Exhibit 99.4

0 40 93 0 60 131 3 80 171 242 199 14 0 155 184 218 208 221 238 Acquisition of OneWest Creating a Commercial Bank for the Middle Market July 22, 2014 [ yt ]XrvQ6mFQsAs[ yt ]

0 40 93 0 60 131 3 80 171 242 199 14 1 155 184 218 208 221 238 Forward Looking Statements This presentation contains forward - looking statements within the meaning of applicable federal securities laws with respect to t he planned acquisition of IMB Holdco LLC and its subsidiaries (“OneWest”), OneWest’s future performance, the expected costs be incurred in connection with the acquisi tio n, integration with CIT Group Inc. (“CIT”), and the impact of the transaction of CIT’s future performance. Forward - looking statements are based upon our current expectations and assumptions concerning future events, which are subject t o a number of risks and uncertainties that could cause actual results to differ materially from those anticipated. The words “expect,” “anticipate,” “es timate,” “forecast,” “initiative,” “objective,” “plan,” “goal,” “project,” “outlook,” “priorities,” “target,” “intend,” “evaluate,” “pursue,” “commence,” “seek,” “may,” “wou ld, ” “could,” “should,” “believe,” “potential,” “continue,” or the negative of any of those words or similar expressions is intended to identify forward - looking statements. All statements contained in this presentation, other than statements of historical fact, including without limitation, statements about our plans, strategies, prospects and ex pectations regarding future events and our financial performance, are forward - looking statements that involve certain risks and uncertainties. While these statements repre sent our current judgment on what the future may hold, and we believe these judgments are reasonable, these statements are not guarantees of any events or financia l r esults, and our actual results may differ materially. In addition, forward - looking statements in this presentation are subject to certain risks and uncertainties related both to the acquisition transaction itself and to the integration of the acquired business with CIT after closing, including the possibility that regulatory and other approvals an d c onditions to the transaction are not received or satisfied on a timely basis or at all or are obtained subject to conditions that are not anticipated; the possibility that mo difications to the terms of the transaction may be required in order to obtain or satisfy such approvals or conditions or that such approvals are obtained subject to conditions th at are not anticipated; changes in the anticipated timing for closing the transaction; difficulty and delays in integrating OneWest with CIT or fully realizing proj ect ed cost savings and other projected benefits of the transaction; business disruption during the pendency of or following the transaction; the inability to sustain revenue an d e arnings growth; changes in general economic conditions, including changes in interest rates and capital markets; changes in law or regulations, diversion of man age ment time on transaction - related issues; reputational risks and the reaction of customers and counterparties to the transaction; and changes in asset quality and risk as a result of the transaction. Annualized, pro forma, projected and estimated numbers are used for illustrative purposes only, are not forecasts and may not re flect actual results. We describe other risks that are applicable to our businesses generally that could affect our results in Item 1A, “Risk Facto rs, ” of our latest Annual Report on Form 10 - K for the year ended December 31, 2013, which was filed with the Securities and Exchange Commission. Accordingly, you should n ot place undue reliance on the forward - looking statements contained in this presentation. These forward - looking statements speak only as of the date on which t he statements were made. CIT undertakes no obligation to update publicly or otherwise revise any forward - looking statements, except where expressly required by law. For additional information, please see CIT’s Form 8 - K filed with the SEC on July 22, 2014. Totals may not foot due to rounding.

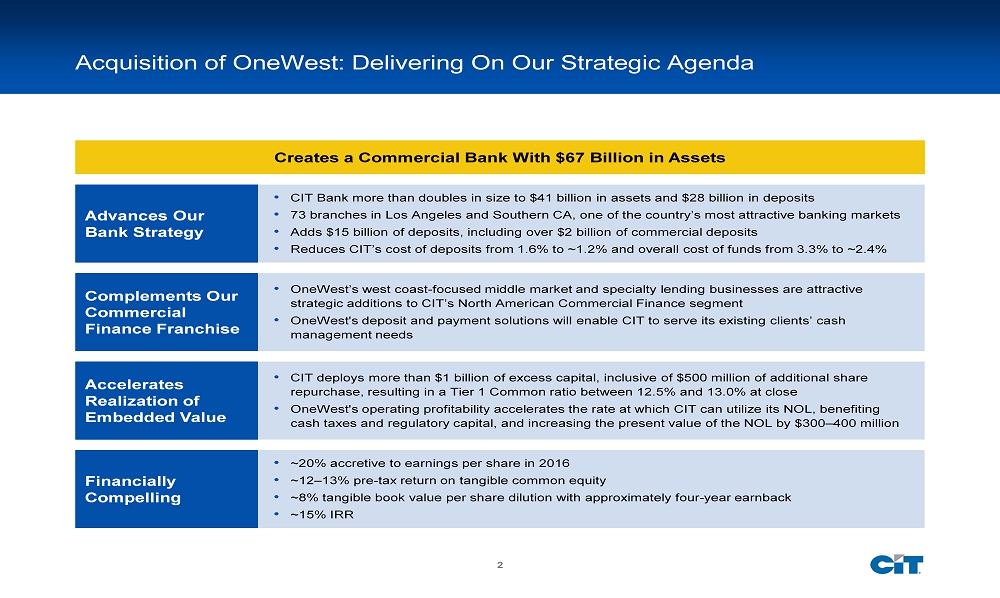

0 40 93 0 60 131 3 80 171 242 199 14 2 155 184 218 208 221 238 • OneWest’s west coast - focused middle market and specialty lending businesses are attractive strategic additions to CIT’s North American Commercial Finance segment • OneWest's deposit and payment solutions will enable CIT to serve its existing clients’ cash management needs • CIT deploys more than $1 billion of excess capital, inclusive of $500 million of additional share repurchase, resulting in a Tier 1 Common ratio between 12.5% and 13.0% at close • OneWest's operating profitability accelerates the rate at which CIT can utilize its NOL, benefiting cash taxes and regulatory capital, and increasing the present value of the NOL by $300 – 400 million • ~20% accretive to earnings per share in 2016 • ~12 – 13% pre - tax return on tangible common equity • ~8% tangible book value per share dilution with approximately four - year earnback • ~15% IRR • CIT Bank more than doubles in size to $41 billion in assets and $28 billion in deposits • 73 branches in Los Angeles and Southern CA, one of the country’s most attractive banking markets • Adds $15 billion of deposits, including over $2 billion of commercial deposits • Reduces CIT’s cost of deposits from 1.6% to ~1.2% and overall cost of funds from 3.3% to ~2.4% Acquisition of OneWest: Delivering On Our Strategic Agenda Advances Our Bank Strategy Complements Our Commercial Finance Franchise Accelerates Realization of Embedded Value Financially Compelling Creates a Commercial Bank With $67 Billion in Assets

