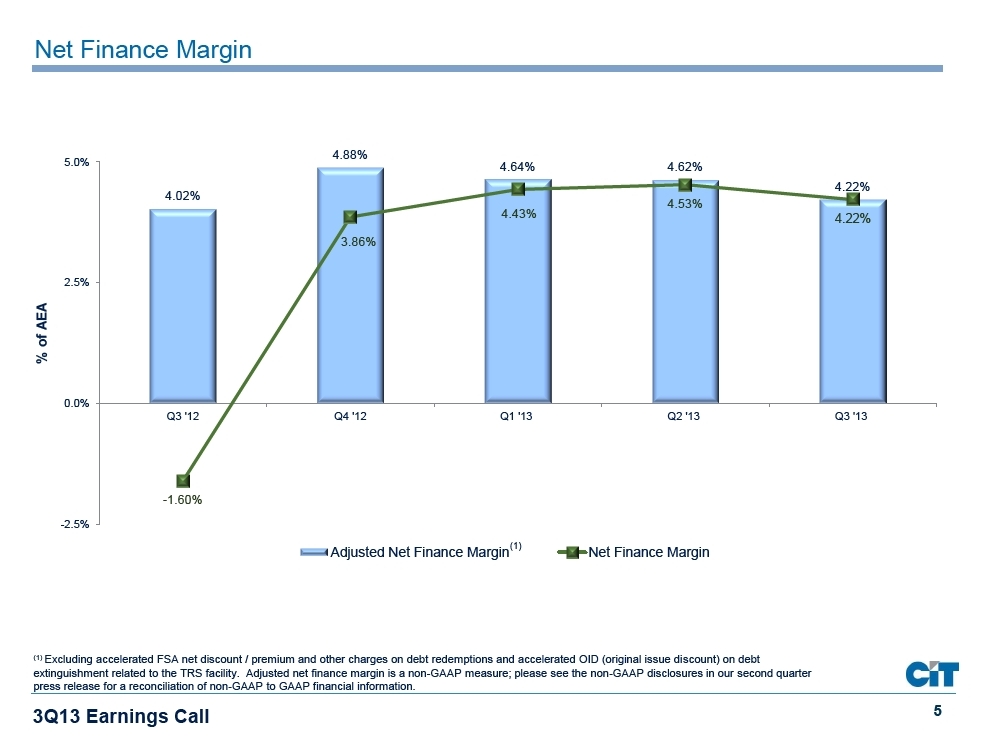

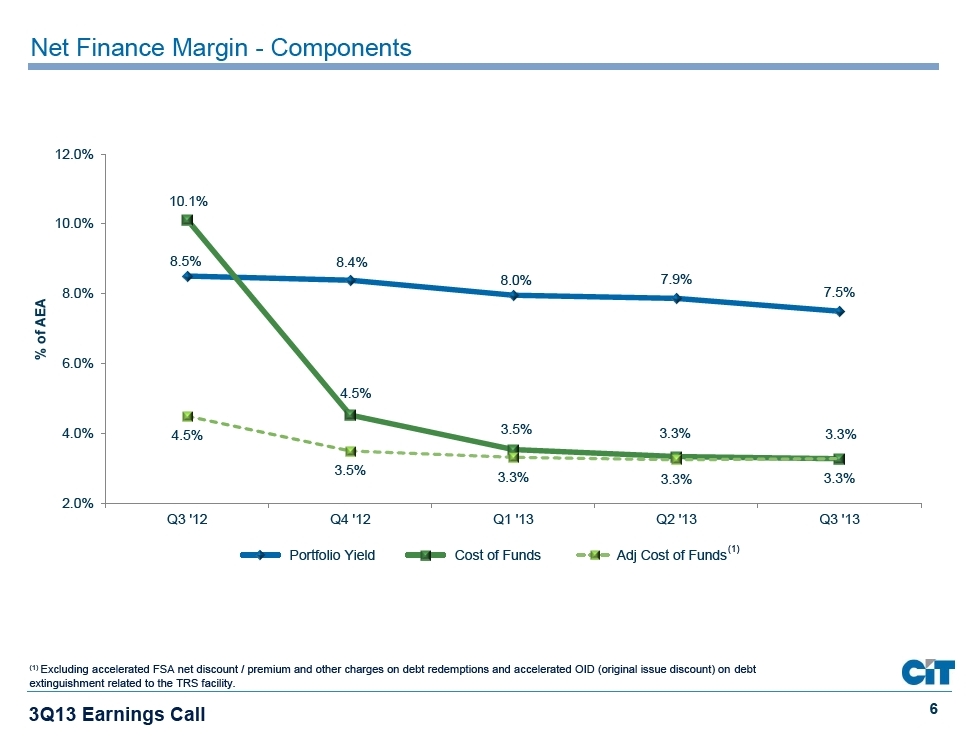

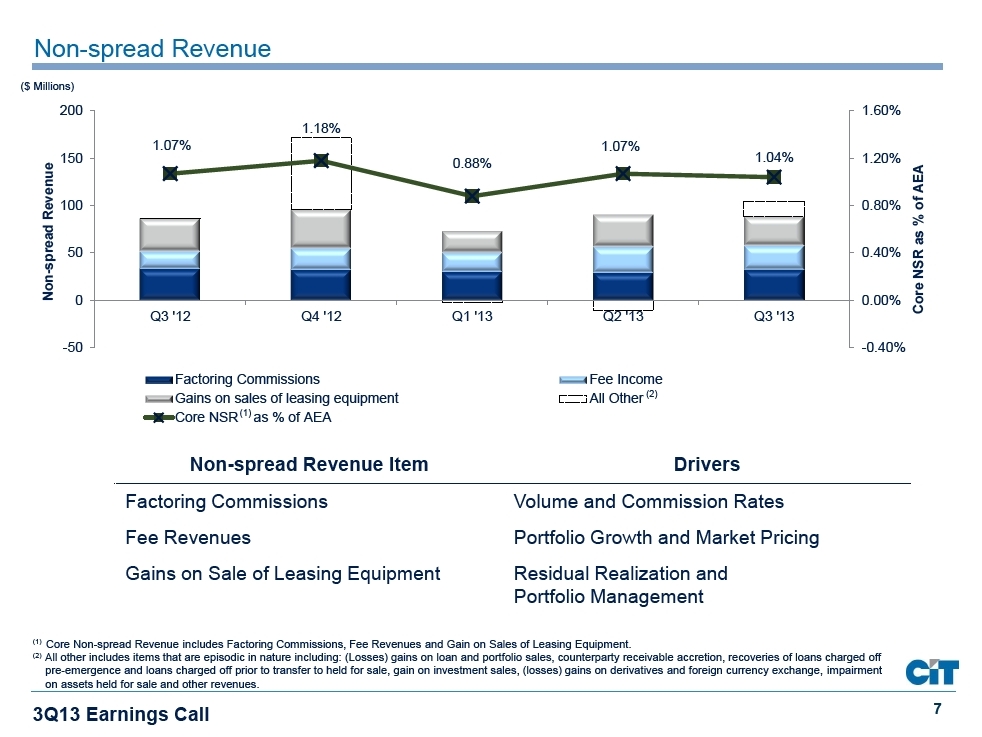

Performance Highlights & TrendsAt or For the Period EndedQ3 ’13 Q2 ’13 Q1 ’13 Q4 ’12 Q3 ’12 FY ’12 FY’11 EPS (Diluted) $0.99 $0.91 $0.81 $1.03 ($1.49) ($2.95) $0.07 Book Value Per Share $44.16 $43.16 $42.21 $41.49 $40.37 $41.49 $44.27 Tangible Book Value Per Share $42.36 $41.33 $40.35 $39.61 $38.47 $39.61 $42.23 Profitability Metrics as a % of AEA(1)Net Finance Margin 4.22% 4.53% 4.43% 3.86% -1.60% -0.24% 1.53% Adjusted Net Finance Margin(2)4.22% 4.62% 4.64% 4.88% 4.02% 4.06% 2.68% Provision for Credit Losses0.19% 0.17% 0.24% 0.00% 0.00% 0.16% 0.78%Non-spread Revenue1.24% 0.94% 0.85% 2.12% 1.07% 2.01% 2.77% Core Non-spread Revenue(3)1.04% 1.07% 0.88% 1.18% 1.07% 1.02% 1.10% Operating Expenses2.74% 2.73% 2.85% 2.87% 2.92% 2.82% 2.61% Pre-tax Income2.52% 2.57% 2.19% 3.12% -3.65% -1.40% 0.52%Net Charge-offs (% of AFR(4)) 0.50% 0.53% 0.18% 0.34% 0.36% 0.37% 1.16% Non-accrual Loans (% of FR(5)) 1.18% 1.28% 1.33% 1.59% 2.02% 1.59% 3.53%Total Capital Ratio(6)17.4% 17.0% 17.1% 17.0% 17.5% 17.0% 19.7% Tier 1 Capital Ratio(6)16.7% 16.3% 16.4% 16.3% 16.7% 16.3% 18.8%(1)Average earning assets (AEA) is computed using month end balances and is the average of finance receivables, operating lease equipment and financing and leasing assets held for sale less the credit balances of factoring clients.(2)Excluding accelerated FSA net discount / premium and other charges on debt redemptions and accelerated OID (original issue discount) on debt extinguishment related to the TRS facility. Adjusted net finance margin is a non-GAAP measure; please see the non-GAAP disclosures in our second quarter press release for a reconciliation of non-GAAP to GAAP financial information.(3)Core Non-spread Revenue includes Factoring Commissions, Fee Revenues and Gain on Sales of Leasing Equipment.(4)Average finance receivables (AFR) is computed using month end balances and is the average of finance receivables (as defined below). It excludes operating lease equipment.(5)Finance receivables (FR) include loans, direct financing lease and leverage lease receivables and factoring receivables.(6)September 30, 2013 capital ratios are preliminary.3Q13 Earnings Call 2