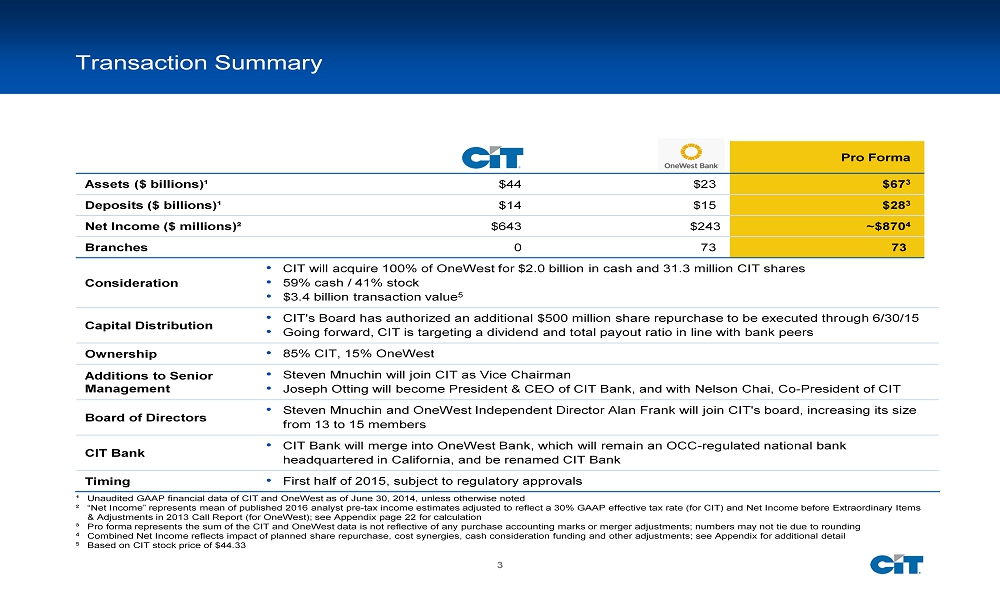

0 40 93 0 60 131 3 80 171 242 199 14 3 155 184 218 208 221 238 Transaction Summary Consideration • CIT will acquire 100% of OneWest for $2.0 billion in cash and 31.3 million CIT shares • 59% cash / 41% stock • $3.4 billion transaction value 5 Capital Distribution • CIT's Board has authorized an additional $500 million share repurchase to be executed through 6/30/15 • Going forward, CIT is targeting a dividend and total payout ratio in line with bank peers Ownership • 85% CIT, 15% OneWest Additions to Senior Management • Steven Mnuchin will join CIT as Vice Chairman • Joseph Otting will become President & CEO of CIT Bank, and with Nelson Chai, Co - President of CIT Board of Directors • Steven Mnuchin and OneWest Independent Director Alan Frank will join CIT's board, increasing its size from 13 to 15 members CIT Bank • CIT Bank will merge into OneWest Bank, which will remain an OCC - regulated national bank headquartered in California, and be renamed CIT Bank Timing • First half of 2015, subject to regulatory approvals Pro Forma Assets ($ billions)¹ $44 $23 $67 3 Deposits ($ billions)¹ $14 $15 $28 3 Net Income ($ millions)² $643 $243 ~$870 4 Branches 0 73 73 . ¹ Unaudited GAAP financial data of CIT and OneWest as of June 30, 2014, unless otherwise noted ² “Net Income” represents mean of published 2016 analyst pre - tax income estimates adjusted to reflect a 30% GAAP effective tax r ate (for CIT) and Net Income before Extraordinary Items & Adjustments in 2013 Call Report (for OneWest); see Appendix page 22 for calculation ³ Pro forma represents the sum of the CIT and OneWest data is not reflective of any purchase accounting marks or merger adjustm e nts; numbers may not tie due to rounding 4 Combined Net Income reflects impact of planned share repurchase, cost synergies, cash consideration funding and other adjustm en ts; see Appendix for additional detail 5 Based on CIT stock price of $44.33

0 40 93 0 60 131 3 80 171 242 199 14 4 155 184 218 208 221 238 Combination With OneWest

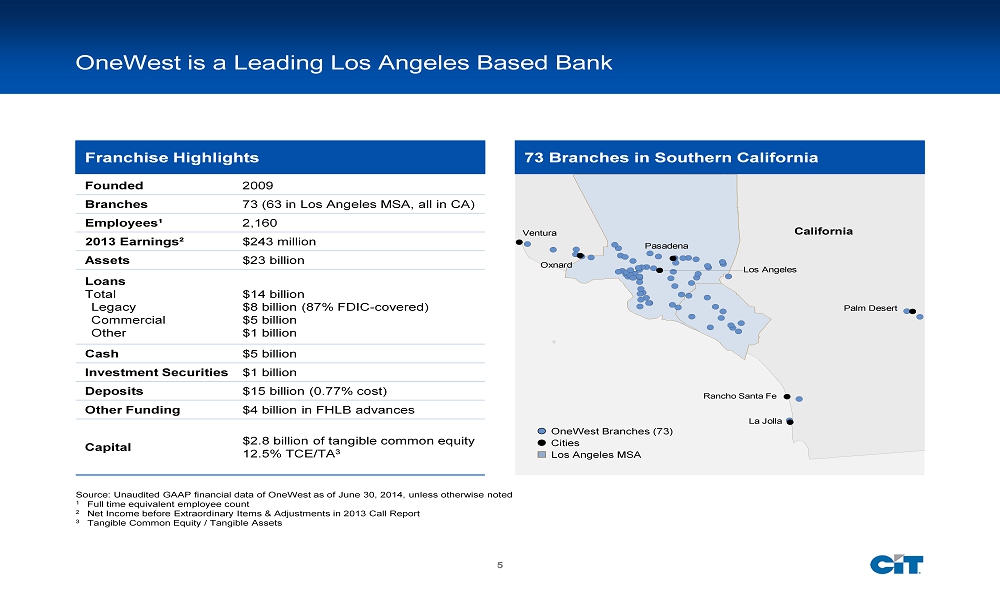

0 40 93 0 60 131 3 80 171 242 199 14 5 155 184 218 208 221 238 OneWest is a Leading Los Angeles Based Bank Founded 2009 Branches 73 (63 in Los Angeles MSA, all in CA) Employees¹ 2,160 2013 Earnings² $243 million Assets $23 billion Loans Total Legacy Commercial Other $14 billion $8 billion (87% FDIC - covered) $5 billion $1 billion Cash $5 billion Investment Securities $1 billion Deposits $15 billion (0.77% cost) Other Funding $4 billion in FHLB advances Capital $2.8 billion of tangible common equity 12.5% TCE/TA 3 Franchise Highlights Source: Unaudited GAAP financial data of OneWest as of June 30, 2014, unless otherwise noted 1 Full time equivalent employee count 2 Net Income before Extraordinary Items & Adjustments in 2013 Call Report 3 Tangible Common Equity / Tangible Assets This map is saved in Dealworks folder 1601736 - 002 This map is saved in Dealworks folder 1601736 - 002 California Los Angeles Pasadena Rancho Santa Fe Oxnard Ventura San Diego Escondido Palm Desert La Jolla Nevada 73 Branches in Southern California Rancho Santa Fe Cities Los Angeles MSA OneWest Branches (73)

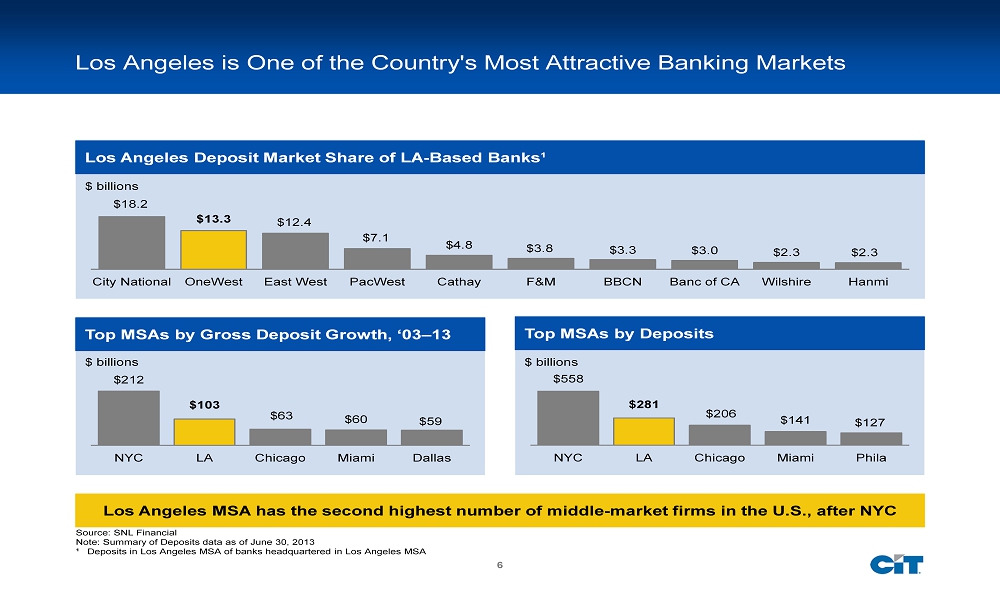

0 40 93 0 60 131 3 80 171 242 199 14 6 155 184 218 208 221 238 $212 $103 $63 $60 $59 NYC LA Chicago Miami Dallas Los Angeles is One of the Country's Most Attractive Banking Markets $558 $281 $206 $141 $127 NYC LA Chicago Miami Phila Top MSAs by Deposits Source: SNL Financial Note: Summary of Deposits data as of June 30, 2013 ¹ D eposits in Los Angeles MSA of banks headquartered in Los Angeles MSA Top MSAs by Gross Deposit Growth, ‘03 – 13 Los Angeles MSA has the second highest number of middle - market firms in the U.S., after NYC $18.2 $13.3 $12.4 $7.1 $4.8 $3.8 $3.3 $3.0 $2.3 $2.3 City National OneWest East West PacWest Cathay F&M BBCN Banc of CA Wilshire Hanmi Los Angeles Deposit Market Share of LA - Based Banks ¹ $ billions $ billions $ billions

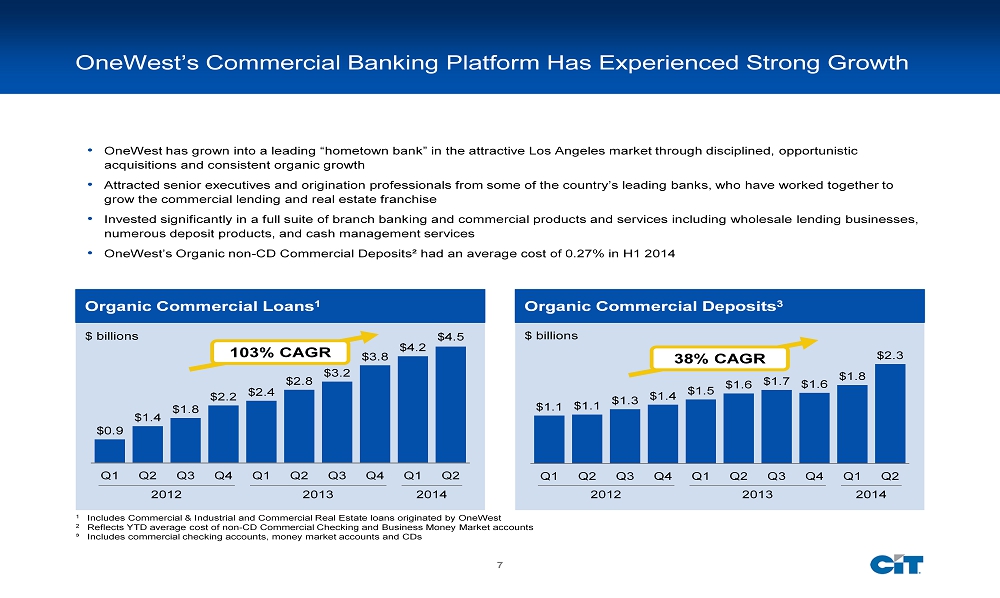

0 40 93 0 60 131 3 80 171 242 199 14 7 155 184 218 208 221 238 $1.1 $1.1 $1.3 $1.4 $1.5 $1.6 $1.7 $1.6 $1.8 $2.3 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 OneWest’s Commercial Banking Platform Has Experienced Strong Growth $0.9 $1.4 $1.8 $2.2 $2.4 $2.8 $3.2 $3.8 $4.2 $4.5 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Organic Commercial Loans 1 Organic Commercial Deposits 3 $ billions $ billions 2012 2013 2014 2012 2013 2014 1 Includes Commercial & Industrial and Commercial Real Estate loans originated by OneWest 2 Reflects YTD average cost of non - CD Commercial Checking and Business Money Market accounts ³ Includes commercial checking accounts, money market accounts and CDs • OneWest has grown into a leading “hometown bank” in the attractive Los Angeles market through disciplined, opportunistic acquisitions and consistent organic growth • Attracted senior executives and origination professionals from some of the country’s leading banks, who have worked together to grow the commercial lending and real estate franchise • Invested significantly in a full suite of branch banking and commercial products and services including wholesale lending bus ine sses, numerous deposit products, and cash management services • OneWest’s Organic non - CD Commercial Deposits² had an average cost of 0.27% in H1 2014 103% CAGR 38% CAGR

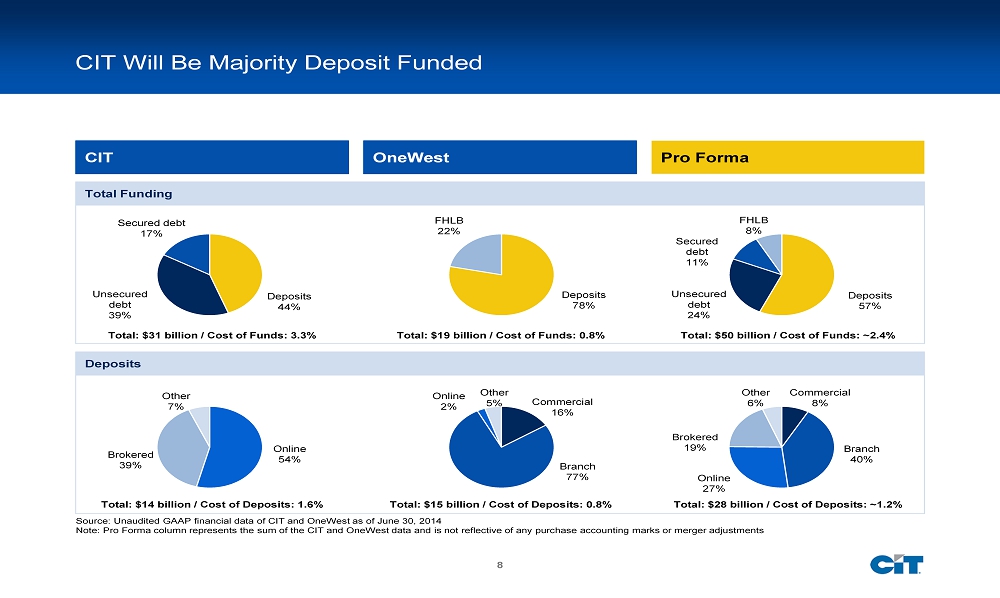

0 40 93 0 60 131 3 80 171 242 199 14 8 155 184 218 208 221 238 CIT Will Be Majority Deposit Funded CIT OneWest Pro Forma Deposits Total Funding Deposits 44% Unsecured debt 39% Secured debt 17% Total: $31 billion / Cost of Funds: 3.3% Source: Unaudited GAAP financial data of CIT and OneWest as of June 30, 2014 Note: Pro Forma column represents the sum of the CIT and OneWest data and is not reflective of any purchase accounting marks or merger adjustments Online 54% Brokered 39% Other 7% Total: $14 billion / Cost of Deposits: 1.6% Branch 40% Online 27% Other 6% Commercial 8% Brokered 19% Deposits 57% Unsecured debt 24% Secured debt 11% FHLB 8% Total: $50 billion / Cost of Funds: ~2.4% Total: $28 billion / Cost of Deposits: ~1.2% Branch 77% Online 2% Other 5 % Commercial 16% Deposits 78% FHLB 22% Total: $19 billion / Cost of Funds: 0.8% Total: $15 billion / Cost of Deposits: 0.8%