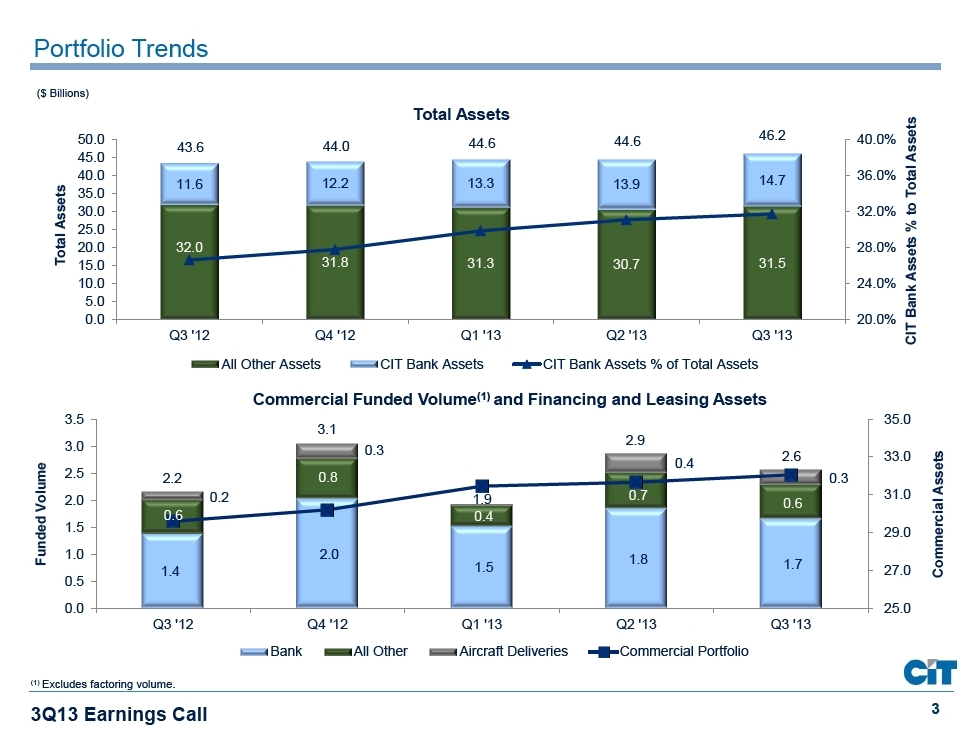

Portfolio Trends($ Billions)Total AssetsAssets50.0 46.2 40.0% 44.0 44.6 44.6 43.6 45.0 40.0 14.7 36.0% 11.6 12.2 13.3 13.9Assets 35.0Total 30.0 32.0%to 25.0% Total 20.032.028.0%Assets 15.031.8 31.3 30.7 31.510.0 24.0% 5.0Bank0.0 20.0% Q3 '12 Q4 '12 Q1 '13 Q2 '13 Q3 '13CITAll Other Assets CIT Bank Assets CIT Bank Assets % of Total AssetsCommercial Funded Volume(1)and Financing and Leasing Assets 3.5 35.0 3.1 2.9 3.0 0.3 2.6 33.0Assets Volume 0.4 2.5 2.20.80.3 2.0 0.2 1.90.731.00.6Commercial 0.6 0.4Funded 1.5 29.0 1.0 2.0 1.8 1.5 1.7 1.4 27.0 0.5 0.0 25.0 Q3 '12 Q4 '12 Q1 '13 Q2 '13 Q3 '13Bank All Other Aircraft Deliveries Commercial Portfolio(1)Excludes factoring volume.3Q13 Earnings Call3