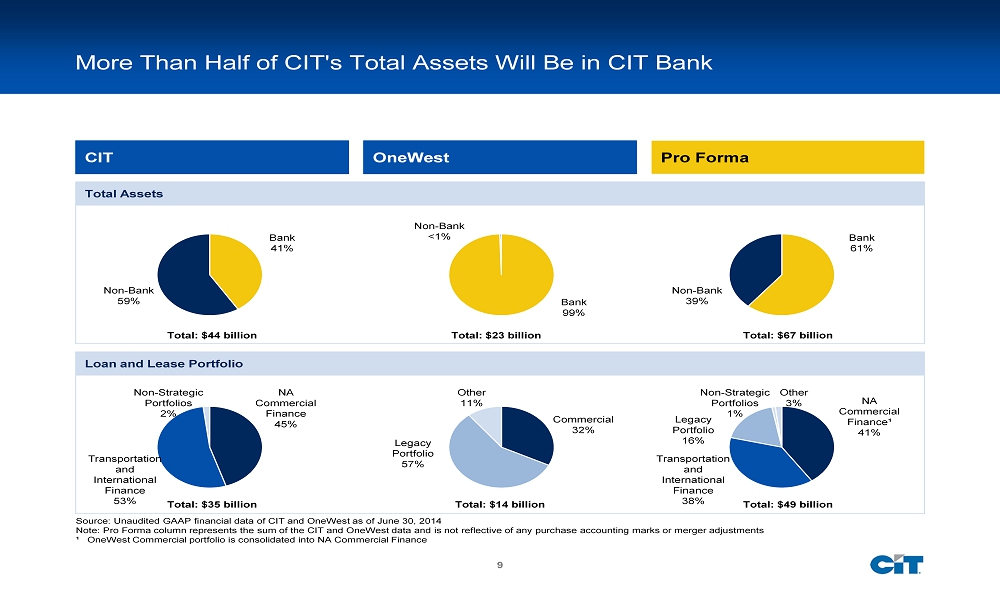

0 40 93 0 60 131 3 80 171 242 199 14 9 155 184 218 208 221 238 More Than Half of CIT's Total Assets Will Be in CIT Bank CIT OneWest Pro Forma Loan and Lease Portfolio Bank 61% Non - Bank 39% Total Assets Bank 41% Non - Bank 59% Total: $67 billion Total: $44 billion NA Commercial Finance¹ 41% Transportation and International Finance 38% Legacy Portfolio 16% Non - Strategic Portfolios 1% Other 3% NA Commercial Finance 45% Transportation and International Finance 53% Non - Strategic Portfolios 2% Total: $49 billion Total: $35 billion Source: Unaudited GAAP financial data of CIT and OneWest as of June 30, 2014 Note: Pro Forma column represents the sum of the CIT and OneWest data and is not reflective of any purchase accounting marks or merger adjustments ¹ OneWest Commercial portfolio is consolidated into NA Commercial Finance Total: $23 billion Other 11% Commercial 32% Legacy Portfolio 57% Total: $14 billion Bank 99% Non - Bank <1%

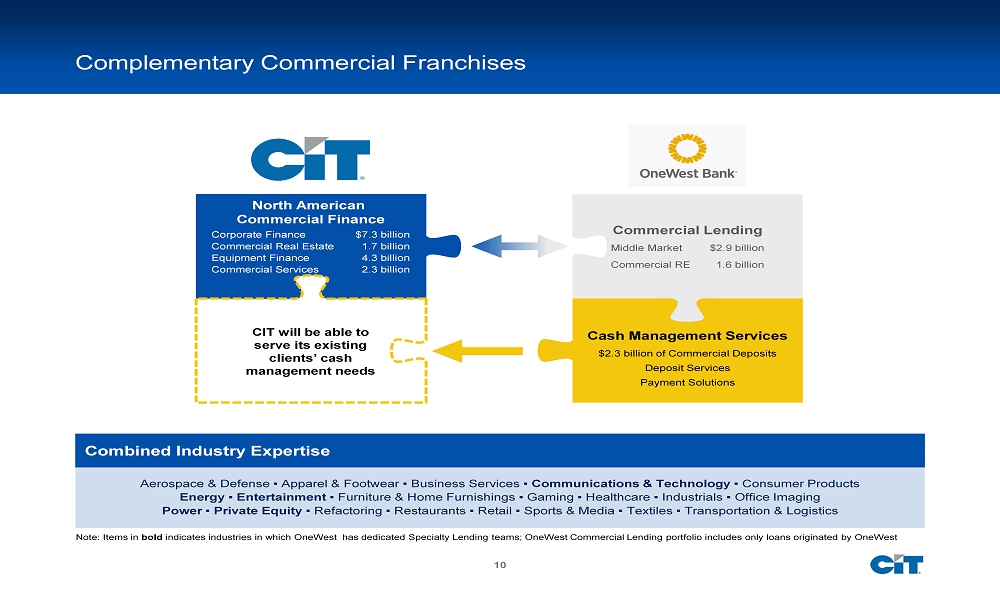

0 40 93 0 60 131 3 80 171 242 199 14 10 155 184 218 208 221 238 Complementary Commercial Franchises Aerospace & Defense ▪ Apparel & Footwear ▪ Business Services ▪ Communications & Technology ▪ Consumer Products Energy ▪ Entertainment ▪ Furniture & Home Furnishings ▪ Gaming ▪ Healthcare ▪ Industrials ▪ Office Imaging Power ▪ Private Equity ▪ Refactoring ▪ Restaurants ▪ Retail ▪ Sports & Media ▪ Textiles ▪ Transportation & Logistics Combined Industry Expertise Note: Items in bold indicates industries in which OneWest has dedicated Specialty Lending teams; OneWest Commercial Lending portfolio includes o nly loans originated by OneWest North American Commercial Finance Corporate Finance $7.3 billion Commercial Real Estate 1.7 billion Equipment Finance 4.3 billion Commercial Services 2.3 billion Commercial Lending Middle Market $2.9 billion Commercial RE 1.6 billion Cash Management Services $2.3 billion of Commercial Deposits Deposit Services Payment Solutions CIT will be able to serve its existing clients’ cash management needs

0 40 93 0 60 131 3 80 171 242 199 14 11 155 184 218 208 221 238 Single family residential² $5bn / 57% CRE, C&I and Other $2bn / 20% MBS $1bn / 13% Reverse mortgages² $1bn / 10% 99% 99% 93% 82% 67% 60% ~35 % 1% 1% 7% 18% 33% 40% ~65 % 2009 2010 2011 2012 2013 Q2 2014 2016E Legacy Loan Portfolio Originated Loan Portfolio OneWest’s Legacy Portfolio is a Low - Risk Earnings Source • $9 billion portfolio yielding ~5% • Acquired through four transactions in 2009 and 2010, three of which were FDIC - assisted • Substantially all loans were originally covered by loss share agreements • Retention of FDIC loss shares agreements is a condition of closing Portfolio Largely Covered by Loss Share Covered Loan Portfolio ~67% of overall Legacy Portfolio expected to have associated loss shares at closing² Loss share through 2019 – 2020 Ongoing Loan Portfolio Transformation Total: $9 billion¹ Source: Unaudited GAAP financial data of OneWest Note: Financial data as of June 30, 2014 ¹ Excludes $1 billion indemnification asset ² Loss share agreements expire in 2019 – 2020

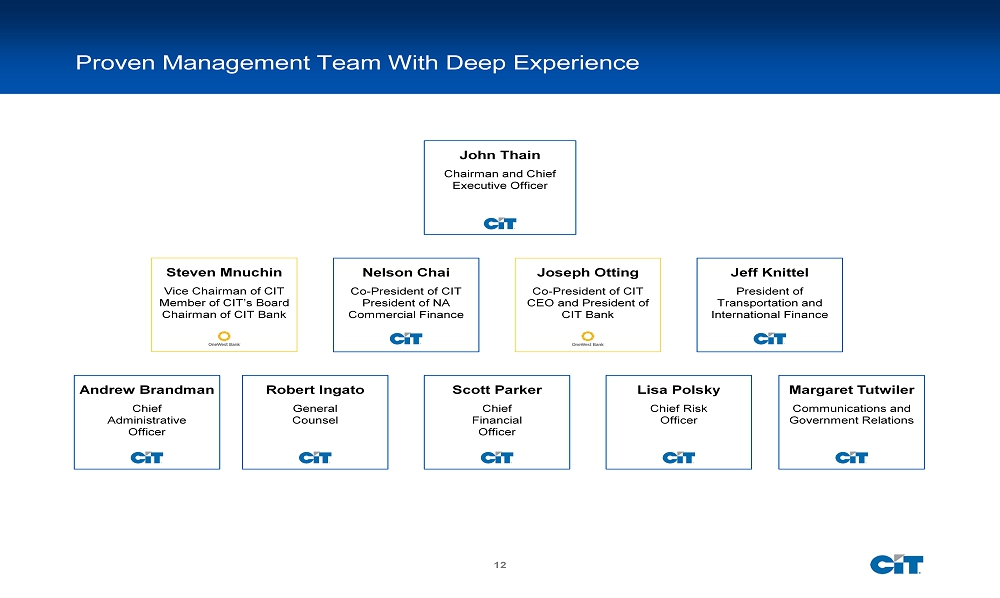

0 40 93 0 60 131 3 80 171 242 199 14 12 155 184 218 208 221 238 Proven Management Team With Deep Experience John Thain Chairman and Chief Executive Officer Nelson Chai Co - President of CIT President of NA Commercial Finance Jeff Knittel President of Transportation and International Finance Joseph Otting Co - President of CIT CEO and President of CIT Bank Steven Mnuchin Vice Chairman of CIT Member of CIT’s Board Chairman of CIT Bank Andrew Brandman Chief Administrative Officer Robert Ingato General Counsel Scott Parker Chief Financial Officer Lisa Polsky Chief Risk Officer Margaret Tutwiler Communications and Government Relations

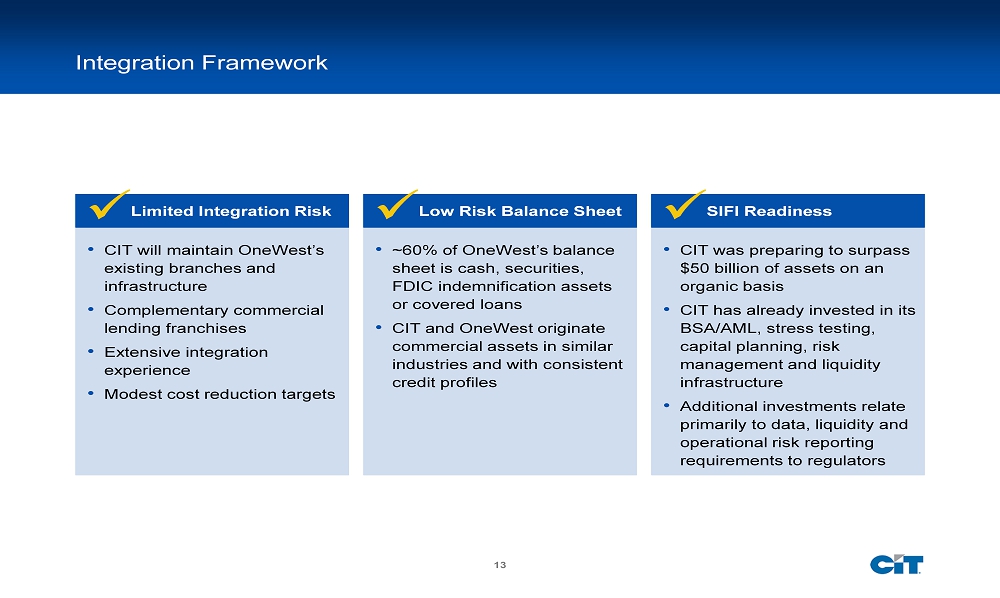

0 40 93 0 60 131 3 80 171 242 199 14 13 155 184 218 208 221 238 Integration Framework • CIT will maintain OneWest’s existing branches and infrastructure • Complementary commercial lending franchises • Extensive integration experience • Modest cost reduction targets Limited Integration Risk x Low Risk Balance Sheet x SIFI Readiness x • ~60% of OneWest’s balance sheet is cash, securities, FDIC indemnification assets or covered loans • CIT and OneWest originate commercial assets in similar industries and with consistent credit profiles • CIT was preparing to surpass $50 billion of assets on an organic basis • CIT has already invested in its BSA/AML, stress testing, capital planning, risk management and liquidity infrastructure • Additional investments relate primarily to data, liquidity and operational risk reporting requirements to regulators

0 40 93 0 60 131 3 80 171 242 199 14 14 155 184 218 208 221 238 Financially Attractive Combination