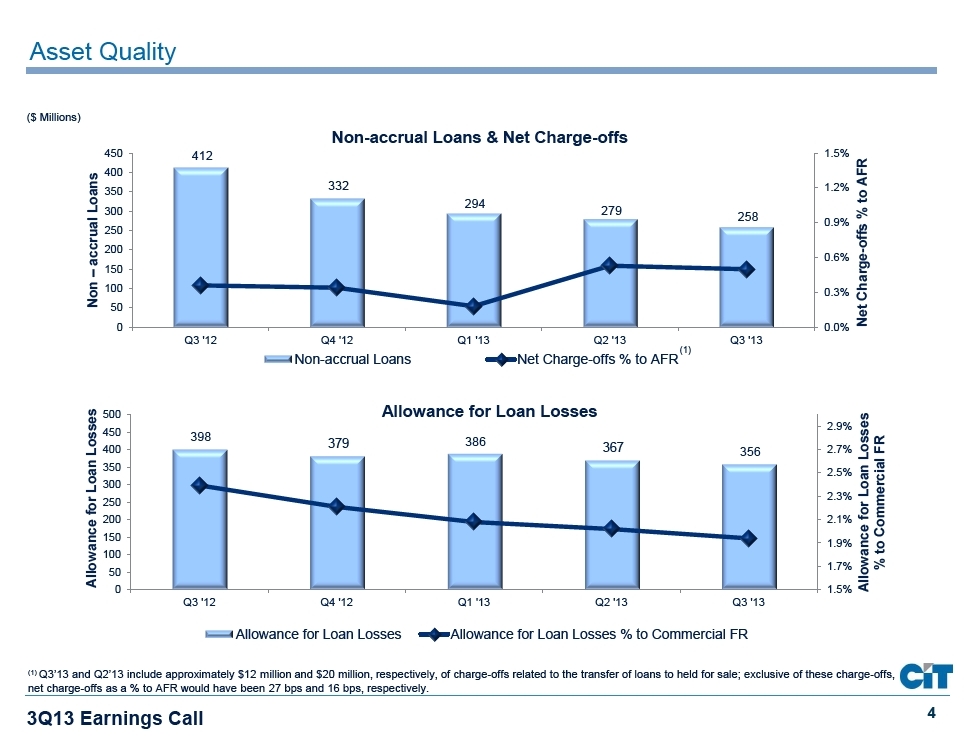

Asset Quality($ Millions)Non-accrual Loans & Net Charge-offs450 412 1.5% 400Loans AFR 332 1.2% 350 to 294 300 279% 258accrual 0.9% 250 -offs2000.6% Charge 150–Non 100 0.3%50 Net0 0.0% Q3 '12 Q4 '12 Q1 '13 Q2 '13 Q3 '13 (1)Non-accrual Loans Net Charge-offs % to AFR Losses 500 Allowance for Loan LossesLosses 2.9% 450 398 379 386 400 367356 2.7%FR 350 Commercial2.5%Loan 300 Loan 2.3% for 250 200 2.1% for Allowance Allowance150 1.9% to 100 1.7% % 500 1.5% Q3 '12 Q4 '12 Q1 '13 Q2 '13 Q3 '13 Allowance for Loan Losses Allowance for Loan Losses % to Commercial FR(1)Q3’13 and Q2’13 include approximately $12 million and $20 million, respectively, of charge-offs related to the transfer of loans to held for sale; exclusive of these charge-offs, net charge-offs as a % to AFR would have been 27 bps and 16 bps, respectively.3Q13 Earnings Call 4

Net Finance Margin4.88%5.0% 4.64% 4.62% 4.22% 4.02%4.53% 4.43%4.22%3.86%2.5%AEA of %0.0%Q3 '12 Q4 '12 Q1 '13 Q2 '13 Q3 '13-1.60%-2.5%Adjusted Net Finance Margin (1) Net Finance Margin(1)Excluding accelerated FSA net discount / premium and other charges on debt redemptions and accelerated OID (original issue discount) on debt extinguishment related to the TRS facility. Adjusted net finance margin is a non-GAAP measure; please see the non-GAAP disclosures in our second quarter press release for a reconciliation of non-GAAP to GAAP financial information.3Q13 Earnings Call5

Net Finance Margin - Components12.0% 10.1% 10.0%8.5% 8.4%8.0% 7.9% 8.0% 7.5%AEA of %6.0% 4.5%4.0% 3.5% 3.3% 3.3% 4.5%3.5% 3.3% 3.3% 3.3% 2.0% Q3 '12 Q4 '12 Q1 '13 Q2 '13 Q3 '13Portfolio Yield Cost of Funds Adj Cost of Funds(1)(1)Excluding accelerated FSA net discount / premium and other charges on debt redemptions and accelerated OID (original issue discount) on debt extinguishment related to the TRS facility.3Q13 Earnings Call 6