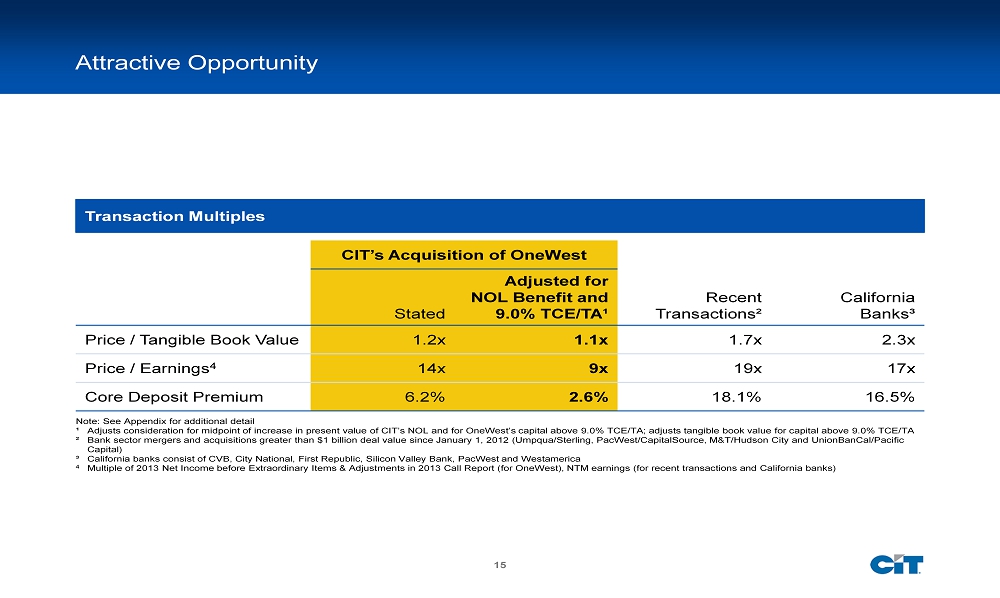

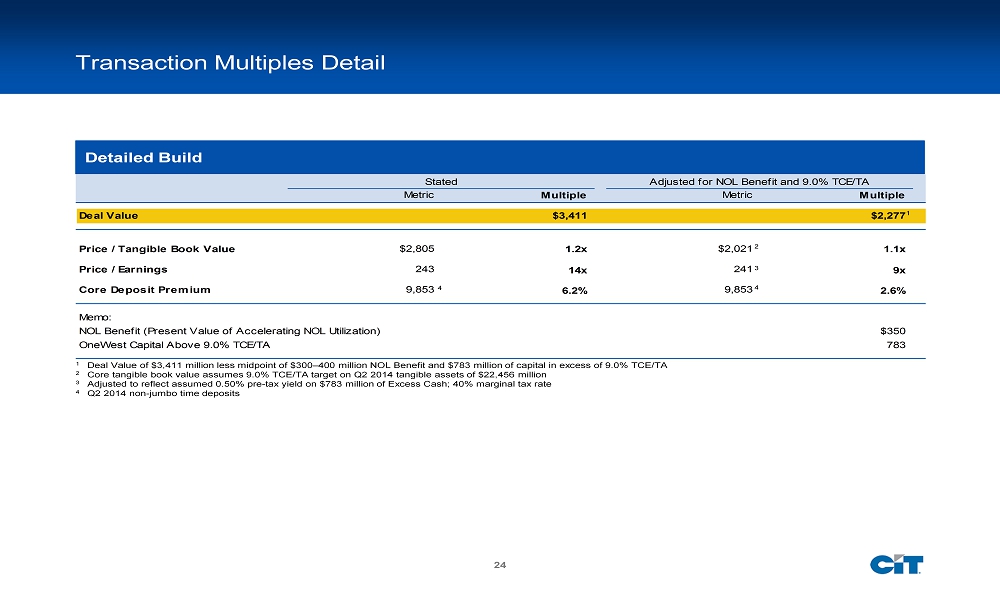

0 40 93 0 60 131 3 80 171 242 199 14 15 155 184 218 208 221 238 Attractive Opportunity Note: See Appendix for additional detail ¹ Adjusts consideration for midpoint of increase in present value of CIT’s NOL and for OneWest’s capital above 9.0% TCE/TA; adj usts tangible book value for capital above 9.0% TCE/TA ² Bank sector mergers and acquisitions greater than $1 billion deal value since January 1, 2012 ( Umpqua/Sterling , PacWest/CapitalSource, M&T/Hudson City and UnionBanCal/Pacific Capital ) ³ California banks consist of CVB, City National, First Republic, Silicon Valley Bank, PacWest and Westamerica 4 Multiple of 2013 Net Income before Extraordinary Items & Adjustments in 2013 Call Report (for OneWest), NTM earnings (for rec ent transactions and California banks) CIT’s Acquisition of OneWest Stated Adjusted for NOL Benefit and 9.0% TCE/TA ¹ Recent Transactions² California Banks³ Price / Tangible Book Value 1.2x 1.1x 1.7x 2.3x Price / Earnings 4 14x 9x 19x 17x Core Deposit Premium 6.2% 2.6% 18.1% 16.5% Transaction Multiples

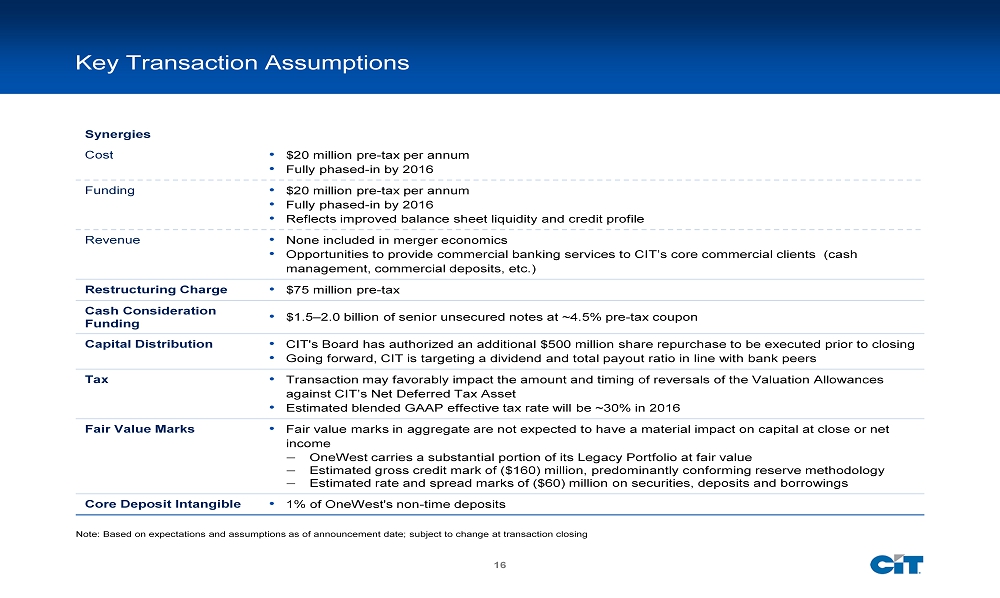

0 40 93 0 60 131 3 80 171 242 199 14 16 155 184 218 208 221 238 Key Transaction Assumptions Synergies Cost • $20 million pre - tax per annum • Fully phased - in by 2016 Funding • $20 million pre - tax per annum • Fully phased - in by 2016 • Reflects improved balance sheet liquidity and credit profile Revenue • None included in merger economics • Opportunities to provide commercial banking services to CIT’s core commercial clients (cash management, commercial deposits, etc.) Restructuring Charge • $75 million pre - tax Cash Consideration Funding • $1.5 – 2.0 billion of senior unsecured notes at ~4.5% pre - tax coupon Capital Distribution • CIT's Board has authorized an additional $500 million share repurchase to be executed prior to closing • Going forward, CIT is targeting a dividend and total payout ratio in line with bank peers Tax • Transaction may favorably impact the amount and timing of reversals of the Valuation Allowances against CIT’s Net Deferred Tax Asset • Estimated blended GAAP effective tax rate will be ~30% in 2016 Fair Value Marks • Fair value marks in aggregate are not expected to have a material impact on capital at close or net income – OneWest carries a substantial portion of its Legacy Portfolio at fair value – Estimated gross credit mark of ($160) million, predominantly conforming reserve methodology – Estimated rate and spread marks of ($60) million on securities, deposits and borrowings Core Deposit Intangible • 1% of OneWest's non - time deposits Note: Based on expectations and assumptions as of announcement date; subject to change at transaction closing

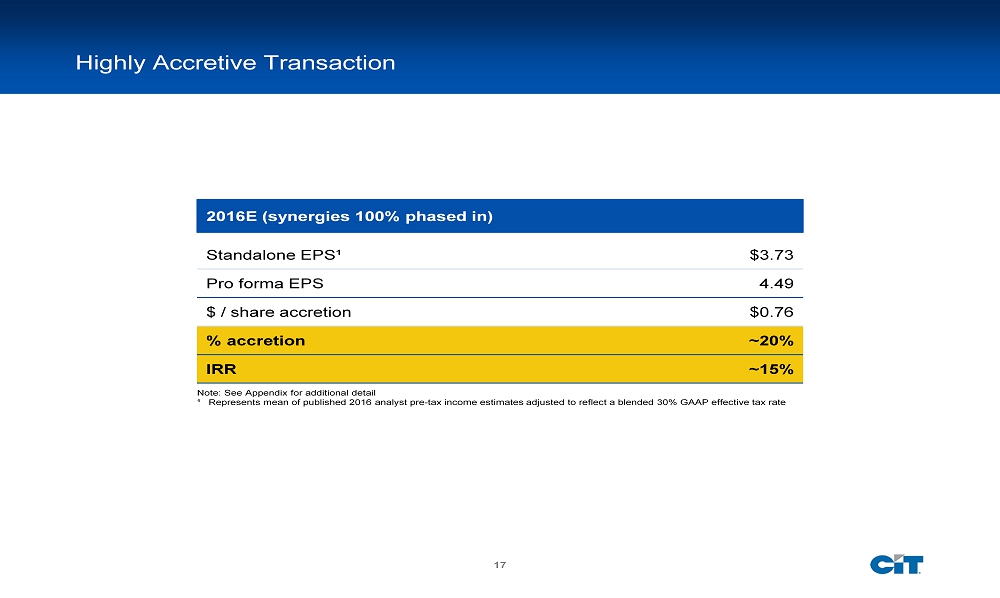

0 40 93 0 60 131 3 80 171 242 199 14 17 155 184 218 208 221 238 Highly Accretive Transaction 2016E (synergies 100% phased in) Standalone EPS¹ $3.73 Pro forma EPS 4.49 $ / share accretion $0.76 % accretion ~20% IRR ~15% Note: See Appendix for additional detail ¹ Represents mean of published 2016 analyst pre - tax income estimates adjusted to reflect a blended 30% GAAP effective tax rate