Non-spread Revenue($ Millions)200 1.60% 1.18% 1.07% 1.07% 150 1.04% 1.20% 0.88%RevenueAEA 100 0.80%of %spreadas50 0.40%NSRNon- 0 0.00%CoreQ3 '12 Q4 '12 Q1 '13 Q2 '13 Q3 '13-50 -0.40%Factoring Commissions Fee Income Gains on sales of leasing equipment All Other (2) Core NSR (1) as % of AEANon-spread Revenue Item DriversFactoring Commissions Volume and Commission Rates Fee Revenues Portfolio Growth and Market Pricing Gains on Sale of Leasing Equipment Residual Realization and Portfolio Management(1)Core Non-spread Revenue includes Factoring Commissions, Fee Revenues and Gain on Sales of Leasing Equipment.(2)All other includes items that are episodic in nature including: (Losses) gains on loan and portfolio sales, counterparty receivable accretion, recoveries of loans charged off pre-emergence and loans charged off prior to transfer to held for sale, gain on investment sales, (losses) gains on derivatives and foreign currency exchange, impairment on assets held for sale and other revenues.3Q13 Earnings Call77

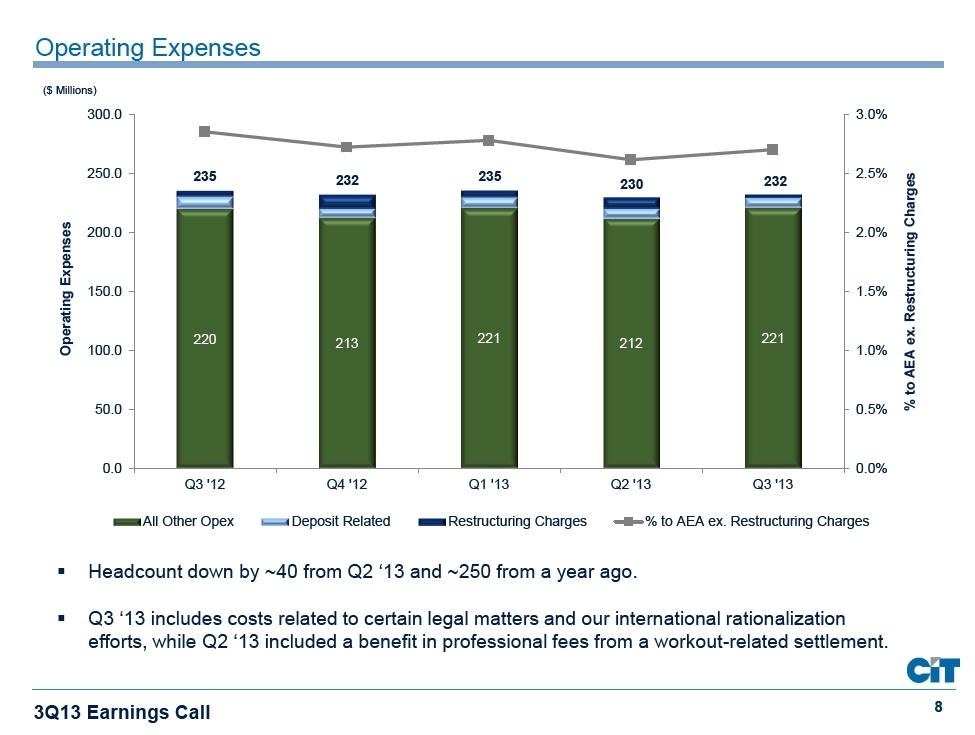

Operating Expenses($ Millions)300.0 3.0%250.0235 235 2.5%232 230 232ChargesExpenses 200.0 2.0%Restructuring150.0 1.5%Operating 220 213 221 212 221ex.100.0 1.0%AEA to50.0 0.5%%0.0 0.0% Q3 '12 Q4 '12 Q1 '13 Q2 '13 Q3 '13All Other Opex Deposit Related Restructuring Charges % to AEA ex. Restructuring Charges§ Headcount down by ~40 from Q2 ‘13 and ~250 from a year ago.§ Q3 ‘13 includes costs related to certain legal matters and our international rationalization efforts, while Q2 ‘13 included a benefit in professional fees from a workout-related settlement.3Q13 Earnings Call88