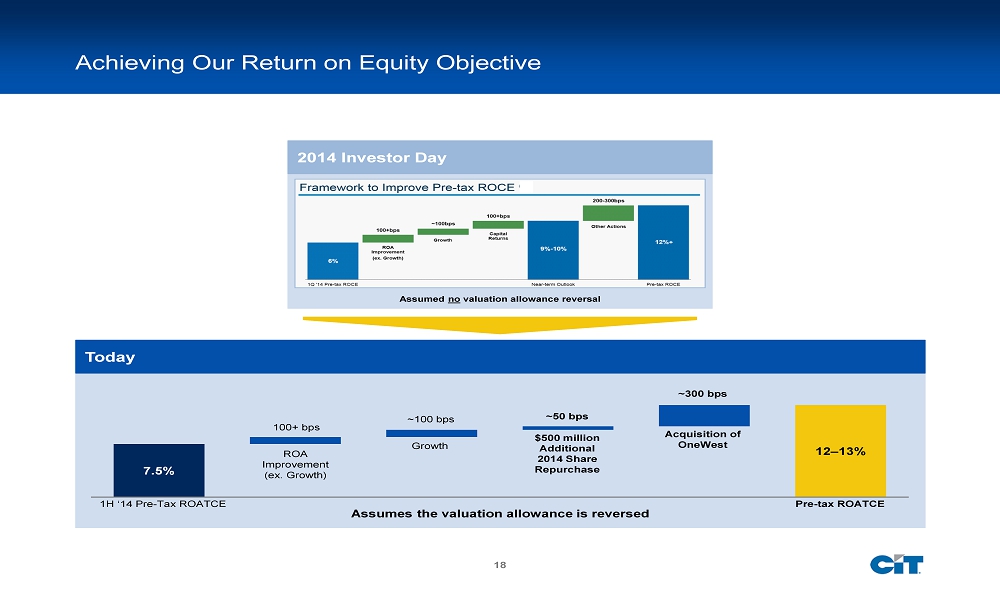

0 40 93 0 60 131 3 80 171 242 199 14 18 155 184 218 208 221 238 Assumes the valuation allowance is reversed Assumed no valuation allowance reversal Achieving Our Return on Equity Objective 2014 Investor Day Today 7.5% 12 – 13% Pre - tax ROATCE ROA Improvement (ex. Growth) ~50 bps 100+ bps 1H ‘14 Pre - Tax ROATCE Growth ~100 bps $500 million Additional 2014 Share Repurchase ~300 bps Acquisition of OneWest

0 40 93 0 60 131 3 80 171 242 199 14 19 155 184 218 208 221 238 Delivering On Our Strategic Agenda

0 40 93 0 60 131 3 80 171 242 199 14 20 155 184 218 208 221 238 Acquisition of OneWest: Delivering On Our Strategic Agenda Advances Our Bank Strategy Complements Our Commercial Finance Franchise Accelerates Realization of Embedded Value Financially Compelling

0 40 93 0 60 131 3 80 171 242 199 14 21 155 184 218 208 221 238 Appendix

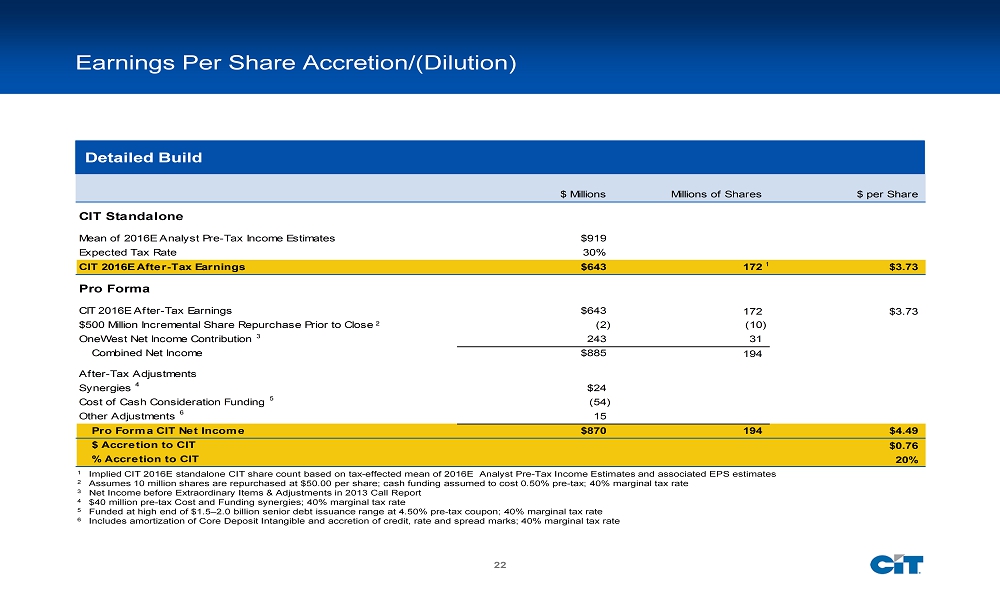

0 40 93 0 60 131 3 80 171 242 199 14 22 155 184 218 208 221 238 Earnings Per Share Accretion/(Dilution) $ Millions Millions of Shares $ per Share CIT Standalone Mean of 2016E Analyst Pre-Tax Income Estimates $919 Expected Tax Rate 30% CIT 2016E After-Tax Earnings $643 172 $3.73 Pro Forma CIT 2016E After-Tax Earnings $643 172 $3.73 $500 Million Incremental Share Repurchase Prior to Close (2) (10) OneWest Net Income Contribution 243 31 Combined Net Income $885 194 After-Tax Adjustments Synergies $24 Cost of Cash Consideration Funding (54) Other Adjustments 15 Pro Forma CIT Net Income $870 194 $4.49 $ Accretion to CIT $0.76 % Accretion to CIT 20% Detailed Build 1 Implied CIT 2016E standalone CIT share count based on tax - effected mean of 2016E Analyst Pre - Tax Income Estimates and associat ed EPS estimates 2 Assumes 10 million shares are repurchased at $50.00 per share; cash funding assumed to cost 0.50% pre - tax; 40% marginal tax rate 3 Net Income before Extraordinary Items & Adjustments in 2013 Call Report 4 $40 million pre - tax Cost and Funding synergies ; 40% marginal tax rate 5 Funded at high end of $1.5 – 2.0 billion senior debt issuance range at 4.50% pre - tax coupon; 40% marginal tax rate 6 Includes amortization of Core Deposit Intangible and accretion of credit, rate and spread marks; 40% marginal tax rate 1 2 3 4 5 6

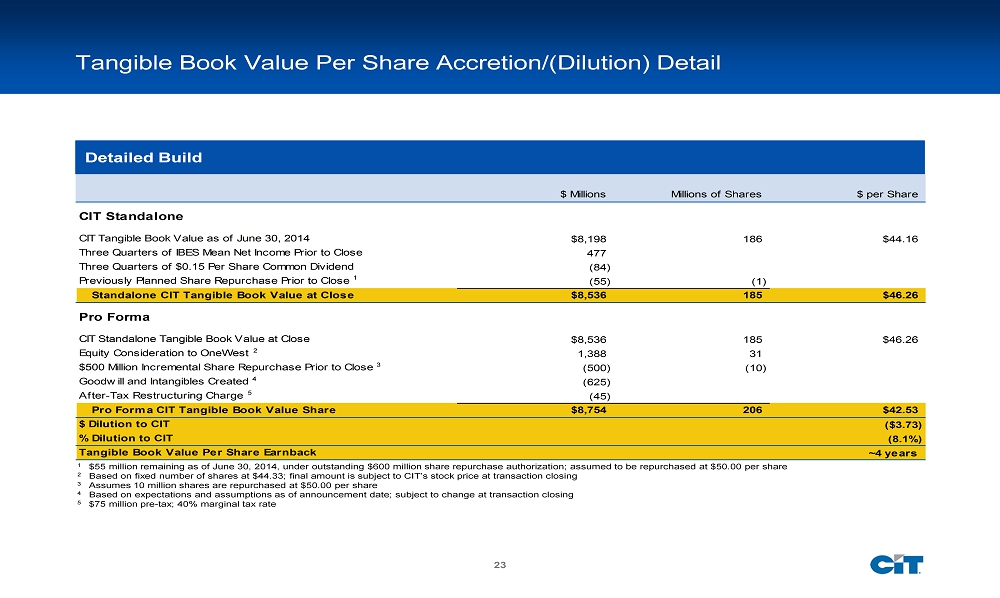

0 40 93 0 60 131 3 80 171 242 199 14 23 155 184 218 208 221 238 $ Millions Millions of Shares $ per Share CIT Standalone CIT Tangible Book Value as of June 30, 2014 $8,198 186 $44.16 Three Quarters of IBES Mean Net Income Prior to Close 477 Three Quarters of $0.15 Per Share Common Dividend (84) Previously Planned Share Repurchase Prior to Close (55) (1) Standalone CIT Tangible Book Value at Close $8,536 185 $46.26 Pro Forma CIT Standalone Tangible Book Value at Close $8,536 185 $46.26 Equity Consideration to OneWest 1,388 31 $500 Million Incremental Share Repurchase Prior to Close (500) (10) Goodwill and Intangibles Created (625) After-Tax Restructuring Charge (45) Pro Forma CIT Tangible Book Value Share $8,754 206 $42.53 $ Dilution to CIT ($3.73) % Dilution to CIT (8.1%) Tangible Book Value Per Share Earnback ~4 years Tangible Book Value Per Share Accretion/(Dilution) Detail Detailed Build 1 $55 million remaining as of June 30, 2014, under outstanding $600 million share repurchase authorization; assumed to be repur ch ased at $50.00 per share 2 B ased on fixed number of shares at $44.33; final amount is subject to CIT’s stock price at transaction closing 3 Assumes 10 million shares are repurchased at $50.00 per share 4 Based on expectations and assumptions as of announcement date; subject to change at transaction closing 5 $75 million pre - tax; 40% marginal tax rate 1 3 4 2 5

0 40 93 0 60 131 3 80 171 242 199 14 24 155 184 218 208 221 238 Stated Adjusted for NOL Benefit and 9.0% TCE/TA Metric Multiple Metric Multiple Deal Value $3,411 $2,277 Price / Tangible Book Value $2,805 1.2x $2,021 1.1x Price / Earnings 243 14x 241 9x Core Deposit Premium 9,853 6.2% 9,853 2.6% Memo: NOL Benefit (Present Value of Accelerating NOL Utilization) $350 OneWest Capital Above 9.0% TCE/TA 783 Transaction Multiples Detail Detailed Build 1 Deal Value of $3,411 million less midpoint of $300 – 400 million NOL Benefit and $783 million of capital in excess of 9.0% TCE/TA 2 Core tangible book value assumes 9.0% TCE/TA target on Q2 2014 tangible assets of $22,456 million 3 Adjusted to reflect assumed 0.50% pre - tax yield on $783 million of Excess Cash; 40% marginal tax rate 4 Q2 2014 non - jumbo time deposits 2 3 4 4 1

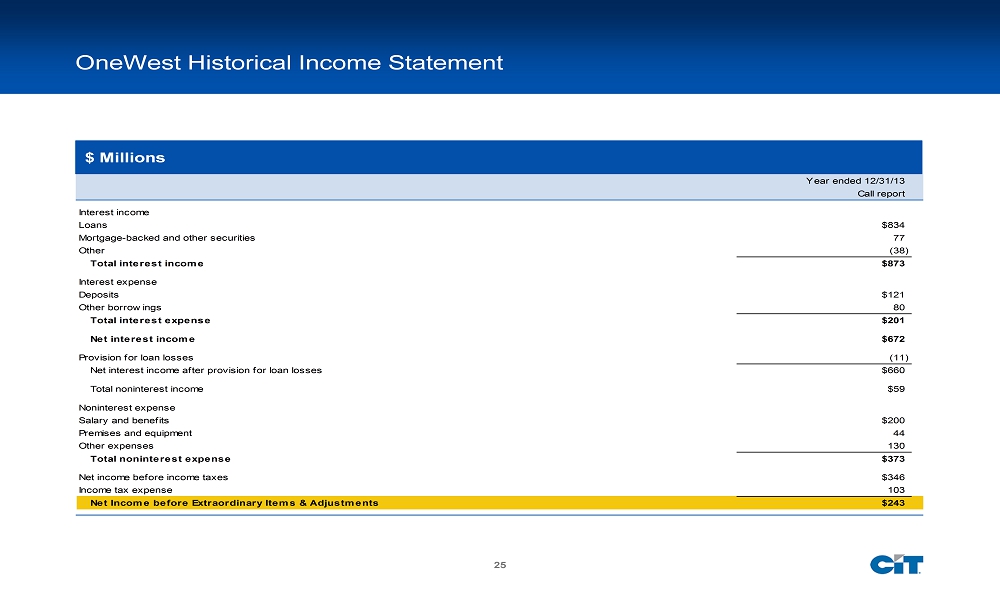

0 40 93 0 60 131 3 80 171 242 199 14 25 155 184 218 208 221 238 Year ended 12/31/13 Call report Interest income Loans $834 Mortgage-backed and other securities 77 Other (38) Total interest income $873 Interest expense Deposits $121 Other borrowings 80 Total interest expense $201 Net interest income $672 Provision for loan losses (11) Net interest income after provision for loan losses $660 Total noninterest income $59 Noninterest expense Salary and benefits $200 Premises and equipment 44 Other expenses 130 Total noninterest expense $373 Net income before income taxes $346 Income tax expense 103 Net Income before Extraordinary Items & Adjustments $243 OneWest Historical Income Statement $ Millions

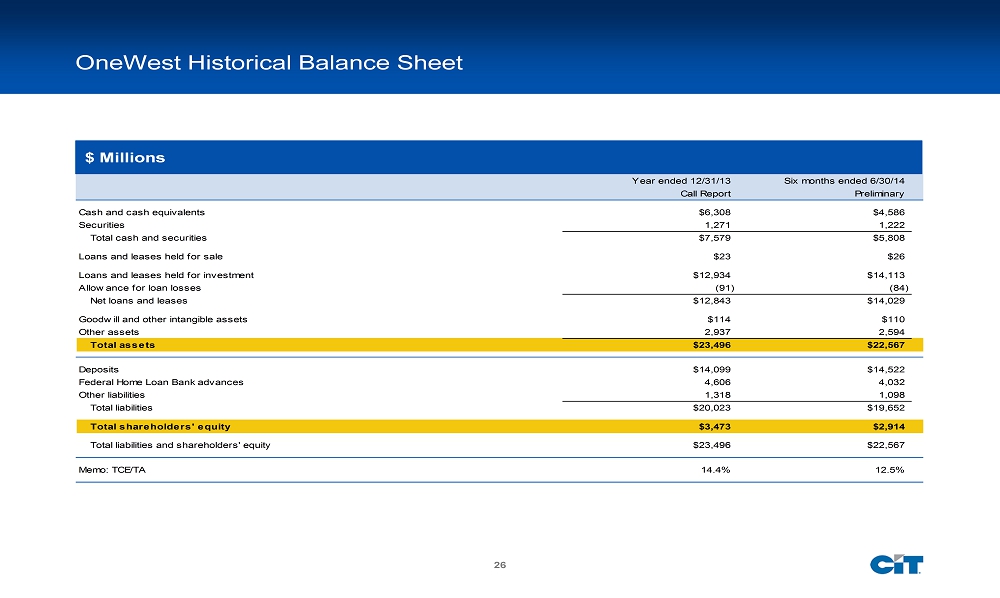

0 40 93 0 60 131 3 80 171 242 199 14 26 155 184 218 208 221 238 Year ended 12/31/13 Six months ended 6/30/14 Call Report Preliminary Cash and cash equivalents $6,308 $4,586 Securities 1,271 1,222 Total cash and securities $7,579 $5,808 Loans and leases held for sale $23 $26 Loans and leases held for investment $12,934 $14,113 Allowance for loan losses (91) (84) Net loans and leases $12,843 $14,029 Goodwill and other intangible assets $114 $110 Other assets 2,937 2,594 Total assets $23,496 $22,567 Deposits $14,099 $14,522 Federal Home Loan Bank advances 4,606 4,032 Other liabilities 1,318 1,098 Total liabilities $20,023 $19,652 Total shareholders' equity $3,473 $2,914 Total liabilities and shareholders' equity $23,496 $22,567 Memo: TCE/TA 14.4% 12.5% OneWest Historical Balance Sheet $ Millions

0 40 93 0 60 131 3 80 171 242 199 14 27 155 184 218 208 221 238